UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_____________________________

FORM

_____________________________

(Mark one)

For the fiscal year ended

For the transition period from __________ to __________.

Commission file number

_____________________________

(Exact name of registrant as specified in its charter)

_____________________________

|

|

|

|

|

(State or other jurisdiction of incorporation or organization) |

|

(I.R.S. Employer Identification No.) |

|

| ||

|

| ||

|

|

| |

|

(Address of principal executive offices) |

(Zip Code) | |

|

|

|

|

|

( | ||

|

(Registrant’s telephone number, including area code) | ||

_____________________________

Securities registered or to be registered pursuant to Section 12(b) of the Act:

|

Title of each class |

Trading Symbols |

Name of each exchange on which registered |

|

|

|

|

Securities registered or to be registered pursuant to Section 12(g) of the Act: None.

_____________________________

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer |

☐ |

|

Accelerated filer |

☐ |

|

|

☒ |

|

Smaller reporting company |

|

|

Emerging growth company |

|

|

|

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report

Indicate by check mark whether registrant is a shell company (as defined in Rule 12b-2 of the Act). YES ☐ NO

The aggregate market value of the voting common stock held by non-affiliates of the registrant June 30, 2021, was $

As of March 25, 2022, 46,557,750 shares of common stock of the registrant were outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant’s definitive Proxy Statement to be filed with respect to its 2022 Annual Meeting of Stockholders are incorporated herein by reference in Part III of this Annual Report on Form 10-K to the extent stated herein. The proxy statement will be filed with the Securities and Exchange Commission within 120 days after the registrant’s fiscal year ended December 31, 2021.

OPGEN, INC.

ANNUAL REPORT ON FORM 10-K

For the Year Ended December 31, 2021

TABLE OF CONTENTS

| 2

|

INFORMATION REGARDING FORWARD-LOOKING STATEMENTS

This annual report on Form 10-K for the year ended December 31, 2021 (the “Annual Report”) contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”) and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). In this Annual Report, we refer to OpGen, Inc. as the “Company,” “OpGen,” “we,” “our” or “us.” All statements other than statements of historical facts contained herein, including statements regarding our future results of operations and financial position, strategy and plans, and our expectations for future operations, are forward-looking statements. The words “believe,” “may,” “will,” “estimate,” “continue,” “anticipate,” “design,” “intend,” “expect” or the negative version of these words and similar expressions are intended to identify forward-looking statements.

We have based these forward-looking statements on our current expectations and projections about future events and trends that we believe may affect our financial condition, results of operations, strategy, short- and long-term business operations and objectives, and financial needs. These forward-looking statements are subject to a number of risks, uncertainties and assumptions, including those described in Part I, Item 1A “Risk Factors.” In light of these risks, uncertainties and assumptions, the forward-looking events and circumstances included herein may not occur, and actual results could differ materially and adversely from those anticipated or implied in the forward-looking statements. Given these uncertainties, you should not place undue reliance on these forward-looking statements. Forward-looking statements include, but are not limited to, statements about:

| · | the continued impact of COVID-19 on our business and operations; |

| · | our liquidity and working capital requirements, including our cash requirements over the next 12 months; |

| · | our use of proceeds from capital financing transactions; |

| · | the completion of our development efforts for our Unyvero UTI and IJI panels, Unyvero A30 RQ platform and ARESdb and the timing of regulatory submissions; |

| · | our ability to establish a market for and sell our Acuitas AMR Gene Panel test for use with bacterial isolates; |

| · | our ability to obtain regulatory clearance for and commercialize our product and services offerings; |

| · | our ability to sustain or grow our customer base for our Unyvero IVD and Acuitas AMR Gene Panel products as well as our current research use only products; |

| · | regulations and changes in laws or regulations applicable to our business, including regulation by the FDA, European Union, including pending IVDR requirements, and China’s NMPA; |

| · | our ability to further integrate the OpGen, Curetis, and Ares Genetics businesses; |

| · | anticipated trends and challenges in our business and the competition that we face; |

| · | the execution of our business plan and our growth strategy; |

| · | our expectations regarding the size of and growth in potential markets; |

| · | our opportunity to successfully enter into new collaborative or strategic agreements; |

| · | our ability to maintain compliance with the ongoing listing requirements for the Nasdaq Capital Market; |

| · | compliance with the U.S. and international regulations applicable to our business; and |

| · | our expectations regarding future revenue and expenses. |

Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, level of activity, performance or achievements. In addition, neither we nor any other person assumes responsibility for the accuracy and completeness of any of these forward-looking statements. Any forward-looking statement made by us in this Annual Report speaks only as of the date on which it is made. We disclaim any duty to update any of these forward-looking statements after the date of this Annual Report to confirm these statements to actual results or revised expectations.

These factors should not be construed as exhaustive and should be read in conjunction with our other disclosures, including but not limited to the risk factors described in Part I, Item 1A of this Annual Report. Other risks may be described from time to time in our filings made under the securities laws. New risks emerge from time to time. It is not possible for our management to predict all risks. All forward-looking statements in this Annual Report speak only as of the date made and are based on our current beliefs and expectations. We undertake no obligation to update or revise any forward-looking statement, whether as a result of new information, future events or otherwise.

| 3

|

NOTE REGARDING TRADEMARKS

We own various U.S. federal trademark registrations and applications and unregistered trademarks and servicemarks, including but not limited to OpGen®, Curetis®, Unyvero®, ARES® and ARES GENETICS®, Acuitas®, Acuitas Lighthouse®, AdvanDx®, QuickFISH®, and PNA FISH®. All other trademarks, servicemarks or trade names referred to in this Annual Report are the property of their respective owners. Solely for convenience, the trademarks and trade names in this Annual Report are sometimes referred to without the ® and ™ symbols, but such references should not be construed as any indicator that their respective owners will not assert, to the fullest extent under applicable law, their rights thereto. We do not intend the use or display of other companies’ trademarks and trade names to imply a relationship with, or endorsement or sponsorship of us by, any other companies, products or services.

| 4

|

PART I

Item 1. Business

Please refer to the Glossary at the end of this Business section for definitions or descriptions of scientific, diagnostic, healthcare, regulatory, and OpGen-specific terms used in this Annual Report.

Overview

OpGen, Inc. (the “Company”) is a precision medicine company harnessing the power of molecular diagnostics and informatics to help combat infectious disease. Along with our subsidiaries, Curetis GmbH and Ares Genetics GmbH, we are developing and commercializing molecular microbiology solutions helping to guide clinicians with more rapid and actionable information about life threatening infections to improve patient outcomes and decrease the spread of infections caused by multidrug-resistant microorganisms, or MDROs. Our current product portfolio includes Unyvero, Acuitas AMR Gene Panel, and the ARES Technology Platform including ARESdb, using NGS technology and AI-powered bioinformatics solutions for antibiotic response prediction, as well as the Curetis CE-IVD-marked PCR-based SARS-CoV-2 test kit. The Company exited its FISH business in early 2021, and the Company's license agreement with Life Technologies, a subsidiary of Thermo Fisher, was terminated as of June 30, 2021.

On April 1, 2020, the Company completed a business combination transaction whereby the Company acquired Curetis GmbH, a private limited liability company organized under the laws of the Federal Republic of Germany (“Curetis GmbH”). Curetis is an early commercial-stage molecular diagnostics (MDx) company focused on rapid infectious disease testing for hospitalized patients with the aim to improve the treatment of hospitalized, critically ill patients with suspected microbial infection and has developed the innovative Unyvero molecular diagnostic solution for comprehensive infectious disease testing. The business combination transaction was designed principally to leverage each company’s existing research and development and relationships with hospitals and clinical laboratories to accelerate the sales of both companies’ products and services.

