0001293971DEF 14AFALSEiso4217:USD00012939712023-01-012023-12-310001293971blue:AndrewObenshainMember2023-01-012023-12-310001293971blue:AndrewObenshainMember2022-01-012022-12-3100012939712022-01-012022-12-310001293971blue:AndrewObenshainMember2021-01-012021-12-310001293971blue:NickLeschlyMember2021-01-012021-12-3100012939712021-01-012021-12-310001293971blue:NickLeschlyMember2021-01-012021-11-040001293971blue:AndrewObenshainMember2021-11-052021-12-310001293971ecd:EqtyAwrdsInSummryCompstnTblForAplblYrMemberecd:PeoMember2023-01-012023-12-310001293971ecd:EqtyAwrdsAdjsExclgValRprtdInSummryCompstnTblMemberecd:PeoMember2023-01-012023-12-310001293971ecd:EqtyAwrdsInSummryCompstnTblForAplblYrMemberecd:NonPeoNeoMember2023-01-012023-12-310001293971ecd:EqtyAwrdsAdjsExclgValRprtdInSummryCompstnTblMemberecd:NonPeoNeoMember2023-01-012023-12-310001293971ecd:YrEndFrValOfEqtyAwrdsGrntdInCvrdYrOutsdngAndUnvstdMemberecd:PeoMember2023-01-012023-12-310001293971ecd:ChngInFrValOfOutsdngAndUnvstdEqtyAwrdsGrntdInPrrYrsMemberecd:PeoMember2023-01-012023-12-310001293971ecd:VstngDtFrValOfEqtyAwrdsGrntdAndVstdInCvrdYrMemberecd:PeoMember2023-01-012023-12-310001293971ecd:ChngInFrValAsOfVstngDtOfPrrYrEqtyAwrdsVstdInCvrdYrMemberecd:PeoMember2023-01-012023-12-310001293971ecd:FrValAsOfPrrYrEndOfEqtyAwrdsGrntdInPrrYrsFldVstngCondsDrngCvrdYrMemberecd:PeoMember2023-01-012023-12-310001293971ecd:YrEndFrValOfEqtyAwrdsGrntdInCvrdYrOutsdngAndUnvstdMemberecd:NonPeoNeoMember2023-01-012023-12-310001293971ecd:ChngInFrValOfOutsdngAndUnvstdEqtyAwrdsGrntdInPrrYrsMemberecd:NonPeoNeoMember2023-01-012023-12-310001293971ecd:VstngDtFrValOfEqtyAwrdsGrntdAndVstdInCvrdYrMemberecd:NonPeoNeoMember2023-01-012023-12-310001293971ecd:ChngInFrValAsOfVstngDtOfPrrYrEqtyAwrdsVstdInCvrdYrMemberecd:NonPeoNeoMember2023-01-012023-12-310001293971ecd:FrValAsOfPrrYrEndOfEqtyAwrdsGrntdInPrrYrsFldVstngCondsDrngCvrdYrMemberecd:NonPeoNeoMember2023-01-012023-12-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

______________________________________________

SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

______________________________________________

Filed by the Registrant x Filed by a party other than the Registrant ¨

Check the appropriate box: | | | | | |

| ¨ | Preliminary Proxy Statement |

| |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| |

| x | Definitive Proxy Statement |

| |

| ¨ | Definitive Additional Materials |

| |

| ¨ | Soliciting Material under §240.14a-12 |

bluebird bio, Inc.

(Name of Registrant as Specified in its Charter)

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

Payment of Filing Fee (Check all boxes that apply): | | | | | | | | | | | | | | |

| x | | No fee required. |

| | |

| ¨ | | Fee paid previously with preliminary materials. |

| | | | |

| ¨ | | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | | | |

September 26, 2024

Dear Stockholder:

You are cordially invited to attend the 2024 Annual Meeting of Stockholders (the "Annual Meeting") of bluebird bio, Inc. The Annual Meeting will be held on November 6, 2024 at 8.30 a.m. EST at the offices of the Company, at 455 Grand Union Boulevard, Somerville, Massachusetts. As always, we encourage you to vote your shares prior to the Annual Meeting.

Details regarding admission to the Annual Meeting and the business to be conducted are more fully described in the accompanying Notice of Annual Meeting and Proxy Statement.

At this Annual Meeting, the agenda includes the election of three Class II directors for three-year terms ("Proposal 1"), the approval of named executive officer compensation by a non-binding advisory vote ("Proposal 2"), the approval of an amendment to our Amended and Restated Certificate of Incorporation, as amended (the "Amended and Restated Certificate of Incorporation") to provide for the exculpation of officers for certain breaches of fiduciary duty to the extent permitted by the General Corporation Law of the State of Delaware ("Proposal 3"), the approval of amendments to our Amended and Restated Certificate of Incorporation to effect a reverse stock split of our common stock at a ratio ranging from any whole number between 1-for-15 and 1-for-20, as determined by our Board of Directors in its discretion ("Proposal 4"), the approval of an amendment and restatement of our 2023 Incentive Award Plan to, among other things, increase the number of shares of our common stock authorized for issuance thereunder ("Proposal 5"), the ratification of the appointment of Ernst & Young LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2024 ("Proposal 6"), and the approval of an adjournment of the Annual Meeting, if necessary, to solicit additional proxies if there are not sufficient votes at the time of the Annual Meeting to approve Proposal 3, Proposal 4 and/or Proposal 5 ("Proposal 7").

Under Securities and Exchange Commission rules, we are providing access to the proxy materials for the Annual Meeting to stockholders via the Internet. Accordingly, you can access the proxy materials and vote at www.proxyvote.com. Instructions for accessing the proxy materials and voting are described below and in the Notice of Internet Availability of Proxy Materials that you received in the mail. Your vote is very important. Whether or not you plan to attend the Annual Meeting, please carefully review the enclosed proxy statement and then cast your vote, regardless of the number of shares you hold. If you are a stockholder of record, you may vote over the Internet, by telephone, or, if you request to receive a printed set of the proxy materials, by completing, signing, dating and mailing the accompanying proxy card in the return envelope. Submitting your vote via the Internet or by telephone or proxy card will not affect your right to vote at the Annual Meeting if you decide to attend the Annual Meeting. If your shares are held in street name (held for your account by a broker or other nominee), you will receive instructions from your broker or other nominee explaining how to vote your shares, and you will have the option to cast your vote by telephone or over the Internet if your voting instruction form from your broker or nominee includes instructions and a toll-free telephone number or Internet website to do so. In any event, to be sure that your vote will be received in time, please cast your vote by your choice of available means at your earliest convenience.

We hope that you will join us on November 6, 2024. Your continuing interest in bluebird is very much appreciated.

Sincerely,

Andrew Obenshain

President & Chief Executive Officer

NOTICE OF 2024 ANNUAL MEETING OF STOCKHOLDERS | | | | | |

| Date | November 6, 2024 |

| Time | 8:30 a.m. Eastern Time |

| Place | 455 Grand Union Boulevard, Somerville, Massachusetts 02145 |

| Record Date | September 16, 2024. Only stockholders of record at the close of business on the record date are entitled to receive notice of, and to vote at, the Annual Meeting. A complete list of such stockholders will be open to the examination of any stockholder for a period of ten days prior to the Annual Meeting for a purpose germane to the meeting by sending an email to investor@bluebirdbio.com, stating the purpose of the request and providing proof of ownership of Company stock. |

| Purpose | •To elect John O. Agwunobi, Elisabeth Leiderman and Andrew Obenshain as Class II members of the Board of Directors, to serve until the Company’s 2027 Annual Meeting of Stockholders and until their successors are duly elected and qualified ("Proposal 1"); |

| •To approve, on a non-binding, advisory basis, the compensation paid to the Company’s named executive officers ("Proposal 2"); |

| •To approve an amendment to the Company's Amended and Restated Certificate of Incorporation to provide for the exculpation of officers for certain breaches of fiduciary duty to the extent permitted by the General Corporation Law of the State of Delaware ("Proposal 3"); |

| •To approve amendments to the Company's Amended and Restated Certificate of Incorporation to effect a reverse stock split of our common stock at a ratio ranging from any whole number between 1-for-15 and 1-for-20, as determined by our Board of Directors in its discretion ("Proposal 4"); |

| •To approve an amendment and restatement of the Company's 2023 Incentive Award Plan to, among other things, increase the number of shares of our common stock authorized for issuance thereunder ("Proposal 5"); |

| •To ratify the selection of Ernst & Young LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2024 ("Proposal 6"); |

