Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

(Mark One)

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

FOR THE YEAR ENDED DECEMBER 31, 2011

OR

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

FOR THE TRANSITION PERIOD FROM TO

COMMISSION FILE NUMBER 001-33089

EXLSERVICE HOLDINGS, INC.

(Exact name of registrant as specified in its charter)

| DELAWARE | 82-0572194 | |

| (State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) | |

| 280 PARK AVENUE, 38TH FLOOR, NEW YORK, NEW YORK |

10017 | |

| (Address of principal executive offices) | (Zip code) | |

(212) 277-7100

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| Title of Each Class: |

Name of Each Exchange on Which Registered: | |

| Common Stock, par value $0.001 per share | NASDAQ Global Select Market |

Securities registered pursuant to Section 12(g) of the Act:

None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer | ¨ | Accelerated filer | x | |||||

| Non-accelerated filer | ¨ | Smaller reporting company | ¨ | |||||

| (Do not check if a smaller reporting company) | ||||||||

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x

As of June 30, 2011, the aggregate market value of common stock held by non-affiliates was approximately $377,789,120.

As of February 29, 2012, there were 31,402,714 shares of the registrant’s common stock outstanding (excluding 330,852 shares held in treasury and 63,834 shares of restricted stock), par value $0.001 per share.

DOCUMENTS INCORPORATED BY REFERENCE

Part III incorporates information from certain portions of the registrant’s definitive proxy statement to be filed with the Securities and Exchange Commission within 120 days after the fiscal year end of December 31, 2011.

Table of Contents

| Page | ||||||

| ITEM 1. |

1 | |||||

| ITEM 1A. |

16 | |||||

| ITEM 1B. |

31 | |||||

| ITEM 2. |

31 | |||||

| ITEM 3. |

31 | |||||

| ITEM 4. |

31 | |||||

| ITEM 5. |

32 | |||||

| ITEM 6. |

35 | |||||

| ITEM 7. |

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

37 | ||||

| ITEM 7A. |

55 | |||||

| ITEM 8. |

56 | |||||

| ITEM 9. |

Changes in and Disagreement with Accountants on Accounting and Financial Disclosure |

56 | ||||

| ITEM 9A. |

56 | |||||

| ITEM 9B. |

58 | |||||

| ITEM 10. |

59 | |||||

| ITEM 11. |

59 | |||||

| ITEM 12. |

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters |

59 | ||||

| ITEM 13. |

Certain Relationships and Related Transactions, and Director Independence |

59 | ||||

| ITEM 14. |

59 | |||||

| ITEM 15. |

60 | |||||

| 61 | ||||||

| 62 | ||||||

| INDEX TO CONSOLIDATED FINANCIAL STATEMENTS | 65 | |||||

Table of Contents

| ITEM 1. | Business |

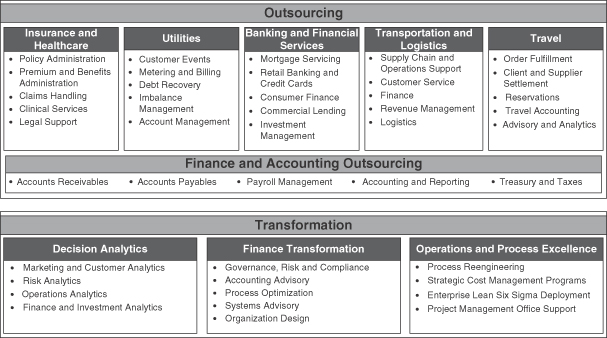

We are a leading provider of outsourcing and transformation services and focus on providing our clients with a positive business impact and enhancing their long term financial value. We customize our services to improve the economics of business performance and transform organizations to be leaner and more flexible. Our outsourcing services provide front-, middle- and back-office processing services for our primarily U.S.-based and U.K.-based clients. Outsourcing services involve the transfer to us of select business operations of a client, such as claims processing, finance and accounting and customer service, after which we administer and manage the operations for our client on an ongoing basis. We also offer a number of transformation services that include decision analytics, finance transformation and operations and process excellence services. These transformation services help our clients improve their operating environments through cost reduction, enhanced efficiency and productivity initiatives, and improve the risk and control environments within our clients’ operations whether or not they are outsourced to us. We serve primarily the needs of Global 1000 companies in the insurance and healthcare, utilities, banking and financial services, transportation and logistics and travel sectors.

Our services for each of the sectors include:

We combine in-depth knowledge of the industry sectors in which we focus with proven expertise in transferring business operations to our offshore and onshore delivery centers, and administering and managing such operations. We have successfully transferred more than 780 processes covering a broad array of products and services to our operations centers, including approximately 150 new processes that were transferred to us in 2011.

Our largest clients in 2011 were The Travelers Companies, Inc. (Travelers), Centrica plc (Centrica), and American Express Company (American Express). Other clients include 68 global insurance and healthcare companies, 27 global banks and financial services companies, six European utility companies, seven transportation and logistics services providers and a global travel management company. Our operations centers are located in India, the Philippines, the Czech Republic, the U.S., Bulgaria, Malaysia and Romania. Our geographic footprint enables us to leverage a large pool of highly qualified and educated technical professionals who are able to handle complex processes and services that require functional skills and industry expertise.

1

Table of Contents

While a majority of our professionals provide services in the English language, our operations in the Czech Republic, Bulgaria and Romania have provided us with multi-lingual delivery capabilities. We believe we can offer consistent high quality services at substantially lower costs than those available from U.S.- or U.K.-based in-house facilities or U.S.- or U.K.-based outsourcing providers. As of December 31, 2011, we had a headcount of approximately 18,900 employees, a substantial portion of whom are based in India. Our operations platforms are supported by a state-of-the-art infrastructure that can be expanded to meet each client’s needs. We market our services directly through our sales and marketing and client management teams, which operate outside of the U.S. and Europe. Our senior managers have extensive experience in the industry sectors on which we are focused and are well versed in the business practices of leading multinational corporations.

We believe our reputation for operational excellence is widely recognized by our clients and is an important competitive advantage. We use Lean and Six Sigma, which are data-driven methodologies for eliminating defects in any process, to identify process inefficiencies and improve productivity in client and support processes. We deliver continued process enhancements by soliciting and implementing process improvements from employees and through our proprietary software tools. As a part of our commitment to quality, information security and employee safety, several of our delivery centers are certified to various standards, such as the ISO 9001:2008 standard for quality management, the ISO 27001:2005 standard for our information security management system and the OHSAS 18001:2007 standard for our occupational health and safety management processes. Our client operations processes in our operations center in the Philippines are certified as compliant with the Payment Card Industry Data Security Standard. We have received an unqualified SSAE 16 (SOC I – Type II) report on general controls from Ernst & Young Pvt. Ltd., an affiliate of our independent registered public accounting firm, for several delivery centers and certain client operations processes.

Services

Outsourcing Services

Our outsourcing services are structured around industry-focused business process outsourcing (BPO) services, such as insurance and healthcare, utilities, banking and financial services, transportation and logistics and travel sectors, as well as cross-industry BPO services, such as finance and accounting services.

