Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT

COMPANIES

Investment Company Act file number: 811-21622

Thrivent Financial Securities Lending Trust

(Exact name of registrant as specified in charter)

625 Fourth Avenue South

Minneapolis, Minnesota 55415

(Address of principal executive offices) (Zip code)

John L. Sullivan, Assistant Secretary

625 Fourth Avenue South

Minneapolis, Minnesota 55415

(Name and address of agent for service)

Registrant’s telephone number, including area code: (612) 844-5704

Date of fiscal year end: October 31

Date of reporting period: April 30, 2012

Table of Contents

Item 1. Report to Stockholders

Table of Contents

Semiannual Report

APRIL 30, 2012

Thrivent Financial

Securities Lending Trust

Table of Contents

| 1 | ||||

| 2 | ||||

| 3 | ||||

| 5 | ||||

| 6 | ||||

| 7 | ||||

| 8 | ||||

| 12 | ||||

| 14 | ||||

Table of Contents

THRIVENT FINANCIAL SECURITIES LENDING TRUST

William D. Stouten, Portfolio Manager

Thrivent Financial Securities Lending Trust (the “Trust”) seeks to maximize current income to the extent consistent with the preservation of capital and liquidity and to maintain a stable $1.00 per share net asset value by investing in dollar-denominated securities with a remaining maturity of 397 calendar days or less.

Thrivent Financial Securities Lending Trust

As of April 30, 2012*

| 7-Day Yield |

0.13 | % | ||

| 7-Day Yield Gross of Waivers |

0.15 | % | ||

| 7-Day Effective Yield |

0.13 | % | ||

| 7-Day Effective Yield Gross of Waivers |

0.15 | % |

Average Annual Total Returns**

| For the Period Ended April 30, 2012 |

1-Year | 5-Year | Since

Inception, 9/16/2004 |

|||||||||

| Total Return |

0.12 | % | 1.45 | % | 2.35 | % | ||||||

| * | Seven-day yields of the Thrivent Financial Securities Lending Trust refer to the income generated by an investment in the Trust over a specified seven-day period. Effective yields reflect the reinvestment of income. A yield gross of waivers represents what the yield would have been if the investment adviser were not waiving or reimbursing certain expenses. Yields are subject to daily fluctuation and should not be considered an indication of future results. |

| ** | Average annual total returns represent past performance and reflect changes in share prices, the reinvestment of all dividends and capital gains, and the effects of compounding. The returns shown do not reflect taxes a shareholder would pay on distributions or redemptions. |

Past performance is not an indication of future results. Current performance may be lower or higher than the performance data quoted. The prospectus contains more complete information on the investment objectives, risks, charges and expenses of the Trust. Investors should read and consider carefully before investing. To obtain a prospectus, call 1-800-THRIVENT.

An investment in the Trust is not insured or guaranteed by the FDIC or any other government agency. Although the Trust seeks to preserve the value of your investment at $1.00 per share, it is possible to lose money by investing in the Trust.

1

Table of Contents

(Unaudited)

As a shareholder of the Trust, you incur ongoing costs, including management fees and other Trust expenses. This Example is intended to help you understand your ongoing costs (in dollars) of investing in the Trust and to compare these costs with the ongoing costs of investing in other mutual funds. The Example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period from November 1, 2011 through April 30, 2012.

Actual Expenses

In the table below, the first line provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid during Period” to estimate the expenses you paid on your account during the period.

Hypothetical Example for Comparison Purposes

In the table below, the second line provides information about hypothetical account values and hypothetical expenses based on the Trust’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Trust’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Trust and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical example that appears in the shareholder reports of the other funds.

| Beginning Account Value 11/1/2011 |

Ending Account Value 4/30/2012 |

Expenses Paid During Period 11/1/2011 - 4/30/2012* |

Annualized Expense Ratio |

|||||||||||||

| Thrivent Financial Securities Lending Trust |

|

|||||||||||||||

| Actual |

$ | 1,000 | $ | 1,001 | $ | 0.17 | 0.05 | % | ||||||||

| Hypothetical** |

$ | 1,000 | $ | 1,016 | $ | 0.17 | 0.05 | % | ||||||||

| * | Expenses are equal to the Fund’s annualized expense ratio, multiplied by the average account value over the period, multiplied by 182/365 to reflect the one-half year period. |

| ** | Assuming 5% annualized total return before expenses. |

2

Table of Contents

Thrivent Financial Securities Lending Trust

Schedule of Investments as of April 30, 2012

(unaudited)

| The accompanying Notes to Financial Statements are an integral part of this schedule. |

| 3 |

Table of Contents

Thrivent Financial Securities Lending Trust

Schedule of Investments as of April 30, 2012

(unaudited)

