DocuSign Envelope ID: 0FF373E1-3F98-4EB7-A6C9-B5DAC2B8E8B9

Exhibit 10.5

STANDARD INDUSTRIAL/COMMERCIAL MULTI-TENANT LEASE - NET

1.1 Parties. This Lease ("Lease"), dated for reference purposes only July 27, 2023, is made by and between Townsgate Business Park 2, LLC, a Delaware limited liability company and Majestic Luna 2, LLC, a Delaware limited liability company, as tenants-in-common ("Lessor") and Inogen, Inc., a Delaware corporation ("Lessee"), (collectively the "Parties", or individually a "Party").

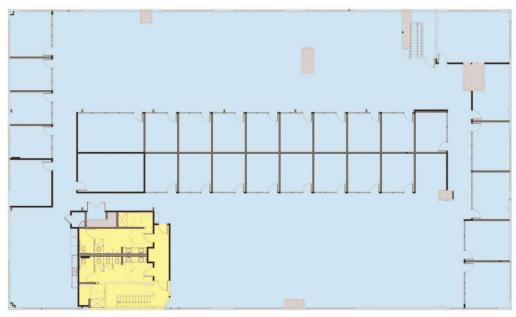

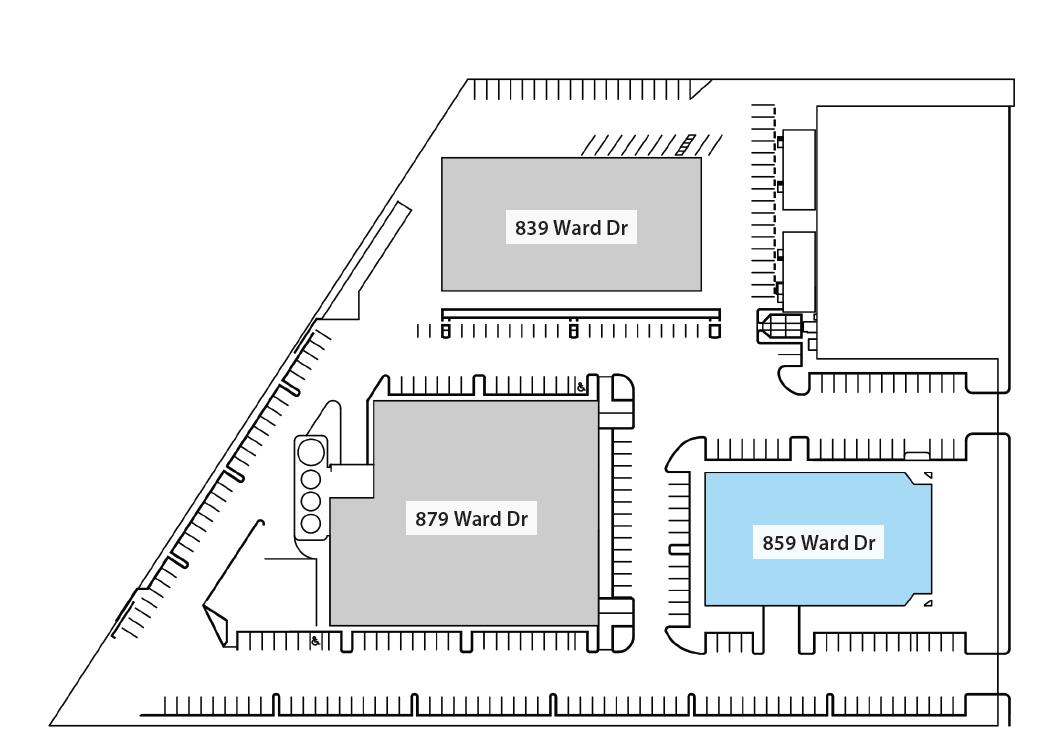

1.2(a) Premises: That certain real property, including all improvements therein or to be provided by Lessor under the terms of this Lease, commonly known as (street address, unit/suite, city, state, zip): 859 Ward Dr, Goleta, CA 93111 ("Premises"). The Premises are located in the County of Santa Barbara, and are generally described as (describe briefly the nature of the Premises and the "Project"): the entire second floor and the northeast first floor lobby of approximately 17,928 rentable square feet. In addition to Lessee's rights to use and occupy the Premises as hereinafter specified, Lessee shall have non-exclusive rights to any utility raceways of the building containing the Premises ("Building") and to the Common Areas (as defined in Paragraph 2.7 below), but shall not have any rights to the roof, or exterior walls of the Building or to any other buildings in the Project. The Premises, the Building, the Common Areas, the land upon which they are located, along with all other buildings and improvements thereon, are herein collectively referred to as the "Project." (See also Paragraph 2)

1.2(b) Parking: Five (5) reserved parking spaces and forty-eight (48) unreserved vehicle parking spaces on-site, as designated by Lessor. (See also Paragraph 2.6)

1.3 Term: Four (4) years and _-0- months ("Original Term") commencing See Paragraph 50 of Addendum ("Commencement Date") and ending January 31, 2028 ("Expiration Date"). (See also Paragraph 3)

1.4 Early Possession: If the Premises are available Lessee may have non-exclusive possession of the Premises commencing September 1, 2023 ("Early Possession Date"). (See also Paragraphs 3.2 and 3.3)

1.5 Base Rent: $26,892 per month ("Base Rent"), payable on the 1st day of each month commencing February 1, 2024 . (See also Paragraph 4)

☑ If this box is checked, there are provisions in this Lease for the Base Rent to be adjusted. See Paragraph 4 and 51.

1.6 Lessee's Share of Common Area Operating Expenses: 52.46% of the Building and 14.08% of the Project ("Lessee’s Share”). In the event that the size of the Premises and/or the Project are modified during the term of this Lease, Lessor shall recalculate Lessee's Share to reflect such modification.

1.7 Base Rent and Other Monies Paid Upon Execution:

(a) Base Rent: $26,892.00 for the period February 1-29, 2024 .

(b) Common Area Operating Expenses: The current estimate for the period February 1-29, 2024 is $10,577.52.

(c) Intentionally omitted

(d) Other: __ for __ .

(e) Total Due Upon Execution of this Lease: $37,469.52.

1.8 Agreed Use: General office space, research and development, and any other legally permitted uses compatible with comparable buildings subject to Landlord’s approval, which will not be unreasonably withheld, conditioned, or delayed . (See also Paragraph 6)

1.9 Insuring Party. Lessor is the "Insuring Party". (See also Paragraph 8)

1.10 Real Estate Brokers. (See also Paragraphs 15 and 25)

(a) Representation: Each Party acknowledges receiving a Disclosure Regarding Real Estate Agency Relationship, confirms and consents to the following agency relationships in this Lease with the following real estate brokers ("Broker(s)") and/or their agents ("Agent(s)"):

Lessor's Brokerage Firm Hayes Commercial Group, Inc. License No. 02017017 Is the broker of (check one): ☑ the Lessor; or ☐ both the Lessee and Lessor (dual agent).

Lessor's Agent Francois DeJohn License No. 01144570 is (check one): ☑ the Lessor's Agent (salesperson or broker associate); or ☐ both the Lessee's Agent and the Lessor's Agent (dual agent).

Lessee's Brokerage Firm CBRE | Hayes Commercial Group, Inc. License No. 00409987 | 02017017 Is the broker of (check one): ☑ the Lessee; or ☐ both the Lessee and Lessor (dual agent).

Lessee's Agent Dennis Hearst | Francois DeJohn License No. 00800238 | 01144570 is (check one): ☑ the Lessee's Agent (salesperson or broker associate); or ☐ both the Lessee's Agent and the Lessor's Agent (dual agent).

(b) Payment to Brokers. Upon execution and delivery of this Lease by both Parties, Lessor shall pay to the Brokers the brokerage fee agreed to in a separate written agreement for the brokerage services rendered by the Brokers.

1.11 Guarantor. The obligations of the Lessee under this Lease are to be guaranteed by ("Guarantor"). (See also Paragraph 37)

1.12 Attachments. Attached hereto are the following, all of which constitute a part of this Lease:

☑ an Addendum consisting of Paragraphs 50 through 70;

☑ a site plan depicting the Premises; Exhibit A

|

|

|

© 2019 AIR CRE. All Rights Reserved. |

|

Last Edited: 7/28/2023 3:49 PM |

MTN-26.30, Revised 10-22-2020 |

|

Page 1 of 19 |

DocuSign Envelope ID: 0FF373E1-3F98-4EB7-A6C9-B5DAC2B8E8B9

☑ a site plan depicting the Project; Exhibit B

☑ a current set of the Rules and Regulations for the Project; Exhibit C

☐ a current set of the Rules and Regulations adopted by the owners' association;

☐ a Work Letter;

☑ other (specify): Lessor Work (Exhibit D).

