GREAT PANTHER SILVER LIMITED

ANNUAL INFORMATION FORM

FOR THE YEAR ENDED

DECEMBER 31, 2017

MARCH 23, 2018

| CONTENTS |

| Great Panther Silver Limited | 2 |

| Annual Information Form for the year ended December 31, 2017 | |

| Great Panther Silver Limited | 3 |

| Annual Information Form for the year ended December 31, 2017 | |

| 1. | PRELIMINARY NOTES |

| 1. A. |

DATE OF INFORMATION |

Unless otherwise identified, all information contained in this Annual Information Form (“AIF”) is as at December 31, 2017.

| 1.B. | NOMENCLATURE |

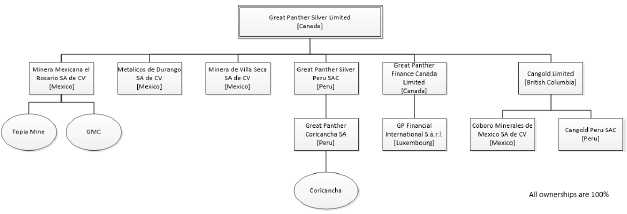

In this AIF, unless the context otherwise dictates, “Great Panther” or the “Company” refers to Great Panther Silver Limited, and its subsidiaries, Minera Mexicana el Rosario SA de CV (“MMR”), Metálicos de Durango SA de CV (“MDU”), Minera de Villa Seca SA de CV (“MVS”), Great Panther Coricancha SA, Coboro Minerales de Mexico SA de CV (“Coboro”), Cangold Limited (“Cangold”), Great Panther Silver Peru SAC (“GP Peru”), Great Panther Finance Canada Limited and GP Finance International sàrl.

| 1.C. | CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS |

Certain of the statements and information in this AIF constitute “forward-looking information” within the meaning of Canadian securities laws. Forward-looking statements are often, but not always, identified by the words “anticipates”, “believes”, “expects”, “may”, “likely”, “plans” and similar words. Forward-looking statements reflect the Company’s current expectations and assumptions, and are subject to a number of known and unknown risks, uncertainties and other factors which may cause the Company’s actual results, performance or achievements to be materially different from any anticipated future results, performance or achievements expressed or implied by the forward-looking statements.

In particular, this AIF includes forward-looking statements as noted throughout the document. These relate to estimates, forecasts, and statements as to management’s expectations with respect to the future production of silver, gold, lead and zinc; profit, operating costs and cash flow; grade improvements, sales volume and selling prices of products; capital and exploration expenditures, plans, timing, progress and expectations for the development of the Company’s mines and projects; progress in the development of mineral properties; the timing of production and the cash and total costs of production; sensitivity of earnings to changes in commodity prices and exchange rates; the impact of foreign currency exchange rates; the impact of taxes and royalties; expenditures to increase or determine reserves and resources; sufficiency of available capital resources; expansions and acquisition plans; and the future plans and expectations for the Company’s properties and operations.

These forward-looking statements are necessarily based on a number of factors and assumptions that, while considered reasonable by the Company as of the date of such statements, are inherently subject to significant business, economic and competitive uncertainties and contingencies. The assumptions made by the Company in preparing the forward looking information contained in this AIF, which may prove to be incorrect, include, but are not limited to, general business and economic conditions; the supply and demand for, deliveries of, and the level and volatility of prices of silver, gold, lead and zinc; expectations regarding recoveries from Nyrstar in relation to its Coricancha indemnification obligations, expected exchange rates; expected taxes and royalties; the likelihood or timing of the receipt of necessary regulatory and governmental approvals; costs of production and production and productivity levels; estimated future capital expenditures and cash flows; the continuing availability of water and power resources for operations; the accuracy of the interpretation and assumptions and the method or methods used in calculating reserve and resource estimates (including with respect to size, grade and recoverability); the accuracy of the information included or implied in the various published technical reports; the geological, operational and price assumptions on which these technical reports are based; conditions in the financial markets; the ability to attract and retain skilled staff; the ability to procure equipment and operating supplies and that there are no material unanticipated variations in the cost of energy or supplies; the ability to secure contracts for the sale of the Company’s products (metals concentrates); the execution and outcome of current or future exploration activities; the ability to obtain adequate financing for planned activities and to complete further exploration programs; the possibility of project delays and cost overruns, or unanticipated excessive operating cost and expenses, the Company’s ability to maintain adequate internal control over financial reporting, and disclosure controls and procedures; the ability of contractors to perform their contractual obligations; and operations not being disrupted by issues such as mechanical failures, labour disturbances, illegal occupations or mining, seismic events, and adverse weather conditions.

| Great Panther Silver Limited | 4 |

| Annual Information Form for the year ended December 31, 2017 | |

This list is not exhaustive of the factors that may affect any of the Company’s forward-looking statements or information. Forward-looking statements or information are statements about the future and are inherently uncertain, and actual achievements of the Company or other future events or conditions may differ materially from those reflected in the forward-looking statements or information due to a variety of risks, uncertainties and other factors, including, without limitation, changes in commodity prices; changes in foreign currency exchange rates; acts of foreign governments; political risk; labour or social unrest; uncertainties related to title to the Company’s mineral properties and the surface rights thereon, including the Company’s ability to acquire, or economically acquire, the surface rights to certain of the Company’s exploration and development projects; unanticipated operational difficulties due to adverse weather conditions, failure of plant or mine equipment and unanticipated events related to health, safety, and environmental matters; failure of counterparties to perform their contractual obligations; uncertainty of mineral resource estimates, and deterioration of general economic conditions.

Readers are advised to carefully review and consider the risk factors identified in this AIF under the heading “Risk Factors” for a discussion of the factors that could cause the Company’s actual results, performance and achievements to be materially different from any anticipated future results, performance or achievements expressed or implied by the forward-looking statements. Readers are further cautioned that the foregoing list of assumptions and risk factors is not exhaustive and it is recommended that prospective investors consult the more complete discussion of the Company’s business, financial condition and prospects that is included in this AIF.

The Company’s forward-looking statements and information are based on the assumptions, beliefs, expectations and opinions of management as of the date of this AIF. The Company will update forward-looking statements and information if and when, and to the extent, required by applicable securities laws. Readers should not place undue reliance on forward-looking statements. The forward-looking statements and information contained herein are expressly qualified by this cautionary statement.

| 1.D. | FINANCIAL INFORMATION |

The Company prepares its consolidated financial statements in accordance with International Accounting Standards as issued by the International Accounting Standards Board ("IFRS"). IFRS differs in some respects from US GAAP, and thus the Company’s financial statements may not be comparable to financial statements of US companies.

The Company’s financial statements are presented in United States dollars (the reporting currency). Financial and operating information presented in this AIF is presented in US dollars unless otherwise noted.

| 1.E. | TECHNICAL INFORMATION |

The technical information in this AIF relating to the Company’s mineral projects has been reviewed and approved by Matthew C. Wunder, P. Geo., a “Qualified Person” under National Instrument 43-101.

| Great Panther Silver Limited | 5 |

| Annual Information Form for the year ended December 31, 2017 | |

| 1.F. | CAUTIONARY NOTES TO U.S. INVESTORS REGARDING RESOURCE AND RESERVE ESTIMATES |

Certain terms contained in this AIF have been prepared in accordance with the requirements of the securities laws in effect in Canada, which differ from the requirements of United States securities laws. The terms “Mineral Reserve”, “Proven Mineral Reserve” and “Probable Mineral Reserve” are Canadian mining terms as defined in accordance with Canadian National Instrument 43-101 – Standards of Disclosure for Mineral Projects (“NI 43-101”) and the Canadian Institute of Mining, Metallurgy and Petroleum (the “CIM”) – CIM Definition Standards on Mineral Resources and Mineral Reserves, adopted by the CIM Council, as amended. These definitions differ from the definitions in SEC Industry Guide 7 under the United States Securities Exchange Act of 1934, as amended. Under SEC Industry Guide 7 standards, mineralization may not be classified as a “reserve” unless the determination has been made that the mineralization could be economically and legally produced or extracted at the time the reserve determination is made. Among other things, all necessary permits would be required to be in hand or issuance imminent in order to classify mineralized material as reserves under the SEC standards. Under SEC Industry Guide 7, a “final” or “bankable” feasibility study is required to report reserves, the three-year historical average price is used in any reserve or cash flow analysis to designate reserves and the primary environmental analysis or report must be filed with the appropriate governmental authority.

