UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant x Filed by a Party other than the Registrant ¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement | |||

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |||

| x | Definitive Proxy Statement | |||

| ¨ | Definitive Additional Materials | |||

| ¨ | Soliciting Material Pursuant to §240.14a-12 | |||

INVENSENSE, INC.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

| Payment of Filing Fee (Check the appropriate box): | ||||

| x | No fee required. | |||

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |||

| 1. | Title of each class of securities to which transaction applies: | |||

|

| ||||

| 2. | Aggregate number of securities to which transaction applies: | |||

|

| ||||

| 3. | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | |||

|

| ||||

| 4. | Proposed maximum aggregate value of transaction: | |||

|

| ||||

| 5. | Total fee paid: | |||

|

| ||||

| ¨ | Fee paid previously with preliminary materials. | |||

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||

| 1. | Amount Previously Paid: | |||

|

| ||||

| 2. | Form, Schedule or Registration Statement No.: | |||

|

| ||||

| 3. | Filing Party: | |||

|

| ||||

| 4. | Date Filed: | |||

|

| ||||

INVENSENSE, INC.

1745 Technology Drive, Suite 200

San Jose, California 95110

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

To Be Held On September 12, 2014

Dear Stockholder:

You are cordially invited to attend the annual meeting of stockholders of InvenSense, Inc., a Delaware corporation. The meeting will be held on September 12, 2014 at 10:00 a.m. pacific daylight time at our headquarters, at the ground floor of 1745 Technology Drive, San Jose, California 95110.

Proposals to be considered at the annual meeting:

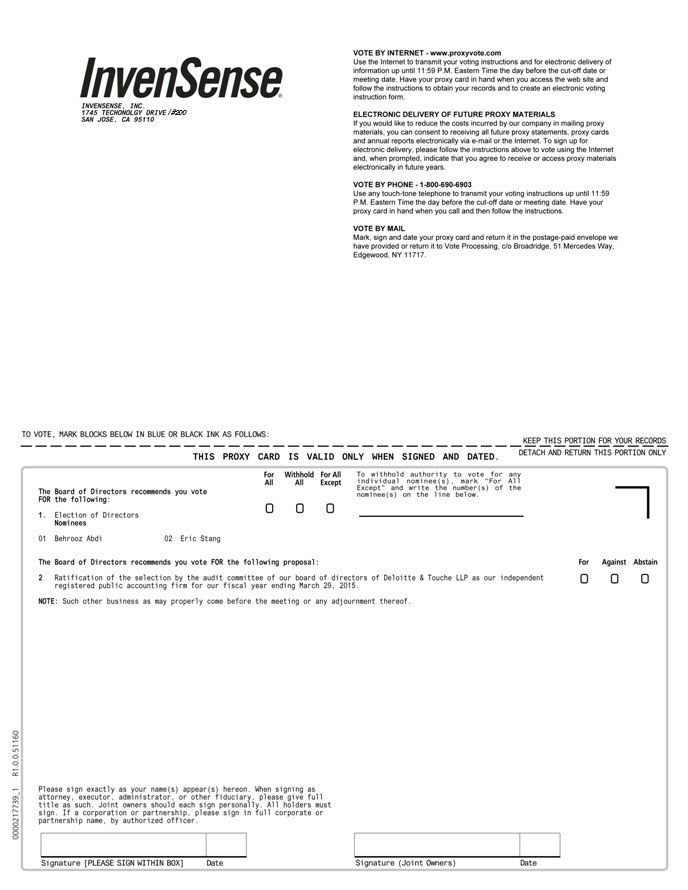

| 1. | Election of our board’s two nominees for Class III directors to serve for the ensuing three years and until their successors are elected. |

| 2. | Ratification of the selection by the audit committee of our board of directors of Deloitte & Touche LLP as our independent registered public accounting firm for our fiscal year ending March 29, 2015. |

These items of business are more fully described in the proxy statement accompanying this notice. The record date for the annual meeting is July 18, 2014. Only stockholders of record at the close of business on that date may vote at the meeting or any postponement or adjournment thereof.

We are providing our stockholders with access to the proxy materials over the Internet. This permits us to conserve natural resources and reduces our printing costs, while giving our stockholders a convenient and efficient way to access our proxy materials and vote their shares. On or about July 30, 2014, we intend to mail a Notice of Internet Availability of Proxy Materials to our stockholders, informing them that our notice of annual meeting and proxy statement, annual report to stockholders and voting instructions are available on the Internet. As described in more detail in that notice, stockholders may choose to access our materials through the Internet or may request to receive paper copies of the proxy materials.

| By Order of the Board of Directors | ||||

|

||||

| Alan Krock Vice President and Chief Financial Officer |

||||

July 25, 2014

| You are cordially invited to attend the meeting in person. Whether or not you expect to attend the meeting, please vote on the matters to be considered as promptly as possible in order to ensure your representation at the meeting. You may vote via the Internet or by requesting a printed copy of the proxy materials and returning the proxy card that will be mailed to you. Even if you have voted by proxy, you may still vote in person if you attend the meeting. Please note, however, that if your shares are held of record by a broker, bank or other nominee and you wish to vote at the meeting, you must obtain a proxy issued in your name from that record holder. |

1745 Technology Drive, Suite 200

San Jose, California 95110

PROXY STATEMENT

FOR THE 2014 ANNUAL MEETING OF STOCKHOLDERS

QUESTIONS AND ANSWERS ABOUT THESE PROXY MATERIALS AND VOTING

Why did I receive a notice regarding the availability of proxy materials on the Internet?

Under rules adopted by the Securities and Exchange Commission, or SEC, we have elected to provide access to our proxy materials over the Internet. Accordingly, we are sending a Notice of Internet Availability of Proxy Materials, or the Notice, to our stockholders of record. All stockholders will have the ability to access the proxy materials on the website referred to in the Notice or to request to receive a printed set of the proxy materials. Instructions on how to access the proxy materials over the Internet or to request a printed copy may be found in the Notice. You will not receive a printed copy of the proxy materials unless you request one in the manner set forth in the Notice. This permits us to conserve natural resources and reduces our printing costs, while giving stockholders a convenient and efficient way to access our proxy materials and vote their shares.

We intend to mail the Notice and, as required, any other printed proxy materials, on or about July 30, 2014 to all stockholders of record entitled to vote at the 2014 Annual Meeting of Stockholders, or annual meeting.

Why are these proxy materials being made available?

We are providing you with these proxy materials because the board of directors of InvenSense, Inc. (which we refer to in this proxy statement as InvenSense, the Company, we, or us) is soliciting your proxy to vote at the annual meeting. You are invited to attend the annual meeting and we request that you vote on the proposals described in this proxy statement. However, you do not need to attend the meeting to vote your shares. Instead, you may simply vote your shares by proxy via the Internet or, if you receive a paper copy of the proxy statement, by completing, signing and returning a paper proxy card.

How do I attend the annual meeting?

The annual meeting will be held on September 12, 2014 at 10:00 a.m. Pacific Daylight Time at our headquarters at the ground floor of 1745 Technology Drive, San Jose, California 95110.

Who can vote at the annual meeting?

Only stockholders of record at the close of business on July 18, 2014 will be entitled to vote at the annual meeting. On the record date, there were 88,634,030 shares of common stock outstanding and entitled to vote.

Stockholder of Record: Shares Registered in Your Name

If, on July 18, 2014, your shares of InvenSense’s common stock were registered directly with Computershare Trust Company, N.A., our transfer agent for our common stock, then you are a stockholder of record. As a stockholder of record, you may vote in person at the meeting or vote by proxy. Whether or not you

1

plan to attend the meeting, we urge you to vote your proxy on the matters to be considered as promptly as possible in order to ensure your representation at the meeting. You may vote your proxy via the Internet or by requesting a printed copy of the proxy materials and returning the enclosed proxy card.

Beneficial Owner: Shares Registered in the Name of a Broker or Bank

If, on July 18, 2014, your shares were held in an account at a brokerage firm, bank, dealer, or other similar organization, then you are the beneficial owner of shares held in “street name” and the Notice is being forwarded to you by that organization. The organization holding your account is considered the stockholder of record for purposes of voting at the annual meeting. As a beneficial owner, you have the right to direct your broker or other agent on how to vote the shares in your account. You are also invited to attend the annual meeting. However, since you are not the stockholder of record, you may not vote your shares in person at the meeting unless you request and obtain a valid proxy from your broker or other agent.

