UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

|

[X]

|

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

For the fiscal year ended December 31, 2011

Or

[ ] TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES

EXCHANGE ACT OF 1934

For the transition period from _________ to _____________

Commission file number: 000-51139

TWO RIVERS WATER COMPANY

(Exact name of registrant as specified in its charter)

|

Colorado

|

13-4228144

|

|

|

State or other jurisdiction of incorporation or organization

|

I.R.S. Employer Identification No.

|

|

|

2000 South Colorado Boulevard, Annex Ste. 420,

Denver, CO 80222

|

||

|

(Address of principal executive offices) (Zip Code)

|

||

|

Registrant’s telephone number, including area code:

(303) 222-1000

|

||

|

Securities registered pursuant to Section 12(b) of the Act:

|

||

|

Title of each class registered

|

Name of each exchange on which registered

|

|

|

Not Applicable

|

Not Applicable

|

|

|

Securities registered pursuant to Section 12(g) of the Act:

|

||

|

Common Stock

(Title of class)

|

i

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes |_| No |X|

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

Yes |X| No |_|

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes |X| No |_|

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data file required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

Yes |X| No |_|

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (ss. 229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. |X|

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check One).

|

Large accelerated filer

|

[___]

|

Accelerated filer

|

[___]

|

|

|

Non-accelerated filer

(Do not check if a smaller reporting company)

|

[___]

|

Smaller reporting company

|

[X]

|

Indicate by check mark whether the Registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes |_| No |X|

The aggregate market value of voting stock held by non-affiliates of the registrant was approximately $40,472,000 as of December 31, 2011.

There were 23,616,824 shares outstanding of the registrant's Common Stock as of March 5, 2012.

ii

[Missing

Two Rivers Water Company 2011 Annual Report - 10K

iii

|

PART I

|

|||

|

Page

|

|||

|

Business

|

1

|

||

|

Risk Factors

|

14

|

||

|

Unresolved Staff Comments

|

22

|

||

|

Properties

|

22

|

||

|

Legal Proceedings

|

24

|

||

|

Mine Safety Disclosures

|

24

|

||

|

PART II

|

|||

|

Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities

|

25

|

||

|

Selected Financial Data

|

29

|

||

|

Management’s Discussion and Analysis of Financial Condition and Results of Operations

|

30

|

||

|

Quantitative and Qualitative Disclosures About Market Risk

|

38

|

||

|

Financial Statements and Supplementary Data

|

38

|

||

|

Changes in and Disagreements with Accountants on Accounting and Financial Disclosure

|

38

|

||

|

Controls and Procedures

|

38

|

||

|

Controls and Procedures

|

39

|

||

|

ITEM 9B

|

Other Information

|

40

|

|

|

PART III

|

|||

|

Directors, Executive Officers, and Corporate Governance

|

41

|

||

|

Executive Compensation

|

45

|

||

|

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters

|

50

|

||

|

Certain Relationships and Related Transactions, and Director Independence

|

51

|

||

|

Principal Accounting Fees and Services

|

52

|

||

|

PART IV

|

|||

|

Exhibits Listing

|

53

|

||

|

55

|

|||

|

57

|

|||

|

54

|

|||

Two Rivers Water Company 2011 Annual Report - 10K

iv

|

|

Bibliography

|

|

|

Colorado Foundation for Water Education. (2009). Citizens Guide to Colorado Water Law. Denver : Colorado Foundation for Water Education.

|

|

|

Colorado Springs Utiltiies . (2009). Southern Delivery System. Retrieved Feburary 17, 2012, from http://www.sdswater.org/overview.asp

|

|

|

Colorado Water Consveration Board. (2011). Colorado's Water Supply Future. Denver: Colorado Water Conservation Board.

|

|

|

Driscoll, G. M. (2011, January 7). Front Range Water Planning Supply Update: Increased Storage, Increased Demands, Incerased Transmountain Diversions. Carbondale: Elk Mountain Consulting. Retrieved February 17, 2012, from http://www.rwapa.org/reports/Front_Range_Water_Supply_Planning_Update_(Final)11011.pdf

|

|

|

Finley, B. (2012, Feburary 17). The Denver Post. EPA wants further review of water diversion project to protect the Colorado River, p. 3.

|

|

|

Grantham, J. (2011). Time to Wake Up: Days of Abundant Resources and Falling Prices are Over. GMO, 18.

|

|

|

U.S. Department of the Interior Bureau of Reclamation . (2005, October ). SDS EIS Newsletter. Southern Delivery System Project, p. 5.

|

Two Rivers Water Company 2011 Annual Report - 10K

v

Unless the context requires otherwise, references in this document to “Two Rivers Water Company,” “We,” “Our,” “Us” or the “Company” is to Two Rivers Water Company and its subsidiaries.

Note about Forward-Looking Statements

This Form 10-K contains forward-looking statements, such as statements relating to our financial condition, results of operations, plans, objectives, future performance and business operations. These statements relate to expectations concerning matters that are not historical facts. These forward-looking statements reflect our current views and expectations based largely upon the information currently available to us and are subject to inherent risks and uncertainties. Although we believe our expectations are based on reasonable assumptions, they are not guarantees of future performance and there are a number of important factors that could cause actual results to differ materially from those expressed or implied by such forward-looking statements. By making these forward-looking statements, we do not undertake to update them in any manner except as may be required by our disclosure obligations in filings we make with the Securities and Exchange Commission under the federal securities laws. Our actual results may differ materially from our forward-looking statements.

