Exhibit 99.1

NextSource Materials Inc.

Unaudited Condensed Consolidated Interim Financial

Statements

For the

six months ended December 31, 2019 and 2018

Expressed

in US Dollars

In

accordance with National Instrument 51-102, the

Company

discloses that its auditors have not reviewed these

unaudited

condensed interim financial statements.

NextSource Materials Inc.

Unaudited Condensed Consolidated Interim Statements of Financial

Position

Expressed in US Dollars

|

|

Note

|

December

31,

|

June

30,

|

|

|

|

2019

|

2019

|

|

Assets

|

|

|

|

|

|

|

|

|

|

Current

Assets:

|

|

|

|

|

Cash and cash

equivalents

|

|

$567,774

|

$529,331

|

|

Amounts

receivable

|

|

20,549

|

33,640

|

|

Prepaid

expenses

|

16

|

38,884

|

50,432

|

|

Total

Assets

|

|

$627,207

|

$613,403

|

|

|

|

|

|

|

Liabilities

|

|

|

|

|

|

|

|

|

|

Current

Liabilities:

|

|

|

|

|

Accounts

payable

|

16

|

$304,699

|

$109,020

|

|

Accrued

liabilities

|

|

216,354

|

654,999

|

|

Provision

|

9

|

180,652

|

180,652

|

|

Warrant

liability

|

13

|

374,876

|

334,618

|

|

Total

Liabilities

|

|

1,076,581

|

1,279,289

|

|

|

|

|

|

|

Shareholders’

Deficit

|

|

|

|

|

Share

capital

|

10

|

$103,901,774

|

$103,172,066

|

|

Accumulated

deficit

|

|

(104,468,852)

|

(103,955,431)

|

|

Accumulated other

comprehensive income

|

|

117,704

|

117,479

|

|

Total

Shareholders’ Deficit

|

|

(449,374)

|

(665,886)

|

|

|

|

|

|

|

Total

Liabilities and Shareholders’ Deficit

|

|

$627,207

|

$613,403

|

|

|

|

|

|

The accompanying notes are an integral part of these unaudited

condensed consolidated interim financial statements.

Nature

of Operations and Going Concern (note 1)

Mineral

Exploration Properties (note 3)

1

NextSource Materials Inc.

Unaudited Condensed Consolidated Interim Statements of Operations

and Comprehensive Loss

Expressed in US Dollars

|

|

Note

|

For

the three months ended

|

For

the six months ended

|

||

|

|

|

December

31, 2019

|

December

31, 2018

|

December

31, 2019

|

December

31, 2018

|

|

|

|

|

|

|

|

|

Revenues

|

|

$-

|

$-

|

$-

|

$-

|

|

|

|

|

|

|

|

|

Expenses

and other income

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Exploration and

evaluation expenses

|

3, 5

|

51,178

|

112,651

|

120,801

|

207,335

|

|

Management and

professional fees

|

6, 16

|

173,983

|

264,594

|

449,324

|

475,309

|

|

Share based

compensation

|

11, 16

|

-

|

-

|

-

|

-

|

|

General and

administrative expenses

|

7

|

93,596

|

72,424

|

161,348

|

192,433

|

|

Depreciation

|

8

|

-

|

-

|

-

|

-

|

|

Foreign currency

translation (gain) loss

|

|

4,120

|

(3,609)

|

1,811

|

(24,938)

|

|

Change in value of

warrant liability

|

13

|

20,178

|

-

|

(220,832)

|

-

|

|

Interest expense

(income)

|

|

155

|

-

|

200

|

(600)

|

|

Tax

Expenses

|

|

769

|

-

|

769

|

-

|

|

|

|

|

|

|

|

|

Net

loss for the period

|

|

$(343,980)

|

$(446,060)

|

$(513,422)

|

$(849,539)

|

|

|

|

|

|

|

|

|

Other comprehensive income

|

|

|

|

|

|

|

Items that will be reclassified subsequently to loss

|

|

|

|

|

|

|

Translation

adjustment for foreign operations

|

|

3,970

|

(15,933)

|

225

|

(28,027)

|

|

|

|

|

|

|

|

|

Net

loss and comprehensive loss for the period

|

|

$(340,010)

|

$(461,993)

|

$(513,197)

|

$(877,566)

|

|

|

|

|

|

|

|

|

Weighted-average

common shares,

|

|

528,740,718

|

491,330,595

|

509,798,767

|

485,862,477

|

|

-

basic and diluted

|

|

|

|

|

|

|

Net loss per common

shares,

|

|

$(0.00)

|

$(0.00)

|

$(0.00)

|

$(0.00)

|

|

-

basic and diluted

|

|

|

|

|

|

|

|

|

|

|

|

|

The accompanying notes are an integral part of these unaudited

condensed consolidated interim financial statements.

2

NextSource Materials Inc.

Unaudited Condensed Consolidated Interim Statements of Cash

Flows

Expressed in US Dollars

|

|

For

the six months ended

|

For

the six months ended

|

|

|

December

31, 2019

|

December

31, 2018

|

|

|

|

|

|

Cash

flows from operating activities

|

|

|

|

|

|

|

|

Net

loss for the period

|

$(513,422)

|

$(849,539)

|

|

|

|

|

|

Items not affecting

cash:

|

|

|

|

Change in value of

warrant derivative liability

|

(220,832)

|

-

|

|

|

|

|

|

Change in working

capital balances:

|

|

|

|

(Increase) decrease

in amounts receivable and prepaid expenses

|

24,639

|

(10,067)

|

|

Increase (decrease)

in accounts payable and accrued liabilities

|

(242,966)

|

(27,437)

|

|

Net cash used in

operating activities

|

(952,581)

|

(887,043)

|

|

|

|

|

|

Cash

flows from financing activities

|

|

|

|

Proceeds from

issuance of common shares

|

998,619

|

1,141,622

|

|

Common share issue

costs

|

(7,820)

|

(46,158)

|

|

Net cash provided

by financing activities

|

990,799

|

1,095,464

|

|

|

|

|

|

Effect of exchange

rate changes on cash

|

225

|

(28,027)

|

|

|

|

|

|

Increase (decrease)

in cash and cash equivalents

|

38,443

|

180,394

|

|

Cash and cash

equivalents - beginning of period

|

529,331

|

338,702

|

|

Cash

and cash equivalents - end of period

|

$567,774

|

$519,096

|

|

|

|

|

The accompanying notes are an integral part of these unaudited

condensed consolidated interim financial statements.

3

NextSource Materials Inc.

