Exhibit 10.01

LEASE AGREEMENT

BETWEEN

EPC-IBP 16, LLC

AND

REACHLOCAL, INC.

BASIC LEASE INFORMATION

|

|

Lease Date: |

June 17, 2013 |

| Tenant: | REACHLOCAL, INC., a Delaware corporation |

| Tenant’s Address: | ReachLocal, Inc. | |

| 21700 Oxnard Street, Suite 1600 | ||

| Woodland Hills, CA 91367 | ||

| Attn: Adam F. Wergeles, General Counsel | ||

|

With a copy to: | ||

| ReachLocal, Inc | ||

|

At the address for the Premises | ||

|

Attn: Glynn Patin |

| Landlord: | EPC-IBP 16, LLC, a Texas limited liability company |

| Landlord’s Address: | Billingsley Property Services, Inc. | |

| 1722 Routh Street, Suite 1313 | ||

| Dallas, Texas 75201 | ||

| Attention: Office Asset Manager | ||

| Telephone: (214) 270-1000 | ||

|

With a copy to: | ||

|

Billingsley Property Services, Inc. | ||

|

1722 Routh Street, Suite 1313 | ||

|

Dallas, Texas 75201 | ||

|

Attention: Legal Department | ||

|

Telephone: (214) 270-1000 |

|

Premises: |

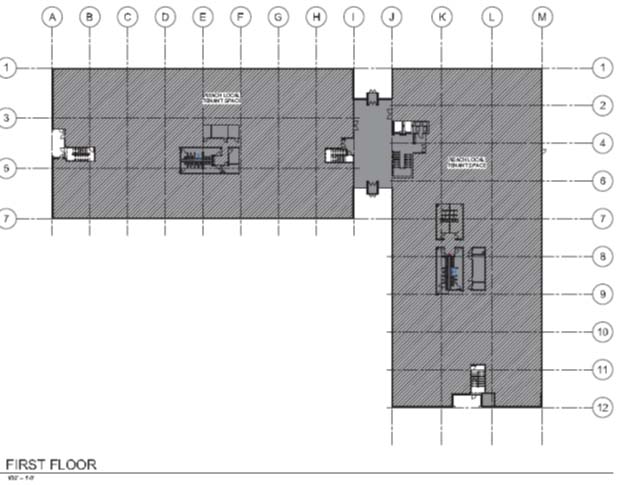

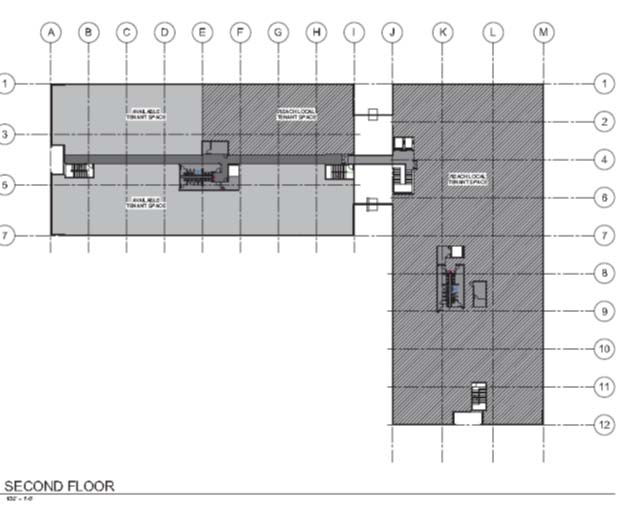

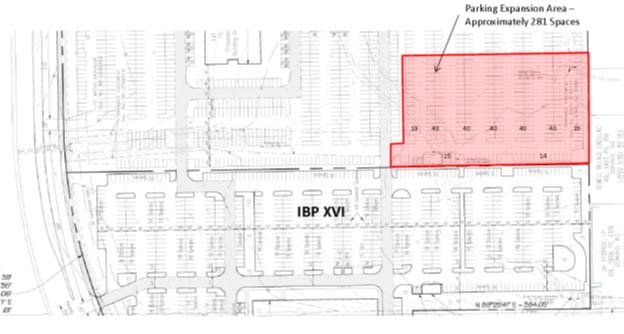

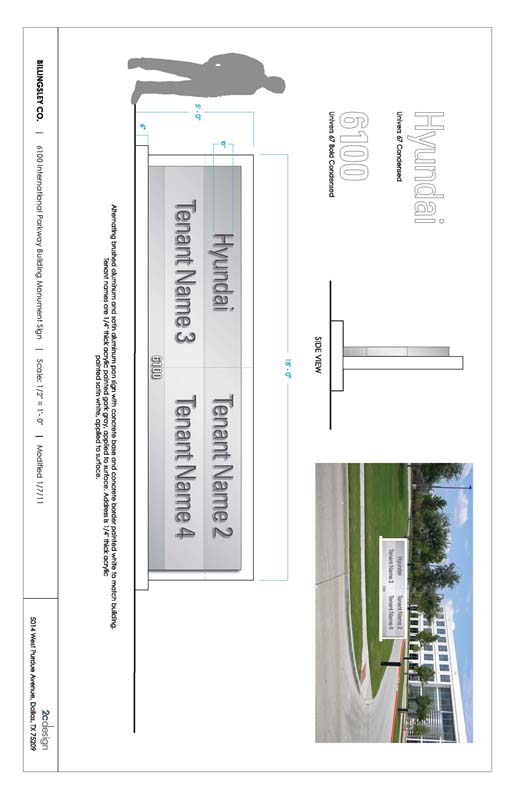

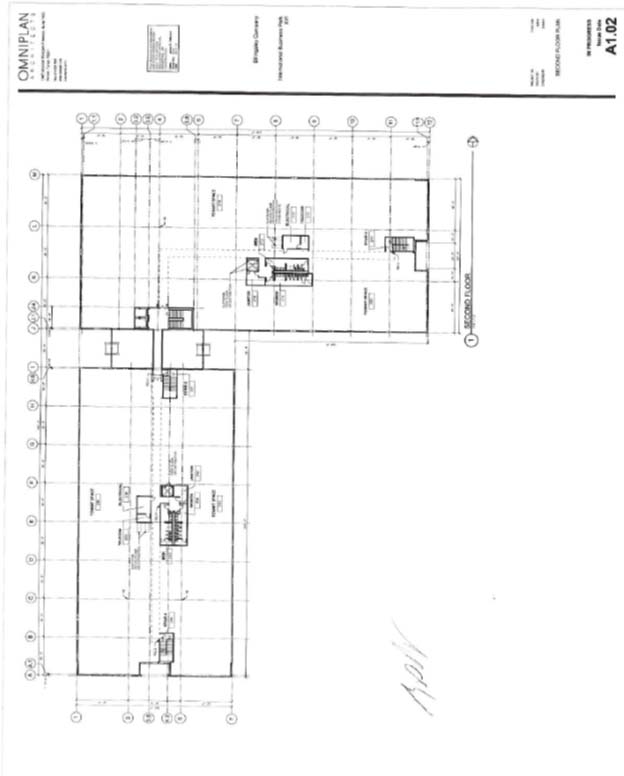

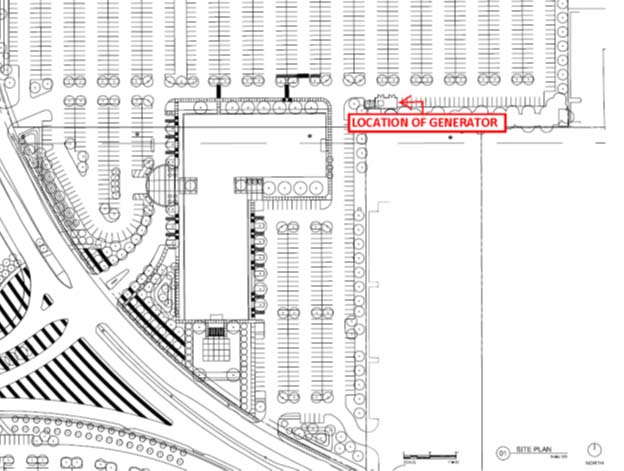

That certain space depicted and labeled as “ReachLocal Tenant Space” in EXHIBIT A-1 hereto, in the building to be constructed by Landlord and to be known as IBP XVI (the “Building”), to be located on land whose street address is likely to be 6111 W. Plano Parkway, Plano, Texas, as such land is more particularly described in EXHIBIT A-2 (the “Land”). The Building and Land together comprise the “Project”. The Premises shall contain approximately 100,000 square feet of rentable area (“Total Premises Rentable Square Feet,” or singularly “Premises Rentable Square Foot”). The Building is expected to contain approximately 181,711 of total square feet of rentable area (“Total Building Rentable Square Feet”). |

