UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C.

20549

FORM 10-Q

[X] QUARTERLY REPORT UNDER SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934

For the quarterly period ended August 31, 2015

[ ] TRANSITION REPORT UNDER SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from _____ to _____

Commission File Number: 000-50907

HANDENI GOLD INC.

(Exact name of registrant as specified in its

charter)

| Nevada | 98-0430222 |

| (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) |

| P.O. Box 33507, | |

| Plot 82A, ITV Road, Mikocheni Light Industrial Area, | N/A |

| Dar es Salaam, the United Republic of Tanzania | |

| (Address of principal executive offices) | (Zip Code) |

+255 222 70 00 84

(Registrant’s telephone

number, including area code)

Indicate by check mark whether the registrant (1) has filed all

reports required to be filed by Section 13 or 15(d) of the Exchange Act during

the past 12 months (or for such shorter period that the registrant was required

to file such reports), and (2) has been subject to such filing requirements for

the past 90 days.

Yes [X] No [

]

Indicate by check mark whether the registrant has submitted

electronically and posted on its corporate Web site, if any, every Interactive

Data File required to be submitted and posted pursuant to Rule 405 of Regulation

S-T (§232.405 of this chapter) during the preceding 12 months (or for such

shorter period that the registrant was required to submit and post such files).

Yes [X] No [ ]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer,” “non-accelerated filer,” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer [ ] | Accelerated filer [ ] |

| Non-accelerated filer [ ] | Smaller reporting company [X] |

| (Do not check if a smaller reporting company) |

Indicate by check mark whether the registrant is a shell

company (as defined in Rule 12b-2 of the Exchange Act).

Yes [

] No [X]

State the number of shares outstanding of each of the issuer’s

classes of common equity, as of the latest practicable date,

321,416,654 shares of common stock as of October 5, 2015.

| HANDENI GOLD INC. (FORMERLY DOUGLAS LAKE MINERALS INC.) |

| Quarterly Report On Form 10-Q |

| For The Quarterly Period Ended |

| August 31, 2015 |

| INDEX |

FORWARD-LOOKING STATEMENTS

This quarterly report on Form 10-Q contains forward-looking statements that involve risks and uncertainties. Forward-looking statements in this quarterly report include, among others, statements regarding our capital needs, business plans and expectations. Such forward-looking statements involve risks and uncertainties regarding the market price of gold, availability of funds, government regulations, permitting, common share prices, operating costs, capital costs, outcomes of ore reserve development, recoveries and other factors. Forward-looking statements are made, without limitation, in relation to operating plans, property exploration and development, availability of funds, environmental reclamation, operating costs and permit acquisition. Any statements contained herein that are not statements of historical facts may be deemed to be forward-looking statements. In some cases, you can identify forward-looking statements by terminology such as “may”, “will”, “should”, “expect”, “plan”, “intend”, “anticipate”, “believe”, “estimate”, “predict”, “potential” or “continue”, the negative of such terms or other comparable terminology. Actual events or results may differ materially. In evaluating these statements, you should consider various factors, including the risks outlined in our annual report on Form 10-K for the year ended May 31, 2015, and, from time to time, in other reports that we file with the Securities and Exchange Commission (the “SEC”). These factors may cause our actual results to differ materially from any forward-looking statement. Given these uncertainties, readers are cautioned not to place undue reliance on such forward-looking statements.

1

PART I – FINANCIAL INFORMATION

| Item 1. | Financial Statements |

The following unaudited interim consolidated financial statements of Handeni Gold Inc. (sometimes referred to as “we”, “us” or “our Company”) are included in this quarterly report on Form 10-Q:

2

| Handeni Gold Inc. |

| Consolidated Balance Sheets |

| (Expressed in U.S. dollars) |

| August 31, 2015 | May 31, 2015 | |||||

| (Unaudited) | (Audited) | |||||

| ASSETS | ||||||

| Current Assets | ||||||

| Cash | $ | 107,171 | $ | 85,985 | ||

| Amounts receivable (Note 3) | 40,323 | 38,751 | ||||

| Prepaid expenses and deposits (Note 4) | 10,487 | 306 | ||||

| Total Current Assets | 157,981 | 125,042 | ||||

| Restricted cash equivalent (Note 5) | 13,045 | 13,858 | ||||

| Mineral licenses (Note 6) | 1,650,000 | 1,650,000 | ||||

| Property and equipment, net (Note 7) | 679 | 1,474 | ||||

| TOTAL ASSETS | $ | 1,821,705 | $ | 1,790,374 | ||

| LIABILITIES AND STOCKHOLDERS' DEFICIENCY | ||||||

| Current Liabilities | ||||||

| Accounts payable and accrued liabilities | $ | 52,958 | $ | 52,785 | ||

| Accounts payable and accrued liabilities - related parties (Note 8) | - | 454,615 | ||||

| Total Current Liabilities | 52,958 | 507,400 | ||||

| Loans from related parties (Note 8 (a)) | 1,475,000 | 1,340,000 | ||||

| Payables due to related parties (Note 8) | 451,000 | - | ||||

| Total Liabilities | 1,978,958 | 1,847,400 | ||||

| Nature of Operations and Going Concern (Note 1) | ||||||

| Commitments and Contingencies (Notes 6 and 12) | ||||||

| Stockholders' Equity (Deficiency) | ||||||

| Common stock (Note

9) Authorized: 500,000,000 shares, $0.001 par value Issued and outstanding: 321,416,654 shares (May 31, 2015 – 321,416,654 shares) |

321,417 | 321,417 | ||||

| Additional paid-in capital (Note 9) | 116,414,824 | 116,414,824 | ||||

| Donated capital (Note 8 (a)) | 350,989 | 314,982 | ||||

| Deficit accumulated during the exploration stage | (117,244,483 | ) | (117,108,249 | ) | ||

| Total Stockholders' Deficiency | (157,253 | ) | (57,026 | ) | ||

| TOTAL LIABILITIES AND STOCKHOLDERS' DEFICIENCY | $ | 1,821,705 | $ | 1,790,374 |

(The accompanying notes are an integral part of these consolidated financial statements)

3

| Handeni Gold Inc. |

| Interim Consolidated Statements of Operations and Comprehensive Loss |

| (Expressed in U.S. dollars) |

| (Unaudited) |

| For the Three Months Ended, | ||||||

| August 31, 2015 | August 31, 2014 | |||||

| Revenue | $ | - | $ | - | ||

| Expenses | ||||||

| Consulting fees | 1,350 | 5,850 | ||||

| Depreciation | 795 | 22,206 | ||||

| Exploration expenses | 20,303 | 45,577 | ||||

| General and administrative | 47,868 | 125,760 | ||||

| Interest expense | 36,007 | 26,987 | ||||

| Professional | 3,347 | 32,503 | ||||

| Rent | 36,411 | 48,215 | ||||

| Travel and investor relations | 165 | 1,134 | ||||

| Total Expenses | 146,246 | 308,232 | ||||

| Loss From Operations | (146,246 | ) | (308,232 | ) | ||

| Other Income (Expenses) | ||||||

| Gain on disposal of equipment | 10,000 | 20,209 | ||||

| Interest income | 12 | 64 | ||||

| Total other Income | 10,012 | 20,273 | ||||

| Net Loss | (136,234 | ) | (287,959 | ) | ||

| Other Comprehensive Loss | ||||||

| Unrealized loss on marketable securities | - | (13,600 | ) | |||

| Comprehensive Loss | $ | (136,234 | ) | $ | (301,559 | ) |

| Net Loss per Share - Basic and Diluted | $ | (0.00 | ) | $ | (0.00 | ) |

| Basic and Diluted Weighted

Average

Number of Common Shares Outstanding |

321,416,654 | 321,416,654 | ||||

(The accompanying notes are an integral part of these consolidated financial statements)