Unaudited Condensed Consolidated Interim Statements of Changes in

Shareholders’ Equity

Expressed in US Dollars

|

|

Shares

|

Share Capital

|

Accumulated Deficit

|

Accumulated Other Comprehensive Income

|

Total (Deficit) Equity

|

|

|

#

|

$

|

$

|

$

|

$

|

|

|

|

|

|

|

|

|

Balance

– June 30, 2018

|

469,933,611

|

100,544,293

|

(100,744,927)

|

75,766

|

(124,868)

|

|

|

|

|

|

|

|

|

Private

placement of common shares

|

21,059,270

|

1,138,350

|

|

|

1,138,350

|

|

Cost

of issue of private placement of common shares

|

337,714

|

(46,158)

|

|

|

(46,158)

|

|

Net

loss for the period

|

|

|

(849,539)

|

|

(849,539)

|

|

Cumulative

translation adjustment

|

|

|

|

(28,027)

|

(28,027)

|

|

|

|

|

|

|

|

|

Balance

– December 31, 2018

|

491,330,595

|

101,636,485

|

(101,594,466)

|

47,739

|

89,758

|

|

|

|

|

|

|

|

|

Private

placement of common shares

|

16,086,426

|

1,305,665

|

|

|

1,305,665

|

|

Reclassification

as warrant liability

|

|

(408,150)

|

|

|

(408,150)

|

|

Cost

of issue of private placement of common shares

|

|

(31,592)

|

|

|

(31,592)

|

|

Cost

of issue finder shares

|

-

|

17,966

|

|

|

17,966

|

|

Share-based

compensation

|

|

651,692

|

|

|

651,692

|

|

Net

loss for the period

|

|

|

(2,360,965)

|

|

(2,360,965)

|

|

Cumulative

translation adjustment

|

|

|

|

69,740

|

69,740

|

|

|

|

|

|

|

|

|

Balance

– June 30, 2019

|

507,417,021

|

103,172,066

|

(103,955,431)

|

117,479

|

(665,886)

|

|

|

|

|

|

|

|

|

Private

placement of common shares

|

29,077,768

|

998,619

|

|

|

998,619

|

|

Cost

of issue of private placement of common shares

|

|

(7,820)

|

|

|

(7,820)

|

|

Reclassification

as warrant liability

|

|

(261,090)

|

|

|

(261,090)

|

|

Net

loss for the period

|

|

|

(513,422)

|

|

(513,422)

|

|

Cumulative

translation adjustment

|

|

|

|

225

|

225

|

|

|

|

|

|

|

|

|

Balance

– December 31, 2019

|

536,494,789

|

103,901,775

|

(104,468,853)

|

117,704

|

(449,374)

|

|

|

|

|

|

|

|

The accompanying notes are an integral part of these consolidated

financial statements.

4

NextSource Materials Inc.

Notes to Unaudited Condensed Consolidated Interim Financial

Statements

For the six months ended December 31, 2019 and 2018

Expressed in US Dollars

1.

Nature

of Operations and Going Concern

NextSource

Materials Inc. (the "Company" or “NextSource”) is

incorporated under the laws of Canada and has a fiscal year end of

June 30. The Company's registered head office and primary location

of records is 130 King Street West, Exchange Tower Suite 1940,

Toronto, Ontario, Canada, M5X 2A2.

The

Company's principal business is the acquisition, exploration and

development of mineral resources. The Company has yet to generate

any revenue from mining operations or pay dividends and is unlikely

to do so in the immediate or foreseeable future.

The

Company, through a wholly owned foreign subsidiary, obtained a

mining permit and environmental certificate for its Molo Graphite

Project in Madagascar.

These

consolidated financial statements were approved by the Board of

Directors on February 13, 2020.

Corporate Redomicile

The

Company completed a corporate redomicile from the State of

Minnesota to Canada on December 27, 2017.

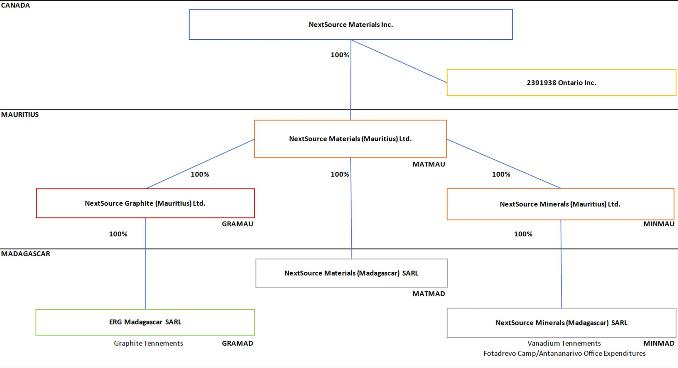

Corporate Structure

NextSource

owns 100% of NextSource Materials (Mauritius) Ltd.

(“MATMAU”), a Mauritius subsidiary, and 2391938 Ontario

Inc., an Ontario Company.

MATMAU

owns 100% of NextSource Minerals (Mauritius) Ltd.

(“MINMAU”), a Mauritius subsidiary, NextSource Graphite

(Mauritius) Ltd (“GRAMAU”), a Mauritius subsidiary, and

NextSource Materials (Madagascar) SARL (“MATMAD”), a

Madagascar subsidiary.

MINMAU

owns 100% of NextSource Minerals (Madagascar) SARL

(“MINMAD”), a Madagascar subsidiary. MINMAD holds the

Green Giant Vanadium Project exploration permits.

GRAMAU

owns 100% of ERG Madagascar SARL (“GRAMAD”), a

Madagascar subsidiary. GRAMAD holds the Molo Graphite Project

mining and exploration permits.

Going Concern Assumption

The

accompanying consolidated financial statements have been prepared

on the basis of a going concern, which contemplates the realization

of assets and liquidation of liabilities in the normal course of

business.

As of

December 31, 2019, the Company had an accumulated deficit of

$104,468,852 (June 30, 2019:

$103,955,431), has experienced

recurring net losses and has negative operating cash flows. As

such, conditions exist that may raise substantial doubt regarding

the Company's ability to continue as a going concern.

In

assessing whether the going concern assumption is appropriate,

management considers all available information about the future,

which is at least, but not limited to, twelve months from the end

of the reporting period. The Company's ability to continue

operations and fund its exploration and development expenditures is

dependent on management's ability to secure additional financing.

Management is actively pursuing such additional sources of

financing, and while it has been successful in doing so in the

past, there can be no assurance it will be able to do so in the

future. The Company has obtained a mining permit for the Molo

Graphite project but has not secured all supporting permits and has

not secured sufficient financing to begin construction. The Company

has not commenced commercial operation of a mine. These conditions

may raise substantial doubt about the Company’s ability to

continue as a going concern.