|

Commencement Date: |

The earliest of (a) the date on which Tenant occupies any portion of the Premises and begins conducting business therein, or (b) the 120th day after the Premises are tendered to Tenant for the commencement of Tenant’s Work (with Landlord’s Work complete to a degree that the remaining items of Landlord’s Work will not materially interfere with Tenant’s Work as jointly determined by Landlord and Tenant’s Representative designated in EXHIBIT D attached hereto; which for purposes of clarification is intended to occur approximately 30 days prior to Substantial Completion of Landlord’s Work), provided that such 120-day period shall be extended day-for-day for any Landlord Delay Days. Landlord and Tenant presently anticipate that possession of the Premises will be tendered to Tenant in the condition required by this Lease on or about April 1, 2014 (the “Estimated Delivery Date”). The Estimated Delivery Date, as extended day-for-day for any (i) Tenant Delay Days, (ii) days of force majeure delay to Landlord’s Work, provided that Landlord delivers written notice of such delay to Tenant within five (5) days following the occurrence of the delay, and (iii) each day after March 31, 2013 that elapses until this Lease is fully executed and delivered, is referred to as the “Adjusted Estimated Delivery Date”. “Tenant Delay Day” means each day of delay in the performance of Landlord’s Work that occurs because (a) Tenant fails to attend (either in person or via telephone conference) any scheduled meeting with Landlord, the Architect, any design professional, or any contractor, or their respective employees or representatives, as may be required hereunder in connection with the preparation or completion of any construction documents, or in connection with the performance of Landlord's Work, so long as Tenant receives reasonable prior notice of such meeting (which notice may be electronic), or (b) because a Tenant Party otherwise delays completion of Landlord’s Work, in either case provided that Landlord delivers written notice of such delay to Tenant within two business days following the occurrence of the delay. “Landlord Delay Day” means each day of the delay in the performance of Tenant’s Work that occurs because (a) Landlord fails to attend any scheduled meeting with Tenant, the Architect, any design professional, or any contractor, or their respective employees or representatives, as may be required hereunder in connection with the preparation or completion of any construction documents, such as the Space Plans or Working Drawings, or in connection with the performance of the Work, or (b) because a Landlord Party otherwise delays completion of Tenant’s Work, in either case provided that Tenant delivers written notice of such delay to Landlord within two business days following the occurrence of the delay. |

|

Term: |

Commencing on the Commencement Date and ending at 5:00 p.m. on the last day of the 120th full calendar month thereafter (the “Expiration Date”), subject to extension as provided in the Lease. |

Basic Rental:

|

Period |

Basic Annual Rental Per Square Foot of Rentable Area |

Monthly Basic Rental |

|

Lease Months 1-12 |

$14.21 NNN |

$118,416.67 |

|

Lease Months 13-24 |

$14.71 NNN |

$122,583.33 |

|

Lease Months 25-36 |

$15.21 NNN |

$126,750.00 |

|

Lease Months 37-48 |

$15.71 NNN |

$130,916.67 |

|

Lease Months 49-60 |

$16.21 NNN |

$135,083.33 |

|

Lease Months 61-72 |

$16.71 NNN |

$139,250.00 |

|

Lease Months 73-84 |

$17.21 NNN |

$143,416.67 |

|

Lease Months 85-96 |

$17.71 NNN |

$147,583.33 |

|

Lease Months 97-108 |

$18.21 NNN |

$151,750.00 |

|

Lease Months 109-120 |

$18.71 NNN |

$155,916.67 |

|

As used herein, the term “Lease Month” means each calendar month during the Term (and if the Commencement Date does not occur on the first day of a calendar month, the period from the Commencement Date to the first day of the next calendar month shall be included in the first Lease Month for purposes of determining the duration of the Term and the monthly Basic Rental rate applicable for such partial month). | ||

|

Security Deposit: |

$411,500.00 due upon Commencement of Construction (defined herein). |

|

Rent: |

Basic Rental, Tenant’s Proportionate Share of Electrical Costs, Tenant’s Proportionate Share of Basic Cost, and all other sums that Tenant may owe to Landlord under the Lease. |

|

Permitted Use: |

General office use any other lawful purpose common to and suitable for Comparable Buildings. |

|

Tenant’s Proportionate Share: |

55.0324% (which is the percentage obtained by dividing the Total Premises Rentable Square Feet by the Total Building Rentable Square Feet. |

|

Construction Allowance: |

$40.00 per Rentable Premises Square Foot, as more particularly described in EXHIBIT D hereto |

|

Comparable Buildings: |

As used herein or in the Lease, the term “Comparable Buildings” shall mean those low-rise suburban, multi-tenant, commercial office buildings completed on or after January 1, 2008, which are comparable to the Building in size, design, quality, use, and tenant mix, and which are located in the same market area (i.e., Plano area North of Frankford, East of I-35E, West of Preston Road and South of State Hwy. 121). |

|

Common Area: |

Tenant shall have the non-exclusive right to utilize all areas and facilities within the Building and within the exterior boundaries of the Project that are provided by Landlord for the general use and convenience of Tenant and the other tenants of the Project, including stairways, elevators, driveways, parking areas, courtyards and walkways as same may exist from time to time (the “Common Area”). |

The foregoing Basic Lease Information is incorporated into and made a part of the related lease (the “Lease”). If any conflict exists between any Basic Lease Information and the Lease, then the Lease shall control.

|

LANDLORD: |

|||

| EPC – IBP 16, LLC, a Texas limited liability company | |||

| By: |

EPC Exchange Corporation, a Washington corporation, its Sole Member |

||

| By: /s/ Kenneth D. Mabry | |||

| Name: Kenneth D. Mabry | |||

| Title: Manager | |||

|

TENANT: |

|||

|

REACHLOCAL, INC.,a Delaware corporation |

|||

| By: /s/ Ross G. Landsbaum | |||

| Name: Ross G. Landsbaum | |||

| Title: CFO | |||

THIS LEASE AGREEMENT (this “Lease”) is entered into as of June 17, 2013 between EPC – IBP 16, LLC, a Texas limited liability company (“Landlord”), and REACHLOCAL, INC., a Delaware corporation (“Tenant”).

1. Definitions and Basic Provisions. The definitions and basic provisions set forth in the Basic Lease Information (the “Basic Lease Information”) executed by Landlord and Tenant contemporaneously herewith are incorporated herein by reference for all purposes. To the extent of any conflict between the Basic Lease Information and any provision contained in this Lease, this Lease shall control.

2. Lease Grant. Subject to the terms of this Lease, Landlord leases to Tenant, and Tenant leases from Landlord, the Premises. The rights conveyed herein shall also permit Tenant, at all times during the Term, to use, at no cost additional or fee to Tenant, its Proportionate Share of all risers, raceways and plenum areas, for Tenant’s wiring and cabling and any conduit or connectors associated therewith.

3. Term; Landlord’s Work; Tender of Possession.

(a) Generally. The Term shall commence upon the Commencement Date (as defined in the Basic Lease Information) and end at 5:00 p.m. on the Expiration Date, subject to renewal as provided in EXHIBIT E.

(b) Landlord’s Work; Tender of Possession. Landlord shall diligently pursue Substantial Completion of Landlord’s Work. As used herein, the phrase “Substantial Completion of Landlord’s Work” (and derivations thereof) means that Landlord’s construction of the base building improvements in the Premises is substantially completed (as reasonably determined by Landlord) in substantial accordance with EXHIBIT I. Substantial Completion of Landlord’s Work shall have occurred even though minor details of construction, decoration, landscaping and mechanical adjustments remain to be completed by Landlord, provided that Landlord and Tenant’s Representative (designated in EXHIBIT D attached hereto) jointly determine such remaining Landlord’s Work can be (i) performed without material interruption of Tenant’s Work, and (ii) completed within thirty (30) days following Substantial Completion of Landlord’s Work subject only to minor punch-list items which do not materially interfere with the completion of Tenant’s Work or the use and occupancy of the Premises. Landlord shall use reasonable efforts to complete any punchlist items within thirty (30) days following receipt of the punchlist. By occupying the Premises, Tenant shall be deemed to have accepted the Premises in their condition as of the date of such occupancy, subject to Landlord’s repair of latent defects and Landlord's completion of any related punch-list items. Tenant shall execute and deliver to Landlord, within ten (10) days after Landlord has requested same, a letter confirming (1) the Commencement Date, (2) the size of the Premises and the Building, (3) that Tenant has accepted the Premises, and (4) that Landlord has performed all of its obligations with respect to the Premises.

(c) Abated Rent for Late Delivery of Premises. Landlord hereby covenants and agrees to complete the construction of Landlord’s Work in a good and workmanlike manner substantially in accordance with EXHIBIT I, and in compliance with all applicable legal requirements as such requirements existed the time of delivery to Tenant. If Landlord fails to achieve Substantial Completion of Landlord’s Work on or prior to the date that is 30 days after the Adjusted Estimated Delivery Date, Tenant’s obligation to pay Rent for the Premises shall be abated one and one-half days for each day after the 30th day after the Adjusted Estimated Delivery Date that Landlord fails to achieve Substantial Completion of Landlord’s Work. By way of example, if Landlord achieves Substantial Completion of the Landlord’s Work on the 35th day after the Adjusted Estimated Delivery Date, Tenant’s obligation to pay Rent shall be abated for seven and one half total days (that is, one and one-half days for each of the five days of delay). Tenant shall have the right to periodically inspect Landlord’s Work to confirm completion pursuant to the approved plans so long as (i) Tenant provides Landlord with reasonable prior notice of such inspection, and (ii) such inspections do not interfere with the performance of Landlord’s Work.