2.1 Letting. Lessor hereby leases to Lessee, and Lessee hereby leases from Lessor, the Premises, for the term, at the rental, and upon all of the terms, covenants and conditions set forth in this Lease. While the approximate square footage of the Premises may have been used in the marketing of the Premises for purposes of comparison, the Base Rent stated herein is NOT tied to square footage and is not subject to adjustment should the actual size be determined to be different. NOTE: Lessee is advised to verify the actual size prior to executing this Lease.

2.2 Condition. Lessor shall deliver that portion of the Premises contained within the Building ("Unit") to Lessee broom clean and free of debris on the Commencement Date or the Early Possession Date, whichever first occurs ("Start Date"), and, so long as the required service contracts described in Paragraph 7.1(b) below are obtained by Lessee and in effect within thirty days following the Start Date, warrants that the existing electrical, plumbing, fire sprinkler, lighting, heating, ventilating and air conditioning systems ("HVAC"), loading doors, sump pumps, if any, and all other such elements in the Unit, other than those constructed by Lessee, shall be in good operating condition on said date, that the structural elements of the roof, bearing walls and foundation of the Unit shall be free of material defects, and that the Unit does not contain hazardous levels of any mold or fungi defined as toxic under applicable state or federal law. If a non-compliance with such warranty exists as of the Start Date, or if one of such systems or elements should malfunction or fail within the appropriate warranty period, Lessor shall, as Lessor's sole obligation with respect to such matter, except as otherwise provided in this Lease, promptly after receipt of written notice from Lessee setting forth with specificity the nature and extent of such non-compliance, malfunction or failure, rectify same at Lessor's expense. The warranty periods shall be as follows: (i) 12 months as to the HVAC systems, and (ii) 12 months as to the remaining systems and other elements of the Unit. If Lessee does not give Lessor the required notice within the appropriate warranty period, correction of any such non-compliance, malfunction or failure shall be the obligation of Lessee at Lessee's sole cost and expense (except for the repairs to the fire sprinkler systems, roof, foundations, and/or bearing walls - see Paragraph 7). Lessor also warrants, that unless otherwise specified in writing, Lessor is unaware of (i) any recorded Notices of Default affecting the Premise; (ii) any delinquent amounts due under any loan secured by the Premises; and (iii) any bankruptcy proceeding affecting the Premises.

2.3 Compliance. Lessor warrants that to the best of its knowledge the improvements on the Premises comply with the building codes, applicable laws, covenants or restrictions of record, regulations, and ordinances ("Applicable Requirements") that were in effect at the time that each improvement, or portion thereof, was constructed. Said warranty does not apply to the use to which Lessee will put the Premises, modifications which may be required by the Americans with Disabilities Act or any similar laws as a result of Lessee's use (see Paragraph 49), or to any Alterations or Utility Installations (as defined in Paragraph 7.3(a)) made or to be made by Lessee. NOTE: Lessee is responsible for determining whether or not the Applicable Requirements, and especially the zoning are appropriate for Lessee's intended use, and acknowledges that past uses of the Premises may no longer be allowed. If the Premises do not comply with said warranty, Lessor shall, except as otherwise provided, promptly after receipt of written notice from Lessee setting forth with specificity the nature and extent of such non-compliance, rectify the same at Lessor's expense. If Lessee does not give Lessor written notice of a non-compliance with this warranty within 6 months following the Start Date, correction of that non-compliance shall be the obligation of Lessee at Lessee's sole cost and expense. If the Applicable Requirements are hereafter changed so as to require during the term of this Lease the construction of an addition to or an alteration of the Unit, Premises and/or Building, the remediation of any Hazardous Substance, or the reinforcement or other physical modification of the Unit, Premises and/or Building ("Capital Expenditure"), Lessor and Lessee shall allocate the cost of such work as follows:

(a) Subject to Paragraph 2.3(c) below, if such Capital Expenditures are required as a result of the specific and unique use of the Premises by Lessee as compared with uses by tenants in general, Lessee shall be fully responsible for the cost thereof, provided, however, that if such Capital Expenditure is required during the last 2 years of this Lease and the cost thereof exceeds 6 months' Base Rent, Lessee may instead terminate this Lease unless Lessor notifies Lessee, in writing, within 10 days after receipt of Lessee's termination notice that Lessor has elected to pay the difference between the actual cost thereof and the amount equal to 6 months' Base Rent. If Lessee elects termination, Lessee shall immediately cease the use of the Premises which requires such Capital Expenditure and deliver to Lessor written notice specifying a termination date at least 90 days thereafter. Such termination date shall, however, in no event be earlier than the last day that Lessee could legally utilize the Premises without commencing such Capital Expenditure.

(b) If such Capital Expenditure is not the result of the specific and unique use of the Premises by Lessee (such as, governmentally mandated seismic modifications), then Lessor shall pay for such Capital Expenditure and Lessee shall only be obligated to pay, each month during the remainder of the term of this Lease or any extension thereof, on the date that on which the Base Rent is due, an amount equal to 1/144th of the portion of such costs reasonably attributable to the Premises. Lessee shall pay Interest on the balance but may prepay its obligation at any time. If, however, such Capital Expenditure is required during the last 2 years of this Lease or if Lessor reasonably determines that it is not economically feasible to pay its share thereof, Lessor shall have the option to terminate this Lease upon 90 days prior written notice to Lessee unless Lessee notifies Lessor, in writing, within 10 days after receipt of Lessor's termination notice that Lessee will pay for such Capital Expenditure. If Lessor does not elect to terminate, and fails to tender its share of any such Capital Expenditure, Lessee may advance such funds and deduct same, with Interest, from Rent until Lessor's share of such costs have been fully paid. If Lessee is unable to finance Lessor's share, or if the balance of the Rent due and payable for the remainder of this Lease is not sufficient to fully reimburse Lessee on an offset basis, Lessee shall have the right to terminate this Lease upon 30 days written notice to Lessor.

(c) Notwithstanding the above, the provisions concerning Capital Expenditures are intended to apply only to non-voluntary, unexpected, and new Applicable Requirements. If the Capital Expenditures are instead triggered by Lessee as a result of an actual or proposed change in use, change in intensity of use, or modification to the Premises then, and in that event, Lessee shall either: (i) immediately cease such changed use or intensity of use and/or take such other steps as may be necessary to eliminate the requirement for such Capital Expenditure, or (ii) complete such Capital Expenditure at its own expense. Lessee shall not have any right to terminate this Lease.

|

|

|

© 2019 AIR CRE. All Rights Reserved. |

|

Last Edited: 7/28/2023 3:49 PM |

MTN-26.30, Revised 10-22-2020 |

|

Page 2 of 19 |

DocuSign Envelope ID: 0FF373E1-3F98-4EB7-A6C9-B5DAC2B8E8B9

2.4 Acknowledgements. Lessee acknowledges that: (a) it has been given an opportunity to inspect and measure the Premises; (b) it has been advised by Lessor and/or Brokers to satisfy itself with respect to the size and condition of the Premises (including but not limited to the electrical, HVAC and fire sprinkler systems, security, environmental aspects, and compliance with Applicable Requirements and the Americans with Disabilities Act), and their suitability for Lessee's intended use; (c) Lessee has made such investigation as it deems necessary with reference to such matters and assumes all responsibility therefor as the same relate to its occupancy of the Premises; (d) it is not relying on any representation as to the size of the Premises made by Brokers or Lessor; (e) the square footage of the Premises was not material to Lessee's decision to lease the Premises and pay the Rent stated herein; and (f) neither Lessor, Lessor's agents, nor Brokers have made any oral or written representations or warranties with respect to said matters other than as set forth in this Lease. In addition, Lessor acknowledges that: (i) Brokers have made no representations, promises or warranties concerning Lessee's ability to honor the Lease or suitability to occupy the Premises and (ii) it is Lessor's sole responsibility to investigate the financial capability and/or suitability of all proposed tenants.

2.5 Lessee as Prior Owner/Occupant. The warranties made by Lessor in Paragraph 2 shall be of no force or effect if immediately prior to the Start Date Lessee was the owner or occupant of the Premises. In such event, Lessee shall be responsible for any necessary corrective work.

2.6 Vehicle Parking. Lessee shall be entitled to use the number of Parking Spaces specified in Paragraph 1.2(b) on those portions of the Common Areas designated from time to time by Lessor for parking. Lessee shall not use more parking spaces than said number. Said parking spaces shall be used for parking by vehicles no larger than full-size passenger automobiles or pick-up trucks, herein called "Permitted Size Vehicles." Lessor may regulate the loading and unloading of vehicles by adopting Rules and Regulations as provided in Paragraph 2.9. No vehicles other than Permitted Size Vehicles may be parked in the Common Area without the prior written permission of Lessor. In addition:

(a) Lessee shall not permit or allow any vehicles that belong to or are controlled by Lessee or Lessee's employees, suppliers, shippers, customers, contractors or invitees to be loaded, unloaded, or parked in areas other than those designated by Lessor for such activities.

