DWA 3.31.14 10Q

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

___________________________

FORM 10-Q

___________________________

QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF

THE SECURITIES EXCHANGE ACT OF 1934

For the quarterly period ended March 31, 2014

Commission File Number 001-32337

DREAMWORKS ANIMATION SKG, INC.

(Exact name of registrant as specified in its charter)

|

| |

Delaware | 68-0589190 |

(State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) |

1000 Flower Street

Glendale, California 91201

(Address of principal executive offices) (Zip code)

(818) 695-5000

(Registrant's telephone number, including area code)

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No o.

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definition of "large accelerated filer," "accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Exchange Act. (Check one):

|

| | | |

Large accelerated filer | T | Accelerated filer | o |

Non-accelerated filer | o (Do not check if a smaller reporting company) | Smaller reporting company | o |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes o No x.

Indicate the number of shares outstanding of each of the registrant's classes of common stock: As of April 18, 2014, there were 76,797,154 shares of Class A common stock and 7,838,731 shares of Class B common stock of the registrant outstanding.

TABLE OF CONTENTS

|

| | |

| | Page |

PART I. | | |

| | |

Item 1. | | |

| | |

Item 2. | | |

| | |

Item 3. | | |

| | |

Item 4. | | |

| | |

PART II. | | |

| | |

Item 1. | | |

| | |

Item 1A. | | |

| | |

Item 2. | | |

| | |

Item 5. | | |

| | |

Item 6. | | |

| | |

| |

| |

| |

Unless the context otherwise requires, the terms "DreamWorks Animation," the "Company," "we," "us" and "our" refer to DreamWorks Animation SKG, Inc., its consolidated subsidiaries, predecessors in interest and the subsidiaries and assets and liabilities contributed to it by the entity then known as DreamWorks L.L.C. ("Old DreamWorks Studios") on October 27, 2004 (the "Separation Date") in connection with our separation from Old DreamWorks Studios (the "Separation").

PART I—FINANCIAL INFORMATION

| |

ITEM 1. | FINANCIAL STATEMENTS |

DREAMWORKS ANIMATION SKG, INC.

CONSOLIDATED BALANCE SHEETS

(Unaudited)

|

| | | | | | | |

| March 31,

2014 | | December 31,

2013 |

| (in thousands, except par value and share amounts) |

Assets | | | |

Cash and cash equivalents | $ | 69,648 |

| | $ | 95,467 |

|

Trade accounts receivable, net of allowance for doubtful accounts (see Note 7 for related party amounts) | 148,922 |

| | 130,744 |

|

Receivables from distributors, net of allowance for doubtful accounts (see Note 7 for related party amounts) | 203,934 |

| | 283,226 |

|

Film and other inventory costs, net | 914,634 |

| | 943,486 |

|

Prepaid expenses | 20,236 |

| | 20,555 |

|

Other assets | 28,505 |

| | 23,385 |

|

Investments in unconsolidated entities | 44,290 |

| | 38,542 |

|

Property, plant and equipment, net of accumulated depreciation and amortization | 183,152 |

| | 186,670 |

|

Deferred taxes, net | 244,664 |

| | 221,920 |

|

Intangible assets, net of accumulated amortization | 147,605 |

| | 150,511 |

|

Goodwill | 179,294 |

| | 179,722 |

|

Total assets | $ | 2,184,884 |

| | $ | 2,274,228 |

|

Liabilities and Equity | | | |

Liabilities: | | | |

Accounts payable | $ | 5,684 |

| | $ | 5,807 |

|

Accrued liabilities | 214,861 |

| | 263,668 |

|

Payable to former stockholder | 263,390 |

| | 262,309 |

|

Deferred revenue and other advances | 29,131 |

| | 36,425 |

|

Senior unsecured notes | 300,000 |

| | 300,000 |

|

Total liabilities | 813,066 |

| | 868,209 |

|

Commitments and contingencies (Note 17) |

|

| |

|

|

Equity: | | | |

DreamWorks Animation SKG, Inc. Stockholders' Equity: | | | |

Class A common stock, par value $0.01 per share, 350,000,000 shares authorized, 104,279,149 and 104,155,993 shares issued, as of March 31, 2014 and December 31, 2013, respectively | 1,043 |

| | 1,042 |

|

Class B common stock, par value $0.01 per share, 150,000,000 shares authorized, 7,838,731 shares issued and outstanding, as of March 31, 2014 and December 31, 2013 | 78 |

| | 78 |

|

Additional paid-in capital | 1,109,461 |

| | 1,100,101 |

|

Accumulated other comprehensive loss | (468 | ) | | (600 | ) |

Retained earnings | 1,029,462 |

| | 1,072,398 |

|

Less: Class A Treasury common stock, at cost, 27,482,030 and 27,439,119 shares, as of March 31, 2014 and December 31, 2013, respectively | (769,502 | ) | | (768,224 | ) |

Total DreamWorks Animation SKG, Inc. stockholders' equity | 1,370,074 |

| | 1,404,795 |

|

Non-controlling interests | 1,744 |

| | 1,224 |

|

Total equity | 1,371,818 |

| | 1,406,019 |

|

Total liabilities and equity | $ | 2,184,884 |

| | $ | 2,274,228 |

|

See accompanying notes.

DREAMWORKS ANIMATION SKG, INC.

CONSOLIDATED STATEMENTS OF OPERATIONS

(Unaudited)

|

| | | | | | | |

| Three Months Ended |

| March 31, |

| 2014 | | 2013 |

| (in thousands, except per share amounts) |

Revenues (see Note 7 for related party amounts) | $ | 147,241 |

| | $ | 134,648 |

|

Costs of revenues | 160,689 |

| | 85,521 |

|

Gross (loss) profit | (13,448 | ) | | 49,127 |

|

Product development | 540 |

| | 963 |

|

Selling, general and administrative expenses | 49,679 |

| | 42,789 |

|

Other operating income (see Note 7 for related party amounts) | (1,672 | ) | | — |

|

Operating (loss) income | (61,995 | ) | | 5,375 |

|

| | | |

Non-operating income (expense): | | | |

Interest (expense) income, net | (1,773 | ) | | 863 |

|

Other income, net | 1,218 |

| | 992 |

|

Decrease (increase) in income tax benefit payable to former stockholder | 927 |

| | (698 | ) |

(Loss) income before loss from equity method investees and income taxes | (61,623 | ) | | 6,532 |

|

| | | |

Loss from equity method investees | 3,260 |

| | — |

|

(Loss) income before income taxes | (64,883 | ) | | 6,532 |

|

(Benefit) provision for income taxes | (22,467 | ) | | 418 |

|

Net (loss) income | (42,416 | ) | | 6,114 |

|

Less: Net income attributable to non-controlling interests | 520 |

| | 537 |

|

Net (loss) income attributable to DreamWorks Animation SKG, Inc. | $ | (42,936 | ) | | $ | 5,577 |

|

| | | |

Net (loss) income per share of common stock attributable to DreamWorks Animation SKG, Inc. | | | |

Basic net (loss) income per share | $ | (0.51 | ) | | $ | 0.07 |

|

Diluted net (loss) income per share | $ | (0.51 | ) | | $ | 0.07 |

|

Shares used in computing net (loss) income per share | | | |

Basic | 84,484 |

| | 84,671 |

|

Diluted | 84,484 |

| | 85,265 |

|

See accompanying notes.

DREAMWORKS ANIMATION SKG, INC.

CONSOLIDATED STATEMENTS OF COMPREHENSIVE (LOSS) INCOME

(Unaudited)

|

| | | | | | | | |

| | Three Months Ended |

| | March 31, |

| | 2014 | | 2013 |

| | (in thousands) |

Net (loss) income | | $ | (42,416 | ) | | $ | 6,114 |

|

Other comprehensive (loss) income, net of tax: | | | | |

Foreign currency translation gains (losses) | | 132 |

| | (2,492 | ) |

Comprehensive (loss) income | | (42,284 | ) | | 3,622 |

|

Less: Comprehensive income attributable to non-controlling interests | | 520 |

| | 537 |

|

Comprehensive (loss) income attributable to DreamWorks Animation SKG, Inc. | | $ | (42,804 | ) | | $ | 3,085 |

|

See accompanying notes.

DREAMWORKS ANIMATION SKG, INC.

