UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 20-F

(Mark One)

REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR (g) OF THE SECURITIES EXCHANGE ACT OF 193 4 |

OR

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31 , 2021

OR

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

OR

SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Date of event requiring this shell company report

For the transition period from to

Commission file number 001-38159

(Exact name of Registrant as specified in its charter)

(Translation of Registrant’s name into English)

(Jurisdiction of incorporation or organization)

(Address of principal executive offices)

Fax: +44 (0)20 7240 0555

(Name, Telephone,

E-mail

and/or Facsimile number and Address of Company Contact Person) Securities registered or to be registered pursuant to Section 12(b) of the Act.

Title of each class |

Trading symbol(s) |

Name of each exchange on which registered | ||

each representing one ordinary share |

||||

4.906% Notes due 203 0 |

||||

| * | Application made for registration purposes only, not for trading, and only in connection with the registration of the American Depositary Shares pursuant to the requirements of the Securities and Exchange Commission. |

Securities registered or to be registered pursuant to Section 12(g) of the Act.

None

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act.

None

Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered by the Annual Report.

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. ☒ Yes ☐ No

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934. ☐ Yes ☒ No

Note – Checking the box above will not relieve any registrant required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 from their obligations under those Sections.

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. ☒ Yes ☐ No

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation Yes ☐ No

S-T

(§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). ☒ Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a

non-accelerated

filer, or an emerging growth company. See definition of “large accelerated filer,” “accelerated filer,” and “emerging growth company” in Rule 12b-2

of the Exchange Act. | ☒ | Accelerated filer | ☐ | ||||

Non-accelerated filer |

☐ | Emerging growth company | ||||

If an emerging growth company that prepares its financial statements in accordance with US GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards† provided pursuant to Section 13(a) of the Exchange Act. ☐

| † | The term “new or revised financial accounting standard” refers to any update issued by the Financial Accounting Standards Board to its Accounting Standards Codification after April 5, 2012. |

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☒

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

| US GAAP ☐ | International Accounting Standards Board ☒ |

Other ☐ | ||

If “Other” has been checked in response to the previous question, indicate by check mark which financial statement item the registrant has elected to follow. ☐ Item 17 ☐ Item 18

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule ☒ No

12b-2

of the Exchange Act). ☐ Yes | Name of the auditor’s firm | ||

| Auditors’ firm ID/ PCAOB issued Audit Firm Identifier | ||

| Auditors’ Location – City, State/Province, Country |

For the forward-looking

non-GAAP

information contained in this Annual Report on Form 20-F,

no comparable GAAP or IFRS information is available on a forward-looking basis and our forward-looking revenue cannot be estimated, as the effect of rates of exchange, which could be significant, may be highly variable and cannot be estimated with reasonable certainty. In addition, other components of the Group’s results, including the revenue generated from combustibles, cannot be estimated with reasonable certainty due to, among other things, the impact of foreign exchange, pricing and volume, which could be significant, being highly variable. As such, no reconciliations for this forward-looking non-GAAP

information are available and we are unable to: present revenue before presenting New Category revenue or constant currency revenue.

