Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 20-F

(Mark One)

| ☐ | REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR (g) OF THE SECURITIES EXCHANGE ACT OF 1934 |

OR

| ☒ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2019

OR

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

OR

| ☐ | SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Date of event requiring this shell company report

For the transition period from to

Commission file number 001-38159

British American Tobacco p.l.c.

(Exact name of Registrant as specified in its charter)

(Translation of Registrant’s name into English)

England and Wales

(Jurisdiction of incorporation or organization)

Globe House, 4 Temple Place, London WC2R 2PG, United Kingdom

(Address of principal executive offices)

Paul McCrory, Company Secretary Tel: +44 (0)20 7845 1000

Fax: +44 (0)20 7240 0555

Globe House, 4 Temple Place, London WC2R 2PG, United Kingdom

(Name, Telephone, E-mail and/or Facsimile number and Address of Company Contact Person)

Securities registered or to be registered pursuant to Section 12(b) of the Act.

| Title of each class |

Trading symbol(s) |

Name of each exchange on which registered | ||

| American Depositary Shares (evidenced by American Depositary Receipts) each representing one ordinary share | BTI | New York Stock Exchange | ||

| Ordinary shares, nominal value 25 pence per share | BTI | New York Stock Exchange* | ||

| 2.789% Notes due 2024 | BTI24 | New York Stock Exchange | ||

| 3.215% Notes due 2026 | BTI26 | New York Stock Exchange | ||

| 3.462% Notes due 2029 | BTI29 | New York Stock Exchange | ||

| 4.758% Notes due 2049 | BTI49 | New York Stock Exchange | ||

| 2.764% Notes due 2022 | BTI22 | New York Stock Exchange | ||

| 3.222% Notes due 2024 | BTI24A | New York Stock Exchange | ||

| 3.557% Notes due 2027 | BTI27 | New York Stock Exchange | ||

| 4.390% Notes due 2037 | BTI37 | New York Stock Exchange | ||

| 4.540% Notes due 2047 | BTI47 | New York Stock Exchange | ||

| Floating Rate Notes due 2020 | BTI20 | New York Stock Exchange | ||

| Floating Rate Notes due 2022 | BTI22A | New York Stock Exchange |

| * | Application made for registration purposes only, not for trading, and only in connection with the registration of the American Depositary Shares pursuant to the requirements of the Securities and Exchange Commission. |

Securities registered or to be registered pursuant to Section 12(g) of the Act.

None

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act.

None

Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered by the Annual Report.

2,456,520,738 ordinary shares

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. ☒ Yes ☐ No

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934. ☐ Yes ☒ No

Note – Checking the box above will not relieve any registrant required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 from their obligations under those Sections.

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. ☒ Yes ☐ No

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). ☒ Yes ☐ No

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or an emerging growth company. See definition of “large accelerated filer,” “accelerated filer,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ☒ | Accelerated filer | ☐ | |||

| Non-accelerated filer | ☐ | Emerging growth company | ☐ | |||

If an emerging growth company that prepares its financial statements in accordance with US GAAP, indicate

by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards† provided pursuant to Section 13

(a) of the Exchange Act. ☐

| † | The term “new or revised financial accounting standard” refers to any update issued by the Financial Accounting Standards Board to its Accounting Standards Codification after April 5, 2012. |

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

| US GAAP ☐ | International Financial Reporting Standards as issued by the International Accounting Standards Board ☒ | Other ☐ |

If “Other” has been checked in response to the previous question, indicate by check mark which financial statement item the registrant has elected to follow. ☐ Item 17 ☐ Item 18

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). ☐ Yes ☒ No

Table of Contents

References in this document to information on websites or social media platforms, including the web address and social media channels of BAT, have been included as inactive textual references only. These websites and social media channels and the information contained therein or connected thereto are not intended to be incorporated into or to form part of the Annual Report on Form 20-F.

Table of Contents

Table of Contents

Table of Contents

Table of Contents

Table of Contents

Table of Contents

Table of Contents

|

Strategic Report

|

Governance

|

Financial Statements

|

Other Information

|

British American Tobacco p.l.c. (No. 3407696)

Annual Report 2019

This document constitutes the Annual Report and Accounts of British American Tobacco p.l.c. (the ‘Company’) and the British American Tobacco Group prepared in accordance with UK requirements and the Annual Report on Form 20-F prepared in accordance with the US Securities Exchange Act of 1934 (the ‘Exchange Act’) for the year ended 31 December 2019. Moreover, the information in this document may be updated or supplemented only for purposes of the Annual Report on Form 20-F at the time of filing with the SEC or later amended if necessary. Any such updates, supplements or amendments will also be denoted with a ‘»’ symbol. Insofar as this document constitutes the Annual Report and Accounts, it has been drawn up and is presented in accordance with, and reliance upon, applicable English company law and the liabilities of the Directors in connection with this report shall be subject to the limitations and restrictions provided by such law.

This document is made up of the Strategic Report, the Governance Report, the Financial Statements and Notes, and certain other information. Our Strategic Report, pages 2 to 62, includes our purpose and strategy, global market overview, business model, global performance, as well as our financial performance and principal group risks. The Strategic Report has been approved by the Board of Directors and signed on its behalf by Paul McCrory, Company Secretary. Our Governance Report on pages 63 to 114 contains detailed corporate governance information and our Committee reports. The Directors’ Report on pages 63 to 89 (the Governance pages) and 254 to 323 (the Additional disclosure and Shareholder information pages) has been approved by the Board of Directors and signed on its behalf by Paul McCrory, Company Secretary. Our Financial Statements and Notes are on pages 115 to 253. The Other Information section commences on page 254.

This document provides alternative performance measures (APMs) which are not defined or specified under the requirements of International Financial Reporting Standards (IFRS). We believe these APMs provide readers with important additional information on our business. We have included a Non-GAAP measures section on pages 258 to 268 which provides a comprehensive list of the APMs that we use, an explanation of how they are calculated, why we use them and a reconciliation to the most directly comparable IFRS measure where relevant.

British American Tobacco p.l.c. has shares listed on the London Stock Exchange (BATS) and the Johannesburg Stock Exchange (BTI), and, as American Depositary Shares, on the New York Stock Exchange (BTI).

The Annual Report is published on bat.com. A printed copy is mailed to shareholders on the UK main register who have elected to receive it. Otherwise, shareholders are notified that the Annual Report is available on the website and will, at the time of that notification, receive a short Performance Summary (which sets out an overview of the Group’s performance, headline facts and figures and key dates in the Company’s financial calendar) and Proxy Form.

Specific local mailing and/or notification requirements will apply to shareholders on the South Africa branch register.

References in this publication to ‘British American Tobacco’, ‘BAT’, ‘Group’, ‘we’, ‘us’ and ‘our’ when denoting opinion refer to British American Tobacco p.l.c. and when denoting tobacco business activity refer to British American Tobacco Group operating companies, collectively or individually as the case may be.

The material in this Annual Report is provided for the purpose of giving information about the Company to investors only and is not intended for general consumers. The Company, its directors, employees, agents or advisers do not accept or assume responsibility to any other person to whom this material is shown or into whose hands it may come and any such responsibility or liability is expressly disclaimed. The material in this Annual Report is not provided for product advertising, promotional or marketing purposes. This material does not constitute and should not be construed as constituting an offer to sell, or a solicitation of an offer to buy, any of our products. Our products are sold only in compliance with the laws of the particular jurisdictions in which they are sold.

References in this document to information on websites, including the web address of BAT, have been included as inactive textual references only. These websites and the information contained therein or connected thereto are not intended to be incorporated into or to form part of the Annual Report and Form 20-F.

Cautionary statement

This document contains forward-looking statements. For our full cautionary statement, please see page 298.

| BAT Annual Report and Form 20-F 2019 |

01 | |

Table of Contents

Table of Contents

|

Strategic Report

|

Governance

|

Financial Statements

|

Other Information

|

REVIEW

|

Dear shareholders and stakeholders,

I write this reflecting on my first year as Chief Executive of BAT. It is a privilege to lead the Group, with its record of achievements both past and present.

Since taking the helm in early 2019, I have focused the business on three clear priorities: driving value from combustibles, ensuring a step change in New Categories performance and simplifying the business. Stronger, simpler, faster.

My new management team has fully embraced these priorities and is already delivering against them.