Fair Valuation Measurements

The following table is a summary of the inputs used, as of April 30, 2012, in valuing Thrivent Financial Securities Lending Trust’s assets carried at fair value or amortized cost, which approximates fair value.

| Investments in Securities |

Total | Level 1 | Level 2 | Level 3 | ||||||||||||

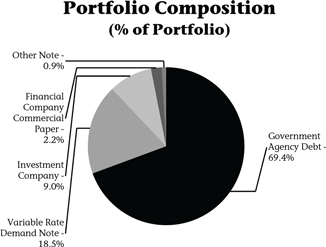

| Financial Company Commercial Paper |

12,775,000 | – | 12,775,000 | – | ||||||||||||

| Government Agency Debt |

392,713,463 | – | 392,713,463 | – | ||||||||||||

| Investment Company |

50,739,000 | 50,739,000 | – | – | ||||||||||||

| Other Note |

5,037,731 | – | 5,037,731 | – | ||||||||||||

| Variable Rate Demand Note |

104,896,056 | – | 104,896,056 | – | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total |

$ | 566,161,250 | $ | 50,739,000 | $ | 515,422,250 | $ | – | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| The accompanying Notes to Financial Statements are an integral part of this schedule. |

| 4 |

Table of Contents

Thrivent Financial Securities Lending Trust

Statement of Assets and Liabilities

| As of April 30, 2012 (unaudited) |

Securities Lending Trust |

|||

| Assets |

||||

| Investments at cost |

$ | 566,161,250 | ||

| Investments in securities at value |

566,161,250 | |||

| Investments at Value |

566,161,250 | 1 | ||

| Cash |

7,744,131 | |||

| Dividends and interest receivable |

108,265 | |||

| Prepaid expenses |

5,807 | |||

| Total Assets |

574,019,453 | |||

| Liabilities |

||||

| Distributions payable |

55,598 | |||

| Accrued expenses |

21,536 | |||

| Payable to affiliate |

29,121 | |||

| Total Liabilities |

106,255 | |||

| Net Assets |

||||

| Capital stock (beneficial interest) |

573,902,732 | |||

| Accumulated undistributed net realized gain/(loss) |

10,466 | |||

| Total Net Assets |

$ | 573,913,198 | ||

| Shares of beneficial interest outstanding |

573,902,732 | |||

| Net asset value per share |

$ | 1.00 | ||

| 1 | Securities held by the Trust are valued on the basis of amortized cost, which approximates market value. |

The accompanying Notes to the Financial Statements are an integral part of this schedule.

5

Table of Contents

Thrivent Financial Securities Lending Trust

Statement of Operations

| For the six months ended April 30, 2012 (unaudited) |

Securities Lending Trust |

|||

| Investment Income |

||||

| Dividends |

$ | 32,688 | ||

| Interest |

379,400 | |||

| Total Investment Income |

412,088 | |||

| Expenses |

||||

| Adviser fees |

106,061 | |||

| Administrative service fees |

45,000 | |||

| Audit and legal fees |

13,300 | |||

| Custody fees |

11,611 | |||

| Insurance expenses |

3,954 | |||

| Printing and postage expenses |

3,270 | |||

| Transfer agent fees |

20,804 | |||

| Trustees’ fees |

2,482 | |||

| Other expenses |

4,759 | |||

| Total Expenses Before Reimbursement |

211,241 | |||

| Less: |

||||

| Reimbursement from adviser |

(93,421 | ) | ||

| Custody earnings credit |

(297 | ) | ||

| Total Net Expenses |

117,523 | |||

| Net Investment Income/(Loss) |

294,565 | |||

| Realized and Unrealized Gains/(Losses) |

||||

| Net realized gains/(losses) on: |

||||

| Investments |

10,466 | |||

| Net Realized and Unrealized Gains/(Losses) |

10,466 | |||

| Net Increase/(Decrease) in Net Assets Resulting From Operations |

$ | 305,031 | ||

The accompanying Notes to the Financial Statements are an integral part of this schedule.