What am I voting on?

There are two matters scheduled for a vote and for which we are soliciting your proxy:

| 1. | Election of our board’s two nominees for Class III directors. |

| 2. | Ratification of the selection by the audit committee of our board of directors of Deloitte & Touche LLP as our independent registered public accounting firm for our fiscal year ending March 29, 2015. |

You may either vote “For” all the nominees to the board of directors or you may “Withhold” your vote for any nominee(s) you specify. For the proposal regarding approval of ratification of the selection of Deloitte & Touche LLP as our independent registered public accounting firm, you may vote “For” or “Against” the proposal or abstain from voting.

How do I vote?

The procedures for voting are as follows:

Voting via the Internet

| • | You can vote your shares via the Internet by following the instructions in the Notice. The Internet voting procedures are designed to authenticate your identity and to allow you to vote your shares and confirm your voting instructions have been properly recorded. If you vote via the Internet, you do not need to mail a proxy card. |

Voting by Mail

| • | You can vote your shares by mail by requesting that a printed copy of the proxy materials be sent to your address. When you receive the proxy materials, you may fill out the proxy card enclosed therein and return it per the instructions on the card. |

What if I return a proxy card or otherwise complete a ballot or give voting instructions but do not make specific choices?

If you return a signed and dated proxy card or otherwise complete a ballot or voting instructions without marking your selections, your shares will be voted, as applicable, “For” the election of both nominees for director and “For” the ratification of Deloitte & Touche LLP as our independent registered public accounting firm for our fiscal year ending March 29, 2015. The board of directors knows of no other matters that will be presented for consideration at the annual meeting. If any other matter is properly presented at the meeting, your proxy (one of the individuals named on your proxy card) will vote your shares using his best judgment.

2

Who is paying for this proxy solicitation?

We are paying for the entire cost of soliciting proxies. In addition to these proxy materials, our directors and employees may also solicit proxies in person, by telephone or by other means of communication. Directors and employees will not be paid any additional compensation for soliciting proxies. We may also reimburse brokerage firms, banks and other agents for the cost of forwarding proxy materials to beneficial owners.

What does it mean if I receive more than one Notice?

If you receive more than one Notice, your shares are registered in more than one name or are registered in different accounts. Please follow the voting instructions on the Notice and vote your shares for each name or account to ensure that all of your shares are voted.

Can I change my vote after submitting my proxy?

Yes. You can revoke your proxy at any time before the final vote at the annual meeting. If you are the record holder of your shares, you may revoke your proxy in any one of four ways:

| • | You may submit another properly completed proxy card with a later date; |

| • | You may grant a subsequent proxy through our Internet voting site; |

| • | You may send a written notice that you are revoking your proxy to our Corporate Secretary at 1745 Technology Drive, Suite 200, San Jose, California 95110; or |

| • | You may attend the annual meeting and vote in person. Simply attending the meeting will not, by itself, revoke your proxy. Please remember, as mentioned above, if you are a beneficial owner of shares you may not vote your shares in person at the meeting unless you request and obtain a valid proxy from your broker, bank or other agent that holds your shares in street name. |

If your shares are held by your broker, bank or another agent as a nominee or agent, you should follow the instructions provided by your broker, bank or other agent.

What are broker non-votes? How do I vote if I hold my shares in street name?

A “broker non-vote” occurs when a nominee holding shares for a beneficial owner does not vote on a particular proposal because the nominee does not have discretionary voting power with respect to that proposal and has not received instructions with respect to that proposal from the beneficial owner (despite voting on at least one other proposal for which it does have discretionary authority or for which it has received instructions).

If your shares are held by your broker as your nominee (that is, in “street name”), you will need to obtain a proxy form from the institution that holds your shares and follow the instructions included on that form regarding how to instruct your broker to vote your shares. If you do not give instructions to your broker, your broker can vote your shares with respect to routine “discretionary” items, but not with respect to “non-discretionary” items under the rules of the New York Stock Exchange, or NYSE, on which your broker may vote shares held in street name in the absence of your voting instructions. On non-discretionary items for which you do not give your broker instructions, the shares will be treated as broker non-votes. Under NYSE rules, elections of directors are considered to be non-routine and, therefore, brokers and other nominees will not be able to vote in the election of directors unless they receive instructions from the beneficial owners of the shares.

How are votes counted?

Votes will be counted by the inspector of election appointed for the meeting, who will separately count “For” and “Withhold” votes and any broker non-votes for the election of directors. Broker non-votes will not count for or against any nominees or for any frequency of named executive officer compensation advisory votes.

3

With respect to the ratification of Deloitte & Touche, the inspector of election will separately count “For” and “Against” votes. Abstentions will be counted towards the vote total for the proposal, and will have the same effect as “Against” votes. Broker non-votes will have no effect and will not be counted towards the vote total for the proposal.

How many votes are needed to approve each of the proposals?

| • | Proposal 1 — Election of our two nominees for Class III director. The two nominees receiving the most “For” votes (among votes properly cast in person or by proxy) will be elected. |

| • | Proposal 2 — Ratification of the selection by the audit committee of our board of directors of Deloitte & Touche LLP as the independent registered public accounting firm for our fiscal year ending March 29, 2015. This proposal must receive a “For” vote from the holders of a majority of the voting power present and entitled to vote either in person or by proxy on the proposal. If you “Abstain” from voting, it will have the same effect as an “Against” vote. |

What is the quorum requirement?

A quorum of stockholders is necessary to hold a valid meeting. A quorum will be present if at the meeting there are present in person or represented by proxy the holders of outstanding shares of common stock entitled to cast a majority of the votes that could be cast by all outstanding shares of common stock. On the record date, there were 88,634,030 shares of common stock outstanding, all of which are entitled to vote. Thus, holders of shares representing at least 44,317,016 votes must be present in person or represented by proxy at the meeting to have a quorum.

Shares that are voted in person or by proxy are treated as being present at the meeting for purposes of establishing a quorum. Abstentions and broker non-votes will also be counted for purposes of calculating whether a quorum is present at the annual meeting. If there is no quorum, the holders of shares representing a majority of the votes present at the meeting may adjourn the meeting to another date.

How many votes do I have?

On each matter to be voted upon, for holders of our common stock, you have one vote for each share of common stock you owned as of July 18, 2014.

How can I find out the results of the voting at the annual meeting?

Preliminary voting results will be announced at the annual meeting. Final voting results will be published in a current report on Form 8-K that we expect to file within four business days after the annual meeting. If final voting results are not available to us in time to file a Form 8-K within four business days after the meeting, we intend to file a Form 8-K to publish preliminary results and, within four business days after the final results are known to us, file an additional Form 8-K to publish the final results.

4

PROPOSAL ONE

ELECTION OF CLASS III DIRECTORS

Pursuant to our certificate of incorporation, our board of directors is divided into three classes with staggered three-year terms. The total number of authorized directors on our board of directors has been fixed at seven by a resolution of our board of directors, and two directors will serve as Class III directors whose terms will expire at the annual meeting of stockholders to be held in 2017.

There are two nominees for Class III director at this annual meeting, Behrooz Abdi and Eric Stang. Stockholders cannot submit proxies voting for a greater number of persons than the two nominees named in this Proposal One. Each director to be elected will hold office until the annual meeting of stockholders held in 2017 and until his successor is elected or until the director’s death, resignation or removal. Each nominee is currently a director of InvenSense and has agreed to serve if elected, and we have no reason to believe that any nominee will be unable to serve.

There are no family relationships between any of our directors, nominees or executive officers. There are also no arrangements or understandings between any director, nominee or executive officer and any other person pursuant to which he or she has been or will be selected as a director or executive officer.

Required Vote

The two nominees receiving the highest number of “FOR” votes shall be elected as Class III directors. Shares represented by executed proxies will be voted, if authority to do so is not withheld, for the election of the two nominees named above. If any nominee becomes unavailable for election as a result of an unexpected occurrence, shares that would have been voted for such nominee will instead be voted for the election of a substitute nominee proposed by our board of directors and the nominating and corporate governance committee. Under the rules of the NYSE, brokers are prohibited from giving proxies to vote on elections of directors unless the beneficial owner of such shares has given voting instructions on the matter. This means that if your broker is the record holder of your shares, you must give voting instructions to your broker with respect to the two nominees in this Proposal One if you want your broker to vote your shares on the matter. Otherwise, your shares will be treated as broker non-votes. Broker non-votes will have no effect on the outcome of the vote.