In my first Annual Report as Chief Executive, I want to take this opportunity to set out my vision for BAT’s future. |

| BAT Annual Report and Form 20-F 2019 |

03 | |

Table of Contents

|

Overview

|

CHIEF EXECUTIVE’S REVIEW

CONTINUED

| 04 |

BAT Annual Report and Form 20-F 2019 | |

Table of Contents

|

Strategic Report

|

Governance

|

Financial Statements

|

Other Information

|

| BAT Annual Report and Form 20-F 2019 |

05 | |

Table of Contents

|

Overview

|

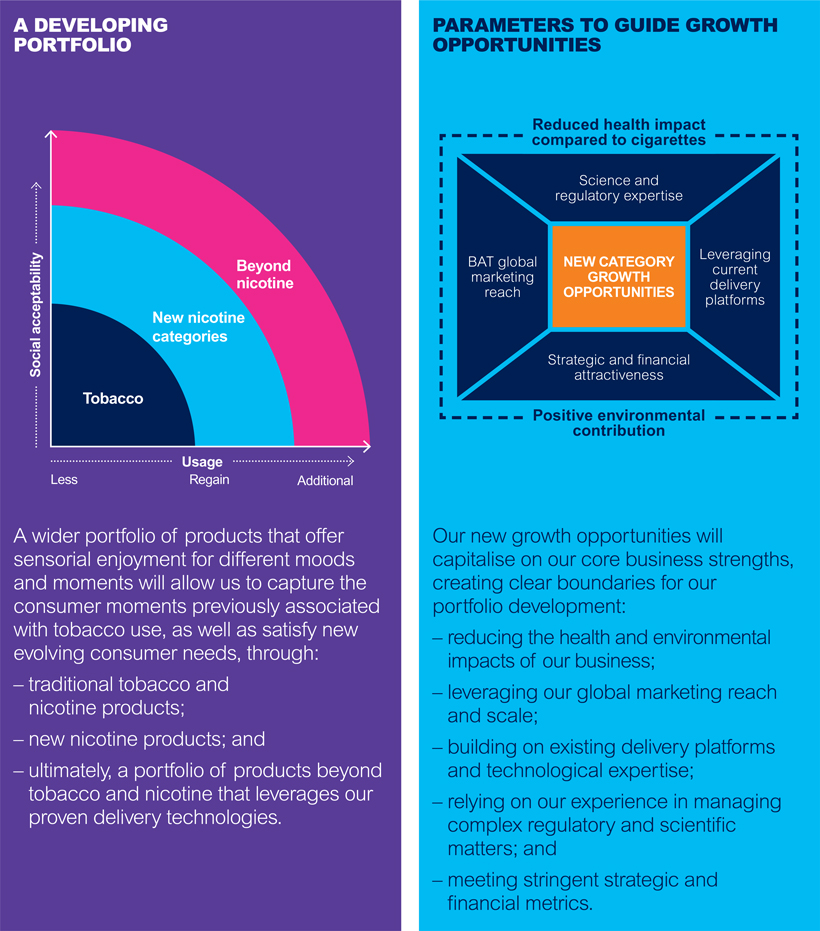

OUR EVOLVED STRATEGY

We are committed to providing a better tomorrow for all our stakeholders. Our ambition is to deliver long-term sustainable

growth with a range of innovative and less harmful products

that stimulate the senses of new adult generations.

| 06 |

BAT Annual Report and Form 20-F 2019 | |

Table of Contents

|

Strategic Report

|

Governance

|

Financial Statements

|

Other Information

|

| BAT Annual Report and Form 20-F 2019 |

07 | |

Table of Contents

|

Overview

|

A STRATEGY FOR

ACCELERATED GROWTH

While combustible tobacco will be at the core of our business for some time

to come, we aim to generate an increasingly greater proportion of our revenues

from products other than cigarettes, thereby reducing the health impact

of our business.

This will deliver a better tomorrow for our consumers who will have a range of

enjoyable and potentially less risky choices for every mood and moment; for society

through reducing the overall health and environmental impacts of our business;

for our employees by creating a dynamic and purposeful place to work; and for

our shareholders by delivering sustainable superior returns.

| OUR MISSION

Stimulating the senses of new adult generations

Today, we see opportunities to capture consumer moments which have, over time, become limited by societal and regulatory shifts, and to satisfy evolving consumer needs and preferences.

Our mission is to anticipate and satisfy this ever-evolving consumer: provide pleasure, reduce risk, increase choice and stimulate the senses of adult consumers worldwide. |

MUST WINS

High Growth Segments

Driven by our unique and data-driven consumer insight platform (PRISM), we will focus on product categories and consumer segments across our global business that have the best potential for long-term sustainable growth.

Priority Markets

By relying on a rigorous market prioritisation system (MAPS), we will focus the strengths of our unparalleled retail and marketing reach, as well as our regulatory and scientific expertise, on those markets and marketplaces with the greatest opportunities for growth. |

HOW WE WIN

Inspirational foresights

As one of the most long-standing and established consumer goods businesses in the world, we have a unique view of the consumer across four product categories, which is increasingly driven by powerful data and analytics. These insights ensure that the development and responsible marketing of our products is fit to satisfy consumer needs.

Remarkable innovation

As consumer preferences and technology evolve rapidly, we rely on our growing global network of digital hubs, innovation super centres, world-class R&D laboratories, external partnerships and an upcoming corporate venturing initiative to stay ahead of the curve.

|

| 08 |

BAT Annual Report and Form 20-F 2019 | |

Table of Contents

|

Strategic Report

|

Governance

|

Financial Statements

|

Other Information

|

|

|

|||||

|

OUR STRATEGY PUTS THE CONSUMER FIRST, FOCUSING ON UNDERSTANDING ADULT CONSUMER CHOICE AND ENJOYMENT. WE WILL CAPTURE LOST CONSUMER MOMENTS WITH A PORTFOLIO IN TOBACCO, NICOTINE AND BEYOND. THIS WILL ENABLE SUSTAINABLE, LONG-TERM GROWTH WITH A CLEAR FOCUS ON FORESIGHTS, INNOVATION, BRANDS, ACTIVATION, TEAMS AND TECHNOLOGY. WE WILL BECOME A BUSINESS THAT DEFINES ITSELF NOT BY THE PRODUCTS IT SELLS BUT BY THE CONSUMER NEEDS IT MEETS.

| ||||||

|

Kingsley Wheaton Chief Marketing Officer |

| |||||

|

Powerful brands

For over a century, we have built trusted and powerful brands that satisfy our consumers and serve as a promise for quality and enjoyment. We will focus on fewer, stronger and global brands across all our product categories, delivered through our deep understanding and segmenting of our consumers.

Connected

Few companies can claim over 150 million daily consumers, over 11 million retail points of sale, as well as a network of expert and skilled employees around the world. Staying connected to all of them, especially through digital means (including e-commerce), ensures better consumer connections, access to markets and innovations that offer sensorial enjoyment and satisfy consumer needs. |

People and partnerships

Our highly-motivated people are being empowered through a new ethos that is responsive to constant change, embodies a learning culture and is dedicated to continuous improvement. But we cannot succeed on our own, and our partnerships with farmers, suppliers and customers are also key for ensuring sustainable future growth.

US focus

The United States comprises nearly half of our global business. It is also the single largest economy in the world, the largest single centre for technology and the key driver of global consumer trends, and is where we have the deep consumer understanding and financial strength to support the delivery of our mission to stimulate consumer senses around the rest of the world. |

OUR PURPOSE

By stimulating the senses of new adult generations, our purpose is to create A Better Tomorrow for all our stakeholders.

We will create A Better Tomorrow for:

Consumers

By responsibly offering enjoyable and stimulating choices for every mood and every moment, today and tomorrow; Society

By reducing the health impact of our business by offering a range of alternative products, as well as by reducing our environmental and social impacts; Employees

By creating a dynamic, inspiring and purposeful place to work; and Shareholders

By delivering sustainable and superior returns. |

| BAT Annual Report and Form 20-F 2019 |

09 | |

Table of Contents

|

Overview

|

PUTTING SUSTAINABILITY

FRONT AND CENTRE

| As we evolve our Group strategy, we are also evolving our Sustainability Agenda. We are moving ourselves from a business where sustainability has always been important, to one where it is front and centre in all that we do.

|

New Sustainability Targets

We are committed to making a step-change in our sustainability ambition. As a result, we have announced a number of stretching targets that we are confident will deliver A Better Tomorrow for all our stakeholders.

These include:

– increasing our number of non-combustible product consumers from 11 million to 50 million by 2030;

– achieving carbon neutrality by 2030*; and

– bringing forward our existing 2030 environmental targets to 2025.

* Based on Scope 1 and 2 carbon dioxide equivalent (CO2e) emissions.

| |||

| Our commitment to reduce the health impacts of our cigarette business – by providing a range of potentially less risky products – is central to our corporate purpose. This is underpinned by excellence in all other environmental, social and governance (ESG) measures.