(d) Tenant Termination Right for Late Delivery. If Landlord does not achieve Substantial Completion of Landlord’s Work on or prior to the date that is 120 days after the Adjusted Estimated Delivery Date, Tenant may terminate this Lease by delivering written notice to Landlord and Landlord’s Mortgagee within 30 days following the expiration of such 120-day period and prior to the date upon which Landlord Substantially Completes Landlord’s Work. Such termination shall be effective as of the date of Tenant’s termination notice, subject to the remainder of this Section 3(d). If Tenant fails to timely give such termination notice, Tenant shall be deemed to have waived its right to terminate this Lease, time being of the essence with respect thereto. Notwithstanding the foregoing, if upon the receipt of Tenant’s written election to terminate this Lease as provided in this Section 3(d), Landlord reasonably believes it can Substantially Complete Landlord’s Work within 30 days following the receipt of such notice, Landlord may, in its sole discretion, elect to proceed with such work and, provided Landlord Substantially Completes Landlord’s Work within such 30-day period, Tenant’s election to terminate shall be null and void.

(e) Tenant Termination Right for Late Start of Construction. Provided Tenant has executed this Lease by March 31, 2013 and Commencement of Construction has not occurred by August 15, 2013, Tenant, at Tenant’s sole discretion, may terminate this Lease by delivering written notice to Landlord and Landlord’s Mortgagee within ten days following August 15, 2013. If the Tenant signs the Lease later than March 31, 2013, the August 15, 2013 date shall be extended on a day for day basis for every day past March 31, 2013 until this Lease is fully executed. Such termination shall be effective as of the date of Tenant’s termination notice. If Tenant fails to timely give such termination notice, Tenant shall be deemed to have waived its right to terminate this Lease, time being of the essence with respect thereto.

(f) Measurement. Landlord’s architect shall measure the Building based on the final approved construction documents used to construct the Building. Said measurement shall be calculated using the Standard Method for Measuring Floor Area in Office Buildings, ANSI/BOMA Z65.1-2010. The Basic Lease Information shall be updated to incorporate the results of such measurement. In connection with any renewal or extension of the Term hereof, Landlord may elect to again measure the Premises.

(g) Remeasurement. If either party so requests in writing within ninety (90) days following Substantial Completion of Landlord’s Work, the area of the Premises or the Building shall be remeasured, at the requesting party’s cost, by an engineer or architect reasonably satisfactory to both parties using the Standard Method for Measuring Floor Area in Office Buildings, ANSI/BOMA Z65.1-2010. If neither party elects to remeasure the Premises pursuant to this Section 3(g), the Total Premises Rentable Square Feet stipulated in the Basic Lease Information (as updated pursuant to Section 3(f)) shall be fully applicable and binding on the parties.

4. Rent.

(a) Payment. Tenant shall timely pay to Landlord the Rent without deduction or set off (except as otherwise expressly provided herein), at Landlord's Address (or such other address as Landlord may from time to time designate in writing to Tenant). Basic Rental, adjusted as herein provided, shall be payable monthly in advance. The first full monthly installment of Basic Rental shall be payable contemporaneously with the execution of this Lease; thereafter, monthly installments of Basic Rental shall be due on the first day of each succeeding calendar month during the Term. Basic Rental for any partial month at the beginning or end of the Term shall be prorated based upon the number of days within the Term during the partial month multiplied by 1/365 of the then current annual Basic Rental and shall be due on or before the fifth business day immediately preceding the Commencement Date, or first day of the last calendar month of the Term, as applicable.

(b) Electrical Costs. Tenant shall pay to Landlord (collectively, the “Electrical Costs”): (i) Tenant’s Proportionate Share of the cost of electricity utilized for the Common Area, (ii) Tenant’s usage of electricity for any portion of the Premises which includes an entire wing within the Building measured by a submeter converted to the utility rate set by the applicable utility provider applicable to such usage; and (iii) with respect to portions of the Premises within any multi-tenant wing of the Building, Tenant’s Proportionate Share of the cost of electricity utilized for such wing of the Building. The costs of electricity used to calculate the electrical costs shall not include the cost of any electrical use payable by another tenant of the Building on account of that Tenant’s specific use that is in excess of that Tenant’s Proportionate Share, nor shall it include any mark-up of such cost by Landlord. Such amount shall be payable monthly based on Landlord’s reasonable estimate of the amount due for each month, and shall be due on the Commencement Date and on the first day of each calendar month thereafter. From time to time, Landlord may estimate and re-estimate the Electrical Costs to be due by Tenant and deliver a copy of the estimate or re-estimate to Tenant. Thereafter, the monthly installments of Electrical Costs payable by Tenant shall be appropriately adjusted in accordance with the estimations so that, by the end of the calendar year in question, Tenant shall have paid all of the Electrical Costs as estimated by Landlord.

(c) Annual Electrical Cost Statement. By April 1 of each calendar year, or as soon thereafter as practicable, Landlord shall furnish to Tenant a statement of Landlord's actual Electrical Costs (the “Annual Electrical Cost Statement”) for the previous year, which shall include a reconciliation of the actual amount Tenant owes for its share of Electrical Costs against the estimated amount collected from Tenant. If such reconciliation shows that Tenant paid more than owed, then Landlord shall reimburse Tenant by check or cash for such excess within thirty (30) days after delivery of the Annual Electrical Cost Statement; conversely, if Tenant paid less than it owed, then Tenant shall pay Landlord such deficiency within thirty (30) days after delivery of the Annual Electrical Cost Statement.

(d) Adjustments to Electrical Costs. With respect to any calendar year or partial calendar year in which the Building is not occupied to the extent of 95% of the rentable area thereof, the Electrical Costs for such period shall, for the purposes hereof, be increased to the amount which would have been incurred had the Building been occupied to the extent of 95% of the rentable area thereof; provided, however, that the total electrical charges to be paid by tenants of the Building shall not exceed the total amount paid by Landlord for the electricity for the Project.

(e) Delinquent Payment. If any payment required by Tenant under this Lease is not paid within five (5) business days of when due as to Basic Rental, Tenant’s Proportionate Share of Electrical Costs, and Tenant’s Proportionate Share of Basic Cost, and within 30 days following Landlord’s written request therefor as to all other payments, Landlord may charge Tenant a fee equal to 5% of the delinquent payment (the “Late Charge”) to reimburse Landlord for its cost and inconvenience incurred as a consequence of Tenant's delinquency. Notwithstanding the foregoing, the Late Charge shall not be charged with respect to the first occurrence during any 12-month period that Tenant fails to make a payment of Basic Rental, Tenant’s Proportionate Share of Electrical Costs, or Tenant’s Proportionate Share of Basic Cost when due, unless such payment is not made within five (5) business days after Landlord delivers written notice of such delinquency to Tenant.

(f) Taxes. Tenant shall be liable for all taxes levied or assessed against personal property, furniture, or fixtures placed by Tenant in the Premises. If any taxes for which Tenant is liable are levied or assessed against Landlord or Landlord's property then Landlord and Tenant shall work together to ensure the applicable taxing authority reconciles their records to accurately reflect the tax liability; provided that if Landlord elects to pay the same, or if the assessed value of Landlord's property is increased by inclusion of such personal property, furniture or fixtures and Landlord elects to pay the taxes based on such increase, then Tenant shall pay to Landlord, within thirty (30) business days after Tenant receives written demand, that part of such taxes for which Tenant is primarily liable.

(g) Basic Cost. Tenant shall pay Tenant’s Proportionate Share of Basic Cost, as defined in EXHIBIT C.

5. Security Deposit. Contemporaneously with Commencement of Construction of the Building, Tenant shall pay to Landlord, in immediately available funds, the Security Deposit, which shall be held by Landlord without liability for interest and as security for performance by Tenant of its obligations under this Lease. The Security Deposit is not an advance payment of Rent or a measure or limit of Landlord's damages upon an Event of Default (defined below). Landlord may, from time to time upon notice to Tenant and without prejudice to any other remedy, use all or a part of the Security Deposit to perform any obligation which Tenant was obligated, but failed to perform hereunder following the expiration of any applicable notice and cure period. Following any such application of the Security Deposit, Tenant shall pay to Landlord on demand the amount so applied in order to restore the Security Deposit to its original amount. Within thirty (30) days after the expiration of the Term, as may have been extended, provided Tenant has performed all of its obligations hereunder, Landlord shall return to Tenant the balance of the Security Deposit not applied to satisfy Tenant's obligations. If Landlord transfers its interest in the Premises, then Landlord shall assign the Security Deposit to the transferee and if the transferee provides written notice to Tenant accepting such Security Deposit, Landlord thereafter shall have no further liability for the return of the Security Deposit.

