Exhibit 99.1

The

North American Divested Brands of GlaxoSmithKline Plc

Report and Combined Financial Statements

For the years ended 31 December

2011, 31 December 2010 and 31 December 2009

The

North American Divested Brands of GlaxoSmithKline Plc

| Index |

|

| |

|

| Independent Auditor’s Report |

3 |

| |

|

| Combined Statements of Revenue and Direct Operating Expenses |

4 |

| |

|

| Combined Statements of Net Assets to be Sold |

5 |

| |

|

| Notes to statements |

6 |

| |

|

| 1. Background |

6 |

| |

|

| 2. Basis of preparation and accounting policies |

7 |

| |

|

| 3. Intangible assets |

14 |

| |

|

| 4. Related party transactions |

16 |

| |

|

| 5. Post balance sheet events |

17 |

| |

|

| 6. Commitments and Contingencies |

17 |

Report of Independent Registered Public Accounting Firm

To: the Directors of GlaxoSmithKline Plc

We have audited the accompanying Combined Statement of Net Assets

to be Sold of The North American Divested Brands of GlaxoSmithKline Plc (the ‘Divested Brands’) as of 31 December 2011,

31 December 2010 and 31 December 2009, the related Combined Statement of Revenue and Direct Operating Expenses for the years ended

31 December 2011, 31 December 2010 and 31 December 2009 and associated footnotes (collectively referred to as the “Combined

Financial Statements”). The Combined Financial Statements are the responsibility of GlaxoSmithKline Plc’s management.

Our responsibility is to express an opinion on the Combined Financial Statements based on our audit.

We conducted our audit in accordance with auditing standards

generally accepted in the United States of America. Those standards require that we plan and perform the audit to obtain reasonable

assurance that the Combined Financial Statements are free of material misstatement. An audit also includes examining, on a test

basis, evidence supporting the amounts and disclosures in the Combined Financial Statements. An audit also includes assessing the

accounting principles used and significant estimates made by management, as well as evaluating the overall Combined Financial Statements

presentation. We believe that our audit provides a reasonable basis for our opinion.

The Combined Financial Statements were prepared to present the

net assets to be sold of the Divested Brands and the revenue and direct operating expenses pursuant to the basis of preparation

described in Note 2 of the Combined Financial Statements, and are not intended to be a complete presentation of the Divested Brands’

financial position, operating results or cash flows.

In our opinion, the Combined Financial Statements referred to

above present fairly, in all material respects, the net assets to be sold of the Divested Brands as of 31 December 2011, 31 December

2010 and 31 December 2009 and the Divested Brands’ revenue and direct operating expenses for the years ended 31 December

2011, 31 December 2010 and 31 December 2009 in conformity with the basis of preparation described in Note 2.

/s/ PricewaterhouseCoopers LLP

PricewaterhouseCoopers LLP

Chartered Accountants

London

9 March 2012

PricewaterhouseCoopers

LLP, 1 Embankment Place, London WC2N 6RH

T: +44 (0) 20 7583 5000,

F: +44 (0) 20 7212 4652, www.pwc.co.uk

PricewaterhouseCoopers LLP is

a limited liability partnership registered in England with registered number OC303525. The registered office of

PricewaterhouseCoopers LLP is

1 Embankment Place, London WC2N 6RH.PricewaterhouseCoopers LLP is authorised and regulated by the Financial Services Authority

for designated investment business.

The

North American Divested Brands of GlaxoSmithKline Plc

Combined

Statements of Revenue and Direct Operating Expenses

For

the years ended 31 December 2011, 31 December 2010 and 31 December 2009

| | |

Note | | |

12/31/2011 | | |

12/31/2010 | | |

12/31/2009 | |

| | |

| | | |

$ | 000 | s | |

$ | 000 | s | |

$ | 000 | s |

| Revenue | |

| | | |

| 206,154 | | |

| 207,342 | | |

| 215,991 | |

| Cost of sales | |

| | | |

| (65,186 | ) | |

| (64,676 | ) | |

| (65,270 | ) |

| Gross profit | |

| | | |

| 140,968 | | |

| 142,666 | | |

| 150,721 | |

| | |

| | | |

| | | |

| | | |

| | |

| Selling, general and administration | |

| | | |

| (56,974 | ) | |

| (59,719 | ) | |

| (72,987 | ) |

| Research and development | |

| | | |

| - | | |

| - | | |

| (6 | ) |

| Amortisation and impairment | |

| 3 | | |

| (550 | ) | |

| (10,311 | ) | |

| (550 | ) |

| Other operating income/(expenses) | |

| 4 | | |

| 648 | | |

| (295 | ) | |

| (611 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Excess of revenue over direct operating expenses | |

| | | |

| 84,092 | | |

| 72,341 | | |

| 76,567 | |

The accompanying notes on pages 6 to 17

are an integral part of these Combined Financial Statements.