Accelerating A Better Tomorrow Annual Report and Form 20-F 2021

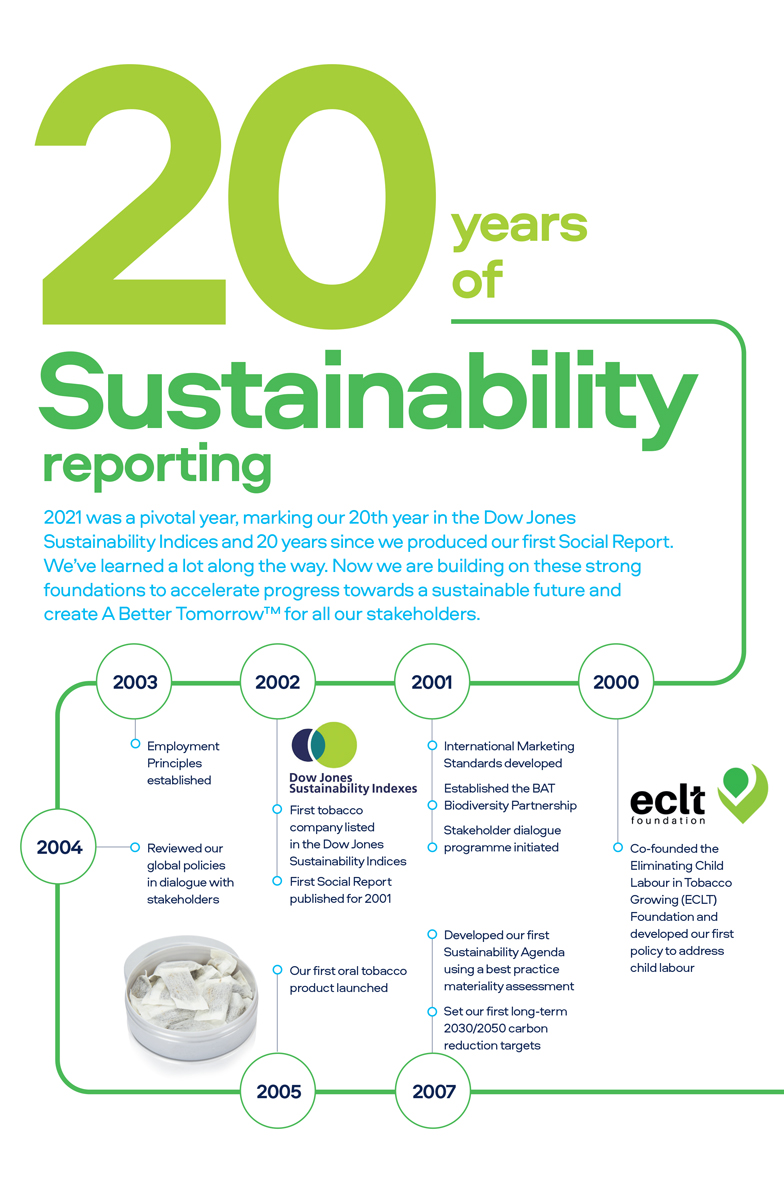

years years of of ustainability Sustainability eporting eporting was a 2021 pivotal was year, a pivotal marking year, our marking 20th year our in 20th the year Dowin Jon thesDow Jones inability Sustainability Indices andIndic 20 yes ars and since 20 years we produced since we our produced first Social our Report first Social . Report. learned We've a lot learned along a the lot way along . Now the we way are . Now building we are onbuilding these strong on these strong ations foundations to accelerate to accelerate progress towards progress a sustainable towards a sus future ainable and future and A Better create T

om

om

om

om

CO e 2 Our first vapour CO e targets 2 product launched approved by the in the UK Science-Based Targets Initiative 2013 2014 2016 2017 2019 Listed in the Dow Jones Sustainability Indices for the 20th consecutive year Thrive farmer Our first tobacco Signed up to the livelihoods heating product UN-backed Race programme launched to Zero global developed campaign Enhanced global ethics programme, 2021 Delivery with Integrity, introduced 2022 BAT celebrates 120th Accelerating anniversary Our A Better TomorrowTM ambitions in numbers £5 billion in New Category revenues Carbon 100% Neutral NetZero of plastic packaging capable operations value chain of being reusable, recyclable or (Scope 1 and 2) In October 2021, we signed compostable and unnecessary up to the UN-backed Race to Zero global campaign, single-use plastic removed 50million committing to set science- based targets aiming non-combustible for net zero value chain Zero product consumers emissions by 2050 child labour ambition for our tobacco supply chain 2025 2030 2050