In addition, the terms “Mineral Resource”, “Measured Mineral Resource”, “Indicated Mineral Resource” and “Inferred Mineral Resource” are defined in and required to be disclosed by NI 43-101; however, these terms are not defined terms under SEC Industry Guide 7 and are normally not permitted to be used in reports and registration statements filed with the SEC. Investors are cautioned not to assume that any part or all of mineral deposits in these categories will ever be converted into reserves. “Inferred Mineral Resources” have a great amount of uncertainty as to their existence, and great uncertainty as to their economic and legal feasibility. It cannot be assumed that all or any part of an Inferred Mineral Resource will ever be upgraded to a higher category. Under Canadian rules, estimates of Inferred Mineral Resources may not form the basis of feasibility or pre-feasibility studies, except in rare cases. Investors are cautioned not to assume that all or any part of an Inferred Mineral Resource exists or is economically or legally mineable. Disclosure of “contained ounces” in a resource is permitted disclosure under Canadian regulations; however, the SEC normally only permits issuers to report mineralization that does not constitute “reserves” by SEC Industry Guide 7 standards as in place tonnage and grade without reference to unit measures.

Accordingly, information contained in this AIF and the documents incorporated by reference herein contain descriptions of the Company’s mineral deposits that may not be comparable to similar information made public by US companies subject to the reporting and disclosure requirements under the United States federal securities laws and the rules and regulations thereunder.

| 1.G. | GLOSSARY OF TERMS AND UNITS OF MEASURE |

The following glossary, which is not exhaustive, should be used only as an adjunct to a thorough reading of the entire document of which it forms a part.

| AAS | Atomic absorption spectroscopy. |

| adit | A horizontal or close-to-horizontal tunnel, man-made for mining purposes. |

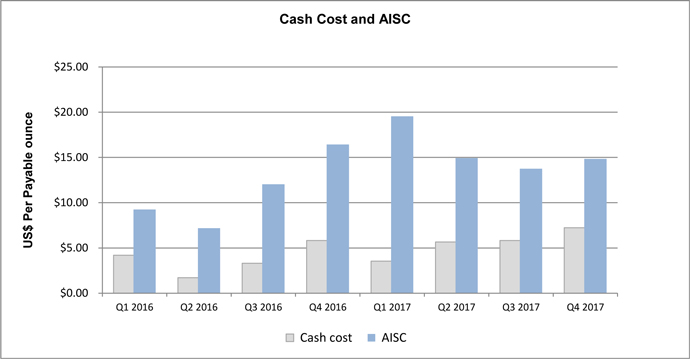

| AISC | All in sustaining cost, a widely reported non-GAAP measure in the silver industry. |

| Ag | Silver. |

| Ag eq oz | Silver equivalent ounces, reflecting the equivalent values of silver and all other products produced by the Company, relative to the prevailing silver price. |

| Great Panther Silver Limited | 6 |

| Annual Information Form for the year ended December 31, 2017 | |

| andesite | A fine-grained brown, green or greyish intermediate volcanic rock. |

| Au | Gold. |

| breccia | A course-grained rock, composed of angular, broken rock fragments held together by a mineral cement or a fine-grained matrix. |

| cash cost | Cash cost per payable silver ounce, a widely reported non-GAAP measure in the silver industry. |

| cfm | Cubic feet per minute. |

| CIM | Canadian Institute of Mining, Metallurgy and Petroleum. |

| CONAGUA | Comisión Nacional del Agua, or National Water Commission, in Mexico responsible for managing and preserving national waters and their inherent good in order to achieve sustainable use. |

| Cu | Copper. |

| cut and fill | A mining method which removes ore in horizontal slices and the remaining void is filled with waste rock before proceeding to mine the next slice of ore. |

| EIA | Environmental Impact Assessment. |

| eq. | Equivalent values or quantities of products, expressed relative to the prevailing silver and co-product prices. |

| epithermal | Hydrothermal deposits formed at low temperature and pressure. |

|

feasibility study |

A detailed study of a deposit in which geological, engineering, operating, economic and other relevant factors are engineered in sufficient detail that it could reasonably serve as the basis for a final decision by a financial institution to finance the development of the deposit for mineral production. |

| felsic | An igneous rock having abundant light-coloured materials. |

| GDLR Project | The advanced stage Guadalupe de Los Reyes gold and silver project located in the Sierra Madre Mountains in Sinaloa State, Mexico. |

| g/t | Grams per metric tonne. |

| gpm | Gallons per minute. |

| hectare, or ha | A metric unit of land measure equal to 10,000 square metres or 2.471 acres. |

| hydrothermal | Relating to hot fluids circulating in the earth's crust. |

| IFRS | International Financial Reporting Standards as issued by the International Accounting Standards Board and interpretations of the International Financial Reporting Interpretations Committee, collectively. |

| Great Panther Silver Limited | 7 |

| Annual Information Form for the year ended December 31, 2017 | |

|

Indicated Mineral Resource |

As defined by the CIM Definition Standards on Mineral Resources and Reserves (“CIM Definition Standards”), an Indicated Mineral Resource is part of a Mineral Resource for which quantity, grade or quality, densities, shape, and physical characteristics, can be estimated with a level of confidence sufficient to allow the appropriate application of technical and economic parameters, to support mine planning and evaluation of the economic viability of the deposit. The estimate is based on detailed and reliable exploration and testing information gathered through appropriate techniques from locations such as outcrops, trenches, pits, workings, and drill holes that are spaced closely enough for geological and grade continuity to be reasonably assumed. |

| Inferred Mineral Resource |

As defined by the CIM Definition Standards, an Inferred Mineral Resource is that part of a Mineral Resource for which quantity and grade or quality can be estimated on the basis of geological evidence and limited sampling and reasonably assumed, but not verified, geological and grade continuity. The estimate is based on limited information and sampling gathered through appropriate techniques from locations such as outcrops, trenches, pits, workings, and drill holes. |

| JORC | Joint Ore Reserves Committee of the Australasian Institute of Mining and Metallurgy, Australian Institute of Geoscientists and Minerals Council of Australia. |

| LHD | Load-haul-dump loader. |

| LOM | Life of Mine. |

| masl | Metres above sea level. |

| Measured Mineral Resource |

As defined by the CIM Definition Standards, a Measured Mineral Resource is part of a Mineral Resource for which quantity, grade or quality, densities, shape and physical characteristics are so well established that they can be estimated with confidence sufficient to allow the appropriate application of technical and economic parameters, to support production planning and evaluation of the economic viability of the deposit. The estimate is based on a detailed and reliable exploration, sampling and testing information gathered through appropriate techniques from locations such as outcrops, trenches, pits, workings, and drill holes that are spaced closely enough to confirm both geological and grade continuity. |

|

mineral |

An inorganic substance usually having a definite chemical composition and, if formed under favourable conditions, having a certain characteristic atomic structure which is expressed in its crystalline form and other physical properties. |

|

Mineral Resource |

As defined by the CIM Definition Standards, a Mineral Resource is a concentration or occurrence of natural, solid, inorganic, or fossilized organic material in or on the Earth’s crust in such form and quantity and of such a grade or quality that it has reasonable prospects for economic extraction. The location, quantity, grade geological characteristics and continuity of a Mineral Resource are known, estimated or interpreted from specific geological evidence and knowledge. |

| Great Panther Silver Limited | 8 |

| Annual Information Form for the year ended December 31, 2017 | |

|

Mineral Reserve |

As defined by the CIM Definition Standards, a Mineral Reserve is the economically mineable part of a Measured or Indicated Mineral Resource demonstrated by at least a Preliminary Feasibility Study. This Study must include adequate information on mining, processing, metallurgical, economic, and other relevant factors that demonstrate, at the time of reporting, that economic extraction can be justified. A Mineral Reserve includes diluting materials and allowances for losses that may occur when the material is mined. |

| mineral claim | The portion of mining ground held under law by a claimant. |

| mineralization | Implication that the rocks contain metallic minerals and that these could be related to ore. |

| M&I | Measured and Indicated. |

| NSR | Net smelter return. |

| OEFA | The Environmental Evaluation and Oversight Agency, in Peru. |

| ore | That part of a mineral deposit which could be economically and legally extracted. |

| oz | Troy ounces. |

| Pb | Lead |

| Preliminary Feasibility Study, or PFS |

A comprehensive study of the viability of a mineral project that has advanced to a stage where the mining method, in the case of underground mining, or the pit configuration, in the case of an open pit, has been established and an effective method of mineral processing has been determined, and includes a financial analysis based on reasonable assumptions of technical, engineering, legal, operating, economic, social, and environmental factors and the evaluation of other relevant factors which are sufficient for a Qualified Person, acting reasonably, to determine if all or part of the Mineral Resource may be classified as a Mineral Reserve. |

