UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark one)

| x | ANNUAL REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2015

| ¨ | TRANSITION REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from _______

to _______.

Commission file number 001-31812

OPGEN, INC.

(Exact name of registrant as specified in its charter)

| Delaware | 06-1614015 | |

| (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) | |

| 708 Quince Orchard Road, Suite 205 | ||

| Gaithersburg, Maryland | 20878 | |

| (Address of principal executive offices) | (Zip Code) |

(240) 813-1260

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Name of each exchange on which registered | |

| Common Stock, par value $0.01 per share | The NASDAQ Capital Market | |

| Warrants, exercisable for one share of common stock |

The NASDAQ Capital Market |

Securities registered pursuant to Section 12(g) of

the Act:

None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. YES ¨ NO x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. YES ¨ NO x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. YES x NO ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). YES x NO ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer ¨ | Accelerated filer ¨ | |

| Non-accelerated filer ¨ (Do not check if a smaller reporting company) |

Smaller reporting company x |

Indicate by check mark whether registrant is a shell company (as defined in Rule 12b-2 of the Act). YES ¨ NO x

The aggregate market value of the voting common stock held by non-affiliates of the registrant as of June 30, 2015, was $39.9 million (based upon the last reported sale price of $3.72 per share on June 30, 2015, on The NASDAQ Capital Market).

As of March 17, 2016, 12,574,303 shares of common stock of the registrant were outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the definitive proxy statement for the registrant’s 2016 annual meeting of stockholders to be filed within 120 days after the end of the period covered by this Annual Report on Form 10-K are incorporated by reference into Part III of this Annual Report on Form 10-K.

OPGEN, INC.

ANNUAL REPORT ON FORM 10-K

For the Year Ended December 31, 2015

TABLE OF CONTENTS

| 2 |

INFORMATION REGARDING FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K for the year ended December 31, 2015 (the “Annual Report”) and certain information incorporated herein by reference contain forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”) and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). In this Annual Report, we refer to OpGen, Inc. as the “Company,” “we,” “our” or “us.” All statements other than statements of historical facts contained herein, including statements regarding our future results of operations and financial position, strategy and plans, and our expectations for future operations, are forward-looking statements. The words “believe,” “may,” “will,” “estimate,” “continue,” “anticipate,” “design,” “intend,” “expect” or the negative version of these words and similar expressions are intended to identify forward-looking statements.

We have based these forward-looking statements on our current expectations and projections about future events and trends that we believe may affect our financial condition, results of operations, strategy, short- and long-term business operations and objectives, and financial needs. These forward-looking statements are subject to a number of risks, uncertainties and assumptions, including those described in Part I Item 1A “Risk Factors.” In light of these risks, uncertainties and assumptions, the forward-looking events and circumstances included herein may not occur, and actual results could differ materially and adversely from those anticipated or implied in the forward-looking statements. Given these uncertainties, you should not place undue reliance on these forward-looking statements. Forward-looking statements include, but are not limited to, statements about:

| · | the commercialization of our current products, including our QuickFISH® and PNA FISH diagnostic products for infectious diseases, Acuitas® MDRO test products and completed development and commercialization of our Acuitas Lighthouse™ bioinformatics products and services; |

| · | integration of the operations of AdvanDx, Inc. acquired by merger on July 14, 2015; |

| · | anticipated trends and challenges in our business and the competition that we face; |

| · | the execution of our business plan and our growth strategy; |

| · | our expectations regarding the size of and growth in potential markets; |

| · | changes in laws or regulations applicable to our business, including potential regulation by the FDA; |

| · | our ability to develop and commercialize new products and the timing of commercialization; |

| · | our liquidity and working capital requirements, including our long-term future cash requirements beyond the next 12 months; and |

| · | our expectations regarding future revenue and expenses. |

Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, level of activity, performance or achievements. In addition, neither we nor any other person assumes responsibility for the accuracy and completeness of any of these forward-looking statements. Any forward-looking statement made by us in this Annual Report speaks only as of the date on which it is made. We disclaim any duty to update any of these forward looking statements after the date of this Annual Report to confirm these statements to actual results or revised expectations.

These factors should not be construed as exhaustive and should be read in conjunction with our other disclosures, including but not limited to the risk factors described in Part I, Item 1A of this Annual Report. Other risks may be described from time to time in our filings made under the securities laws. New risks emerge from time to time. It is not possible for our management to predict all risks. All forward-looking statements in this Annual Report speak only as of the date made and are based on our current beliefs and expectations. We undertake no obligation to update or revise any forward-looking statement, whether as a result of new information, future events or otherwise.

NOTE REGARDING TRADEMARKS

We own various U.S. federal trademark registrations and applications and unregistered trademarks and servicemarks, including OpGen®, Acuitas®, Acuitas LighthouseTM Argus®, MapIt®, MapSolver™, AdvanDx®, QuickFISH® and PNA FISH®. All other trademarks, servicemarks or trade names referred to in this Annual Report are the property of their respective owners. Solely for convenience, the trademarks and trade names in this Annual Report are sometimes referred to without the ® and ™ symbols, but such references should not be construed as any indicator that their respective owners will not assert, to the fullest extent under applicable law, their rights thereto. We do not intend the use or display of other companies’ trademarks and trade names to imply a relationship with, or endorsement or sponsorship of us by, any other companies, products or services.

| 3 |

Please refer to the Glossary beginning on page 22 of this Business section for definitions or descriptions of scientific, diagnostic, health care and regulatory terms used in this Annual Report.

Overview

We are a precision medicine company using molecular diagnostics and informatics to combat infectious disease. We are developing molecular information solutions to combat infectious disease in global healthcare settings, helping to guide clinicians with more rapid information about life threatening infections, improve patient outcomes, and decrease the spread of infections caused by multidrug-resistant microorganisms. Our proprietary DNA tests and bioinformatics address the rising threat of antibiotic resistance by helping physicians and healthcare providers optimize patient care decisions and protect the hospital biome through customized screening and surveillance solutions.

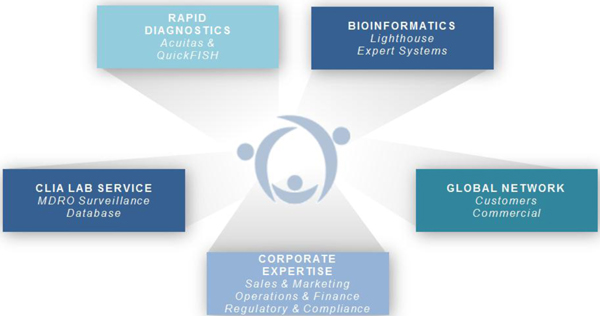

Our molecular information solution combines Acuitas® DNA tests, Acuitas Lighthouse™ bioinformatics systems, CLIA lab services for MDRO surveillance, and a proprietary data warehouse including genomic data matched with antibiotic susceptibility information for microbes and patient information from healthcare providers. We are working to deliver our molecular information solution to a global network of customers and partners. Our Acuitas DNA tests provide rapid microbial ID, and antibiotic resistance gene information. These products include the QuickFISH® family of FDA-cleared and CE-marked diagnostics used to rapidly detect pathogens in positive blood cultures, the Acuitas MDRO Gene Test to detect, type, track, and trend antibiotic resistant organisms in real-time and our rapid antibiotic resistance test in development. We are working to provide actionable, precise diagnostic information powered by pathogen surveillance data collected through hospital screening programs and a network of hospital and public health laboratories globally. The Acuitas Lighthouse™ data warehouse is a cloud-based HIPAA compliant solution that combines clinical lab test results with patient and hospital information and provides analytics to help manage MDROs in the hospital and patient care environment.

