Document

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

__________________________________________________

FORM 10-K

__________________________________________________

(Mark One) |

| | |

ý | | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| | |

For the fiscal year ended December 31, 2016 |

|

OR |

| | |

o | | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| | |

For the transition period from to |

|

Commission file number 001-32240 |

NEENAH PAPER, INC.

(Exact name of registrant as specified in its charter)

|

| | |

Delaware | | 20-1308307 |

(State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification No.) |

| | |

3460 Preston Ridge Road Alpharetta, Georgia | | 30005 |

(Address of principal executive offices) | | (Zip Code) |

| | |

Registrant's telephone number, including area code: (678) 566-6500 |

Securities registered pursuant to Section 12(b) of the Act: |

| | |

Title of Each Class | | Name of Each Exchange on Which Registered |

Common Stock — $0.01 Par Value | | New York Stock Exchange |

Indicate by check mark if the registrant is a well-seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ý No o

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No ý

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ý No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or such shorter period that the registrant was required to submit and post such files). Yes ý No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definitions of "large accelerated filer," "accelerated filer," and "smaller reporting company" in Rule 12b-2 of the Exchange Act. (Check one): |

| | | | | | |

Large accelerated filer ý | | Accelerated filer o | | Non-accelerated filer o (Do not check if a smaller reporting company) | | Smaller reporting company o |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes o No ý

The aggregate market value of the registrant's common stock held by non-affiliates on June 30, 2016 (based on the closing stock price on the New York Stock Exchange) on such date was approximately $1,190,000,000.

As of February 21, 2017, there were 16,805,000 shares of the Company's common stock outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Certain information contained in the definitive proxy statement for the Company's Annual Meeting of Stockholders to be held on May 23, 2017 is incorporated by reference into Part III hereof.

TABLE OF CONTENTS

PART I

In this report, unless the context requires otherwise, references to "we," "us," "our," "Neenah" or the "Company" are intended to mean Neenah Paper, Inc., its consolidated subsidiaries and predecessor companies.

Item 1. Business

Overview

We are organized into two primary businesses: a performance-based technical products business and a premium fine paper and packaging business.

Our technical products business is a leading international producer of transportation, water and other filter media and durable, saturated and coated substrates for a variety of end markets. We focus on categories where we believe we are, or can be, a market leader. These categories include filtration media for transportation, water and other uses, backings for specialty tapes and abrasives, performance labels and other specialty markets. Our dedicated technical products manufacturing facilities are located near Munich, Germany, in Bolton, England, in Munising, Michigan and in Pittsfield, Massachusetts. In addition, certain technical products are manufactured along with fine paper and packaging products in shared facilities located in upstate New York and Quakertown, Pennsylvania. In 2017, a filtration machine (which was converted from a fine paper machine) will begin production in Appleton, Wisconsin, a site also shared with the fine paper and packaging business. For a description of the shared facilities, see Item 2, "Properties."

We believe our fine paper and packaging business is the leading supplier of premium printing and other high end specialty papers in North America. Our products include some of the most recognized and preferred papers in North America, where we enjoy leading market positions in many of our product categories. We sell our products primarily to authorized paper distributors, as well as through converters, major national retailers and specialty businesses. Our primary fine paper and packaging manufacturing facilities are located in Neenah and Whiting, Wisconsin and in Brattleboro, Vermont. In addition, certain products are manufactured in shared facilities located in upstate New York and Quakertown, Pennsylvania, as well as an existing site shared with technical products in 2017 in Appleton, Wisconsin. For a description of the shared facilities, see Item 2, "Properties."

Company Structure

Our corporate structure consists of Neenah Paper, Inc. and seven direct wholly owned subsidiaries.

Neenah Paper, Inc. is a Delaware corporation that holds our trademarks and patents related to all of our U.S. businesses (except Neenah Paper FVC, Inc), all of our U.S. fine paper and packaging inventory, the real estate, mills and manufacturing assets associated with our fine paper and packaging operations in Neenah and Whiting, Wisconsin and all of the equity in our subsidiaries listed below. The common stock of Neenah is publicly traded on the New York Stock Exchange under the symbol "NP."

Neenah Paper Michigan, Inc. is a Delaware corporation and a wholly owned subsidiary of Neenah that owns the real estate, mill and manufacturing assets associated with our U.S. technical products business in Munising, Michigan.

Neenah Paper FVC, LLC is a Delaware limited liability company and wholly owned subsidiary of Neenah that owns all of the equity of Neenah Paper FR, LLC. Neenah Paper FR, LLC ("Fox River") is a Delaware limited liability company that owns the real estate, mill and manufacturing assets associated with our fine paper and packaging operation in Appleton, Wisconsin.

Neenah Paper International Holding Company, LLC is a Delaware limited liability company and wholly owned subsidiary of Neenah that owns all of the equity of Neenah Paper International, LLC. Neenah Paper International, LLC is a Delaware limited liability company that owns all of the equity of Neenah Germany GmbH and in conjunction with Neenah Germany GmbH all of the equity of Neenah Services GmbH & Co. KG.

NPCC Holding Company LLC is a Delaware limited liability company and wholly owned subsidiary of Neenah that owns all of the equity of Neenah Paper Company of Canada ("Neenah Canada"). Neenah Canada is a Nova Scotia unlimited liability corporation that holds certain post-employment liabilities of our former Canadian operations.

Neenah Paper International Finance Company BV is a private company with limited liability organized under the laws of the Netherlands and a wholly owned subsidiary of Neenah that facilitates the financing of our international operations.

Neenah Filtration, LLC is a Delaware limited liability company and wholly owned subsidiary of Neenah that owns all of the equity of Neenah Technical Materials, Inc. ("NTM") and Neenah Filtration Appleton, LLC ("NFA"). NTM is a Massachusetts corporation that owns all of the real estate, mills and manufacturing assets associated with our technical materials business in Pittsfield, Massachusetts. NFA is a Delaware limited liability company that owns certain assets associated with our filtration business in Appleton, Wisconsin. The filtration assets in Appleton, Wisconsin have started production in January 2017. See "Management's Discussion and Analysis of Financial Condition and Results of Operations — Liquidity and Capital Resources."

Neenah FMK Holdings, LLC is a Delaware limited liability company and a wholly owned subsidiary of Neenah that owns all of the equity of ASP FiberMark, LLC ("ASP"). ASP is a Delaware limited liability company that owns all of the equity of Neenah Northeast, LLC ("NNE") and Neenah International UK Limited, a United Kingdom corporation ("Neenah UK"). NNE is a Delaware limited liability company that owns certain real estate, mills and manufacturing assets associated with our fine paper and packaging business and technical products business located in Brattleboro, Vermont, West Springfield, Massachusetts, Quakertown and Reading, Pennsylvania, and Brownville and Lowville, New York. Neenah UK is a United Kingdom corporation that owns all of the equity of Neenah Red Bridge International Limited ("Red Bridge"). Red Bridge is a United Kingdom corporation that owns all of the real estate, manufacturing assets and inventory associated with our technical products business in Bolton, England.

History of the Businesses

Neenah was incorporated in April 2004 in contemplation of the spin-off by Kimberly-Clark Corporation ("Kimberly-Clark") of its technical products and fine paper businesses in the United States and its Canadian pulp business (collectively, the "Pulp and Paper Business"). We had no material assets or activities until Kimberly-Clark's transfer to us of the Pulp and Paper business on November 30, 2004. On that date, Kimberly-Clark completed the distribution of all of the shares of our common stock to the stockholders of Kimberly-Clark (the "Spin-Off"). Following the Spin-Off, we are an independent public company and Kimberly-Clark has no ownership interest in us.