| •To approve an adjournment of the Annual Meeting, if necessary, to solicit additional proxies if there are not sufficient votes at the time of the Annual Meeting to approve Proposal 3, Proposal 4 and/or Proposal 5 ("Proposal 7"); and |

| •To transact any other business that may properly come before the meeting or any adjournment thereof. |

| Meeting Admission | All stockholders as of the record date, or their duly appointed proxies, may attend the Annual Meeting. If you attend, you will be asked to present valid picture identification such as a driver’s license or passport. If your bluebird stock is held in a brokerage account or by a bank or other nominee, you are considered the beneficial owner of shares held in street name, and this proxy statement is being forwarded to you by your broker or nominee. As a result, your name does not appear on our list of stockholders. If your stock is held in street name, in addition to picture identification, you should bring with you a letter or account statement showing that you were the beneficial owner of the stock on the record date, in order to be admitted to the Annual Meeting. |

| Proxy Voting | If you are a stockholder of record, please vote via the Internet or, for shares held in street name, please submit the voting instruction form you receive from your broker or nominee, as soon as possible so your shares can be voted at the Annual Meeting. You may submit your voting instruction form by mail. If you are a stockholder of record, you may also vote by telephone or by submitting a proxy card by mail. If your shares are held in street name, you will receive instructions from your broker or other nominee explaining how to vote your shares, and you may also have the choice of instructing the record holder as to the voting of your shares over the Internet or by telephone. Follow the instructions on the voting instruction form you received from your broker or nominee. |

| Corporate Headquarters | 455 Grand Union Boulevard, Somerville, Massachusetts 02145 |

By order of the Board of Directors,

Joseph Vittiglio

Chief Legal and Business Officer and Secretary

Somerville, Massachusetts

September 26, 2024

BLUEBIRD BIO, INC.

455 GRAND UNION BOULEVARD

SOMERVILLE, MASSACHUSETTS 02145

PROXY STATEMENT

FOR THE 2024 ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON NOVEMBER 6, 2024

AT 8:30 AM EST

GENERAL INFORMATION

When are this proxy statement and the accompanying materials scheduled to be sent to stockholders?

We have elected to provide access to our proxy materials to our stockholders via the Internet. Accordingly, on or about September 26, 2024, we will begin mailing a Notice of Internet Availability of Proxy Materials and the proxy materials, including the Notice of 2024 Annual Meeting of Stockholders, this proxy statement and accompanying proxy card or, for shares held in street name (held for your account by a broker or other nominee), voting instruction form, and the Annual Report on Form 10-K for the year ended December 31, 2023 (the "Annual Report") will be made available to stockholders on the Internet on the same date.

Why did I receive a Notice of Internet Availability of Proxy Materials instead of a full set of proxy materials?

Pursuant to rules adopted by the Securities and Exchange Commission (SEC), we are providing access to our proxy materials over the Internet rather than printing and mailing the proxy materials. We believe electronic delivery will expedite the receipt of materials and will help lower our costs and reduce the environmental impact of our annual meeting materials. Therefore, a Notice of Internet Availability will be mailed to holders of record and beneficial owners of our common stock starting on or around September 26, 2024. The Notice of Internet Availability will provide instructions as to how stockholders may access and review the proxy materials, including the Notice of Annual Meeting, proxy statement, proxy card and Annual Report, on the website referred to in the Notice of Internet Availability or, alternatively, how to request that a copy of the proxy materials, including a proxy card, be sent to them by mail. The Notice of Internet Availability will also provide voting instructions. In addition, stockholders of record may request to receive the proxy materials in printed form by mail or electronically by e-mail on an ongoing basis for future stockholder meetings. Please note that, while our proxy materials are available at the website referenced in the Notice of Internet Availability, and our Notice of Annual Meeting, proxy statement and Annual Report are available on our website, no other information contained on either website is incorporated by reference in or considered to be a part of this document.

| | |

Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting to Be Held on November 6, 2024 |

| The Notice of 2024 Annual Meeting of Stockholders, Proxy Statement and our Annual Report on Form 10-K for the fiscal year ended December 31, 2023, are available at investor.bluebirdbio.com. |

Who is soliciting my vote?

The Board of Directors of bluebird bio, Inc. is soliciting your vote for the 2024 Annual Meeting of Stockholders (the "Annual Meeting").

When is the record date for the Annual Meeting?

The Board has fixed the record date for the Annual Meeting as of the close of business on September 16, 2024.

How many votes can be cast by all stockholders?

A total of 193,913,585 shares of our common stock were outstanding on September 16, 2024, and entitled to be voted at the meeting. Each share of common stock is entitled to one vote on each matter.

How do I vote?

If you are a stockholder of record and your shares are registered directly in your name, you may vote:

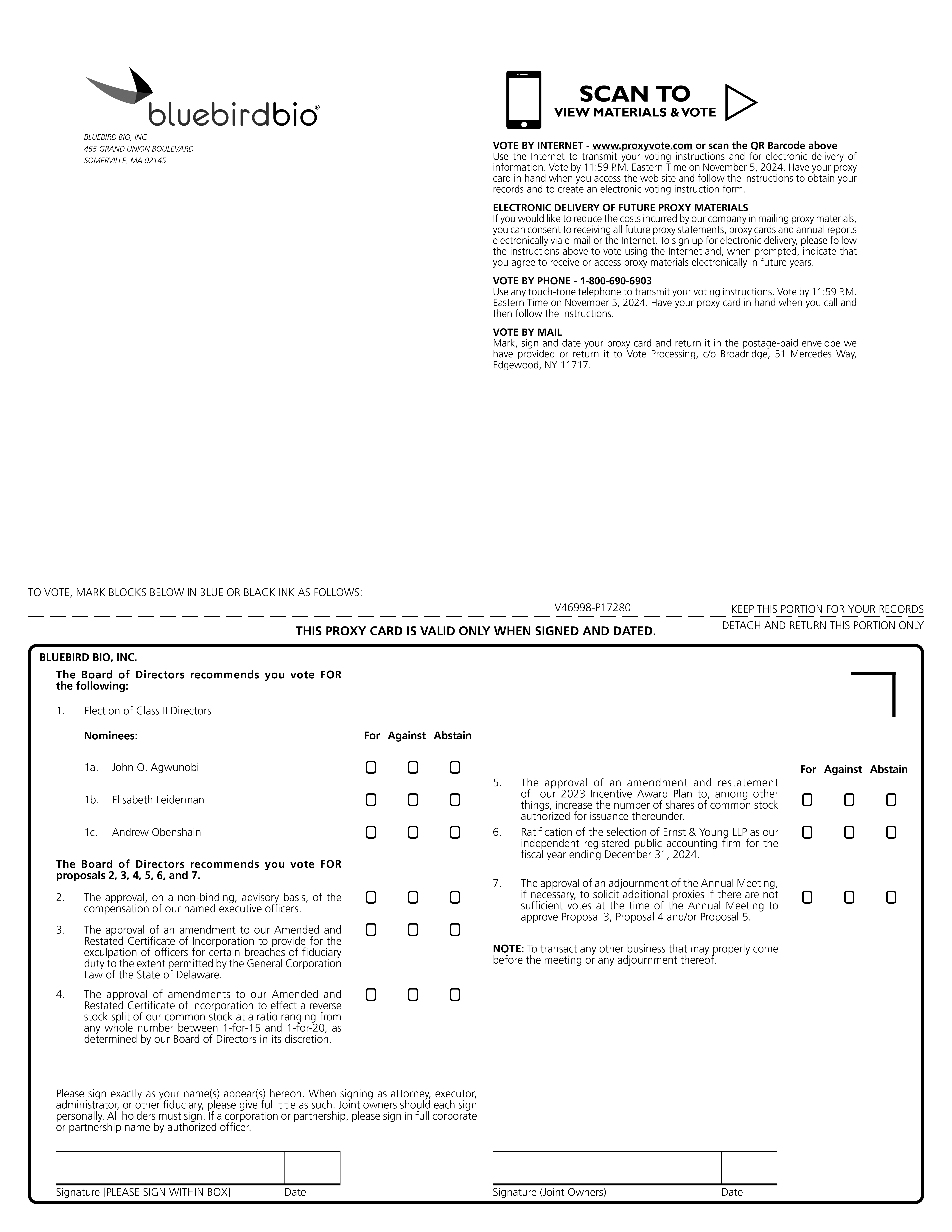

•By Internet. Access the website of our tabulator, Broadridge, at: www.proxyvote.com, using the voter control number printed on the furnished proxy card. Your shares will be voted in accordance with your instructions. You must specify how you want your shares voted or your Internet vote cannot be completed and you will receive an error message. If you vote on the Internet, you may also request electronic delivery of future proxy materials.