(b) Lessee shall not service or store any vehicles in the Common Areas.

(c) If Lessee permits or allows any of the prohibited activities described in this Paragraph 2.6, then Lessor shall have the right, without notice, in addition to such other rights and remedies that it may have, to remove or tow away the vehicle involved and charge the cost to Lessee, which cost shall be immediately payable upon demand by Lessor.

(d) Lessee shall be responsible for monitoring its own reserved parking spaces.

2.7 Common Areas - Definition. The term "Common Areas" is defined as all areas and facilities outside the Premises and within the exterior boundary line of the Project and interior utility raceways and installations within the Unit that are provided and designated by the Lessor from time to time for the general non-exclusive use of Lessor, Lessee and other tenants of the Project and their respective employees, suppliers, shippers, customers, contractors and invitees, including parking areas, loading and unloading areas, trash areas, roofs, roadways, walkways, driveways and landscaped areas.

2.8 Common Areas - Lessee's Rights. Lessor grants to Lessee, for the benefit of Lessee and its employees, suppliers, shippers, contractors, customers and invitees, during the term of this Lease, the non-exclusive right to use, in common with others entitled to such use, the Common Areas as they exist from time to time, subject to any rights, powers, and privileges reserved by Lessor under the terms hereof or under the terms of any rules and regulations or restrictions governing the use of the Project. Under no circumstances shall the right herein granted to use the Common Areas be deemed to include the right to store any property, temporarily or permanently, in the Common Areas. Any such storage shall be permitted only by the prior written consent of Lessor or Lessor's designated agent, which consent may be revoked at any time. In the event that any unauthorized storage shall occur, then Lessor shall have the right, without notice, in addition to such other rights and remedies that it may have, to remove the property and charge the cost to Lessee, which cost shall be immediately payable upon demand by Lessor.

2.9 Common Areas - Rules and Regulations. Lessor or such other person(s) as Lessor may appoint shall have the exclusive control and management of the Common Areas and shall have the right, from time to time, to establish, modify, amend and enforce reasonable rules and regulations ("Rules and Regulations") for the management, safety, care, and cleanliness of the grounds, the parking and unloading of vehicles and the preservation of good order, as well as for the convenience of other occupants or tenants of the Building and the Project and their invitees. Lessee agrees to abide by and conform to all such Rules and Regulations, and shall use its best efforts to cause its employees, suppliers, shippers, customers, contractors and invitees to so abide and conform. Lessor shall not be responsible to Lessee for the non-compliance with said Rules and Regulations by other tenants of the Project.

2.10 Common Areas - Changes. Lessor shall have the right, in Lessor's sole discretion, from time to time:

(a) To make changes to the Common Areas, including, without limitation, changes in the location, size, shape and number of driveways, entrances, parking spaces, parking areas, loading and unloading areas, ingress, egress, direction of traffic, landscaped areas, walkways and utility raceways;

(b) To close temporarily any of the Common Areas for maintenance purposes so long as reasonable access to the Premises remains available;

(c) To designate other land outside the boundaries of the Project to be a part of the Common Areas;

(d) To add additional buildings and improvements to the Common Areas;

(e) To use the Common Areas while engaged in making additional improvements, repairs or alterations to the Project, or any portion thereof; and

(f) To do and perform such other acts and make such other changes in, to or with respect to the Common Areas and Project as Lessor may, in the exercise of sound business judgment, deem to be appropriate.

3.1 Term. The Commencement Date, Expiration Date and Original Term of this Lease are as specified in Paragraph 1.3.

3.2 Early Possession. Any provision herein granting Lessee Early Possession of the Premises is subject to and conditioned upon the Premises being available for such possession prior to the Commencement Date. Any grant of Early Possession only conveys a non-exclusive right to occupy the Premises. If Lessee totally or partially occupies the Premises prior to the Commencement Date, the obligation to pay Base Rent and Operating Expenses shall be abated for the period of such Early Possession. All other terms of this Lease shall be in effect during such period. Any such Early Possession shall not affect the Expiration Date.

|

|

|

© 2019 AIR CRE. All Rights Reserved. |

|

Last Edited: 7/28/2023 3:49 PM |

MTN-26.30, Revised 10-22-2020 |

|

Page 3 of 19 |

DocuSign Envelope ID: 0FF373E1-3F98-4EB7-A6C9-B5DAC2B8E8B9

3.3 Delay In Possession. Lessor agrees to use commercially reasonable efforts to deliver exclusive possession of the Premises to Lessee by the Commencement Date. If, despite said efforts, Lessor is unable to deliver possession by such date, Lessor shall not be subject to any liability therefor, nor shall such failure affect the validity of this Lease or change the Expiration Date. Lessee shall not, however, be obligated to pay Rent or perform its other obligations until Lessor delivers possession of the Premises and any period of rent abatement that Lessee would otherwise have enjoyed shall run from the date of delivery of possession and continue for a period equal to what Lessee would otherwise have enjoyed under the terms hereof, but minus any days of delay caused by the acts or omissions of Lessee. If possession is not delivered within 60 days after the Commencement Date, as the same may be extended under the terms of any Work Letter executed by Parties, Lessee may, at its option, by notice in writing within 10 days after the end of such 60 day period, cancel this Lease, in which event the Parties shall be discharged from all obligations hereunder. If such written notice is not received by Lessor within said 10 day period, Lessee's right to cancel shall terminate. If possession of the Premises is not delivered within 120 days after the Commencement Date, this Lease shall terminate unless other agreements are reached between Lessor and Lessee, in writing.

3.4 Lessee Compliance. Lessor shall not be required to tender possession of the Premises to Lessee until Lessee complies with its obligation to provide evidence of insurance (Paragraph 8.5). Pending delivery of such evidence, Lessee shall be required to perform all of its obligations under this Lease from and after the Start Date, including the payment of Rent, notwithstanding Lessor's election to withhold possession pending receipt of such evidence of insurance. Further, if Lessee is required to perform any other conditions prior to or concurrent with the Start Date, the Start Date shall occur but Lessor may elect to withhold possession until such conditions are satisfied.

4.1 Rent Defined. All monetary obligations of Lessee to Lessor under the terms of this Lease are deemed to be rent ("Rent").

4.2 Common Area Operating Expenses. Lessee shall pay to Lessor during the term hereof, in addition to the Base Rent, Lessee's Share (as specified in Paragraph 1.6) of all Common Area Operating Expenses, as hereinafter defined, during each calendar year of the term of this Lease, in accordance with the following provisions:

(a) "Common Area Operating Expenses" are defined, for purposes of this Lease, as all costs relating to the ownership and operation of the Project, including, but not limited to, the following:

(i) The operation, repair and maintenance, in neat, clean, good order and condition, and if necessary the replacement, of the following:

(aa) The Common Areas and Common Area improvements, including parking areas, loading and unloading areas, trash areas, roadways, parkways, walkways, driveways, landscaped areas, bumpers, irrigation systems, Common Area lighting facilities, fences and gates, elevators, roofs, exterior walls of the buildings, building systems and roof drainage systems.

(bb) Exterior signs and any tenant directories.

(cc) Any fire sprinkler systems.

(dd) All other areas and improvements that are within the exterior boundaries of the Project but outside of the Premises and/or any other space occupied by a tenant.

(ii) The cost of water, gas, electricity and telephone to service the Common Areas and any utilities not separately metered.

(iii) The cost of trash disposal, pest control services, property management, security services, owners' association dues and fees, the cost to repaint the exterior of any structures and the cost of any environmental inspections.

(iv) Reserves set aside for maintenance, repair and/or replacement of Common Area improvements and equipment.

(v) Real Property Taxes (as defined in Paragraph 10).

(vi) The cost of the premiums for the insurance maintained by Lessor pursuant to Paragraph 8. (vii) Any deductible portion of an insured loss concerning the Building or the Common Areas.

(viii) Auditors', accountants' and attorneys' fees and costs related to the operation, maintenance, repair and replacement of the Project.

(ix) The cost of any capital improvement to the Building or the Project not covered under the provisions of Paragraph 2.3 provided; however, that Lessor shall allocate the cost of any such capital improvement over a 12 year period and Lessee shall not be required to pay more than Lessee's Share of 1/144th of the cost of such capital improvement in any given month. Lessee shall pay Interest on the unamortized balance but may prepay its obligation at any time.

(x) The cost of any other services to be provided by Lessor that are stated elsewhere in this Lease to be a Common Area Operating Expense.