Former Pulp Operations. At the Spin-Off, our pulp operations consisted of mills located in Terrace Bay, Ontario and Pictou, Nova Scotia and approximately 975,000 acres of related woodlands. We disposed of these mills and woodlands in a series of transactions from 2006 to 2010.

Technical Products. The Munising, Michigan mill was purchased by Kimberly-Clark in 1952. Subsequent to the purchase, the mill was converted to produce durable, saturated and coated papers for sale and use in a variety of industrial applications for our technical products business.

In October 2006, we purchased the outstanding interests of FiberMark Services GmbH & Co. KG and the outstanding interests of FiberMark Beteiligungs GmbH (collectively "Neenah Germany"). At acquisition, the Neenah Germany assets consisted of two mills located near Munich, Germany and a third mill near Frankfurt, Germany. These mills produced a wide range of products, including transportation filter media, nonwoven wall coverings, masking and other tapes, abrasive backings, and specialized printing and coating substrates.

In July 2014, we purchased all of the outstanding equity of Crane Technical Materials, Inc. from Crane & Co., Inc. The acquired business provides performance-oriented wet laid nonwoven media for water filtration end markets as well as environmental, energy and industrial uses. The business has two manufacturing facilities in Pittsfield, Massachusetts.

On October 31, 2015, we sold our paper mill located near Frankfurt, Germany (the "Lahnstein Mill") to the Kajo Neukirchen Group (the "Buyer") for net cash proceeds of approximately $5.4 million. The Lahnstein Mill, which had annual sales of approximately €50 million, had been operating as a stand-alone business, manufacturing non-woven wallcoverings and various other specialty papers. See Note 13 of Notes to Consolidated Financial Statements, "Discontinued Operations."

Fine Paper and Packaging. The fine paper and packaging business was incorporated in 1885 as Neenah Paper Company, which initially operated a single paper mill in Neenah, Wisconsin. Kimberly-Clark acquired the mill in 1956. In 1981, Kimberly-Clark purchased an additional mill located in Whiting, Wisconsin and in the late 1980s and early 1990s, the capacity of the fine paper and packaging business was expanded by building two new paper machines at the Whiting mill and completing a major expansion of the Neenah facility with the installation of a new paper machine, finishing center, customer service center and an expanded distribution center.

In March 2007, we acquired the assets and brands of Fox River, which was a consolidating acquisition. In January 2012, we purchased certain premium fine paper brands and other assets from Wausau Paper Mills, LLC, a subsidiary of Wausau Paper Corp. ("Wausau") and in January 2013, we purchased certain premium business paper brands from the Southworth Company ("Southworth").

FiberMark Acquisition. On August 1, 2015, we purchased all of the outstanding equity of ASP FiberMark, LLC ("FiberMark") from ASP FiberMark Holdings, LLC ("American Securities") for approximately $118 million (the "FiberMark Acquisition"). We added specialty coating and finishing capabilities with this acquisition, particularly in luxury packaging and technical products. The results of operations and assets related to the FiberMark Acquisition are reflected in each of our business segments.

Business Strategy

Our mission is to create value by improving the image and performance of everything we touch. We expect to create value by growing in specialized niche markets that value performance or image and where we have competitive advantages. In managing our businesses, we believe that achieving and maintaining a leadership position in our markets, responding effectively to customer needs and competitive challenges, employing capital optimally, controlling costs and managing risks are important to our long-term success. Strategies to deliver value include:

Leading in profitable, specialty niche markets — We will increase our participation in niche markets that can provide us with leading positions and value our core competencies in performance-based fiber and non-woven media production, coating and saturating. Key markets include filtration, specialty backings and technical products, and premium fine paper and packaging.

Increasing our size, growth rate and portfolio diversification — We will invest and focus resources in higher growth specialty markets to grow with customers in new geographies and to enter into adjacent markets that are growing and profitable. We will do this both through organic initiatives that build on our technologies and capabilities, and through acquisitions that fit with our competencies and provide attractive financial returns.

Delivering consistent, attractive returns to our shareholders — We will continue to use Return on Invested Capital ("ROIC") as a key metric to evaluate investment decisions, measure our performance, maintain a prudent capital structure and deploy cash flows in ways that can provide value, including direct cash returns to shareholders through a meaningful dividend.

Products

Technical Products. Our technical products business is a leading international producer of performance-based substrates such as filtration media for transportation, water and other filtration markets, and saturated and coated performance materials used for industrial backings, labels and a variety of other end markets. In general, our technical products are sold to other manufacturers as key components for their finished products. Several of our key market segments served, including filtration and specialty backings for tape and abrasives, are global in scope. JET-PRO®SofStretchTM , KIMDURA®, PREVAILTM, NEENAH®, and GESSNER® are brands of our technical products business.

The following is a description of certain key products and markets:

Filtration media for transportation including induction air, fuel, oil, and cabin air applications. Transportation filtration media are sold to suppliers of automotive companies as original equipment on new cars and trucks as well as to the automotive aftermarket, which represents the large majority of sales.

Filtration media for water and other industrial end markets. Primary applications include reverse osmosis, catalytic conversion, nanofiltration, ultrafiltration, pervaporation and vapor permeation, as well as other applications for specialty markets.

Specialty backings including a) saturated and unsaturated crepe and flat paper tapes sold to manufacturers to produce finished pressure sensitive products for sale in automotive, transportation, manufacturing, building construction, and industrial general purpose applications, including sales in the consumer do-it-yourself retail channel and b) coated lightweight abrasive paper used in the automotive, construction, metal and woodworking industries for both dry and wet sanding applications.

Label and tag products made from both saturated base label stock and purchased synthetic base label stock, with coatings applied to allow for high quality variable and digital printing. The synthetic label stock is recognized as a high quality, UV (ultra-violet) stable product used for outdoor applications. Label and tag stock is sold to pressure sensitive coaters, who in turn sell the coated label and tag stock to the label printing community.

Other latex saturated and coated papers for use by a wide variety of manufacturers. Premask paper is used as a protective over wrap for products during the manufacturing process and for applying signs, labeling and other finished products. Medical packaging paper is a polymer impregnated base sheet that provides a breathable sterilization barrier that provides unique properties. Image transfer papers used to transfer an image from paper to tee shirts, hats, coffee mugs, and other surfaces using a proprietary imaging coating for use in digital printing applications. Publishing and security papers used to produce book covers, stationery, fancy packaging and passports. Other specialty products include clean room papers, durable printing papers, release papers and furniture backers.

Fine Paper and Packaging. Our fine paper and packaging business manufactures and sells world-class branded premium writing, text, cover and specialty papers and envelopes used in corporate identity packages, advertising collateral, premium labels and packaging, and wide format applications. Often these papers are characterized by distinctive coating, finishing, colors, and textures.

