UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

----------------------------------------------------------------

FORM

CERTIFIED SHAREHOLDER REPORT

OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number 811-21593

----------------------------------------------------------------

INFRASTRUCTURE FUND, INC.

(Exact name of registrant as specified in charter)

----------------------------------------------------------------

|

717 Texas Avenue, Suite 2200, Houston, Texas |

77002 |

|

|

(Address of principal executive offices) |

(Zip code) |

Michael J. O’Neil

KA Fund Advisors, LLC, 717 Texas Avenue, Suite 2200, Houston, Texas 77002

(Name and address of agent for service)

----------------------------------------------------------------

Registrant’s telephone number, including area code: (713) 493-2020

Date of fiscal year end:

Date of reporting period: November 30, 2023

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Reports to Stockholders.

The report of Kayne Anderson Energy Infrastructure Fund, Inc. (the “Registrant”) to stockholders for the fiscal year ended November 30, 2023 is attached below.

CONTENTS

|

Page |

||

|

Disclosure Pursuant to Rule 8b-16 under the Investment Company Act of 1940, as amended |

1 |

|

|

2 |

||

|

9 |

||

|

10 |

||

|

16 |

||

|

19 |

||

|

20 |

||

|

Statement of Changes in Net Assets Applicable to Common Stockholders |

21 |

|

|

22 |

||

|

23 |

||

|

27 |

||

|

50 |

||

|

51 |

||

|

52 |

||

|

80 |

||

|

82 |

||

|

86 |

||

|

89 |

||

|

90 |

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS: This report of Kayne Anderson Energy Infrastructure Fund, Inc. (the “Company”) contains “forward-looking statements” as defined under the U.S. federal securities laws. Generally, the words “believe,” “expect,” “intend,” “estimate,” “anticipate,” “project,” “will” and similar expressions identify forward-looking statements, which generally are not historical in nature. Forward-looking statements are subject to certain risks and uncertainties that could cause actual results to materially differ from the Company’s historical experience and its present expectations or projections indicated in any forward-looking statements. These risks include, but are not limited to, changes in economic and political conditions; regulatory and legal changes; energy infrastructure company industry risk; leverage risk; valuation risk; interest rate risk; tax risk; and other risks discussed in the Company’s filings with the Securities and Exchange Commission (“SEC”). You should not place undue reliance on forward-looking statements, which speak only as of the date they are made. The Company undertakes no obligation to update or revise any forward-looking statements made herein. There is no assurance that the Company’s investment objectives will be attained.

All investments in securities involve risks, including the possible loss of principal. The value of an investment in the Company could be volatile, and you could suffer losses of some or a substantial portion of the amount invested. The Company’s concentration of investments in energy infrastructure companies subjects it to the risks of midstream, renewable infrastructure and utility entities and the energy sector, including the risks of declines in energy and commodity prices, decreases in energy demand, adverse weather conditions, natural or other disasters, changes in government regulation, and changes in tax laws. Leverage creates risks that may adversely affect return, including the likelihood of greater volatility of net asset value and market price of common shares and fluctuations in distribution rates, which increases a stockholder’s risk of loss.

Performance data quoted in this report represent past performance and are for the stated time period only. Past performance is not a guarantee of future results. Current performance may be lower or higher than that shown based on market fluctuations from the end of the reported period.

KAYNE ANDERSON ENERGY INFRASTRUCTURE FUND, INC.

ADOPTION OF AN OPTIONAL DELIVERY METHOD FOR SHAREHOLDER REPORTS

Rule 8b-16 Disclosure

Rule 8b-16 under the Investment Company Act of 1940, as amended, requires that we disclose certain information to stockholders in our annual report. That disclosure is included in this report as follows: (1) information about our dividend investment plan is included on pages 86-88, (2) information about our investment objectives and policies is included on page 52, and (3) information regarding the principal risk factors associated with investment in the Company is included on pages 53-79. On March 24, 2023, our Board of Directors amended the Second Amended and Restated Bylaws of the Company to remove Article XVI which had made the Company subject to the Maryland Control Share Acquisition Act (“MCSAA”). As a result, the Company is no longer subject to the MCSAA. During the fiscal year ended November 30, 2023, there were no changes to our charter or by-laws that were not approved by stockholders that delay or prevent a change of control, nor were there changes to persons who are primarily responsible for the day-to-day management of the Company’s investment portfolio, other than the retirement of J.C. Frey effective as of December 31, 2023. After Mr. Frey’s retirement, James C. Baker, Jr. continues to be primarily responsible for the day-to-day management of the Company’s investment portfolio.

1

December 22, 2023

Dear fellow stockholders,

We hope that you and your families are well and enjoying the holiday season.

Fiscal 2023 was a successful year for KYN, and our team is very proud of what we accomplished. KYN generated returns that exceeded its benchmark, meaningfully increased distributions to stockholders, and completed an accretive merger.(1) This success builds on very strong returns during fiscal 2021 and 2022 — KYN’s Net Asset Return over the last three years is 100%. Importantly, as we will discuss in this letter, we are excited about the Company’s prospects — the energy infrastructure sector remains a compelling investment opportunity.

Fiscal 2024 marks KYN’s twentieth year as a publicly traded closed-end fund. I have been fortunate to be involved since the fund’s early days — what a privilege it has been. As I reflect on all that has changed over this twenty-year period, it is equally important to consider what has not changed: KYN’s core mission of providing a high after-tax return with an emphasis on making cash distributions to stockholders. KYN is designed to be an efficient way for investors to gain exposure to the midstream sector — this remains as true today as it was at the Company’s initial public offering.

While the broader economic outlook for fiscal 2024 is uncertain, KYN is well positioned to generate attractive returns in a variety of scenarios. The fund is well capitalized, leverage is at the lower end of our targeted range, and we have a meaningful downside cushion to navigate potential stock market volatility.(2) The Company’s midstream investments are generating record levels of free cash flow, have very strong balance sheets and are poised to increase the amount of capital they are returning to shareholders. Actions taken by the sector over the last several years are beginning to bear fruit — fiscal 2024 could prove to be an inflection point in investors’ recognition (in the form of higher stock prices) of the progress the sector has made. KYN’s portfolio is positioned to benefit as this plays out.

We appreciate the trust you have placed in us and are grateful for your support. We were fortunate to engage with a multitude of KYN’s investors on a wide range of topics during fiscal year 2023. These interactions were invaluable. In addition to receiving your feedback, it gave us the opportunity to explain our rationale for KYN’s merger with Kayne Anderson NextGen Energy & Infrastructure Fund (“KMF”) and to articulate KYN’s portfolio positioning. We look forward to similar discussions with our investors in the coming year.

Topics covered in this year’s annual letter include a summary of KYN’s performance during fiscal 2023, an overview of the Company’s portfolio, and our outlook for the energy infrastructure sector. We hope you find this discussion informative and insightful.

KYN’s key accomplishments during the year include:

• Generated a Net Asset Return of 8.7%(3);

• Increased its quarterly distribution by 10%(4);

• Maintained conservative leverage levels;

• Opportunistically reduced exposure to floating rate debt;

• Completed its merger with KMF; and

• Implemented new management fee waivers.

____________

Endnotes can be found on page 8.

2

KAYNE ANDERSON ENERGY INFRASTRUCTURE FUND, INC.

LETTER TO STOCKHOLDERS

We believe the recent merger helps solidify the company as the market-leading energy infrastructure closed-end fund. The energy infrastructure industry’s future is bright, and we have worked hard to best position KYN to capitalize on the sector’s long-term tailwinds. Our investors should continue to benefit from KYN’s size and scale, trading liquidity, and “best-in-class” access to the capital markets. These attributes, in our opinion, provide the Company competitive advantages relative to peer closed-end funds. KYN is a natural consolidator, and the Company is well positioned to pursue additional fund acquisitions on terms favorable for our stockholders.

KYN’s Investment Mandate and Performance Benchmarking

The Company’s structure provides maximum flexibility in pursuit of its investment mandate, which is to thoughtfully invest in a portfolio of North American-focused energy infrastructure companies. Most of the portfolio is comprised of investments in midstream companies. The remainder is a mix of investments in energy companies, utilities, and renewable infrastructure companies. We believe this portfolio composition will generate superior risk-adjusted returns over the longer term and best capitalize on the sector’s key macro trends. Importantly, we can quickly modify subsector allocations based on market conditions and relative valuations.

Within our midstream allocation, KYN can invest in both master limited partnerships and C-corporations. Said differently, KYN’s structure as a taxable entity enables it to be agnostic as to the investment’s corporate structure. This may seem like a subtle point, but we consider it to be very important — we invest in the companies best positioned to generate attractive returns and are not forced to make investment decisions based on structural constraints. Further, the Company has a growing allocation to privately held midstream companies. We are very excited about this piece of the portfolio and believe KYN — due to its permanent capital base — is particularly well positioned to make long-term investments in private businesses. KYN’s flexibility is an important point of distinction relative to certain peer funds and passive investment products where their structure (or investment mandate) constrains their portfolios. KYN can dynamically allocate its portfolio across the full spectrum of energy infrastructure businesses in both public and private markets, which is not the case for most of the Company’s peers.

