UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-21667

Fidelity Central Investment Portfolios LLC

(Exact name of registrant as specified in charter)

245 Summer St., Boston, MA 02210

(Address of principal executive offices) (Zip code)

Marc Bryant, Secretary

245 Summer St.

Boston, Massachusetts 02210

(Name and address of agent for service)

Registrant's telephone number, including area code:

617-563-7000

| Date of fiscal year end: | September 30 |

| | |

| Date of reporting period: | March 31, 2017 |

Item 1.

Reports to Stockholders

|

Fidelity® Equity Sector Central Funds Semi-Annual Report March 31, 2017 |

|

Contents

To view a fund's proxy voting guidelines and proxy voting record for the 12-month period ended June 30, visit http://www.fidelity.com/proxyvotingresults or visit the Securities and Exchange Commission's (SEC) web site at http://www.sec.gov.

You may also call 1-800-544-8544 to request a free copy of the proxy voting guidelines.

Standard & Poor's, S&P and S&P 500 are registered service marks of The McGraw-Hill Companies, Inc. and have been licensed for use by Fidelity Distributors Corporation.

Other third-party marks appearing herein are the property of their respective owners.

All other marks appearing herein are registered or unregistered trademarks or service marks of FMR LLC or an affiliated company. © 2017 FMR LLC. All rights reserved.

A fund files its complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-Q. Forms N-Q are available on the SEC’s web site at http://www.sec.gov. A fund's Forms N-Q may be reviewed and copied at the SEC’s Public Reference Room in Washington, DC. Information regarding the operation of the SEC's Public Reference Room may be obtained by calling 1-800-SEC-0330.

Fidelity® Consumer Discretionary Central Fund

Investment Summary (Unaudited)

Top Ten Stocks as of March 31, 2017

| % of fund's net assets | % of fund's net assets 6 months ago | |

| Amazon.com, Inc. | 14.7 | 14.6 |

| Home Depot, Inc. | 9.1 | 8.3 |

| The Walt Disney Co. | 8.1 | 7.1 |

| Charter Communications, Inc. Class A | 7.0 | 6.1 |

| NIKE, Inc. Class B | 5.1 | 5.1 |

| Starbucks Corp. | 4.6 | 4.8 |

| Comcast Corp. Class A | 3.8 | 3.5 |

| Ross Stores, Inc. | 3.6 | 4.1 |

| Hilton, Inc. | 2.6 | 4.0 |

| Las Vegas Sands Corp. | 2.5 | 2.9 |

| 61.1 |

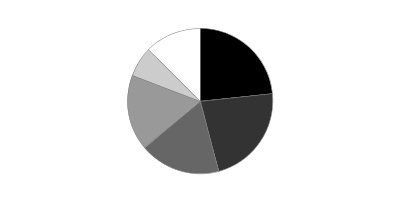

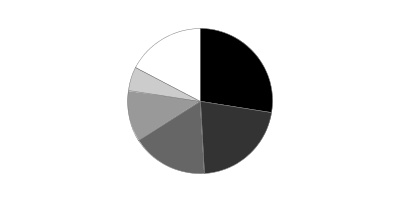

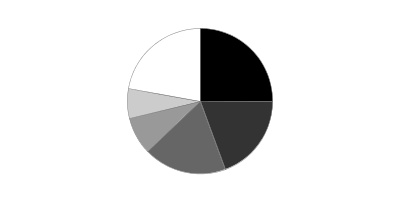

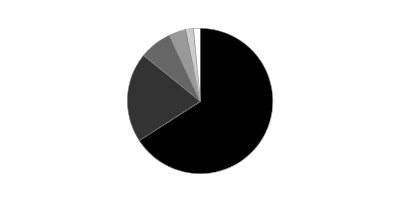

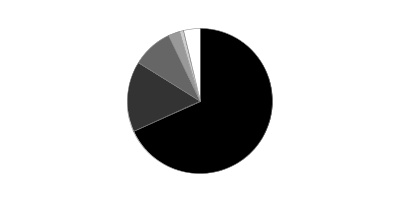

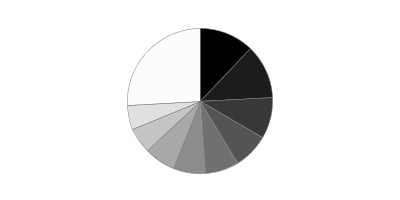

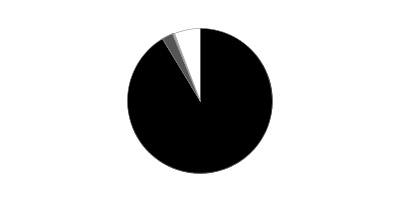

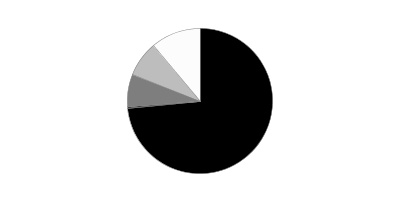

Top Industries (% of fund's net assets)

| As of March 31, 2017 | ||

| Media | 21.9% | |

| Hotels, Restaurants & Leisure | 21.7% | |

| Specialty Retail | 21.6% | |

| Internet & Direct Marketing Retail | 16.3% | |

| Textiles, Apparel & Luxury Goods | 7.4% | |

| All Others* | 11.1% | |

| As of September 30, 2016 | ||

| Specialty Retail | 23.4% | |

| Media | 22.4% | |

| Hotels, Restaurants & Leisure | 18.0% | |

| Internet & Direct Marketing Retail | 17.0% | |

| Textiles, Apparel & Luxury Goods | 6.7% | |

| All Others* | 12.5% | |

* Includes short-term investments and net other assets (liabilities).

Fidelity® Consumer Discretionary Central Fund

Investments March 31, 2017 (Unaudited)