4

| Handeni Gold Inc. |

| Interim Consolidated Statements of Cash Flows |

| (Expressed in U.S. dollars) |

| (Unaudited) |

| For the Three Months Ended, | ||||||

| August 31, 2015 | August 31, 2014 | |||||

| CASH AND CASH EQUIVALENTS PROVIDED BY (USED IN): | ||||||

| Operating Activities: | ||||||

| Net loss | $ | (136,234 | ) | $ | (287,959 | ) |

| Adjustments for non-cash items in net loss: | ||||||

| Depreciation | 795 | 22,206 | ||||

| Donated capital, services, interest and rent | 36,007 | 26,987 | ||||

| Loss on unrealized foreign exchange | 813 | 95 | ||||

| Gain on disposal of equipment | (10,000 | ) | (20,209 | ) | ||

| Changes in non-cash operating working capital: | ||||||

| Amounts receivable | (1,572 | ) | (2,104 | ) | ||

| Prepaid expenses and deposits | (10,181 | ) | (5,077 | ) | ||

| Accounts payable and accrued liabilities | 173 | (22,669 | ) | |||

| Due to related parties | (3,615 | ) | 43,656 | |||

| Cash Used in Operating Activities | (123,814 | ) | (245,074 | ) | ||

| Investing Activities: | ||||||

| Proceeds from disposal of equipment | 10,000 | 20,209 | ||||

| Cash Provided by Investing Activities | 10,000 | 20,209 | ||||

| Financing Activities: | ||||||

| Loan from a related party | 135,000 | - | ||||

| Cash Provided by Financing Activities | 135,000 | - | ||||

| Increase (Decrease) in cash | 21,186 | (224,865 | ) | |||

| Cash, at beginning of the period | 85,985 | 532,694 | ||||

| Cash, at end of the period | $ | 107,171 | $ | 307,829 | ||

(The accompanying notes are an integral part of these consolidated financial statements)

5

| Handeni Gold Inc. |

| Notes to the Interim Consolidated Financial Statements as of August 31, 2015 |

| (Expressed in U.S. dollars) |

| (Unaudited) |

| 1. |

Nature of Operations and Going Concern |

The Company was incorporated in the State of Nevada on January 5, 2004. On February 14, 2012, the Company changed its name from Douglas Lake Minerals Inc. to Handeni Gold Inc. (the “Company”). The Company’s principal business is the acquisition and exploration of mineral resources located in Tanzania, Africa. The Company has not presently determined whether its properties contain mineral reserves that are economically recoverable.

These consolidated financial statements have been prepared on a going concern basis, which implies the Company will continue to realize its assets and discharge its liabilities in the normal course of business. The Company has never generated revenues since inception and has never paid any dividends and is unlikely to pay dividends or generate earnings in the immediate or foreseeable future. The continuation of the Company as a going concern is dependent upon the continued financial support from its stockholders, the ability of the Company to obtain necessary equity financing to continue operations and to determine the existence, discovery and successful exploitation of economically recoverable reserves in its resource properties, confirmation of the Company’s interests in the underlying properties, and the attainment of profitable operations.

As at August 31, 2015, the Company has not generated any revenues and has accumulated losses of $117,244,483 since inception. These factors raise substantial doubt regarding the Company’s ability to continue as a going concern. The Company plans to raise equity and/or debt financing to fund its operations which may result in substantial dilution to the Company’s stockholders or may not be available, if at all, in amounts or on terms acceptable to the Company. If additional capital is not obtained, the Company may be forced to cease operations. These consolidated financial statements do not include any adjustments to the recoverability and classification of recorded asset amounts and classification of liabilities that might be necessary should the Company be unable to continue as a going concern.

| 2. |

Summary of Significant Accounting Policies |

| a) |

Basis of Presentation | |

|

These consolidated financial statements and related notes are presented in accordance with accounting principles generally accepted in the United States, and are expressed in U.S. dollars. These consolidated financial statements include the accounts of the Company and its subsidiaries described as follows. In June 2011, the Company incorporated in Tanzania a wholly-owned subsidiary, HG Limited (formerly DLM Tanzania Limited), which undertakes mineral property exploration activities in Tanzania. The Company also has a wholly-owned non-operating Tanzanian subsidiary (Douglas Lake Tanzania Limited). | ||

|

All significant intercompany transactions and balances have been eliminated. The Company’s fiscal year-end is May 31. | ||

| b) |

Interim Consolidated Financial Statements | |

|

The interim unaudited consolidated financial statements have been prepared in accordance with accounting principles generally accepted in the United States for interim financial information and with the instructions to Securities and Exchange Commission (“SEC”) Form 10-Q. They do not include all of the information and footnotes required by generally accepted accounting principles for complete financial statements. Therefore, these financial statements should be read in conjunction with the Company’s audited consolidated financial statements and notes thereto for the year ended May 31, 2015, included in the Company’s Annual Report on Form 10-K filed on August 21, 2015 with the SEC. | ||

|

The interim financial statements included herein are unaudited; however, they contain all normal recurring accruals and adjustments that, in the opinion of management, are necessary to present fairly the Company’s financial position at August 31, 2015, and the results of its operations and cash flows for the interim period ended August 31, 2015. The results of operations for the three months ended August 31, 2015 are not necessarily indicative of the results to be expected for future quarters or the full year. | ||

| c) |

Use of Estimates | |

|

The preparation of consolidated financial statements in accordance with United States generally accepted accounting principles requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities at the date of the consolidated financial statements and the reported amounts of revenue and expenses in the reporting period. The Company regularly evaluates estimates and assumptions related to the recoverability and useful life of long-lived assets, mineral prospecting licenses, stock-based compensation, deferred income tax asset valuation allowances and contingent liabilities. The Company bases its estimates and assumptions on current facts, historical experience and various other factors that it believes to be reasonable under the circumstances, the results of which form the basis for making judgments about the carrying values of assets and liabilities and the accrual of costs and expenses that are not readily apparent from other sources. The actual results experienced by the Company may differ materially and adversely from the Company’s estimates. To the extent there are material differences between the estimates and the actual results, future results of operations will be affected. | ||

| d) |

Basic and Diluted Net Income (Loss) Per Share | |

|

The Company computes net income (loss) per share in accordance with ASC 260, Earnings per Share which requires presentation of both basic and diluted earnings per share (EPS) on the face of the income statement. Basic EPS is computed by dividing net income (loss) available to common shareholders (numerator) by the weighted average number of shares outstanding (denominator) during the period. Diluted EPS gives effect to all dilutive potential common shares outstanding during the period using the treasury stock method and convertible preferred stock using the if-converted method. In computing diluted EPS, the average stock price for the period is used in determining the number of shares assumed to be purchased from the exercise of stock options or warrants. Diluted EPS excludes all dilutive potential shares if their effect is anti-dilutive. |

6

| Handeni Gold Inc. |

| Notes to the Interim Consolidated Financial Statements as of August 31, 2015 |

| (Expressed in U.S. dollars) |

| (Unaudited) |

| 2. |

Summary of Significant Accounting Policies (continued) |

| e) |

Comprehensive Income (Loss) | |

|

ASC 220, Comprehensive Income establishes standards for the reporting and display of comprehensive income (loss) and its components in the consolidated financial statements. As at August 31, 2015, the Company has no component of other comprehensive income (loss) and accumulated other comprehensive income (loss). | ||

| f) |

Cash and Cash Equivalents | |

|

Cash and cash equivalents are carried at fair value and they comprise cash on hand, deposits held with banks and other highly liquid investments. Highly liquid investments are readily convertible to cash and generally have maturities of three months or less from the time acquired. The Company places its cash and cash equivalents with high quality financial institutions which the Company believes limits credit risk. | ||

| g) |

Marketable Securities | |

|

The Company reports investments in marketable equity securities at fair value based on quoted market prices. All investment securities are designated as available for sale with unrealized gains and losses included in stockholders’ equity. Realized gains and losses are accounted for based on the specific identification method. | ||

|

The Company periodically reviews these investments for other-than-temporary declines in fair value based on the specific identification method. When an other-than-temporary decline has occurred, unrealized losses that are other than temporary are recognized in earnings. When determining whether a decline is other-than-temporary, the Company examines (i) the length of time and the extent to which the fair value of an investment has been lower than its carrying value; (ii) the financial condition and near-term prospects of the investee, including any specific events that may influence the operations of the investee such as changes in technology that may impair the earnings potential of the investee; and (iii) the Company’s intent and ability to retain its investment in the investee for a sufficient period of time to allow for any anticipated recovery in market value. The Company generally believes that an other-than-temporary decline has occurred when the fair value of the investment is below the carrying value for one year, absent of evidence to the contrary. | ||

| h) |

Property and Equipment | |

|

Property and equipment consists of office equipment, automobiles and computer software recorded at cost and depreciated on a straight- line basis as follows: |