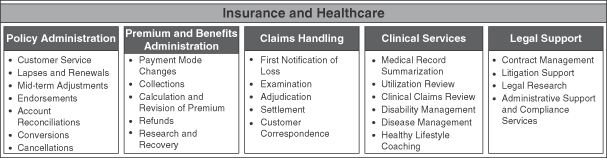

Insurance and Healthcare. Within the life insurance, property and casualty insurance, health and disability insurance and retirement services business lines, we have expertise in providing services in the areas of claims processing, premium and benefit administration, agency management, account reconciliation, policy research, underwriting support, new business processing, policy servicing, trades/sub-account transactions, add-on processing, premium audit, billing and collection and customer service. We have acquired significant experience in transferring and managing processes in these areas. As a result of our acquisition of Trumbull Services, LLC (Trumbull) on October 1, 2011 (the Trumbull Acquisition), we acquired the capability to provide subrogation services as well as access to a software platform called SubroSource™ for providing subrogation services to property and casualty insurers. In connection with our acquisition of Professional Data Management Again, Inc. (PDMA) in 2010, we acquired an insurance policy administration platform called LifePRO®. Approximately 40 insurance companies use LifePRO® to administer their life insurance, health insurance, annuities and credit life and disability insurance policies. Our services include:

2

Table of Contents

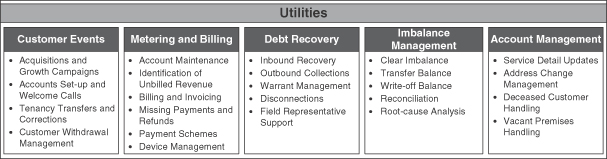

Utilities. We have expertise in providing end-to-end back-office processing for customer operations, metering-related services and billing, debt recovery operations, imbalance management and account management. A large part of these services involves complex processing of transactions that cannot be managed by customary tools or methodologies. Our services include:

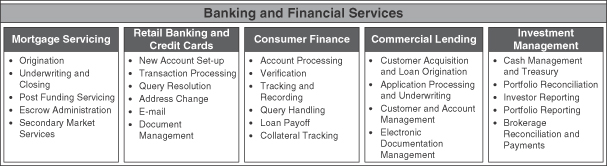

Banking and Financial Services. We have expertise in servicing and processing various banking products, including residential mortgage lending, retail banking, credit cards, consumer finance, commercial lending and investment management. Our services include:

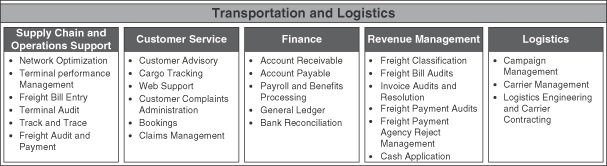

Transportation and Logistics. We have expertise in processing transactions, including end-to-end supply chain management, warehousing, transloading, transportation management and international logistics services. Our services include:

3

Table of Contents

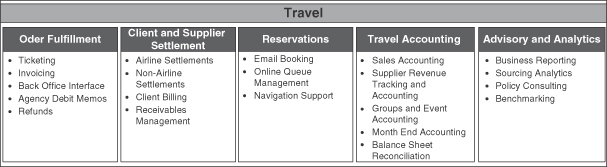

Travel. We have expertise in managing and improving operational, financial and analytical functions for travel management companies. We offer similar services to other travel industry participants, such as airlines, hotels, cruise operators, global distribution systems companies and shipping. Our services include:

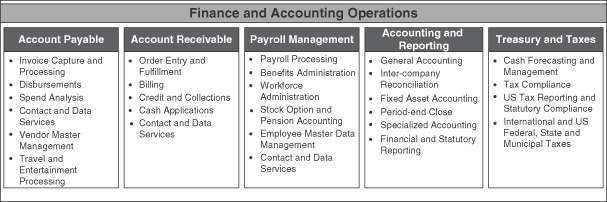

Finance and Accounting. We have expertise in providing finance and accounting services, including accounts payable, accounts receivable, inter-company reconciliations, financial and statutory reporting, treasury management and tax compliance. In connection with our acquisition of Business Process Outsourcing, Inc. (OPI) on May 31, 2011 (the OPI Acquisition), we enhanced our finance and accounting outsourcing capabilities and acquired proprietary technology tools. We also increased our onshore outsourcing presence in the U.S. Our services include:

Transformation Services

We offer a number of service offerings that we refer to collectively as transformation services. These offerings include decision analytics, finance transformation and operations and process excellence services.

These transformation services focus on helping our clients by improving their operating environments through cost reduction, enhanced efficiency, higher productivity, improved effectiveness of business decisions and improved risk and control environment within our clients’ operations whether or not they are outsourced to us. Our transformation services have enabled us to expand our client base by providing complementary service offerings to our clients and also to migrate clients into our BPO services. We have experienced a significant increase in demand for our annuity-based transformation services, which are engagements that are contracted for periods of one year or more. We actively cross-sell and, where appropriate, integrate our transformation services with our BPO services as part of an integrated solution for our clients. Our transformation services team is comprised of over 850 professionals who provide services at our clients’ locations or from our offshore delivery centers.

4

Table of Contents

Decision Analytics

We offer decision analytics services, including data filtering, organization and synthesis, management information system reporting, trend and variance analysis, statistical and econometric modeling and economic and financial markets research. Our decision analytics services access and analyze large volumes of data from multiple sources in order to understand historical performance or behavior to predict particular outcomes. We utilize the insights that we generate to assist our clients in making better business decisions, which should lead to tangible financial benefits.

Our decision analytics services include analytical consulting, management consulting and analytical services. Analytical consulting and management consulting services include advising our clients on customer acquisition and retention, credit risk, customer data integration and fraud detection, marketing strategy, product and service strategy, volume forecasting, social media analytics, global resource optimization and scheduling. Analytical services include end-to-end marketing campaign management, advanced text mining, collections services, primary and secondary research, data management and actuarial analysis. Our offerings emphasize our expertise within our industry focus areas which are complemented by quantitative modeling, proprietary intellectual property, business intelligence techniques, technology tools and methodologies to deliver optimal results with faster turnaround times for our clients.

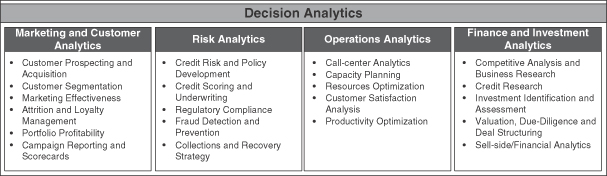

We deliver these services through a team of industry specialists and graduates with mathematical, statistical, engineering, economics, business or accounting backgrounds. Most of our decision analytics team members have received post-graduate degrees in business or other quantitative or financial disciplines. Our services include:

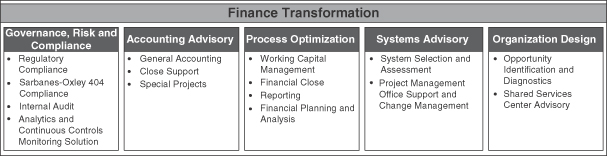

Finance Transformation

As part of our finance transformation services, we evaluate the efficiency, effectiveness and internal controls of our clients’ finance and accounting processes, systems and organization through various diagnostic methods. We also provide advisory and implementation support for process improvement, systems implementation, performance management, process consolidation and outsourcing.