| Probable Mineral Reserve |

As defined by the CIM Definition Standards, a Probable Mineral Reserve is the economically mineable part of an Indicated, and in some circumstances a Measured, Mineral Resource demonstrated by at least a Preliminary Feasibility Study. This Study must include adequate information on mining, processing, metallurgical, economic, and other relevant factors that demonstrate, at the time of reporting, that economic extraction can be justified. |

|

PROFEPA |

Procuraduría Federal de Protección al Ambiente, or Federal Agency of Environmental Protection, creates and enforces the Federal environmental laws of Mexico, with the aim of sustainable development. It has no relationship with the SEMARNAT, and maintains its own technical and operational autonomy. |

| Proven Mineral Reserve |

As defined by the CIM Definition Standards, a Proven Mineral Reserve is the economically mineable part of a Measured Mineral Resource demonstrated by at least a Preliminary Feasibility Study. This Study must include adequate information on mining, processing, metallurgical, economic, and other relevant factors that demonstrate, at the time of reporting, that economic extraction is justified. |

| Great Panther Silver Limited | 9 |

| Annual Information Form for the year ended December 31, 2017 | |

| psi | Pounds per square inch. |

| QA/QC | Quality Assurance/Quality Control. |

| quartz | A common rock forming mineral consisting of silicon and oxygen. |

| resuing | A method of stoping wherein the wall rock on one side of the vein is removed before the ore is broken. Employed on narrow veins, and yields cleaner ore than when wall and ore are broken together. |

| rhyolite | A fine-grained volcanic (extrusive) rock of granitic composition. |

| SEC | United States Securities and Exchange Commission. |

| SEDAR | System for Electronic Document Analysis and Retrieval, a mandatory document filing and retrieval system for Canadian public companies. |

|

SEMARNAT |

Secretaría de Medio Ambiente y Recursos Naturales, or Ministry of Environment and Natural Resources, the Mexican federal agency responsible for environmental protection, including permitting of surface work and some mining programs. |

| stockwork | A metalliferous deposit characterized by the impregnation of the mass of rock with many small veins or nests irregularly grouped. |

| stoping | The extraction of ore or other minerals by creating underground openings through the application of drill and blast techniques. |

| TSF | Tailings storage facility. |

| tonne | A metric tonne, equal to 1,000 kilograms and approximately 2,205 lbs. |

| tpd | Metric tonnes per day. |

| t/m³ | Metric tonnes per cubic metre. |

| US GAAP | United States generally accepted accounting principles. |

|

vein |

A zone or belt of mineralized rock lying within boundaries clearly distinguished from neighbouring rock. A mineralized zone has, more or less, a regular development in length, width and depth to give it a tabular form and is commonly inclined at a considerable angle to the horizontal. The term "lode" is commonly used synonymously for vein. |

| Zn | Zinc. |

| Great Panther Silver Limited | 10 |

| Annual Information Form for the year ended December 31, 2017 | |

| 2. | CORPORATE STRUCTURE |

| 2. A. |

NAME, ADDRESS AND INCORPORATION |

Great Panther Silver Limited was originally incorporated under the Company Act (British Columbia) in 1965 under the name “Lodestar Mines Ltd.”. On June 18, 1980, the Company’s common shares were listed on the TSX Venture Exchange. On March 22, 1996, the Company was continued under the Business Corporation Act (Yukon). On July 9, 2004, the Company was continued to British Columbia under the Business Corporations Act (British Columbia). On November 14, 2006, the Company’s common shares began trading on the TSX under the symbol “GPR”. On February 8, 2011, the Company’s common shares were listed on the NYSE American under the trading symbol “GPL”, while the Company retained its listing on the TSX in Canada.

The articles of the Company were amended on June 28, 2012, to provide for and facilitate the electronic delivery and receipt of notices, statements, reports or other records to shareholders.

Great Panther’s principal and registered offices are located at 1330 – 200 Granville Street, Vancouver, British Columbia, V6C 1S4, Canada. The Company’s telephone number is 604-608-1766, its facsimile number is 604-608-1768, and the Company’s website can be found at www.greatpanther.com.

| 2.B. | INTERCORPORATE RELATIONSHIPS |

The following companies are the subsidiaries of the Company, each of which is 100% beneficially owned, directly or indirectly, by the Company.

| Great Panther Silver Limited | 11 |

| Annual Information Form for the year ended December 31, 2017 | |

| 3. | GENERAL DEVELOPMENT OF THE BUSINESS |

| 3. A. |

GENERAL |

Great Panther Silver Limited is a primary silver mining and precious metals producer and exploration company listed on the Toronto Stock Exchange (“TSX”) trading under the symbol GPR, and on the NYSE American trading under the symbol GPL. The Company’s wholly-owned mining operations in Mexico are the Topia Mine (“Topia”), and the Guanajuato Mine Complex (“GMC”) which comprises the Company’s Guanajuato Mine, the San Ignacio Mine (“San Ignacio”), and the Cata processing plant.

The GMC produces silver and gold concentrate and is located in central Mexico, approximately 380 kilometres north-west of Mexico City, and approximately 30 kilometres from the Guanajuato International Airport. The Topia Mine is located in the Sierra Madre Mountains in the state of Durango in northwestern Mexico and produces concentrates containing silver, gold, lead and zinc at its own processing facility.

The method of production at Topia and the GMC consists of conventional mining incorporating cut and fill and resue methods. Extracted ore is trucked to on-site conventional processing plants which consist of zinc and lead-silver flotation circuits at Topia Mine, and a pyrite-silver-gold flotation circuit at the GMC.

On June 30, 2017, the Company acquired a 100% interest in the Coricancha Mine Complex ("Coricancha"), by acquiring all the common shares of Nyrstar Coricancha SA. Coricancha is a gold-silver-copper-lead-zinc mine, located in the Peruvian province of Huarochirí, approximately 90 kilometres east of Lima, and has been on care and maintenance since August 2013.

The Company’s exploration properties include the El Horcón, Santa Rosa and Plomo projects in Mexico; and the Argosy project in Canada. El Horcón is located 100 kilometres by road northwest of Guanajuato city, Santa Rosa is located approximately 15 kilometres northeast of Guanajuato city, and the Plomo property is located in the state of Sonora, Mexico. The Argosy property is in the Red Lake Mining District in northwestern Ontario, Canada. The Company has not undertaken any significant exploration programs on El Horcón, Santa Rosa, Plomo and Argosy in the last three years, and none of these properties is considered material.

The GMC, Topia, El Horcón and Santa Rosa are held by MMR, a wholly-owned subsidiary acquired in February 2004. In 2005, the Company incorporated MDU and MVS which are responsible for the day-today affairs and operations of Topia and the GMC, respectively, through service agreements with MMR.

Argosy is held by Cangold, and Plomo is held by Coboro.

The Company continues to evaluate additional mining opportunities in the Americas.

| 3.B. | THREE-YEAR HISTORY |

| 3. B.1 |

Year ended December 31, 2017 |

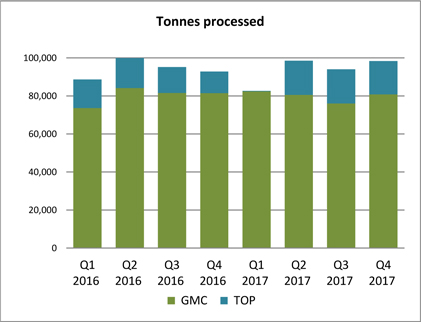

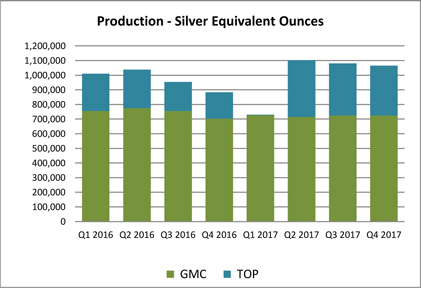

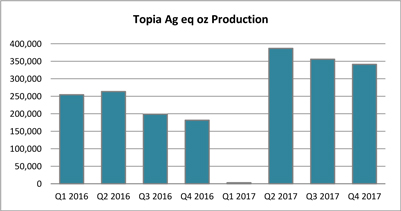

Overall metal production for 2017 was 3,978,731 Ag eq oz, a 2% increase over the prior year despite a slight decrease in tonnes milled. This was due to an increase in production from the higher grade Topia Mine, which benefited from higher throughput and increase in ore grades.