6. Landlord’s Obligations.

(a) Services; Maintenance. Landlord shall furnish to Tenant (1) water (hot and cold) at those points of supply provided for general use of tenants of the Building; (2) heated and refrigerated air conditioning in accordance with ASHRAE standards from 7 a.m. to 7 p.m. Monday through Friday and 8 a.m. to 1 p.m. on Saturday (except for Holidays) sufficient to maintain temperatures during these hours in the range of from 70 degrees Fahrenheit to 78 degrees Fahrenheit; (3) janitorial service to the Premises on weekdays other than Holidays (Landlord reserves the right to bill Tenant separately for extra janitorial service required for any special improvements installed by or at the request of Tenant) and such window washing as may from time to time in Landlord's judgment be reasonably required, such janitorial services to be generally in accordance with those services described on EXHIBIT G; (4) two (2) non-exclusive elevators for ingress and egress to the floors on which the Premises are located except that key card access may be installed at Tenant’s expense for full floors leased by Tenant (provided that Landlord shall at all times be provided with key cards or codes necessary to access such floors); (5) replacement of Building-standard light bulbs and fluorescent tubes within the Premises and Common Areas; and (6) electrical current (subject to Tenant’s obligation to pay its share of Electrical Costs as provided herein) pursuant to the specifications set forth in Section N of EXHIBIT I. If Tenant desires heat and air conditioning at any time other than times herein designated, such services shall be supplied to Tenant upon reasonable advance notice (which may be verbal and not less than four (4) hours in advance of when required) and Tenant shall pay to Landlord its actual per-hour cost for such service (including equipment depreciation and maintenance costs but only to the extent such costs are not included in the Basic Cost pursuant to EXHIBIT C) without mark-up (as reasonably calculated by Landlord), such amount being payable within thirty (30) days of receipt of an invoice therefor. Landlord's obligation to furnish services under this Section shall be subject to the rules, regulations and other conditions or requirements of the supplier of such services and any applicable governmental entity or agency. As used herein, the term “Holidays” means New Year’s Day, Memorial Day, Independence Day, Labor Day, Thanksgiving Day and the day after, Christmas Day, any Monday following one of the foregoing holidays that occurs on a Sunday, and any Friday preceding one of the foregoing holidays that occurs on a Saturday.

(b) Maintenance. Landlord shall maintain all shell construction items (including exterior and structural elements of the Building), Building’s Systems (defined below), and Building common areas including all common lobby areas, parking areas and landscaping, in good order and condition as customary for Comparable Buildings. “Building’s Systems” means all life-safety, electrical, plumbing, and air conditioning systems within the Building which were included in the shell construction; but such term shall exclude any improvements below the ceiling within the Premises (except in Shell Building core areas) including but not limited to appliances, fixtures and supplemental air systems, and other items not customary for office tenants in Comparable Buildings.

(c) Excess Electrical Use. Landlord shall use reasonable efforts to furnish electrical current for computers, electronic data processing equipment, special lighting, or other equipment that requires more than 120 volts, or other equipment whose electrical energy consumption exceeds normal office usage, through any existing feeders and risers serving the Building and the Premises. Tenant shall not install any electrical equipment requiring special wiring or requiring voltage in excess of 120 volts or otherwise exceeding the Building capacity of eight (8) watts per rentable square foot for lighting and equipment unless approved in advance by Landlord. The use of electricity in the Premises (excluding electricity for HVAC service) shall not exceed the capacity of existing feeders and risers to or wiring in the Premises which shall be designed and built to provide eight (8) watts per rentable square foot. Any risers or wiring required to meet Tenant's excess electrical requirements (in excess of eight (8) watts per rentable square foot for lighting and equipment) shall, upon Tenant's request, be installed by Landlord (unless otherwise agreed by Landlord) at Tenant's expense, if, in Landlord's reasonable judgment, the same are necessary and shall not cause permanent damage or injury to the Building or the Premises, cause or create a dangerous or hazardous condition, entail excessive or unreasonable alterations, repairs, or expenses, or interfere with or disturb other tenants of the Building. Landlord may determine the amount of such additional consumption and potential consumption by any verifiable method, including installation of a separate meter in the Premises installed, maintained, and read by Landlord, and Tenant shall reimburse Landlord for the reasonable cost of installing and maintaining a separate meter within thirty (30) days after Landlord has delivered to Tenant an invoice therefor. If Tenant uses machines or equipment (other than general office machines, excluding computers and electronic data processing equipment) in the Premises which affect the temperature otherwise maintained by the air conditioning system or otherwise overload any utility, Landlord may install or require Tenant to install supplemental air conditioning units or other supplemental equipment in the Premises, and the cost thereof, including the cost of installation, operation, use, and maintenance, shall be paid by Tenant. At the time of Tenant’s submission of plans and specifications for Landlord’s approval pursuant to Section 7 herein or EXHIBIT D to this Lease, Landlord and Tenant shall cooperate in good faith to identify any fixtures, equipment and/or appliances to be installed or placed in the Premises which fixtures, equipment or appliances would exceed eight (8) watts per rentable square foot of electrical use and consumption or would affect the temperature otherwise maintained by the air conditioning system.

(d) Interruption of Services. If Tenant shall be unable to conduct business from the Premises in a manner reasonably comparable to Tenant’s normal conduct of business due to any failure or stoppage of critical services provided by Landlord (and under the control of Landlord) which failure or stoppage continues for three (3) consecutive business days after written notice from Tenant to Landlord which notice must be labeled "CONFIDENTIAL/URGENT" and alert Landlord to the possibility of a rental abatement pursuant to this Paragraph 6, and provided such unavailability was not caused by (i) Tenant or the employees, contractors, subcontractors or agents of Tenant, (ii) a governmental directive, (iii) the interruption of utility service by the local utility provider, or (iv) a cause outside of Landlord’s reasonable control, then Tenant shall be entitled to a reasonable abatement of Rent for each consecutive day after the third business day following Tenant’s notice that Tenant shall continue to unable to conduct business from the Premises in a manner reasonably comparable to Tenant’s normal conduct of business.

(e) Intentionally Deleted.

(f) Access. Subject to any Building rules and regulations, necessary repairs and maintenance, and any events beyond Landlord’s reasonable control which would prevent access, Tenant shall have access to the Premises twenty-four (24) hours a day, seven (7) days a week. The Building shall include twenty-four (24) hour access by security card which cards shall be provided to Tenant upon payment of a $10 refundable deposit per card.

(g) Security. Landlord shall provide to Tenant all security functions and services provided to the Building as set forth in EXHIBIT I including, but not limited to, card key access into the Building and security personnel on-site within International Business Park.

(h) Tenant’s Security System. Tenant may, at its sole cost and expense, install an electronic card key system within the Premises, which must tie-in with Landlord’s access system. Tenant shall furnish Landlord with a copy of all key codes or access cards and Tenant shall ensure that Landlord shall have access to the Premises at all times subject to the provisions of Section 21(d) below. Additionally, Tenant shall ensure that such system shall comply with all laws, including all fire safety laws, and in no event shall Landlord be liable for, and Tenant shall defend, indemnify, and hold harmless Landlord and its representatives and agents from any claims, demands, liabilities, causes of action, suits, judgments, damages and expenses arising from, such system or the malfunctioning thereof in accordance with Tenant’s indemnity contained in Section 10(c) hereof. Sections 7 and 19 of this Lease shall govern the installation, maintenance and Landlord’s removal rights with respect to such security system.

7. Improvements; Alterations; Repairs; Maintenance.

(a) Improvements; Alterations. Except as set forth below, no improvements or alterations in or upon the Premises, including not by limitation paint, wall coverings, floor coverings, light fixtures, window treatments, signs, advertising, or promotional lettering or other media, shall be installed or made by Tenant except in accordance with plans and specifications which have been previously submitted to and approved in writing by Landlord, which approval shall not be unreasonably withheld or delayed except that Landlord may withhold approval of any improvements or alterations which it determines, in its sole but reasonable opinion, will materially and adversely affect any structural or aesthetic (only to the extent visible from outside the Premises or common areas) aspect of the Building or Building’s Systems. Notwithstanding the foregoing, Tenant shall not be required to obtain Landlord’s consent for repainting, recarpeting, or other alterations, tenant improvements, alterations or physical additions to the Premises totaling less than $50,000 in any single instance or series of related alterations performed within a six-month period (provided that Tenant shall not perform any improvements, alterations or additions to the Premises in stages as a means to subvert this provision), in each case provided that (A) Tenant delivers to Landlord written notice thereof, a list of contractors and subcontractors to perform the work (and certificates of insurance for each such party) and any plans and specifications therefor prior to commencing any such alterations, additions, or improvements (for informational purposes only so long as no consent is required by Landlord as required by this Lease), (B) the installation thereof does not require the issuance of any building permit or other governmental approval, or involve any core drilling or the configuration or location of any exterior or interior walls of the Building, and (C) such alterations, additions and improvements will not affect (i) the Building’s Structure or the Building’s Systems, (ii) the provision of services to other Building tenants, or (iii) the appearance of the Building’s common areas or the exterior of the Building. All improvements and alterations (whether temporary or permanent in character) made in or upon the Premises, either by Landlord or Tenant, shall (i) comply with all applicable laws, ordinances, rules and regulations, and (ii) with the exception of trade fixtures and unattached equipment which may be removed by Tenant, be Landlord's property at the end of the Term and shall remain on the Premises without compensation to Tenant unless prior to installation, Tenant provides Landlord with written notice of all items which may be removed by Tenant and Landlord consents to such removal in advance. Such consent shall not be unreasonably withheld provided Landlord may condition such consent as it deems reasonably necessary including not by limitation requiring Tenant to replace any items upon removal with similar items comparable to any such items in the Building or, if not applicable, then Comparable Buildings. Approval by Landlord of any of Tenant's drawings and plans and specifications prepared in connection with any improvements in the Premises shall not constitute a representation or warranty of Landlord as to the adequacy or sufficiency of such drawings, plans and specifications, or the improvements to which they relate, for any use, purpose, or condition, but such approval shall merely be the consent of Landlord as required hereunder. Landlord warrants and agrees that it shall complete Landlord’s Work in compliance with all then applicable governmental laws, rules and regulations, including not by limitation the Disabilities Acts and the Texas Accessibility Standards (“TAS”) Article 9102, Texas Civil Statutes, The Administrative Rules of the Texas Department of Licensing and Regulation. Thereafter, notwithstanding anything in this Lease to the contrary, Tenant shall be responsible for all costs incurred to cause the interior non-structural elements of the Premises to comply with any such laws, rules or regulations, including not by limitation the retrofit requirements of TAS, as may be amended.