The focus of OpGen is on its combined broad portfolio of products, which includes high impact rapid diagnostics and bioinformatics to interpret AMR genetic data. The Company currently expects to focus on the following products for lower respiratory infection, urinary tract infection and invasive joint infection:

| · | The Unyvero Lower Respiratory Tract, or LRT, test (e.g. for bacterial pneumonias) is the first U.S. Food and Drug Administration, or FDA, cleared test that can be used for the detection of more than 90% of common causative agents of hospitalized pneumonia. According to the National Center for Health Statistics (2018), pneumonia is a leading cause of admissions to the hospital and is associated with substantial morbidity and mortality. The Unyvero LRT automated test detects 19 pathogens within less than five hours, with approximately two minutes of hands-on time and provides clinicians with a comprehensive overview of 10 genetic antibiotic resistance markers. We have commercialized the Unyvero LRT BAL test for testing bronchoalveolar lavage, or BAL, specimens from patients with lower respiratory tract infections following FDA clearance received by Curetis in December 2019. The Unyvero LRT BAL automated test simultaneously detects 20 pathogens and 10 antibiotic resistance markers, and it is the first and only FDA-cleared panel that also includes Pneumocystis jirovecii, a key fungal pathogen often found in immunocompromised patients (such as AIDS and transplant patients) that can be difficult to diagnose, as the 20th pathogen on the panel. We believe the Unyvero LRT and LRT BAL tests have the ability to help address a significant, previously unmet medical need that causes over $10 billion in annual costs for the U.S. healthcare system, according to the Centers for Disease Control, or CDC. |

| · | Following registration of the Unyvero instrument system as an IVD for the Chinese market in early 2021, we are supporting our strategic partner Beijing Clear Biotech (BCB) in pursuing execution of a supplemental clinical trial with the Unyvero HPN test. As requested by the Chinese regulatory authority NMPA, this study is geared towards generating additional data in China that will complement a larger data set with data from abroad compiled from other clinical and analytical studies performed in the past. |

| · | The Unyvero Urinary Tract Infection, or UTI, test, which is CE-IVD marked in Europe, is currently being made available to laboratories in the United States as a research use only or RUO kit. The test detects a broad range of pathogens as well as antimicrobial resistance markers directly from native urine specimens. We initiated a prospective multi-center clinical trial for the Unyvero UTI in the United States in the third quarter of 2021. |

| · | The Unyvero Invasive Joint Infection, or IJI, test, which is a variant being developed for the U.S. market, has also been selected for analytical and clinical performance evaluation including clinical trials towards a future U.S. FDA submission. Microbial diagnosis of IJI is difficult because of challenges in sample collection, usually at surgery, and patients being on prior antibiotic therapy which minimizes the chances of recovering viable bacteria. We believe that Unyvero IJI could be useful in identifying pathogens as well as their AMR markers to help guide optimal antibiotic treatment for these patients. |

| 5

|

| · | On September 30, 2021, we received clearance from the FDA for our Acuitas AMR Gene Panel for bacterial isolates. The Acuitas AMR Gene Panel detects 28 genetic antimicrobial resistance, or AMR, markers in isolated bacterial colonies from 26 different pathogens. We believe the panel provides clinicians with a valuable diagnostic tool that informs about potential antimicrobial resistance patterns early and supports appropriate antibiotic treatment decisions in this indication. We expect to commercialize the Acuitas AMR Gene Panel for isolates more broadly to customers in the United States. |

| · | We are also developing novel bioinformatics tools and solutions to accompany or augment our current and potential future IVD products and may seek regulatory clearance for such bioinformatics tools and solutions to the extent they would be required either as part of our portfolio of IVD products or even as a standalone bioinformatics product. |

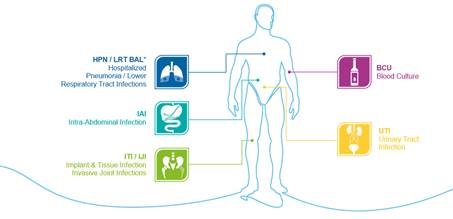

OpGen has extensive offerings of additional IVD tests including CE-IVD-marked Unyvero tests for hospitalized pneumonia patients, implant and tissue infections, intra-abdominal infections, complicated urinary tract infections, and blood stream infections. Our portfolio furthermore includes a CE-IVD-marked PCR based rapid test kit for SARS-CoV-2 detection in combination with our PCR compatible universal lysis buffer (PULB).

OpGen’s combined AMR bioinformatics offerings, when and if such products are cleared for marketing, will offer important new tools to clinicians treating patients with AMR infections. OpGen’s subsidiary Ares Genetics’ ARESdb is a comprehensive database of genetic and phenotypic information. ARESdb was originally designed based on the Siemens microbiology strain collection covering resistant pathogens and its development has significantly expanded, as a result of transferring data from the discontinued Acuitas Lighthouse into ARESdb to now cover > 78,000 bacterial isolates that have been sequenced using NGS technology and tested for susceptibility with applicable antibiotics from a range of over 100 antimicrobial drugs. In the fourth quarter of 2021, Ares Genetics entered into a strategic database access deal with one of the world’s leading microbiology and IVD corporations for their non-exclusive access to approximately 1.1% of Ares Genetics’ total database asset at the time of signing. Ares Genetics continues to explore various discussions with several interested parties in potential future collaboration or licensing opportunities. Additional partnerships with a U.S. CLIA lab, a contract research organization (“CRO”) and a major University Medical Center have been initiated and are ongoing and the collaboration master service agreement with Sandoz has recently been extended until January 2025.

In addition to potential future licensing and partnering, Ares Genetics intends to independently utilize the proprietary biomarker content in this database, as well as to build an independent business in NGS and AI based offerings for AMR research and diagnostics in collaboration with its current and potential future partners in the life science, pharmaceutical and diagnostics industries. Ares Genetics signed up Siemens Technology Accelerator and AGES (Austrian Agency for Health and Food Safety), as well as several other national institutions from various European countries as new customers.

OpGen’s subsidiary Curetis’ Unyvero A50 tests for up to 130 diagnostic targets (pathogens and resistance genes) in under five hours with approximately two minutes of hands-on time. The system was first CE-IVD-marked in 2012 and was FDA cleared in 2018 along with the LRT test through a De Novo request. The Unyvero A30 RQ is a new device designed to address the low-to mid-plex testing market for 5-30 DNA targets and to provide results in approximately 30 to 90 minutes with 2-5 minutes of hands-on time. The Unyvero A30 RQ has a small benchtop footprint and has an attractive cost of goods profile. Curetis has been following a partnering strategy for the Unyvero A30 RQ and, following the successful completion of a key development milestone, Curetis has completed final verification and validation testing of the A30 instruments and is actively engaged in several ongoing partnering discussions and due diligence under respective material transfer agreements.

The Company has extensive partner and distribution relationships to help accelerate the establishment of a global infectious disease diagnostic testing and informatics business. The Company’s partners include A. Menarini Diagnostics S.r.l. for pan-European distribution to currently 12 countries and Beijing Clear Biotech Co. Ltd. for Unyvero A50 product distribution in China. We have a network of distributors covering countries in Europe, the Middle East and Africa, Asia Pacific and Latin America. With the discontinuation of our FISH products business in Europe, we have reduced our network of distributors to only those distributors actively commercializing our Unyvero line of products or CE-IVD-marked SARS-CoV-2 test kits.

OpGen will continue to develop and seek FDA and other regulatory clearances or approvals, as applicable, for our Unyvero UTI and IJI products. OpGen will continue to offer the FDA-cleared Unyvero LRT and LRT BAL Panels, and FDA-cleared Acuitas AMR Gene Panel tests, as well as the Unyvero UTI Panel as a RUO product to hospitals, public health departments, clinical laboratories, pharmaceutical companies and CROs. OpGen’s subsidiary, Curetis, continues its preparations for achieving compliance with the upcoming European Union’s In-Vitro-Diagnostic Device Regulation (IVDR), which officially will go into effect in May 2022. Given the lack of designated Notified Bodies at this time, and with the recently approved EU commission proposal to provide for generous multi-year grace periods for IVD products with current In-Vitro-Diagnostic Device Directive (IVDD) CE marking, it is now possible for Curetis to continue its portfolio of existing CE-IVD marked products until at least May 2025 and May 2026, respectively, as long as no material changes are being made to any of its products. Following May 2022, however, any new or changed CE marked products will be required to be IVDR compliant from the outset.

| 6

|

Our headquarters are in Rockville, Maryland, and our principal operations are in Rockville, Maryland and Holzgerlingen and Bodelshausen, both in Germany. We also have operations in Vienna, Austria. We operate in one business segment.

