Dear Stockholder:

It is a pleasure to invite you to the 2024 annual meeting of stockholders (the “Annual Meeting”) of Sunstone Hotel Investors, Inc. (“Sunstone”), a Maryland corporation, to be held at the Hilton San Diego Bayfront hotel, located at 1 Park Boulevard, San Diego, CA 92101, on Friday, May 3, 2024 at 8:00 a.m. local time, for the following purposes:

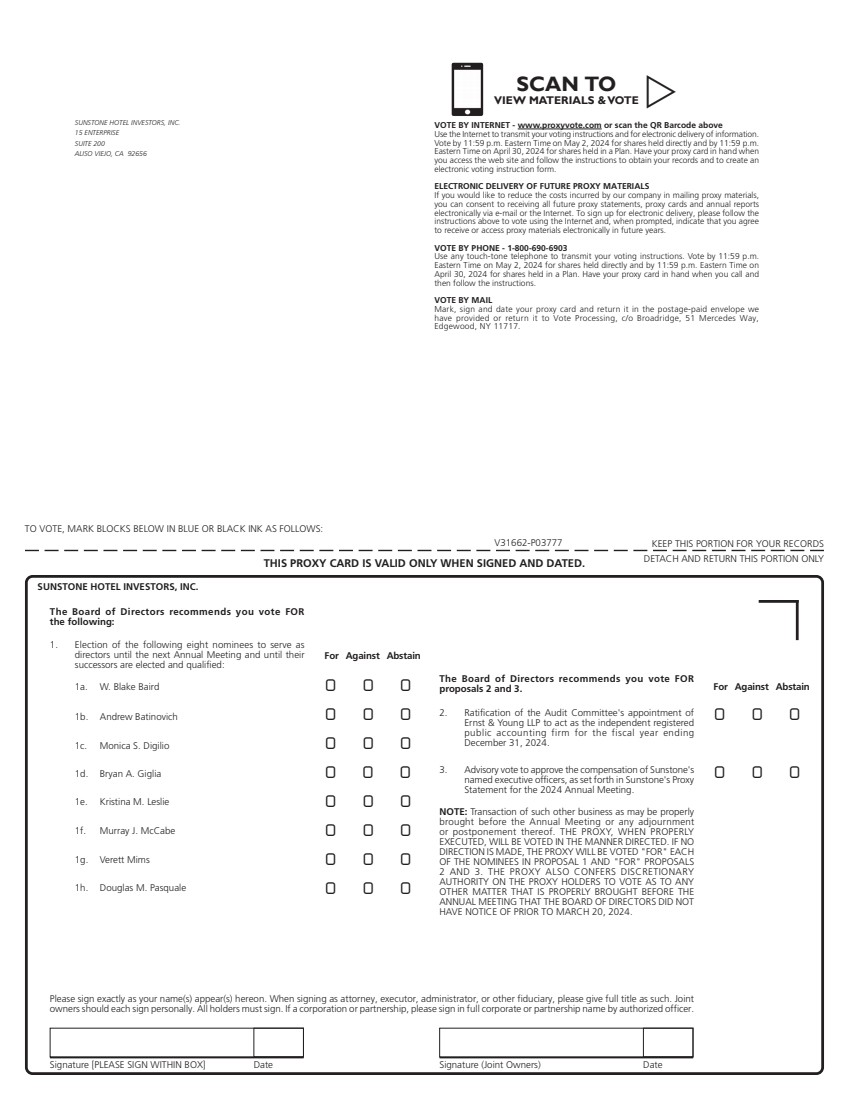

| 1. | Election of eight directors to serve until the next annual meeting and until their successors are elected and qualified; |

| 2. | Ratification of the Audit Committee’s appointment of Ernst & Young LLP to act as the independent registered public accounting firm for the fiscal year ending December 31, 2024; |

| 3. | Advisory vote to approve the compensation of Sunstone’s Named Executive Officers, as set forth in the proxy statement for Sunstone’s Annual Meeting (“Say-on-Pay Vote”); and |

| 4. | Transaction of other business as may properly come before the Annual Meeting, including any motion to adjourn to a later date to permit further solicitation of proxies, if necessary, or before any adjournment or postponement thereof. |

Only stockholders of record of shares of Sunstone common stock, par value $0.01 per share, at the close of business on March 6, 2024 are entitled to notice of and to vote at the Annual Meeting or any adjournment or postponement of the meeting.