(b) Tenant Repairs; Maintenance. Except for those janitorial services to be provided by Landlord as expressly provided in this Lease, Tenant shall maintain its personal property and all improvements or alterations to the Premises other than those items included in shell construction (which shall be maintained by Landlord) in a clean, safe, operable, attractive condition, and shall not permit or allow to remain any waste or damage to any portion of the Premises, normal wear and tear and casualty excepted. Tenant shall repair or replace, subject to Landlord's direction and supervision, any damage to the Project caused by Tenant or Tenant's agents, contractors, or invitees. If Tenant fails to make such repairs or replacements within thirty (30) days after receipt by Tenant of a written demand from Landlord, or if such repairs or replacements cannot reasonably be made within a period of fifteen (15) days, if Tenant shall not commence to make such repairs or replacements within such 15-day period and thereafter diligently prosecute such repairs or replacements to completion, then Landlord, upon written notice to Tenant, may make the same and Tenant shall reimburse Landlord for the reasonable costs and expenses incurred by Landlord in making such repairs or replacements within thirty (30) days after Landlord has delivered to Tenant written invoices evidencing such costs.

(c) Performance of Work. All work described in this Section 7 shall be performed only by Landlord or by contractors and subcontractors hired by Tenant and approved in writing by Landlord which approval may not be unreasonably withheld, conditioned or delayed. Tenant shall cause all contractors and subcontractors to procure and maintain insurance coverage against such risks, in such amounts, and with such companies as Landlord may reasonably require. All such work shall be performed in accordance with all legal requirements and in a good and workmanlike manner so as not to damage the Premises, the structure of the Building, or plumbing, electrical lines, or other utility transmission facilities or Building mechanical systems. All such work which may affect the Building’s electrical, mechanical, plumbing or other systems must be approved by the Building's engineer of record who shall either be located in the Building, in International Business Park, or work for Landlord’s property management company, and shall be reasonably available to respond to any approvals.

(d) Mechanic's Liens. Tenant shall not permit any mechanic's liens to be filed against the Project for any work performed, materials furnished, or obligation incurred by or at the request of Tenant. If such a lien is filed, then Tenant shall, within thirty (30) days after Landlord has delivered notice of the filing to Tenant, either pay the amount of the lien or diligently contest such lien and deliver to Landlord a bond or other security reasonably satisfactory to Landlord. If Tenant fails to timely take either such action, then Landlord may pay the lien claim without inquiry as to the validity thereof, and any amounts so paid, including expenses and interest, shall be paid by Tenant to Landlord within thirty (30) days after Landlord has delivered to Tenant an invoice therefor.

8. Use.

(a) Tenant shall occupy and use the Premises only for the Permitted Use and shall comply with all laws, orders, rules, and regulations relating to the use, condition, and occupancy of the Premises.

(b) Landlord and Tenant agree that the population density within the Premises shall at no time exceed eight persons for each 1,000 square feet of rentable area located therein. If the population density within the Premises exceeds seven persons for each 1,000 square feet of rentable area located therein (the “Baseline Density”) during any calendar quarter during the Term (other than on a temporary basis for meetings and conferences), then Basic Rental shall be increased, prospectively, as follows:

|

If the population density in the Premises is (each a “Density Band”): |

then the then-applicable Basic Annual Rental Per Square Foot of Rentable Area in the Premises shall be increased by: |

|

greater than the Baseline Density but less than seven and one-half persons for each 1,000 square feet of rentable area |

$0.17 |

|

equal to or greater than seven and one-half persons for each 1,000 square feet of rentable area, but less than eight persons for each 1,000 square feet of rentable area |

$0.34 |

On the first day of each calendar quarter during the lease term, an officer of Tenant shall certify in a written letter to Landlord the then-current population density in the Premises, and, should such certification indicate a population density therein greater than the Baseline Density, then Tenant shall pay the applicable increased Basic Rental during such calendar quarter as set forth above. Under no circumstances shall Tenant be entitled to a downward adjustment of Basic Rental during the course of any calendar quarter; provided, however, that Basic Rental may be adjusted downward based upon the population density within the Premises as it exists on the first day of a calendar quarter. Landlord may request reasonable documentation from Tenant substantiating Tenant’s calculation of the population density within the Premises and may, in its discretion, verify such calculation using any reasonable method. Nothing in this Section 8(b) shall increase Landlord’s obligations under the Lease with respect to parking.

(c) The Premises shall not be used for any use which (i) is demonstrably disreputable (such that the presence of such use in the Building will have a negative impact on Landlord’s ability to attract qualified office tenants [as determined by Landlord in good faith]), (ii) creates extraordinary fire hazards, (iii) results in an increased rate of insurance on the Building or its contents, or (iv) the storage of any hazardous materials or substances. If, because of Tenant's acts, the rate of insurance on the Building or its contents increases, Tenant shall pay to Landlord the amount of such increase within thirty (30) days following receipt of written invoices evidencing such cost, and acceptance of such payment shall not constitute a waiver of any of Landlord's other rights. Landlord hereby confirms that general office use with customary incidental uses such as training and sales (by telephone or Internet; but not directly to the public on site) will not cause the rate of insurance on the Building or its contents to increase. Tenant shall conduct its business and control its agents, employees, and invitees in such a manner as not to create any nuisance or interfere with other tenants or Landlord in its management of the Project. Notwithstanding anything in this Lease to the contrary, as between Landlord and Tenant, (a) from and after the date Landlord tenders possession of the Premises to Tenant, Tenant shall bear the risk of complying with Title III of the Americans With Disabilities Act of 1990, any state laws governing handicapped access or architectural barriers, and all rules, regulations, and guidelines promulgated under such laws, as amended from time to time (the “Disabilities Acts”) in the Premises, and (b) Landlord shall bear the risk of complying with the Disabilities Acts in the Common Areas of the Building (other than compliance that is necessitated by the use of the Premises for other than the Permitted Use or as a result of any alterations or additions, including any initial tenant improvement work, made by or on behalf of a Tenant Party [which risk and responsibility shall be borne by Tenant]).