Commercial printing papers include premium writing, text and cover papers, and envelopes. Uses include advertising collateral, stationery, corporate identity packages and brochures, pocket folders, annual reports, advertising inserts, direct mail, business cards, scrapbooks, and a variety of other uses where colors, texture, coating, unique finishes or heavier weight papers are desired. Our market leading brands in this category include CLASSIC®, CLASSIC CREST®, ESSE®, ENVIRONMENT®, CAPITOL BOND®, ROYAL SUNDANCE®, SOUTHWORTH®, and TOUCHE® trademarks. Our fine paper and packaging business has an exclusive agreement to manufacture, market and distribute Crane & Co.'s CRANE'S CREST®, CRANE'S BOND®, and CRANE'S LETTRA®, branded fine papers in the commercial print category. Our fine paper and packaging business has an exclusive agreement to market and distribute Gruppo Cordenons SpA's SO...SILK®, PLIKE® and STARDREAM® branded fine papers in the U.S. and Canada. The fine paper and packaging business also sells private watermarked paper and other specialty writing, text, and cover papers. Additionally, the fine paper and packaging business provides leading solutions in the wide format arena, led by its Neenah Wide Format® and CONVERD® brands.

Premium packaging and label papers are used for wine, spirits and beer labels, folding cartons, box wrap, bags, hang tags, and stored value cards servicing high-end retail, cosmetics, spirits, and electronics end-use markets. Our market leading brands in these categories include NEENAH® Folding Board, "ESTATE LABEL®, Neenah® Box Wrap, PELLAQ®, KIVAR®, SKIVERTEX®, ILLUSIO®, and SENZO®.

Bright papers are used in applications such as direct mail, advertising inserts, scrapbooks and marketing collateral. Our brands in this category include ASTROBRIGHTS® and CREATIVE COLLECTIONTM. Additionally, business papers for professionals and small businesses are sold under our Southworth® brand through major retailers.

The fine paper and packaging business also produces and sells other specialty papers that address a consumer's need for enhanced image such as translucent papers, art papers, papers for optical scanning and other specialized applications.

Markets and Customers

Technical Products. The technical products business sells its products globally into product categories generally used as base materials in the following applications: filtration, component backing materials for manufactured products such as tape and abrasives, and other specialized product uses such as graphics and identification.

Several products (filtration media, abrasives, specialty tapes, labels) are used in markets that are directly affected by economic business cycles. Other market segments such as image transfer papers used in small/home office and consumer applications are relatively stable. Most products are performance-based and require qualification at customers; however, certain categories may also be subject to price competition and the substitution of lower cost substrates in some less demanding applications.

The technical products business relies on a team of direct sales representatives and customer service representatives to market and sell approximately 95 percent of its sales volume directly to customers and converters.

The technical products business has more than 500 customers worldwide. The distribution of sales in 2016 was approximately 43 percent in North America, 35 percent in Europe and 22 percent in Latin America and Asia. Customers typically convert and transform base papers and film into finished rolls and sheets by adding adhesives, coatings, and finishes. These transformed products are then sold to end-users.

Sales to the technical products business's three largest customers represented approximately 14 percent of total sales for the segment in 2016. Although a complete loss of any of these customers would cause a temporary decline in the business's sales volume, the decline could be partially offset by expanding sales to existing customers, and further offset over a several month period with the addition of new customers.

Fine Paper and Packaging. We believe our fine paper and packaging business is the leading supplier of premium writing, text and cover papers, bright papers and specialty papers in North America. These products are used in high-end collateral material, business and legal professions, and corporate identity products. Our premium packaging business includes products such as food and beverage labels and high-end packaging materials such as folding cartons and box wrap used for luxury retail goods. Bright papers are generally used by consumers for flyers, direct mail and packaging.

The fine paper and packaging business sells its products in a variety of channels including authorized paper distributors, converters, retailers, and direct to end users. Sales to distributors account for approximately 60 percent of revenue in the fine paper and packaging business. During 2016, approximately 10 percent of the sales of our fine paper and packaging business were exported to markets outside the United States.

Sales to the largest customer of the fine paper and packaging business represented approximately 15 percent of its total sales in 2016. We practice limited sales distribution to improve our ability to control the marketing of our products. Although a complete loss of this customer would cause a temporary decline in the business's sales volume, the decline could be partially offset by expanding sales to existing customers, and further offset over a several month period with the addition of new customers.

Concentration. In July 2014, Unisource Worldwide, Inc ("Unisource") and xpedx, formerly owned by International Paper ("xpedx") merged to form Veritiv Corporation ("Veritiv"). For the year ended December 31, 2016, sales to Veritiv represented approximately 8 percent of consolidated net sales and approximately 15 percent of net sales of the fine paper and packaging business. For the year ended December 31, 2015 and 2014 sales to Unisource and xpedx (and as merged Veritiv) represented approximately 10 percent of consolidated net sales and approximately 20 percent of net sales of the fine paper and packaging business.

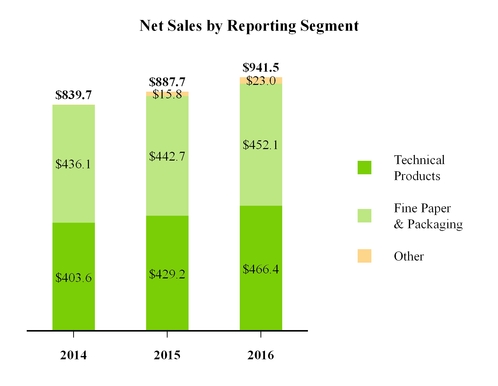

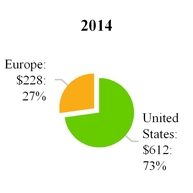

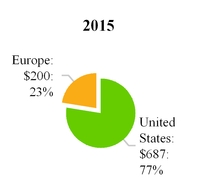

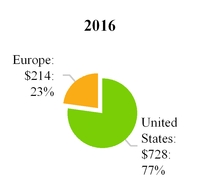

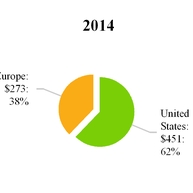

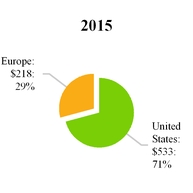

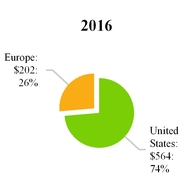

The following graphs present further information about our businesses by geographic area (dollars in millions):

Net Sales from Geographic Region

(in Millions)

Total Assets by Geographic Region

(in Millions)

Net sales and total assets are attributed to geographic areas based on the physical location of the selling entities and the physical location of the assets. See Note 14 of Notes to Consolidated Financial Statements, "Business Segment and Geographic Information", for information with respect to net sales, profits and total assets by business segment.

Raw Materials

Technical Products. Softwood pulp, specialty pulp and fibers, and latex are the primary raw materials consumed by our technical products business. The technical products business purchases softwood pulp, specialty pulp and fibers, and latex from various external suppliers. We believe that all of the raw materials for our technical products operations, except for certain specialty latex grades and specialty softwood pulp, are readily available from several sources and that the loss of a single supplier would not cause a shutdown of our manufacturing operations.

Our technical products business acquires all of its specialized pulp requirements from two global suppliers and certain critical specialty latex grades from four suppliers. In general, these supply arrangements are not covered by formal contracts, but represent multi-year business relationships that have historically been sufficient to meet our needs. We expect these relationships to continue to operate in a satisfactory manner in the future. In the event of an interruption of production at any one supplier, we believe that each of these suppliers individually would be able to satisfy our short-term requirements for specialized pulp or specialty latex. In the event of a long-term disruption in our supply of specialized pulp or specialty latex, we believe we would be able to substitute other pulp grades or other latex grades that would allow us to meet required product performance characteristics and incur only a limited disruption in our production. As a result, we do not believe that the substitution of such alternative pulp or latex grades would have a material effect on our operations.