OpGen’s Products and Products in Development

Through its subsidiary Curetis, OpGen maintains a comprehensive portfolio of molecular diagnostics for rapid infectious disease and AMR testing. At the core of the portfolio is the Unyvero platform and product family, which is developed, manufactured and commercialized via the wholly owned Curetis GmbH subsidiary. On the bioinformatics side, OpGen has combined data from its now discontinued Acuitas Lighthouse with the Ares Genetics (Ares) data into the ARESdb. Ares develops and commercializes its NGS as well as bioinformatics based, AI-powered prediction models and solutions to partners and customers in the pharma, biotech and diagnostics industries as well as to public research institutions.

OpGen is a molecular diagnostics company that focuses on the development and commercialization of reliable, fast and cost-effective products for diagnosing severe infectious diseases in hospitalized patients, an indication with a high unmet medical need and significant prevalence in developed countries. Our unique Unyvero Platform currently comprises the Unyvero System with the Unyvero A50 Analyzer at its core, proprietary software, and single use Application Cartridges. These Application Cartridges contain molecular tests addressing specific severe infectious diseases and detect a broad range of pathogens relevant in a given indication and associated toxin genes and genetic antimicrobial resistance markers.

The Unyvero Platform has been CE-IVD-marked since 2012 and is commercialized in Europe and certain other markets that accept CE-IVD-marking or where it has successfully passed the registration process (i.e. Colombia, Kuwait, Belarus, Singapore), and has been rolled out commercially in the United States following De Novo clearance of the Unyvero System and the LRT Application Cartridge by the FDA in April 2018 and the 510(k) clearance of the LRT Application for BAL samples in December 2019.

Today, the diagnosis of infectious diseases in the hospital setting is still largely carried out through traditional culture-based microbiology methods. This process is labor-intensive and time-consuming, typically delivering results only after 24 to 72 hours or, in some cases, weeks. As a result, informed antibiotic therapy decisions may be delayed, which can lead to poor patient outcomes, including higher mortality rates for indications such as pneumonia and sepsis, longer hospital stays, increased hospital costs and overall spread of antibiotic resistance, a significant and increasing problem throughout the world. All of these factors pose clinical and economic challenges to hospitals and a significant threat to public health globally.

OpGen aims to improve on this standard-of-care by offering comprehensive test information in a timely manner that allows for early, efficacious treatment, which OpGen believes results in improved clinical and health economic outcomes. The Company’s Unyvero Platform delivers results within four to five hours and can cover over 100 diagnostic targets. The broad Unyvero test panels also allow the identification of microorganisms that are difficult to culture and hence missed in culture-based test methods, as well as rare but critical pathogens not routinely tested for by standard methods, a conclusion confirmed by a number of clinical studies. The FDA clinical trial for the LRT Application Cartridge concluded that the Unyvero System identified 32 positive atypical pathogen results in 1,653 prospectively tested specimens, as opposed to only four confirmed positive atypical pathogen results identified in 116 specimens from this cohort using traditional culture-based diagnostic methods. The Company believes this allows clinicians to make early adjustments to the specific treatment of the patient, saving significant time and cost, in particular by reducing the duration of the patient’s hospital stay.

The Unyvero Platform is intended to complement rather than replace traditional microbiology-based diagnostics testing. OpGen believes, however, that timely diagnosis of the underlying pathogens and their resistances could greatly improve outcomes for patients and is likely to provide net savings to hospitals.

The Unyvero Platform is marketed through a combination of direct sales in the United States and a growing network of distribution partners in Europe, Middle East, the ASEAN Region, Asia and Latin America. As of December 31, 2021, the distribution network comprises 14 distributors covering 31 countries in those regions with regulatory clearance for the Unyvero System and the Unyvero Application Cartridges in some of these countries still pending.

| 7

|

There are currently seven commercially available Application Cartridges, consisting of:

| · | the HPN Application Cartridge, which addresses severe forms of pneumonia and is CE-IVD-marked in Europe; |

| · | the ITI Application Cartridge, which addresses severe cases of implant and tissue infections and is CE-IVD-marked in Europe; |

| · | the BCU Application Cartridge, which addresses severe blood stream infections and is CE-IVD-marked in Europe; |

| · | the IAI Application Cartridge, which addresses intra-abdominal infections and is CE-IVD-marked in Europe; |

| · | The UTI Application Cartridge, which addresses severe urinary tract infections and is CE-IVD-marked in Europe. The Company has begun analytical and clinical performance evaluations, including clinical trials initiated in the third quarter of 2021, required for a subsequent U.S. FDA submission; |

| · | the LRT Application Cartridge, which is technically similar to the HPN Application Cartridge and also addresses severe forms of pneumonia, which was cleared by the FDA in April 2018 for use with tracheal aspirates and is now being marketed in the United States; and |

| · | the LRT BAL Application Cartridge which was cleared on December 20, 2019 by the FDA for use with BAL specimens and has been launched in the Unites States in the first quarter of 2020. |

In addition to the current Unyvero System, the Company through its subsidiary Curetis also develops its Unyvero A30 RQ Analyzer module designed to offer a rapid time-to-result (potentially as fast as 30 to 90 minutes), qualitative and, where needed, quantitative real-time PCR testing in a cartridge format that can provide up to 11 parallel multiplex (i.e. simultaneously running multiple assays in one reaction) PCR reactions from one sample, with up to three assays per reaction (for a total of up to 33 assays per cartridge). The Unyvero A30 RQ Analyzer is expected to be operated on a stand-alone basis or fully integrated into the Unyvero System suite of products with respect to system architecture, design, software and handling, thereby expanding the Unyvero Platform to include low- and mid-plex capabilities. We expect that the costs of the Unyvero A30 RQ Analyzer and cartridges will be lower than those for the current Unyvero System and A50 Application Cartridges, potentially opening up commercial opportunities in the medium multiplexing infectious disease testing market segment. Initially developed as an expansion of the Unyvero platform, complementing the Unyvero A50 high-plex Application Cartridges with low- to mid-plex Unyvero A30 RQ Application Cartridges for infectious diseases, OpGen adjusted its strategy and now also seeks partners in the global IVD industry that may want to license the Unyvero A30 RQ for commercialization of their own assays on this platform, potentially even as legal manufacturer under their own branding.

The Unyvero Platform

Curetis launched its CE-IVD-marked Unyvero Platform with a first disposable Application Cartridge for pneumonia in 2012. The FDA cleared the Unyvero System and LRT Application Cartridge in April 2018 and the LRT BAL Application Cartridge in December 2019. The Chinese authorities National Medical Products Administration (“NMPA”) cleared the Unyvero System in early 2021.

The Unyvero Platform is a highly automated sample-to-answer molecular diagnostics platform, based on multiplexed end-point PCR with an array-based detection process. It integrates fully automated sample preparation, analysis and identification of disease relevant pathogens and antibiotic resistance markers to provide timely high-quality information to its end-users. The scalable system is designed to be either placed in laboratory settings or directly in hospital wards or intensive care units. Time-to-result is four to five hours for the different Application Cartridges commercially available today, including 30 minutes of automated sample preparation (lysis) and total hands-on time of no more than five minutes. The Unyvero Platform’s intuitive workflow with only minimal hands-on time enables untrained hospital staff to perform molecular tests at the point of need, such as ICUs.

| 8

|

Unyvero Platform, System Components and Workflow

The Unyvero System consists of three devices, the Unyvero L4 Lysator, the Unyvero C8 Cockpit and the Unyvero A50 Analyzer. The Unyvero L4 Lysator is used for sample pre-processing and pathogen lysis. The Unyvero C8 Cockpit is the control panel for the Unyvero L4 Lysator and Unyvero A50 Analyzer and displays the results of patient sample analysis. The Unyvero A50 Analyzer integrates mechanical, electronic, pneumatic and optical elements and enables a fully automatic random-access processing of the Application Cartridges. The Application Cartridges are single-use, disposable and disease specific. The Unyvero System, together with proprietary software and the Application Cartridges, comprise the Unyvero Platform.

