UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 10-K

| þ | annual report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 |

| For the fiscal year ended | June 30, 2017 |

or

| ¨ | Transition report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 |

| For the transition period from | __________________________________ to _________________________________ |

| Commission File Number: | 001-37776 |

| SHINECO, INC. |

| (Exact name of issuer as specified in its charter) |

| Delaware | 52-2175898 | |

| (State or other jurisdiction of incorporation or | (I.R.S. employer identification number) | |

| organization) | ||

| Room 1001, Building T5, DaZu Square, | ||

| Daxing District, Beijing | ||

| People’s Republic of China | ||

| 100176 | ||

| (Address of principal executive offices) | (Zip Code) |

| Registrant’s telephone number, including area code | (+86) 10-87227366 |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Name of each exchange on which registered | |

| Common stock, $0.001 par value | NASDAQ Capital Market |

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No þ

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No þ

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes þ No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every, Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (Sec. 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes þ No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§ 229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. þ

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer |

¨ | Accelerated filer | ¨ |

| Non-accelerated filer | ¨ (Do not check if a smaller reporting company) | Smaller reporting company | x |

| Emerging growth company | x |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ¨ No þ

The aggregate market value of 16,947,172 shares of voting and non-voting common equity stock held by non-affiliates of the registrant was approximately $71,178,122 as of December 31, 2016, the last business day of the registrant’s most recently completed second fiscal quarter, based on the last sale price of the registrant’s common stock on such date of $4.2 per share, as reported on the Nasdaq Capital Market.

As of October 9, 2017, the registrant had 21,034,072 shares of common stock outstanding.

TABLE OF CONTENTS

TO ANNUAL REPORT ON FORM 10-K

FOR YEAR ENDED JUNE 30, 2017

i

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This annual report on Form 10-K (the “Report”) and other reports (collectively the “Filings”) filed by the registrant from time to time with the Securities and Exchange Commission (the “SEC”) contain or may contain forward looking statements and information that are based upon beliefs of, and information currently available to, the registrant’s management as well as estimates and assumptions made by the registrant’s management. When used in the filings the words “anticipate,” “believe,” “estimate,” “expect,” “future,” “intend,” “plan” or the negative of these terms and similar expressions as they relate to the registrant or the registrant’s management identify forward looking statements. Such statements reflect the current view of the registrant with respect to future events and are subject to risks, uncertainties, assumptions and other factors (including the risks contained in the section of this Report entitled “Risk Factors”) relating to the registrant’s industry, the registrant’s operations and results of operations and any businesses that may be acquired by the registrant. Should one or more of these risks or uncertainties materialize, or should the underlying assumptions prove incorrect, actual results may differ significantly from those anticipated, believed, estimated, expected, intended or planned.

Although the registrant believes that the expectations reflected in the forward looking statements are reasonable, the registrant cannot guarantee future results, levels of activity, performance or achievements. Except as required by applicable law, including the securities laws of the United States, the registrant does not intend to update any of the forward-looking statements to conform these statements to actual results. The following discussion should be read in conjunction with the registrant’s financial statements and the related notes thereto included in this Report.

All references to “we,” “us,” “our,” “TYHT,” “Company,” “Registrant” or similar terms used in this report refer to Shineco, Inc., a Delaware corporation (“TYHT”), including its consolidated subsidiaries and variable interest entities (“VIE”), unless the context otherwise indicates.

ii

| ITEM 1. | Business |

General Overview

We are a Delaware holding company that uses our subsidiaries’ and variable interest entities’ vertically- and horizontally-integrated production, distribution and sales channels to provide health and well-being focused plant-based products. Our products are only sold domestically in China. We utilize modern engineering technologies and biotechnologies to produce, among other products, Chinese herbal medicines, organic agricultural produce and specialized textiles. Our health and well-being focused plant-based products business is divided into three major segments:

1. Processing and distributing traditional Chinese herbal medicine products as well as other pharmaceutical products. This segment is conducted through Ankang Longevity Group, which operates 66 cooperative retail pharmacies throughout Ankang, a city in southern Shaanxi province, China, through which we sell directly to individual customers traditional Chinese medicinal products produced by us as well as by third parties. Ankang Longevity Group also owns a factory specializing in decoction, which is the process by which solid materials are heated or boiled in order to extract liquids, and distributes decoction products to wholesalers and pharmaceutical companies around China. This segment accounted for approximately 39.4% of our revenues for the year ended June 30, 2017.

2. Processing and distributing green and organic agricultural produce as well as growing and cultivating yew trees (taxus media). We currently cultivate and sell yew mainly to large group and corporate customers, but do not currently process yew into Chinese or Western medicines. This segment is conducted through the Company’s variable interest entities: the Zhisheng Group, which comprises the following Chinese companies participating in our yew tree business: Shineco Zhisheng (Beijing) Bio-Technology Co. (“Zhisheng Bio-Tech”), Yantai Zhisheng International Freight Forwarding Co., Ltd (“Zhisheng Freight”), Yantai Zhisheng International Trade Co., Ltd (“Zhisheng Trade”), Yantai Mouping District Zhisheng Agricultural Produce Cooperative (“Zhisheng Agricultural”), and Qingdao Zhihesheng Agricultural Produce Services, Ltd (“Qingdao Zhihesheng”). This segment accounted for approximately 49.8% of our revenues for the year ended June 30, 2017.

3. Developing and distributing specialized fabrics, textiles and other byproducts derived from an indigenous Chinese plant Apocynum Venetum, grown in the Xinjiang region of China, and known in Chinese as “Luobuma” or “bluish dogbane”. Our Luobuma products are specialized textile and health supplement products designed to incorporate traditional Eastern medicines with modern scientific methods. These products are predicated on centuries-old traditions of Eastern herbal remedies derived from the Luobuma raw material. This segment is channeled through the Company’s directly-owned subsidiary, Beijing Tenet-Jove Technological Development Co., Ltd. (“Tenet-Jove”). This segment accounted for approximately 10.8% of our revenues for the year ended June 30, 2017.

We primarily market our health and wellbeing-focused products in China. At present, we do not sell any of our products in the United States or Canada. China’s domestic pharmaceutical and healthcare products market is fast-growing but, in our opinion, underdeveloped. We believe China’s healthcare sector has the capacity to develop even further. From pharmaceuticals to medical products to general consumer health, China remains among the world’s most attractive markets, and by far the fastest-growing of all the large emerging ones. Driving this growth is China’s aging population, increased incidence of chronic diseases, and a material increase in investment from both domestic and foreign corporations. The growth also reflects the Chinese government’s focus on healthcare as both a social priority (as witnessed in its late 2000s healthcare reforms) and a strategic priority (as witnessed in the 12th five-year plan’s stated focus on growing the biomedical industry in the future).

| 1 |

History and Corporate Structure

Shineco, Inc. was incorporated under the laws of the State of Delaware on August 20, 1997 as Supcor, Inc. From 1997 to 2004, the Company’s only activities were organizational ones, directed at developing its business plan and raising initial capital. On December 30, 2004, the Company acquired all of the issued and outstanding shares of Tenet-Jove, a company organized under the laws of the People’s Republic of China on December 15, 2003 that operated in the fabrics and textile business, in exchange for restricted shares of Shineco’s common stock; as a result, Tenent-Jove became our wholly-owned subsidiary. At that point, the sole operating business of Tenet-Jove then became that of the Company. On June 9, 2005, we changed our name to Shineco, Inc.

On April 19, 2017, Tenet-Jove established Xinjiang Tiankunrunze Biological Engineering Co., Ltd. (“Tiankunrunze”) and owned 65% interest of Tiankunrunze. On April 28, 2017, Tiankunrunze established Xinjiang Tianzhuo Technology Development Co., Ltd. (“Tianzhuo”) with registered capital of RMB 10.0 million ($1,450,233). On May 22, 2017, Tiankunrunze established Xinjiang Tianhuihechuang Agriculture Development Co., Ltd. (“Tianhuihechuang”) with registered capital of RMB 10.0 million ($1,452,294). On May 23, 2017, Tiankunrunze established Xinjiang Tianxintongye Biotechnology Development Co., Ltd. (“Tianxintongye”) with registered capital of RMB 10.0 million ($1,451,615). Tianzhuo, Tianhuihechuang and Tianxintongye became subsidiaries of Tenet-Jove.