PART I

Summary

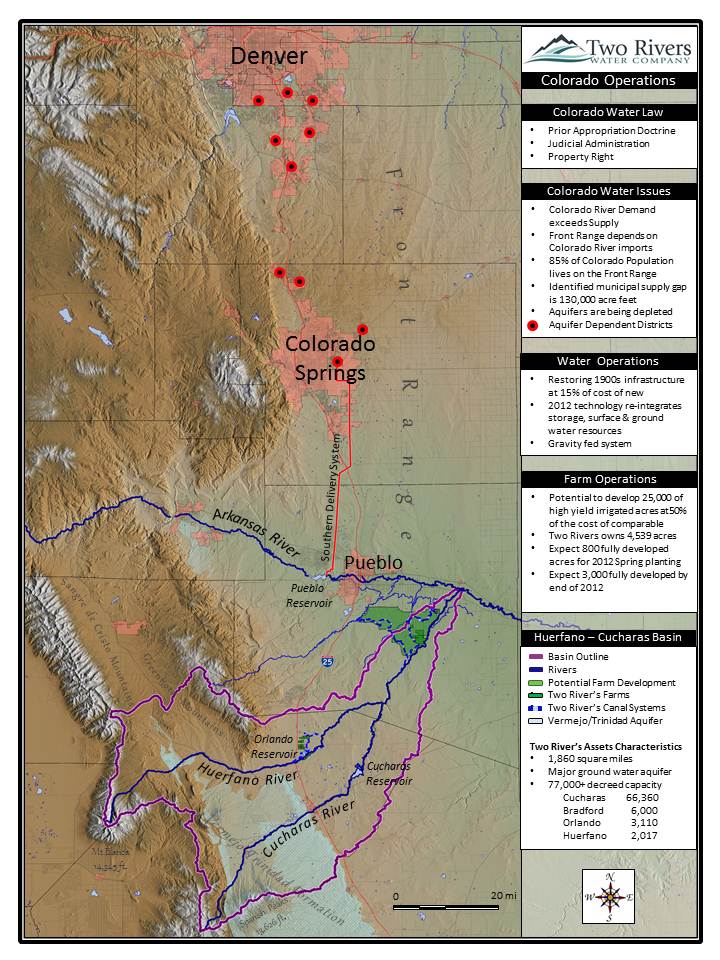

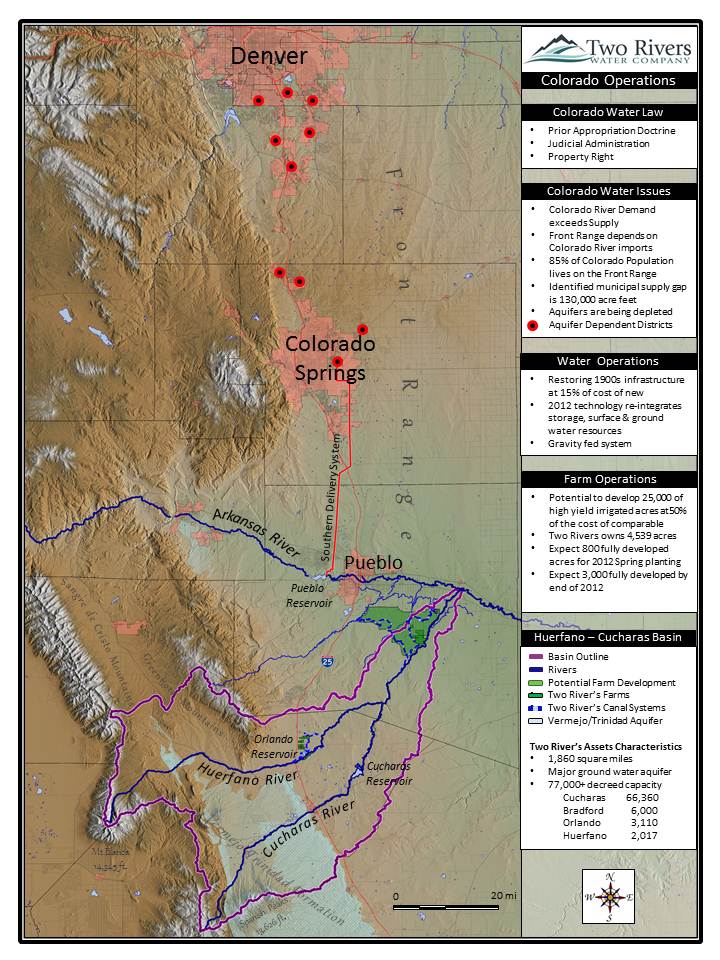

Two Rivers Water Company acquires and develops high yield irrigated farmland and associated water rights and infrastructure in the watershed of the Huerfano and Cucharas Rivers in Southeastern Colorado. This combined watershed encompasses approximately 1,860 square miles and extends from the eastern crest of the Continental Divide in the Spanish Peaks and Sangre de Christo Mountains to the Huerfano River’s confluence with the Arkansas River, just downstream of Pueblo, Colorado. The elevations in the watershed thus begin at more than 14,000 feet above sea level to approximately 4,500 feet at the confluence. As noted, the Huerfano and Cucharas Rivers are tributaries of the Arkansas River, which, in turn, is a tributary of the Mississippi River. The Arkansas River basin is subject to legal administration under the 1948 compact between Colorado and Kansas.

In acquiring land and water assets in the Huerfano/Cucharas watershed, the Company plans to create an integrated system in which our farming assets and water assets work in synergy. Our primary focus is the profitable production of annual crops. As we build our agriculture business, we also acquire agriculture water rights. In times of municipal need, we can deploy rotational farm fallowing and other conservation methods so as to reduce the need for irrigation water and thereby make surplus water available to support water users along Colorado’s Front Range. Thus, our secondary focus is to integrate our water system with urban water delivery systems serving the Front Range.

The Company has already acquired and begun to refurbish a significant portfolio of land and water assets, some of which were first brought into use more than 100 years ago. Because older, more senior water rights are accorded preference under Colorado water law and regulation, and because refurbishment of continuously operating facilities is more readily permitted than new construction, redevelopment of mature rights and facilities is economically and operationally preferable to establishing new rights and facilities. Moreover, by managing an integrated land/water system in the watershed, the Company believes it has established a sustainable competitive advantage both in its farming business and in its water supply and management business. The Company seeks to generate profits by developing each of these lines of business in tandem and in long-term balance. However, the Company will require additional capital in order to acquire and refurbish additional assets so as to attain critical mass and achieve positive cash flow.

In 2009 and 2010, the Company accumulated, through a series of transactions, a 91% interest in the Huerfano Cucharas Irrigation Company (“Mutual Ditch Company”), a mutual irrigation company incorporated in 1944. The Company’s acquisition of the Mutual Ditch Company shares involved the payment of cash, the issuance of seller take-back notes and the issuance of 7.5 million shares of the Company’s common stock. The aggregate purchase price, calculated as $22,018,000, is supported by an independent appraisal commissioned by the Company following our acquisition of the Mutual Ditch Company’s shares. Based on our controlling position, the Company has assumed effective management of the Mutual Ditch Company and, along with the residual minority shareholders, is refurbishing an extensive storage and irrigation system to support its farming operations in Huerfano and Pueblo Counties.

In February 2011, the Company also purchased, for a combination of cash and stock, the Orlando Reservoir and Butte Valley water rights as well as a small amount of nearby farmland. During the year ended December 31, 2011, the Company commenced a construction project to refurbish and improve the Orlando Reservoir; the project was completed and successfully tested in February 2012. Similarly, the Company is incrementally refurbishing diversion, storage and distribution facilities throughout its water asset portfolio with the overall objective of improving the portfolio’s efficiency, reliability and operational flexibility.

As of the date of this annual report, the Company has the operable right to store 15,000 acre-feet of water1 within the Huerfano and Cucharas Rivers watershed. When the Company’s reservoirs are fully restored, we will have the operable capacity and legal right to store in excess of 70,000 acre-feet of water. Similarly, based on its portfolio of water rights, some of which are more senior than others, the Company has the right to divert from the natural flows of the two rivers in excess of 90 cubic feet per second. Seasonal variability in the natural flow of the rivers, as well as the priorities of other water users in the system, limits the Company’s ability to divert the decreed amounts of water on a continuous basis. The Company’s current water rights produce a long-term historic average annual diversion of approximately 15,000 acre-feet of water which produces 9,661 acre-feet of consumptive use at the plant, an amount sufficient to fully irrigate approximately 3,000 acres of corn or organic alfalfa.

1 An acre-foot of water is the amount of water required to cover one acre to a depth of one foot. An acre-foot of water contains 325,851 gallons, generally considered enough water to supply two average households for a year. Annual irrigation of alfalfa in Southeastern Colorado consumes approximately three acre-feet of water per acre of crop.

Consumptive use is the transferable component of a water right, and is often the measure of value for a water right. It is measured by the amount of water consumed by the plants. For farmland that has been out of production, the amount can increase over time. However this report shows the current historic consumptive use in our water portfolio.

The Company currently owns approximately 4,600 gross acres of irrigable farmland within the watershed of the Huerfano and Cucharas Rivers. Based on progress in preparing this land for long-term farming, the Company expects that approximately 800 acres of our land will be in production during the 2012 growing season and an additional 2,200 acres of land developed for 2012 fall planting. Each acre of irrigated farmland is capable of producing approximately six tons of alfalfa during a typical annual growing season. The Company plans to acquire and develop in excess of 25,000 acres of such farmland within the Huerfano/Cucharas watershed within the next five years, subject to capital availability and operational constraints.

The Company’s ownership and control of water rights, water storage facilities and diversion canals in proximity to its irrigable farmland gives the Company a unique and sustainable economic advantage within our Southeastern Colorado sphere of farm operations. The Company’s water assets also have inherent advantages compared to other water assets which are tributary to the Arkansas River as a result of our assets’ seniority, entitlements, elevation and proximity to Front Range communities and water conveyance facilities. To capitalize on these advantages, the Company plans to refurbish the Cucharas Reservoir as well as smaller reservoirs currently under our ownership and control which, together with our diversion rights and facilities will allow us to store an additional 55,000 acre-feet of water (over and above our 15,000 acre-feet of currently operable storage) in the two rivers watershed within the next five years. The additional water storage will provide reliability during dry years and dry seasons, enabling the Company to expand our farming operations to maintain balance between irrigable land and available irrigation water.

In February 2012, the Company received approval of a plan that allows use of water leased from Pueblo Board of Water Works to be stored in its reservoirs and used to irrigate farmlands in Huerfano and Pueblo County. The administrative approval follows an application filed in the Water Court by Two Rivers in December 2011 to capture high river flows during the spring runoff to make it available for farming later in the summer. The Pueblo Board of Water Works lease is for a five year period to allow Two Rivers to invest in modernizing its farms and upgrade the condition of the reservoirs. The lease period will also provide an opportunity to collaborate with other regional water purveyors by establishing the validity of the exchange.