There were no fatalities at any of the Company’s operations during 2017. The Company introduced and implemented additional safety measures during 2017, including the SafeStart program, with the objective of further educating workers and their families about the importance of operating a safe work environment.

A total of 12,002 metres of development were completed at the GMC during 2017. At Topia, underground development totaled 5,167 metres, with the majority carried out at the Argentina, 15-22, San Miguel and Recompensa mines.

The Company completed 22,207 metres of exploration drilling at the GMC during 2017, a significant increase over 15,685 metres in 2016. The Company undertakes ongoing exploration of the GMC with the objective of replacing mined resources and expanding the mineral resource base. On January 25, 2018, the Company provided an update to the Mineral Resource at the GMC which reported an increase in Measured and Indicated Mineral Resources of 91%. During 2017, exploration at San Ignacio consisted of both surface and underground drilling which totaled 17,885 metres. This drilling resulted in the extension and continued delineation of the Melladito and Nombre de Dios zones at the San Ignacio Mine, and a significant increase in Measured and Indicated Mineral Resources. Underground drilling at the Guanajuato Mine totaled 4,322 metres, and was focused on the Cata, Los Pozos, Guanajuatito, San Cayetano, Santa Margarita and Valenciana mining areas.

| Great Panther Silver Limited | 12 |

| Annual Information Form for the year ended December 31, 2017 | |

The Company completed 2,485 metres of surface exploration drilling at Topia during 2017, while no such drilling was completed in 2016.

In June 2017, the Company successfully completed the commissioning phase of the refurbished processing plant at Topia and the plant was operating at planned capacity. Milling operations had been suspended from early December 2016 until early April 2017 to facilitate the construction of a tailings filtration plant, and completion of plant upgrades. In December 2017, SEMARNAT granted the Company all permits for the construction and operation of the new Phase II TSF at its Topia Mine. The Company is utilizing the existing Phase I TSF during the construction of Phase II.

On June 30, 2017, the Company completed the acquisition of Coricancha from subsidiaries of Nyrstar NV (see "Significant Acquisitions" below).

On August 14, 2017, the Company announced the results of the exploration drilling program conducted at Coricancha which focussed on three main veins – Wellington, Constancia and Colquipallana, in addition to a new exploration target, the Animas vein.

On August 16, 2017, James Bannantine was appointed President and Chief Executive Officer and Director of the Company, succeeding Robert Archer. Mr. Archer remains on the Board of Directors.

On December 20, 2017, the Company completed an updated Mineral Resource Estimate for Coricancha. The Measured and Indicated tonnes and grades in the updated Mineral Resource Estimate compare well with those from the historical resource estimate of 2012. The Company is completing feasibility studies and is evaluating opportunities to reduce costs and project risk. The Company expects to complete additional technical studies for Coricancha in the second quarter of 2018.

The Company compiled supplemental information requested by CONAGUA during its inspections conducted during 2016 and submitted it in December 2017. The Company awaits the results of the review by CONAGUA (see further information see "Infrastructure, Permitting and Compliance Activities" in section 5.A).

| 3. B.2 |

Year ended December 31, 2016 |

Overall metal production for 2016 was 3,884,960 Ag eq oz, representing a decrease of 7% over the prior year. The decrease in production reflected 15% lower throughput at Topia due to three temporary shutdowns in operations, as well as lower ore grades and recoveries at the GMC.

A total of 9,540 metres of development were completed at the GMC during 2016, with the majority focused on the San Ignacio Mine. At Topia, mine development totaled 7,118 metres and was focused on the Argentina, 15-22, La Prieta and El Rosario mines.

The Company’s drill program during 2016 totaled 15,685 metres for the GMC compared to 17,680 metres in 2015. Drilling at the Guanajuato Mine totaled 7,200 metres and was focused on the Guanajuatito and Valenciana mines. At San Ignacio, total drilling amounted to 8,458 metres for the year.

There was no exploration drilling conducted at Topia during 2016 as the mine had sufficient mineral resources to support mining for several years at current production levels.

The Company experienced one fatality at its Topia Mine and two fatalities at the GMC in 2016. The Company considers health and safety of its workers, and others in the communities in which it operates, to be a top priority. The Company completed extensive investigations into each event and routinely undertakes safety training and updates and makes improvements to safety procedures and practices to minimize injuries and provide a safe work environment.

On January 14, 2016, the Company reported a theft of explosives from one of the mines at the GMC. The Company voluntarily suspended the use of all explosives material at the GMC to facilitate ongoing investigations by regulatory authorities, and to enhance security. On February 16, 2016, the regulatory authorities concluded their formal investigation. Operations at the GMC were intermittently halted over the investigation period and fully resumed on February 16, 2016.

| Great Panther Silver Limited | 13 |

| Annual Information Form for the year ended December 31, 2017 | |

In February 2016, CONAGUA required that the Company make formal applications for permits associated with the occupation and construction of the TSF at the GMC. After the Company filed the applications, CONAGUA carried out an inspection of the TSF and requested further technical information.

On February 24, 2016, the Company terminated an option to purchase the Guadalupe de Los Reyes Project in Sinaloa, Mexico, after conducting an evaluation of the project, which included a surface diamond drill program.

On April 21, 2016, the Company entered into an At-the-Market Offering (the “ATM Offering”) agreement under which the Company had the discretion to sell common shares up to a maximum in gross sales proceeds of $10.0 million, until December 31, 2016. The Company issued 3,498,627 common shares under the ATM Offering for aggregate gross proceeds of $5.7 million.

On May 11, 2016, the Company elected to terminate an option agreement to acquire a 100% interest in Coricancha; however, it continued with the evaluation of the project.

On July 12, 2016, the Company closed an equity bought deal offering that was announced on July 6, 2016. Upon closing, the Company sold 18,687,500 Units at a price of $1.60 per Unit for gross proceeds of $29.9 million. Each Unit consisted of one common share of the Company and one-half of one common share purchase warrant (each whole warrant, a “Warrant”). Each Warrant entitled the holder to purchase one share at the exercise price of $2.25 per share for a period of 18 months after the closing of the offering. The Company paid a cash commission to the underwriters equal to 6% of the gross proceeds of the offering. The intended use of net proceeds from this offering, along with the net proceeds from the aforementioned ATM Offering, was to fund operating, development and exploration expenditures at the Company’s mining operations and projects, for possible future acquisitions, and for general corporate and working capital purposes. To the date of this AIF, the net proceeds of the ATM Offering and the bought deal offering have not been used and have been placed in short-term bank guaranteed deposits or other similarly secure deposits. Since completing the offerings and to the date of this AIF, the Company has funded all operating, general working capital and investment needs from operating cash-flow. The Company continues to seek out other precious metal mining acquisition opportunities in the Americas.

On October 31, 2016, the Company filed a short form base shelf prospectus with the securities commissions in each of the provinces and territories of Canada, except for Quebec, and a corresponding registration statement on Form F-10 with the SEC. Subject to the subsequent preparation and filing of a prospectus supplement, these filings allow Great Panther to make offerings of common shares, warrants, subscription receipts, units, or any combination thereof, having an aggregate offering price of up to C$80.0 million in Canada and the United States over a 25-month period. Great Panther filed this base shelf prospectus with the intention of maintaining financial flexibility, and the maximum amount that could potentially be offered under the base shelf prospectus does not reflect an estimate of future financing requirements. At this time, there are no foreseeable financing requirements associated with the Company’s existing operating and development plans, however, the execution of the Company’s growth strategy may warrant further financing.

In early December 2016, the Company temporarily halted processing at the Topia Mine in order to facilitate certain plant upgrades and a transition to a new TSF under construction. Mine operations continued during the plant shutdown and all ore was stockpiled to be processed upon resumption of processing activities towards the end of the first quarter of 2017. Further details regarding the new TSF is included in the Topia Development section.

On December 19, 2016, the Company entered into an agreement to acquire a 100% interest in Coricancha.

| 3. B.3 |

Year ended December 31, 2015 |

Overall metal production for 2015 was a record 4,159,121 Ag eq oz, representing an increase of 30% over the prior year. The increase reflected the continued ramp-up in production at the San Ignacio Mine since commercial production commenced in June 2014, and higher ore grades at all operations.