We plan to benchmark the Company’s performance vs. the Alerian Midstream Energy Index (“AMNA”) on a go-forward basis. This index best captures KYN’s target investment universe and is aligned with our goal of being the premier investment vehicle for investors to gain exposure to the midstream sector. We do include comparisons to the KYN Benchmark in this letter for the sake of consistency, but we do not plan to use that composite benchmark in future periods.

____________

Endnotes can be found on page 8.

3

KAYNE ANDERSON ENERGY INFRASTRUCTURE FUND, INC.

LETTER TO STOCKHOLDERS

Performance

Midstream equities generated solid returns during the year, while higher interest rates and less accommodative capital markets weighed on renewables and utilities equities, driving a wide divergence in relative performance. KYN was consistently overweight midstream relative to its composite benchmark during the year, but its renewable infrastructure and utility holdings negatively impacted the Company’s results. Despite this drag, KYN’s Net Asset Return for fiscal 2023 was 8.7%; the Company outperformed the broader midstream sector (as measured by the AMNA) by approximately 100 basis points.

|

Comparison of Returns in Fiscal 2023 |

Returns |

% of |

||||||

|

KYN Net Asset Return(3) |

8.7 |

% |

|

|||||

|

Midstream(6), (7) |

7.7 |

% |

89 |

% |

||||

|

Renewable Infrastructure(8) |

-14.1 |

% |

4 |

% |

||||

|

U.S. Utilities(9) |

-9.3 |

% |

4 |

% |

||||

|

KYN Benchmark(10) |

2.8 |

% |

|

|||||

KYN’s Market Return, which is based on stock price performance rather than net asset value, was 4.3% for fiscal 2023.(11) This trailed our Net Asset Return as our stock price traded at a 18.5% discount to NAV at fiscal year-end compared to a 15.0% discount at the beginning of the year. Technical factors in the later part of 2023 associated with the KMF merger likely played a role in the expansion of KYN’s discount. We believe this will prove to be a transitory event. That said, we are keenly focused on the discount and continue to evaluate actions that would result in a closer relationship between KYN’s stock price and its NAV. As we have communicated previously, we believe consistent performance, a substantial return of cash to stockholders (through attractive quarterly distributions), and strategic transactions that are accretive to our stockholders will be rewarded over time in the form of a narrowing discount. We recently announced a 1 cent per share increase to KYN’s quarterly distribution rate (to 22 cents per share) and have increased the distribution by 10% over the last twelve months. We understand how important distributions are to our investors, and our goal is to steadily increase KYN’s distribution over time as supported by the Company’s operating results.

____________

Endnotes can be found on page 8.

4

KAYNE ANDERSON ENERGY INFRASTRUCTURE FUND, INC.

LETTER TO STOCKHOLDERS

Portfolio

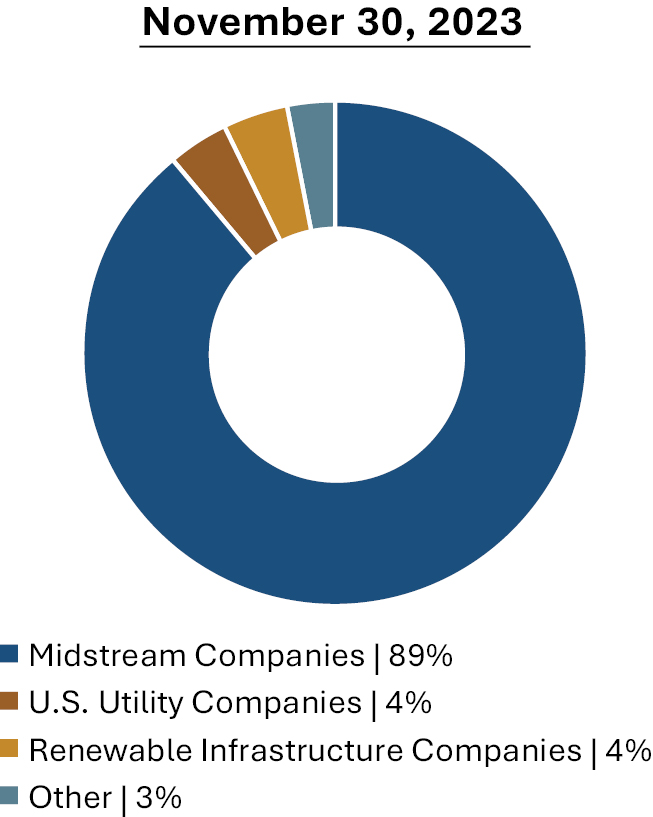

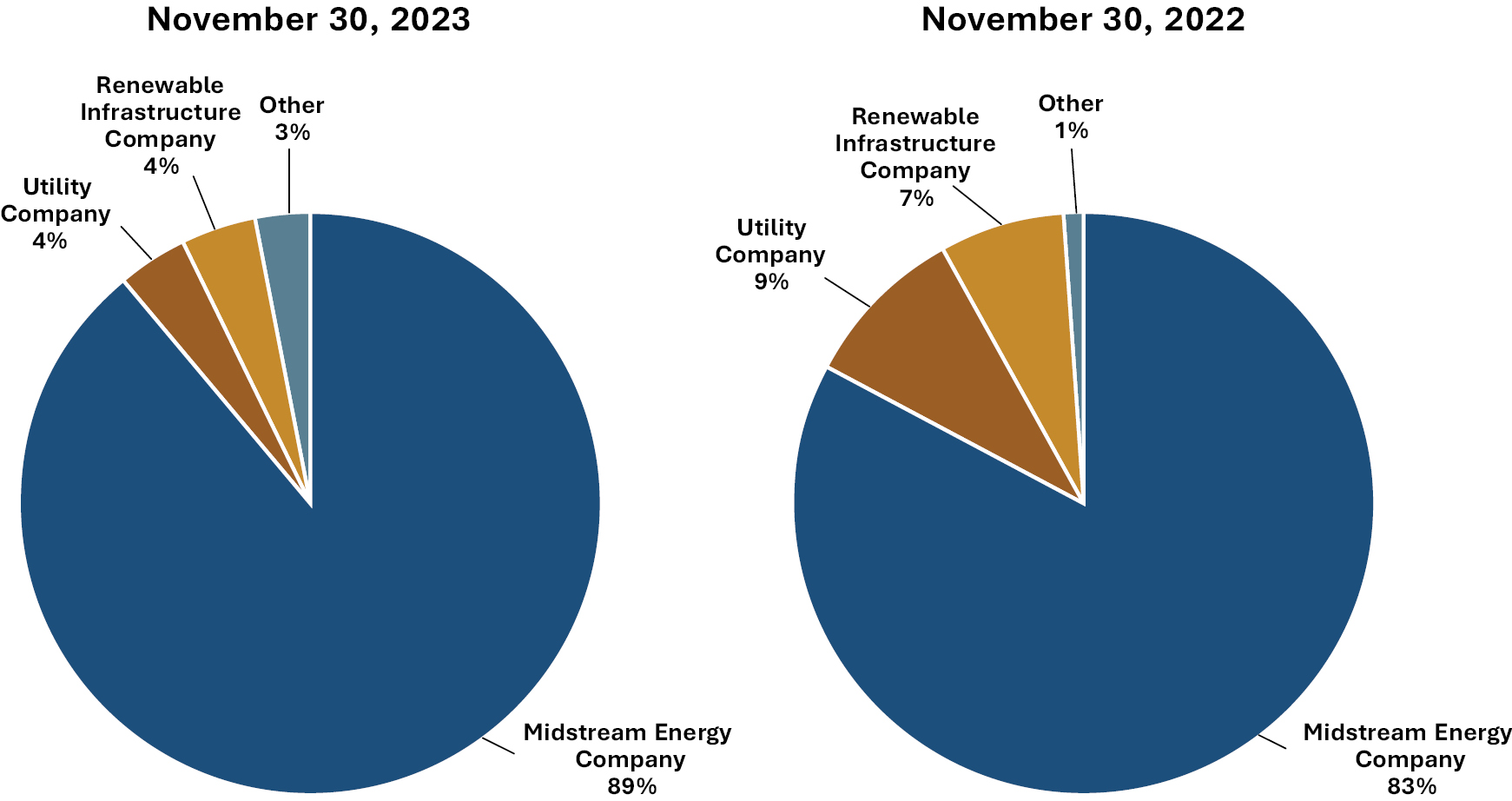

KYN’s portfolio is comprised of 40 investments in 34 companies. Approximately 94% of the portfolio is invested in common equity with the remainder invested in preferred equity. The pie chart below highlights KYN’s exposure to the different energy subsectors. The overwhelming majority of KYN’s portfolio is invested in the midstream sector, which is a balanced mix of MLPs and midstream c-corps. We are overweight large capitalization midstream companies as we are very bullish on these companies’ prospects. These businesses have integrated suites of assets that are extremely well positioned to benefit from growing domestic production and increased exports. These companies are also poised to capitalize on the energy security and energy transition macro themes.

