Exhibit 10.4

SUBLEASE

THIS SUBLEASE (this “Sublease”) is dated for reference purposes as of October 26, 2018, and is

made by and between ONCOMED PHARMACEUTICALS, INC., a Delaware corporation (“Sublandlord”), and VENN BIOSCIENCES CORPORATION, a Delaware corporation (“Subtenant”). Sublandlord and Subtenant hereby agree as follows:

1.Recitals: This Sublease is made with reference to the fact that HCP LS Redwood City, LLC, as “Landlord,” (“Master Landlord”) and Sublandlord, as “Tenant,” are parties to that certain Lease dated May 30, 2006, as amended by that certain First Amendment to Lease dated November, 2006, that certain Acknowledgement of Rent Commencement Date dated as of March 9, 2007, that certain Second Amendment to Office Lease dated December 22, 2010, and that certain Third Amendment to Lease dated November 11, 2016 (the “Third Amendment”, which collectively with the other amendments and documents referenced above are referred to herein as the “Master Lease”), with respect to those certain premises consisting of approximately 45,690 rentable square feet described therein (the “Master Premises”) located at 800 Chesapeake Drive, in the Britannia Seaport Centre in Redwood City, California. A copy of the Master Lease is attached hereto as Exhibit A. Capitalized terms used and not defined herein shall have the meaning ascribed to them in the Master Lease.

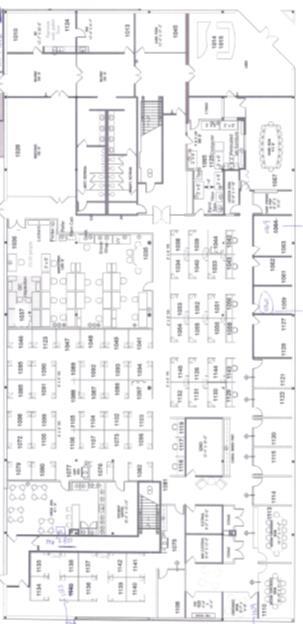

2.Subleased Premises: Subject to the terms and conditions of this Sublease, Sublandlord hereby subleases to Subtenant, and Subtenant hereby subleases from Sublandlord, a portion of the Master Premises consisting of approximately 11,100 rentable square feet located on portions of the first and second floors as more particularly shown on Exhibit B attached hereto (the “Subleased Premises”). The Subleased Premises shall be delivered in phases identified on Exhibit B as “Phase I” and “Phase II”. Phase I consists of approximately 9,300 rentable square feet and shall be delivered to Subtenant on the date by which this Sublease is executed by Sublandlord and Subtenant and Master Landlord’s written consent to this Sublease is obtained. Phase II shall consist of the area identified as “Phase II” on Exhibit B which contains approximately 1,800 rentable square feet and shall be delivered by Sublandlord to Subtenant on or about the date which is twelve (12) months after the Commencement Date. In connection with its use of the Subleased Premises, and subject to Sublandlord’s reasonable rules and regulations, Subtenant shall have the non- exclusive right to use the common space outlined on Exhibit B, including the foyer, kitchen, restrooms, electrical room, “Clarke” conference room, stairways, certain hallways, and the common loading dock area (the “Shared Areas”), in each case to the extent permitted by and on the terms set forth in the Master Lease and subject to Sublandlord’s reasonable rules and regulations. Subtenant shall have no right to enter, and shall prevent its employees, agents, contractors and invitees from entering any portions of the Master Premises other than the Subleased Premises and the Shared Areas. Sublandlord’s entry into the Subleased Premises shall be subject to the terms of Section 12.1 of the Master Lease incorporate herein, except that no notice shall be required in connection with an entry for recurring services to the Subleased Premises (e.g., janitorial). The Subleased Premises (and Phase I and Phase II thereof) are stipulated to contain the amount of rentable square feet as set forth herein, and Rent under the Sublease shall not be revised in the event the actual rentable square feet of the Subleased Premises is more or less.

|

|

3. |

Term: |

A.Term. The term (the “Term”) of this Sublease shall be for the period commencing on the

date by which this Sublease is executed by Sublandlord and Subtenant, Master Landlord’s written consent to this Sublease is obtained and Sublandlord delivers Phase I of the Subleased Premises to Subtenant (the

“Commencement Date”) and ending twenty-four (24) months after the Commencement Date unless this

Sublease is sooner terminated pursuant to its terms or the Master Lease is sooner terminated pursuant to its

terms (the “Expiration Date”); provided, however, that if the Commencement Date of this Sublease does not occur within thirty (30) days after the date by which both Sublandlord and Subtenant have executed this Sublease, through no fault of Subtenant, then at any time thereafter until the Commencement Date has occurred, Subtenant shall be entitled to terminate this Sublease by written notice to Sublandlord, in which event Sublandlord shall promptly refund and deliver to Subtenant the prepaid Base Rent paid by Subtenant and the Security Deposit, and Subtenant and Sublandlord shall thereupon be released of all further obligations under this Sublease. The term shall commence with respect to Phase II on the later of the date which is twelve (12) months after the Commencement Date or the date by which Sublandlord delivers Phase II of the Subleased Premises to Subtenant (the “Phase II Commencement Date”). If the Phase II Commencement Date does not occur on or before the date which is thirteen (13) months after the Commencement Date, then at any time thereafter until the Phase II Commencement Date has occurred, Subtenant shall be entitled to terminate this Sublease with respect to Phase II (but not as to Phase I), by written notice to Sublandlord.

B.No Options to Extend or Expand. Notwithstanding anything to the contrary in the Sublease or the Master Lease, Subtenant shall not have any options to extend or renew the term of the Sublease or any options to expand the Subleased Premises.

C.Right of First Offer. In the event that Sublandlord, as of November 1, 2019 and until January 1, 2020, determines in its sole discretion that Sublandlord does not need or desire to (i) occupy the Subleased Premises after the Expiration Date, (ii) sublease to a third party a larger space in the Master Premises which includes all or a portion of the Subleased Premises, or (iii) negotiate a termination of the Master Lease, and so long as Subtenant is not and has not been in default of any term or provision of this Sublease beyond any applicable notice and cure period and has not assigned this Sublease or sublet any space covered thereby or agreed to do so in the future, then Sublandlord shall notify Subtenant of the terms and conditions on which Sublandlord would be willing to extend the Term of the Sublease (the “Offer Notice”).

If Subtenant, within ten (10) business days after receipt of Sublandlord’s written notice indicates in writing its agreement extend the Term on the terms stated in the Offer Notice, then the Term shall be extended on the

terms of the Offer Notice. If Subtenant does not timely indicate in writing its agreement to extend the

Sublease Term on the terms contained in the Offer Notice within said ten (10) business day period, then Subtenant’s rights under this Paragraph 3.C shall be null and void and of no force or effect, and Sublandlord thereafter shall have the right to sublease the Subleased Premises to a third party on any terms Sublandlord desires.

D.Termination Option. Notwithstanding anything to the contrary in the Sublease, in the event that Sublandlord enters into an agreement with Master Landlord to terminate the Master Lease or otherwise vacates the Master Premises during the Term of this Sublease, either party shall have the right to terminate this Sublease upon one hundred twenty (120) days’ prior written notice to Subtenant delivered on or after the date which is ten (10) months after the Commencement Date, in which event this Sublease shall terminate without any liability to either party.

|

|

4. |

Rent: |

A.Base Rent. Commencing on the Commencement Date and continuing each month throughout the Term of this Sublease, Subtenant shall pay to Sublandlord as base rent (“Base Rent”) for the Subleased Premises monthly installments as follows:

-2-

For Phase I of the Subleased Premises:

|

Months |

Rentable Square Feet |

Base Rent per Month |

|

Commencement Date – Month 12 |

9,300 |

$68,000 |

|

Month 13 – Expiration Date |

9,300 |

$71,216 |

For Phase II of the Subleased Premises:

|

Months |

Rentable Square Feet |

Base Rent per Month |

|

Phase II Commencement Date – Expiration Date |

1,800 |

$13,784 |

Base Rent and Additional Rent, as defined in Paragraph 4.B below, (collectively, hereinafter “Rent”) shall be paid in advance on or before the first (1st) day of each month. Rent for any period during the Term hereof which is for less than one (1) month of the Term shall be a pro rata portion of the monthly installment based on a thirty (30) day month. Rent shall be payable without notice or demand and without any deduction, offset, or abatement (except as otherwise expressly set forth in this Sublease), in lawful money of the United States of America. Rent shall be paid directly to Sublandlord at 800 Chesapeake Drive, Redwood City, CA 94063, Attention: Accounting, or such other address as may be designated in writing by Sublandlord.