The

North American Divested Brands of GlaxoSmithKline Plc

Combined

Statements of Net Assets to be Sold

As of

31 December 2011, 31 December 2010 and 31 December 2009

| | |

Note | | |

12/31/2011 | | |

12/31/2010 | | |

12/31/2009 | |

| | |

| | | |

$ | 000 | s | |

$ | 000 | s | |

$ | 000 | s |

| Non-current assets | |

| | | |

| | | |

| | | |

| | |

| Intangible assets | |

| 3 | | |

| 211,339 | | |

| 212,134 | | |

| 221,928 | |

| Total non-current assets | |

| | | |

| 211,339 | | |

| 212,134 | | |

| 221,928 | |

| | |

| | | |

| | | |

| | | |

| | |

| Current assets | |

| | | |

| | | |

| | | |

| | |

| Finished goods inventories | |

| | | |

| 12,511 | | |

| 12,816 | | |

| 21,481 | |

| Total current assets | |

| | | |

| 12,511 | | |

| 12,816 | | |

| 21,481 | |

| | |

| | | |

| | | |

| | | |

| | |

| Net assets to be sold | |

| | | |

| 223,850 | | |

| 224,950 | | |

| 243,409 | |

The accompanying notes on pages 6 to 17

are an integral part of these Combined Financial Statements.

The

North American Divested Brands of GlaxoSmithKline Plc

Notes

to Combined Financial Statements

For

the years ended 31 December 2011, 31 December 2010 and 31 December 2009

The GlaxoSmithKline

Plc (“GSK” or “Group”) Consumer Healthcare business operates in three key areas: over the counter (“OTC”)

medicines, oral healthcare and nutritional healthcare. The North American Divested Brands of GlaxoSmithKline Plc (“Divested

Brands”) operate as part of the Consumer Healthcare business of GSK. GSK, its subsidiaries and associated undertakings,

constitute a major global healthcare group engaged in the creation, discovery, development, manufacture and marketing of pharmaceutical

and consumer health-related products.

In

April 2011, GSK identified certain non-core, OTC brands that it intended to divest as the Group focuses its Consumer Healthcare

business around a portfolio of priority brands and the emerging markets.

On

20 December 2011 Prestige Brands Holdings Inc (the “Purchaser”) entered into two sale and purchase agreements (the

“Agreements”) with GSK to acquire the Divested Brands in the respective countries where these Divested Brands are

sold.

The

first arrangement covers the outright transfer of the respective brands from the completion date for all products besides Debrox

and Gly-oxide. This agreement closed on 31 January 2012.

The

second agreement relates to the transfer and transitional supply arrangement for Debrox and Gly-oxide anticipated

to close on or before 1 May 2012. These brands are supplied to

GSK under licence from Sanofi Aventis. The agreement provides for the transfer of the licences for these brands and the transitional

supply arrangement of the brands to the Purchaser.

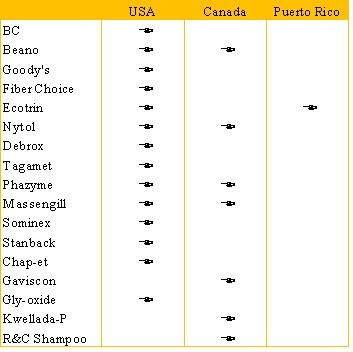

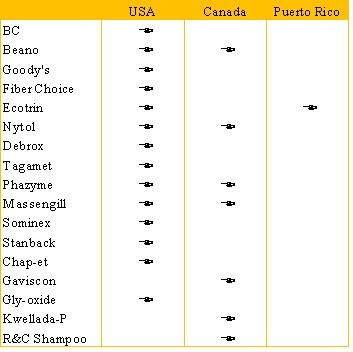

Included

in the scope of this transaction are the following brands and the respective countries where these Divested Brands are sold.

The

North American Divested Brands of GlaxoSmithKline Plc

Notes

to Financial Statements

| 2 | Basis of preparation and accounting policies |

The Divested

Brands and related net assets to be sold are not within separate legal entities and historically GSK has not maintained separate

records for the Divested Brands. The Combined Statements of Net Assets to be Sold and Combined Statements of Revenue and Direct

Operating Expenses, including the accompanying notes (collectively referred to as the “Combined Financial Statements”)

have been derived from the consolidated financial statements and the underlying accounting records of GSK. The accounting policies

herein are reflective of those used for the historical GSK consolidated financial statements unless stated otherwise.