On June 9, 2017, the Company and its subsidiary Tiankunrunze have entered into a Strategic Cooperation Agreement with Beijing Zhongke Biorefinery Engineering Technology Co., Ltd. (“Biorefinery”), a leading high-tech biomass refining company financially backed by the Chinese Academy of Sciences Institute of Process Engineering, to establish the Institute of Chinese Apocynum Industrial Technology Research (“ICAITR”). Pursuant to the Strategic Cooperation Agreement entered into on May 2, 2017 among the three parties, Tiankunrunze, Shineco and Biorefinery agreed to establish the ICAITR and each will own 45%, 35% and 20% of the equity interests of ICAITR, respectively. Shineco and Tiankunrunze will invest RMB 5.0 million ($737,745) as the registered capital, and Biorefinery will invest technology such as the patent for “Steam Explosion Degumming” as well as other resources.

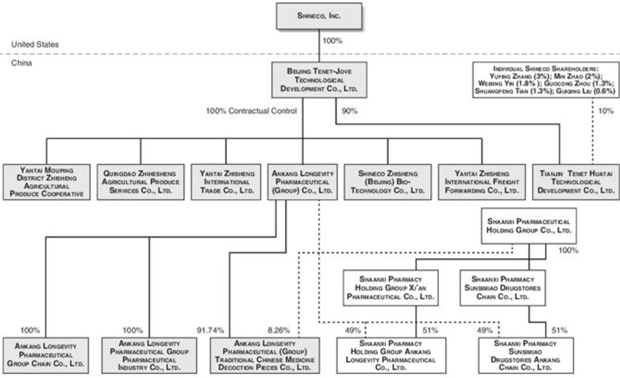

As of June 30, 2017, Tenet-Jove, through a series of contractual relationships, effectively controls and manages:

| • | Ankang Longevity Pharmaceutical (Group) Co., Ltd. (“Ankang Longevity Group”), which owns a controlling interest in the following Chinese companies participating in our traditional Chinese medicine business: Ankang Longevity Pharmaceutical (Group) Traditional Chinese Medicine Decoction Pieces Co., Ltd. (“Ankang Longevity Decoction Pieces”), Ankang Longevity Pharmaceutical Group Chain Co., Ltd. (“Ankang Longevity Chain”), and Ankang Longevity Pharmaceutical Group Pharmaceutical Industry Co., Ltd. (“Ankang Longevity Industry”); and |

| • | Zhisheng Group, which comprises the following Chinese companies participating in our yew tree business: Shineco Zhisheng (Beijing) Bio-Technology Co., Yantai Zhisheng International Freight Forwarding Co., Ltd, Yantai Zhisheng International Trade Co., Ltd, Yantai Mouping District Zhisheng Agricultural Produce Cooperative, and Qingdao Zhihesheng Agricultural Produce Services, Ltd. |

The Company is also a majority shareholder of Tiankunrunze, Tianjin Tenet Huatai Technological Development Co., Ltd. (“Tianjin Tenet Huatai”), and it owns 49% of Shaanxi Pharmacy Holding Group Ankang Longevity Pharmaceutical Co., Ltd. and Shaanxi Pharmacy Sunsimiao Drugstores Ankang Chain Co., Ltd. through a joint venture with Shaanxi Pharmaceutical Group Pai’ang Medicine Co. Ltd. (“Shaanxi Pharmaceutical Group”), a Chinese state-owned pharmaceutical enterprise.

| 2 |

Our current corporate structure as of June 30, 2017 is as follows:

On September 30, 2017, Tenet-Jove established Xinjiang Tianyitaihe Agriculture Development Co., Ltd. (“Tianyitaihe”) with registered capital of RMB 10.0 million ($1,502,652). On September 30, 2017, Tenet-Jove also established Xinjiang Tianyirunze Biotechnology Development Co., Ltd. (“Tianyirunze”) with registered capital of RMB 10.0 million ($1,502,652). Tianyitaihe and Tianyirunze became 100% owned subsidiaries of Tenet-Jove.

Contractual Arrangements with Ankang Longevity Group or Zhisheng Group and their Owners

We conduct our business through a combination of contractual arrangements with PRC operating companies and equity ownership of PRC subsidiaries. In most cases we have had to use contractual relationships because direct investment by foreign-owned companies like our Delaware company is prohibited or restricted. In other cases we have elected to do so in spite of being permitted to own such operating company directly. Where we operate our business through such contractual relationships, we are subject to risks related to such operation.

The principal regulation governing foreign ownership of businesses in the PRC is the Foreign Investment Industrial Guidance Catalogue, effective as of April 10, 2015 (the “Catalogue”). The Catalogue classifies various industries into three categories: encouraged, restricted and prohibited. Shineco is engaged in business in industries where direct foreign investment is expressly prohibited: the preparation of traditional Chinese medicines in small pieces ready for decoction.

Due, in part, to the regulations on foreign ownership of PRC businesses, neither we nor our subsidiaries own any equity interest in Ankang Longevity Group or the Zhisheng Group. The foregoing companies are referred to herein as the “Controlled Companies.” Instead, we control and receive the economic benefits of the Controlled Companies’ business operations through a series of contractual arrangements. Tenet-Jove, each of the Controlled Companies and its shareholders have entered into a series of contractual arrangements, also known as VIE Agreements. The VIE Agreements are designed to provide Tenet-Jove with the power, rights and obligations equivalent in all material respects to those it would possess as the sole equity holder of each Controlled Company, including absolute control rights and the rights to the assets, property and revenue of each Controlled Company. Based on a legal opinion issued by Dentons LLP to Tenet-Jove, the VIE Agreements constitute valid and binding obligations of the parties to such agreements and are enforceable and valid in accordance with the laws of the PRC.

| 3 |

Each of the types of VIE Agreements is described below and consist of, for each of Ankang Longevity Group and the Zhisheng Group, (a) exclusive business cooperation agreements, (b) timely reporting agreements, (c) equity interest pledge agreements, (d) exclusive option agreements, and (e) powers of attorney. As an overview, these agreements taken together are designed to allow our Company to manage the operations of each of the Controlled Companies and to receive all of the net income of such Controlled Companies in return therefor. To secure our interest in the Controlled Companies, the equity interest pledges and option agreements and the powers of attorney are designed to allow us to step in and convert our contractual interest into an equity interest in the event we determine that doing so is warranted. Finally, the timely reporting agreement is designed to ensure that we have timely access to the financial and other information from the Controlled Companies that we require in order to prepare regulatory and other filings.

The controlling shareholders of the Company and the VIEs could cancel these agreements or permit them to expire at the end of the agreement terms, as a result of which the Company would not retain control of the VIEs.

The following is a summary of the common contractual arrangements that provide us with effective control of our VIEs and that enable us to receive substantially all of the economic benefits from their operations.

Exclusive Business Cooperation Agreements

Pursuant to substantially identical Exclusive Business Cooperation Agreements between each Controlled Company and Tenet-Jove, Tenet-Jove provides such Controlled Company with technical support, consulting services and other management services relating to its day-to-day business operations and management, on an exclusive basis, utilizing its advantages in technology, human resources, and information. Additionally, each Controlled Company has granted an irrevocable and exclusive option to Tenet-Jove to purchase from such Controlled Company, any or all of its assets, to the extent permitted under applicable PRC law. Tenet-Jove may exercise, at its sole discretion, the option to purchase from each Controlled Company any or all of such Controlled Company’s assets at the lowest purchase price permitted by PRC law. Should Tenet-Jove exercise such option, the parties shall enter into a separate asset transfer or similar agreement. Tenet-Jove shall own all intellectual property rights that are developed during the course of each Exclusive Business Cooperation Agreement. For services rendered to each Controlled Company by Tenet-Jove under the agreement to which such Controlled Company is a party, Tenet-Jove is entitled to collect a service fee calculated based on the time of services rendered multiplied by the corresponding rate, which is approximately equal to the net income of such Controlled Company.