CONSOLIDATED STATEMENTS OF CASH FLOWS

(Unaudited) |

| | | | | | | |

| Three Months Ended |

| March 31, |

| 2014 | | 2013 |

| (in thousands) |

Operating activities | | | |

Net (loss) income | $ | (42,416 | ) | | $ | 6,114 |

|

Adjustments to reconcile net (loss) income to net cash (used in) provided by operating activities: | | | |

Amortization and write-off of film and other inventory costs(1) | 145,412 |

| | 60,042 |

|

Amortization of intangible assets | 3,154 |

| | 1,686 |

|

Stock-based compensation expense | 5,309 |

| | 4,075 |

|

Amortization of deferred financing costs | 242 |

| | — |

|

Depreciation and amortization | 1,081 |

| | 983 |

|

Revenue earned against deferred revenue and other advances | (16,188 | ) | | (11,153 | ) |

Income related to investment contributions | (1,672 | ) | | — |

|

Loss from equity method investees | 3,260 |

| | — |

|

Deferred taxes, net | (22,314 | ) | | 231 |

|

Changes in operating assets and liabilities: | | | |

Trade accounts receivable | (19,091 | ) | | 4,119 |

|

Receivables from distributors | 79,267 |

| | 52,231 |

|

Film and other inventory costs | (122,837 | ) | | (109,346 | ) |

Intangible assets | — |

| | 1,015 |

|

Prepaid expenses and other assets | (4,870 | ) | | (6,367 | ) |

Accounts payable and accrued liabilities | (48,594 | ) | | 6,590 |

|

Payable to former stockholder | 1,080 |

| | (25,700 | ) |

Income taxes payable/receivable, net | (658 | ) | | 2,521 |

|

Deferred revenue and other advances | 27,348 |

| | 54,641 |

|

Net cash (used in) provided by operating activities | (12,487 | ) | | 41,682 |

|

Investing activities | | | |

Investments in unconsolidated entities | (7,000 | ) | | (500 | ) |

Purchases of property, plant and equipment | (5,711 | ) | | (8,088 | ) |

Net cash used in investing activities | (12,711 | ) | | (8,588 | ) |

Financing activities | | | |

Proceeds from stock option exercises | 261 |

| | — |

|

Purchase of treasury stock | (1,278 | ) | | (16,552 | ) |

Net cash used in financing activities | (1,017 | ) | | (16,552 | ) |

Effect of exchange rate changes on cash and cash equivalents | 396 |

| | 447 |

|

(Decrease) increase in cash and cash equivalents | (25,819 | ) | | 16,989 |

|

Cash and cash equivalents at beginning of period | 95,467 |

| | 59,246 |

|

Cash and cash equivalents at end of period | $ | 69,648 |

| | $ | 76,235 |

|

| | | |

Non-cash investing activities: | | | |

Intellectual property and technology licenses granted in exchange for equity interest | $ | 1,294 |

| | $ | — |

|

Services provided in exchange for equity interest | 383 |

| | — |

|

Total non-cash investing activities | $ | 1,677 |

| | $ | — |

|

| | | |

Supplemental disclosure of cash flow information: | | | |

Cash paid (refunded) during the period for income taxes, net | $ | 503 |

| | $ | (2,278 | ) |

Cash paid during the period for interest, net of amounts capitalized | $ | 7,515 |

| | $ | 217 |

|

(1) Included within this amount is depreciation and amortization, interest expense and stock-based compensation previously capitalized to "Film and other inventory costs" (see Note 1). During the three months ended March 31, 2014 and 2013, these amounts totaled $8,821 and $5,603, respectively.

See accompanying notes.

DREAMWORKS ANIMATION SKG, INC.

NOTES TO UNAUDITED CONSOLIDATED FINANCIAL STATEMENTS

| |

1. | Business and Basis of Presentation |

Business

The businesses of DreamWorks Animation SKG, Inc. ("DreamWorks Animation" or the "Company") is primarily devoted to the development, production and exploitation of animated films and their associated characters in the worldwide theatrical, home entertainment, digital, television, merchandising and licensing and other markets. The Company continues to build upon the value of its intellectual property created from its animated films by creating high-quality entertainment through the development and production of non-theatrical content such as television series and specials and live performances based on characters from its feature films. In addition, the Company has an extensive library of other intellectual property rights through its acquisition of Classic Media, which can be exploited in various markets. The Company's activities also include technology initiatives as it explores opportunities to exploit its internally developed software.

Distribution and Servicing Arrangements

The Company derives revenue from Twentieth Century Fox Film Corporation's worldwide (excluding China and South Korea) exploitation of its films in the theatrical and post-theatrical markets. Pursuant to a binding term sheet (the "Fox Distribution Agreement") entered into with Twentieth Century Fox and Twentieth Century Fox Home Entertainment, LLC (collectively, "Fox"), the Company has agreed to license Fox certain exclusive distribution rights and exclusively engage Fox to render fulfillment services with respect to certain of the Company's animated feature films and other audiovisual programs during the five-year period beginning on January 1, 2013. The rights licensed to, and serviced by, Fox will terminate on the date that is one year after the initial home video release date in the United States ("U.S.") of the last film theatrically released by Fox during such five-year period.

Also beginning in 2013, the Company's films are distributed in China and South Korea territories by distinct distributors. The key terms of the Company's distribution arrangements with its Chinese and South Korean distributors are largely similar to those with Fox and Paramount such that the Company also recognizes revenues earned under these arrangements on a net basis. The Company's distribution partner in China is Oriental DreamWorks Holding Limited ("ODW"), which is a related party.

Lastly, the Company continues to derive revenues from the distribution in worldwide theatrical, home entertainment, digital and television markets by Paramount Pictures Corporation, a subsidiary of Viacom Inc., and its affiliates (collectively, "Paramount"), for films that were released on or before December 31, 2012, pursuant to a distribution agreement and a fulfillment services agreement (collectively, the "Paramount Agreements"). With respect to each film for which Paramount has rendered fulfillment services, Paramount generally has the right to continue rendering such services for 16 years from such film's initial general theatrical release.

The Company generally retains all other rights to exploit its films, including commercial tie-in and promotional rights with respect to each film, as well as merchandising, interactive, literary publishing, music publishing and soundtrack rights. The Company's activities associated with its Classic Media properties and AwesomenessTV, Inc. ("ATV") business are not subject to the Company's distribution agreements with its theatrical distributors.

Basis of Presentation

The accompanying unaudited financial data as of March 31, 2014 and for the three months ended March 31, 2014 and 2013 has been prepared by the Company pursuant to the rules and regulations of the Securities and Exchange Commission (the "SEC") and in accordance with U.S. generally accepted accounting principles ("U.S. GAAP") for interim financial information. Accordingly, certain information and footnote disclosures normally included in comprehensive financial statements have been condensed or omitted pursuant to such rules and regulations. The consolidated balance sheet as of December 31, 2013 was derived from the audited financial statements at that date, but does not include all the information and footnotes required by U.S. GAAP. These financial statements should be read in conjunction with the consolidated financial statements and related notes included in the Company's Annual Report on Form 10-K for the year ended December 31, 2013 (the "2013 Form 10-K"). Certain amounts in the prior period consolidated financial statements have been reclassified to conform to the Company's 2014 presentation.

Table of Contents

DREAMWORKS ANIMATION SKG, INC.

NOTES TO UNAUDITED CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

The accompanying unaudited consolidated financial statements reflect all adjustments, consisting of only normal recurring items, which in the opinion of management, are necessary for a fair statement for the periods shown. The results of operations for such periods are not necessarily indicative of the results expected for the full year, or for any future period, as fluctuations can occur based upon the timing of the Company's films' theatrical and home entertainment releases, and television series and specials broadcasts.

Consolidation

The consolidated financial statements of the Company present the financial position, results of operations and cash flows of DreamWorks Animation and its wholly-owned subsidiaries. The Company also consolidates less-than-wholly owned entities if the Company has a controlling financial interest in that entity. The Company uses the equity method of accounting for investments in companies in which it has a 50% or less ownership interest and has the ability to exercise significant influence. Such investments are presented as investments in unconsolidated entities on the Company's consolidated balance sheets (refer to Note 7 for further information of such investments). Prior to recording its share of net income or losses from equity method investees, investee financial statements are converted to U.S. GAAP. All significant intercompany accounts and transactions have been eliminated. Intra-entity profit related to transactions with equity method investees is eliminated until the amounts are ultimately realized.

In addition, the Company reviews its relationships with other entities to identify whether they are variable interest entities ("VIE") as defined by the Financial Accounting Standards Board ("FASB"), and to assess whether the Company is the primary beneficiary of such entity. If the determination is made that the Company is the primary beneficiary, then the entity is consolidated. As of March 31, 2014, the Company determined that it continued to have a variable interest in ODW as ODW does not have sufficient equity at risk (i.e., cash on hand to fund its operations) as a result of the timing of capital contributions to the entity in accordance with the Transaction and Contribution Agreement (see Note 7). However, the Company concluded that it is not the primary beneficiary of ODW as it does not have the ability to control ODW. As a result, it does not consolidate ODW into its financial statements. Refer to Note 7 for further discussion of how the Company accounts for its investment in ODW, including the Company's remaining contributions (which represent the maximum exposure to the Company).