Showing Percentage of Net Assets

| Common Stocks - 99.6% | |||

| Shares | Value | ||

| Auto Components - 1.1% | |||

| Auto Parts & Equipment - 1.1% | |||

| Tenneco, Inc. | 275,296 | $17,183,976 | |

| Automobiles - 0.9% | |||

| Automobile Manufacturers - 0.9% | |||

| Ferrari NV | 67,222 | 4,998,628 | |

| Tesla, Inc. (a) | 28,416 | 7,908,173 | |

| Thor Industries, Inc. | 7,900 | 759,427 | |

| 13,666,228 | |||

| Beverages - 2.4% | |||

| Distillers & Vintners - 1.9% | |||

| Constellation Brands, Inc. Class A (sub. vtg.) | 184,207 | 29,854,428 | |

| Soft Drinks - 0.5% | |||

| Monster Beverage Corp. (a) | 180,650 | 8,340,611 | |

| TOTAL BEVERAGES | 38,195,039 | ||

| Distributors - 0.5% | |||

| Distributors - 0.5% | |||

| LKQ Corp. (a) | 255,400 | 7,475,558 | |

| Diversified Consumer Services - 0.4% | |||

| Specialized Consumer Services - 0.4% | |||

| ServiceMaster Global Holdings, Inc. (a) | 168,411 | 7,031,159 | |

| Food & Staples Retailing - 1.6% | |||

| Food Distributors - 0.6% | |||

| Performance Food Group Co. (a) | 376,675 | 8,964,865 | |

| Hypermarkets & Super Centers - 1.0% | |||

| Costco Wholesale Corp. | 100,249 | 16,810,755 | |

| TOTAL FOOD & STAPLES RETAILING | 25,775,620 | ||

| Hotels, Restaurants & Leisure - 21.7% | |||

| Casinos & Gaming - 3.7% | |||

| Las Vegas Sands Corp. | 699,516 | 39,921,378 | |

| Melco Crown Entertainment Ltd. sponsored ADR | 301,900 | 5,597,226 | |

| MGM Mirage, Inc. | 340,300 | 9,324,220 | |

| Wynn Resorts Ltd. | 35,515 | 4,070,374 | |

| 58,913,198 | |||

| Hotels, Resorts & Cruise Lines - 3.6% | |||

| Hilton, Inc. | 723,951 | 42,322,175 | |

| Marriott International, Inc. Class A | 81,208 | 7,648,169 | |

| Park Hotels & Resorts, Inc. | 1,881 | 48,285 | |

| Royal Caribbean Cruises Ltd. | 88,428 | 8,675,671 | |

| 58,694,300 | |||

| Leisure Facilities - 2.1% | |||

| Vail Resorts, Inc. | 173,123 | 33,222,304 | |

| Restaurants - 12.3% | |||

| ARAMARK Holdings Corp. | 147,900 | 5,453,073 | |

| Buffalo Wild Wings, Inc. (a) | 57,293 | 8,751,506 | |

| Chipotle Mexican Grill, Inc. (a) | 19,800 | 8,821,296 | |

| Dave & Buster's Entertainment, Inc. (a) | 275,393 | 16,823,758 | |

| Del Taco Restaurants, Inc. (a) | 259,527 | 3,441,328 | |

| Domino's Pizza, Inc. | 80,820 | 14,895,126 | |

| Dunkin' Brands Group, Inc. | 66,300 | 3,625,284 | |

| Jack in the Box, Inc. | 216,411 | 22,013,327 | |

| McDonald's Corp. | 64,549 | 8,366,196 | |

| Panera Bread Co. Class A (a)(b) | 14,700 | 3,849,489 | |

| Papa John's International, Inc. | 138,216 | 11,062,809 | |

| Ruth's Hospitality Group, Inc. | 341,181 | 6,840,679 | |

| Shake Shack, Inc. Class A (a) | 26,000 | 868,400 | |

| Starbucks Corp. | 1,273,041 | 74,332,864 | |

| Texas Roadhouse, Inc. Class A | 36,400 | 1,620,892 | |

| U.S. Foods Holding Corp. | 262,000 | 7,330,760 | |

| Wingstop, Inc. | 20,988 | 593,541 | |

| 198,690,328 | |||

| TOTAL HOTELS, RESTAURANTS & LEISURE | 349,520,130 | ||

| Household Durables - 0.1% | |||

| Household Appliances - 0.1% | |||

| Techtronic Industries Co. Ltd. | 428,500 | 1,734,070 | |

| Household Products - 0.7% | |||

| Household Products - 0.7% | |||

| Spectrum Brands Holdings, Inc. | 86,217 | 11,985,025 | |

| Internet & Direct Marketing Retail - 16.3% | |||

| Internet & Direct Marketing Retail - 16.3% | |||

| Amazon.com, Inc. (a) | 267,526 | 237,172,503 | |

| Liberty Interactive Corp. QVC Group Series A (a) | 765,706 | 15,329,434 | |

| Netflix, Inc. (a) | 62,427 | 9,227,335 | |

| 261,729,272 | |||

| Internet Software & Services - 0.2% | |||

| Internet Software & Services - 0.2% | |||

| Facebook, Inc. Class A (a) | 25,862 | 3,673,697 | |

| Leisure Products - 0.4% | |||

| Leisure Products - 0.4% | |||

| Mattel, Inc. | 249,800 | 6,397,378 | |

| Media - 21.9% | |||

| Advertising - 1.2% | |||

| Interpublic Group of Companies, Inc. | 811,105 | 19,928,850 | |

| Cable & Satellite - 11.4% | |||

| Charter Communications, Inc. Class A (a) | 342,637 | 112,151,943 | |

| Comcast Corp. Class A | 1,646,790 | 61,902,836 | |

| DISH Network Corp. Class A (a) | 49,041 | 3,113,613 | |

| Naspers Ltd. Class N | 34,184 | 5,890,324 | |

| 183,058,716 | |||

| Movies & Entertainment - 9.3% | |||

| The Walt Disney Co. | 1,148,078 | 130,180,564 | |

| Time Warner, Inc. | 202,741 | 19,809,823 | |

| 149,990,387 | |||

| TOTAL MEDIA | 352,977,953 | ||

| Multiline Retail - 2.1% | |||

| General Merchandise Stores - 2.1% | |||

| B&M European Value Retail S.A. | 1,627,882 | 6,106,483 | |

| Dollar Tree, Inc. (a) | 357,129 | 28,020,341 | |

| 34,126,824 | |||

| Personal Products - 0.1% | |||

| Personal Products - 0.1% | |||

| Herbalife Ltd. (a) | 32,900 | 1,912,806 | |

| Specialty Retail - 21.6% | |||

| Apparel Retail - 7.7% | |||

| Burlington Stores, Inc. (a) | 49,100 | 4,776,939 | |

| Foot Locker, Inc. | 82,200 | 6,149,382 | |

| Inditex SA | 187,499 | 6,603,072 | |

| L Brands, Inc. | 294,892 | 13,889,413 | |

| Ross Stores, Inc. | 872,569 | 57,476,120 | |

| TJX Companies, Inc. | 452,090 | 35,751,277 | |

| 124,646,203 | |||

| Automotive Retail - 4.5% | |||

| Advance Auto Parts, Inc. | 83,040 | 12,311,510 | |

| AutoZone, Inc. (a) | 40,574 | 29,337,031 | |

| O'Reilly Automotive, Inc. (a) | 112,059 | 30,238,001 | |

| 71,886,542 | |||

| Home Improvement Retail - 9.1% | |||

| Home Depot, Inc. | 1,001,082 | 146,988,870 | |

| Specialty Stores - 0.3% | |||

| Dick's Sporting Goods, Inc. | 30,700 | 1,493,862 | |

| Sally Beauty Holdings, Inc. (a) | 50,344 | 1,029,031 | |

| Ulta Beauty, Inc. (a) | 5,700 | 1,625,811 | |

| 4,148,704 | |||

| TOTAL SPECIALTY RETAIL | 347,670,319 | ||

| Technology Hardware, Storage & Peripherals - 0.2% | |||

| Technology Hardware, Storage & Peripherals - 0.2% | |||

| Apple, Inc. | 24,000 | 3,447,840 | |

| Textiles, Apparel & Luxury Goods - 7.4% | |||

| Apparel, Accessories & Luxury Goods - 2.3% | |||

| adidas AG | 43,110 | 8,199,972 | |

| G-III Apparel Group Ltd. (a) | 370,916 | 8,119,351 | |

| Kate Spade & Co. (a) | 70,300 | 1,633,069 | |

| LVMH Moet Hennessy - Louis Vuitton SA | 20,049 | 4,406,619 | |

| VF Corp. | 256,019 | 14,073,364 | |

| 36,432,375 | |||

| Footwear - 5.1% | |||

| NIKE, Inc. Class B | 1,475,348 | 82,221,144 | |

| TOTAL TEXTILES, APPAREL & LUXURY GOODS | 118,653,519 | ||

| TOTAL COMMON STOCKS | |||

| (Cost $1,137,110,117) | 1,603,156,413 | ||

| Money Market Funds - 0.8% | |||

| Fidelity Cash Central Fund, 0.84% (c) | 8,801,737 | 8,803,497 | |

| Fidelity Securities Lending Cash Central Fund 0.84% (c)(d) | 4,280,750 | 4,281,178 | |

| TOTAL MONEY MARKET FUNDS | |||

| (Cost $13,084,403) | 13,084,675 | ||

| TOTAL INVESTMENT PORTFOLIO - 100.4% | |||

| (Cost $1,150,194,520) | 1,616,241,088 | ||

| NET OTHER ASSETS (LIABILITIES) - (0.4)% | (6,768,758) | ||

| NET ASSETS - 100% | $1,609,472,330 |

Legend

(a) Non-income producing

(b) Security or a portion of the security is on loan at period end.

(c) Affiliated fund that is generally available only to investment companies and other accounts managed by Fidelity Investments. The rate quoted is the annualized seven-day yield of the fund at period end. A complete unaudited listing of the fund's holdings as of its most recent quarter end is available upon request. In addition, each Fidelity Central Fund's financial statements are available on the SEC's website or upon request.

(d) Investment made with cash collateral received from securities on loan.

Affiliated Central Funds

Information regarding fiscal year to date income earned by the Fund from investments in Fidelity Central Funds is as follows:

| Fund | Income earned |

| Fidelity Cash Central Fund | $38,332 |

| Fidelity Securities Lending Cash Central Fund | 174,341 |

| Total | $212,673 |

Investment Valuation

The following is a summary of the inputs used, as of March 31, 2017, involving the Fund's assets and liabilities carried at fair value. The inputs or methodology used for valuing securities may not be an indication of the risk associated with investing in those securities. For more information on valuation inputs, and their aggregation into the levels used below, please refer to the Investment Valuation section in the accompanying Notes to Financial Statements.

| Valuation Inputs at Reporting Date: | ||||

| Description | Total | Level 1 | Level 2 | Level 3 |

| Investments in Securities: | ||||

| Common Stocks | $1,603,156,413 | $1,586,256,398 | $16,900,015 | $-- |

| Money Market Funds | 13,084,675 | 13,084,675 | -- | -- |

| Total Investments in Securities: | $1,616,241,088 | $1,599,341,073 | $16,900,015 | $-- |

See accompanying notes which are an integral part of the financial statements.

Fidelity® Consumer Discretionary Central Fund

Financial Statements

Statement of Assets and Liabilities

| March 31, 2017 (Unaudited) | ||

| Assets | ||

| Investment in securities, at value (including securities loaned of $4,294,668) — See accompanying schedule: Unaffiliated issuers (cost $1,137,110,117) | $1,603,156,413 | |

| Fidelity Central Funds (cost $13,084,403) | 13,084,675 | |

| Total Investments (cost $1,150,194,520) | $1,616,241,088 | |

| Receivable for investments sold | 12,990,591 | |

| Receivable for fund shares sold | 189,253 | |

| Dividends receivable | 612,610 | |

| Distributions receivable from Fidelity Central Funds | 11,875 | |

| Other receivables | 195,757 | |

| Total assets | 1,630,241,174 | |

| Liabilities | ||

| Payable for investments purchased | $9,433,450 | |

| Payable for fund shares redeemed | 7,042,533 | |

| Other payables and accrued expenses | 16,561 | |

| Collateral on securities loaned | 4,276,300 | |

| Total liabilities | 20,768,844 | |

| Net Assets | $1,609,472,330 | |

| Net Assets consist of: | ||

| Paid in capital | $1,130,803,188 | |

| Undistributed net investment income | 2,826,960 | |

| Accumulated undistributed net realized gain (loss) on investments and foreign currency transactions | 9,803,485 | |

| Net unrealized appreciation (depreciation) on investments and assets and liabilities in foreign currencies | 466,038,697 | |

| Net Assets, for 5,900,360 shares outstanding | $1,609,472,330 | |

| Net Asset Value, offering price and redemption price per share ($1,609,472,330 ÷ 5,900,360 shares) | $272.78 |

See accompanying notes which are an integral part of the financial statements.

Statement of Operations

| Six months ended March 31, 2017 (Unaudited) | ||

| Investment Income | ||

| Dividends | $10,020,092 | |

| Income from Fidelity Central Funds (including $174,341 from security lending) | 212,673 | |

| Total income | 10,232,765 | |

| Expenses | ||

| Custodian fees and expenses | $20,317 | |

| Independent directors' fees and expenses | 3,286 | |

| Interest | 5,949 | |

| Total expenses before reductions | 29,552 | |

| Expense reductions | (3,287) | 26,265 |

| Net investment income (loss) | 10,206,500 | |

| Realized and Unrealized Gain (Loss) | ||

| Net realized gain (loss) on: | ||

| Investment securities: | ||

| Unaffiliated issuers | 9,816,950 | |

| Fidelity Central Funds | 5,354 | |

| Foreign currency transactions | (18,819) | |

| Total net realized gain (loss) | 9,803,485 | |

| Change in net unrealized appreciation (depreciation) on: Investment securities | 138,632,948 | |

| Assets and liabilities in foreign currencies | 685 | |

| Total change in net unrealized appreciation (depreciation) | 138,633,633 | |

| Net gain (loss) | 148,437,118 | |

| Net increase (decrease) in net assets resulting from operations | $158,643,618 |

See accompanying notes which are an integral part of the financial statements.

Statement of Changes in Net Assets

| Six months ended March 31, 2017 (Unaudited) | Year ended September 30, 2016 | |

| Increase (Decrease) in Net Assets | ||

| Operations | ||

| Net investment income (loss) | $10,206,500 | $23,856,688 |

| Net realized gain (loss) | 9,803,485 | (60,572,495) |

| Change in net unrealized appreciation (depreciation) | 138,633,633 | 153,175,647 |

| Net increase (decrease) in net assets resulting from operations | 158,643,618 | 116,459,840 |

| Distributions to shareholders from net investment income | (7,379,540) | (23,912,876) |

| Affiliated share transactions | ||

| Proceeds from sales of shares | 98,304,594 | 167,822,899 |

| Reinvestment of distributions | 7,379,368 | 23,912,313 |

| Cost of shares redeemed | (226,509,025) | (193,149,714) |

| Net increase (decrease) in net assets resulting from share transactions | (120,825,063) | (1,414,502) |

| Total increase (decrease) in net assets | 30,439,015 | 91,132,462 |

| Net Assets | ||

| Beginning of period | 1,579,033,315 | 1,487,900,853 |

| End of period | $1,609,472,330 | $1,579,033,315 |

| Other Information | ||

| Undistributed net investment income end of period | $2,826,960 | $– |

| Shares | ||

| Sold | 389,751 | 687,541 |

| Issued in reinvestment of distributions | 29,209 | 98,072 |

| Redeemed | (866,338) | (793,764) |

| Net increase (decrease) | (447,378) | (8,151) |

See accompanying notes which are an integral part of the financial statements.

Financial Highlights — Fidelity Consumer Discretionary Central Fund

| Six months ended (Unaudited) March 31, | Years ended September 30, | |||||

| 2017 | 2016 | 2015 | 2014 | 2013 | 2012 | |

| Selected Per–Share Data | ||||||

| Net asset value, beginning of period | $248.76 | $234.10 | $213.75 | $196.26 | $150.90 | $114.27 |

| Income from Investment Operations | ||||||

| Net investment income (loss)A | 1.62 | 3.75 | 3.36 | 2.23 | 2.00 | 1.84 |

| Net realized and unrealized gain (loss) | 23.55 | 14.67 | 20.24 | 17.43 | 45.30 | 36.60 |

| Total from investment operations | 25.17 | 18.42 | 23.60 | 19.66 | 47.30 | 38.44 |

| Distributions from net investment income | (1.15) | (3.76) | (3.25) | (2.17) | (1.94) | (1.81) |

| Total distributions | (1.15) | (3.76) | (3.25) | (2.17) | (1.94) | (1.81) |

| Net asset value, end of period | $272.78 | $248.76 | $234.10 | $213.75 | $196.26 | $150.90 |

| Total ReturnB,C | 10.15% | 7.91% | 11.01% | 10.03% | 31.56% | 33.79% |

| Ratios to Average Net AssetsD,E | ||||||

| Expenses before reductionsF | - %G | -% | -% | -% | -% | -% |

| Expenses net of fee waivers, if anyF | - %G | -% | -% | -% | -% | -% |

| Expenses net of all reductionsF | - %G | -% | -% | -% | -% | -% |

| Net investment income (loss) | 1.26%G | 1.54% | 1.41% | 1.06% | 1.17% | 1.32% |

| Supplemental Data | ||||||

| Net assets, end of period (000 omitted) | $1,609,472 | $1,579,033 | $1,487,901 | $1,431,901 | $1,340,686 | $914,137 |

| Portfolio turnover rateH | 34%G,I | 27% | 68% | 169%I | 122%I | 191% |

A Calculated based on average shares outstanding during the period.

B Total returns for periods of less than one year are not annualized.

C Total returns would have been lower if certain expenses had not been reduced during the applicable periods shown.