We also offer governance, risk and compliance services as well as accounting and financial reporting advisory services. Our governance, risk and compliance services include compliance support, internal audit and controls monitoring services. Compliance support services include implementation and controls testing services that assist our clients with their efforts to comply with laws and regulations, such as the Sarbanes-Oxley Act of 2002, the Bank Holding Company Act of 1956, the EU’s Data Protection Directive and Solvency II standards, the regulations of the UK’s Financial Services Authority and industry standards such as the Payment Card Industry Data Security Standard. We also provide advisory services, which include support for our clients’ internal audit departments, design and implementation of enterprise and operational risk management programs, and risk and control analytics and reporting. In addition, we provide assistance with automation and monitoring of compliance programs and controls, implementation of specialized risk management compliance tools and services designed to optimize the efficiency and effectiveness of risk management and compliance processes.

5

Table of Contents

Our accounting and financial advisory reporting services include transaction assurance, general accounting, financial reporting and finance and accounting process optimization services. Our transaction assurance services include account reconciliation and transaction data analysis. In addition, we provide financial statement analysis and preparation assistance for regulatory reports and filings. Many of our professionals who provide these services are certified accountants, internal auditors and process and technology experts. Our services include:

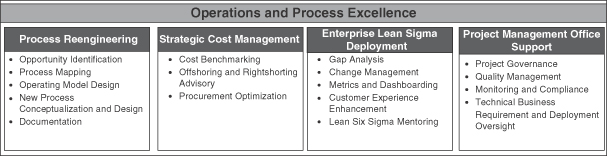

Operations and Process Excellence Services

We assist clients in understanding, controlling and improving their business processes with a view to improving effectiveness at optimized cost. We utilize Lean and Six Sigma methodologies to advise our clients on strategic cost management where we identify areas to reduce costs and subsequently manage the implementation of our recommendations. Our services also identify business processes that can be improved by documenting processes, creating standard operating procedures, defining metrics and evaluation criteria as well as creating customized dashboards and reporting using our proprietary methodology. By diagnosing existing processes, we are able to assist our clients in improving their processes by modifying, eliminating or automating certain activities.

Geographic and Segment Information

Please see the disclosures in Notes 4 and 16 to our consolidated financial statements for segment and geographic information regarding our business.

Business Strategy

Our goal is to continue to be a leading provider of outsourcing and transformation services in the industry sectors on which we are focused. Specific elements of our growth strategy include:

Creating Positive Business Impact for Clients by Offering a Broad Range of Outsourcing and Transformation Services

In servicing our clients, we seek to differentiate ourselves by emphasizing the broad range of outsourcing and transformation services that we provide, including BPO, decision analytics, finance transformation and operations and process excellence services. We believe that clients are increasingly viewing their service

6

Table of Contents

providers as long-term partners that provide a full range of service offerings. We intend to deploy a combination of operational levers such as analytics, technology platforms, Lean and Six Sigma methodologies as well as leverage our global geographical presence to create a positive business impact for our clients’ businesses. We intend to improve our clients’ businesses through tangible measures such as revenue enhancement, revenue leakage prevention, cost reduction, write-off reduction, expense leakage prevention and working capital reduction.

Utilizing Innovative Approaches in our Service Delivery to Enhance Margin Sustainability

We believe that we can better enhance our margin sustainability by utilizing innovative approaches in our service delivery. Successful innovative approaches will require the use of acquired or owned intellectual property, methodologies and analytical models as well as a range of proprietary technology tools, and licensed and software platforms. In this light, we have significantly increased our proprietary technology tools and platforms through a combination of acquisitions and in-house development. For example, our proprietary Freight Bill Audit and Payment platform automates the process of receiving and validating customer invoices, and processing exceptions for our clients in the transportation and logistics sectors. We also acquired the LifePRO® platform and obtained access to the SubroSourceTM platform for our clients in the insurance and healthcare sectors in connection with our respective acquisitions of PDMA and Trumbull. We also employ data-driven methodologies, such as Lean and Six Sigma, to better identify process inefficiencies and improve productivity in client and support processes.

In addition, we believe that the increased utilization of transaction-based pricing models, supplemented by these innovative tools and methodologies, may also enhance the sustainability of our margins while delivering increased value to our clients. Currently, a majority of our revenues are billed to our clients on a time and materials basis. We intend to increase the number of processes in which we utilize transaction-based pricing to better align our incentives with our clients, thereby assisting them with variable cost structures and driving service improvements.

Extending Our Industry Expertise

We have developed expertise in transferring and servicing more than 780 BPO processes to our operations centers, including more than 480 processes in the insurance and healthcare industry. This expertise continues to distinguish us from other providers of BPO services and has established our reputation as a leading provider of BPO services. We intend to continue to strengthen our processing capabilities by focusing on the more complex and value-enhancing services that are common to these sectors. We intend to selectively identify industry-specific technologies and intellectual property we can use to develop greater levels of domain expertise and provide a wide range of outsourcing and transformation services. Our industry-specific academics provide domain training to employees providing services to clients in those industries.

Continuing to Focus on Complex Processes

We intend to continue to leverage our industry expertise to provide increasingly more complex services for our clients. As a result of our established and developing industry expertise and knowledge of our clients’ businesses and processes, our employees are able to handle processes that are non-routine and that cannot be readily automated or transferred to other parties. Examples of our newest outsourcing processes include auditing of insurance premiums, providing support for clients who are underwriting business and personal insurance, analyzing invoices based on loss experience history, reviewing gas metering arrangements, verifying and settling cargo loss claims and calculating and recovering overpayments. Recent transformation services include proprietary solutions in social media analytics, healthcare analytics and advanced text mining capabilities.

7

Table of Contents

Maintaining Our Focus on Large-scale, Long-term Relationships

We intend to continue to maintain our focus on large-scale, long-term client relationships. We believe there are significant opportunities for additional growth with our existing clients, and we seek to expand these relationships by increasing the depth and breadth of the services we provide. This strategy should allow us to use our in-depth client-specific knowledge to provide more fully integrated outsourcing and transformation services and develop closer relationships with our clients. However, we will also continue to initiate long-term relationships with small and medium sized companies in our focus industries and expand our relationships with such companies over time.

Expanding Our Client Base

We intend to develop long-term relationships that present recurring revenue opportunities with new clients by leveraging our industry experience and expanding our marketing activities in a manner designed to strengthen, encourage and accelerate long-term relationship building. We continue to target Global 1000 companies that have the most complex and diverse processes and, accordingly, stand to benefit significantly from our services. We believe that our geographically distributed network of operations centers will enable us to expand our client base and range of services. In developing new client relationships, we continue to be highly selective and seek industry-leading clients who are committed to long-term, strategic relationships with us.

Continuing to Invest in Operational Infrastructure

We intend to continue to invest in infrastructure, including human resources, process optimization and delivery platforms, to meet our growing client requirements. We intend to further refine and supplement the innovative methods we use to recruit, train and retain our skilled employees. We intend to continue focusing on recruiting highly qualified employees and developing our employees’ leadership skills through specialized programs, rigorous promotion standards, industry-specific training and competitive compensation packages that include incentive-based compensation. During 2011, we expanded our operation center located in a special economic zone (a SEZ) in Noida, India. We commenced operations in Hartford, Connecticut, Dallas, Texas Richmond, Virginia and Jersey City, New Jersey in the U.S., Bengaluru and Kochi in India, Sofia and Verna in Bulgaria and Kuala Lumpur in Malaysia.