Fiscal 2023 Market Review

Broader equity markets rebounded nicely during fiscal 2023 after challenges in the prior year. There were several periods of heightened volatility, and the state of the economy, inflation considerations and the direction of interest rates were the key topics of debate. These topics will continue to influence sentiment in fiscal 2024. The year was punctuated by a material rise in interest rates (both short-term and long-term rates) and phrases such as “higher for longer.” The best illustration of this point is the change in yield on 10-year U.S. Treasury bonds over the last 12 months. Yields began fiscal 2023 at 3.7% and briefly exceeded 5% in mid-October. More recently, yields have fallen below 4% as investors take stock of inflation trends and dovish commentary from the Federal Reserve.

|

Total Return |

|||||||||||||||||||||

|

Equity Market Indices |

Energy Indices |

||||||||||||||||||||

|

S&P 500 |

DJIA |

NASDAQ |

XLE(13) |

AMNA(6) |

KRII(8) |

XLU(9) |

|||||||||||||||

|

Fiscal 2023(12) |

13.8 |

% |

6.2 |

% |

25.1 |

% |

-3.7 |

% |

7.7 |

% |

-14.1 |

% |

-9.3 |

% |

|||||||

____________

Endnotes can be found on page 8.

5

KAYNE ANDERSON ENERGY INFRASTRUCTURE FUND, INC.

LETTER TO STOCKHOLDERS

In a reversal of what occurred the prior two years, midstream equities meaningfully outperformed other energy subsectors during fiscal 2023. Weakness in commodity prices and concerns about the state of the global economy were headwinds for the broader energy sector. Further, after two years of market leading returns, it is not surprising that the energy sector “took a breather” in fiscal 2023. In contrast to fiscal 2022 when “old economy” stocks (like energy) performed best, this year was all about artificial intelligence and large capitalization tech stocks.

Fiscal 2024 Outlook

We believe it is prudent to be cautious in the near term as the global economy adjusts to higher (and volatile) interest rates, Congress faces a severe political challenge in dealing with a growing federal deficit, and the U.S. is entering what is expected to be a very contentious election cycle. Further, we are closely monitoring a host of troubling geopolitical developments that threaten global cooperation and commerce. Simply put, the world is volatile, and we have tried to position KYN’s portfolio and balance sheet with that in mind.

As we contemplate what is in store for our investment universe during fiscal 2024, little has changed to alter the constructive outlook on the midstream sector. We continue to believe that consistent operating results, commitment to returning capital to investors, and steadily growing dividends will prove to be a winning formula. The backdrop for our utility and renewable infrastructure has evolved over the last year, and we are optimistic about each subsector’s outlook in fiscal 2024. Valuations for these companies are much more compelling today than they were twelve months ago.

For the midstream sector, volumes, not commodity prices, are the primary profit drivers. Importantly, domestic production and exports of crude oil, natural gas, and NGLs are at all-time highs. Over the last two years the sector has witnessed an amazing recovery in domestic production levels — exceeding what we (and other industry experts) predicted. Critically, midstream businesses are not over-extending themselves to support this volume growth. Balance sheets remain healthy (with historically low leverage levels), and companies are largely adhering to well-articulated return of capital strategies that, when combined with investor input, function as governors on low-return growth projects.

Fiscal 2023 was a challenging year for KYN’s investments in the utility and renewable infrastructure sectors. A common question during the year centered around project returns. More specifically, would project returns keep pace with companies’ higher cost of capital (due to higher interest rates). Several missteps by industry leaders heightened investors’ concerns on this topic. This culminated in a dramatic industry-wide selloff during the fourth quarter of fiscal 2023 that had all the classic signs of investor capitulation. Stock prices have rebounded over the last two months as companies have done a good job of addressing investor concerns. We will continue to pick our spots within renewable infrastructure and utilities, investing in the companies with the scale and leadership to capitalize on what continues to be an attractive long-term outlook. In our opinion, well-run companies in this sector will be able to apply learnings from this recent downturn to achieve profitable long-term growth.

____________

Endnotes can be found on page 8.

6

KAYNE ANDERSON ENERGY INFRASTRUCTURE FUND, INC.

LETTER TO STOCKHOLDERS

Why Invest in KYN?

For investors that share our conviction in the long-term trends discussed in this letter, we believe KYN — with its flexible investment mandate, permanent capital base, and expertise providing capital solutions to both public and private companies — is a very attractive means to receive diversified exposure to the North American energy infrastructure sector in an income-producing vehicle. The Company provides this exposure in an easy-to-own structure — daily liquidity via its NYSE listing, an attractive quarterly distribution, and the tax simplicity of a single Form 1099. Lastly, conservative leverage and active portfolio and risk management from an experienced portfolio management team set the stage for a successful 2024 and beyond.

We look forward to executing on our investment objective of achieving high after-tax total returns. Please do not hesitate to contact us with any questions or comments.

Sincerely,

James C. Baker, Jr.

Chairman of the Board

President and Chief Executive Officer

For more information:

cef@kaynecapital.com // 877.657.3863

www.kaynefunds.com

____________

Endnotes can be found on page 8.

7

KAYNE ANDERSON ENERGY INFRASTRUCTURE FUND, INC.

LETTER TO STOCKHOLDERS

|

(1) |

Relative performance commentary based on the difference between the Company’s Net Asset Return and the total return of the Alerian Midstream Energy Index (AMNA) and KYN’s Benchmark. |

|||||||||||||||||

|

(2) |

Downside cushion reflects the decrease in total asset value that could be sustained while maintaining compliance with 1940 Act leverage levels and KYN’s financial covenants. |

|||||||||||||||||

|

(3) |

Net Asset Return is defined as the change in net asset value per share plus cash distributions paid during the period (assuming reinvestment through our dividend reinvestment plan). |

|||||||||||||||||

|

(4) |

Based on KYN’s $0.22/share distribution payable January 10, 2024 compared to $0.20/share distribution paid January 11, 2023. |

|||||||||||||||||

|

(5) |

Weightings based on KYN’s portfolio as of November 30, 2023. The remaining 3% of KYN’s portfolio is invested in other energy companies. |

|||||||||||||||||

|

(6) |

The benchmark for the midstream sector is the AMNA. |

|||||||||||||||||

|

(7) |

Whenever we reference “midstream companies”, the “midstream sector” or the “midstream industry” it includes both traditional midstream companies and natural gas & LNG infrastructure companies. Traditional midstream companies are defined as midstream companies that own and/or operate midstream assets related to crude oil, refined products, natural gas liquids or water. Natural gas & LNG infrastructure companies are defined as midstream companies that primarily own and/or operate midstream assets related to natural gas or liquefied natural gas. |

|||||||||||||||||

|

(8) |

The benchmark for the renewable infrastructure sector is the Kayne Anderson Renewable Infrastructure Index (KRII), a market-cap weighted index of 35 domestic and international renewable infrastructure companies with individual constituents capped at a 5% weighting. |

|||||||||||||||||

|

(9) |

The benchmark for the U.S. utility sector is the Utilities Select Sector SPDR Fund (XLU), which is an exchange-traded fund (“ETF”) linked to the Utilities Select Sector Index (IXU), a subset of the S&P 500. |

|||||||||||||||||

|

(10) |

KYN’s Benchmark is a composite of energy infrastructure companies. For fiscal 2023, this composite is comprised of a 75% weighting to the midstream sector, a 12.5% weighting to the renewable infrastructure sector, and a 12.5% weighting to the U.S. utility sector. The subsector allocations for this composite were established by Kayne Anderson at the beginning of fiscal 2023 based on the estimated target subsector allocations of the Company’s assets over the intermediate term. KYN’s portfolio holdings and/or subsector allocations may change at any time. As discussed in the letter, we will not be publishing a composite benchmark for fiscal 2024. |

|||||||||||||||||

|

(11) |

Market Return is defined as the change in share price plus cash distributions paid during the period (assuming reinvestment through our dividend reinvestment program). |

|||||||||||||||||

|

(12) |

Fiscal year 2023 (12/1/22 – 11/30/23). |

|||||||||||||||||

|

(13) |

The benchmark for the broad U.S. energy sector is the Energy Select Sector SPDR Fund (XLE), which is an exchange-traded fund (“ETF”) linked to the Energy Select Sector Index (IXE), a subset of the S&P 500. |

|||||||||||||||||

8

Portfolio of Long-Term Investments by Category

Top 10 Holdings by Issuer(1)

|

Percent of Long-Term |

||||

|

Holding |

Category |

2023 |

2022 |

|

|

1. |

Enterprise Products Partners L.P. |

Midstream Energy Company |

10.9% |

10.0% |

|

2. |

Energy Transfer LP |

Midstream Energy Company |

10.0 |

10.6 |

|

3. |

MPLX LP |

Midstream Energy Company |

9.3 |

10.2 |

|

4. |

The Williams Companies, Inc. |

Midstream Energy Company |

7.9 |

7.3 |

|

5. |

Targa Resources Corp. |

Midstream Energy Company |

7.3 |

8.0 |

|

6. |

Cheniere Energy, Inc. |

Midstream Energy Company |

7.1 |

6.7 |

|

7. |

ONEOK, Inc. |

Midstream Energy Company |

6.7 |

2.7 |

|

8. |

Plains All American Pipeline, L.P.(2) |

Midstream Energy Company |

6.6 |

7.0 |

|

9. |

Western Midstream Partners, LP |

Midstream Energy Company |

4.0 |

5.0 |

|

10. |

Kinder Morgan, Inc. |

Midstream Energy Company |

3.6 |

1.4 |

(1) Includes ownership of common and preferred units.

(2) Includes ownership of Plains All American Pipeline, L.P. (“PAA”), Plains AAP, L.P. (“PAGP-AAP”) and Plains GP Holdings, L.P. (“PAGP”).