There is rising global concern about the profound health and macroecnomic consequences if the growing threat of antimicrobial resistance is not tackled. Drug resistant infections currently claim at least 50,000 lives each year in the United States and Europe alone, with many hundreds of thousands more dying in other areas of the world. Recognizing this emerging threat, the White House issued a National Action Plan for Combating Antibiotic Resistance Bacteria in March 2015. The National Action Plan aims to achieve major reductions in the incidence of these urgent and serious threats and improvements in antibiotic stewardship during the next five years. The 2016 U.S. government budget includes approximately $1 billion to help combat drug resistant infections. Three key areas have been highlighted for investment: rapid diagnostics, surveillance, and new antibiotics. We are focused in rapid diagnostics where our tests help identify microorganisms and determine their antibiotic resistance genes and susceptibility. Through the use of our Acuitas Lighthouse analytics we are working to provide antibiotic decision support tools to help physicians interpret and act on this information. A second area of our focus is surveillance of microbial infections and colonization with MDROs in the hospital environment. These products and services are designed to help enable effective response to resistant organisms and to help control MDRO transmission and outbreaks in the hospital.

We believe that the diagnostic paradigm for management of drug resistant infections is poised for change. In acute care settings, initial treatment today relies heavily on initial use of broad spectrum antibiotics on an empiric basis. It is common for patients to receive the antibiotic vancomycin for treatment of potential Gram positive infections such as Staphylococcus and the antibiotic cefipime for treatment of potential Gram negative infections from organisms such as Escherichia coli, Klebsiella pneumoniae, or Pseudomonas. These powerful antibiotics are often prescribed without previous knowledge of whether the organism they are intended to treat is present. Current methods require 2-4 days to determine the organism ID and antibiotic susceptibility. During this period in advance of receiving the correct diagnosis, patients are often over treated or treated with the wrong antibiotic leading to potentially undesirable outcomes such as morbidity from expanded infection, drug resistance, and opportunistic C. difficile infections. If the diagnosis is that the initial empiric antibiotic therapy was incorrect, a new therapy must be chosen often resulting in poor clinical outcomes, additional length of stay, and increased health care costs.

| 4 |

Improved diagnostics for detection of resistant bacteria and characterization of resistance patterns will help healthcare providers make optimal treatment decisions and assist public health officials in taking action to prevent and control disease. Improved and more rapid diagnostics will also help decrease unnecessary or inappropriate use of antibiotics. Optimal precision medicine tests for combatting infectious disease will provide diagnostic information in the first hours after presentation of the acutely ill patient in order to impact initial antibiotic selection decisions. Conventional microbiology methods have been largely unchanged, and we believe that it is unlikely that they will be adapted to provide rapid one-hour diagnostic tests for high resolution microbial analysis. DNA analysis technology, such as our Acuitas DNA tests, has the potential to help revolutionize rapid diagnostics for microbiology. DNA tests are highly accurate and can be performed in just 30 minutes to an hour. Our FDA-cleared QuickFISH rapid pathogen ID tests are examples of such rapid detection technology. In addition, DNA sequencing technology now makes it possible to sequence the entire genome of microbes for subsequent analysis, antibiotic selection decision making software, and microbe tracking.

Our suite of DNA-based products and products in development are intended to provide actionable, precise diagnostics powered by microbial surveillance data. The high resolution Acuitas DNA tests use multiplex PCR to help provide reliable and accurate detection of drug resistance. The QuickFISH tests are powered by PNA technology and provide rapid pathogen ID, typically in less than 30 minutes from a positive blood culture result. The Acuitas MDRO Gene Test is used for determining if ICU patients are colonized with MDROs. Positive samples are confirmed using microbiological methods and the Acuitas Resistome™ test for high resolution genotyping. Test results are maintained in the Acuitas Lighthouse™ data warehouse for subsequent interpretation by physicians and healthcare providers.

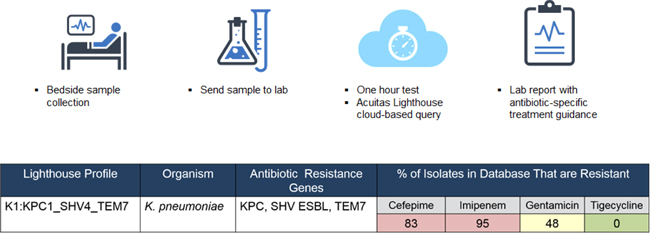

We are developing a new disruptive one-hour-testing paradigm that we believe could help address many of the current issues with testing for antibiotic resistance. Results from a new high resolution Acuitas DNA test designed to detect the key resistome profiles of Gram negative organisms will be informed by a smart cloud based clinical database that will provide molecular profiles to aid initial antibiotic selection and clinical decision making. Our proprietary Acuitas Lighthouse profiles distill large amounts of data into one actionable profile. We believe our disruptive approach will be globally applicable and could be an important new weapon in the fight against drug-resistant bacteria. The figure below describes the potential workflow and anticipated results from our new testing approach.

Our Strategy

We are using our current products and products in development to provide precision medicine solutions for combatting infectious diseases with a focus on developing diagnostic tests for rapid pathogen identification and genetic profiling, antibiotic resistance analysis and advanced bioinformatics to store and analyze MDRO and other infectious disease data for hospitals, out-patient settings and other health care providers. We believe more rapid genetic identification methods will reduce morbidity from MDROs, reduce health care costs through reduced length of stay, and assist in the identification of targeted antibiotic therapy. Current conventional microbiology, largely unchanged in 50 years, requires one to two days for growth and phenotypic analysis and often leads to the use of broad spectrum antibiotic therapy in the early stages of infection. Our current QuickFISH, PNA FISH and XpressFISH FDA-cleared, CE-marked diagnostic tests can accelerate accurate pathogen identification by one to three days when compared to conventional methods by providing identification of the pathogen within 20 to 90 minutes of positive blood culture results. We are working to:

| 5 |

| · | Expand our rapid diagnostics product offerings through development of additional Acuitas Gene Tests, with a goal of achieving one hour antibiotic resistance analysis; |

| · | Grow our Acuitas Lighthouse bioinformatics platform to serve as a data warehouse for resistance and susceptibility data in a hospital, hospital system, or broader community; |

| · | Continue development of our Acuitas Lighthouse Portal and decision-making software and work to install Acuitas Lighthouse Portals at all customer sites in the United States and globally who meet minimum test volume license requirements; |

| · | Accelerate the commercialization of our Acuitas Gene Tests and Acuitas Lighthouse informatics; |

| · | Expand our lab service offerings and capabilities through the supply of kits for use on our DNA probe assay platform and commercially available rapid diagnostic testing systems, develop additional MDRO DNA sequencing tests and informatics; |

| · | Partner with reference laboratories, government agencies, diagnostic companies and information technology providers to offer our Acuitas Lighthouse portal on a global basis; and |

| · | Accelerate growth through strategic partnerships, which may include companies developing rapid diagnostic tests for MDROs, sponsored research programs with governments and industry, and strategic acquisitions. |

We believe our products and services can be integrated into a single solution for healthcare providers. By seeking to address institutional needs for informatics, genetic analysis and microbiologic testing, we are working to establish a market leadership position in MDRO analysis. The OpGen solution is intended to help hospitals reduce hospital acquired infection rates by helping to rapidly identify patients colonized with MDROs who should receive contact precautions, and helping to guide antibiotic therapy.

Molecular Information Business

We are working to build a unique and highly proprietary molecular information business. Our approach combines FDA-cleared and CE-marked rapid diagnostics and CLIA lab-based MDRO surveillance tests with our Acuitas Lighthouse bioinformatics systems.

| 6 |

We operate in one segment. Substantially all of our operations are in the United States. Total revenues from customers for the years ended December 31, 2015 and 2014 were $3.2 million and $4.1 million, respectively. Net loss for the years ended December 31, 2015 and 2014 was $17.4 million and $5.7 million, respectively. Total assets at December 31, 2015 and 2014 were $13.8 million and $2.7 million, respectively.