•By Telephone. Call 1-800-690-6903 toll-free from the U.S., U.S. territories and Canada, and follow the instructions on the enclosed proxy card. Your shares will be voted in accordance with your instructions. You must specify how you want your shares voted or your telephone vote cannot be completed.

•By Mail. Complete and mail a proxy card in the enclosed postage prepaid envelope to Broadridge. Your proxy will be voted in accordance with your instructions. If you sign and return the enclosed proxy but do not specify how you want your shares voted, they will be voted FOR the director nominees named herein to our Board, FOR the non-binding advisory resolution approving the compensation of the named executive officers, FOR the approval of the amendment to the Amended and Restated Certificate of Incorporation to provide for exculpation of officers for certain breaches of fiduciary duty to the extent permitted by the General Corporation Law of the State of Delaware, FOR the approval of amendments to the Amended and Restated Certificate of Incorporation to effect a reverse stock split of our common stock at a ratio ranging from any whole number between 1-for-15 and 1-for-20, as determined by our Board of Directors in its discretion, FOR the approval of the amendment and restatement of the 2023 Incentive Award Plan to, among other things, increase the number of shares of common stock authorized for issuance thereunder, FOR the ratification of Ernst & Young LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2023, and FOR the approval of an adjournment of the Annual Meeting, if necessary, to solicit additional proxies if there are not sufficient votes at the time of the Annual Meeting to approve Proposal 3, Proposal 4 and/or Proposal 5, and will be voted according to the discretion of the proxy holder upon any other business that may properly be brought before the meeting and at all adjournments and postponements thereof. If you are mailed or otherwise receive or obtain a proxy card or voting instruction form, and you choose to vote by telephone or by Internet, you do not have to return your proxy card or voting instruction form.

•In Person. If you are a stockholder of record, you may vote in person at the Annual Meeting.

Whether or not you plan to attend the meeting, we urge you to vote by proxy.

If your shares of common stock are held in street name (held for your account by a broker or other nominee), you will receive instructions on how to vote from your broker or other nominee. You must follow their instructions in order for your shares to be voted. Internet and telephone voting also may be offered to stockholders owning shares through certain banks and brokers. As a beneficial owner, you are invited to attend the Annual Meeting. However, since you are not a stockholder of record, you may not vote your shares in person at the Annual Meeting unless you request and obtain a legal proxy from the organization that holds your shares.

What are the Board’s recommendations on how to vote my shares?

Our Board recommends a vote:

Proposal 1: FOR the election of John O. Agwunobi, Elisabeth Leiderman and Andrew Obenshain as Class II directors (page 7)

Proposal 2: FOR the approval, on a non-binding, advisory basis, of the compensation of our named executive officers (page 22)

Proposal 3: FOR the approval of the amendment to our Amended and Restated Certificate of Incorporation to provide for the exculpation of officers for certain breaches of fiduciary duty to the extent permitted by the General Corporation Law of the State of Delaware (page 23)

Proposal 4: FOR the approval of amendments to our Amended and Restated Certificate of Incorporation to effect a reverse stock split of our common stock at a ratio ranging from any whole number between 1-for-15 and 1-for-20, as determined by our Board of Directors in its discretion (page 41)

Proposal 5: FOR the approval of the amendment and restatement of our 2023 Incentive Award Plan to, among other things, increase the number of shares of common stock authorized for issuance thereunder (page 50)

Proposal 6: FOR ratification of the selection of Ernst & Young LLP as our independent registered public accounting firm (page 61); and

Proposal 7: FOR the approval of an adjournment of the Annual Meeting, if necessary, to solicit additional proxies if there are not sufficient votes at the time of the Annual Meeting to approve Proposal 3, Proposal 4 and/or Proposal 5 (page 62)

Who pays the cost for soliciting proxies?

We will pay the cost for the solicitation of proxies by the Board. The solicitation of proxies will be made primarily by mail and through Internet access to materials. Proxies may also be solicited personally, by telephone, fax or e-mail by employees of bluebird without any remuneration to such individuals other than their regular compensation. We will also reimburse brokers, banks, custodians, other nominees and fiduciaries for forwarding these materials to their principals to obtain the authorization for the execution of proxies.

Will my shares be voted if I do not return my proxy?

If your shares are registered directly in your name, your shares will not be voted if you do not vote over the Internet, by telephone, by returning your proxy or by ballot at the Annual Meeting. If your shares are held in street name, your bank, broker or other nominee may under certain circumstances vote your shares if you do not timely return your proxy. Banks, brokers and other nominees can vote customers’ unvoted shares on routine matters, but cannot vote such shares on non-routine matters. If you do not timely return a proxy to your bank, broker or other nominee to vote your shares, your bank, broker or other nominee may, on routine matters, either vote your shares or leave your shares unvoted. Your bank, broker or other nominee cannot vote your shares on any non-routine matter. The election of directors (Proposal 1), the non-binding advisory vote to approve named executive officer compensation (Proposal 2), the approval of the amendment to our Amended and Restated Certificate of Incorporation to provide for the exculpation of officers for certain breaches of fiduciary duty to the extent permitted by the General Corporation Law of the State of Delaware (Proposal 3) and the approval of the amendment and restatement of our 2023 Incentive Award Plan to, among other things, increase the number of shares of common stock authorized for issuance thereunder (Proposal 5) are non-routine matters. The approval of amendments to our Amended and Restated Certification of Incorporation to effect a reverse stock split of our common stock at a ratio ranging from any whole number between 1-for-15 and 1-for-20, as determined by our Board of Directors in its discretion (Proposal 4), the ratification of the appointment of our independent registered public accounting firm (Proposal 6) and the approval of an adjournment of the Annual Meeting, if necessary, to solicit additional proxies if there are not sufficient votes at the time of the Annual Meeting to approve Proposal 3, 4 or 5 (Proposal 7) are routine matters. We encourage you to provide voting instructions to your bank, broker or other nominee by giving your proxy to them. This ensures that your shares will be voted at the Annual Meeting according to your instructions. You should receive directions from your bank, broker or other nominee about how to submit your proxy to them at the time you receive this proxy statement.

Can I change my vote?

You may revoke your proxy at any time before it is voted by notifying the Secretary in writing, by returning a signed proxy with a later date, by transmitting a subsequent vote over the Internet or by telephone prior to the close of the Internet voting facility or the telephone voting facility, or by attending the Annual Meeting and voting in person. If your stock is held in street name, you must contact your broker or nominee for instructions as to how to change your vote.

How is a quorum reached?

The presence, in person or by proxy, of holders of at least a majority of the total number of outstanding shares entitled to vote is necessary to constitute a quorum for the transaction of business at the Annual Meeting. Shares held of record by stockholders or brokers, bankers or other nominees who do not return a signed and dated proxy or attend the Annual Meeting in person will not be considered present or represented at the Annual Meeting and will not be counted in determining the presence of a quorum. Abstentions and broker non-votes, if any, will be counted for purposes of determining whether a quorum is present for the transaction of business at the meeting.

What vote is required to approve each item and how are votes counted?

Votes cast by proxy or in person at the Annual Meeting will be counted by the persons appointed by bluebird to act as tabulators for the meeting. A broker non-vote occurs when a nominee holding shares for a beneficial owner does not vote on a particular proposal because the nominee does not have discretionary voting power with respect to that item and has not received instructions from the beneficial owner.

Proposal 1 – Election of three Class II director nominees

For the election of the three Class II director nominees, each director nominee presented must be elected by a majority of the votes cast in person or by proxy at the Annual Meeting. Director nominees are elected by a majority vote for non-contested director elections. Because the number of director nominees properly nominated for the Annual Meeting does not exceed the number of positions on the Board to be filled by election at the Annual Meeting, this election of directors is non-contested. To elect a director nominee to the Board, the votes cast FOR the director nominee must exceed the votes cast AGAINST. Only FOR and AGAINST votes will affect the outcome. Abstentions will have no effect on the outcome of the vote on Proposal 1. Proposal 1 is a non-routine matter. Therefore, if your shares are held by your bank, broker or other nominee in street name and you do not vote your shares, your bank, broker or other nominee cannot vote your shares on Proposal 1. Shares held in street name by banks, brokers or nominees who indicate on their proxies that they do not have authority to vote the shares on Proposal 1 will not be counted as votes FOR or AGAINST any director nominee and will be treated as broker non-votes. As a result, broker non-votes will have no effect on the outcome of the vote on Proposal 1.