Recommendation

The board of directors recommends a vote FOR each nominee named in Proposal One.

5

INFORMATION REGARDING OUR NOMINEES AND DIRECTORS

The following table sets forth information as of July 18, 2014 with respect to the nominees for election as Class III directors of our board.

Class III Director Nominees

| Name |

Age | Position | ||||

| Behrooz Abdi |

52 | President and Chief Executive Officer and Director | ||||

| Eric Stang |

54 | Director and Member of the Audit Committee, Compensation Committee and Nominating and Corporate Governance Committee | ||||

Continuing Directors

| Name |

Age | Class(1) |

Position | |||

| Jon Olson |

61 | I | Director, Chairman of the Audit Committee | |||

| Amit Shah |

49 | I | Chairman of the Board and Chairman of the Compensation Committee | |||

| Tim Wilson |

55 | II | Director and Member of the Audit Committee and Chairman of the Nominating and Corporate Governance Committee | |||

| Yunbei “Ben” Yu, Ph.D. |

44 | I | Director and Member of the Compensation Committee | |||

| (1) | The terms of Class I directors will expire at the 2015 annual meeting. The terms of Class II directors will expire at the 2016 annual meeting. The terms of Class III directors will expire at the 2017 annual meeting. |

Nominees for Class III Directors

Behrooz Abdi has served on our board of directors since June 2011 and was appointed President and Chief Executive Officer in October 2012. Mr. Abdi served as Executive Vice President and General Manager at NetLogic Microsystems, Inc., a provider of semiconductor solutions, from November 2009 to December 2011. Mr. Abdi served as the President and Chief Executive Officer of RMI Corporation (formerly Raza Microelectronics Inc.), a fabless semiconductor company, from November 2007 to October 2009. He served as Senior Vice President and General Manager of CDMA Technologies (QCT) at Qualcomm, Inc., a provider of wireless technology and services, from March 2004 to November 2007. Prior to joining Qualcomm, he held leadership and engineering positions of increasing responsibility at Motorola, Inc. in its Semiconductor Products Sector (SPS). From September 1999 to March 2003, he served as Vice President and General Manager for Motorola’s radio products division, in charge of RF and mixed signal ICs for the wireless mobile market. He currently serves as a director at Tabula, Inc. He also serves as a director at Exar Corporation, a provider of high performance mixed-signal integrated circuits and sub-system solutions for networking and telecommunications, and industrial markets. Mr. Abdi served as the Chairman and director of SMSC Storage, Inc. (Formerly Symwave, Inc.), from September 2009 to November 2010 and as a director of RMI Corporation from November 2007 to November 2009. Mr. Abdi holds a B.S. from Montana State University and an M.S. from the Georgia Institute of Technology, both in Electrical Engineering. We believe Mr. Abdi’s qualifications to sit on our board of directors include his over 26 years of experience in the semiconductor industry, his track record of growing profitable businesses and his experience as a board member of various private semiconductor and technology companies.

6

Eric Stang has served on our board of directors since September 2013. Mr. Stang has also served as a Director and President and Chief Executive Officer of Ooma, Inc., a provider of broadband telephony products, since January 2009. Prior to joining Ooma, Mr. Stang served as Chief Executive Officer and President of Reliant Technologies, Inc., a developer of medical technology solutions for aesthetic applications, from 2006 to 2008. From 2001 to 2006, Mr. Stang served as Chief Executive Officer and President of Lexar Media, Inc., a provider of solid state memory products and its Chairman from 2004 to 2006. Mr. Stang currently serves on the board of Rambus Inc., a public company, and other private companies. Mr. Stang received his B.A. from Stanford University and M.B.A. from the Harvard Business School. We believe Mr. Stang’s qualifications to sit on our board of directors include his years of service as a chief executive officer of various technology companies and his perspective gained in management of and service as a board member of various companies. Mr. Stang qualifies as independent according to the rules and regulations of the NYSE as determined by our board of directors.

Continuing Directors

Jon Olson has served on our board of directors since October 2011. Mr. Olson has been the Executive Vice President Finance and Chief Financial Officer at Xilinx, Inc., a provider of programmable semiconductor platforms, since June 2014 and joined Xilinx as Vice President, Finance and Chief Financial Officer in June 2005. Prior to joining Xilinx, he served from 1979 to 2005 at Intel Corporation, a semiconductor chip maker, in various senior financial positions, including Vice President, Finance and Enterprise Services and Director of Finance. Mr. Olson holds an M.B.A. in Finance from Santa Clara University and a B.S. in Accounting from Indiana University. We believe Mr. Olson’s qualifications to sit on our board of directors include his over 30 years of experience in senior roles of financial responsibility in the semiconductor industry, his track record of growing profitable businesses and his experience at various semiconductor and technology companies. Mr. Olson qualifies as independent according to the rules and regulations of the NYSE as determined by our board of directors.

Amit Shah has served on our board of directors since April 2004. As a Managing Member of Artiman Management since 2000, he serves on the boards of Auryn, Inc., AbsolutelyNew, Inc., Guavus, Inc., Aditazz, Inc., Adama Materials, Inc., CellMax, Ltd., Kaybus, Inc., HomeUnion Holdings, Inc., Tonbo Imaging Pte. Ltd., Dyyno, Inc., VuCast Media, Inc. and Motif, Inc. In addition, he previously served on the boards of MYNDnet, Inc., Mastek, Inc., Sierra Design Automation, Inc., Net Devices, Inc., Zyme Solutions, Inc. and Lightwire, Inc. Prior to founding Artiman Management, Mr. Shah founded Anthelion I & II, seed stage venture funds, which he has managed since 1996. From 1998 to 2000, he worked as Vice President of New Markets and Technologies for the Business Development and Alliances Group of Cisco Systems, Inc., a consumer electronics company, and he founded and was Chief Executive Officer of PipeLinks, Inc., an optical network company, until its acquisition by Cisco Systems in 1998. Mr. Shah also founded ZeitNet, a networking systems company, which was acquired by Cabletron Systems in 1996. Mr. Shah holds a B.S. in Electrical Engineering from The Maharaja Sayajirao University of Baroda, India and has done graduate work at the University of California, Irvine. We believe Mr. Shah’s qualifications to sit on our board of directors include his understanding of our company acquired during his years of service on our board of directors, his experience serving as a director of various technology companies and his perspective gained as a venture capital investor. Mr. Shah qualifies as independent according to the rules and regulations of the NYSE as determined by our board of directors.

Tim Wilson has served on our board of directors since April 2004. Mr. Wilson joined Artiman Management in January 2012 as Managing Director. From 2001 until December 2011, he was a Partner of Partech International, LLC. Mr. Wilson currently serves on the boards of Five9 (NASDAQ:FIVN), Prysm, LEDEngin, Crossbar, Nutrinsic, and Kaybus. Between 1998 and 2001, he served as Vice President of Marketing and as Chief Marketing Officer for Digital Island, a Partech portfolio company. From 1996 to 1998, he was a General Manager at Lucent Technology. From 1983 to 1996, he held a variety of senior management positions within AT&T (North America and Australia) and AT&T Bell Labs. Mr. Wilson graduated summa cum laude, Phi Beta Kappa from Bowdoin College receiving his undergraduate degree in Physics. He received his M.B.A. from Duke

7

University’s Fuqua School of Business, where he was named a Fuqua Scholar. We believe Mr. Wilson’s qualifications to sit on our board of directors include his years of service on our board, his experience with capital markets and his perspective gained in management of and service as a board member of various public and private companies. Mr. Wilson qualifies as independent according to the rules and regulations of the NYSE as determined by our board of directors.

Yunbei “Ben” Yu, Ph.D. has served on our board of directors since March 2008. Dr. Yu also currently serves on the boards of 800App, Applied MicroStructures, Inc., CNEX, Miox, Qeexo, Social Touch, TempoAI and VeriSilicon Holdings Co., Ltd., and serves as an observer on the board of Novariant, Inc. Dr. Yu has previously served on the boards of AuthenTec, Inc., mSilica, Inc., Multigig, Inc. and SyChip Inc. (acquired by Murata Manufacturing Co., Ltd.), and previously served as an observer on the board of Verari Systems. Dr. Yu has served as a Venture Partner or Managing Director at Sierra Ventures since 2000. Prior to joining Sierra Ventures, he worked from 1997 to 2000 at 3Com Corporation, an electronics manufacturer, where he held a number of engineering and project management positions. He received his B.S. in Engineering from the University of Western Australia and a Ph.D. in Electrical Engineering from Princeton University. We believe Dr. Yu’s qualifications to sit on our board of directors include his extensive experience in investment management of and service as a board member of various companies in the semiconductor, communications component and systems industries. Dr. Yu qualifies as independent according to the rules and regulations of the NYSE as determined by our board of directors.