D Fees and expenses of any underlying Fidelity Central Funds are not included in the Fund's expense ratio. The Fund indirectly bears its proportionate share of the expenses of any underlying Fidelity Central Funds.

E Expense ratios reflect operating expenses of the Fund. Expenses before reductions do not reflect amounts reimbursed by the investment adviser or reductions from expense offset arrangements and do not represent the amount paid by the Fund during periods when reimbursements or reductions occur. Expenses net of fee waivers reflect expenses after reimbursement by the investment adviser but prior to reductions from expense offset arrangements. Expenses net of all reductions represent the net expenses paid by the Fund.

F Amount represents less than .005%.

G Annualized

H Amount does not include the portfolio activity of any underlying Fidelity Central Funds.

I Portfolio turnover rate excludes securities received or delivered in-kind.

See accompanying notes which are an integral part of the financial statements.

Fidelity® Consumer Staples Central Fund

Investment Summary (Unaudited)

Top Ten Stocks as of March 31, 2017

| % of fund's net assets | % of fund's net assets 6 months ago | |

| Philip Morris International, Inc. | 12.6 | 4.3 |

| British American Tobacco PLC sponsored ADR | 11.4 | 11.1 |

| CVS Health Corp. | 8.5 | 9.1 |

| Kroger Co. | 5.9 | 5.9 |

| Reynolds American, Inc. | 5.8 | 4.6 |

| The Coca-Cola Co. | 5.1 | 3.7 |

| Estee Lauder Companies, Inc. Class A | 4.9 | 1.4 |

| Colgate-Palmolive Co. | 3.9 | 2.5 |

| Monster Beverage Corp. | 3.5 | 3.3 |

| Altria Group, Inc. | 3.4 | 3.9 |

| 65.0 |

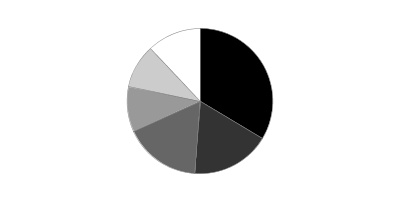

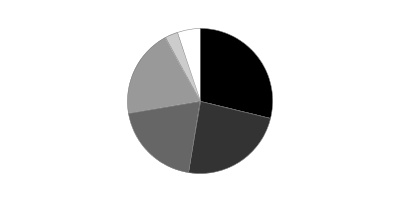

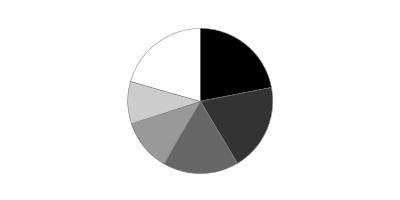

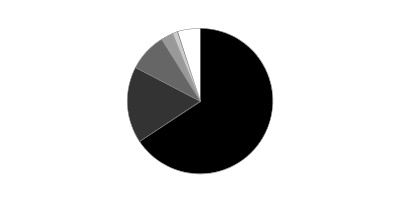

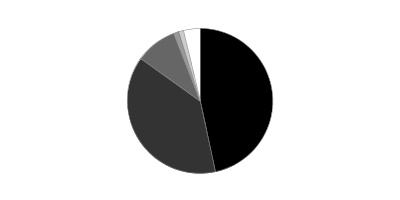

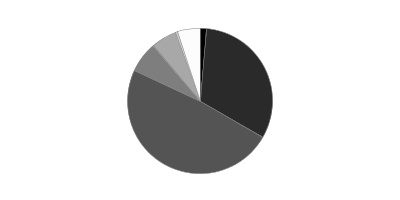

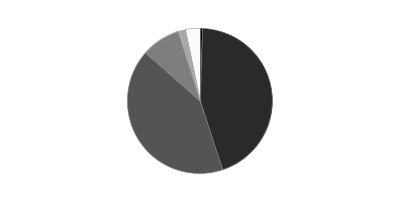

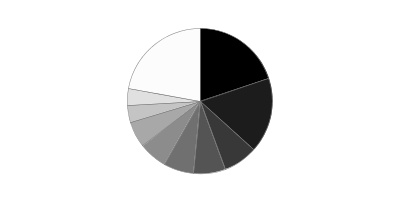

Top Industries (% of fund's net assets)

| As of March 31, 2017 | ||

| Tobacco | 33.6% | |

| Food & Staples Retailing | 17.5% | |

| Beverages | 17.1% | |

| Food Products | 9.9% | |

| Personal Products | 9.9% | |

| All Others* | 12.0% | |

| As of September 30, 2016 | ||

| Tobacco | 24.2% | |

| Food & Staples Retailing | 23.9% | |

| Beverages | 17.1% | |

| Household Products | 15.8% | |

| Food Products | 11.1% | |

| All Others* | 7.9% | |

* Includes short-term investments and net other assets (liabilities).

Fidelity® Consumer Staples Central Fund

Investments March 31, 2017 (Unaudited)

Showing Percentage of Net Assets

| Common Stocks - 96.2% | |||

| Shares | Value | ||

| Beverages - 16.9% | |||

| Brewers - 3.0% | |||

| Anheuser-Busch InBev SA NV | 317,059 | $34,741,822 | |

| China Resources Beer Holdings Co. Ltd. | 1,413,210 | 3,215,023 | |

| 37,956,845 | |||

| Distillers & Vintners - 3.2% | |||

| Brown-Forman Corp. Class B (non-vtg.) | 62,265 | 2,875,398 | |

| Constellation Brands, Inc. Class A (sub. vtg.) | 98,966 | 16,039,420 | |

| Kweichow Moutai Co. Ltd. (A Shares) | 114,018 | 6,396,305 | |

| Pernod Ricard SA | 106,874 | 12,644,062 | |

| Wuliangye Yibin Co. Ltd. Class A | 534,788 | 3,338,979 | |

| 41,294,164 | |||

| Soft Drinks - 10.7% | |||

| Britvic PLC | 964,033 | 7,820,744 | |

| Coca-Cola Bottling Co. Consolidated | 53,495 | 11,021,040 | |

| Coca-Cola European Partners PLC | 47,005 | 1,771,618 | |

| Coca-Cola FEMSA S.A.B. de CV sponsored ADR (a) | 27,849 | 1,996,773 | |

| Coca-Cola Icecek Sanayi A/S | 249,735 | 2,448,941 | |

| Embotelladora Andina SA Series A sponsored ADR Series A | 111,882 | 2,516,226 | |

| Monster Beverage Corp. (b) | 973,878 | 44,963,947 | |

| The Coca-Cola Co. | 1,542,761 | 65,474,777 | |

| 138,014,066 | |||

| TOTAL BEVERAGES | 217,265,075 | ||

| Food & Staples Retailing - 17.5% | |||

| Drug Retail - 11.6% | |||

| CVS Health Corp. | 1,384,003 | 108,644,236 | |

| Drogasil SA (b) | 140,600 | 2,634,959 | |

| Rite Aid Corp. (b) | 1,388,400 | 5,900,700 | |

| Walgreens Boots Alliance, Inc. | 382,878 | 31,798,018 | |

| 148,977,913 | |||

| Food Retail - 5.9% | |||

| Kroger Co. | 2,576,523 | 75,981,663 | |

| TOTAL FOOD & STAPLES RETAILING | 224,959,576 | ||

| Food Products - 9.9% | |||

| Agricultural Products - 2.7% | |||

| Bunge Ltd. | 434,618 | 34,447,823 | |

| Packaged Foods & Meats - 7.2% | |||

| Amplify Snack Brands, Inc. (b) | 133,226 | 1,119,098 | |

| Blue Buffalo Pet Products, Inc. (a)(b) | 230,274 | 5,296,302 | |

| Mondelez International, Inc. | 673,912 | 29,032,129 | |

| Nestle SA | 105,290 | 8,081,194 | |

| The Hain Celestial Group, Inc. (b) | 541,246 | 20,134,351 | |

| TreeHouse Foods, Inc. (b) | 345,473 | 29,247,744 | |

| 92,910,818 | |||

| TOTAL FOOD PRODUCTS | 127,358,641 | ||

| Hotels, Restaurants & Leisure - 0.8% | |||

| Restaurants - 0.8% | |||

| U.S. Foods Holding Corp. | 347,508 | 9,723,273 | |

| Household Products - 7.6% | |||

| Household Products - 7.6% | |||

| Colgate-Palmolive Co. | 678,520 | 49,660,879 | |

| Kimberly-Clark Corp. | 38,524 | 5,070,914 | |

| Procter & Gamble Co. | 377,040 | 33,877,044 | |

| Spectrum Brands Holdings, Inc. | 64,266 | 8,933,617 | |

| 97,542,454 | |||

| Personal Products - 9.9% | |||

| Personal Products - 9.9% | |||

| Avon Products, Inc. (b) | 1,421,100 | 6,252,840 | |

| Coty, Inc. Class A | 1,886,678 | 34,205,472 | |

| Estee Lauder Companies, Inc. Class A | 736,067 | 62,411,121 | |

| Herbalife Ltd. (b) | 140,632 | 8,176,344 | |

| L'Oreal SA | 35,138 | 6,752,962 | |

| Unilever NV (Certificaten Van Aandelen) (Bearer) | 134,300 | 6,667,881 | |

| Unilever PLC sponsored ADR | 49,155 | 2,425,308 | |

| 126,891,928 | |||

| Tobacco - 33.6% | |||

| Tobacco - 33.6% | |||

| Altria Group, Inc. | 607,167 | 43,363,867 | |

| British American Tobacco PLC sponsored ADR (a) | 2,215,132 | 146,907,554 | |

| ITC Ltd. | 1,163,393 | 5,027,738 | |

| Philip Morris International, Inc. | 1,426,804 | 161,086,175 | |

| Reynolds American, Inc. | 1,179,574 | 74,336,753 | |

| 430,722,087 | |||

| TOTAL COMMON STOCKS | |||

| (Cost $898,214,530) | 1,234,463,034 | ||

| Nonconvertible Preferred Stocks - 0.2% | |||

| Beverages - 0.2% | |||

| Brewers - 0.2% | |||

| Ambev SA sponsored ADR | |||

| (Cost $1,810,274) | 484,283 | 2,789,470 | |

| Money Market Funds - 14.7% | |||

| Fidelity Cash Central Fund, 0.84% (c) | 33,935,014 | 33,941,801 | |

| Fidelity Securities Lending Cash Central Fund 0.84% (c)(d) | 153,687,069 | 153,702,438 | |

| TOTAL MONEY MARKET FUNDS | |||

| (Cost $187,643,876) | 187,644,239 | ||

| TOTAL INVESTMENT PORTFOLIO - 111.1% | |||

| (Cost $1,087,668,680) | 1,424,896,743 | ||

| NET OTHER ASSETS (LIABILITIES) - (11.1)% | (142,029,727) | ||

| NET ASSETS - 100% | $1,282,867,016 |

Legend

(a) Security or a portion of the security is on loan at period end.

(b) Non-income producing

(c) Affiliated fund that is generally available only to investment companies and other accounts managed by Fidelity Investments. The rate quoted is the annualized seven-day yield of the fund at period end. A complete unaudited listing of the fund's holdings as of its most recent quarter end is available upon request. In addition, each Fidelity Central Fund's financial statements are available on the SEC's website or upon request.

(d) Investment made with cash collateral received from securities on loan.