The Company also determined that, as of March 31, 2014, it continued to have a variable interest in an entity that was created to operate and tour its live arena show that is based on its feature film How to Train Your Dragon, and that the Company is the primary beneficiary of this entity as a result of the Company's obligation to fund all losses. Accordingly, the Company's consolidated financial statements included the activities of the VIE. The consolidation of the VIE had an immaterial impact as of and for the three months ended March 31, 2014 and 2013.

Film and Other Inventory Costs Amortization

Amortization and write-off of film and other inventory costs in any period includes depreciation and amortization, interest expense and stock-based compensation expense that were capitalized as part of film and other inventory costs in the period that those charges were incurred. The total amount of such expenses reflected as a component of amortization and write-off of film and other inventory costs for the three months ended March 31, 2014 and 2013 is presented in the statements of cash flows.

Use of Estimates

The preparation of financial statements in conformity with U.S. GAAP requires management to make estimates and assumptions that affect the amounts reported in the financial statements and accompanying notes. The most significant estimates made by management in the preparation of the financial statements relate to the following:

| |

• | ultimate revenues and ultimate costs of film, television product and live performance productions; |

| |

• | relative selling price of the Company's products for purposes of revenue allocation in multi-property licenses and other multiple deliverable arrangements; |

| |

• | determination of fair value of assets and liabilities for the allocation of the purchase price in an acquisition; |

| |

• | determination of fair value of non-cash contributions to investments in unconsolidated entities; |

| |

• | useful lives of intangible assets; |

| |

• | product sales that will be returned and the amount of receivables that ultimately will be collected; |

| |

• | the potential outcome of future tax consequences of events that have been recognized in the Company's financial statements; |

Table of Contents

DREAMWORKS ANIMATION SKG, INC.

NOTES TO UNAUDITED CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

| |

• | loss contingencies and contingent consideration arrangements; and |

| |

• | assumptions used in the determination of the fair value of equity-based awards for stock-based compensation or their probability of vesting. |

Actual results could differ from those estimates. To the extent that there are material differences between these estimates and actual results, the Company's financial condition or results of operations will be affected. Estimates are based on past experience and other assumptions that management believes are reasonable under the circumstances, and management evaluates these estimates on an ongoing basis.

| |

2. | Recent Accounting Pronouncements |

In July 2013, the FASB issued an accounting standard update relating to the presentation of unrecognized tax benefits. The accounting update requires companies to present a deferred tax asset net of related unrecognized tax benefits if there is a net operating loss or other tax carryforwards that would apply in settlement of the uncertain tax position. To the extent that an uncertain tax position would not be settled through a reduction of a net operating loss or other tax carryforwards, the unrecognized tax benefit will be presented as a liability. The guidance is effective for the Company's fiscal year beginning January 1, 2014, with early adoption permitted. The Company adopted the new guidance effective January 1, 2014. The adoption of this guidance did not have a material impact on the Company's consolidated financial statements.

AwesomenessTV

On May 1, 2013, the Company entered into an Agreement and Plan of Merger (the "Merger Agreement") pursuant to which, on May 3, 2013 (the "ATV Closing Date"), a wholly-owned subsidiary of the Company ("the Merger Sub") merged with and into ATV. As a result of this transaction, ATV became a wholly-owned subsidiary of the Company. ATV is an online next-generation media production company that generates revenues primarily from online advertising sales and distribution of content through media channels such as theatrical, home entertainment and television. Through ATV's multi-channel network presence on the Internet, the Company will be able to gain access to new content distribution methods, as well as a broader audience. The goodwill acquired represents the potential synergies between ATV's filmed content, character portfolio and the Company's cross-platform expansion plans. The goodwill is allocated to a reporting unit that is currently not part of a separately reportable segment.

The Company's total consideration for this transaction totaled $128.5 million, including an accrual for estimated contingent consideration of $95.0 million. The following table outlines the components of consideration for the transaction (in thousands):

|

| | | |

| As of |

| May 3, 2013 |

Cash payment | $ | 33,460 |

|

Estimated contingent consideration | 95,000 |

|

Total consideration | $ | 128,460 |

|

Table of Contents

DREAMWORKS ANIMATION SKG, INC.

NOTES TO UNAUDITED CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

The following table summarizes the preliminary allocation of the purchase price (in thousands):

|

| | | | |

| | As of |

| | May 3, 2013(1) |

Cash and cash equivalents | | $ | 1,340 |

|

Trade receivables(2) | | 1,279 |

|

Prepaid and other assets | | 434 |

|

Production costs | | 612 |

|

Property, plant and equipment | | 183 |

|

Intangible assets | | 12,900 |

|

Total identified assets acquired | | 16,748 |

|

| | |

Accounts payable | | 655 |

|

Deferred revenue | | 2,057 |

|

Deferred tax liabilities, net | | 3,765 |

|

Total liabilities assumed | | 6,477 |

|

Net identified assets acquired | | 10,271 |

|

Goodwill(3) | | 118,189 |

|

Total consideration | | $ | 128,460 |

|

____________________

| |

(1) | Measurement period adjustments include a $0.9 million decrease in goodwill, which resulted from changes in the fair value of the estimated contingent consideration of $0.5 million, as well as a decrease to deferred tax liabilities of $0.4 million. |

| |

(2) | Gross contractual amounts due total $1.3 million and, of this amount, no amounts are deemed to be uncollectible. |

| |

(3) | The goodwill resulting from the acquisition of ATV is not deductible for tax purposes. |

Contingent Consideration

Pursuant to the Merger Agreement, the Company may be required to make future cash payments to ATV's former shareholders as part of the total purchase price to acquire ATV. The contingent consideration is based on whether ATV increases its adjusted earnings before interest expense, income taxes, depreciation and amortization ("EBITDA") over an adjusted EBITDA threshold, over a two-year period (which commenced on January 1, 2014). Adjustments to EBITDA for purposes of determining the contingent consideration earned include, but are not limited to: ATV's employee bonus plan, non-cash gains and losses (such as those related to foreign currency accounting and reversals of prior year accruals) and changes in the fair value of contingent payment liabilities resulting from the acquisition of ATV. The Company estimates the fair value of contingent consideration using significant unobservable inputs in a Monte-Carlo simulation model and bases the fair value on the estimated risk-adjusted cost of capital of ATV's adjusted EBITDA following integration into the Company (an income approach). The estimate of the liability may fluctuate if there are changes in the forecast of ATV's future earnings or as a result of actual earnings levels achieved. Any changes in estimate of the contingent consideration liability will be reflected in the Company's results of operations in the period that the change occurs and classified in selling, general and administrative expenses.

The estimated fair value of the contingent consideration arrangement at the acquisition date was $95.0 million. The key assumptions in applying the income approach were as follows: an 8.5% discount rate, volatility of 32.6% and a probability-adjusted earnings measure for ATV of $25.0 million for 2014 and $41.0 million for 2015. Changes in one or more of the key assumptions could lead to a different fair value estimate of the contingent consideration. For example, using a discount rate of 15.0% or a volatility rate of 20.0% would change the estimated fair value of the contingent consideration to $90.5 million and $103.5 million, respectively. Under the Merger Agreement, the maximum contingent consideration that may be earned is $117.0 million. The estimate of contingent consideration liability increased from $96.5 million as of December 31, 2013 to $99.0 million as of March 31, 2014, primarily due to the passage of time, changes in the forecast of cash flows and changes in the Company's credit risk adjusted rate used to discount obligations to present value. As of March 31, 2014, the discount rate and volatility applied were 18.0% and 35.9%, respectively. Using a discount rate of 15% or a volatility of 20% would change the

Table of Contents

DREAMWORKS ANIMATION SKG, INC.

NOTES TO UNAUDITED CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

estimated fair value of the contingent consideration to $100.0 million and $107.0 million, respectively. The change in estimate was recorded in selling, general and administrative expenses in the consolidated statements of operations.