Each Exclusive Business Cooperation Agreement shall remain in effect for ten years until it is extended or terminated by Tenet-Jove, which may be done unilaterally, except in the case of gross negligence or fraud, in which case the Controlled Companies may terminate the agreements. Tenet-Jove entered into an Exclusive Business Cooperation Agreement with Zhisheng Bio-Tech, Ankang Longevity Group, and Qingdao Zhihesheng on February 24, 2014, December 31, 2008, and May 24, 2012, respectively, and with each of Zhisheng Freight, Zhisheng Trade, and Zhisheng Agricultural on June 16, 2011.

Tenet-Jove is currently managing each Controlled Company pursuant to the terms of an Exclusive Business Cooperation Agreement. Pursuant to each such agreement, Tenet-Jove has absolute authority relating to the management of each Controlled Company, including but not limited to decisions with regard to expenses, salary raises and bonuses, hiring, firing and other operational functions. Although the Exclusive Business Cooperation Agreements do not prohibit related party transactions, the audit committee of Shineco will be required to review and approve in advance any related party transactions, including transactions involving Tenet-Jove or any Controlled Company.

| 4 |

Timely Reporting Agreements

To ensure each Controlled Company promptly provides all of the information that Tenet-Jove and the Company need to file various reports with the SEC and other applicable regulatory authorities, a Timely Reporting Agreement was entered between each Controlled Company and Shineco on July 3, 2014.

Under the Timely Reporting Agreements, each Controlled Company agrees that it is obligated to make its officers and directors available to Shineco and promptly provide all information required by Shineco so that Shineco can file all necessary SEC and other regulatory reports as required.

Equity Interest Pledge Agreements

Under the Equity Interest Pledge Agreements among each Controlled Company (other than Zhisheng Agricultural, which is a cooperative and thus has no equity interests that can be pledged), the shareholders of each such Controlled Company and Tenet-Jove, the shareholders pledged all of their equity interests in each such Controlled Company to Tenet-Jove to guarantee the performance of such Controlled Company’s obligations under the respective Exclusive Business Cooperation Agreement. Under the terms of each agreement, in the event that the Controlled Company or its shareholders breach their respective contractual obligations under the Exclusive Business Cooperation Agreement to which they are a party, Tenet-Jove, as pledgee, will be entitled to certain rights, including, but not limited to, the right to collect dividends generated by the pledged equity interests. Each Controlled Company’s shareholders also agreed that upon occurrence of any event of default, as set forth in the applicable Equity Interest Pledge Agreement, Tenet-Jove is entitled to dispose of the pledged equity interest in accordance with applicable PRC laws. Each Controlled Company’s shareholders further agree not to dispose of the pledged equity interests or take any actions that would prejudice Tenet-Jove’s interest in the applicable Controlled Company.

Each Equity Interest Pledge Agreement shall be effective until all payments due under the related Exclusive Business Cooperation Agreement have been paid by the Controlled Company party thereto. Tenet-Jove shall cancel or terminate an Equity Interest Pledge Agreement upon a Controlled Company’s full payment of fees payable under its applicable Exclusive Business Cooperation Agreement.

Exclusive Option Agreements

Under the Exclusive Option Agreements, shareholders of each of the Controlled Companies (other than Zhisheng Agricultural, which is a cooperative and thus has no equity holders) irrevocably granted Tenet-Jove (or its designee) an exclusive option to purchase, to the extent permitted under PRC law, once or at multiple times, at any time, part or all of their equity interests in each Controlled Company. The option price is equal to the capital paid in by the applicable Controlled Company shareholders subject to any appraisal or restrictions required by applicable PRC laws and regulations. The option purchase price shall increase in case the applicable Controlled Company shareholders make additional capital contributions to such Controlled Company.

Each agreement remains effective for a term of ten years and may be unilaterally renewed at Tenet-Jove’s election.

Powers of Attorney

Under the Powers of Attorney, the shareholders of each Controlled Company authorize Tenet-Jove to act on their behalf as their exclusive agent and attorney with respect to all rights as shareholders of the respective Controlled Companies, including but not limited to: (a) attending shareholders’ meetings; (b) exercising all the shareholder’s rights, including voting, that shareholders are entitled to under the laws of China and the Articles of Association, including but not limited to the sale or transfer or pledge or disposition of shares in part or in whole; and (c) designating and appointing on behalf of shareholders the legal representative, the executive director, supervisor, the chief executive officer and other senior management members of the respective Controlled Companies.

| 5 |

Guarantee Agreement

As noted above, Zhisheng Agricultural is a cooperative and has no equity interests to pledge and no equity holders to grant options. Thus, in order to secure the obligations of Zhisheng Agricultural to pay certain service fees owing to Tenet-Jove under the Exclusive Business Cooperation Agreement to which it is a party, it has entered into a Guarantee Agreement among Zhisheng Agricultural, Tenet-Jove, and Wang Qiwei, a member of the Zhisheng Agricultural cooperative dated June 16, 2011. Pursuant to the terms of the Guarantee Agreement, Wang Qiwei has agreed to guarantee the payment of service fees under the Exclusive Business Cooperation Agreement should Zhisheng Agricultural breach its obligation to do so.

Our Products and Operations

Our health and well-being focused plant-based products business is divided into three major segments:

| 1. | Processing and distributing traditional Chinese herbal medicine products as well as other pharmaceutical products. This segment is conducted by the Company’s VIE, Ankang Longevity Group. |

| 2. | Planting, processing and distributing green and organic agricultural produce as well as growing and cultivating yew trees (taxus media). This segment is conducted through the Company’s VIEs, the Zhisheng Group. |

| 3. | Developing and distributing specialized fabrics, textiles and other byproducts derived from an indigenous Chinese plant Apocynum Venetum, known in Chinese as “Luobuma” or “bluish dogbane”. This segment is channeled through the Company’s directly-owned subsidiary, Tenet-Jove. |

The details of each business segment are described as follows:

Ankang Longevity Group

The companies of this segment, Ankang Longevity Group, operates 66 cooperative retail pharmacies throughout Ankang, a city in southern Shaanxi province, PRC, through which we sell directly to individual customers traditional Chinese medicinal products produced by us as well as by third parties. This group also processes more than 600 kinds of Chinese medicinal herbal products such as medicines for bone and joint pain, arthritis, respiratory infections and insomnia, and distribute such products through an established Chinese domestic sales and distribution network, including more than twenty pharmaceutical companies and more than fifty hospitals throughout China. Ankang Longevity Group has recently established a joint venture with a large state-owned domestic pharmacy chain group, Shaanxi Pharmaceutical Group Pai’ang Medicine Co. Ltd.. As part of the joint venture, Ankang Longevity Group contributed 13 retail pharmacies— operating as Sunsimiao Pharmacies— to the joint venture while retaining 66 retail pharmacies whereby Ankang Longevity Group acts as a franchisor. We also provide evaluation and diagnostic services by on-site doctors at pharmacies to support and drive our Chinese medicine product sales. The operations of this segment are focused in the northwest region of Mainland China, particularly Shaanxi province. This segment accounts for approximately 40% of our revenues.

| 6 |

Ankang Longevity Group has built a scalable decocting-free Chinese herbal medicine manufacturing facility that passed the Good Manufacturing Practice (“GMP”) certification in 2009 and was recognized as a Key Agricultural Industrialization Companies by the Shaanxi Provincial Government. The facility covers an area of over 4,000 square meters and is equipped with an advanced toxic herbal medicine treatment production line and herbal medicine testing instruments.

Ankang Longevity Group has recently acquired land use rights to use 8,200 acres of selenium-rich farmland and woodland in Ziyang County, China to grow our Chinese medicine and other plant products.