Figure 1: Unyvero Platform

The Unyvero L4 Lysator

The Unyvero L4 Lysator instrument is used for sample pre-processing and pathogen lysis. It performs proprietary software-controlled lysis of up to four samples, simultaneously within 30 minutes, combining mechanical, thermal, enzymatic and chemical lysis steps and allows the use of a wide range of native sample types due to a proprietary sample processing method (in respect of which several patents have been granted or are currently pending). Biofilm-forming pathogens can be detected by the Unyvero Platform. In addition, the Unyvero Platform is CE-IVD-marked for a broad variety of native patient sample types including sputum, (mini) BAL, tracheal aspirates, aspirates and exudates, catheter tips, pus, sonication fluid, synovial fluid, swabs and tissue. The lysis of further sample types such as blood, urine, stool and formalin-fixed paraffin embedded tissues is also possible with the proprietary Unyvero lysis method. Up to two Unyvero L4 Lysators can be attached to a single Unyvero C8 Cockpit to allow processing of up to eight samples simultaneously within 30 minutes.

The Unyvero C8 Cockpit

The Unyvero C8 Cockpit device is the control panel for the Unyvero L4 Lysator and Unyvero A50 Analyzer. It has a touchscreen and built-in bar code reader and runs on proprietary in-house developed Unyvero software. Step-by-step instructions guide the user from preparing a test to executing the fully automated process in the Unyvero A50 Analyzer in just a few minutes. The results display, storage of results and data storage, as well as information about the performed tests including the Application Cartridges’ shelf-life and lot numbers, are generated automatically. Data can be exported as PDF files via a USB key or to a connected printer. It also features built-in interfaces for connectivity to hospital and laboratory information systems.

| 9

|

The Unyvero A50 Analyzer

The Unyvero A50 Analyzer instrument consists of mechanical, electronic, pneumatic and optical elements and enables a fully-automatic random-access processing of the A50 Application Cartridges. Once a run is started, the Unyvero A50 Analyzer automatically executes and controls all sample processing and analysis steps (including DNA extraction, DNA purification, PCR set-up, highly multiplexed end-point PCR amplification and a hybridization array-based fluorescence detection) inside the Application Cartridge. For safety and equipment longevity, and to avoid issues of calibration or waste-removal, the Unyvero A50 Analyzer contains neither reagents nor waste. All fluids are handled within the sealed Application Cartridge. Up to four Unyvero A50 Analyzers can be attached to a single Unyvero C8 Cockpit and each Unyvero A50 Analyzer includes the two available slots that provide full random access per Unyvero A50 Analyzer, allowing the processing of up to eight patient samples simultaneously within four to five hours. In the future, OpGen believes a further expansion to up to eight Unyvero A50 Analyzers will also be possible.

Figure 2: Unyvero sample tube, sample tube cap, sample pre-treatment tool and Master Mix tube

Workflow

The Unyvero Platform is a modular, flexible easy-to-use platform, which substantially reduces turnaround time from up to 24 hours or even weeks for traditional microbiology culture-based tests to approximately four to five hours. This allows physicians to adjust treatment at a much earlier stage than with the traditional microbiology culture-based test, which is the current clinical standard of care. OpGen believes that the reduced hands-on time of no more than five minutes and the intuitive workflow make the system operable by non-specialty trained laboratory personnel and reduce the risks of errors.

Unyvero A50 Application Cartridge Portfolio

Figure 3: Currently available Application Cartridges

| 10

|

The HPN and LRT Application Cartridges

The HPN Application Cartridge was commercially launched in April 2015 and is the second-generation version of the P50 Application Cartridge, the Pneumonia Application Cartridge originally launched in 2012. It is a CE-IVD-marked Application Cartridge for the fully automated performance of currently 21 PCR assays for microorganisms and 19 PCR assays for antibiotic resistance markers combined in a total of eight multiplex PCR reactions on native respiratory samples, such as sputum, tracheal aspirates and BAL fluids with no pre-culturing required. This Application Cartridge combines the necessary detection of bacteria, fungus and resistance markers into a single test to aid diagnosing pneumonia. With the HPN Application Cartridge, the Company aims to detect the vast majority of pneumonia-causing pathogens and antibiotic resistance markers in hospitalized patients.

The HPN Application Cartridge of microorganisms and resistance gene markers was designed based on feedback of clinical experts and international and national guidelines. It aims to detect at least 90% of healthcare-associated pneumonia-causing pathogens and clinically relevant resistances against antimicrobials. The Application Cartridge is primarily designed to capture patients at risks for:

| · | microorganisms causing severe, and complicated to treat, forms of pneumonia, e.g. Pseudomonas aeruginosa; |

| · | microorganisms carrying antibiotic resistance and where patients may need isolation (MRSA, Klebsiella); |

| · | infections with multidrug-resistant bacteria that might not be targeted by empiric treatment schemes; and |

| · | rare and difficult to detect pathogens like Legionella sp. |

The Application Cartridge composition takes pathogen incidences into account. It includes those microorganisms showing an incidence of above 1%. The Application Cartridge is completed by adding pathogens with lower incidence but a high clinical need, such as Legionella sp.

The HPN Application Cartridge covers 19 antibiotic resistance markers, including: (i) ß-Lactam resistance, including ESBL; (ii) kpc resistance; (iii) macrolide resistance; (iv) quinolone resistance; and (v) multi-drug resistance.

The LRT Application Cartridge was launched in the United States in April 2018. It is an FDA-cleared Application Cartridge for the fully automated detection of 46 targets, covering 36 microorganisms and 10 antibiotic resistance markers, for lower respiratory tract infections with a total of 29 PCR assays combined in eight multiplexed PCR reactions. Although similar in most respects to the HPN Application Cartridge, the LRT differs from the HPN in its pathogen reporting due to FDA reporting requirements. In accordance with a De Novo request that was granted by the FDA in April 2018, the initial label claim covers the use of LRT with tracheal aspirate samples only and has cleared 19 pathogen assays as well as 10 antibiotic resistance marker assays.

The LRT BAL Application Cartridge that was 510(k)-cleared by the U.S. FDA in December 2019 and launched in the United States in January 2020, is a version of the LRT Application Cartridge that is optimized for use with commonly obtained BAL specimens. The Unyvero LRT BAL application is the first and only U.S. FDA-cleared molecular diagnostic panel that detects Pneumocystis jirovecii in addition to a broad spectrum of clinically relevant bacterial pathogens and antibiotic resistance markers associated with pneumonia.

The ITI Application Cartridge

The ITI Application Cartridge was launched in May 2016 and is the second-generation version of the ITI Application Cartridge originally launched in the second quarter of 2014. Improvements were made to the panel and analytical performance as well as clinical sensitivity and specificity. It is a CE-IVD-marked Application Cartridge for the fully automated detection of currently 102 targets, covering 85 microorganisms and 17 antibiotic resistance markers for eight different clinical indications within the areas of prosthetic joint infections, surgical site infections, diabetic foot ulcers, catheter-associated infections, deep skin and tissue infections, cardiology-related infections, burn wounds and other implant infections. CE performance evaluation has demonstrated sensitivity of 86.9% at specificity of 99.2%. A diverse range of sample types such as aspirates and exudates, pus, sonication fluid, swabs, synovial fluid and tissue can be used on this Application Cartridge. Moreover, biofilm-forming pathogens can be identified by the Unyvero Platform. The ITI Application Cartridge was jointly developed and co-funded with a worldwide market leader in orthopedic bone cement, which offers comprehensive infection management solutions. The Company pays a customer referral commission but has retained full control on product commercialization.