Pro Forma Financial Information

The following table presents (in thousands, except per share data) pro forma results of the Company as though ATV had been acquired as of January 1, 2012 (the beginning of the prior annual reporting period based on the period in which the acquisition occurred).

|

| | | | |

| | Three Months Ended |

| | March 31, 2013 |

Revenues | | $ | 134,886 |

|

Net income attributable to DreamWorks Animation SKG, Inc. | | $ | 3,662 |

|

Basic net income per share | | $ | 0.04 |

|

Diluted net income per share | | $ | 0.04 |

|

These pro forma results do not necessarily represent what would have occurred if the ATV transaction had taken place on January 1, 2012, nor do they represent the results that may occur in the future. The pro forma amounts include the historical operating results of the Company and ATV prior to the acquisition, with adjustments directly attributable to the acquisition. The pro forma results include a decrease to tax expense assuming ATV was part of the Company in the amount of $0.5 million for the three months ended March 31, 2013. The pro forma results also include an increase to amortization expense related to the fair value of the intangible assets acquired of $2.9 million for the three months ended March 31, 2013.

The fair value of cash and cash equivalents, accounts payable, advances and amounts outstanding under the revolving credit facility approximates carrying value due to the short-term maturity of such instruments and floating interest rates. As of March 31, 2014, the fair value of trade accounts receivable approximated carrying value due to the similarities in the initial and current discount rates. In addition, as of March 31, 2014, the fair value of the senior unsecured notes approximated carrying value as the current borrowing rate approximated the debt instrument's actual interest rate. The fair value of trade accounts receivable and the senior unsecured notes was determined using significant unobservable inputs by performing a discounted cash flow analysis and using current discount rates as appropriate for each type of instrument.

The Company has short-term money market investments which are classified as cash and cash equivalents on the consolidated balance sheets. The fair value of these investments at March 31, 2014 and December 31, 2013 was measured based on quoted prices in active markets.

Table of Contents

DREAMWORKS ANIMATION SKG, INC.

NOTES TO UNAUDITED CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

| |

5. | Film and Other Inventory Costs |

Film, television, live performance and other inventory costs consist of the following (in thousands):

|

| | | | | | | |

| March 31,

2014 | | December 31,

2013 |

In release, net of amortization: | | |

|

|

Feature films | $ | 312,861 |

| | $ | 285,238 |

|

Television series and specials | 62,217 |

| | 58,631 |

|

In production: | | |

|

|

Feature films | 396,407 |

| | 474,609 |

|

Television series and specials | 28,260 |

| | 15,332 |

|

In development: | | |

|

|

Feature films | 97,922 |

| | 75,498 |

|

Television series and specials | 456 |

| | 1,500 |

|

Product inventory and other(1) | 16,511 |

| | 32,678 |

|

Total film, television, live performance and other inventory costs, net | $ | 914,634 |

| | $ | 943,486 |

|

____________________

| |

(1) | This category includes $8.6 million and $24.8 million of capitalized live performance costs as of March 31, 2014 and December 31, 2013, respectively. In addition, as of March 31, 2014 and December 31, 2013, this category includes $7.9 million of physical inventory of certain DreamWorks Animation and Classic Media titles for distribution in the home entertainment market. |

The Company anticipates that approximately 39% and 77% of the above "in release" film and other inventory costs as of March 31, 2014 will be amortized over the next 12 months and three years, respectively.

As a result of the weaker-than-expected worldwide theatrical performance of Mr. Peabody and Sherman (released into the domestic theatrical market during March 2014), the Company performed an analysis to determine whether the unamortized film inventory costs exceeded fair value and was thus impaired. Key assumptions used in the fair value measurement were a discount rate of 7% and estimated remaining cash flows over a period of approximately 15 years. As a result of the analysis, during the three months ended March 31, 2014, the Company recorded an impairment charge of $57.1 million, resulting in a remaining carrying value of $86.0 million as of March 31, 2014. An increase in the discount rate of 5% would change the fair value measurement by approximately $7.8 million for the three months ended March 31, 2014. The estimate of remaining cash flows is dependent on, among other things, the title's performance in post-theatrical markets which have not yet released (e.g., home entertainment and television). A reduction of 10% in the estimated future variable revenues would result in an additional impairment charge of approximately $5.0 million to $10.0 million for this title.

No impairment charges were recorded on film and other inventory costs during the three months ended March 31, 2013.

Table of Contents

DREAMWORKS ANIMATION SKG, INC.

NOTES TO UNAUDITED CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

As of March 31, 2014 and December 31, 2013, intangible assets included $49.5 million of indefinite-lived intangible assets. In addition, intangible assets were comprised of definite-lived intangible assets as follows (in thousands, unless otherwise noted):

|

| | | | | | | | | | | | | | | | | |

| Weighted Average Estimated Useful Life (in years) | | Gross | | Accumulated Amortization | | Impact of Foreign Currency Translation | | Net |

As of March 31, 2014: | | | | | | | | | |

Character rights | 13.9 | | $ | 99,000 |

| | $ | (10,322 | ) | | $ | 1,999 |

| | $ | 90,677 |

|

Programming content | 2.0 | | 11,200 |

| | (5,133 | ) | | — |

| | 6,067 |

|

Trademarks and trade names | 10.0 | | 1,200 |

| | (110 | ) | | — |

| | 1,090 |

|

Other intangibles | 2.0 | | 500 |

| | (229 | ) | | — |

| | 271 |

|

Total | | | $ | 111,900 |

| | $ | (15,794 | ) | | $ | 1,999 |

| | $ | 98,105 |

|

| | | | | | | | | |

As of December 31, 2013: | | | | | | | | | |

Character rights | 13.9 | | $ | 99,000 |

| | $ | (8,663 | ) | | $ | 1,754 |

| | $ | 92,091 |

|

Programming content | 2.0 | | 11,200 |

| | (3,733 | ) | | — |

| | 7,467 |

|

Trademarks and trade names | 10.0 | | 1,200 |

| | (80 | ) | | — |

| | 1,120 |

|

Other intangibles | 2.0 | | 500 |

| | (167 | ) | | — |

| | 333 |

|

Total | | | $ | 111,900 |

| | $ | (12,643 | ) | | $ | 1,754 |

| | $ | 101,011 |

|

| |

7. | Investments in Unconsolidated Entities |

The Company has made investments in entities which are accounted for under either the cost or equity method of accounting. These investments are classified as investments in unconsolidated entities in the consolidated balance sheets and consist of the following (in thousands, unless otherwise indicated):

|

| | | | | | | | | |

| Ownership | | | | |

| Percentage at | | March 31, | | December 31, |

| March 31, 2014 | | 2014 | | 2013 |

Oriental DreamWorks Holding Limited | 45.45% | | $ | 15,856 |

| | $ | 16,389 |

|

All Other | 30%-50% | | 4,421 |

| | 3,140 |

|

Total equity method investments | | | 20,277 |

| | 19,529 |

|

| | | | | |

Total cost method investments | | | 24,013 |

| | 19,013 |

|

Total investments in unconsolidated entities | | | $ | 44,290 |

| | $ | 38,542 |

|

Under the equity method of accounting, the carrying value of an investment is adjusted for the Company's proportionate share of the investees' earnings and losses (adjusted for the amortization of any differences in the basis of the Company's investment in ODW compared to the Company's share of venture-level equity), as well as contributions to and distributions from the investee. The Company classifies its share of income or loss from investments accounted for under the equity method as income/loss from equity method investees in its consolidated statements of operations.

Table of Contents

DREAMWORKS ANIMATION SKG, INC.

NOTES TO UNAUDITED CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

Loss from equity method investees consist of the following (in thousands):

|

| | | |

| Three Months Ended |

| March 31, 2014 |

Oriental DreamWorks Holding Limited(1) | $ | 2,210 |

|

All Other | 1,050 |

|

Loss from equity method investees | $ | 3,260 |

|

____________________

| |

(1) | The Company currently records its share of ODW results on a one-month lag. Accordingly, the Company's consolidated financial statements include its share of losses incurred by ODW from December 1, 2013 to February 28, 2014. |

Oriental DreamWorks Holding Limited

On April 3, 2013 ("ODW Closing Date"), the Company formed a Chinese Joint Venture, ODW (or the "Chinese Joint Venture"), through the execution of a Transaction and Contribution Agreement, as amended, with its Chinese partners, China Media Capital (Shanghai) Center L.P. ("CMC"), Shanghai Media Group ("SMG") and Shanghai Alliance Investment Co., Ltd. ("SAIL", and together with CMC and SMG, the "CPE Holders"). In exchange for 45.45% of the equity of ODW, the Company has committed to making a total cash capital contribution to ODW of $50.0 million (of which $5.7 million was funded at the ODW Closing Date, with the balance to be funded over time) and non-cash contributions valued at approximately $100.0 million (of which approximately $25.4 million had been satisfied as of March 31, 2014). Such non-cash contributions include licenses of technology and certain other intellectual property of the Company, rights in certain trademarks of the Company, two in-development feature film projects developed by the Company and consulting and training services. During the three months ended March 31, 2014, the Company's consolidated statements of operations included $1.7 million of other operating income recognized in connection with non-cash contributions made to ODW.