Fine Paper and Packaging. Hardwood pulp is the primary fiber used to produce products of the fine paper and packaging business. Other significant raw material inputs in the production of fine paper and packaging products include softwood pulp, recycled fiber, cotton fiber, dyes and fillers. The fine paper and packaging business purchases all of its raw materials externally. We believe that all of the raw materials for our fine paper and packaging operations are readily available from several sources and that the loss of a single supplier would not cause a shutdown of our manufacturing operations.

Energy and Water

The equipment used to manufacture the products of our technical products and fine paper and packaging businesses uses significant amounts of energy, primarily electricity, natural gas, oil and coal. We generate substantially all of our electrical energy at the Munising mill and approximately 25 percent of the electrical energy at our mills in Appleton, Wisconsin and Bruckmühl, Germany. We also purchase electrical energy from external sources, including electricity generated from renewable sources.

Availability of energy is not expected to be a problem in the foreseeable future, but the purchase price of such energy can and likely will fluctuate significantly based on changes in demand and other factors.

An adequate supply of water is needed to manufacture our products. We believe that there is an adequate supply of water for this purpose at each of our manufacturing locations.

Working Capital

Technical Products. The technical products business maintains approximately 25 to 30 days of raw materials and supplies inventories to support its manufacturing operations and approximately 25 to 35 days of finished goods and semi-finished goods inventory to support customer orders for its products. Sales terms in the technical products business vary depending on the type of product sold and customer category. Extended credit terms of up to 120 days are offered to customers located in certain international markets. In general, sales are collected in approximately 45 to 55 days and supplier invoices are paid within 20 to 30 days.

Fine Paper and Packaging. The fine paper and packaging business maintains approximately 10 days of raw material inventories to support its paper making operations and about 55 days of finished goods inventory to fill customer orders. Fine paper and packaging sales terms range between 20 and 30 days with discounts of zero to two percent for customer payments, with discounts of one percent and 20-day terms used most often. Extended credit terms are offered to customers located in certain international markets. Supplier invoices are typically paid within 60 days.

Competition

Technical Products. Our technical products business competes in global markets with a number of large multinational competitors, including Ahlstrom Corporation, Munksjö, ArjoWiggins SAS and Hollingsworth & Vose Company. It also competes in some, but not all, of these segments with smaller regional manufacturers, such as Monadnock Paper Mills, Inc., Expera Specialty Solutions LLC., Potsdam Specialty Paper, Inc. and Paper Line S.p.A. We believe the basis of competition in most of these segments are the ability to design and develop customized product features to meet customer specifications while maintaining quality, customer service and price. We believe our research and development program gives us an advantage in customizing base papers and developing advanced filter media to meet customer needs.

Fine Paper and Packaging. We believe our fine paper and packaging business is the leading supplier of premium printing and other high end specialty papers in North America. Our fine paper and packaging business also competes in the premium segment of the uncoated free sheet market. The fine paper and packaging business competes directly in North America with Mohawk Fine Paper Inc. and other smaller companies. We believe the primary basis of competition for premium fine papers are brand recognition, product quality, customer service, product availability, promotional support and variety of colors and textures. Price also can be a factor particularly for lower quality printing needs that may compete with opaque and offset papers. We have and will continue to invest in advertising and other programs aimed at graphic designers, printers and corporate end-users in order to maintain a high level of brand awareness as well as communicate the advantages of using our products. Our premium packaging business is focused on high-end packaging needs in end market verticals like beauty products, spirits and retail. Primary bases of competition are similarly brand recognition, product quality, customer service, product availability, and a variety of colors and textures. Premium packaging is primarily a North American business, but we also sell to customers in Asia and other markets outside the U.S. We believe the premium packaging market to be highly fragmented, with multiple competitors, many of which produce premium packaging products as a small subset of larger packaging operations.

Research and Development

Our technical products business maintains research and development laboratories in Feldkirchen-Westerham, Germany, Munising, Michigan and Pittsfield, Massachusetts to support its strategy of developing new products and technologies, and to support growth in its existing product lines and other strategically important markets. We also have a research and development laboratory in West Springfield, Massachusetts that supports both our technical products and fine paper and packaging businesses. We have continually invested in product research and development with spending of $9.4 million in 2016, $6.8 million in 2015 and $5.7 million in 2014.

Intellectual Property

We own more than 100 granted patents and have multiple pending patent applications in the United States, Canada, Europe and certain other countries covering image transfer paper, abrasives and medical packaging, and other paper processing. We also own more than 150 trademarks with registrations in approximately 80 countries. Our image transfer patents have contributed to establishing the technical products business as a leading global supplier of image transfer papers through our highly recognized JET-PRO®, 3G JET-OPAQUE®, TECHNIPRINT®, LASER-ONE OPAQUE® and IMAGE CLIP® brands, and our global trademark collection demonstrates strong product brand recognition.

For more than 100 years, Neenah’s fine paper and packaging business has built its market leading reputation on creating and manufacturing trademarked brands for premium writing, text, cover, digital, packaging, and specialty needs. The Neenah Paper

signature portfolio includes innovative, market leading brands such as ASTROBRIGHTS®, CLASSIC® (including CLASSIC CREST®, CLASSIC® Linen, CLASSIC® Laid, CLASSIC COLUMNS®, CLASSIC® Stipple, CLASSIC® Woodgrain, and CLASSIC® Techweave), ENVIRONMENT®, The Design Collection, ROYAL SUNDANCE® Papers, and many more. Our fine paper and packaging business provides unique and sustainable packaging papers and custom solutions for premium packaging needs. With brands that stand for consistency and quality such as NEENAH® Folding Board, NEENAH® Box Wrap, ESTATE LABEL®, BELLA® Label, and NEENAH IMAGEMAX® Paper Card, our fine paper and packaging business enables leading and emerging brands to deliver on their brand’s promise. In 2012, we entered the retail channel by acquiring the brand portfolio of Wausau Paper including ASTROBRIGHTS® Papers, the first brightly colored paper in the industry, followed by the SOUTHWORTH Brand, a time-honored product for business professionals. Our fine paper and packaging business maintains a well-rounded and well-respected portfolio of brands allowing us to be recognized as an industry leader setting standards for quality, consistency, and dependability on press.

The 2015 acquisition of FiberMark added other trademarks recognized in both the publishing and packaging markets, including SKIVERTEX®, KIVAR®, CORVON®, HYFLEX®, TOUCHE®, and MULTICOLOR®. Development work after the acquisition added the MONTELENA® mark to our portfolio as well.

The KIMDURA® and MUNISING LP® trademarks have made a significant contribution to the marketing of synthetic film and clean room papers of the technical products business. Finally, the GESSNER® trademark has played an important role in the marketing of Neenah’s filtration product lines.

Backlog and Seasonality

Technical Products. In general, sales and profits for the technical products business have been relatively stronger in the first half of the year with reductions in the third quarter due to reduced customer converting schedules and in the fourth quarter due to a reduction in year-end inventory levels by our customers. The order flow for the technical products business is subject to seasonal peaks for several of its products, such as the larger volume grades of specialty tape, abrasives, premask, and label stock used primarily in the downstream finished goods manufacturing process. To assure timely shipments during these seasonal peaks, the technical products business provides certain customers with finished goods inventory on consignment. Historically, consignment sales have represented approximately 15 percent of the technical products business's annual sales. Orders are typically shipped within six to eight weeks of receipt of the order. However, the technical products business periodically experiences periods where order entry levels surge, and order backlogs can increase substantially. Raw materials are purchased and manufacturing schedules are planned based on customer forecasts, current market conditions and individual orders for custom products. The order backlog in the technical products business on December 31, 2016 was approximately $101 million and represented approximately 22 percent of prior year sales. The order backlog in the technical products business on December 31, 2015 was approximately $103 million and represented approximately 25 percent of prior year sales. We previously filled the order backlog from December 31, 2015 and expect to fill the order backlog from December 31, 2016 within the next year.