6

Table of Contents

Thrivent Financial Securities Lending Trust

Statement of Changes in Net Assets

| Securities Lending Trust | ||||||||

| For the periods ended |

4/30/2012 (unaudited) |

10/31/2011 | ||||||

| Operations |

||||||||

| Net investment income/(loss) |

$ | 294,565 | $ | 1,092,143 | ||||

| Net realized gains/(losses) |

10,466 | 10,103 | ||||||

| Net Change in Net Assets Resulting From Operations |

305,031 | 1,102,246 | ||||||

| Distributions to Shareholders |

||||||||

| From net investment income |

(294,565 | ) | (1,092,143 | ) | ||||

| From net realized gains |

(10,103 | ) | (5,215 | ) | ||||

| Total Distributions to Shareholders |

(304,668 | ) | (1,097,358 | ) | ||||

| Capital Stock Transactions |

||||||||

| Sold |

2,128,462,604 | 6,807,739,373 | ||||||

| Redeemed |

(2,164,453,116 | ) | (6,977,241,677 | ) | ||||

| Total Capital Stock Transactions |

(35,990,512 | ) | (169,502,304 | ) | ||||

| Net Increase/(Decrease) in Net Assets |

(35,990,149 | ) | (169,497,416 | ) | ||||

| Net Assets, Beginning of Period |

609,903,347 | 779,400,763 | ||||||

| Net Assets, End of Period |

$ | 573,913,198 | $ | 609,903,347 | ||||

| Accumulated Undistributed Net Investment Income/(Loss) |

$ | – | $ | – | ||||

| Capital Stock Share Transactions |

||||||||

| Sold |

2,128,462,604 | 6,807,739,373 | ||||||

| Redeemed |

(2,164,453,116 | ) | (6,977,241,677 | ) | ||||

|

|

|

|

|

|||||

| Total Capital Stock Share Transactions |

(35,990,512 | ) | (169,502,304 | ) | ||||

|

|

|

|

|

|||||

The accompanying Notes to the Financial Statements are an integral part of this schedule.

7

Table of Contents

Thrivent Financial Securities Lending Trust

Notes to Financial Statements

As of April 30, 2012

(unaudited)

8

Table of Contents

Thrivent Financial Securities Lending Trust

Notes to Financial Statements

As of April 30, 2012

(unaudited)

9

Table of Contents

Thrivent Financial Securities Lending Trust

Notes to Financial Statements

As of April 30, 2012

(unaudited)

10

Table of Contents

[THIS PAGE INTENTIONALLY LEFT BLANK]

11

Table of Contents

Thrivent Financial Securities Lending Trust

Financial Highlights

FOR A SHARE OUTSTANDING THROUGHOUT EACH PERIOD*

| Income from Investment Operations | Less Distributions From |

|||||||||||||||||||||||

| Net Asset Value, Beginning of Period |

Net Investment Income /(Loss) |

Net

Realized and Unrealized Gain/(Loss) on Investment(a) |

Total from Investments Operations |

Net Investment Income |

Net Realized Gain on Investments |

|||||||||||||||||||

| SECURITIES LENDING TRUST |

||||||||||||||||||||||||

| Period Ended 4/30/2012 (unaudited) |

$ | 1.00 | $ | – | $ | – | $ | – | $ | – | $ | – | ||||||||||||

| Year Ended 10/31/2011 |

1.00 | – | – | – | – | – | ||||||||||||||||||

| Year Ended 10/31/2010 |

1.00 | – | – | – | – | – | ||||||||||||||||||

| Year Ended 10/31/2009 |

1.00 | 0.01 | – | 0.01 | (0.01 | ) | – | |||||||||||||||||

| Year Ended 10/31/2008 |

1.00 | 0.03 | – | 0.03 | (0.03 | ) | – | |||||||||||||||||

| Year Ended 10/31/2007 |

1.00 | 0.05 | – | 0.05 | (0.05 | ) | – | |||||||||||||||||

| (a) | The amount shown may not correlate with the change in aggregate gains and losses of portfolio securities due to the timing of sales and redemptions of fund shares. |

| * | All per share amounts have been rounded to the nearest cent. |

The accompanying Notes to the Financial Statements are an integral part of this schedule.