Pursuing Strategic Relationships and Acquisitions

We intend to continue to selectively consider strategic relationships with industry leaders that add new long-term client relationships, enhance the depth and breadth of our services or complement our business strategy. We also intend to selectively consider acquisitions, partnerships or investments that will expand the scope and effectiveness of our services by adding proprietary technology assets and intellectual property, add new clients or allow us to enter new geographic markets. On May 31, 2011, we acquired OPI, a leading global provider of finance and accounting outsourcing services with approximately 3,700 employees in the U.S., Europe and Asia serving roughly 80 clients. On October 1, 2011, we acquired Trumbull, a market leader in subrogation services for property and casualty insurance companies.

Other Information

ExlService Holdings, Inc. was incorporated in Delaware on October 29, 2002.

The Company files annual, quarterly and current reports, proxy statements and other information with the Securities and Exchange Commission (the SEC) under the Securities Exchange Act of 1934, as amended (the Exchange Act). You may read and copy this information at the Public Reference Room of the SEC, Room 1580, 100 F Street, N.E., Washington, D.C. 20549. You may obtain information about the Public Reference Room by calling the SEC at 1-800-SEC-0330. In addition, the SEC maintains a website (http://www.sec.gov) that contains reports, proxy and information statements, and other information regarding issuers that file electronically through the EDGAR System.

8

Table of Contents

The Company also maintains a website at http://www.exlservice.com. The Company makes available, free of charge, on its website its annual reports on Form 10-K, quarterly reports on Form 10-Q, proxy statements, current reports on Form 8-K and amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Exchange Act, as soon as reasonably practicable after such reports are electronically filed with, or furnished to, the SEC.

The BPO Industry

BPO service providers work with clients to develop and deliver business operational improvements with the goal of achieving higher performance at lower costs. Outsourcing can enable organizations to enhance profitability and increase efficiency and reliability, permitting them to concentrate on their core areas of competence. BPO is a long-term strategic commitment for companies that, once implemented, is generally not subject to cyclical spending or information technology budget reductions. Organizations outsource their key business processes to third parties to reduce costs, improve process quality, handle increased transaction volumes and reduce redundancy. Increased global demand, cost improvements in international communications and the automation of many business services have created a significant opportunity for offshore business process service providers, and many companies are moving select office processes to providers with the capacity to perform these functions from overseas locations.

Companies have historically also used outsourcing to drive revenue growth by expanding service offerings that otherwise would be too costly to administer or through enhanced receivable collections that would not be cost-efficient to pursue using internal staff. We believe the demand for BPO services will be primarily led by industries that are transaction-driven and that require significant customer interactions, such as insurance and healthcare, utilities, banking and financial services, transportation and logistics and travel services. The high cost of servicing a large number of small customer accounts makes outsourcing a compelling strategic alternative for these industries.

Trend Toward Offshore Delivery of BPO Services

Global demand for high quality, lower-cost BPO services from external providers, combined with operational and cost improvements in international telecommunications and the automation of many business services, have created a significant opportunity for BPO service providers that are able to take advantage of an offshore talent pool. Many companies are moving selected front-, middle- and back-office processes to providers with the capacity to perform these functions from overseas locations.

Over the past decade, India and the Philippines have emerged as preferred locations for organizations planning to outsource services ranging from insurance claims processing, payroll processing, medical transcription, customer relationship management to back-office operations such as accounting and data processing, filtering and organization. India currently accounts for the largest share of the offshore BPO services market. Recently, in order to take advantage of multiple language capabilities and large educated talent pools at competitive costs, companies have engaged service providers with operations in other geographies such as Eastern Europe and Latin America.

Sales and Marketing and Client Management

We market our services to our existing and prospective clients through our sales and client management teams, which are aligned by industry verticals and cross-industry domains such as finance and accounting. Our sales and client management teams operate from the U.S. and Europe and are supported by our business development team, which operates from the U.S. and India. In 2011, we strengthened our marketing efforts with new leadership, an expanded team and the execution of integrated marketing campaigns. The U.S.-based marketing team drives the marketing initiatives of sales and client management teams across industry verticals and domains.

9

Table of Contents

Our sales, marketing and business development teams are responsible for new client acquisitions, public relations, relations with outsourcing advisory companies, brand awareness and participation in industry forums and conferences in the U.S., Europe and India. Our sales, marketing and business development teams identify prospective clients based on selective criteria that apply our industry expertise to the prospective client’s business lines, goals and operating constraints, and qualify the long-term relationship potential with the client. Our client relationships vary from a single discrete process to multiple complex integrated processes.

Our client management team is responsible for managing client relationships, understanding client needs and developing customized services that create value for clients from our suite of outsourcing and transformation services. Each strategic client relationship is assigned a team that consists of members from the client management team, an operations delivery leader, a member of our transformation services group and a member of our technology team. Members of the client management team work closely with the delivery team to ensure high levels of client satisfaction and are also responsible for business expansion and revenue growth of their respective client accounts.

Our sales and client management professionals focus on identifying, qualifying and initiating discussions with our current and prospective clients. They operate collaboratively with our business development team which prepares responses to requests for proposals, hosts client visits to our facilities and coordinates due diligence on processes to be outsourced to us.

As of December 31, 2011, we employed 67 sales, marketing, business development and client management professionals in the U.S., India and Europe. Each professional has significant experience in global outsourcing and expertise in identifying outsourcing opportunities and process migration. Our sales, client management, marketing and business development teams work actively with our service delivery team as the sales process moves closer to the client’s final decision to either select or expand a service provider relationship. The client executive or sales executive works with the service delivery team to define the scope, services, assumptions and execution strategies for each proposed project and to develop project estimates, pricing and sales proposals. Senior management reviews and approves each proposal. The selling cycle varies depending on the type of service required, generally ranging from six months to eighteen months.

Members of our sales, client management, marketing and business development teams remain actively involved in a project through the execution phase. Each client team consists of a corporate sponsor, executive steering committee, operations leadership team and, in some cases, a dedicated human resources, technology and infrastructure team.

Clients

We currently have approximately 200 clients. Our largest clients in 2011 were Travelers, Centrica and American Express, which together accounted for approximately 31.8% of our total revenues in 2011. Other clients include 68 global insurance and healthcare companies, 27 global banks and financial services companies, six European utility companies, seven transportation and logistics services providers and a global travel management company. While we are developing relationships with new clients and expect to continue to diversify our client base, we believe that the loss of any of our three largest clients could have a material adverse effect on our financial performance. See “Item 1A. Risk Factors—Risks Related to Our Business—We have a limited number of clients and provide services to few industries. In 2011, approximately 31.8% of our total revenues came from three clients.”

Our long-term relationships with our clients typically evolve from providing a single, discrete process into providing a series of complex, integrated processes across multiple business lines. For outsourcing services, we enter into long-term agreements with our clients with typical initial terms of between three and eight years. Agreements for transformation services generally have shorter initial terms. Each agreement is individually negotiated with the client.