Affiliated Central Funds

Information regarding fiscal year to date income earned by the Fund from investments in Fidelity Central Funds is as follows:

| Fund | Income earned |

| Fidelity Cash Central Fund | $75,182 |

| Fidelity Securities Lending Cash Central Fund | 786,811 |

| Total | $861,993 |

Investment Valuation

The following is a summary of the inputs used, as of March 31, 2017, involving the Fund's assets and liabilities carried at fair value. The inputs or methodology used for valuing securities may not be an indication of the risk associated with investing in those securities. For more information on valuation inputs, and their aggregation into the levels used below, please refer to the Investment Valuation section in the accompanying Notes to Financial Statements.

| Valuation Inputs at Reporting Date: | ||||

| Description | Total | Level 1 | Level 2 | Level 3 |

| Investments in Securities: | ||||

| Common Stocks | $1,234,463,034 | $1,184,972,137 | $49,490,897 | $-- |

| Nonconvertible Preferred Stocks | 2,789,470 | 2,789,470 | -- | -- |

| Money Market Funds | 187,644,239 | 187,644,239 | -- | -- |

| Total Investments in Securities: | $1,424,896,743 | $1,375,405,846 | $49,490,897 | $-- |

Other Information

Distribution of investments by country or territory of incorporation, as a percentage of Total Net Assets, is as follows (Unaudited):

| United States of America | 76.7% |

| United Kingdom | 12.3% |

| Belgium | 2.7% |

| Bermuda | 2.7% |

| France | 1.5% |

| Others (Individually Less Than 1%) | 4.1% |

| 100.0% |

See accompanying notes which are an integral part of the financial statements.

Fidelity® Consumer Staples Central Fund

Financial Statements

Statement of Assets and Liabilities

| March 31, 2017 (Unaudited) | ||

| Assets | ||

| Investment in securities, at value (including securities loaned of $150,976,786) — See accompanying schedule: Unaffiliated issuers (cost $900,024,804) | $1,237,252,504 | |

| Fidelity Central Funds (cost $187,643,876) | 187,644,239 | |

| Total Investments (cost $1,087,668,680) | $1,424,896,743 | |

| Receivable for investments sold | 6,334,582 | |

| Receivable for fund shares sold | 140,784 | |

| Dividends receivable | 7,461,195 | |

| Distributions receivable from Fidelity Central Funds | 335,991 | |

| Total assets | 1,439,169,295 | |

| Liabilities | ||

| Payable to custodian bank | $101 | |

| Payable for investments purchased | 2,008,748 | |

| Payable for fund shares redeemed | 264,571 | |

| Other payables and accrued expenses | 320,899 | |

| Collateral on securities loaned | 153,707,960 | |

| Total liabilities | 156,302,279 | |

| Net Assets | $1,282,867,016 | |

| Net Assets consist of: | ||

| Paid in capital | $888,532,137 | |

| Undistributed net investment income | 7,300,463 | |

| Accumulated undistributed net realized gain (loss) on investments and foreign currency transactions | 50,135,615 | |

| Net unrealized appreciation (depreciation) on investments and assets and liabilities in foreign currencies | 336,898,801 | |

| Net Assets, for 5,385,044 shares outstanding | $1,282,867,016 | |

| Net Asset Value, offering price and redemption price per share ($1,282,867,016 ÷ 5,385,044 shares) | $238.23 |

See accompanying notes which are an integral part of the financial statements.

Statement of Operations

| Six months ended March 31, 2017 (Unaudited) | ||

| Investment Income | ||

| Dividends | $16,223,829 | |

| Income from Fidelity Central Funds (including $786,811 from security lending) | 861,993 | |

| Total income | 17,085,822 | |

| Expenses | ||

| Custodian fees and expenses | $26,615 | |

| Independent directors' fees and expenses | 2,584 | |

| Interest | 814 | |

| Total expenses before reductions | 30,013 | |

| Expense reductions | (2,971) | 27,042 |

| Net investment income (loss) | 17,058,780 | |

| Realized and Unrealized Gain (Loss) | ||

| Net realized gain (loss) on: | ||

| Investment securities: | ||

| Unaffiliated issuers | 67,867,973 | |

| Fidelity Central Funds | (8,675) | |

| Foreign currency transactions | (43,700) | |

| Total net realized gain (loss) | 67,815,598 | |

| Change in net unrealized appreciation (depreciation) on: Investment securities (net of increase in deferred foreign taxes of $47,938) | 984,787 | |

| Assets and liabilities in foreign currencies | (16,903) | |

| Total change in net unrealized appreciation (depreciation) | 967,884 | |

| Net gain (loss) | 68,783,482 | |

| Net increase (decrease) in net assets resulting from operations | $85,842,262 |

See accompanying notes which are an integral part of the financial statements.

Statement of Changes in Net Assets

| Six months ended March 31, 2017 (Unaudited) | Year ended September 30, 2016 | |

| Increase (Decrease) in Net Assets | ||

| Operations | ||

| Net investment income (loss) | $17,058,780 | $29,480,460 |

| Net realized gain (loss) | 67,815,598 | 41,183,188 |

| Change in net unrealized appreciation (depreciation) | 967,884 | 101,713,579 |

| Net increase (decrease) in net assets resulting from operations | 85,842,262 | 172,377,227 |

| Distributions to shareholders from net investment income | (9,758,317) | (28,718,321) |

| Distributions to shareholders from net realized gain | (17,679,983) | – |

| Total distributions | (27,438,300) | (28,718,321) |

| Affiliated share transactions | ||

| Proceeds from sales of shares | 64,743,990 | 155,551,923 |

| Reinvestment of distributions | 27,437,783 | 28,717,765 |

| Cost of shares redeemed | (152,493,015) | (140,925,877) |

| Net increase (decrease) in net assets resulting from share transactions | (60,311,242) | 43,343,811 |

| Total increase (decrease) in net assets | (1,907,280) | 187,002,717 |

| Net Assets | ||

| Beginning of period | 1,284,774,296 | 1,097,771,579 |

| End of period | $1,282,867,016 | $1,284,774,296 |

| Other Information | ||

| Undistributed net investment income end of period | $7,300,463 | $– |

| Shares | ||

| Sold | 298,003 | 706,377 |

| Issued in reinvestment of distributions | 127,974 | 128,022 |

| Redeemed | (675,790) | (624,503) |

| Net increase (decrease) | (249,813) | 209,896 |

See accompanying notes which are an integral part of the financial statements.

Financial Highlights — Fidelity Consumer Staples Central Fund

| Six months ended (Unaudited) March 31, | Years ended September 30, | |||||

| 2017 | 2016 | 2015 | 2014 | 2013 | 2012 | |

| Selected Per–Share Data | ||||||

| Net asset value, beginning of period | $228.00 | $202.36 | $205.11 | $181.33 | $161.05 | $131.58 |

| Income from Investment Operations | ||||||

| Net investment income (loss)A | 3.03 | 5.30 | 5.31 | 5.20 | 4.77 | 4.33 |

| Net realized and unrealized gain (loss) | 12.00 | 25.50 | (2.84) | 23.75 | 20.13 | 29.39 |

| Total from investment operations | 15.03 | 30.80 | 2.47 | 28.95 | 24.90 | 33.72 |

| Distributions from net investment income | (1.72) | (5.16) | (5.22) | (5.17) | (4.62) | (4.25) |

| Distributions from net realized gain | (3.07) | – | – | – | – | – |

| Total distributions | (4.80)B | (5.16) | (5.22) | (5.17) | (4.62) | (4.25) |

| Net asset value, end of period | $238.23 | $228.00 | $202.36 | $205.11 | $181.33 | $161.05 |

| Total ReturnC,D | 6.83% | 15.29% | 1.07% | 16.13% | 15.58% | 25.90% |

| Ratios to Average Net AssetsE,F | ||||||

| Expenses before reductions | - %G,H | - %H | - %H | .01% | .01% | .01% |

| Expenses net of fee waivers, if any | - %G,H | - %H | - %H | .01% | .01% | - %H |

| Expenses net of all reductions | - %G,H | - %H | - %H | .01% | .01% | - %H |

| Net investment income (loss) | 2.69%G | 2.38% | 2.45% | 2.67% | 2.72% | 2.91% |

| Supplemental Data | ||||||

| Net assets, end of period (000 omitted) | $1,282,867 | $1,284,774 | $1,097,772 | $1,166,861 | $1,016,534 | $880,205 |

| Portfolio turnover rateI | 65%G,J | 50% | 65% | 36%J | 34%J | 27% |

A Calculated based on average shares outstanding during the period.

B Total distributions of $4.80 per share is comprised of distributions from net investment income of $1.724 and distributions from net realized gain of $3.073 per share.

C Total returns for periods of less than one year are not annualized.

D Total returns would have been lower if certain expenses had not been reduced during the applicable periods shown.

E Fees and expenses of any underlying Fidelity Central Funds are not included in the Fund's expense ratio. The Fund indirectly bears its proportionate share of the expenses of any underlying Fidelity Central Funds.

F Expense ratios reflect operating expenses of the Fund. Expenses before reductions do not reflect amounts reimbursed by the investment adviser or reductions from expense offset arrangements and do not represent the amount paid by the Fund during periods when reimbursements or reductions occur. Expenses net of fee waivers reflect expenses after reimbursement by the investment adviser but prior to reductions from expense offset arrangements. Expenses net of all reductions represent the net expenses paid by the Fund.

G Annualized

H Amount represents less than .005%.

I Amount does not include the portfolio activity of any underlying Fidelity Central Funds.

J Portfolio turnover rate excludes securities received or delivered in-kind.

See accompanying notes which are an integral part of the financial statements.

Fidelity® Energy Central Fund

Investment Summary (Unaudited)

Top Ten Stocks as of March 31, 2017

| % of fund's net assets | % of fund's net assets 6 months ago | |

| Exxon Mobil Corp. | 8.2 | 5.4 |

| Chevron Corp. | 7.4 | 4.0 |

| EOG Resources, Inc. | 6.5 | 6.0 |

| Baker Hughes, Inc. | 5.3 | 4.8 |

| Pioneer Natural Resources Co. | 4.7 | 4.6 |

| Anadarko Petroleum Corp. | 4.3 | 4.6 |

| Halliburton Co. | 4.0 | 1.5 |

| Diamondback Energy, Inc. | 3.7 | 3.0 |

| Schlumberger Ltd. | 3.2 | 5.7 |

| Kinder Morgan, Inc. | 2.6 | 0.6 |

| 49.9 |

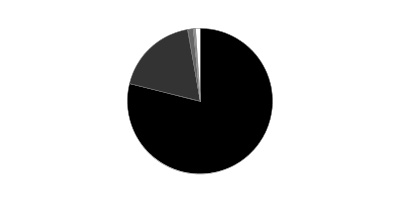

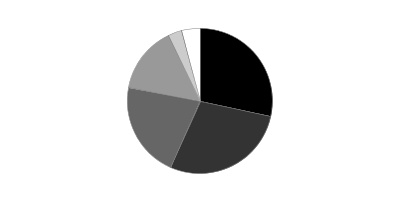

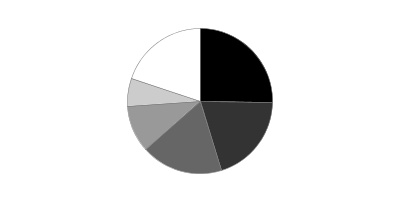

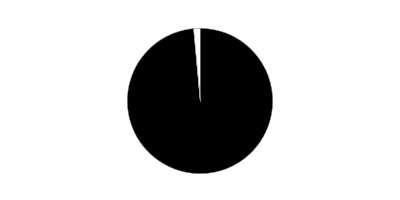

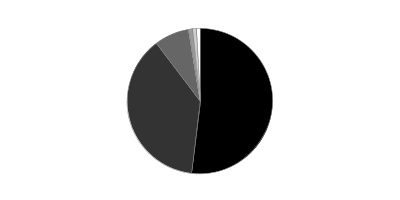

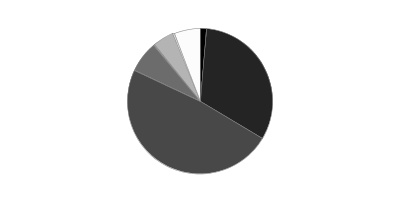

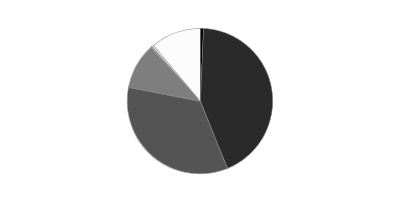

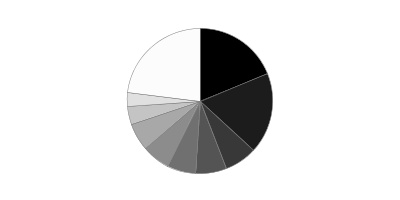

Top Industries (% of fund's net assets)

| As of March 31, 2017 | ||

| Oil, Gas & Consumable Fuels | 78.8% | |

| Energy Equipment & Services | 18.5% | |

| Chemicals | 1.2% | |

| Gas Utilities | 0.3% | |

| Diversified Financial Services | 0.3% | |

| All Others* | 0.9% | |

| As of September 30, 2016 | ||

| Oil, Gas & Consumable Fuels | 79.6% | |

| Energy Equipment & Services | 16.5% | |

| Electric Utilities | 1.1% | |

| Independent Power and Renewable Electricity Producers | 0.7% | |

| Chemicals | 0.6% | |

| All Others* | 1.5% | |

* Includes short-term investments and net other assets (liabilities).