The safety performance in 2015 improved over the prior years in terms of incident and severity rates. There were no fatalities. Improvements in the safety program centered on improving organizational safety policies and practices.

| Great Panther Silver Limited | 14 |

| Annual Information Form for the year ended December 31, 2017 | |

Mine development at the GMC during 2015 was focused on San Ignacio, with additional development at the Cata, Los Pozos, Santa Margarita and Guanajuatito zones. Development at San Ignacio concentrated on infrastructure work including the maintenance facilities on the surface, preparation of loading bays, pumping stations and developing access levels to stopes. At Topia, mine development was focused on the Argentina, 15-22, La Prieta and El Rosario mines.

The goal of the Company’s exploration program for the GMC during 2015 was to expand the Mineral Resource base, and on February 25, 2016, the Company provided an update to the Mineral Resource at the GMC. Drilling at the Guanajuato Mine in 2015 totaled 13,024 metres, and was focused on the Valenciana, Cata and Los Pozos zones. At San Ignacio, total drilling amounted to 4,657 metres for the year and consisted of underground drilling to better define the Mineral Resource in the Intermediate and Melladito zones, and a surface drill program to define the southern extension of the Mineral Resource in the Melladito, Melladito Splay, Melladito 2 and Melladito 3 zones.

There was no exploration drilling conducted at Topia during 2015 as the mine had sufficient mineral resources to support an 11-year mine life at average annual production levels. The Company provided an update to the Mineral Resource at Topia on July 9, 2015, based on the results of prior years’ drill programs. Measured Mineral Resources were estimated at 6,006,000 Ag eq oz, Indicated Mineral Resources were estimated at 5,574,000 Ag eq oz, and Inferred Mineral Resources were estimated at 11,050,000 Ag eq oz. In light of the updated Mineral Resource Estimate, management changed its estimate of the useful life of Topia to 11 years (as at July 1, 2015), an increase from the previous estimate of 6.5 years. The full technical report is available under the Company’s profile on SEDAR located at www.sedar.com.

On May 27, 2015, the Company completed the acquisition of all of the 42,780,600 common shares of Cangold issued and outstanding to third parties, in exchange for 2,138,898 common shares of Great Panther and derecognition of $1,349,000 loaned by the Company to Cangold and its subsidiary, Coboro.

A surface drill program at the GDLR Project commenced in mid-August and was completed in early December with a total of 5,514 metres drilled. The objectives of this drill program were to test the continuity of the mineralized structures and associated gold-silver mineralization with fill-in holes, and to expand the mineralized zones with select step-outs. The remainder of 2015 was spent interpreting and 3D-modelling the results of the 2015 drill program, in conjunction with the historic drilling results, for use in a 'high-level' economic evaluation. Based on the results of the economic evaluation the Company terminated the option agreement for the GDLR Project on February 24, 2016.

During the year, the Company fully secured mineral property titles for all of its 7,909 hectares related to El Horcón. Three of the Company’s mineral property title claims were previously cancelled due to an administrative oversight on the part of the government agency which manages mineral property titles in Mexico. All titles have been restored. No drilling was conducted at El Horcón during 2015.

Great Panther announced in May 2015 that it had entered into a two-year option agreement with Nyrstar which gave the Company the right to acquire 100% of the shares of Coricancha.

| 3. C. |

SIGNIFICANT ACQUISITIONS |

Coricancha is located in the Peruvian province of Huarochirí in the central Andes of Peru, approximately 90 kilometres by paved highway east of the city of Lima. Coricancha is a polymetallic mine that includes a 600 tonne per day flotation and gold BIOX® bio-leach plant along with supporting mining infrastructure. Coricancha has been on care and maintenance since August 2013 when it was closed due to falling commodity prices. The Coricancha property comprises more than 3,700 hectares in the prolific Central Polymetallic Belt and production at the mine dates back to 1906. Gold-silver-lead-zinc-copper mineralization (approximately 80% gold-silver by value) occurs as massive sulphide veins that have been mined underground by cut and fill methods.

The Company’s Peruvian subsidiary, Great Panther Silver Peru SAC (“GP Peru”), completed the acquisition (the “Acquisition”) of all of the issued and outstanding shares of Nyrstar Coricancha SA from Nyrstar International B.V. and Nyrstar Netherlands (Holdings) B.V., as sellers (together “Nyrstar”) on June 30, 2017 (the “Completion”). Nyrstar Coricancha SA was the 100% owner of the Coricancha gold-silver-lead-zinc-copper mine and mill complex in Peru at Completion.

| Great Panther Silver Limited | 15 |

| Annual Information Form for the year ended December 31, 2017 | |

The Acquisition was completed pursuant to a Share Purchase Agreement (the “SPA”) originally dated December 19, 2016, among the Company, GP Peru, Nyrstar and Nyrstar Coricancha SA (the “Original SPA”). The SPA was amended and restated on June 9, 2017 (the “Amended and Restated SPA”) and further amended by agreement dated June 28, 2017 (the “Second Amendment Agreement”).

The legal name of Nyrstar Coricancha SA was changed to Great Panther Coricancha SA subsequent to the Acquisition. In the foregoing Nyrstar Coricancha SA is also referred to as Great Panther Coricancha SA.

| 3. C.1 |

The SPA |

The parties entered into the Amended and Restated SPA on June 9, 2017 in order to incorporate certain amendments to facilitate the reorganization of Nyrstar’s investments in Peru in connection with its planned divestitures. The amendments in the Amended and Restated SPA did not materially impact the terms of the Acquisition under the Original SPA. The parties entered into the Second Amendment Agreement effective June 28, 2017 in order to defer payment of the initial US$0.1 million portion of the Purchase Price (the “Completion Price”) from the closing date to a date no later than five business days following the receipt of a final cost certificate from the Peruvian tax authority (“SUNAT”) that related to the cost base of Nyrstar’s shares in Great Panther Coricancha SA (the “Cost Certificate”). The Second Amendment Agreement also included corresponding agreements relating to certain tax matters.

A copy of the Original SPA was filed on SEDAR on January 13, 2017. A copy of each of the Amended and Restated Share Purchase Agreement and the Second Amendment Agreement were filed on SEDAR on July 10, 2017. Readers are advised to refer to the filed agreements for a complete description of the terms of the Acquisition. The forms of the Mine Closure Agreement, Earn-Out Agreement and Nyrstar Parent Guarantee, each as discussed below, are each included as exhibits to the Original SPA and Amended and Restated SPA. The summary of material terms of each of the agreements provided in this AIF is qualified by reference to the entirety of the SPA.

Capitalized terms used in the discussion below that are not defined have the meaning prescribed to them in the SPA and related exhibits.

| 3. C.2 |

Closing of the Acquisition |

The Acquisition was completed by Nyrstar transferring all of the issued and outstanding shares of Nyrstar Coricancha SA to GP Peru. Concurrently, the following agreements were executed in accordance with the SPA and came into effect on Completion:

| • | An earn-out agreement between the Company, GP Peru, Nyrstar and Nyrstar Coricancha SA, in the form attached to the SPA (the “Earn-Out Agreement”); | |

| • | A mine closure agreement between Nyrstar and Nyrstar Coricancha SA, in the form attached to the SPA (the “Mine Closure Agreement”); and | |

| • | A guarantee of Nyrstar NV, the ultimate parent of Nyrstar, in favour of GP Peru and the Company, in the form attached to the SPA (the “Nyrstar Parent Guarantee”). |

Nyrstar and the Company also executed a transition services agreement on closing in order to facilitate the transition of management and ownership of Nyrstar Coricancha SA to the Company and GP Peru. The transition services agreement was in effect for several months following Completion.