10

Table of Contents

We provide services to Travelers under a services agreement and work assignments and orders generated thereunder. Although the services agreement does not have a fixed term, the work assignments and work orders expire in December 2013 and renew every year thereafter unless either party elects not to renew within a specified period before the next renewal date. Travelers may terminate the services agreement, or any work assignment or work order, without cause upon 60 days prior notice.

We provide services to Centrica under a services agreement that expires in April 2015. Centrica has the option to extend the contract for two annual extension periods. This contract can be terminated by Centrica without cause upon three months prior notice and payment of a breakup fee. See “Item 1A. Risk Factors—Risks Related to Our Business—Our client contracts contain certain termination provisions that could have an adverse effect on our business, results of operations and financial condition.”

We provide services to American Express under a separate agreement for each of our outsourcing services and transformation services. The master services agreement for our outsourcing services provides a minimum volume commitment over a period of eight years until February 2018 and renews automatically for successive twelve month periods unless either we or American Express provides notice six months prior to the expiration of the initial term. The master services agreement for our outsourcing services cannot be terminated by American Express without cause. The master agreement for our transformation services may be terminated by American Express without cause upon five days prior written notice.

In addition, our agreements generally limit our liability to our clients to a maximum amount, subject in many cases to certain exceptions such as indemnification for third-party claims and breaches of confidentiality. In order to meet the specific needs of our clients, we enter into contracts with varying contractual provisions.

Competition

Competition in the BPO services industry is intense and growing. See “Item 1A. Risk Factors—Risks Related to Our Business—We face significant competition from U.S.-based and non-U.S.-based outsourcing and information technology companies and from our clients, who may perform outsourcing services themselves, either in-house, in the U.S. or through offshore groups or other arrangements.” Many companies, including certain of our clients, choose to perform some or all of their customer service, collections and back-office processes internally. Their employees provide these services as part of their regular business operations. Some companies have moved portions of their in-house customer management functions offshore, including to offshore affiliates. We believe our key advantage over in-house business processes is that we give companies the opportunity to focus on their core products and services while we focus on service delivery and operational excellence. We believe that clients who operate a hybrid business model—partnering with external BPO providers while handling other BPO functions in-house—have the opportunity to benchmark the performance of their internal BPO operations against ours.

We compete primarily against:

| • | BPO service companies based in offshore locations, particularly India, such as Genpact Limited and WNS (Holdings) Limited; |

| • | the BPO divisions of large information technology, or IT, service companies and global BPO services companies, such as Accenture, Cognizant Technology Solutions and International Business Machines; |

| • | small, niche service providers that provide services in a specific geographic market, industry or service area; and |

| • | leading accounting and management consulting firms. |

We compete against these entities by establishing ourselves as a service provider with deep industry expertise, superior operational capabilities and process expertise, and unique transformation service capabilities, which enables us to respond rapidly to market trends and the evolving needs of our clients in this sector. See

11

Table of Contents

“—Business Strategy—Creating Positive Business Impact for Clients by Offering a Broad Range of Outsourcing and Transformation Services,” “—Extending Our Industry Expertise” and “—Continuing to Focus on Complex Processes.”

We expect that competition will increase. A significant part of our competitive advantage has historically been a wage cost advantage relative to companies in the U.S. and Europe and the ability to attract and retain highly experienced and skilled employees. We believe, however, that as a result of rising wage costs in India and other locations of our operations centers and the infrastructure improvements that are taking place in other emerging markets around the world, our ability to compete effectively will increasingly depend on our ability to provide high quality, on-time, complex services that require expertise in certain technical areas, to utilize proprietary tools, technologies and methodologies and to expand geographically.

Intellectual Property

We generally use our clients’ software systems and third-party software platforms to provide our services. We customarily enter into licensing and nondisclosure agreements with our clients and third parties with respect to the use of their software systems and platforms. Our contracts usually provide that all intellectual property created specifically for use of our clients will automatically be assigned to our clients.

Our principal intellectual property consists of proprietary software, proprietary and accessed platforms and the know-how of our management. We have received approvals for several trademark applications, including applications for our logo and mark, with the U.S. Patent and Trademark Office and the U.K. Trademark Office. In addition, we have filed trademark applications for certain marks in several jurisdictions. We consider our business processes and implementation methodologies to be confidential, proprietary information and to include trade secrets that are important to our business. Clients and business partners sign a nondisclosure agreement requiring confidential treatment of our information. Our employees are also required to sign confidentiality agreements as a condition to their employment.

Technology

We have a well-developed international telecommunications capacity to support our business operations. We use an international network from India, the Philippines, the Czech Republic, Bulgaria, Romania and Malaysia to connect to our points of presence in the U.S. and the U.K. Our networking and telecommunications hubs are situated in Sunnyvale, California, Jersey City, New Jersey and New York, New York, providing technology interface locations on the east and west coasts of the U.S. Our business continuity management plan includes plans to eliminate certain risks inherent in critical applications by building redundancies and resilience into the connectivity and telecommunications infrastructure, network, systems, power availability, transportation, physical security, and trained manpower availability, as well as utilizing distributed computing.

To increase stable data and telecommunications capacity, we lease bandwidth from a number of different providers globally. Currently, we have a bandwidth of over 620 megabits-per-second, or Mbps, in the U.S. and over 275 Mbps in the U.K. and Europe, which we believe is adequate for our business. We have implemented multiprotocol label switching and internet based connectivity across all processing centers and technology hubs, which should allow seamless transition from one center to the other in case of an outage.

Our infrastructure is built on industry standards and we work closely with several leading original equipment manufacturers and principal technology partners. The robustness of our telecommunications network has allowed us to achieve an average network availability of over 99.7% for day-to-day operations.

We customize our technology solutions in line with our clients’ business and outsourcing requirements. Our technology teams are comprised of expert professionals from technology project management, infrastructure management, information security and technology operational service delivery, thereby permitting us to adapt our infrastructure services to our clients through various phases of our client engagements. We seek to

12

Table of Contents

understand our clients’ business and outsourcing requirements and their process platforms, develop and implement customized services to our clients and deliver reliable services that facilitate the offshore conduct and management of their business processes.

We have the following systems in place to protect the privacy of our clients and their customers and to ensure compliance with the laws and regulations governing our activities:

| • | our information security policies comply with International Standards, including ISO 27001, for optimal management of various aspects of information security, including personnel, physical, systems and operations center security; |

| • | our information security framework addresses compliance requirements and protection of our clients’ and their customers’ information; |

| • | specific provisions for complying with the FDIC Safe Harbor Provisions, the Gramm-Leach-Bliley Act, the Health Insurance Portability and Accountability Act, the EU Privacy Directive and other client-specific needs; |

| • | information systems teams formed for each client for the development, implementation and coordination of policies and procedures specific to that client’s processes; and |

| • | periodic internal and external audits and vulnerability assessments of both our information security management system and implemented controls. |

Process Compliance and Management

We have an independent quality compliance team to monitor, analyze, provide feedback on and report process performance and compliance. In addition, we have a customer experience team to assess and improve end-customer experience for all processes. Currently, we have over 350 quality compliance analysts and customer experience analysts.