| Automobiles | 3 years |

| Camp and equipment | 3 years |

| Office furniture and equipment | 3 years |

| Software | 1 year |

| i) |

Mineral Property Costs | |

|

The Company has been in the exploration stage since its inception on January 5, 2004 and has not yet realized any revenues from its planned operations. It is primarily engaged in the acquisition and exploration of mining properties. Mineral property exploration costs are expensed as incurred. Mineral prospecting licenses and mineral property acquisition costs are initially capitalized. The Company assesses the carrying costs for impairment under ASC 360, Property, Plant, and Equipment, whenever events or changes in circumstances indicate that the carrying costs may not be recoverable. | ||

|

When it has been determined that a mineral property can be economically developed as a result of establishing proven and probable reserves, the costs then incurred to develop such property, are capitalized. Such costs will be amortized using the units-of-production method over the estimated life of the probable reserve. If mineral properties are subsequently abandoned or impaired, any capitalized costs will be charged to operations. | ||

| j) |

Long-Lived Assets | |

|

In accordance with ASC 360, Property Plant and Equipment, the Company tests long-lived assets or asset groups for recoverability when events or changes in circumstances indicate that their carrying amount may not be recoverable. Circumstances which could trigger a review include, but are not limited to: significant decreases in the market price of the asset; significant adverse changes in the business climate or legal factors; accumulation of costs significantly in excess of the amount originally expected for the acquisition or construction of the asset; current period cash flow or operating losses combined with a history of losses or a forecast of continuing losses associated with the use of the asset; and current expectation that the asset will more likely than not be sold or disposed significantly before the end of its estimated useful life. Recoverability is assessed based on the carrying amount of the asset and its fair value, which is generally determined based on the sum of the undiscounted cash flows expected to result from the use and the eventual disposal of the asset, as well as specific appraisal in certain instances. An impairment loss is recognized when the carrying amount is not recoverable and exceeds fair value. |

7

| Handeni Gold Inc. |

| Notes to the Interim Consolidated Financial Statements as of August 31, 2015 |

| (Expressed in U.S. dollars) |

| (Unaudited) |

| 2. |

Summary of Significant Accounting Policies (continued) |

| k) |

Asset Retirement Obligations | |

|

The Company accounts for asset retirement obligations in accordance with the provisions of ASC 440, Asset Retirement and Environmental Obligations, which requires the Company to record the fair value of an asset retirement obligation as a liability in the period in which it incurs a legal obligation associated with the retirement of tangible long-lived assets that result from the acquisition, construction, development and/or normal use of the assets. The Company did not have any asset retirement obligations as of August 31, 2015 and May 31, 2015. | ||

| l) |

Financial Instruments | |

|

ASC 825, Financial Instruments, requires an entity to maximize the use of observable inputs, and the fair value of financial instruments, which include cash, restricted cash equivalent, restricted marketable securities, and accounts payable were estimated to approximate their carrying values due to the immediate or short-term maturities of these financial instruments. | ||

|

The Company’s operations are in Canada and Africa, which results in exposure to market risks from changes in foreign currency rates. The financial risk is the risk to the Company’s operations that arise from fluctuations in foreign exchange rates and the degree of volatility of these rates. Currently, the Company does not use derivative instruments to reduce its exposure to foreign currency risk. | ||

| m) |

Income Taxes | |

|

The Company accounts for income taxes using the asset and liability method in accordance with ASC 740, Income Taxes. The asset and liability method provides that deferred tax assets and liabilities are recognized for the expected future tax consequences of temporary differences between the financial reporting and tax bases of assets and liabilities, and for operating loss and tax credit carry-forwards. Deferred tax assets and liabilities are measured using the currently enacted tax rates and laws that will be in effect when the differences are expected to reverse. The Company records a valuation allowance to reduce deferred tax assets to the amount that is believed more likely than not to be realized. | ||

| n) |

Foreign Currency Translation | |

|

The functional and reporting currency of the Company is the United States dollar. Monetary assets and liabilities denominated in foreign currencies are translated to United States dollars in accordance with ASC 830, Foreign Currency Translation Matters, using the exchange rate prevailing at the consolidated balance sheet date. Non-monetary assets and liabilities denominated in foreign currencies are translated at rates of exchange in effect at the date of the transaction. Average rates are used to translate revenues and expenses. | ||

|

Gains and losses arising on translation or settlement of foreign currency denominated transactions or balances are included in the determination of income. The Company has not, to the date of these consolidated financial statements, entered into derivative instruments to offset the impact of foreign currency fluctuations. | ||

|

To the extent that the Company incurs transactions that are not denominated in its functional currency, they are undertaken in Canadian dollars (“Cdn$”) and Tanzanian shillings. The Company has not, to the date of these consolidated financial statements, entered into derivative instruments to offset the impact of foreign currency fluctuations. | ||

| o) |

Stock-based Compensation | |

|

The Company records stock-based compensation in accordance with ASC 718, Compensation – Stock Based Compensation, and ASC 505, Equity Based Payments to Non-Employees, which requires the measurement and recognition of compensation expense based on estimated fair values for all share-based awards made to employees and directors, including stock options. | ||

|

ASC 718 requires companies to estimate the fair value of share-based awards on the date of grant using an option-pricing model. The Company uses the Black-Scholes option-pricing model as its method of determining fair value. This model is affected by the Company’s stock price as well as assumptions regarding a number of subjective variables. These subjective variables include, but are not limited to the Company’s expected stock price volatility over the term of the awards, and actual and projected employee stock option exercise behaviours. The value of the portion of the award that is ultimately expected to vest is recognized as an expense in the consolidated statement of operations and comprehensive loss over the requisite service period. | ||

|

All transactions in which goods or services are the consideration received for the issuance of equity instruments are accounted for based on the fair value of the consideration received or the fair value of the equity instrument issued, whichever is more reliably measurable. | ||

| p) |

Reclassification | |

|

Certain reclassifications have been made to the prior periods’ consolidated financial statements to conform to the current period’s presentation. |

8

| Handeni Gold Inc. |

| Notes to the Interim Consolidated Financial Statements as of August 31, 2015 |

| (Expressed in U.S. dollars) |

| (Unaudited) |

| 2. |

Summary of Significant Accounting Policies (continued) |

| q) |

Recently Issued Accounting Pronouncements | |

|

The Company has adopted all new accounting pronouncements that are mandatorily effective and none have a material impact on its consolidated financial statements. | ||

|

New accounting pronouncements effective June 1, 2015 | ||

|

During the year ended May 31, 2015, the Company elected to early adopt Accounting Standards Update No. 2014- 10, Development Stage Entities (Topic 915): Elimination of Certain Financial Reporting Requirements. The adoption of this standard allowed the Company to remove the previously disclosed inception-to-date information and all references to exploration stage. | ||

|

The Company does not believe that there are any other new accounting pronouncements that have been issued that are expected to have a material impact on its financial position or results of operations. |

| 3. |

Amounts Receivable |

The components of amounts receivable are as follows:

| August 31, | May 31, | ||||||

| 2015 | 2015 | ||||||

| $ | $ | ||||||

| Recoverable value added tax | 27,187 | 28,797 | |||||

| Recoverable goods and services / harmonized sales tax | 13,136 | 9,830 | |||||

| Other receivable | - | 124 | |||||

| 40,323 | 38,751 |

| 4. |

Prepaid Expenses and Deposits |

The components of prepaid expenses and deposits are as follows:

| August 31, | May 31, | ||||||

| 2015 | 2015 | ||||||

| $ | $ | ||||||

| General and administrative | 10,337 | - | |||||

| Rent | 150 | 306 | |||||

| 10,487 | 306 |

| 5. |

Restricted Cash Equivalent |

|

As of August 31, 2015, the Company has pledged a GIC of $13,045 (May 31, 2015: $13,858) as security held on a corporate credit card. The $813 difference compared to May 31, 2015 is attributed to loss on unrealized Canadian dollar foreign exchange. |

| 6. |

Mineral Properties and Licenses |

| a) |

Handeni Properties, Tanzania, Africa | |

|

Prospecting Licenses (“PLs”) | ||

|

On September 21, 2010, the Company completed a Mineral Property Acquisition Agreement with IPP Gold Limited (“IPP Gold”), and the Company acquired four PLs totaling approximately 800 square kilometers, located in the Handeni District of Tanzania (the “Handeni Properties”). IPP Gold retained a 2.5% net smelter royalty (“NSR”) on the Handeni Properties and the Company has the option to reduce the NSR to 1.25% by paying $5,000,000. If the NSR is reduced to 1.25% the maximum NSR for any year is capped at $1,000,000. In any year the NSR payment is less than $1,000,000 the difference between the actual NSR payment and $1,000,000 will be carried forward to subsequent years. In addition if the London spot price for gold is equal to or greater than $1,500 then the NSR will increase from 2.5% to 3%. The Company issued 133,333,333 restricted shares of common stock to IPP Gold to acquire the Handeni Properties and no further payments to IPP Gold in shares or cash are required. | ||