(b) Any Common Area Operating Expenses and Real Property Taxes that are specifically attributable to the Unit, the Building or to any other building in the Project or to the operation, repair and maintenance thereof, shall be allocated entirely to such Unit, Building, or other building. However, any Common Area Operating Expenses and Real Property Taxes that are not specifically attributable to the Building or to any other building or to the operation, repair and maintenance thereof, shall be equitably allocated by Lessor to all buildings in the Project.

(c) The inclusion of the improvements, facilities and services set forth in Subparagraph 4.2(a) shall not be deemed to impose an obligation upon Lessor to either have said improvements or facilities or to provide those services unless the Project already has the same, Lessor already provides the services, or Lessor has agreed elsewhere in this Lease to provide the same or some of them.

(d) Lessee's Share of Common Area Operating Expenses is payable monthly on the same day as the Base Rent is due hereunder. The amount of such payments shall be based on Lessor's estimate of the annual Common Area Operating Expenses. Within 60 days after written request (but not more than once each year) Lessor shall deliver to Lessee a reasonably detailed statement showing Lessee's Share of the actual Common Area Operating Expenses for the preceding year. If Lessee's payments during such year exceed Lessee's Share, Lessor shall credit the amount of such over-payment against Lessee's future payments. If Lessee's payments during such year were less than Lessee's Share, Lessee shall pay to Lessor the amount of the deficiency within 10 days after delivery by Lessor to Lessee of the statement.

(e) Common Area Operating Expenses shall not include any expenses paid by any tenant directly to third parties, or as to which Lessor is otherwise reimbursed by any third party, other tenant, or insurance proceeds.

|

|

|

© 2019 AIR CRE. All Rights Reserved. |

|

Last Edited: 7/28/2023 3:49 PM |

MTN-26.30, Revised 10-22-2020 |

|

Page 4 of 19 |

DocuSign Envelope ID: 0FF373E1-3F98-4EB7-A6C9-B5DAC2B8E8B9

4.3 Payment. Lessee shall cause payment of Rent to be received by Lessor in lawful money of the United States, without offset or deduction (except as specifically permitted in this Lease), on or before the day on which it is due. All monetary amounts shall be rounded to the nearest whole dollar. In the event that any statement or invoice prepared by Lessor is inaccurate such inaccuracy shall not constitute a waiver and Lessee shall be obligated to pay the amount set forth in this Lease. Rent for any period during the term hereof which is for less than one full calendar month shall be prorated based upon the actual number of days of said month. Payment of Rent shall be made to Lessor at its address stated herein or to such other persons or place as Lessor may from time to time designate in writing. Acceptance of a payment which is less than the amount then due shall not be a waiver of Lessor's rights to the balance of such Rent, regardless of Lessor's endorsement of any check so stating. In the event that any check, draft, or other instrument of payment given by Lessee to Lessor is dishonored for any reason, Lessee agrees to pay to Lessor the sum of $25 in addition to any Late Charge to compensate Lessor for additional time and expenses incurred in handling the dishonored payment and Lessor, at its option, may require all future Rent be paid by cashier's check. Payments will be applied first to accrued late charges and attorney's fees, second to accrued interest, then to Base Rent and Common Area Operating Expenses, and any remaining amount to any other outstanding charges or costs.

6.1 Use. Lessee shall use and occupy the Premises only for the Agreed Use, or any other legal use which is reasonably comparable thereto, and for no other purpose. Lessee shall not use or permit the use of the Premises in a manner that is unlawful, creates damage, waste or a nuisance, or that disturbs occupants of or causes damage to neighboring premises or properties. Other than guide, signal and seeing eye dogs, Lessee shall not keep or allow in the Premises any pets, animals, birds, fish, or reptiles. Lessor shall not unreasonably withhold or delay its consent to any written request for a modification of the Agreed Use, so long as the same will not impair the structural integrity of the Building or the mechanical or electrical systems therein, and/or is not significantly more burdensome to the Project. If Lessor elects to withhold consent, Lessor shall within 7 days after such request give written notification of same, which notice shall include an explanation of Lessor's objections to the change in the Agreed Use.

6.2 Hazardous Substances.

(a) Reportable Uses Require Consent. The term "Hazardous Substance" as used in this Lease shall mean any product, substance, or waste whose presence, use, manufacture, disposal, transportation, or release, either by itself or in combination with other materials expected to be on the Premises, is either: (i) potentially injurious to the public health, safety or welfare, the environment or the Premises, (ii) regulated or monitored by any governmental authority, or (iii) a basis for potential liability of Lessor to any governmental agency or third party under any applicable statute or common law theory. Hazardous Substances shall include, but not be limited to, hydrocarbons, petroleum, gasoline, and/or crude oil or any products, byproducts or fractions thereof. Lessee shall not engage in any activity in or on the Premises which constitutes a Reportable Use of Hazardous Substances without the express prior written consent of Lessor and timely compliance (at Lessee's expense) with all Applicable Requirements. "Reportable Use" shall mean (i) the installation or use of any above or below ground storage tank, (ii) the generation, possession, storage, use, transportation, or disposal of a Hazardous Substance that requires a permit from, or with respect to which a report, notice, registration or business plan is required to be filed with, any governmental authority, and/or (iii) the presence at the Premises of a Hazardous Substance with respect to which any Applicable Requirements requires that a notice be given to persons entering or occupying the Premises or neighboring properties. Notwithstanding the foregoing, Lessee may use any ordinary and customary materials reasonably required to be used in the normal course of the Agreed Use, ordinary office supplies (copier toner, liquid paper, glue, etc.) and common household cleaning materials, so long as such use is in compliance with all Applicable Requirements, is not a Reportable Use, and does not expose the Premises or neighboring property to any meaningful risk of contamination or damage or expose Lessor to any liability therefor. In addition, Lessor may condition its consent to any Reportable Use upon receiving such additional assurances as Lessor reasonably deems necessary to protect itself, the public, the Premises and/or the environment against damage, contamination, injury and/or liability, including, but not limited to, the installation (and removal on or before Lease expiration or termination) of protective modifications (such as concrete encasements) and/or increasing the Security Deposit.

(b) Duty to Inform Lessor. If Lessee knows, or has reasonable cause to believe, that a Hazardous Substance has come to be located in, on, under or about the Premises, other than as previously consented to by Lessor, Lessee shall immediately give written notice of such fact to Lessor, and provide Lessor with a copy of any report, notice, claim or other documentation which it has concerning the presence of such Hazardous Substance.

(c) Lessee Remediation. Lessee shall not cause or permit any Hazardous Substance to be spilled or released in, on, under, or about the Premises (including through the plumbing or sanitary sewer system) and shall promptly, at Lessee's expense, comply with all Applicable Requirements and take all investigatory and/or remedial action reasonably recommended, whether or not formally ordered or required, for the cleanup of any contamination of, and for the maintenance, security and/or monitoring of the Premises or neighboring properties, that was caused or materially contributed to by Lessee, or pertaining to or involving any Hazardous Substance brought onto the Premises during the term of this Lease, by or for Lessee, or any third party.

(d) Lessee Indemnification. Lessee shall indemnify, defend and hold Lessor, its agents, employees, lenders and ground lessor, if any, harmless from and against any and all loss of rents and/or damages, liabilities, judgments, claims, expenses, penalties, and attorneys' and consultants' fees arising out of or involving any Hazardous Substance brought onto the Premises by or for Lessee, or any third party (provided, however, that Lessee shall have no liability under this Lease with respect to underground migration of any Hazardous Substance under the Premises from areas outside of the Project not caused or contributed to by Lessee). Lessee's obligations shall include, but not be limited to, the effects of any contamination or injury to person, property or the environment created or suffered by Lessee, and the cost of investigation, removal, remediation, restoration and/or abatement, and shall survive the expiration or termination of this Lease. No termination, cancellation or release agreement entered into by Lessor and Lessee shall release Lessee from its obligations under this Lease with respect to Hazardous Substances, unless specifically so agreed by Lessor in writing at the time of such agreement.

(e) Lessor Indemnification. Except as otherwise provided in paragraph 8.7, Lessor and its successors and assigns shall indemnify, defend, reimburse and hold Lessee, its employees and lenders, harmless from and against any and all environmental damages, including the cost of remediation, which are suffered as a direct result of Hazardous Substances on the Premises prior to Lessee taking possession or which are caused by the gross negligence or willful misconduct of Lessor, its agents or employees. Lessor's obligations, as and when required by the Applicable Requirements, shall include, but not be limited to, the cost of investigation, removal, remediation, restoration and/or abatement, and shall survive the expiration or termination of this Lease.