For some of our operations processes, we report process performance on B-ProMPT, a web-based application accessible by both our clients and us. B-ProMPT includes process control capabilities such as digital dashboards for evaluating process management and performance at any level within an organization, including tracking the individual performance of agents, supervisors and other employees. B-ProMPT includes advanced analytics capacity to provide Six Sigma-based process analysis, including trend analysis, distribution analysis and correlation analysis and tracking.

Employees

As of December 31, 2011, we had a headcount of approximately 18,900 individuals, a substantial portion of whom are based in India. We have approximately 600 employees in the U.S. and the U.K., approximately 1,500 employees in the Philippines and an aggregate of approximately 600 employees in the Czech Republic, Bulgaria and Romania. Our employees are not unionized. We have never experienced any work stoppages and believe that we enjoy good employee relations.

Hiring and Recruiting

Our employees are critical to the success of our business. Accordingly, we focus heavily on recruiting, training and retaining our professionals.

We have developed effective strategies that enable an efficient recruitment process. We have approximately 85 employees dedicated to recruitment. Some of the strategies we have adopted to increase efficiency in our hiring practices include online voice assessment and a centralized hiring center. Our hiring policies focus on identifying high quality employees who demonstrate a propensity for learning, contribution to client services and

13

Table of Contents

growth. Candidates must undergo numerous tests and interviews before we extend offers for employment. We also conduct extensive background checks on candidates, including criminal background checks as required by clients or on a sample basis. In addition, we perform random drug testing on the workforce on a regular basis. In 2011, we received more than 45,000 applications for employment and hired approximately 9,000 new professionals. We also have an employee referral program that provides us with a cost effective way of accessing qualified potential employees.

We offer our professionals competitive compensation packages that include significant incentive-based compensation and offer a variety of benefits, including free transport to and from home in certain circumstances, subsidized meals and free access to recreational facilities that are located within some of our operations centers. Our turnover rate for billable employees—employees who execute business processes for our clients following the completion of our six-month probationary period—has reduced from approximately 34.4% for the year ended December 31, 2010 to approximately 31.2% for the year ended December 31, 2011. The reduced turnover rate is largely attributable to an increase in employee engagement initiatives and reduced employment opportunities as a result of the economic environment in India and the Philippines, where a substantial portion of our professionals are based. However, as competition in our industry increases, our turnover rate could increase. See “Item 1A. Risk Factors—Risks Related to Our Business—We may fail to attract and retain enough sufficiently trained professionals to support our operations, as competition for highly skilled personnel is intense and we experience significant employee turnover rates.”

Training and Development

We dedicate significant resources to the training and development of our professionals. On December 31, 2011, we had over 290 certified trainers. Our trainers work with professionals in our recruitment, operations and quality control teams to create an end-to-end process for value addition, skill evaluation, skill enhancement and certification. We also use training to provide continuity by linking skill assessment at the point of recruitment to subsequent assessment and on-the-job training.

We customize our training to country, client, industry and service, closely collaborating with the client throughout the training process. Approximately 4,000 employees received training for the insurance and healthcare industry and processes at the insurance academy established by us in 2009. Our finance and accounting academy, inaugurated in November 2011, has trained approximately 200 employees in basic accounting, payroll and taxation. Training for new employees includes culture, voice and accent training. We also have ongoing training that includes refresher training programs and personality development programs. We develop our employees’ leadership skills through various capability development programs, talent identification and performance management mechanisms, and significant monetary and non-monetary incentives. In 2011, we placed an increased focus on capability development initiatives using an electronic learning platform to supplement our traditional instructor led programs. The overall participation in various programs administered in 2011 resulted in approximately 32,000 days of training and covered over 9,000 employees. We have also created career development programs for our middle and junior level management employees, helping them define and identify their career paths within the company. In 2011, we provided training to over 1,200 of our junior and middle managers at the EXL School of Management Development, which was launched in 2010.

In February 2012, we inaugurated the EXL Center for Talent in Noida, India, our first facility exclusively dedicated to recruitment, capability enhancement and talent development.

Regulation

Because of the diversity and highly complex nature of our service offerings, our operations are subject to a variety of rules and regulations and several U.S. and foreign federal and state agencies regulate aspects of our business. In addition, our clients may contractually require that we comply with certain rules and regulations, even if those rules and regulations do not actually apply to us. Failure to comply with any applicable laws and

14

Table of Contents

regulations could result in restrictions on our ability to provide our products and services, as well as the imposition of civil fines and criminal penalties, which could have a material adverse effect on our operations.

We are one of the few service providers that can provide third-party administrator insurance services from India in 44 states of the U.S. and from the Philippines in 19 states of the U.S., having been licensed or exempted from, or not subject to, licensing in each of those states, which may help make us an attractive service provider to future clients. Additionally, we are also licensed to provide third-party administrator services from the U.S. in 30 states of the U.S.

Our debt collection services may be subject to the Fair Debt Collection Practices Act, which regulates debt collection practices. In addition, many states require a debt collector to apply for, be granted and maintain a license to engage in debt collection activities within a state. We are currently licensed (or exempt from licensing requirements) to provide debt collection services from India in all but two states in the U.S. and from the Philippines in 35 states of the U.S. that have non-exempt requirements and have separate conditional exemptions with respect to our ongoing collection obligations.

Our operations are also subject to compliance with a variety of other laws, including federal and state regulations, that apply to certain portions of our business, such as the Fair Credit Reporting Act, the Gramm-Leach-Bliley Act, the Health Insurance Portability and Accountability Act of 1996, the HITECH Act of 2009, the Truth in Lending Act, the Fair Credit Billing Act and U.S. Federal Deposit Insurance Company, or FDIC, rules and regulations. We must also comply with applicable regulations relating to healthcare and other personal information that we process as part of our services. Additionally, our client contracts may specify other regulatory requirements we must meet in connection with the services we provide. We provide our employees with training for applicable laws and regulations.

Regulation of our business by the Indian government affects us in several ways. We previously benefited from certain tax incentives promulgated by the Indian government, including a tax holiday from Indian corporate income taxes for the operation of some of our Indian operations centers. The tax benefit for some of our operations centers in India had already expired in 2010 and for most of our other operations centers expired on April 1, 2011. Our operations centers in Jaipur and Noida, which were established in SEZs in 2010, are eligible for tax incentives until 2020. As part of the OPI Acquisition, we also acquired operations centers in Bengaluru and Kochi, India that are also established in SEZs. The operations center in Bengaluru will complete its first five years of operations on March 31, 2012. Under the tax regulations, the Bengaluru operations center will be entitled to a 50% tax exemption on profits from April 1, 2012, after which there will be an increase in the tax expense for such center. We anticipate establishing additional operations centers in SEZs in the future. We also benefit from certain tax incentives for our operations in the Philippines. See “Item 1A. Risk Factors—Risks Related to the International Nature of our Business—Our financial condition could be negatively affected if foreign governments reduce or withdraw tax benefits and other incentives currently provided to companies within our industry, or if the same are not available for other reasons.” Our subsidiaries in India are also subject to certain currency transfer restrictions. See “Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations—Foreign Exchange” and “—Income Taxes.”

15

Table of Contents

| ITEM 1A. | Risk Factors |

Risks Related to Our Business

We have a limited number of clients and provide services to few industries. In 2011, approximately 31.8% of our total revenues came from three clients.