|

On September 1, 2010, the Company entered into a Transaction Fee Agreement with a consultant for services related to soliciting offers from and in assisting in the negotiation with potential Company financiers, purchasers, acquisition targets and/or joint venture development partners (each such party being a “Potential Investor”). The initial term of the agreement was a period of 60 days and automatically renews monthly unless otherwise specifically renewed in writing by each party or terminated by the Company. Pursuant to the agreement, the Company agreed to pay the consultant a transaction fee for each completed property acquisition transaction in Tanzania (a “Completed Transaction”). The transaction fee is 12.5% of the shares issuable under each Completed Transaction, payable in restricted common shares at the lowest priced security issuable under each Completed Transaction. On September 30, 2010, the Company issued 16,666,667 restricted shares of common stock pursuant to the Transaction Fee Agreement in relation to the acquisition of the Handeni Properties. |

9

| Handeni Gold Inc. |

| Notes to the Interim Consolidated Financial Statements as of August 31, 2015 |

| (Expressed in U.S. dollars) |

| (Unaudited) |

| 6. |

Mineral Properties and Licenses (continued) |

| a) |

Handeni Properties, Tanzania, Africa (continued) | |

|

Prospecting Licenses (“PLs”) (continued) | ||

|

The fair value of the 133,333,333 shares of the Company’s common stock issued to IPP Gold pursuant to the Acquisition Agreement and the 16,666,667 shares of the Company’s common stock issued pursuant to the Transaction Fee Agreement totaled $60,000,000. | ||

|

On November 30, 2010, the capitalized acquisition costs of the Handeni Properties were tested for impairment by the Company’s management as required by ASC 360. Management determined that no positive cash flows from the Handeni Properties could be identified or supported and a full impairment loss was recognized in expenses for the $60,000,000 acquisition cost. | ||

|

Under Tanzanian law, 50% of the area of PLs need to be relinquished following a period of three years after allocation of the PLs to the Company (1998 Mining Act applicable to the Companies’ PLs). The Company has received four renewal PLs of the renewal areas under PL6742/2010, PL6744/2010, PL6743/2010 and PL6779/2010 effective on October 5, 2013, September 13, 2013, October 13, 2013 and September 13, 2013, respectively. These four PLs are valid until October 4, 2016, September 12, 2016, October 12, 2016 and September 12, 2016, respectively. The total area occupied by the renewal licenses is approximately 359.80 km2 or 45% of the original area. | ||

|

In addition to the renewal areas, the Company had also applied for the remainder of the license areas and has received four additional PLs. The Company now holds a total license area of approximately 423.03 km2 (53% of its original 800 km2 license area). | ||

|

During the quarter ended August 31, 2015, the Company paid $1,223 (the year ended May 31, 2015: $62,584) in annual rental and licenses renewal fees for PLs. Such license related fees have been recorded as exploration expenses. | ||

|

Primary Mining Licenses (“PMLs”), | ||

|

On August 5, 2011, the Company entered a Mineral Property Acquisition Agreement (the “2011 Acquisition Agreement”) with Handeni Resources Limited (“Handeni Resources”), a limited liability company registered under the laws of Tanzania. The Chairman of the Board of Directors of the Company has an existing ownership and/or beneficial interest(s) in Handeni Resources. Pursuant to the 2011 Acquisition Agreement, the Company had an exclusive option to acquire from Handeni Resources a 100% interest in mineral licenses covering an area of approximately 2.67 square kilometers to the east of Magambazi Hill, which is adjacent to the area covered by the Company’s four existing PLs in the Handeni District. | ||

|

On November 30, 2011, the Company completed the 2011 Acquisition Agreement and issued 15,000,000 restricted common shares to Handeni Resources as payment. As at November 30, 2011, the fair market price of the Company’s common stock was $0.11 per share; accordingly, the Company recorded a total fair market value of $1,650,000 as the mineral licenses acquisition cost. | ||

|

To comply with the laws and regulations of the Republic of Tanzania whereby foreign companies may not own PMLs, on July 19, 2012, the Company entered into an Addendum agreement to the 2011 Acquisition Agreement whereby Handeni Resources, on behalf of the Company, administers the 32 PMLs until such time as a mining license on the 32 PMLs (2.67 km2) have been allocated. During this period Handeni Resources is conducting exploration and mining activities on the PMLs as directed by the Company. | ||

| b) |

Mkuvia Alluvial Gold Project, Tanzania, Africa | |

|

The Mkuvia Alluvial Gold Project was comprised of four PLs covering a total area of 380 square kilometers located in the Nachingwea District, Lindi Region of the Republic of Tanzania. The Company is aware that the four PLs expired during May and June of 2012. As at August 31, 2015 and May 31, 2015, the Company has no capitalized costs related to the Mkuvia Alluvial Gold Project. | ||

|

On January 13, 2015, the Company reached a binding settlement agreement with regards to its litigation with RCR (see Note 12, below). Based on this agreement with RCR, the Company will relinquish its interest in the Mkuvia Alluvial Project after the formal agreement is delivered by RCR as agreed. |

| 7. |

Property and Equipment |

| August 31, 2015 | May 31, 2015 | ||||||||||||

| Accumulated | Net Book | Net Book | |||||||||||

| Cost | Depreciation | Value | Value | ||||||||||

| $ | $ | $ | $ | ||||||||||

| Automobile vehicles | 230,879 | 230,879 | - | - | |||||||||

| Camp and equipment | 197,011 | 197,011 | - | - | |||||||||

| Office furniture and equipment | 100,222 | 99,543 | 679 | 1,252 | |||||||||

| Software | 7,930 | 7,930 | - | 222 | |||||||||

| 536,042 | 535,363 | 679 | 1,474 | ||||||||||

10

| Handeni Gold Inc. |

| Notes to the Interim Consolidated Financial Statements as of August 31, 2015 |

| (Expressed in U.S. dollars) |

| (Unaudited) |

| 8. |

Related Party Transactions |

| a) |

The Company has entered into the following facility agreements with related parties: |

| i) |

On December 7, 2012, and as amended on September 4, 2013, June 18, 2014 and March 20, 2015, the Company entered into a facility agreement with IPP Ltd., a private company controlled by the Chairman of the Company. The funding is in the form of an interest free unsecured loan to the Company of up to $720,000 due May 31, 2017. As of August 31, 2015 and May 31, 2015, IPP Ltd. has fully advanced $720,000 to the Company pursuant to this facility agreement. | |

| ii) |

On October 9, 2013, and as amended on June 18, 2014 and March 20, 2015, the Company entered into a facility agreement with Consultancy & Finance Company Associates Ltd. (“C&F”), a private company controlled by the Chairman of the Company. The funding is in the form of an interest free unsecured loan to the Company of up to $405,000 due May 31, 2017. As of August 31 2015 and May 31, 2015, C&F has fully advanced $405,000 to the Company pursuant to this facility agreement. | |

| iii) |

On November 20, 2014, the Company entered into a facility agreement with C&F. The funding is in the form of an interest-free unsecured loan to the Company of up to $500,000 due May 31, 2017. As of August 31, 2015, C&F has advanced $350,000 (May 31, 2015: $215,000) to the Company pursuant to this facility agreement. |

For the three months ended August 31, 2015, $36,007 (three months ended August 31, 2014: $26,987) of deemed interest was calculated at an annual interest rate of 10% which approximates the fair market value of the borrowings, and was recorded as interest expense and donated capital.