Proposal 2 – Non-binding advisory vote on named executive officer compensation

For the non-binding advisory vote on named executive officer compensation, the votes cast FOR must exceed the votes cast AGAINST to approve, on a non-binding advisory basis, the compensation of our named executive officers. Only FOR and AGAINST votes will affect the outcome. Abstentions will have no effect on the outcome of the vote on Proposal 2. Proposal 2 is a non-routine matter. Therefore, if your shares are held by your bank, broker or other nominee in street name and you do not vote your shares, your bank, broker or other nominee cannot vote your shares on Proposal 2. Shares held in street name by banks, brokers or nominees who indicate on their proxies that they do not have authority to vote the shares on Proposal 2 will not be counted as votes FOR or AGAINST the proposal and will be treated as broker non-votes. As a result, broker non-votes will have no effect on the outcome of the vote on Proposal 2.

Proposal 3 – Approval of the amendment to our Amended and Restated Certificate of Incorporation to provide for the exculpation of officers for certain breaches of fiduciary duty

For the approval of the amendment to our Amended and Restated Certificate of Incorporation to provide for the exculpation of officers for certain breaches of fiduciary duty to the extent permitted by the General Corporation Law of the State of Delaware, the holders of at least a majority of the outstanding shares of our common stock entitled to vote at the Annual Meeting must vote FOR this proposal. Proposal 3 is a non-routine matter. Therefore, if your shares are held by your bank, broker or other nominee in street name and you do not vote your shares, your bank, broker or other nominee cannot vote your shares on Proposal 3. Abstentions and broker non-votes will have the effect of votes AGAINST Proposal 3.

Proposal 4 – Approval of amendments to our Amended and Restated Certificate of Incorporation to effect a reverse stock split of our common stock at a ratio ranging from any whole number between 1-for-15 and 1-for-20, as determined by our Board of Directors in its discretion

For the approval of amendments to our Amended and Restated Certificate of Incorporation to effect a reverse stock split of our common stock at a ratio ranging from any whole number between 1-for-15 and 1-for-20, as determined by our Board of Directors in its discretion, the holders of at least a majority of the outstanding shares of our common stock entitled to vote at the Annual Meeting must vote FOR this proposal. Proposal 4 is a routine matter. Therefore, if your shares are held by your bank, broker or other nominee in street name and you do not vote your shares, your bank, broker or other nominee may vote your shares on Proposal 4. Therefore, we do not expect any broker non-votes with respect to this proposal. Abstentions will have the same effect as an AGAINST vote on Proposal 4.

Proposal 5 - Approval of the amendment and restatement of our 2023 Incentive Award Plan to, among other things, increase the number of shares of our common stock authorized for issuance thereunder.

For the approval of the amendment and restatement of our 2023 Incentive Award Plan, the votes cast FOR must exceed the votes cast AGAINST. Only FOR and AGAINST votes will affect the outcome. Abstentions will have no effect on the

outcome of the vote on Proposal 5. Proposal 5 is a non-routine matter. Therefore, if your shares are held by your bank, broker or other nominee in street name and you do not vote your shares, your bank, broker or other nominee cannot vote your shares on Proposal 5. Shares held in street name by banks, brokers or nominees who indicate on their proxies that they do not have authority to vote the shares on Proposal 5 will not be counted as votes FOR or AGAINST the proposal and will be treated as broker non-votes. As a result, broker non-votes will have no effect on the outcome of the vote on Proposal 5.

Proposal 6 – Ratification of selection of Ernst & Young LLP as our independent registered public accounting firm

For the ratification of the selection of Ernst & Young LLP as our independent registered public accounting firm for our 2024 fiscal year, the votes cast FOR must exceed the votes cast AGAINST. Only FOR and AGAINST votes will affect the outcome. Abstentions will have no effect on the outcome of Proposal 6. Proposal 6 is a routine matter. Therefore, if your shares are held by your bank, broker or other nominee in street name and you do not vote your shares, your bank, broker or other nominee may vote your shares on Proposal 6. Therefore, we do not expect any broker non-votes with respect to this proposal.

Proposal 7 – Approval of an adjournment of the Annual Meeting, if necessary, to solicit additional proxies if there are not sufficient votes at the time of the Annual Meeting to approve Proposal 3, Proposal 4 and/or Proposal 5

For the approval of an adjournment of the Annual Meeting, if necessary, to solicit additional proxies if there are not sufficient votes at the time of the Annual Meeting to approve Proposal 3, Proposal 4 and/or Proposal 5, the votes cast FOR must exceed the votes cast AGAINST. Only FOR and AGAINST votes will affect the outcome. Abstentions will have no effect on the voting of Proposal 7. Proposal 7 is a routine matter. Therefore, if your shares are held by your bank, broker or other nominee in street name and you do not vote your shares, your bank, broker or other nominee may vote your shares on Proposal 7. Therefore, we do not expect any broker non-votes with respect to this proposal.

If the Annual Meeting is adjourned or postponed for any purpose, at any subsequent reconvening of the meeting, your proxy will be voted in the same manner as it would have been voted at the original convening of the Annual Meeting unless you withdraw or revoke your proxy. Your proxy may be voted in this manner even though it may have been voted on the same or on any other matter at a previous session of the Annual Meeting.

Could other matters be decided at the Annual Meeting?

bluebird does not know of any other matters that may be presented for action at the Annual Meeting. Should any other business come before the meeting, the persons named on the enclosed proxy will have discretionary authority to vote the shares represented by such proxies in accordance with their best judgment. If you hold shares through a broker, bank or other nominee as described above, they will not be able to vote your shares on any other business that comes before the Annual Meeting unless they receive instructions from you with respect to such matter.

What happens if the meeting is postponed or adjourned?

Your proxy may be voted at the postponed or adjourned meeting. You will still be able to change your proxy until it is voted.

How can I find out the results of the voting at the Annual Meeting?

Preliminary voting results will be announced at the Annual Meeting. Final voting results will be published in a Current Report on Form 8-K that we expect to file with the SEC within four business days after the Annual Meeting. If final voting results are not available to us in time to file a Form 8-K within four business days after the Annual Meeting, we intend to file a Form 8-K to publish preliminary results and, within four business days after the final results are known to us, file an amended Form 8-K to publish the final results.

What does it mean if I receive more than one proxy card or voting instruction form?

It means that you have multiple accounts at the transfer agent or with brokers. Please complete and return all proxy cards or voting instruction forms to ensure that all of your shares are voted.

Who should I call if I have any additional questions?

If you hold your shares directly, please call Joseph Vittiglio, Secretary of the Company, at (339) 499-9300. If your shares are held in street name, please contact the telephone number provided on your voting instruction form or contact your broker or nominee holder directly.

PROPOSAL 1

ELECTION OF DIRECTORS

In accordance with Delaware law and our certificate of incorporation and By-laws, our Board is divided into three classes of approximately equal size. The members of each class are elected to serve a three-year term with the term of office of each class ending in successive years. John O. Agwunobi, Elisabeth Leiderman and Andrew Obenshain are the Class II directors whose terms expire at this Annual Meeting. Each of John O. Agwunobi, Elisabeth Leiderman and Andrew Obenshain has been nominated for and has agreed to stand for re-election to the Board to serve as a Class II director of the Company until the 2027 Annual Meeting and until his or her successor is duly elected and qualified.

Our By-laws provide for a majority voting standard for the election of directors in uncontested elections, which provides that to be elected, a director nominee must receive a greater number of votes FOR his or her election than votes AGAINST such election. The number of votes cast with respect to that director’s election excludes abstentions and broker non-votes with respect to that director’s election. In contested elections where the number of director nominees exceeds the number of directors to be elected, the voting standard will be a plurality of the shares present in person or by proxy and entitled to vote. In an uncontested election, if a director nominee who already serves as a director is not elected and no successor is elected, the resignation policy in our Corporate Governance Guidelines provides that such director will offer to tender his or her resignation to the Board. Our Nominating and Corporate Governance Committee will make a recommendation to the Board on whether to accept or reject the resignation, or whether to take some other action. The Board will act on the Nominating and Corporate Governance Committee’s recommendation and publicly disclose its decision within 90 days from the date of the certification of the election results.

It is intended that, unless you give contrary instructions, shares represented by proxies solicited by the Board will be voted for the election of the two director nominees listed below. We have no reason to believe that any director nominee will be unable to serve, or for good cause will not serve, if elected at the Annual Meeting. In the event that one or more director nominees is unexpectedly unable to serve, or for good cause will not serve, proxies may be voted for another person designated as a substitute nominee by the Board, or the Board may reduce its size. Information relating to each director nominee and for each continuing director, including his or her period of service as a director of bluebird, principal occupation and other biographical material is shown below. Pursuant to the By-laws, the Board has fixed the number of directors at nine as of the date of the Annual Meeting, and we have one vacancy. Vacancies on the Board are filled exclusively by the affirmative vote of a majority of the remaining directors, even if less than a quorum is present, and not by the stockholders. Your proxy cannot be voted for a greater number of persons than the number of director nominees named in this proxy statement.