8

BOARD OF DIRECTORS AND CORPORATE GOVERNANCE

Board Composition and Leadership Structure

Our board of directors consists of six members, including our President and Chief Executive Officer, Behrooz Abdi, as well as five non-management directors, Messrs. Jon Olson, Amit Shah, Eric Stang, Tim Wilson and Dr. Yunbei “Ben” Yu, each of whom qualifies as independent according to the rules and regulations of the NYSE as determined by our board of directors.

Our board of directors is divided into three classes with staggered three-year terms. At each annual meeting, the directors whose terms then expire or their successors will be elected to serve from the time of election and qualification until the third annual meeting following their election. Our directors are divided among the three classes as follows:

| • | The Class I directors are Mr. Olson, Mr. Shah and Dr. Yu, and their terms will expire at the annual meeting of stockholders to be held in 2015; |

| • | The Class II director is Mr. Wilson, and his term will expire at the annual meeting of stockholders to be held in 2016; and |

| • | The Class III directors are Messrs. Abdi and Stang and their terms will expire at the annual meeting of stockholders to be held on September 12, 2014 as described in this proxy statement. |

Our board highly values independent directors. Currently, all of the members of our board of directors other than our Chief Executive Officer, Mr. Abdi, are independent, as well as all members of the audit committee, the compensation committee and the nomination and corporate governance committee. Our board of directors retains the flexibility to determine on a case-by-case basis whether the Chief Executive Officer, or an independent director, should serve as Chairman. This flexibility permits our board of directors to organize its functions and conduct its business in a manner it deems most effective in then-prevailing circumstances.

The board currently separates the role of Chairman and Chief Executive Officer, with Mr. Abdi serving as Chief Executive Officer and Mr. Shah serving as Chairman. The board believes that separating these two roles promotes balance between the board’s independent authority to oversee our business and the Chief Executive Officer and our management team, which manages the business on a day-to-day basis. The current separation of the Chairman and Chief Executive Officer roles allows the Chief Executive Officer to focus his time and energy on operating and managing the Company and leverage the experience and perspectives of the Chairman.

Contacting the Board of Directors

Any stockholder who desires to contact our board, committees of the board and individual directors may do so by writing to: 1745 Technology Drive, Suite 200, San Jose, California 95110 Attention: Adam Tachner, General Counsel. Mr. Tachner will direct such communication to the appropriate persons.

Role of the Board in Risk Oversight

The board of directors is actively involved in the oversight of our risk management process. The board does not have a standing risk management committee, but administers this oversight function directly through the board as a whole, as well as through its standing committees that address risks inherent in their respective areas of oversight. In particular, our audit committee has the responsibility to consider and discuss our major financial risk exposures and the steps our management has taken to monitor and control these exposures, our compensation committee assesses and monitors whether any of our compensation policies and programs has the potential to encourage excessive risk-taking, our nominating and corporate governance committee monitors our major legal compliance risk exposures and our program for promoting and monitoring compliance with applicable legal and regulatory requirements and our board is responsible for monitoring and assessing strategic risk exposure and other risks not covered by our committees.

9

The full board, or the appropriate committee, receives reports on risks facing our company from our Chief Executive Officer or other members of management to enable it to understand our risk identification, risk management and risk mitigation strategies. We believe that our board’s leadership structure supports effective risk management because it allows the independent directors on our committees to exercise oversight over management.

Board Meetings

During the fiscal year ended March 30, 2014, the board held five meetings. Each of our incumbent directors attended more than seventy-five percent of the meetings of the board and of the committees on which the director served that were held during the last fiscal year. Board members are expected to regularly attend all meetings of the board and committees on which they serve. Our independent directors held an executive session in conjunction with each in-person board meeting.

Committees of the Board

In fiscal year 2014, our board of directors had three standing committees: an audit committee, a compensation committee and a nominating and corporate governance committee. The following table provides membership and meeting information for each of the board committees in fiscal year 2014:

| Member of our board of directors in fiscal year 2014 |

Audit | Compensation | Nominating and Corporate Governance |

|||||||||

| Jon Olson(1) |

|

|||||||||||

| Amit Shah |

|

|||||||||||

| Eric Stang(2) |

|

|

||||||||||

| Tim Wilson |

|

|

||||||||||

| Yunbei “Ben” Yu, Ph.D. |

|

|||||||||||

| R. Douglas Norby(3) |

|

|||||||||||

|

|

||||||||||||

| (1) | Mr. Olson became chair of the audit committee in July 2014. |

| (2) | Mr. Stang joined the board, the compensation committee and nominating and corporate governance committee in September 2013. Mr. Stang joined the audit committee in July 2014. |

| (3) | Mr. Norby resigned from our board of directors on July 16, 2014. |

Below is a description of each committee of the board of directors. Each of the committees has authority to engage legal counsel or other experts or consultants, as it deems appropriate to carry out its responsibilities. The board of directors concluded that each of the board members serving on a committee was independent as defined in the rules and regulations of the NYSE.

Audit Committee

Our audit committee is comprised of Messrs. Olson, Stang and Wilson, each of whom is a non-employee member of our board of directors. Mr. Olson is our audit committee chairman and our audit committee financial expert, as currently defined under the SEC rules. Our board of directors has determined that each of Messrs. Olson, Stang and Wilson is independent within the meaning of the applicable SEC rules and regulations of the NYSE.

10

Our audit committee oversees our corporate accounting and financial reporting process. Among other matters, the audit committee evaluates the independent registered public accounting firm’s qualifications, independence and performance; determines the engagement of the independent registered public accounting firm; reviews and approves the scope of the annual audit and the audit fee; discusses with management and the independent registered public accounting firm the results of the annual audit and the review of our quarterly consolidated financial statements; approves the retention of the independent registered public accounting firm to perform any proposed permissible non-audit services; monitors the rotation of partners of the independent registered public accounting firm on our engagement team as required by law; reviews our critical accounting policies and estimates; and will annually review the audit committee charter and the committee’s performance. The audit committee met five times during fiscal year 2014, including meetings with our independent registered public accounting firm to review our quarterly and annual financial statements and their review or audit of such statements. Our audit committee operates under a written charter adopted by the board that satisfies the applicable standards of the NYSE that is posted on our website at ir.invensense.com under the heading “Corporate Governance.”

Nominating and Corporate Governance Committee

Our nominating and corporate governance committee is comprised of Messrs. Wilson and Stang, each of whom is a non-employee member of our board of directors. Mr. Wilson is our nominating and corporate governance committee chairman. Our nominating and corporate governance committee is responsible for making recommendations regarding candidates for directorships and the size and the composition of our board of directors. In addition, the nominating and corporate governance committee is responsible for overseeing our corporate governance principles and making recommendations concerning governance matters. Our nominating and corporate governance committee operates under a written charter adopted by the board that satisfies the applicable standards of the NYSE that is posted on our website at ir.invensense.com under the heading “Corporate Governance.” The nominating and corporate governance committee met three times during fiscal year 2014.

The nominating and corporate governance committee will consider director candidates recommended by stockholders. The nominating and corporate governance committee does not intend to alter the manner in which it evaluates candidates, including the minimum criteria set forth above, based on whether or not the candidate was recommended by a stockholder. Stockholders who wish to recommend individuals for consideration by the nominating and corporate governance committee to become nominees for election to the board for next year’s annual meeting of stockholders may do so by delivering a written recommendation to the nominating and corporate governance committee at the following address: Chair of the nominating and corporate governance committee c/o Corporate Secretary of InvenSense at 1745 Technology Drive, Suite 200, San Jose, California 95110, by March 29, 2015. Submissions must include the full name of the proposed nominee, a description of the proposed nominee’s business experience for at least the previous five years, complete biographical information, a description of the proposed nominee’s qualifications as a director and a representation that the nominating stockholder is a beneficial or record owner of our common stock. Any such submission must be accompanied by the written consent of the proposed nominee to be named as a nominee and to serve as a director if elected.