(f) Investigations and Remediations. Lessor shall retain the responsibility and pay for any investigations or remediation measures required by governmental entities having jurisdiction with respect to the existence of Hazardous Substances on the Premises prior to the Lessee taking possession, unless such remediation measure is required as a result of Lessee's use (including "Alterations", as defined in paragraph 7.3(a) below) of the Premises, in which event Lessee shall be responsible for such payment. Lessee shall cooperate fully in any such activities at the request of Lessor, including allowing Lessor and Lessor's agents to have reasonable access to the Premises at reasonable times in order to carry out Lessor's investigative and remedial responsibilities.

|

|

|

© 2019 AIR CRE. All Rights Reserved. |

|

Last Edited: 7/28/2023 3:49 PM |

MTN-26.30, Revised 10-22-2020 |

|

Page 5 of 19 |

DocuSign Envelope ID: 0FF373E1-3F98-4EB7-A6C9-B5DAC2B8E8B9

(g) Lessor Termination Option. If a Hazardous Substance Condition (see Paragraph 9.1(e)) occurs during the term of this Lease, unless Lessee is legally responsible therefor (in which case Lessee shall make the investigation and remediation thereof required by the Applicable Requirements and this Lease shall continue in full force and effect, but subject to Lessor's rights under Paragraph 6.2(d) and Paragraph 13), Lessor may, at Lessor's option, either (i) investigate and remediate such Hazardous Substance Condition, if required, as soon as reasonably possible at Lessor's expense, in which event this Lease shall continue in full force and effect, or (ii) if the estimated cost to remediate such condition exceeds 12 times the then monthly Base Rent or $100,000, whichever is greater, give written notice to Lessee, within 30 days after receipt by Lessor of knowledge of the occurrence of such Hazardous Substance Condition, of Lessor's desire to terminate this Lease as of the date 60 days following the date of such notice. In the event Lessor elects to give a termination notice, Lessee may, within 10 days thereafter, give written notice to Lessor of Lessee's commitment to pay the amount by which the cost of the remediation of such Hazardous Substance Condition exceeds an amount equal to 12 times the then monthly Base Rent or $100,000, whichever is greater. Lessee shall provide Lessor with said funds or satisfactory assurance thereof within 30 days following such commitment. In such event, this Lease shall continue in full force and effect, and Lessor shall proceed to make such remediation as soon as reasonably possible after the required funds are available. If Lessee does not give such notice and provide the required funds or assurance thereof within the time provided, this Lease shall terminate as of the date specified in Lessor's notice of termination.

6.3 Lessee's Compliance with Applicable Requirements. Except as otherwise provided in this Lease, Lessee shall, at Lessee's sole expense, fully, diligently and in a timely manner, materially comply with all Applicable Requirements, the requirements of any applicable fire insurance underwriter or rating bureau, and the recommendations of Lessor's engineers and/or consultants which relate in any manner to the Premises, without regard to whether said Applicable Requirements are now in effect or become effective after the Start Date. Lessee shall, within 10 days after receipt of Lessor's written request, provide Lessor with copies of all permits and other documents, and other information evidencing Lessee's compliance with any Applicable Requirements specified by Lessor, and shall immediately upon receipt, notify Lessor in writing (with copies of any documents involved) of any threatened or actual claim, notice, citation, warning, complaint or report pertaining to or involving the failure of Lessee or the Premises to comply with any Applicable Requirements. Likewise, Lessee shall immediately give written notice to Lessor of: (i) any water damage to the Premises and any suspected seepage, pooling, dampness or other condition conducive to the production of mold; or (ii) any mustiness or other odors that might indicate the presence of mold in the Premises.

6.4 Inspection; Compliance. Lessor and Lessor's "Lender" (as defined in Paragraph 30) and consultants authorized by Lessor shall have the right to enter into Premises at any time in the case of an emergency, and otherwise at reasonable times after reasonable notice, for the purpose of inspecting and/or testing the condition of the Premises and/or for verifying compliance by Lessee with this Lease. The cost of any such inspections shall be paid by Lessor, unless a violation of Applicable Requirements, or a Hazardous Substance Condition (see Paragraph 9.1(e)) is found to exist or be imminent, or the inspection is requested or ordered by a governmental authority. In such case, Lessee shall upon request reimburse Lessor for the cost of such inspection, so long as such inspection is reasonably related to the violation or contamination. In addition, Lessee shall provide copies of all relevant material safety data sheets (MSDS) to Lessor within 10 days of the receipt of written request therefor. Lessee acknowledges that any failure on its part to allow such inspections or testing will expose Lessor to risks and potentially cause Lessor to incur costs not contemplated by this Lease, the extent of which will be extremely difficult to ascertain. Accordingly, should the Lessee fail to allow such inspections and/or testing in a timely fashion the Base Rent shall be automatically increased, without any requirement for notice to Lessee, by an amount equal to 10% of the then existing Base Rent or $100, whichever is greater for the remainder to the Lease. The Parties agree that such increase in Base Rent represents fair and reasonable compensation for the additional risk/costs that Lessor will incur by reason of Lessee's failure to allow such inspection and/or testing. Such increase in Base Rent shall in no event constitute a waiver of Lessee's Default or Breach with respect to such failure nor prevent the exercise of any of the other rights and remedies granted hereunder.

7.1 Lessee's Obligations.

(a) In General. Subject to the provisions of Paragraph 2.2 (Condition), 2.3 (Compliance), 6.3 (Lessee's Compliance with Applicable Requirements), 7.2 (Lessor's Obligations), 9 (Damage or Destruction), and 14 (Condemnation), Lessee shall, at Lessee's sole expense, keep the Premises, Utility Installations (intended for Lessee's exclusive use, no matter where located), and Alterations in good order, condition and repair (whether or not the portion of the Premises requiring repairs, or the means of repairing the same, are reasonably or readily accessible to Lessee, and whether or not the need for such repairs occurs as a result of Lessee's use, any prior use, the elements or the age of such portion of the Premises), including, but not limited to, all equipment or facilities, such as plumbing, HVAC equipment, electrical, lighting facilities, boilers, pressure vessels, fixtures, interior walls, interior surfaces of exterior walls, ceilings, floors, windows, doors, plate glass, and skylights but excluding any items which are the responsibility of Lessor pursuant to Paragraph 7.2. Lessee, in keeping the Premises in good order, condition and repair, shall exercise and perform good maintenance practices, specifically including the procurement and maintenance of the service contracts required by Paragraph 7.1(b) below. Lessee's obligations shall include restorations, replacements or renewals when necessary to keep the Premises and all improvements thereon or a part thereof in good order, condition and state of repair.

(b) Service Contracts. Lessee shall, at Lessee's sole expense, procure and maintain contracts, with copies to Lessor, in customary form and substance for, and with contractors specializing and experienced in the maintenance of the following equipment and improvements, if any, if and when installed on the Premises: (i) HVAC equipment, (ii) boiler and pressure vessels, and (iii) clarifiers. However, Lessor reserves the right, upon notice to Lessee, to procure and maintain any or all of such service contracts, and Lessee shall reimburse Lessor, upon demand, for the cost thereof.

(c) Failure to Perform. If Lessee fails to perform Lessee's obligations under this Paragraph 7.1, Lessor may enter upon the Premises after 10 days' prior written notice to Lessee (except in the case of an emergency, in which case no notice shall be required), perform such obligations on Lessee's behalf, and put the Premises in good order, condition and repair, and Lessee shall promptly pay to Lessor a sum equal to 115% of the cost thereof.

(d) Replacement. Subject to Lessee's indemnification of Lessor as set forth in Paragraph 8.7 below, and without relieving Lessee of liability resulting from Lessee's failure to exercise and perform good maintenance practices, if an item described in Paragraph 7.1(b) cannot be repaired other than at a cost which is in excess of 50% of the cost of replacing such item, then such item shall be replaced by Lessor, and the cost thereof shall be prorated between the Parties and Lessee shall only be obligated to pay, each month during the remainder of the term of this Lease or any extension thereof, on the date on which Base Rent is due, an amount equal to the product of multiplying the cost of such replacement by a fraction, the numerator of which is one, and the denominator of which is 144 (i.e. 1/144th of the cost per month). Lessee shall pay Interest on the unamortized balance but may prepay its obligation at any time.

|

|

|

© 2019 AIR CRE. All Rights Reserved. |

|

Last Edited: 7/28/2023 3:49 PM |

MTN-26.30, Revised 10-22-2020 |

|

Page 6 of 19 |

DocuSign Envelope ID: 0FF373E1-3F98-4EB7-A6C9-B5DAC2B8E8B9

7.2 Lessor's Obligations. Subject to the provisions of Paragraphs 2.2 (Condition), 2.3 (Compliance), 4.2 (Common Area Operating Expenses), 6 (Use), 7.1 (Lessee's Obligations), 9 (Damage or Destruction) and 14 (Condemnation), Lessor, subject to reimbursement pursuant to Paragraph 4.2, shall keep in good order, condition and repair the foundations, exterior walls, structural condition of interior bearing walls, exterior roof, fire sprinkler system, Common Area fire alarm and/or smoke detection systems, fire hydrants, parking lots, walkways, parkways, driveways, landscaping, fences, signs and utility systems serving the Common Areas and all parts thereof, as well as providing the services for which there is a Common Area Operating Expense pursuant to Paragraph 4.2. Lessor shall not be obligated to paint the exterior or interior surfaces of exterior walls nor shall Lessor be obligated to maintain, repair or replace windows, doors or plate glass of the Premises.