12

Table of Contents

Thrivent Financial Securities Lending Trust

Financial Highlights—continued

RATIOS / SUPPLEMENTAL DATA

| Ratio to Average Net Assets** | Ratios to Average Net Assets Before Expenses Waived, Credited or Paid Indirectly** |

|||||||||||||||||||||||||||||||||

| Total |

Net Asset Value, End of Period |

Total Return(b) |

Net Assets, End of Period (in millions) |

Expenses | Net Investment Income/(Loss) |

Expenses | Net Investment Income/(Loss) |

Portfolio Turnover Rate |

||||||||||||||||||||||||||

| $ | – | $ | 1.00 | 0.06 | % | $ | 573.9 | 0.05 | % | 0.13 | % | 0.09 | % | 0.09 | % | N/A | ||||||||||||||||||

| – | 1.00 | 0.15 | % | 609.9 | 0.05 | % | 0.15 | % | 0.08 | % | 0.12 | % | N/A | |||||||||||||||||||||

| – | 1.00 | 0.22 | % | 779.4 | 0.05 | % | 0.21 | % | 0.08 | % | 0.19 | % | N/A | |||||||||||||||||||||

| (0.01 | ) | 1.00 | 0.76 | % | 746.7 | 0.05 | % | 0.92 | % | 0.06 | % | 0.91 | % | N/A | ||||||||||||||||||||

| (0.03 | ) | 1.00 | 3.38 | % | 2,461.9 | 0.05 | % | 3.36 | % | 0.05 | % | 3.36 | % | N/A | ||||||||||||||||||||

| (0.05 | ) | 1.00 | 5.46 | % | 5,051.1 | 0.05 | % | 5.33 | % | 0.05 | % | 5.33 | % | N/A | ||||||||||||||||||||

| (b) | Total investment return assumes dividend reinvestment. Not annualized for periods less than one year. |

| ** | Computed on an annualized basis for periods less than one year. |

The accompanying Notes to the Financial Statements are an integral part of this schedule.

13

Table of Contents

(unaudited)

PROXY VOTING

The policies and procedures that the Trust uses to determine how to vote proxies relating to portfolio securities are attached to the Trust’s Statement of Additional Information. You may request a free copy of the Statement of Additional Information or the report of how the Trust voted proxies relating to portfolio securities during the most recent 12-month period ended June 30 by calling 1-800-847-4836. You also may review the Statement of Additional Information or the report of how the Trust voted proxies relating to portfolio securities during the most recent 12-month period ended June 30 at www.sec.gov.

QUARTERLY SCHEDULE OF PORTFOLIO HOLDINGS

The Trust files its Schedule of Portfolio Holdings on Form N-Q with the SEC for the first and third quarters of each fiscal year. You may request a free copy of the Trust’s Forms N-Q by calling 1-800-847-4836. The Trust’s Forms N-Q also are available at www.sec.gov. You also may review and copy the Forms N-Q for the Trust at the SEC’s Public Reference Room in Washington, DC. You may get information about the operation of the Public Reference Room by calling 1-800-SEC-0330.

BOARD APPROVAL OF INVESTMENT ADVISORY AGREEMENT AND SUBADVISORY AGREEMENTS

Both the Investment Company Act of 1940 (the “Investment Company Act”) and the terms of the investment advisory agreement of the Thrivent Financial Securities Lending Trust (the “Trust”) require that the agreement be approved annually by a majority of the Board of Trustees, including a majority of the Trustees who are not “interested persons” of the Trust, as defined by the Investment Company Act (the “Independent Trustees”).