B.Additional Rent. All monies other than Base Rent required to be paid by Subtenant under this Sublease shall be deemed additional rent (“Additional Rent”). Base Rent shall include, and Subtenant shall have no obligation to pay or reimburse Sublandlord for, any and all “Operating Expenses” under the Master Lease, the cost to perform Sublandlord’s maintenance obligations under Paragraph 8 (subject to Subtenant’s obligation thereunder to pay for increases in such cost to the extent required therein), electricity, natural gas (if applicable), sewer charges, water and heating, ventilation and air conditioning (“HVAC”) and office janitorial services (collectively, “Included Services”). Subtenant shall pay for all environmental health and safety services and hazardous waste management with respect to Subtenant’s operations at the Subleased Premises, internet, phone and information technology services and support, administrative support, business services, office supplies, food and beverage, and other similar items and services with respect to the Subleased Premises. In the event Sublandlord reasonably determines that Subtenant is using a disproportionate amount of Included Services, Sublandlord may either (1) charge a reasonable proportion to be reasonably determined by Sublandlord of all Included Services jointly metered or invoiced to the Master Premises or (2) separately meter and/or invoice the Included Services to the Subleased Premises at Subtenant’s sole cost and expense.

C.Prepayment of Rent. Upon execution hereof by Subtenant, Subtenant shall pay to Sublandlord the sum of Sixty-Eight Thousand Dollars ($68,000.00), which shall be applied as a credit against Base Rent for the first (1st) month(s) of the Term.

|

|

5. |

Security Deposit: |

A.Within five (5) business days after execution of this Sublease, Subtenant shall deposit with Sublandlord One Hundred Thousand Dollars ($100,000.00) in cash and Six Hundred Thousand Dollars

-3-

($600,000.00) in the form of an irrevocable and unconditional letter of credit (the “Letter of Credit”) as security for the performance by Subtenant of its obligations under this Sublease, and not as a prepayment of rent (collectively, the “Security Deposit”). If Subtenant defaults (beyond any applicable notice and cure period) under this Sublease, Sublandlord may, upon written notice to Subtenant, apply all or any part of the Security Deposit for the payment of any rent or other sum in default, the repair of any damage to the Subleased Premises caused by Subtenant or the payment of any other amount which Sublandlord may spend or become obligated to spend by reason of Subtenant’s default or to compensate Sublandlord for any other loss or damage which Sublandlord may suffer by reason of Subtenant’s default to the full extent permitted by law. Subtenant hereby waives any restriction on the use or application of the Security Deposit by Sublandlord as set forth in California Civil Code Section 1950.7 (with the exception of subsection (b)). To the extent any portion of the Security Deposit is used, Subtenant shall within five (5) business days after demand from Sublandlord restore the Security Deposit to its full amount. Sublandlord may keep the Security Deposit in its general funds and shall not be required to pay interest to Subtenant on the deposit amount. Sublandlord shall return all of the remaining Security Deposit to Subtenant within thirty (30) days after the later of the end of the Term or Subtenant’s surrender of possession of the Subleased Premises to Sublandlord, less any amounts that have been applied by Sublandlord pursuant to this Paragraph. The Security Deposit shall not serve as an advance payment of rent or a measure of Sublandlord’s damages for any default under this Sublease. Subtenant covenants and agrees that it shall not assign or encumber or attempt to assign or encumber the Security Deposit and neither Sublandlord nor its successors or assigns shall be bound by any such agreement, encumbrance, attempted assignment or attempted encumbrance.

B.The Letter of Credit shall be governed by the International Chamber of Commerce Publication No. 590, and shall be in an amount equal to Six Hundred Thousand Dollars ($600,000.00), issued to Sublandlord, as beneficiary, in form and substance reasonably satisfactory to Sublandlord, by Silicon Valley Bank, or another bank reasonably approved by Sublandlord and qualified to transact banking business in California with an office in the Greater San Francisco Bay Area at which drafts drawn on the Letter of Credit may be presented for payment. The full amount of the Letter of Credit shall be available to Sublandlord upon presentation of Sublandlord’s sight draft accompanied only by the Letter of Credit and Sublandlord’s signed statement that Sublandlord is entitled to draw on the Letter of Credit pursuant to this Sublease. Subtenant shall maintain the Letter of Credit for the entire Term and any extension thereof. The Letter of Credit shall expressly state that the Letter of Credit and the right to draw thereunder may be transferred or assigned by Sublandlord to any successor-in-interest to or assignee of Sublandlord under this Sublease. Subtenant shall pay any fees related to the issuance or amendment of the Letter of Credit, including, without limitation, any transfer fees. The Letter of Credit shall permit partial draws. The Letter of Credit shall provide that it will be automatically renewed for periods of one (1) year until thirty (30) days after the Expiration Date unless the issuer provides Sublandlord with written notice of non-renewal at the notice address herein at least sixty (60) days prior to the expiration thereof. If Sublandlord receives such a notice of non-renewal, and not later than thirty (30) days prior to the expiration of the Letter of Credit, Subtenant fails to furnish Sublandlord with a replacement Letter of Credit pursuant to the terms and conditions of this section, then Sublandlord shall have the right to draw the full amount of the Letter of Credit, by sight draft, and shall hold the proceeds of the Letter of Credit as a cash Security Deposit pursuant to the terms and conditions of Paragraph 5.A above.

C.So long as Subtenant is not then in default under this Sublease, and no default has at any time occurred under this Sublease beyond any applicable notice and cure period, upon Subtenant’s payment of at least Three Hundred Thousand Dollars ($300,000.00) in Base Rent in the aggregate pursuant to the schedule set forth in Paragraph 4.A above, then the amount of the Letter of Credit may be reduced by Subtenant, by delivery by Subtenant to Sublandlord of a replacement Letter of Credit or by an amendment to the existing Letter of Credit, to Three Hundred Thousand Dollars ($300,000.00). So long as Subtenant is not then in default under this Sublease, and no default has at any time occurred under this Sublease beyond any

-4-

applicable notice and cure period, upon Subtenant’s payment of at least Six Hundred Thousand Dollars ($600,000.00) in Base Rent in the aggregate pursuant to the schedule set forth in Paragraph 4.A above, then within thirty (30) days of Subtenant’s written request delivered from and after such payment, Sublandlord shall return to Subtenant the Letter of Credit.

6.Holdover: Subtenant acknowledges that it is critical that Subtenant surrender the Subleased Premises on or before the expiration or earlier termination of the Sublease in accordance with the terms of this Sublease. Accordingly, Subtenant shall indemnify, defend and hold harmless Sublandlord from and against all losses, costs, claims, liabilities and damages resulting from Subtenant’s failure to surrender the Subleased Premises on or before the expiration or earlier termination of the Sublease in the condition required under the terms of this Sublease (including, without limitation, any liability or damages sustained by Sublandlord as a result of a holdover of the Master Premises by Sublandlord occasioned by the holdover of the Subleased Premises by Subtenant). In addition, Subtenant shall pay Sublandlord holdover rent equal to one hundred fifty percent (150%) of Base Rent plus any Additional Rent payable hereunder for any period from the Expiration Date through the date Subtenant surrenders the Subleased Premises decommissioned and/or closed pursuant to Paragraph 20 below. The provisions of this Paragraph 6 shall survive the expiration or earlier termination of this Sublease.

|

|

7. |

“AS IS” Condition: |

A.Except as expressly set forth herein, the parties acknowledge and agree that Subtenant is subleasing the Subleased Premises on an “AS IS” basis, and that Sublandlord has made no representations or warranties, express or implied, whatsoever, with respect to the Subleased Premises, including, without limitation, any representation or warranty as to the suitability of the Subleased Premises for Subtenant’s intended use or any representation or warranty made by Master Landlord under the Master Lease. Notwithstanding the foregoing, Sublandlord shall deliver Phase I and Phase II in broom clean condition and free of any personal property (with the exception of the Furniture). Prior to delivery, Sublandlord shall perform any closure or decommissioning of the lab portions of the Subleased Premises required under applicable laws in connection with the use, storage, release or disposal of Hazardous Substances by Sublandlord or its agents, employees, contractors or invitees. Except as set forth in Paragraph 8 below, Sublandlord shall have no obligation whatsoever to make or pay the cost of any alterations, improvements or repairs to the Subleased Premises, including, without limitation, any improvement or repair required to comply with any law, regulation, building code or ordinance (including the Americans with Disabilities Act of 1990, as may be amended). Subtenant expressly waives all rights under law to make repairs at the expense of Sublandlord. Subtenant hereby expressly waives the provisions of subsection 1 of Section 1932 and Sections 1941 and 1942 of the Civil Code of California and all rights to make repairs at the expense of Sublandlord as provided in Section 1942 of said Civil Code.