Fine Paper and Packaging. The fine paper and packaging business has historically not experienced seasonality. Orders for stock products are typically shipped within two days, while custom orders are shipped within two to three weeks of receipt. Raw material purchases and manufacturing schedules are planned based on a combination of historical trends, customer forecasts and current market conditions. The order backlogs in the fine paper and packaging business on December 31, 2016 and 2015 were $19.6 million and $19.2 million, respectively, which represent approximately 15 days of sales. The order backlogs from December 31, 2016 and 2015 were filled in the respective following years.

The operating results at each of our businesses are influenced by the timing of our annual maintenance downs, which are generally scheduled in the third quarter.

Employee and Labor Relations

As of December 31, 2016, we had approximately 2,303 regular full-time employees of whom 1,099 hourly and 526 salaried employees were located in the United States and 405 hourly and 273 salaried employees were located in Europe.

Approximately 50 percent of salaried employees and 80 percent of hourly employees of Neenah Germany are eligible to be represented by the Mining, Chemicals and Energy Trade Union, Industriegewerkschaft Bergbau, Chemie and Energie (the "IG BCE"). In June 2015, the IG BCE and a national trade association representing all employers in the industry signed a collective bargaining agreement covering union employees of Neenah Germany that expires in June 2017. Under German law union membership is voluntary and does not need to be disclosed to the Company. As a result, the number of employees covered by the collective bargaining agreement with the IG BCE that expires in June 2017 cannot be determined.

As of December 31, 2016, no employees are covered under collective bargaining agreements that expire in the next 12 months, with the exception of the employees covered by the collective bargaining arrangement with the IG BCE. We believe we have satisfactory relations with our employees covered by collective bargaining agreements and do not expect the negotiation of new collective bargaining agreements to have a material effect on our results of operations or cash flows. See Note 12 of Notes to Consolidated Financial Statements, "Contingencies and Legal Matters — Employees and Labor Relations."

Environmental, Health and Safety Matters

Our operations are subject to federal, state and local laws, regulations and ordinances relating to various environmental, health and safety matters. We believe our operations are in compliance with, or we are taking actions designed to ensure compliance with, these laws, regulations and ordinances. However, the nature of our operations exposes us to the risk of claims concerning non-compliance with environmental, health and safety laws or standards, and there can be no assurance that material costs or liabilities will not be incurred in connection with those claims. Except for certain orders issued by environmental, health and safety regulatory agencies with which we believe we are in compliance and which we believe are immaterial to our financial condition, results of operations and liquidity, we are not currently named as a party in any judicial or administrative proceeding relating to environmental, health and safety matters.

Greenhouse gas ("GHG") emissions have increasingly become the subject of political and regulatory focus. Concern over potential climate change, including global warming, has led to legislative and regulatory initiatives directed at limiting GHG emissions. In addition to certain federal proposals in the United States to regulate GHG emissions, Germany, the United Kingdom (“U.K.”) and all the states in which we operate are currently considering GHG legislation or regulations, either individually and/or as part of regional initiatives. While not all are likely to become law it is reasonably possible that additional climate change related mandates will be forthcoming, and it is expected that they may adversely impact our costs by increasing energy costs and raw material prices, requiring operational or equipment modifications to reduce emissions and creating costs to comply with regulations or to mitigate the financial consequences of such compliance.

While we have incurred in the past several years, and will continue to incur, capital and operating expenditures in order to comply with environmental, health and safety laws, regulations and ordinances, we believe that our future cost of compliance with environmental, health and safety laws, regulations and ordinances, and our exposure to liability for environmental, health and safety claims will not have a material effect on our financial condition, results of operations or liquidity. However, future events, such as changes in existing laws and regulations, new legislation to limit GHG emissions or contamination of sites owned, operated or used for waste disposal by us (including currently unknown contamination and contamination caused by prior owners and operators of such sites or other waste generators) may give rise to additional costs which could have a material effect on our financial condition, results of operations or liquidity.

We have planned capital expenditures to comply with environmental, health and safety laws, regulations and ordinances during the period 2017 through 2018 of approximately $1 million to $2 million annually. Our anticipated capital expenditures for environmental projects are not expected to have a material effect on our financial condition, results of operations or liquidity.

AVAILABLE INFORMATION

We are subject to the reporting requirements of Section 13(a) or 15(d) of the Securities Exchange Act of 1934. As such, we file annual, quarterly and current reports, proxy statements and other information with the Securities and Exchange Commission ("SEC"). Our SEC filings are available to the public on the SEC's web site at www.sec.gov. You may also read and copy any document we file at the SEC's Public Reference Room located at 100 F Street, N.E., Washington, D.C. 20549. Please call the SEC at 1-800-SEC-0330 for further information on the Public Reference Room. Our common stock is traded on the New York Stock Exchange under the symbol NP. You may inspect the reports, proxy statements and other information concerning us at the offices of the New York Stock Exchange, 20 Broad Street, New York, New York 10005.

Our web site is www.neenah.com. Information on our web site is not incorporated by reference in this document. Our reports on Form 10-K, Form 10-Q and Form 8-K, as well as amendments to those reports, are and will be available free of charge on our web site as soon as reasonably practicable after we file or furnish such reports with the SEC. In addition, you may request a copy of any of these reports (excluding exhibits) at no cost upon written request to us at: Investor Relations, Neenah Paper, Inc., 3460 Preston Ridge Road, Suite 600, Alpharetta, Georgia 30005.

Item 1A. Risk Factors

You should carefully consider each of the following risks and all of the other information contained in this Annual Report on Form 10-K. Some of the risks described below relate principally to our business and the industry in which we operate, while

others relate principally to our indebtedness. The remaining risks relate principally to the securities markets generally and ownership of our common stock.

Our business, financial condition, results of operations or liquidity could be materially affected by any of these risks, and, as a result, the trading price of our common stock could decline. The risks described below are not the only ones we face. Additional risks not presently known to us or that we currently deem immaterial may also impair our business operations.

Risks Related to Our Business and Industry

Our business will suffer if we are unable to effectively respond to decreased demand for some of our products due to conditions in the global economy or secular pressures in some markets.

We have experienced and may experience in the future decreased demand for some of our products due to slowing or negative global economic growth, uncertainty in credit markets, declining consumer and business confidence, fluctuating commodity prices, increased unemployment and other challenges affecting the global economy. Parts of our fine paper and packaging business are subject to electronic substitution. In addition, our customers may experience deterioration of their businesses, cash flow shortages, and difficulty obtaining financing. If we are unable to implement business strategies to effectively respond to decreased demand for our products, our financial position, cash flows and results of operations would be adversely affected.

Changes in international geopolitical and macro economic conditions generally, and particularly in Germany, could adversely affect our business and results of operations. Fluctuations in the prices of and the demand for products could result in smaller profit margins and lower sales volumes.

Our operating results and business prospects could be adversely affected by risks related to the countries outside the United States in which we have manufacturing facilities or sell our products, including Germany, the Eurozone and elsewhere. Downturns in economic activity, adverse tax consequences, fluctuations in the value of local currency versus the U.S. dollar, or any change in social, political, macro economic or labor conditions in any of these countries or regions could negatively affect our financial results.