7.3 Utility Installations; Trade Fixtures; Alterations.

(a) Definitions. The term "Utility Installations" refers to all floor and window coverings, air and/or vacuum lines, power panels, electrical distribution, security and fire protection systems, communication cabling, lighting fixtures, HVAC equipment, plumbing, and fencing in or on the Premises. The term "Trade Fixtures" shall mean Lessee's machinery and equipment that can be removed without doing material damage to the Premises. The term "Alterations" shall mean any modification of the improvements, other than Utility Installations or Trade Fixtures, whether by addition or deletion. "Lessee Owned Alterations and/or Utility Installations" are defined as Alterations and/or Utility Installations made by Lessee that are not yet owned by Lessor pursuant to Paragraph 7.4(a).

(b) Consent. Lessee shall not make any Alterations or Utility Installations to the Premises without Lessor's prior written consent. Lessee may, however, make non-structural Alterations or Utility Installations to the interior of the Premises (excluding the roof) without such consent but upon notice to Lessor, as long as they are not visible from the outside, do not involve puncturing, relocating or removing the roof or any existing walls, will not affect the electrical, plumbing, HVAC, and/or life safety systems, do not trigger the requirement for additional modifications and/or improvements to the Premises resulting from Applicable Requirements, such as compliance with Title 24, and/or life safety systems, and the cumulative cost thereof during this Lease as extended does not exceed a sum equal to 3 month's Base Rent in the aggregate or a sum equal to one month's Base Rent in any one year. Notwithstanding the foregoing, Lessee shall not make or permit any roof penetrations and/or install anything on the roof without the prior written approval of Lessor. Lessor may, as a precondition to granting such approval, require Lessee to utilize a contractor chosen and/or approved by Lessor. Any Alterations or Utility Installations that Lessee shall desire to make and which require the consent of the Lessor shall be presented to Lessor in written form with detailed plans. Consent shall be deemed conditioned upon Lessee's: (i) acquiring all applicable governmental permits, (ii) furnishing Lessor with copies of both the permits and the plans and specifications prior to commencement of the work, and (iii) compliance with all conditions of said permits and other Applicable Requirements in a prompt and expeditious manner. Any Alterations or Utility Installations shall be performed in a workmanlike manner with good and sufficient materials. Lessee shall promptly upon completion furnish Lessor with as-built plans and specifications. For work which costs an amount in excess of one month's Base Rent, Lessor may condition its consent upon Lessee providing a lien and completion bond in an amount equal to 150% of the estimated cost of such Alteration or Utility Installation and/or upon Lessee's posting an additional Security Deposit with Lessor.

(c) Liens; Bonds. Lessee shall pay, when due, all claims for labor or materials furnished or alleged to have been furnished to or for Lessee at or for use on the Premises, which claims are or may be secured by any mechanic's or materialmen's lien against the Premises or any interest therein. Lessee shall give Lessor not less than 10 days notice prior to the commencement of any work in, on or about the Premises, and Lessor shall have the right to post notices of non-responsibility. If Lessee shall contest the validity of any such lien, claim or demand, then Lessee shall, at its sole expense defend and protect itself, Lessor and the Premises against the same and shall pay and satisfy any such adverse judgment that may be rendered thereon before the enforcement thereof. If Lessor shall require, Lessee shall furnish a surety bond in an amount equal to 150% of the amount of such contested lien, claim or demand, indemnifying Lessor against liability for the same. If Lessor elects to participate in any such action, Lessee shall pay Lessor's attorneys' fees and costs.

7.4 Ownership; Removal; Surrender; and Restoration.

(a) Ownership. Subject to Lessor's right to require removal or elect ownership as hereinafter provided, all Alterations and Utility Installations made by Lessee shall be the property of Lessee, but considered a part of the Premises. Lessor may, at any time, elect in writing to be the owner of all or any specified part of the Lessee Owned Alterations and Utility Installations. Unless otherwise instructed per paragraph 7.4(b) hereof, all Lessee Owned Alterations and Utility Installations shall, at the expiration or termination of this Lease, become the property of Lessor and be surrendered by Lessee with the Premises.

(b) Removal. By delivery to Lessee of written notice from Lessor not earlier than 90 and not later than 30 days prior to the end of the term of this Lease, Lessor may require that any or all Lessee Owned Alterations or Utility Installations be removed by the expiration or termination of this Lease. Lessor may require the removal at any time of all or any part of any Lessee Owned Alterations or Utility Installations made without the required consent.

(c) Surrender; Restoration. Lessee shall surrender the Premises by the Expiration Date or any earlier termination date, with all of the improvements, parts and surfaces thereof broom clean and free of debris, and in good operating order, condition and state of repair, ordinary wear and tear excepted. "Ordinary wear and tear" shall not include any damage or deterioration that would have been prevented by good maintenance practice. Notwithstanding the foregoing and the provisions of Paragraph 7.1(a), if the Lessee occupies the Premises for 12 months or less, then Lessee shall surrender the Premises in the same condition as delivered to Lessee on the Start Date with NO allowance for ordinary wear and tear. Lessee shall repair any damage occasioned by the installation, maintenance or removal of Trade Fixtures, Lessee owned Alterations and/or Utility Installations, furnishings, and equipment as well as the removal of any storage tank installed by or for Lessee. Lessee shall also remove from the Premises any and all Hazardous Substances brought onto the Premises by or for Lessee, or any third party (except Hazardous Substances which were deposited via underground migration from areas outside of the Project) to the level specified in Applicable Requirements. Trade Fixtures shall remain the property of Lessee and shall be removed by Lessee. Any personal property of Lessee not removed on or before the Expiration Date or any earlier termination date shall be deemed to have been abandoned by Lessee and may be disposed of or retained by Lessor as Lessor may desire. The failure by Lessee to timely vacate the Premises pursuant to this Paragraph 7.4(c) without the express written consent of Lessor shall constitute a holdover under the provisions of Paragraph 26 below.

8.1 Payment of Premiums. The cost of the premiums for the insurance policies required to be carried by Lessor, pursuant to Paragraphs 8.2(b), 8.3(a) and 8.3(b), shall be a Common Area Operating Expense. Premiums for policy periods commencing prior to, or extending beyond, the term of this Lease shall be prorated to coincide with the corresponding Start Date or Expiration Date.

|

|

|

© 2019 AIR CRE. All Rights Reserved. |

|

Last Edited: 7/28/2023 3:49 PM |

MTN-26.30, Revised 10-22-2020 |

|

Page 7 of 19 |

DocuSign Envelope ID: 0FF373E1-3F98-4EB7-A6C9-B5DAC2B8E8B9

8.2 Liability Insurance.

(a) Carried by Lessee. Lessee shall obtain and keep in force a Commercial General Liability policy of insurance protecting Lessee and Lessor as an additional insured against claims for bodily injury, personal injury and property damage based upon or arising out of the ownership, use, occupancy or maintenance of the Premises and all areas appurtenant thereto. Such insurance shall be on an occurrence basis providing single limit coverage in an amount not less than $1,000,000 per occurrence with an annual aggregate of not less than $2,000,000. Lessee shall add Lessor as an additional insured by means of an endorsement at least as broad as the Insurance Service Organization's "Additional Insured-Managers or Lessors of Premises" Endorsement. The policy shall not contain any intra-insured exclusions as between insured persons or organizations, but shall include coverage for liability assumed under this Lease as an "insured contract" for the performance of Lessee's indemnity obligations under this Lease. The limits of said insurance shall not, however, limit the liability of Lessee nor relieve Lessee of any obligation hereunder. Lessee shall provide an endorsement on its liability policy(ies) which provides that its insurance shall be primary to and not contributory with any similar insurance carried by Lessor, whose insurance shall be considered excess insurance only.

(b) Carried by Lessor. Lessor shall maintain liability insurance as described in Paragraph 8.2(a), in addition to, and not in lieu of, the insurance required to be maintained by Lessee. Lessee shall not be named as an additional insured therein.