As of March 31, 2014, the Company's remaining contributions consisted of the following: (i) $44.3 million in cash (which is expected to be funded over the next three years), (ii) two of the Company's in-development film projects (the specific projects of which have not yet been identified), (iii) remaining delivery requirements under the licenses of technology and certain other intellectual property of the Company and (iv) approximately $7.2 million in consulting and training services. Some of these remaining contribution commitments will require future cash outflows for which the Company is not currently able to estimate the timing of contributions as this will depend on, among other things, ODW's operations.

Basis Differences. The Company's investment in ODW does not equal the venture-level equity (the amount recorded on the balance sheet of ODW) due to various basis differences. Basis differences related to definite-lived assets are being amortized based on the useful lives of the related assets. Basis differences related to indefinite-lived assets are not being amortized. The following are the differences between the Company's venture-level equity and the balance of its investment in ODW (in thousands):

|

| | | |

| March 31, 2014 |

Company's venture-level equity | $ | 44,445 |

|

Technology and intellectual property licenses(1) | (19,150 | ) |

Other(2) | (9,439 | ) |

Total ODW investment recorded | $ | 15,856 |

|

____________________

| |

(1) | Represents differences between the Company's historical cost basis and the equity basis reflected at the venture-level (the amount recorded on the balance sheet of ODW) related to the Company's contributions of technology and intellectual property licenses. These basis differences arise because the contributed assets are recorded at fair value by ODW. |

| |

(2) | Represents the Company's net contribution commitment due to ODW. |

Other Transactions with ODW. The Company has various other transactions with ODW, a related party. The Company has entered into a distribution agreement with ODW for the distribution of the Company's feature films in China (beginning with The Croods). In addition, from time to time, the Company may provide consulting and training services to ODW, the charges of which are based on a pre-determined rate schedule which approximates the Company's actual cost of providing such services. During the three months ended March 31, 2014, the Company's consolidated statements of operations included $0.7

Table of Contents

DREAMWORKS ANIMATION SKG, INC.

NOTES TO UNAUDITED CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

million of revenues earned through ODW's distribution of the Company's feature films. As of March 31, 2014 and December 31, 2013, the Company's consolidated balance sheets included receivables from ODW of $5.1 million and $3.8 million, respectively, which were classified as a component of trade accounts receivable, and $4.3 million and $16.7 million, respectively, which were classified as a component of receivables from distributors.

Accrued liabilities consist of the following (in thousands):

|

| | | | | | | |

| March 31,

2014 | | December 31,

2013 |

Employee compensation | $ | 22,805 |

| | $ | 65,625 |

|

Participations and residuals | 48,799 |

| | 50,690 |

|

Contingent consideration(1) | 100,051 |

| | 97,545 |

|

Interest payable | 2,635 |

| | 7,849 |

|

Deferred rent | 8,553 |

| | 8,114 |

|

Other accrued liabilities | 32,018 |

| | 33,845 |

|

Total accrued liabilities | $ | 214,861 |

| | $ | 263,668 |

|

____________________

| |

(1) | Primarily represents the Company's estimate of the amount of contingent consideration payable in connection with the acquisition of ATV (refer to Note 3 for further information). |

As of March 31, 2014, the Company estimates that over the next 12 months it will pay approximately $23.1 million of its accrued participation and residual costs.

| |

9. | Deferred Revenue and Other Advances |

The following is a summary of deferred revenue and other advances included in the consolidated balance sheets as of March 31, 2014 and December 31, 2013 and the related amounts earned and recorded either as revenue in the consolidated statements of operations or recorded as an offset to other costs (as described below) for the three-month periods ended March 31, 2014 and 2013 (in thousands):

|

| | | | | | | | | | | | | | | |

| | | | | Amounts Earned |

| | | | | Three Months Ended |

| March 31, | | December 31, | March 31, |

| 2014 | | 2013 | 2014 | | 2013 |

Deferred Revenue | $ | 11,632 |

| | $ | 14,578 |

| | $ | 7,637 |

| | $ | 7,721 |

|

Strategic Alliance/Development Advances(1) | 962 |

| | 1,667 |

| | 7,138 |

| | 9,074 |

|

Other(2) | 16,537 |

| | 20,180 |

| | 19,897 |

| | 4,763 |

|

Total deferred revenue and other advances | $ | 29,131 |

| | $ | 36,425 |

| | | | |

____________________

| |

(1) | Of the total amounts earned against the "Strategic Alliance/Development Advances," for the three months ended March 31, 2014 and 2013, $2.4 million and $5.2 million, respectively, were capitalized as an offset to property, plant and equipment. Additionally, during the three months ended March 31, 2014 and 2013, of the total amounts earned, $1.0 million and $0.5 million, respectively, were recorded as a reduction to other assets, respectively. During the three months ended March 31, 2014 and 2013, of the total amounts earned, $0.5 million and $0.9 million, respectively, were recorded as a reduction to prepaid expenses. During the three months ended March 31, 2014 and 2013, of the total amounts earned, $1.1 million and $0.4 million, respectively, were recorded as a reduction to operating expenses. |

| |

(2) | Of the total amounts earned, for the three months ended March 31, 2014, $14.0 million was recorded as a reduction to film and other inventory costs. |

Table of Contents

DREAMWORKS ANIMATION SKG, INC.

NOTES TO UNAUDITED CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

| |

10. | Financing Arrangements |

Senior Unsecured Notes. On August 14, 2013, the Company issued $300.0 million in aggregate principal amount of 6.875% Senior Notes due 2020 (the "Notes"). In connection with the issuance of the Notes, the Company entered into an indenture (the “Indenture”) with The Bank of New York Mellon Trust Company, N.A., as trustee, specifying the terms of the Notes. The Notes were sold at a price to investors of 100% of their principal amount and were issued in a private placement pursuant to the exemptions under Rule 144A and Regulation S under the Securities Act of 1933, as amended. The net proceeds from the Notes amounted to $294.0 million and a portion was used to repay the outstanding borrowings under the Company's revolving credit facility. The Notes are effectively subordinated to indebtedness under the revolving credit facility. Beginning on February 15, 2014, the Company is required to pay interest on the Notes semi-annually in arrears on February 15 and August 15 of each year. The principal amount is due upon maturity. The Notes are guaranteed by all of the Company's domestic subsidiaries that also guarantee its revolving credit facility.

The Indenture contains certain restrictions and covenants that, subject to certain exceptions, limit the Company's ability to incur additional indebtedness, pay dividends or repurchase the Company's common shares, make certain loans or investments, and sell or otherwise dispose of certain assets, among other limitations. The Indenture also contains customary events of default, which, if triggered, may accelerate payment of principal, premium, if any, and accrued but unpaid interest on the Notes. Such events of default include non-payment of principal and interest, non-performance of covenants and obligations, default on other material debt, failure to satisfy material judgments and bankruptcy or insolvency. If a change of control as described in the Indenture occurs, the Company may be required to offer to purchase the Notes from the holders thereof at a repurchase price equal to 101% of their principal amount, plus accrued and unpaid interest, if any, to, but not including, the date of repurchase.

At any time prior to August 15, 2016, the Company may redeem all or part of the Notes at a redemption price equal to the sum of (i) 100% of the principal amount thereof, plus (ii) a specified premium as of the date of redemption, plus (iii) accrued and unpaid interest to, but not including, the date of redemption, subject to the rights of holders of Notes on the relevant record date to receive interest due on the relevant interest payment date. On or after August 15, 2016, the Company may redeem all or a part of the Notes, at specified redemption prices plus accrued and unpaid interest thereon, to, but not including, the applicable redemption date, subject to the rights of holders of Notes on the relevant record date to receive interest due on the relevant interest payment date. In addition, at any time prior to August 15, 2016, the Company may redeem up to 35% of the Notes with the net proceeds of certain equity offerings at a redemption price equal to 106.875% of the principal amount thereof, in each case plus accrued and unpaid interest and additional interest, if any, thereon to, but not including, the redemption date.