Fidelity® Energy Central Fund

Investments March 31, 2017 (Unaudited)

Showing Percentage of Net Assets

| Common Stocks - 99.5% | |||

| Shares | Value | ||

| Chemicals - 1.2% | |||

| Commodity Chemicals - 1.2% | |||

| LyondellBasell Industries NV Class A | 133,850 | $12,205,782 | |

| Construction & Engineering - 0.2% | |||

| Construction & Engineering - 0.2% | |||

| C&J Energy Services, Inc. (a) | 54,800 | 1,865,940 | |

| Diversified Financial Services - 0.3% | |||

| Other Diversified Financial Services - 0.3% | |||

| Smart Sand, Inc. | 157,000 | 2,551,250 | |

| Energy Equipment & Services - 18.5% | |||

| Oil & Gas Drilling - 0.9% | |||

| Ensco PLC Class A | 253,800 | 2,271,510 | |

| Nabors Industries Ltd. | 114,338 | 1,494,398 | |

| Odfjell Drilling A/S (a) | 736,222 | 1,594,853 | |

| Trinidad Drilling Ltd. (a) | 1,042,751 | 1,803,457 | |

| Xtreme Drilling & Coil Services Corp. (a) | 1,083,100 | 1,742,929 | |

| 8,907,147 | |||

| Oil & Gas Equipment & Services - 17.6% | |||

| Baker Hughes, Inc. | 868,336 | 51,943,860 | |

| Dril-Quip, Inc. (a) | 169,700 | 9,257,135 | |

| Exterran Corp. (a) | 58,060 | 1,825,987 | |

| Frank's International NV (b) | 437,760 | 4,627,123 | |

| Halliburton Co. | 800,317 | 39,383,600 | |

| National Oilwell Varco, Inc. | 270,100 | 10,828,309 | |

| Newpark Resources, Inc. (a) | 938,458 | 7,601,510 | |

| Oceaneering International, Inc. | 262,951 | 7,120,713 | |

| RigNet, Inc. (a) | 153,492 | 3,292,403 | |

| Schlumberger Ltd. | 407,052 | 31,790,761 | |

| Tesco Corp. (a) | 249,152 | 2,005,674 | |

| TETRA Technologies, Inc. (a) | 592,900 | 2,413,103 | |

| Total Energy Services, Inc. | 45,200 | 452,051 | |

| 172,542,229 | |||

| TOTAL ENERGY EQUIPMENT & SERVICES | 181,449,376 | ||

| Gas Utilities - 0.3% | |||

| Gas Utilities - 0.3% | |||

| Indraprastha Gas Ltd. | 195,344 | 3,056,805 | |

| Machinery - 0.2% | |||

| Industrial Machinery - 0.2% | |||

| ProPetro Holding Corp. (a)(b) | 172,400 | 2,222,236 | |

| Oil, Gas & Consumable Fuels - 78.8% | |||

| Coal & Consumable Fuels - 0.3% | |||

| CONSOL Energy, Inc. | 192,883 | 3,236,577 | |

| Integrated Oil & Gas - 15.6% | |||

| Chevron Corp. | 679,364 | 72,943,313 | |

| Exxon Mobil Corp. | 982,164 | 80,547,265 | |

| 153,490,578 | |||

| Oil & Gas Exploration & Production - 49.0% | |||

| Anadarko Petroleum Corp. | 685,861 | 42,523,382 | |

| Cabot Oil & Gas Corp. | 63,300 | 1,513,503 | |

| Callon Petroleum Co. (a) | 1,085,855 | 14,289,852 | |

| Canadian Natural Resources Ltd. | 71,600 | 2,344,222 | |

| Carrizo Oil & Gas, Inc. (a) | 266,871 | 7,648,523 | |

| Centennial Resource Development, Inc. Class A (c) | 45,400 | 827,642 | |

| Cimarex Energy Co. | 152,922 | 18,272,650 | |

| Concho Resources, Inc. (a) | 84,753 | 10,877,200 | |

| ConocoPhillips Co. | 214,142 | 10,679,262 | |

| Continental Resources, Inc. (a) | 296,772 | 13,479,384 | |

| Devon Energy Corp. | 232,681 | 9,707,451 | |

| Diamondback Energy, Inc. (a) | 348,763 | 36,171,955 | |

| Encana Corp. | 1,131,800 | 13,259,724 | |

| EOG Resources, Inc. | 655,801 | 63,973,388 | |

| Extraction Oil & Gas, Inc. | 560,946 | 10,405,548 | |

| Hess Corp. | 229,565 | 11,067,329 | |

| Jones Energy, Inc. (b) | 85,267 | 217,431 | |

| Marathon Oil Corp. | 644,017 | 10,175,469 | |

| Newfield Exploration Co. (a) | 439,492 | 16,221,650 | |

| Noble Energy, Inc. | 448,513 | 15,401,936 | |

| Oasis Petroleum, Inc. (a) | 333,436 | 4,754,797 | |

| Parsley Energy, Inc. Class A (a) | 613,032 | 19,929,670 | |

| PDC Energy, Inc. (a) | 251,580 | 15,686,013 | |

| Pioneer Natural Resources Co. | 247,593 | 46,109,244 | |

| QEP Resources, Inc. (a) | 416,774 | 5,297,198 | |

| Range Resources Corp. | 170,100 | 4,949,910 | |

| Resolute Energy Corp. (a)(b) | 123,200 | 4,977,280 | |

| Rice Energy, Inc. (a) | 827,238 | 19,605,541 | |

| Ring Energy, Inc. (a) | 310,216 | 3,356,537 | |

| RSP Permian, Inc. (a) | 453,670 | 18,795,548 | |

| Sanchez Energy Corp. (a)(b) | 18,035 | 172,054 | |

| Seven Generations Energy Ltd. (a) | 423,111 | 7,731,396 | |

| SM Energy Co. | 253,832 | 6,097,045 | |

| Viper Energy Partners LP | 203,100 | 3,651,738 | |

| Whiting Petroleum Corp. (a) | 283,425 | 2,681,201 | |

| WPX Energy, Inc. (a) | 634,000 | 8,489,260 | |

| 481,341,933 | |||

| Oil & Gas Refining & Marketing - 5.7% | |||

| Alon U.S.A. Energy, Inc. | 255,000 | 3,108,450 | |

| Delek U.S. Holdings, Inc. | 506,700 | 12,297,609 | |

| HollyFrontier Corp. | 86,900 | 2,462,746 | |

| Marathon Petroleum Corp. | 320,000 | 16,172,800 | |

| Phillips 66 Co. | 210,985 | 16,714,232 | |

| Western Refining, Inc. | 29,000 | 1,017,030 | |

| World Fuel Services Corp. | 114,245 | 4,141,381 | |

| 55,914,248 | |||

| Oil & Gas Storage & Transport - 8.2% | |||

| GasLog Partners LP | 125,700 | 3,079,650 | |

| Gener8 Maritime, Inc. (a) | 555,346 | 3,148,812 | |

| Golar LNG Ltd. (b) | 207,500 | 5,795,475 | |

| Kinder Morgan, Inc. | 1,167,900 | 25,390,146 | |

| Noble Midstream Partners LP | 126,875 | 6,607,650 | |

| Plains All American Pipeline LP | 391,800 | 12,384,798 | |

| Targa Resources Corp. | 164,664 | 9,863,374 | |

| Teekay LNG Partners LP | 69,300 | 1,216,215 | |

| The Williams Companies, Inc. | 430,604 | 12,741,573 | |

| 80,227,693 | |||

| TOTAL OIL, GAS & CONSUMABLE FUELS | 774,211,029 | ||

| TOTAL COMMON STOCKS | |||

| (Cost $849,529,710) | 977,562,418 | ||

| Money Market Funds - 2.9% | |||

| Fidelity Cash Central Fund, 0.84% (d) | 14,166,748 | 14,169,581 | |

| Fidelity Securities Lending Cash Central Fund 0.84% (d)(e) | 14,181,360 | 14,182,778 | |

| TOTAL MONEY MARKET FUNDS | |||

| (Cost $28,350,961) | 28,352,359 | ||

| TOTAL INVESTMENT PORTFOLIO - 102.4% | |||

| (Cost $877,880,671) | 1,005,914,777 | ||

| NET OTHER ASSETS (LIABILITIES) - (2.4)% | (23,845,050) | ||

| NET ASSETS - 100% | $982,069,727 |

Legend

(a) Non-income producing

(b) Security or a portion of the security is on loan at period end.

(c) Restricted securities - Investment in securities not registered under the Securities Act of 1933 (excluding 144A issues). At the end of the period, the value of restricted securities (excluding 144A issues) amounted to $827,642 or 0.1% of net assets.

(d) Affiliated fund that is generally available only to investment companies and other accounts managed by Fidelity Investments. The rate quoted is the annualized seven-day yield of the fund at period end. A complete unaudited listing of the fund's holdings as of its most recent quarter end is available upon request. In addition, each Fidelity Central Fund's financial statements are available on the SEC's website or upon request.

(e) Investment made with cash collateral received from securities on loan.

Additional information on each restricted holding is as follows:

| Security | Acquisition Date | Acquisition Cost |

| Centennial Resource Development, Inc. Class A | 10/11/16 | $454,000 |

Affiliated Central Funds

Information regarding fiscal year to date income earned by the Fund from investments in Fidelity Central Funds is as follows:

| Fund | Income earned |

| Fidelity Cash Central Fund | $28,923 |

| Fidelity Securities Lending Cash Central Fund | 202,533 |

| Total | $231,456 |

Investment Valuation

All investments are categorized as Level 1 under the Fair Value Hierarchy. The inputs or methodology used for valuing securities may not be an indication of the risk associated with investing in those securities. For more information on valuation inputs please refer to the Investment Valuation section in the accompanying Notes to Financial Statements.

Other Information

Distribution of investments by country or territory of incorporation, as a percentage of Total Net Assets, is as follows (Unaudited):

| United States of America | 90.0% |

| Curacao | 3.2% |

| Canada | 3.0% |

| Netherlands | 1.7% |

| Others (Individually Less Than 1%) | 2.1% |

| 100.0% |

See accompanying notes which are an integral part of the financial statements.