The accompanying

Combined Financial Statements were prepared to present the net assets to be sold pursuant to the two Agreements between GSK and

Prestige Brands Holdings Inc signed on 20 December 2011 and the related revenue and direct operating expenses. The basis of preparation

describes how the Combined Financial Statements have been prepared in conformity with International Accounting Standards (“IAS”),

International Financial Reporting Standards (“IFRS”) and related interpretations, as issued by the International Accounting

Standards Board (“IASB”) as applicable to the items included in these Combined Financial Statements. These Combined

Financial Statements are not intended to be a complete presentation of assets, revenues and expenses of the Divested Brands.

The Combined

Statements of Net Assets to be Sold have been prepared on a basis which includes only those assets which are directly attributable

to the Divested Brands and are identified in the Agreements as being transferred to the Purchaser as described in Clause 2.1 of

the Agreements. No liabilities, contingent or otherwise are being assumed by the Purchaser. The Combined Statements of Revenue

and Direct Operating Expenses include revenue and expenses that are directly attributable to the Divested Brands and certain allocations

of other direct expenses incurred by GSK attributable to the Divested Brands as discussed below.

GSK maintains

all debt and notes payable on a consolidated basis to fund and manage operations; accordingly, debt and related interest expense

were not allocated to the Divested Brands. GSK also maintains its tax functions on a consolidated basis; accordingly, tax expense

was not allocated to the Divested Brands.

Historically

GSK has not maintained separate financial records for the Divested Brands and, as such, it is impracticable for GSK to identify

operating or financing cash flows associated with the Divested Brands. There were no acquisitions or disposals of intangible assets

during the years ended 31 December 2009, 2010 and 2011 respectively and therefore no investing cash flows associated with the

Divested Brands are presented.

Accounting

convention

The Combined Financial Statements

have been prepared using the historical cost convention.

The Combined

Financial Statements are reported in United States Dollars (“USD”). It is assumed for the preparation of these Combined

Financial Statements that the functional currency for revenue, expenses and assets is the same as that previously adopted by GSK.

Any exchange differences arising on re-stating functional currencies of the Canadian business to a US dollar presentation currency

are recognised under IFRS in other comprehensive income and, consequently, are not presented as part of these Combined Financial

Statements. It is also assumed that all foreign currency transactions were settled in local markets at the rate in force at the

date the transaction arose and, as such, no transactional exchange differences have been recognised or presented in these Combined

Financial Statements.

The

North American Divested Brands of GlaxoSmithKline Plc

Notes

to Financial Statements

Revenue, cost

of sales, selling, general and administration expenses, research and development and other operating income and expenses were

derived as follows:

Revenue

Data has been derived from

underlying accounting records without adjustment, including gross sales, discounts on invoices and other discounts.

Revenue is

recognised in the Combined Statements of Revenue and Direct Operating Expenses when all of the following have taken place: (i)

goods or services are supplied or made available to external customers against orders received, (ii) title and risk of loss is

passed to the customer, (iii) reliable estimates can be made of relevant deductions and (iv) all relevant obligations have been

fulfilled, such that the earnings process is regarded as being complete. Revenue represents net invoice value after the deduction

of discounts and allowances given and accruals for estimated future rebates and returns. The methodology and assumptions used

to estimate rebates and returns are monitored and adjusted regularly in the light of contractual and legal obligations, historical

trends, past experience and projected market conditions. Sales taxes are excluded from revenue.

The

top three customers accounted for 21%, 8%, 6% of revenue for the year ended 31 December 2011, 22%, 7%, 6% of revenue for the year

ended 31 December 2010 and 25%, 7% and 6% of revenue for the year ended 2009. No other customer individually accounted for more

than 5% of revenue in any of the three years ended 31 December 2011. The top five customers of Divested Brands accounted for 41%,

43% and 45% of total revenue for the years ended 31 December 2011, 2010 and 2009, respectively.

Cost of sales

Data has been

derived from the underlying accounting records at transfer cost for products sourced from GSK and its affiliates, which approximates

the actual manufacturing cost to the Group. Transfer cost for products sourced externally reflects actual cost to the Group.

Selling, general

and administration expenses

Comprises:

(i) Consumer Healthcare selling and distribution expenses allocated on the basis of revenue, (ii) Consumer Healthcare other marketing

expenses allocated on the basis of advertising and promotion spend, (iii) administration expenses including Consumer Healthcare

finance, information technology, legal and human resource costs allocated on the basis of revenue or other methodologies which

management believes are reasonable. Expenses have been derived from the underlying accounting records of GSK and the Consumer

Healthcare business.