9. Assignment and Subletting.

(a) Transfers; Consent. Other than permitted transfers as described below, Tenant shall not, without the prior written consent of Landlord, which consent shall not be unreasonably withheld, delayed or conditioned: (1) assign, transfer, or encumber this Lease or any estate or interest herein whether directly or by operation of law, (2) if Tenant is an entity other than a corporation whose stock is publicly traded, permit the transfer of an ownership interest in Tenant so as to result in a change in the current control of Tenant, (3) sublet any portion of the Premises, (4) grant any license, concession, or other right of occupancy of any portion of the Premises, or (5) permit the use of the Premises by any parties other than Tenant (any of the events listed in Sections 9(a)(1) through 9(a)(5) being a “Transfer”). Tenant shall notify Landlord in advance of publishing any advertisement that any portion of the Premises is available for lease; should Tenant fail to provide advance notice to Landlord of such advertisement, Landlord may require Tenant to withdraw such advertising for a period not to exceed 30 days (for purposes of clarification, failure to deliver prior notice to Landlord shall not be an Event of Default under this Lease, but failure to timely withdraw advertising if so required by Landlord pursuant to this sentence could mature into an Event of Default [following applicable notice and cure]). If Tenant requests Landlord's consent to a Transfer, then Tenant shall provide Landlord with a written description of all terms and conditions of the proposed Transfer, copies of the proposed documentation, and the following information about the proposed transferee: name and address; reasonably satisfactory information about its business and business history; its proposed use of the Premises; and general references sufficient to enable Landlord to determine the proposed transferee's reputation and character. Landlord shall respond in writing to Tenant’s request for a Transfer within ten (10) business days of receipt of written request therefor. It shall be presumed to be unreasonable for Landlord to withhold its consent to a proposed Transfer in the event the proposed transferee or subtenant: (i) has a tangible net worth (excluding good will) reasonably sufficient to allow for performance of its obligations following the proposed Transfer, (ii) will use the Premises for the Permitted Use and not for credit processing or telemarketing and will not use the Premises in any manner that would conflict with any exclusive use agreement or other similar agreement entered into by Landlord with any other tenant of the Building, (iii) will not use the Premises or Building in a manner that would materially increase the pedestrian or vehicular traffic to the Premises or Building, (iv) is proven by Tenant to not be in violation of any laws relating to terrorism or money laundering, and (v) does not have a demonstrably bad reputation in the business community. Landlord specifically agrees that if a proposed transferee or sublicensee is already a tenant in the Building or the International Business Park or is an active prospect for space in another building in the International Business Park, such fact shall not be a factor against Landlord’s approval thereof; notwithstanding the foregoing, Landlord may withhold its consent in its sole and absolute discretion to a proposed Transfer to an active prospect for a lease in the Building directly from Landlord (“active prospect” means a prospect with whom Landlord can demonstrate that negotiations have been ongoing, and the last communication from such prospect to Landlord was not longer than 120 days prior to the time Tenant proposes such prospect). Tenant shall reimburse Landlord for its reasonable attorneys' fees (not to exceed $1,000 per request) and other reasonable expenses incurred in connection with considering any request for its consent to a Transfer. If Landlord consents to a proposed Transfer, then the proposed transferee shall deliver to Landlord a written agreement whereby it expressly assumes the Tenant's obligations hereunder; however, any transferee of less than all of the space in the Premises shall be liable only for obligations under this Lease that are properly allocable to the space subject to the Transfer, and only to the extent of the rent it has agreed to pay Tenant therefor. Landlord's consent to a Transfer shall not release Tenant from performing its obligations under this Lease, but rather Tenant and its transferee shall be jointly and severally liable therefor. Landlord's consent to any Transfer shall not waive Landlord's rights as to any subsequent Transfers. If an Event of Default occurs while the Premises or any part thereof are subject to a Transfer, then Landlord, in addition to its other remedies, may collect directly from such transferee all rents becoming due to Tenant and apply such rents against Rent so long as such Event of Default is continuing. In such case, Tenant authorizes its transferees to make payments of rent directly to Landlord upon Tenant’s receipt of notice from Landlord to do so; however, Landlord shall not be obligated to accept separate Rent payments from any transferees and may require that all Rent be paid directly by Tenant.

(b) Permitted Transfers. Tenant shall be permitted to periodically sublet portions of the Premises or to assign its rights to any parent or wholly-owned subsidiary entity, any organization resulting from a merger or a consolidation with the Tenant, or any organization succeeding to the business assets of the Tenant (a “Permitted Transferee”), provided the Premises continue to be used solely for the Permitted Use, the business and parking requirements of the subtenant or assignee are substantially the same as Tenant and the net worth of the subtenant or assignee is equal to or greater than Tenant's at the time of Lease execution (but in no event shall such tangible net worth be less than $100,000,000 at the time of the transfer) (“Permitted Transfers”); the foregoing net worth test shall not apply, however to a Permitted Transfer to an Affiliate, provided that such Permitted Transfer is not undertaken as part of an effort to deliberately distance the “Tenant” party hereunder from a creditworthy party. Tenant shall promptly notify Landlord in writing within fifteen (15) days after such assignment or subletting. A Permitted Transfer shall not release Tenant from its obligations under this Lease.

(c) Additional Compensation. Tenant shall pay to Landlord, immediately upon receipt thereof, fifty percent (50%) of the all net compensation received by Tenant after deducting reasonable transaction costs such as brokerage commissions, tenant improvements and legal fees for a Transfer that exceeds the Rent allocable to the portion of the Premises covered thereby. Tenant shall hold such amounts in trust for Landlord and pay them to Landlord within ten (10) days after receipt.

(d) Cancellation. Landlord may, within twenty (20) days after submission of Tenant’s written request for Landlord’s consent to a Transfer (excluding Permitted Transfers) of the entire Premises (or 75% or more of the Premises) which transfer is for the entire remaining term of this Lease, cancel this Lease as of the date the proposed Transfer was to be effective as to the portion of the Premises covered by the Transfer. If Landlord cancels this Lease, then this Lease shall cease for such portion of the Premises and Tenant shall pay to Landlord all Rent accrued through the cancellation date. Thereafter, Landlord may lease the Premises to the prospective transferee (or to any other person) without liability to Tenant.

10. Insurance; Waivers; Subrogation; Indemnity.

(a) Insurance. Effective as of the earlier of (1) the date Tenant enters or occupies the Premises, or (2) the Commencement Date, and continuing throughout the Term, Tenant shall maintain the following insurance policies: (A) commercial general liability insurance in amounts of $1,000,000 per occurrence, $5,000,000 general aggregate, or, following the expiration of the initial Term, such other amounts as Landlord may from time to time reasonably require, provided that such requirements are generally consistent with requirements of landlords in the Comparable Buildings for a similarly situated tenant (and, if the use and occupancy of the Premises include any activity or matter that is or may be excluded from coverage under a commercial general liability policy [e.g., the sale, service or consumption of alcoholic beverages], Tenant shall obtain such endorsements to the commercial general liability policy or otherwise obtain insurance to insure all liability arising from such activity or matter in such amounts as Landlord may reasonably require), insuring Tenant, Landlord, Landlord's property management company, and, if requested in writing by Landlord, Landlord's Mortgagee, against all liability for injury to or death of a person or persons or damage to property arising from the use and occupancy of the Premises and (without implying any consent by Landlord to the installation thereof) the installation, operation, maintenance, repair or removal of Tenant's equipment located outside the Premises, (B) insurance covering the full value of all alterations and improvements and betterments in the Premises, naming Landlord and Landlord's Mortgagee as additional loss payees as their interests may appear, (C) insurance covering the full value of all furniture, trade fixtures and personal property (including property of Tenant or others) in the Premises or otherwise placed in the Project by or on behalf of a Tenant Party (including Tenant's equipment located outside the Premises), (D) contractual liability insurance sufficient to cover Tenant's indemnity obligations hereunder (but only if such contractual liability insurance is not already included in Tenant's commercial general liability insurance policy), (E) worker's compensation insurance, and (F) business interruption insurance in an amount reasonably acceptable to Landlord. Tenant's insurance shall provide primary coverage to Landlord when any policy issued to Landlord provides duplicate or similar coverage, and in such circumstance Landlord's policy will be excess over Tenant's policy. The commercial general liability insurance to be maintained by Tenant may have a deductible of no more than $25,000.00 per occurrence; and the property insurance to be maintained by Tenant may have a deductible of no more than $50,000.00 per occurrence. Tenant shall furnish to Landlord certificates of such insurance and such other evidence satisfactory to Landlord of the maintenance of all insurance coverages required hereunder at least ten days prior to the earlier of the Commencement Date or the date Tenant enters or occupies the Premises, and at least 15 days prior to each renewal of said insurance, and Tenant shall notify Landlord at least 30 days before cancellation or a material change of any such insurance policies. All such insurance policies shall be in form, and issued by companies with a Best's rating of A+:VII or better, reasonably satisfactory to Landlord. If Tenant fails to comply with the foregoing insurance requirements or to deliver to Landlord the certificates or evidence of coverage required herein, and such failure continues for three (3) business days following written notice to Tenant, Landlord, in addition to any other remedy available pursuant to this Lease or otherwise, may, but shall not be obligated to, obtain such insurance and Tenant shall pay to Landlord on demand the premium costs thereof, plus an administrative fee of 15% of such cost. Landlord shall at all times during the Term maintain the following insurance policies: (A) commercial general liability insurance in amounts of not less than $1,000,000.00 per occurrence, $5,000,000.00 general aggregate, and (B) property insurance insuring the Building against loss or damage by fire or other casualty, and (C) contractual liability insurance sufficient to cover Landlord’s indemnity obligations hereunder (but only if such contractual liability insurance is not already included in Landlord’s commercial general liability insurance policy).

(b) Waiver of Claims; No Subrogation. Notwithstanding any provision in this Lease to the contrary, Landlord, its agents, employees and contractors shall not be liable to Tenant or to any party claiming by, through or under Tenant for (and Tenant hereby releases Landlord and its servants, agents, contractors, employees and invitees from any claim or responsibility for) any damage to or destruction, loss, or loss of use, or theft of any property of any Tenant Party located in or about the Project, caused by casualty, theft, fire, third parties or any other matter or cause, regardless of whether the negligence of any party caused such loss in whole or in part. Tenant acknowledges that Landlord shall not carry insurance on, and shall not be responsible for damage to, any property of any Tenant Party located in or about the Project. LANDLORD AND TENANT EACH WAIVES ANY CLAIM IT MIGHT HAVE AGAINST THE OTHER FOR ANY DAMAGE TO OR THEFT, DESTRUCTION, LOSS OR LOSS OF USE OF ANY PROPERTY, TO THE EXTENT THE SAME IS INSURED AGAINST UNDER ANY INSURANCE POLICY THAT COVERS THE BUILDING, THE PREMISES, LANDLORD’S OR TENANT’S FIXTURES, PERSONAL PROPERTY, LEASEHOLD IMPROVEMENTS, OR BUSINESS, OR IS REQUIRED TO BE INSURED AGAINST UNDER THE TERMS HEREOF, REGARDLESS OF WHETHER THE NEGLIGENCE OR FAULT OF THE OTHER PARTY CAUSED SUCH LOSS. EACH PARTY SHALL CAUSE ITS INSURANCE CARRIER TO ENDORSE ALL APPLICABLE POLICIES WAIVING THE CARRIER’S RIGHTS OF RECOVERY UNDER SUBROGATION OR OTHERWISE AGAINST THE OTHER PARTY.