We have derived and believe that we will continue to derive a substantial portion of our total revenues from a limited number of large clients. In 2011, our three largest clients Travelers, Centrica and American Express, accounted for approximately 31.8% of our total revenues. We generated 11.6% of our total revenues in 2011 from Travelers, 10.8% of our total revenues in 2011 from Centrica and 9.4% of our total revenues in 2011 from American Express. We provide services to Travelers under a services agreement and work assignments and orders generated thereunder. Although the services agreement does not have a fixed term, the work assignments and work orders expire in December 2013 and renew every year thereafter unless either party elects not to renew within a specified period before the next renewal date. Travelers may terminate the services agreement, or any work assignment or work order, without cause upon 60 days prior notice. We provide services to Centrica under an agreement that expires in April 2015. Centrica will have the option to extend the contract for two annual extension periods. This contract can be terminated by Centrica without cause upon three months prior notice and payment of a breakup fee. We provide services to American Express under a separate agreement for each of our BPO services and our transformation services. The agreement for transformation services can be terminated by American Express without cause upon five days prior written notice. We expect that a significant portion of our total revenues will continue to be contributed by a limited number of large clients in the near future. The loss or financial difficulties of either of our large clients would have a material adverse effect on our business, results of operations, financial condition and cash flows.

General economic and business conditions could negatively affect our business in multiple ways.

The recent global economic downturn adversely impacted companies in the industries to which we provide services, including the banking, financial services and insurance industries. In 2011, approximately 55.1% of our total revenues were derived from clients in those industries, including 48.5% of our total revenues that were derived from clients in the insurance industry. Our business largely depends on continued demand for our services from clients and potential clients in these industries. Adverse developments in these industries or the other select industries to which we provide services could further unfavorably affect our business. In particular, we currently derive, and are likely to continue to derive, a significant portion of our revenues from clients located in the U.S. Any future decreases in the general level of economic activity, such as decreases in business and consumer spending, could result in a decrease in demand for our services, particularly our transformation services, thus reducing our revenue. Continued high unemployment rates in the U.S. could also adversely affect the demand for our services. Other developments in response to economic events, such as consolidations, restructurings or reorganizations, particularly involving our clients, could also cause the demand for our services to decline.

Any future disruptions in the commercial credit markets may impact liquidity in the global credit market as greatly, or even more, than in recent years, and we may not be able to predict the impact such worsening conditions will have on our targeted industries in general, and our results of operations specifically. Future turbulence in global markets and economies may adversely affect our liquidity and financial condition, and the liquidity and financial condition of our clients, and they may limit our ability to access financing or increase our cost of financing to meet liquidity needs, and affect the ability of our customers to use credit to purchase our services or to make timely payments to us, resulting in adverse effects on our financial condition and results of operations. Changes in global economic conditions could also shift demand to services for which we do not have competitive advantages, and this could negatively affect the amount of business that we are able to obtain.

Our industry may not develop in ways that we currently anticipate due to negative public reaction in the U.S. and elsewhere to offshore outsourcing, recently proposed legislation or otherwise.

We have based our strategy of future growth on certain assumptions regarding our industry and future developments in the market for outsourcing services. For example, we believe that there will continue to be

16

Table of Contents

changes in product and service requirements, and investments in the products offered by our clients will continue to increase. However, the trend to outsource business processes may not continue and could reverse. Offshore outsourcing is a politically sensitive topic in the U.S. and elsewhere, and many organizations and public figures have publicly expressed concern about a perceived association between offshore outsourcing providers and the loss of jobs in the U.S. and elsewhere. In addition, there has been limited publicity about the negative experience of certain companies that use offshore outsourcing, particularly in India. Current or prospective clients may elect to perform such services themselves or may be discouraged from transferring these services to offshore providers to avoid any negative perception that may be associated with using an offshore provider. Any slowdown or reversal of existing industry trends would harm our ability to compete effectively with competitors that operate out of facilities located in the U.S. and elsewhere.

A variety of U.S. federal and state legislation has been proposed that, if enacted, could restrict or discourage U.S. companies from outsourcing their services to companies outside the U.S. For example, legislation has been proposed that would require offshore providers to identify where they are located and that would require notice to individuals whose personal information is disclosed to non-U.S. companies. In addition, recently introduced bills have proposed providing tax and other economic incentives for companies that create employment in the U.S. by reducing their offshore outsourcing. Other bills have proposed requiring call centers to disclose their geographic locations, requiring notice to individuals whose personal information is disclosed to non-U.S. affiliates or subcontractors, requiring disclosures of companies’ foreign outsourcing practices or restricting U.S. private sector companies that have federal government contracts, federal grants or guaranteed loan programs from outsourcing their services to offshore service providers. Because most of our clients are located in the U.S., any expansion of existing laws or the enactment of new legislation restricting offshore outsourcing could adversely impact our ability to do business with U.S. clients and have a material and adverse effect on our business, results of operations, financial condition and cash flows.

In other countries, such as the U.K., which comprised 22.0% of our total revenues in 2011, there has also been some negative publicity and concern expressed regarding the possible effect of job losses caused by outsourcing. Legislation enacted in the U.K. provides that if a company transfers or outsources its business or a part of its business to a transferee or a service provider, the employees who were employed in such business are entitled to become employed by the transferee or service provider on the same terms and conditions as they had been employed before the transfer. The dismissal of such employees as a result of such transfer of business is deemed unfair dismissal and entitles the employees to compensation. As a result, we may become liable for redundancy payments to the employees of our clients in the U.K. who outsource business to us. We are generally indemnified in our existing contracts with clients in the U.K. to the extent we incur losses or additional costs due to the application of this legislation to us, and we intend to obtain indemnification in future contracts with clients. However, if we are unable to obtain indemnification in future contracts with clients, we may be liable under any agreements we enter into in the future with U.K. clients. Similar legislation has also been enacted in certain other European jurisdictions.

Our client contracts contain certain termination and other provisions that could have an adverse effect on our business, results of operations and financial condition.

Most of our client contracts may be terminated by our clients without cause and do not commit our clients to provide us with a specific volume of business. Any failure to meet a client’s expectations could result in a cancellation or non-renewal of a contract or a decrease in business provided to us. We may not be able to replace any client that elects to terminate or not renew its contract with us, which would reduce our revenues. For example, we provide services to Travelers under a services agreement that Travelers may terminate without cause upon 60 days prior notice, we provide services to Centrica under an agreement that can be terminated by Centrica without cause upon three months prior notice and payment of a breakup fee and we provide transformation services to American Express under an agreement that can be terminated by American Express without cause upon five days prior written notice. We generated 11.6% of our total revenues in 2011 from Travelers, 10.8% of our total revenues in 2011 from Centrica and 9.4% of our total revenues in 2011 from American Express. The termination of any of these contracts with or without cause could have a material adverse impact on the predictability of our expected revenue stream.