On June 23, 2016, the U.K. voted by referendum to exit the European Union (“E.U.”); this vote is commonly referred to as “Brexit.” The referendum is non-binding and the exit from the E.U. is not immediate. Once the U.K. invokes E.U. Article 50, there is a two-year window in which the U.K. and European Commission can negotiate the future terms for imports, exports, taxes, employment, immigration and other areas. Brexit has caused volatility in global stock markets and currency exchange rates, affecting the markets in which we operate. The implications of Brexit could adversely affect demand for our products, our financial results and operations, and our relationships with customers, suppliers and employees in the short- or long-term.

Historically, economic and market shifts, and fluctuations in capacity have created cyclical changes in prices, sales volume and margins for products in the paper, packaging and related industries. The length and magnitude of industry cycles have varied over time and by product, but generally reflect changes in macroeconomic conditions and levels of industry capacity. The overall levels of demand for many of our products reflect fluctuations in levels of end-user demand, which depend in large part on general macroeconomic conditions in North America and regional economic conditions in our markets (including Europe, Asia, and Central and South America), as well as foreign currency exchange rates. The foregoing factors could materially and adversely impact our sales, cash flows, profitability and results of operations.

The availability of and prices for raw materials and energy will significantly impact our business.

We purchase a substantial portion of the raw materials and energy necessary to produce our products on the open market, and, as a result, the price and other terms of those purchases are subject to change based on factors such as worldwide supply and demand and government regulation. We do not have significant influence over our raw material or energy prices and our ability to pass increases in those prices along to purchasers of our products may be challenged, unless those increases coincide with increased demand for the product. Therefore, raw material or energy prices could increase at the same time that prices for our products are steady or decreasing. In addition, we may not be able to recoup other cost increases we may experience, such as those resulting from inflation or from increases in wages or salaries or increases in health care, pension or other employee benefits costs, insurance costs or other costs.

Our technical products business acquires all of its specialized pulp requirements from two global suppliers and certain critical specialty latex grades from four suppliers. In general, these supply arrangements are not covered by formal contracts, but represent multi-year business relationships that have historically been sufficient to meet our needs. We expect these relationships to continue to operate in a satisfactory manner in the future. In the event of an interruption of production at any one supplier, we believe that each of these suppliers individually would be able to satisfy our short-term requirements for

specialized pulp or specialty latex. In the event of a long-term disruption in our supply of specialized pulp or specialty latex, we believe we would be able to substitute other pulp grades or other latex grades that would allow us to meet required product performance characteristics and incur only a limited disruption in our production.

Our fine paper and packaging business acquires a substantial majority of the cotton fiber used in the production of certain branded bond paper products pursuant to annual agreements with two North American producers. The balance of our cotton fiber requirements are acquired through "spot market" purchases from a variety of other producers. We believe that a partial or total disruption in the production of cotton fibers at our two primary suppliers would increase our reliance on "spot market" purchases with a likely corresponding increase in cost.

Our operating results are likely to fluctuate.

Our operating results are subject to substantial quarterly and annual fluctuations due to a number of factors, many of which are beyond our control. Operating results could be adversely affected by general economic conditions causing a downturn in the market for paper products. Additional factors that could affect our results include, among others, changes in the market price of pulp, the effects of competitive pricing pressures, production capacity levels and manufacturing yields, availability and cost of products from our suppliers, the gain or loss of significant customers, our ability to develop, introduce and market new products and technologies on a timely basis, changes in the mix of products produced and sold, seasonal customer demand, the relative strength of the Euro versus the U.S. dollar, increasing interest rates and environmental costs. The timing and effect of the foregoing factors are difficult to predict, and these or other factors could materially adversely affect our quarterly or annual operating results.

We face many competitors, several of which have greater financial and other resources.

We face competition in each of our business segments from companies that produce the same type of products that we produce or that produce lower priced alternative products that customers may use instead of our products. Some of our competitors have greater financial, sales and marketing, or research and development resources than we do. Greater financial resources and product development capabilities may also allow our competitors to respond more quickly to new opportunities or changes in customer requirements.

Our businesses are significantly dependent on sales to their largest customers.

Sales to the largest customer of the fine paper and packaging business represented approximately 15 percent of total sales for the segment in 2016. Sales to the three largest customers of the technical products business represented approximately 14 percent of total sales for the segment in 2016. A significant loss of business from any of our major fine paper and packaging or technical products customers may have a material adverse effect on our financial condition, results of operations and liquidity. We are also subject to credit risk associated with our customer concentration. If one or more of our largest fine paper and packaging or technical products customers were to become bankrupt, insolvent or otherwise were unable to pay for services provided, we may incur significant write-offs of accounts receivable.

We cannot be certain that our tax planning strategies will be effective and that our research and development tax credits will continue to be available to offset our tax liability.

We are continuously undergoing examination by the Internal Revenue Service (the "IRS") as well as taxing authorities in various state and foreign jurisdictions in which we operate. The IRS and other taxing authorities routinely challenge certain deductions and credits reported on our income tax returns.

As of December 31, 2016, we had $25.2 million of U.S. federal and state research and development credits ("R&D Credits") which, if not used, will expire between 2027 and 2035 for the U.S. federal R&D Credits and between 2017 and 2031 for the state R&D Credits. The availability of state NOLs and state credits to offset taxable income and income tax, respectively, could also be substantially reduced if we were to undergo an "ownership change" as defined within certain state tax codes.

In accordance with Accounting Standards Codification ("ASC") Topic 740, Income Taxes ("ASC Topic 740"), as of December 31, 2016, we have recorded a liability of $10.3 million for uncertain tax positions where we believe it is "more likely than not" that the benefit reported on our income tax return will not be realized. There can be no assurance, however, that the actual amount of unrealized deductions will not exceed the amounts we have recognized for uncertain tax positions.

We have significant obligations for pension and other postretirement benefits.

We have significant obligations for pension and other postretirement benefits which could require future funding beyond that which we have funded in the past or which we currently anticipate. At December 31, 2016, our projected pension benefit obligations were $370.9 million and exceeded the fair value of pension plan assets by $52.8 million. In 2016, we made total contributions to qualified pension trusts of $17.8 million. In addition, during 2016 we paid pension benefits for unfunded

qualified and supplemental retirement plans of $0.6 million. At December 31, 2016, our projected other postretirement benefit obligations were $40.7 million. No assets have been set aside to satisfy our other postretirement benefit obligations. In 2016, we made payments for postretirement benefits other than pensions of $3.8 million. A material increase in funding requirements or benefit payments could have a material effect on our cash flows.

We may be required to pay material amounts under multiemployer pension plans.

We contribute to The PACE Industry Union-Management Pension Fund ("the PIUMPF"), a multiemployer pension plan. The amount of our annual contributions to the PIUMPF is negotiated with the plan and the bargaining unit representing our employees covered by the plan. In 2016, we contributed approximately $0.1 million to the PIUMPF. In addition, in the event of a partial or complete withdrawal by us from the PIUMPF at a time when the plan is underfunded, we would be liable for a proportionate share of such plan's unfunded vested benefits, referred to as a withdrawal liability. In the event that any other contributing employer withdrew from the PIUMPF at a time when the plan is underfunded, and such employer cannot satisfy its obligations to the plan at the time of withdrawal, then the proportionate share of the plan's unfunded vested benefits that would be allocable to us and to the other remaining contributing employers, would increase and there could be an increase to our required annual contributions. In future negotiations of collective bargaining agreements with the labor union that participates in the PIUMPF, we may decide to discontinue participation in the plan.