9

Company Overview

Kayne Anderson Energy Infrastructure Fund, Inc. (the “Company” or “KYN”) is a non-diversified, closed-end fund that commenced operations in September 2004. Our investment objective is to provide a high after-tax total return with an emphasis on making cash distributions to stockholders. We intend to achieve our investment objective by investing at least 80% of our total assets in the securities of Energy Infrastructure Companies. Please refer to the Glossary of Key Terms for the meaning of capitalized terms not otherwise defined herein.

As of November 30, 2023, we had total assets of $2.4 billion, net assets applicable to our common stockholders of $1.8 billion (net asset value of $10.51 per share), and 169.1 million shares of common stock outstanding.

Recent Events

On November 13, 2023, we completed our merger with Kayne Anderson NextGen Energy & Infrastructure, Inc. (“KMF”). Pursuant to the merger agreement, KMF was merged with and into KYN, and KMF stockholders received either (i) newly issued common stock of KYN (“Stock Consideration”) or (ii) cash (“Cash Consideration”), subject to the adjustment and proration procedures as set forth in the merger agreement. The exchange ratio for Stock Consideration was based on each fund’s net asset value (“NAV”) per share as of November 10, 2023, and the per share Cash Consideration was based on 95% of KMF’s NAV per share as of the same date.

The merger qualified as a tax-free reorganization under Section 368(a) of the Internal Revenue Code. In the merger, a total of 33.0 million new shares of KYN common stock were issued and Cash Consideration paid was $54.9 million. For additional information related to the merger, see Note 1 — Organization.

Results of Operations — For the Three Months Ended November 30, 2023

Investment Income. Investment income totaled $25.6 million for the quarter. We received $31.6 million of dividends and distributions. We estimated that $6.0 million of the dividends and distributions received were return of capital distributions and/or distribution in excess of cost basis.

Operating Expenses. Operating expenses totaled $12.9 million, including $6.8 million of investment management fees, $3.8 million of interest expense, $1.2 million of preferred stock distributions $0.3 million of merger related expenses and $0.8 million of other operating expenses.

Net Investment Income. Our net investment income was $10.7 million and included a current tax expense of $0.9 million and a deferred tax expense of $1.1 million.

Net Realized Gains. We had net realized gains from our investments of $66.5 million, consisting of realized gains from long term investments of $82.9 million, a current income tax expense of $5.7 million and a deferred tax expense of $10.7 million.

10

KAYNE ANDERSON ENERGY INFRASTRUCTURE FUND, INC.

MANAGEMENT DISCUSSION

(UNAUDITED)

Net Change in Unrealized Gains. We had a net increase in our unrealized gains of $7.6 million. The net change consisted of a $9.7 million increase in unrealized gains on investments, $0.2 million of unrealized gains from option activity and a deferred tax expense of $2.3 million.

Net Increase in Net Assets Resulting from Operations. As a result of the above, we had a net increase in net assets resulting from operations of $84.8 million.

Results of Operations — For the Fiscal Year Ended November 30, 2023

Investment Income. Investment income totaled $69.6 million for the fiscal year. We received $121.8 million of dividends and distributions. We estimated that $52.4 million of the dividends and distributions received were return of capital distributions and/or distributions in excess of cost basis. Interest income for the year was $0.2 million.

Operating Expenses. Operating expenses totaled $49.8 million, including $26.1 million of net investment management fees, $15.8 million of interest expense, $4.5 million of preferred stock distributions $0.3 million of merger related expenses and $3.1 million of other operating expenses.

Net Investment Income. Our net investment income totaled $17.2 million and included a current tax expense of $1.4 million and a deferred tax expense of $1.2 million.

Net Realized Gains. We had net realized gains from our investments of $107.0 million, consisting of realized gains from long term investments of $134.5 million, $0.2 million of realized gains from option activity, a current tax expense of $14.8 million and a deferred tax expense of $12.9 million.

Net Change in Unrealized Gains. We had a net decrease in unrealized gains of $11.6 million. The net change consisted of a $14.6 million decrease in our unrealized gains on investments and a deferred tax benefit of $3.0 million.

Net Increase in Net Assets Resulting from Operations. As a result of the above, we had a net increase in net assets resulting from operations of $112.6 million.

11

KAYNE ANDERSON ENERGY INFRASTRUCTURE FUND, INC.

MANAGEMENT DISCUSSION

(UNAUDITED)

Management Discussion of Fund Performance

See Letter to Stockholders for a more fulsome discussion of the Company’s performance during the fiscal year ended November 30, 2023.

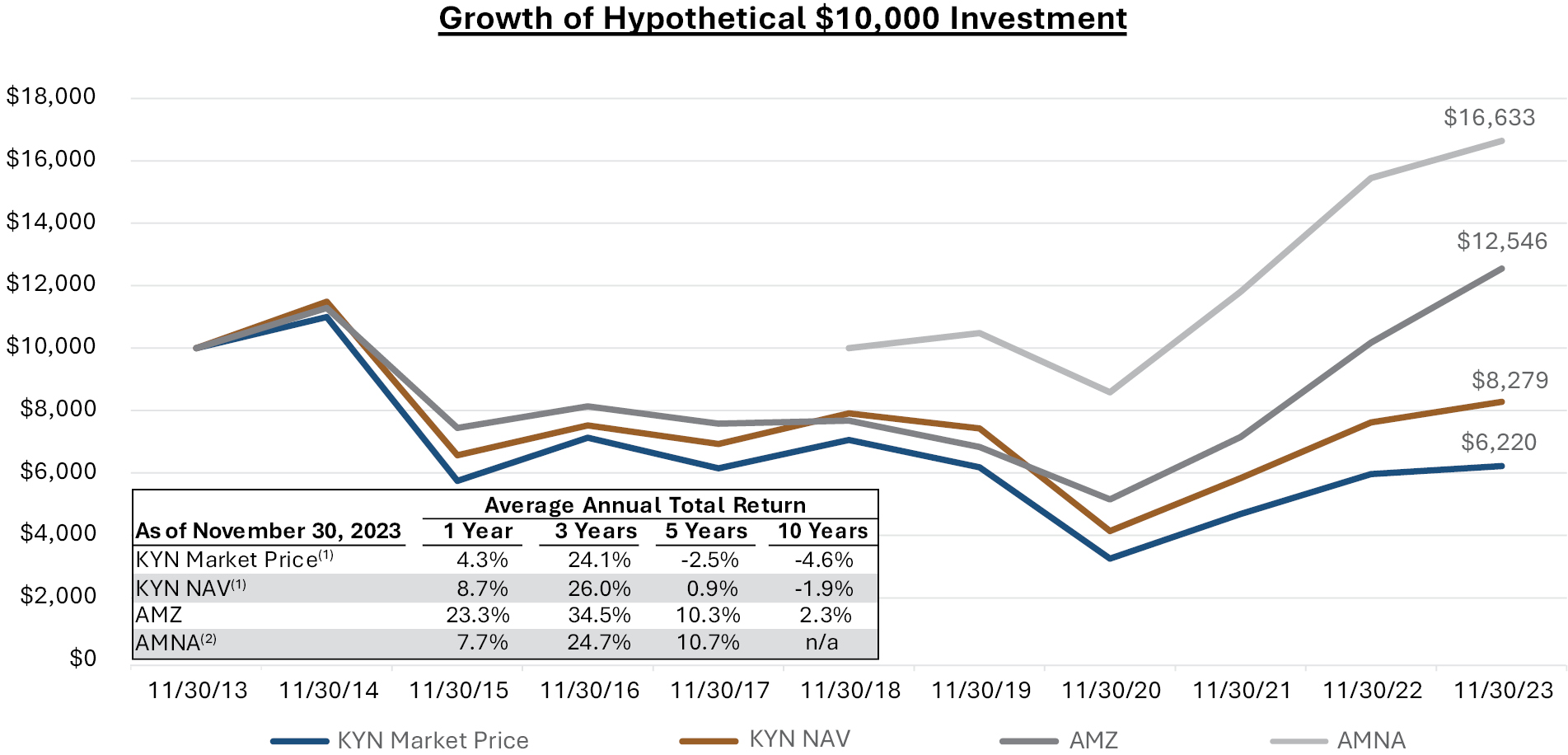

The below graph illustrates the hypothetical growth of $10,000 based upon the total return performance of the Company’s common share price (“KYN Market Price”) and net asset value per share price (“KYN NAV”) for the 10-year period ended November 30, 2023 as compared to the total return of the Alerian MLP Index (“AMZ”).

____________

(1) KYN Market Price and NAV return assume that distributions have been reinvested at actual prices pursuant to the Company’s dividend reinvestment plan. Return reflects the deduction of management fees and expenses but does not reflect transaction fees or broker commissions.

(2) The Alerian Midstream Energy Index (“AMNA”) launched on June 25, 2018. For the purposes of this chart, the hypothetical growth of $10,000 begins with the value of the AMNA as of November 30, 2018. As such, there is no return data for the 10-year period ended November 30, 2023.

The table and graph do not reflect any deduction for taxes that a shareholder may pay on distributions or the disposition of Company shares. Index performance is shown for illustrative purposes only and does not reflect any fees, expenses or sales charges. It is not possible to invest directly in an index.

Performance data quoted represents past performance and is no guarantee of future results. Current performance may be lower or higher than that shown based on market fluctuations from the end of the reported period.

The AMZ is an index of energy infrastructure Master Limited Partnerships (MLPs). The AMZ is a capped, float-adjusted, capitalization-weighted index, whose constituents earn the majority of their cash flow from midstream activities involving energy commodities.

The AMNA is a broad-based composite of North American energy infrastructure companies (which includes both MLPs and taxable corporations). The AMNA is a capped, float-adjusted, capitalization-weighted index, whose constituents earn the majority of their cash flow from midstream activities involving energy commodities.

12

KAYNE ANDERSON ENERGY INFRASTRUCTURE FUND, INC.

MANAGEMENT DISCUSSION

(UNAUDITED)

Distributions to Common Stockholders

On December 19, 2023, KYN declared a quarterly distribution of $0.22 per common share for the fourth quarter, which was paid on January 10, 2024. Payment of future distributions is subject to Board of Directors approval, as well as meeting the covenants on our debt agreements and terms of our preferred stock.

The Board of Directors considers several items in setting our distributions to common stockholders including net distributable income (as defined below), realized and unrealized gains and expected returns for portfolio investments.

Net distributable income (“NDI”) is the amount of income received by us from our portfolio investments less operating expenses, subject to certain adjustments as described below. NDI is not a financial measure under the accounting principles generally accepted in the United States of America (“GAAP”). Refer to the Reconciliation of NDI to GAAP section below for a reconciliation of this measure to our results reported under GAAP.

For the purposes of calculating NDI, income from portfolio investments includes (a) cash dividends and distributions, (b) paid-in-kind dividends received (i.e., stock dividends), (c) interest income from debt securities and (d) net premiums received from the sale of covered calls.

For the purposes of calculating NDI, operating expenses include (a) investment management fees paid to our investment adviser, (b) other expenses (mostly comprised of fees paid to other service providers), (c) interest expense and preferred stock distributions and (d) current and deferred income tax expense/benefit on net investment income/loss.

Net Distributable Income (NDI)

(amounts in millions, except for per share amounts)

|

Three Months |

Fiscal Year |

|||||

|

Distributions and Other Income from Investments |

|

|

||||

|

Dividends and Distributions |

$ 31.6 |

|

$ 121.8 |

|

||

|

Interest Income and Other Income |

— |

|

0.2 |

|

||

|

Net Premiums Received from Call Options Written |

— |

|

0.5 |

|

||

|

Total Distributions and Other Income from Investments |

$ 31.6 |

|

$ 122.5 |

|

||

|

Expenses |

|

|

||||

|

Net Investment Management Fee |

(6.8 |

) |

(26.1 |

) |

||

|

Other Expenses(1) |

(1.1 |

) |

(3.4 |

) |

||

|

Interest Expense |

(3.8 |

) |

(15.8 |

) |

||

|

Preferred Stock Distributions |

(1.2 |

) |

(4.5 |

) |

||

|

Income Tax Expense, net |

(2.0 |

) |

(2.6 |

) |

||

|

Net Distributable Income (NDI) |

$ 16.7 |

|

$ 70.1 |

|

||

|

Weighted Shares Outstanding |

142.7 |

|

137.8 |

|

||

|

NDI per Weighted Share Outstanding |

$ 0.12 |

|

$ 0.51 |

|

||

____________

(1) Includes $0.3 million of merger related expenses.

13

KAYNE ANDERSON ENERGY INFRASTRUCTURE FUND, INC.

MANAGEMENT DISCUSSION

(UNAUDITED)

Reconciliation of NDI to GAAP

The difference between distributions and other income from investments in the NDI calculation and total investment income as reported in our Statement of Operations is reconciled as follows:

• A significant portion of the cash distributions received from our investments is characterized as return of capital. For GAAP purposes, return of capital distributions are excluded from investment income, whereas the NDI calculation includes the return of capital portion of such distributions.

• GAAP recognizes distributions received from our investments that exceed the cost basis of our securities to be realized gains and are therefore excluded from investment income, whereas the NDI calculation includes these distributions.

• We may sell covered call option contracts to generate income or to reduce our ownership of certain securities that we hold. In some cases, we are able to repurchase these call option contracts at a price less than the call premium that we received, thereby generating a profit. The premium we receive from selling call options, less (i) the premium that we pay to repurchase such call option contracts and (ii) the amount by which the market price of an underlying security is above the strike price at the time a new call option is written (if any), is included in NDI. For GAAP purposes, premiums received from call option contracts sold are not included in investment income. See Note 2 — Significant Accounting Policies for the GAAP treatment of option contracts.

Liquidity and Capital Resources

At November 30, 2023, we had total leverage outstanding of $499 million, which represented 21% of total assets. Our current policy is to utilize leverage in an amount that represents approximately 20% to 25% of our total assets. Total leverage was comprised of $9 million of borrowings outstanding under our unsecured revolving credit facility (the “Credit Facility”), $50 million outstanding under our unsecured term loan (the “Term Loan”), $287 million of senior unsecured notes (“Notes”) and $153 million of mandatory redeemable preferred stock (“MRP Shares”). As of November 30, 2023, we had $1 million of cash. As of January 19, 2024, we had $39 million of borrowings outstanding under our Credit Facility, $50 million outstanding under our Term Loan and $2 million of cash.

Our Credit Facility has a total commitment of $175 million and matures on February 23, 2024. The interest rate on borrowings under the Credit Facility may vary between the secured overnight financing rate (“SOFR”) plus 1.40% and SOFR plus 2.25%, depending on our asset coverage ratios. We pay a fee of 0.20% per annum on any unused amounts of the Credit Facility.

Our $50 million Term Loan has a three-year term, maturing August 6, 2024. The interest rate on $25 million of the Term Loan is fixed at a rate of 1.735% and the interest rate on the remaining $25 million is SOFR plus 1.40%. Amounts repaid under the Term Loan cannot be reborrowed.

As of November 30, 2023, we had $287 million of Notes outstanding that mature between 2024 and 2034 and we had $153 million of MRP Shares outstanding that are subject to mandatory redemption between 2024 and 2032.

On October 30, 2023, we redeemed all of our Series NN Notes at par upon their maturity ($16 million principal).

In our merger with KMF, we assumed all of KMF’s unsecured notes outstanding immediately prior to the closing of the merger ($58 million aggregate principal amount). We also issued, on a one-for-one basis, new KYN preferred shares having substantially identical terms as the KMF preferred shares outstanding immediately prior to the closing of the merger ($41 million aggregate liquidation value).

14

KAYNE ANDERSON ENERGY INFRASTRUCTURE FUND, INC.

MANAGEMENT DISCUSSION

(UNAUDITED)

On January 10, 2024, we issued $25 million of Series VV Notes (5.79% fixed interest rate). Net proceeds from this issuance were used to refinance existing leverage and for general corporate purposes. We expect to refinance upcoming 2024 Notes and MRP Shares maturities with borrowings under our Credit Facility, additional issuances of Notes and/or MRP Shares, cash on hand or some combination thereof.

At November 30, 2023, our asset coverage ratios under the Investment Company Act of 1940, as amended (“1940 Act”), were 659% for debt and 456% for total leverage (debt plus preferred stock). We target asset coverage ratios that give us the ability to withstand declines in the market value of the securities we hold before breaching the financial covenants in our leverage (we often refer to this as our “downside cushion”). At this time, we target asset coverage ratios that provide approximately 50% of downside cushion relative to our financial covenants. Our leverage targets are dependent on market conditions as well as certain other factors and may vary from time to time.

As of November 30, 2023, our total leverage consisted of 79% of fixed rate obligations and 21% of floating rate obligations. At such date, the weighted average interest/dividend rate on our total leverage was 4.56%.

15

KAYNE ANDERSON ENERGY INFRASTRUCTURE FUND, INC.

SCHEDULE OF INVESTMENTS

NOVEMBER 30, 2023

(amounts in 000’s)

|

Description |

No. of |

Value |

|||

|

Long-Term Investments — 135.8% |

|

||||

|

Equity Investments(1) — 135.8% |

|

||||

|

Midstream Energy Company(2) — 121.0% |

|

||||

|

AltaGas Ltd.(3) |

627 |

$ |

12,760 |

||

|

Antero Midstream Corporation |

2,218 |

|

29,549 |

||

|

Archrock, Inc. |

368 |

|

5,333 |

||

|

Aris Water Solutions, Inc. |

618 |

|

4,992 |

||

|

Cheniere Energy, Inc. |

942 |

|

171,531 |

||

|

DT Midstream, Inc. |

531 |

|

30,421 |

||

|

Enbridge Inc.(3) |

1,433 |

|

49,976 |

||

|

Energy Transfer LP |

17,059 |

|

236,950 |

||

|

Energy Transfer LP — Series A Preferred Unit(4) |

4,000 |

|

3,800 |

||

|

EnLink Midstream, LLC |

1,298 |

|

17,742 |

||

|

Enterprise Products Partners L.P. |

8,317 |

|

222,723 |

||

|

Enterprise Products Partners L.P. — Convertible Preferred |

40 |

|

40,503 |

||

|

Equitrans Midstream Corporation |

2,045 |

|

19,183 |

||

|

Hess Midstream LP |

774 |

|

25,182 |

||

|

Keyera Corp.(3) |

214 |

|

5,399 |

||

|

Kinder Morgan, Inc. |

4,979 |

|

87,489 |

||

|

Kodiak Gas Services, Inc. |

142 |

|

2,500 |

||

|

MPLX LP |

3,904 |

|

142,349 |

||

|

MPLX LP — Convertible Preferred Units(5)(6)(8) |

2,255 |

|

82,231 |

||

|

NuStar Energy L.P. |

650 |

|

12,376 |

||

|

ONEOK, Inc. |

2,355 |

|

162,110 |

||

|

Pembina Pipeline Corporation(3) |

1,787 |

|

59,726 |

||

|

Plains All American Pipeline, L.P. |

8,703 |

|

138,198 |

||

|

Plains GP Holdings, L.P. |

653 |

|

10,559 |

||

|

Plains GP Holdings, L.P. — Plains AAP, L.P.(6)(9) |

690 |

|

11,143 |

||

|

Sentinel Midstream Highline JV Holdings LLC(5)(6)(10)(11)(12) |

1,500 |

|

30,600 |

||

|

Streamline Innovations Holdings, Inc. — Series C Preferred |

5,500 |

|

28,325 |

||

|

Targa Resources Corp. |

1,956 |

|

176,918 |

||

|

TC Energy Corporation(3) |

1,131 |

|

42,420 |

||

|

The Williams Companies, Inc. |

5,162 |

|

189,892 |

||

|

Western Midstream Partners, LP |

3,270 |

|

97,515 |

||

|

|

2,150,395 |

||||

|

Utility Company(2) — 5.4% |

|

||||

|

NextEra Energy, Inc. |

400 |

|

23,410 |

||

|

Sempra Energy |

989 |

|

72,068 |

||

|

|

95,478 |

||||

See accompanying notes to financial statements.

16

KAYNE ANDERSON ENERGY INFRASTRUCTURE FUND, INC.

SCHEDULE OF INVESTMENTS

NOVEMBER 30, 2023

(amounts in 000’s)

|

Description |

No. of |

Value |

||||

|

Renewable Infrastructure Company(2) — 5.3% |

|

|

||||

|

Atlantica Sustainable Infrastructure plc(3) |

2,453 |

$ |

46,658 |

|

||

|

Brookfield Renewable Partners L.P.(3) |

285 |

|

7,062 |

|

||

|

Clearway Energy, Inc. — Class A |

342 |

|

8,094 |

|

||

|

Clearway Energy, Inc. — Class C |

661 |

|

16,505 |

|

||

|

NextEra Energy Partners, LP |

714 |

|

16,807 |

|

||

|

|

95,126 |

|

||||

|

Energy Company(2) — 4.1% |

|

|

||||

|

Exxon Mobil Corporation |

449 |

|

46,151 |

|

||

|

Phillips 66 |

210 |

|

27,062 |

|

||

|

|

73,213 |

|

||||

|

Total Long-Term Investments — 135.8% (Cost — $2,270,202) |

|

2,414,212 |

|

|||

|

|

|

|||||

|

Debt |

|

(345,679 |

) |

|||

|

Mandatory Redeemable Preferred Stock at Liquidation Value |

|

(153,094 |

) |

|||

|

Current Income Tax Receivable, net |

|

8,710 |

|

|||

|

Deferred Income Tax Liability, net |

|

(134,796 |

) |

|||

|

Other Liabilities in Excess of Other Assets |

|

(11,795 |

) |

|||

|

Net Assets Applicable to Common Stockholders |

$ |

1,777,558 |

|

|||

____________

(1) Unless otherwise noted, equity investments are common units/common shares.

(2) Refer to Glossary of Key Terms for definitions of Energy Company, Midstream Energy Company, Renewable Infrastructure Company and Utility Company.

(3) Foreign security.

(4) Energy Transfer LP (“ET”) Series A Fixed-to-Floating Rate Cumulative Redeemable Perpetual Preferred Units (“ET Series A Units”). ET Series A Units have a liquidation preference of $1,000 per unit and pay a quarterly distribution at a rate equal to three-month SOFR plus a spread of 4.2896%. ET Series A Units are redeemable anytime at a redemption price of $1,000 per ET Series A Unit plus accumulated and unpaid distributions. As of November 30, 2023, the distribution rate was 9.669%.

(5) Fair valued on a recurring basis using significant unobservable inputs (Level 3). See Notes 2 and 3 in Notes to Financial Statements.

(6) The Company’s ability to sell this security is subject to certain legal or contractual restrictions. As of November 30, 2023, the aggregate value of restricted securities held by the Company was $192,802 (7.9% of total assets), which included $11,143 of Level 2 securities and $181,659 of Level 3 securities. See Note 7 — Restricted Securities.

(7) Enterprise Products Partners L.P. (“EPD”) Series A Cumulative Convertible Preferred Units (“EPD Convertible Preferred Units”) are senior to the common units in terms of liquidation preference and priority of distributions, and pay a distribution of 7.25% per annum. The EPD Convertible Preferred Units are convertible into EPD common units at any time after September 29, 2025 at the liquidation preference amount divided by 92.5% of the 5-day volume weighted average price of EPD’s common units at such time. See Note 3 — Fair Value.

(8) MPLX LP (“MPLX”) Series A Convertible Preferred Units (“MPLX Convertible Preferred Units”) are convertible on a one-for-one basis into common units of MPLX and are senior to the common units in terms of liquidation preference and priority of distributions. See Note 3 — Fair Value.

See accompanying notes to financial statements.

17

KAYNE ANDERSON ENERGY INFRASTRUCTURE FUND, INC.

SCHEDULE OF INVESTMENTS

NOVEMBER 30, 2023

(amounts in 000’s)

(9) The Company’s ownership of Plains AAP, L.P. (“PAGP-AAP”) is exchangeable on a one-for-one basis into either Plains GP Holdings, L.P. (“PAGP”) shares or Plains All American Pipeline, L.P. (“PAA”) units at the Company’s option. The Company values its PAGP-AAP investment on an “as exchanged” basis based on the higher public market value of either PAGP or PAA. As of November 30, 2023, the Company’s PAGP-AAP investment is valued at PAGP’s closing price. See Note 7 — Restricted Securities.

(10) Sentinel Midstream Highline JV Holdings LLC (“Sentinel Midstream”) is a privately-held company that operates energy infrastructure assets near the Texas and Louisiana Gulf Coast which are referred to as Enercoast Energy Infrastructure (“EEI”). The Company is the owner of Series A-2 units which represent a membership interest in Sentinel Midstream (“Sentinel-EEI Series A-2 Units”). The Sentinel-EEI Series A-2 Units are pari passu with Series A-1 Units (together, “Series A Units”), and are senior to other classes of common equity in terms of liquidation preference and priority of distributions. The Series A Units are entitled to receive cash distributions beginning June 30, 2024. See Note 3 — Fair Value.

(11) The Company believes that it is an affiliate of Sentinel Midstream and Streamline Innovations Holdings, Inc. (“Streamline”). See Note 5 — Agreements and Affiliations.

(12) Security is non-income producing.

(13) Streamline is a privately-held company. Streamline Series C Preferred Shares are convertible into common equity at any time at the Company’s option and are senior to common equity and Series A and Series B preferred shares in terms of liquidation preference and priority of distributions. Streamline Series C Preferred Shares are entitled to receive a quarterly dividend beginning on March 31, 2025, at an annual rate of 12.0%, which rate shall increase 2.0% each year thereafter to a maximum rate of 18.0%. Streamline Series C Preferred Shares are redeemable by Streamline at any time after March 31, 2025, at a price sufficient for the Company to achieve a 20.0% internal rate of return on its investment.

At November 30, 2023, the Company’s geographic allocation was as follows:

|

Geographic Location |

% of Long-Term |

|

|

United States |

90.7% |

|

|

Canada |

7.4% |

|

|

Europe/U.K. |

1.9% |

See accompanying notes to financial statements.

18

KAYNE ANDERSON ENERGY INFRASTRUCTURE FUND, INC.

STATEMENT OF ASSETS AND LIABILITIES

NOVEMBER 30, 2023

(amounts in 000’s, except share and per share amounts)

| ASSETS |

|

| ||

| Investments at fair value: |

|

| ||

| Non-affiliated (Cost — $2,212,122) | $ | 2,355,287 |

| |

| Affiliated (Cost — $58,080) |

| 58,925 |

| |

| Cash |

| 589 |

| |

| Deposits with brokers |

| 250 |

| |

| Dividends, distributions and interest receivable (Cost — $3,211) |

| 3,218 |

| |

| Current income tax receivable, net |

| 8,710 |

| |

| Deferred credit facility offering costs and other assets |

| 643 |

| |

| Total Assets |

| 2,427,622 |

| |

|

|

| |||

| LIABILITIES |

|

| ||

| Payable for securities purchased |

| 5,001 |

| |

| Investment management fee payable |

| 6,965 |

| |

| Accrued directors’ fees |

| 264 |

| |

| Accrued expenses and other liabilities |

| 7,255 |

| |

| Deferred income tax liability, net |

| 134,796 |

| |

| Credit facility |

| 9,000 |

| |

| Term loan |

| 50,000 |

| |

| Unamortized term loan issuance costs |

| (39 | ) | |

| Notes |

| 286,679 |

| |

| Unamortized notes issuance costs |

| (1,425 | ) | |

| Mandatory redeemable preferred stock, $25.00 liquidation value per share (6,123,774 shares issued and outstanding) |

| 153,094 |

| |

| Unamortized mandatory redeemable preferred stock issuance costs |

| (1,526 | ) | |

| Total Liabilities |

| 650,064 |

| |

| NET ASSETS APPLICABLE TO COMMON STOCKHOLDERS | $ | 1,777,558 |

| |

| NET ASSETS APPLICABLE TO COMMON STOCKHOLDERS CONSIST OF |

|

| ||

| | $ | 169 |

| |

| Paid-in capital |

| 2,609,492 |

| |

| Total distributable earnings (loss) |

| (832,103 | ) | |

| NET ASSETS APPLICABLE TO COMMON STOCKHOLDERS | $ | 1,777,558 |

| |

| NET ASSET VALUE PER COMMON SHARE | $ | 10.51 |

|

See accompanying notes to financial statements.

19

KAYNE ANDERSON ENERGY INFRASTRUCTURE FUND, INC.

STATEMENT OF OPERATIONS

FOR THE FISCAL YEAR ENDED NOVEMBER 30, 2023

(amounts in 000’s)

|

INVESTMENT INCOME |

|

|

||

|

Income |

|

|

||

|

Dividends and distributions: |

|

|

||

|

Non-affiliated investments |

$ |

121,491 |

|

|

|

Money market mutual funds |

|

331 |

|

|

|

Total dividends and distributions (after foreign taxes withheld of $1,261) |

|

121,822 |

|

|

|

Return of capital |

|

(50,414 |

) |

|

|

Distributions in excess of cost basis |

|

(2,029 |

) |

|

|

Net dividends and distributions |

|

69,379 |

|

|

|

Interest income |

|

|

||

|

Non-affiliated investments |

|

178 |

|

|

|

Total Investment Income |

|

69,557 |

|

|

|

Expenses |

|

|

||

|

Investment management fees |

|

26,140 |

|

|

|

Directors’ fees |

|

899 |

|

|

|

Professional fees |

|

696 |

|

|

|

Administration fees |

|

616 |

|

|

|

Merger expenses |

|

311 |

|

|

|

Reports to stockholders |

|

257 |

|

|

|

Insurance |

|

184 |

|

|

|

Stock exchange listing fees |

|

152 |

|

|

|

Custodian fees |

|

90 |

|

|

|

Other expenses |

|

205 |

|

|

|

Total Expenses — before interest expense, preferred distributions and taxes |

|

29,550 |

|

|

|

Investment management fee waiver |

|

(35 |

) |

|

|

Interest expense including amortization of offering costs |

|

15,772 |

|

|

|

Distributions on mandatory redeemable preferred stock including amortization of offering costs |

|

4,546 |

|

|

|

Total Expenses — before taxes |

|

49,833 |

|

|

|

Net Investment Income — Before Taxes |

|

19,724 |

|

|

|

Current income tax expense |

|

(1,394 |

) |

|

|

Deferred income tax expense |

|

(1,207 |

) |

|

|

Net Investment Income |

|

17,123 |

|

|

|

|

|

|||

|

REALIZED AND UNREALIZED GAINS (LOSSES) |

|

|

||

|

Net Realized Gains (Losses) |

|

|

||

|

Investments — non-affiliated |

|

134,522 |

|

|

|

Foreign currency transactions |

|

(55 |

) |

|

|

Options |

|

205 |

|

|

|

Current income tax expense |

|

(14,816 |

) |

|

|

Deferred income tax expense |

|

(12,832 |

) |

|

|

Net Realized Gains (Losses) |

|

107,024 |

|

|

|

Net Change in Unrealized Gains (Losses) |

|

|

||

|

Investments — non-affiliated |

|

(16,462 |

) |

|

|

Investments — affiliated |

|

1,897 |

|

|

|

Foreign currency translations |

|

18 |

|

|

|

Options |

|

1 |

|

|

|

Deferred income tax benefit |

|

2,986 |

|

|

|

Net Change in Unrealized Gains (Losses) |

|

(11,560 |

) |

|

|

Net Realized and Unrealized Gains (Losses) |

|

95,464 |

|

|

|

NET INCREASE IN NET ASSETS APPLICABLE TO COMMON STOCKHOLDERS RESULTING FROM OPERATIONS |

$ |

112,587 |

|

See accompanying notes to financial statements.

20

KAYNE ANDERSON ENERGY INFRASTRUCTURE FUND, INC.

STATEMENT OF CHANGES IN NET ASSETS APPLICABLE TO COMMON STOCKHOLDERS

(amounts in 000’s, except share amounts)

|

For the Fiscal Year Ended |

||||||||

|

2023 |

2022 |

|||||||

|

OPERATIONS |

|

|

|

|

||||

|

Net investment income, net of tax(1) |

$ |

17,123 |

|

$ |

9,700 |

|

||

|

Net realized gains, net of tax |

|

107,024 |

|

|

83,081 |

|

||

|

Net change in unrealized gains (losses), net of tax |

|

(11,560 |

) |

|

230,562 |

|

||

|

Net Increase in Net Assets Resulting from Operations |

|

112,587 |

|

|

323,343 |

|

||

|

DIVIDENDS AND DISTRIBUTIONS TO COMMON STOCKHOLDERS(1)(2) |

|

|

|

|

||||

|

Dividends |

|

(112,989 |

) |

|

(103,807 |

) |

||

|

Distributions — return of capital |

|

— |

|

|

— |

|

||

|

Dividends and Distributions to Common Stockholders |

|

(112,989 |

) |

|

(103,807 |

) |

||

|

CAPITAL STOCK TRANSACTIONS |

|

|

|

|

||||

|

Issuance of 32,994,508 shares of common stock in connection with the merger of Kayne Anderson NextGen Energy & Infrastructure, Inc. |

|

330,599 |

|

|

— |

|

||

|

Offering expenses associated with the issuance of common stock in merger |

|

(661 |

)(3) |

|

— |

|

||

|

Issuance of 9,683,976 shares of common stock in connection with the merger of Fiduciary/Claymore Energy Infrastructure Fund |

|

— |

|

|

102,007 |

|

||

|

Net Increase in Net Assets Applicable to Common Stockholders from Capital Stock Transactions |

|

329,938 |

|

|

102,007 |

|

||

|

Total Increase in Net Assets Applicable to Common Stockholders |

|

329,536 |

|

|

321,543 |

|

||

|

NET ASSETS APPLICABLE TO COMMON STOCKHOLDERS |

|

|

|

|

||||

|

Beginning of year |

|

1,448,022 |

|

|

1,126,479 |

|

||

|

End of year |

$ |

1,777,558 |

|

$ |

1,448,022 |

|

||

____________

(1) Distributions on the Company’s mandatory redeemable preferred stock (“MRP Shares”) are treated as an operating expense under GAAP and are included in the calculation of net investment income (loss). See Note 2 — Significant Accounting Policies.

(2) Distributions paid to common stockholders for the fiscal years ended November 30, 2023 and 2022 were characterized as dividends (eligible to be treated as qualified dividend income). This characterization is based on the Company’s earnings and profits.

(3) Represents offering costs incurred in connection with the merger of Kayne Anderson NextGen Energy & Infrastructure, Inc.

See accompanying notes to financial statements.

21

KAYNE ANDERSON ENERGY INFRASTRUCTURE FUND, INC.

STATEMENT OF CASH FLOWS

FOR THE FISCAL YEAR ENDED NOVEMBER 30, 2023

(amounts in 000’s)

|

CASH FLOWS FROM OPERATING ACTIVITIES |

|

|

||

|

Net increase in net assets resulting from operations |

$ |

112,587 |

|

|

|

Adjustments to reconcile net increase in net assets resulting from operations to net cash provided by operating activities: |

|

|

||

|

Return of capital distributions |

|

50,414 |

|

|

|

Distributions in excess of cost basis |

|

2,029 |

|

|

|

Net realized gains (excluding foreign currency transactions) |

|

(134,727 |

) |

|

|

Net change in unrealized gains and losses (excluding foreign currency |

|

14,564 |

|

|

|

Accretion of bond discounts, net |

|

(2 |

) |

|

|

Purchase of long-term investments |

|

(942,869 |

) |

|

|

Proceeds from sale of long-term investments |

|

1,016,966 |

|

|

|

Proceeds from sale of short-term investments, net |

|

1,777 |

|

|

|

Cash consideration paid in merger with Kayne Anderson NextGen Energy Infrastructure, Inc. (KMF) |

|

(54,945 |

) |

|

|

Cash acquired in merger with KMF |

|

48,508 |

|

|

|

Amortization of deferred debt offering costs |

|

1,284 |

|

|

|

Amortization of mandatory redeemable preferred stock offering costs |

|

224 |

|

|

|

Decrease in deposits with brokers |

|

256 |

|

|

|

Decrease in receivable for securities sold |

|

5,145 |

|

|

|

Decrease in dividends, distributions and interest receivable |

|

2,556 |

|

|

|

Increase in current income tax receivable |

|

(920 |

) |

|

|

Decrease in other assets |

|

46 |

|

|

|

Increase in payable for securities purchased |

|

4,986 |

|

|

|

Decrease in investment management fee payable |

|

(160 |

) |

|

|

Increase in accrued directors’ fees |

|

5 |

|

|

|

Decrease in premiums received on call option contracts written |

|

(44 |

) |

|

|

Decrease in accrued expenses and other liabilities |

|

(738 |

) |

|

|

Increase in deferred income tax liability |

|

11,050 |

|

|

|

Net Cash Provided by Operating Activities |

|

137,992 |

|

|

|

CASH FLOWS FROM FINANCING ACTIVITIES |

|

|

||

|

Increase in borrowings under credit facility |

|

9,000 |

|

|

|

Costs associated with renewal of credit facility |

|

(913 |

) |

|

|

Offering expenses associated with the merger of KMF |

|

(661 |

) |

|

|

Redemption of notes |

|

(32,345 |

) |

|

|

Cash distributions paid to common stockholders |

|

(112,989 |

) |

|

|

Net Cash Used in Financing Activities |

|

(137,908 |

) |

|

|

NET CHANGE IN CASH |

|

84 |

|

|

|

CASH — BEGINNING OF YEAR |

|

505 |

|

|

|

CASH — END OF YEAR |

$ |

589 |

|

____________

Supplemental disclosure of cash flow information:

Non-cash financing activities included herein consisted of the issuance of shares of common stock in the Company’s merger with KMF ($385,545 of net assets acquired before considering cash consideration paid in connection with merger).