Each year we engage with a wide range of stakeholders to understand the issues that are most important to them. 2019 was a significant year, with many stakeholders re-emphasising the importance of addressing the health impacts of our cigarette business and with governments and cities around the world declaring a climate emergency.

|

Consequently, we refreshed our Sustainability Agenda (as an integral part of our evolved Group Strategy) to reflect the prominence of tobacco harm reduction and also to place a greater emphasis on the importance of addressing climate change and environmental management. At the same time, we remain committed to delivering a positive social impact and ensuring robust corporate governance across the Group. | |||

OUR SUSTAINABILITY AGENDA

| 10 |

BAT Annual Report and Form 20-F 2019 | |

Table of Contents

|

Strategic Report

|

Governance

|

Financial Statements

|

Other Information

|

ETHOS

Our purpose is to build a better tomorrow by reducing

the health impact of our business through offering a greater

choice of enjoyable and less-risky products for our consumers.

|

|

| |||

| A KEY DRIVER TO DELIVER THIS WILL BE OUR ETHOS – AN EVOLUTION OF OUR GUIDING PRINCIPLES – WHICH GUIDES OUR CULTURE AND BEHAVIOURS ACROSS THE ENTIRE GROUP. IT HAS BEEN DEVELOPED WITH SIGNIFICANT INPUT FROM OUR EMPLOYEES, AND ENSURES AN ORGANISATION THAT IS FUTURE FIT FOR SUSTAINABLE GROWTH.

| ||||

|

Hae In Kim Director, Talent and Culture |

| |||

| BAT Annual Report and Form 20-F 2019 |

11 | |

Table of Contents

|

Overview

|

OUR

PEOPLE

As our business evolves, so too does our employee value proposition. Today, as we have expanded our portfolio across a number of new categories, we are attracting a different

and wider range of people and skillsets than we did before, injecting exciting new capabilities into the business.

|

THERE ARE 141 NATIONALITIES REPRESENTED AT MANAGEMENT LEVEL WITHIN OUR GROUP

|

| |

|

OUR GLOBAL EMPLOYEE SURVEY RESULTS DEMONSTRATE THAT WE OUTPERFORM OUR FMCG COMPARATOR GROUP

| |

| 12 |

BAT Annual Report and Form 20-F 2019 | |

Table of Contents

|

Strategic Report

|

Governance

|

Financial Statements

|

Other Information

|

|

|

LAST YEAR WE

WE WERE AWARDED

| |||

|

|

|

DIVERSITY MATTERS TO THE GROUP BECAUSE IT MAKES GOOD COMMERCIAL SENSE

|

| |||

| BAT Annual Report and Form 20-F 2019 |

13 | |

Table of Contents

|

Overview

|

BUILDING WORLD-CLASS

CAPABILITIES FOR INNOVATION

To achieve a step-change in New Categories, we are building new capabilities around the world focused on science, innovation, and digital information.

Consumer preferences and technology are evolving rapidly, and we are staying ahead of the curve with our digital hubs, the creation of innovation super centres, and further development of our world-class R&D laboratories. We are also leveraging the expertise of our external partners, and are looking forward to exciting results from our upcoming venturing initiative.

| 14 |

BAT Annual Report and Form 20-F 2019 | |

Table of Contents

|

Strategic Report

|

Governance

|

Financial Statements

|

Other Information

|

| BAT Annual Report and Form 20-F 2019 |

15 | |

Table of Contents

Table of Contents

Table of Contents

|

Overview

|

IN NUMBERS

| Notes: To supplement our results of operations presented in accordance with IFRS, the information presented also includes several non-GAAP measures used by management to monitor the Group’s performance. See the section non-GAAP measures beginning on page 258 for information on these non-GAAP measures, including their definitions and reconciliations from the most directly comparable IFRS measure, where applicable. Certain of our measures are presented based on constant rates of exchange, on an adjusted basis, and on a representative basis and on an organic basis. |

The information presented also includes several non-financial key performance indicators (“KPIs”) used by management to monitor the Group’s performance. The Group’s Management Board believes that these KPIs provide information that enables investors to better understand the Group’s performance across periods. See the section “Non-Financial KPIs” on page 257 for more information on these non-financial KPIs. |

1. Where measures are presented ‘at constant rates’, the measures are calculated based on a re-translation, at the prior year’s exchange rates, of the current year results of the Group and, where applicable, its segments. See page 51 for the major foreign exchange rates used for Group reporting.

2. Where measures are presented as ‘adjusted’, they are presented before the impact of adjusting items. Adjusting items represent certain items of income and expense which the Group considers distinctive based on their size, nature or incidence. |

|

| 18 |

BAT Annual Report and Form 20-F 2019 | |

Table of Contents

|

Strategic Report

|

Governance

|

Financial Statements

|

Other Information

|

| 3. Where measures are presented as ‘organic’ or ‘org’, they are presented before the impact of the contribution of brands and businesses acquired during the comparator period, including Reynolds American, Bulgartabac, Winnington and Fabrika Duhana Sarajevo in 2017. There were no material acquisitions or disposals in 2018 or 2019. |

4. Where measures are presented as ‘representative’, ‘rep’ or ‘on a representative basis’, they are presented inclusive of the acquired businesses in the 2017 comparator period as though those businesses had been included in the consolidated results for the whole of that comparator period and including certain additional adjusting items related to the acquired companies. |

| BAT Annual Report and Form 20-F 2019 |

19 | |

Table of Contents

|

|

OVERVIEW*

While the total tobacco and nicotine market comprises a growing

user pool of over one billion individual adult consumers, global trends

are shifting and our industry is experiencing a period of ongoing change.

Generational differences, as well as shifting attitudes towards health and

wellness, are expected to increase the growth of new categories of products

including and beyond tobacco and nicotine, which are able to provide

stimulation and pleasure for consumers in ways previously associated with

cigarettes. This is expected to play a role in off-setting the predicted steady

decline in cigarette consumption.

| 20 |

BAT Annual Report and Form 20-F 2019 | |

Table of Contents

|

Strategic Report

|

Governance

|

Financial Statements

|

Other Information

|

| BAT Annual Report and Form 20-F 2019 |

21 | |

Table of Contents

|

Strategic Management

|

Our global business understands our diverse consumers, develops products to satisfy their preferences, and ultimately distributes them across over 200 markets. Five key enablers support us in turning powerful insights into products that provide enjoyment to our consumers, while engagement helps our key stakeholders benefit from our sustainable growth.

| 22 |

BAT Annual Report and Form 20-F 2019 | |

Table of Contents

|

Strategic Report

|

Governance

|

Financial Statements

|

Other Information

|

| BAT Annual Report and Form 20-F 2019 |

23 | |

Table of Contents

|

Strategic Management

|

BUSINESS

BAT is a leading, multi-category consumer goods business dedicated to stimulating the senses of adult consumers worldwide.

Our Strategic Portfolio comprises our key brands in both the combustible and new categories. This drives focus and investment on the brands and categories that will underpin the Group’s future growth.

We also have a portfolio of international and local brands which, while not the focus of our investment, contribute valuable returns across several key markets.*

| * | These combustible brands include Vogue, Viceroy, 555, Benson and Hedges, Peter Stuyvesant, Double Happiness, Kool, and Craven A, while oral brands include Granit, Mocca, and Kodiak. |

| 24 |

BAT Annual Report and Form 20-F 2019 | |

Table of Contents

|

Strategic Report

|

Governance

|

Financial Statements

|

Other Information

|

Our portfolio reflects our commitment to meeting the evolving

and varied needs of today’s consumer who seeks sensorial

enjoyment for different moods and moments.

BAT’s marketplace analysis delivers insights regarding

consumer trends and segmentation, which ultimately

facilitates our geographic brand prioritisation across over

180 markets. Our business is divided into four regions, and

covers over 150 million consumers and 11 million retail

points of sale, with a balanced presence in both high-growth

emerging markets and highly profitable developed markets.