The PIUMPF was certified to be in "critical status" for the plan year beginning January 1, 2010, and continued to be in critical status for the plan year beginning January 1, 2016. In 2013, two large employers withdrew from the PIUMPF. Further withdrawals by other contributing employers could cause a "mass withdrawal" from, or effectively a termination of, the PIUMPF or alternatively we could elect to withdraw. Although we have no current intention to withdraw from the PIUMPF, if we were to withdraw, either completely or partially, we would incur a withdrawal liability based on our share of the PIUMPF's unfunded vested benefits. Based on information as of December 31, 2015 provided by the PIUMPF and reviewed by our actuarial consultant, we estimate that, as of December 31, 2016, the payments that we would be required to make to PIUMPF in the event of our complete withdrawal would be approximately $0.1 million per year on a pre-tax basis. These payments would continue for 20 years, unless we were deemed to be included in a "mass withdrawal" from the PIUMPF, in which case these payments would continue in perpetuity. However, we are not able to determine the exact amount of our withdrawal liability because the amount could be higher or lower depending on the nature and timing of any triggering event, the funded status of the plan and our level of contributions to the plan prior to the triggering event. These withdrawal liability payments would be in addition to pension contributions to any new pension plan adopted or contributed to by us to replace the PIUMPF and could have a material effect on our cash flows. Adverse changes to pension laws and regulations could increase the likelihood and amount of our liabilities arising under the PIUMPF.

The outcome of legal actions and claims may adversely affect us.

We are involved in legal actions and claims arising in the ordinary course of our business. The outcome of such legal actions and claims against us cannot be predicted with certainty. Legal actions and claims against us could have a material effect on our financial condition, results of operations and liquidity.

Labor interruptions would adversely affect our business.

Except for our Pittsfield, Massachusetts, Brownville, New York and Quakertown, Pennsylvania manufacturing facilities which are non-union, substantially all of our hourly employees are unionized. In addition, some key customers and suppliers are also unionized. Strikes, lockouts or other work stoppages or slowdowns involving our unionized employees could have a material effect on us.

If we are unable to continue to implement our business strategies, our financial conditions and operating results could be materially affected.

Our future operating results will depend, in part, on the extent to which we can successfully implement our business strategies in a cost effective manner. However, our strategies are subject to significant business, economic and competitive uncertainties and contingencies, many of which are beyond our control. If we are unable to successfully implement our business strategies, our business, financial condition and operating results could be materially adversely affected.

We may not successfully integrate acquisitions and may be unable to achieve anticipated cost savings or other synergies.

The integration of the operations of acquired companies involves a number of risks and presents financial, managerial, legal and operational challenges. We may have difficulty, and may incur unanticipated expenses related to, integrating information systems, financial reporting activities, and integrating and retaining management and personnel from acquired companies. We may not be able to achieve anticipated cost savings or commercial or growth synergies, for a number of reasons, including contractual constraints and obligations or an inability to take advantage of expected commercial opportunities, increased

operating efficiencies or commercial expansion of key technologies. Failure to successfully integrate acquired companies may have an adverse effect on our business, financial condition, results of operations, and cash flows.

We may not be able to adequately protect our intellectual property and proprietary rights, which could harm our future success and competitive position.

Our future success and competitive position also depends, in part, upon our ability to obtain and maintain protection for our intellectual property and proprietary rights. Failure to protect our existing intellectual property rights may result in the loss of valuable technologies or may require us to license other companies' intellectual property rights. It is possible that any of our patents may be invalidated, rendered unenforceable, circumvented, challenged or licensed to others or any of our pending or future patent applications may not be issued within the scope of the claims sought by us, if at all. Further, others may develop technologies that are similar or superior to our technologies, duplicate our technologies or design around our patents, and steps taken by us to protect our technologies may not prevent misappropriation of such technologies.

Future dividends on our common stock may be restricted or eliminated.

Dividends are declared at the discretion of our Board of Directors, and future dividends will depend on our future earnings, cash flow, financial requirements and other factors. Our ability to pay cash dividends on our common stock is limited under the terms of both our bank credit agreement and the indenture for our $175 million of senior notes due November 2021 (the "2021 Senior Notes"). As of December 31, 2016, under the most restrictive terms of our bank credit agreement and the indenture for the 2021 Senior Notes, our ability to pay cash dividends on our common stock is limited, as described under "Risks Relating to Our Indebtedness." There can be no assurance that we will continue to pay dividends in the future.

We may be required to record a charge to our earnings if our goodwill or intangible assets become impaired.

As of December 31, 2016, we had goodwill of $70.4 million and other intangible assets of $74.0 million. Goodwill and other intangible assets are recorded at fair value on the date of acquisition. In accordance with applicable accounting guidance, we review goodwill and other indefinite-lived intangible assets at least annually for impairment, and long-lived intangible assets when facts and circumstances warrant an impairment review. Impairment may result from, among other things, deterioration in performance, adverse market conditions, adverse changes in applicable laws or regulations, and a variety of other factors. The amount of any non-cash impairment would be recognized immediately through our consolidated statement of operations. Any future goodwill or other intangible asset impairment could have a material adverse effect on our results of operations and financial position.

If we have a catastrophic loss or unforeseen or recurring operational problems at any of our facilities, we could suffer significant lost production and/or cost increases.

Our technical products and fine paper and packaging businesses may suffer catastrophic loss due to fire, flood, terrorism, mechanical failure, or other natural or man-made events. If any of our facilities were to experience a catastrophic loss, it could disrupt our operations, delay production, delay or reduce shipments, reduce revenue, and result in significant expenses to repair or replace the facility. These expenses and losses may not be adequately covered by property or business interruption insurance. Even if covered by insurance, our inability to deliver our products to customers, even on a short-term basis, may cause us to lose market share on a more permanent basis.

Fluctuations in currency exchange rates could adversely affect our results.

Exchange rate fluctuations for the Euro do not have a material effect on the operations or cash flows of our German technical products business. Our German technical products business incurs most of its costs and sells most of its production in Europe and, therefore, its operations and cash flows are not materially affected by changes in the exchange rate of the Euro relative to the U.S. dollar. Changes in the Euro exchange rate relative to the U.S. dollar will, however, have an effect on our balance sheet and reported results of operations. See Item 7A, "Quantitative and Qualitative Disclosures About Market Risk — Foreign Currency Risk."

In addition, because we transact business in other foreign countries, some of our revenues and expenses are denominated in a currency other than the local currency of our operations. As a result, changes in exchange rates between the currency in which the transaction is denominated and the local currency of our operations into which the transaction is being recorded can impact the amount of local currency recorded for such transaction. This can result in more or less local currency revenues or costs related to such transaction, and thus have an effect on our reported sales and income before income taxes.

Our activities are subject to extensive government regulation, which could increase our costs, cause us to incur liabilities and adversely affect the manufacturing and marketing of our products.