Two Rivers Water Company plans to operate two core businesses, organic crop production from potentially high yield irrigated farmland and water supply to municipal markets in Huerfano County and the Front Range of Colorado. The Company’s initial crop production will consist of organic premium to supreme alfalfa hay and, potentially, exchange traded grains. The Company may also initiate production of organic vegetable and fruit crops following further development of its water asset portfolio. Based on rotational farm fallowing and other advanced agronomy, the Company expects to be able to support long-term crop production and to supply water on a highly reliable basis for municipal water users within Southeastern Colorado.

The Company has aggressively expanded operations through various funding mechanisms, which include debt, convertible debt and equity capital. Since inception, the Company has raised and invested over $30 million in assembling and improving assets necessary to support its two integrated businesses. The Company plans to raise an additional $100 million to support expansion over the next five years in order to fully develop the high yield irrigated farmland and water assets within and in proximity to the Huerfano/Cucharas watershed. We cannot make any assurances that we will be able to raise such funds or whether we would be able to raise such funds on terms that are acceptable to us.

The Company is developing a business model whereby it acquires and develops agricultural assets (both land and associated water rights and facilities) to create a profitable, synergistic relationship between crop production and other water uses in the arid western regions of the United States.

Corporate Evolution

Prior to 2009, the Company was named Navidec Financial Services, Inc. (“Navidec”) and had been engaged in mortgage lending and other enterprises unrelated to its current lines of business. The Company was incorporated in the state of Colorado on December 20, 2002. On July 28, 2009, Navidec formed a wholly-owned Colorado corporation for the purpose of acquiring farm and water assets in the Huerfano/Cucharas watershed. On November 19, 2009, with shareholder approval, Navidec changed its name to Two Rivers Water Company.

The Farming and Water Business in Colorado

Water is a scarce and crucial commodity in the Western United States. As world markets present increasing demand for high quality food, the arable land and water required to produce food and fiber make those resources more valuable. In Colorado, both land and water rights are real property rights that transfer by deed. Allocation of water is based on appropriation date; the first date the water was beneficially used, meaning that senior (older) water rights are much more valuable. Colorado’s hydraulic dilemma is that 85% of the water consumed in Colorado is on the Front Range, the east side of the Continental Divide, while 85% of the precipitation falls to the west in the Colorado River basin. Precipitation on the Front Range and water diverted from the Colorado River watershed, drain to the Mississippi through the South Platte and Arkansas Rivers.

The Colorado River supplies water for Arizona, California, Colorado, Nevada, New Mexico, Utah, and Wyoming. Although Colorado reserved the right to consume about 500,000 acre-feet of water per year under the Colorado Compact of 1922, the sustainable use of Colorado River water, particularly through further diversion to the Front Range, has been severely restricted. Because most of the Colorado River Basin States have seen tremendous growth in populations and water demands over the past few decades, Colorado has had to look for other resources to meet the needs of its growing Front Range communities. A substantial but unsustainable portion of the new water demands on the Front Range has been met through pumping water from underground aquifers which, as a result, have become depleted and more expensive to manage. As a further result, many Front Range communities have sought to replace or supplement their groundwater resources with renewable surface water supplies such as those being refurbished by the Company.

Further, the increased world population and rising incomes are increasing the demand for high quality food and fiber, yet there has been a reduction of arable land and pressure on finite water supplies to keep up with this demand. As a result, food production, distribution and prices are experiencing a paradigm shift. (Grantham, 2011, p. 1).

Two Rivers Water Company recognizes this opportunity and is developing an integrated system to re-aggregate and refurbish dispersed water assets and efficiently use them to irrigate farmland. In addition to producing valuable agricultural products, this irrigated farmland can be operated as a flexible “water bank” to support municipal use in Huerfano County and, through exchanges, along the Front Range. Based on the foundation of efficient and independently profitable farming, the Company plans to manage our water assets, through rotational farm fallowing and other farm water conservation techniques, to provide a reliable and affordable source of supplemental water for municipal and industrial use without damaging our farming business. Rotational farm fallowing is an agricultural practice whereby portions of farm acreage are fallowed on a rotational basis each year and thereby allow the water, which would otherwise be used for irrigation to be diverted for alternative beneficial uses.

Water in Colorado’s Front Range

Along the Front Range of Colorado, water is a scarce and valuable resource. Natural precipitation varies widely throughout the year and from one year to another. Rivers which flood with the spring melt from the snowpack in the mountains may be refreshed only with the occasional thunderstorm in the heat of the summer growing season. Annual precipitation also varies between surplus and drought. The resulting variability in stream flows lead to the development of water laws in Colorado.

This legal framework is referred to as the “Prior Appropriation Doctrine.” This doctrine accords priority in times of shortage to the earliest sustained recorded use, so that the most senior water right is assured its full historic allotment before the next most senior right is honored and so on through a reverse hierarchy to the most junior water right on a stream system which may be allowed to exercise its right through diversion only in the wettest period or the wettest years. To manage the Prior Appropriation Doctrine, Colorado maintains both judicial oversight through regional water courts with subject matter expertise and jurisdiction and administrative oversight through the Office of the Sate Engineer. Water rights claims are filed in the court, adjudicated as necessary to resolve any adverse claims, and then decreed though an enforceable judgment. The State Engineer is charged with administering the accorded priorities among the various water rights in each of the State’s river systems.

Colorado water law further recognizes two distinct but related prior appropriative rights: direct diversion rights and storage rights. Direct diversion rights permit a user in priority to divert water directly from the river for immediate beneficial use (such as irrigation); storage rights permit a user in priority to divert water from the river and impound the water in a reservoir to re-time the water for later beneficial use. Thus, in Colorado, a direct diversion right must be conveyed to an immediate use; it cannot be stored without a storage right. As a result, both types of appropriative rights are often paired, when possible, so that in priority diversion rights can re-timed through the exercise of a companion storage right to address seasonal and year-to-year variability in natural supplies. The older the appropriation date of any water right, the more value it holds; similarly, the more effectively a senior diversion right is paired with a senior storage right the more valuable each becomes. A corollary of the Prior Appropriation Doctrine is that appropriated water must be put to a beneficial use (such as irrigation or municipal use) and not wasted.

In addition to the intra-state administration of water flowing in its rivers, Colorado also has inter-state water administration responsibilities because each of its major rivers (the Colorado, the North Platte and the Arkansas) is governed as well by interstate compacts with downstream states. These compacts are subject to judicial review, interpretation and enforcement under the original jurisdiction of the U.S. Supreme Court to resolve disputes among the states. In 1948, Colorado and Kansas reached an agreement that apportioned the water of the Arkansas River; Colorado was apportioned 60% of the water while Kansas is apportioned 40% of the River’s flow (Colorado Foundation for Water Education, 2009, p. 23). In order to comply with Colorado’s obligations under the Arkansas River Compact, therefore, water rights on the Arkansas and its tributaries (including the Huerfano and Cucharas Rivers) are administered to assure the Compact-required water flows at the Colorado-Kansas state line. When necessary, Colorado’s in-state uses are curtailed, in order of priority, to assure compliance with the compact.

The interstate compacts (beginning with the Colorado River Compact of 1922) increased Colorado’s need to husband its apportioned water to meet the needs of its growing population along the Front Range. Trans-basin diversions (primarily tunnels and canals) were developed, under the Prior Appropriation Doctrine, to divert water from one watershed for conveyance to and use in another. Mainly, water from the Colorado River Basin, west of the Continental Divide, was diverted east to meet the water needs along the earlier developing Front Range by so-called “conservancy districts”. These projects began in the 1930’s and, although many have been in operation for decades, some remain incomplete (Driscoll, 2011, p. 3). Increasingly, further trans-basin diversions are limited not only by competing appropriative water rights in the basins of origin but also by increasingly stringent environmental restrictions.