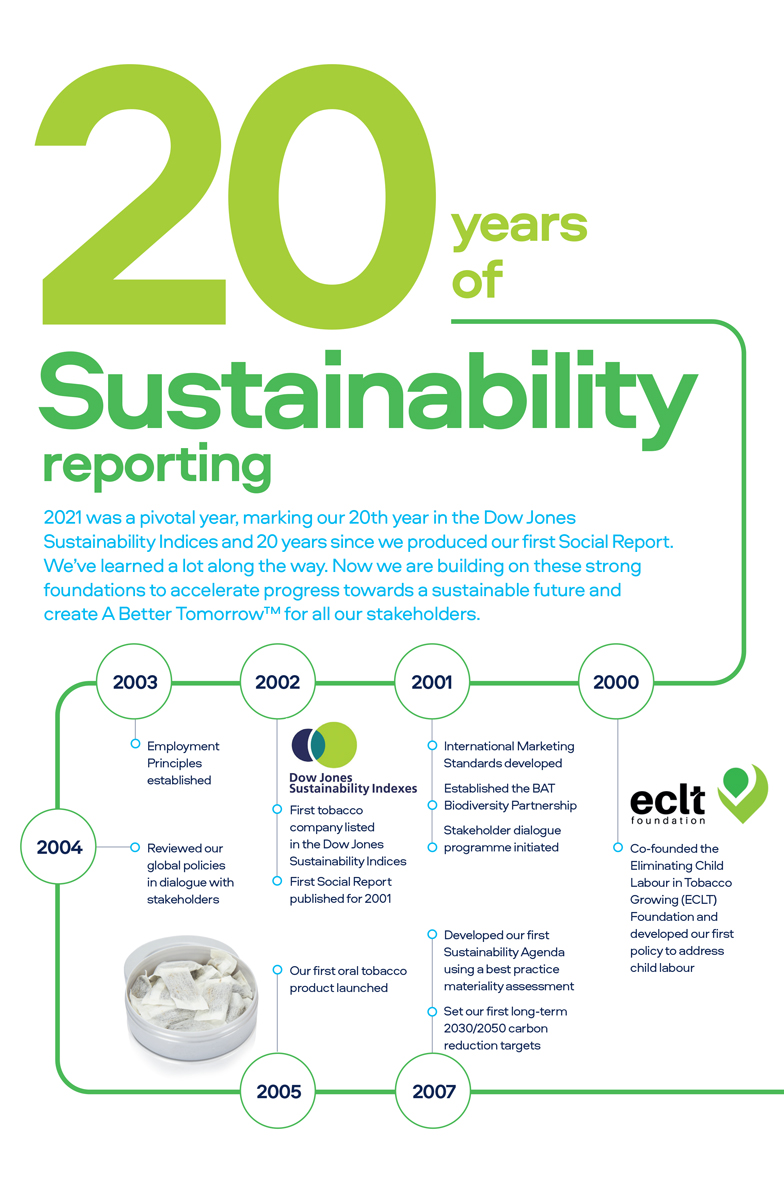

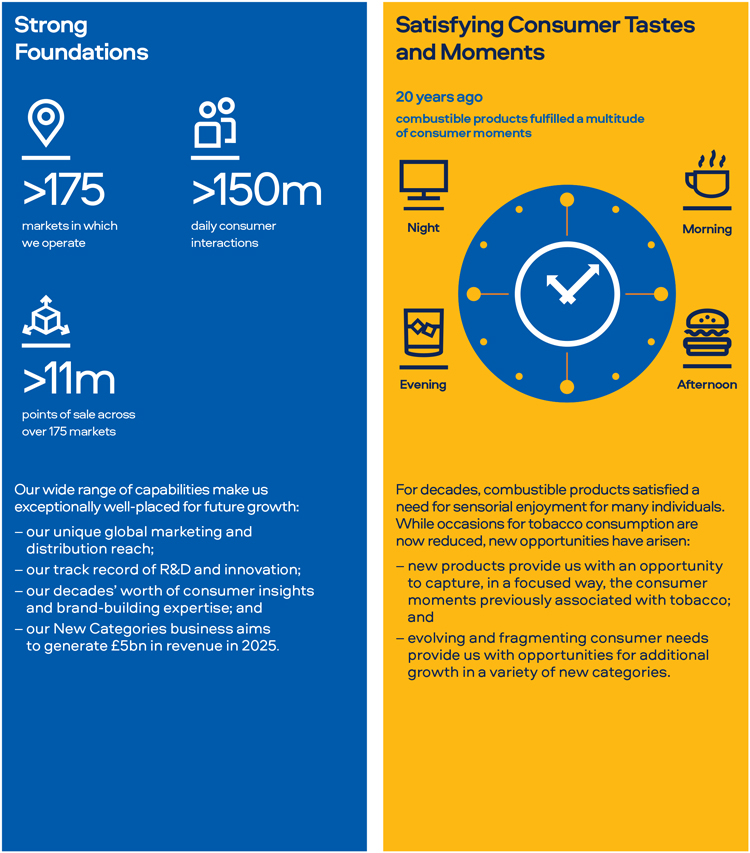

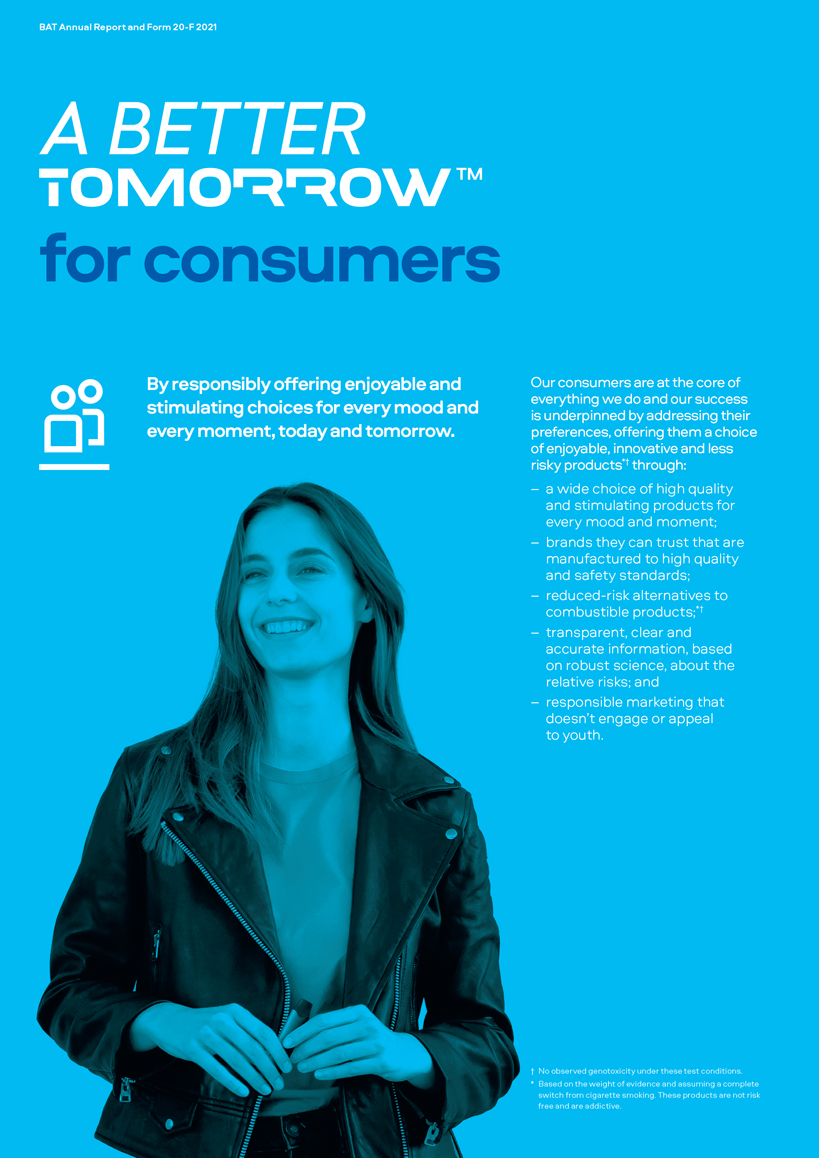

Our Purpose To reduce the health impact of our business by offering a greater choice of enjoyable and less risky products for our consumers. We are clear that combustible cigarettes pose serious health risks. The only way to avoid these risks is not to start or to quit. However, we encourage those who would otherwise continue to smoke to switch completely to scientifically-substantiated, reduced-risk alternatives.* In order to deliver this, BAT is transforming into a truly multi-category consumer products business, with a mission to stimulate the senses of new adult generations. years of 20Sustainability reporting Sustainability isnt new at BAT. 2021 was a pivotal year, marking our 20th year in the Dow Jones Sustainability Indices and 20 years since producing our first Social Report. Weve learned a lot along the way. And now we are building on these strong foundations to accelerate progress towards a sustainable future and create A Better Tomorrow

2021 was a pivotal year in BAT’s

2021 was a pivotal year in BAT’s

2021 was indeed a pivotal year, with constant

2021 was indeed a pivotal year, with constant

Our ongoing commitment to fostering a diverse and inclusive culture at BAT is underpinned by our ethos, which encourages our employees to be Bold, Fast, Empowered, Responsible and Diverse. Our transformation is driven by our people. By combining existing and new capabilities, we are radically redefining our organisation. Together, we will build A Better Tomorrow.

Our ongoing commitment to fostering a diverse and inclusive culture at BAT is underpinned by our ethos, which encourages our employees to be Bold, Fast, Empowered, Responsible and Diverse. Our transformation is driven by our people. By combining existing and new capabilities, we are radically redefining our organisation. Together, we will build A Better Tomorrow.

With Vuse approaching value

With Vuse approaching value

Leadership of vapour in

Leadership of vapour in

ci´ca 2/a, 10000 Zagreb, Croatia

ci´ca 2/a, 10000 Zagreb, Croatia