2015 Events

Initial Public Offering

On May 8, 2015, we completed our initial public offering (“IPO”) in which we offered and sold 2,850,000 units, each unit consisting of one share of our common stock and a detachable stock purchase warrant to purchase an additional share of common stock, at an initial offering price of $6.00 per unit. Of the total gross proceeds of $17.1 million, approximately $2.1 million was used to satisfy outstanding demand notes by exchanging such notes for 350,000 units in the IPO. After considering the demand notes, underwriting discounts and commissions and offering expenses, the total net cash proceeds were $12.1 million. On the IPO closing date, the underwriters exercised their over-allotment option to acquire an additional 422,500 stock purchase warrants. In connection with the IPO, all of our then-outstanding Series A Preferred Stock, 2014 convertible notes and 2015 convertible notes were converted into 7,374,852 shares of common stock.

Acquisition of AdvanDx

On July 14, 2015, we completed the strategic acquisition by merger (the “Merger”) of AdvanDx, Inc. and its wholly owned subsidiary AdvanDx A/S, collectively referred to as AdvanDx. Pursuant to the terms of a Merger Agreement, our newly formed subsidiary, Velox Acquisition Corp. merged with and into AdvanDx, Inc. with AdvanDx, Inc. surviving as OpGen’s wholly owned subsidiary.

Merck GHI Investment

In connection with the Merger, on July 14, 2015, the Company entered into a Common Stock and Note Purchase Agreement with Merck Global Health Innovation Fund, LLC (“Merck GHI”) pursuant to which Merck GHI purchased 1,136,364 shares of common stock of the Company at a price of $4.40 per share for gross proceeds of approximately $5,000,000. Pursuant to the Purchase Agreement, the Company also issued to Merck GHI a Senior Secured Promissory Note (the “Note”) in the principal amount of $1,000,000 with a two-year maturity date from the date of issuance. The Company’s obligations under the Note are secured by a lien on all of the Company’s assets.

Market Overview

Antibiotic Resistance – An Urgent Global Issue

We believe that antimicrobial resistance is an urgent global healthcare issue. MDROs have been prioritized as an urgent national and global threat by the CDC, the President of the United States and the WHO. In September 2014, The White House issued a National Strategy for combating antibiotic-resistant bacteria. The strategy calls for the strengthening of surveillance efforts to combat resistance, the development and use of innovative diagnostic tests for identification and characterization of resistant bacteria and antibiotic stewardship and development.

The CDC estimates that in the United States more than two million people are sickened every year with antibiotic-resistant infections, with at least 23,000 dying as a result. Antibiotic-resistant infections add considerable but often avoidable costs to the U.S. healthcare system. In most cases, these infections require prolonged and/or costlier treatments, extended hospital stays, additional doctor visits and healthcare facilities use, and result in greater disability and death compared with infections that are treatable with antibiotics. Estimates for the total economic cost to the U.S. economy range between $20 and $35 billion annually. As described in a December 2014 report issued by the Review on Antimicrobial Resistance commissioned by the U.K. Prime Minister titled “Antimicrobial Resistance: Tackling a Crisis for the Health and Wealth of Nations,” 300 million people are expected to die prematurely because of drug resistance over the next 35 years, which could result in $60 to $100 trillion worth of economic output if the problem of antimicrobial drug resistance is not resolved.

In the United States, on August 1, 2014, CMS issued a final rule under the PPACA that, among other things, establishes CMS’ financial incentive program to hospitals that can demonstrate reduction in HAIs. The estimated amount available for these value-based incentive payments in fiscal year 2015 was approximately $1.4 billion. On the other hand, in December 2014, CMS announced its Hospital Acquired Condition Reduction Program, under which CMS will penalize hospitals for excess rates of infections and other patient injuries by reducing Medicare payments. Total penalties are estimated to be approximately $373 million in the first year.

| 7 |

Another emerging global threat are CREs that are either difficult to treat or wholly untreatable. According to CDC Director Dr. Tom Frieden, CREs are a “nightmare bacteria.” The strongest antibiotics do not work and patients are left with potentially untreatable infections with mortality rates ranging between 40% and 80%. CRE strains are transmitted easily in healthcare settings from patients with asymptomatic intestinal colonization, and the CRE strains have the potential to spread antibiotic resistance through plasmid transfer to other bacterial species, including common human flora and potential pathogens such as Escherichia coli. The CDC has called for urgent action to combat the threat of CRE bacteria. Core prevention measures recommended by the CDC for all acute and long-term care facilities include: contact precautions for all patients who are colonized or infected with CRE, single patient room housing or cohorting, laboratory notification procedures, antibiotic stewardship and screening to identify unrecognized CRE colonization in patients admitted to high risk settings such as ICUs, long-term acute care units or facilities, or epidemiologically linked contacts.

Emergence of Superbugs and Lack of Treatment Options

Over the last decade multidrug-resistant Gram negative bacteria, frequently referred to as Superbugs, have been implicated in severe HAIs, and their occurrence has increased steadily. For example, Klebsiella pneumoniae, or K. pneumoniae, is responsible for roughly 15% of Gram-negative infections in hospital intensive care units. Infections caused by KPC strains have few treatment options and are associated with a mortality rate upwards of 50%.

Exacerbating the problems associated with the emergence of these highly resistant KPC strains is their propensity to cause outbreaks in healthcare institutions. These pathogens persist both in the flora of hospitalized patients and in the hospital environment, and they have the capacity to silently colonize patients or hospital personnel by establishing residence in the gastrointestinal tract without causing any signs of infection. Individuals can be silently colonized or become asymptomatic carriers for long periods of time, with detection of these carriers often proving difficult. These silent carriers act as reservoirs for continued transmission, which makes subsequent spread difficult to control and outbreaks difficult to stop. In addition, KPC strains can survive for several hours on the hands of hospital personnel, which likely facilitates spread from patient to patient. Effective control of KPC outbreaks requires a detailed understanding of how transmission occurs, but current technologies do not allow healthcare providers to routinely perform these investigations on a timely basis.

The lack of currently available treatment options and scarcity of new treatment options in development are compounding the emerging Superbug problem. It has been close to 30 years since a new class of antibiotics was developed and successfully introduced. As a result, we believe that rapid, accurate identification of the pathogen and its genetic make-up, screening, infection control and antibiotic stewardship have become the most powerful weapons in the fight to contain this threat.

Based on industry analyses, we believe the global HAI market is a $2 billion dollar market with the molecular diagnostic segment representing a fast growing segment of such market with multiple high acuity patients and significant infectious sites, including urinary tract infections, surgical site infections, pneumonia, bloodstream infections.

The initial focus of our MDRO surveillance business is the U.S. hospital market where there are approximately 5,000 hospitals and a potential market opportunity of six million tests annually for our Acuitas MDRO Gene Test. According to statistics issued by AHA Hospitals Statistics in 2011, there are 1,395 acute care hospitals in the United States with 200 or more beds that are candidates for weekly screening of the approximately 20% of patients who are at high risk for MDRO colonization or infection. There are also 290 long term acute care hospitals where we believe all patients are candidates for bi-weekly screening. We believe the high-risk MDRO testing market opportunity in the United States is approximately $400 million. The trend toward consolidated health systems is resulting in the combination of small and mid-sized hospitals into large health systems that are the initial targets for our test and informatics products. A typical large health system could have more than $4 billion in annual revenue, a central hospital with more than 400 beds and 6-8 smaller hospitals and long-term care facilities. These large health systems have started to centralize their microbiology lab testing, making them an attractive target market for us.