B.Sublandlord hereby discloses to Subtenant that Sublandlord has constructed in the Subleased Premises certain improvements without obtaining permits therefor including, without limitation, interior walls to create the offices labeled 106, 107 and 108 on Exhibit B (collectively, the “Prior Improvements”). The Prior Improvements shall remain in the Subleased Premises; provided, however, if the same are required to be removed by Master Landlord, the City of Redwood City or other governmental entity, agency or department, then (i) Sublandlord shall remove the same at Sublandlord’s sole cost and expense, and

(ii) Sublandlord shall reasonably cooperate with Subtenant in minimizing any interference with or adverse effects on Subtenant’s operations in the Subleased Premises as a result of such removal.

8.Repair and Maintenance. Subtenant shall repair and maintain the Subleased Premises in good and sanitary order, condition and repair as set forth in Section 8.2(a) of the Master Lease incorporated herein. Notwithstanding the foregoing, Sublandlord shall continue to repair and maintain the Building electrical,

-5-

plumbing, fire protection, HVAC and other main building systems (excluding telephone and communications systems), all to the extent required to be maintained by “Tenant” pursuant to Section 8.2(a) of the Master Lease. In the event Sublandlord’s cost to maintain and repair such Building systems increases materially as a result of Subtenant’s use of the Subleased Premises, Subtenant shall pay to Sublandlord such increase in cost. In addition, Subtenant shall pay the entire cost of any repair, maintenance or replacement required as a result of the misuse or excess use of such systems, or the negligence, willful misconduct or violation of this Sublease, by Subtenant or its agents, employees, contractors or invitees.

9.Master Landlord Obligations. Sublandlord shall have no obligation to perform any repairs or any other obligation of Master Landlord required to be performed by Master Landlord under the terms of the Master Lease (including, without limitation, Master Landlord’s obligations under Sections 6, 8, 9, 10, 13, 15, and 17.20 of the Master Lease and Master Landlord’s obligation to comply with laws and carry building insurance). Sublandlord shall, however, request performance of the same in writing from Master Landlord promptly after being requested to do so by Subtenant, and shall use Sublandlord’s reasonable efforts (not including the payment of monies unless Subtenant agrees to reimburse Sublandlord for any reasonable out-of- pocket costs incurred by Sublandlord, the incurring of any liabilities, or the institution of legal proceedings, which may be instituted only at Sublandlord’s sole discretion) to obtain Master Landlord’s performance.

10.Right to Cure Defaults: If Subtenant fails to pay any sum of money to Sublandlord, or fails to perform any other act on its part to be performed hereunder, and in either case fails to cure the same within five (5) days after written notice from Sublandlord of such failure, then Sublandlord may, but shall not be obligated to, make such payment or perform such act. All such sums paid, and all reasonable costs and expenses of performing any such act, shall be deemed Additional Rent payable by Subtenant to Sublandlord upon demand, together with interest thereon at the lesser of (i) ten percent (10%) per annum or (ii) the maximum rate allowable under law (the “Interest Rate”) from the date of the expenditure until repaid.

11.Assignment and Subletting: Subtenant may not assign any interest in this Sublease (by operation of law or otherwise), sublet any of the Subleased Premises, transfer any interest of Subtenant therein or permit any use of the Subleased Premises by another party (collectively, “Transfer”), without the prior written consent of Sublandlord and Master Landlord. Sublandlord’s consent may be withheld by Sublandlord in its sole and absolute discretion. A consent to one Transfer shall not be deemed to be a consent to any subsequent Transfer. Any Transfer without such consent shall be void and, at the option of Sublandlord, shall be a material default under this Sublease. Sublandlord’s waiver or consent to any assignment or subletting shall be ineffective unless set forth in writing, and Subtenant shall not be relieved from any of its obligations under this Sublease. Notwithstanding the foregoing, Sublandlord’s consent shall not be required for a “Permitted Transfer” of Subtenant as described in Section 11.1 of the Master Lease, as incorporated herein, so long as Master Landlord’s consent is received (to the extent Master Landlord’s consent is required under the Master Lease) and the conditions therein are satisfied; provided, however, in the event of any such Permitted Transfer of Subtenant (other than a venture equity financing, initial public offering, or other issuance of capital stock for bona fide financing purposes; or an internal corporate reorganization of Subtenant or its affiliates not in connection with any merger, consolidation, or acquisition involving Subtenant or its affiliates, unless the entity merging, consolidating, or acquiring Subtenant is not engaged in a substantially similar or a competing line of business as Sublandlord, as reasonably determined by Sublandlord), Sublandlord shall have the right to terminate this Sublease upon written notice to Subtenant, in which event this Sublease shall terminate ninety (90) days after such notice of termination.

|

|

12. |

Use: |

A.Subject to the terms of the Master Lease, Subtenant may use the Subleased Premises for office, research and development, engineering, laboratory, Clinical Laboratory Improvement Amendments

-6-

(CLIA)-certified laboratory, and/or warehousing facility, and for administrative and other lawful purposes reasonably related to or incidental to such specified uses (subject in each case to receipt of all necessary approvals from the City of Redwood City and all other governmental agencies having jurisdiction over the Subleased Premises), and for no other purpose whatsoever.

|

|

B. |

Hazardous Substances. |

(i)Subtenant shall not use, store, transport or dispose of any Hazardous Substances (as defined in the Master Lease) in or about the Subleased Premises or the Master Premises, except that Subtenant may keep, store and use in the Subleased Premises (a) those Hazardous Substances, and their respective quantities, specifically listed on the Environmental Questionnaire attached to this Sublease as Exhibit D to the extent permitted pursuant to the terms and conditions of Section 9.6 of the Master Lease incorporated herein, and (b) any other quantities and types of Hazardous Substances approved in writing by Master Landlord (to the extent required under the Master Lease) and Sublandlord, which approval by Sublandlord shall not be unreasonably withheld, conditioned or delayed as long as such quantities and types of Hazardous Substances are permitted pursuant to the terms and conditions of Section 9.6 of the Master Lease incorporated herein. Subtenant shall at all times comply with Sublandlord’s reasonable environmental, health and safety (“EH&S”) standards, rules and regulations, and Sublandlord shall have the right at any time to audit Subtenant’s compliance with the same.

(ii)As of the date of this Sublease, Sublandlord represents to Subtenant that, to Sublandlord's knowledge, (a) no litigation has been brought or threatened against Sublandlord, nor any settlements reached by Sublandlord with any governmental or private party, concerning the actual or alleged handling, transportation, storage, treatment, disposal, release or use by Sublandlord or any of its agents, employees, invitees (excluding Subtenant or its agents, employees, contractors or invitees), or contractors (collectively, “Sublandlord Parties”) of Hazardous Substances on or about the Subleased Premises or Building, or the soil, groundwater or surface water thereof, nor has Sublandlord received any notice of any violation or alleged violation by Sublandlord Parties of any Hazardous Substances laws, pending claims or pending investigations with respect to the presence of Hazardous Substances on or about the Subleased Premises or Building, or the soil, groundwater or surface water thereof, and (b) there are no Hazardous Substances released by Sublandlord on the Subleased Premises that require removal, remediation, or encasement of materials or reporting to any governmental authority, or that violate any Hazardous Substance laws. As used in this Paragraph 12(B)(ii), the phrase “to Sublandlord’s knowledge” shall be deemed to refer to facts within the actual knowledge of Eric Mendonca, Sublandlord’s Facility Manager, as of the date of this Sublease, without duty of inquiry.

(iii)Sublandlord's Indemnity Obligations. In addition to Sublandlord’s other indemnity obligations under this Sublease, Sublandlord shall protect, indemnify, defend (with counsel reasonably acceptable to Subtenant), and hold harmless Subtenant and its officers, directors, employees, agents, successors and assigns from and against any and all liabilities, losses, claims, damages, interest, penalties, fines, monetary sanctions, attorneys' fees, experts' fees, court costs, remediation costs, investigation costs, and other expenses to the extent caused by the release of Hazardous Substances on or about the Subleased Premises, the Master Premises or the Building by Sublandlord or any of its agents, employees or contractors in violation of applicable Hazardous Substance laws. The provisions of this Paragraph shall survive the expiration or earlier termination of this Sublease.

(iv)Subtenant's Indemnity. In addition to Subtenant’s other indemnity obligations under this Sublease, Subtenant shall protect, indemnify, defend (with counsel reasonably acceptable to Sublandlord), and hold harmless Sublandlord and its officers, directors, employees, agents, successors and assigns from and against any and all liabilities, losses, claims, damages, interest, penalties,

-7-

fines, monetary sanctions, attorneys' fees, experts' fees, court costs, remediation costs, investigation costs, and other expenses to the extent caused by the release of Hazardous Substances on or about the Subleased Premises, the Master Premises or the Building by Subtenant or Subtenant's agents, employees, contractors or invitees in violation of this Sublease, the Master Lease or any applicable Hazardous Substance laws. The provisions of this Paragraph shall survive the expiration or earlier termination of this Sublease.

C.Subtenant shall comply with all reasonable rules and regulations promulgated from time to time by Master Landlord or Sublandlord. Without limiting the generality of the foregoing, Subtenant shall comply with Sublandlord’s reasonable emergency policies and procedures.

13.Effect of Conveyance: As used in this Sublease, the term “Sublandlord” means the holder of the Tenant’s interest under the Master Lease. In the event of any assignment or transfer of the Tenant’s interest under the Master Lease, which assignment or transfer may occur at any time during the Term hereof in Sublandlord’s sole discretion, Sublandlord shall be and hereby is entirely relieved of all covenants and obligations first accruing and thereafter to be performed by Sublandlord hereunder, and it shall be deemed and construed, without further agreement between the parties hereto, that any transferee has assumed and shall carry out all covenants and obligations first accruing and thereafter to be performed by Sublandlord hereunder. Sublandlord shall transfer and deliver any security of Subtenant to the transferee of the Tenant’s interest under the Master Lease, and thereupon Sublandlord shall be discharged from any further liability with respect thereto.

14.Delivery and Acceptance: Subject to Subtenant’s termination rights in Paragraph 3.A of this Sublease, this Sublease shall not be void or voidable, nor shall Sublandlord be liable to Subtenant for any loss or damage, by reason of delays in the Commencement Date or the Phase II Commencement Date or delays in Sublandlord delivering the Subleased Premises to Subtenant for any reason whatsoever; provided, however, that Rent shall abate with respect to the applicable portion of the Subleased Premises until Sublandlord delivers possession of the such portion of the Subleased Premises to Subtenant.

15.Improvements: Subtenant shall not make any alterations or improvements to the Subleased Premises (i) without the prior written consent of both Master Landlord and Sublandlord and (ii) except in accordance with the Master Lease. Sublandlord’s consent shall not be unreasonably withheld, conditioned or delayed, provided, however, Sublandlord’s withholding of consent shall in all events be deemed reasonable if for any reason Master Landlord’s consent is not obtained. Notwithstanding anything to the contrary, unless otherwise agreed upon in writing by Sublandlord, Subtenant, at Subtenant’s expense, shall remove prior to the expiration or earlier termination of the Sublease all alterations or improvements constructed by or for Subtenant and restore the affected areas to their condition prior to such alteration or improvement.

16.Release and Waiver of Subrogation: Notwithstanding anything to the contrary in this Sublease, the parties hereto release each other and their respective agents, employees, successors and assigns from all liability for damage to any property that is actually covered by property insurance in force or which would normally be covered by full replacement value “Special Form” property insurance, without regard to the negligence or willful misconduct of the entity so released. Each party shall cause each insurance policy it obtains to include a waiver of subrogation regarding the liabilities released hereby. Sublandlord shall not be liable to Subtenant, nor shall Subtenant be entitled to terminate this Sublease or to abate Rent (except if and to the extent Sublandlord is allowed and receives a proportionate abatement of Rent under the Master Lease with respect to the Subleased Premises) for any (i) failure or interruption of any utility system or service or (ii) failure of Master Landlord to maintain the Subleased Premises or the Building as may be required under the Master Lease. Notwithstanding anything to the contrary in the Sublease, in no event shall Sublandlord be liable to Subtenant for any lost profit, damage to or loss of business or any form of special, indirect or consequential damages; it being understood, however, that in no event shall such waiver be construed to

-8-

release Sublandlord from any of Sublandlord’s indemnity obligations to Subtenant under this Sublease regarding claims asserted by third parties against Subtenant.

17.Insurance: Subtenant shall obtain and keep in full force and effect, at Subtenant’s sole cost and expense, during the Term the insurance required to be carried by the “Tenant” under the Master Lease. Subtenant shall include Sublandlord and Master Landlord as an additional insured in any liability policy of insurance carried by Subtenant in connection with this Sublease and shall provide Sublandlord with certificates of insurance promptly upon Sublandlord’s request.

18.Default: Subtenant shall be in material default of its obligations under this Sublease if any of the following events occur:

A.Subtenant fails to pay any Rent within three (3) business days after delivery by Sublandlord to Subtenant of written notice of nonpayment; or

B.Subtenant fails to perform any term, covenant or condition of this Sublease (except those requiring payment of Rent) and fails to cure such breach within twenty (20) days after delivery by Sublandlord to Subtenant of a written notice specifying the nature of the breach, provided that if such failure is curable in nature but cannot reasonably be cured within such twenty (20) day period, a material default shall not be deemed to have occurred if Subtenant promptly commences such cure (and in all events within such twenty (20) day period) and diligently pursues such cure to completion and an event of default (as set forth in the Master Lease) has not occurred under the Master Lease; provided that, notwithstanding the foregoing, Subtenant shall in any event be in material default of its obligations under this Sublease if Subtenant fails to cure any such breach within sixty (60) days after delivery by Sublandlord to Subtenant of written notice of such breach (the “Outside Breach Date”), such Outside Breach Date to be extended for delays in such cure that are beyond the reasonable control of Subtenant; or

C.the bankruptcy or insolvency of Subtenant, transfer by Subtenant in fraud of creditors, an assignment by Subtenant for the benefit of creditors, or the commencement of any proceedings of any kind by or against Subtenant under any provision of the Federal Bankruptcy Act or under any other insolvency, bankruptcy or reorganization act unless, in the event any such proceedings are involuntary, Subtenant is discharged from the same within thirty (30) days thereafter;

D.the appointment of a receiver for a substantial part of the assets of Subtenant, which receiver is not discharged within thirty (30) days;

E.the levy upon this Sublease or any estate of Subtenant hereunder by any attachment or execution and the failure within thirty (30) days thereafter to have such attachment or execution vacated or such other action taken with respect thereto so as to put Sublandlord at no risk of having an unconsented transfer of this Sublease;

|

|

F. |

A breach by Subtenant occurs under the NDA (as defined below); |

occurred; or

|

G. |

an “Abandonment” (as defined in the Master Lease) of the Subleased Premises has |

H.Subtenant commits any other act or omission which constitutes an event of default under the Master Lease.

-9-

19.Remedies: In the event of any default by Subtenant, Sublandlord shall have all remedies provided to the “Landlord” under Section 14.2 of the Master Lease as if an “event of default” had occurred thereunder and all other rights and remedies otherwise available at law and in equity. Sublandlord may resort to its remedies cumulatively or in the alternative.

|

|

20. |

Surrender: |

A.On or before the Expiration Date or any sooner termination of this Sublease, Subtenant shall remove all of its trade fixtures, personal property and all alterations constructed by Subtenant in the Subleased Premises which are required to be removed under the terms of this Sublease or the Master Lease and shall surrender the Subleased Premises to Sublandlord in the same condition received (reasonable wear and tear, damage by casualty or condemnation, and repairs that are the obligation of Sublandlord under this Sublease or Master Landlord under the Master Lease excepted), after performance of any closure or decommissioning of the Subleased Premises required under applicable laws in connection with the use, storage, release or disposal of Hazardous Substances by Subtenant or its agents, employees, contractors or invitees. Subtenant shall repair any damage to the Subleased Premises caused by Subtenant’s removal of its personal property, furnishings and equipment. If the Subleased Premises are not so surrendered, then Subtenant shall be liable to Sublandlord for all costs incurred by Sublandlord in returning the Subleased Premises to the required condition, plus interest thereon at the Interest Rate.

21.Broker: Sublandlord and Subtenant each represent to the other that they have dealt with no real estate brokers, finders, agents or salesmen in connection with this transaction other than Kidder Mathews representing Subtenant ( “Subtenant Broker”) and CBRE representing Sublandlord ( “Sublandlord Broker”). Sublandlord shall be responsible for payment of a broker commission to Sublandlord Broker pursuant to a separate agreement, and Sublandlord Broker shall be responsible for payment of any broker commission to Subtenant Broker pursuant to a separate agreement. Under no circumstances will Sublandlord be responsible for any payments to Subtenant Broker. Sublandlord and Subtenant each agrees to indemnify and hold the other harmless from and against all claims for brokerage commissions, finder’s fees or other compensation made by any other agent, broker, salesman or finder as a consequence of the indemnifying party’s actions or dealings with such other agent, broker, salesman, or finder.

22.Notices: Unless at least five (5) days’ prior written notice is given in the manner set forth in this paragraph, the address of each party for all purposes connected with this Sublease shall be that address set forth below their signatures at the end of this Sublease. All notices, demands and communications in connection with this Sublease shall be properly addressed and delivered as follows: (a) personally delivered; or (b) submitted to an overnight courier service, charges prepaid; or (c) deposited in the mail (certified, return- receipt requested, and postage prepaid). Notices shall be deemed delivered upon receipt, if personally delivered, one (1) business day after being so submitted to an overnight courier service and two (2) business days after deposit in the United States mail, if mailed as set forth above. All notices given to Master Landlord under the Master Lease shall be considered received only when delivered in accordance with the Master Lease.

|

|

23. |

Other Sublease Terms: |

A.Incorporation By Reference. Except as set forth below and except as otherwise provided in this Sublease, the terms and conditions of this Sublease shall include all of the terms of the Master Lease and such terms are incorporated into this Sublease as if fully set forth herein, except that: (i) each reference in such incorporated sections to “Lease” shall be deemed a reference to this “Sublease”; (ii) each reference to the “Premises” shall be deemed a reference to the “Subleased Premises”; (iii) each reference to “Landlord” shall be deemed a reference to “Sublandlord” and each reference to “Tenant” shall be deemed a

-10-

reference to “Subtenant”, except as otherwise expressly set forth herein; (iv) each reference to “Rent Commencement Date” shall be deemed a reference to the “Commencement Date”; (v) with respect to work, services, utilities, electricity, repairs (or damage caused by Master Landlord), restoration, insurance, indemnities, reimbursements, representations, warranties or the performance of any other obligation of “Landlord” under the Master Lease, whether or not incorporated herein, the sole obligation of Sublandlord shall be to request the same in writing from Master Landlord as and when requested to do so by Subtenant, and to use Sublandlord’s reasonable efforts (not including the payment of money unless Subtenant agrees to reimburse Sublandlord for any reasonable out-of-pocket costs incurred by Sublandlord, the incurring of any liabilities, or the institution of legal proceedings, which may be instituted only at Sublandlord’s sole discretion) to obtain Master Landlord’s performance; (vi) with respect to any obligation of Subtenant to be performed under this Sublease, wherever the Master Lease grants to “Tenant” a specified number of days to perform its obligations under the Master Lease (including, without limitation, curing any defaults), except as otherwise provided herein, Subtenant shall have three (3) fewer days to perform the obligation or one-half the time period permitted under the Master Lease, which ever allows Subtenant the greater amount of time; (vii) with respect to any approval required to be obtained from the “Landlord” under the Master Lease, such approval must be obtained from both Master Landlord and Sublandlord, and Sublandlord’s withholding of approval shall in all events be deemed reasonable if for any reason Master Landlord’s approval is not obtained; (viii) in any case where the “Landlord” reserves or is granted the right to manage, supervise, control, repair, alter, regulate the use of, enter or use the Premises or any areas beneath, above or adjacent thereto, such reservation or grant of right of entry shall be deemed to be for the benefit of both Master Landlord and Sublandlord; (ix) in any case where “Tenant” is to indemnify, release or waive claims against “Landlord”, such indemnity, release or waiver shall be deemed to run from Subtenant to both Master Landlord and Sublandlord, but such indemnity obligations shall only apply with respect to the use and occupancy of the Subleased Premises or the Center by Subtenant and its agents, employees, contractors or invitees; (x) in any case where “Tenant” is to execute and deliver certain documents or notices to “Landlord”, such obligation shall be deemed to run from Subtenant to both Master Landlord and Sublandlord; and (xi) the following modifications shall be made to the Master Lease as incorporated herein:

(i)the following provisions of the Master Lease are not incorporated herein: Sections 1.1(a)(except last sentence), 2, 3.1, 4.2, 5, 6.1, 7.1(first sentence), 7.2(a)(except clause (i)), 7.2(b),

7.5, 8.1(b), 9.6(b)(xi) 9.6(c), 10.6(b), 14.1, 15.2, 16, 17.1, 17.15, 17.16, 17.21, Exhibit B, Exhibit C, Exhibit

D, First Amendment to Lease, Acknowledgment of Rent Commencement Date, Second Amendment to Lease, and Third Amendment to Lease;

(ii)references to “one-half (1/2)” in Sections 11.2(b) and 11.2(c) of the Master Lease shall be changed to “one hundred percent (100%)”; and

(iii)the proportion of Subtenant’s rent abated pursuant to any right to abate rent provided to Subtenant through incorporation of the provisions of the Master Lease shall not exceed the proportion of Sublandlord’s rent actually abated under the Master Lease with respect to the Subleased Premises. As an example only, if Sublandlord is entitled to receive an abatement of 50% of the rent payable under the Master Lease with respect to the Subleased Premises for a period of the Term, then Subtenant shall be entitled to receive an abatement of 50% of the Base Rent payable under this Sublease for such period. However, as a further example, if Sublandlord is entitled to receive an abatement of 50% of the rent payable under the Master Lease solely with respect to portions of the Building that do not include the Subleased Premises for a period of the Term, then Subtenant shall not be entitled to any abatement of Base Rent for such period.

B.Performance of Obligations. This Sublease is and at all times shall be subject and subordinate to the Master Lease and the rights of Master Landlord thereunder. Subtenant hereby expressly

-11-

agrees: (i) to comply with all provisions of the Master Lease with respect to the Term which are incorporated hereunder; and (ii) to perform all the obligations on the part of the “Tenant” to be performed under the terms of the Master Lease which are incorporated hereunder with respect to the Subleased Premises during the term of this Sublease except as expressly provided otherwise in this Sublease, including Paragraphs 4.B, 8, 16, and

23.A above. So long as Subtenant performs its obligations under the Sublease, Sublandlord shall continue to perform the obligations of “Tenant” under the Master Lease that Subtenant has not agreed to perform under this Sublease. Subject to Sublandlord’s rights under Paragraph 3.D above, Sublandlord shall not agree to amend or modify the Master Lease in any way so as to materially and adversely affect Subtenant’s rights or obligations under the Sublease without the prior written approval of Subtenant, which shall not be unreasonably withheld, conditioned or delayed. Except in connection with any termination right that Sublandlord may have under Article 13 of the Master Lease, Sublandlord shall not otherwise voluntarily terminate the Master Lease during the first fourteen (14) months of the Term without Subtenant’s prior written approval unless Master Landlord agrees to continue Subtenant’s occupancy of the Subleased Premises for the remainder of such first fourteen (14) months of the Term on the same terms and conditions of this Sublease. In the event the Master Lease is terminated for any reason whatsoever, this Sublease shall terminate simultaneously with such termination without any liability of Sublandlord to Subtenant, unless such termination is occasioned by (a) an “event of default” by Sublandlord as the “Tenant” under the Master Lease not arising out of any act or omission of Subtenant or its employees, agents, contractors or invitees, or (b) a breach of Sublandlord’s obligations under the preceding sentence of this Paragraph, which termination in either case shall constitute a default by Sublandlord hereunder unless Master Landlord agrees to continue Subtenant’s occupancy of the Subleased Premises for the remainder of the first fourteen (14) months of the Term on the same terms and conditions of this Sublease. In the event of a conflict between the provisions of this Sublease and the Master Lease, as between Sublandlord and Subtenant, the provisions of this Sublease shall control.

24.Right to Contest: If Sublandlord does not have the right to contest any matter in the Master Lease due to expiration of any time limit that may be set forth therein or for any other reason, then notwithstanding any incorporation of any such provision from the Master Lease in this Sublease, Subtenant shall also not have the right to contest any such matter.

25.Network Room: Subtenant shall be responsible for obtaining internet and network services for the Subleased Premises at Subtenant’s sole cost and expense. Sublandlord shall reasonably cooperate with Subtenant in submitting requests for any necessary approvals or consents required from Master Landlord under the Master Lease to obtain such services. Subtenant shall have the right to use the existing cabling and wiring exclusively serving the Subleased Premises and may connect the same to Subtenant’s own switch and firewall, which switch and firewall may be installed by Subtenant in the network room for the Master Premises (the “Network Room”). Subtenant shall not enter or access the Network Room except upon reasonable advance notice to Sublandlord, and only with the supervision by an authorized employee of Sublandlord and only for the purpose of accessing Subtenant’s switch and firewall therein. If Subtenant elects to install its switch and firewall in the Network Room, Subtenant shall install, maintain and operate such switch and firewall equipment in the Network Room without damaging or otherwise affecting the equipment of Sublandlord in the Network Room (or the equipment of any other subtenants of the Master Premises) or any cabling serving the Master Premises and shall otherwise perform such installation in a good and workmanlike manner, in compliance with all laws, codes, ordinances, rules and regulations, and in a manner reasonably prescribed by Sublandlord. The Network Room and all cabling and wiring in the Subleased Premises are provided by Sublandlord in their “AS IS” condition, and Subtenant shall use such cabling and wiring at Subtenant’s sole risk. No representations or warranties as to such cabling and wiring’s condition or fitness for a particular purpose, express or implied, are made by Sublandlord.

-12-

26.Furniture, Fixtures and Equipment: Subtenant shall have the right to use during the Term the furnishings within the Subleased Premises shown on Exhibit C attached hereto (the “Furniture”) at no additional cost to Subtenant. The Furniture is provided in its “AS IS, WHERE IS” condition, without representation or warranty whatsoever. Subtenant shall insure the Furniture under the property insurance policy required under the Master Lease, as incorporated herein, and pay all taxes with respect to the Furniture. Subtenant shall maintain the Furniture in good condition and repair, reasonable wear and tear excepted, and shall be responsible for any loss or damage to the same occurring during the Term. Subtenant shall surrender the Furniture to Sublandlord upon the termination of this Sublease in the same condition as exists as of the Commencement Date, reasonable wear and tear excepted. Subtenant shall not remove any of the Furniture from the Subleased Premises.

27.Signage: Subject to Master Landlord’s (to the extent required under the Master Lease) and Sublandlord’s consent (with Sublandlord’s consent not to be unreasonably withheld, conditioned or delayed), and provided the same do not reduce or diminish Sublandlord’s ability to install its own signs, Subtenant shall have the right to install suite identification signage at the separate entrance to the Subleased Premises. All costs for installation, maintenance, and removal or restoration of such signage shall be at Subtenant’s sole

cost and expense.

28.Generator: Subtenant shall have access to its pro-rata share of the generator servicing the Master Premises throughout the Term.

29.Contingent Allowance: If approved, permitted and paid by Master Landlord, Subtenant shall be entitled to receive from Master Landlord the benefit of a portion of remaining available “Tenant Improvement Allowance” under the Master Lease up to maximum amount of $200,000 (the “Contingent Allowance”), subject to the conditions, restrictions and deadlines set forth in the Master Lease (except as otherwise waived or modified by Master Landlord). Receipt of such Tenant Improvement Allowance shall not be a condition to this Sublease, Sublandlord shall not be responsible for paying such Tenant Improvement Allowance, and Sublandlord shall not be liable for any failure by Master Landlord to pay the same to Subtenant. Sublandlord shall, however, upon Subtenant’s request use Sublandlord’s reasonable efforts (not including the payment of monies unless Subtenant agrees to reimburse Sublandlord for any reasonable out-of-pocket costs incurred by Sublandlord, the incurring of any liabilities, or the institution of legal proceedings, which may be instituted only at Sublandlord’s sole discretion) to obtain Master Landlord’s performance of the same. Subtenant shall forfeit and shall no longer be entitled to receive any portion of the Contingent Allowance that is not disbursed or requested for disbursement before the six (6) month anniversary of the Commencement Date.

30.Review Costs: Subtenant shall reimburse Master Landlord promptly for any and all reasonable costs and expenses that are payable under the Master Lease, including without limitation reasonable attorneys’ fees, incurred by Master Landlord in connection with any consent requested from the Master Landlord in connection with the Sublease, including without limitation, Master Landlord consent to any further subleasing of the Subleased Premises by Subtenant or approval of alterations or improvements to be installed by Subtenant.

31.Employee Non-Solicitation: Sublandlord and Subtenant each agree not to disrupt or interfere with the respective business of the other by directly or indirectly soliciting, recruiting, attempting to recruit, or raiding employees that are employed by the other at any time between (a) the date on which the Sublease is fully executed by the parties hereto and approved in writing by Master Landlord and (b) the expiration or earlier termination of the Sublease. If a party breaches this provision, such breaching party agrees to pay the other party, as a liquidated damage and not as a penalty, the amount of $500,000 for each employee recruited by such breaching party in breach of this provision.

-13-

32.Inspection by a CASp in Accordance with Civil Code Section 1938: To Sublandlord’s actual knowledge, the property being leased or rented pursuant to this Sublease has not undergone inspection by a Certified Access Specialist (CASp). In addition, the following notice is hereby provided pursuant to

Section 1938(e) of the California Civil Code: “A Certified Access Specialist (CASp) can inspect the subject premises and determine whether the subject premises comply with all of the applicable construction-related

accessibility standards under state law. Although state law does not require a CASp inspection of the subject

premises, the commercial property owner or lessor may not prohibit the lessee or tenant from obtaining a CASp inspection of the subject premises for the occupancy or potential occupancy of the lessee or tenant, if

requested by the lessee or tenant. The parties shall mutually agree on the arrangements for the time and

manner of the CASp inspection, the payment of the fee for the CASp inspection, and the cost of making any repairs necessary to correct violations of construction-related accessibility standards within the premises.” Sublandlord and Subtenant agree that if Subtenant requests a CASp inspection of the Subleased Premises, then Subtenant shall pay (a) the fee for such inspection, and (b) the cost of making any repairs necessary to correct violations of construction-related accessibility standards within the Subleased Premises.

33.Conditions Precedent: Notwithstanding anything to the contrary in this Sublease, this Sublease and Sublandlord’s obligations hereunder are conditioned upon Sublandlord’s receipt of the written consent of Master Landlord to this Sublease. Unless waived in writing by Sublandlord, such consent shall provide that Master Landlord waives its rights under Sections 11.2(b)-(c) of the Master Lease with respect to the Rent payable under this Sublease, and Master Landlord approves of Subtenant’s use of the Subleased Premises as a Clinical Laboratory Improvement Amendments (CLIA)-certified laboratory. In addition, unless waived in writing by Subtenant, such consent shall provide that the terms of Section 10.4 of the Master Lease (Mutual Waiver of Subrogation) shall also apply as between Master Landlord and Subtenant,. If Sublandlord does not receive such consent within thirty (30) days after execution of this Sublease by Sublandlord, then either party may terminate this Sublease by giving the other party ten (10) days’ prior written notice, in which case this Sublease shall terminate on the day following the last day of the ten (10)-day notice period (unless Master Landlord’s consent is obtained during such ten (10)-day period, in which case this Sublease shall remain in full force and effect), and upon such termination, Sublandlord shall return to Subtenant all prepaid rent and the Security Deposit. Subtenant shall pay all consent and review fees set forth in the Master Lease for Master Landlord’s consent to the subletting hereunder. This Sublease is further conditioned upon Sublandlord and Subtenant entering into a Mutual Confidentiality Agreement in the form attached hereto as Exhibit E (the “NDA”).

34.Termination; Recapture: Notwithstanding anything to the contrary herein, Subtenant acknowledges that, under the Master Lease, both Master Landlord and Sublandlord have certain termination and recapture rights, including, without limitation, in Sections 11 and 13 of the Master Lease. Nothing herein shall prohibit Master Landlord or Sublandlord from exercising any such rights and neither Master Landlord nor Sublandlord shall have any liability to Subtenant as a result thereof. In the event Master Landlord or Sublandlord exercise any such termination or recapture rights, this Sublease shall terminate without any liability to Master Landlord or Sublandlord.

hereof.

|

35. |

No Recording: Subtenant agrees that it will not record this Sublease, or a short memorandum |

hereto.

|

36. |

Amendment: This Sublease may not be amended except by the written agreement of all parties |

37.No Drafting Presumption: The parties acknowledge that this Sublease has been agreed to by both the parties, that both Sublandlord and Subtenant have consulted with attorneys with respect to the terms

-14-

of this Sublease and that no presumption shall be created against Sublandlord because Sublandlord drafted this Sublease.

38.Entire Agreement: This Sublease constitutes the entire agreement between the parties with respect to the subject matter herein, and there are no binding agreements or representations between the parties except as expressed herein. No subsequent change or addition to this Lease shall be binding unless in writing and signed by the parties hereto.

39. Sublandlord’s Additional Representations : Sublandlord represents and warrants to Subtenant that, as of the date first written above: (i) the copy of the Master Lease attached hereto is a true, correct and complete copy thereof, (ii) to Sublandlord’s knowledge, there exists no default or event of default by Master Landlord under the Master Lease, (iii) Sublandlord has not received written notice from Master Landlord of any default by Sublandlord under the Master Lease, (iv) to Sublandlord’s knowledge, there are no pending or threatened actions, suits or proceedings before any court or administrative agency against Sublandlord that could, in the aggregate, materially adversely affect the Subleased Premises or the Master Premises, and (v) at least $200,000 of the Existing Premises Improvement Allowance is unused and shall remain unused by Sublandlord during the six (6)-month period set forth in Paragraph 29 above. As used in this Paragraph 39, the phrase “to Sublandlord’s knowledge” shall be deemed to refer to facts within the actual knowledge only of Yvonne Li, Sublandlord’s Vice President of Finance, Controller and Administration, as of the date of this Sublease, without duty of inquiry.

40.Quiet Enjoyment: Subtenant shall peacefully have, hold and enjoy the Subleased Premises, subject to the terms and conditions of this Sublease, provided that Subtenant pays all Rent and performs all of Subtenant’s covenants and agreements contained therein.

|

|

41. |

Parking: Subtenant shall have the non-exclusive and non-reserved use of approximately three |

(3) automobile parking stalls in the Center per 1,000 rentable square feet of space in the Subleased Premises pursuant to Section 17.20 of the Master Lease incorporated herein.

42.Counterparts: This Sublease may be executed in one (1) or more counterparts each of which shall be deemed an original but all of which together shall constitute one (1) and the same instrument. Signature copies may be detached from the counterparts and attached to a single copy of this Sublease physically to form one (1) document. The signatures of all of the parties need not appear on the same counterpart, and delivery of an executed counterpart signature page in PDF is as effective as executing and delivering this Sublease in the presence of the other parties to this Sublease.

-15-

IN WITNESS WHEREOF, the parties have executed this Sublease as of the day and year first above written.

SUBLANDLORD:SUBTENANT:

ONCOMED PHARMACEUTICALS, INC.,VENN BIOSCIENCES CORPORATION,

a Delaware corporationa Delaware corporation

By: /s/ John LewickiBy: /s/ Aldo Carrascoso

Print Name: John Lewicki, Ph.D.Print Name: Aldo Carrascoso

Title:President & CEOTitle: CEO

Address:Address:

800 Chesapeake Drive[800 Chesapeake Drive]

Redwood City, CA 94063Redwood City, CA 94063

Attn: LegalAttn:

-16-

EXHIBIT A

MASTER LEASE

-17-

|

|

|

|

|

Landlord: |

|

Slough Redwood City, LLC |

|

|

|

|

|

Tenant: |

|

OncoMed Pharmaceuticals, Inc. |

|

|

|

|

|

Date: |

|

May 30, 2006 |

TABLE OF CONTENTS

|

|

|

|

|

|

|

|

|

|

|

|

|

1. |

|

PROPERTY |

|

|

1 |

|

||||

|

|

|

1.1 |

|

Lease of Premises |

|

|

1 |

|

||

|

|

|

1.2 |

|

Landlord’s Reserved Rights |

|

|

2 |

|

||

|

2. |

|

TERM |

|

|

2 |

|

||||

|

|

|

2.1 |

|

Term |

|

|

2 |

|

||

|

|

|

2.2 |

|

Early Possession |

|

|

4 |

|

||

|

|

|

2.3 |

|

Condition of Premises |

|

|

5 |

|

||

|

|

|

2.4 |

|

Acknowledgment of Rent Commencement Date |

|

|

8 |

|

||

|

|

|

2.5 |

|

Holding Over |

|

|

9 |

|

||

|

|

|

2.6 |

|

Options to Extend Term |

|

|

9 |

|

||

|

3. |

|

RENTAL |

|

|

10 |

|

||||

|

|

|

3.1 |

|

Minimum Rental |

|

|

10 |

|

||

|

|

|

|

|

(a) |

|

Rental Amounts |

|

|

10 |

|

|

|

|

|

|

(b) |

|

Rental Amounts During Extended Term(s) |

|

|

10 |

|

|

|

|

|

|

(c) |

|

Square Footage of Premises |

|

|

10 |

|

|

|

|

3.2 |

|

Late Charge |

|

|

11 |

|

||

|

4. |

|

TAXES |

|

|

12 |

|

||||

|

|

|

4.1 |

|

Personal Property |

|

|

12 |

|

||

|

|

|

4.2 |

|

Real Property |

|

|

12 |

|

||

|

5. |

|

OPERATING EXPENSES |

|

|

13 |

|

||||

|

|

|

5.1 |

|

Payment of Operating Expenses |

|

|

13 |

|

||

|

|

|

5.2 |

|

Definition of Operating Expenses |

|

|

13 |

|

||

|

|

|

5.3 |

|

Determination of Operating Expenses |

|

|

15 |

|

||

|

|

|

5.4 |

|

Final Accounting for Expense Year |

|

|

16 |

|

||

|

|

|

5.5 |

|

Proration |

|

|

16 |

|

||

|

6. |

|

UTILITIES |

|

|

17 |

|

||||

|

|

|

6.1 |

|

Payment |

|

|

17 |

|

||

|

|

|

6.2 |

|

Interruption |

|

|

17 |

|

||

|

7. |

|

ALTERATIONS; SIGNS |

|

|

18 |

|

||||

|

|

|

7.1 |

|

Right to Make Alterations |

|

|

18 |

|

||

|

|

|

7.2 |

|

Title to Alterations |

|

|

18 |

|

||

|

|

|

7.3 |

|

Tenant Trade Fixtures |

|

|

20 |

|

||

|

|

|

7.4 |

|

No Liens |

|

|

20 |

|

||

|

|

|

7.5 |

|

Signs |

|

|

20 |

|

||

|

8. |

|

MAINTENANCE AND REPAIRS |

|

|

20 |

|

||||

|

|

|

8.1 |

|

Landlord’s Obligation for Maintenance |

|

|

20 |

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(a) |

|

Repairs and Maintenance |

|

|

20 |

|

|

|

|

|

|

(b) |

|

Tenant’s Remedy |

|

|

21 |

|

|

|

|

8.2 |

|

Tenant’s Obligation for Maintenance |

|

|

21 |

|

||

|

|

|

|

|

(a) |

|

Good Order, Condition and Repair |

|

|

21 |

|

|

|

|

|

|

(b) |

|

Landlord’s Remedy |

|

|

22 |

|

|

|

|

|

|

(c) |

|

Condition Upon Surrender |

|

|

22 |

|

|

9. |

|

USE OF PROPERTY |

|

|

22 |

|

||||

|

|

|

9.1 |

|

Permitted Use |

|

|

22 |

|

||

|

|

|

9.2 |

|

[Intentionally Deleted.] |

|

|

23 |

|

||

|

|

|

9.3 |

|

No Nuisance |

|

|

23 |

|

||

|

|

|

9.4 |

|

Compliance with Laws |

|

|

23 |

|

||

|

|

|

9.5 |

|

Liquidation Sales |

|

|

24 |

|

||

|

|

|

9.6 |

|

Environmental Matters |

|

|

24 |

|

||

|

10. |

|

INSURANCE AND INDEMNITY |

|

|

30 |

|

||||

|

|

|

10.1 |

|

Insurance |

|

|

30 |

|

||

|

|

|

10.2 |

|

Quality of Policies and Certificates |

|

|

32 |

|

||

|

|

|

10.3 |

|

Workers’ Compensation; Employees |

|

|

33 |

|

||

|

|

|

10.4 |

|

Waiver of Subrogation |

|

|

33 |

|

||

|

|

|

10.5 |

|

Increase in Premiums |

|

|

33 |

|

||

|

|

|

10.6 |

|

Indemnification |

|

|

33 |

|

||

|

|

|

10.7 |

|

Blanket Policy |

|

|

34 |

|

||

|

11. |

|

SUBLEASE AND ASSIGNMENT |

|

|

34 |

|

||||

|

|

|

11.1 |

|

Assignment and Sublease of Building |

|

|

34 |

|

||

|

|

|

11.2 |

|

Rights of Landlord |

|

|

35 |

|

||

|

12. |

|

RIGHT OF ENTRY AND QUIET ENJOYMENT |

|

|

36 |

|

||||

|

|

|

12.1 |

|

Right of Entry |

|

|

36 |

|

||

|

|

|

12.2 |

|

Quiet Enjoyment |

|

|

37 |

|

||

|

13. |

|

CASUALTY AND TAKING |

|

|

37 |

|

||||

|

|

|

13.1 |

|

Damage or Destruction |

|

|

37 |

|

||

|

|

|

13.2 |

|

Condemnation |

|

|

39 |

|

||

|

|

|

13.3 |

|

Reservation of Compensation |

|

|

40 |

|

||

|

|

|

13.4 |

|

Restoration of Improvements |

|

|

41 |

|

||

|

14. |

|

DEFAULT |

|

|

41 |

|

||||

|

|

|

14.1 |

|

Events of Default |

|

|

41 |

|

||

|

|

|

|

|

(a) |

|

Abandonment |

|

|

41 |

|

|

|

|

|

|

(b) |

|

Nonpayment |

|

|

41 |

|

|

|

|

|

|

(c) |

|

Other Obligations |

|

|

41 |

|

|

|

|

|

|

(d) |

|

General Assignment |

|

|

41 |

|

|

|

|

|

|

(e) |

|

Bankruptcy |

|

|

42 |

|

|

|

|

|

|

(f) |

|

Receivership |

|

|

42 |

|

|

|

|

|

|

(g) |

|

Attachment |

|

|

42 |

|

|

|

|

|

|

(h) |

|

Insolvency |

|

|

42 |

|

|

|

|

14.2 |

|

Remedies Upon Tenant’s Default |

|

|

42 |

|

||

|

|

|

14.3 |

|

Remedies Cumulative |

|

|

43 |

|

||

|

15. |

|

SUBORDINATION, ATTORNMENT AND SALE |

|

|

43 |

|

||||

|

|

|

15.1 |

|

Subordination to Mortgage |

|

|

43 |

|

||

-ii-

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

15.2 |

|

Sale of Landlord’s Interest |

|

|

44 |

|

||

|

|

|

15.3 |

|

Estoppel Certificates |

|

|

44 |

|

||

|

|

|

15.4 |

|

Subordination to CC&R’s |

|

|

45 |

|

||

|

|

|

15.5 |

|

Mortgagee Protection |

|

|

45 |

|

||

|

16. |

|

SECURITY |

|

|

46 |

|

||||

|

|

|

16.1 |

|

Deposit |

|

|

46 |

|

||

|

17. |

|

MISCELLANEOUS |

|

|

46 |

|

||||

|

|

|

17.1 |

|

Notices |

|

|

46 |

|

||

|

|

|

17.2 |

|

Successors and Assigns |

|

|

48 |

|

||

|

|

|

17.3 |

|

No Waiver |

|

|

48 |

|

||

|

|

|

17.4 |

|

Severability |

|

|

48 |

|

||

|

|

|

17.5 |

|

Litigation Between Parties |

|

|

48 |

|

||

|

|

|

17.6 |

|

Surrender |

|

|

48 |

|

||

|

|

|

17.7 |

|

Interpretation |

|

|

48 |

|

||

|

|

|

17.8 |

|

Entire Agreement |

|

|

48 |

|

||

|

|

|

17.9 |

|

Governing Law |

|

|

49 |

|

||

|

|

|

17.10 |

|

No Partnership |

|

|

49 |

|

||

|

|

|

17.11 |

|

Financial Information |

|

|

49 |

|

||

|

|

|

17.12 |

|

Costs |

|

|

50 |

|

||

|

|

|

17.13 |

|

Time |

|

|

50 |

|

||

|

|

|

17.14 |

|

Rules and Regulations |

|

|

50 |

|

||

|

|

|

17.15 |

|

Brokers |

|

|

50 |

|

||

|

|

|

17.16 |

|

Memorandum of Lease |

|

|

50 |

|

||

|

|

|

17.17 |

|

Organizational Authority |

|

|

50 |

|

||

|

|

|

17.18 |

|

Execution and Delivery |

|

|

50 |

|

||

|

|

|

17.19 |

|

Survival |

|

|

51 |

|

||

|

|

|

17.20 |

|

Parking |

|

|

51 |

|

||

|

|

|

17.21 |

|

Warrant |

|

|

51 |

|

||

|

|

|

17.22 |

|

Approvals |

|

|

51 |

|

||

|

|

||||||||||

|

EXHIBITS |

|

|||||||||

|

|

|

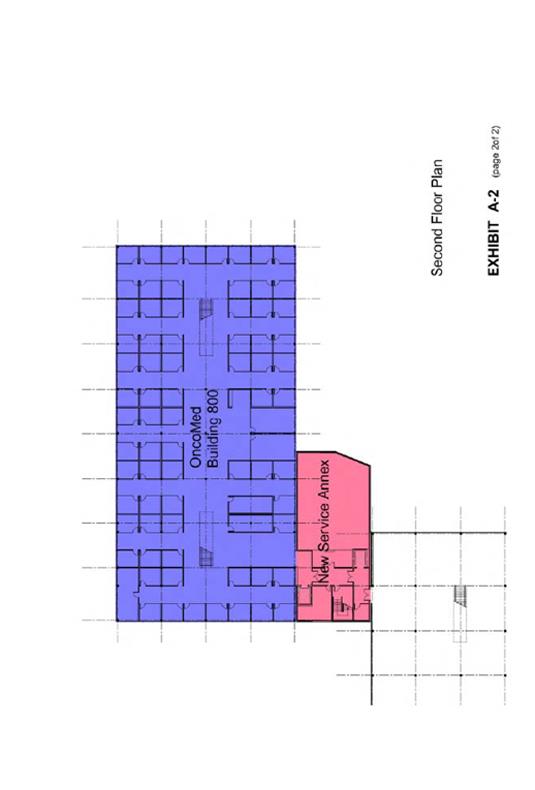

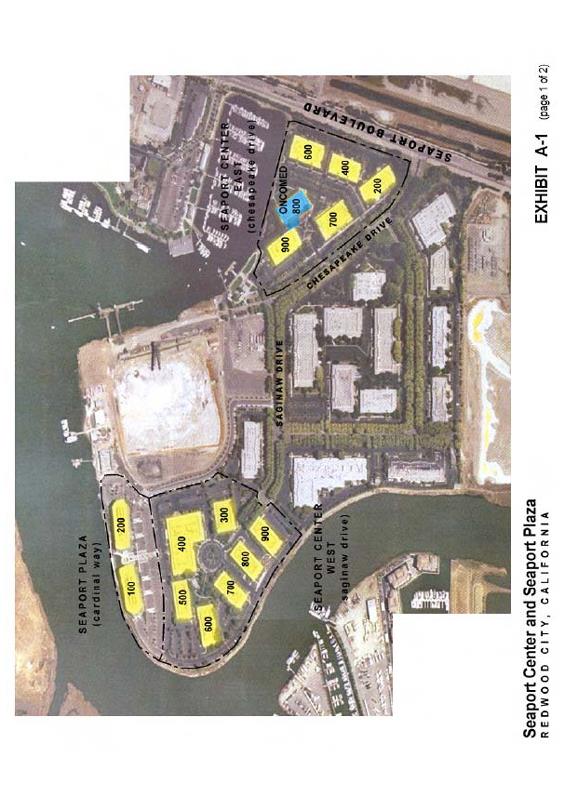

EXHIBIT A-1 |

|

Site Plan (The Center) |

|

|

|

|

||

|

|

|

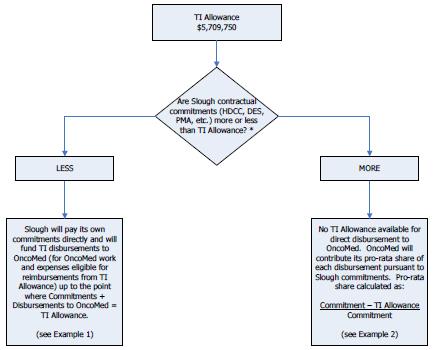

EXHIBIT A-2 |

|

Building Plan/Service Annex |

|

|

|

|

||

|

|

|

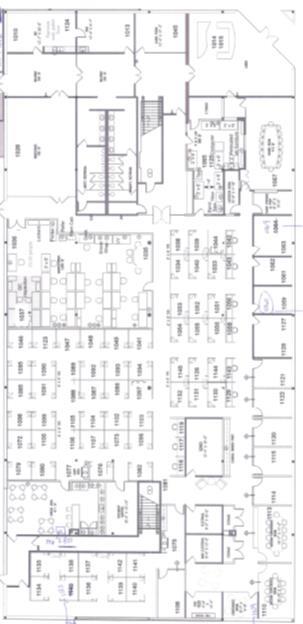

EXHIBIT B |

|

Workletter |

|

|

|

|

||

|

|

|

EXHIBIT C |

|

Form of Acknowledgment of Rent Commencement Date |

|

|

|

|

||

|

|

|

EXHIBIT D |

|

Form of Warrant |

|

|

|

|

||

-iii-

THIS LEASE (“Lease”) is made and entered into as of May 30, 2006 (the “Lease Commencement Date”), by and between SLOUGH REDWOOD CITY, LLC, a Delaware limited liability company (“Landlord”), and ONCOMED PHARMACEUTICALS, INC., a Delaware corporation (“Tenant”).

THE PARTIES AGREE AS FOLLOWS:

1. PROPERTY

1.1 Lease of Premises.