Compensation Committee

Our compensation committee is comprised of Mr. Shah, Mr. Stang and Dr. Yu, each of whom is a non-employee member of our board of directors. Mr. Shah is our compensation committee chairman.

Our compensation committee reviews and recommends policies relating to the compensation and benefits of our officers and employees. The compensation committee reviews and approves corporate goals and objectives relevant to the compensation of our chief executive officer and other executive officers, evaluates the performance of these officers in light of those goals and objectives, and sets the compensation of these officers based on such evaluations. The compensation committee administers the issuance of stock options and other

11

awards under our stock plans. The compensation committee will review and evaluate, at least annually, the performance of the compensation committee and its members. Our compensation committee operates under a written charter adopted by the board that satisfies the applicable standards of the NYSE and is posted on our website at ir.invensense.com under the heading “Corporate Governance.” The compensation committee met twice during fiscal year 2014. The compensation committee has authority to retain compensation consultants, outside counsel and other advisors that the committee deems appropriate, in its sole discretion, to assist it in discharging its duties, and to approve the terms of retention and fees to be paid to such consultants.

Compensation Committee Interlocks and Insider Participation

Mr. Shah, Mr. Stang and Dr. Yu served on our compensation committee for fiscal year 2014. During fiscal year 2014, none of our executive officers served on the compensation committee (or its equivalent) or board of directors of another entity whose executive officer served on our compensation committee.

Corporate Governance

Corporate Governance Guidelines

Our board has adopted written Corporate Governance Guidelines to assure that the board will have the necessary authority and practices in place to review and evaluate our business operations as needed and to make decisions that are independent of our management. The guidelines are also intended to align the interests of directors and management with those of our stockholders. The Corporate Governance Guidelines set forth the practices the board intends to follow with respect to board composition and selection, board meetings and involvement of senior management, Chief Executive Officer performance evaluations and succession planning, and board committees and compensation. The nominating and corporate governance committee assists the board in implementing and adhering to the Corporate Governance Guidelines. Our Corporate Governance Guidelines are available on the investor relations section of our website at ir.invensense.com under the heading “Corporate Governance.” The Corporate Governance Guidelines are reviewed at least annually by our nominating and corporate governance committee, and changes are recommended to our board of directors with respect to changes as warranted.

Code of Business Conduct and Ethics

We have adopted the InvenSense Code of Business Conduct and Ethics that applies to all officers, directors and employees. Our Code of Business Conduct and Ethics is available on the investor relations section of our website at ir.invensense.com under the heading “Corporate Governance.” If we make any substantive amendments to our Code of Business Conduct and Ethics or grant any waiver from a provision of the Code of Business Conduct and Ethics to any executive officer or director, we will promptly disclose the nature of the amendment or waiver on the investor relations section of our website at ir.invensense.com under the heading “Corporate Governance.”

Corporate Governance Materials

Our Corporate Governance Guidelines, Code of Business Conduct and Ethics, charters for each committee of the board and other corporate governance documents, are posted on the investor relations section of our website at ir.invensense.com under the heading “Corporate Governance.” In addition, stockholders may obtain a print copy of our Corporate Governance Guidelines, Code of Business Conduct and Ethics as well as the charters of our audit committee, compensation committee and nominating and corporate governance committee by writing to our Corporate Secretary at 1745 Technology Drive, Suite 200, San Jose, California 95110.

12

Director Compensation

Director Compensation for Fiscal Year 2014

Our non-employee directors who served during the fiscal year ended March 30, 2014 received the following compensation for their service on our board of directors.

| Name |

Fees Earned

or Paid in Cash ($)(1) |

Option Awards ($)(2)(3) | Total ($) |

|||||||||

| R. Douglas Norby(4) |

43,000 | 137,446 | 180,446 | |||||||||

| Jon Olson |

31,500 | 145,084 | 176,584 | |||||||||

| Amit Shah |

— | 71,771 | 71,771 | |||||||||

| Eric Stang |

19,250 | 605,481 | 624,731 | |||||||||

| Tim Wilson |

— | 71,771 | 71,771 | |||||||||

| Yunbei “Ben” Yu, Ph.D. |

— | 165,293 | 165,293 | |||||||||

| (1) | Reflects board retainer fees, as well as committee and committee chair retainer fees. |

| (2) | At March 30, 2014, the following non-employee directors each held stock options covering the following aggregate numbers of outstanding shares: |

| Name |

Stock Options (number of shares outstanding) |

|||

| R. Douglas Norby(4) |

185,000 | |||

| Jon Olson |

130,000 | |||

| Amit Shah |

26,667 | |||

| Eric Stang |

90,000 | |||

| Tim Wilson |

40,000 | |||

| Yunbei “Ben” Yu, Ph.D. |

80,000 | |||

| (3) | The amounts reported for the stock option awards are based on the grant date fair value computed in accordance with FASB ASC Topic 718. The assumptions made in the valuation of the stock option awards are discussed in Note 6, “Stockholders’ Equity,” of the Notes to the Consolidated Financial Statements included in our Annual Report on Form 10-K for the year ended March 30, 2014 which was filed with the SEC on May 29, 2014. |

| (4) | Mr. Norby resigned from our board of directors on July 16, 2014. |

Discussion of Director Compensation

Directors who are employees of ours do not receive any compensation for their service on our board of directors. Our board of directors has adopted the following compensation policy that is applicable to all of our current non-employee directors:

| • | Initial Equity Grants. Each non-employee director who joins the board receives an option to purchase 90,000 shares of our common stock, with 1/48th of the shares subject to the option vesting on a monthly basis over four years, subject to the director’s continuous service as a member of the board of directors. If still vesting, the grant accelerates in full upon a change in control of our Company. |

| • | Annual Equity Grants. Each non-employee director receives annually an option to purchase 20,000 shares of our common stock, with 1/12th of the shares subject to the option vesting on a monthly basis commencing the month after the completion of vesting of any existing grants held by such director. The annual option grant is made on the anniversary of the date on which a non-employee director joins the board of directors. Any such grant which has commenced vesting will accelerate in full upon a change of control of our Company. |

13

| • | Retainers. Each non-employee director who is not an affiliate of an investor holding more than 5% of our outstanding shares of common stock as of November 15, 2011 receives annual cash retainers, payable quarterly in arrears. The unpaid amounts of these retainers are payable in full for the current fiscal year in the event of a change of control of our Company during that fiscal year. The annual retainer for service on the board of directors is $25,000, and the annual retainers for service on committees of our board of directors is as follows: |

| Position |

Audit Committee |

Compensation Committee |

Nominating And Corporate Governance Committee |

|||||||||

| Chair |

$ | 15,000 | $ | 10,000 | $ | 7,000 | ||||||

| Member |

$ | 6,500 | $ | 5,000 | $ | 3,000 | ||||||

14

EXECUTIVE COMPENSATION

Executive Officers

Our executive officers as of July 18, 2014, and their positions, and their respective ages on that date, are:

| Name |

Age | Position | ||||

| Behrooz Abdi |

52 | President and Chief Executive Officer | ||||

| Alan Krock |

53 | Vice President and Chief Financial Officer | ||||

| Daniel Goehl |

43 | Vice President – Worldwide Sales | ||||

| Stephen Lloyd |

49 | Vice President – Engineering and New Product Development | ||||

| Adam Tachner |

48 | Vice President, General Counsel and Corporate Secretary | ||||

Biographical information for Mr. Abdi is provided above. See “Information Regarding Our Nominees and Directors.”

Alan Krock joined us in May 2011 as our Chief Financial Officer. Prior to joining us, Mr. Krock gained extensive experience in financial and audit control related matters as the Chief Financial Officer of Beceem Communications, Inc., a provider of integrated circuit products, from January 2010 until January 2011, Vice President and Chief Financial Officer of PMC-Sierra, Inc., a provider of integrated circuit products, from November 2002 until March 2007, Vice President of Corporate Affairs for PMC-Sierra, Inc., from March 2007 until March 2008, and Vice President and Chief Financial Officer of Integrated Device Technology, Inc., a provider of semiconductor solutions, from January 1998 until November 2002. Mr. Krock also served as a member of the board of directors of NetLogic Microsystems, Inc. from August 2005 to February 2012. Mr. Krock holds a B.S. in Business Administration from the University of California, Berkeley, and is a California Certified Public Accountant.