|

United States of America |

Americas and Sub-Saharan Africa

|

Europe and North Africa |

Asia-Pacific and Middle East |

| BAT Annual Report and Form 20-F 2019 |

25 | |

Table of Contents

|

Strategic Management

|

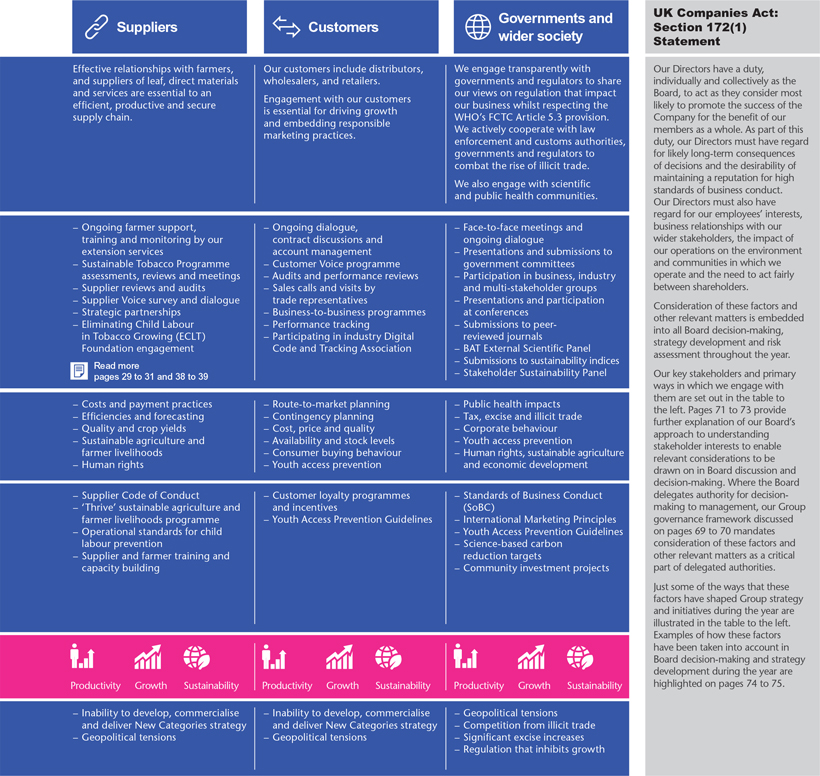

OUR STAKEHOLDERS

|

|

|

|

|

CIVIC PARTICIPATION IS A FUNDAMENTAL ASPECT OF RESPONSIBLE BUSINESS AND POLICY MAKING, AND BRITISH AMERICAN TOBACCO EMPLOYEES WILL PARTICIPATE IN THE POLICY PROCESS IN A TRANSPARENT AND OPEN MANNER, IN COMPLIANCE WITH ALL LAWS AND REGULATIONS OF THE MARKETS IN WHICH IT OPERATES | |||

|

Jerry Abelman Director, Legal & External Affairs and General Counsel |

| |||

| * | These engagement examples took place in 2019 and the strategic impact of engagement is measured against the strategic pillars in place for 2019. |

| Reporting for FY2020 will measure against our evolved strategy discussed on pages 8 to 9. |

| 26 |

BAT Annual Report and Form 20-F 2019 | |

Table of Contents

|

Strategic Report

|

Governance

|

Financial Statements

|

Other Information

|

|

|

|

|

OUR 2019 ‘YOUR

VOICE’ GLOBAL EMPLOYEE

|

||||||||

|

|

|

| BAT Annual Report and Form 20-F 2019 |

27 | |

Table of Contents

Table of Contents

|

Strategic Report

|

Governance

|

Financial Statements

|

Other Information

|

| BAT Annual Report and Form 20-F 2019 |

29 | |

Table of Contents

|

Strategic Management

|

DELIVERING OUR STRATEGY

CONTINUED

| Sustainability: Our policies* | Summary of areas covered | Key stakeholder groups | ||||||||

| Standards of Business Conduct (SoBC) | Speak Up, conflicts of interest, anti-bribery and anti-corruption, gifts and entertainment, respect in the work place, human rights, lobbying and engagement, political and charitable contributions, corporate assets and financial integrity, competition and anti-trust, anti-money laundering and tax evasion, anti-illicit trade, data privacy and information security. |

|

Our People |

|

Governments and Wider Society | |||||

| Environmental Policy | Our commitments to following high standards of environmental protection, adhering to the principles of sustainable development and protecting biodiversity covering our direct operations and supply chain, including agricultural, manufacturing and distribution operations. |

|

Our People |

|

Suppliers | |||||

|

|

Consumers |

|

Governments and Wider Society | |||||||

|

|

Customers | |||||||||

| Health and Safety Policy | Our commitments to applying the highest standards of health and safety. |

|

Our People |

|||||||

| Supplier Code of Conduct | Standards required of our suppliers worldwide, including business integrity, anti-bribery and anti-corruption, environmental sustainability, anti-illicit trade and respect for human rights (covering equal opportunities and fair treatment, health and safety, prevention of harassment and bullying, child labour and modern slavery, conflict minerals and freedom of association).

|

|

Our People |

|

Suppliers | |||||

|

|

Customers |

|

Governments and Wider Society | |||||||

| Strategic Framework for Corporate Social Investment(CSI) |

Sets out our Group CSI strategy and how we expect our local operating companies to develop, deliver and monitor community investment programmes within two themes: Sustainable Agriculture and Rural Communities; and Empowerment. |

|

Governments and Wider Society |

|||||||

| International Marketing | The standards that govern marketing across all our product categories and including the requirement for all our marketing to be targeted at adult consumers only.

|

|

Consumers |

|

Suppliers | |||||

| Principles |

|

Customers |

|

Our People | ||||||

|

These policies and procedures are endorsed by our Board, apply to all Group companies and support the effective identification, management and mitigation of risks and issues for our business in these and other areas.

| ||||||||||

| * | Further details of our Group policies and principles can be found at www.bat.com/principles |

| Further details of our Strategic Framework for Corporate Social Investment can be found at bat.com/csi |

| 30 |

BAT Annual Report and Form 20-F 2019 | |

Table of Contents

|

Strategic Report

|

Governance

|

Financial Statements

|

Other Information

|

| BAT Annual Report and Form 20-F 2019 |

31 | |

Table of Contents

|

Strategic Management

|

DELIVERING OUR STRATEGY

CONTINUED

| 32 |

BAT Annual Report and Form 20-F 2019 | |

Table of Contents

|

Strategic Report

|

Governance

|

Financial Statements

|

Other Information

|

Our sustainability efforts and commitment to high

standards have received notable independent

recognition over the years, including the following.

|

|

|

| |||||||||

| CDP Climate A List

These recognise our actions to cut emissions, mitigate climate risks and develop the low-carbon economy, as well as engaging with our suppliers to manage climate risk and reduce Scope 3 carbon emissions in our supply chain. |

Dow Jones Sustainability Indices BAT is the only company in our industry listed in the prestigious World Index, representing the world’s top 10% ESG performers. We have achieved inclusion in the DJSI for 18 consecutive years. |

Global Top Employer

We have been accredited as a Global Top Employer for three consecutive years, acknowledging our commitment to providing best-in-class working environments and career opportunities. |

SEAL Awards

BAT has been awarded with the SEAL Organizational Impact Award, which recognises overall corporate sustainability performance and represents the 50 most sustainable companies globally. | |||||||||

|

|

|

| |||||||||

| Top 5 FTSE ranking for our Modern Slavery Statement |

Diversity leader in the Financial Times Diversity Leaders report |

Leader status in the Global Child Forum’s benchmark study |

International Women’s Day Best Practice Winner | |||||||||

| The Business and Human Rights Resource Centre and Development International ranked BAT as being among the top five highest scoring companies in the FTSE for the detailed disclosure and action reflected in our Modern Slavery Statement. |

BAT was ranked in the top 10% of the total of 8,000 organisations covered by this inaugural report. It was compiled from extensive research, with 80,000 people surveyed across 10 European countries. |

In the Global Child Forum’s 2019 benchmarking study of children’s rights across the work place and supply chain, we were awarded ‘leader’ status with a score of 9.2 out of 10, compared to ‘industry’ and ‘all companies’ averages of just 5.6. |

Our global campaigns for International Women’s Day have been recognised for two consecutive years as examples of best practice and featured as case studies by the International Women’s Day Association. | |||||||||

| BAT Annual Report and Form 20-F 2019 |

33 | |

Table of Contents

|

Strategic Management

|

DELIVERING OUR STRATEGY

CONTINUED

|

|

GROWTH | |||||

|

Our multi-category portfolio of brands continued to deliver strong growth in 2019, driven by our Strategic Portfolio.