8.3 Property Insurance - Building, Improvements and Rental Value.

(a) Building and Improvements. Lessor shall obtain and keep in force a policy or policies of insurance in the name of Lessor, with loss payable to Lessor, any ground-lessor, and to any Lender insuring loss or damage to the Premises. The amount of such insurance shall be equal to the full insurable replacement cost of the Premises, as the same shall exist from time to time, or the amount required by any Lender, but in no event more than the commercially reasonable and available insurable value thereof. Lessee Owned Alterations and Utility Installations, Trade Fixtures, and Lessee's personal property shall be insured by Lessee not by Lessor. If the coverage is available and commercially appropriate, such policy or policies shall insure against all risks of direct physical loss or damage (except the perils of flood and/or earthquake unless required by a Lender), including coverage for debris removal and the enforcement of any Applicable Requirements requiring the upgrading, demolition, reconstruction or replacement of any portion of the Premises as the result of a covered loss. Said policy or policies shall also contain an agreed valuation provision in lieu of any coinsurance clause, waiver of subrogation, and inflation guard protection causing an increase in the annual property insurance coverage amount by a factor of not less than the adjusted U.S. Department of Labor Consumer Price Index for All Urban Consumers for the city nearest to where the Premises are located. If such insurance coverage has a deductible clause, the deductible amount shall not exceed $5,000 per occurrence.

(b) Rental Value. Lessor shall also obtain and keep in force a policy or policies in the name of Lessor with loss payable to Lessor and any Lender, insuring the loss of the full Rent for one year with an extended period of indemnity for an additional 180 days ("Rental Value insurance"). Said insurance shall contain an agreed valuation provision in lieu of any coinsurance clause, and the amount of coverage shall be adjusted annually to reflect the projected Rent otherwise payable by Lessee, for the next 12 month period.

(c) Adjacent Premises. Lessee shall pay for any increase in the premiums for the property insurance of the Building and for the Common Areas or other buildings in the Project if said increase is caused by Lessee's acts, omissions, use or occupancy of the Premises.

(d) Lessee's Improvements. Since Lessor is the Insuring Party, Lessor shall not be required to insure Lessee Owned Alterations and Utility Installations unless the item in question has become the property of Lessor under the terms of this Lease.

8.4 Lessee's Property; Business Interruption Insurance; Worker's Compensation Insurance.

(a) Property Damage. Lessee shall obtain and maintain insurance coverage on all of Lessee's personal property, Trade Fixtures, and Lessee Owned Alterations and Utility Installations. Such insurance shall be full replacement cost coverage with a deductible of not to exceed $1,000 per occurrence. The proceeds from any such insurance shall be used by Lessee for the replacement of personal property, Trade Fixtures and Lessee Owned Alterations and Utility Installations.

(b) Business Interruption. Lessee shall obtain and maintain loss of income and extra expense insurance in amounts as will reimburse Lessee for direct or indirect loss of earnings attributable to all perils commonly insured against by prudent lessees in the business of Lessee or attributable to prevention of access to the Premises as a result of such perils.

(c) Worker's Compensation Insurance. Lessee shall obtain and maintain Worker's Compensation Insurance in such amount as may be required by Applicable Requirements. Such policy shall include a 'Waiver of Subrogation' endorsement. Lessee shall provide Lessor with a copy of such endorsement along with the certificate of insurance or copy of the policy required by paragraph 8.5.

(d) No Representation of Adequate Coverage. Lessor makes no representation that the limits or forms of coverage of insurance specified herein are adequate to cover Lessee's property, business operations or obligations under this Lease.

8.5 Insurance Policies. Insurance required herein shall be by companies maintaining during the policy term a "General Policyholders Rating" of at least A-, VII, as set forth in the most current issue of "Best's Insurance Guide", or such other rating as may be required by a Lender. Lessee shall not do or permit to be done anything which invalidates the required insurance policies. Lessee shall, prior to the Start Date, deliver to Lessor certified copies of policies of such insurance or certificates with copies of the required endorsements evidencing the existence and amounts of the required insurance. No such policy shall be cancelable or subject to modification except after 30 days prior written notice to Lessor. Lessee shall, at least 10 days prior to the expiration of such policies, furnish Lessor with evidence of renewals or "insurance binders" evidencing renewal thereof, or Lessor may increase his liability insurance coverage and charge the cost thereof to Lessee, which amount shall be payable by Lessee to Lessor upon demand. Such policies shall be for a term of at least one year, or the length of the remaining term of this Lease, whichever is less. If either Party shall fail to procure and maintain the insurance required to be carried by it, the other Party may, but shall not be required to, procure and maintain the same.

8.6 Waiver of Subrogation. Without affecting any other rights or remedies, Lessee and Lessor each hereby release and relieve the other, and waive their entire right to recover damages against the other, for loss of or damage to its property arising out of or incident to the perils required to be insured against herein. The effect of such releases and waivers is not limited by the amount of insurance carried or required, or by any deductibles applicable hereto. The Parties agree to have their respective property damage insurance carriers waive any right to subrogation that such companies may have against Lessor or Lessee, as the case may be, so long as the insurance is not invalidated thereby.

8.7 Indemnity. Except for Lessor's gross negligence or willful misconduct, Lessee shall indemnify, protect, defend and hold harmless the Premises, Lessor and its agents, Lessor's master or ground lessor, partners and Lenders, from and against any and all claims, loss of rents and/or damages, liens, judgments, penalties, attorneys' and consultants' fees, expenses and/or liabilities arising out of, involving, or in connection with, a Breach of the Lease by Lessee and/or the use and/or occupancy of the Premises and/or Project by Lessee and/or by Lessee's employees, contractors or invitees . If any action or proceeding is brought against Lessor by reason of any of the foregoing matters, Lessee shall upon notice defend the same at Lessee's expense by counsel reasonably satisfactory to Lessor and Lessor shall cooperate with Lessee in such defense. Lessor need not have first paid any such claim in order to be defended or indemnified.

|

|

|

© 2019 AIR CRE. All Rights Reserved. |

|

Last Edited: 7/28/2023 3:49 PM |

MTN-26.30, Revised 10-22-2020 |

|

Page 8 of 19 |

DocuSign Envelope ID: 0FF373E1-3F98-4EB7-A6C9-B5DAC2B8E8B9

8.8 Exemption of Lessor and its Agents from Liability. Notwithstanding the negligence or breach of this Lease by Lessor or its agents, neither Lessor nor its agents shall be liable under any circumstances for: (i) injury or damage to the person or goods, wares, merchandise or other property of Lessee, Lessee's employees, contractors, invitees, customers, or any other person in or about the Premises, whether such damage or injury is caused by or results from fire, steam, electricity, gas, water or rain, indoor air quality, the presence of mold or from the breakage, leakage, obstruction or other defects of pipes, fire sprinklers, wires, appliances, plumbing, HVAC or lighting fixtures, or from any other cause, whether the said injury or damage results from conditions arising upon the Premises or upon other portions of the Building, or from other sources or places; (ii) any damages arising from any act or neglect of any other tenant of Lessor or from the failure of Lessor or its agents to enforce the provisions of any other lease in the Project; or (iii) injury to Lessee's business or for any loss of income or profit therefrom. Instead, it is intended that Lessee's sole recourse in the event of such damages or injury be to file a claim on the insurance policy(ies) that Lessee is required to maintain pursuant to the provisions of paragraph 8.

8.9 Failure to Provide Insurance. Lessee acknowledges that any failure on its part to obtain or maintain the insurance required herein will expose Lessor to risks and potentially cause Lessor to incur costs not contemplated by this Lease, the extent of which will be extremely difficult to ascertain. Accordingly, for any month or portion thereof that Lessee does not maintain the required insurance and/or does not provide Lessor with the required binders or certificates evidencing the existence of the required insurance, the Base Rent shall be automatically increased, without any requirement for notice to Lessee, by an amount equal to 10% of the then existing Base Rent or $100, whichever is greater. The parties agree that such increase in Base Rent represents fair and reasonable compensation for the additional risk/costs that Lessor will incur by reason of Lessee's failure to maintain the required insurance. Such increase in Base Rent shall in no event constitute a waiver of Lessee's Default or Breach with respect to the failure to maintain such insurance, prevent the exercise of any of the other rights and remedies granted hereunder, nor relieve Lessee of its obligation to maintain the insurance specified in this Lease.

9.1 Definitions.

(a) "Premises Partial Damage" shall mean damage or destruction to the improvements on the Premises, other than Lessee Owned Alterations and Utility Installations, which can reasonably be repaired in 3 months or less from the date of the damage or destruction, and the cost thereof does not exceed a sum equal to 6 month's Base Rent. Lessor shall notify Lessee in writing within 30 days from the date of the damage or destruction as to whether or not the damage is Partial or Total.