Daniel Goehl joined us in 2004 as our Director of Business Development and became our Vice President of Worldwide Sales in March 2007. Prior to joining us, Mr. Goehl held senior management positions and led sales and business development initiatives at start-up companies in semiconductor and wireless technology markets, such as Nazomi Communications, CSI Wireless, Meridian Wireless and Omni Telecommunications. Mr. Goehl has a B.A. in Economics from the University of Illinois and attended Kansai Gaidai University in Osaka, Japan for International Business and Japanese language studies.

Stephen Lloyd has been our Vice President of Engineering and New Product Development since December 2008. Prior to joining us, he worked at several semiconductor companies, including service from 2004 to 2008 at Beceem Communications, first as Vice President of Engineering for RF Microelectronics and later as Executive Vice President of Engineering. From 2002 to 2004, he served as Executive Director of RF IC Design for Skyworks Solutions, and from 1997 to 2002, he served as an Executive Director of Conexant Systems. Mr. Lloyd received his B.S. in Electrical Engineering from the University of California, Berkeley.

Adam H. Tachner has served as our Vice President and General Counsel since August 2013 and as our Corporate Secretary since October 2013. Prior to joining us, Mr. Tachner served as Vice President and General Counsel of Qualcomm Atheros, Inc. from May 2011 to August 2013. From October 2000 to May 2011, he served as Vice President and General Counsel, and from October 2000 to October 2003, he served as Director, Intellectual Property at Atheros Communications, Inc. From September 1994 to September 2000, Mr. Tachner was an associate attorney with Crosby, Heafy, Roach & May, P.C., a law firm. Mr. Tachner currently serves on the board of directors of two private companies. Mr. Tachner holds a J.D. from the University of Oregon School of Law, a Master of Business Administration from Columbia University, a Bachelor of Science degree in Electrical Engineering from California State University at Fullerton and a Bachelor of Arts degree in Social Science from the University of California at Berkeley.

15

Compensation Discussion and Analysis

The following discussion and analysis of the compensation arrangements of our named executive officers identified below for fiscal year 2014 should be read together with the compensation tables and related disclosures set forth below.

We refer to our chief executive officer, our chief financial officer and our three other most highly compensated executive officers during fiscal year 2014 as our “named executive officers.” Our named executive officers for fiscal year 2014 are as follows:

| • | Behrooz Abdi, President and Chief Executive Officer |

| • | Alan Krock, Vice President and Chief Financial Officer |

| • | Daniel Goehl, Vice President — Worldwide Sales |

| • | Stephen Lloyd, Vice President — Engineering and New Product Development |

| • | Adam Tachner, Vice President, General Counsel and Corporate Secretary |

Compensation Objectives

We structure our compensation programs to reward high performance and innovation, promote accountability and ensure that employee interests are aligned with the interests of our stockholders. Our executive compensation program is structured to attract, motivate and retain highly qualified executive officers by paying them competitively and tying their compensation to our success as a whole and to their individual contributions to such success.

Specifically, the compensation committee believes that the primary objectives of our compensation policies are:

| • | creating long-term incentives for management to increase stockholder value; |

| • | motivating our executives to achieve our short-term and long-term goals; |

| • | providing clear company and individual objectives that promote innovation to achieve our objectives; |

| • | rewarding the achievement of targeted results; and |

| • | retaining executive officers whose abilities are critical to our long-term success and competitiveness. |

Framework for Determining Executive Compensation

The executive compensation program we adopted for fiscal 2014 had three primary components: (i) base salary, (ii) non-equity incentive plan compensation and (iii) equity awards. In addition, we provided our executive officers with other compensation, including a variety of benefits that are available generally to all salaried employees in the geographic locations where such executives are based.

We utilize a discretionary approach for determining our named executive officers’ compensation, which is based upon the business judgment and experience of our compensation committee and our chief executive officer. We rely in part on the experience and familiarity of our compensation committee members with current information relating to total aggregate compensation levels paid by technology companies of similar scale to ours. Our compensation committee members have obtained this experience and familiarity as venture capitalists and/or executives at technology companies.

In making its compensation decisions in fiscal 2014, the compensation committee engaged Compensia, Inc., as its independent compensation advisor, to conduct a market assessment of our compensation. This market assessment consisted of a review of compensation information from a select group of peer companies (identified

16

below) and utilized information from a database selected by Compensia. The compensation committee, with the assistance of Compensia, developed the list of peer companies based on companies meeting one or more of the following criteria: (i) industry group, a company that competes within the semiconductor and related devices industry; (ii) annual revenue, revenue growth rate and profitability; (iii) market cap size and (iv) the size of employee base. Based on these criteria, the following seventeen companies were selected to form our peer group:

| Ambarella | Applied Micro Circuits | Audience | ||

| Cavium | Cirrus Logic | Entropic Communications | ||

| Exar | Hittie Microwave | Integrated Device Tech | ||

| Integrated Silicon Solutions | Monolithic Power Systems | Peregrine Semiconductor | ||

| RealD | Semtech | Sigma Designs | ||

| Silicon Image | Volterra Semiconductor |

While we considered information with respect to our peer companies, we did not formally benchmark our compensation levels to these companies.

In fiscal 2014, our chief executive officer, Mr. Abdi, provided recommendations to the compensation committee in connection with the establishment of compensation of our executive officers. Mr. Abdi discussed the target compensation and past performance of all executive officers, excluding himself, with the compensation committee. Mr. Abdi based his recommendations for 2014 compensation in part upon annual performance reviews of our executive officers conducted at beginning of fiscal 2014. In addition, our compensation committee adopted a new non-equity incentive program for the 2014 fiscal year.

The compensation of our current president and chief executive officer, Mr. Abdi, for 2014 was determined pursuant to an employment agreement described below under “— Employment Agreements; Change in Control Arrangements; and Potential Payments upon Termination or Change in Control — Behrooz Abdi.”

Elements of Compensation

Base Salary

We pay base salaries to provide a fixed level of cash compensation for our named executive officers to compensate them for services rendered during the fiscal year. Each year we determine salary increases, if any, based upon a subjective evaluation of each executive’s individual performance, position, tenure, experience, expertise, leadership, management capability, and the extent to which the executive has been successful in managing and growing the operations or organization for which such executive is responsible. We do not apply formulaic base salary increases to our named executive officers. For fiscal year 2014, the compensation committee approved increases in the base salaries of Messrs. Krock, Goehl and Lloyd recommended by our chief executive officer from $270,000 to $280,000, $230,000 to $250,000 and $240,000 to $250,000, respectively, in each case in recognition of the increased responsibility of their positions resulting the increasing scale and scope of our operations resulting from growth in our business. In fiscal 2014, Messrs. Abdi and Tachner received the base salary amounts that were set at the time such officer joined us as an executive officer.

Non-Equity Incentive Awards

In fiscal 2013, Mr. Abdi, with approval from the compensation committee, discontinued existing executive bonus plans due to business and operational challenges the Company was facing at that time.

For fiscal 2014, the compensation committee adopted a new non-equity incentive program for the executive team as a result of improved Company performance. While the Company performance was improving, the Company was in a transitional phase both in terms of its operations and management team. In light of this, the executive bonus program as designed to reward performance based on fifteen different strategic and tactical goals for the Company as well as specific individual performance objectives customized for each executive.

17

Specific bonus targets were determined to align individual performance with the annual goals and objectives of the Company, after taking into consideration the practices of the Company’s peer group, general market practices and recognition that the executives have a greater level of influence over and impact on the overall success of the Company. Upon completion of fiscal 2014, an assessment was conducted by Mr. Abdi of the results achieved by each executive relative to the established goals and objectives and the Committee approved the payment of bonus amounts based on Mr. Abdi’s recommendations.

For fiscal 2015, our non-equity incentive program will depend on two performance factors: fifty percent will be based on the Company’s financial performance and fifty percent will be related to the executive’s individual performance as measured against specific management objective goals.

Equity Awards

We believe that equity ownership in our Company is an important component of each named executive officer’s total compensation because it promotes long-term performance by aligning the interests of our named executive officers with the interests of our stockholders. We believe that equity awards will incentivize our named executive officers to achieve long-term performance because they provide greater opportunities for our named executive officers to benefit from any future successes in our business. We have not adopted stock ownership guidelines, and our equity compensation plans have provided the principal method for our named executive officers to acquire equity or equity-linked interests in our Company.

The number of shares subject to options granted to each named executive officer is determined by our compensation committee based upon several factors, including individual performance reviews and the levels of equity ownership we believe to be representative of and competitive with ownership levels of officers having similar responsibilities in technology companies of similar scale and stage of development to ours. In addition to the annual awards, grants of options may be made to executive officers as an inducement to accept employment, following a significant change in job responsibility or in recognition of a significant achievement.