| b) |

The Company’s President and Chief Executive Officer (the “CEO”) has voluntarily terminated the CEO services fees for one year effective as of June 1, 2015. As a result, the Company incurred $Nil of administration and professional services fees to the CEO during the three months ended August 31, 2015 (three Months ended August 31, 2014: $36,000). As at August 31 and May 31, 2015, there was a total of $306,000 incurred CEO fees remaining as payable. Such payables will not be paid until the Company’s financial situation improves and accordingly it was recorded in long term liabilities as of August 31, 2015. | |

|

During the three months ended August, 2015 and 2014, the Company paid $36,000 representing 60% of annual rental expenses associated with renting the CEO’s family house in Tanzania, pursuant to the Executive Services Agreement. | ||

|

In addition, during the three months ended August 31, 2015 and 2014, the Company paid geological service fees of $9,000 to a private company controlled by a person who is related to the CEO. | ||

| c) |

During the three months ended August 31, 2015, the Company incurred administration and professional services fees of $28,298 (three months ended August 31, 2014: $33,449) to the Company’s Chief Financial Officer (the “CFO”). | |

| d) |

During the three months ended August 31, 2015, the Company’s Board of Directors reached a directors’ resolution, effective June 1, 2015, which ratified the termination of the Company’s monetary directors’ fees and all accumulated outstanding directors’ fees will not be paid until the Company’s financial situation improves. As such, during the three months ended August 31, 2015, the Company incurred $Nil of directors’ fees (three months ended August 31, 2014: $20,000). As at August 31, 2015 and May 31, 2015, the Company had $145,000 of unpaid independent directors’ fees, which was recorded in long term liabilities as of August 31, 2015. |

| 9. |

Common Stock and Additional Paid-in Capital |

|

The authorized common stock of the Company consists of 500,000,000 shares, with $0.001 par value. During the three months ended August 31, 2015 and the year ended May 31, 2015, the Company had no changes in its common stock and additional paid-in capital. |

| 10. |

Stock Options |

|

The Company adopted a Stock Option Plan, dated November 29, 2010 (the “November 2010 Stock Incentive Plan”), under which the Company is authorized to grant stock options to acquire up to a total of 40,000,000 shares of common shares. The stock options outstanding are exercisable for cash or on a cashless exercise basis using a prorated formula whereby the number of shares issuable is equal to (a) the average closing price for the five days prior to exercise date (“ACP”) in excess of the exercise price, divided by (b) the exercise price multiplied by (c) the number of options exercised. | |

|

During the three months ended August 31, 2015 and 2014, there were no stock options granted or exercised. As at August 31, 2015 and May 31, 2015, there were no intrinsic values attributed to outstanding options, all stock options were fully vested, and the Company had 10,700,000 shares of common stock available to be issued under the November 2010 Stock Incentive Plan. | |

|

The following table summarizes the continuity of the Company’s stock options: |

11

| Handeni Gold Inc. |

| Notes to the Interim Consolidated Financial Statements as of August 31, 2015 |

| (Expressed in U.S. dollars) |

| (Unaudited) |

| 10. |

Stock Options (continued) |

| Weighted | Weighted Average | Aggregate | |||||||||||

| Number of | Average | Remaining | Intrinsic | ||||||||||

| Options | Exercise Price | Contractual Terms | Value | ||||||||||

| # | $ | (years) | $ | ||||||||||

| Outstanding, May 31, 2014 | 28,300,000 | 0.23 | 6.56 | - | |||||||||

| Outstanding, May 31, 2015 | 28,300,000 | 0.23 | 5.56 | - | |||||||||

| Outstanding and exercisable, August 31, 2015 | 28,300,000 | 0.23 | 5.31 | - |

| 11. |

Common Stock Purchase Warrants |

|

During the three months ended August 31, 2015 and the year ended May 31, 2015, there were no stock purchase warrants granted, exercised or outstanding. |

| 12. |

Commitments and Contingencies |

|

On February 8, 2012, RCR filed a lawsuit against the Company in the Supreme Court, State of New York, in which RCR alleged that the Company participated in a fraudulent transfer of certain mineral property interests in Tanzania that RCR had the right to purchase pursuant to a series of agreements with the Company. | |

|

On January 13, 2015, the Company reached a binding settlement of its litigation with RCR, and is currently waiting for RCR to finalize the formal settlement documentation. The settlement does not require any monetary payment by the Company to RCR. Under the terms of the settlement, the Company will turn over its interest in Ruby Creek Resources (Tanzania) Limited and has agreed to return the 4,000,000 shares of restricted RCR common stock to RCR. Such 4,000,000 shares were issued to the Company on December 16, 2010 as partial consideration to purchase the mineral property interests under the agreements between RCR and the Company. The initial fair market value of these shares was $2,760,000 based on RCR’s quoted stock price on the issuance date. Both parties have agreed to dismiss their respective claims, with prejudice, and the litigation is now concluded. |

| 13. |

Fair Value Measurements |

ASC 820, Fair Value Measurements and Disclosures, requires an entity to maximize the use of observable inputs and minimize the use of unobservable inputs when measuring fair value. ASC 820 establishes a fair value hierarchy based on the level of independent, objective evidence surrounding the inputs used to measure fair value. A financial instrument’s categorization within the fair value hierarchy is based upon the lowest level of input that is significant to the fair value measurement. ASC 820 prioritizes the inputs into three levels that may be used to measure fair value:

Level 1 applies to assets or liabilities for which there are quoted prices in active markets for identical assets or liabilities.

Level 2 applies to assets or liabilities for which there are inputs other than quoted prices that are observable for the asset or liability such as quoted prices for similar assets or liabilities in active markets; quoted prices for identical assets or liabilities in markets with insufficient volume or infrequent transactions (less active markets); or model-derived valuations in which significant inputs are observable or can be derived principally from, or corroborated by, observable market data.

Level 3 applies to assets or liabilities for which there are unobservable inputs to the valuation methodology that are significant to the measurement of the fair value of the assets or liabilities.

Pursuant to ASC 820, the fair value of cash, restricted cash equivalent and restricted marketable securities are determined based on Level 1 inputs, which consist of quoted prices in active markets for identical assets. Management believes that the recorded values of all of the Company’s other financial instruments approximate their current fair values because of their nature and respective maturity dates or durations.

As at August 31, 2015, there were no liabilities measured at fair value on a recurring basis presented on the Company’s consolidated balance sheet. Assets measured at fair value on a recurring basis were presented on the Company’s consolidated balance sheet as of August 31, 2015, as follows:

| Fair Value Measurements Using | |||||||||||||

| Quoted Prices in | Significant | ||||||||||||

| Active Markets | Other | Significant | |||||||||||

| For Identical | Observable | Unobservable | Balance as of | ||||||||||

| Instruments | Inputs | Inputs | August 31, | ||||||||||

| (Level 1 | ) | (Level 2 | ) | (Level 3 | ) | 2015 | |||||||

| Assets: | |||||||||||||

| Cash | $ | 107,171 | $ | – | $ | – | $ | 107,171 | |||||

| Restricted cash equivalent | 13,045 | – | – | 13,045 | |||||||||

| Total assets measured at fair value | $ | 120,216 | $ | – | $ | – | $ | 120,216 | |||||

12

| Handeni Gold Inc. |

| Notes to the Interim Consolidated Financial Statements as of August 31, 2015 |

| (Expressed in U.S. dollars) |

| (Unaudited) |

| 13. |

Fair Value Measurements (continued) |

As at May 31, 2015, there were no liabilities measured at fair value on a recurring basis presented on the Company’s consolidated balance sheet. Assets measured at fair value on a recurring basis were presented on the Company’s consolidated balance sheet as of May 31, 2015, as follows:

| Fair Value Measurements Using | |||||||||||||

| Quoted Prices in | Significant | ||||||||||||

| Active Markets | Other | Significant | |||||||||||

| For Identical | Observable | Unobservable | Balance as of | ||||||||||

| Instruments | Inputs | Inputs | May 31, | ||||||||||

| (Level 1 | ) | (Level 2 | ) | (Level 3 | ) | 2015 | |||||||

| Assets: | |||||||||||||

| Cash | $ | 85,985 | $ | – | $ | – | $ | 85,985 | |||||

| Restricted cash equivalent | 13,858 | – | – | 13,858 | |||||||||

| Total assets measured at fair value | $ | 99,843 | $ | – | $ | – | $ | 99,843 | |||||

| 14. |

Segment Disclosures |

The Company operates in one reportable segment, being the acquisition and exploration of mineral properties. Segmented information has been compiled based on the geographic regions that the Company and its subsidiary registered and performed exploration and administration activities. Assets by geographical segment are as follows:

| Canada | Tanzania, Africa | Total | ||||||||

| Current assets | $ | 98,930 | $ | 59,051 | $ | 157,981 | ||||

| Restricted cash equivalent | 13,045 | - | 13,045 | |||||||

| Mineral licenses | - | 1,650,000 | 1,650,000 | |||||||

| Equipment, net | - | 679 | 679 | |||||||

| Total assets, at August 31, 2015 | $ | 111,975 | $ | 1,709,730 | $ | 1,821,705 |

| Canada | Tanzania, Africa | Total | ||||||||

| Current assets | $ | 61,447 | $ | 63,595 | $ | 125,042 | ||||

| Restricted cash equivalent | 13,858 | - | 13,858 | |||||||

| Mineral licenses | - | 1,650,000 | 1,650,000 | |||||||

| Equipment, net | 332 | 1,142 | 1,474 | |||||||

| Total assets, at May 31, 2015 | $ | 75,637 | $ | 1,714,737 | $ | 1,790,374 |

13

| Item 2. | Management’s Discussion and Analysis of Financial Condition and Results of Operations |