Fidelity® Energy Central Fund

Financial Statements

Statement of Assets and Liabilities

| March 31, 2017 (Unaudited) | ||

| Assets | ||

| Investment in securities, at value (including securities loaned of $13,906,008) — See accompanying schedule: Unaffiliated issuers (cost $849,529,710) | $977,562,418 | |

| Fidelity Central Funds (cost $28,350,961) | 28,352,359 | |

| Total Investments (cost $877,880,671) | $1,005,914,777 | |

| Receivable for investments sold | 14,486,121 | |

| Receivable for fund shares sold | 110,003 | |

| Dividends receivable | 272,685 | |

| Distributions receivable from Fidelity Central Funds | 23,890 | |

| Total assets | 1,020,807,476 | |

| Liabilities | ||

| Payable for investments purchased | $20,999,893 | |

| Payable for fund shares redeemed | 3,457,806 | |

| Other payables and accrued expenses | 99,634 | |

| Collateral on securities loaned | 14,180,416 | |

| Total liabilities | 38,737,749 | |

| Net Assets | $982,069,727 | |

| Net Assets consist of: | ||

| Paid in capital | $814,568,363 | |

| Distributions in excess of net investment income | (176,887) | |

| Accumulated undistributed net realized gain (loss) on investments and foreign currency transactions | 39,724,327 | |

| Net unrealized appreciation (depreciation) on investments and assets and liabilities in foreign currencies | 127,953,924 | |

| Net Assets, for 7,760,443 shares outstanding | $982,069,727 | |

| Net Asset Value, offering price and redemption price per share ($982,069,727 ÷ 7,760,443 shares) | $126.55 |

See accompanying notes which are an integral part of the financial statements.

Statement of Operations

| Six months ended March 31, 2017 (Unaudited) | ||

| Investment Income | ||

| Dividends | $5,293,399 | |

| Income from Fidelity Central Funds (including $202,533 from security lending) | 231,456 | |

| Total income | 5,524,855 | |

| Expenses | ||

| Custodian fees and expenses | $24,728 | |

| Independent directors' fees and expenses | 2,119 | |

| Interest | 1,853 | |

| Total expenses before reductions | 28,700 | |

| Expense reductions | (2,119) | 26,581 |

| Net investment income (loss) | 5,498,274 | |

| Realized and Unrealized Gain (Loss) | ||

| Net realized gain (loss) on: | ||

| Investment securities: | ||

| Unaffiliated issuers | 40,559,434 | |

| Fidelity Central Funds | 1,026 | |

| Foreign currency transactions | (32,915) | |

| Total net realized gain (loss) | 40,527,545 | |

| Change in net unrealized appreciation (depreciation) on: Investment securities (net of increase in deferred foreign taxes of $79,020) | (44,843,361) | |

| Assets and liabilities in foreign currencies | (769) | |

| Total change in net unrealized appreciation (depreciation) | (44,844,130) | |

| Net gain (loss) | (4,316,585) | |

| Net increase (decrease) in net assets resulting from operations | $1,181,689 |

See accompanying notes which are an integral part of the financial statements.

Statement of Changes in Net Assets

| Six months ended March 31, 2017 (Unaudited) | Year ended September 30, 2016 | |

| Increase (Decrease) in Net Assets | ||

| Operations | ||

| Net investment income (loss) | $5,498,274 | $13,813,006 |

| Net realized gain (loss) | 40,527,545 | (105,883,827) |

| Change in net unrealized appreciation (depreciation) | (44,844,130) | 296,762,640 |

| Net increase (decrease) in net assets resulting from operations | 1,181,689 | 204,691,819 |

| Distributions to shareholders from net investment income | (5,675,161) | (13,359,513) |

| Distributions to shareholders from net realized gain | (803,218) | – |

| Total distributions | (6,478,379) | (13,359,513) |

| Affiliated share transactions | ||

| Proceeds from sales of shares | 106,153,136 | 116,296,655 |

| Reinvestment of distributions | 6,478,271 | 13,359,286 |

| Cost of shares redeemed | (130,252,268) | (119,805,438) |

| Net increase (decrease) in net assets resulting from share transactions | (17,620,861) | 9,850,503 |

| Total increase (decrease) in net assets | (22,917,551) | 201,182,809 |

| Net Assets | ||

| Beginning of period | 1,004,987,278 | 803,804,469 |

| End of period | $982,069,727 | $1,004,987,278 |

| Other Information | ||

| Distributions in excess of net investment income end of period | $(176,887) | $– |

| Shares | ||

| Sold | 816,280 | 1,067,076 |

| Issued in reinvestment of distributions | 48,571 | 119,194 |

| Redeemed | (989,251) | (1,068,144) |

| Net increase (decrease) | (124,400) | 118,126 |

See accompanying notes which are an integral part of the financial statements.

Financial Highlights — Fidelity Energy Central Fund

| Six months ended (Unaudited) March 31, | Years ended September 30, | |||||

| 2017 | 2016 | 2015 | 2014 | 2013 | 2012 | |

| Selected Per–Share Data | ||||||

| Net asset value, beginning of period | $127.46 | $103.49 | $154.78 | $144.89 | $123.82 | $100.57 |

| Income from Investment Operations | ||||||

| Net investment income (loss)A | .69 | 1.72 | 2.32 | 2.37 | 2.25 | 2.15 |

| Net realized and unrealized gain (loss) | (.80) | 23.93 | (51.31) | 9.87 | 20.98 | 23.15 |

| Total from investment operations | (.11) | 25.65 | (48.99) | 12.24 | 23.23 | 25.30 |

| Distributions from net investment income | (.70) | (1.68) | (2.30) | (2.35) | (2.16) | (2.05) |

| Distributions from net realized gain | (.10) | – | – | – | – | – |

| Total distributions | (.80) | (1.68) | (2.30) | (2.35) | (2.16) | (2.05) |

| Net asset value, end of period | $126.55 | $127.46 | $103.49 | $154.78 | $144.89 | $123.82 |

| Total ReturnB,C | (.12)% | 25.02% | (31.92)% | 8.44% | 18.97% | 25.27% |

| Ratios to Average Net AssetsD,E | ||||||

| Expenses before reductions | .01%F | - %G | - %G | - %G | - %G | - %G |

| Expenses net of fee waivers, if any | .01%F | - %G | - %G | - %G | - %G | - %G |

| Expenses net of all reductions | .01%F | - %G | - %G | - %G | - %G | - %G |

| Net investment income (loss) | 1.06%F | 1.55% | 1.80% | 1.52% | 1.72% | 1.81% |

| Supplemental Data | ||||||

| Net assets, end of period (000 omitted) | $982,070 | $1,004,987 | $803,804 | $1,106,807 | $1,055,394 | $906,219 |

| Portfolio turnover rateH | 91%F,I | 105% | 70% | 109%I | 93%I | 98% |

A Calculated based on average shares outstanding during the period.

B Total returns for periods of less than one year are not annualized.

C Total returns would have been lower if certain expenses had not been reduced during the applicable periods shown.

D Fees and expenses of any underlying Fidelity Central Funds are not included in the Fund's expense ratio. The Fund indirectly bears its proportionate share of the expenses of any underlying Fidelity Central Funds.

E Expense ratios reflect operating expenses of the Fund. Expenses before reductions do not reflect amounts reimbursed by the investment adviser or reductions from expense offset arrangements and do not represent the amount paid by the Fund during periods when reimbursements or reductions occur. Expenses net of fee waivers reflect expenses after reimbursement by the investment adviser but prior to reductions from expense offset arrangements. Expenses net of all reductions represent the net expenses paid by the Fund.

F Annualized

G Amount represents less than .005%.

H Amount does not include the portfolio activity of any underlying Fidelity Central Funds.

I Portfolio turnover rate excludes securities received or delivered in-kind.

See accompanying notes which are an integral part of the financial statements.

Fidelity® Financials Central Fund

Investment Summary (Unaudited)

Top Ten Stocks as of March 31, 2017

| % of fund's net assets | % of fund's net assets 6 months ago | |

| Bank of America Corp. | 6.0 | 4.6 |

| Berkshire Hathaway, Inc. Class B | 5.8 | 5.5 |

| Citigroup, Inc. | 5.1 | 4.2 |

| Wells Fargo & Co. | 5.0 | 4.1 |

| JPMorgan Chase & Co. | 4.6 | 3.5 |

| Capital One Financial Corp. | 4.0 | 2.8 |

| Goldman Sachs Group, Inc. | 3.5 | 2.4 |

| Huntington Bancshares, Inc. | 3.1 | 1.1 |

| Chubb Ltd. | 2.6 | 3.7 |

| PNC Financial Services Group, Inc. | 2.4 | 1.4 |

| 42.1 |

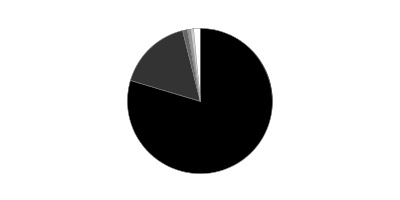

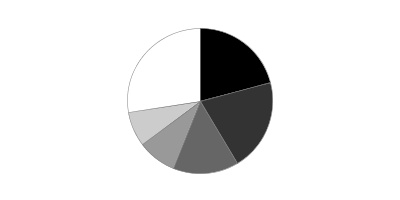

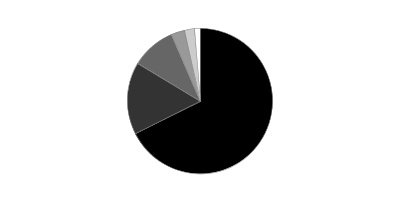

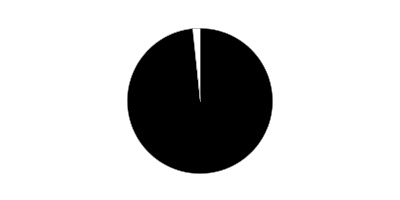

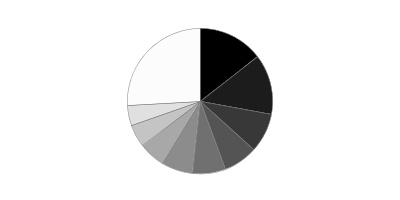

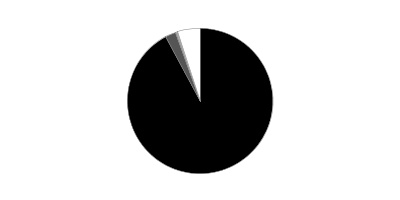

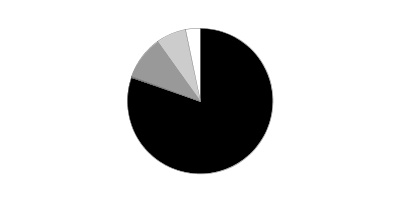

Top Industries (% of fund's net assets)

| As of March 31, 2017 | ||

| Banks | 34.9% | |

| Equity Real Estate Investment Trusts (Reits) | 17.8% | |

| Capital Markets | 15.5% | |

| Insurance | 13.7% | |

| Consumer Finance | 6.3% | |

| All Others* | 11.8% | |

| As of September 30, 2016 | ||

| Banks | 27.6% | |

| Equity Real Estate Investment Trusts (Reits) | 21.5% | |

| Insurance | 16.8% | |

| Capital Markets | 11.3% | |

| Diversified Financial Services | 5.5% | |

| All Others* | 17.3% | |

* Includes short-term investments and net other assets (liabilities).