| 3. C.2.a |

Acquisition Consideration |

Under the terms of the SPA, GP Peru acquired Nyrstar Coricancha SA from Nyrstar for a purchase price (the “Purchase Price”) comprised of:

| • | the Completion Priceof US$0.1 million, which was paid subsequent to Completion in September 2017; and |

| Great Panther Silver Limited | 16 |

| Annual Information Form for the year ended December 31, 2017 | |

| • | up to US$10.0 million in earn-out consideration to be paid under the Earn-Out Agreement, as described further below. |

| 3. C.3 |

Earn-Out Agreement |

Under the Earn-Out Agreement, Great Panther Coricancha SA will pay Earn-Out Consideration to Nyrstar that will equal 15% of the free cash flow generated by Coricancha during the five-year period after which Coricancha is cumulative free cash flow positive from Completion, to a maximum of US$10.0 million. Specific material terms of the Earn-Out Agreement include the following:

|

• |

the Earn-Out Consideration will be determined as being equal to 15% of the Free Cash Flow of the Company during the Earn-Out Period, calculated and paid at the end of each relevant fiscal year of the Company during the Earn-Out Period; | |

|

• |

Free Cash Flow will be determined as the net income or loss of Coricancha, with adjustment for certain amounts specified in the Earn-Out Agreement related to depreciation and amortization, non-cash expenses and losses, deferred income tax and sustaining capital expenditures, each as determined in accordance with IFRS; | |

| • | the Earn-Out Period will begin on the Trigger Date and will expire on the earlier of; |

| • | the date that is five years from the Trigger Date, and | |

|

• |

the date on which the Cumulative Free Cash Flow generated from Coricancha since the Trigger Date has equaled an amount such that the Earn-Out Consideration to be paid by the Company to Nyrstar under the Earn-Out Agreement will equal US$10.0 million; |

|

• |

the Trigger Date will be the date on which the aggregate cumulative Free Cash Flow generated by Coricancha from the Date of Commencement of Commercial Production has equaled or exceeded the amount of the Start-Up Expenditures, as defined in the Earn-Out Agreement, incurred by the Company from the date of Completion of the Acquisition to the Date of Commencement of Commercial Production; and | |

|

• |

the Date of Commencement of Commercial Production will be the date after Completion which is the first day of the first three month period (whether calendar months or otherwise) during which period the average rate of production at Coricancha is at least 400 tonnes per day (with production calculated on the basis of mined material processed through the plant). |

The Company will guarantee to Nyrstar the payment by Great Panther Coricancha SA of the Earn-Out Consideration under the Earn-Out Agreement. To date, no consideration has been paid under the terms of the Earn-Out Agreement.

| 3. C.4 |

Reclamation Agreements |

The SPA includes agreements between the Company, GP Peru, Great Panther Coricancha SA and Nyrstar regarding legacy environmental matters relating to Coricancha. These agreements became effective on Completion and are set out in clause 6 of the SPA and relate to the reclamation of tailings facilities at Coricancha and the funding of the corresponding reclamation costs. These terms include the following material provisions:

|

• |

GP Peru will cause Great Panther Coricancha SA to reclaim the Cancha 1 and Cancha 2 tailings facilities (being part of Coricancha), in accordance with the mine closure plan approved by the Peru Ministry of Mines (the “Coricancha Mine Closure Plan”); | |

|

• |

GP Peru will cause Great Panther Coricancha SA to reclaim the Triana tailings facility (being part of Coricancha), in accordance with the mine tailings abandonment plan approved by the Peru Ministry of Mines (the “Triana Tailings Abandonment Plan”); | |

|

• |

Nyrstar will fund the payment of the Reclamation Costs associated with undertaking the reclamation work required to complete the Coricancha Mine Closure Plan and the Triana Tailings Abandonment Plan, to a maximum of US$20 million; and |

| Great Panther Silver Limited | 17 |

| Annual Information Form for the year ended December 31, 2017 | |

| • | Nyrstar will advance funds to Great Panther Coricancha SA to fund the Reclamation Costs on a quarterly basis in accordance with agreed upon mechanics set forth in the SPA. |

In addition, Nyrstar has agreed to settle all outstanding fines or sanctions relating to Coricancha, to a maximum of US$4.0 million (subject to certain exclusions to which the cap will not apply).

To date, the Company has completed some of the reclamation work under the Coricancha Mine Closure Plan and the Triana Tailings Abandonment Plan, and Nyrstar has funded these works in accordance with the SPA.

| 3. C.5 |

Mine Closure Agreement |

The Mine Closure Agreement relates to the mine closure bond required to be maintained by Great Panther Coricancha SA for Coricancha (the “Mine Closure Bond”) in order to comply with the mine closure bond requirements imposed by the Ministerio de Energia y Minas of Peru (the “Peru Ministry of Mines”). Under the Mine Closure Agreement, Nyrstar has agreed to maintain the required Mine Closure Bond up to an amount of US$9.7 million for a three year period following Completion (the “Mine Closure Period”). During this Mine Closure Period, Great Panther Coricancha SA will be responsible for any portion of the Mine Closure Bond required by the Peru Ministry of Mines that is in excess of this US$9.7 million amount. In accordance with these obligations, Nyrstar is responsible, at its expense, for providing security for the initial US$9.7 million amount of the Mine Closure Bond and Great Panther Coricancha SA is responsible, at its expense, for providing security for any excess amount.

In the event that Great Panther Coricancha SA makes a final, irrevocable decision to permanently close Coricancha during the Mine Closure Period, the following will apply:

| • | Nyrstar will pay to Great Panther Coricancha SA the amount of US$9.7 million in full and final release of its obligations under the Mine Closure Bond (the “Closing Contribution”); | |

| • | Great Panther Coricancha SA will take all steps necessary to establish a new Mine Closure Bond in the amount of US$9.7 million; | |

| • | Nyrstar will terminate its original Mine Closure Bond in the amount of US$9.7 million; | |

| • | Great Panther Coricancha SA will proceed with the mine closure plan for Coricancha using the Closing Contribution paid to Coricancha by Nyrstar; | |

| • | if the costs of closing Coricancha are less than the Closing Contribution paid by Nyrstar, Great Panther Coricancha SA will return to Nyrstar the difference; and | |

| • | if the costs of closing Coricancha are greater than the Closing Contribution paid by Nyrstar, Coricancha will be responsible for any excess closure costs. |

In the event that Great Panther Coricancha SA does not make a final, irrevocable decision to permanently close Coricancha during the Mine Closure Bond Period, Great Panther Coricancha SA will make arrangements for the release of the obligations of Nyrstar under its portion of the Mine Closure Bond, which arrangements will be in effect upon expiry of the Mine Closure Bond Period, and Nyrstar will then have no further responsibility or liability in connection with the Mine Closure Bond.

In December 2017, the Mine Closure Bond requirement was increased by $1.2 million. This additional amount was funded by Great Panther Coricancha SA at that time in accordance with the Mine Closure Agreement.

| 3. C.6 |

Parent Company Guarantee of Nyrstar NV |

Under the Nyrstar Parent Guarantee, Nyrstar NV has guaranteed to the Company, GP Peru and Great Panther Coricancha SA, as beneficiaries, the punctual payment and performance by Nyrstar of the obligations of Nyrstar under:

| • | Clause 2 of the Mine Closure Agreement relating to the obligations of Nyrstar to post the Mine Closure Bond and advance the Closure Contribution, in each case to a maximum of US$9.7 million; |

| Great Panther Silver Limited | 18 |

| Annual Information Form for the year ended December 31, 2017 | |

| • | Clause 5(h) of the SPA relating to tax indemnification matters; and | |

| • | Clause 6 of the SPA relating to the obligations of Nyrstar to fund the Reclamation Costs for Coricancha. | |

| • | The obligations of Nyrstar NV are limited to the following maximum guaranteed amounts: | |

| • | US$9.7 million with respect to the guaranteed obligations under clause 2 of the Mine Closure Agreement, and | |

| • | US$20.0 million with respect to the guaranteed obligations under clause 6 of the SPA relating to Reclamation Costs. |

The guaranteed obligations with respect to the tax indemnification under clause 5(h) of the SPA will not be subject to the foregoing maximum guaranteed amounts and will be subject to the indemnification provisions of the SPA with respect to these obligations.

| 3. C.7 |

Further information |

The information contained in this AIF is presented in summarized form and reference should be made to the full text of the Form 51-102F4 "Business Acquisition Report" dated September 12, 2017 and related Material Change Report filed on July 10, 2017, each of which is available for review under the Company’s profile on SEDAR located at www.sedar.com.

| 4. | DESCRIPTION OF THE BUSINESS |

| 4. A. |

PRINCIPAL MARKETS |

While Great Panther is primarily a silver producer, it mines ore which it processes in its plants to produce concentrates which contain silver, gold, lead and zinc. These concentrates are then sold to metal traders or directly to smelters and refiners which extract the metals from the concentrates (see “Product Marketing, Sales and Distribution”). In 2017, silver accounted for 49% of the Company’s revenues and gold accounted for 41%. The remaining 10% of the Company’s revenues are from the production of lead and zinc at Topia.

Silver and gold are precious metals traded as commodities primarily on the London Bullion Market Association (the “LBMA”) and Comex in New York (the “CME”). The LBMA is an international trade association, representing the London market for gold and silver bullion which has a global client base. This includes the majority of the gold-holding central banks, private sector investors, mining companies, producers, refiners and fabricators. The on-going work of the LBMA covers a number of areas, among them refining standards, trading documentation and the development of good trading practices. The maintenance of the “Good Delivery List”, including the accreditation of new refiners and the regular retesting of listed refiners, is the most important core activity of the LBMA.