THE BOARD UNANIMOUSLY RECOMMENDS THAT YOU VOTE

FOR

EACH OF THE FOLLOWING DIRECTOR NOMINEES FOR CLASS II DIRECTOR:

JOHN O. AGWUNOBI

ELISABETH LEIDERMAN

ANDREW OBENSHAIN

(PROPOSAL 1 ON YOUR PROXY CARD)

CORPORATE GOVERNANCE

Board Composition

We currently have eight directors and the terms of office of the directors are divided into three classes: | | | | | | | | |

| Class I | Term expiring 2026 |

| Class II | Current term expiring 2024, if elected, subsequent term expiring 2027 |

| Class III | Term expiring 2025 |

At each Annual Meeting, the successors to directors whose terms will then expire shall serve from the time of election and qualification until the third Annual Meeting following election and until their successors are duly elected and qualified. A resolution of the Board may change the authorized number of directors. Any additional directorships resulting from an increase in the number of directors will be distributed among the three classes so that, as nearly as possible, each class will consist of one-third of the directors. This classification of the Board may have the effect of delaying or preventing changes in control or management of our company.

Our directors as of September 16, 2024 are as set forth below.

CLASS II DIRECTOR NOMINEES:

| | | | | | | | | | | |

| John O. Agwunobi, M.D. | |

| Other Current Board Experience: | | Previous Board Experience within the Last Five Years: |

| Ensign Group Inc. (ENSG) | | Herbalife Nutrition Inc. (HLF) | |

| U.S. African Development Foundation (USADF) | Magellan Health Inc. (MGLN) | |

| The Akkermansia Company (private) | | | |

| Professional Highlights: | | | |

Dr. Agwunobi was Chief Executive Officer and Chairman of the Board of Herbalife Nutrition Inc. from 2020 to 2022. Previously, Dr. Agwunobi served as Co-President of Herbalife from May 2018 to 2020. He also served as Chief Health and Nutrition Officer at Herbalife, responsible for training, education, science strategy and product development from 2016 to 2018. Prior to joining Herbalife, Dr. Agwunobi was an independent consultant, advising a number of privately-held health-related companies, including serving as an advisory board member of Shopko Stores Operating Co., LLC on behalf of the private equity firm Sun Capital Partners. From September 2007 to April 2014, Dr. Agwunobi served as Senior Vice President and President of Health and Wellness for Wal-Mart (NYSE: WMT) in the United States where he grew the business and provided insight and advice on the company’s health reform position. From December 2005 to September 2007, he served as the Assistant Secretary of Health for the U.S. Department of Health and Human Services, where he was responsible for disease prevention and health promotion. His responsibilities included the oversight of the Centers for Disease Control, National Institute of Health, the U.S. Food and Drug Administration, the Office of the U.S. Surgeon General, and numerous other public health offices and programs. Dr. Agwunobi also serves on the Board of the Ensign Group, Inc. and the Board of the U.S. African Development Foundation. |

| Key Qualifications and Expertise: |

| Dr. Agwunobi has significant experience as a senior executive and board member in the health and wellness field. In addition, he has deep expertise in public health programs and governmental agencies relevant to the healthcare industry, from his prior service and experience with the public sector. The insights he has developed from these roles provides our Board with important perspectives on the issues facing our company. |

| | | | | | | | | | | |

| Elisabeth Leiderman, M.D. |

| Other Current Board Experience: | | Previous Board Experience within the Last Five Years: |

| Autolus Therapeutics (AUTL) | | None | |

| Professional Highlights: | | | |

Since June 2024, Dr. Leiderman has served as Chief Financial Officer and Corporate Development Officer at Dewpoint Therapeutics, a biotechnology company applying biomolecular condensates to drug discovery. From November 2022 to November 2023, Dr. Leiderman served as Chief Financial Officer and Chief Business Officer at Atsena Therapeutics, a clinical-stage gene therapy company. Before joining Atsena, from September 2020 to October 2022, Dr. Leiderman was Chief Financial Officer and Head of Corporate Development at Decibel Therapeutics, a clinical stage biotechnology company developing novel gene therapeutics for restoration of hearing loss and balance disorders. From January 2020 to August 2020, Dr. Leiderman served as Chief Business Officer for Complexa, Inc., a clinical stage biopharmaceutical company focused on life-threatening fibrosis and inflammatory diseases. Prior to Complexa, Dr. Leiderman was Senior Vice President, Head of Corporate Development at Fortress Biotech from November 2016 to November 2019. Earlier in her career from 2007 to 2016, Dr. Leiderman developed her transaction and capital markets expertise in the healthcare investment banking groups at Nomura, Credit Suisse, Jefferies and UBS. Dr. Leiderman began her career in medical affairs at AstraZeneca, where she analyzed product and industry trends related to the central nervous system. Since December 2023, Dr. Leiderman has served on the Board of Directors of Autolus Therapeutics and is a member of the Audit Committee. Dr. Leiderman earned an M.D. from the American Medical Program at Tel Aviv University, an M.B.A. from The Wharton School at the University of Pennsylvania and a B.A. from The University of Pennsylvania. |

| Key Qualifications and Expertise: |

| Dr. Leiderman has over 20 years of experience in finance, strategy and business development in the life sciences industry. She is an "audit committee financial expert" with particular experience in matters faced by the audit committee of a life sciences company. |

| | | | | | | | | | | |

| Andrew Obenshain |

| Other Current Board Experience: | | Previous Board Experience within the Last Five Years: |

| Biotechnology Innovation Organization (BIO) (private) | None | |

| Professional Highlights: | | | |

Since November 2021, Mr. Obenshain has served as bluebird's President and Chief Executive Officer. Mr. Obenshain previously served as bluebird's President, Severe Genetic Diseases from August 2020 to November 2021, and as bluebird's Senior Vice President, Head of Europe from 2016 to August 2020. Prior to that, from September 2015 to September 2016, Mr. Obenshain was the general manager of France and Benelux at Shire Pharmaceuticals, Inc. and from 2007 to 2015, he held roles of increasing responsibility at Genzyme/Sanofi. Mr. Obenshain received his M.B.A. from Northwestern University's Kellogg School of Management, and his B.A. in genetics, cell and developmental biology from Dartmouth College. |

| Key Qualifications and Expertise: |

| Mr. Obenshain has deep operating and historical experience with our Company gained from serving as our President, Chief Executive Officer and in other roles. Mr. Obenshain also has significant management experience in the biotechnology and pharmaceutical fields. |

CONTINUING DIRECTORS:

| | | | | | | | | | | |

| Charlotte Jones-Burton, M.D., M.S. |

| Other Current Board Experience: | | Previous Board Experience within the Last Five Years: |

| American Kidney Fund (private) | | None | |

| Women of Color in Pharma (private) | | | |

| Professional Highlights: | | | |

Since May 2024, Dr. Jones-Burton has been Director and Head of Life Science Product Development and Strategy at 2Flo Ventures, an emerging venture capital firm and startup studio focused on the discovery, development, and commercialization of healthcare solutions. From January 2022 to November 2023, Dr. Jones-Burton served as Senior Vice President, Product Development and Strategy at Chinook Therapeutics, a clinical-stage biotechnology company discovering, developing and commercializing precision medicines for rare, severe kidney diseases. Prior to her role at Chinook Therapeutics she was VP, Global Clinical Development Head, Nephrology at Otsuka Pharmaceutical Development & Commercialization, Inc. from September 2019 to December 2021. From October 2016 until September 2019, Dr. Jones-Burton held various positions at Bristol-Myers Squibb Company with increasing responsibilities, most recently as Executive Director, Full Development Team Leader of Cardiovascular, Anti-Thrombosis. Prior to that, Dr. Jones-Burton was with Merck & Co. from 2007 to May 2011. With more than 20 years of experience as a clinical development leader, internal medicine and nephrology physician and academician, Dr. Jones-Burton is dedicated to creating healthier communities through drug development, patient advocacy and people engagement. Dr. Jones-Burton is also active in numerous professional associations and organizations and founded Women of Color in Pharma (WOCIP), a non-profit professional society focused women of color in the pharmaceutical industry. Dr. Jones-Burton earned a medical degree and Master of Science degree in Epidemiology and Preventive Medicine, with a concentration in Clinical Research, from the University of Maryland School of Medicine. Dr. Jones-Burton's postgraduate training included an internal medicine residency and a nephrology fellowship at the University of Maryland Medical Systems. |