Fidelity® Financials Central Fund

Investments March 31, 2017 (Unaudited)

Showing Percentage of Net Assets

| Common Stocks - 97.4% | |||

| Shares | Value | ||

| Banks - 34.9% | |||

| Diversified Banks - 22.9% | |||

| Bank of America Corp. | 7,150,900 | $168,689,726 | |

| Citigroup, Inc. | 2,431,400 | 145,446,348 | |

| JPMorgan Chase & Co. | 1,472,300 | 129,326,832 | |

| U.S. Bancorp | 1,200,000 | 61,800,000 | |

| Wells Fargo & Co. | 2,530,400 | 140,842,064 | |

| 646,104,970 | |||

| Regional Banks - 12.0% | |||

| Bank of the Ozarks, Inc. | 337,363 | 17,546,250 | |

| CIT Group, Inc. | 550,000 | 23,611,500 | |

| CoBiz, Inc. | 913,100 | 15,340,080 | |

| First Republic Bank | 300,000 | 28,143,000 | |

| Huntington Bancshares, Inc. | 6,500,000 | 87,035,000 | |

| M&T Bank Corp. | 225,000 | 34,814,250 | |

| PNC Financial Services Group, Inc. | 550,000 | 66,132,000 | |

| Popular, Inc. | 671,947 | 27,368,401 | |

| Preferred Bank, Los Angeles | 155,628 | 8,350,998 | |

| SVB Financial Group (a) | 160,000 | 29,774,400 | |

| 338,115,879 | |||

| TOTAL BANKS | 984,220,849 | ||

| Capital Markets - 15.5% | |||

| Asset Management & Custody Banks - 4.8% | |||

| Affiliated Managers Group, Inc. | 185,000 | 30,328,900 | |

| Ameriprise Financial, Inc. | 150,000 | 19,452,000 | |

| BlackRock, Inc. Class A | 48,600 | 18,638,586 | |

| Northern Trust Corp. | 559,200 | 48,415,536 | |

| Oaktree Capital Group LLC Class A | 400,000 | 18,120,000 | |

| 134,955,022 | |||

| Financial Exchanges & Data - 3.6% | |||

| CBOE Holdings, Inc. | 483,422 | 39,191,022 | |

| IntercontinentalExchange, Inc. | 1,069,800 | 64,048,926 | |

| 103,239,948 | |||

| Investment Banking & Brokerage - 7.1% | |||

| E*TRADE Financial Corp. (a) | 1,500,000 | 52,335,000 | |

| Goldman Sachs Group, Inc. | 425,000 | 97,631,000 | |

| Investment Technology Group, Inc. | 518,359 | 10,496,770 | |

| TD Ameritrade Holding Corp. | 1,000,000 | 38,860,000 | |

| 199,322,770 | |||

| TOTAL CAPITAL MARKETS | 437,517,740 | ||

| Consumer Finance - 6.3% | |||

| Consumer Finance - 6.3% | |||

| Capital One Financial Corp. | 1,300,400 | 112,692,664 | |

| Synchrony Financial | 1,900,000 | 65,170,000 | |

| 177,862,664 | |||

| Diversified Financial Services - 5.8% | |||

| Multi-Sector Holdings - 5.8% | |||

| Berkshire Hathaway, Inc. Class B (a) | 990,900 | 165,163,212 | |

| Equity Real Estate Investment Trusts (REITs) - 17.8% | |||

| Diversified REITs - 0.9% | |||

| American Assets Trust, Inc. | 91,201 | 3,815,850 | |

| Empire State Realty Trust, Inc. | 156,632 | 3,232,884 | |

| Gramercy Property Trust | 74,100 | 1,948,830 | |

| VEREIT, Inc. | 1,421,624 | 12,069,588 | |

| Washington REIT (SBI) | 147,300 | 4,607,544 | |

| 25,674,696 | |||

| Health Care REITs - 1.9% | |||

| CareTrust (REIT), Inc. | 49,600 | 834,272 | |

| Healthcare Realty Trust, Inc. | 438,821 | 14,261,683 | |

| Sabra Health Care REIT, Inc. | 307,500 | 8,588,475 | |

| Ventas, Inc. | 344,292 | 22,392,752 | |

| Welltower, Inc. | 100,103 | 7,089,294 | |

| 53,166,476 | |||

| Hotel & Resort REITs - 0.7% | |||

| DiamondRock Hospitality Co. | 503,400 | 5,612,910 | |

| FelCor Lodging Trust, Inc. | 292,660 | 2,197,877 | |

| Host Hotels & Resorts, Inc. | 243,511 | 4,543,915 | |

| Sunstone Hotel Investors, Inc. | 434,100 | 6,654,753 | |

| 19,009,455 | |||

| Industrial REITs - 1.3% | |||

| DCT Industrial Trust, Inc. | 316,200 | 15,215,544 | |

| Duke Realty Corp. | 439,700 | 11,550,919 | |

| Prologis, Inc. | 107,323 | 5,567,917 | |

| Terreno Realty Corp. | 160,000 | 4,480,000 | |

| 36,814,380 | |||

| Office REITs - 2.1% | |||

| Boston Properties, Inc. | 159,589 | 21,131,179 | |

| Corporate Office Properties Trust (SBI) | 220,200 | 7,288,620 | |

| Douglas Emmett, Inc. | 249,100 | 9,565,440 | |

| Highwoods Properties, Inc. (SBI) | 146,425 | 7,193,860 | |

| Hudson Pacific Properties, Inc. | 268,040 | 9,284,906 | |

| Mack-Cali Realty Corp. | 158,666 | 4,274,462 | |

| Vornado Realty Trust | 18,700 | 1,875,797 | |

| 60,614,264 | |||

| Residential REITs - 2.7% | |||

| American Homes 4 Rent Class A | 162,312 | 3,726,684 | |

| Apartment Investment & Management Co. Class A | 213,365 | 9,462,738 | |

| AvalonBay Communities, Inc. | 110,794 | 20,341,778 | |

| Colony NorthStar, Inc. | 321,413 | 4,149,442 | |

| Equity Lifestyle Properties, Inc. | 96,044 | 7,401,151 | |

| Equity Residential (SBI) | 16,825 | 1,046,852 | |

| Essex Property Trust, Inc. | 57,023 | 13,202,535 | |

| Mid-America Apartment Communities, Inc. | 151,639 | 15,427,752 | |

| 74,758,932 | |||

| Retail REITs - 2.8% | |||

| Agree Realty Corp. | 132,493 | 6,354,364 | |

| Brixmor Property Group, Inc. | 97,132 | 2,084,453 | |

| Cedar Shopping Centers, Inc. | 410,300 | 2,059,706 | |

| DDR Corp. | 255,583 | 3,202,455 | |

| General Growth Properties, Inc. | 62,759 | 1,454,754 | |

| National Retail Properties, Inc. | 244,837 | 10,679,790 | |

| Pennsylvania Real Estate Investment Trust (SBI) (b) | 151,834 | 2,298,767 | |

| Simon Property Group, Inc. | 183,546 | 31,575,418 | |

| Taubman Centers, Inc. | 106,325 | 7,019,577 | |

| Urban Edge Properties | 498,176 | 13,102,029 | |

| 79,831,313 | |||

| Specialized REITs - 5.4% | |||

| American Tower Corp. | 334,788 | 40,690,134 | |

| Communications Sales & Leasing, Inc. | 98,334 | 2,541,934 | |

| CoreSite Realty Corp. | 86,070 | 7,750,604 | |

| Corrections Corp. of America | 168,200 | 5,284,844 | |

| Equinix, Inc. | 64,952 | 26,004,832 | |

| Extra Space Storage, Inc. | 225,210 | 16,753,372 | |

| Four Corners Property Trust, Inc. | 83,300 | 1,901,739 | |

| Gaming & Leisure Properties | 112,566 | 3,761,956 | |

| Outfront Media, Inc. | 211,128 | 5,605,448 | |

| Potlatch Corp. | 136,108 | 6,220,136 | |

| Public Storage | 51,674 | 11,311,955 | |

| SBA Communications Corp. Class A (a) | 122,091 | 14,696,094 | |

| Weyerhaeuser Co. | 273,914 | 9,307,598 | |

| 151,830,646 | |||

| TOTAL EQUITY REAL ESTATE INVESTMENT TRUSTS (REITS) | 501,700,162 | ||

| Hotels, Restaurants & Leisure - 0.2% | |||

| Hotels, Resorts & Cruise Lines - 0.2% | |||

| Marriott International, Inc. Class A | 58,800 | 5,537,784 | |

| Insurance - 13.7% | |||

| Insurance Brokers - 1.6% | |||

| Brown & Brown, Inc. | 200,000 | 8,344,000 | |

| Willis Group Holdings PLC | 291,800 | 38,193,702 | |

| 46,537,702 | |||

| Life & Health Insurance - 2.0% | |||

| Torchmark Corp. | 729,400 | 56,192,976 | |

| Multi-Line Insurance - 1.0% | |||

| American Financial Group, Inc. | 233,700 | 22,299,654 | |

| American International Group, Inc. | 100,000 | 6,243,000 | |

| 28,542,654 | |||

| Property & Casualty Insurance - 7.9% | |||

| Allstate Corp. | 747,800 | 60,938,222 | |

| Chubb Ltd. | 540,000 | 73,575,000 | |

| FNF Group | 900,000 | 35,046,000 | |

| The Travelers Companies, Inc. | 444,000 | 53,519,760 | |

| 223,078,982 | |||

| Reinsurance - 1.2% | |||

| Reinsurance Group of America, Inc. | 257,000 | 32,633,860 | |

| TOTAL INSURANCE | 386,986,174 | ||

| IT Services - 1.6% | |||

| Data Processing & Outsourced Services - 1.6% | |||

| Visa, Inc. Class A | 373,900 | 33,228,493 | |

| WEX, Inc. (a) | 125,000 | 12,937,500 | |

| 46,165,993 | |||

| Mortgage Real Estate Investment Trusts - 0.1% | |||

| Mortgage REITs - 0.1% | |||

| American Capital Mortgage Investment Corp. | 102,200 | 1,711,850 | |

| Real Estate Management & Development - 0.7% | |||

| Real Estate Development - 0.1% | |||

| Howard Hughes Corp. (a) | 34,576 | 4,054,036 | |

| Real Estate Operating Companie - 0.1% | |||

| Kennedy-Wilson Holdings, Inc. | 67,450 | 1,497,390 | |

| Real Estate Services - 0.5% | |||

| CBRE Group, Inc. (a) | 309,202 | 10,757,138 | |

| Invitation Homes, Inc. | 180,100 | 3,931,583 | |

| 14,688,721 | |||

| TOTAL REAL ESTATE MANAGEMENT & DEVELOPMENT | 20,240,147 | ||

| Thrifts & Mortgage Finance - 0.8% | |||

| Thrifts & Mortgage Finance - 0.8% | |||

| MGIC Investment Corp. (a) | 1,158,000 | 11,730,540 | |

| Radian Group, Inc. | 530,495 | 9,527,690 | |

| Washington Mutual, Inc. (a) | 155,200 | 2 | |

| 21,258,232 | |||

| TOTAL COMMON STOCKS | |||

| (Cost $2,138,797,835) | 2,748,364,807 | ||

| Money Market Funds - 2.5% | |||

| Fidelity Cash Central Fund, 0.84% (c) | 68,668,856 | 68,682,590 | |

| Fidelity Securities Lending Cash Central Fund 0.84% (c)(d) | 1,876,862 | 1,877,050 | |

| TOTAL MONEY MARKET FUNDS | |||

| (Cost $70,559,640) | 70,559,640 | ||

| TOTAL INVESTMENT PORTFOLIO - 99.9% | |||

| (Cost $2,209,357,475) | 2,818,924,447 | ||

| NET OTHER ASSETS (LIABILITIES) - 0.1% | 2,746,950 | ||

| NET ASSETS - 100% | $2,821,671,397 |

Legend

(a) Non-income producing

(b) Security or a portion of the security is on loan at period end.

(c) Affiliated fund that is generally available only to investment companies and other accounts managed by Fidelity Investments. The rate quoted is the annualized seven-day yield of the fund at period end. A complete unaudited listing of the fund's holdings as of its most recent quarter end is available upon request. In addition, each Fidelity Central Fund's financial statements are available on the SEC's website or upon request.

(d) Investment made with cash collateral received from securities on loan.

Affiliated Central Funds

Information regarding fiscal year to date income earned by the Fund from investments in Fidelity Central Funds is as follows:

| Fund | Income earned |

| Fidelity Cash Central Fund | $133,953 |

| Fidelity Securities Lending Cash Central Fund | 3,969 |

| Total | $137,922 |

Investment Valuation

The following is a summary of the inputs used, as of March 31, 2017, involving the Fund's assets and liabilities carried at fair value. The inputs or methodology used for valuing securities may not be an indication of the risk associated with investing in those securities. For more information on valuation inputs, and their aggregation into the levels used below, please refer to the Investment Valuation section in the accompanying Notes to Financial Statements.

| Valuation Inputs at Reporting Date: | ||||

| Description | Total | Level 1 | Level 2 | Level 3 |

| Investments in Securities: | ||||

| Common Stocks | $2,748,364,807 | $2,748,364,805 | $-- | $2 |

| Money Market Funds | 70,559,640 | 70,559,640 | -- | -- |

| Total Investments in Securities: | $2,818,924,447 | $2,818,924,445 | $-- | $2 |

See accompanying notes which are an integral part of the financial statements.