Zhisheng Group

The Company’s other VIEs, the Zhisheng Group, which includes Zhisheng Bio-Tech, Zhisheng Freight, Zhisheng Trade, Zhisheng Agricultural and Qingdao Zhihesheng, engage in the business of organic agricultural products, principally yew trees, as well as providing logistics services for all of the agricultural products we produce. Since 2013, this segment is focusing its efforts on the growing and cultivation of yew trees (taxus media), small evergreen trees that can be used for the production of anti-cancer medication as well as ornamental bonsai trees, which are known to have the effect of purifying indoor air quality. We currently cultivate and sell yew but do not currently process yew into Chinese or Western medicines. The entities composing the Zhisheng Group are currently focusing on researching, developing and cultivating organic produce, yew ecological products and other native plants. The operations of this segment are focused in the East region of Mainland China, principally Shandong Province, and in Beijing where we have newly developed over 100 acres of modern greenhouses for cultivating yew and other plants. This segment accounts for approximately 49.8% of our revenues.

Tenet-Jove

Through Tenet-Jove, the Company develops and distributes specialized textiles and health supplements derived from a native Chinese plant Apocynum venetum, grown in the Xinjiang region of China and known in Chinese as “Luobuma” or “bluish dogbane” and referred to herein as Luobuma. This plant has traditionally been used in China both internally and externally for centuries to treat high blood pressure, depression, dizziness, pain, insomnia, and other common ailments. The stems of Luobuma serve as raw material for fiber used in textile production, and the leaves serve as raw material for pharmaceutical drugs. This segment accounts for approximately 10.8% of our revenues.

The companies of this segment, Tenet-Jove and Tianjin Tenet Huatai, specialize in Luobuma sourcing and developing Luobuma byproducts. With rich experience and broad channels in the Chinese domestic market, we believe that we are one of the leaders in Luobuma textile sales in China. This segment’s operations are focused in the north region of Mainland China, mostly carried out in Xinjiang and Tianjin. We are presently in preliminary negotiations to build a new facility in Hefei, Anhui Province, China to exploit our steam explosion Luobuma fiber production technology. Our Luobuma products are specialized textile and health supplement products designed to incorporate traditional Eastern medicines with modern scientific methods. These products are predicated on centuries-old traditions of Eastern herbal remedies derived from the Luobuma raw material.

In addition to developing textile products, we expect to use our high-pressure steam degumming process to extract other Luobuma byproducts we intend to commercialize and distribute: flavonoids, xylooligosaccharides (XOS), edible pectin, fiberboard, and organic fertilizer. The traditional method of degumming Luobuma only produces Luobuma fiber, whereas our high-pressure steam degumming process produces these five additional Luobuma byproducts. Flavonoids are organic compounds widely distributed in plants, and flavonoid-rich Luobuma extract can be used in the manufacture of many pharmaceuticals. Xylooligosaccharides, or XOS, is a sugar that can be used as a food additive that provides various health benefits like lowering glucose levels. Pectin is a thickener and stabilizer used in food, beverages and cosmetics, as well as a gelling agent for jellies. Fiberboard is a type of engineered wood alternative that is made out of Luobuma fibers; it is used widely for furniture manufacturing and packaging.

| 7 |

Product Descriptions

Traditional Chinese Medicines

Our Ankang Longevity Group manufactures hundreds of Chinese medicinal herbal products and decoction pieces such as medicines for bone and joint pain, arthritis, respiratory infections, insomnia, as well as many other common ailments. We distribute such products through an established Chinese domestic sales and distribution network, including through more than twenty pharmaceutical wholesale companies and more than fifty hospitals throughout China, as well as through our own and cooperative retail pharmacies. In addition to distributing Chinese medicinal herbal products, we also distribute many popular Western medicines we purchase from outside parties through our wholesale and retail channels so that we can offer a good variety of products to meet customer demands. In the second quarter of 2013, this group entered the Pharmaceutical retailing industry through a joint venture with another large domestic pharmacy chain group, Shaanxi Pharmaceutical Group. Ankang’s main products include the following traditional Chinese medicines:

| • | Polygonum cuspidatum or Japanese knotweed, which is ingested to treat colds, digestive diseases, hepatitis and Cholecystitis (gallbladder inflammation); |

| • | Salvia mint, which is ingested to improve microcirculation; |

| • | Tianma, which is ingested to treat Rheumatoid arthritis; |

| • | Eucommia, which is ingested for bone and join pain; |

| • | Radix, which is ingested to treat respiratory infections; |

| • | Schisandra shrub, which is ingested to treat insomnia; and |

| • | Berberis shrub, which is used as a raw material for antibiotics. |

Yew Trees

Currently, through our Zhisheng Group VIEs, we sell ornamental yew trees and yew cuttings to third parties. We also rent ornamental yew trees to companies who desire the environmental benefits of natural plants in their workplaces. Until recently we were primarily engaged in the production, distribution and sale of agricultural products, including the planting and processing of organic fruits and vegetables, such as tomato, eggplants, string beans, peppers as well as certain popular fruits in China like blueberries and wine grapes, but those operations have been temporarily scaled back due to stiff competition and a change of our internal policy in favor of the expansion of our yew tree business.

As our inventories of young yew trees mature, our long-term goals are particularly focused on the extraction of paclitaxel or taxol, which is derived from certain species of yew trees including those we grow. Taxol, a broad-spectrum mitotic inhibitor used in cancer chemotherapy, can be extracted from mature yew trees. As a mitotic inhibitor, taxol adheres to rapidly dividing cancerous cells during mitosis (cell division) and interferes with the division process. It may suppress tumor growth through regulating microtubule stabilization, inducing apoptosis and adjusting immunologic mechanism. Taxol is also used for the prevention of restenosis, which is the narrowing of blood vessels. In the treatment of certain soft tissue cancers, such as breast cancer, taxol is given for early stage and metastatic breast cancer after combination anthracycline and cytoxan therapy and is also given as treatment to shrink a tumor before surgery. It can also be used together with a drug called Cisplatin to treat advanced ovarian cancer and non-small cell lung cancer, or “NSCLC.” The U.S. Food and Drug Administration approved taxol as the primary and secondary treatment for NSCLC. There are other generally accepted protocols for the use of taxol as a cancer drug alone or in combination with other drugs depending upon the diagnosis, staging and type of cancer, as well as a patient’s medical history, tolerances and allergies, among other relevant factors. Taxol is usually sold to large pharmaceutical companies to be used in their products, which can be used to treat patients with lung, ovarian, breast, head and neck cancer, and advanced forms of Kaposi’s sarcoma.

| 8 |

We believe that in three to five years at the earliest, the yew trees we are cultivating at present will begin to mature to a point where taxol extraction could be possible. We intend to invest in extraction equipment and facilities, as well as to increase planting and growing of yew trees.

Tenet-Jove Textiles

Our company’s scientists and other Chinese researchers have brought modern scientific methods to the study of Luobuma, and have determined that Luobuma fibers have an increased tendency to radiate light at the “far infrared” end of the light spectrum, with wavelengths measuring between 8-15 microns (referred to as “FIR”). Based on Chinese scientific studies some believe that Luobuma’s FIR-radiating qualities exert a positive effect on various functions of the human body, including cellular metabolism. For this reason, we have marketed and sold these products utilizing such technology. These products are popular with Chinese customers seeking the perceived benefits of traditional Chinese medicine.

For example, according to a report by the College of Science of Tianjin University, tests conducted by the PRC’s National Institute of Metrology have reported that the radiance rate of far infrared light from Luobuma fiber is 84%, 2 to 4 times higher than that from cotton and other natural fibers. The same tests found that the FIR radiance rate from our proprietary bio-ceramic powder reaches 91%. Healthful benefits have been observed at radiance rate levels above 70%. Based on these observations about FIR radiance, we have developed textiles that our customers can wear and from which we believe they can receive those health benefits commonly associated with Chinese herbal remedies.