In May 2013, we granted Messrs. Krock, Goehl and Lloyd additional equity awards in connection with their annual performance reviews. In addition, we granted these named executive officers additional equity awards each quarter in fiscal 2014 to award these officers for their contributions to the increasing success of the business while further aligning these named executive officer’s interests with those of our stockholders. We did not make any additional equity grants to Mr. Abdi as we believed the equity ownership he received in connection with his appointment as Chief Executive Officer was sufficient to continue to motivate and retain him. We granted Mr. Tachner equity awards in connection with his appointment as our Vice President and General Counsel.

18

Executive Compensation Tables

Summary Compensation Table

The following table presents information regarding compensation earned by or awards to our named executive officers for fiscal year 2014 during each of our last three fiscal years.

| Name and Principal Position |

Fiscal Year |

Salary ($) |

Bonus ($) |

Option Awards ($)(1) |

Stock Awards ($)(2) |

Non-Equity Incentive Plan Compensation ($) |

All Other Compensation ($)(3) |

Total ($) | ||||||||||||||||||||||||

| Behrooz Abdi |

2014 | 400,000 | — | — | — | 175,000 | 14,361 | 589,361 | ||||||||||||||||||||||||

| President and Chief Executive Officer |

2013 | 159,231 | — | 6,345,720 | (4) | — | — | 22,199 | (5) | 6,527,150 | ||||||||||||||||||||||

| (Principal Executive Officer) |

||||||||||||||||||||||||||||||||

| Alan Krock |

2014 | 279,583 | — | — | 1,186,850 | 50,000 | 14,361 | 1,530,794 | ||||||||||||||||||||||||

| Vice President and Chief Financial Officer (Principal Financial Officer) |

2013 | 258,571 | — | — | — | — | 13,174 | 271,745 | ||||||||||||||||||||||||

| 2012 | 163,114 | 50,000 | 1,854,409 | — | 65,625 | 4,157 | 2,137,305 | |||||||||||||||||||||||||

| Daniel Goehl |

2014 | 249,167 | 80,000 | 461,182 | 1,017,300 | 120,000 | 13,408 | 1,941,057 | ||||||||||||||||||||||||

| Vice President — Worldwide Sales |

2013 | 228,750 | 5,000 | (6) | — | — | — | 11,580 | 245,330 | |||||||||||||||||||||||

| 2012 | 190,880 | 38,500 | 271,279 | — | 92,400 | 9,720 | 602,780 | |||||||||||||||||||||||||

| Stephen Lloyd |

2014 | 249,583 | 1,033 | 461,182 | 1,017,300 | 55,000 | 13,925 | 1,798,024 | ||||||||||||||||||||||||

| Vice President — Engineering and New Product Development |

2013 | 233,926 | — | — | — | — | 12,768 | 246,694 | ||||||||||||||||||||||||

| 2012 | 205,270 | 42,500 | 141,364 | — | 63,750 | 11,365 | 464,249 | |||||||||||||||||||||||||

| Adam Tachner |

2014 | 168,269 | — | 2,061,689 | 2,025,100 | 120,000 | 7,367 | 4,382,425 | ||||||||||||||||||||||||

| Vice President, General Counsel and Corporate Secretary |

||||||||||||||||||||||||||||||||

| (1) | This column reflects the aggregate grant date fair value of option awards granted to our named executive officers estimated pursuant to Financial Accounting Standards Board Accounting Standards Codification Topic 718 (“FASB ASC Topic 718”). The amounts reported for the stock option awards are based on the grant date fair value computed in accordance with FASB ASC Topic 718. The assumptions made in the valuation of the stock option awards are discussed in Note 6, “Stockholders’ Equity,” of the Notes to the Consolidated Financial Statements included in our Annual Report on Form 10-K for the year ended March 30, 2014 which was filed with the SEC on May 29, 2014. |

| (2) | This column reflects the aggregate grant date fair value of our common stock for the restricted stock units granted to our named executive officers estimated pursuant to Financial Accounting Standards Board Accounting Standards Codification Topic 718 (“FASB ASC Topic 718”). The amounts reported for the restricted stock units are based on the grant date fair value computed in accordance with FASB ASC Topic 718. The assumptions made in the valuation of our common stock on the grant date are discussed in Note 6, “Stockholders’ Equity,” of the Notes to the Consolidated Financial Statements included in our Annual Report on Form 10-K for the year ended March 30, 2014 which was filed with the SEC on May 29, 2014. |

| (3) | Represents our contribution to the executive’s medical and life insurance payments and health savings account contributions. |

| (4) | This amount includes a grant of 20,000 options made to Mr. Abdi for service as a director that were subsequently cancelled upon Mr. Abdi’s commencement of employment as Chief Executive Officer. |

| (5) | This amount includes fees earned as compensation for service as a director in the amount of $16,333. |

| (6) | This amount reflects an employee referral bonus paid out under the Company’s employee referral program. |

19

Grants of Plan-Based Awards

The following table sets forth certain information with respect to grants of plan-based awards to our named executive officers during fiscal year 2014.

| Name |

Grant Date | Estimated Future Payouts Under Non-Equity Incentive Based Plans |

All Other

Stock Awards: Number of Shares of Stock or Units (#) |

Option Awards: Number of Securities Underlying Options |

Exercise or Base Price of Option Awards ($/Sh) |

Grant Date Fair Value Of Stock and Option Awards ($)(1) |

||||||||||||||||||||||||||

| Threshold ($) |

Target ($) |

Maximum ($) |

||||||||||||||||||||||||||||||

| Behrooz Abdi |

— | 300,000 | 300,000 | — | — | — | — | |||||||||||||||||||||||||

| Alan Krock |

5/15/2013 | — | — | — | 17,500 | — | — | 226,100 | ||||||||||||||||||||||||

| 8/15/2013 | — | — | — | 17,500 | — | — | 290,500 | |||||||||||||||||||||||||

| 11/15/2013 | — | — | — | 17,500 | — | — | 309,050 | |||||||||||||||||||||||||

| 2/15/2014 | — | — | — | 17,500 | — | — | 361,200 | |||||||||||||||||||||||||

| — | 75,000 | 75,000 | ||||||||||||||||||||||||||||||

| Daniel Goehl |

5/15/2013 | — | — | — | — | 100,000 | 12.92 | 461,182 | ||||||||||||||||||||||||

| 5/15/2013 | — | — | — | 15,000 | — | — | 193,800 | |||||||||||||||||||||||||

| 8/15/2013 | — | — | — | 15,000 | — | — | 249,000 | |||||||||||||||||||||||||

| 11/15/2013 | — | — | — | 15,000 | — | — | 264,900 | |||||||||||||||||||||||||

| 2/15/2014 | — | — | — | 15,000 | — | — | 309,600 | |||||||||||||||||||||||||

| — | 150,000 | 150,000 | ||||||||||||||||||||||||||||||

| Stephen Lloyd |

5/15/2013 | — | — | — | — | 100,000 | 12.92 | 461,182 | ||||||||||||||||||||||||

| 5/15/2013 | — | — | — | 15,000 | — | — | 193,800 | |||||||||||||||||||||||||

| 8/15/2013 | — | — | — | 15,000 | — | — | 249,000 | |||||||||||||||||||||||||

| 11/15/2013 | — | — | — | 15,000 | — | — | 264,900 | |||||||||||||||||||||||||

| 2/15/2014 | — | — | — | 15,000 | — | — | 309,600 | |||||||||||||||||||||||||

| — | ||||||||||||||||||||||||||||||||

| Adam Tachner |

9/15/2013 | — | — | — | — | 300,000 | 18.41 | 2,061,689 | ||||||||||||||||||||||||

| 9/15/2013 | — | — | — | 110,000 | — | — | 2,025,100 | |||||||||||||||||||||||||

| — | 120,000 | 120,000 | — | — | — | — | ||||||||||||||||||||||||||

| (1) | This column reflects the aggregate grant date fair value of option awards granted to our named executive officers estimated pursuant to Financial Accounting Standards Board Accounting Standards Codification Topic 718. The assumptions made in the valuation of the stock option awards are discussed in Note 6, “Stockholders’ Equity,” of the Notes to the Consolidated Financial Statements included in our Annual Report on Form 10-K for the year ended March 30, 2014 which was filed with the SEC on May 29, 2014. |