Revolving Credit Facility. The Company has a revolving credit facility with a number of banks. On August 10, 2012, the Company and the facility banks terminated the then-existing credit agreement and entered into a new Credit Agreement ("New Credit Agreement"). The New Credit Agreement allows the Company to have outstanding borrowings up to $400.0 million at any one time, on a revolving basis. Borrowings are secured by substantially all of the Company's assets. The New Credit Agreement requires the Company to maintain a specified ratio of total debt to total capitalization and a specified ratio of net remaining ultimates to facility exposure. In addition, subject to specified exceptions, the New Credit Agreement also restricts the Company and its subsidiaries from taking certain actions, such as granting liens, entering into any merger or other significant transactions, making distributions, entering into transactions with affiliates, agreeing to negative pledge clauses and restrictions on subsidiary distributions, and modifying organizational documents. The revolving credit facility also prohibits the Company from paying dividends on its capital stock if, after giving pro forma effect to such dividend, an event of default would occur or exist under the revolving credit facility. The Company is required to pay a commitment fee on undrawn amounts at an annual rate of 0.375%. Interest on borrowed amounts (per draw) is determined by reference to either i) the lending banks' base rate plus 1.50% per annum or ii) the London Interbank Offered Rate ("LIBOR") plus 2.50% per annum.

Table of Contents

DREAMWORKS ANIMATION SKG, INC.

NOTES TO UNAUDITED CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

The following table summarizes information associated with the Company's financing arrangements (in thousands, except percentages):

|

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | Interest Expense |

| | | | | | | | | Three Months Ended |

| Balance Outstanding at | | Maturity Date | | | | March 31, |

| March 31, 2014 | | December 31, 2013 | | | Interest Rate at March 31, 2014 | | 2014 | | 2013 |

Senior Unsecured Notes | $ | 300,000 |

| | $ | 300,000 |

| | August 2020 | | 6.875% | | $ | 2,234 |

| | N/A |

Revolving Credit Facility | $ | — |

| | $ | — |

| | August 2017 | | N/A | | $ | 375 |

| | $ | 220 |

|

____________________

N/A: Not applicable

Additional Financing Information

Interest Capitalized to Film Costs. Interest on borrowed funds that are invested in major projects with substantial development or construction phases is capitalized as part of the asset cost until the projects are released or construction projects are put into service. Thus, capitalized interest is amortized over future periods on a basis consistent with that of the asset to which it relates. During the three months ended March 31, 2014 and 2013, the Company incurred interest costs totaling $6.1 million and $1.6 million, respectively, of which $3.2 million and $1.4 million, respectively, were capitalized to film costs.

As of March 31, 2014, the Company was in compliance with all applicable financial debt covenants.

The Company typically determines its interim income tax provision by using the estimated annual effective tax rate and applying that rate to income/loss on a current year-to-date basis. However, if minor changes to forecasted annual pre-tax earnings have a significant effect on the annual effective tax rate, the Company may determine that this method would not be appropriate and that a different method should be applied. For the three months ended March 31, 2014, the Company determined that the annual effective tax rate method would not represent a reliable estimate of the interim income tax provision. As a result, the Company utilized a discrete period method to calculate taxes for the three months ended March 31, 2014. Under the discrete method, the Company determined the income tax provision based upon actual results as if the interim period were an annual period.

Table of Contents

DREAMWORKS ANIMATION SKG, INC.

NOTES TO UNAUDITED CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

Set forth below is a reconciliation of the components that caused the Company's benefit/provision for income taxes (including the income statement line item "Decrease (increase) in income tax benefit payable to former stockholder") to differ from amounts computed by applying the U.S. Federal statutory rate of 35% for the three months ended March 31, 2014 and 2013.

|

| | | | | |

| Three Months Ended |

| March 31, |

| 2014 | | 2013 |

Provision for income taxes (combined with decrease/increase in income tax benefit payable to former stockholder)(1) | | | |

U.S. Federal statutory rate | 35.0 | % | | 35.0 | % |

U.S. state taxes, net of Federal benefit | 1.6 |

| | (2.7 | ) |

Export sales exclusion/manufacturer's deduction(2) | 1.2 |

| | 7.3 |

|

Research and development credit(2) | — |

| | (25.4 | ) |

Federal energy tax credit(3) | — |

| | (2.5 | ) |

Executive compensation | (0.3 | ) | | 3.2 |

|

Stock-based compensation | — |

| | 1.3 |

|

Other | (2.0 | ) | | (0.8 | ) |

Effective tax rate (combined with decrease/increase in income tax benefit payable to former stockholder)(1) | 35.5 | % | | 15.4 | % |

Less: change in income tax benefit payable to former stockholder(1): |

| |

|

Export sales exclusion/manufacturer's deduction(2) | (1.1 | ) | | (7.6 | ) |

Imputed interest on payable to former stockholder | 0.1 |

| | (1.8 | ) |

Other | (0.4 | ) | | (0.2 | ) |

Total change in income tax benefit payable to former stockholder(1) | (1.4 | )% | | (9.6 | )% |

Effective tax rate | 34.1 | % | | 5.8 | % |

____________________

| |

(1) | As a result of a partial increase in the tax basis of the Company's tangible and intangible assets attributable to transactions entered into by affiliates controlled by a former stockholder at the time of the Company's 2004 initial public offering, the Company may pay reduced tax amounts to the extent it generates sufficient taxable income in the future. The Company is obligated to remit to an affiliate of the former stockholder 85% of any realized cash savings in U.S. Federal income tax and California franchise tax and certain other related tax benefits. Refer to the Company's 2013 Form 10-K for a more detailed description. |

| |

(2) | The American Taxpayer Relief Act of 2012 (the "Act"), enacted on January 2, 2013, included extensions to many expiring corporate income tax provisions. The Act included a two-year extension of research and development credits and other federal tax incentives, which were to be retroactively applied beginning with January 1, 2012 and ending on December 31, 2013. The Company recognized the effects of the retroactive changes in its results for the three months ended March 31, 2013 (the period of enactment). |

| |

(3) | The Company's policy for accounting for investment tax credits is to recognize the income tax benefit in the year that the credit is generated. |

The Company's federal income tax returns for the tax years ended December 31, 2007 through 2009 are currently under examination by the Internal Revenue Service, and all subsequent tax years remain open to audit. The Company's California state tax returns for all years subsequent to 2007 remain open to audit. The Company's India subsidiary's income tax returns are currently under examination for the tax years ended March 31, 2010 through 2012.

Table of Contents

DREAMWORKS ANIMATION SKG, INC.

NOTES TO UNAUDITED CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

| |

12. | Stockholders’ Equity and Non-controlling Interests |

Class A Common Stock

Stock Repurchase Program. In July 2010, the Company's Board of Directors terminated the then-existing stock repurchase program and authorized a new stock repurchase program pursuant to which the Company may repurchase up to an aggregate of $150.0 million of its outstanding stock. During the three months ended March 31, 2014, the Company did not repurchase any shares of its Class A Common Stock. During the three months ended March 31, 2013, the Company repurchased 0.8 million shares of its outstanding Class A Common Stock for $16.2 million under the July 2010 authorization. As of March 31, 2014, the Company's remaining authorization under the current stock repurchase program was $100.0 million.

Non-controlling Interests

The Company's consolidated balance sheets include non-controlling interests, which is presented as a separate component of equity. The non-controlling interest represents the other equity holder's interest in a joint venture that the Company consolidates. The net income attributable to the non-controlling interests is presented in the Company’s consolidated statements of operations. There is no other comprehensive income or loss attributable to the non-controlling interests.

The following table presents the changes in equity for the three-month periods ended March 31, 2014 and 2013 (in thousands):

|

| | | | | | | | | | | |

| DreamWorks Animation SKG, Inc. Stockholders' Equity | | Non-controlling Interests | | Total Equity |

Balance as of December 31, 2013 | $ | 1,404,795 |

| | $ | 1,224 |

| | $ | 1,406,019 |

|

Proceeds from stock option exercises | 261 |

| | — |

| | 261 |

|

Stock-based compensation | 9,068 |

| | — |

| | 9,068 |

|

Purchase of treasury shares | (1,246 | ) | | — |

| | (1,246 | ) |

Foreign currency translation adjustments | 132 |

| | — |

| | 132 |

|

Net (loss) income | (42,936 | ) | | 520 |

| | (42,416 | ) |

Balance as of March 31, 2014 | $ | 1,370,074 |

| | $ | 1,744 |

| | $ | 1,371,818 |

|

| | | | | |

Balance as of December 31, 2012 | $ | 1,345,616 |

| | $ | 630 |

| | $ | 1,346,246 |

|

Stock-based compensation | 8,404 |

| | — |

| | 8,404 |

|

Purchase of treasury shares | (16,534 | ) | | — |

| | (16,534 | ) |

Foreign currency translation adjustments | (2,492 | ) | | — |

| | (2,492 | ) |

Net income | 5,577 |

| | 537 |

| | 6,114 |

|

Balance as of March 31, 2013 | $ | 1,340,571 |

| | $ | 1,167 |

| | $ | 1,341,738 |

|

| |

13. | Stock-Based Compensation |

The Company recognizes compensation costs for equity awards granted to its employees based on each award's grant-date fair value. Most of the Company's equity awards contain vesting conditions dependent upon the completion of specified service periods or achievement of established sets of performance criteria. Compensation cost for service-based equity awards is recognized ratably over the requisite service period. Compensation cost for certain performance-based awards is recognized using a graded expense-attribution method. The Company has granted performance-based awards where the value of the award upon vesting will vary depending on the level of performance ultimately achieved. The Company recognizes compensation cost for these awards based on the level of performance expected to be achieved. The Company will recognize the impact of any change in estimate in the period of the change.