Growth remains a key focus of our evolved strategy, and will be delivered by our inspirational foresights, remarkable innovation and powerful brands. |

||||||||

|

Highlights during the year: |

||||||||

| – group revenue grew by 6%, driven by price mix and growth in New Categories;

|

||||||||

| – New Categories revenue grew 37%; and

|

||||||||

| – Strategic Portfolio revenue grew 9%, driven by robust cigarette pricing and growth from New Categories and Traditional Oral.

|

||||||||

| 34 |

BAT Annual Report and Form 20-F 2019 | |

Table of Contents

|

Strategic Report

|

Governance

|

Financial Statements

|

Other Information

|

Volume by product category

| Units | 2019 units |

vs 2018 % |

2018 units |

vs 2017 (rep) % |

2017 (rep) units |

|||||||||||||||||

| Cigarette |

Sticks (bn) | 668 | -5% | 701 | -4% | 732 | ||||||||||||||||

| Other (incl RYO/MYO) |

Sticks (bn) | 21 | -7% | 22 | -8% | 24 | ||||||||||||||||

| Combustibles |

Sticks (bn) | 689 | -5% | 723 | -4% | 756 | ||||||||||||||||

| New categories: |

||||||||||||||||||||||

| Vapour |

10ml units/pods (mn) | 226 | +19% | 189 | +35% | 140 | ||||||||||||||||

| THP |

Sticks (bn) | 9 | +32% | 7 | +217% | 2 | ||||||||||||||||

| Modern oral |

Pouches (mn) | 1,194 | +188% | 414 | +108% | 199 | ||||||||||||||||

| Traditional oral |

Stick equivalent (bn) | 8 | -1% | 8 | -0.4% | 9 | ||||||||||||||||

Revenue by product category

| 2019 £m |

vs 2018 % |

Adjusting £m |

Impact of exchange £m |

2019 £m |

vs 2018 (adjusted) % |

2018 £m |

vs 2017 % |

vs 2017 adjusted repres at constant rates % |

||||||||||||||||||||||||||||

| Combustibles |

23,001 | +4% | (50 | ) | (59 | ) | 22,892 | +5% | 22,072 | +22% | +2% | |||||||||||||||||||||||||

| New Categories: |

||||||||||||||||||||||||||||||||||||

| Vapour |

401 | +26% | – | (9 | ) | 392 | +23% | 318 | +89% | +26% | ||||||||||||||||||||||||||

| THP |

728 | +29% | – | (35 | ) | 693 | +23% | 565 | +180% | +184% | ||||||||||||||||||||||||||

| Modern oral |

126 | +267% | – | 3 | 129 | +273% | 34 | +127% | +140% | |||||||||||||||||||||||||||

| Total New Categories |

1,255 | +37% | – | (41 | ) | 1,214 | +32% | 917 | +140% | +98% | ||||||||||||||||||||||||||

| Traditional oral |

1,081 | +15% | – | (45 | ) | 1,036 | +10% | 941 | +127% | +8% | ||||||||||||||||||||||||||

| Other |

540 | -4% | – | 1 | 541 | -4% | 562 | -5% | -10% | |||||||||||||||||||||||||||

| Revenue |

25,877 | +6% | (50 | ) | (144 | ) | 25,683 | +6% | 24,492 | +25% | +4% | |||||||||||||||||||||||||

| BAT Annual Report and Form 20-F 2019 |

35 | |

Table of Contents

|

Strategic Management

|

DELIVERING OUR STRATEGY

CONTINUED

| 36 |

BAT Annual Report and Form 20-F 2019 | |

Table of Contents

|

Strategic Report

|

Governance

|

Financial Statements

|

Other Information

|

| BAT Annual Report and Form 20-F 2019 |

37 | |

Table of Contents

|

Strategic Management

|

DELIVERING OUR STRATEGY

CONTINUED

| 38 |

BAT Annual Report and Form 20-F 2019 | |

Table of Contents

|

Strategic Report

|

Governance

|

Financial Statements

|

Other Information

|

| BAT Annual Report and Form 20-F 2019 |

39 | |

Table of Contents

|

Strategic Management

|

DELIVERING OUR STRATEGY

CONTINUED

| 40 |

BAT Annual Report and Form 20-F 2019 | |

Table of Contents

|

Strategic Report

|

Governance

|

Financial Statements

|

Other Information

|

|

Our policies and principles*

|

Summary of areas covered

|

Key stakeholder groups

| ||||

|

Employment Principles |

Employment practices, including commitments to diversity, reasonable working hours, family-friendly policies, employee wellbeing, talent, performance and equal opportunities, and fair, clear and competitive remuneration and benefits. |

|

||||

|

Health and Safety Policy |

Health, safety and welfare of all employees, other members of our workforce and third-party personnel. |

|

| |||

|

Standards of Business Conduct (SoBC) |

Respect in the work place, including promoting equality and diversity, preventing harassment and bullying, and safeguarding employee wellbeing. |

|

||||

|

Group Data Privacy Policy |

The manner in which BAT processes personal data about all individuals, including consumers, employees, contractors and employees of suppliers.

|

|

| |||

| These policies and procedures are endorsed by our Board, apply to all Group companies and support the effective identification, management and mitigation of risks and issues for our business in these and other areas.

| ||||||

| * | Further details of our Group policies and principles can be found at www.bat.com/principles |

| BAT Annual Report and Form 20-F 2019 |

41 | |

Table of Contents

|

Strategic Management

|

DELIVERING OUR STRATEGY

CONTINUED

| 42 |

BAT Annual Report and Form 20-F 2019 | |

Table of Contents

|

|

Strategic Report

|

Governance

|

Financial Statements

|

Other Information

|

SUMMARY

|

|

|

STRONG OPERATIONAL PERFORMANCE DRIVES DELEVERAGING

Tadeu Marroco Finance Director

|

|

Highlights

– Group revenue was up 5.7% with profit from operations 3.2% lower than 2018;

– At constant rates of exchange, adjusted revenue grew 5.6% with adjusted profit from operations up 6.6%;

– Diluted earnings per share decreased 5.4%. Adjusted diluted earnings per share was up 9.1%, or 8.4% at constant rates;

– Dividend per share was up 3.6% at 210.4p;

– Net cash generated from operating activities declined 12.6%; and

– Cash conversion at 100%.

| ||||||

|

Reconciliation of revenue to adjusted revenue at constant rates

| 2019 | 2018 | 2018 | 2017 | |||||||||||||||||

| £m | Change % (vs 2018) |

£m | Change % (vs 2017) |

£m | ||||||||||||||||

| Revenue |

25,877 | +5.7% | 24,492 | +25% | 19,564 | |||||||||||||||

| Adjusting items |

(50) | – | (180 | ) | – | (258 | ) | |||||||||||||

| Add impact of acquisition (for representative calculation) |

– | – | – | – | 5,577 | |||||||||||||||

| Adjusted revenue (2017 shown on a representative basis) |

25,827 | +6.2% | 24,312 | -2.3% | 24,883 | |||||||||||||||

| Impact of exchange |

(144) | – | 1,448 | – | – | |||||||||||||||

| Adjusted revenue at constant rates |

25,683 | +5.6% | 25,760 | +3.5% | 24,883 | |||||||||||||||

| BAT Annual Report and Form 20-F 2019 |

43 | |

Table of Contents

|

Financial Review

|

STATEMENT

Analysis of profit from operations, net finance costs and results from associates and joint ventures

| 2019 |

|

2018 |

||||||||||||||||||||||||||||||||

| Reported £m |

Adjusting £m |

Adjusted £m |

Impact of exchange £m |

Adjusted at CC £m |

Reported £m |

Adjusting £m |

Adjusted £m |

|||||||||||||||||||||||||||

| Profit from operations |

||||||||||||||||||||||||||||||||||

| US |

4,410 | 626 | 5,036 | (238 | ) | 4,798 | 4,006 | 505 | 4,511 | |||||||||||||||||||||||||

| APME |

1,753 | 306 | 2,059 | 43 | 2,102 | 1,858 | 90 | 1,948 | ||||||||||||||||||||||||||

| AmSSA |

1,204 | 638 | 1,842 | 70 | 1,912 | 1,544 | 194 | 1,738 | ||||||||||||||||||||||||||

| ENA |

1,649 | 544 | 2,193 | 27 | 2,220 | 1,905 | 245 | 2,150 | ||||||||||||||||||||||||||

| Total regions |

9,016 | 2,114 | 11,130 | (98 | ) | 11,032 | 9,313 | 1,034 | 10,347 | |||||||||||||||||||||||||

| Net finance (costs)/income |

(1,602 | ) | 80 | (1,522 | ) | 56 | (1,466 | ) | (1,381 | ) | (4 | ) | (1,385 | ) | ||||||||||||||||||||

| Associates and joint ventures |

498 | (25 | ) | 473 | (7 | ) | 466 | 419 | (32 | ) | 387 | |||||||||||||||||||||||

| Profit before tax |

7,912 | 2,169 | 10,081 | 49 | 10,032 | 8,351 | 998 | 9,349 | ||||||||||||||||||||||||||

| 44 |

BAT Annual Report and Form 20-F 2019 | |

Table of Contents

|

Strategic Report

|

Governance

|

Financial Statements

|

Other Information

|

Analysis of profit from operations, net finance costs and results from associates and joint ventures

| 2018 | 2017 | |||||||||||||||||||||||||||||||||||||||||

| Reported £m |

Adjusting items £m |

Adjusted £m |

Impact of exchange £m |

Adjusted at CC £m |

Reported £m |

Adjusting items £m |

Adjusted £m |

Uplift due to acq £m |

Adjusted repres £m |

|||||||||||||||||||||||||||||||||

| Profit from operations |

||||||||||||||||||||||||||||||||||||||||||

| US |

4,006 | 505 | 4,511 | 175 | 4,686 | 1,165 | 763 | 1,928 | 2,502 | 4,430 | ||||||||||||||||||||||||||||||||