The following discussion of our financial condition, changes in financial condition and results of operations for the three months ended August 31, 2015 and 2014 should be read in conjunction with our unaudited interim financial statements and related notes for the three months ended August 31, 2015 and 2014 included herewith and our audited consolidated financial statements as at May 31, 2015 and 2014 included in our Annual Report on Form 10-K for our fiscal year ended May 31, 2015 as filed with the SEC. All financial information in this Management’s Discussion and Analysis (“MD&A” or the “discussion”) is expressed and prepared in conformity with U.S. generally accepted accounting principles. All dollar references are to the U.S. dollar, the Company’s reporting currency, unless otherwise noted. Some numbers in this MD&A have been rounded to the nearest thousand for discussion purposes.

FORWARD-LOOKING STATEMENTS

This MD&A contains forward-looking statements that involve risks, uncertainties and assumptions with respect to the Company’s activities and future financial results, which are made based upon management’s current expectations and beliefs. These forward-looking statements involve risks and uncertainties, including statements regarding the Company’s capital needs, business plans and expectations. Our actual results may differ materially from those anticipated in these forward-looking statements as a result of many factors, including, but not limited to, those set forth under “Risk Factors” and elsewhere in this annual report. Any statements contained herein that are not statements of historical facts may be deemed to be forward-looking statements. Management disclaims any obligation to publicly update these statements, or disclose any difference between its actual results and those reflected in these statements. Given these uncertainties, readers are cautioned not to place undue reliance on such forward-looking statements.

Overview

We are engaged in the acquisition and exploration of mineral properties. Our principal area of focus is the Handeni Gold Project located in the Handeni district, within the Tanga region of the Republic of Tanzania in East Africa, in which we have interests in mineral claims through prospecting licenses (“PLs”) and/or primary mining licenses (“PMLs”) issued by the government of the Republic of Tanzania. None of our mineral claims contain any substantiated mineral deposits, resources or reserves of minerals to date. Exploration has been carried out on these claims, in particular the eight PLs in the Handeni District. Accordingly, additional exploration of these mineral claims is required before any conclusion can be drawn as to whether any commercially viable mineral deposit may exist on any of our mineral claims. Our plan of operations is to continue exploration and drilling work when funds are available in order to ascertain whether our mineral claims warrant further advanced exploration to determine whether they possess commercially exploitable deposits of minerals. We will not be able to determine whether or not any of our mineral claims contain a commercially exploitable mineral deposit, resource or reserve, until appropriate exploratory work has been completed and an economic evaluation based on that work concludes economic viability.

We are considered an exploration or exploratory stage company, because we are involved in the examination and investigation of land that we believe may contain valuable minerals, for the purpose of discovering the presence of ore, if any, and its extent. There is no assurance that a commercially viable mineral deposit exists on the properties underlying our mineral claim interests, and considerable further exploration will be required before a final evaluation as to the economic and legal feasibility for our future exploration is determined.

Our Mineral Claims

Handeni District Gold Project

Location and Access

The Handeni Gold properties lie within the historic Handeni artisanal gold mining district, located in Tanga Province, roughly 175 km northwest of Tanzania’s largest city, Dar Es Salaam, and 100 km southwest of the more northerly coastal city of Tanga (Fig. 1). The road from Dar Es Salaam to Tanga is paved; the secondary road that heads northwest from this road to the town of Handeni, a distance of 65 km, has recently been paved. The Handeni property is located roughly 35 km south of the town of Handeni along a secondary gravel road. From this point, a number of dirt roads head south across various portions of the Handeni property and beyond. Driving time from Dar Es Salaam to the Handeni Gold properties is approximately five hours, depending on traffic and the weather.

20

Prospecting Licenses (PLs)

Currently, our primary focus is on the undivided 100% legal, beneficial and registerable interest in and to eight PLs, located in the Handeni District of Tanzania. The total area held by the Company in the Handeni district is now 423.03 km2 (Fig. 2) (Table 1).

Table 1: List of Prospecting Licenses, Handeni Property (prior to the 2013 renewal of the licenses)

| PL No. |

Area (Sq Km) |

Issue Date |

Original Recipient |

Transfer Date (To IPP Gold) |

Transfer Date (To

Handeni Gold) |

Expiry Date |

Renewal Date |

| 6742/2010 | 197.98 | 05/10/10 | Diamonds Africa Ltd. | 18/11/10 | 12/12/10 | 04/10/13 | 05/10/13 |

| 6743/2010 | 195.48 | 13/10/10 | Gold Africa Ltd. | 18/11/10 | 12/12/10 | 12/10/13 | 13/10/13 |

| 6744/2010 | 198.70 | 13/09/10 | M-Mining Ltd. | 18/11/10 | 12/12/10 | 12/09/13 | 13/09/13 |

| 6779/2010 | 197.74 | 13/09/10 | Tanzania Gem Center Ltd. | 18/11/10 | 12/12/10 | 12/09/13 | 13/09/13 |

21

Following the 2013 renewal of the properties and acquisition of PLs in the current period, the Company now holds interests in PLs with details as described in Table 2, below.

Table 2: Handeni Gold Prospecting Licenses

| PL Number | Granted Date | Expiry Date | Area Size (km2) |

| 6742/2010 6743/2010 6744/2010 6779/2010 9853/2014 10000/2014 10262/2014 10409/2014 |

5/10/2013 13/10/2013 13/9/2013 13/9/2013 2/7/2014 22/7/2014 25/9/2014 02/12/2014 |

4/10/2016 12/10/2016 12/9/2016 12/9/2016 1/7/2018 21/7/2018 24/9/2018 01/12/2018 |

70.32 95.08 97.56 96.84 12.32 33.62 6.97 10.32 |

Primary Mining Licenses (PMLs)

On November 30, 2011, the Company acquired from Handeni Resources a 100% interest in primary mining licenses covering an area of approximately 2.67 square kilometers to the east of Magambazi Hill (Figs. 2 and 3). To comply with the laws and regulations of the Republic of Tanzania whereby foreign companies may not own PMLs, on July 19, 2012, the Company:

| (1) |

entered into an Addendum agreement to the 2011 Acquisition Agreement whereby Handeni Resources will administer the 32 PMLs until such time as a mining license (“ML”) on the 32 PMLs (2.67 km2) have been allocated; and | |

| (2) |

during this period Handeni Resources will be conducting exploration and mining activities on the PMLs as directed by the Company. |

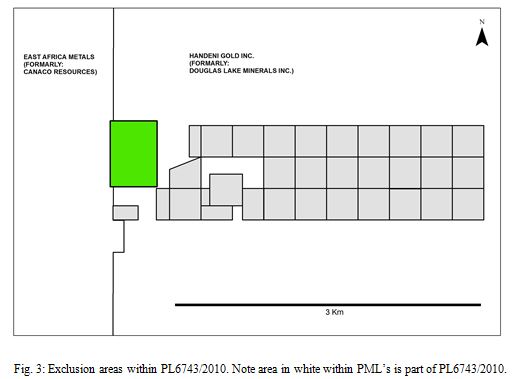

An enlargement of the “excluded area” as delineated on Fig. 2 is presented below (Fig. 3). An area within the outline of the 32 PML’s without a PML number (Fig. 3) has now been confirmed to be part of PL6743/2010. The block of 32 PMLs, shown in grey below, belongs to the Company as described above and are being explored

West of the western border of PL 6743/2010 are several more PMLs that do not belong to the Company. The area colored in green (Fig. 3) is a unitized block of four PMLs that were apparently acquired by Canaco Resources Inc. (“CRI”) (now East Africa Metals Inc.) from their owners.