The BCU Application Cartridge

The BCU Application Cartridge was launched in Europe in April 2016. It is a CE-IVD-marked and Singapore HSA-cleared Application Cartridge for the fully automated detection of 103 targets, covering 87 microorganisms and 16 antibiotic resistance markers relevant in the area of blood stream infections. The CE-IVD performance evaluation has demonstrated a weighted average sensitivity for all pathogens of 96.2%, and a weighted average specificity of 99.4%. Unlike other Unyvero Application Cartridges, BCU uses samples from positive blood cultures rather than native patient samples. Such blood cultures are started in cases of suspected blood stream infections.

| 11

|

The IAI Application Cartridge

The IAI Application Cartridge was launched in April 2017. It is a CE-IVD-marked Application Cartridge for the fully automated detection of 130 targets, covering 105 pathogens, three toxins and 22 resistance markers for several different clinical indications within the areas of severe intra-abdominal infections such as symptoms of peritonitis, appendicitis, acute abdomen, acute pancreatitis, and megacolon. Overall weighted average sensitivity for the pathogens specifically targeted by the test panel was 93.8% at an overall weighted average specificity of 99.7% following discrepant result resolution.

The UTI Application Cartridge

The UTI Application Cartridge was launched in April 2018. It is a CE-IVD-marked Application Cartridge for the fully automated detection of up to 103 diagnostic targets, covering 88 microorganisms and 15 genetic resistance markers for the areas of severe urinary tract infections in patients with anatomical, structural and functional alterations, renal impairments, impaired immune status, catheter-associated UTI, patients failing to respond to therapy and suffering from severe manifestations, urosepsis. OpGen estimates that the addressable market for the UTI Application Cartridge is 1.6 million cases eligible for testing per year in the EU and the United States. The UTI Application Cartridge is also available as RUO in the USA since 2020. As part of our portfolio strategy update in the fourth quarter of 2020, we decided to proceed with the analytical and clinical performance evaluation including clinical trials required for a subsequent U.S. FDA submission for this Application Cartridge and initiated clinical trials in the third quarter of 2021.

Curetis’ SARS-CoV-2 Kit

CE IVD marked in 2020, Curetis has developed and commercializes a PCR based rapid test kit for SARS-CoV-2 detection. It uses real-time reverse transcription polymerase chain reaction (RT-PCR) technology for qualitative detection of the SARS-CoV-2 virus isolated from oropharyngeal and nasopharyngeal swab specimens from individuals suspected of COVID-19 by their healthcare provider or for screening of asymptomatic individuals. This kit can be used with RNA isolated by performing standard RNA isolation processes, as well as with oropharyngeal or nasopharyngeal swabs collected in PCR compatible viral transport medium treated with PCR-Compatible Universal Lysis Buffer (PULB) provided in the kit.

Ares Genetics’ NGS and Bioinformatics Services for Molecular Microbiology

OpGen’s other core business in NGS and bioinformatics based solutions for molecular microbiology is operated by its wholly-owned subsidiary Ares Genetics GmbH, or Ares Genetics, founded in 2017 and based in Vienna, Austria. Ares Genetics’ business is based on the proprietary ARES Technology Platform and Ares Genetics’ proprietary genetic database on AMR, ARESdb. The ARES Technology Platform and ARESdb build and expand upon the GEAR assets acquired from Siemens Technology Accelerator GmbH in 2016. On the bioinformatics side, OpGen has combined data from its now discontinued Acuitas Lighthouse with the Ares Genetics (Ares) data into the ARESdb. Ares Genetics believes ARESdb is a unique comprehensive database on the genetics of antibiotic resistance. Ares Genetics also pursues an active out-licensing and collaboration strategy with suitable partners in the life science, pharmaceutical, and diagnostic industry to jointly develop solutions for microbiology relying on the database and/or the Ares Technology Platform. Ares Genetics entered into its first partnering and strategic collaborations with QIAGEN, Sandoz, and recently entered into a strategic data access deal with one of the world’s leading microbiology and IVD corporations which obtained non-exclusive access to approximately 1.1% of Ares Genetics’ then-current datasets.

In addition to its out-licensing strategy, Ares Genetics offers next-generation molecular AMR testing services out of its NGS service lab opened in mid-2019 in Vienna, Austria, with initial focus on infection control, AMR epidemiology and surveillance, clinical research and pharmaceutical anti-infectives research and development.

Ares Genetics has also developed its ARESupa Universal Pathogenome Assay, which is based on the ARES Technology Platform and ARESdb. ARESupa is intended to cover nearly any pathogen in a broad array of sample types and to predict antimicrobial drug response to a wide variety of treatment options using a single NGS laboratory workflow.

In August 2019, Ares Genetics opened a specialized service laboratory offering next-generation AMR testing services with an initial focus on infection control, AMR epidemiology and surveillance, clinical research and pharmaceutical anti-infectives research and development. All services are based on NGS and Ares Genetics’ proprietary, AI-powered antimicrobial resistance database ARESdb and the ARES Technology Platform for data interpretation. Ares Genetics expects to also begin offering its services in the United States.

| 12

|

In 2022, Ares Genetics launched AREScloud, a software as a service offering. The commercially available web application is intended for research use only and aims at professionals in clinical microbiology, public health, and microbial R&D. AREScloud intends to automate the accurate analysis and comprehensive interpretation of microbial genome data for surveillance and infection prevention and control applications. The web application leverages the contents of the proprietary ARESdb to enable the AI-assisted antibiogram prediction (referred to as predictive AST) directly from bacterial genome data.

OpGen’s Acuitas AMR Gene Panel

We believe more rapid genetic identification methods will reduce morbidity from MDROs, reduce healthcare costs through reduced length of stay, and assist in the identification of targeted antibiotic therapy. Current conventional microbiology, largely unchanged in 50 years, requires one to two days for growth and phenotypic analysis and often leads to the use of broad spectrum antibiotic therapy in the early stages of infection.

OpGen has developed the Acuitas AMR Gene Panel, which was 510(k)-cleared by the U.S. FDA on September 30, 2021 for testing bacterial isolates. This test had been made available in the United States as RUO before and had been used in such capacity in connection with The New York State Infectious Disease Digital Health Initiative for testing of bacterial isolates.

The Acuitas AMR Gene Panel is FDA cleared to detect a comprehensive panel of 28 genetic antimicrobial resistance (AMR) markers, covering select drugs in 9 classes of antibiotics, in isolated bacterial colonies from 26 different pathogens. An identified bacterial isolate is tested, and the antibiotic resistance gene markers associated with the selected bacterial species are reported as “Detected”, “Not Detected” or “NA/NR”.

Market Overview

Antibiotic Resistance – An Urgent Global Issue

Antimicrobial resistance (AMR) is one of the greatest global public health threats that has been recognized by many international bodies, including the World Health Organization (WHO) and the U.S. Centers for Disease Control and Prevention (CDC). A recent publication in The Lancet (January 19, 2022) confirms the rapid spread of AMR infections and highlights that an estimated 4.95 million deaths were associated with AMR in 2019, and between 2014 and 2019, the burden of fatalities directly attributable to bacterial AMR rose from 700K to 1.27M. The growing threat of AMR to public health is exacerbated by existing and newly developed antibiotics facing a wide range of drug resistance mechanisms in pathogens of concern. Recent Infectious Diseases Society of America (IDSA) treatment guidance for multidrug-resistant Gram-negative bacterial infections (Clin Infect Dis 2021 Apr 8;72(7):e169-e183) highlights how detection of AMR genes or a specific mechanism of resistance can help guide reporting practices for novel antimicrobial agents and tailor therapy for these difficult to treat infections. Furthermore, it can help with infection prevention and control initiatives such as patient isolation procedures when multiple isolates with the same AMR profile are detected as an early indication of transmission within a facility or for surveillance of serious or emerging AMR threats.