Our operations are subject to federal, state and local laws, regulations and ordinances in the United States and Germany relating to various environmental, health and safety matters. The nature of our operations requires that we invest capital and incur operating costs to comply with those laws, regulations and ordinances and exposes us to the risk of claims concerning non-compliance with environmental, health and safety laws or standards. We cannot assure that significant additional expenditures will not be required to maintain compliance with, or satisfy potential claims arising from, such laws, regulations and ordinances. Future events, such as changes in existing laws and regulations or contamination of sites owned, operated or used for waste disposal by us (including currently unknown contamination and contamination caused by prior owners and operators of such sites or other waste generators) may give rise to additional costs that could require significantly higher capital expenditures and operating costs, which would reduce the funds otherwise available for operations, capital expenditures, future business opportunities or other purposes.

We are subject to risks associated with possible climate change legislation and various cost and manufacturing issues associated with such legislation.

GHG emissions have increasingly become the subject of political and regulatory focus. Concern over potential climate change, including global warming, has led to legislative and regulatory initiatives directed at limiting GHG emissions. In addition to certain federal proposals in the United States to regulate GHG emissions, Germany, the U.K. and all the states in which we operate are currently considering GHG legislation or regulations, either individually and/or as part of regional initiatives. While not all are likely to become law it is reasonably possible that additional climate change related mandates will be forthcoming, and it is expected that they may adversely impact our costs by increasing energy costs and raw material prices, requiring operational or equipment modifications to reduce emissions and creating costs to comply with regulations or to mitigate the financial consequences of compliance.

We are subject to cybersecurity risks related to breaches of security pertaining to sensitive company, customer, employee and vendor information as well as breaches in the technology that manages operations and other business processes.

We use information technologies to securely manage operations and various business functions. We rely on various technologies to process, store and report on our business and interact with customers, vendors and employees. The secure processing, maintenance and transmission of this information is critical to our operations and business strategy. Despite our security design and controls, and those of our third party providers, our information technology and infrastructure may be vulnerable to cyber attacks by hackers or breaches due to employee error, malfeasance or other disruptions. Any such breach could result in operational disruptions or the misappropriation of sensitive data that could subject us to civil and criminal penalties, litigation or have a negative impact on our reputation. There can be no assurance that such disruptions or misappropriations and the resulting repercussions will not negatively impact our cash flows and materially affect our results of operations or financial condition. The U.S. Congress is considering cybersecurity legislation that, if enacted, could impose additional obligations on us and could expand our potential liability in the event of a cyber-security incident.

Our business may suffer if we do not retain our senior management.

We depend on our senior management. The loss of services of members of our senior management team could adversely affect our business until suitable replacements can be found. There may be a limited number of persons with the requisite skills to serve in these positions and we may be unable to locate or employ qualified personnel on acceptable terms. In addition, our future success requires us to continue to attract and retain competent personnel.

Risks Relating to Our Indebtedness

We may not be able to fund our future capital requirements internally or obtain third-party financing.

We may be required or choose to obtain additional debt or equity financing to meet our future working capital requirements, as well as to fund capital expenditures and acquisitions. To the extent we must obtain financing from external sources to fund our capital requirements, we cannot guarantee financing will be available on favorable terms, if at all. As of December 31, 2016, we have required debt payments of $1.2 million during the year ending December 31, 2017.

We may not be able to generate sufficient cash flow to meet our debt obligations, including the 2021 Senior Notes.

Our ability to make scheduled payments or to refinance our obligations with respect to the 2021 Senior Notes, our other debt and our other liabilities will depend on our financial and operating performance, which, in turn, is subject to prevailing economic conditions and to certain financial, business and other factors beyond our control. If our cash flow and capital

resources are insufficient to fund our debt obligations and other liabilities, we could face substantial liquidity problems and may be forced to reduce or delay scheduled expansions and capital expenditures, sell material assets or operations, obtain additional capital or restructure our debt. We cannot assure that our operating performance, cash flow and capital resources will be sufficient to repay our debt in the future. In the event that we are required to dispose of material assets or operations or restructure our debt to meet our debt and other obligations, we can make no assurances as to the terms of any such transaction or how quickly any such transaction could be completed.

If we cannot make scheduled payments on our debt, we will be in default and, as a result:

| |

• | our debt holders could declare all outstanding principal and interest to be due and payable; |

| |

• | our senior secured lenders could terminate their commitments and commence foreclosure proceedings against our assets; and |

| |

• | we could be forced into bankruptcy or liquidation. |

If our operating performance declines in the future or we breach our covenants under our revolving credit facility, we may need to obtain waivers from the lenders under our revolving credit facility to avoid being in default. We may not be able to obtain these waivers. If this occurs, we would be in default under our revolving credit facility.

We have significant indebtedness which subjects us to restrictive covenants relating to the operation of our business.

As of December 31, 2016, we had $175 million of 2021 Senior Notes, $42.9 million in revolving credit borrowings and $6.8 million of project financing outstanding. In addition, availability under our bank credit agreement was approximately $125 million. Our leverage could have important consequences. For example, it could:

| |

• | make it difficult for us to satisfy our financial obligations, including making scheduled principal and interest payments on the 2021 Senior Notes and our other indebtedness; |

| |

• | place us at a disadvantage to our competitors; |

| |

• | require us to dedicate a substantial portion of our cash flow from operations to service payments on our indebtedness, thereby reducing funds available for other purposes; |

| |

• | increase our vulnerability to a downturn in general economic conditions or the industry in which we operate; |

| |

• | limit our ability to obtain additional financing for working capital, capital expenditures, acquisitions and general corporate and other purposes; and |

| |

• | limit our ability to plan for and react to changes in our business and the industry in which we operate. |

The terms of our indebtedness, including our bank credit agreement and the indenture governing the 2021 Senior Notes, contain covenants restricting our ability to, among other things, incur certain additional debt, incur or create certain liens, make specified restricted payments, pay dividends, authorize or issue capital stock, enter into transactions with our affiliates, consolidate or merge with or acquire another business, sell certain of our assets or liquidate, dissolve or wind-up our Company. Under the most restrictive terms of the Third Amended and Restated Credit Agreement, we are permitted to pay cash dividends on or repurchase shares of our common stock up to the amount available under the Third Amended and Restated Credit Agreement, as long as the availability under the Third Amended and Restated Credit Agreement exceeds $25 million. If the availability is below $25 million, we are restricted from paying dividends or repurchasing shares. Under the most restrictive terms of the 2021 Senior Notes, we are permitted to pay cash dividends of up to $25 million in a calendar year, but not permitted to repurchase shares of our common stock. However, as long as the net leverage ratio (net debt/EBITDA) under the 2021 Senior Notes is below 2.5x, we can pay dividends or repurchase shares without limitation. Refer to Item 7A, "Management's Discussion and Analysis of Financial Condition and Results of Operations — Liquidity and Capital Resources" for the current limitations on our ability to pay dividends on or repurchase shares of our common stock.

In addition, if the aggregate availability under our revolving credit facilities is less than the greater of (i) $25 million and (ii) 12.5 percent of the maximum aggregate commitments under our revolving credit facilities as then in effect, we will be subject to increased reporting obligations and controls until such time as availability is more than the greater of (a) $35 million and (b) 17.5 percent of the maximum aggregate commitments under our revolving credit facilities as then in effect for at least 60 consecutive days and no default or event of default has occurred or is continuing during such 60-day period.

If aggregate availability under our revolving credit facilities is less than the greater of (i) $20 million and (ii) 10 percent of the maximum aggregate commitments under our revolving credit facilities as then in effect, we are required to comply with a fixed charge coverage ratio (as defined in our bank credit agreement) of not less than 1.1 to 1.0 for the preceding four-quarter period, tested as of the end of each quarter. Such compliance, once required, would no longer be necessary once (x) aggregate