Whether you own a few or many shares and whether or not you plan to attend the Annual Meeting, it is important that your shares be voted on matters that come before the meeting. You can ensure that your shares are voted at the meeting by completing, signing, dating and returning the enclosed proxy card in the envelope provided or, if you own shares through a bank or broker that provides for voting by telephone or over the Internet, by submitting your authorization to vote by telephone or over the Internet in accordance with your bank’s or broker’s instructions. If your proxy card is signed and returned without specifying your choices, your shares will be voted on each proposal in accordance with our Board of Directors’ recommendations.

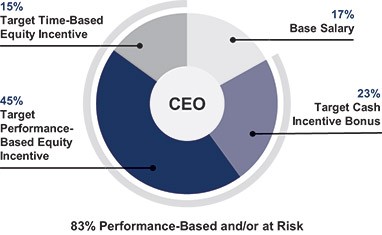

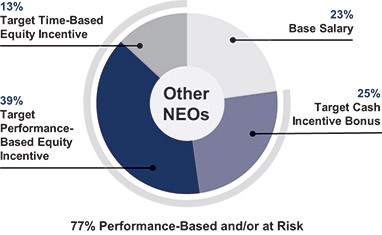

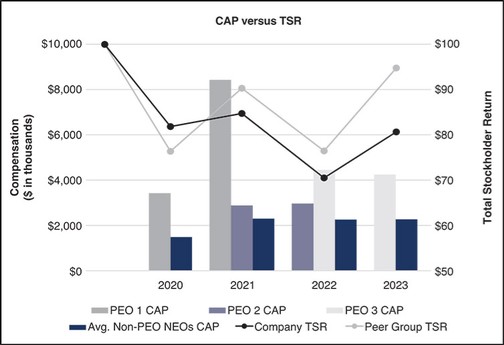

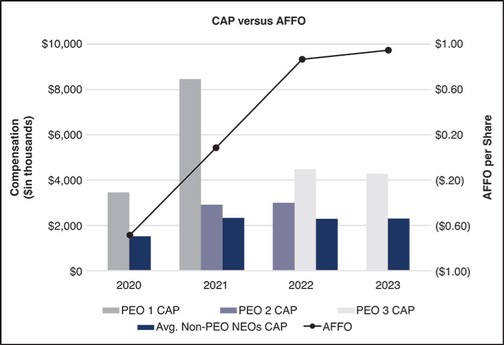

We would like to take this opportunity to thank you for your support of Sunstone. We believe that our continued refinement of our compensation and corporate governance practices, coupled with our commitment to building long-term value for our stockholders, positions Sunstone for a promising future. We continue to focus on improvements to our compensation and corporate governance practices, as reflected by the following previously implemented initiatives: Proxy Access; Director Holdover Resignation Guidelines; Limitations on Stockholder Rights Plans; Right of Stockholders to Amend Company Bylaws; Restrictions on Classifying Directors; Anti-Hedging and Pledging policies; Clawback Policy; comprehensive Insider Trading Policy; Double-Trigger accelerated vesting; a Pay-For-Performance structure that is aligned with both our stockholders and the expansion of Environmental, Social and Governance initiatives; and on-going Director refreshment and commitment to diversity.

Again, we thank you for your continued support and look forward to a promising future.

By Order of the Board of Directors

David M. Klein

Executive Vice President—General Counsel

and Secretary

March 20, 2024