Tenet-Jove first commercially developed the natural FIR-radiant properties of the Luobuma plant in 1997. We refer to this natural Luobuma fiber as a “Second Generation” FIR textile. The “First Generation” of FIR-radiant textiles initially became popular in China around 1989, when manufacturers learned to add 3% of a FIR-radiant inorganic material to synthetic fibers comparable to nylon or polyester. This “First Generation” FIR material employs a relatively low level of technology and has relatively few perceived or measurable health benefits. The “Second Generation” FIR textiles we have developed are softer, smoother and more breathable natural fibers that are not as prone to static electricity as the low technology “First Generation” FIR-radiant textiles.

Our Luobuma fabrics have been a success in the Chinese domestic market and have also received numerous awards. The technology applied to our Luobuma-based FIR Therapeutic Clothing and Textile Products has received a “Special Golden Award” from the China National Intellectual Property Bureau at China’s National Patent and Brand Expo. Our products under the brand name of “Tenethealth®” have also been honored with the title of “Consumer’s Favorite Products” by the Chinese Consumer Association.

The fibers of natural Luobuma FIR materials can contain up to 32 medicinal compounds, many of which are familiar to practitioners of traditional Chinese medicine. In addition, our processes for manufacturing Luobuma textiles produce a fabric that is smooth, air-permeable, and soft. By combining a product that is familiar to Chinese consumers seeking the benefits of traditional Chinese medicine with quality and comfort, we believe we are well positioned in the Chinese textile market.

| 9 |

Tenet-Jove Product Development

We have developed what we term a “Third Generation” of FIR textiles under a contract with the Institute of Process Engineering at the Chinese Academy of Sciences, one of the leading scientific institutions in China. Our research and development has focused on adding nanotechnology enhancements to our Luobuma textile products, in which we use small-scale nanotechnology to embed or impregnate our Luobuma-fiber textiles with other FIR-radiant materials, bio-ceramic materials, or other Chinese herbal remedies. Using these nanotechnology methods, we have developed and marketed health-promoting textile goods that are impregnated with FIR-radiant materials or other Chinese herbal remedies, which are then absorbed through the wearer’s skin. We believe these “Third Generation” FIR textiles will better combine the health benefits of Luobuma with an even softer, more natural cotton-like fabric that will be popular with Chinese consumers.

The Company presently produces approximately one hundred “Third Generation” FIR textile products. These textile products include:

| • | Far Infrared bedding sets (including various pillows, comforters, and sheets); |

| • | Far Infrared underwear, T-shirts, and socks; |

| • | Far Infrared knee and shin pads, waist supports and other protective clothing; and |

| • | Far Infrared body wraps or protectors (for the ankle, elbow, wrist, and knee). |

All our textile products are made of Luobuma-based fibers and are impregnated with bio-ceramic powder, which contains various minerals such as halloysite. Both the fiber and the bio-ceramic powder are developed with the Company’s patented, proprietary techniques.

Manufacturing and Production Facilities

We have formed strategic alliances with several certified knitting and clothing manufacturers throughout China in order to produce our Luobuma products. We assign them limited manufacturing jobs and require certain conditions, including protecting our proprietary techniques and meeting our rigid quality standards. We are in preliminary negotiations to build a new facility in Kuerle, Xinjiang Uyghur Autonomous Region, China to exploit our steam explosion Luobuma fiber production technology.

In 2013, we began large-scale operations in newly leased, energy efficient greenhouses aggregating 50,000 square meters in Beijing and have temporarily scaled back our operations in our former greenhouses located in Shandong Province. At this time, we rent our greenhouses in Shandong Province to local farmers. Our new greenhouse facilities are used primarily for the cultivation of yew trees and other decorative plants and trees. These state-of-the-art facilities allow us to better regulate light, temperate, humidity and other conditions within the greenhouse as well as to significantly increase the number of plants that can be housed in a particular greenhouse footprint. To a lesser degree, we expect these new greenhouses will reduce our manual labor costs associated with our greenhouse operations by approximately 25%. Rather than competing on price, which has become increasingly difficult in the Chinese market, we expect that technological and productivity advances from our new greenhouses will improve our competitive position within our agricultural segment, but there can be no guarantee that we will experience such advances, or if we do, that such advances would improve our competitive position.

Ankang Longevity Group has an approximately 4,000 square meter production factory and an approximately 2,000 square meter production facility in Ankang City, Shaanxi Provice, China, which are used for production of decoction pieces.

| 10 |

Our Strategy for Research and Development

| • | To keep our products proprietary and patented; |

| • | To focus on our core existing product lines: Chinese herbal medicines and pharmaceutical sales, yew cultivation, Luobuma-based products, and FIR technology; |

| • | To commit to further development of our Luobuma byproducts, houpu magnolia products, and selenium-enriched herbs and plants; and |

| • | To build strategic alliances with universities and scientific institutions, which will allow us exposure to advanced technologies, excellent researchers and scientists and we believe will lower the costs and timing of the development of new products. |

Tenet-Jove specializes in developing Luobuma products and combining FIR technology with natural herbal medicines. We estimate that there are large supplies of Luobuma in China, especially Xinjiang Province. In China, Luobuma can grow as high as 3.6 meters. In the first year after planting, Luobuma can be harvested once during that year; thereafter, it can be harvested twice per year before or at the beginning of the flowering period in June and a second time around September. Currently, we believe China’s Luobuma supplies are largely undeveloped. The Company’s future success will depend on improving its techniques to industrialize Luobuma by developing new Luobuma-derived products such as improved Luobuma functional fiber and various Luobuma nutritional supplements, which can be marketed and distributed through the Company’s Ankang Longevity business segment.

High-Pressure Steam Degumming Process

We currently produce an extensive line of Luobuma-based textile products; we have an exclusive patent on a Luobuma fiber yarn spinning method. Large-scale production of Luobuma fiber products is generally difficult due to the limited yield of Luobuma fiber and the high cost of obtaining that fiber. The current mainstream technology used to produce Luobuma fiber mainly uses chemical agents to remove gum from Luobuma, which destroys Luobuma fiber and causes lower Luobuma fiber production and pollution and makes it very difficult to extract other valuable by-products. A central technical challenge is how to quickly and efficiently remove the gum and sap from the Luobuma plants so that only the natural fiber remains.

To solve this technical challenge, in August 2006 we signed a technology development contract with the Institute of Process Engineering at the Chinese Academy of Science (the “Institute of Process Engineering”), one of China’s leading scientific institutes. Pursuant to our contract, we and the Institute of Process Engineering worked together to develop a high-pressure steam degumming process for the mass production of Luobuma fiber, as well as its byproducts, which was completed in 2008. A literal translation of the project name is “The Stream Steam Explosion Project.” Essentially, the project will develop a modern material engineering method of quickly blasting a large amount of high-pressure steam into a large container filled with raw Luobuma plants. The steam will remove the gum and sap and leave the fiber for use in textile production. The gum and sap and other Luobuma byproducts will be washed out with the steam and collected in a separate place for other uses.

If we can successfully implement our high-pressure steam degumming process, we expect that our annual yield of Luobuma fiber can rise by over one hundredfold— from less than 200 tons to approximately 27,000 tons per year, and the cost of extracting the fiber will be reduced by approximately 50%. For example, the older method of production might require 150 laborers to produce one ton of Luobuma fiber in one day, whereas our high-pressure steam degumming process can utilize just 30 laborers to produce 15 tons of Luobuma fiber in one day. During the process, a certain amount of steam will be used, but unlike the traditional method of degumming, our high-pressure steam degumming process discharges no hazardous byproducts of any kind, because the fiber will be collected in one place, and the liquefied gum and sap and other material will be collected in another place to further separate flavonoids, xylooligosaccharides (XOS), and edible pectin through biological reverse osmosis membrane. The remaining material could be used to produce fiberboard and organic fertilizer, leaving no hazardous discharge or waste. We expect that this technique will be relatively simple and convenient for us to operate with our advanced technology. Luobuma fiber produced by this technique is more like cotton and more spinnable than before.

| 11 |

Intellectual Property

Trademarks

We regard our trademarks as an important part of our business due to the name recognition of our customers. Our subsidiary, Tenet-Jove, has currently obtained 18 trademark registrations at the China Trademark Office and applying for another seven trademarks covering various categories of the company’s products. As of June 30, 2017, we are not aware of any valid claim or challenges to our right to use our registered trademark or any counterfeit or other infringement to our registered trademark.