Generally, equity awards are forfeited by employees who terminate prior to vesting. However, certain employment contracts for certain executive officers provide for the acceleration of vesting in the event of a change in control or specified termination events. The Company currently satisfies exercises of stock options and stock appreciation rights, the vesting of restricted stock and the delivery of shares upon the vesting of restricted stock units with the issuance of new shares.

Table of Contents

DREAMWORKS ANIMATION SKG, INC.

NOTES TO UNAUDITED CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

The impact of stock options (including stock appreciation rights) and restricted stock awards on net income (excluding amounts capitalized) for the three-month periods ended March 31, 2014 and 2013, respectively, was as follows (in thousands):

|

| | | | | | | |

| Three Months Ended |

| March 31, |

| 2014 | | 2013 |

Total stock-based compensation | $ | 5,309 |

| | $ | 4,075 |

|

Tax impact(1) | (1,885 | ) | | (628 | ) |

Reduction in net income, net of tax | $ | 3,424 |

| | $ | 3,447 |

|

____________________

| |

(1) | Tax impact is determined at the Company's combined effective tax rate, which includes the income statement line item "Decrease/increase in income tax benefit payable to former stockholder" (see Note 11). |

Stock-based compensation cost capitalized as a part of film costs was $3.7 million and $4.3 million for the three-month periods ended March 31, 2014 and 2013, respectively.

The following table sets forth the number and weighted average grant-date fair value of equity awards granted during the three-month periods ended March 31, 2014 and 2013:

|

| | | | | | |

| Three Months Ended |

| March 31, |

| Number Granted | | Weighted Average Grant-Date Fair Value |

| (in thousands) | | |

2014 | | | |

Restricted stock and restricted stock units | 224 |

| | $ | 29.91 |

|

2013 | | | |

Restricted stock and restricted stock units | 261 |

| | $ | 16.87 |

|

As of March 31, 2014, the total compensation cost related to unvested equity awards granted to employees (excluding equity awards with performance objectives not probable of achievement) but not yet recognized was approximately $78.5 million and will be amortized on a straight-line basis over a weighted average period of 1.9 years.

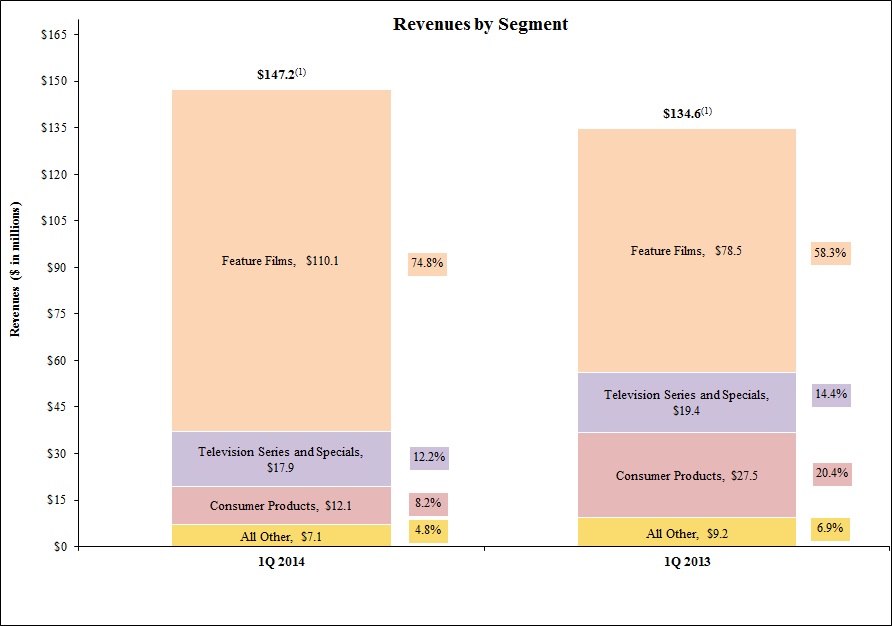

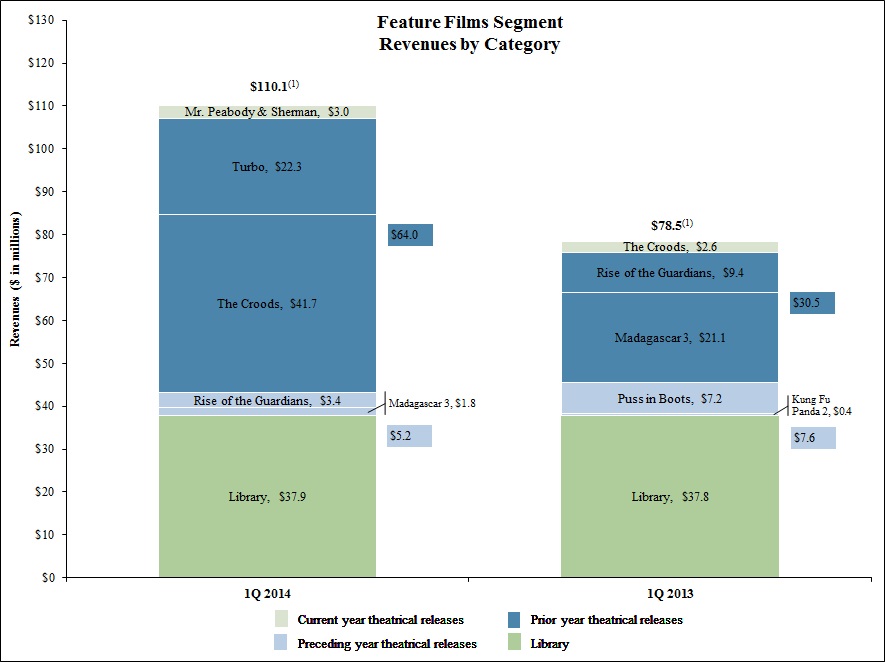

During the three months ended September 30, 2013, the Company reorganized its internal management structure to align with changes in how it operates the business and evaluates financial performance of individual business units. As a result, there were changes to its operating segments and the Company has revised its segment information for prior periods to conform to the current presentation. The Company's current reportable segments are the following: Feature Films, Television Series and Specials and Consumer Products. Feature Films consists of the development, production and exploitation of feature films in the theatrical, television, home entertainment and digital markets. Television Series and Specials consists of the development, production and exploitation of television, direct-to-video and other non-theatrical content in the television, home entertainment and digital markets. Consumer Products consists of the Company's merchandising and licensing activities related to the exploitation of its intellectual property rights. Operating segments that are not separately reportable are categorized in "All Other" and include ATV and live performances.

Table of Contents

DREAMWORKS ANIMATION SKG, INC.