| Key Qualifications and Expertise: |

Dr. Jones-Burton has extensive experience as an executive in the pharmaceutical industry in drug development, physician and patient engagement and advocacy. The insights she has developed in her work, together with her involvement in professional service organizations, also provide her with important perspectives on the issues facing our company in the development and potential commercialization of our therapies, as well as matters of diversity, equity and inclusion. |

| | | | | | | | | | | |

| Michael Cloonan |

| Other Current Board Experience: | | Previous Board Experience within the Last Five Years: |

| Sionna Therapeutics (private) | | Certego Therapeutics (private) | |

| Professional Highlights: | | | |

Since May 2021, Mr. Cloonan has served as President and Chief Executive Officer of Sionna Therapeutics, where he leads company strategy and operations. From May 2017 to April 2021, Mr. Cloonan served as Chief Operating Officer at Sage Therapeutics, where he led all business functions (commercial, medical affairs, government affairs, business development, technical operations, strategy and program management) as well as general and administrative functions. Prior to Sage, Mr. Cloonan served in various business and commercial roles at Biogen for fourteen years, including most recently as Senior Vice President, U.S. Commercial, where he was the general manager of the multi-billion-dollar multiple sclerosis, hemophilia, and spinal muscular atrophy franchises. Prior to Biogen, Mr. Cloonan worked at Bain & Company as a consultant specializing in healthcare. Mr. Cloonan earned his M.B.A. from the Darden Graduate School of Business Administration at the University of Virginia and a B.A. from College of the Holy Cross. |

| Key Qualifications and Expertise: |

Mr. Cloonan has extensive operating experience gained from serving as President and Chief Executive Officer at Sionna and leadership roles at Sage and Biogen. |

| | | | | | | | | | | |

| Nick Leschly | | | |

| Other Current Board Experience: | | Previous Board Experience within the Last Five Years: |

| Synlogic, Inc. (SYBX) | | Proclara Biosciences, Inc. (private) | |

| 2seventy bio, Inc. (TSVT) | | | |

| Biotechnology Innovation Organization (BIO) (private) | | |

| Professional Highlights: | | | |

Mr. Leschly is Chairman of the Board of 2seventy bio, Inc., a cell and gene therapy company, and from November 2021 to March 2024, Mr. Leschly served as its Chief Executive Officer. Mr. Leschly previously served as bluebird's President and Chief Executive Officer from October 2010 to November 2021. Formerly a partner of Third Rock Ventures, L.P. since its founding in 2007 until 2010, Mr. Leschly played an integral role in the overall formation, development and business strategy of several of Third Rock’s portfolio companies, including Agios Pharmaceuticals, Inc. and Edimer Pharmaceuticals, Inc. Prior to joining Third Rock, he worked at Millennium Pharmaceuticals, Inc. (now a subsidiary of Takeda), leading several early-stage drug development programs and served as the product and alliance leader for VELCADE. Mr. Leschly also founded and served as Chief Executive Officer of MedXtend Corporation. He received his B.S. in molecular biology from Princeton University and his M.B.A. from The Wharton School of the University of Pennsylvania. |

| Key Qualifications and Expertise: |

Mr. Leschly has deep operating and historical experience with our Company gained from serving as our President, Chief Executive Officer and member of the Board. In addition, Mr. Leschly also has significant experience in the venture capital industry and drug research and development. |

| | | | | | | | | | | |

| Richard Paulson |

| Other Current Board Experience: | | Previous Board Experience within the Last Five Years: |

| Karyopharm Therapeutics, Inc. (KPTI) | None | |

| Sequent AG (private) | | | |

| Professional Highlights: | | | |

| Since 2021, Mr. Paulson has been President, Chief Executive Officer and Director at Karyopharm Therapeutics, a commercial-stage pharmaceutical company. Previously, Mr. Paulson was Executive Vice President of Ipsen Pharmaceuticals and Chief Executive Officer of Ipsen North America from 2018 to 2021 where he focused on innovative therapies and specialty care for oncology, neuroscience and rare diseases. Before joining Ipsen, Mr. Paulson work at Amgen for 10 years holding various leadership positions across Europe and North America. Mr. Paulson received his M.B.A. from the University of Toronto and his B.Com in marketing and finance from the University of Saskatchewan. |

| Key Qualifications and Expertise: |

| Mr. Paulson has deep operating experience gained from serving as President, Chief Executive Officer and Director at Karyopharm and leadership roles at Ipsen and Amgen. Mr. Paulson also has significant experience in sales, marketing, and market access in the biotechnology and pharmaceutical fields. |

| | | | | | | | | | | |

| Najoh Tita-Reid | |

| Other Current Board Experience: | | Previous Board Experience within the Last Five Years: |

| CMI Marketing, Inc. (private) | | None | |

| Professional Highlights: | | | |

Since November 2023, Ms. Tita-Reid has served as Chief Brand and Experience Officer at Mars Petcare, to lead brand, experience, digitalization and technology to drive business transformation. From April 2021 to October 2023, Ms. Tita-Reid served as Global Chief Marketing Officer for Logitech, a global manufacturer of computer peripherals, software and services, where she led the global marketing function. Prior to this role, Ms. Tita-Reid served as Global Commercial Marketing Head from June 2020 to March 2021 and on the Global Marketing Reinvention team from February 2020 to May 2020 at Logitech. Previously, Ms. Tita-Reid served as Global Chief Marketing Officer and Executive Board Member for Hero-AG, a family-run healthy food company, from August 2017 to January 2020. In this role, she developed the organization’s marketing function and brand strategy and built the first global innovation pipeline while overseeing the R&D, innovation, sustainability and quality functions. Prior to Hero-AG, Ms. Tita-Reid held leadership positions at Bayer PLC, where she served as Vice President-Country Division Head for Consumer Care in the UK and Ireland from 2014 to 2017 and Merck & Co, Inc., where she served in various roles from 2011 to 2014, including General Manager for Western Europe from 2013 to 2014. Earlier in her career, Ms. Tita-Reid spent 19 years at Procter & Gamble, where she managed a number of consumer brands in the baby and feminine care categories, spearheaded multi-cultural marketing strategy across 15 billion-dollar brands, and led the multi-brand business unit for Hispanic and African American consumers. During her tenure, Ms. Tita-Reid trained and developed the P&G marketing function on ethnic marketing, and created breakthrough marketing strategies. Ms. Tita-Reid graduated with a Bachelor of Arts from Spelman College and holds an M.B.A. from Fuqua School of Business at Duke University. |

| Key Qualifications and Expertise: |

Ms. Tita-Reid has extensive experience as a multi-faceted executive with global marketing expertise, she has a record of strategic and operational ingenuity and transformation across complex organizations and a breadth of experience across the US and Europe. |

| | | | | | | | | | | |

| Mark Vachon (Chair of the Board) | | | |

| Other Current Board Experience: | | Previous Board Experience within the Last Five Years: |

| Beacon Mobility (private) | | Charitable Health and Retirement Trust (private) |

| Clergy Trust of Boston (private) | | Klöckner Pentaplast Group (private) | |

| Panoramic Health (private) | | Numotion (private) | |

| Professional Highlights: | | | |

Mr. Vachon served as President and Executive Vice President at Change Healthcare Holdings, Inc. from November 2016 to April 2018. For over 30 years, Mr. Vachon held a variety of leadership positions across the General Electric organization, and was a company officer beginning in 1999 and a member of GE’s Corporate Executive Council. Mr. Vachon was President and CEO of GE Healthcare Americas from 2009 to 2010, and prior to that he was President and CEO of Global Diagnostics Imaging, GE Healthcare, between 2006 and 2009. Between 2003 and 2006, Mr. Vachon was Executive Vice President and CFO of GE Healthcare. Mr. Vachon holds a B.S. in Finance from Northeastern University and an M.A. from Boston College. |

| Key Qualifications and Expertise: | | | |

Mr. Vachon's corporate leadership experience and financial expertise make him a valuable contributor to our Board. In addition, Mr. Vachon has extensive experience in executive operating roles and in the healthcare field on a global basis. He is an "audit committee financial expert" with particular experience in matters faced by the audit committee of a life sciences company. |

Identifying and Evaluating Director Nominees

Our Board is responsible for selecting its own members. The Board delegates the selection and nomination process to the Nominating and Corporate Governance Committee, with the expectation that other members of the Board, and of management, will be requested to take part in the process as appropriate.