Handeni District Project

We obtained a Technical Report on the Handeni Property (the “Handeni Report”), dated April 25, 2011, as prepared at our request by Avrom E. Howard, MSc, FGA, PGeol (Ontario), Principal Consultant at Nebu Consulting LLC. Mr. Howard is a Qualified Person in accordance with Canadian National Instrument 43-101 “Standards for Disclosure of Mineral Projects” and its Companion Policy (collectively, “NI 43-101”) and is a Practicing Professional Geologist registered with the Association of Professional Geoscientists of Ontario (registration number 0380).

22

Subsequent to the publishing of the April 25, 2011 NI 43-101 report by Mr. Howard, the Company produced numerous in-house technical reports and is in the process of compiling an updated NI 43-101 report that will include the updated model for mineralization on our Handeni property. The drilling conducted by the Company was done implementing and following Quality Control and Quality Assessment procedures recommended by SRK (Stephen, Robertson and Kirsten).

Property Description

General

Exploration, mining and related activities is regulated and controlled under the Mining Act of 1998 (revised in 2010) (the “Mining Act”). Tanzania is Africa’s fourth leading gold producer, with several major companies producing and exploring for gold, mostly in northwestern Tanzania, south of Lake Victoria, in an area informally known as the Lake Victoria gold belt.

The Handeni Property

The increase in gold prices at the turn of the century and consequent increase in artisanal gold mining activity in the Handeni area led to the discovery of deposits of placer gold, in turn leading in 2003 to a classic gold rush. The discovery and mining of lode deposits followed, soon after, along with the growth of a shanty mining town at the northern base of Magambazi Hill.

Between 2005 and 2010, IPP Gold carried out exploration over its PLR leading to the upgrading of its holdings from one PLR to four PL’s of 800 km2, in August 2010. Exploration work included airborne magnetic and radiometric surveys, ground magnetic surveys, reconnaissance geological mapping, soil sampling, pitting and trenching. It is these four PLs that were acquired by the Company from IPP Gold under a September 2010 agreement.

Geological Setting

Regional Geology

Regional geological mapping programs led to the recognition of several major litho-structural provinces from Archean to recent age in Tanzania. The Archean craton covers most of the western two thirds of the country, roughly bounded to the east by the East African Rift. Archean rocks host all of the country’s kimberlite pipes and contained lode diamond deposits, and most of its lode gold deposits. The Archean basement terrain is bounded to the east and west by a series of Proterozoic mobile belts; this area, particularly that to the east, hosts most of the country’s wide variety of colored gemstone deposits. Some recent research suggests that portions of this assumed Proterozoic terrane may actually consist of Archean crust that has undergone a later phase of higher grade metamorphism.

The Handeni district forms part of the Tanzanian Mozambique belt. The belt was subjected to four tectonothermal events at 830-800Ma, ~760Ma, 630-580Ma and 560-520Ma. All except the last attained upper amphibolites / granulite grade.

Property Geology

The Handeni area is situated in the Palaeoproterozoic, Usugaran/Ubendian Metamorphic Terrane of Tanzania, along the northern extension of the north-trending Proterozoic Mozambique Mobile Belt.

The geology of the Handeni area comprises amphibolite to granulite facies metamorphic rocks interpreted to originally have formed a sequence of ultramafic to felsic volcanic flows, black shales and quartz-bearing sedimentary rocks. It is furthermore interpreted to comprise a metamorphosed/overprinted eastern extension/remnant of the Lake Victoria cratonic greenstone belt. High grade metamorphism has converted these original lithologies to a variety of metamorphic equivalents, including biotite-hornblende-garnet-pyroxene gneiss, migmatitic augen garnet- hornblende-pyroxene gneiss, quartzo-feldspathic hornblende-biotite-pyroxene gneiss, pyroxene-hornblende-biotite-garnet granulite and others.

Recent research by geologists from the University of Western Australia suggests that much of what has previously been considered to be of Proterozic age (Usagaran System) may in fact be overprinted Archean crust. This hypothesis has been invoked to help interpret the geology within which gold in this area is found and as the basis for an analogy between this gold mineralization and that found in less metamorphosed, bona fide Archean rocks in the Lake Victoria gold district, a few hundred km to the northwest. However, this is a hypothesis, only, one that may be used for exploration modeling purposes but one that still requires more work.

Mineralization

The Handeni property is at an early stage of exploration. There are no known mineral resources or reserves on the Handeni property, nor are there any known economically mineable deposits on the property. Gold is found within garnet-amphibolite zones within biotite-feldspar gneiss at three k n o w n locations in the Company’s property, locations where historical lode gold occurrences have been documented. Gold occurs in quartz veins as well as within the garnet amphibolites adjacent to the quartz veins. Proof of this association is informally corroborated by the testimony of local, illegal artisanal miners, who recover gold both from quartz veins and gold-bearing gneiss that is not quartz vein bearing. Gold in the Company’s property has also been documented in soils and placers, at a variety of locations, as well.

Our geophysical and structural geological interpretation on which the drilling program conducted in 2012 was based, supported the mineralization model described above in broad terms.

23

Whereas gold was known in the Handeni area prior to the arrival in 2005 of the Company’s predecessor, IPP Gold, there is no history of any formal exploration in the area aside from limited work at Magambazi Hill itself and the work conducted in recent years by Canaco (East African Metals) in the region

Handeni Gold’s intensive early exploration program following the Company’s September 2010 agreement with IPP achieved the following in terms of mineralization on the properties:

| • |

It outlined a number of locations where intensive placer and illegal artisanal gold mining took place within the Handeni property, notably the Kwandege, Magambazi and Mjembe areas. |

|

| |

| • |

A helicopter based TEM electromagnetic and radiometric aerial survey program clearly delineated subsurface geological features of importance to gold and base metal mineralization in this high grade metamorphic terrain. The data proved to be invaluable in the definition of structurally important sites and target definition and was key in defining areas for ground geophysical surveys including ground magnetics, - radiometrics and I.P (Induced Polarization Surveys). Based on this exploration priority drill targets were selected including Magambazi East as well as the Kwandege targets that were subsequently drilled. |

|

| |

| • |

Twenty-eight (28) diamond core holes (5,347 meters) were drilled on the Magambazi East and related targets and delineated a gold enriched mineralization zone extending for a distance of approximately 500 meters to the south east of the Magambazi Hill mineralization as defined by CRI. Based on drill data and re-interpretation of this target we are now convinced that the gold potential of this target may be proven or disproven with drilling of 5 directional drill holes. |

|

| |

| • |

Thirty-seven (37) drill holes (4,989 meters in total) have been drilled on the Kwandege mineralized zone, completing the first phase drilling program on this project. Twenty-six of the 32 drill holes on the main Kwandege target yielded gold assay values of more than 0.5 g/t over a one-meter interval or thicker intersection, whereas four of the remaining holes had anomalous gold values of up to 0.49 g/t. An important feature of the Kwandege target is the fact that low level gold values (0.5 g/t to 1 g/t) were encountered in numerous intersections in the drill holes and also confirmed by the latest assay results. Anomalous gold with some potentially economic intersections have been encountered in an E - W (strike) direction of 1,501 meters (based on the results of the completed phase 1 drilling program). The open ended nature of the mineralization in an E-W direction was confirmed. Recently acquired data confirms the potential of the Kwandege target area as part of a much larger structure with high gold potential. |

|

| |

| • |

The results of the soil sampling program on Target 5 yielded gold in soil values of up to 200 ppb. Au (gold) assay results received for 2331 samples coincides with a magnetic and electro-magnetic geophysical anomaly on surface over an area of approximately 1.8 km (N-S) by 900 m (E-W). The evaluation of this target is to be continued by pitting, trenching and ground IP. |

|

| |

| • |

Data collected from our intensive efforts to delineate alluvial gold mineralization with economic potential yielded the following: |

| a) |

The fluvial environment has the largest potential for the extraction of coarse grained gold in the Handeni area. | |

| b) |

A large proportion of gold is contained as fine grained gold. This conclusion was based on the fact that geochemically analyzed samples of the same locations as the bulk sampled areas yielded significantly higher gold values. | |

| c) |

Some specific horizons in the fluvial horizon yield higher values than others. | |

| d) |

Allowing for a mere 50% efficiency of the applied processes, the overburden, the grade as well as consistency of gold on the alluvial targets evaluated thus far our results indicated that secondary gold mineralization is not economically mineable. |

| • |

The exploration results on our Mjembe target defined a significant potential gold mineralization zone with a high correlation between geochemical, structural and geophysical data. Mjembe will be the Company’s primary target during the 2015/2016 field season. The potential of this area has been exploited by illegal artisanal miners. |