| APME |

1,858 | 90 | 1,948 | 151 | 2,099 | 1,902 | 147 | 2,049 | 25 | 2,074 | ||||||||||||||||||||||||||||||||

| AmSSA |

1,544 | 194 | 1,738 | 184 | 1,922 | 1,648 | 134 | 1,782 | 22 | 1,804 | ||||||||||||||||||||||||||||||||

| ENA |

1,905 | 245 | 2,150 | 67 | 2,217 | 1,697 | 473 | 2,170 | 29 | 2,199 | ||||||||||||||||||||||||||||||||

| Total regions |

9,313 | 1,034 | 10,347 | 577 | 10,924 | 6,412 | 1,517 | 7,929 | 2,578 | 10,507 | ||||||||||||||||||||||||||||||||

| Net finance (costs)/income |

(1,381 | ) | (4 | ) | (1,385 | ) | (30 | ) | (1,415 | ) | (1,094 | ) | 205 | (889 | ) | |||||||||||||||||||||||||||

| Associates and joint ventures |

419 | (32 | ) | 387 | 33 | 420 | 24,209 | (23,197 | ) | 1,012 | ||||||||||||||||||||||||||||||||

| Profit before tax |

8,351 | 998 | 9,349 | 580 | 9,929 | 29,527 | (21,475 | ) | 8,052 | |||||||||||||||||||||||||||||||||

| BAT Annual Report and Form 20-F 2019 |

45 | |

Table of Contents

|

Financial Review

|

INCOME STATEMENT

CONTINUED

| 46 |

BAT Annual Report and Form 20-F 2019 | |

Table of Contents

|

Strategic Report

|

Governance

|

Financial Statements

|

Other Information

|

|

The discussion of 2017 results that are not necessary to an understanding of the Group’s financial condition, changes in financial condition and results of operations is excluded from this Financial Review in accordance with applicable US Securities laws. Discussion of such 2017 metrics is contained in the Group’s Annual Report on Form 20-F 2018, which is available at bat.com/annualreport and has been filed with the SEC. Information contained in pages 33 to 47 of the Annual Report on Form 20-F 2018 are accordingly incorporated by reference into this Annual Report on Form 20-F 2019 only to the extent such information pertains to the Group’s financial condition and results of operations for the fiscal year ended 31 December 2017.

|

| BAT Annual Report and Form 20-F 2019 |

47 | |

Table of Contents

|

Financial Review

|

| 48 |

BAT Annual Report and Form 20-F 2019 | |

Table of Contents

|

Strategic Report

|

Governance

|

Financial Statements

|

Other Information

|

| BAT Annual Report and Form 20-F 2019 |

49 | |

Table of Contents

|

Financial Review

|

TREASURY AND CASH FLOW

CONTINUED

| 50 |

BAT Annual Report and Form 20-F 2019 | |

Table of Contents

|

Strategic Report

|

Governance

|

Financial Statements

|

Other Information

|

| BAT Annual Report and Form 20-F 2019 |

51 | |

Table of Contents

Table of Contents

|

Strategic Report

|

Governance

|

Financial Statements

|

Other Information

|

| BAT Annual Report and Form 20-F 2019 |

53 | |

Table of Contents

|

Financial Review

|

REGIONAL REVIEW

CONTINUED

UNITED STATES

|

|

|

|||

|

COMBUSTIBLES PRICING DRIVES STRONG REVENUE GROWTH

Ricardo Oberlander President and CEO (RAI)

| ||||

|

| 54 |

BAT Annual Report and Form 20-F 2019 | |

Table of Contents

|

Strategic Report

|

Governance

|

Financial Statements

|

Other Information

|

AMERICAS AND

SUB-SAHARAN AFRICA

|

|

|

| ||

|

STRATEGIC CIGARETTE BRANDS PERFORM VERY WELL

Luciano Comin Regional Director

Key markets: Argentina, Brazil, Canada, Chile, Colombia, Mexico, Nigeria, South Africa

| ||||

|

| BAT Annual Report and Form 20-F 2019 |

55 | |

Table of Contents

|

Financial Review

|

REGIONAL REVIEW

CONTINUED

EUROPE AND NORTH AFRICA

|

||||||

|

|

MODERN ORAL AND VAPOUR PERFORMANCE DRIVES GROWTH

Johan Vandermeulen Regional Director

Key markets: Algeria, Belgium, Bulgaria, Egypt, Czech Republic, Denmark, France, Germany, Italy, Kazakhstan, Morocco, Netherlands, Poland, Romania, Russia, Spain, Sweden, Switzerland, Turkey, Ukraine, UK

| |||||

| ||||||

| 56 |

BAT Annual Report and Form 20-F 2019 | |

Table of Contents

|

Strategic Report

|

Governance

|

Financial Statements

|

Other Information

|

ASIA-PACIFIC AND

MIDDLE EAST

|

||||||

|

|

COMBUSTIBLES AND THP COMBINE TO ACCELERATE GROWTH

Guy Meldrum Regional Director

Key markets: Australia, Bangladesh, Indonesia, Japan, Malaysia, Middle East (incl KSA), New Zealand, Pakistan, South Korea, Taiwan, Vietnam

| |||||

| ||||||

| BAT Annual Report and Form 20-F 2019 |

57 | |

Table of Contents

Table of Contents

|

Strategic Report

|

Governance

|

Financial Statements

|

Other Information

|

Risks

|

Competition from illicit trade

| ||||||

|

Increased competition from illicit trade – either local duty evaded, smuggled illicit white cigarettes or counterfeits.

| ||||||

| Time frame |

Strategic impact |

|||||

|

Long term

|

Growth

|

|||||

| Impact |

||||||

| Erosion of brand equity, with lower volumes and reduced profits.

Reduced ability to take price increases.

Investment in trade marketing and distribution is undermined.

|

||||||

|

Tobacco, New Categories and other regulation interrupts growth strategy

| ||||||

|

The enactment of regulation that significantly impairs the Group’s ability to communicate, differentiate, market or launch its products.

| ||||||

| Time frame |

Strategic impact |

|||||

|

Medium term |

Growth and Sustainability |

|||||

| Impact | ||||||

| Erosion of brand value through commoditisation, the inability to launch innovations, differentiate products, maintain or build brand equity and leverage price.

Regulation in respect of menthol, nicotine levels and New Categories may adversely impact individual brand portfolios.

Adverse impact on ability to compete within the legitimate tobacco, nicotine or New Categories industry and with illicit traders.

Reduced consumer acceptability of new product specifications, leading to consumers seeking alternatives in illicit markets.

Shocks to share price on the announcement or enactment of restrictive regulation.

Reduced ability to compete in future product categories and make new market entries.

Increased scope and severity of compliance regimes in new regulation leading to higher costs, greater complexity and potential reputational damage or fines for inadvertent breach.

Proposed EU Directive on single-use plastics could result in increased operational costs and/or a decline in sales volume.

|

||||||

|

|

Please refer to pages 287 to 290 for details of tobacco and nicotine regulatory regimes under which the Group’s businesses operate

|

|||||

|

Disputed taxes, interest and penalties

| ||||||

|

The Group may face significant financial penalties, including the payment of interest, in the event of an unfavourable ruling by a tax authority in a disputed area.

| ||||||

|

Time frame |

Strategic impact |

|||||

|

Short/Medium term |

Productivity |

|||||

|

Impact |

||||||

| Significant fines and potential legal penalties.

Disruption and loss of focus on the business due to diversion of management time.

Impact on profit and dividend. |

||||||

|

|

Please refer to note 27 in the Notes on the Accounts for details of contingent liabilities applicable to the Group

|

|||||

| BAT Annual Report and Form 20-F 2019 |

59 | |

Table of Contents

|

Business Environment

|

PRINCIPAL GROUP RISKS

CONTINUED

Risks continued

|

Inability to develop, commercialise and deliver the New Categories strategy

| ||||||

|

Risk of not capitalising on the opportunities in developing and commercialising successful, safe and consumer-appealing innovations.

| ||||||

|

Time frame |

Strategic impact |

|||||

|

Long term |

Growth and Sustainability |

|||||

|

Impact |

||||||

| Failure to deliver Group strategic imperative and 2024 growth ambition.

Potentially missed opportunities, unrecoverable costs and/or erosion of brand.

Reputational damage and recall costs may arise in the event of defective product design or manufacture.

Loss of market share due to non-compliance of product portfolio with regulatory requirements.

|

||||||

|

Market size reduction and consumer down-trading

| ||||||

|

The Group is faced with steep excise-led price increases and, due in part to the continuing difficult economic and regulatory environment in many countries, market contraction and consumer down-trading is a risk.

| ||||||

|

Time frame |

Strategic impact |

|||||

|

Short/Medium term |

Growth |

|||||

|

Impact |

||||||

| Volume decline and portfolio mix erosion.