These

consolidated financial statements do not give effect to adjustments

that would be necessary should the Company be unable to continue as

a going concern and therefore need to realize its assets and

liquidate its liabilities and commitments in other than the normal

course of business and at amounts different from those in the

accompanying consolidated financial statements.

5

NextSource Materials Inc.

Notes to Unaudited Condensed Consolidated Interim Financial

Statements

For the six months ended December 31, 2019 and 2018

Expressed in US Dollars

2.

Significant

Accounting Policies

Statement of compliance with IFRS

These

condensed consolidated interim financial statements have been

prepared in accordance and comply with International Accounting

Standard 34 Interim Financial Reporting (“IAS 34”)

using accounting principles consistent with International Financial

Reporting Standards (“IFRS”) as issued by the

International Accounting Standards Board (“IASB”) and

interpretations issued by the IFRS Interpretations Committee

(“IFRIC”). The accounting policies adopted are

consistent with those of the previous financial year and the

corresponding interim reporting period. Furthermore, the

information on accounting standards effective in future periods and

not yet adopted remains unchanged from that disclosed in the annual

financial statements.

These

condensed consolidated interim financial statements should be read

in conjunction with the Company’s 2019 annual audited

consolidated financial statements, including the accounting

policies and notes thereto, included in the Annual Information

Form/Form 40-F for the year ended June 30, 2019, which were

prepared in accordance with IFRS.

These

condensed consolidated interim financial statements follow the same

accounting policies and methods of their application as the June

30, 2019 annual audited consolidated financial statements except as

described below for new accounting standards adopted effective July

1, 2019.

Basis of measurement

These

condensed consolidated interim financial statements have been

prepared under the historical cost basis except for certain

financial instruments that are measured at fair values, as

explained in the accounting policies below.

Basis of consolidation

These

condensed consolidated interim financial statements include the

financial position, results of operation and cash flows of the

Company and its wholly owned subsidiaries. Intercompany balances,

transactions, income and expenses, profits and losses, including

gains and losses relating to subsidiaries have been eliminated on

consolidation.

Significant accounting estimates, judgments and

assumptions

To

prepare financial statements in conformity with IFRS, the Company

must make estimates, judgements and assumptions concerning the

future that affect the carrying values of assets and liabilities as

of the date of the financial statements and the reported values of

revenues and expenses during the reporting period. By their nature,

these are uncertain and actual outcomes could differ from the

estimates, judgments and assumptions.

The

impacts of such estimates are pervasive throughout the financial

statements and may require accounting adjustments based on future

occurrences. Revisions to accounting estimates are recognized in

the period in which the estimate is revised and also in future

periods when the revision affects both current and future periods.

Significant accounting judgments, estimates and assumptions are

reviewed on an ongoing basis.

The

areas involving significant judgments, estimates and assumptions

have been detailed in Note 2 to the Company’s annual audited

consolidated financial statements for the year ended June 30, 2019,

except for new significant judgments related to the application of

IFRS 16.

6

NextSource Materials Inc.

Notes to Unaudited Condensed Consolidated Interim Financial

Statements

For the six months ended December 31, 2019 and 2018

Expressed in US Dollars

2.

Significant

Accounting Policies - continued

Accounting standards adopted during the period

The

Company has adopted IFRS 16, Leases (‘‘IFRS

16’’) with the date of initial application of July 1,

2019. Comparative information has not been restated and continues

to be reported under IAS 17, Leases (‘‘IAS

17’’) (the accounting standard in effect for those

periods). The impact of adoption of IFRS 16 had no impact on the

financial statements since the Company does not have any leases

exceeding one year.

Policy applicable from July 1, 2019:

At

inception of a contract, the Company assesses whether a contract

is, or contains, a lease. A contract contains a lease if the

contract conveys the right to control the use of an identified

asset for a period of time in exchange for consideration. The

Company assesses whether:

●

The contract

involves the use of an explicitly or implicitly identified

asset;

●

The Company has the

right to obtain substantially all of the economic benefits from the

use of the asset throughout the contract term;

●

The Company has the

right to direct the use of the asset.

The

Company recognizes a right-of-use asset and a lease liability at

the commencement date of the lease (i.e. the date the underlying

asset is available for use).

Right-of-use

assets are measured at cost, less any accumulated depreciation and

impairment losses, and adjusted for any remeasurement of lease

liabilities. The cost of right-of-use assets includes the initial

amount of lease liabilities recognized, initial direct costs

incurred, and lease payments made at or before the commencement

date less any lease incentives received.

Unless

the Company is reasonably certain to obtain ownership of the leased

asset at the end of the lease term, the right-of-use assets are

depreciated on a straight-line basis over the shorter of the

estimated useful life and the lease term. Right-of-use assets are

subject to impairment.

At the

commencement date of the lease, the Company recognizes lease

liabilities measured at the present value of lease payments to be

made over the lease term, discounted using the interest rate

implicit in the lease or, if that rate cannot be readily

determined, the Company’s incremental borrowing rate. The

lease payments include fixed payments, variable lease payments that

depend on an index or a rate, amounts expected to be paid under

residual value guarantees and the exercise price of a purchase

option reasonably certain to be exercised by the

Company.

After

the commencement date, the amount of lease liabilities is increased

to reflect the accretion of interest and reduced for the lease

payments made. In addition, the carrying amount of lease

liabilities is remeasured if there is a modification, a change in

the lease term, a change in the fixed lease payments or a change in

the assessment to purchase the underlying asset.

The

Company presents right-of-use assets in the property, plant and

mine development line item on the condensed interim consolidated

balance sheets and lease liabilities in the lease obligations line

item on the condensed interim consolidated balance

sheets.

Short-term leases and leases of low value assets

The

Company has elected not to recognize right-of-use assets and lease

liabilities for leases that have a lease term of 12 months or less

and do not contain a purchase option or for leases related to low

value assets. Lease payments on short-term leases and leases of low

value assets are recognized as an expense in the condensed interim

consolidated statements of income.

7

NextSource Materials Inc.

Notes to Unaudited Condensed Consolidated Interim Financial

Statements

For the six months ended December 31, 2019 and 2018

Expressed in US Dollars

3.

Mineral

Exploration Properties

The

Company has not capitalized any acquisition and exploration costs

for its mineral properties.