During the fiscal year ended November 30, 2023, interest paid related to debt obligations were $13,900 and income tax paid was $17,132 (net of refunds received).

See accompanying notes to financial statements.

22

KAYNE ANDERSON ENERGY INFRASTRUCTURE FUND, INC.

FINANCIAL HIGHLIGHTS

(amounts in 000’s, except share and per share amounts)

|

For the Fiscal Year Ended November 30, |

||||||||||||

|

2023 |

2022 |

2021 |

||||||||||

|

Per Share of Common Stock(1) |

|

|

|

|

|

|

||||||

|

Net asset value, beginning of period |

$ |

10.64 |

|

$ |

8.91 |

|

$ |

6.90 |

|

|||

|

Net investment income (loss)(2) |

|

0.12 |

|

|

0.07 |

|

|

(0.08 |

) |

|||

|

Net realized and unrealized gain (loss) |

|

0.59 |

|

|

2.44 |

|

|

2.74 |

|

|||

|

Total income (loss) from operations |

|

0.71 |

|

|

2.51 |

|

|

2.66 |

|

|||

|

Common dividends(3) |

|

(0.83 |

) |

|

(0.78 |

) |

|

— |

|

|||

|

Common distributions — return of capital(3) |

|

— |

|

|

— |

|

|

(0.65 |

) |

|||

|

Total dividends and distributions — common |

|

(0.83 |

) |

|

(0.78 |

) |

|

(0.65 |

) |

|||

|

Offering expenses associated with the issuance of common stock |

|

(0.01)(4) |

|

|

— |

|

|

— |

|

|||

|

Effect of issuance of common stock |

|

— |

|

|

— |

|

|

— |

|

|||

|

Effect of shares issued in reinvestment of dividends |

|

— |

|

|

— |

|

|

— |

|

|||

|

Total capital stock transactions |

|

— |

|

|

— |

|

|

— |

|

|||

|

Net asset value, end of period |

$ |

10.51 |

|

$ |

10.64 |

|

$ |

8.91 |

|

|||

|

Market value per share of common stock, |

$ |

8.57 |

|

$ |

9.04 |

|

$ |

7.77 |

|

|||

|

Total investment return based on common stock market value(5) |

|

4.3 |

% |

|

27.2 |

% |

|

44.0 |

% |

|||

|

Total investment return based on net asset value(6) |

|

8.7 |

% |

|

30.5 |

% |

|

41.0 |

% |

|||

|

Supplemental Data and Ratios(7) |

|

|

|

|

|

|

||||||

|

Net assets applicable to common stockholders, |

$ |

1,777,558 |

|

$ |

1,448,022 |

|

$ |

1,126,479 |

|

|||

|

Ratio of expenses to average net assets |

|

|

|

|

|

|

||||||

|

Management fees (net of fee waiver) |

|

1.9 |

% |

|

2.0 |

% |

|

1.8 |

% |

|||

|

Other expenses |

|

0.2 |

|

|

0.2 |

|

|

0.3 |

|

|||

|

Subtotal |

|

2.1 |

|

|

2.2 |

|

|

2.1 |

|

|||

|

Interest expense and distributions on mandatory redeemable preferred stock(2) |

|

1.5 |

|

|

1.2 |

|

|

1.3 |

|

|||

|

Income tax expense(8) |

|

1.9 |

|

|

6.1 |

|

|

5.1 |

|

|||

|

Total expenses |

|

5.5 |

% |

|

9.5 |

% |

|

8.5 |

% |

|||

|

Ratio of net investment income (loss) to average net assets(2) |

|

1.2 |

% |

|

0.7 |

% |

|

(0.9 |

)% |

|||

|

Net increase (decrease) in net assets to common stockholders resulting from operations to |

|

8.0 |

% |

|

24.1 |

% |

|

31.4 |

% |

|||

|

Portfolio turnover rate |

|

48.8 |

% |

|

28.2 |

% |

|

50.8 |

% |

|||

|

Average net assets |

$ |

1,399,694 |

|

$ |

1,344,102 |

|

$ |

1,068,396 |

|

|||

|

Notes outstanding, end of period(9) |

$ |

286,679 |

|

$ |

260,789 |

|

$ |

209,686 |

|

|||

|

Borrowings under credit facilities, end of period(9) |

$ |

9,000 |

|

$ |

— |

|

$ |

63,000 |

|

|||

|

Term loan outstanding, end of period(9) |

$ |

50,000 |

|

$ |

50,000 |

|

$ |

50,000 |

|

|||

|

Mandatory redeemable preferred stock, |

$ |

153,094 |

|

$ |

111,603 |

|

$ |

101,670 |

|

|||

|

Average shares of common stock outstanding |

|

137,758,656 |

|

|

133,664,106 |

|

|

126,447,554 |

|

|||

|

Asset coverage of total debt(10) |

|

658.5 |

% |

|

601.8 |

% |

|

480.6 |

% |

|||

|

Asset coverage of total leverage (debt and preferred stock)(11) |

|

456.4 |

% |

|

442.8 |

% |

|

365.5 |

% |

|||

|

Average amount of borrowings per share of common stock during the period(1) |

$ |

2.30 |

|

$ |

2.79 |

|

$ |

2.43 |

|

|||

See accompanying notes to financial statements.

23

KAYNE ANDERSON ENERGY INFRASTRUCTURE FUND, INC.

FINANCIAL HIGHLIGHTS

(amounts in 000’s, except share and per share amounts)

|

For the Fiscal Year Ended November 30, |

||||||||||||||||

|

2020 |

2019 |

2018 |

2017 |

|||||||||||||

|

Per Share of Common Stock(1) |

|

|

|

|

|

|

|

|

||||||||

|

Net asset value, beginning of period |

$ |

13.89 |

|

$ |

16.37 |

|

$ |

15.90 |

|

$ |

19.18 |

|

||||

|

Net investment income (loss)(2) |

|

(0.34 |

) |

|

(0.26 |

) |

|

(0.45 |

) |

|

(0.45 |

) |

||||

|

Net realized and unrealized gain (loss) |

|

(5.87 |

) |

|

(0.75 |

) |

|

2.74 |

|

|

(0.92 |

) |

||||

|

Total income (loss) from operations |

|

(6.21 |

) |

|

(1.01 |

) |

|

2.29 |

|

|

(1.37 |

) |

||||

|

Common dividends(3) |

|

— |

|

|

— |

|

|

(1.80 |

) |

|

(0.53 |

) |

||||

|

Common distributions — return of capital(3) |

|

(0.78 |

) |

|

(1.47 |

) |

|

— |

|

|

(1.37 |

) |

||||

|

Total dividends and distributions — common |

|

(0.78 |

) |

|

(1.47 |

) |

|

(1.80 |

) |

|

(1.90 |

) |

||||

|

Offering expenses associated with the issuance of common stock |

|

— |

|

|

— |

|

|

(0.01 |

)(12) |

|

— |

|

||||

|

Effect of issuance of common stock |

|

— |

|

|

— |

|

|

— |

|

|

— |

|

||||

|

Effect of shares issued in reinvestment of dividends and distributions |

|

— |

|

|

— |

|

|

(0.01 |

) |

|

(0.01 |

) |

||||

|

Total capital stock transactions |

|

— |

|

|

— |

|

|

(0.02 |

) |

|

(0.01 |

) |

||||

|

Net asset value, end of period |

$ |

6.90 |

|

$ |

13.89 |

|

$ |

16.37 |

|

$ |

15.90 |

|

||||

|

Market value per share of common stock, end of period |

$ |

5.89 |

|

$ |

12.55 |

|

$ |

15.85 |

|

$ |

15.32 |

|

||||

|

Total investment return based on common stock market value(5) |

|

(47.3 |

)% |

|

(12.4 |

)% |

|

14.8 |

% |

|

(13.8 |

)% |

||||

|

Total investment return based on net asset value(6) |

|

(44.3 |

)% |

|

(6.1 |

)% |

|