Antibiotic-resistant infections add considerable but often avoidable costs to the U.S. healthcare system. In most cases, these infections require prolonged and/or costlier treatments, extended hospital stays, additional doctor visits and healthcare facilities use, and result in greater disability and death compared with infections that are treatable with antibiotics. Estimates for the total economic cost to the U.S. economy are difficult to calculate but have been estimated to be as high as $20 billion in excess direct healthcare costs annually.

Over the last decade, multidrug-resistant Gram-negative bacteria, frequently referred to as Superbugs, have been implicated in severe healthcare-associated infections (HAIs), and their occurrence has increased steadily. For example, Klebsiella pneumoniae, or K. pneumoniae, is responsible for roughly 15% of Gram-negative infections in hospital intensive care units. Infections caused by KPC strains have few treatment options and are associated with a mortality rate upwards of 50%.

Exacerbating the problems associated with the emergence of these highly resistant KPC strains is their propensity to cause outbreaks in healthcare institutions. These pathogens persist both in the flora of hospitalized patients and in the hospital environment, and they have the capacity to silently colonize patients or hospital personnel by establishing residence in the gastrointestinal tract without causing any signs of infection. Individuals can be silently colonized or become asymptomatic carriers for long periods of time, with detection of these carriers often proving difficult. These silent carriers act as reservoirs for continued transmission, which makes subsequent spread difficult to control and outbreaks difficult to stop. In addition, KPC strains can survive for several hours on the hands of hospital personnel, which likely facilitates the spread of organisms from patient to patient. Effective control of KPC outbreaks requires a detailed understanding of how transmission occurs, but current technologies do not allow healthcare providers to routinely perform these investigations on a timely basis.

| 13

|

The lack of currently available treatment options and scarcity of new treatment options in development are compounding the emerging Superbug problem. It has been close to 30 years since a new class of antibiotics was developed and successfully introduced. As a result, we believe that rapid, accurate identification of the pathogen and its genetic make-up, screening, infection control and antibiotic stewardship have become one of the most powerful weapons in the fight to contain this threat.

The emergence of multidrug resistant pathogens has made the treatment of patients with UTIs a growing problem in the United States and internationally. There are approximately 10 million patients each year in the United States with UTIs and more than one million of these patients have cUTI often requiring hospitalization with intravenous antibiotic therapy. Among these patients E. coli represents the most common pathogen, and recent data indicate that 18.3% of U.S. E. coli isolates are extended spectrum β-lactamase (ESBL) resistant. These patients present complicated therapeutic choices for clinicians and often require last resort carbapenem antibiotics. The rate of ESBL resistant E. coli increased 34% annually between 2010 and 2014. Therapy with carbapenem antibiotics has contributed to growing Carbapenem resistance (CRE) rates and high patient treatment costs.

Based on industry analyses, we believe the global HAI market is a $2 billion dollar market with the molecular diagnostic segment representing a fast-growing segment of such market with multiple high acuity patients and significant infectious sites, including UTIs, surgical site infections, pneumonia and bloodstream infections.

Commercial Sales

We currently sell and market our products and services directly in the United States through a dedicated sales and marketing support team. Internationally, we sell our products through a network of 14 distributors covering 31 countries.

We operate in one segment. Our operations are located in the United States, Germany, and Austria.

Competition

We are developing a molecular diagnostics (MDx) business focused on leading a transformation in microbiology and infectious disease through precision medicine products and services that combine genomic data and bioinformatics. Our approach combines proprietary platforms and content, namely the FDA cleared and CE-IVD-marked Unyvero System and its DNA-based A50 Unyvero Panels, the FDA-cleared Acuitas AMR Gene Panel, and NGS applications based on leading AI-powered AMR knowledge-bases. Our competitors include rapid diagnostic testing, next-generation sequencing testing, and traditional microbiology companies, commercial laboratories, information technology companies, and hospital laboratories who may internally develop testing capabilities. Principal competitive factors in our target market include: organizational size, scale, and breadth of product offerings; rapidity of test results; quality and strength of clinical and analytical validation data and confidence in diagnostic results; cost effectiveness; ease of use; and regulatory approval status.

Our principal competition comes from traditional methods used by healthcare providers to diagnose and screen for MDROs and from other molecular diagnostic companies creating screening and diagnostic products such as Cepheid (a subsidiary of Danaher), Becton-Dickinson (BD), bioMérieux, Accelerate Diagnostics, T2 Biosystems, GenMark (a subsidiary of Roche), Qiagen, Luminex (acquired by DiaSorin), Thermo Fisher and Mobidiag (a subsidiary of Hologic). We believe our focus on identifying antibiotic-resistant genes in addition to broad panels of organisms from a wide variety of native clinical sample types, and our Ares Genetics bioinformatics offerings differentiate us from such competitors.

Competitors may develop their own versions of our product offerings in countries where we do not have patents or where our intellectual property rights are not recognized.

Many of our potential competitors have widespread brand recognition and substantially greater financial, technical, research and development and selling and marketing capabilities than we do. Others may develop products with prices lower than ours that could be viewed by hospitals, physicians and payers as functionally equivalent to our products and services, or offer products and services at prices designed to promote market penetration, which could force us to lower our list prices and affect our ability to achieve profitability. If we are unable to change clinical practice in a meaningful way or compete successfully against current and future competitors, we may be unable to increase market acceptance and sales of our products, which could prevent us from increasing our revenue or achieving profitability and could cause our stock price to decline.

| 14

|

Competition to the Unyvero System

The Unyvero Platform is a sample-to-answer MDx solution. There are several other companies who develop and commercialize similar systems. In terms of devices and assays, OpGen believes its key competitors include bioMérieux (BioFire with its FilmArray® platform), GenMark (now a subsidiary of Roche) with its ePlex® platform, and Accelerate Diagnostics with its Pheno™. Taking into consideration the broader market, devices of other key competitors can be extended to include Cepheid (GeneXpert®), T2 Biosystems (T2DX®), Luminex Corporation (formerly known as Nanosphere; now acquired by DiaSorin) (Verigene System® and Aries®), Becton-Dickinson (BD Max™), Binx Health (with io™ System), Roche (Cobas® Liat® and GeneWEAVE), Qiagen (QIAstat-Dx™), Biocartis N.V (Idylla™), Bosch (Vivalytic platform), SpeeDx (Plex/Resistance), and the Meridian Bioscience (formerly GenePOC) Revogene® system. Disease-related assay competitors including those providing reagent kits only (e.g. Seegene, Fast-Track Diagnostics/Siemens Healthineers, Genetic Signatures) and LDT developers have to be separately assessed by each application. OpGen believes that its Unyvero Platform has certain key characteristics that clearly differentiate it from other sample-to-answer systems.

Based on its corporate market analysis, OpGen believes that due to the proprietary lysis technology its Unyvero Platform is able to process a broader variety of sample types than competing platforms. In most cases, no labor or time intensive manual sample preparation is necessary and even difficult and blood-contaminated native samples can be processed. Furthermore, the Unyvero Platform is CE-IVD-marked for a variety of samples including sputum, bronchoalveolar lavage, tracheal aspirate, exudate, catheter tip, pus, sonication fluid, synovial fluid, swab and tissue. Further samples such as blood, urine, stool and formalin-fixed paraffin embedded tissues present further options for extending the variety of samples for future applications. Fresh or frozen samples as well as samples that have been stored in different media can be processed easily on the Unyvero Platform. As the lysis is integrated into the workflow, hands-on time and potential handling errors are significantly reduced.

The Unyvero Platform is also differentiated from competing products by its high multiplexing capability based on end-point PCR, which allows for the execution of eight independent multiplex PCR reactions simultaneously. Therefore, Unyvero can identify a broad range of microorganisms and a large variety of antibiotic resistance markers in a single run.