The LBMA silver price auction is operated by CME and administered by Thomson Reuters. The price is set daily in US dollars per ounce at 12:00 noon London time and is displayed on the LBMA's website with a 15-minute delay. The LBMA gold price auction takes place twice daily by ICE Benchmark Administration at 10:30 and 15:00 London time with the price set in US dollars per ounce. The price is displayed on the LBMA'S website with a 30-minute delay. Reference prices for both silver and gold are also available in British Pounds and in Euros.

The silver and gold business is cyclical as smelting and refining charges rise and fall depending upon the demand for, and supply of, silver-gold concentrates in the market. In addition, the market prices of silver and gold have historically fluctuated widely, and are affected by numerous global factors beyond the control of the Company and the mining industry in general. A decline in such market prices may have an adverse effect on revenues from the sale of silver and gold.

In 2016, total physical silver demand accounted for 1,027.8 million ounces per the Silver Institute, World Silver Survey 2017, and comprised the following end market categories: industrial use (55%), coins and bars (20%), silver jewelry (20%) and silverware (5%). Approximately 42% of the industrial use is for electrical and electronic components and 14% is accounted for by use in the manufacturing of photovoltaics (solar cells). Silver has a number of key and, in some cases, unique properties such as durability, malleability, ductility, reflectivity, electrical conductivity. It also has antibacterial properties, and all these properties make it valuable in numerous industrial applications. Applications include: circuit boards, electrical wiring, superconductors, brazing and soldering, mirror and window coatings, electroplating, chemical catalysts, pharmaceuticals, filtration systems, solar panels, batteries, televisions, household appliances, clothing and automobile components. The unique properties of silver also make it difficult to substitute the element in its industrial applications.

| Great Panther Silver Limited | 19 |

| Annual Information Form for the year ended December 31, 2017 | |

Gold demand comprises four primary categories: jewelry, investment, central banks and other financial institutions; and technology. Jewelry has always been a dominant source of demand for gold and accounts for approximately half of world gold demand. Investment in gold by institutional and private investors accounts for around one third of global demand and is made up of direct ownership of bars and coins, or indirect ownership via Exchange-Traded Funds and similar products. Gold is also one of the few assets that is universally permitted by the investment guidelines of the world’s central banks due, in part, to the gold market being deep and liquid. Around nine per cent of the world demand for gold is for technical applications. The electronics industry accounts for the majority of this, where gold’s conductivity and resistance to corrosion make it the material of choice for manufacturers of high-specification components. In addition, the metal’s excellent biocompatibility means that it continues to be used in dentistry. Beyond electronics and dentistry, gold is used across a variety of high-technology industries, in complex and difficult environments, including the space industry and in fuel cells. Gold’s catalytic properties are also beginning to create demand both within the automotive sector, as the metal has now been proven to be a commercially viable alternative to other materials in catalytic converters, and within the chemical industry.

| 4. B. |

PRODUCT MARKETING, SALES AND DISTRIBUTION |

The Company produces metallic concentrates which contain silver, gold, lead and zinc. The principal customers for the concentrates are smelters in Mexico, Asia and Europe, and international traders. For the year ended December 31, 2017, three customers accounted for all of the Company’s revenues.

There is a global market for metallic concentrates and the Company continues to identify and evaluate new buyers for its concentrates through an active marketing process. Great Panther’s head office in Vancouver provides sales and marketing services to its Mexican operations in respect of the sale of concentrates produced by its operations. This generally involves an annual competitive tendering process and marketing and relationship development throughout the year. The tendering process culminates in the Company’s Mexican subsidiary entering into contracts with metal traders or smelting and refining companies for generally a one-year term. The tendering process enables the Company to review and renegotiate the terms of its contracts annually to ensure that it receives the most competitive pricing and terms possible. The Company also seeks not to be completely dependent on any single smelter, refiner or trader for the purchase of its concentrates at any given time.

The smelters and international traders pay the Company for metal contained in the Company’s concentrates, less charges associated with refining and smelting. Revenues reported by the Company are net of these charges. The pricing for the contained metals in the concentrate is typically the average of all the daily quoted market prices within a specific month or other agreed period of time.

During 2017, the Company delivered its concentrates by truck and by ship. In 2018, as a result of changes in contract terms, the Company delivers its concentrates by truck to customers' warehouses. As concentrates can vary in terms of grade and quality from shipment to shipment, the sales are subject to a final settlement process to adjust for any variances. After the physical transfer of the metal concentrate, the Company has the right to request advances based on the provisional value of shipments calculated at spot prices for the contained metals. Such advances are typically 90% to 95% of the provisional value, and are typically payable from 8 to 75 days subsequent to delivery, depending on the specific contract. A final payment or adjustment is made on the date of final settlement, once all information regarding concentrate content is known. The credit period for sales can range from two to four months depending on timing of final settlements.

| Great Panther Silver Limited | 20 |

| Annual Information Form for the year ended December 31, 2017 | |

Revenue Figures

| Year ended December 31, 2017 | Year ended December 31, 2016 | |||||||||||||||||

| (in thousands) | GMC | Topia | Total | GMC | Topia | Total | ||||||||||||

| Silver revenue | $ | 24,129 | $ | 9,016 | $ | 33,145 | $ | 25,287 | $ | 9,188 | $ | 34,475 | ||||||

| Gold revenue | 27,432 | 755 | 28,187 | 26,749 | 521 | 27,270 | ||||||||||||

| Lead revenue | - | 2,741 | 2,741 | - | 1,808 | 1,808 | ||||||||||||

| Zinc revenue | - | 3,853 | 3,853 | - | 2,318 | 2,318 | ||||||||||||

| Ore processing revenue and other | - | - | - | - | 410 | 410 | ||||||||||||

| Smelting and refining charges | (2,195 | ) | (1,985 | ) | (4,180 | ) | (2,955 | ) | (2,323 | ) | (5,278 | ) | ||||||

| Impact of change in functional currency | - | - | - | 750 | 128 | 878 | ||||||||||||

| Total revenue | $ | 49,366 | $ | 14,380 | $ | 63,746 | $ | 49,831 | $ | 12,050 | $ | 61,881 | ||||||

| 4.C. | SEASONALITY |

Even though revenue will vary based on the quantity of metal production, metal prices and terms of sales agreements, the Company’s business is not considered to be seasonal.

The climate in Mexico allows exploration, mining and milling operations to be carried out year-round. Therefore, revenue and cost of sales generally do not exhibit variations due to seasonality. The exceptions are periods of excessive drought which may limit or defer processing of ore and/or concentrate. The dry season in Mexico generally extends from October through April. The Company has not experienced a suspension of mining and processing activities due to drought in any of the last three fiscal years.

The climate in Peru also allows exploration and mining activities to be carried out year-round. There is a rainy season from January to March that has in the past caused flooding and disruptions to operations in the area where Coricancha is located.

| 4.D. | SPECIALIZED SKILL AND KNOWLEDGE |

The Company’s business requires specialized skills and knowledge in the areas of geology, mining, metallurgy, social and environmental studies, permitting, claim management and finance. The Company has a number of employees with extensive experience in mining, engineering, finance, geology, exploration and development, including, but not limited to, James Bannantine, President & Chief Executive Officer and director; Ali Soltani, Chief Operating Officer; Jim Zadra, Chief Financial Officer & Corporate Secretary; and Matthew Wunder, VP Exploration.

| 4.E. | COMPETITIVE CONDITIONS |

The Company’s business is to mine and process ore and sell precious metal and base metal concentrates. Prices for its products are determined by world markets over which it has no influence or control. The Company also competes with other mining companies, some of which have greater financial resources and technical facilities, for the acquisition of mineral interests, as well as for the recruitment and retention of qualified employees.

| 4.F. | DOING BUSINESS IN MEXICO AND PERU |

| 4.F.1 |

Mining in Mexico |

The mining industry in Mexico is controlled by the Secretaría de Economía – Dirección General de Minas which is located in, and administered from Mexico City. Mining concessions in Mexico may only be obtained by Mexican nationals or Mexican companies incorporated under Mexican laws. The construction of processing plants requires further governmental approval.