Patents

Currently, the Company holds a patent in the People’s Republic of China for Luobuma fiber yarn preparation and an application method (patent number: 201110429362.9), which serves as our core technology and its derivative applications for our Luobuma business.

Distribution Network

We sell our products through various distribution networks. Our traditional Chinese medicinal products and Western medicines are largely sold through either our wholesale customers or our Ankang retail pharmacies — 13 pharmacies operating as Sunsimiao Pharmacies and 66 pharmacies operated by third parties as Ankang Longevity Group Pharmacy cooperatives. Additionally, we sell decoction pieces on the Anhui Bozhou Chinese medicine transaction market, to medical materials company, such as Qianhe Pharmaceutical Industry Co. and to Chinese patent medicine factories, such as Wanxi Pharmaceutical Factory.

Our Luobuma product distribution networks consists of four distributors who distributed our products to a total of approximately 21 outlets, including flagship stores, retail stores and sales counters. These distributors sell our products throughout mainland China. They all carried our proprietary brand name and “Tenethealth®” trademark. We also sell our Luobuma textile products online through third party e-commerce websites, such as Taobao, Tmall and 360buy. Our yew trees and agricultural products are primarily sold through our sales personnel and group and institutional sales. In 2013, the Company placed its Luobuma, traditional Chinese medicine and yew products in a total of 144 retail stores and sales counters throughout China and on four e-commerce websites.

| 12 |

Our sales and distribution strategy for our products focuses on expanding our distribution network of retail stores and sales counters into all major provinces and cities of China. We also plan to use our current distribution network to introduce our newly developed products into target markets more efficiently and effectively.

All of these certified outlets operate independently, but they prominently display products mainly carrying our trade name “Tenethealth®”. These independent retailers sell our products as well as other products.

The location and number of retail stores and sales counters selling our products, including all sales outlets (both those connected with our major distributors (i.e., our most frequently used distributors) and other independent sellers), as of June 30, 2017 are listed below:

| Location | Number of Major Distributors | Number of Sales Outlets | ||||||

| Liaoning | 1 | 1 | ||||||

| Jilin | 1 | 1 | ||||||

| Shandong | 2 | 16 | ||||||

| Jiangsu | 2 | 6 | ||||||

| Anhui | 2 | 4 | ||||||

| Shaanxi | 5 | 94 | ||||||

| Xinjiang | 1 | 2 | ||||||

| Sichuan | 1 | 5 | ||||||

| Guangdong | 1 | 3 | ||||||

| Tianjin | 1 | 2 | ||||||

| Beijing | 1 | 4 | ||||||

| Chongqing | 1 | 3 | ||||||

| Hubei | 1 | 3 | ||||||

| TOTALS | 20 | 144 | ||||||

| 13 |

Sales and Marketing

We market Luobuma to consumers primarily by highlighting its unique characteristics— the material is soft like cotton, breathable like hemp and is smooth to the touch like silk, and its FIR-radiating qualities are believed by some to exert a positive effect on various functions of the human body. Very few other companies in China are involved with Luobuma fiber production, so we are chiefly able to market our products against products of natural and man-made fibers that do not have the perceived advantages of Luobuma. The small number of companies that are involved in Luobuma fiber production are still using the traditional, outdated methods of producing Luobuma. We are the only company using advanced technologies. Tenet-Jove’s overall marketing strategy includes:

| • | Brand marketing strategy, primarily through media publicity, product- and market-oriented strategy; |

| • | Distinguishing Luobuma as a high-end, technologically advanced native Chinese product; and |

| • | Online advertising, which includes online advertisements appearing on the sites where we sell our products, as well as social media advertising, including Wechat, and direct e-mail solicitations. |

Ankang Longevity Group’s overall marketing strategy of its traditional Chinese medicine products focuses on promoting the Ankang district’s place in traditional Chinese medicine history and its geographic location. First, Ankang City is located in the Han River area between Qinling Mountain and Ba Mountain. Because of its geographic location and favorable climate, it is the principal production location of the ancient Qin medicine, which dates from the Qin dynasty, the first imperial dynasty of China. This area contains more than 1,200 types of herbs and plants used in traditional Chinese medicine and is home to 176 of the 282 types of herbal medicine set forth in The Pharmacopoeia of the People’s Republic of China (PPRC), compiled by the Pharmacopoeia Commission of the Ministry of Health of the PRC. The PPRC is the PRC’s official compendium of drugs, covering traditional Chinese and western medicines. Second, the soil in Ankang City, especially in Ziyang County, which is located in Ziyang District of Ankang City, contains large quantities of selenium. Because the selenium content of food is largely dependent on location and soil conditions, which can vary widely, the tea, traditional Chinese medicines and raw materials produced and cultivated in Ankang contain great amounts of selenium, which is a beneficial nutrient in foods and an important raw material for medicines. Ankang Longevity Group has entered into an agreement with the local government in Ziyang County for the use of an approximately 8,200 acre selenium-rich parcel of farmland and woodlands for the cultivation of herbs and plants — principally houpu magnolia and eucommia — used in traditional Chinese medicine. Selenium has also attracted attention because of its antioxidant properties; antioxidants protect cells from damage.

Ankang Longevity emphasizes the following marketing strategies:

| • | A focus on the excellent quality of its selenium Chinese herbal medicines; |

| • | Establishment of a long-term supply relationships with pharmaceutical companies and hospitals nationwide; and |

| • | Developing its Chinese herbal medicine wholesale market and e-commerce platform. |

Finally, the Zhisheng Group emphasizes the following marketing strategies:

| • | Focusing on the advanced growing conditions provided by our modern greenhouse operations and the potential pharmaceutical byproducts of yew, especially paclitaxel or taxol; and |

| • | Brand marketing to focus on our yew’s brand positioning. |

| 14 |

In October 2012, the Company, through its VIEs, Zhisheng Freight and Zhisheng Agricultural, entered into an agreement with an unrelated third party, Zhejiang Zhen’Ai Network Warehousing Services Co., Ltd. (“Zhen’Ai Network”), to invest RMB 14.5 million (approximately $2.4 million) into the Tiancang Systematic Warehousing Project (“Tiancang Project”) operated by Zhen’Ai Network in exchange for a 29% equity interest in this project upon completion. The Tiancang Project is an online platform aiming to provide comprehensive warehousing and logistic solutions for various companies’ e-commerce needs. The Company expects to increase its distribution channels through this platform as well as to benefit from boosting its own revenue by providing synergetic logistic and warehousing services using its existing facilities and a service team in the Eastern port city of Qingdao.