17

Table of Contents

A limited number of our contracts allow a client, in certain limited circumstances, to request a benchmark study comparing our pricing and performance with that of an agreed list of other service providers for comparable services. Based on the results of the study and depending on the reasons for any unfavorable variance, we may be required to make improvements in the services we provide or reduce the pricing for services on a prospective basis to be performed under the remaining term of the contract or our client could elect to terminate the contract, which could have an adverse effect on our business, results of operations and financial condition. Many of our contracts contain provisions that would require us to pay penalties to our clients and/or provide our clients with the right to terminate the contract if we do not meet pre-agreed service level requirements or if we do not provide certain productivity benefits. Failure to meet these requirements or accurately estimate the productivity benefits could result in the payment of significant penalties by us to our clients which in turn could have a material adverse effect on our business, results of operations and financial condition. Some of our contracts with clients specify that if a change of control of our company occurs during the term of the contract, the client has the right to terminate the contract. These provisions may result in our contracts being terminated if there is such a change in control, resulting in a potential loss of revenues. In addition, these provisions may act as a deterrent to any attempt by a third party to acquire our company.

We may fail to attract and retain enough sufficiently trained employees to support our operations, as competition for highly skilled personnel is intense and we experience significant employee turnover rates.

The BPO industry is very labor intensive and our success depends to a significant extent on our ability to attract, hire, train and retain qualified employees, including our ability to attract employees with needed skills in the geographic areas in which we operate. The industry, including us, experiences high employee turnover. In 2011, our turnover rate for billable employees was approximately 31.2%. There is significant competition for professionals with skills necessary to perform the services we offer to our clients. Increased competition for these professionals, in the BPO industry or otherwise, could have an adverse effect on us. A significant increase in the turnover rate among our employees, particularly among the highly skilled workforce needed to provide BPO services, would increase our recruiting and training costs and decrease our operating efficiency, productivity and profit margins, and could lead to a decline in demand for our services. High turnover rates generally do not impact our revenues as we factor the attrition rate into our pricing models by maintaining additional employees for each process. However, high turnover rates do increase our cost of revenues and therefore impact our profit margins due to higher recruitment, training and retention costs as a result of maintaining larger hiring, training and human resources departments and higher operating costs due to having to reallocate certain business processes among our operations centers where we have access to the skilled workforce needed for the business. In 2011, we incurred approximately $3.1 million on recruitment and approximately $1.3 million on training costs due to employee turnover, thereby increasing our costs and reducing our profit margins for that period by $4.4 million.

In addition, our ability to maintain and renew existing engagements and obtain new business will depend, in large part, on our ability to attract, train and retain personnel with skills that keep pace with the demand for outsourcing, evolving industry standards and changing client preferences. A lack of sufficiently qualified personnel could also inhibit our ability to establish operations in new markets and our efforts to expand geographically. Our failure to attract, train and retain personnel with the qualifications necessary to fulfill the needs of our existing and future clients or to assimilate new employees successfully could have a material adverse effect on our business, results of operations, financial condition and cash flows.

We have a long selling cycle for our BPO services that requires significant funds and management resources and a long implementation cycle that requires significant resource commitments.

We have a long selling cycle for our BPO services, which requires significant investment of capital, resources and time by both our clients and us. Before committing to use our services, potential clients require us to expend substantial time and resources educating them as to the value of our services, including testing our services for a limited period of time, and assessing the feasibility of integrating our systems and processes with theirs. Our clients then evaluate our services before deciding whether to use them. Therefore, our selling cycle,

18

Table of Contents

which generally ranges from six to eighteen months, is subject to many risks and delays over which we have little or no control, including our clients’ decision to choose alternatives to our services (such as other providers or in-house offshore resources) and the timing of our clients’ budget cycles and approval processes. In addition, we may not be able to successfully conclude a contract after the selling cycle is complete.

Implementing our services involves a significant commitment of resources over an extended period of time from both our clients and us. Our clients may also experience delays in obtaining internal approvals or delays associated with technology or system implementations, thereby delaying further the implementation process. Our clients and future clients may not be willing or able to invest the time and resources necessary to implement our services, and we may fail to close sales with potential clients to which we have devoted significant time and resources, which could have a material adverse effect on our business, results of operations, financial condition and cash flows.

Once we are engaged by a client, it may take us several months before we start to recognize significant revenues.

When we are engaged by a client after the selling process for our BPO services, it takes from four to six weeks to integrate the client’s systems with ours, and up to three months thereafter to build up our services to the client’s requirements. Depending on the complexity of the processes being implemented, these time periods may be significantly longer. Implementing processes can be subject to potential delays similar to certain of those affecting the selling cycle. Therefore, we do not recognize significant revenues until after we have completed the implementation phase.

We enter into long-term contracts with our BPO clients, and our failure to estimate the resources and time required for our contracts may negatively affect our profitability.

The initial terms of our BPO client contracts typically range from three to five years. In many of our BPO contracts we commit to long-term pricing with our clients and therefore bear the risk of cost overruns, completion delays, wage inflation and adverse movements in exchange rates in connection with these contracts. If we fail to estimate accurately the resources and time required for a contract, future wage inflation rates or currency exchange rates (or fail to accurately hedge our currency exchange rate exposure) or if we fail to complete our contractual obligations within the contracted timeframe, our revenues and profitability may be negatively affected.

Consistency in our revenues from period to period depends in part on our ability to reflect the changing demands and needs of our existing and potential BPO clients. If we are unable to adjust our pricing terms or the mix of products and services we provide to meet the changing demands of our BPO clients and potential BPO clients, our business, results of operations and financial condition may be adversely affected.

Most of our BPO contracts use a pricing model that provides for hourly or annual billing rates. Industry pricing models are evolving, however, and we anticipate that clients may increasingly request transaction-based or other pricing models. If we are unable to obtain operating efficiencies or if we make inaccurate assumptions for contacts with transaction-based pricing, our profitability may be negatively affected. If we are unable to adapt our operations to evolving pricing protocols, our results of operations may be adversely affected or we may not be able to offer pricing that is attractive relative to our competitors.

In addition, the BPO services we provide to our clients and the revenues and income from those services may decline or vary as the type and quantity of services we provide under those contracts changes over time, including as a result of a shift in the mix of products and services we provide. Furthermore, our clients, some of which have experienced significant and adverse changes in their prospects, substantial price competition and pressures on their profitability, have in the past and may in the future demand price reductions, automate some or all of their processes or change their outsourcing strategy by moving more work in-house or to other providers, any of which could reduce our profitability. Any significant reduction in or the elimination of the use of the services we provide to any of our clients, or any requirement to lower our prices, would harm our business.

19

Table of Contents

Our profitability will suffer if we are not able to appropriately price our services or manage our asset utilization levels.

Our profitability is largely a function of the efficiency with which we utilize our assets, and in particular our people and our operations centers, and the pricing that we are able to obtain for our services. Our asset utilization levels are affected by a number of factors, including our ability to transition employees from completed projects to new assignments, attract, train and retain employees, forecast demand for our services and maintain an appropriate headcount in each of our locations, as well as our need to dedicate resources to employee training and development and other typically non-chargeable activities. The prices we are able to charge for our services are affected by a number of factors, including our clients’ perceptions of our ability to add value through our services, substantial price competition, introduction of new services or products by us or our competitors, our ability to accurately estimate, attain and sustain revenues from client engagements, our ability to estimate resources for long-term pricing, margins and cash flows for long-term contracts and general economic and political conditions. Therefore, if we are unable to appropriately price our services or manage our asset utilization levels, there could be a material adverse effect on our business, results of operations and financial condition.

Our transformation services are cyclical and based on specific projects involving short-term contracts.