Stymied in their attempts to import additional surface water from distant watersheds, some municipalities and water providers began to rely on inherently unsustainable groundwater “mining” (depleting aquifers for current consumption at a rate in excess of the rate at which natural recharge occurs). After decades of such groundwater mining, many of the aquifers on the Front Range have been severely depleted. Some municipalities also purchased farms with water diversion rights and then ceased irrigating the farmland, transferring the water to their urban uses. Because neither the practice of groundwater mining nor the practice of “buying up and drying up” farmland is sustainable, both Colorado and federal law have placed limits and regulations on both practices.

Recognizing the need for additional water sources along the Front Range, the Colorado Water Conservation Board (“CWCB”) published its 2050 Municipal and Industrial Gap Analysis in 2011. This report estimates that the Arkansas and South Platte basins (essentially the Front Range) have a combined projected by 2050 the average annual supply shortage of 130,000 acre-feet of water (Colorado Water Consveration Board, 2011, p. table 2.2). The difficulty and expense of incremental trans-mountain diversions coupled with the unsustainability of groundwater mining and agricultural-to-urban transfers—as documented by the CWCB—motivates Front Range water purveyors to address the projected gap and to identify and develop inherently scarce renewable sources of water.

As early as 2005, the Colorado General Assembly created basin roundtables to convene regional water purveyors to address the looming municipal supply gap. The roundtables were charged to identify “projects and methods to meet the consumptive and nonconsumptive needs of the basin.” (Colorado House Bill 05-1177). The potential solutions include Identified Plans and Process (“IPP’s”), Conservation, New Supply Development and Alternatives to Agricultural Transfers.

The Arkansas River Basin Roundtable has only a few IPPs to meet the municipal water supply gap identified in its basin. The most significant of the Arkansas Basin IPPs is the Southern Delivery System (SDS), an $800 million, 62-mile water supply pipeline and associated pumping plants currently under construction by a consortium of four regional water purveyors including Colorado Springs. These purveyors will use a portion of the capacity in the SDS to transport water made available to each of them under their respective contracts with the United State Bureau of Reclamation (USBR). (U.S. Department of the Interior Bureau of Reclamation, 2005, p.1) The SDS connects USBR’s Pueblo Reservoir on the Arkansas River, the point of delivery under the USBR contracts, with the purveyors’ service areas. (Colorado Springs Utilities, 2009)

In order to address a portion of the identified gap between forecast supply and demand within the Arkansas Basin and to provide a substitute source of water for Front Range communities that are too reliant on depleted groundwater aquifers, the design and planning for the SDS anticipate that other water purveyors will subscribe for pipeline capacity to transport renewable water supplies to their service areas. (Recommended Terms and Conditions and Mitigation of Project Impacts, Southern Delivery System 1041 Application, March 18, 2009).

The Company has commenced discussions with some of these purveyors to determine whether the Company’s water storage and management assets can be integrated with other water resources to meet a portion of the identified gap between forecast supply and demand along the Front Range. In order to facilitate such collaborative regional water resource planning, in late 2011, the Company filed a water court case seeking authorization for routine exchanges of water between the Company’s storage facilities in the Huerfano/Cucharas watershed and the main stem of the Arkansas River. Through such exchanges, the water management infrastructure developed for and dedicated to the Company’s Farming Business could also support management of the urban water districts’ demand by delivering water to the SDS for transport to such districts’ service areas. In February of 2012, the Office of the State Engineer administratively approved such exchanges as part of the Company’s substitute water supply plan (SWSP). The SWSP is expected to remain in effect until the water court adjudicates the Company’s case. Although no water management agreement has yet been reached, the Company believes that, based on the identified demand for renewable water supplies and the availability of conveyance capacity in the SDS, we will be able to negotiate mutually satisfactory water management contracts with one or more of these purveyors.

Our Farming Business (“Farming Business”)

In the early 1900’s, coal and other mining in Southeastern Colorado was an important industry, which used significant amounts of water to extract and wash the mined aggregate. In many cases, it was also necessary to pump groundwater out of the mines to keep the mine shafts from filling. In both cases, the extracted mineral rich water was drained to the Huerfano and Cucharas Rivers. This continuous artificial augmentation of the flow in the two rivers created an opportunity for farmers downstream to capture and store that water in reservoirs and to distribute it to their fields through a series of ditches.

However, when the region’s mining business faded in the late 1950s, it was no longer necessary to extract water from the mine shafts so that the mines could be worked. Thus, the artificial augmentation of the natural flow of the rivers ceased. As a result, many farmers who had relied on junior water rights to extend their farming operations lost the opportunity to consistently irrigate their fields. With less water and more variability of flows based on natural hydrography, fewer farms survived to support the mutual irrigation efforts and the remaining farms withered as the water management facilities deteriorated for lack of maintenance, renewal and replacement.

Two Rivers Water Company saw the opportunity to apply modern agronomy and sufficient capital to redevelop the main ditch system (still owned and operated in its reduced state by the Mutual Ditch Company) and other ditch systems (e.g., the Orlando Reservoir No. 2 Company, LLC) to deliver sufficient water to revitalize a portion of the neglected farmlands. The Company commenced a program to systematically:

|

·

|

purchase and redevelop available farmland by deep-plowing the fields, laser-leveling the planting areas (to optimize plant absorption and minimize runoff), installing state-of-the-art irrigation facilities, and applying only organic fertilizers,

|

|

·

|

purchase a suite of water rights (including both diversion rights and storage rights),

|

|

·

|

refurbish the historic ditch systems and reservoirs to restore and upgrade their efficiency,

|

|

·

|

re-establish a sustainable and profitable farming enterprise which could achieve the scale required by modern farming methods and which could put the revived water supply to consistent beneficial use,

|

|

·

|

develop a customer base to consistently buy the farms’ output at prices sufficient to generate profits, and

|

|

·

|

build a reliable, integrated water supply system capable of serving both agricultural and urban needs.

|

In redeveloping our farmland, we deploy state-of-the-art methods and equipment with the aim of optimizing product yield, water efficiencies, and labor inputs. In addition, by using organic compost as fertilizer and by exercising USDA organic farming practices we will be able to maintain a high quality product with optimal yields. Based on our farming methods and standards, in 2011, Two Rivers Water Company was able to enter into an alfalfa supply contract with a large organic dairy. The contract commits the dairy to purchase all the alfalfa grown by the Company on up to 5,000 acres and includes provisions to expand that commitment on mutually agreeable terms as the Company expands its Farming Business. The Company expects to meet the dairy’s high standards for the alfalfa feed based on our farms’ relatively high elevations, modern agronomy, organic farm practices and mineral rich irrigation water.

Our Water Business (“Water Business”)

Two Rivers Water Company owns and operates various senior water rights in the Huerfano/Cucharas watershed, which we use or plan to use to irrigate our farmland. This diversified portfolio is made up of a combination of direct flow rights and storage rights.

Table 1 – Surface rights owned by the Company

|

Structure

|

Elevation

|

Priority No.

|

Appropriation Date

|

Consumptive Use

|

Decreed Amount

|

|

Butte Valley Ditch

|

5,909 ft

|

1

|

5/15/1862

|

360 A.F.

|

1.2 cfs

|

|

Butte Valley Ditch

|

9

|

5/15/1865

|

1.8 cfs

|

||

|

Butte Valley Ditch

|

86

|

5/15/1886

|

3.0 cfs

|

||

|

Butte Valley Ditch

|

111

|

5/15/1886

|

3.0 cfs

|

||

|

Robert Rice Ditch

|

5,725 ft

|

19

|

3/01/1867

|

131 A.F.

|

3.0 cfs

|

|

Huerfano Valley Ditch

|

4,894 ft

|

120

|

2/2/1888

|

2,891 A.F.

|

42.0 cfs

|

|

Huerfano Valley Ditch

|

342

|

5/1/1905

|

18.0 cfs

|

Table 2 – Storage rights owned by the Company

|

Structure

|

Elevation

|

Priority No.

|

Appropriation Date

|

Consumptive Use

|

Decreed Amount

|

|

Huerfano Valley Reservoir

|

4,702 ft

|

6

|

2/2/1888

|

1,424 A.F.

|

2,017 A.F.

|

|

Cucharas Valley Reservoir

|

5,570 ft

|

66

|

3/14/1906

|

3,055 A.F.

|

31,956 A.F.

|

|

Cucharas Valley Reservoir*

|

5,705 ft

|

66c

|

3/14/1906

|

34,404 A.F.

|

|

|

Bradford Reservoir

|

5,850 ft

|

64.5

|

12/15/1905

|

-

|

6,000 A.F.

|

|

Orlando Reservoir # 2

|

5,911 ft

|

349

|

12/14/1905

|

1,800 A.F.

|

3,110 A.F.

|

* A conditional right is a place holder while the engineering and construction of structures are completed to perfect a water right, in this case, to physically store the water. The conditional right establishes a seniority date but allows time for completion of the project. Conditional rights are reviewed every six years by the water court to confirm that progress is being made on the effort to perfect the right. When a conditional water right is perfected, which can be done incrementally in the case of storage, the water right becomes absolute.