The trend towards forming ACOs is expected to increase the focus on reducing length of stay and the overall cost of hospital procedures. Since HAIs result in increased costs of approximately $24,000 per affected patient, we anticipate ACOs will be particularly receptive to our MDRO management solutions. According to Diagnostic Kit – second edition, March 2014 by Cowen & Co., the MRSA surveillance testing market and C. difficile testing market in the United States are approximately $300 million and $150 million, respectively.

| 8 |

Products

Our current product offerings include our QuickFISH® and PNA FISH® products, which are FDA-cleared, CE-marked in vitro diagnostic tests designed to rapidly identify antimicrobial resistant pathogens significantly earlier than currently available conventional methods, our Acuitas MDRO Gene Test, Acuitas CR Elite Test and Acuitas Resistome Test, each a CLIA lab-based test that provides a profile of MDRO resistant genes for surveillance and response to outbreaks, and our Acuitas Lighthouse bioinformatics platform which is being developed to provide an evergreen database for comprehensive testing and bioinformatics analysis to help guide antibiotic therapy decision making.

FISH Products

We have commercialized 15 QuickFISH, PNA FISH and XpressFISH diagnostic test products in the United States and Europe for the identification of various infectious pathogens. The pathogens identified and differentiated by our FISH products are:

| QuickFISH | PNA FISH | XpressFISH |

| Staphylococcus | Staphylococcus | MRSA |

| Enterococcus | Enterococcus | MSSA |

| Gram-negative bacteria | Gram-negative bacteria | |

| Gram –positive bacteria | Gram-positive bacteria | |

| Candida | Candida |

Our FISH products can provide pathogen identification and differentiation within 20 to 90 minutes of positive blood culture results. Differentiation of the pathogen, such as, for example differentiating a methicillin resistant Staphylococcus aureus (“MRSA”) infection from a methicillin susceptible Staphylococcus aureus (“MSSA”) infection provides actionable information that can be used by the health care provider to determine appropriate antibiotic therapy.

We currently have approximately 100 U.S. hospital customers purchasing our FISH products, and sell our FISH products to hospitals in 10 countries with antibiotic stewardship programs. Our hospital customers include academic medical centers, tertiary care hospitals and community hospitals.

An example of the usefulness of our QuickFISH products at Winter Haven Hospital in Florida was described in a recent publication “The Impact of Implementation of Rapid QuickFISH Testing for Detection of Coagulase Negative Staphylococci at a Community-Based Hospital,” American Journal of Clinical Pathology, January 2016. In such case study our QuickFISH products demonstrated clinical utility and cost effectiveness in the more rapid identification and differentiation of staph-infected patients which resulted in a 90% reduction in pathogen identification (1.4 hours as compared to 17.2 hours from a positive blood culture), decreased utilization of Vancomycin antibiotic therapy, a 30% reduction in length of stay and annual savings of approximately $764,000.

Acuitas Products

Our high resolution DNA tests are marketed under the Acuitas trade name. We have developed Acuitas DNA tests for use in our CLIA lab such as the Acuitas MDRO Gene Test and we are developing a rapid Acuitas DNA test for use in hospital laboratories that will combine rapid pathogen ID and detection of antibiotic resistance genes. In the future we anticipate marketing new FISH products that we may develop under the Acuitas trade name.

| · | Our Acuitas MDRO Gene Test is, to our knowledge, the first CLIA lab-based test able to provide information regarding the presence of ten MDRO resistance genes from one patient specimen. The ten drug-resistant genes identified by our Acuitas MDRO Gene Test are associated with CRE, ESBL and VRE organisms, and are gastrointestinal organisms frequently associated with antibiotic-resistant infections. The test results can be used by healthcare providers to identify patients colonized with organisms expressing the drug-resistant genes or who are actively infected. |

| 9 |

| · | Our Acuitas CR Elite Test adds the ability for the healthcare provider to order a microbiology culture screen to be performed from the same specimen sent for our Acuitas MDRO Gene Test, thereby providing additional information about the organism(s) associated with an active infection, as well as an antibiotic susceptibility profile for such organism(s). |

| · | Our Acuitas Resistome Test, launched in the second quarter of 2015, is a more comprehensive MDRO molecular test which detects 49 genes covering over 900 subtypes associated with antibiotic resistance. The test includes additional resistance genes for carbapenemases, ESBLs and AmpC genes, in replacement of the vancomycin resistant genes found in the Acuitas MDRO Gene Test. We believe the AmpC targets of the Acuitas Resistome Test are more specific for Gram-negative bacteria, thereby strengthening the coverage provided by our Acuitas Resistome Test to detect resistance genes found in Klebsiella pneumoniae, Escherichia coli, Acinetobacter baumannii, Pseudomonas aeruginosa, Enterobacter cloacae, and Citrobacter freundii. We use Acuitas Resistome Test results for Acuitas Lighthouse profiling of specimens collected in hospitals and clinical isolates from infected patients. Information from our Acuitas Resistome Test provides additional gene detection information to supplement our Acuitas MDRO Gene Test. Acuitas Resistome Test results can be used in conjunction with the Acuitas CR Elite Test to provide high resolution Acuitas Lighthouse profiles. Our goal is to provide DNA test-based Acuitas Lighthouse profiles, within 24 hours of sample receipt, and, using the Acuitas CR Elite Test to supplement our Acuitas Lighthouse profiles, with biologically derived, phenotypic antibiotic susceptibility data within 84 hours. We anticipate improving the accuracy, over time, of our Acuitas Resistome Test by performing DNA sequence analysis of microbial isolates within our Acuitas Lighthouse data warehouse. We believe our menu of genotypic and phenotypic tests along with our Acuitas Lighthouse bioinformatics platform profiles, will enable better surveillance and epidemiology, improved infection control practices, improved antibiotic stewardship and individualized patient care, as well as help to facilitate outbreak detection and response in healthcare settings. We also anticipate combining tests for infectious diseases such as C. difficile, MRSA and others to provide enhanced MDRO screening and patient management solutions. |

Acuitas Lighthouse

Our Acuitas Lighthouse bioinformatics platform enables proactive MDRO management to prevent in-hospital transmission events and to help improve patient outcomes. Trend analysis of patient specific data, data specific to individual hospital facilities and health systems can be provided safely and confidentially to healthcare providers. Our Acuitas Lighthouse’s dynamic profiling incorporates identity, phenotype and MDRO gene presence and assigns unique microbe identifiers, or Acuitas Lighthouse profiles, based on MDRO gene composition, and antibiotic susceptibility, or AST, data. We believe our Acuitas Lighthouse profiling will provide a comprehensive diagnostic tracking tool for MDRO infections in the hospital setting. It is based on our CLIA- and HIPAA-compliant LIMS database system. We have developed a web-based portal to allow our customers access to LIMS-based lab reports and Acuitas Lighthouse data reports.

We are also focused on further developing Acuitas Lighthouse as an evergreen database with continual global pathogen data from our CLIA lab and hospital customers, with such data to be used to:

| · | assist in accelerating more rapid diagnosis with improved molecular susceptibility data; |

| · | provide MDRO screening and surveillance capabilities to hospitals to identify pathogen and resistance profiles; and |

| · | potentially accelerate new antibiotic development as the data are used to reveal genetic resistance patterns to direct drug discovery. |

In November 2015, the Company and the District of Columbia Hospital Association (“DCHA”) initiated a comprehensive citywide evaluation, HARP-DC (Healthcare facility Antibiotic Resistance Prevalence-District of Columbia), to be overseen by Washington D.C. public health departments, to gauge the prevalence of the multidrug-resistant CREs in healthcare facilities throughout the District of Columbia. The DC Department of Health led study is being funded by the CDC’s Epidemiology and Laboratory Capacity for Infectious Diseases (“ELC”) Funding program for tracking healthcare associated infections. The DC Department of Health contracted with OpGen to perform the related laboratory services using OpGen’s products, including Acuitas Lighthouse. The HARP-DC study marks the first effort of its kind in the District of Columbia to proactively combat CREs.

| 10 |

Other Products

Prior to our shift in focus to developing and commercializing our MDRO products, OpGen had developed and commercialized the Argus® Whole Genome Mapping System, MapIt® Services and MapSolver™ bioinformatics products and services. Such products and services were sold to academic, public health and corporate customers to allow them to perform Whole Genome Mapping and analysis of microbial, plant, animal and human genomes for life sciences applications. We have more than ten years of experience mapping microbial genomes. Our customers for these products include government and public health agencies such as the CDC, FDA, USDA and biodefense organizations, who use the Argus and MapSolver products in research and development, food safety and public health settings. We continue to provide these products and services to existing customers, however, we anticipate that such revenues will continue to decline as we have shifted our focus to our MDRO, rapid diagnosis and bioinformatics products and services.

In September 2013, we entered into a strategic collaboration with Hitachi High-Technologies Corporation (“Hitachi”) to commercialize our Whole Genome Mapping technology for mapping, assembly and analysis of human DNA. Under that collaboration we developed cloud-based human genome map assembly capabilities. The collaboration agreement ended in December 2015. We have seen declining revenues from our current customers for our Whole Genome Mapping products and services over the past few years, as DNA sequencing techniques and products have grown in popularity. While we continue to provide products and services to our existing customer base, we intend to monetize our Whole Genome Mapping technology by out-licensing or selling our technology to the extent possible.

For the year ended December 31, 2015, revenue earned from Hitachi represented 11% of total revenues. For the year ended December 31, 2014, revenue earned from Hitachi represented 64% of total revenues.

Research and Development

For the years ended December 31, 2015 and 2014, our research and development expenses were $6.0 million and $4.4 million, respectively. We intend to continue to invest in the development of additional Acuitas gene tests, our Acuitas Lighthouse bioinformatics platform, and our QuickFISH rapid identification tests. Our current focus is on completing the development of our product offerings to provide actionable, precise diagnostics powered by surveillance data for rapid diagnostics of pathogens, determination of the correct antibiotics appropriate to treat the infection and accumulation of actionable surveillance data to provide information useful for monitoring and controlling outbreaks and promoting antibiotic stewardship.

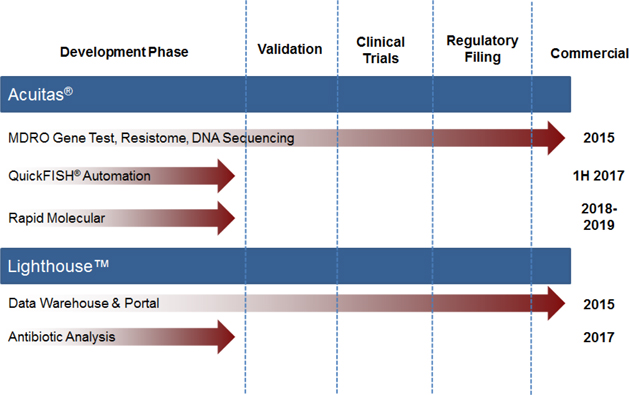

Our ongoing research and development efforts include:

| · | Development of a one hour rapid Acuitas DNA test capable of providing genetic resistance information for up to 150 drug resistance genes and a cloud-based Acuitas Lighthouse data warehouse for interpretation of test results and clinical decision making support tools to help select appropriate antibiotic therapies; |

| · | Development of more rapid molecular diagnostic products to achieve actionable pathogen identification and differentiation in the first few hours of presentation or symptoms; |

| · | Automating our QuickFISH products through digital imaging and analysis, new formats requiring less hands on time to process samples, multiplex formats that allow for testing of a broader range of microorganisms; |

| · | Continued investments in our Acuitas Lighthouse bioinformatics platform, focused on (i) data warehouse and portal for MDRO data and (ii) antibiotic analysis; |

| · | Further development of our Acuitas MDRO Gene Test, Acuitas Resistome Test and DNA sequencing; and |

| · | Converting our CLIA lab-based products to in vitro diagnostic kits that can be sold, upon receipt of FDA clearance and other approvals, directly to our customers and to other clinical reference laboratories. |

Our ongoing research and development programs and their stage of development are provided below.

| 11 |

Sales and Marketing

We currently sell and market our products and services in the United States through a 12 person sales and marketing organization including direct sales professionals and a dedicated marketing support organization. Internationally, we sell our products through a network of distributors in 16 countries. We operate a subsidiary in Denmark that provides support for our European customers and to distributors in other parts of the world. We are involved in pilot programs in approximately 10 countries to demonstrate the clinical and cost effectiveness of our FISH products. We are working to expand our market reach by entering into strategic co-marketing relationships with larger diagnostic and pharmaceutical companies and by expanding our network of distributors globally.

Competition

We believe we are currently the only company developing a molecular information business focused on leading a transformation in microbiology and infectious disease through precision medicine solutions combining bioinformatics and clinical diagnostics. Our approach combines proprietary DNA tests developed in our CLIA laboratory, FDA-cleared and CE-marked rapid diagnostics, and our Acuitas Lighthouse bioinformatics and data warehouse offerings. Our competitors include rapid diagnostic testing and traditional microbiology companies, commercial laboratories, information technology companies, and hospital laboratories who may internally develop testing capabilities. Principal competitive factors in our target market include: organizational size, scale, and breadth of product offerings; rapidity of test results; quality and strength of clinical and analytical validation data and confidence in diagnostic results; cost effectiveness; ease of use; and regulatory approval status.

Our principal competition comes from traditional methods used by healthcare providers to diagnose and screen for MDROs and from other molecular diagnostic companies creating screening and diagnostic products such as Cepheid, Becton-Dickinson, bioMerieux, Accelerate Diagnostics, T2 Biosystems and Nanosphere. We believe our focus on identifying antibiotic-resistant genes, rather than organisms, the genes and associated diseases included in our gene tests, and our Acuitas Lighthouse bioinformatics platform products and services to distinguish us from such competitors.

We also face competition from commercial laboratories, such as Bio-Reference Laboratories, Inc., Laboratory Corporation of America Holdings and Quest Diagnostics Incorporated, which have strong infrastructure to support the commercialization of diagnostic services.

| 12 |

Competitors may develop their own versions of our product offerings in countries where we do not have patents or where our intellectual property rights are not recognized.

Many of our potential competitors have widespread brand recognition and substantially greater financial, technical, research and development and selling and marketing capabilities than we do. Others may develop products with prices lower than ours that could be viewed by hospitals, physicians and payers as functionally equivalent to our solution, or offer solutions at prices designed to promote market penetration, which could force us to lower the list prices of our solutions and affect our ability to achieve profitability. If we are unable to change clinical practice in a meaningful way or compete successfully against current and future competitors, we may be unable to increase market acceptance and sales of our products, which could prevent us from increasing our revenue or achieving profitability and could cause our stock price to decline.

Laboratory Operations

Our laboratory operations are headquartered at our CLIA-certified laboratory in Gaithersburg, Maryland, where we perform all Acuitas testing. Samples are transported to the laboratory by FedEx or by courier. Once received, samples are assessed for acceptability, accessioned into our LIMS, prepared for processing and analyzed with traditional microbiology culture methods or using molecular testing instrumentation. Laboratory test data is housed in a proprietary LIMS database that is CLIA laboratory compliant. Customers access CLIA laboratory test results through individual PDF test reports and through our Acuitas Lighthouse portal. Our laboratory also performs testing for research and development purposes and for both the creation and ongoing maintenance of our Acuitas Lighthouse data warehouse.

We believe we have sufficient laboratory capacity to perform Acuitas testing for at least the next 24 months.

Manufacturing

We manufacture our FDA-cleared and CE-marked QuickFISH products in our Woburn, Massachusetts research and manufacturing facility. We are currently operating this facility under a one year lease with an option to extend our lease for subsequent periods. Specialty reagents for our CLIA laboratory are manufactured at our Gaithersburg, Maryland facility.

Manufacturing of our FDA-cleared products is performed under the current Good Manufacturing Practices - Quality System Regulation as required by the FDA for the manufacture of diagnostic products. These regulations carefully control the manufacture, testing and release of diagnostics products as well as raw material receipt and control. Both before and after a product is commercially released, we have ongoing responsibilities under FDA regulations. We are also subject to periodic inspections by the FDA to determine compliance with the FDA’s requirements, including primarily the quality system regulations and medical device reporting regulations. The results of these inspections can include inspectional observations on FDA’s Form 483, warning letters, or other forms of enforcement. Our Woburn, Massachusetts facility was inspected by the FDA in 2015. Following such inspection, the FDA issued a report of its findings and observations, typically referred to as “Form 483 observations," primarily related to our quality systems and testing policies and documentation. We have responded, or intend to respond, to all inspection observations within the required timeframe and are working with the FDA’s Office of Compliance to satisfy the identified deficiencies.

Quality Assurance

Our quality assurance function oversees the quality of our laboratory and our FDA-cleared and CE-marked diagnostic products as well as the quality systems used in research and development, client services, billing operations and sales and marketing. We have established a quality assurance system across our entire business, including implementation and maintenance, document control, supplier qualification, corrective or preventive actions, oversight, and employee training processes. We monitor and seek to improve our quality over time.

| 13 |

Raw Materials and Suppliers

We procure reagents, equipment, chips and other materials we use to perform our Acuitas MDRO Gene Test from sole suppliers such as Fluidigm Corporation. We purchase the PNA probes, glass slides and specialty consumables for our QuickFISH products from third party manufacturers who have long lead times and who manufacture several of these products for us on a sole source basis. We also purchase our collection kits from sole-source suppliers. Some of these items are unique to these suppliers and vendors. While we have developed alternative sourcing strategies for these materials and vendors, we cannot be certain whether these strategies will be effective or whether alternative sources will be available when we need them. If these suppliers can no longer provide us with the materials we need to perform our Acuitas MDRO Gene Test or manufacture our QuickFISH products, if the materials do not meet our quality specifications, or if we cannot obtain acceptable substitute materials, our business would be negatively affected.

Payments and Reimbursement

Our Acuitas MDRO test products, our Acuitas Lighthouse bioinformatics platform and our QuickFISH tests are, and other future products and services will be, sold to hospitals and public health organizations on a fee-for-service basis. When hospital and health system clients purchase our QuickFISH tests we bill them directly for the purchase of test kits and consumables. Hospitals that purchase MDRO services from our CLIA laboratory are billed on a per test basis. Currently we provide access to our Acuitas Lighthouse through portals. The portal capability is provided to our test customers who have sufficient test volume as part of our MDRO test offerings.

In the future we envision selling our Acuitas Lighthouse bioinformatics platform to health systems, hospitals and long-term care facilities under capitated, flat-rate contracts. Health systems and hospitals absorb the costs of extended stay from HAIs and poor treatment outcomes. For healthcare providers to support the use of our tests and services, OpGen needs to demonstrate improved outcomes and reduced costs. Various studies have documented increased hospital stays of six days or more for patients infected with MDROs, resulting in increased costs of $14,000 to $33,000 per infected patient. Determining if an infection is hospital-acquired or was originally obtained from another source is an important issue for hospitals. We believe our tests will help adjudicate payment favorably for hospitals. Isolation procedures are also costly to hospitals, so it is critical that isolation/de-isolation decisions are made accurately. Two recent studies documented a daily extra cost of approximately $101 for contact precaution equipment and approximately $57 for nursing time and contact precaution supplies for each infected patient. In addition to costs to individual hospitals, estimates of the economic costs of antibiotic resistance to the U.S. economy range from $20 billion to $35 billion annually.

Our marketing strategy focuses on the rapid turn-around time of our Acuitas MDRO and QuickFISH test results and the panel of results available from one patient sample. We believe the combination of our Acuitas MDRO test products, including QuickFISH, and our Acuitas Lighthouse bioinformatics platform differentiates us in the marketplace by offering a single sample process for identification and management of MDROs. Our approach can deliver a number of benefits to healthcare organizations including: (1) reduced lengths of stays; (2) cost savings and improved patient outcomes; and (3) avoidance of penalties by third-party payers for HAIs.

We employ diverse marketing programs to inform key stakeholders of the value of our solutions in order to drive adoption. As part of our marketing strategy, we educate hospitals, other health care institutions, and healthcare professionals about our value proposition. We intend to expand our marketing efforts using proceeds from this offering to increase these activities by expanding our sales and marketing efforts to microbiology and infection control professionals and hospital executives. We anticipate supporting efforts to advocate for expanded MDRO hospital surveillance, legislation at the state and federal level to encourage best practices for MDRO surveillance, and clinical practice guidelines. Finally, our website serves as a portal for educational material for hospitals, healthcare professionals and patients.

Third-Party Payers

We do not currently rely on any third-party payers for payment or reimbursement to us for our Acuitas MDRO or QuickFISH test products. Although we do not anticipate seeking direct reimbursement to us, we do believe that federal healthcare programs and other third-party payers may, in the future, reimburse hospitals for implementing institution-wide surveillance, infection control and antibiotic stewardship programs. Our management team has experience seeking reimbursement from federal healthcare programs and other third-party payers, and would work to:

| · | Meet the evidence standards necessary to be consistent with leading clinical guidelines. We believe demonstrating that our solution meets leading clinical practice guidelines plays a critical role in payers’ coverage decisions; |

| 14 |

| · | Engage reimbursement specialists to ensure the payor outreach strategy reacts to and anticipates the changing needs of our customer base. A customer service team would be an integral part of our reimbursement strategy, working with hospitals to navigate the claims process; |

| · | Cultivate a network of key opinion leaders. Key opinion leaders are able to influence clinical practice by publishing research and determining whether new tests should be integrated into practice guidelines. We would collaborate with key opinion leaders early in the development process to ensure our clinical studies are designed and executed in a way that clearly demonstrates the benefits of our tests to physicians and payers; and |

| · | Compile a library of peer-reviewed studies that demonstrate that our Acuitas MDRO test products are effective, accurate and faster than current methods. |

Intellectual Property

In order to remain competitive, we must develop and maintain protection of the proprietary aspects of our technologies. To that end, we rely on a combination of patents, copyrights and trademarks, as well as contracts, such as confidentiality, invention assignment and licensing agreements. We also rely upon trade secret laws to protect unpatented know-how and continuing technological innovation. In addition, we have what we consider to be reasonable security measures in place to maintain confidentiality. Our intellectual property strategy is intended to develop and maintain our competitive position.

As of December 31, 2015, we had total license or ownership rights to 132 patents, including 31 pending United States non-provisional patent applications, and 71 issued United States patents. More specifically, as of December 31, 2015, related to our FISH products, we had license or ownership rights to 84 patents, including 12 pending United States non-provisional patent applications, and 52 issued United States patents. These issued patents began to expire in December 2015 and will be fully expired by January 2029. As of December 31, 2015, related to our Acuitas products, we had license or ownership right to 3 pending United States non-provisional patent applications and no issued United States patents. As of December 31, 2015, related to our other products, we had license or ownership rights to 45 patents, including 16 pending United States non-provisional patent applications, and 19 issued United States patents related to our other products. These issued patents begin to expire in April 2016 and will be fully expired by January 2032.