GSK management believes

that the Consumer Healthcare allocations included within the Combined Statements of Revenue and Direct Operating Expenses are

reasonable; however, these allocated expenses are not necessarily indicative of expenses that would have been incurred by the

Divested Brands on a standalone basis.

Also included

are direct expenses for advertising and promotion, which have been sourced from the underlying accounting records.

Expenditure

for goods and services is recognised when supplied, in accordance with contractual terms. Expenses are recorded when an obligation

exists for a future liability in respect of a past event and where the amount of the obligation can be reliably estimated and

will be transferred to the buyer within the Agreements. Advertising and promotion expenditure is charged to the Combined Statements

of Revenue and Direct Operating Expenses as incurred. Inbound shipment costs on purchases and distribution expenses on sales to

customers are included in selling, general and administrative expenditure. Purchases from other GSK entities for the Divested

Brands are recorded on the date of shipment from the manufacturer as risks and rewards are considered to be transferred on that

date.

The

North American Divested Brands of GlaxoSmithKline Plc

Notes

to Financial Statements

Research and

development

Research and

development expenditure is charged to the Combined Statements of Revenue and Direct Operating Expenses in the period in which

it is incurred. Research and development costs are directly attributable to the brands and contain no allocations. Research and

development costs incurred by GSK Corporate are not allocated as they are not directly related to the Divested Brands.

Other operating income and

expenses

Other operating income and

expenses includes Consumer Healthcare allocated costs covering bad debt expense and other sundry items which are allocated on

the basis of revenue.

Certain expenses

and income, including corporate overhead, interest income, interest expense, restructuring costs and income taxes are not included

in the accompanying Combined Statements of Revenue and Direct Operating Expenses, as they are not historically allocated to individual

businesses and are not directly associated with revenue generating operations of the Divested Brands. Corporate overhead expenses

include expenses incurred for insurance, legal, finance, human resources and executive management functions.

Product liability

Product

liability costs included in these Combined Financial Statements are directly attributable to the brands and contain no

allocations. No product liability costs are incurred by the Consumer Healthcare business of GSK which are not allocated to

the brands. Product liability costs incurred by GSK Corporate are not allocated to the Divested Brands as they are not

directly related to the Divested Brands. No provisions related to product liability are included in the Combined Statements

of Net Assets to be Sold as historical product liabilities for

sale prior to completion are not being assumed by the

Purchaser.

In

respect of product liability claims related to certain products, an expense is recorded when there is evidence of claims and settlements

to enable management to make a reliable estimate of the amount required to cover unasserted claims. In certain cases, an actuarial

technique is used to determine this estimate.

Intangible

assets

Intangible assets are stated

at cost less provisions for amortisation and impairment.

Acquired brands

are valued independently, as part of the fair value of businesses acquired from third parties, where the brand has a value which

is substantial and long-term and where the brands are either contractual or legal in nature or can be sold separately from the

rest of the businesses acquired.

Brands are

amortised over their estimated useful lives of up to 20 years, except where they are considered indefinite life brands.

Intangible

assets included in the Combined Financial Statements are specific to the Divested Brands and do not therefore include any allocated

balances.

The

North American Divested Brands of GlaxoSmithKline Plc

Notes

to Financial Statements

Amortisation and impairment

The

carrying values of intangible assets which have a definitive life are reviewed for impairment when there is an indication that

the asset value might be impaired. Intangible assets with indefinite useful lives are tested for impairment annually and if there

was any indication of impairment during the year. Any provision for impairment is charged to the Combined Statements of Revenue

and Direct Operating Expenses in the year concerned. Impairment losses are reversed if there has been a change in the estimates

used to determine recoverable amounts and only to the extent that the revised recoverable amounts do not exceed the carrying values

that would have existed, net of amortisation, had no impairments been recognised.

Impairment

testing is performed using post tax discount rate and post tax cash flows as deferred tax balances and a standalone tax rate is

not available due to the limited nature of these Combined Financial Statements. Refer to Note 3 for a sensitivity analysis which

includes the impact on the fair value of the Fiber Choice asset as a result of an increase or decrease in the discount rate by

1%.

Inventories

Inventories are included

in the Combined Statements of Net Assets to be Sold at the lower of cost and net realisable value. Cost is determined on a first

in, first out basis and been derived from the underlying accounting records at transfer cost for products sourced from GSK and

its affiliates, which approximates the actual manufacturing cost to the Group. Transfer cost for products sourced externally reflects

actual cost to the Group.

Inventory data

has been derived from the underlying accounting records and includes direct costs of the Divested Brands only, no allocations

have been included.