Because the Company’s water rights and operating structures are located at succeeding elevations in the watershed, the system moves water supplies from point of diversion, through storage, to place of use primarily by means of gravity, making the Company’s system far more economical to operate than systems requiring energy to pump water for beneficial use.

In order to use these rights and structures most efficiently, the Company has planned and begun to implement a program of renovation and integration. For example, the Company began construction of new outlet works for the 1905 Orlando Reservoir in November of 2011. The work was completed and successfully tested in February of 2012, approximately a year after the Company’s acquisition. Also in February of 2012, the Company commenced re-construction of the diversion structure, which takes water from the Huerfano River for storage in the Orlando reservoir, and to irrigate the Company’s nearby farmland. Pictures of the recent projects are posted on the Company’s website, http://www.2riverswater.com/projects.html.

Additional water facility renovation projects are planned on a phased basis as necessary to provide reliable irrigation for the Company’s expanding farming operations. The all-in cost for acquisition and renovation of these facilities is much less than the cost required to build new facilities (even if associated water rights were available), because rehabilitating “grandfathered” structures does not require the same kind and scope of analysis and permitting demanded for new facilities under more recent state and federal laws. In addition, the Company has been able to take advantage of private contracting, value engineering and off-peak scheduling to reduce the cost of its renovation projects.

Also during 2011, Two Rivers Water Company developed and filed two water court cases (District Court, Water Division 2, Colorado) designed to improve the overall efficiency of the emerging system. The first water court case, designated 11CW94, seeks approval of the Company’s plan to divert and store water even when its rights are not in priority by replacing the water downstream pursuant to a replacement water contract with the Pueblo Board of Water Works. Although the water court’s ultimate approval to routinely carried out, such an exchange awaits the completion of the judicial process. The Office of the State Engineer administratively granted a temporary substitute water supply plan (“SWSP”) implementing such an exchange until the case is adjudicated. Under the SWSP, the Company will be allowed to capture Huerfano River water this spring for upstream storage and later use, even when our rights are not in priority. To avoid injury to senior water rights which have priority over the Company’s rights during the period of the exchange, the Pueblo Board of Water Works will release water pursuant to the replacement water contract upon the order of the Company. By means of such exchanges, the Company plans to eventually integrate its water supply system with the overall water use and delivery systems served by the Arkansas River and its tributaries.

The second water court case, 11CW96, seeks changes to the place of use point of diversion for the Robert Rice Ditch (Water Right No. 19). The proposed changes would not only increase the flexibility of the Company’s water system but would also make Company water available to augment supplies for the Huerfano County town of Gardner. The second water court case seeks to allow the Robert Rice Ditch direct diversion water right to be moved to storage in the Orlando Reservoir under the Company’s storage right so that the water can be re-timed and used more efficiently to irrigate the Company’s farmland or, alternatively, to augment Gardner’s depletion of the Huerfano River, thus allowing Gardner to operate its municipal wells in the winter.

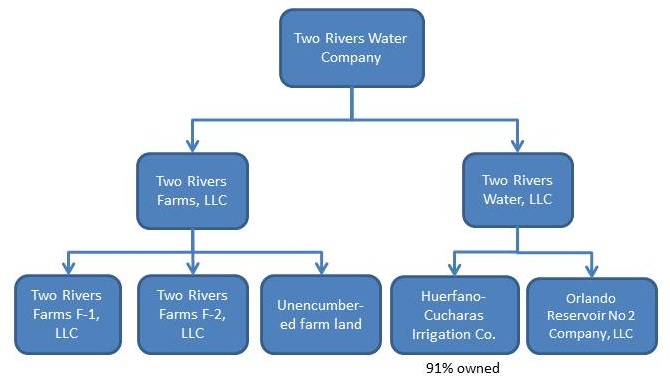

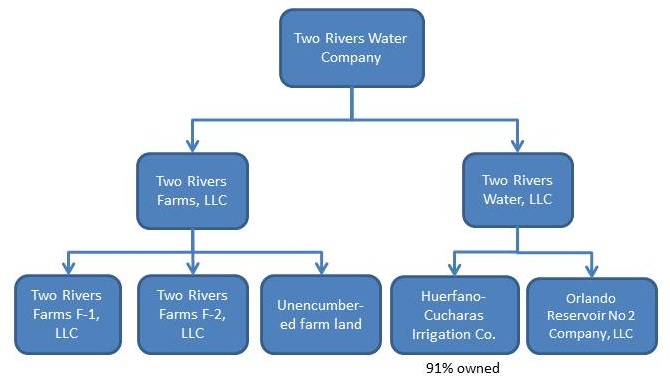

Two Rivers Water Company Corporate Organization

The Company’s organizational structure is illustrated in the above chart. Two Rivers Water Company is the parent company and owns 100% of Two Rivers Farms, LLC and Two Rivers Water, LLC. Two Rivers Farms owns 100% of Two Rivers Farms F-1, LLC and Two Rivers Farms F-2, LLC. Two Rivers Farms also owns unencumbered farmland that will eventually redeveloped and brought into production. Two Rivers Water, LLC owns 91% of the Huerfano-Cucharas Irrigation Company (sometimes referred to elsewhere in this annual report as the Mutual Ditch Company) and 100% of the Orlando Reservoir No. 2 Company LLC.

Two Rivers Farms, LLC (“Farms”) – Our Farming Business

In order to put its water rights and facilities to productive use, the Company formed Farms to manage farms in proximity to our water distribution facilities and has undertaken a program of redeveloping the land, introducing modern agricultural and water management practices including deep plowing, laser leveling and installing efficient irrigation facilities.

During the 2010 growing season, approximately 400 acres of the Company’s land were farmed, primarily for wheat and feed corn, to determine the fertility of the soil and the most efficient and cost effective means of irrigation.

During 2011, the Company developed innovative ways to add irrigable acreage. As a result, the Company developed 533 acres in 2011. These additions increased the Company’s farmable acreage to 713. However, because of the extensive drought in the area Farms did not produce a 2011 crop.

Two Rivers Farms F-1, LLC (“F-1”) and Two Rivers Farms F-2, LLC (“F-2”)

On January 21, 2011 the Company formed F-1 to hold certain farming assets and as an entity to raise debt financing for the Company’s expansion of the Farming Business. In February 2011, F-1 sold $2,000,000 in 5% per annum, 3-year convertible promissory notes that also participates in 1/3 of the crop profit from the related land. Proceeds from these notes were used to acquire improve irrigation systems, pay for the farmland and retire seller carry-back debt from the purchase of the Mutual Ditch Company. This allowed water available through the Mutual Ditch Company to be used to irrigate the F-1 farms without encumbrance.

On April 5, 2011 the Company formed F-2 to hold certain farming and water assets and as an entity to raise additional debt for the Company’s expansion of the Farming Business. During the summer of 2011, F-2 sold $5,332,000 in 6% per annum, 3-year convertible promissory notes that also participates in 10% of the crop revenue from the related lands. Further, for each $2.50 borrowed, the lender received a warrant to purchase one common share of the Company’s stock at $2.50. These warrants expire December 31, 2012. Proceeds from these notes were used to acquire the Orlando and additional farmland and to install irrigation systems.

Both F-1 and F-2 lease their farmland and farming assets to Farms as the operator of the Company’s farming activities.