(b) "Premises Total Destruction" shall mean damage or destruction to the improvements on the Premises, other than Lessee Owned Alterations and Utility Installations and Trade Fixtures, which cannot reasonably be repaired in 3 months or less from the date of the damage or destruction and/or the cost thereof exceeds a sum equal to 6 month's Base Rent. Lessor shall notify Lessee in writing within 30 days from the date of the damage or destruction as to whether or not the damage is Partial or Total.

(c) "Insured Loss" shall mean damage or destruction to improvements on the Premises, other than Lessee Owned Alterations and Utility Installations and Trade Fixtures, which was caused by an event required to be covered by the insurance described in Paragraph 8.3(a), irrespective of any deductible amounts or coverage limits involved.

(d) "Replacement Cost" shall mean the cost to repair or rebuild the improvements owned by Lessor at the time of the occurrence to their condition existing immediately prior thereto, including demolition, debris removal and upgrading required by the operation of Applicable Requirements, and without deduction for depreciation.

(e) "Hazardous Substance Condition" shall mean the occurrence or discovery of a condition involving the presence of, or a contamination by, a Hazardous Substance, in, on, or under the Premises which requires restoration.

9.2 Partial Damage - Insured Loss. If a Premises Partial Damage that is an Insured Loss occurs, then Lessor shall, at Lessor's expense, repair such damage (but not Lessee's Trade Fixtures or Lessee Owned Alterations and Utility Installations) as soon as reasonably possible and this Lease shall continue in full force and effect; provided, however, that Lessee shall, at Lessor's election, make the repair of any damage or destruction the total cost to repair of which is $10,000 or less, and, in such event, Lessor shall make any applicable insurance proceeds available to Lessee on a reasonable basis for that purpose. Notwithstanding the foregoing, if the required insurance was not in force or the insurance proceeds are not sufficient to effect such repair, the Insuring Party shall promptly contribute the shortage in proceeds as and when required to complete said repairs. In the event, however, such shortage was due to the fact that, by reason of the unique nature of the improvements, full replacement cost insurance coverage was not commercially reasonable and available, Lessor shall have no obligation to pay for the shortage in insurance proceeds or to fully restore the unique aspects of the Premises unless Lessee provides Lessor with the funds to cover same, or adequate assurance thereof, within 10 days following receipt of written notice of such shortage and request therefor. If Lessor receives said funds or adequate assurance thereof within said 10 day period, the party responsible for making the repairs shall complete them as soon as reasonably possible and this Lease shall remain in full force and effect. If such funds or assurance are not received, Lessor may nevertheless elect by written notice to Lessee within 10 days thereafter to: (i) make such restoration and repair as is commercially reasonable with Lessor paying any shortage in proceeds, in which case this Lease shall remain in full force and effect, or (ii) have this Lease terminate 30 days thereafter. Lessee shall not be entitled to reimbursement of any funds contributed by Lessee to repair any such damage or destruction. Premises Partial Damage due to flood or earthquake shall be subject to Paragraph 9.3, notwithstanding that there may be some insurance coverage, but the net proceeds of any such insurance shall be made available for the repairs if made by either Party.

9.3 Partial Damage - Uninsured Loss. If a Premises Partial Damage that is not an Insured Loss occurs, unless caused by a negligent or willful act of Lessee (in which event Lessee shall make the repairs at Lessee's expense), Lessor may either: (i) repair such damage as soon as reasonably possible at Lessor's expense (subject to reimbursement pursuant to Paragraph 4.2), in which event this Lease shall continue in full force and effect, or (ii) terminate this Lease by giving written notice to Lessee within 30 days after receipt by Lessor of knowledge of the occurrence of such damage. Such termination shall be effective 60 days following the date of such notice. In the event Lessor elects to terminate this Lease, Lessee shall have the right within 10 days after receipt of the termination notice to give written notice to Lessor of Lessee's commitment to pay for the repair of such damage without reimbursement from Lessor. Lessee shall provide Lessor with said funds or satisfactory assurance thereof within 30 days after making such commitment. In such event this Lease shall continue in full force and effect, and Lessor shall proceed to make such repairs as soon as reasonably possible after the required funds are available. If Lessee does not make the required commitment, this Lease shall terminate as of the date specified in the termination notice.

9.4 Total Destruction. Notwithstanding any other provision hereof, if a Premises Total Destruction occurs, this Lease shall terminate 60 days following such Destruction. If the damage or destruction was caused by the gross negligence or willful misconduct of Lessee, Lessor shall have the right to recover Lessor's damages from Lessee, except as provided in Paragraph 8.6.

|

|

|

© 2019 AIR CRE. All Rights Reserved. |

|

Last Edited: 7/28/2023 3:49 PM |

MTN-26.30, Revised 10-22-2020 |

|

Page 9 of 19 |

DocuSign Envelope ID: 0FF373E1-3F98-4EB7-A6C9-B5DAC2B8E8B9

9.5 Damage Near End of Term. If at any time during the last 6 months of this Lease there is damage for which the cost to repair exceeds one month's Base Rent, whether or not an Insured Loss, Lessor may terminate this Lease effective 60 days following the date of occurrence of such damage by giving a written termination notice to Lessee within 30 days after the date of occurrence of such damage. Notwithstanding the foregoing, if Lessee at that time has an exercisable option to extend this Lease or to purchase the Premises, then Lessee may preserve this Lease by (a) exercising such option and (b) providing Lessor with any shortage in insurance proceeds (or adequate assurance thereof) needed to make the repairs on or before the earlier of (i) the date which is 10 days after Lessee's receipt of Lessor's written notice purporting to terminate this Lease, or (ii) the day prior to the date upon which such option expires. If Lessee duly exercises such option during such period and provides Lessor with funds (or adequate assurance thereof) to cover any shortage in insurance proceeds, Lessor shall, at Lessor's commercially reasonable expense, repair such damage as soon as reasonably possible and this Lease shall continue in full force and effect. If Lessee fails to exercise such option and provide such funds or assurance during such period, then this Lease shall terminate on the date specified in the termination notice and Lessee's option shall be extinguished.

9.6 Abatement of Rent; Lessee's Remedies.

(a) Abatement. In the event of Premises Partial Damage or Premises Total Destruction or a Hazardous Substance Condition for which Lessee is not responsible under this Lease, the Rent payable by Lessee for the period required for the repair, remediation or restoration of such damage shall be abated in proportion to the degree to which Lessee's use of the Premises is impaired, but not to exceed the proceeds received from the Rental Value insurance. All other obligations of Lessee hereunder shall be performed by Lessee, and Lessor shall have no liability for any such damage, destruction, remediation, repair or restoration except as provided herein.

(b) Remedies. If Lessor is obligated to repair or restore the Premises and does not commence, in a substantial and meaningful way, such repair or restoration within 90 days after such obligation shall accrue, Lessee may, at any time prior to the commencement of such repair or restoration, give written notice to Lessor and to any Lenders of which Lessee has actual notice, of Lessee's election to terminate this Lease on a date not less than 60 days following the giving of such notice. If Lessee gives such notice and such repair or restoration is not commenced within 30 days thereafter, this Lease shall terminate as of the date specified in said notice. If the repair or restoration is commenced within such 30 days, this Lease shall continue in full force and effect. "Commence" shall mean either the unconditional authorization of the preparation of the required plans, or the beginning of the actual work on the Premises, whichever first occurs.

9.7 Termination; Advance Payments. Upon termination of this Lease pursuant to Paragraph 6.2(g) or Paragraph 9, an equitable adjustment shall be made concerning advance Base Rent and any other advance payments made by Lessee to Lessor. Lessor shall, in addition, return to Lessee so much of Lessee's Security Deposit as has not been, or is not then required to be, used by Lessor.

10.1 Definition. As used herein, the term "Real Property Taxes" shall include any form of assessment; real estate, general, special, ordinary or extraordinary, or rental levy or tax (other than inheritance, personal income or estate taxes); improvement bond; and/or license fee imposed upon or levied against any legal or equitable interest of Lessor in the Project, Lessor's right to other income therefrom, and/or Lessor's business of leasing, by any authority having the direct or indirect power to tax and where the funds are generated with reference to the Project address. The term "Real Property Taxes" shall also include any tax, fee, levy, assessment or charge, or any increase therein: (i) imposed by reason of events occurring during the term of this Lease, including but not limited to, a change in the ownership of the Project, (ii) a change in the improvements thereon, and/or (iii) levied or assessed on machinery or equipment provided by Lessor to Lessee pursuant to this Lease. In calculating Real Property Taxes for any calendar year, the Real Property Taxes for any real estate tax year shall be included in the calculation of Real Property Taxes for such calendar year based upon the number of days which such calendar year and tax year have in common.

10.2 Payment of Taxes. Except as otherwise provided in Paragraph 10.3, Lessor shall pay the Real Property Taxes applicable to the Project, and said payments shall be included in the calculation of Common Area Operating Expenses in accordance with the provisions of Paragraph 4.2.