20

Outstanding Equity Awards at the End of Fiscal Year 2014

The following table presents, for the fiscal year ended March 30, 2014, certain information regarding outstanding equity awards held by our named executive officers at March 30, 2014.

| Option Awards | Stock Awards | |||||||||||||||||||||||||||

| Name |

Grant Date | Number of Securities Underlying Unexercised Options Exercisable (#) |

Number

of Securities Underlying Unexercised Options Unexercisable (#) |

Option Exercise Price ($) |

Option Expiration Date |

Number of Shares or Units of Stock That Have Not Vested (#) |

Market Value of Shares or Units of Stock That Have Not Vested ($) |

|||||||||||||||||||||

| Behrooz Abdi |

7/9/2011 | 28,125 | (1) | — | 7.32 | 7/9/2021 | — | — | ||||||||||||||||||||

| 10/24/2012 | 293,795 | (2) | 535,745 | 11.57 | 10/23/2022 | — | — | |||||||||||||||||||||

| 10/24/2012 | 34,563 | (3) | 172,822 | 11.57 | 10/23/2022 | — | — | |||||||||||||||||||||

| 10/24/2012 | 21,602 | (4) | 185,783 | 11.57 | 10/23/2022 | — | — | |||||||||||||||||||||

| 10/24/2012 | — | (5) | 207,385 | 11.57 | 10/23/2022 | — | — | |||||||||||||||||||||

| 10/24/2012 | — | — | — | — | 267,873 | (6) | 6,080,717 | (7) | ||||||||||||||||||||

| Alan Krock |

7/9/2011 | 142,307 | (8) | 156,250 | 7.32 | 7/9/2021 | — | — | ||||||||||||||||||||

| 10/21/2011 | — | (9) | 20,000 | 7.32 | 10/21/2021 | — | — | |||||||||||||||||||||

| 5/15/2013 | — | — | — | — | 17,500 | (10) | 397,250 | (7) | ||||||||||||||||||||

| 08/15/2013 | — | — | — | — | 17,500 | (11) | 397,250 | (7) | ||||||||||||||||||||

| 11/15/2013 | — | — | — | — | 17,500 | (12) | 397,250 | (7) | ||||||||||||||||||||

| 2/15/2014 | — | — | — | — | 17,500 | (13) | 397,250 | (7) | ||||||||||||||||||||

| Dan Goehl |

1/19/2011 | — | (14) | 20,000 | 6.11 | 1/18/2021 | — | — | ||||||||||||||||||||

| 10/21/2011 | 3,334 | (15) | 11,667 | 7.32 | 10/21/2021 | — | — | |||||||||||||||||||||

| 10/21/2011 | — | (9) | 25,000 | 7.32 | 10/21/2021 | — | — | |||||||||||||||||||||

| 5/15/2013 | 22,916 | (16) | 77,084 | 12.92 | 5/15/2023 | — | — | |||||||||||||||||||||

| 5/15/2013 | — | — | — | — | 15,000 | (10) | 340,500 | (7) | ||||||||||||||||||||

| 8/15/2013 | — | — | — | — | 15,000 | (11) | 340,500 | (7) | ||||||||||||||||||||

| 11/15/2013 | — | — | — | — | 15,000 | (12) | 340,500 | (7) | ||||||||||||||||||||

| 2/15/2014 | — | — | — | — | 15,000 | (13) | 340,500 | (7) | ||||||||||||||||||||

| Stephen Lloyd |

12/10/2008 | 23,000 | (17) | — | 1.02 | 12/9/2018 | — | — | ||||||||||||||||||||

| 1/19/2011 | 25,000 | (18) | 25,000 | 6.11 | 1/18/2021 | — | — | |||||||||||||||||||||

| 10/21/2011 | 9,166 | (19) | 10,834 | 7.32 | 10/21/2021 | — | — | |||||||||||||||||||||

| 10/21/2011 | — | (9) | 25,000 | 7.32 | 10/21/2021 | — | — | |||||||||||||||||||||

| 5/15/2013 | 22,916 | (16) | 77,084 | 12.92 | 5/15/2023 | — | — | |||||||||||||||||||||

| 5/15/2013 | — | — | — | — | 15,000 | (10) | 340,500 | (7) | ||||||||||||||||||||

| 8/15/2013 | — | — | — | — | 15,000 | (11) | 340,500 | (7) | ||||||||||||||||||||

| 11/15/2013 | — | — | — | — | 15,000 | (12) | 340,500 | (7) | ||||||||||||||||||||

| 2/15/2014 | — | — | — | — | 15,000 | (13) | 340,500 | (7) | ||||||||||||||||||||

| Adam Tachner |

9/15/2013 | — | 300,000 | (20) | 18.41 | 9/15/2023 | — | — | ||||||||||||||||||||

| 9/15/2013 | — | — | — | — | 110,000 | (21) | 2,497,000 | (7) | ||||||||||||||||||||

| (1) | The option vests with respect to 1/48th of the total shares subject to the option monthly for 48 months with a vesting commencement date of July 9, 2011. On October 24, 2012, 28,125 shares had vested and the Company and employee agreed that no additional shares will vest under this option. |

| (2) | The option vests with respect to 1/4th of the total shares subject to the option on the first anniversary of the vesting commencement date of October 24, 2012, and with respect to 1/48th of the total shares subject to the option monthly thereafter for 36 months, such that all the shares will be fully vested upon the fourth anniversary of the option’s vesting commencement date. |

21

| (3) | The option award will vest ratably at a rate of 1/48th per month after commencement of vesting, with vesting commencing upon the closing price of the Company’s publicly traded stock equaling or exceeding $15.00 for a period of 20 consecutive trading days. |

| (4) | The option award will vest ratably at a rate of 1/48th per month after commencement of vesting, with vesting commencing upon the closing price of the Company’s publicly traded stock equaling or exceeding $17.50 for period a period of 20 consecutive trading days. |

| (5) | The option award will vest ratably at a rate of 1/48th per month after commencement of vesting, with vesting commencing upon the closing price of the Company’s publicly traded stock equaling or exceeding $20.00 for a period of 20 consecutive trading days. |

| (6) | Restricted stock granted on October 24, 2012. The restricted stock vests with respect to 1/4th of the total shares subject to the grant on the first anniversary of the vesting commencement date of October 24, 2012, and with respect to 1/48th of the total shares subject to the grant monthly thereafter for 36 months, such that all the shares will be fully vested upon the fourth anniversary of the Restricted stock grant date. |

| (7) | The value of the unvested restricted stock was calculated by multiplying the number of shares of unvested restricted stock by the estimated fair market value of $22.70 per share of our common stock on the last trading day of our 2014 fiscal year. |

| (8) | The option vests with respect to 1/4th of the total shares subject to the option on the first anniversary of the vesting commencement date of May 31, 2011, and with respect to 1/48th of the total shares subject to the option monthly thereafter for 36 months, such that all the shares will be fully vested upon the fourth anniversary of the option’s vesting commencement date. |

| (9) | The option vests with respect to 1/12th of the total shares subject to the option monthly from the vesting commencement date of April 1, 2015. |

| (10) | The restricted stock units vest with respect to 1/4th of the total shares subject to the restricted stock units yearly from the vesting commencement date of May 15, 2013. |

| (11) | The restricted stock units vest with respect to 1/4th of the total shares subject to the restricted stock units yearly from the vesting commencement date of August 15, 2013. |

| (12) | The restricted stock units vest with respect to 1/4th of the total shares subject to the restricted stock units yearly from the vesting commencement date of November 15, 2013. |

| (13) | The restricted stock units vest with respect to 1/4th of the total shares subject to the restricted stock units yearly from the vesting commencement date of February 15, 2014. |

| (14) | The option vests with respect to all of the shares subject to the option 45 months after the vesting commencement date of February 15, 2011. |

| (15) | The option vests with respect to 1/36th of the total shares subject to the option monthly from the vesting commencement date of October 1, 2011. |

| (16) | The option vests with respect to 1/48th of the total shares subject to the option monthly from the vesting commencement date of April 1, 2013. |

| (17) | The option vested with respect to 1/4th of the total shares subject to the option on the first anniversary of the vesting commencement date of December 8, 2008, and with respect to 1/48th of the total shares subject to the option monthly thereafter for 36 months, such that all the shares became fully vested upon the fourth anniversary of the option’s vesting commencement date. |