(c) Indemnity. Subject to Section 10(b), Tenant shall defend, indemnify, and hold harmless Landlord and its representatives and agents from and against all claims, demands, liabilities, causes of action, suits, judgments, damages, and expenses (including reasonable attorneys’ fees) arising from any injury to or death of any person or the damage to or theft, destruction, loss, or loss of use of, any property or inconvenience (a “Loss”) (1) occurring in or on the Project (other than within the Premises) to the extent caused by the negligence or willful misconduct of any Tenant Party, (2) occurring in the Premises, unless caused by the gross negligence or willful misconduct of Landlord, its agents, contractors or employees (each being referred to herein as a “Landlord Party”), or (3) arising out of the installation, operation, maintenance, repair or removal of any property of any Tenant Party located in or about the Project, including Tenant’s property or equipment located outside the Premises. It being agreed that clauses (2) and (3) of this indemnity are intended to indemnify Landlord and its agents against the consequences of their own negligence or fault, even when Landlord or its agents are jointly, comparatively, contributively, or concurrently negligent with Tenant, and even though any such claim, cause of action or suit is based upon or alleged to be based upon the strict liability of Landlord or its agents; however, such indemnity shall not apply to the sole or gross negligence or willful misconduct of Landlord and its agents. Subject to Section 10(b), Landlord shall defend, indemnify, and hold harmless Tenant and its agents from and against all claims, demands, liabilities, causes of action, suits, judgments, damages, and expenses (including reasonable attorneys’ fees) for any Loss arising from any occurrence in or on the Building’s common areas to the extent caused by the negligence or willful misconduct of Landlord or its agents. The indemnities set forth in this Lease shall survive termination or expiration of this Lease and shall not terminate or be waived, diminished or affected in any manner by any abatement or apportionment of Rent under any provision of this Lease. If any proceeding is filed for which indemnity is required hereunder, the indemnifying party agrees, upon request therefor, to defend the indemnified party in such proceeding at its sole cost utilizing counsel satisfactory to the indemnified party.

11. Subordination; Attornment; Notice To Landlord's Mortgagee.

(a) Subordination. This Lease shall be subordinate to any deed of trust, mortgage, or other security instrument (a “Mortgage”), or any ground lease, master lease, or primary lease (a “Primary Lease”), that now or hereafter covers all or any part of the Premises (the mortgagee under any Mortgage or the lessor under any Primary Lease is referred to herein as “Landlord's Mortgagee”), provided that as a condition precedent to such subordination in each instance, each Landlord’s Mortgagee shall execute and deliver to Tenant an SNDA. Any out-of-pocket costs charged by Landlord’s Mortgagee in connection with obtaining such subordination, non-disturbance and attornment agreement shall be paid by Tenant within 15 days after Landlord’s written request therefor which shall include reasonable evidence of such costs.

(b) Attornment. Provided that Tenant and Landlord’s Mortgagee have executed an SNDA, Tenant shall attorn to any Landlord’s Mortgagee succeeding to Landlord's interest in the Premises, whether by purchase, foreclosure, deed in lieu of foreclosure, power of sale, termination of lease, or otherwise, in accordance with the terms of the SNDA.

(c) Notice to Landlord's Mortgagee. Tenant shall not seek to enforce any remedy it may have for any default on the part of the Landlord without first giving written notice by certified mail, return receipt requested, specifying the default in reasonable detail, to any Landlord's Mortgagee whose address has been given to Tenant, and affording such Landlord's Mortgagee a period to perform Landlord's obligations hereunder, which period shall equal the cure period applicable to Landlord hereunder.

(d) Subordination, Non-Disturbance and Attornment Agreement. Landlord shall obtain a subordination, non-disturbance and attornment agreement (an “SNDA”) from the current Landlord’s Mortgagee, and Landlord shall use reasonable efforts to obtain a subordination, non-disturbance and attornment agreement from any future Landlord’s Mortgagee, in a form reasonably acceptable to such Landlord’s Mortgagee or other institutional lenders; however, Landlord’s failure to obtain such agreement shall not constitute a default by Landlord hereunder or prohibit the mortgaging of the Building; and further provided that any out-of-pocket costs charged by Landlord’s Mortgagee in connection with obtaining such subordination, non-disturbance and attornment agreement shall be paid by Tenant within 15 days after Landlord’s written request therefor which request shall include reasonable evidence of such costs. The subordination of Tenant’s rights hereunder to any future Landlord’s Mortgagee under Section 11(a) shall be conditioned upon such future Landlord’s Mortgagee’s execution and delivery of a subordination, non-disturbance and attornment agreement in a form reasonably acceptable to such Landlord’s Mortgagee or other institutional lenders. Contemporaneously with execution of this Lease, Tenant, and the fee simple owner of the Land shall execute a recognition agreement in the form of EXHIBIT O attached hereto; Landlord and Tenant agree that the form of Recognition Agreement attached hereto as EXHIBIT O is acceptable for any current or future Landlord's Mortgagee pursuant to a Primary Lease (i.e., not a Mortgage).

12. Rules and Regulations. Tenant shall comply with the rules and regulations of the Building which are attached hereto as EXHIBIT B. Landlord may, from time to time, change such rules and regulations for the safety, care, or cleanliness of the Building and related facilities, provided that such changes are applicable to all tenants of the Building and will not unreasonably interfere with Tenant's use of the Premises; Landlord will provide Tenant written notice of such changes. Tenant shall be responsible for the compliance with such rules and regulations by its employees, agents, and invitees. To the extent of any conflict between the terms and provisions of this Lease and the rules and regulations, the terms and provisions of this Lease shall control.

13. Condemnation.

(a) Total Taking. If the entire Building or Premises are taken by right of eminent domain or conveyed in lieu thereof (a “Taking”), this Lease shall terminate as of the date of the Taking.

(b) Partial Taking - Landlord's Rights. If any material portion, but less than all, of the Project or related parking becomes subject to a Taking, or if Landlord is required to pay a material portion of the proceeds received for a Taking to Landlord's Mortgagee, then this Lease, at the option of Landlord, exercised by written notice to Tenant within thirty (30) days after such Taking, shall terminate and Rent shall be apportioned as of the date of such Taking. Upon the occurrence of a Taking, Rent shall be adjusted on a reasonable basis from the first day of the Taking until such termination.

(c) Partial Taking - Tenant’s Rights. If any part of the Project becomes subject to a Taking and such Taking will prevent Tenant from conducting on a permanent basis its business in the Premises in a manner reasonably comparable to that conducted immediately before such Taking, then Tenant may terminate this Lease as of the date of such Taking by giving written notice to Landlord within 30 days after the Taking, and Rent shall be apportioned as of the date of such Taking. If Tenant does not terminate this Lease, then Rent shall be abated on a reasonable basis.

(d) Award. If any Taking occurs, all proceeds shall belong to and be paid to Landlord, and Tenant shall not be entitled to any portion thereof except that Tenant shall have all rights permitted under the laws of the State of Texas to appear, claim and prove in proceedings relative to such taking (i) the value of any fixtures, furnishings, and other personal property which are taken but which under the terms of this Lease Tenant is permitted to remove at the end of the Term, (ii) the unamortized cost (such costs having been amortized on a straight-line basis over the Term excluding any renewal terms) of Tenant’s leasehold improvements which are taken that Tenant is not permitted to remove at the end of the Term and which were installed solely at Tenant’s expense (i.e., not made or paid for by Landlord from the Construction Allowance or otherwise), and (iii) relocation and moving expenses, but not the value of Tenant’s leasehold estate created by this Lease and only so long as such claims in no way diminish the award Landlord is entitled to from the condemning authority as provided hereunder.

14. Fire or Other Casualty.

(a) Repair Estimate. If the Premises or the Building are damaged by fire or other casualty (a “Casualty”), Landlord shall, within sixty (60) days after such Casualty, deliver to Tenant a good faith estimate (the “Damage Notice”) of the time needed to repair or replace the damage caused by such Casualty.

(b) Tenant’s Rights. If a material portion of the Building is damaged by Casualty such that Tenant is prevented from conducting its business in the Premises in a manner reasonably comparable to that conducted immediately before such Casualty and Landlord reasonably estimates that the damage caused thereby cannot be repaired within 300 days after the date of the casualty (the “Repair Period”), then Tenant may terminate this Lease by delivering written notice to Landlord of its election to terminate within 30 days after the Damage Notice has been delivered to Tenant.