Currently, the Company’s sales are generated through the following five major channels:

| 1. | Retail stores and sales counters. We mainly sell our Luobuma related products through sales counters and medicine through our pharmacy chain stores. |

| 2. | Sales to group or institutional customers. We mainly sell our organic agricultural products and yew trees to group or corporate customers. |

| 3. | Seminars and conferences. Because a majority of new consumers need to learn about our new products before buying them, it becomes very important and effective for us to organize or sponsor seminars and events to present healthcare knowledge while introducing and selling our products to new users. |

| 4. | Wholesale. We mainly sell our decocting-free Chinese herbal medicines to large Chinese medicine resellers and pharmaceutical companies. |

| 5. | E-commerce. We mainly sell the Luobuma related products through Tmall and Taobao to underdeveloped regions in China, Taiwan and Macau. We are currently one of only three certified online sellers of Luobuma textile products on China’s largest online sales platform, Tmall run by Alibaba. Selling through the Internet has become increasingly important to our sales in undeveloped regions and developed cities. |

The Market

We primarily market our health and wellbeing-focused products in China. At present, we do not sell any of our products in the United States or Canada. On the demand side, we believe that the following four forces drive market growth in all three of our business segments:

| 1. | The rapid growth of China’s economy, which has produced one of the largest groups of middle-class families in the world, with the largest collective purchasing power in the world. The Brookings Institution estimates that by 2030, over 70 percent of China’s population could be middle class, consuming approximately $10 trillion in goods and services. |

| 2. | The increase of China’s aging population. The China Census Bureau predicts that the majority of the China “baby boom” population (representing 40% of China’s total population) will be 65 or older by 2020, which represents over 500 million potential consumers of our pharmaceutical and healthcare products, the majority of which are sold to older customers. |

| 3. | Chinese people’s increasing attention and awareness to healthy and active lifestyles, especially in urban areas. |

| 4. | Chinese healthcare reforms. |

We believe China’s healthcare sector has the capacity to grow in the coming years. From pharmaceuticals to medical products to general consumer health, China remains among the world’s most attractive markets, and by far the fastest-growing of all the large emerging ones. This growth is being driven by China’s aging population, increased incidence of chronic diseases, and a material increase in investment from both domestic and foreign corporations.

| 15 |

China’s healthcare market is being shaped by positive economic and demographic trends, further healthcare reform efforts, and the policies set forth in the government’s 12th five-year plan. We believe that improvements in infrastructure, the broadening of insurance coverage, and government encouragement and support for innovation will have positive implications for us and other healthcare companies.

Strong growth in the Chinese healthcare sector has been fueled by favorable demographic trends, continued urbanization throughout China, the overall Chinese economy’s expansion, and income growth (which encourages a greater awareness of and access to healthcare among Chinese consumers). It also reflects the Chinese government’s focus on healthcare as both a social priority (as witnessed in its late 2000s healthcare reforms) and a strategic priority (as witnessed in the 12th five-year plan’s stated focus on growing the Chinese biomedical industry). From pharmaceuticals to medical devices to traditional Chinese medicine, almost every health sector has benefited.

Competition

We compete with other top-tier pharmaceutical and healthcare companies in China. Many of them are more established than we are and have significantly greater financial, technical, marketing and other resources than we presently possess. Some of our competitors have greater name recognition and a larger customer base. Those competitors may be able to respond more quickly to new or changing opportunities and customer requirements and may be able to undertake more extensive promotional activities, offer more attractive terms to customers, and adopt more aggressive pricing policies. Some of our competitors have also developed similar products that compete with ours.

Our most prominent competitors in China’s textile products market are primarily large-scale textile companies, such as Luolai Home Textile Co., Fuanna Bedding and Furnishing Co., Ltd., Violet Home Textile Co., and Shuixing Home Textile Co., Ltd, as well as Bauerfeind Sports and Albert Medical, makers of protective clothing products similar to our protective clothing products. Our most prominent competitors in our pharmaceutical sales market include Ankang City Zhenning Chinese Medicine Decoction Pieces Co. Ltd. and Zhenping County Chinese Medicine Decoction Pieces Co. Ltd. Our most prominent competitors in China’s agricultural market are Beijing Jinfu Yinong Agricultural Technology Group Co., Ltd. for vegetables and other produce and Shenyang Xincheng Garden Engineering Co., Ltd. for yew trees. In the pharmaceutical sales market, we believe that our competitive position is strong because Shaanxi Pharmacy Holding in which Ankang Longevity Group has a 49% ownership stake, is a participant in the Ankang municipal government’s “Three Unities of Medicine” program, which is designed to facilitate the purchase, sale and delivery of pharmaceuticals. The “Three Unities of Medicine” program refers to “unified procurement price, unified selling price, and unified logistics”. This project is promoted by the Shaanxi Government to regulate the price of medicines in the local market. Under the program, the Shaanxi Pharmacy Holding joint venture directly sells medicines to local institutional purchasers, like hospitals; these institutional purchasers are only permitted to purchase pharmaceuticals from selected preferred providers. After a bidding process, Shaanxi Pharmacy Holding, along with other two companies, were selected by the Ankang municipal government as preferred providers under the program. However, Shaanxi Pharmacy Holding is entitled to cover all counties and districts of Ankang City, and the other two providers only cover portions of Ankang City. This program is valid until 2020, and the participants are subject to an ongoing review of their qualifications by the local pharmaceutical supervision authority every three years until 2020.

| 16 |

Ankang Longevity Group

Ankang Longevity Group competes within its traditional Chinese medicinal products and Western medicine wholesale and retail business primarily against Ankang City Zhenning Chinese Medicine Decoction Pieces Co. Ltd. and Zhenping County Chinese Medicine Decoction Pieces Co. Ltd., which conduct their wholesale pharmaceuticals business in the Ankang area, but Ankang Longevity Group has greater revenues than any of its competitors; its two main competitors’ output value and sales combined are just one-third of Ankang Longevity Group’s. The Ankang Longevity Group has formed a new pharmaceutical company and chain of drug stores with two entities wholly owned by the state-owned Shaanxi Pharmaceutical Group that has resulted in a favorable market position in the Ankang area.

Numerous competitors nationwide, including Ankang City Zhenning Chinese Medicine Decoction Pieces Co. Ltd. and Zhenping County Chinese Medicine Decoction Pieces Co. Ltd., participate in the sale of Chinese medicinal herbs and Chinese medicine decoction pieces; among them are some high-profile and large-scale companies along with some companies that have huge production and storage capacity to influence the market price. Because we believe we are able to obtain early access to and to occupy natural resources for producing selenium Chinese herbal medicines, the Group is especially focusing on those products in order to gain market share.

Zhisheng Group

There are dozens of companies planting and cultivating yew trees in China, some of which are large-scale companies. Shenyang Xincheng Garden Engineering Co., Ltd. is a large agricultural competitor whose main product is yew. Their nurseries have the most mature yew in northeast China, and the average age of their yew trees is more than eleven years old. Another competitor, Chongqing Jiangjin District Mansheng Agricultural Development Co., Ltd., has the biggest nursery for young plants in Southwest China. And Jingyin City Hengtu Town Green Industry Yew Base specializes in cultivating, planting, gardening, and technological development of yew. They were the first company to introduce taxus media yew trees in China.

Tenet-Jove

There are few viable competitors producing advanced technology textile products with health benefits like our Luobuma textile products. Principally, our competitors are those that market and sell traditional textile products, such as Luolai Home Textile Co., Fuanna Bedding and Furnishing Co., Ltd., Violet Home Textile Co., and Shuixing Home Textile Co., Ltd, as well as those companies that market and sell protective clothing, like Bauerfeind Sports and Albert Medical. Luobuma is native to China, thus our ability to source raw materials locally greatly enhances our competitive position in the Chinese market for high quality textile products with perceived health benefits.

| 17 |

Employees

As of June 30, 2017, we employed a total of 380 full-time and no part-time employees in the following functions.

| Department | June 30, 2017 | |||

| Senior Management | 25 | |||

| Human Resource & Administration | 20 | |||

| Finance | 34 | |||

| Research & Development | 15 | |||

| Production & Procurement | 132 | |||

| Sales & Marketing | 154 | |||

| Total | 380 | |||

Our employees are not represented by a labor organization or covered by a collective bargaining agreement. We have not experienced any work stoppages.

The Company plans to hire additional employees as required. Its management and employees enjoy both compensation and welfare benefits pursuant to Chinese laws. We are required under PRC law to make contributions to employee benefit plans at specified percentages of our after-tax profit. In addition, we are required by PRC law to cover employees in China with various types of social insurance. In 2017, 2016, and 2015, we contributed approximately $139,736, $128,763, and $124,452, respectively, to employee social insurance. The effect on our liquidity by the payments for these contributions is immaterial. We believe that we are in material compliance with the relevant PRC employment laws.

Relevant PRC Regulations

Laws and Regulations in China Regarding Agriculture and Pharmaceutical Products and Distribution

Laws regulating pharmaceutical and healthcare products and agriculture cover a broad array of subjects. We must comply with numerous additional provincial and local laws relating to matters such as safe working conditions, manufacturing practices, environmental protection and fire hazard control. We believe we are in compliance with these laws and regulations in all material respects. We may be required to incur significant costs to comply with these laws and regulations. Unanticipated changes in existing regulatory requirements or adoption of new requirements could materially adversely affect our business, financial condition and results of operations.

| 18 |

Pharmaceutical Administration Law of The People’s Republic of China and its detailed implementation provisions

According to Pharmaceutical Administration Law of The People’s Republic of China effective on December 1, 2001, a Pharmaceutical Trade License is required in order to sell pharmaceutical products and a Pharmaceutical Manufacture License shall be obtained to manufacture pharmaceutical products. Our license currently expires in April 2019. The regulations indicate the specific procedure to obtain and maintain other licenses, packaging, price control, advertising and relevant penalty.

Notice on Supervision of Manufacture of Chinese Medicine in Pieces

According to Notice on Supervision of Manufacture of Chinese medicine in Pieces on February 1, 2008 and effective on June 1, 2008, companies processing raw Chinese medicine shall be a GMP certified company. Our GMP license currently expires on April 17, 2019.

Standards of Preparation for Chinese Medicine in Pieces

Shaanxi province has issued standards of preparation for Chinese Medicine in Pieces, which became effective on July 1, 2011. Our company is required to follow the procedures designated in the standards during the process of preparing the pieces of herbs.

Food Safety Law of the People’s Republic of China

The Food Safety Law of the People’s Republic of China as adopted at the 7th Session of the Standing Committee of the 11th National People’s Congress of the People’s Republic of China and effective on June 1, 2009, governs the food safety in food production and business operation activities. Pursuant to the Food Safety Law of the People’s Republic of China, food producers must establish an internal inspection and record system for raw materials and pre-delivery products, and food distributors must also establish internal systems to record and inspect food products procured from suppliers. In addition, any food additives that are not in the approved government catalog must not be used and no food products can be sold inspection-free.

Regulations on the Implementation of the Food Safety Law of the People’s Republic of China

The Regulations on the Implementation of the Food Safety Law of the People’s Republic of China as adopted at the 73rd Standing Committee Meeting of the State Council on July 8, 2009 and effective on July 20, 2009, are promulgated in accordance with the Food Safety Law of the People’s Republic of China. The Regulations require that the local People’s Government at or above the county level shall perform the responsibility specified in the Food Safety Law of the People’s Republic of China, improve the ability for supervision and administration of food safety, ensure supervision and administration of food safety; establish and improve the coordination mechanism between food safety regulatory authorities, integrate and improve the food safety information network, and realize the sharing of food safety and food inspection information and other technical resources.

Law of the People’s Republic of China on Quality and Safety of Agricultural Products

The Law of the People’s Republic of China on Quality and Safety of Agricultural Products was adopted at the 21st Meeting of the Standing Committee of the Tenth National People’s Congress on April 29, 2006. This Law was enacted in order to ensure the quality and safety of agricultural products, maintain the health of the general public, and promote the development agriculture and rural economy. Pursuant to this Law, agricultural products distribution enterprises shall establish a sound system of inspection and acceptance for their purchases. In addition, agricultural products that fail to pass the inspection based on the quality and safety standards of agricultural products cannot be marketed.

| 19 |

Regulation on Product Advertisements and Promotion

Article 5 of the Provisions for Health Food Management provides that foods claimed to have health function shall be approved by the Chinese Ministry of Health. The developer or manufacturer shall submit an application to the provincial level health administrative departments where such developer or manufacturer is located. After preliminary examination and approval by Ministry of Health, the Ministry of Health may issue a health food license to the qualified health food. Under Article 21, the label and package insert of health foods shall conform to national standards and requirements and indicate, among other things, its function and suitable users; dosage and administration; storage methods; and active ingredients.

When promoting health foods, the advertisement of health food shall conform to the other regulations. Article 19 of The Advertisement Law of People’s Republic of China provides that “an advertisement for foods, alcoholic drinks or cosmetics must meet requirements for public health, and shall not employ medical jargon or terms liable to confuse them with pharmaceuticals.” In Interim Provisions on Health Food Advertisements Review, Article 4 provides that prior to advertising health foods, developers or manufacturers should first submit an application to the food and drug administration departments on the provincial, autonomous, municipal level under the Central Government. Article 8 provides that publicizing of health functions, active ingredients, content, suitable users, dosage in health food advertisements shall be subject to prior review of the package insert ratified by the food and drug administration departments in the State Council and cannot be changed without permission. Certain content may not appear in health food advertisements, including: a guarantee of its functions; exaggerated claims; jargon, mysterious terms and technical content; promises such as “safe” or “no side effects”; or comprehensive assessment information such as efficiency, cure rate, ranking and awards.

Laws and Regulations Regarding Promotion and Advertisement of Health Textiles

In The Model Code of Health Textiles, “health textiles” refer to textiles without toxic side effects that have far infrared functions, magnetic functions and/or antibacterial effects, and which aim at regulating the body, but not healing illnesses. The Code requires that the effect of health textiles cannot be exaggerated in any form of advertising.

In addition, the promotion of health textiles should comply with The Advertisement Law of People’s Republic of China. Where there are statements in an advertisement on the performance, place of origin, usage, quality, price, producer or manufacturer, or on the items, forms, quality, price and promise of service, such statements shall be clear and explicit.

Regulation on Product Liability

Manufacturers and vendors of defective products in the PRC may incur liability for losses and injuries caused by such products. Under the General Principles of the Civil Laws of the PRC, which became effective on January 1, 1987 and were amended on August 27, 2009, manufacturers or retailers of defective products that cause property damage or physical injury to any person will be subject to civil liability.

In 1993, the General Principles of the PRC Civil Law were supplemented by the Product Quality Law of the PRC (as amended in 2000 and 2009) and the Law of the PRC on the Protection of the Rights and Interests of Consumers (as amended in 2009), which were enacted to protect the legitimate rights and interests of end-users and consumers and to strengthen the supervision and control of the quality of products. If our products are defective and cause any personal injuries or damage to assets, our customers have the right to claim compensation from us.

The PRC Tort Law was promulgated on December 26, 2009 and became effective from July 1, 2010. Under this law, a patient who suffers injury from a defective product can claim damages from either the hospital or medical institution or the manufacturer of the defective product. If our pharmaceutical products injure a patient, for example, and if the patient claims damages from the medical institution, the medical institution is entitled to claim repayment from us. Pursuant to the PRC Tort Law, where a personal injury is caused by a tort, the tortfeasor shall compensate the victim for the reasonable costs and expenses for treatment and rehabilitation, as well as death compensation and funeral costs and expenses if it causes the death of the victim. There is no cap on monetary damages the plaintiffs may seek under the PRC Tort Law.

| 20 |

Regulation of Work Safety

On June 29, 2002, the Work Safety Law of the PRC was adopted by the Standing Committee of the 9th National People’s Congress and came into effect on November 1, 2002, as amended on August 27, 2009. The Work Safety Law provides general work safety requirements for entities engaging in manufacturing and business activities within the PRC. Additionally, Regulation on Work Safety Licenses, as adopted by the State Council on January 7, 2004 and effective on January 13, 2004, requires enterprises engaging in the manufacture of dangerous chemicals to obtain a work safety license with a term of three years. If a work safety license needs to be extended, the enterprise must go through extension procedures with authorities three months prior to its expiration. In addition, on May 17, 2004, the Measures for Implementation of Work Safety Licenses of Dangerous Chemicals Production was promulgated as implementing measures to the Regulation on Work Safety Licenses which provides that entities producing dangerous chemicals are required to obtain work safety licenses pursuant to specific requirements. Without work safety licenses, no entity may engage in the formal manufacture of dangerous chemicals.