Generally, our Nominating and Corporate Governance Committee identifies candidates for director nominees in consultation with management, through the use of search firms or other advisors, and through the recommendations submitted by stockholders or through such other methods as the Nominating and Corporate Governance Committee deems to be helpful in identifying candidates. Once candidates have been identified, our Nominating and Corporate Governance

Committee confirms that the candidates meet all of the minimum qualifications for director nominees established by the Nominating and Corporate Governance Committee. The Nominating and Corporate Governance Committee may gather information about the candidates through interviews, detailed questionnaires, background checks or any other means that the Nominating and Corporate Governance Committee deems to be appropriate in the evaluation process. The Nominating and Corporate Governance Committee then meets as a group to discuss and evaluate the qualities and skills of each candidate, both on an individual basis and taking into account the overall composition and needs of our Board. Based on the results of the evaluation process, the Nominating and Corporate Governance Committee recommends candidates for the Board’s approval as director nominees for election to the Board. Elisabeth Leiderman, one of our Class II directors, was recommended by a third-party search firm.

Director Qualifications and Diversity

Our Nominating and Corporate Governance Committee will consider, among other things, the following qualifications, skills and attributes when recommending candidates for the Board’s selection as director nominees for the Board and as candidates for appointment to the Board’s committees: a director nominee shall have the highest personal and professional integrity, shall have demonstrated exceptional ability and judgment, and shall be effective, in conjunction with the other director nominees to the Board, in collectively serving the long-term interests of the stockholders.

In evaluating proposed director candidates, our Nominating and Corporate Governance Committee may consider, in addition to the minimum qualifications and other criteria for board membership approved by the Board from time to time, all facts and circumstances that it deems appropriate or advisable, including, among other things, diversity considerations, the skills of the proposed director candidate, his or her depth and breadth of professional experience or other background characteristics, his or her independence, and the needs of the Board. While we do not have a formal policy with respect to diversity, our Nominating and Corporate Governance Committee believes that it is essential that the members of the Board represent diverse viewpoints. Our Nominating and Corporate Governance Committee believes that the backgrounds and qualifications of our directors, considered as a group, should provide a composite mix of experience, knowledge and abilities that will allow our Board to promote our strategic objectives and fulfill its responsibilities to our stockholders, and considers diversity of gender, race, national origin, education, professional experience, and differences in viewpoints and skills when evaluating proposed director candidates.

Our Nominating and Corporate Governance Committee’s priority in selecting directors is identification of persons who will further the interests of our Company through his or her established record of professional accomplishment, the ability to contribute positively to the collaborative culture among directors, and professional and personal experiences and expertise relevant to our growth strategy. The Nominating and Corporate Governance Committee will consider candidates recommended by stockholders. The policy adopted by the Nominating and Corporate Governance Committee provides that candidates recommended by stockholders are given appropriate consideration in the same manner as other candidates.

The expertise and experience, characteristics and committee assignments for each of our directors are summarized in the table below: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Director Nominees | Continuing Directors |

| Agwunobi | Leiderman | Obenshain | Cloonan | Jones-Burton | Leschly | Paulson | Tita-Reid | Vachon |

| Expertise & Experience | | | | | | | | | |

| Public Company Experience | ü | ü | ü | ü | ü | ü | ü | ü | ü |

| International Business Experience | | ü | ü | ü | ü | ü | ü | ü | ü |

| Corporate Governance Experience | ü | ü | ü | ü | ü | ü | ü | ü | ü |

| Capital Allocation / Corporate Financing Experience | ü | ü | ü | ü | | ü | ü | ü | ü |

| Financial Literacy / Expertise | ü | ü | ü | ü | ü | ü | ü | ü | ü |

| Information Services & Technology Experience | ü | ü | | ü | ü | | ü | ü | ü |

| Legal / Regulatory / Public Policy Experience | ü | | | ü | ü | ü | ü | ü | ü |

| Marketing / Sales / Business Development Experience | ü | ü | ü | ü | | ü | ü | ü | ü |

| Risk Management Experience | ü | ü | ü | ü | ü | ü | ü | ü | ü |

| Strategic Planning Experience | ü | ü | ü | ü | ü | ü | ü | ü | ü |

| Human Resource, Executive Compensation, and Talent Management Experience | ü | ü | | ü | ü | ü | ü | ü | ü |

| Senior Leadership Experience | ü | ü | ü | ü | | ü | ü | ü | ü |

| Cybersecurity / Data Privacy | ü | ü | | ü | | | ü | ü | ü |

| ESG and Climate Risks | ü | ü | | ü | | | ü | ü | ü |

| Industry Experience | ü | ü | ü | ü | ü | ü | ü | ü | ü |

| Shareholder Advocacy | ü | ü | ü | ü | ü | ü | ü | ü | ü |

| Director Characteristics | | | | | | | | | |

| Independence | ü | ü | | ü | ü | | ü | ü | ü |

| Term expiring | 2024 | 2024 | 2024 | 2026 | 2026 | 2025 | 2025 | 2025 | 2026 |

| Age | 59 | 47 | 50 | 53 | 51 | 52 | 57 | 51 | 65 |

| Director Since | 2017 | 2021 | 2021 | 2024 | 2022 | 2010 | 2023 | 2021 | 2014 |

| Gender | M | F | M | M | F | M | M | F | M |

| Ethnic or Racial Diversity | ü | | | | ü | | | ü | |

| Committee Composition | | | | | | | | | |

| Audit Committee | ü | Chair | | | | | | | ü |

| Compensation Committee | | ü | | | | | | ü | Chair |

| Nominating & Corporate Governance Committee | Chair | | | | ü | | | ü | |

The following Board Diversity Matrix presents our Board diversity statistics in accordance with Nasdaq Rule 5606, as self-disclosed by our directors.

| | | | | | | | | | | | | | |

Board Diversity Matrix as of September 26, 2024 |

| Part I: Gender Identity | Female | Male | Non-Binary | Did Not Disclose Gender |

| Directors (9 total) | 3 | 6 | - | - |

| Part II: Demographic Background | Female | Male | Non-Binary | Did Not Disclose Gender |

| African American or Black | 2 | 1 | - | - |

| Alaskan Native or Native American | - | - | - | - |

| Asian | - | - | - | - |

| Hispanic or Latinx | - | - | - | - |

| Native Hawaiian or Pacific Islander | - | - | - | - |

| White | 1 | 5 | - | - |

| Two or More Races or Ethnicities | - | - | - | - |

| LGBTQ+ | - |

| Did Not Disclose Demographic Background | - |

Board Independence

Our Board has determined, upon the recommendation of our Nominating and Corporate Governance Committee, that each of our directors, other than Andrew Obenshain who serves as our President and Chief Executive Officer, and Nick Leschly, who served as our President and Chief Executive Officer from October 2010 to November 2021, has no relationship that would interfere with the exercise of independent judgment in carrying out the responsibilities of a director and is independent within the meaning of the director independence standards of the Nasdaq Stock Market rules. At least annually, our Board evaluates all relationships between us and each director in light of relevant facts and circumstances for the purposes of determining whether a relationship exists that would interfere with the exercise of independent judgment in carrying out the responsibilities of a director. Based on this evaluation, our Board makes an annual determination of whether each director is independent within the meaning of Nasdaq, and the SEC independence standards.

Board Meetings and Attendance

Our Board held four meetings during the fiscal year ended December 31, 2023. In the fiscal year ended December 31, 2023, each of our directors attended at least 75% of the meetings of the Board and the committees of the Board, in the period for which he or she served.

We encourage our directors to attend the Annual Meeting of Stockholders. Of the eight members of our Board at the time of last year’s Annual Meeting, six attended the meeting.

Board Committees

Our Board has established three standing committees: the Audit Committee, the Compensation Committee and the Nominating and Corporate Governance Committee, each of which is comprised solely of independent directors, and is described more fully below. Each of the Audit Committee, Compensation Committee and Nominating and Corporate Governance Committee operates pursuant to a written charter and each committee reviews and assesses the adequacy of its charter and submits its charter to the Board for approval on an annual basis. The charters for the Audit Committee, Compensation Committee and Nominating and Corporate Governance Committee are all available on our website www.bluebirdbio.com in the Investors & Media—Corporate Governance section. Our Board establishes additional committees from time to time.