(c) Landlord's Rights. If a Casualty damages a material portion of the Building, and if Landlord is required to pay a material portion of insurance proceeds arising out of the Casualty to Landlord's Mortgagee or the estimated Repair Period exceeds 270 days, then Landlord may terminate this Lease by giving written notice of its election to terminate within thirty (30) days after the Damage Notice has been delivered to Tenant, and Rent hereunder shall be abated as of the date of the Casualty.

(d) Repair Obligation. If neither party elects to terminate this Lease following a Casualty, then Landlord shall, within a reasonable time after such Casualty, commence to repair the Building and the Premises and shall proceed with reasonable diligence to restore the Building and Premises to substantially the same condition as they existed immediately before such Casualty; however, Landlord shall not be required to repair or replace any part of the furniture, equipment, fixtures, and other improvements which may have been placed by, or at the request of, Tenant or other occupants in the Building or the Premises, and Landlord's obligation to repair or restore the Building or Premises shall be limited to the extent of the insurance proceeds actually received by Landlord for the Casualty in question or the amount Landlord would have received had Landlord maintained the insurance under Section 10(a) above. Rent shall be equitably abated during any period of restoration pursuant to this subsection (d).

15. Events of Default. Each of the following occurrences shall constitute an “Event of Default” by Tenant:

(a) Tenant's failure to pay Rent, or any other sums due from Tenant to Landlord under the Lease (or any other lease executed by Tenant for space in the Building), within five (5) days after written notice of such failure;

(b) Tenant's failure to perform, comply with, or observe any other agreement or obligation of Tenant under this Lease (or any other lease executed by Tenant for space in the Building) within thirty (30) days after written notice of such failure, or such longer period as may be reasonably necessary in order to cure such default (not to exceed 60 days), provided that Tenant has commenced such cure within the initial 30 day period and thereafter is diligently pursuing such cure to completion;

(c) The filing of a petition by or against Tenant (the term “Tenant” shall include, for the purpose of this Section 15(c), any guarantor of the Tenant's obligations hereunder) (i) in any bankruptcy or other insolvency proceeding; (ii) seeking any relief under any state or federal debtor relief law; (iii) for the appointment of a liquidator or receiver for all or substantially all of Tenant's property or for Tenant's interest in this Lease; or (iv) for the reorganization or modification of Tenant's capital structure; and provided that in the case of any of the foregoing which is filed against Tenant, the same is not dismissed within ninety (90) days after it is filed; and

(d) The admission by Tenant that it cannot meet its obligations as they become due or the making by Tenant of an assignment for the benefit of its creditors.

16. Remedies.

(a) Landlord’s Remedies. Upon any Event of Default by Tenant, Landlord may, subject to any judicial process and notice to the extent required by Title 4, Chapter 24 of the Texas Property Code, as may be amended, in addition to all other rights and remedies afforded Landlord hereunder or by law or equity, take any of the following actions:

(i) Terminate this Lease by giving Tenant written notice thereof, in which event, Tenant shall pay to Landlord the sum of (1) all Rent accrued hereunder through the date of termination, (2) all amounts due under Section 15(a), and (3) an amount equal to (A) the total Rent that Tenant would have been required to pay for the remainder of the Term discounted to present value at a per annum rate equal to the “Prime Rate” as published on the date this Lease is terminated by The Wall Street Journal, Southwest Edition, in its listing of “Money Rates”, minus (B) the then present fair rental value of the Premises for such period, similarly discounted; or

(ii) Terminate Tenant's right to possession of the Premises without terminating this Lease by giving written notice thereof to Tenant, in which event Tenant shall pay to Landlord (1) all Rent and other amounts accrued hereunder to the date of termination of possession, (2) all amounts due from time to time under Section 15(a), and (3) all Rent and other sums required hereunder to be paid by Tenant during the remainder of the Term, diminished by any net sums thereafter received by Landlord through reletting the Premises during such period. Landlord shall use reasonable efforts to relet the Premises on such terms and conditions as Landlord in its sole discretion may determine (including a term different from the Term, rental concessions, and alterations to, and improvement of , the Premises); however, Landlord shall not be obligated to relet the Premises before leasing other portions of the Building. Landlord shall not be liable for, nor shall Tenant's obligations hereunder be diminished because of, Landlord's failure to relet the Premises or to collect rent due for such reletting. Tenant shall not be entitled to the excess of any consideration obtained by reletting over the Rent due hereunder. Re-entry by Landlord in the Premises shall not affect Tenant's obligations hereunder for the unexpired Term; rather, Landlord may, from time to time, bring action against Tenant to collect amounts due by Tenant, without the necessity of Landlord's waiting until the expiration of the Term. Unless Landlord delivers written notice to Tenant expressly stating that it has elected to terminate this Lease, all actions taken by Landlord to exclude or dispossess Tenant of the Premises shall be deemed to be taken under this Section 16(a)(ii). If Landlord elects to proceed under this Section 16(a)(ii), it may at any time elect to terminate this Lease under Section 16(a)(i).

(iii) Notwithstanding anything to the contrary herein, Tenant shall not be deemed to have waived any requirements of Landlord to mitigate damages upon an Event of Default as required by law.

(b) Tenant’s Remedies.

(i) If Landlord shall fail to perform any act or acts required of Landlord by this Lease which results in the cessation of HVAC, sewer, water, electricity or elevator service to the Premises (provided that (a) the provision of such services are within Landlord’s reasonable control, and (b) the cessation of such service materially impairs Tenant’s ability to conduct business from the Premises), and if such failure continues for fifteen (15) days after receipt of notice from Tenant (or, if such default cannot reasonably be cured within fifteen (15) days, Landlord fails to commence to cure the same within fifteen (15) days of notice and diligently proceed to cure such default) Tenant may, upon not less than five (5) business days' notice to Landlord (such notice being the second notice to Landlord of such failure) that Tenant elects to proceed under this Section 16(b), take such commercially reasonable steps as are required to cure such default.

(ii) Any work performed by or on behalf of Tenant shall be performed in good and workmanlike manner and compliance with all laws and this Lease. In addition, Tenant shall reasonably cooperate with Landlord in enforcing any warranties obtained by Tenant in connection with such work at Landlord's sole cost and expense. If the obligation to be performed by Tenant will affect the Building’s heating, venting, air conditioning, life safety, electrical, plumbing, or sprinkler systems, Tenant shall use only those contractors used by Landlord in the Building for work on such systems. All other contractors shall be subject to Landlord’s reasonable approval and Landlord agrees to approve or reject any contractor proposed to be used by Tenant within 48 hours of receipt of the second notice from Tenant referenced above. If a proposed contractor is duly licensed, bonded, is able to satisfy Landlord’s vendor insurance requirements, then (a) Landlord agrees not to withhold its approval of the proposed contractor, and (b) if Landlord fails to respond to a request for approval of such contractor within the 48-hour time period referenced in the preceding sentence, then Landlord shall be deemed to have approved such contractor.

(iii) Provided that such repairs are completed in a good and workmanlike manner, Landlord shall reimburse Tenant for its actual, out-of-pocket costs therefor within 30 days after delivery to Landlord of a reasonably detailed invoice and, if requested by Landlord, receipts, bills paid affidavits, and appropriate releases of liens. If Landlord fails to pay to Tenant any amounts owing pursuant to the preceding sentence, then Tenant shall deliver to Landlord a second demand for payment that shall include a phrase substantially similar to the following, in bold all caps language (an “Offset Exercise Notice”): “FAILURE TO EITHER ISSUE AN OFFSET DISPUTE NOTICE OR PAY SUCH AMOUNTS WITHIN FIVE BUSINESS DAYS FOLLOWING THIS NOTICE WILL RESULT IN TENANT’S ABILITY TO OFFSET THE DEMANDED SUMS FROM UPCOMING RENT OBLIGATIONS.” If Landlord fails to respond timely to an Offset Exercise Notice, Tenant may elect to offset such amounts against twenty-five percent (25%) of the next due installment of Rent and, to the extent necessary to fully satisfy such amount, twenty-five percent (25%) of the next subsequent installments of Rent. In addition, if the remaining Term is insufficient to allow Tenant to recover any amounts owing Tenant pursuant to this Section 16(b), Tenant may elect to extend the Term for the period of time necessary to allow Tenant recover in full any such amounts owing to Tenant. Notwithstanding the foregoing, in the event that Landlord believes that Tenant is not entitled to exercise the offset rights described in an Offset Exercise Notice, Landlord shall have the right to notify Tenant (not later than five (5) business days following the Offset Exercise Notice) that Landlord has elected to dispute such exercise by Tenant of its offset rights hereunder (an “Offset Dispute Notice”) (which Offset Dispute Notice shall describe, with reasonable specificity, the reason(s) that Landlord believes that Tenant is not entitled to exercise such offset), in which event Tenant shall not offset the amount in question, except to the extent that the dispute shall thereafter be resolved in Tenant's favor, as provided below. In the event that Landlord timely delivers an Offset Dispute Notice to Tenant as provided above, then Tenant shall have the right to submit the dispute to arbitration as follows: