hli-20230331false00013022152023FYhttp://fasb.org/us-gaap/2022#OtherCostAndExpenseOperatinghttp://fasb.org/us-gaap/2022#OtherCostAndExpenseOperating00013022152022-04-012023-03-3100013022152022-09-30iso4217:USD0001302215us-gaap:CommonClassAMember2023-05-23xbrli:shares0001302215us-gaap:CommonClassBMember2023-05-2300013022152023-03-3100013022152022-03-310001302215us-gaap:CommonClassAMember2023-03-31iso4217:USDxbrli:shares0001302215us-gaap:CommonClassAMember2022-03-310001302215us-gaap:CommonClassBMember2022-03-310001302215us-gaap:CommonClassBMember2023-03-3100013022152021-04-012022-03-3100013022152020-04-012021-03-310001302215us-gaap:CommonStockMemberus-gaap:CommonClassAMember2020-03-310001302215us-gaap:CommonClassBMemberus-gaap:CommonStockMember2020-03-310001302215us-gaap:AdditionalPaidInCapitalMember2020-03-310001302215us-gaap:RetainedEarningsMember2020-03-310001302215us-gaap:AccumulatedOtherComprehensiveIncomeMember2020-03-310001302215us-gaap:ParentMember2020-03-310001302215us-gaap:RetainedEarningsMembersrt:CumulativeEffectPeriodOfAdoptionAdjustmentMember2020-03-310001302215us-gaap:ParentMembersrt:CumulativeEffectPeriodOfAdoptionAdjustmentMember2020-03-310001302215us-gaap:CommonStockMemberus-gaap:CommonClassAMember2020-04-012021-03-310001302215us-gaap:CommonClassBMemberus-gaap:CommonStockMember2020-04-012021-03-310001302215us-gaap:AdditionalPaidInCapitalMember2020-04-012021-03-310001302215us-gaap:ParentMember2020-04-012021-03-310001302215us-gaap:RetainedEarningsMember2020-04-012021-03-310001302215us-gaap:AccumulatedOtherComprehensiveIncomeMember2020-04-012021-03-310001302215us-gaap:CommonStockMemberus-gaap:CommonClassAMember2021-03-310001302215us-gaap:CommonClassBMemberus-gaap:CommonStockMember2021-03-310001302215us-gaap:AdditionalPaidInCapitalMember2021-03-310001302215us-gaap:RetainedEarningsMember2021-03-310001302215us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-03-310001302215us-gaap:ParentMember2021-03-310001302215us-gaap:CommonClassBMemberus-gaap:CommonStockMember2021-04-012022-03-310001302215us-gaap:AdditionalPaidInCapitalMember2021-04-012022-03-310001302215us-gaap:ParentMember2021-04-012022-03-310001302215us-gaap:RetainedEarningsMember2021-04-012022-03-310001302215us-gaap:CommonStockMemberus-gaap:CommonClassAMember2021-04-012022-03-310001302215us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-04-012022-03-310001302215us-gaap:CommonStockMemberus-gaap:CommonClassAMember2022-03-310001302215us-gaap:CommonClassBMemberus-gaap:CommonStockMember2022-03-310001302215us-gaap:AdditionalPaidInCapitalMember2022-03-310001302215us-gaap:RetainedEarningsMember2022-03-310001302215us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-03-310001302215us-gaap:ParentMember2022-03-310001302215us-gaap:CommonClassBMemberus-gaap:CommonStockMember2022-04-012023-03-310001302215us-gaap:AdditionalPaidInCapitalMember2022-04-012023-03-310001302215us-gaap:ParentMember2022-04-012023-03-310001302215us-gaap:RetainedEarningsMember2022-04-012023-03-310001302215us-gaap:CommonStockMemberus-gaap:CommonClassAMember2022-04-012023-03-310001302215us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-04-012023-03-310001302215us-gaap:CommonStockMemberus-gaap:CommonClassAMember2023-03-310001302215us-gaap:CommonClassBMemberus-gaap:CommonStockMember2023-03-310001302215us-gaap:AdditionalPaidInCapitalMember2023-03-310001302215us-gaap:RetainedEarningsMember2023-03-310001302215us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-03-310001302215us-gaap:ParentMember2023-03-3100013022152021-03-3100013022152020-03-31hli:segment0001302215us-gaap:ForeignExchangeForwardMember2023-03-31hli:numberOfInstrumentsiso4217:EUR0001302215us-gaap:ForeignExchangeForwardMember2022-03-310001302215us-gaap:ForeignExchangeForwardMember2022-04-012023-03-310001302215us-gaap:ForeignExchangeForwardMember2021-04-012022-03-310001302215us-gaap:PrincipalOwnerMemberhli:ManagementAccountingLegalRegulatoryAndOtherAdministrativeServicesMember2022-04-012023-03-310001302215us-gaap:PrincipalOwnerMemberhli:ManagementAccountingLegalRegulatoryAndOtherAdministrativeServicesMember2021-04-012022-03-310001302215us-gaap:PrincipalOwnerMemberhli:ManagementAccountingLegalRegulatoryAndOtherAdministrativeServicesMember2020-04-012021-03-310001302215us-gaap:OtherAssetsMember2023-03-310001302215us-gaap:OtherAssetsMember2022-03-310001302215us-gaap:CorporateDebtSecuritiesMemberus-gaap:FairValueInputsLevel1Member2023-03-310001302215us-gaap:FairValueInputsLevel2Memberus-gaap:CorporateDebtSecuritiesMember2023-03-310001302215us-gaap:FairValueInputsLevel3Memberus-gaap:CorporateDebtSecuritiesMember2023-03-310001302215us-gaap:CorporateDebtSecuritiesMember2023-03-310001302215us-gaap:USTreasurySecuritiesMemberus-gaap:FairValueInputsLevel1Member2023-03-310001302215us-gaap:USTreasurySecuritiesMemberus-gaap:FairValueInputsLevel2Member2023-03-310001302215us-gaap:FairValueInputsLevel3Memberus-gaap:USTreasurySecuritiesMember2023-03-310001302215us-gaap:USTreasurySecuritiesMember2023-03-310001302215us-gaap:CommonStockMemberus-gaap:FairValueInputsLevel1Member2023-03-310001302215us-gaap:CommonStockMemberus-gaap:FairValueInputsLevel2Member2023-03-310001302215us-gaap:FairValueInputsLevel3Memberus-gaap:CommonStockMember2023-03-310001302215us-gaap:CommonStockMember2023-03-310001302215us-gaap:CertificatesOfDepositMemberus-gaap:FairValueInputsLevel1Member2023-03-310001302215us-gaap:CertificatesOfDepositMemberus-gaap:FairValueInputsLevel2Member2023-03-310001302215us-gaap:FairValueInputsLevel3Memberus-gaap:CertificatesOfDepositMember2023-03-310001302215us-gaap:CertificatesOfDepositMember2023-03-310001302215us-gaap:FairValueInputsLevel1Member2023-03-310001302215us-gaap:FairValueInputsLevel2Member2023-03-310001302215us-gaap:FairValueInputsLevel3Member2023-03-310001302215us-gaap:CorporateDebtSecuritiesMemberus-gaap:FairValueInputsLevel1Member2022-03-310001302215us-gaap:FairValueInputsLevel2Memberus-gaap:CorporateDebtSecuritiesMember2022-03-310001302215us-gaap:FairValueInputsLevel3Memberus-gaap:CorporateDebtSecuritiesMember2022-03-310001302215us-gaap:CorporateDebtSecuritiesMember2022-03-310001302215us-gaap:USTreasurySecuritiesMemberus-gaap:FairValueInputsLevel1Member2022-03-310001302215us-gaap:USTreasurySecuritiesMemberus-gaap:FairValueInputsLevel2Member2022-03-310001302215us-gaap:FairValueInputsLevel3Memberus-gaap:USTreasurySecuritiesMember2022-03-310001302215us-gaap:USTreasurySecuritiesMember2022-03-310001302215us-gaap:CertificatesOfDepositMemberus-gaap:FairValueInputsLevel1Member2022-03-310001302215us-gaap:CertificatesOfDepositMemberus-gaap:FairValueInputsLevel2Member2022-03-310001302215us-gaap:FairValueInputsLevel3Memberus-gaap:CertificatesOfDepositMember2022-03-310001302215us-gaap:CertificatesOfDepositMember2022-03-310001302215us-gaap:FairValueInputsLevel1Member2022-03-310001302215us-gaap:FairValueInputsLevel2Member2022-03-310001302215us-gaap:FairValueInputsLevel3Member2022-03-310001302215us-gaap:EquipmentMember2022-04-012023-03-310001302215us-gaap:EquipmentMember2023-03-310001302215us-gaap:EquipmentMember2022-03-310001302215us-gaap:FurnitureAndFixturesMember2022-04-012023-03-310001302215us-gaap:FurnitureAndFixturesMember2023-03-310001302215us-gaap:FurnitureAndFixturesMember2022-03-310001302215us-gaap:LeaseholdImprovementsMember2022-04-012023-03-310001302215us-gaap:LeaseholdImprovementsMember2023-03-310001302215us-gaap:LeaseholdImprovementsMember2022-03-310001302215hli:ComputersAndSoftwareMember2022-04-012023-03-310001302215hli:ComputersAndSoftwareMember2023-03-310001302215hli:ComputersAndSoftwareMember2022-03-310001302215us-gaap:OtherCapitalizedPropertyPlantAndEquipmentMember2023-03-310001302215us-gaap:OtherCapitalizedPropertyPlantAndEquipmentMember2022-03-310001302215hli:CorporateFinanceMember2022-03-310001302215hli:CorporateFinanceMember2023-01-012023-03-310001302215hli:CorporateFinanceMember2023-03-310001302215hli:FinancialRestructuringMember2022-03-310001302215hli:FinancialRestructuringMember2023-01-012023-03-310001302215hli:FinancialRestructuringMember2023-03-310001302215hli:FinancialAdvisoryServicesMember2022-03-310001302215hli:FinancialAdvisoryServicesMember2023-01-012023-03-310001302215hli:FinancialAdvisoryServicesMember2023-03-310001302215us-gaap:RevolvingCreditFacilityMemberhli:BankofAmericaMember2019-08-230001302215us-gaap:RevolvingCreditFacilityMemberhli:A2019LineofCreditExpansionOptionMemberhli:BankofAmericaMember2019-08-230001302215us-gaap:RevolvingCreditFacilityMemberhli:SecuredOvernightFinancingRateSOFRMemberhli:BankofAmericaMember2019-08-232019-08-23xbrli:pure0001302215us-gaap:RevolvingCreditFacilityMemberhli:BankofAmericaMember2019-08-232019-08-230001302215us-gaap:RevolvingCreditFacilityMemberus-gaap:FederalFundsEffectiveSwapRateMemberhli:BankofAmericaMember2019-08-232019-08-230001302215us-gaap:RevolvingCreditFacilityMemberhli:BankofAmericaMember2023-03-310001302215hli:NonInterestBearingUnsecuredConvertibleLoanMemberus-gaap:LoansPayableMember2018-04-300001302