Legal and other disputes

No provision

for the costs of legal disputes are included in the Combined Statements of Net Assets to be Sold as the liability for any existing

litigation claims will not be assumed by the Purchaser. An expense is recorded for the anticipated settlement costs of legal or

other disputes against the Divested Brands where an outflow of resources is considered probable and a reliable estimate can be

made of the likely outcome. The Divested Brands may become involved in legal proceedings, in respect of which it is not possible

to make a reliable estimate of the expected financial effect, if any, that could result from ultimate resolution of the proceedings.

In these cases, appropriate disclosures about such cases are included but no expenses are included in the Combined Financial Statements.

Key

accounting judgements and estimates

In preparing

the Combined Financial Statements, management is required to make estimates and assumptions that affect the amounts of assets,

liabilities, revenue and expenses reported in the Combined Financial Statements. Actual amounts and results could differ from

those estimates. The following are considered to be the key accounting judgements and estimates made:

Revenue

Revenue is

recognised when title and risk of loss is passed to the customer, reliable estimates can be made of relevant deductions and all

relevant obligations have been fulfilled, such that the earnings process is regarded as being complete.

Gross revenue

is reduced by rebates, discounts, allowances and product returns given or expected to be given, which vary by product arrangements

and contractual arrangements. These arrangements with customers are dependent upon the submission of claims some time after the

initial recognition of the sale.

The

North American Divested Brands of GlaxoSmithKline Plc

Notes

to Financial Statements

Amounts are

recorded at the time of sale for the estimated rebates, discounts or allowances payable or returns to be made, based on available

market information and historical experience. Since the amounts are estimated they may not fully reflect the final outcome, and

the amounts are subject to change dependent upon, amongst other things, the types of customer and product sales mix.

The level of

expense is reviewed and adjusted regularly in the light of contractual and legal obligations, historical trends, past experience

and projected market conditions. Market conditions are evaluated using wholesaler and other third-party analyses, market research

data and internally generated information. Future events could cause the assumptions on which the expenses are based to change,

which could affect the future results of the Divested Brands. There are no accruals, product liability claims or liabilities transferred

to the Purchaser of the Divested Brands.

In respect

of product liability claims related to certain products, an expense is recorded when there is evidence of claims made and settlements

to enable management to make a reliable estimate of the amount required to cover unasserted claims. In certain cases, an actuarial

technique is used to determine this estimate.

Legal

and other disputes

The Divested

Brands provide for anticipated settlement expenses where an outflow of resources is considered probable and a reliable estimate

may be made of the likely outcome of the dispute and legal and other expenses arising from claims against the Divested Brands.

GSK management

having taken legal advice, records legal expense after taking into account the relevant facts and circumstances of each matter

and in accordance with accounting requirements.

The Divested

Brands may become involved in legal proceedings, in respect of which it is not possible to make a reliable estimate of the expected

financial effect, if any, that could result from ultimate resolution of the proceedings, for which no expense is recorded. At

31 December 2011, 31 December 2010 and 31 December 2009 management believes no material provisions for legal and other

disputes were required.

The ultimate

liability for legal claims may vary from the amounts provided and is dependent upon the outcome of litigation proceedings, investigations

and possible settlement negotiations. The position could change over time, however, litigation claims and assessments are not

assumed by the Purchaser.

Intangible assets

Where intangible

assets are acquired by the Divested Brands from third parties, the costs of acquisition are capitalised. Brands acquired with

businesses are capitalised independently where they are separable and have an expected life of more than one year. Brands are

amortised on a straight-line basis over their estimated useful lives, not exceeding 20 years, except where the end of the useful

economic life cannot be foreseen. Where brands are not amortised, they are subject to annual impairment tests in accordance with

the assumptions set out in note 3. Patents are amortised from the point at which they are available for use, over their estimated

useful lives, which may include periods of non-exclusivity.

Estimated useful

lives are reviewed annually and impairment tests are undertaken if events occur which call into question the carrying values of

the assets. Both initial valuations and valuations for subsequent impairment tests are based on established market multiples or

risk-adjusted future cash flows discounted using appropriate interest rates reflecting GSK’s risk profile. These future

cash flows are based on business forecasts and are therefore inherently judgemental. Future events could cause the assumptions

used in these impairment analyses to change with a consequent adverse effect on the future results of the Divested Brands.

The

North American Divested Brands of GlaxoSmithKline Plc

Notes

to Financial Statements

Implementation of new accounting

standards

With effect

from 1 January 2011, the Divested Brands have implemented IAS 24 (Revised) ‘Related party disclosures’ and IFRIC 19

‘Extinguishing financial liabilities with equity instruments’ and minor amendments to a number of other accounting

standards. There is no material impact on the Combined Financial Statements on application of these standards.