Funds to invest in growth opportunities are reduced.

|

||||||

|

Litigation

| ||||||

|

Product liability, regulatory or other significant cases may be lost or compromised resulting in a material loss or other consequence.

| ||||||

|

Time frame |

Strategic impact |

|||||

|

Long term |

Growth |

|||||

|

Impact |

||||||

| Damages and fines, negative impact on reputation, disruption and loss of focus on the business.

Consolidated results of operations, cash flows and financial position could be materially affected, in a particular fiscal quarter or fiscal year, by region or country, by an unfavourable outcome or settlement of pending or future litigation.

Inability to sell products as a result of patent infringement action may restrict growth plans and competitiveness.

|

||||||

|

|

Please refer to note 27 in the Notes on the Accounts for details of contingent liabilities applicable to the Group |

|||||

| 60 |

BAT Annual Report and Form 20-F 2019 | |

Table of Contents

|

Strategic Report

|

Governance

|

Financial Statements

|

Other Information

|

|

Significant increases or structural changes in tobacco, nicotine and New Categories related taxes

| ||||||

|

The Group is exposed to unexpected and/or significant increases or structural changes in tobacco, nicotine and New Categories related taxes in key markets.

| ||||||

|

Time frame |

Strategic impact |

|||||

|

Long term |

Growth |

|||||

|

Impact |

||||||

| Consumers reject the Group’s legitimate tax-paid products for products from illicit sources or cheaper alternatives.

Reduced legal industry volumes.

Reduced sales volume and/or portfolio erosion.

Partial absorption of excise increases.

|

||||||

|

Foreign exchange rate exposures

| ||||||

|

The Group faces translational and transactional foreign exchange (FX) rate exposure for earnings/cash flows from its global businesses.

| ||||||

|

Time frame |

Strategic impact |

|||||

|

Short/Medium term |

Productivity |

|||||

|

Impact |

||||||

| Fluctuations in FX rates of key currencies against sterling introduce volatility in reported earnings per share (EPS), cash flow and the balance sheet driven by translation into sterling of our financial results and these exposures are not normally hedged.

The dividend may be impacted if the payout ratio is not adjusted.

Differences in translation between earnings and net debt may affect key ratios used by credit rating agencies.

Volatility and/or increased costs in our business, due to transactional FX, may adversely impact financial performance.

|

||||||

|

Geopolitical tensions

| ||||||

|

Geopolitical tensions, civil unrest, economic policy changes, global health crises, terrorism and organised crime have the potential to disrupt the Group’s business in multiple markets.

| ||||||

|

Time frame |

Strategic impact |

|||||

|

Medium term |

Growth and Productivity |

|||||

|

Impact |

||||||

| Potential loss of life, loss of assets and disruption to supply chains and normal business processes.

Increased costs due to more complex supply chain arrangements and/or the cost of building new facilities or maintaining inefficient facilities.

Lower volumes as a result of not being able to trade in a country.

Higher taxes or other costs of doing business as a foreign company or the loss of assets as a result of nationalisation. |

||||||

| BAT Annual Report and Form 20-F 2019 |

61 | |

Table of Contents

|

Business Environment

|

PRINCIPAL GROUP RISKS

CONTINUED

Risks continued

|

Solvency and liquidity

| ||||||

|

Liquidity (access to cash and sources of finance) is essential to maintaining the Group as a going concern in the short term (liquidity) and medium term (solvency).

| ||||||

|

Time frame |

Strategic impact |

|||||

|

Short/Medium term |

Productivity and Sustainability |

|||||

|

Impact |

||||||

| Inability to fund the business under the current capital structure resulting in missed strategic opportunities or inability to respond to threats.

Decline in our creditworthiness and increased funding costs for the Group.

Requirement to issue equity or seek new sources of capital.

Reputational risk of failure to manage the financial risk profile of the business, resulting in an erosion of shareholder value reflected in an underperforming share price. |

||||||

|

Injury, illness or death in the work place

| ||||||

|

The risk of injury, death or ill health to employees and those who work with the business is a fundamental concern of the Group and can have a significant effect on its operations.

| ||||||

|

Time frame |

Strategic impact |

|||||

|

Short term |

Sustainability |

|||||

|

Impact |

||||||

| Serious injuries, ill health, disability or loss of life suffered by employees and the people who work with the Group.

Exposure to civil and criminal liability and the risk of prosecution from enforcement bodies and the cost of associated fines and/or penalties.

Interruption of Group operations if issues are not addressed immediately.

High staff turnover or difficulty recruiting employees if perceived to have a poor Environment, Health and Safety (EHS) record.

Reputational damage to the Group.

|

||||||

|

The Strategic Report was approved by the Board of Directors on 17 March 2020 and signed on its behalf by Paul McCrory, Company Secretary.

| ||||||

| 62 |

BAT Annual Report and Form 20-F 2019 | |

Table of Contents

Table of Contents

Table of Contents

|

Strategic Report

|

Governance

|

Financial Statements

|

Other Information

|

GOVERNANCE

Throughout the year ended 31 December 2019, we applied the Principles of the July 2018 version of the UK Corporate Governance Code (the Code). The Company was compliant with all provisions of the Code during the year.

The Board considers that this Annual Report and Form 20-F, and notably this Governance section, provides the information shareholders need to evaluate how we have complied with our obligations under the Code.

| Board leadership and Company purpose

|

Chairman’s introduction on governance | page 63 | ||||

|

|

||||||

| Board of Directors | page 66

|

|||||

|

|

||||||

| Management Board | page 68 | |||||

|

|

||||||

| Leadership and purpose | page 69 | |||||

|

|

||||||

| Our culture and values | page 70 | |||||

|

|

||||||

| Board engagement with stakeholders | page 71 | |||||

|

|

||||||

| Board activities in 2019 | page 74 | |||||

|

|

||||||

|

|

||||||

| Division of responsibilities

|

Division of responsibilities | page 76 | ||||

|

|

||||||

| Non-Executive Directors’ independence | page 76 | |||||

|

|

||||||

| Directors’ commitment | page 77 | |||||

|

|

||||||

|

Composition, succession, evaluation

|

Board evaluation | page 78 | ||||

|

|

||||||

| Nominations Committee report | page 79 | |||||

|

|

||||||

| Board balance and diversity | page 81 | |||||

|

|

||||||

| Senior management succession and diversity | page 81 | |||||

|

|

||||||

| Audit, risk, internal control

|

Audit Committee report | page 83 | ||||

|

|

||||||

| External auditors | page 85 | |||||

|

|

||||||

| Risk management and internal control | page 87 | |||||

|

|

||||||

| Internal audit function | page 88 | |||||

|

|

||||||

|

Remuneration

|

Annual statement on remuneration | page 90 | ||||

|

|

||||||

| Annual report on remuneration | page 93 | |||||

|

|

||||||

| Committee composition, role and responsibility | page 111 | |||||

|

|

||||||

| BAT Annual Report and Form 20-F 2019 |

65 | |

Table of Contents

|

Directors’ Report

|

AS AT 17 MARCH 2020

|

|

|

|

|||||||||||||||||||||||||

|

Nationality: Irish

Position: Chairman since November 2009; Non-Executive Director since September 2009.

Skills, experience and contributions: Richard brings considerable consumer goods and international business experience to the Board, having been Chief Executive of Irish Distillers and Co-Chief Executive of Pernod Ricard. Prior to joining the Board, Richard was Governor of the Bank of Ireland. He is an experienced non-executive director and brings a variety of perspectives to the Board. Richard is a Fellow of the Institute of Chartered Accountants of Ireland.

Other appointments: Supervisory Board member and Chairman of the Remuneration Committee at Carlsberg A/S. |

Nationality: French

Position: Chief Executive since 1 April 2019; Executive Director since 1 January 2019.

Skills, experience and contributions: Jack brings significant experience in management, innovation and strategic leadership to the Board, developed through his previous roles across many of the Group’s key geographies and areas of business. He joined the Group in 2004 and was appointed as Chairman of British American Tobacco France in 2005, before becoming Managing Director of British American Tobacco Malaysia in 2007. He joined the Management Board as Regional Director for Western Europe in 2009, becoming Regional Director for the Americas in 2011, then Regional Director for Asia-Pacific in 2013. Jack became Chief Operating Officer in 2017 and Chief Executive Designate in November 2018, before being appointed to the Board in January 2019.

Other appointments: No external appointments. |

Nationality: Brazilian

Position: Finance Director since 5 August 2019.

Skills, experience and contributions: Tadeu brings broad experience gained in various national, regional and global finance and general leadership roles, having joined the Group in Brazil in 1992. These experiences make Tadeu particularly well-placed to contribute to the Group’s transformation and broader strategic agenda. He joined the Management Board as Director, Business Development in 2014, becoming Regional Director, Western Europe in 2016, then Regional Director, Europe and North Africa in January 2018. He was appointed Director, Group Transformation in January 2019 and, in addition to this role, he was appointed Deputy Finance Director in March 2019, before joining the Board as Finance Director in August 2019.

Other appointments: No external appointments. |

Nationality: British

Position: Non-Executive Director since February 2015.

Skills, experience and contributions: Sue contributes considerable expertise in relation to marketing, branding and consumer issues, which are key areas of focus for the Board. Prior to joining the Chime Group in 2003, where she was Director, Strategic and Business Development until 2015, Sue held a number of senior marketing and communications positions, including: Director of Marketing BBC, Corporate Affairs Director of Thames Television and Director of Communications of Vauxhall Motors. Sue is a former Chairwoman of both the Marketing Society and the Marketing Group of Great Britain.

Other appointments: Special Adviser, Chime Group; Non-Executive Director and Chair of the Remuneration Committee of Accsys Technologies PLC; Non-Executive Director of Helical plc; Non-Executive Director and Chair of the Remuneration Committee of DNEG Limited.

|

|||||||||||||||||||||||||

|

|

|

|

|

|||||||||||||||||||||||||

|

Nationality: British

Position: Non-Executive Director since 1 September 2019.

Skills, experience and contributions: Jerry brings extensive experience in leadership and strategic transformation to the Board and contributes considerable insight in relation to US operational issues, an important market for the Group. He is Chairman of Primo Water Corporation (‘Primo’) (formerly Cott Corporation), a US pure-play water solutions provider, having been CEO from 2009 until December 2018. Prior to joining Primo, Jerry held a variety of executive roles, including: CEO of Auto Trader Group; a number of roles at AB InBev, including CEO of Bass Breweries in the UK, Global Chief Operating Officer and European President; Executive Director of The Rank Group; and CEO of the Beverage Division at the Hero Group.

Other appointments: Chairman of Primo; Non-Executive Director and Chair of the Compensation and Human Resources Committee of Constellation Brands, Inc. |

Nationality: German

Position: Non-Executive Director since August 2016.

Skills, experience and contributions: Marion brings significant financial expertise and operational experience gained at an international level, having spent her working life managing businesses across Europe, the Americas and Asia. Her extensive career includes Chief Financial Officer positions at Celesio, Q-Cells and ThyssenKrupp Elevator Technology and, more recently, as a member of a variety of supervisory boards, which enables Marion to bring a range of insights to the Board’s discussions.

Other appointments: Vice Chairwoman of the Supervisory Board and Co-Chairwoman of the Presiding and Nomination Committee of ProSiebenSat.1 Media SE; Supervisory Board member and Chairman of the Audit Committee of Heineken N.V.; Supervisory Board member of Siemens Healthineers AG and Uniper SE. |

Nationality: Canadian

Position: Non-Executive Director since July 2017.

Skills, experience and contributions: Luc contributes extensive financial and strategic experience to the Board, including in the US tobacco sector as an independent director of RAI from 2008 until the acquisition in 2017. Luc was President and Chief Executive Officer of Canadian National Railway Company from July 2016 until March 2018, having served as Executive Vice President and Chief Financial Officer since 2009. He was Executive Vice President of Power Corporation of Canada from 2005 to 2009. Luc was Chief Executive Officer of Imperial Tobacco Canada, a subsidiary of the Company, from 2003 to 2005 and Executive Vice President and Chief Financial Officer from 1998 to 2003.

Other appointments: Independent Director of Hydro-Quebec and Gildan Activewear Inc.; Independent Consultant providing executive leadership advisory services to corporate clients. |

Nationality: American

Position: Non-Executive Director since July 2017.

Skills, experience and contributions: Holly’s extensive international operational and financial management experience in a range of industry sectors enables her to make important contributions to the Board. Holly served as an independent director on the Board of RAI from 2008 until the acquisition in 2017. From 2010 until her retirement in 2017, she was Managing Partner and Head of Citigroup’s Infrastructure Investor Fund (CII and its successor, Gateway Infrastructure) with operations on three continents. Prior to 2010, she held a number of global operational positions with Consolidated Natural Gas Company and American Electric Power Company, Inc. (AEP), ultimately serving as Chief Financial Officer of AEP.

Other appointments: Non-Executive Director of Vesuvius plc; Director and Chair of the Governance Committee of AES Corporation; Director of Arch Coal Inc.

|

|||||||||||||||||||||||||

| 66 |

BAT Annual Report and Form 20-F 2019 | |

Table of Contents

|

Strategic Report

|

Governance

|

Financial Statements

|

Other Information

|

|

|

|

| |||||||||||||||||||

|

|

Nationality: British

Position: Non-Executive Director since January 2014.

Skills, experience and contributions: Savio brings significant business leadership experience to the Board, together with a deep knowledge of Greater China and Asia, an important region for the Group. During his extensive career he has worked broadly in technology for General Electric, BTR plc and Alibaba Group, China’s largest internet business, where he was both Chief Operating Officer and, later, a Non-Executive Director.

Other appointments: Co-Founder and CEO of A&K Consulting Co Ltd, advising entrepreneurs and their start-up businesses in China; Member of the Governing Body of the London Business School; Non-Executive Director of the Alibaba Hong Kong Entrepreneur Fund and Crossborder Innovative Ventures International Limited; and a Non- Executive Director and Advisory Board member of Homaer Financial.

|

Nationality: Greek/British

Position: Non-Executive Director since February 2015. Dimitri will become Senior Independent Director at the conclusion of the AGM on 30 April 2020.

Skills, experience and contributions: Dimitri has extensive general management and international sales and brand building expertise, which enables him to make valuable contributions to Board discussions on these important topics. He was Vice Chairman and Adviser to the Chairman and CEO of Procter & Gamble (P&G), where he started his career in 1977. During his time at P&G, Dimitri led on significant breakthrough innovations and continued to focus on this, speed-to-market and scale across all of P&G’s businesses while Vice Chairman of all the Global Business Units.

Other appointments: Senior Adviser at The Boston Consulting Group; Advisory Board member of JBS USA; Board Member of IRI. |

Nationality: British

Position: Senior Independent Director since October 2016; Non-Executive Director since July 2010. Kieran will retire at the conclusion of the AGM on 30 April 2020.

Skills, experience and contributions: Kieran brings a wealth of financial and international experience to the Board. He was Chairman and Senior Partner of PricewaterhouseCoopers from 2000 to his retirement in 2008, having started as a graduate trainee in 1971, and is a former Chairman of Nomura International PLC. Kieran is a Chartered accountant.

Other appointments: Non-Executive Director and Chair of the Audit and Compliance Committee of International Consolidated Airlines Group S.A.; Chairman and Chair of the Nominations, Audit and Compliance and Risk and Remuneration Committees of BMO Asset Management plc (previously called F&C Asset Management plc). |

Attendance at Board meetings in 20191

| Attended/Eligible to attend | ||||||||||||

| Name | Director since | Scheduled4 | Ad hoc | |||||||||

| Richard Burrows | 2009 | 6/6 | 2/2 | |||||||||

| Jack Bowles3(b) | 2019 | 6/6 | 2/2 | |||||||||

| Nicandro Durante3(e) | 2008-2019 | 1/1 | 2/2 | |||||||||

| Tadeu Marroco3(c) | 2019 | 2/2 | 0/0 | |||||||||

| Ben Stevens3(f) | 2008-2019 | 4/4 | 2/2 | |||||||||

| Sue Farr2(a) | 2015 | 6/6 | 1/2 | |||||||||

| Jerry Fowden3(d) | 2019 | 2/2 | 0/0 | |||||||||

| Dr Marion Helmes2(c) | 2016 | 6/6 | 2/2 | |||||||||

| Luc Jobin2(b) | 2017 | 6/6 | 1/2 | |||||||||

| Holly Keller Koeppel | 2017 | 6/6 | 2/2 | |||||||||

| Savio Kwan | 2014 | 6/6 | 2/2 | |||||||||

| Dimitri Panayotopoulos | 2015 | 6/6 | 2/2 | |||||||||

| Kieran Poynter | 2010 | 6/6 | 2/2 | |||||||||

Notes:

| 1. | Number of meetings in 2019: The Board held eight meetings in 2019, two of which were ad hoc and convened at short notice, one to discuss Board Committee appointments and one to discuss the status of litigation in Quebec province. Part of the October Board meeting was held off-site at the Group’s R&D facilities in Southampton, UK, to review Group strategy and product portfolios. |

| 2. | (a) Sue Farr did not attend the ad hoc Board meeting in January due to prior commitments; (b) Luc Jobin did not attend the ad hoc Board meeting in January due to prior commitments; and (c) Marion Helmes did not attend the 2019 AGM due to prior commitments. |