Fidelity® Financials Central Fund

Financial Statements

Statement of Assets and Liabilities

| March 31, 2017 (Unaudited) | ||

| Assets | ||

| Investment in securities, at value (including securities loaned of $1,833,454) — See accompanying schedule: Unaffiliated issuers (cost $2,138,797,835) | $2,748,364,807 | |

| Fidelity Central Funds (cost $70,559,640) | 70,559,640 | |

| Total Investments (cost $2,209,357,475) | $2,818,924,447 | |

| Receivable for investments sold | 20,892,365 | |

| Receivable for fund shares sold | 353,307 | |

| Dividends receivable | 3,798,177 | |

| Distributions receivable from Fidelity Central Funds | 33,635 | |

| Total assets | 2,844,001,931 | |

| Liabilities | ||

| Payable to custodian bank | $360 | |

| Payable for investments purchased | 18,940,856 | |

| Payable for fund shares redeemed | 1,477,556 | |

| Other payables and accrued expenses | 34,712 | |

| Collateral on securities loaned | 1,877,050 | |

| Total liabilities | 22,330,534 | |

| Net Assets | $2,821,671,397 | |

| Net Assets consist of: | ||

| Paid in capital | $2,089,978,153 | |

| Undistributed net investment income | 6,201,333 | |

| Accumulated undistributed net realized gain (loss) on investments and foreign currency transactions | 115,923,073 | |

| Net unrealized appreciation (depreciation) on investments and assets and liabilities in foreign currencies | 609,568,838 | |

| Net Assets, for 28,710,601 shares outstanding | $2,821,671,397 | |

| Net Asset Value, offering price and redemption price per share ($2,821,671,397 ÷ 28,710,601 shares) | $98.28 |

See accompanying notes which are an integral part of the financial statements.

Statement of Operations

| Six months ended March 31, 2017 (Unaudited) | ||

| Investment Income | ||

| Dividends | $24,332,563 | |

| Income from Fidelity Central Funds (including $3,969 from security lending) | 137,922 | |

| Total income | 24,470,485 | |

| Expenses | ||

| Custodian fees and expenses | $34,775 | |

| Independent directors' fees and expenses | 5,575 | |

| Interest | 628 | |

| Total expenses before reductions | 40,978 | |

| Expense reductions | (5,642) | 35,336 |

| Net investment income (loss) | 24,435,149 | |

| Realized and Unrealized Gain (Loss) | ||

| Net realized gain (loss) on: | ||

| Investment securities: | ||

| Unaffiliated issuers | 119,522,762 | |

| Fidelity Central Funds | 4,353 | |

| Foreign currency transactions | (1,052) | |

| Total net realized gain (loss) | 119,526,063 | |

| Change in net unrealized appreciation (depreciation) on: Investment securities | 287,155,491 | |

| Assets and liabilities in foreign currencies | 5,703 | |

| Total change in net unrealized appreciation (depreciation) | 287,161,194 | |

| Net gain (loss) | 406,687,257 | |

| Net increase (decrease) in net assets resulting from operations | $431,122,406 |

See accompanying notes which are an integral part of the financial statements.

Statement of Changes in Net Assets

| Six months ended March 31, 2017 (Unaudited) | Year ended September 30, 2016 | |

| Increase (Decrease) in Net Assets | ||

| Operations | ||

| Net investment income (loss) | $24,435,149 | $46,307,844 |

| Net realized gain (loss) | 119,526,063 | (13,282,024) |

| Change in net unrealized appreciation (depreciation) | 287,161,194 | 119,841,902 |

| Net increase (decrease) in net assets resulting from operations | 431,122,406 | 152,867,722 |

| Distributions to shareholders from net investment income | (18,233,816) | (43,616,969) |

| Distributions to shareholders from net realized gain | (3,602,990) | – |

| Total distributions | (21,836,806) | (43,616,969) |

| Affiliated share transactions | ||

| Proceeds from sales of shares | 181,566,544 | 345,722,943 |

| Reinvestment of distributions | 21,836,622 | 43,616,590 |

| Cost of shares redeemed | (335,068,607) | (255,720,898) |

| Net increase (decrease) in net assets resulting from share transactions | (131,665,441) | 133,618,635 |

| Total increase (decrease) in net assets | 277,620,159 | 242,869,388 |

| Net Assets | ||

| Beginning of period | 2,544,051,238 | 2,301,181,850 |

| End of period | $2,821,671,397 | $2,544,051,238 |

| Other Information | ||

| Undistributed net investment income end of period | $6,201,333 | $– |

| Shares | ||

| Sold | 1,954,544 | 4,203,336 |

| Issued in reinvestment of distributions | 235,812 | 519,116 |

| Redeemed | (3,502,197) | (3,158,480) |

| Net increase (decrease) | (1,311,841) | 1,563,972 |

See accompanying notes which are an integral part of the financial statements.

Financial Highlights — Fidelity Financials Central Fund

| Six months ended (Unaudited) March 31, | Years ended September 30, | |||||

| 2017 | 2016 | 2015 | 2014 | 2013 | 2012 | |

| Selected Per–Share Data | ||||||

| Net asset value, beginning of period | $84.74 | $80.86 | $83.90 | $72.85 | $58.36 | $44.37 |

| Income from Investment Operations | ||||||

| Net investment income (loss)A | .82 | 1.59 | 1.57 | 1.54 | 1.63 | 1.07 |

| Net realized and unrealized gain (loss) | 13.45 | 3.79 | (3.30) | 10.84 | 14.22 | 13.82 |

| Total from investment operations | 14.27 | 5.38 | (1.73) | 12.38 | 15.85 | 14.89 |

| Distributions from net investment income | (.61) | (1.50) | (1.31) | (1.33) | (1.36) | (.90) |

| Distributions from net realized gain | (.12) | – | – | – | – | – |

| Total distributions | (.73) | (1.50) | (1.31) | (1.33) | (1.36) | (.90) |

| Net asset value, end of period | $98.28 | $84.74 | $80.86 | $83.90 | $72.85 | $58.36 |

| Total ReturnB,C | 16.89% | 6.68% | (2.18)% | 17.08% | 27.41% | 33.71% |

| Ratios to Average Net AssetsD,E | ||||||

| Expenses before reductions | - %F,G | - %G | - %G | - %G | .01% | .01% |

| Expenses net of fee waivers, if any | - %F,G | - %G | - %G | - %G | .01% | .01% |

| Expenses net of all reductions | - %F,G | - %G | - %G | - %G | .01% | .01% |

| Net investment income (loss) | 1.75%F | 1.94% | 1.80% | 1.92% | 2.44% | 1.97% |

| Supplemental Data | ||||||

| Net assets, end of period (000 omitted) | $2,821,671 | $2,544,051 | $2,301,182 | $2,387,026 | $1,956,278 | $1,400,699 |

| Portfolio turnover rateH | 61%F,I | 57% | 40% | 43%I | 249%I | 383% |

A Calculated based on average shares outstanding during the period.

B Total returns for periods of less than one year are not annualized.

C Total returns would have been lower if certain expenses had not been reduced during the applicable periods shown.

D Fees and expenses of any underlying Fidelity Central Funds are not included in the Fund's expense ratio. The Fund indirectly bears its proportionate share of the expenses of any underlying Fidelity Central Funds.

E Expense ratios reflect operating expenses of the Fund. Expenses before reductions do not reflect amounts reimbursed by the investment adviser or reductions from expense offset arrangements and do not represent the amount paid by the Fund during periods when reimbursements or reductions occur. Expenses net of fee waivers reflect expenses after reimbursement by the investment adviser but prior to reductions from expense offset arrangements. Expenses net of all reductions represent the net expenses paid by the Fund.

F Annualized

G Amount represents less than .005%.

H Amount does not include the portfolio activity of any underlying Fidelity Central Funds.

I Portfolio turnover rate excludes securities received or delivered in-kind.

See accompanying notes which are an integral part of the financial statements.

Fidelity® Health Care Central Fund

Investment Summary (Unaudited)

Top Ten Stocks as of March 31, 2017

| % of fund's net assets | % of fund's net assets 6 months ago | |

| Amgen, Inc. | 8.6 | 6.8 |

| Allergan PLC | 7.6 | 7.9 |

| Medtronic PLC | 7.3 | 10.0 |

| UnitedHealth Group, Inc. | 5.9 | 3.6 |

| Boston Scientific Corp. | 5.2 | 5.0 |

| Alexion Pharmaceuticals, Inc. | 3.7 | 3.1 |

| Anthem, Inc. | 3.6 | 1.7 |

| Bristol-Myers Squibb Co. | 3.6 | 1.4 |

| Vertex Pharmaceuticals, Inc. | 3.3 | 3.6 |

| Intuitive Surgical, Inc. | 2.5 | 2.6 |

| 51.3 |

Top Industries (% of fund's net assets)

| As of March 31, 2017 | ||

| Biotechnology | 28.8% | |

| Health Care Equipment & Supplies | 23.7% | |

| Pharmaceuticals | 19.8% | |

| Health Care Providers & Services | 19.7% | |

| Health Care Technology | 2.9% | |

| All Others* | 5.1% | |

| As of September 30, 2016 | ||

| Biotechnology | 28.4% | |

| Health Care Equipment & Supplies | 28.2% | |

| Pharmaceuticals | 21.3% | |

| Health Care Providers & Services | 15.0% | |

| Health Care Technology | 3.1% | |

| All Others* | 4.0% | |

* Includes short-term investments and net other assets (liabilities).

Fidelity® Health Care Central Fund

Investments March 31, 2017 (Unaudited)

Showing Percentage of Net Assets

| Common Stocks - 97.0% | |||

| Shares | Value | ||

| Biotechnology - 28.8% | |||

| Biotechnology - 28.8% | |||

| Ablynx NV (a)(b) | 660,000 | $8,199,105 | |

| AC Immune SA (b) | 178,800 | 1,852,368 | |

| ACADIA Pharmaceuticals, Inc. (a) | 60,000 | 2,062,800 | |

| Acorda Therapeutics, Inc. (a) | 400,000 | 8,400,000 | |

| Advanced Accelerator Applications SA sponsored ADR (a) | 150,000 | 5,979,000 | |

| Advaxis, Inc. (a)(b) | 600,000 | 4,902,000 | |

| Alexion Pharmaceuticals, Inc. (a) | 630,000 | 76,381,200 | |

| Alnylam Pharmaceuticals, Inc. (a) | 126,711 | 6,493,939 | |

| Amgen, Inc. | 1,080,000 | 177,195,597 | |

| Amicus Therapeutics, Inc. (a)(b) | 1,220,000 | 8,698,600 | |

| Array BioPharma, Inc. (a) | 690,000 | 6,168,600 | |

| Ascendis Pharma A/S sponsored ADR (a) | 200,000 | 5,600,000 | |

| BeiGene Ltd. ADR (a) | 84,093 | 3,078,645 | |

| BioMarin Pharmaceutical, Inc. (a) | 400,000 | 35,112,000 | |

| bluebird bio, Inc. (a) | 43,000 | 3,908,700 | |

| Blueprint Medicines Corp. (a) | 220,000 | 8,797,800 | |

| Celgene Corp. (a) | 52,000 | 6,470,360 | |

| Cellectis SA sponsored ADR (a) | 148,000 | 3,552,000 | |

| China Biologic Products, Inc. (a) | 70,000 | 7,009,100 | |

| Curis, Inc. (a) | 1,200,000 | 3,336,000 | |

| Cytokinetics, Inc. (a) | 366,475 | 4,709,204 | |

| CytomX Therapeutics, Inc. (a) | 93,500 | 1,614,745 | |

| Five Prime Therapeutics, Inc. (a) | 105,387 | 3,809,740 | |