Audit Committee

Our Audit Committee is currently composed of Dr. Agwunobi, Dr. Leiderman and Mr. Vachon, with Dr. Leiderman serving as chair of the committee. Our Board has determined that each member of the Audit Committee meets the independence requirements of Rule 10A-3 under the Securities Exchange Act of 1934, as amended, and the applicable listing standards of Nasdaq. Our Board has determined that Dr. Leiderman and Mr. Vachon are “audit committee financial experts” within the meaning of the SEC regulations and applicable listing standards of Nasdaq. During the fiscal year ended December 31, 2023, the Audit Committee met five times. The report of the Audit Committee is included in this Proxy Statement under Report of the Audit Committee. The Audit Committee’s responsibilities include:

•appointing, approving the compensation of, and assessing the independence of our independent registered public accounting firm;

•approving audit and permissible non-audit services, and the terms of such services, to be provided by our independent registered public accounting firm;

•reviewing the audit plan (both internal and external) with the independent registered public accounting firm and members of management responsible for performing our internal audit and preparing our financial statements;

•reviewing and discussing with management and the independent registered public accounting firm our annual and quarterly financial statements and related disclosures, including critical audit matters as well as critical accounting policies and practices used by us;

•reviewing the adequacy of our internal control over financial reporting;

•overseeing the qualifications, independence and performance of our internal audit function;

•establishing policies and procedures for the receipt and retention of accounting-related complaints and concerns;

•recommending, based upon the Audit Committee’s review and discussions with management and the independent registered public accounting firm, whether our audited financial statements shall be included in our Annual Report on Form 10-K;

•monitoring the integrity of our financial statements and our compliance with legal and regulatory requirements as they relate to our financial statements and accounting matters;

•preparing the Audit Committee report required by the rules of the SEC to be included in our annual proxy statement;

•reviewing all related party transactions for potential conflict of interest situations and approving all such transactions;

•monitoring compliance with our investment policy;

•monitoring information security matters and risks, including those regarding data privacy and cybersecurity;

•overseeing our enterprise risk assessment program; and

•reviewing quarterly earnings releases.

Compensation Committee

Our Compensation Committee is currently composed of Dr. Leiderman, Ms. Tita-Reid and Mr. Vachon, with Mr. Vachon serving as chair of the committee. Our Board has determined each member of the Compensation Committee is “independent” as defined under the applicable listing standards of Nasdaq. In addition, each member qualifies as a non-employee director, as defined in Rule 16b-3 of the Securities Exchange Act. During the fiscal year ended December 31, 2023, the Compensation Committee met four times. The Compensation Committee’s responsibilities include, as applicable:

•reviewing and approving corporate goals and objectives relevant to the compensation of our Chief Executive Officer;

•evaluating the performance of our Chief Executive Officer in light of such corporate goals and objectives and determining the compensation of our Chief Executive Officer;

•reviewing and approving the compensation of our other executive officers and certain other members of senior management;

•appointing, compensating and overseeing the work of any compensation consultant, legal counsel or other advisor retained by the Compensation Committee;

•conducting the independence assessment outlined in Nasdaq rules with respect to any compensation consultant, legal counsel or other advisor retained by the Compensation Committee;

•annually reviewing and reassessing the adequacy of the committee charter in its compliance with the listing requirements of Nasdaq;

•reviewing and establishing our overall management compensation, philosophy and policy, including practices regarding competitive pay opportunity and program design;

•overseeing and administering our compensation and similar plans;

•reviewing and approving our policies and procedures for the grant of equity-based awards;

•reviewing and making recommendations to the Board with respect to director compensation;

•reviewing and discussing with management the compensation discussion and analysis to be included in our annual proxy statement or Annual Report on Form 10-K;

•reviewing and discussing with the Board corporate succession plans for our Chief Executive Officer and other key executives;

•overseeing the application of our policies for clawback or recoupment of incentive compensation;

•overseeing our strategies, policies and practices with respect to human capital management, diversity, equity, inclusion; and

•overseeing the management of risks relating to our compensation policies and programs.

Historically, our Compensation Committee has made most of the significant adjustments to annual compensation, determined cash incentive and equity awards and established new performance objectives at one or more meetings held during the first and last quarters of the year. However, our Compensation Committee also considers matters related to individual compensation, such as compensation for new executive hires, as well as high-level strategic issues, such as the efficacy of our compensation strategy, potential modifications to that strategy and new trends, plans or approaches to compensation, at various meetings throughout the year. Generally, the Compensation Committee’s process consists of two related elements: the determination of compensation levels and the establishment of performance objectives for the current year. For executives other than our Chief Executive Officer, our Compensation Committee solicits and considers evaluations and recommendations submitted to the Compensation Committee by our Chief Executive Officer. In the case of our Chief Executive Officer, the evaluation of his performance is conducted by the Compensation Committee, which determines any adjustments to his compensation as well as awards to be granted. For all executives and directors as part of its deliberations, the Compensation Committee may review and consider, as appropriate, materials such as financial reports and projections, operational data, tax and accounting information, tally sheets that set forth the total compensation that may become payable to executives in various hypothetical scenarios, executive and director stock ownership information, company stock performance data, analyses of historical executive compensation levels and current Company-wide compensation levels and recommendations of our People & Culture management team. In addition, in 2023, the Compensation Committee engaged the Human Capital Solutions practice of Aon plc ("Aon") to assist in making decisions regarding the amount and types of compensation to provide our executive officers and non-employee directors. For more information, see Executive Officer and Director Compensation - Role of Our Independent Compensation Consultant below. Aon reports directly to the Compensation Committee. The Compensation Committee has considered the adviser independence factors required SEC rules as they relate to Aon and has determined that Aon's work does not raise a conflict of interest. The Compensation Committee may delegate its authority to grant certain equity awards to certain individuals to our Chief Executive Officer and in 2023, delegated such authority to Mr. Obenshain.

Nominating and Corporate Governance Committee

Our Nominating and Corporate Governance Committee is composed of Dr. Agwunobi, Dr. Jones-Burton, and Ms. Tita-Reid, with Dr. Agwunobi serving as chair of the committee. Our Board has determined that each member of the Nominating and Corporate Governance Committee is “independent” as defined under the applicable listing standards of Nasdaq. During the fiscal year ended December 31, 2023, the Nominating and Corporate Governance Committee met two times. The Nominating and Corporate Governance Committee’s responsibilities include:

•developing and recommending to the Board for its approval criteria for membership of the Board and its committees;

•establishing procedures for identifying and evaluating Board candidates, including candidates recommended by stockholders;

•identifying individuals qualified to become members of the Board;

•recommending to the Board the persons to be nominated for election as directors and to each of the committees of the Board;

•developing and recommending to the Board a set of corporate governance guidelines; and

•overseeing the evaluation of the Board.

The Nominating and Corporate Governance Committee oversees an annual self-evaluation process of the Board and its committees with the assistance of an external advisor specializing in strategic planning and organizational development. The results of the self-evaluation are presented to the Nominating and Corporate Governance Committee, which determines what actions, if any, to present to the Board and the other committees to further enhance the performance and effectiveness of the Board and its committees.

Independent Director Meetings

In addition to the meetings of the committees of the Board described above, in connection with the Board meetings, the independent directors met four times in executive session during the fiscal year ended December 31, 2023. The Chair of the Board presides at these executive sessions. The Audit Committee and the Board have established a procedure whereby interested parties may make their concerns known to independent directors, which is described on our website.

Leadership Structure and Risk Oversight

Our Corporate Governance Guidelines provide that the Board shall fill the Chair of the Board and Chief Executive Officer positions based on the Board's view of what is in the Company's best interest. The roles of Chair of the Board and Chief Executive Officer are currently separate, with Mr. Vachon serving as Chair and Mr. Obenshain serving as Chief Executive Officer. Our Board believes that separation of the positions of Chair and Chief Executive Officer reinforces the independence of the Board from management, creates an environment that encourages objective oversight of management’s performance and enhances the effectiveness of the Board as a whole. The Board retains the flexibility to change its leadership structure from time to time as appropriate based on its view of the best interests of the Company.

We face a number of risks in our business, including risks related to commercial operations and our ability to obtain reimbursement for our approved products; competition; manufacturing and supply chain; growth and capacity expansion in the United States; research and development; regulatory reviews and approvals; intellectual property filings, prosecution, maintenance and challenges; the establishment and maintenance of strategic alliances; litigation and government investigations; and the ability to access additional funding for our business; among other risks. Our management is responsible for the day-to-day management of the risks that we face, while our Board, as a whole and through its committees, has responsibility for the oversight of risk management.

Our Board performs its oversight role by using several different levels of review. Our Chair meets regularly with our Chief Executive Officer and other executive officers to discuss our strategy and material risks. Members of senior management attend the quarterly Board meetings, present on strategic matters involving our business, and are available to address any questions or concerns raised by the Board on risk management-related issues and any other matters. Our Board reviews the risks, including any environmental, social or governance risks, associated with our business strategies periodically throughout the year as part of its consideration of undertaking any such business strategies. Moreover, our Audit Committee oversees enterprise risk management and discusses guidelines and policies that govern the process by which the Company's exposure to risk is assessed and managed by management.