New accounting requirements

The following

new and amended accounting standards and International Financial Reporting Interpretations Committee (“IFRIC”) interpretations

have been issued by the IASB and are likely to affect future financial information produced by the Divested Brands, although,

in their current forms, none is expected to have a material impact on the Combined Financial Statements of the Divested Brands.

IFRS 9 ‘Financial

instruments’ was first issued in November 2009 and amended in October 2010 and will be effective from 1 January 2015. The

standard will eventually replace IAS 39 and covers the classification, measurement and de-recognition of financial assets and

financial liabilities. The IASB intends to expand IFRS 9 to add new requirements for impairment and hedge accounting at future

dates.

An amendment

to IFRS 7 ‘Disclosures – Transfers of financial assets’ was issued in October 2010 and will be effective from

1 January 2012. The amendment requires additional disclosures regarding the risk exposures relating to transfers of financial

assets.

An amendment

to IAS 12 ‘Deferred tax: recovery of underlying assets’ was issued in December 2010 and will be effective from 1 January

2012. The amendment requires that the deferred tax on non-depreciated assets measured using the revaluation model should be calculated

on a sale basis.

IFRS 10 'Consolidated

financial statements' was issued in May 2011 and will be effective from 1 January 2013. The standard builds on existing principles

by identifying the concept of control as the determining factor in whether an entity should be included within the consolidated

financial statements. The standard provides additional guidance to assist in determining control where this is difficult to assess.

IAS 27 (Revised

2011), ‘Separate financial statements’ was issued in May 2011 and will be effective from 1 January 2013. The revised

standard includes the provisions on separate financial statements that are left after the control provisions of IAS 27 have been

included in the new IFRS 10.

IFRS 11 'Joint

arrangements' was issued in May 2011 and will be effective from 1 January 2013. The standard provides for a more realistic reflection

of joint arrangements by focusing on the rights and obligations of the arrangement, rather than its legal form. Proportional consolidation

of joint ventures is no longer allowed.

IAS 28 (Revised

2011) ‘Investments in associates and joint ventures’ was issued in May 2011 and will be effective from 1 January 2013.

The revised standard now includes the requirements for joint ventures, as well as associates, to be equity accounted following

the issue of IFRS 11.

IFRS 12 'Disclosure

of interests in other entities' was issued in May 2011 and will be effective from 1 January 2013. The standard includes disclosure

requirements for all forms of interests in other entities, including joint arrangements, associates, special purpose vehicles

and other off balance sheet vehicles.

The

North American Divested Brands of GlaxoSmithKline Plc

Notes

to Financial Statements

IFRS 13 ‘Fair

value measurement’ was issued in May 2011 and will be effective from 1 January 2013. The standard explains how to measure

fair value and aims to enhance fair value disclosures; it does not say when to measure fair value or require additional fair value

measurements.

An amendment

to IAS 1 ‘Presentation of Items of Other Comprehensive Income’ was issued in June 2011 and will be effective from

1 January 2013. The amendments improved the consistency and clarity of the presentation of items of other comprehensive income

(OCI).

The

North American Divested Brands of GlaxoSmithKline Plc

Notes

to Financial Statements

3 Intangible

assets

| | |

Licences and Patents | | |

Indefinite Life brands | | |

Total | |

| | |

$ | 000 | s | |

$ | 000 | s | |

$ | 000 | s |

| Cost at 1 January 2009 | |

| 5,500 | | |

| 216,937 | | |

| 222,437 | |

| Exchange adjustments | |

| - | | |

| 1,382 | | |

| 1,382 | |

| Cost at 31 December 2009 | |

| 5,500 | | |

| 218,319 | | |

| 223,819 | |

| | |

| | | |

| | | |

| | |

| Amortisation at 1 January 2009 | |

| (1,341 | ) | |

| - | | |

| (1,341 | ) |

| Charge for the year | |

| (550 | ) | |

| - | | |

| (550 | ) |

| Amortisation at 31 December 2009 | |

| (1,891 | ) | |

| - | | |

| (1,891 | ) |

| | |

| | | |

| | | |

| | |

| Net book value at 31 December 2009 | |

| 3,609 | | |

| 218,319 | | |

| 221,928 | |

| | |

Licences and Patents | | |

Indefinite Life brands | | |

Total | |

| | |

$ | 000 | s | |

$ | 000 | s | |

$ | 000 | s |

| Cost at 1 January 2010 | |

| 5,500 | | |

| 218,319 | | |

| 223,819 | |

| Exchange adjustments | |

| - | | |

| 517 | | |

| 517 | |

| Cost at 31 December 2010 | |

| 5,500 | | |

| 218,836 | | |

| 224,336 | |

| | |

| | | |

| | | |

| | |

| Amortisation at 1 January 2010 | |

| (1,891 | ) | |

| - | | |

| (1,891 | ) |

| Charge for the year | |

| (550 | ) | |

| - | | |

| (550 | ) |

| Amortisation at 31 December 2010 | |

| (2,441 | ) | |

| - | | |

| (2,441 | ) |

| | |

| | | |

| | | |

| | |

| Impairment at 1 January 2010 | |

| - | | |

| - | | |

| - | |

| Impairment losses | |

| - | | |

| (9,761 | ) | |

| (9,761 | ) |

| Impairment at 31 December 2010 | |

| - | | |

| (9,761 | ) | |

| (9,761 | ) |

| | |

| | | |

| | | |

| | |

| Net book value at 31 December 2010 | |

| 3,059 | | |

| 209,075 | | |

| 212,134 | |

| | |

Licences and Patents | | |

Indefinite Life brands | | |

Total | |

| | |

$ | 000 | s | |

$ | 000 | s | |

$ | 000 | s |

| Cost at 1 January 2011 | |

| 5,500 | | |

| 218,836 | | |

| 224,336 | |

| Exchange adjustments | |

| - | | |

| (245 | ) | |

| (245 | ) |

| Cost at 31 December 2011 | |

| 5,500 | | |

| 218,591 | | |

| 224,091 | |

| | |

| | | |

| | | |

| | |

| Amortisation at 1 January 2011 | |

| (2,441 | ) | |

| - | | |

| (2,441 | ) |

| Charge for the year | |

| (550 | ) | |

| - | | |

| (550 | ) |

| Amortisation at 31 December 2011 | |

| (2,991 | ) | |

| - | | |

| (2,991 | ) |

| | |

| | | |

| | | |

| | |

| Impairment at 1 January 2011 | |

| - | | |

| (9,761 | ) | |

| (9,761 | ) |

| Impairment losses | |

| - | | |

| - | | |

| - | |

| Impairment at 31 December 2011 | |

| - | | |

| (9,761 | ) | |

| (9,761 | ) |

| | |

| | | |

| | | |

| | |

| Net book value at 31 December 2011 | |

| 2,509 | | |

| 208,830 | | |

| 211,339 | |

The

North American Divested Brands of GlaxoSmithKline Plc

Notes

to Financial Statements

The Licences

and Patents relate to a Fiber Choice Patent acquired with the acquisition of CNS, Inc in 2006. The estimated useful life of the

Patent is ten years from the acquisition date which is the date of expiration of the patent.

Indefinite

life brands comprise a portfolio of consumer healthcare products primarily acquired with the acquisitions of Sterling Winthrop,

Inc in 1994, Block Drug Company Inc in 2001 and CNS, Inc in 2006. The net book values of the major brands are as follows:

| | |

12/31/2011 | | |

12/31/2010 | | |

12/31/2009 | |

| | |

$ | 000 | s | |

$ | 000 | s | |

$ | 000 | s |

| Gaviscon | |

| 9,437 | | |

| 9,682 | | |

| 9,165 | |

| Fiber Choice | |

| 45,839 | | |

| 45,839 | | |

| 55,600 | |

| BC | |

| 89,240 | | |

| 89,240 | | |

| 89,240 | |

| Goody's | |

| 29,701 | | |

| 29,701 | | |

| 29,701 | |

| Phazyme | |

| 24,278 | | |

| 24,278 | | |

| 24,278 | |

| Nytol | |

| 10,335 | | |

| 10,335 | | |

| 10,335 | |

| | |

| 208,830 | | |

| 209,075 | | |

| 218,319 | |

Each of these

brands is considered to have an indefinite life, given the strength and durability of the brand and the level of marketing support.

The brands are in relatively similar stable and profitable market sectors, with similar risk profiles, and their size, diversification

and market shares mean that the risk of market-related factors causing a reduction in the lives of the brands is considered to

be relatively low. Management is not aware of any material legal, regulatory, contractual, competitive, economic or other factor

which could limit their useful lives. Accordingly, these brands are not amortised.

Each brand

is tested annually for impairment applying a value in use methodology, generally using five year post-tax cash flow forecasts

(2009: four year post-tax cash flow forecasts) with a terminal value calculation and a discount rate equal to the GSK North American

post-tax discount rate of 7%. The main assumptions include future sales price and volume growth, product contribution and the

future expenditure required to maintain the product’s marketability and registration in the relevant jurisdictions. These

assumptions are based on past experience and are reviewed as part of management’s budgeting and strategic planning cycle

for changes in market conditions and sales erosion through competition. The terminal growth rates applied are between 0% and 2.5%

and are management’s estimates of future long-term average growth rates of the relevant markets.