Focusing on severe infectious diseases and having developed an HPN Application Cartridge, an ITI Application Cartridge, a BCU Application Cartridge, an IAI Application Cartridge and a UTI Application Cartridge and planning to develop further Application Cartridges (e.g. on the Unyvero A30 platform) in the severe infectious disease area, Unyvero has a highly differentiated positioning in the market.

Although several direct competitors have in the past several years started to develop or commercialize their own infectious disease tests, OpGen believes that the variety and breadth of its menu of cartridges targeting different infectious diseases positions it favorably to answer patient and customer needs.

Competition to the Unyvero Application Cartridges

Considering its panel design, the Company believes that there are currently few assays directly comparable to the Company’s HPN, LRT, LRT BAL, ITI, IAI, and UTI Unyvero Application Cartridges that are commercially available to date. Various competitors offer testing in some, but not all, of the infections targeted by Unyvero Application Cartridges. For example, for the HPN and LRT Application Cartridges, currently only two companies (OpGen and bioMérieux/BioFire) offer an FDA-cleared IVD automated molecular panel for lower respiratory tract infections and pneumonia. According to publicly available sources, Accelerate Diagnostics has a CE-IVD pneumonia assay and it is believed to be planned for future U.S. FDA submission. Other companies, such as, Luminex (formerly Nanosphere; now DiaSorin), GenMark (now Roche), Seegene, Genomica, Miacom, PathoFinder, Fast-Track Diagnostics (now a Siemens Healthineers company), Randox, ArcDia, Qiagen, and iCubate are primarily targeting the upper respiratory tract with their panels. Their panels mainly cover viruses and a few bacteria, and in some occasions a limited number of antibiotic resistance markers only. Diatherix offers a manual test claiming to cover both upper and lower respiratory infections. OpGen believes that it offers the most comprehensive panel for severe bacterial pneumonia for critically ill patients that require hospitalization, as the panel includes unique and differentiated bacterial targets and the broadest coverage of carbapenem resistance markers, while BioFire’s panel has a limited range of resistance markers and viral targets.

Competition by Conventional Microbiology

The conventional microbiology market consists of culture and MALDI-TOF based testing and is largely shared by well-established players including BD, bioMérieux, Bio-Rad Laboratories, Danaher (Cepheid, Beckman Coulter), Thermo Fisher Scientific. Culture-based testing is usually performed in the central laboratory at TATs of 48 to 72 h and it is yet to be seen whether it can robustly be accelerated by miniaturization, an approach pursued by the company Accelerate Diagnostics and other companies developing rapid AST methods (Pattern Bioscience, Q-Linea ASTar, Lifescale, Specific Diagnostics Reveal, Gradientech, oCelloScope), as well as efforts to achieve AST with MALDI-TOF. While TATs for MALDI-TOF based testing are much faster, overall TATs from sample to report are still greater than 24 hours as MALDI-TOF generally depends on an initial culturing step for pathogen isolation and cannot be performed from native patient samples. Generally, providers of conventional microbiology solutions are focusing on reducing TAT, use of labor and lab space, as well as overall costs by automatic specimen processing and pathogen identification.

| 15

|

Competition by Molecular Diagnostics – PCR

Key players in the PCR-based molecular diagnostics market include bioMérieux, BD, Danaher, Roche, Qiagen, Abbott, Hologic, OpGen (including Curetis GmbH), amongst others. PCR-based microbiology testing is usually performed at the point of need or in the central laboratory at rapidly reduced TAT compared to conventional microbiology. Generally, providers of PCR-based molecular diagnostics are focusing on further reducing TAT to less than 30 minutes to one hour and/or increasing multi-plexing degree as well as reducing use of labor, lab space, and overall costs. The Company believes that its ability to predict phenotypic antibiotic susceptibility based on the pathogen’s genetic profile complements PCR-based approaches detecting panels of genes and mutations as indicators of resistance.

Competition to Ares Genetics

Ares Genetics’ peers and competitors include companies providing conventional microbiology, PCR- and NGS based molecular diagnostics, as well as AMR databases and bioinformatics solutions. In general, many peers and competitors are at the same time also considered potential ARESdb licensing partners due to the unique content and positioning of ARES’ artificial intelligence curated reference database, ARESdb, and demonstrated capability to predict phenotypic antibiotic susceptibility.

Competition by Molecular Diagnostics – NGS

The emerging NGS-based molecular diagnostics market is shared by start-up-like companies such as IDbyDNA, Karius, CosmosID, Noscendo, Day Zero Diagnostics, or ArcBio aiming at disrupting the molecular microbiology by pathogen detection via direct sequencing from patient samples, as well as established players such as bioMérieux focusing on isolate sequencing to monitor outbreaks in hospitals (in partnership with Illumina). NGS-based testing is currently performed as a service and companies mostly focus on reducing TAT as well as increasing the NGS market share in molecular microbiology. NGS-based molecular diagnostics companies are considered as Ares Genetics’ closest competitors, while Ares Genetics believes to have a competitive advantage by its ability to predict antibiotic susceptibility based on the pathogen’s genetic profile with performance meeting FDA requirements for functional testing of AST by culture.

Competing AMR Databases & Bioinformatics Solutions

To date, several AMR databases exist (e.g. CARD, PATRIC, etc.) but they are purely designed for academic research applications as they neither represent IVD-grade reference databases, nor systematically cover high-resolution resistance profiles including confidence levels and diagnostic performance parameters for associated AMR markers. The commercial microbial bioinformatics solution market on the other hand, is largely covered by Qiagen, a strategic licensing partner of Ares for co-marketing bioinformatics research solutions based on ARESdb. Start-ups participating in this market include companies such as 1928 Diagnostics or Ridom developing bioinformatics software for surveillance and outbreak analysis.

Research and Development

We intend to continue to invest in the development of additional Unyvero panels such as UTI for the Unyvero A50 platform, a Unyvero IJI panel, and we intend to invest in the further development of the Unyvero A30 RQ platform, as well as the Ares Genetics bioinformatics solutions such as ARESdb and ares-genetics.cloud.

Our ongoing and anticipated research and development efforts include:

| · | Expanding the Ares Genetics bioinformatics and NGS offerings such as ARESdb, ares-genetics.cloud, ARESiss, ARESid, ARESupa etc. |

| · | Development of Unyvero A30 RQ platform |

| · | Clinical trials and regulatory filings for Unyvero UTI in the USA (expected as De Novo with clinical trial at a minimum of 3 trial sites and minimum of 1,500 samples tested) |

| · | Clinical trials and regulatory filings for Unyvero IJI in the USA (expected as De Novo with clinical trial at a minimum of 3 trial sites and minimum of 1,500 samples tested) |

| 16

|

Sales and Marketing

We currently sell and market our products and services directly in the United States through a dedicated sales and marketing support team. Internationally, we sell our products through 14 distributors covering 31 countries.

Our strategy to build demand for our products following receipt of such regulatory clearance includes completing clinical verification studies, customer driven evaluations and studies as well as sales of our tests for RUO purposes.

Customers

OpGen’s commercial teams have identified several stakeholder groups: treating clinicians, doctors of pharmacy (PharmDs), antibiotic stewardship programs, microbiologists, molecular biologists and laboratory managers as well as hospital administration, all of whom will be actively involved in the purchase decision at varying levels and stages. In terms of product benefits, OpGen believes that clinicians and physicians seek timely diagnostic results that can be used to better inform or confirm a treatment decision and improve patient outcomes, while microbiology laboratory managers, who have to contend with the steadily decreasing availability of trained lab technicians and the need to perform testing during off-shifts, need simple-to-use, robust technologies. Ultimately, however, the decision whether a proposed new testing solution is cost effective and affordable on a routine basis must be made by the payer, which in the case of hospitalized inpatients under the DRG-reimbursement system is typically the hospital’s purchasing and finance departments. OpGen’s key account management ensures that all stakeholders are targeted early and throughout the sales process.