Two Rivers Water Company, LLC (“TR Water”) – our Water Business

During 2011, the Company formed TR Water to secure additional water rights, rehabilitate water diversion, conveyance and storage facilities and to develop one or more special water districts.

The Huerfano-Cucharas Irrigation Company (“Mutual Ditch Company”)

In order to supply its farms with irrigation water, the Company began to acquire shares in the Mutual Ditch Company, a historic mutual ditch company formed by area farmers in order to develop and put to use their water rights on the two rivers. At the time the historic Mutual Ditch Company was formed in 1944, the water in the two rivers was continuously augmented by groundwater pumped from coal mines that operated in the watershed. The augmented and natural flow of the rivers, along with the water rights and facilities of the Mutual Ditch Company were sufficient to provide reliable irrigation water for the Mutual Ditch Company shareholders and their expanding farm enterprises. However, in the years following World War II, the mines began to cease production and, therefore, stopped pumping groundwater out of the mine shafts and into the river channels. As a result of the reduction in downstream flow in the rivers, the extent of farming in the watershed could no longer be reliably irrigated. In some years, crops failed for lack of late summer irrigation water and, over time, once thriving farms withered. Because of such failures and the reduced flow in the rivers, the shareholders of the Mutual Ditch Company were unable or unwilling to adequately maintain the water diversion, conveyance and storage facilities. Therefore, at the time the Company decided to invest in the Huerfano/Cucharas watershed, the shares in the Mutual Ditch Company had become less valuable and the residual farming in the area had reverted primarily to pasture and dry grazing.

Beginning in 2009, the Company systematically acquired shares in the Mutual Ditch Company and, as of December 31, 2010, had acquired 91% of the shares, which it continues to own. The shares were acquired from willing sellers in a series of arm’s length, negotiated transactions for cash and the Company’s common shares. As the controlling shareholder, the Company currently operates the Mutual Ditch Company and has undertaken a long-term program to refurbish and restore the historic water management facilities. Based on an independent appraisal delivered on September 30, 2010 and giving effect to investments and operating results since then, the Company’s interest in the historic Mutual Ditch Company had a book value, measured through fair value accounting, of $24,196,000, on December 31, 2011. The Mutual Ditch Company assets, liabilities and results are consolidated in the Company’s financial statements.

Orlando Reservoir No. 2 Company, LLC (“Orlando”)

Orlando is a Colorado limited liability company originally formed to divert water from the Huerfano River, for storage in the Orlando Reservoir to be re-timed and used for irrigation of farmland in Huerfano and Pueblo Counties. At the time the Company began investing in the Huerfano/Cucharas watershed, Orlando owned the historic diversion structure, a conveyance system and a reservoir and also owned a small amount of irrigable farmland. However, the water facilities were in deteriorated condition. Beginning in January, 2011, through a series of transactions, the latest of which closed on September 7, 2011, the Company acquired 100% ownership of Orlando (through its wholly-owned subsidiary, TR Water) for a combination of cash, stock and seller-financing. Promptly following the acquisition, the Company began the program for refurbishing the facilities to restore their operating efficiency. The stated purchase price for Orlando was $3,450,000; however, for reporting the financial statements dated September 30, 2011 (and pending the results of the independent appraisal), we used the value of Company stock used as partial consideration, the purchase price was computed as $3,156,750 based on cash paid, the seller carry-back note and 650,000 of the Company’s common shares issued to the seller. The purchase price was allocated $3 million to water assets and $100,000 to farm land. The Company also recorded a forgiveness of debt of $384,000.

Following the purchase of Orlando and considering the refurbishment already underway, the Orlando was independently appraised as of January 16, 2012 at $5,195,000, considering agricultural irrigation as its highest and best use. The gain from the bargain purchase of $1,736,000 was allocated $1,520,000 to water assets and $216,000 to land.

The Orlando assets include not only the reservoir, but also the senior-most direct flow water right on the Huerfano River (the #1 priority), along with the #9 priority and miscellaneous junior water rights. These water rights are now integrated with the Company’s other water rights on the Huerfano and Cucharas River to optimize the natural water supply. In addition, the water storage rights, and the physical storage reservoirs, are critical to water supply reliability in the watershed, because the storage system allows the natural spring runoff from snowmelt to be captured and re-timed for delivery to irrigate crops throughout the growing season. Coupled with the Company’s distribution facilities and farmland, these water diversion and storage rights provide consistent supplies to irrigate and grow our crops.

Discontinued Operations

In early 2009, the Company (then named Navidec Financial Services, Inc.) discontinued its short-term real estate lending and development in an effort to reduce its exposure to credit risk. The wind down of discontinued operations was completed by December 31, 2011.

Competition

The rights to use water in Colorado have been fully appropriated to beneficial uses (such as agriculture irrigation and municipal and industrial applications) under court decrees and state regulation according to the prevailing Prior Appropriation Doctrine in which more senior (older) water rights take precedence in times of shortage over junior (newer) water rights. Notwithstanding significant conservation, growth in Colorado with related incremental demands for water has made the rights to divert, convey, store and use water relatively scarce and valuable. There is significant competition for the acquisition and redeployment of historic water rights. Many competitors for the acquisition of such rights have significantly greater financial resources, technical expertise and managerial capabilities than the Company and, consequently, we could be at a competitive disadvantage in assembling, developing and deploying water assets required to support our businesses. Competitors' resources could overwhelm our efforts and cause adverse consequences to our operational performance. To mitigate such competitive risks, the Company concentrates its efforts in the Huerfano and Cucharas Rivers watershed where its local knowledge and control of a portfolio of water rights, storage facilities, distribution canals and productive farmland create a somewhat protected geographic niche.

Employees

At December 31, 2011, the Company and its subsidiaries employed 12 full-time employees and 3 part-time employees. None of these employees is covered by a collective bargaining agreement. The Chief Executive Officer, the Chief Operating Officer and the Chief Financial Officer have entered into employment agreements with Two Rivers Water Company. We consider our relationship with our employees to be good.

Available Information

The Company’s common stock is traded on the Over the Counter Market under the symbol “TURV.” Our Annual Report on Form 10-K, as well as our quarterly reports on Form 10-Q and current reports on Form 8-K are required to be filed with the Securities and Exchange Commission pursuant to the Securities Exchange Act of 1934, as amended, and they can be found on the Edgar database at www.sec.gov. In addition, our SEC reports are available free of charge from the Company upon written request to Wayne Harding, CFO, Two Rivers Water Company, Annex Ste. 420, 2000 South Colorado Blvd., Denver CO 80222, or you may retrieve investor information by going to the Company’s website at www.2riverswater.com.

Two Rivers can give no assurance of success or profitability to investors.

There is no assurance that the Company will operate profitably. There is no assurance that the Company will generate revenues or profits, or that the market price of its common stock will be increased thereby. During the year ended December 31, 2011, the Company incurred a net loss of $6,112,000, and during the year ended December 31, 2010, the Company recognized a net loss of $9,466,000. The Company’s cumulative net loss from operations since January 1, 2009 is $18,504,000.

Two Rivers has a relatively short operating history, so investors have no way to gauge our long-term performance.

The Company is in the early stages of acquiring farm and water assets. We have not yet produced any significant crops and have not generated any significant revenue. Although the Company has hired experienced personnel, there can be no assurance that the Company will be successful in either our Farming Business or our Water Business.

We may in the future issue more shares which could cause a loss of control by present management and current stockholders and/or dilution to investors.

There may be substantial dilution to our shareholders as a result of future decisions of our Board to issue shares for cash, services, or acquisitions at prices solely determined by our Board. Such issuance, up to the 100 million shares authorized, would not require shareholder approval. Additionally, upon issuance, such shares could represent a majority of the voting power and equity of the Company. The result of such an issuance could be that new stockholders would control the Company and could replace management and otherwise direct the affairs of the Company.

Officers and directors may have conflicts of interest which may not be resolved favorably to the Company.