Due to adverse

economic conditions, Fiber Choice experienced a decline in sales volume from 2008 to 2010. Management announced a significant

price decrease in the fourth quarter of 2010, effective January 2011, to counter the volume drop and make the brand more competitive.

The recoverable amount of the Fiber Choice brand was estimated, using the GSK value in use methodology, to be lower than its carrying

value by $9,761,000. Consequently these Combined Financial Statements recognise an impairment loss in 2010 of $9,761,000 which

was recorded in the Combined Statements of Revenue and Direct Operating Expenses within amortisation and impairment.

The estimate

of value in use was determined using a post-tax discount rate of 7% specific to the US and the impairment loss was allocated entirely

to the indefinite life brands. Impairment testing is performed using a post tax discount rate and post tax cash flows as deferred

tax balances and a standalone tax rate is not available due to the limited nature of these Combined Financial Statements.

The

North American Divested Brands of GlaxoSmithKline Plc

Notes

to Financial Statements

The table below

shows the effects on the Fiber Choice impairment analysis if an alternative discount rate of 6% and 8% had been used, with all

other assumptions remaining unchanged.

Impairment Sensitivity Analysis

Fiber Choice Discount Rate Sensitivity | | |

| |

| Discount Rate | |

| Headroom/ (impairment) | | |

| | |

| | |

| 2011 | | |

| 2010 | | |

| 2009 | |

| | |

$ | 000 | s | |

$ | 000 | s | |

$ | 000 | s |

| 8% | |

| (5,618 | ) | |

| (12,168 | ) | |

| (3,926 | ) |

| 6% | |

| 8,271 | | |

| (308 | ) | |

| 23,354 | |

| 4 | Related party transactions |

The Divested

Brands enter into a significant number of transactions with GSK and affiliated entities for sale and purchase transactions and

other support services.

Cost of sales

GSK entities supply the

Divested Brands with inventory. These transactions have been recorded at transfer cost transfer cost for products sourced from

GSK and its affiliates which approximates to the actual manufacturing cost to the Group. Amounts of $43,893,000, $42,776,000 and

$41,764,000 are included in cost of sales in the Combined Statements of Revenue and Direct Operating Expenses for these transactions

for the years ended 31 December 2011, 2010 and 2009, respectively.

Cost

allocation

GSK

and affiliated entities provide various services to the Consumer Healthcare business, including the Divested Brands. These services

include selling and distribution, marketing, administration, and medical administration. Costs of these services are allocated

to the Divested Brands based on the allocation methodology described under Note 2 – Basis of preparation and accounting

policies. The total expenses allocated to the Divested Brands for these services were $24,497,000,

$22,998,000 and $29,233,000 for the years ended 31 December 2011, 2010 and 2009, respectively and are included in selling, general

and administration expenses in Combined Statements of Revenue and Direct Operating Expenses. Although the cost of these services

cannot be quantified on a stand-alone basis, management believes that these allocations are reasonable.

The

other operating income/(expenses) allocated to the Divested Brands were $648,000, $(295,000) and $(611,000) for the years ended

31 December 2011, 2010 and 2009, respectively and related to items such as bad debt expense and corporate cost allocation, franchise

tax and sundry expenses and income. In the year ended 31 December 2011 there was a release of bad debt provision compared to bad

debt expense being recognised in prior years.

The costs incurred

by GSK’s corporate headquarters for services such as group insurance, legal, finance, human resources and the executive

management functions are not allocated to the Divested Brands as they were not historically allocated to individual businesses

and are not directly associated with revenue generating operations of the Divested Brands. Refer to Note 2 – Basis of preparation

and accounting policies.

Remuneration

of key management personnel

The Divested

Brands operate as part of the overall Consumer Healthcare business within GSK and were historically not managed on a standalone

basis, as a result there are no key management personnel identified for the Divested Brands.

The

North American Divested Brands of GlaxoSmithKline Plc

Notes

to Financial Statements

5 Post

balance sheet events

These Combined

Financial Statements are prepared in expectation of a sale of the Divested Brands in early 2012 as discussed in Note 2 - Basis

of preparation and accounting policies.

The first agreement

completed on 31 January 2012 for all brands excluding Debrox and Gly-oxide. The second agreement for Debrox and Gly-oxide is expected

to complete on or before 1 May 2012.

There were

no other subsequent events relevant to these Combined Financial Statements.

6 Commitments

and Contingencies

The

Divested Brands are involved in various legal matters and product liability claims arising in the ordinary course of business.

Although the outcome of these matters cannot be presently determined, in the opinion of management, the disposition of these matters

will not have a material adverse effect on the revenues or direct operating expenses of the Divested Brands.