Sales Process

OpGen expects that the entire sales process, from the introductory visit to the point in time when the hospital begins routinely purchasing Application Cartridges or Acuitas consumables, known as the push-pull triangle model, which includes the lab, the clinicians and the finance entity, will take around six to twelve months, based on the experience of competitors and peer companies, in the United States and about the same time from start to finish in the EU. Depending on the time of year and budget cycle, however, a contractual arrangement can take significantly longer. An integral part of the sales process is the placement of demo systems without payment for demo evaluation purpose.

OpGen’s marketing provides sales and sales support tools adapted to the specifics of each stakeholder and stimulates demand by setting up awareness campaigns for lab personnel, clinicians and general hospital stakeholders. In the more developed markets of the EU and the RoW, additional customer segmentation reflects the business opportunity per customer or institution and is linked to size of the hospital reflected in the number of beds available at the institution. Therefore, the sales strategy is based on a key account management approach, initially only targeting large hospitals with clear focus on departments like pulmonology/pneumology, large ICUs or orthopedics wards depending on the particular Application Cartridge of interest.

The focus is on high-volume consumable orders (Application Cartridges, Acuitas AMR Gene Panel kits and other consumables) instead of driving revenues and profits through hardware placements (Unyvero System or EZ1/QS5 installations for Acuitas). Consequently, OpGen and its distribution partners aim to optimize the utilization of each placed hardware unit rather than solely maximizing the installed base of instruments. Therefore, OpGen, with its tests primarily targeting inpatients (hospitalized) with severe infections, is focusing its sales and commercialization efforts on laboratories in hospitals and independent laboratories serving larger hospitals.

OpGen and its distribution partners will also face certain market entry barriers mostly related to upfront investments for the implementation of its new technology, as most laboratories and microbiology centers are cost centers, which do not directly benefit from the current DRG reimbursement scheme. Additionally, the Unyvero and Acuitas platforms will be an add-on test not replacing traditional testing – in this case cultures, which are perceived as comparatively cheap. Therefore, OpGen pursues a sales strategy whereby it offers customers a number of different financial options for its products and services, including rental agreements (pursuant to which OpGen would provide the instruments on the basis that the customer commits to buying a certain number of Application Cartridges or other consumables from OpGen over a set period of time, with the cost of such Application Cartridges or Acuitas consumables incorporating a reagent rental charge for the use of the instrumentation), or a straight cash purchase of the Unyvero or Acuitas platforms, as applicable. Similar concepts are employed by OpGen’s distribution partners at their discretion.

As OpGen is marketing its innovative Unyvero and Acuitas Platforms to a diverse and demanding customer base implementing solutions that offer the potential to improve upon the current standard of care, the Company’s management believes it will need to continue making additional investments in clinical validation, scientific publications, brand awareness and market education worldwide, but with a focus in the EU and United States. Some of the Company’s tests will require market access activities to prove their value and to obtain sufficient reimbursement by relevant payers for certain countries.

| 17

|

OpGen has developed a full suite of marketing communications tools using print and online channels. OpGen also supplies supporting evidence for the various individual stakeholders, for instance approaching microbiologists and clinicians with first-in-class scientific marketing. This not only includes the classical marketing mix (i.e. a set of marketing tools regarding product, price, place and promotion), but also compiles information on health economics and clinical outcomes research.

In addition, OpGen’s marketing focuses on medical education of physicians through its scientific affairs team, participation in scientific conferences, organizing scientific sessions and symposia, and by publications in peer-reviewed journals.

In order to receive valuable input during research and development, stimulate market awareness and the demand for its products, OpGen has made a significant investment in establishing clinical and scientific advisory boards in the United States, comprised of key opinion leaders. In addition, follow-on research and clinical studies are conducted at key opinion leader, or KOL, sites, which assist in increasing market awareness. The KOL selection by OpGen is based on the following criteria:

| · | The KOL has a strong reputation in the area of infectious diseases and/or in molecular diagnostics; |

| · | The KOL is a key opinion leader in the clinical and/or laboratory space with strong influence on peers; and |

| · | The KOL is an 'early innovator', a member of a clinical society, an editor of scientific journals or a member of a guideline-setting agency and could therefore act as a promoter of the product. |

Distribution Channels

To distribute the Unyvero System and the Application Cartridges, OpGen has adopted a dual approach combining direct sales in the United States with indirect sales through specialized distributors in European countries such as Germany, Switzerland, UK, France, Belgium, Netherlands, Luxemburg, Spain, Italy, Greece, Portugal, Austria, Serbia, Northern Macedonia, Bosnia and Herzegovina, Montenegro, Croatia, Russia, Belarus, Ukraine, Kazakhstan, Romania, Kuwait, Egypt and Asian countries such as Singapore, Vietnam, China, Taiwan and Hong Kong and other markets such as Central and Latin American markets such as Mexico and Colombia.

As of December 31, 2021, OpGen had an installed base of 195 Unyvero Analyzers across global markets.

The choice between direct sales and indirect sales distribution is based on available funding for OpGen’s commercial operations, the attractiveness of the market in terms of size, pricing, and reimbursement, the ease of market access in terms of regulations, structure and complexity of the healthcare system, and payer situation. Markets are also selected based on the availability of suitable distributors with appropriate size, portfolio, sales channels, experience, networks, and reputation to introduce an innovative product like Unyvero in their respective market. It is also not uncommon for MDx companies to start with a distributor model before going direct once economics permit establishing a direct sales infrastructure.

OpGen going forward will regularly evaluate on a case-by-case basis whether the chosen distribution channel is adequate to also cater for the new target disease segments, or whether a new structure should be put in place.

Direct Sales U.S. Market

OpGen markets and sells the Unyvero and Acuitas platforms and will market any future cleared Application Cartridges and other consumables directly in the United States through its own U.S.-based commercial organization including sales, marketing and after-sales support.

As of December 31, 2021, OpGen had an installed base of 30 Unyvero Analyzers across the United States and in different types of hospitals and labs.

Indirect Sales Markets

OpGen enters into a standard distribution agreement

with most of its Unyvero distributors, which specifies the particular Unyvero products and the respective distribution territory. The

distribution agreements typically contain provisions for exclusive distribution within a particular territory and for specified term,

typically from three to five-years. During that period, the distributor has exclusive rights to market, sell and distribute all Unyvero

products. In return, each distributor needs to commit to annual minimum purchases of Unyvero Systems as well as Application Cartridges.

Transfer prices for the Unyvero Systems and Application Cartridges are defined and reflect typical MDx industry distributor margins on

consumable sales. If a distributor fails to meet its annual minimum commitments fixed in the contract, the Company has the right to either

terminate such agreement in its entirety, or to terminate such distributor’s territory exclusivity in such country. Each of these

agreements can be extended by mutual agreement between the parties. Furthermore, the agreements also contain typical change of control

provisions, which comprise a merger of the company, the sale of all assets or the liquidation of the company.

| 18

|

OpGen, through its subsidiary Curetis, has entered into distribution agreements with 12 distributors covering 31 countries. Distribution agreements usually feature minimal sales commitments and purchase commitments of the Unyvero Systems and Application Cartridges commensurate with the size and structure of the respective market. The Company has several distribution agreements in place for the following European countries:

| · | Austria, Belgium, France, Germany, Greece, Italy, Luxemburg, Netherlands, Portugal, Spain, Switzerland, United Kingdom: A. Menarini Diagnostics; |

| · | Romania: Synttergy Consult LTD; |

| · | Russia, Ukraine, Kazakhstan: BioLine LLC; |

| · | Belarus: BioLine BS LLC; and |

| · | Bosnia and Hercegovina, Montenegro, Serbia, North Macedonia, Croatia: Ako Med d.o.o. |

In connection with these distribution agreements, distributors are contractually obligated to:

| · | cater for local product registrations as required; |

| · | perform local clinical studies as required; |

| · | take responsibility for local marketing based on guidelines and materials provided by Curetis’ global marketing team; |