NOTES TO UNAUDITED CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

Segment performance is evaluated based on revenues and gross profit. The Company does not allocate assets to each of its operating segments, nor does the Company's chief operating decision maker evaluate operating segments using discrete asset information. Information on the reportable segments and a reconciliation of total segment revenues and gross (loss) profit to consolidated financial statements are presented below (in thousands):

|

| | | | | | | | |

| | Three Months Ended |

| | March 31, |

| | 2014 | | 2013 |

Revenues | | | |

| Feature Films | $ | 110,097 |

| | $ | 78,546 |

|

| Television Series and Specials | 17,969 |

| | 19,368 |

|

| Consumer Products | 12,067 |

| | 27,484 |

|

| All Other | 7,108 |

| | 9,250 |

|

Total revenues | $ | 147,241 |

| | $ | 134,648 |

|

| | | | |

Gross (loss) profit(1) | | | |

| Feature Films | $ | (25,388 | ) | | $ | 25,950 |

|

| Television Series and Specials | 5,759 |

| | 4,917 |

|

| Consumer Products | 6,004 |

| | 18,428 |

|

| All Other | 177 |

| | (168 | ) |

Total gross (loss) profit | $ | (13,448 | ) | | $ | 49,127 |

|

____________________

| |

(1) | The Company defines segment profit as segment revenues less segment costs of revenues ("segment gross profit"). The Company's segment gross profit is equivalent to total gross profit (or loss) as presented on the consolidated statements of operations, which includes a reconciliation to consolidated (loss) income before income taxes. |

The following table presents goodwill for each of the Company's reportable segments (in thousands):

|

| | | | | | | | | | | | | | | | | | | |

| Feature Films | | Television Series and Specials | | Consumer Products | | All Other | | Total |

Balance as of December 31, 2013 | $ | 43,995 |

| | $ | 6,111 |

| | $ | 10,999 |

| | $ | 118,617 |

| | $ | 179,722 |

|

Measurement period adjustments related to the acquisition of ATV | — |

| | — |

| | — |

| | (428 | ) | | (428 | ) |

Balance as of March 31, 2014 | $ | 43,995 |

| | $ | 6,111 |

| | $ | 10,999 |

| | $ | 118,189 |

| | $ | 179,294 |

|

| |

15. | Related Party Transactions |

Transactions with ODW

During the three months ended March 31, 2014, the Company had various transactions with a related party, ODW. See Note 7 for further discussion related to these transactions.

Transactions with Universal Music Group

One of the Company's directors, Lucian Grainge, is the chief executive officer of Universal Music Group ("UMG"). From time to time, the Company and UMG make payments to each other in connection with the licensing of music that is owned by the other company (or for which the other company serves as the music publisher). In addition, UMG serves as the music publisher for the Company's Classic Media properties (which the Company acquired in August 2012). Finally, UMG and ATV (which the Company acquired in May 2013) have formed joint ventures related to the music business. For the three months ended March 31, 2014, revenues recognized related to the arrangements were not material. During the three months ended March 31, 2014, the Company incurred expenses (which were recorded as film inventory costs) totaling $0.2 million related to these arrangements.

Table of Contents

DREAMWORKS ANIMATION SKG, INC.

NOTES TO UNAUDITED CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

| |

16. | Concentrations of Credit Risk |

A substantial portion of the Company's revenue is derived directly from the Company's third-party distributors, Paramount and Fox. Paramount represented approximately 28% and 55% of total revenue for the three-month periods ended March 31, 2014 and 2013, respectively. Fox represented approximately 14% of total revenue for the three-month periods ended March 31, 2014.

As of March 31, 2014 and December 31, 2013, approximately 62% and 49%, respectively, of the Company's trade accounts receivable balance consisted of long-term receivables related to licensing arrangements with Netflix, Inc.

17.Commitments and Contingencies

Legal Proceedings. From time to time, the Company is involved in legal proceedings arising in the ordinary course of its business, typically intellectual property litigation and infringement claims related to the Company's feature films and other commercial activities, which could cause the Company to incur significant expenses or prevent the Company from releasing a film or other properties. The Company also has been the subject of patent and copyright claims relating to technology and ideas that it may use or feature in connection with the production, marketing or exploitation of the Company's feature films and other properties, which may affect the Company's ability to continue to do so. Furthermore, from time to time the Company may introduce new products or services, including in areas where it currently does not operate, which could increase its exposure to litigation and claims by competitors, consumers or other intellectual property owners. Defending intellectual property litigation is costly and can impose a significant burden on management and employees, and there can be no assurances that favorable final outcomes will be obtained in all cases. While the resolution of these matters cannot be predicted with certainty, the Company does not believe, based on current knowledge, that any existing legal proceedings or claims are likely to have a material effect on its financial position, results of operations or cash flows.

Contributions to ODW. The Company has committed to making certain contributions in connection with the formation of ODW. Refer to Note 7 for further discussion related to these commitments.

Contingent Consideration. As a result of the Company's acquisition of ATV, the Company may be obligated to make additional contingent cash payments as part of the purchase price. Refer to Note 3 for further discussion.

| |

18. | Earnings Per Share Data |

The following table sets forth the computation of basic and diluted net (loss) income per share (in thousands, except per share amounts):

|

| | | | | | | |

| Three Months Ended |

| March 31, |

| 2014 | | 2013 |

Numerator: | | | |

Net (loss) income attributable to DreamWorks Animation SKG, Inc. | $ | (42,936 | ) | | $ | 5,577 |

|

Denominator: | | | |

Weighted average common shares and denominator for basic calculation: | | | |

Weighted average common shares outstanding | 84,588 |

| | 84,781 |

|

Less: Unvested restricted stock | (104 | ) | | (110 | ) |

Denominator for basic calculation | 84,484 |

| | 84,671 |

|

Weighted average effects of dilutive stock-based compensation awards: | | | |

Restricted stock awards | — |

| | 594 |

|

Denominator for diluted calculation | 84,484 |

| | 85,265 |

|

Net (loss) income per share—basic | $ | (0.51 | ) | | $ | 0.07 |

|

Net (loss) income per share—diluted | $ | (0.51 | ) | | $ | 0.07 |

|

Table of Contents

DREAMWORKS ANIMATION SKG, INC.

NOTES TO UNAUDITED CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

The following table sets forth (in thousands) the weighted average number of options to purchase shares of common stock, stock appreciation rights, restricted stock awards and equity awards subject to performance conditions which were not included in the calculation of diluted per share amounts (for periods where the Company had net income) because the effects would be anti-dilutive:

|

| | |

| Three Months Ended |

| March 31, 2013 |

Options to purchase shares of common stock and restricted stock awards | 3,735 |

|

Stock appreciation rights | 5,151 |

|

Total | 8,886 |

|

The following table sets forth (in thousands) the number of equity awards that are contingently issuable which were not included in the calculation of diluted shares (for periods where the Company had net income) as the required performance conditions had not been met as of March 31, 2013:

|

| | |

| Three Months Ended |

| March 31, 2013 |

Options to purchase shares of common stock and restricted stock awards | 716 |

|

During the three months ended December 31, 2012, the Company made a strategic business decision to change the production and release slates for some of its animated feature films. In connection with this decision, the Company committed to a restructuring plan to align its production and operating infrastructure. During the three months ended March 31, 2013, the Company implemented a restructuring plan to lower the cost structure, which resulted in a commitment to further reduce its workforce. As a result, the Company incurred additional restructuring charges attributable to employee-related costs (primarily related to severance and benefits) totaling $2.5 million for 47 employees for the three months ended March 31, 2013. Restructuring charges were not material for the three months ended March 31, 2014. These charges were recorded in costs of revenues and selling, general and administrative expenses in the Company's consolidated statements of operations. Payments made during the three months ended March 31, 2014 totaled $1.0 million related to these restructuring plans. As of March 31, 2014 and December 31, 2013, $0.7 million and $1.7 million, respectively, remained accrued as a liability. The Company expects to complete its restructuring plans by June 30, 2014. The Company's restructuring plans are primarily attributable to its Feature Films reportable segment.

On April 1, 2014, the Company executed an Agreement and Plan of Merger and Reorganization to acquire Big Frame, Inc. (a multi-channel network). The purchase price consisted of cash payments totaling $15.0 million (inclusive of amounts held in escrow) and was paid upon closing of the transaction, which occurred on April 8, 2014. The Company expects that the acquisition will have an immaterial impact on its consolidated financial statements.

| |

ITEM 2. | MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

This section and other parts of this Quarterly Report on Form 10-Q (the "Quarterly Report") contain forward-looking statements that involve risks and uncertainties. Our actual results may differ significantly from the results discussed in the forward-looking statements. You should read the following discussion and analysis in conjunction with our unaudited consolidated financial statements and the related notes thereto contained elsewhere in this Quarterly Report, and our audited consolidated financial statements and related notes thereto, "Management’s Discussion and Analysis of Financial Condition and Results of Operations" and the "Risk Factors" section included in our Annual Report on Form 10-K for the year ended December 31, 2013 (the "2013 Form 10-K"). We urge you to carefully review and consider the various disclosures made by us in this Quarterly Report and in our other reports filed with the Securities and Exchange Commission (the "SEC"), including our 2013 Form 10-K and Current Reports on Form 8-K, before deciding to purchase, hold or sell our common stock.

Management Overview

The discussion of our revenues and costs of revenues for the three months ended March 31, 2014 and 2013 reflects our new segment categories. Refer to Note 14 of our unaudited consolidated financial statements contained elsewhere in this Quarterly Report for further information, including a description of each of our segments.

The following is a summary of the significant items that affected our financial results for the three months ended March 31, 2014:

| |