Our officers and directors have a fiduciary duty of loyalty to disclose to the Company any business opportunities related to our businesses which come to their attention in their capacities as an officer and/or director. Excluded from this duty, however, would be opportunities which a director learns about through his involvement as an officer or director of another company. (See "Conflicts of Interest")

Certain conflicts of interest may exist between the Company and our Officers and Directors. Our Directors have other business interests to which they devote their attention and may be expected to continue to do so As a result, conflicts of interest may arise that can be resolved only through exercise of such judgment as is consistent with fiduciary duties to the Company. See “Directors, Executive Officers, Promoters and Control Person and Corporate Governance; Compliance with Section 16(a) of the Exchange Act” and "Conflicts of Interest".

The inability to attract and retain qualified employees could significantly harm our business.

The market for skilled executive officers and employees knowledgeable in agriculture and water rights is highly competitive and historically has experienced a high rate of turnover. Competition for quality officers and employees may lead to increased hiring and retention costs. In order to mitigate these risks, the Company has entered into employment contracts with its CEO, COO and CFO.

The Company has agreed to indemnify our officers and directors as is provided by Colorado Statutes.

Colorado Statutes provide for the indemnification of our directors, officers, employees, and agents, under certain circumstances, against attorney's fees and other expenses incurred by them in any litigation to which they become a party arising from their association with any activities on our behalf. The Company will also bear the expenses of such litigation for any of our directors, officers, employees, or agents, upon such person's promise to repay us therefore if it is ultimately determined that any such person shall not have been entitled to indemnification. This indemnification policy could result in substantial expenditures by us that we may be unable to recoup.

Our directors' liability to us and shareholders is limited.

Colorado Revised Statutes exclude personal liability of corporate directors for monetary damages for breach of fiduciary duty except in certain specified circumstances. Accordingly, in the event of such a breach, the Company will have a much more limited right of action against a director than would be the case in many other jurisdictions. This provision of Colorado law does not limit or expand the responsibilities of any director under federal or applicable state securities laws.

The Company depends upon outside advisors, who may not be available on reasonable terms and as needed.

To supplement the business experience of the Company’s officers and directors, we routinely employs accountants, technical experts, appraisers, attorneys, or other consultants or advisors. Our Board, without input from stockholders, makes the selection of any such outside advisors. Furthermore, the Company anticipates that such outside advisors will be engaged on an "as needed” basis without a continuing fiduciary or other obligation to us. When the Company considers it necessary to hire outside advisors, it may elect to hire persons who are affiliates of the Company or of our officers or directors, if they are able to provide the required services on appropriately competitive terms.

Previous material weaknesses in our internal control over financial reporting and disclosure controls and procedures might have had an impact the reliability of our internal control over financial reporting.

Our management assessed the effectiveness of our internal control over financial reporting as of December 31, 2010, and this assessment identified material weaknesses in our internal control over financial reporting. As a result, our management concluded that our internal control over financial reporting was not effective as of December 31, 2010. Therefore, for the year ended December 31, 2010, material weaknesses and other control deficiencies in our internal control over financial reporting and disclosure controls and procedures have led to restatements of our consolidated financial statements. Since the identification of the material weaknesses, we have implemented and are continuing to implement various initiatives intended to improve our internal control over financial reporting and disclosure controls and procedures to address these material weaknesses.

In 2011, we hired internal control consultants, and together we have analyzed and documented our processes for all business units and the establishment of formal policies and procedures with necessary segregation of duties. Based on these controls, management believes there is proper internal control over financial reporting as of December 31, 2011. See the “Controls and Procedures”.

Our success will depend, to a large degree, on the expertise and experience of the members of our management team.

Our success in identifying business opportunities and in acquiring, developing and managing assets to generate profits is, to a large degree, dependent upon the expertise and experience of the management team and our directors and their collective ability to attract and retain quality personnel as the Company develops.

Risk Factors Relating To the Farming Business and the Water Business

Insufficient funds to develop the Farming Business

To date, the Company has relied entirely on borrowing and capital raising to expand its Farming Business. The Company might not have enough incremental funds to continue to expand its Farming Business so that it reaches profitability, and the expansion of the Farming Business is dependent upon raising incremental funds. Without the expansion of the Farming Business, the Company will not be able to meet the principal and interest expenses on its existing obligations nor sustain its general and administration expenses. No assurance can be given that sufficient incremental funds will be available on acceptable terms to fund development of our Farming Business.

The Farming Business requires significant capital expenditures.

The Farming Business is capital intensive, particularly in the land and water acquisition phase and in the redevelopment of the land and rehabilitation of water infrastructure. On an annual basis, we could spend significant sums of money for additions to, or replacement of, land, land improvements, irrigation and farming equipment. We must obtain funds for these capital projects from operations or new capital raises. We cannot provide assurance that available sources of funds will be adequate or that the cost of funds will be at levels permitting us to earn a reasonable rate of return.

Two Rivers Water Company has substantial competitors who have an advantage over the Company in resources and management.

Most of our competitors in both the farming industry and in the water resource management business have significantly greater financial resources, technical expertise and managerial capabilities than us and, consequently, the Company may be at a competitive disadvantage in identifying and developing or exploring suitable business opportunities and/or acquisitions. Competitors’ resources could overwhelm our restricted efforts and adversely impact our operational performance. The Company has attempted to mitigate this risk by concentrating its business efforts in the Huerfano/Cucharas watershed where, by virtue of our local knowledge and our control of water rights, infrastructure and farmland, we enjoy competitive advantages within our geographic niche over larger, better funded companies.

The Company has little operating history in the Farming Business, so investors have no way to gauge our long-term performance.

The Company has little experience in the Farming Business in Colorado. Although the Company employs experienced farmers, to date, the Company has farmed approximately 400 acres for only one year which produced approximately 170 bushels of feed corn per acre. Therefore, its business plan should be considered highly speculative.

Dry weather or droughts may adversely affect the collection of our water and ability to grow crops.

Water to grow our crops is obtained primarily from surface runoff and stream flows. In dry years or droughts less water may be available to supply our farming lands and less water may be available for sale/lease, which could substantially impact revenues and cause losses.

Crop insurance may not be available or not be adequate to cover losses.

Certain crops and certain land locations are either not eligible or eligible at a reduced level for crop insurance. We intend to grow crops in areas where full insurance is available, but the consistent availability and reasonable cost of such insurance cannot be guaranteed. Further, if an insurance claim is made, the amount of funds received might not be sufficient to cover costs and provide debt service.

Adverse weather conditions, natural disasters, crop disease, pests and other natural conditions can impose significant costs and losses on our business.

Crops in the field are vulnerable to adverse weather conditions, including hail storms, high winds, tornados, early and late snow storms, floods, drought and temperature extremes, which are quite common but difficult to predict. In addition, crops are vulnerable to disease and to pests, which may vary in severity and effect, depending on the stage of production at the time of infection or infestation, the type of treatment applied and climatic conditions. Unfavorable growing conditions can reduce both crop size and quality. These factors can directly impact us by decreasing the quality and yields of crops, increasing our costs and decreasing revenue and gross margins, which may have a material adverse effect on our business, results of operations and financial condition.

We operate in areas subject to natural disasters.

We operate in an area that is prone to floods, droughts and other natural disasters. While we plan to maintain insurance policies to help reduce our financial exposure, a significant seismic event in Southeastern Colorado, where our operations are concentrated, or other natural disasters in Colorado could adversely impact our ability to deliver labor to the crops, deliver crops to the marketplace, and receive water and could adversely affect our costs of operations and profitability

Our earnings may be affected, to large extents, by volatility in the market value of our crops.

We intend to grow primarily organic alfalfa. The price of alfalfa, like other commodity crops, can vary widely, thereby directly impacting our revenue. In order to partially mitigate price volatility, the Company has contracted for all of its hay production to a large dairy operation for the next three years at a fixed price. However, the output contract concentrates risk, because the Company is relying on a single purchaser for all of its production. If our single buyer should fail to take or pay for our production, the Company would have to sell its hay to other purchasers who might pay higher or lower prices than specified in our contract.

Because growing cycles are highly seasonal, our revenue, cash flows from operations and operating results are likely to fluctuate on a seasonal and quarterly basis.

The farming business is highly seasonal. The seasonal nature of Farms’ operations results in significant fluctuations in our working capital during the growing and selling cycles. As a result, operating activities during the second and third quarters use significant amounts of cash. In contrast, operating activities for the fourth quarter typically generate cash as we harvest and sell our crops. We expect to experience significant variability in net sales, operating cash flows and net income on a quarterly basis.