We intend to file additional patent applications in the United States and abroad to strengthen our intellectual property rights; however, our patent applications (including the patent applications listed above) may not result in issued patents in a timely fashion or at all, and we cannot assure investors that any patents that have issued or might issue will protect our technology.

We require all employees and technical consultants working for us to execute confidentiality agreements, which provide that all confidential information received by them during the course of the employment, consulting or business relationship be kept confidential, except in specified circumstances. Our agreements with our research employees provide that all inventions, discoveries and other types of intellectual property, whether or not patentable or copyrightable, conceived by the individual while he or she is employed by us are assigned to us. We cannot provide any assurance, however, that employees and consultants will abide by the confidentiality or assignment terms of these agreements. Despite measures taken to protect our intellectual property, unauthorized parties might copy aspects of our technology or obtain and use information that we regard as proprietary.

Regulation

The following is a summary of the regulations materially affecting our business and operations.

Clinical Laboratory Improvement Amendments of 1988

As a clinical reference laboratory, we are required to hold certain federal, state and local licenses, certifications and permits to conduct our business. Under CLIA, we are required to hold a certificate applicable to the type of laboratory examinations we perform and to comply with standards covering personnel, facilities administration, quality systems and proficiency testing.

We have a current Certificate of Compliance under CLIA and a Medical Laboratory Permit from the State of Maryland to perform clinical testing at our Gaithersburg, Maryland laboratory. To renew our CLIA certificate, we are subject to survey and inspection every two years to assess compliance with program standards. The regulatory and compliance standards applicable to the testing we perform may change over time, and any such changes could have a material effect on our business. Our current CLIA certificate expires on October 1, 2017, and our Medical Laboratory Permit expires on June 30, 2016.

If our clinical laboratory is out of compliance with CLIA requirements, we may be subject to sanctions such as suspension, limitation or revocation of our CLIA certificate, as well as a directed plan of correction, state on-site monitoring, civil money penalties, civil injunctive suit or criminal penalties. We must maintain CLIA compliance and certification in order to perform clinical laboratory tests and report patient test results. If we were to be found out of compliance with CLIA requirements and subjected to sanction, our business could be harmed.

| 15 |

Federal Oversight of Laboratory Developed Tests and Research-Use-Only Products

Clinical laboratory tests, like our Acuitas MDRO Gene Test, are regulated under CLIA, as well as by applicable state laws. Historically, most laboratory developed tests (“LDTs”), were not subject to FDA regulations applicable to medical devices, although reagents, instruments, software or components provided by third parties and used to perform LDTs may be subject to regulation. FDA defines the term “laboratory developed test” as an in vitro diagnostic test that is intended for clinical use and designed, manufactured and used within a single laboratory. We believe that our Acuitas MDRO test products are LDTs. Currently, the FDA exercises enforcement discretion with respect to LDTs such that it does not enforce provisions of the Food, Drug and Cosmetic Act applicable to in vitro diagnostic (IVD) devices. In July 2014, due to the increased proliferation of LDTs for complex diagnostic testing, and concerns with several high-risk LDTs related to lack of evidentiary support for claims, erroneous results and falsification of data, the FDA notified Congress that it would issue guidance that, when finalized, would adopt a risk-based framework that would increase FDA oversight of LDTs. As part of this developing framework, the FDA issued draft guidance in October 2014, informing manufacturers of LDTs of its intent to collect information from laboratories regarding their current LDTs and newly developed LDTs through a notification process. The FDA will use this information to classify LDTs and to prioritize enforcement of premarket review requirements for categories of LDTs based on risk, beginning with LDTs that present the highest risk. Specifically, the FDA plans to use advisory panels to provide recommendations to the agency on LDT risks, classification and prioritization of enforcement of applicable regulatory requirements on certain categories of LDTs, as appropriate, for those tests not yet categorized.

Some products are for research use only (“RUO”), or for investigational use only (“IUO”). RUO and IUO products are not intended for human clinical use and must be properly labeled in accordance with FDA guidance. Claims for RUOs and IUOs related to safety, effectiveness, or clinical utility or that are intended for human diagnostic or prognostic use are prohibited. In November 2013, the FDA issued guidance titled “Distribution of In Vitro Diagnostic Products Labeled for Research Use Only or Investigational Use Only - Guidance for Industry and Food and Drug Administration Staff.” This guidance sets forth the requirements to utilize such designations, labeling requirements and acceptable distribution practices, among other requirements. Mere placement of an RUO or IUO label on an in vitro diagnostic product does not render the device exempt from otherwise applicable clearance, approval or other requirements. The FDA may determine that the device is intended for use in clinical diagnosis based on other evidence, including how the device is marketed.

We cannot predict the potential effect the FDA’s current and forthcoming guidance on LDTs and IUOs/RUOs will have on our solutions or materials used to perform our diagnostic services. While we qualify all materials used in our diagnostic services according to CLIA regulations, we cannot be certain that the FDA might not promulgate rules or issue guidance documents that could affect our ability to purchase materials necessary for the performance of our diagnostic services. Should any of the reagents obtained by us from vendors and used in conducting our diagnostic services be affected by future regulatory actions, our business could be adversely affected by those actions, including increasing the cost of service or delaying, limiting or prohibiting the purchase of reagents necessary to perform the service.

We cannot provide any assurance that FDA regulation, including premarket review, will not be required in the future for our surveillance and diagnostic services, whether through additional guidance or regulations issued by the FDA, new enforcement policies adopted by the FDA or new legislation enacted by Congress. On November 17, 2015, the House Committee on Energy and Commerce held one such hearing entitled “Examining the Regulation of Diagnostic Tests and Laboratory Operations.” We expect that new legislative proposals will be introduced from time to time. It is possible that legislation could be enacted into law or regulations or guidance could be issued by the FDA which may result in new or increased regulatory requirements for us to continue to offer our diagnostic services or to develop and introduce new services.

| 16 |

FDA’s Premarket Clearance and Approval Requirements

The FDA classifies medical devices into one of three classes: Class 1, Class 2 or Class 3. Devices deemed to pose lower risk are placed into either Class 1 or Class 2. Class 1 or Class 2 devices that are exempt from the premarket notification process must comply with applicable regulations but can simply list their products with the FDA. Class 1 or Class 2 devices that are non-exempt from the premarket notification process must comply with applicable regulations and submit a 510(k) premarket submission for review to receive clearance to list and market their devices. The 510(k) must establish substantial equivalence to a predicate device. Devices deemed by the FDA to pose the greatest risk, such as life-sustaining, life-supporting or implantable devices, or devices deemed not substantially equivalent to a previously cleared device, are placed in Class 3 and require premarket approval (“PMA”) before commercialization. The majority of the medical devices manufactured by OpGen at its Woburn, Massachusetts facility (i.e., the AdvanDx products) are Class 1; one product manufactured in Woburn is a Class 2 device. All of these products are non-exempt and required 510(k) premarket submissions. At this time our CLIA tests are not required to be reviewed by the FDA; however, our LDTs would be considered non-exempt Class 2 devices and would require a 510(k) premarket submission to continue.

All medical device manufacturers must register their establishments with the FDA; such registrations require the payment of user fees. In addition, both 510(k) premarket submissions and PMA applications are subject to the payment of user fees, paid at the time of submission for FDA review. At this time our CLIA lab is not required to register and list with the FDA; however, the Medical Device User Fee Act IV (“MFUFA IV”) negotiations currently taking place between the FDA and medical device manufacturers include discussions regarding user fees for clinical laboratories running LDTs. This new fee would be in addition to the user fees required to operate a clinical laboratory.