At its meeting on November 29, 2011, the Board of Trustees voted unanimously to renew the existing investment advisory agreement between the Trust and Thrivent Asset Management (the “Adviser”) for. In connection with its evaluation of the agreement with the Adviser, the Board reviewed a broad range of information requested for this purpose and considered a variety of factors, including the following:

| 1. | The nature, extent, and quality of the services provided by the Adviser; |

| 2. | The cost of services provided and profit realized by the Adviser; and |

| 3. | The extent to which economies of scale may be realized as the Trust grows and whether the fee levels reflect these economies of scale for the benefit of shareholders. |

In connection with the renewal process, the Contracts Committee of the Board (consisting of each of the Independent Trustees of the Trust) met on March 8, May 24, August 30, October 27, and November 29 to consider information relevant to the renewal process. The Independent Trustees also retained the services of Management Practice, Inc. (“MPI”) as an independent consultant to assist in the compilation, organization, and evaluation of relevant information. This information included statistical comparisons of the advisory fees, total operating expenses and performance of the Trust in comparison to a peer group of comparable funds; information prepared by management with respect to the cost of services provided to the Trust and fees charged, including effective advisory; profit realized by the Adviser and its affiliates that provide services to the Trust; and information regarding the types of services furnished to the Trust, the personnel providing the services, changes in staff, and systems improvements. The Board also received reports from the Adviser’s investment management staff with respect to the securities lending balances of the Trust. In addition to its review of the information presented to the Board during the contract renewal process and throughout the year, the Board also considered knowledge gained from discussions with management.

The Independent Trustees were represented by independent counsel throughout the review process and during executive sessions without management present to consider reapproval of the agreements. The Independent Trustees relied on their own business judgment in determining the weight to be given to each factor considered in evaluating the materials that were presented to them. The Contracts Committee’s and Board’s review and conclusions were based on a comprehensive consideration of all information presented to them and were not the result of any single controlling factor. The key factors considered and the conclusions reached are described below.

Nature, Extent and Quality of Services

At each of the Board’s regular quarterly meetings, management presented information describing the services furnished to the Trust by the Adviser. During these meetings, management reported on the investment management, securities lending activity, and compliance services provided to the Trust under the advisory agreement. During the renewal process, the Board considered the specific services provided under the advisory agreement. The Board also considered information relating to the investment experience and qualifications of the Adviser’s portfolio manager overseeing the Trust.

14

Table of Contents

Additional Information

(unaudited)

The Board received reports at each of its quarterly meetings from the Adviser’s Director of Fixed Income Investments, as supplemented by the Adviser’s Chief Investment Officer, who was also present at all of the meetings. At each quarterly meeting, the Director Fixed Income Investments presented information about the Trust. These reports and presentations gave the Board the opportunity to evaluate the portfolio manager’s abilities and the quality of services he provides to the Trust. Information was also presented to the Board describing the portfolio compliance functions performed by the Adviser. The Independent Trustees also received quarterly reports from the Trust’s Chief Compliance Officer.

The Board considered the adequacy of the Adviser’s resources used to provide services to the Trust pursuant to the advisory agreement. The Adviser reviewed with the Board the Adviser’s ongoing program to enhance portfolio management capabilities, including recruitment and retention of portfolio managers, research analysts, and other personnel, and investment in additional and updated technology systems and applications to improve investment research, trading, portfolio compliance, and investment reporting functions. The Adviser also discussed improved risk controls. The Board viewed these actions as a positive factor in reapproving the existing advisory agreement, as they demonstrated the Adviser’s commitment to provide the Trust with quality service. The Board concluded that, within the context of its full deliberations, the nature, extent and quality of the investment advisory services provided to the Trust by the Adviser supported renewal of the advisory agreement.

Performance of the Trust

In connection with each of its regular quarterly meetings, the Board received information on the performance of the Trust. At each quarterly Board meeting, the Director of Fixed Income Investments reviewed with the Board the economic and market environment, risk management, and style consistency in connection with management of the Trust. The Board noted that, as a money market fund, the Trust’s performance was impacted by various factors, including the diminishing-yield environment and increased regulatory requirements generally experienced by all money market funds.

Advisory Fees and Fund Expenses

The Board reviewed information prepared by MPI comparing the Trust’s advisory fee with the advisory fees of its peer group of funds. The Board noted that the Trust’s advisory fee as compared to the Trust’s peer group was below the median. On the basis of its review, the Board concluded that the advisory fee rate charged to the Trust for investment management services was reasonable.

The Board also reviewed information prepared by MPI comparing the Trust’s overall expense ratio with the expense ratio of its peer group of funds. The Board noted that the Trust’s net operating expenses were below the median of its peer group.