Molo Graphite Property, Southern Madagascar Region,

Madagascar

On

December 14, 2011, the Company entered into a Definitive Joint

Venture Agreement ("JVA") with Malagasy Minerals Limited

("Malagasy"), a public company listed on the Australian Stock

Exchange, to acquire a 75% interest in a property package for the

exploration and development of industrial minerals, including

graphite, vanadium and 25 other minerals. The land position

consisted of 2,119 permits covering 827.7 square kilometers and is

mostly adjacent towards the south and east with the Company's 100%

owned Green Giant Vanadium Project. Pursuant to the JVA, the

Company paid $2,261,690 and issued 7,500,000 common shares that

were valued at $1,350,000.

On

April 16, 2014, the Company signed a Sale and Purchase Agreement

and a Mineral Rights Agreement (together “the

Agreements”) with Malagasy to acquire the remaining 25%

interest. Pursuant to the Agreements, the Company paid $364,480

(CAD$400,000), issued 2,500,000 common shares subject to a 12-month

voluntary vesting period that were valued at $325,000 and issued

3,500,000 common share purchase warrants, which were valued at

$320,950 using Black-Scholes, with an exercise price of $0.14 and

an expiry date of April 15, 2019. On May 20, 2015 and upon

completion of a bankable feasibility study (“BFS”) for

the Molo Graphite Property, the Company paid $546,000 (CAD$700,000)

and issued 1,000,000 common shares, which were valued at $100,000.

Malagasy retains a 1.5% net smelter return royalty ("NSR") on the

property. A further cash payment of approximately $771,510

(CAD$1,000,000) will be due within five days of the commencement of

commercial production.

The

Company also acquired a 100% interest in the industrial mineral

rights on approximately 1 ½ additional claim blocks covering

10,811 hectares adjoining the east side of the Molo Graphite

Property.

The

Molo Graphite Project is located within Exploration Permit #3432

(“PR 3432”) as issued by the Bureau de Cadastre Minier

de Madagascar (“BCMM”) pursuant to the Mining Code 1999

(as amended) and its implementing decrees. The Molo Graphite

Project exploration permit PR 3432 is currently held under the name

of our Madagascar subsidiary GRAMAD. GRAMAD has paid all taxes and

administrative fees to the Madagascar government and its mining

ministry with respect to all the mining permits held in country.

These taxes and administrative fee payments have been acknowledged

and accepted by the Madagascar government.

During

fiscal 2017, the Company applied to the BCMM to have PR 3432

converted into a mining permit. On February 15, 2019, the Company

announced the Madagascar Government granted a 40-year mining

license for the Molo Graphite Project and that the mining license

does not limit mining to any specific volume.

Following

an Environmental Legal Review and an Environmental and Social

Screening Assessment, which provided crucial information to align

the project’s development and design with international best

practice on sustainable project development, the Company completed

a comprehensive Environmental and Social Impact Assessment

("ESIA"), which was developed to local Madagascar

(“Malagasy”), Equator Principles, World Bank and

International Finance Corporation (“IFC”) standards.

The ESIA was submitted to the Office National d’Environment

(“ONE”) (the Madagascar Environment Ministry) during

fiscal 2018. On April 11, 2019, the Company announced it had

received the Global Environmental Permit for the Molo Graphite

Project from ONE.

Application

for all other necessary permits to construct and operate the mine,

including water use, facilities construction, mineral processing,

transportation, export, and labour have been

initiated.

The

Company cannot provide any assurance as to the timing of the

receipt of sufficient capital and of any of the permits and

licenses necessary to initiate construction of the

mine.

8

NextSource Materials Inc.

Notes to Unaudited Condensed Consolidated Interim Financial

Statements

For the six months ended December 31, 2019 and 2018

Expressed in US Dollars

3.

Mineral

Exploration Properties – continued

Green Giant Vanadium Project, Southern Madagascar Region,

Madagascar

In

2007, the Company entered into a joint venture agreement with

Madagascar Minerals and Resources SARL ("MMR") to acquire a 75%

interest in the Green Giant property. Pursuant to the agreement,

the Company paid $765,000 in cash, issued 2,500,000 common shares

and issued 1,000,000 common share purchase warrants, which have now

expired.

On July

9, 2009, the Company acquired the remaining 25% interest by paying

$100,000. MMR retains a 2% NSR. The first 1% NSR can be acquired at

the Company's option by paying $500,000 in cash or common shares

and the second 1% NSR can be acquired at the Company’s option

by paying $1,000,000 in cash or common shares.

On

April 16, 2014, the Company signed a Joint Venture Agreement with

Malagasy, whereby Malagasy acquired a 75% interest in

non-industrial minerals on the Company's 100% owned Green Giant

Property. On May 21, 2015, Malagasy terminated the Joint Venture

Agreement, which as a result, the Company reverted to its original

100% interest in all minerals on the property.

The

Green Giant property is located within exploration permits issued

by the BCMM pursuant to the Mining Code 1999 (as amended) and its

implementing decrees. The Green Giant property exploration permits

are currently held under the name of our Madagascar subsidiary

MINMAD. MINMAD has paid all taxes and administrative fees to the

Madagascar government and its mining ministry with respect to all

the mining permits held in country. These taxes and administrative

fee payments have been acknowledged and accepted by the Madagascar

government.

Since

early 2012, the Company has focused its efforts on the Molo

Graphite Project and as such only limited work has been completed

on the Green Giant Vanadium Project since that time.

Sagar Property, Labrador Trough Region, Quebec, Canada

In

2006, the Company purchased from Virginia Mines Inc. ("Virginia") a

100% interest in 369 claims located in northern Quebec, Canada.

Virginia retains a 2% net smelter return royalty ("NSR") on certain

claims within the property. Other unrelated parties also retain a

1% NSR and a 0.5% NSR on certain claims within the property, of

which half of the 1% NSR can be acquired by the Company by paying

$200,000 and half of the 0.5% NSR can be acquired by the Company by

paying $100,000.

On

February 28, 2014, the Company signed an agreement to sell a 35%

interest in the Sagar property to Honey Badger Exploration Inc.

(“Honey Badger”), a public company that is a related

party through common management. The terms of the agreement were

subsequently amended on July 31, 2014 and again on May 8, 2015. To

earn the 35% interest, Honey Badger was required to complete a

payment of $36,045 (CAD$50,000) by December 31, 2015, incur

exploration expenditures of $360,450 (CAD$500,000) by December 31,

2016 and issue 20,000,000 common shares to the Company by December

31, 2015. Honey Badger did not complete the earn-in requirements by

December 31, 2015 resulting in the termination of the option

agreement.

Since

early 2012, the Company has focused its efforts on the Molo

Graphite Project and as such only minimal work has been completed

on the Sagar Property since that time.

As of

December 31, 2019, the Sagar property consisted of 234 claims

covering a total area of 10,736.59 ha.

9

NextSource Materials Inc.

Notes to Unaudited Condensed Consolidated Interim Financial

Statements

For the six months ended December 31, 2019 and 2018

Expressed in US Dollars

4.

Segmented

Reporting

The

Company has one operating segment, which involves the acquisition,

exploration and development of mineral resources in Madagascar and

Canada. The Canadian exploration project is not a focus for the

Company at this time. No commercial revenue has ever been generated

by any mineral resource properties. Limited amounts of cash and

equipment are currently held in Madagascar. Substantially all of

the Company assets are held in Canada. The Company's President and

Chief Executive Officer and Chief Financial Officer are the

operating decision-makers and direct the allocation of resources to

its geographic segments.

The

following is the segmented information by geographic

region:

|

Mineral

Exploration Expenses

|

Madagascar

|

Canada

|

Total

|

|

|

$

|

$

|

$

|

|

Three months ended

December 31, 2019

|

48,148

|

3,030

|

51,178

|

|

Three months ended

December 31, 2018

|

106,828

|

5,823

|

112,651

|

|

Six months ended

December 31, 2019

|

116,462

|

4,339

|

120,801

|

|

Six months ended

December 31, 2018

|

195,307

|

12,028

|

207,335

|

|

Cash

and Cash Equivalents

|

Madagascar

|

Canada

|

Total

|

|

|

$

|

$

|

$

|

|

As

of December 31, 2019

|

44,034

|

523,741

|

567,774

|

|

As

of June 30, 2019

|

54,701

|

474,630

|

529,331

|

5.

Exploration

and Evaluation Expenses

Exploration

and evaluation expenses include all costs relating to exploration

activities (drilling, seismic, geological, geophysical, testing and

sampling), metallurgical evaluation activities, local payroll and

consultants, Madagascar travel costs, mineral claims and camp

operations.

The

following is the breakdown by nature of the expenses:

|

|

For

the three months ended

|

For

the six months ended

|

||

|

|

December

31, 2019

|

December

31, 2018

|

December

31, 2019

|

December

31, 2018

|

|

|

$

|

$

|

$

|

$

|

|

Exploration

activities

|

-

|

-

|

-

|

-

|

|

Metallurgical

evaluation

|

-

|

19

|

-

|

2,059

|

|

Mineral claims

(Canada)

|

3,030

|

-

|

4,339

|

-

|

|

Mineral claims and

camp (Madagascar)

|

3,149

|

-

|

3,536

|

-

|

|

Other

|

-

|

21,622

|

-

|

32,963

|

|

Payroll and

consulting fees

|

35,079

|

80,380

|

103,006

|

154,057

|

|

Permits and

licenses

|

-

|

7,916

|

-

|

12,028

|

|

Travel

|

9,920

|

2,714

|

9,920

|

4,091

|

|

Total

exploration and evaluation expenses

|

51,178

|

112,651

|

120,801

|

205,198

|

|

|

|

|

|

|

10

NextSource Materials Inc.

Notes to Unaudited Condensed Consolidated Interim Financial

Statements

For the six months ended December 31, 2019 and 2018

Expressed in US Dollars

6.

Management

and Professional Fees

Management

and professional fees include payroll for management, director fees

and professional fees such as lawyer and auditor fees.

The

following is the breakdown by nature of the expenses:

|

|

For

the three months ended

|

For

the six months ended

|

||

|

|

December

31, 2019

|

December

31, 2018

|

December

31, 2019

|

December

31, 2018

|

|

|

$

|

$

|

$

|

$

|

|

Management

payroll

|

119,492

|

140,601

|

225,851

|

251,710

|

|

Consulting

fees

|

87,015

|

84,187

|

173,082

|

168,123

|

|

Legal

fees

|

(49,246)

|

25,533

|

10,443

|

44,694

|

|

Auditor

fees

|

8,137

|

7,185

|

26,310

|

1,260

|

|

Tax

advisory fees

|

-

|

-

|

|

-

|

|

Other

|

8,585

|

7,087

|

13,638

|

9,521

|

|

Total management and professional fees

|

173,983

|

264,593

|

449,324

|

475,308

|

7.

General

and Administrative Expenses

General

and administrative expenses include all corporate travel, public

filing and transfer agent fees, investor relations, rent,

insurance, bank fees, meals and entertainment, telecommunications

and information technology.

The

following is the breakdown by nature of the expenses:

|

|

For

the three months ended

|

For

the six months ended

|

||

|

|

December

31, 2019

|

December

31, 2018

|

December

31, 2019

|

December

31, 2018

|

|

|

$

|

$

|

$

|

$

|

|

Travel

|

17,217

|

23,678

|

30,133

|

60,019

|

|

Public

filing and transfer agent fees

|

30,575

|

23,349

|

56,063

|

59,650

|

|

Investor

relations

|

2,740

|

5,691

|

17,482

|

27,178

|

|

Rent

|

23,419

|

12,875

|

28,336

|

28,235

|

|

Insurance

|

5,759

|

4,049

|

9,999

|

8,114

|

|

Bank

fees

|

1,145

|

302

|

2,025

|

1,142

|

|

Other

|

12,741

|

1,880

|

17,311

|

7,495

|

|

Total general and administrative expenses

|

93,595

|

71,824

|

161,348

|

191,833

|

11

NextSource Materials Inc.

Notes to Unaudited Condensed Consolidated Interim Financial

Statements

For the six months ended December 31, 2019 and 2018

Expressed in US Dollars

8.

Equipment

The

Company owns metallurgical testing equipment and several vehicles

used for exploration purposes in Madagascar that were deemed

impaired and have no carrying values.

Changes

in the carrying values were as follows:

|

|

Equipment

Costs

$

|

Accumulated

Depreciation

$

|

Net Book

Value

$

|

|

Balance June 30, 2019

|

-

|

-

|

-

|

|

|

|

|

|

|

Balance December 31, 2019

|

-

|

-

|

-

|

9.

Provision

and Contingent Liability

Provision

During fiscal 2014, the Company issued 17,889,215

flow-through shares to eligible Canadian taxpayer subscribers which

included a contractual commitment for the Company to incur

$3,812,642 in eligible Canadian Exploration Expenditures

(“CEEs”) by December 31, 2014 as per the provision of

the Income Tax Act of Canada. The CEEs were renounced as a tax

credit to the flow-through share subscribers on December 31, 2013.

As at December 31, 2014, the Company had unfulfilled CEE

obligations. During the year ended June 30, 2015, the Company

recorded a provision for the Part XII.6 taxes and related penalties

payable to the Canada Revenue Agency and for the indemnification

liability to subscribers of the flow-through shares for the

additional taxes payable related to the CEE renunciation shortfall.

During the year ended June 30, 2017, the Company paid $131,320 in

Part XII.6 taxes, resulting in a reduction in the provision, and

following a reassessment of its obligation to subscribers the

Company increased the provision by $131,320. During the year ended

June 30, 2018, the provision was adjusted due to foreign exchange

fluctuations to $180,652. During the period ended December 31,

2019, there were $NIL adjustments made to the provision

balance.

Contingent Liabilities

On April 16, 2014, the Company signed a Sale and Purchase Agreement

and a Mineral Rights Agreement (together “the

Agreements”) with Malagasy to acquire the remaining 25%

interest in the Molo Graphite Property. Pursuant to the Agreements,

a further cash payment of approximately $771,510 (CAD$1,000,000)

will be due within five days of the commencement of commercial

production. Since this cash payment represents a possible

obligation that depends on the occurrence of an uncertain future

event, no amount has been recognized as a provision.

12

NextSource Materials Inc.

Notes to Unaudited Condensed Consolidated Interim Financial

Statements

For the six months ended December 31, 2019 and 2018

Expressed in US Dollars

10.

Share

Capital

The Company’s common shares have no par value and the

authorized share capital is composed of an unlimited number of

common shares. As of December 31, 2019, the Company had 536,494,789

common shares issued and outstanding (June 30, 2019:

507,417,021).

The Company issued the following common shares during the period

ended December 31, 2019:

(a)

On

October 25, 2019, the Company closed a non-brokered private

placement offering of 29,077,768 units at a price of $0.034

(CAD$0.045) per unit for aggregate gross proceeds of $998,619

(CAD$1,308,500). Each unit consisted of one common share and

one-half common share purchase warrant, with each full warrant

exercisable into one common share at an exercise price of $0.07

(CAD$0.09) for a period of two years. The share issue costs

consisted of private placement listing fees paid to the

exchange.

13

NextSource Materials Inc.

Notes to Unaudited Condensed Consolidated Interim Financial

Statements

For the six months ended December 31, 2019 and 2018

Expressed in US Dollars

11.

Stock

Options

The

Company’s stock option plan is restricted to a maximum of 10%

of the issued and outstanding common shares. Under the stock option

plan, the Company may grant stock options to directors, officers,

employees and consultants. The Board of Directors administers the

plan and determines the vesting and terms of each

grant.

The

Black-Scholes option valuation model is used by the Company to

determine the fair value of stock option grants based on the market

price, the exercise price, compound risk free interest rate,

annualized volatility and number of periods until expiration. Each

stock option entitles the holder to purchase one common share of

the Company at the respective exercise price prior to or on the

respective expiration date.

As of December 31, 2019, the Company had 38,820,000 stock options

issued and outstanding (June 30, 2019: 40,670,000) with a weighted

average expiration of 2.6 years (June 30, 2019: 3.0 years), which

are exercisable into 38,820,000 common shares (June 30, 2019:

40,670,000) at a weighted average exercise price of $0.076 (June

30, 2019: $0.08). All stock options that are currently outstanding

vested on the grant date.

The

following is a schedule of the outstanding stock options for the

period ended December 31, 2019:

|

Grant

Date

|

Expiration

Date

|

Exercise

Price

|

Balance

Outstanding

June

30,

2019

|

Options

Granted (Expired or

Cancelled)

|

Options

Exercised

|

Balance

Outstanding

December

31, 2019

|

|

July 3,

2014

|

July 3,

2019

|

USD

$0.15

|

1,150,000

|

(1,150,000)

|

-

|

-

|

|

February 26,

2015

|

February 26,

2020

|

USD

$0.20

|

2,870,000

|

(300,000)

|

-

|

2,570,000

|

|

December 22,

2015

|

December 22,

2020

|

USD

$0.06

|

6,700,000

|

(400,000)

|

-

|

6,300,000

|

|

June 9,

2017

|

June 9,

2022

|

USD

$0.07

|

18,100,000

|

-

|

-

|

18,100,000

|

|

March 26,

2019

|

March 26,

2024

|

CAD

$0.10

|

11,850,000

|

-

|

-

|

11,850,000

|

|

Total

Outstanding

|

|

|

40,670,000

|

(1,850,000)

|

-

|

38,820,000

|

The

following is a continuity schedule of the Company's outstanding

common stock purchase options:

|

|

Weighted-Average

Exercise

Price

$

|

Number

of

Stock

Options

#

|

|

Outstanding as of

June 30, 2018

|

USD

$0.09

|

37,630,000

|

|

|

|

|

|

Granted

|

CAD

$0.10

|

11,850,000

|

|

Exercised

|

-

|

-

|

|

Expired/cancelled

|

USD

$0.09

|

(8,810,000)

|

|

Outstanding as of

June 30, 2019

|

USD

$0.08

|

40,670,000

|

|

|

|

|

|

Granted

|

-

|

-

|

|

Exercised

|

-

|

-

|

|

Expired/cancelled

|

USD

$0.135

|

(1,850,000)

|

|

Outstanding as of

December 31, 2019

|

USD

$0.076

|

38,820,000

|

The Company did not grant any stock options during the period ended

December 31, 2019.

14

NextSource Materials Inc.

Notes to Unaudited Condensed Consolidated Interim Financial

Statements

For the six months ended December 31, 2019 and 2018

Expressed in US Dollars

12.

Warrants

The

Company has issued common share purchase warrants as part of equity

private placements.

The

Black-Scholes option valuation model is used by the Company to

determine the fair value of warrants issued based on the market

price, the exercise price, compound risk free interest rate,

annualized volatility and number of periods until expiration. Each

warrant entitles the holder to purchase one common share of the

Company at the respective exercise price prior to or on the

respective expiration date.

As of September 30, 2019, the Company had 25,191,522 (June 30,

2019: 10,652,636) common share purchase warrants issued and

outstanding with a weighted average expiration of 1.32 years (June

30, 2019: 1.1 years), which are exercisable into 25,191,522 (June

30, 2019: 10,652,636) common shares at a weighted average exercise

price of $0.07 (June 30, 2019: $0.08). All warrants that are

currently outstanding vested on the issue date.

The

following is a schedule of the outstanding common stock purchase

warrants for the period ended December 31, 2019:

|

Issue

Date

|

Expiration

Date

|

Exercise

Price

|

Balance

Outstanding

June

30,

2019

|

Warrants

Granted (Expired)

|

Warrants

Exercised

|

Balance

Outstanding

December

31,

2019

|

|

August 17,

2018

|

August 17,

2020

|

CAD

$0.10

|

10,652,636

|

-

|

-

|

10,652,636

|

|

October 25,

2019

|

October 25,

2021

|

CAD

$0.09

|

14,538,886

|

-

|

-

|

14,538,886

|

|

Total

Outstanding

|

|

|

25,191,522

|

-

|

-

|

25,191,522

|

The

following is the continuity schedule of the Company's common share

purchase warrants:

|

|

Weighted-Average

Exercise

Price

$

|

Number

of

Warrants

#

|

|

Outstanding as of

June 30, 2018

|

USD

$0.14

|

3,500,000

|

|

|

|

|

|

Issued

|

CAD

$0.10

|

10,652,636

|

|

Expired

|

USD

$0.14

|

(3,500,000)

|

|

Exercised

|

-

|

-

|

|

Outstanding as of

June 30, 2019

|

USD

$0.08

|

10,652,636

|

|

|

|

|

|

Issued

|

CAD

$0.09

|

14,538,886

|

|

Expired

|

-

|

-

|

|

Exercised

|

-

|

-

|

|

Outstanding as of

December 31, 2019

|

USD

$0.07

|

25,191,522

|

The Company issued the following common share purchase warrants

during the period ended December 31, 2019:

(a)

On

October 25, 2019, the Company closed a non-brokered private

placement offering of 29,077,768 units at a price of $0.034

(CAD$0.045) per unit for aggregate gross proceeds of $998,619

(CAD$1,308,500). Each unit consisted of one common share and

one-half common share purchase warrant, with each full warrant

exercisable into one common share at an exercise price of $0.07

(CAD$0.09) for a period of two years. The share issue costs

consisted of private placement listing fees paid to the

exchange.

15

NextSource Materials Inc.

Notes to Unaudited Condensed Consolidated Interim Financial

Statements

For the six months ended December 31, 2019 and 2018

Expressed in US Dollars

13.

Warrant

Liability

The

warrants that were issued on August 17, 2018, as part of the units

as described in notes 10 and 12, were issued in a currency other

than the Company’s functional currency and therefore are

considered a derivative equity instrument as per IFRS 9

Financial Instruments. The

warrant liability was measured at fair value in the statement of

financial position using the Black-Scholes option valuation model

and will be revalued at each reporting period through profit and

loss until expiration or exercise of the underlying

warrants.

The

fair value of the warrant liability was estimated using the

following model inputs on the following valuation

dates:

|

|

Warrant

Liability

$

|

|

As of August 17,

2018 (issue date)

|

408,150

|

|

Exercise

price

|

$0.076

|

|

Risk free

rate

|

1.50%

|

|

Expected

volatility

|

115%

|

|

Expected dividend

yield

|

Nil

|

|

Expected life (in

years)

|

2

|

|

Change in fair

value

|

(73,532)

|

|

|

|

|

As of June 30,

2019

|

334,618

|

|

Exercise

price

|

$0.076

|

|

Risk free

rate

|

1.67%

|

|

Expected

volatility

|

100%

|

|

Expected dividend

yield

|

Nil

|

|

Expected life (in

years)

|

1.13

|

|

Change in fair

value

|

(241,010)

|

|

As of September 30,

2019

|

93,608

|

|

Exercise

price

|

$0.076

|

|

Risk free

rate

|

1.67%

|

|

Expected

volatility

|

117%

|

|

Expected dividend

yield

|

Nil

|

|

Expected life (in

years)

|

0.88

|

|

Change in fair

value

|

(7,449)

|

|

As of December 31,

2019

|

86,159

|

|

Exercise

price

|

$0.077

|

|

Risk free

rate

|

1.66%

|

|

Expected

volatility

|

131.25%

|

|

Expected dividend

yield

|

Nil

|

|

Expected life (in

years)

|

0.63

|

16

NextSource Materials Inc.

Notes to Unaudited Condensed Consolidated Interim Financial

Statements

For the six months ended December 31, 2019 and 2018

Expressed in US Dollars

13.

Warrant

Liability (continued)

The

warrants that were issued on October 25, 2019, as part of the units

as described in notes 10 and 12, were issued in a currency other

than the Company’s functional currency and therefore are

considered a derivative equity instrument as per IFRS 9

Financial Instruments. The

warrant liability was measured at fair value in the statement of

financial position using the Black-Scholes option valuation model

and will be revalued at each reporting period through profit and

loss until expiration or exercise of the underlying

warrants.

The

fair value of the warrant liability was estimated using the

following model inputs on the following valuation

dates:

|

|

Warrant

Liability

$

|

|

As of October 25,

2019 (issue date)

|

261,090

|

|

Exercise

price

|

$0.07

|

|

Risk free

rate

|

1.66%

|

|

Expected

volatility

|

115%

|

|

Expected dividend

yield

|

Nil

|

|

Expected life (in

years)

|

2

|

|

Change in fair

value

|

27,627

|

|

|

|

|

As of December 31,

2019

|

288,717

|

|

Exercise

price

|

$0.07

|

|

Risk free

rate

|

1.66%

|

|

Expected

volatility

|

131.25%

|

|

Expected dividend

yield

|

Nil

|

|

Expected life (in

years)

|

1.82

|

17

NextSource Materials Inc.

Notes to Unaudited Condensed Consolidated Interim Financial

Statements

For the six months ended December 31, 2019 and 2018

Expressed in US Dollars

14.

Capital

Management

As at

December 31, 2019, the Company had a working capital deficit of

$449,374 (June 30, 2019: deficit of $665,886).

There

were no changes in the Company's approach to capital management

during the period ended December 31, 2019.

In

managing liquidity, the Company’s primary objective is to

ensure the entity can continue as a going concern while raising

additional funding to meet its obligations as they come due. The

Company’s operations to date have been funded by issuing

equity. The Company expects to improve the working capital position

by securing additional financing.

The

Company’s investment policy is to invest excess cash in very

low risk financial instruments such as term deposits or by holding

funds in high yield savings accounts with major Canadian banks.

Financial instruments are exposed to certain financial risks, which

may include currency risk, credit risk, liquidity risk and interest

rate risk.

The

Company’s mineral property interests are all in the

exploration stage, as such the Company is dependent on external

financing to fund its exploration activities and administrative

costs. Management continues to assess the merits of mineral

properties on an ongoing basis and may seek to acquire new

properties or to increase ownership interests if it believes there

is sufficient geologic and economic potential.

Management

mitigates the risk and uncertainty associated with raising

additional capital in current economic conditions through cost

control measures that minimizes discretionary disbursements and

reduces exploration expenditures that are deemed of limited

strategic value.

The

Company manages the capital structure (consisting of

shareholders’ deficiency) on an ongoing basis and adjusts in

response to changes in economic conditions and risks

characteristics of its underlying assets. Adjustments to the

Company’s capital structure may involve the issuance of new

shares, assumption of new debt, acquisition or disposition of

assets, or adjustments to the amounts held in cash, cash

equivalents and short-term investments.

The

Company is not subject to any externally imposed capital

requirements.

18

NextSource Materials Inc.

Notes to Unaudited Condensed Consolidated Interim Financial

Statements

For the six months ended December 31, 2019 and 2018

Expressed in US Dollars

15.

Financial

Instruments and Risk Management

The

following disclosures are to enable users of the consolidated

financial statements to evaluate the nature and extent of risks

arising from financial instruments at the end of the reporting

period:

Credit risk

The

Company does not currently have commercial customers and therefore

does not have any credit risk related to accounts receivables. The

Company has credit risk arising from the potential from

counterparty default on cash and cash equivalents held on deposit

with financial institutions. The Company manages this risk by

ensuring that deposits are only held with large Canadian banks and

financial institutions.

Liquidity risk

Liquidity

risk is the risk that the Company will not be able to meet its

obligations associated with financial liabilities. Liquidity risk

arises from the Company’s financial obligations and in the

management of its assets, liabilities and capital structure. The

Company manages this risk by regularly evaluating its liquid

financial resources to fund current and long-term obligations and

to meet its capital commitments in a cost-effective

manner.

The

main factors that affect liquidity include working capital

requirements, capital-expenditure requirements and equity capital

market conditions. The Company’s liquidity requirements are

met through a variety of sources, including cash and cash

equivalents and equity capital markets.

As at

December 31, 2019, the Company expects to access public debt and

equity capital markets for financing over the next 12 months in

order to initiate construction of its Molo Graphite Project in

Madagascar and to satisfy working capital requirements. While the

Company has been successful in obtaining required funding in the

past, there is no assurance that future financings will be

available.

As at

December, 2019, the Company had cash and cash equivalents of

$567,774 (June 30, 2019: $529,331) to settle current liabilities of

$1,076,581 (June 30, 2019: $1,279,289). As a result, the Company is

currently exposed to liquidity risk.

Based

on management’s assessment of its past ability to obtain

required funding, the Company believes that it will be able to

satisfy its current and long-term obligations as they come due.

Other than accounts payable, which are due within 30 days, and the

warrant liability, which will be fully expensed by October 2021,

none of the Company’s obligations have contractual

maturities.

Market risks

Market

risk is the potential for financial loss from adverse changes in

underlying market factors, including foreign exchange rates,

commodity prices and interest rates.

●

Interest rate risk:

This is the sensitivity of the fair value or of the future cash

flows of a financial instrument to changes in interest rates. The

Company does not have any financial assets or liabilities that are

subject to variable interest rates.

●

Commodity price

risks: This is the sensitivity of the fair value of, or of the

future cash flows, from mineral assets. The Company manages this

risk by monitoring mineral prices and commodity price trends to

determine the appropriate timing for funding the exploration or

development of its mineral assets, or for the acquisition or

disposition of mineral assets. The Company does not have any

mineral assets at the development or production stage carried at

historical cost. The Company has expensed the acquisition and

exploration costs of its exploration stage mineral

assets.

●

Currency

risk: This is the sensitivity of the fair value or of the

future cash flows of financial instruments to changes in foreign

exchange rates. The Company transacts in currencies other

than the US dollar, including the Canadian dollar, the Madagascar

Ariary, the Euro and the South African Rand. The Company

purchases services and has certain salary commitments in those

currencies. The Company also has monetary and financial

instruments that may fluctuate due to changes in foreign exchange

rates. Derivative financial instruments are not used to

reduce exposure to fluctuations in foreign exchange rates. The

Company is not sensitive to foreign exchange exposure since it has

not made any commitments to deliver products quoted in foreign

currencies. The Company is not sensitive to foreign exchange risk

arising from the translation of the financial statements of

subsidiaries with a functional currency other than the US dollar

since it does not have any material assets and liabilities measured

through other comprehensive income.

19

NextSource Materials Inc.

Notes to Unaudited Condensed Consolidated Interim Financial

Statements

For the six months ended December 31, 2019 and 2018

Expressed in US Dollars

16.

Related

Party Transactions

Parties

are related if one party has the direct or indirect ability to

control or exercise significant influence over the other party in

making operating and financial decisions. Parties are also related

if they are subject to common control or common significant

influence. A transaction is considered to be a related party

transaction when there is a transfer of economic resources or

financial obligations between related parties. Related party

transactions that are in the normal course of business and have

commercial substance are measured at the fair value.

Balances

and transactions between the Company and its wholly owned

subsidiaries, which are related parties of the Company, have been

eliminated and are not disclosed in this note.

Related

parties include companies controlled by key management personnel.

Key management personnel are composed of the Board of Directors,

Chief Executive Officer, Chief Financial Officer and the Senior

Vice Presidents of the Company.

The

following key management personnel related party transactions

occurred during the period ended December 31, 2019 and

2018:

|

|

For

the three months ended

|

For

the six months ended

|

||

|

|

December

31, 2019

|

December

31, 2018

|

December

31, 2019

|

December

31, 2018

|

|

|

$

|

$

|

$

|

$

|

|

Management and

professional fees

|

180,609

|

226,485

|

361,218

|

420,837

|

|

Share based

compensation

|

-

|

-

|

-

|

-

|

|

Total

|

180,609

|

226,485

|

361,218

|

420,837

|

The

following key management related party balances existed as of

December 31, 2019 and June 30, 2019:

|

|

As

at

December

31, 2019

|

As

at

June

30, 2019

|

|

Prepaid

payroll to officers of the Company

|

$26,425

|

$26,568

|

|

Accounts

payable balance due to officers of the Company

|

$16,400

|

$16,400

|

20

NextSource Materials Inc.

Notes to Unaudited Condensed Consolidated Interim Financial

Statements

For the six months ended December 31, 2019 and 2018

Expressed in US Dollars

21