The FDA has issued a regulation outlining specific requirements for “specimen transport and storage containers.” “Specimen transport and storage containers” are medical devices if “intended to contain biological specimens, body waste, or body exudate during storage and transport” so that the specimen can be used effectively for diagnostic examination. Since medical devices are subject to registration and listing requirements, the reporting of corrections and removals, and responsible for medical device reporting requirements, if the FDA were to determine that our sample collection container is a medical device, the manufacturer would be required to register and list with the FDA for us to use the container for diagnostic purposes. The specimen collection device would be exempt from premarket review, and from QSR requirements except for recordkeeping and complaint handling requirements, so long as no sterility claims are made, but the manufacturer would still be required to comply with applicable regulations.

510(k) Clearance Pathway

If required to obtain 510(k) clearance for our future products or conversion of our Acuitas MDRO test products to diagnostic kits, such tests would be classified as medical devices and we would have to submit a premarket notification demonstrating that the proposed device is substantially equivalent to a previously cleared 510(k) device or a device that was in commercial distribution before May 28, 1976, for which the FDA has not yet called for the submission of premarket approval applications. FDA’s 510(k) clearance pathway usually takes from three to twelve months. On average the review time is approximately six months, but it can take significantly longer than twelve months in some instances, as the FDA may require additional information, including clinical data, to make a determination regarding substantial equivalence.

After a device receives 510(k) clearance, any modification that could significantly affect its safety or effectiveness, or that would constitute a new or major change in its intended use, will require a new 510(k) clearance or, depending on the modification, require premarket approval. The FDA requires each manufacturer to determine whether the proposed change requires submission of a new 510(k) notice, or a premarket approval, but the FDA can review any such decision and can disagree with a manufacturer’s determination. If the FDA disagrees with a manufacturer’s determination, the FDA can require the manufacturer to cease marketing and/or recall the modified device until 510(k) clearance or premarket approval is obtained. If the FDA requires us to seek 510(k) clearance or premarket approval for any modifications to a previously cleared product, we may be required to cease marketing or recall the modified device until we obtain this clearance or approval. Also, in these circumstances, we may be subject to significant regulatory fines or penalties. We have made and plan to continue to make additional product enhancements to products that we believe do not require new 510(k) clearances.

Premarket Approval Pathway

A premarket approval application must be submitted if a device cannot be cleared through the 510(k) process. The premarket approval application process is generally more costly and time consuming than the 510(k) process. A premarket approval application must be supported by extensive data including, but not limited to, analytical, preclinical, clinical trials, manufacturing, statutory preapproval inspections, and labeling to demonstrate to the FDA’s satisfaction the safety and effectiveness of the device for its intended use.

| 17 |

After a premarket approval application is sufficiently complete, the FDA will accept the application and begin an in-depth review of the submitted information. By statute, the FDA has 180 days to review the “accepted application,” although, generally, review of the application can take between one and three years, but it may take significantly longer. During this review period, the FDA may request additional information or clarification of information already provided. Also during the review period, an advisory panel of experts from outside the FDA may be convened to review and evaluate the application and provide recommendations to the FDA as to the approvability of the device. The preapproval inspections conducted by the FDA include an evaluation of the manufacturing facility to ensure compliance with the QSR, as well as inspections of the clinical trial sites by the Bioresearch Monitoring group to evaluate compliance with good clinical practice and human subject protections. New premarket approval applications or premarket approval application supplements are required for modifications that affect the safety or effectiveness of the device, including, for example, certain types of modifications to the device’s indication for use, manufacturing process, labeling and design. Significant changes to an approved PMA require a 180-day supplement, whereas less substantive changes may utilize a 30-day notice, or the 135-day supplement. Premarket approval supplements often require submission of the same type of information as a premarket approval application, except that the supplement is limited to information needed to support any changes from the device covered by the original premarket approval application, and may not require as extensive clinical data or the convening of an advisory panel. None of our products are currently approved under a premarket approval.

Clinical Trials

Clinical trials are almost always required to support a premarket approval application and are usually required to support non-exempt Class 1 and Class 2 510(k) premarket submissions. Clinical trials may also be required to support certain marketing claims. If the device presents a “significant risk,” as defined by the FDA, to human health, the FDA requires the device sponsor to file an investigational device exemption (“IDE”) application with the FDA and obtain IDE approval prior to conducting the human clinical trials. The IDE application must be supported by appropriate data, such as analytical, animal and laboratory testing results, manufacturing information, and an Investigational Review Board (“IRB”) approved protocol showing that it is safe to test the device in humans and that the testing protocol is scientifically sound. The IDE application must be approved in advance by the FDA prior to initiation of enrollment of human subjects. Clinical trials for a significant risk device may begin once the investigational device exemption application is approved by the FDA. If the clinical trial design is deemed to be “non-significant risk,” the clinical trial may eligible for the “abbreviated” IDE requirements; in some instances IVD clinical trials may be exempt from the more burdensome IDE requirements if certain labeling requirements are met. All clinical trials conducted to support a premarket submission must be conducted in accordance with FDA regulations and federal and state regulations concerning human subject protection, including informed consent, oversight by an IRB and healthcare privacy requirements. A clinical trial may be suspended by the FDA or the IRB review board at any time for various reasons, including a belief that the risks to the study participants outweigh the benefits of participation in the study. Even if a study is completed, the results of our clinical testing may not demonstrate the safety and efficacy of the device, or may be equivocal or otherwise not be sufficient to obtain approval of our product. Similarly, in Europe the clinical study must be approved by the local ethics committee and in some cases, including studies of high-risk devices, by the Ministry of Health in the applicable country.

Pervasive and Continuing FDA Regulation

Numerous regulatory requirements apply to our products classified as devices would continue to apply. These include:

| · | product listing and establishment registration, which helps facilitate FDA inspections and other regulatory action; |

| · | QSR, which requires manufacturers, including third-party manufacturers, to follow stringent design, testing, control, documentation and other quality assurance procedures during all aspects of the development and manufacturing process; |

| · | labeling regulations and FDA prohibitions against the promotion of products for uncleared, unapproved or off-label use or indication; |

| · | clearance of product modifications that could significantly affect safety or efficacy or that would constitute a major change in intended use of one of our cleared devices; |

| · | approval of product modifications that affect the safety or effectiveness of one of our cleared devices; |

| 18 |

| · | medical device reporting regulations, which require that manufacturers comply with FDA requirements to report if their device may have caused or contributed to a death or serious injury, or has malfunctioned in a way that would likely cause or contribute to a death or serious injury if the malfunction of the device or a similar device were to recur; |

| · | post-approval restrictions or conditions, including post-approval study commitments; |

| · | post-market surveillance regulations, which apply when necessary to protect the public health or to provide additional safety and effectiveness data for the device; |

| · | the FDA’s recall authority, whereby it can ask, or under certain conditions order, device manufacturers to recall from the market a product that is in violation of governing laws and regulations; |

| · | regulations pertaining to voluntary recalls; and |

| · | notices of corrections or removals. |

OpGen’s Woburn, Massachusetts facility is currently registered as an establishment with the FDA. If the LDTs performed in OpGen’s CLIA lab were deemed medical devices by the FDA, then we and any third-party manufacturers of such devices would need to register with the FDA as medical device manufacturers and obtain all necessary state permits or licenses to operate our business. We and any third-party manufacturers would be subject to announced and unannounced inspections by the FDA to determine our compliance with quality system regulation and other regulations. Our Woburn, Massachusetts facility was inspected by the FDA in 2015. Following such inspection, the FDA issued a report of its findings and observations, typically referred to as “Form 483 observations," primarily related to our quality systems and testing policies and documentation. We have responded, or intend to respond, to all inspection observations within the required time frame and are working with the FDA’s Office of Compliance to satisfy the identified deficiencies.