Economies of Scale

The Board considered information regarding the extent to which economies of scale may be realized as the Trust’s assets increase and whether the fee levels reflect these economies of scale for the benefit of shareholders. The Adviser explained its general goal with respect to the employment of fee waivers, expense reimbursements, and breakpoints. The Board also considered management’s view that it can be difficult to generalize as to whether, or to what extent, economies in the advisory function may be realized as the Trust’s assets increase. The Board noted that expected economies of scale, where they may exist, may be shared through the use of fee waivers by the Adviser and/or a lower overall fee rate. The Board considered the advisory fee rate charged to the Trust and determined that the fee rate was acceptable even though the Adviser did not offer breakpoints or contractual waivers.

Other Benefits to the Adviser and its Affiliates

The Board considered information regarding potential “fall-out” or ancillary benefits that the Adviser and its affiliates may receive as a result of their relationship with the Trust, both tangible and intangible, such as their ability to leverage investment professionals who manage other portfolios, reputational benefits in the investment advisory community and the engagement of affiliates as service providers to the Trust. The Board noted that such benefits were difficult to quantify but were consistent with benefits received by other mutual fund advisers.

Based on the factors discussed above, the Contracts Committee unanimously recommended approval of the Advisory Agreement, and the Board, including all of the Independent Trustees voting separately, approved the agreement.

15

Table of Contents

This report is submitted for the information of shareholders of

Thrivent Financial Securities Lending Trust. It is not authorized

for distribution to prospective investors unless preceded or

accompanied by the current prospectus for Thrivent Financial

Securities Lending Trust, which contains more complete

information about the Trust, including investment objectives,

risks, charges and expenses.

Table of Contents

Item 2. Code of Ethics

Not applicable to semiannual report

Item 3. Audit Committee Financial Expert

Not applicable to semiannual report

Item 4. Principal Accountant Fees and Services

Not applicable to semiannual report

Item 5. Audit Committee of Listed Registrants

Not applicable.

Item 6. Investments

(a) Registrant’s Schedule of Investments is included in the report to shareholders filed under Item 1.

(b) Not applicable to this filing.

Item 7. Disclosure of Proxy Voting Policies and Procedures for Closed-End Management Investment Companies

Not applicable.

Item 8. Portfolio Managers of Closed-End Management Investment Companies

Not applicable.

Item 9. Purchases of Equity Securities by Closed-End Management Investment Company and Affiliated Purchasers.

Not applicable.

Item 10. Submission of Matters to a Vote of Security Holders

There have been no material changes to the procedures by which shareholders may recommend nominees to registrant’s board of trustees.

Item 11. Controls and Procedures

(a)(i) Registrant’s President and Treasurer have concluded that registrant’s disclosure controls and procedures (as defined in Rule 30a-3(c) under the Investment Company Act of 1940) are effective, based on their evaluation of these controls and procedures as of a date within 90 days of the filing date of this report.

(a)(ii) Registrant’s President and Treasurer are aware of no change in registrant’s internal control over financial reporting (as defined in Rule 30a-3(d) under the Investment Company Act of 1940) that occurred during registrant’s most recent fiscal quarter that has materially affected, or is reasonably likely to materially affect, registrant’s internal control over financial reporting.

Item 12. Exhibits

Certifications pursuant to Rules 30a-2(a) and 30a-2(b) under the Investment Company Act of 1940 are attached hereto.

Table of Contents

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| Date: June 26, 2012 | THRIVENT FINANCIAL SECURITIES LENDING TRUST | |||||||||

| By: | ||||||||||

| /s/ Russell W. Swansen | ||||||||||

| Russell W. Swansen | ||||||||||

| President | ||||||||||

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, this report has been signed below by the following persons on behalf of the registrant and in the capacities and on the dates indicated.

| Date: June 26, 2012 | By: | |||||||||

| /s/ Russell W. Swansen | ||||||||||

| Russell W. Swansen | ||||||||||

| President | ||||||||||

| Date: June 26, 2012 | By: | |||||||||

| /s/ Gerard V. Vaillancourt | ||||||||||

| Gerard V. Vaillancourt | ||||||||||

| Treasurer | ||||||||||