Our ability to cultivate, husband and harvest our crop may be compromised by availability of labor and equipment.

When the crop is ready to harvest, we are dependent on seasonal labor and contractors for harvesting. During harvest season, there is demand for such seasonal labor from many farming operations which will compete with our demand. The availability of seasonal farm labor is also affected by uncertain national immigration policies and politically volatile enforcement practices. Thus, adequate labor might not be available when our crops are ready to harvest. This could delay revenue or decrease revenue of our Farming Business.

The adequacy of our water supplies depends upon a variety of uncontrollable factors.

An adequate water supply is necessary for our Farming Business to be profitable. Our Farming Business is located where dry-farming is not profitable, so the Company must make substantial investments in water rights and irrigation facilities. The adequacy of our water supplies varies from year to year depending upon a variety of factors, including:

|

·

|

Rainfall, runoff, flood control and availability of reservoir storage;

|

|

·

|

Availability of Huerfano River water;

|

|

·

|

The amount of useable water stored in reservoirs and groundwater basins;

|

|

·

|

The amount of water used by our customers and others;

|

|

·

|

Water quality; and

|

|

·

|

Legal limitations on production, diversion, storage, conveyance and use.

|

Population growth and consequent increases in the amount of water used in urban areas have created increased demands on both surface water and groundwater resources in many parts of Colorado, including the Southeast part of the State where the Company’s Farming Business is located.

We obtain our water supply from surface streams, the Huerfano and Cucharas Rivers, which are tributaries of the Arkansas River. Our water supply and storage may be subject to interruption or reduction in the case of natural shortages (drought) or increased demand by senior water rights. The exercise of our water rights is subject to court-approved limitations and the requirements of Colorado water law as administered by the courts and the Colorado Office of the State Engineer.

Water shortages may:

|

·

|

adversely affect our supply mix, for instance, causing increased reliance upon more expensive water sources; or

|

|

·

|

adversely affect our operating costs, for instance, by increasing our cost through the purchase or lease of required water.

|

The water business is heavily regulated and, as a result, decisions by regulatory agencies and changes in laws and regulations can significantly affect our business.

Regulatory decisions involving our water rights may impact prospective revenues and earnings, affect the timing of the recognition of revenues and expenses, overturn past decisions used in determining our water rights, revenues and expenses and could result in impairment of goodwill. Management continually evaluates the Company’s assets, liabilities and revenues and provides for allowances and/or reserves as deemed necessary.

Regulatory agencies may also change their rules and policies which may adversely affect our profitability and cash flows.

We may also be subject to fines or penalties if a regulatory agency determines that we have failed to comply with laws, regulations or orders applicable to our water businesses.

The Water Business requires significant capital expenditures.

The refurbishment of the Company’s water assets is capital intensive. On an annual basis, we could spend significant sums of money for additions to, or replacement of, our facilities, reservoirs and equipment. We must obtain funds for these capital projects from operations or capital raised. We cannot provide assurance that any sources will be adequate or that the cost of funds will be at levels permitting us to earn a reasonable rate of return.

Dry weather or droughts may adversely affect the collection of our water.

Our water is obtained primarily from surface runoff and stream flows. In dry years or droughts less water may be available to fill our reservoirs and be available for sale/lease, which could substantially impact revenues and cause losses.

Our water rights may not yield full flow every year.

Water rights in Colorado are subject to the Prior Appropriation Doctrine, which accords lower priority to junior water rights. Water rights that are senior (such as the Company’s Butte Valley Ditch Right Number 1 dating from 1862) have priority over junior rights (such as the Company’s Huerfano Valley Ditch Right Number 342 dating from 1905) as to use in dry years, and junior rights might not get water or as much water as they wish, if senior rights use it all.

We are required to maintain water quality standards and are subject to regulatory and environmental risks.

We face the risk that our water supplies may be contaminated or polluted whether through our error or through actions by other agents or through acts of God. In addition, normal farming practices, including the application of pesticides, herbicides and fertilizers, introduce pollutants to waterways through irrigation water runoff. Improved detection technology, increasingly stringent regulatory requirements, and heightened consumer awareness of water quality contribute to an environment of increased risk with the possibility of increased operating costs. We cannot assure you that in the future we will be able to reduce the amounts of contaminants in our water to acceptable levels.

Our water supplies are subject to contamination, including contamination from naturally occurring compounds, pollution from man-made sources and intentional sabotage. We cannot assure you that we will successfully manage these risks, and failure to do so could have a material adverse effect on our future results of operations. We might not be able to recover the costs associated with these liabilities through our sales or insurance or such recovery may not occur in a timely manner.

Our revenue is seasonal.

The demand for water varies by season. For instance, most water consumption for agriculture usage occurs during the third quarter of each year when weather tends to be hot and dry. During wet weather, there is reduced demand for water delivered from the Company’s reservoirs. Additionally, almost all of our farming revenue is received in the third and fourth quarters of the year as part of harvesting.

Our proposed water operations are geographically concentrated within Colorado.

Our operations are concentrated in Southeastern Colorado. As a result, our financial results are subject to political impacts, regional weather conditions, available water supply, available labor supply, utility cost, regulatory risks, economic conditions and other factors affecting Colorado, our area of operation. Southeastern Colorado has been hard hit by the on-going economic crisis. Colorado is raising taxes in order to balance the state budget and jobs may be lost to other states which are perceived as having a more business friendly climate, thereby exacerbating the impact of the financial crisis in Colorado.

We may lose all of our investment, which could have a material impact on our market valuation.

The Company has made a substantial investment in the Water Business. Our investment in the Water Business will not assure success of the Water Business. If the Water Business fails, the Company and its shareholders will be adversely impacted.

Risk Factors Related To Our Stock

The regulation of penny stocks by SEC and FINRA may discourage the tradability of our securities

We are classified as a “penny stock” company. Our common stock currently trades on the OTCQB Market and is subject to a Securities and Exchange Commission (“SEC”) rule that imposes special sales practice requirements upon broker-dealers who sell such securities to persons other than established customers or accredited investors. For purposes of the rule, the phrase “accredited investors” means, in general terms, institutions with assets in excess of $5,000,000, or individuals having a net worth in excess of $1,000,000 or having an annual income that exceeds $200,000 (or that, when combined with a spouse’s income, exceeds $300,000). For transactions covered by the rule, the broker-dealer must make a special suitability determination for the purchaser and receive the purchaser’s written agreement to the transaction prior to the sale. Effectively, this discourages broker-dealers from executing trades in penny stocks. Consequently, the rule will affect the ability of purchasers in this offering to sell their securities in any market that might develop therefore because it imposes additional regulatory burdens on penny stock transactions.

In addition, the SEC has adopted a number of rules to regulate “penny stocks.” Such rules include Rules 3a51-1, 15g-1, 15g-2, 15g-3, 15g-4, 15g-5, 15g-6, 15g-7, and 15g-9 under the Securities and Exchange Act of 1934, as amended. Because the Company’s securities constitute “penny stocks” within the meaning of the rules, the rules would apply to our securities and us. These rules will further affect the ability of owners of shares to sell our securities in any market that might develop for them because it imposes additional regulatory burdens on penny stock transactions.

Shareholders should be aware that, according to the SEC, the market for penny stocks has suffered in recent years from patterns of fraud and abuse. Such patterns include (i) control of the market for the security by one or a few broker-dealers that are often related to the promoter or issuer; (ii) manipulation of prices through prearranged matching of purchases and sales and false and misleading press releases; (iii) “boiler room” practices involving high-pressure sales tactics and unrealistic price projections by inexperienced sales persons; (iv) excessive and undisclosed bid-ask differentials and markups by selling broker-dealers; and (v) the wholesale dumping of the same securities by promoters and broker-dealers after prices have been manipulated to a desired level, causing investor losses. Our management is aware of the abuses that have occurred historically in the penny stock market. Although we do not expect to be in a position to dictate the behavior of the market or of broker-dealers who participate in the market, management will strive within the confines of practical limitations to prevent the described patterns from being established with respect to our securities.