In Mexico, surface land rights are distinct from the mining concessions.

| Great Panther Silver Limited | 21 |

| Annual Information Form for the year ended December 31, 2017 | |

The holder of a mining concession is granted the exclusive right to explore and develop a designated area. Mining concessions are granted for 50 years from the date of their registration with the Public Registry of Mining to the concession holder as a matter of law, if all regulations have been complied with. During the final five years of this period, the concession holder may apply for one additional 50-year period, which is automatically granted provided all other concession terms have been complied with. Mining rights in Mexico can be transferred by their private holders with no restrictions or requirements other than to register the transaction with the Public Registry of Mining.

In accordance with the Federal Duties Law (“LFD”), the holder of a mining concession is obligated to pay biannual duties in January and July of each year based upon the number of hectares covered by the concession area.

Concessionaires must perform work each year that must begin within ninety days of the concession being granted. Concessionaires must file proof of the work performed each May. Non-compliance with these requirements is cause for cancellation only after the Ministry of Mines communicates in writing to the concessionaire of any such default, granting the concessionaire a specified time frame in which to remedy the default.

If a concession holder does not carry out exploration and exploitation activities for two continuous years within the first 11 years of its concession title, it will be required to pay an additional charge equal to 50% of the two-year concession duty. The concession duty increases to 100% for continued inactivity after the 12th year. Payment of the additional concession duty is due 30 days after the end of the two-year period.

In Mexico, there are no limitations on the total amount of mining concessions or on the amount of land that may be held by an individual or a company. Excessive accumulation of concessions is regulated indirectly through the duties levied on the property and the production and exploration requirements as outlined above.

Mexican mining law requires the payment of a discovery premium related to National Mineral Reserves, Concessions in Marine Zones, and Allotments to the Council of Mineral Resources.

Environmental protection regulations in Mexico require permits for mine operations, for operating a processing plant, for the discharge and/or deposition, and for changes to grandfathered projects. There are four government departments that deal with and regulate such affairs.

On January 1, 2014, the corporate tax rate was increased from 28% to 30%.

Mining companies are subject to a special mining duty of 7.5% on profits derived from the sale of minerals, and an extraordinary mining duty of 0.5% on the gross value of sales of gold, silver and platinum.

| 4.F.2 |

Mining in Peru |

In Peru, the General Mining Law allows mining companies to obtain clear and secure title to mining concessions. Surface land rights are distinct from mining concessions. The government retains ownership of all subsurface land and mineral resources, but the titleholder of the concessions retains ownership of extracted mineral resources. Peruvian law requires that all operators of mines in Peru are required to have an agreement with the owners of the land surface above the mining rights or to establish an easement upon such surface for mining purposes. Mining concessions allow for both exploration and for exploitation.

Mining rights in Peru can be transferred by their private holders with no restrictions or requirements other than to register the transaction with the Public Mining Register. The sale of mineral products is also unrestricted, so there is no obligation to satisfy the internal market before exporting products.

Recently, Peru enacted a new regime of environmental laws whereby the Ministry of Energy and Mines and the Environmental Ministry have issued regulations mandating environmental standards for the mining industry. Under these standards, new mining development and production requires mining companies to file and obtain approval for an Environmental Impact Assessment, which incorporates technical, environmental and social matters, before being authorized to commence operations.

| Great Panther Silver Limited | 22 |

| Annual Information Form for the year ended December 31, 2017 | |

The Environmental Evaluation and Oversight Agency (“OEFA”) monitors environmental compliance. OEFA has the authority to carry out audits and levy fines on companies if they fail to comply with prescribed environmental standards. The following permits are generally needed for a project: Certificate for the Inexistence of Archaeological Remains ("CIRA"); Environmental Impact Assessment; Mine Closure Plan; Establishment of a Financial Guarantee for Closure; Beneficiation Concession; Mining Transportation Concession; Permanent Power Concession; Water Usage Permits; Easements and Rights-of-way; District and Provincial Municipality Licenses and Construction and Operation Permits.

Companies incorporated in Peru are subject to income tax on their worldwide taxable income, while foreign companies that are located in Peru and non-resident entities are taxed on income from Peruvian sources only. The corporate income tax was reduced from 30% in 2014 to 28% in 2015 and 2016, and to 27% for 2017 and 2018. The rate will decrease to 26% in 2019 and thereafter, as part of a broader initiative to reinvigorate Peru’s economy. In general terms, mining companies in Peru are subject to the general corporate income tax regime. If the taxpayer has elected to sign a Stability Agreement, an additional 2% premium is applied on the regular corporate income tax rate. The Company has not signed a Stability Agreement. Also, 50% of income tax paid by a mine to the Central Government is remitted as “Canon” by the Central Government back to the regional and local authorities of the area where the mine is located.

In Peru, a dividend tax rate of 8.0% is imposed on distributions of profits to non-residents and domiciled individuals by resident companies and by branches, permanent establishments and agencies of foreign companies. The rate will increase to 9.3% in 2019.

Peru has a royalty referred to as the "Modified Mining Royalty" that applies to operating income at marginal rates ranging from 1% to 12%, and is payable quarterly. Operating income is defined as revenues from the sale of mineral resources, less cost of goods sold, less operating expenses, based on Peruvian statutory reporting regulations, with minor adjustments for interest and exploration expenditures.

Under the Modified Mining Royalty regime, an “operating income” to “mining operating revenue” measure (operating profit margin) is calculated each quarter and the royalty rate increases with the increase in operating margin. Although the Modified Mining Royalty is based on operating income, a company must pay at least 1% of sales, regardless of its profitability.

In addition, a Special Mining Tax (“SMT”) is a tax imposed in parallel with the Modified Mining Royalty. The SMT is applied on operating mining income based on a progressive scale, with marginal rates ranging from 2.0% to 8.4% . The SMT is also payable on a quarterly basis.

| 4.G. | ENVIRONMENTAL PROTECTION |

The Company has taken a proactive approach to managing environmental risk. It is participating in a voluntary environmental audit of its GMC and Topia operations. The outcomes of these audits are multi-year environmental programs, working in cooperation with PROFEPA to ensure compliance with regulations governing the protection of the environment in Mexico.

As at December 31, 2017, the Company had recorded a provision of $27 million on its Statement of Financial Position for the estimated present cost of reclamation and remediation expenditures associated with the future closure of its mineral properties, and plant and equipment, at the GMC, Topia and Coricancha. The estimated expenditures are to commence near the end of each mine’s useful life.

For additional discussion of environmental considerations, please refer to sections entitled “Infrastructure, Permitting and Compliance” in sections 5 and 6 of this AIF.

| 4.H. | EMPLOYEES |

The following table sets out the Company’s employees at December 31, 2017, 2016 and 2015, by legal entity.

| Great Panther Silver Limited | 23 |

| Annual Information Form for the year ended December 31, 2017 | |

| Company | 2017 | 2016 | 2015 |

| Great Panther Silver Limited | 21 | 23 | 22 |

| Metálicos de Durango SA de CV | 182 | 142 | 147 |

| Minera de Villa Seca SA de CV | 163 | 160 | 161 |

| Great Panther Coricancha SA | 40 | N/A | N/A |

| GP Finance International sàrl | 1 | 1 | 1 |

| TOTAL | 407 | 326 | 331 |

Minera Mexicana el Rosario SA de CV, Coboro Minerales de Mexico SA de CV, Great Panther Silver Peru SAC, Cangold Limited and Great Panther Finance Canada Limited do not have any employees. The increase in employees at MDU resulted from the employment of personnel for operations previously conducted by a contractor.

| 4. I. |

COMMUNITY ENGAGEMENT AND SUSTAINABLE DEVELOPMENT |

Great Panther is committed to sustainable development and believes that sharing the value created by the Company's activities contributes to the social and economic development of its host communities. The Company prioritizes social investment initiatives that contribute to improving the quality of life of the communities surrounding its operations, as well as promoting sustainable development.

The Company’s approach to sustainable development is planned to ensure that programs are designed as catalysts for mutual and lasting socio-economic benefits. These initiatives are based on active participation with host communities and aimed to contribute to healthy and sustainable societies. Great Panther believes that a two-way engagement will build trust and foster genuine collaboration with local stakeholders, and consequently relies on respectful, open and frequent communication with the members of its communities.

Stakeholder engagement and social investment programs implemented by the Company include partnerships with local governments and civil society organizations focused in three main areas: socioeconomic development, public health and safety, and natural and cultural heritage. Great Panther will prioritize social investment that continues to make positive impacts beyond its participation.

| Great Panther Silver Limited | 24 |

| Annual Information Form for the year ended December 31, 2017 | |

| 5. | MINING PROPERTIES |