Exploration conducted during the fiscal year 2015:

| • |

The Company now has 5 high potential drill targets of the 17 areas investigated in detail on its approximately 423 km2 license areas in the Handeni district. Significant anomalous results have been achieved on 3 additional targets. |

|

| |

| • |

In addition to the geological and geophysical maps produced using remote sensing techniques, a total of 143 km2 (35%) of the license area has been mapped in detail (1:2500 and 1:5000 scale). To date, a total of 37,153 drill and soil samples were taken of which 16,212 were assayed for gold and 19,992 by XRF. |

|

| |

| • |

Target 5 is now a fully fledged drill target based on the geochemistry and geophysics results obtained. Grab samples on this target yielded a maximum of 3.12 g/t of gold. |

|

| |

| • |

Nine hundred and thirty five (935) soil samples collected on Target 6 have been analysed by XRF. The results are discouraging and this target did not receive priority status. |

|

| |

| • |

Exploration on Target 7 (Mjembe) was highly successful and 3 potential drill sites have been delineated within the larger Mjembe target area. The Company is experiencing serious interference and illegal mining activities on all of its Mjembe targets which pose a serious restriction on our exploration activities and the future of our exploration on this target as reported under “Risk Factors - Risks Related to Our Company”. |

24

|

• |

Target 8 has been mapped in detail covering an area of approximately 36 km2. The Company is currently evaluating this target for selection of a soil sampling and potential detail geophysics program. The outcome of this will be based on prioritizing this area in relation to the Gole structure program as discussed below. |

|

|

|

|

• |

Target 10 has been mapped in detail and 674 soil samples taken of which 149 were selected based on our XRF screening technique. Although some elevated gold values were obtained the Company will follow this area up utilizing a newly developed assay technique developed and successfully applied to target 16 as reported below. Due to a lack of funding we cannot immediately embark on this planned work. |

|

|

|

|

• |

Mapping and XRF analyses on 793 samples from Target 15 (Dolly) have been completed. Mineralization and structural features on this anomaly show many similarities with that of Magambazi hill. |

|

|

|

|

• |

Geological mapping on target 16 has been completed and a preliminary 1,923 soil samples taken. Of these 20 high priority samples were selected for evaluation of a specialized technique designed to detect gold anomalies in geological terrains with a complex gold in soil distribution profile. The results were highly encouraging and values of up to 8 g/t in soils were obtained. The Company will undoubtedly apply this technique to some selected other targets as funding becomes available. |

|

|

|

|

• |

Detail geological mapping on the Gole sheath fold, a structural feature of 11 km by 4.5 km (Targets 12, 13, 14 and 17), have commenced and is continuing. Potential gold bearing amphibolite zones have been identified, which will be the focus of further investigation. |

|

|

|

|

• |

Further detailed mapping was conducted on Target 16. This was followed by gold assays using specialized geochemical techniques to test the potential of increasing the effectivity of the Company’s soil sampling program. The results were highly successful and the Company will implement this technique on Target 10 when funds become available. |

|

|

|

|

• |

Exploration conducted during the first quarter of fiscal year 2016. |

|

|

|

|

• |

A limited grab sampling program was conducted on illegal artisanal sites within the Mjembe target. The results of this will be available shortly. |

|

|

|

|

• |

Evaluation of gold mining pml’s in the Kilindi district commenced with a visit to the sites and a grab sampling program, aiming to incorporate high potential properties into the company’s license portfolio. |

|

|

|

|

• |

Mapping of the Gole structure is continuing as announced. |

|

|

|

|

• |

XRF analyses and evaluation of drill core on the Magambazi East and Kwandege sites continued. |

|

|

|

|

• |

An updated NI-43_101 is being compiled. |

Compliance with Government Regulation

We are subject to local laws and regulation governing the exploration, development, mining, production, importing and exporting of minerals; taxes; labor standards; occupational health; waste disposal; protection of the environment; mine safety; toxic substances; and other matters. We require licenses and permits to conduct exploration and mining operations. Amendments to current laws and regulations governing operations and activities of mining companies or more stringent implementation thereof could have a material adverse impact on our Company. Applicable laws and regulations will require us to make certain capital and operating expenditures to initiate new operations. Under certain circumstances, we may be required to close an operation once it is started until a particular problem is remedied or to undertake other remedial actions. This would have a material adverse effect on our results and financial condition.

Four of our mineral interests in Tanzania are currently held under PLs granted pursuant to the Mining Act for an initial period of three years and are renewable in two successive periods of two years only. The remaining four PL’s are being held under the 2010 Mining Act and are valid for an initial period of 4 years (the initial period expiring in 2018 (Table 2)). Following this the first renewal is for 3 years and the second renewal for 2 years, each renewal accompanied by a mandatory relinquishment of at least 50% of the license area. The application fees are $300 on initial application and $300 for each renewal. There is a preparation fee of $500 applicable on each license. The annual rent for the licenses are $100/km2 (initial period), $150/km2 (1st renewal) and $200/km2 (2nd renewal).

All PLs in Tanzania require the holder to employ and train local residents, typically amounting to $5,000 per year, and make exploration expenditures, as set out in the Mining Act. At each renewal, at least 50% of our licensed area must be relinquished. If we wish to keep the relinquished one-half portion, we must file a new application for the relinquished portion.

The geographical area covered by a PL may contain one or more previously granted PML’s. A PML is a mining license granted only to a Tanzanian citizen consisting of an area of not to exceed 10 hectares. Once a PL is granted, no additional PMLs can be granted within the geographical area covered by the PL. The PL is subject to the rights of previously granted and existing PMLs. The holder of a PL will have to work around the geographical area of the PML unless the PL holder acquires the PML and any rights to the land covered by the PML.

We must hold a mining license to carry out mining activities, which are granted only to the holder of a PL covering a particular area. A mining license is granted for a period of 25 years or the life of the mine. It is renewable after 10 years for a period not exceeding 15 years. Other than the PMLs being held under Handeni Resources, we do not hold any mining licenses, only PL’s. An application for the 32 PMLs being held under agreement by Handeni Resources to be changed into a mining license (ML) is underway. Prospecting and mining license holders must submit regular reports in accordance with mining regulations. Upon commercial production, the government of Tanzania imposes a royalty on the gross value of all production at the rate of 3% of all gold produced. The applicable regulatory body in Tanzania is the Ministry of Energy and Minerals.

25

In July 1999, environmental management and protection regulations under the Mining Act came into force. An environmental impact statement and an environmental management plan must accompany special mining license, mining license and gemstone mining license applications for mineral rights. In addition to the establishment of environmental regulations, the Tanzanian government has improved management procedures for effective monitoring and enforcement of these regulations by strengthening the institutional capacity, especially in the field offices. The government has provided rules for the creation of reclamation funds to reinstate land to alternative uses after mining and it has developed guidelines for mining in restricted areas, such as forest reserves, national parks, near sources of water and other designated areas. These regulations have not had any material effect on our operations to date.

Competition

We operate in a highly competitive industry, competing with other mining and exploration companies, and institutional and individual investors, which are actively seeking minerals exploration properties throughout the world together with the equipment, labour and materials required to exploit such properties. Many of our competitors have financial resources, staff and facilities substantially greater than ours. The principal area of competition is encountered in the financial ability to cost effectively acquire prime minerals exploration prospects and then exploit such prospects. Competition for the acquisition of minerals exploration properties is intense, with many properties available in a competitive bidding process in which we may lack technological information or expertise available to other bidders. Therefore, we may not be successful in acquiring, exploring and developing profitable properties in the face of this competition. No assurance can be given that a sufficient number of suitable minerals exploration properties will be available for acquisition, exploration and development.

Employees

Other than our directors and executive officers, we had approximate four full-time equivalent employees and consultants as of August 31, 2015 located in Tanzania. We also utilize independent geologists and consultants on a contract basis to conduct the work programs on our mineral properties in order to carry out our plan of operations.

Research and Development Expenditures