215hli:NonInterestBearingUnsecuredConvertibleLoanMemberus-gaap:LoansPayableMember2022-04-012023-03-310001302215hli:NonInterestBearingUnsecuredConvertibleLoanMemberus-gaap:LoansPayableMember2021-04-012022-03-310001302215hli:NonInterestBearingUnsecuredConvertibleLoanMemberus-gaap:LoansPayableMember2020-04-012021-03-310001302215us-gaap:LoansPayableMemberhli:TwoPointEightyEightPercentLoansPayableMember2018-05-310001302215us-gaap:LoansPayableMemberhli:TwoPointEightyEightPercentLoansPayableMember2022-04-012023-03-310001302215us-gaap:LoansPayableMemberhli:TwoPointEightyEightPercentLoansPayableMember2020-04-012021-03-310001302215us-gaap:LoansPayableMemberhli:TwoPointEightyEightPercentLoansPayableMember2021-04-012022-03-310001302215us-gaap:LoansPayableMemberhli:TwoPointSevenFivePercentLoansPayableMember2019-12-310001302215us-gaap:LoansPayableMemberhli:TwoPointSevenFivePercentLoansPayableMember2019-12-012019-12-310001302215us-gaap:LoansPayableMemberhli:TwoPointSevenFivePercentLoansPayableMember2022-04-012023-03-310001302215us-gaap:LoansPayableMemberhli:TwoPointSevenFivePercentLoansPayableMember2021-04-012022-03-310001302215us-gaap:LoansPayableMemberhli:TwoPointSevenFivePercentLoansPayableMember2020-04-012021-03-310001302215hli:NonInterestBearingUnsecuredConvertibleLoanMemberus-gaap:LoansPayableMember2020-08-310001302215hli:NonInterestBearingUnsecuredConvertibleLoanMemberus-gaap:LoansPayableMember2020-08-312020-08-310001302215hli:NonInterestBearingUnsecuredConvertibleLoanMemberus-gaap:LoansPayableMember2023-03-310001302215hli:NonInterestBearingUnsecuredConvertibleLoanMemberus-gaap:LoansPayableMember2022-03-310001302215hli:BaylorKleinLtdMember2023-03-310001302215hli:BaylorKleinLtdMember2022-03-310001302215us-gaap:ForeignCountryMember2023-03-310001302215us-gaap:ForeignCountryMember2022-03-310001302215hli:IncentivePlan2016Member2015-08-012015-08-310001302215us-gaap:RestrictedStockMemberhli:IncentivePlan2016Member2015-08-012015-08-310001302215us-gaap:RestrictedStockMembersrt:DirectorMemberhli:IncentivePlan2016Member2020-04-012020-06-30hli:director0001302215us-gaap:RestrictedStockMembersrt:DirectorMemberhli:IncentivePlan2016Member2020-10-012020-12-310001302215us-gaap:RestrictedStockMembersrt:DirectorMemberhli:IncentivePlan2016Member2021-04-012022-06-300001302215us-gaap:RestrictedStockMembersrt:DirectorMemberhli:IncentivePlan2016Member2022-04-012022-06-300001302215us-gaap:RestrictedStockMember2022-04-012023-03-310001302215hli:IncentivePlan2006Memberus-gaap:RestrictedStockMember2020-03-310001302215hli:IncentivePlan2006Memberus-gaap:RestrictedStockMember2020-04-012021-03-310001302215hli:IncentivePlan2006Memberus-gaap:RestrictedStockMember2021-03-310001302215hli:IncentivePlan2006Memberus-gaap:RestrictedStockMember2021-04-012022-03-310001302215hli:IncentivePlan2006Memberus-gaap:RestrictedStockMember2022-03-310001302215hli:IncentivePlan2006Memberus-gaap:RestrictedStockMember2022-04-012023-03-310001302215hli:IncentivePlan2006Memberus-gaap:RestrictedStockMember2023-03-3100013022152023-01-012023-03-3100013022152022-04-012022-12-3100013022152020-04-012020-12-310001302215us-gaap:RestrictedStockUnitsRSUMember2020-03-310001302215us-gaap:RestrictedStockUnitsRSUMember2020-04-012021-03-310001302215us-gaap:RestrictedStockUnitsRSUMember2021-03-310001302215us-gaap:RestrictedStockUnitsRSUMember2021-04-012022-03-310001302215us-gaap:RestrictedStockUnitsRSUMember2022-03-310001302215us-gaap:RestrictedStockUnitsRSUMember2022-04-012023-03-310001302215us-gaap:RestrictedStockUnitsRSUMember2023-03-310001302215hli:AmendedAndRestated2016IncentiveAwardPlanMember2017-10-190001302215hli:April12018Memberhli:AmendedAndRestated2016IncentiveAwardPlanMemberus-gaap:CommonClassAMember2017-10-190001302215hli:April12018Memberus-gaap:CommonClassBMemberhli:AmendedAndRestated2016IncentiveAwardPlanMember2017-10-190001302215hli:April12018Memberus-gaap:CommonClassBMemberhli:AmendedAndRestated2016IncentiveAwardPlanMember2017-10-192017-10-190001302215hli:April12018Memberhli:AmendedAndRestated2016IncentiveAwardPlanMemberus-gaap:CommonClassAMember2017-10-192017-10-190001302215hli:AmendedAndRestated2016IncentiveAwardPlanMemberus-gaap:CommonClassAMember2022-04-280001302215us-gaap:CommonClassBMemberhli:AmendedAndRestated2016IncentiveAwardPlanMember2022-04-28hli:class_of_stockhli:vote00013022152015-08-180001302215us-gaap:CommonClassAMember2020-05-202020-05-200001302215srt:DirectorMemberus-gaap:CommonClassAMember2022-04-012023-03-310001302215srt:DirectorMemberus-gaap:CommonClassAMember2021-04-012022-03-310001302215us-gaap:InvestorMemberus-gaap:CommonClassAMember2023-03-310001302215srt:DirectorMemberus-gaap:CommonClassAMember2023-03-310001302215us-gaap:InvestorMemberus-gaap:CommonClassAMember2022-03-310001302215srt:DirectorMemberus-gaap:CommonClassAMember2022-03-3100013022152021-07-310001302215us-gaap:CommonClassBMember2022-04-012023-03-310001302215us-gaap:CommonClassBMember2021-04-012022-03-310001302215us-gaap:CommonClassBMember2020-04-012021-03-310001302215us-gaap:CommonClassAMember2022-04-012023-03-310001302215us-gaap:CommonClassAMember2021-04-012022-03-310001302215us-gaap:CommonClassAMember2020-04-012021-03-310001302215srt:MaximumMember2023-03-310001302215srt:MinimumMember2023-03-310001302215us-gaap:OperatingSegmentsMemberhli:CorporateFinanceMember2022-04-012023-03-310001302215us-gaap:OperatingSegmentsMemberhli:CorporateFinanceMember2021-04-012022-03-310001302215us-gaap:OperatingSegmentsMemberhli:CorporateFinanceMember2020-04-012021-03-310001302215us-gaap:OperatingSegmentsMemberhli:FinancialRestructuringMember2022-04-012023-03-310001302215us-gaap:OperatingSegmentsMemberhli:FinancialRestructuringMember2021-04-012022-03-310001302215us-gaap:OperatingSegmentsMemberhli:FinancialRestructuringMember2020-04-012021-03-310001302215hli:FinancialAdvisoryServicesMemberus-gaap:OperatingSegmentsMember2022-04-012023-03-310001302215hli:FinancialAdvisoryServicesMemberus-gaap:OperatingSegmentsMember2021-04-012022-03-310001302215hli:FinancialAdvisoryServicesMemberus-gaap:OperatingSegmentsMember2020-04-012021-03-310001302215us-gaap:CorporateNonSegmentMember2022-04-012023-03-310001302215us-gaap:CorporateNonSegmentMember2021-04-012022-03-310001302215us-gaap:CorporateNonSegmentMember2020-04-012021-03-310001302215us-gaap:MaterialReconcilingItemsMember2020-04-012021-03-310001302215us-gaap:OperatingSegmentsMemberhli:CorporateFinanceMember2023-03-310001302215us-gaap:OperatingSegmentsMemberhli:CorporateFinanceMember2022-03-310001302215us-gaap:OperatingSegmentsMemberhli:CorporateFinanceMember2021-03-310001302215us-gaap:OperatingSegmentsMemberhli:FinancialRestructuringMember2023-03-310001302215us-gaap:OperatingSegmentsMemberhli:FinancialRestructuringMember2022-03-310001302215us-gaap:OperatingSegmentsMemberhli:FinancialRestructuringMember2021-03-310001302215hli:FinancialAdvisoryServicesMemberus-gaap:OperatingSegmentsMember2023-03-310001302215hli:FinancialAdvisoryServicesMemberus-gaap:OperatingSegmentsMember2022-03-310001302215hli:FinancialAdvisoryServicesMemberus-gaap:OperatingSegmentsMember2021-03-310001302215us-gaap:OperatingSegmentsMember2023-03-310001302215us-gaap:OperatingSegmentsMember2022-03-310001302215us-gaap:OperatingSegmentsMember2021-03-310001302215us-gaap:CorporateNonSegmentMember2023-03-310001302215us-gaap:CorporateNonSegmentMember2022-03-310001302215us-gaap:CorporateNonSegmentMember2021-03-310001302215country:US2022-04-012023-03-310001302215country:US2021-04-012022-03-310001302215country:US2020-04-012021-03-310001302215us-gaap:NonUsMember2022-04-012023-03-310001302215us-gaap:NonUsMember2021-04-012022-03-310001302215us-gaap:NonUsMember2020-04-012021-03-310001302215country:US2023-03-310001302215country:US2022-03-310001302215country:US2021-03-310001302215us-gaap:NonUsMember2023-03-310001302215us-gaap:NonUsMember2022-03-310001302215us-gaap:NonUsMember2021-03-310001302215hli:GCACorporationMember2021-10-040001302215hli:GCACorporationMember2021-10-042021-10-040001302215hli:GCACorporationMember2022-01-202022-01-200001302215hli:GCACorporationMember2021-10-042022-01-31iso4217:JPYxbrli:shares0001302215hli:GCACorporationMember2023-03-310001302215us-gaap:OrderOrProductionBacklogMemberhli:GCACorporationMember2023-03-310001302215us-gaap:OrderOrProductionBacklogMemberhli:GCACorporationMember2023-01-012023-03-310001302215us-gaap:TradeNamesMemberhli:GCACorporationMember2023-03-310001302215us-gaap:TradeNamesMemberhli:GCACorporationMember2023-01-012023-03-310001302215hli:GCACorporationMemberus-gaap:CustomerRelationshipsMember2023-03-310001302215hli:GCACorporationMemberus-gaap:CustomerRelationshipsMember2023-01-012023-03-310001302215hli:GCACorporationMember2023-01-012023-03-310001302215us-gaap:AcquisitionRelatedCostsMemberhli:GCACorporationMember2022-04-012023-03-310001302215us-gaap:AcquisitionRelatedCostsMemberhli:GCACorporationMember2021-04-012022-03-310001302215us-gaap:SubsequentEventMember2023-05-042023-05-040001302215us-gaap:SubsequentEventMember2023-05-102023-05-10

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

| | | | | |

| ☒ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended March 31, 2023

OR

| | | | | |

☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

For the transition period from __________ to ______________

Commission File Number: 001-37537

| | | | | | | | |

Houlihan Lokey, Inc. (Exact name of registrant as specified in its charter) |

| Delaware | | 95-2770395 |

(State or other jurisdiction of

incorporation or organization) | | (I.R.S. Employer

Identification Number) |

10250 Constellation Blvd.

5th Floor

Los Angeles, California 90067

(Address of principal executive offices) (Zip Code)

(310) 788-5200

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of Each Class | Trading Symbol(s) | Name of each exchange on which registered |

| Class A Common Stock, par value $.001 | HLI | New York Stock Exchange |

Securities Registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☒ No ☐

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☒

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| | | | | | | | | | | |

| Large accelerated filer | x | Accelerated filer | ¨ |

| | | |

| Non-accelerated filer | ¨ | Smaller reporting company | ☐ |

| | | |

| | Emerging growth company | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management's assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☒

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

As of September 30, 2022, the aggregate market value of the voting and non-voting common equity held by non-affiliates was approximately $3.75 billion.

As of May 23, 2023, the registrant had 50,830,588 shares of Class A common stock, $0.001 par value per share, and 17,231,481 shares of Class B common stock, $0.001 par value per share, outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the Registrant’s definitive proxy statement for its 2023 annual meeting of stockholders, which the Registrant anticipates will be filed no later than 120 days after the end of its fiscal year, are incorporated by reference in Part III of this Form 10‑K.

Auditor Name: KPMG LLP Auditor Location: Los Angeles, California Auditor Firm ID: 185

HOULIHAN LOKEY, INC. AND SUBSIDIARIES

TABLE OF CONTENTS

PART I

Unless the context otherwise requires, as used in this Annual Report on Form 10-K (“Form 10-K”), the terms the “Company,” “Houlihan Lokey, Inc.,” “Houlihan Lokey,” “HL,” "our firm,” “we,” “us” and “our” refer to Houlihan Lokey, Inc., a Delaware corporation (“HL DE”), and, in each case, unless otherwise stated, all of its subsidiaries. We use the term “HL Holders” to refer to our current and former employees and members of our management who hold our Class B common stock through the Houlihan Lokey Voting Trust (the "HL Voting Trust"). Our fiscal year ends on March 31st; references to fiscal 2023, fiscal 2022, and fiscal 2021 are to our fiscal years ended March 31, 2023, 2022, and 2021, respectively; references in this Form 10-K to years are to calendar years unless otherwise noted.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Form 10-K contains forward-looking statements. All statements other than statements of historical fact contained in this Form 10-K may be forward-looking statements. Statements regarding our future results of operations and financial position, business strategy and plans and objectives of management for future operations are forward-looking statements. In some cases, you can identify forward-looking statements by terms such as “may,” “might,” “will,” “should,” “expects,” “plans,” “anticipates,” “could,” “targets,” “projects,” “contemplates,” “believes,” “estimates,” “intends,” “predicts,” “potential” or “continue,” or the negative of these terms or other similar expressions.

Forward-looking statements involve known and unknown risks, uncertainties and other important factors that may cause our actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements. We believe that these factors include, but are not limited to, the following:

•our ability to retain our Managing Directors and our other senior professionals;

•our ability to successfully identify, recruit and develop talent;

•changing market conditions;

•reputational risk;

•our volatile revenue and profits on a quarterly basis;

•risks associated with our acquisitions (including integration), joint ventures and strategic investments;

•strong competition from other financial advisory and investment banking firms;

•potential impairment of goodwill and other intangible assets, which represent a significant portion of our assets;

•our ability to execute on our growth initiatives, business strategies or operating plans;

•risks associated with the U.S. tax law changes;

•risks associated with our international operations;

•terrorism, political hostilities, war and other civil disturbances or other catastrophic events that reduce business activity;

•fluctuations in foreign currency exchange rates;

•costs of compliance associated with broker-dealer, employment, labor, benefits and tax regulations;

•our potential to offer new products within our existing lines of business or enter into new lines of business, which may result in additional risks and uncertainties in our business;

•operational risks;

•extensive and evolving regulation of our business and the business of our clients;

•substantial litigation risks;

•cybersecurity and other security risks;

•our dependence on fee-paying clients;

•our clients' ability to pay us for our services;

•our ability to generate sufficient cash in the future to service our indebtedness;

•an epidemic or pandemic, and the measures that international, federal, state and local governments, agencies, law enforcement and/or health authorities may implement to address it, which may cause a severe and prolonged disruption and instability in the global financial markets and may precipitate or exacerbate one or more of the above-mentioned factors and/or other risks, and significantly disrupt or prevent us from operating our business in the ordinary course for an extended period; and

•other factors beyond our control.

We have based these forward-looking statements largely on our current expectations and projections about future events and financial trends that we believe may affect our business, financial condition and results of operations. Because forward-looking statements are inherently subject to risks and uncertainties, some of which cannot be predicted or quantified, you should not rely on these forward-looking statements as predictions of future events. The events and circumstances reflected in our forward-looking statements may not be achieved or occur and actual results could differ materially from those projected in the forward-looking statements. For information about other important factors that could adversely affect our future results, see “Risk Factors” in this Form 10-K.

These forward-looking statements speak only as of the date of this filing. Except as required by applicable law, we do not plan to publicly update or revise any forward-looking statements contained in this Form 10-K after we file this Form 10-K, whether as a result of any new information, future events or otherwise.

Item 1. Business

Established in 1972, Houlihan Lokey, Inc. is a leading global independent investment bank with expertise in mergers and acquisitions (M&A), capital markets, financial restructurings, and financial and valuation advisory. Through our offices in the United States, South America, Europe, Asia, Australia, and the Middle East, we serve a diverse set of clients worldwide, including corporations, financial sponsors and government agencies. We provide our financial professionals with an integrated platform that enables them to deliver meaningful and differentiated advice to our clients. We advise our clients on critical strategic and financial decisions, employing a rigorous analytical approach coupled with deep product and industry expertise. We market our services through our product areas, our industry groups and our Financial Sponsors group, serving our clients in three primary business practices: Corporate Finance ("CF"), encompassing M&A and capital markets advisory, Financial Restructuring ("FR") both out-of-court and in formal bankruptcy or insolvency proceedings and Financial and Valuation Advisory ("FVA"), including financial opinions and a variety of valuation and financial consulting services.

We are committed to a set of principles that serve as the backbone of our success. Independent advice and intellectual rigor, combined with consistent senior-level involvement, are hallmarks of our commitment to client service. Our entrepreneurial culture engenders our flexibility to collaborate across our business practices to provide world-class solutions for our clients. Our broad-based employee ownership serves to align the interests of employees and shareholders and further encourages a collaborative environment where our CF, FR, and FVA professionals work together productively and creatively to solve our clients’ most critical financial issues. We enter into businesses or offer services where we believe we can excel based on our expertise, analytical sophistication, industry focus and competitive dynamics. Finally, we remain independent and specialized, focusing on advisory products and market segments where our expertise is both differentiating and less subject to conflicts of interest arising from non-advisory products and services, and where we believe we can be a market leader in a particular segment. We do not lend or engage in any securities sales and trading operations or research that might conflict with our clients’ interests.

As of March 31, 2023, we had a team of 1,904 financial professionals across 37 offices globally, serving more than 2,000 clients annually over the past several years, ranging from closely held companies to Fortune Global 500 corporations. Information on our segments is set forth in "Management’s Discussion and Analysis of Financial Condition and Results of Operations."

Our Advisory Services

We provide our financial professionals with an integrated platform that enables them to deliver meaningful and differentiated advice to our clients. We market our services through our three business practices described below, our industry groups and our Financial Sponsors group, who work collaboratively to deliver comprehensive solutions and seamless execution for our clients. This marketing effort is combined with an extensive network of referral relationships with law firms, consulting firms, accounting firms and other professional services firms that have been developed by our financial professionals who maintain those relationships as potential referral sources and direct clients across all of our business practices.

Corporate Finance

As of March 31, 2023, we had 217 CF Managing Directors utilizing a collaborative, interdisciplinary approach to provide our clients with extensive industry and product expertise and global reach in a wide variety of M&A and capital markets transactions. We compete with boutique firms focused on particular industries or geographies as well as other global independent investment banks and bulge-bracket firms. A majority of our engagements relate to mid-cap transactions, which we believe is an attractive segment that is underserved by bulge-bracket investment banks. We believe that our deep sector expertise, significant senior banker involvement and attention, strong financial sponsor relationships and global platform provide a compelling value for our clients, engendering long-term relationships and providing a competitive advantage against our peers in this segment of the market.

We believe that through our industry groups we have a meaningful presence in every major industry segment, including: business services; consumer, food and retail; energy; financial services; fintech; healthcare; industrials; real estate, lodging and leisure; and technology. We continue to expand and deepen our specialized industry capabilities through a combination of internal promotion, external hires and acquisitions. While the majority of our engagements are in the United States, we continue to enhance our presence in other geographies, including Europe, Asia, South America, Australia and the Middle East and we believe there will be continued opportunities to grow in regions outside the United States.

Our CF activities are comprised of two significant categories:

Mergers & Acquisitions: We have extensive expertise in mergers, acquisitions, divestitures, and other related advisory services for a broad range of United States and international clients. Our CF professionals have relationships with thousands of companies and financial sponsors, providing us with valuable insights into a wide variety of relevant markets.

Our M&A business consists primarily of sell-side and buy-side engagements. In particular, we believe we have developed a reputation in the marketplace as one of the most prolific sell-side advisors, consistently selling more companies under $1 billion than any competitor. We provide advice and services to a diverse set of parties, including public and private company executives, boards of directors, special committees and financial sponsors.

We believe our team of experienced and talented financial professionals is well positioned to provide advice across a wide range of M&A advisory services globally, including sell-side, buy-side, joint ventures, asset sales and divestitures that are less subject to conflicts of interest arising from non-advisory services. Our global industry group model with embedded M&A capabilities brings sector-specific knowledge, experience and relationships to our clients, allowing us to provide differentiated expert advice and connect buyers and sellers on a global basis.

Capital Markets Advisory: We provide global financing solutions and capital-raising advisory services for a broad range of corporate and private equity clients across most industry sectors, from large, publicly-held, multinational corporations to financial sponsors to privately-held companies founded and run by entrepreneurs.

Our Capital Markets Advisory professionals leverage a wide array of longstanding, senior-level lender and investor relationships, including with traditional and non-traditional direct capital providers (such as institutional credit funds, commercial finance companies, business development companies, insurance companies, pension funds, mutual funds, global asset managers, special situations investors and structured equity providers). As the traditional syndicated capital markets have become increasingly complex and more regulated, the private capital markets have developed to provide an alternative source of flexible capital that can be tailored to meet clients’ needs.

We believe we excel in providing our clients with sophisticated and thoughtful advice and access to traditional and non-traditional capital providers in the private and public capital markets. Our objective is to help clients create a capital structure that enables them to achieve their strategic priorities on the best terms available in the market, which often involves raising more than one type of capital.

Financial Restructuring

As of March 31, 2023, we had 57 FR Managing Directors working around the globe, which we believe constitutes one of the largest restructuring groups in the investment banking industry. Our FR group has earned a reputation for being the advisor of choice for many of the largest and most complex restructurings, offering knowledge, experience, and creativity to address challenging situations. We operate in all major worldwide markets as debt issuances have increased around the world. Our FR professionals bring to bear deep expertise and experience in restructurings in the United States, Canada, Europe, Asia, Australia, the Middle East, Latin America and Africa. Given the depth and breadth of the team’s expertise and the high barriers to entry for this expertise and experience, international and multi-jurisdictional restructurings represent an attractive opportunity for our FR group.

The group employs an interdisciplinary approach to engagements, calling upon the expertise of our industry groups, Capital Markets Advisory group and Financial Sponsors group, and drawing on the worldwide resources of the FR team as each situation may require. The FR group has deep experience evaluating complex, highly leveraged situations. In addition to comprehensive financial restructurings, we work with distressed companies on changes of control, asset sales and other M&A and capital markets activities, many times involving the sale of a company or its assets quickly, and in contested or litigious settings on expedited timeframes. We advise companies and creditor constituencies at all levels of the capital structure, in both out-of-court negotiations and in formal bankruptcy or insolvency proceedings. Our experience, geographic diversity and size allow us to provide the immediate attention and staffing required for time-sensitive and mission-critical restructuring assignments, making us a valued partner for our clients.

Our dedicated team is active throughout business cycles. Our FR practice serves as a countercyclical hedge across macroeconomic cycles, with increasing levels of restructuring opportunities often occurring during periods when demand for M&A and capital markets advisory services may be reduced. In robust macroeconomic environments, demand for the services of our FR team generally continues due to opportunities arising from secular and cyclical disruptions in certain industries. Our geographic diversity and global market leadership allow our FR group to maintain significant levels of activity even when the U.S. capital markets are vibrant.

Our broad base of clients and our extensive experience allow us to understand the dynamics of each restructuring situation and strengthen our negotiating strategies by providing us insight into the needs, attitudes and positions of all parties-in-interest. Our clients include companies, bondholder groups, financial institutions, banks and other secured creditor groups, trade creditors, official Chapter 11 creditors’ committees, equity holders, acquirers, equity sponsors, and other parties-in-interest involved with financially challenged companies.

Our FR professionals work closely with our CF and FVA professionals to provide holistic advice and services.

Financial and Valuation Advisory

As of March 31, 2023, we had 39 Managing Directors in our FVA group, which we believe represents one of the largest and most respected valuation and financial opinion practices in the United States. We have developed a reputation as a thought-leader in the field of valuation, and our professionals produce influential studies and publications, which are recognized and valued throughout the financial industry. We believe our extensive transaction expertise and leadership in the fields of valuation, diligence, tax and financial analytics inspire the confidence of the financial executives, boards of directors, special committees, retained counsel, financial and strategic investors and business owners that we serve. We believe that our reputation for delivering an outstanding analytical product that will withstand legal or regulatory scrutiny coupled with our independent financial, accounting and tax skills makes us the advisor of choice for clients with complex valuation, transaction opinion, transaction accounting, tax and diligence needs.

Our core competencies in our FVA practice are based in our deep technical financial, accounting and tax skills. These capabilities include our ability to analyze and value companies, security interests, and different types of assets, including complex illiquid investments, as well as our ability to analyze, diligence and structure the financial and tax aspects of public and private transactions. We are organized around different service lines as each line has different regulatory or compliance specializations as well as different marketing channels.

Human Capital Resources

Our goal is to attract, develop and retain the best talent in our industry across all levels. We believe our compensation programs are competitive, offering a portion of compensation in deferred cash and a portion in deferred stock awards to provide incentives for our employees to remain with us. In addition, we strive to foster a collaborative environment to attract and retain employees, and we seek individuals who fit our culture of entrepreneurship, integrity, creativity, and commitment to our clients. For over 20 years, we have emphasized broad employee ownership as a way to align the incentives of our employees and shareholders. As of March 31, 2023, we had approximately 1,000 present and former employee shareholders that collectively owned approximately 27% of our equity with no single employee owning more than 2% of our equity. We believe that a strong emphasis on cultural fit during our recruiting process combined with broad employee ownership results in high retention rates.

Our Managing Directors (other than our executive officers) are compensated based on their ability to deliver profitable revenues on a consistent basis to our firm, the quality of advice and execution provided to our clients, and their collaboration with their colleagues across industries, products, and regions. We do not compensate on a commission-based pay model. Our compensation structure for junior financial professionals is based on a system of meritocracy whereby bankers are rewarded for past performance and expectation of future development, and compensation levels are tested against prevailing market compensation for bankers at similar levels.

The primary sources of recruitment for our junior financial professionals are leading undergraduate and graduate programs around the world. Our consistent hiring practices year after year have created partnerships with these institutions and resulted in a steady and high-quality pipeline of junior financial professionals. To supplement this annual class of new hires, we opportunistically and strategically hire professionals with experience and backgrounds relevant to our various businesses. Regardless of title, we place a high degree of emphasis on cultural fit, technical capability and individual character. When we hire junior financial professionals, we hire them directly into one of our business practices to enable them to begin to develop their relevant skill set from day one.

Across our firm, we devote significant time and resources to training and mentoring our employees to ensure every person achieves their highest possible potential. We strive to identify and cultivate future leaders within our firm and are committed to developing our brightest and most ambitious junior professionals into Managing Directors. This philosophy of investing in our people has been and will continue to be core to our culture and organization. As of March 31, 2023, 2022, and 2021, we employed 2,610, 2,257, and 1,574 people, respectively, worldwide.

Competition

Our competitors are other investment banking and financial advisory firms. We compete on both a global and a regional basis, and on the basis of a number of factors, including industry knowledge, transaction execution skills, strength of client relationships, reputation, and price. We believe our primary competitors vary by product and industry expertise and would include the following: for our CF practice, Jefferies LLC, Lazard Ltd, Moelis & Company, N M Rothschild & Sons Limited, Piper Sandler Companies, Robert W. Baird & Co. Incorporated, Stifel Financial Corp., William Blair & Company, L.L.C., and the bulge-bracket investment banking firms; for our FR practice, Evercore Partners, Lazard Ltd, Moelis & Company, N M Rothschild & Sons Limited and PJT Partners; and for our FVA practice, the “big four” accounting firms, Lincoln International LLC, Kroll, LLC., Alvarez & Marsal and various global financial advisory and accounting firms.

We compete with all of the above as well as with regional and industry-focused boutique firms to attract and retain qualified employees. Our ability to continue to compete effectively in our business will depend upon our ability to attract new employees and retain our existing employees. We may be at a competitive disadvantage in certain situations with regard to certain of our competitors who are able to, and regularly do, provide financing or market making services that are often instrumental in effecting transactions.

Regulation

United States

As a financial services provider, Houlihan Lokey is subject to extensive regulation in the United States and across the globe. As a matter of public policy, regulatory bodies in the United States and the rest of the world are charged with safeguarding the integrity of the securities and other financial markets and with protecting the interests of customers participating in those markets. In the United States, the Securities and Exchange Commission (the "SEC") is the federal agency responsible for the administration of the federal securities laws. Houlihan Lokey Capital, Inc. (“Houlihan Lokey Capital”) and Houlihan Lokey Advisors, LLC ("Houlihan Lokey Advisors"), two of our wholly owned subsidiaries, through which we conduct our CF, FR and transaction opinion businesses in the United States, are registered as a broker-dealers with the SEC. Houlihan Lokey Capital and Houlihan Lokey Advisors are subject to regulation and oversight by the SEC. In addition, the Financial Industry Regulatory Authority, Inc. ("FINRA"), a self-regulatory organization that is subject to oversight by the SEC, adopts and enforces rules governing the conduct, and examines the activities, of its broker-dealer member firms, including Houlihan Lokey Capital and Houlihan Lokey Advisors. State securities regulators also have regulatory or oversight authority over Houlihan Lokey Capital and Houlihan Lokey Advisors in those states in which they do business.

Broker-dealers are subject to regulations that cover all aspects of the securities business, including sales methods, trade practices, the financing of customers’ purchases, capital structure, record-keeping and the conduct and qualifications of directors, officers and employees. In particular, as a registered broker-dealer and member of a self-regulatory organization, we are subject to the SEC’s uniform net capital rule, Rule 15c3-1. Rule 15c3-1 specifies the minimum level of net capital a broker-dealer must maintain and also requires that a significant part of a broker-dealer’s assets be kept in relatively liquid form. The SEC and FINRA impose rules that require notification when net capital falls below certain predefined criteria, limit the ratio of subordinated debt to equity in the regulatory capital composition of a broker-dealer and constrain the ability of a broker-dealer to expand its business under certain circumstances. Additionally, the SEC’s uniform net capital rule imposes certain requirements that may have the effect of prohibiting a broker-dealer from distributing or withdrawing capital and requiring prior notice to the SEC for certain withdrawals of capital.

Houlihan Lokey Financial Advisors, Inc. (“HLFA”), our wholly owned subsidiary, provides valuation services and related financial analyses of various businesses and types of assets which are used by clients in connection with mergers and acquisitions, divestitures, recapitalizations, dispute analysis, and estate, gift, and income tax support. In rendering such analyses, HLFA does not: (i) make recommendations or provide advice with respect to the merits of any security or transaction, the suitability of transacting in any security, or any investment decision with respect to any security, or (ii) manage or hold client accounts, securities or funds. In addition to valuation and financial consulting and analytic services, HLFA provides dispute resolution services.

The USA PATRIOT Act of 2001 and the Treasury Department’s implementing federal regulations require us, as a “financial institution,” to establish and maintain an anti-money-laundering program. The Financial Crimes Enforcement Network (“FinCEN’’), a part of the United States Department of the Treasury, is charged with protecting the financial system from illicit use, combating money laundering, and promoting national security through financial intelligence. FinCEN’s customer due diligence rule requires certain financial institutions, including broker-dealers, to obtain, verify, and record certain client information, including, in some cases, beneficial ownership, as well as to maintain adequate internal controls to prevent and detect possible violations of anti-money laundering rules. In addition, in connection with its administration and enforcement of economic and trade sanctions based on United States foreign policy and national security goals, the Treasury Department’s Office of Foreign Assets Control (“OFAC”) publishes a list of individuals and companies owned or controlled by, or acting for or on behalf of, targeted countries. It also lists individuals, groups, and entities, such as terrorists and narcotics traffickers, designated under programs that are not country-specific. Collectively, such individuals and companies are called “Specially Designated Nationals” (“SDNs”). Assets of SDNs are blocked, and we are generally prohibited from dealing with them. In addition, OFAC administers a number of comprehensive sanctions and embargoes that target certain countries, governments and geographic regions. We are generally prohibited from engaging in transactions involving any country, government, entity, or person that is subject to such comprehensive sanctions.

Certain parts of our business are subject to compliance with laws and regulations of United States federal and state governments, non-United States governments, their respective agencies and/or various self-regulatory organizations or exchanges relating to, among other things, the privacy of client information, and any failure to comply with these regulations could expose us to liability and/or reputational damage.

Europe

Our European advisory business is conducted primarily through our subsidiaries and or one of their branches, namely, as regards the provision of regulated investment services:

•in the United Kingdom, Houlihan Lokey EMEA, LLP ("HL EMEA, LLP"), Houlihan Lokey UK Limited ("HL UK"), Houlihan Lokey (Corporate Finance) Limited (“HLCF Ltd”), and Houlihan Lokey Advisory Limited ("HLA Ltd"), a limited liability partnership and private limited companies, respectively, each of which is organized under the laws of England and Wales; and

•in Germany, Houlihan Lokey (Europe) GmbH (“HLE GmbH”) a private limited company organized under the laws of such jurisdiction with branches in England, France, and Spain in addition to its main office in Germany.

In addition to those entities referenced above, we also provide unregulated corporate finance advisory services through other subsidiaries in Germany, Italy, France, the Netherlands, Sweden, Belgium, Switzerland, and Spain.

Each of HL EMEA, LLP, HL UK, HLCF Ltd, and HLA Ltd are authorized and regulated by the United Kingdom’s Financial Conduct Authority. HL UK, HL CF Ltd, and HLA Ltd were formerly named "GCA Altium Limited", “Quayle Munro Limited” and "Oakley Advisory Limited", respectively, and, following their acquisitions, we have continued to operate their businesses through such entities. The current U.K. regulatory regime is based upon the Financial Services and Markets Act 2000 (“FSMA”), together with secondary legislation and other rules made under FSMA and other relevant legislation. These rules govern our financial advisory business in the United Kingdom, including regulated activities, record keeping, approval standards for individuals, anti-money laundering and periodic reporting.

HLE GmbH, through which we now conduct our regulated business in the EU, was established in order to mitigate the effects of the United Kingdom ceasing to be a member of the EU (“Brexit”) on our European business, further to the end of the Brexit transitional period and the withdrawal of “passport” rights in favor of HL EMEA, LLP and HLCF Ltd. HLE GmbH is approved to conduct regulated investment services by the German regulatory authority, Bundesanstalt für Finanzdienstleistungsaufsicht (“BaFin”).

HLE GmbH has exercised the appropriate European financial services passport rights to provide cross-border services into all other members of the EEA from Germany and to establish branches in France and Spain. These “passport” rights derive from the pan-European regime established by the EU Markets in Financial Instruments Directive, which regulates the provision of investment services and ancillary activities throughout the EEA.

Middle East

Dubai, United Arab Emirates

Houlihan Lokey (MEA Financial Advisory) Ltd. is licensed under Article 48 of the Regulatory Law 2004 by the Dubai Financial Services Authority ("DFSA") to provide certain regulated financial services from its office in the Dubai International Financial Centre. Such entity is subject to DFSA administered law and regulation (most notably certain applicable modules of the DFSA Rulebook), and individuals within it carrying out "licensed functions" (essentially senior management roles) are required to be approved by DFSA to so act.

Israel

In Israel we provide unregulated corporate finance advisory services through the Israel branch of Houlihan Lokey Israel Limited, a private limited company organized under the laws of England and Wales. The branch is registered with the Israeli Corporations Authority.

Asia Pacific

Australia

Houlihan Lokey (Australia) Pty Limited is licensed and subject to regulation by the Australian Securities & Investments Commission and must also comply with applicable provisions of the Corporations Act 2001 and other Australian legal and regulatory requirements, including capital adequacy rules, customer protection rules, and compliance with other applicable trading and investment banking regulations

Hong Kong SAR

In Hong Kong, the Securities and Futures Commission (the “SFC”) regulates our subsidiary, Houlihan Lokey (China) Limited. The compliance requirements of the SFC include, among other things, various codes of conduct and certain capital requirements. The SFC licenses the activities of the officers, directors, and employees of Houlihan Lokey (China) Limited, and requires the registration of such individuals as licensed representatives.

India

Houlihan Lokey’s Indian financial and valuation advisory business is conducted through Houlihan Lokey Advisory (India) Private Limited, which is licensed by the Securities and Exchange Board of India (“SEBI”) as an Investment Adviser.

Japan

In Japan, financial advisory services are provided by Houlihan Lokey Corporation, G-FAS Corporation, HL Succession Corporation, and BIZIT Inc., none of which conducts regulated activities in Japan.

Singapore

In Singapore, Houlihan Lokey conducts its business through Houlihan Lokey (Singapore) Private Limited and Houlihan Lokey Advisers Singapore Private Limited, both of which are registered with the Monetary Authority of Singapore (“MAS”) as “exempt corporate finance advisors” and are therefore able to provide exempt corporate finance advisory services to accredited investors only, subject to compliance with regulation governing such status as applicable from time to time in Singapore.

Vietnam

In Vietnam, Houlihan Lokey provides unregulated corporate finance advisory services through Houlihan Lokey Vietnam LLC.

South America

Brazil

In Brazil, Houlihan Lokey provides unregulated financial advisory services through Houlihan Lokey Assessoria Financeira Limitada.

Other

We are also subject to laws and regulations prohibiting corrupt or illegal payments to government officials and other persons, including the US Foreign Corrupt Practices Act and the UK Bribery Act. We maintain policies, procedures and internal controls intended to comply with those regulations.

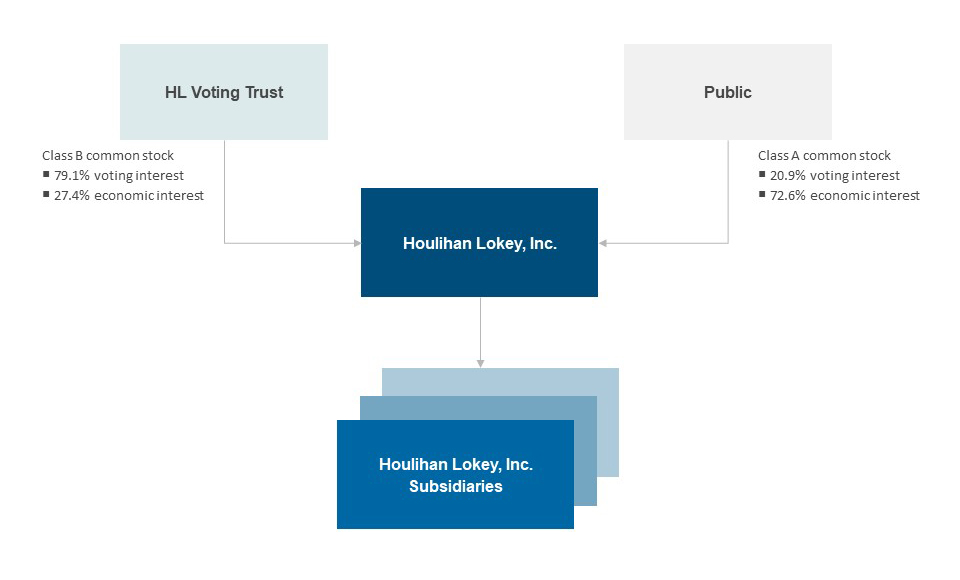

Organizational Structure

Overview

Houlihan Lokey, Inc. is a holding company that operates our business through its subsidiaries, the primary subsidiaries being Houlihan Lokey Capital, HLFA and HL EMEA LLP, each of which is described above under “Regulation.”

The diagram below depicts our current organizational structure and the percentages are as of March 31, 2023:

HL Voting Trust Agreement

In connection with the successful completion of the initial public offering ("IPO") of our Class A common stock in August 2015, we entered into the Voting Trust Agreement (the “HL Voting Trust Agreement”) dated as of August 18, 2015 with the HL Holders and the trustees of the HL Voting Trust. Pursuant to the HL Voting Trust Agreement, the trustees have the right to vote the shares of our common stock deposited by any HL Holder, together with any shares of Class B common stock acquired by such HL Holder, in their sole and absolute discretion on any matter, without fiduciary duties of any kind to the HL Holders. As of March 31, 2023, the HL Voting Trust controlled approximately 79.1% of the total voting power of the Company.

Controlled Company

The HL Voting Trust controls a majority of the voting power of our outstanding common stock. As a result, we are a “controlled company” under the rules of the New York Stock Exchange. Under these rules, a company of which more than 50% of the voting power is held by an individual, group or another company is a “controlled company” and may elect not to comply with certain corporate governance standards, including the requirements that (i) a majority of our board of directors consist of independent directors and (ii) that our board of directors have compensation and nominating and corporate governance committees composed entirely of independent directors, as independence is defined in Rule 10A-3 of the Securities Exchange Act of 1934, as amended (the "Exchange Act") and under the New York Stock Exchange listing standards. We utilize, and intend to continue to utilize, certain of these exemptions. At the present time, the majority of our directors are independent, as required by the New York Stock Exchange, we have a fully independent audit committee, and our compensation and nominating and corporate governance committees are composed entirely of independent directors. See “Risk Factors—Risks Related to Our Class A Common Stock—We are a “controlled company” within the meaning of the New York Stock Exchange listing standards and, as a result, qualify for, and rely on, exemptions from certain corporate governance requirements. Holders of Class A common stock do not have the same protections afforded to stockholders of companies that are subject to such requirements.” In the event that we cease to be a “controlled company” and our shares continue to be listed on the New York Stock Exchange, we will be required to comply with all of these provisions by the expiration of the applicable transition periods.

Market and Industry Data

The industry, market and competitive position data referenced throughout this Form 10-K are based on research, industry and general publications, including surveys and studies conducted by third parties. Industry rankings are based on data provided by Refinitiv unless otherwise noted. Information from Refinitiv relating to industry rankings are sourced through direct deal submissions from financial institutions coupled with research performed by Refinitiv analysts. Industry publications, surveys and studies generally state that they have been obtained from sources believed to be reliable. We have not independently verified such third party information. While we are not aware of any misstatements regarding any industry, market or similar data presented herein, such data involve uncertainties and are subject to change based on various factors, including those discussed under the headings “Cautionary Note Regarding Forward-Looking Statements” and “Risk Factors” in this Form 10-K.

In this Form 10-K, we use the term “independent investment banks” or “independent advisors” when referring to ourselves and other investment banks or financial advisors that are primarily focused on advisory services and that conduct no or limited commercial banking, lending, or securities sales and trading activities, which we believe are well positioned to provide uncompromised advice that is less subject to conflicts of interest arising from non-advisory services. In this Form 10-K, we use the term “mid-cap” when referring to transactions with a value below $1 billion and “large-cap” when referring to transactions with a value equal to or in excess of $1 billion.

Other Information

Our website address is www.hl.com. We make available free of charge in the Investor Relations section of our website (http://investors.hl.com) this Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K and all amendments to those reports as soon as reasonably practicable after such material is electronically filed or furnished with the SEC pursuant to Section 13(a) or 15(d) of the Exchange Act. We also make available through our website other reports filed with or furnished to the SEC under the Exchange Act, including our Proxy Statements and reports filed by officers and directors under Section 16(a) of that Act, as well as various governance documents. From time to time, we may use our website as a channel of distribution of material company information. Financial and other material information regarding the Company is routinely posted on and accessible at http://investors.hl.com. We do not intend for information contained in our website to be part of this Form 10-K. The inclusion of our website address in this Form 10-K does not include or incorporate by reference the information on our website into this Form 10-K or any other document into which this Form 10-K is incorporated by reference.

The SEC maintains a website that contains reports, proxy and information statements, and other information regarding registrants that file electronically with the SEC. The address of the site is http://www.sec.gov.

Item 1A. Risk Factors

Risks Related to Our Business

Changing market conditions can adversely affect our business in many ways, including by reducing the volume of the transactions involving our business, which could materially reduce our revenue.

As a financial services firm, we are materially affected by conditions in the global financial markets and economic conditions throughout the world. Unfavorable market or economic conditions, including reduced expectations for, or further declines in, the U.S. and global economic outlook, may adversely affect our businesses; in particular, where revenue generated is directly related to the volume and size of the transactions in which we are involved. For example, weak market or economic conditions may adversely affect our CF and FVA groups because, in an economic downturn, the volume and size of transactions may decrease, thereby reducing the demand for our M&A, capital raising and opinion advisory services and increasing price competition among financial services companies seeking such engagements. Moreover, in the period following an economic downturn, the volume and size of transactions typically takes time to recover and lags a recovery in market and economic conditions. In particular, our clients engaging in M&A transactions often rely on access to the credit and/or capital markets to finance their transactions. The uncertainty of available credit and interest rates and the volatility of the capital markets and the fact that we do not provide financing or otherwise commit capital to clients can adversely affect the size, volume, timing and ability of such clients to successfully complete M&A transactions and adversely affect our CF and FVA groups. In addition, our profitability would be adversely affected due to our fixed costs and the possibility that we would be unable to reduce our variable costs without reducing revenue or within a timeframe sufficient to offset any decreases in revenue relating to changes in market and economic conditions. On the other hand, strong market or economic conditions may adversely affect our FR group. In a strong environment, the volume and size of recapitalization and restructuring transactions may decrease, thereby reducing the demand for the services provided by our FR business segment and increasing price competition among financial services companies seeking such engagements. Changes in market and economic conditions are expected to impact our businesses in different ways, and we may not be able to benefit from such changes. Further, our business, financial condition and results of operations could be adversely affected by changing market or economic conditions.

Our profitability may also be adversely affected by changes in market and economic conditions because we may not be able to reduce certain fixed costs within a time frame sufficient to match any decreases in revenue. The future market and economic climate may deteriorate because of many factors beyond our control, including rising interest rates or inflation, terrorism or political uncertainty. For example, the U.S. Federal Reserve has raised the federal funds interest rate and has signaled concerns with respect to inflation. In response, market interest rates have risen in recent periods. While the timing and impact of rising interest rates are unknown, a continued increase in market interest rates could have an adverse effect on our transaction volumes, results of operations and financial condition. In addition, recently, concerns have arisen with respect to the financial condition of a number of banking organizations in the United States, in particular those with exposure to certain types of depositors and large portfolios of investment securities. On March 10, 2023, Silicon Valley Bank (“SVB”) was closed by the California Department of Financial Protection and Innovation, and the Federal Deposit Insurance Corporation (the “FDIC”) was appointed receiver of SVB. On March 12, 2023, the FDIC was appointed receiver of Signature Bank. While we do not have any exposure to SVB or Signature Bank, we do maintain our cash at financial institutions, often in balances that exceed the current FDIC insurance limits. If other banks and financial institutions enter receivership or become insolvent in the future due to financial conditions affecting the banking system and financial markets, our ability to access our cash, cash equivalents and investments, including transferring funds, making payments or receiving funds, may be threatened and could have a material adverse effect on our business and financial condition. In addition, the operating environment and public trading prices of financial services sector securities can be highly correlated, in particular in times of stress, which may adversely affect the trading price of our Class A common stock and potentially our results of operations.

A substantial portion of our revenue is derived from advisory engagements in our CF and FR business segments, including engagements under which our fees include a significant component based upon goals, such as the completion of a transaction. As a result, our revenue and profits are highly volatile on a quarterly basis and may cause the price of our Class A common stock to fluctuate and decline.

Revenue and profits derived from our CF and FR business segments can be highly volatile. We derive a substantial portion of our revenue from advisory fees, which are mainly generated at key transaction milestones, such as closing, the timing of which is outside of our control. In many cases, for advisory engagements that do not result in the successful consummation of a transaction, we are not paid a fee other than the reimbursement of certain out-of-pocket expenses and, in some cases, a modest retainer, despite having devoted considerable resources to these transactions. The achievement of these contractually-defined goals is often impacted by factors outside of our control, such as market conditions and the decisions and actions of our clients and interested third parties. For example, a client could delay or terminate an acquisition transaction because of a failure to agree upon final terms with the counterparty, failure to obtain necessary regulatory consents or board or shareholder approvals, failure to secure necessary financing, adverse market conditions or because the target's business is experiencing unexpected financial problems. Anticipated bidders for client assets during a restructuring transaction may not materialize or our client may not be able to restructure its operations or indebtedness due to a failure to reach agreement with its principal creditors. Because these fees are contingent, revenue on such engagements, which is recognized when all revenue recognition criteria are met, is not certain and the timing of receipt is difficult to predict and may not occur evenly throughout the year.

We expect that we will continue to rely on advisory fees, including fees based upon goals, such as the completion of a transaction, for a substantial portion of our revenue for the foreseeable future. Accordingly, a decline in our advisory engagements or the market for advisory services would adversely affect our business. In addition, our financial results will likely fluctuate from quarter to quarter based on when fees are earned, and high levels of revenue in one quarter will not necessarily be predictive of continued high levels of revenue in future periods. Should these contingent fee arrangements represent a greater percentage of our business in the future, we may experience increased volatility in our working capital requirements and greater variations in our quarter-to-quarter results, which could affect the price of our Class A common stock. Because advisory revenue can be volatile and represents a significant portion of our total revenue, we may experience greater variations in our revenue and profits than other larger, more diversified competitors in the financial services industry. Fluctuations in our quarterly financial results could, in turn, lead to large adverse movements in the price of our Class A common stock or increased volatility in our stock price generally.

Our acquisitions, joint ventures, and strategic investments may result in additional risks and uncertainties in our businesses.

In addition to recruiting and organic expansion, we have grown, and intend to continue to grow, our core businesses through acquisitions, joint ventures and strategic investments.

We regularly evaluate opportunities to acquire other businesses. Unless and until acquisitions of other businesses generate meaningful revenues, the purchase prices we pay to acquire such businesses could have a material adverse effect on our business, financial condition and results of operations. If we acquire a business, we may be unable to manage it profitably or successfully integrate its operations with our own. Moreover, we may be unable to realize the financial, operational, and other benefits we anticipate from acquisitions. Competition for future acquisition opportunities in our markets could increase the price we pay for businesses we acquire and could reduce the number of potential acquisition targets. Further, acquisitions may involve a number of special financial and business risks, including expenses related to any potential acquisition from which we may withdraw, diversion of our management's time, attention, and resources, decreased utilization during the integration process, loss of key acquired personnel, difficulties in integrating diverse corporate cultures, increased costs to improve or integrate personnel and financial, accounting, technology and other systems, including compliance with the Sarbanes-Oxley Act, dilutive issuances of equity securities, including convertible debt securities, incurrence of debt, the assumption of legal liabilities, amortization of acquired intangible assets, potential write-offs related to the impairment of goodwill, and additional conflicts of interest. For example, in October 2021 we acquired GCA Corporation for approximately $589.6 million, which significantly expanded our presence in Asia and Europe and there can be no assurance that we will be able realize the full benefits of the acquisition, including the synergies, operating efficiencies, or sales or growth opportunities that are expected. If we are unable to successfully manage these risks, we will not be able to implement our growth strategy, which ultimately could materially adversely affect our business, financial condition and results of operations.

In the case of joint ventures, we are subject to additional risks and uncertainties relating to governance and controls. For example, we may be dependent upon, and subject to, liability, losses or reputational damage relating to personnel, controls and systems that are not fully under our control. In addition, disagreements between us and our joint venture partners may negatively impact our business and profitability.

Goodwill and other intangible assets represent a significant portion of our assets, and an impairment of these assets could have a material adverse effect on our financial condition and results of operations.

Goodwill and other intangible assets represent a significant portion of our assets, and totaled $1.29 billion as of March 31, 2023. Goodwill is the excess of cost over the fair market value of net assets acquired in business combinations. We review goodwill and intangible assets at least annually for impairment. We may need to perform impairment tests more frequently if events occur or circumstances indicate that the carrying amount of these assets may not be recoverable. These events or circumstances could include a significant change in the business climate, attrition of key personnel, a prolonged decline in our stock price and market capitalization, legal factors, operating performance indicators, competition, sale or disposition of a significant portion of one of our businesses and other factors. Although we determined that it is not more likely than not that the fair values of our goodwill and intangible assets were less than their carrying values during fiscal 2023 and fiscal 2022, annual impairment reviews of indefinite-lived intangible assets or any future impairment of goodwill or other intangible assets would result in a non-cash charge against earnings, which would adversely affect our results of operations. The valuation of the reporting units requires judgment in estimating future cash flows, discount rates and other factors. In making these judgments, we evaluate the financial health of our reporting units, including such factors as market performance, changes in our client base and projected growth rates. Because these factors are ever changing, due to market and general business conditions, our goodwill and indefinite-lived intangible assets may be impaired in future periods.

Our international operations are subject to certain risks, which may affect our revenue.

In fiscal 2023, we earned approximately 29% of our revenue from our international operations. We intend to grow our non-United States business, including growth into new regions with which we have less familiarity and experience, and this growth is important to our overall success. For example, the acquisition of GCA Corporation has greatly expanded our international presence in Asia and Europe. In addition, many of our larger clients are non-United States entities. Our international operations carry special financial and business risks, which could include the following:

•greater difficulties in managing and staffing foreign operations;

•fluctuations in foreign currency exchange rates that could adversely affect our results;

•unexpected and costly changes in trading policies, regulatory requirements, tariffs and other barriers;

•cultural and language barriers and the need to adopt different business practices in different geographic areas;

•longer transaction cycles;

•higher operating costs;

•local labor conditions and regulations;

•adverse consequences or restrictions on the repatriation of earnings;

•potentially adverse tax consequences, such as trapped foreign losses;

•potentially less stable political and economic environments;

•terrorism, political hostilities, war and other civil disturbances or other catastrophic events, such as the Russian invasion of Ukraine and the resulting war, that reduce business activity; and

•difficulty collecting fees.

As part of our day-to-day operations outside the United States, we are required to create compensation programs, employment policies, compliance policies and procedures and other administrative programs that comply with the laws of multiple countries. We also must communicate and monitor standards and directives across our global operations. Our failure to successfully manage and grow our geographically diverse operations could impair our ability to react quickly to changing business and market conditions and to enforce compliance with non-United States standards and procedures.

Any payment of distributions, loans or advances to and from our subsidiaries could be subject to restrictions on, or taxation of, dividends or repatriation of earnings under applicable local law, monetary transfer restrictions, foreign currency exchange regulations in the jurisdictions in which our subsidiaries operate or other restrictions imposed by current or future agreements, including debt instruments, to which our non-United States subsidiaries may be a party. Our business, financial condition and/or results of operations could be adversely impacted, possibly materially, if we are unable to successfully manage these and other risks of international operations in a volatile environment. If our international business increases relative to our total business, these factors could have a more pronounced effect on our operating results or growth prospects.