EXECUTION COPY

SUBSCRIPTION AGREEMENT

This SUBSCRIPTION AGREEMENT (the “Agreement”), dated as of February 23, 2012, is by and between Net Element, Inc., a Delaware corporation (the “Company”), and Kenges Rakishev (the “Buyer”).

RECITALS

A. The Company and Buyer are each executing and delivering this Agreement in reliance upon the exemption from securities registration afforded by Section 4(2) of the Securities Act of 1933, as amended (the “1933 Act”), and Rule 506 of Regulation D (“Regulation D”) as promulgated by the United States Securities and Exchange Commission (the “SEC”) under the 1933 Act.

B. Buyer wishes to purchase, and the Company wishes to sell, upon the terms and conditions stated in this Agreement, 13,333,334 shares of Common Stock (as defined below) (such 13,333,334 shares of Common Stock are collectively referred to herein as the “Common Shares”).

AGREEMENT

NOW, THEREFORE, in consideration of the premises and the mutual covenants contained herein and for other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, the Company and Buyer hereby agree as follows:

1. PURCHASE AND SALE OF COMMON SHARES.

(a) Common Shares. Subject to the satisfaction (or waiver) of the conditions set forth in Sections 6 and 7 below, the Company shall issue and sell to Buyer, and Buyer shall purchase from the Company on the Closing Date (as defined below), the Common Shares.

(b) Closing. The closing (the “Closing”) of the purchase of the Common Shares by the Buyer shall occur at the offices of Greenberg Traurig, LLP, 200 Park Avenue, Florham Park, NJ 07932. The date and time of the Closing (the “Closing Date”) shall be 10:00 a.m., New York time, on the first (1st) Business Day (as defined below) on which the conditions to the Closing set forth in Sections 6 and 7

below are satisfied or waived (or such later date as is mutually agreed to by the Company and Buyer). “Business Day” means any day other than a Saturday, Sunday or other day on which commercial banks in New York, New York are authorized or required by law to remain closed.

(c) Purchase Price. The aggregate purchase price for the Common Shares to be purchased by Buyer shall be $2,000,000.10 (the “Purchase Price”).

(d) Payment of Purchase Price; Deliveries. On the Closing Date, (i) (A) Buyer shall pay the Purchase Price to the Company for the Common Shares to be issued and sold to Buyer at the Closing, by wire transfer of immediately available funds in accordance with the Company’s written wire instructions, and (B) Buyer shall deliver to the Company a duly completed and executed Internal Revenue Service Form W-8BEN or other appropriate Form W-8, and (ii) the Company shall deliver to Buyer one or more stock certificates, free and clear of all restrictive and other legends (except as expressly provided in Section 5(c) hereof), evidencing the Common Shares, duly executed on behalf of the Company and registered in the name of Buyer or its designee.

2. BUYER’S REPRESENTATIONS AND WARRANTIES.

Buyer represents and warrants to the Company that:

(a) Authority. Buyer has the requisite power and authority to enter into and to consummate the transactions contemplated by the Transaction Documents (as defined below) to which it is a party and otherwise to carry out its obligations hereunder and thereunder. “Transaction Documents” means, collectively, this Agreement, the Irrevocable Transfer Agent Instructions (as defined below) and each of the other agreements and instruments entered into or delivered by any of the parties hereto in connection with the transactions contemplated hereby and thereby, as may be amended from time to time.

(b) No Public Sale or Distribution. Buyer is acquiring the Common Shares for its own account and not with a view towards, or for resale in connection with, the public sale or distribution thereof in violation of applicable securities laws, except pursuant to sales registered or exempted under the 1933 Act; provided, however, by making the representations herein, Buyer does not agree, or make any representation or warranty, to hold any of the Common Shares for any minimum or other specific term and reserves the right to dispose of the Common Shares at any time in accordance with or pursuant to a registration statement or an exemption under the 1933 Act. Buyer does not presently have any agreement or understanding, directly or indirectly, with any Person (as defined below) to distribute any of the Common Shares in violation of applicable securities laws. “Person” means an individual, a limited liability company, a partnership, a joint venture, a corporation, a trust, an unincorporated organization, any other entity and a government or any department or agency thereof.

(c) Accredited Investor Status; Residence. Buyer is an “accredited investor” as that term is defined in Rule 501(a) of Regulation D (“Regulation D”) as promulgated by the United States Securities and Exchange Commission (the “SEC”) under the 1933 Act. Buyer has such knowledge and experience in financial and business matters that he is capable of evaluating the merits and risks of his investment in the Company through his purchase of the Common Shares. Buyer is able to bear the economic risk of such investment for an indefinite period of time. At the present time, Buyer can afford a complete loss of such investment and has no need for liquidity in such investment. Buyer is a resident of the Republic of Kazakhstan.

| 2 |

(d) Reliance on Exemptions. Buyer understands that the Common Shares are being offered and sold to it in reliance on specific exemptions from the registration requirements of United States federal and state securities laws and that the Company is relying in part upon the truth and accuracy of, and Buyer’s compliance with, the representations, warranties, agreements, acknowledgments and understandings of Buyer set forth herein in order to determine the availability of such exemptions and the eligibility of Buyer to acquire the Common Shares.

(e) Information. Buyer acknowledges that he has carefully reviewed this Agreement and the Company’s filings with the SEC since January 1, 2011, which are available on the Internet at www.sec.gov, all of which filings Buyer acknowledges have been made available to him. Buyer and his advisors, if any, have been furnished with all materials relating to the business, finances and operations of the Company and materials relating to the offer and sale of the Common Shares which have been requested by Buyer. Buyer and his advisors, if any, have been afforded the opportunity to ask questions of the Company. Buyer has sought such accounting, legal and tax advice as he has considered necessary to make an informed investment decision with respect to his acquisition of the Common Shares. Buyer understands that his investment in the Common Shares involves a high degree of risk in that: (i) the Company is a development stage company and has a limited operating history upon which an evaluation of its prospects can be made; (ii) an investment in the Company is highly speculative and only investors who can afford the loss of their entire investment should consider investing in the Company and securities of the Company; (iii) transferability of the Common Shares is limited; (iv) the Company has experienced recurring losses and it must raise substantial additional capital in order to continue operating its business; (v) subsequent equity financings will dilute the ownership and voting interests of Buyer and his affiliates and equity securities issued by the Company to other persons or entities may have rights, preferences or privileges senior to the rights of Buyer; (vi) any debt financing that may be obtained by the Company must be repaid regardless of whether the Company generates revenues or cash flows from operations and may be secured by substantially all of the Company’s assets; (vii) there is absolutely no assurance that any type of financing on terms acceptable to the Company will be available to the Company or otherwise obtained by the Company; and (viii) if the Company is unable to obtain additional financing or is unable to obtain additional financing on terms acceptable to it, then the Company may be unable to implement its business plans or take advantage of business opportunities, which could have a material adverse effect on the Company’s business prospects, financial condition and results of operations and may ultimately require the Company to suspend or cease operations.

(f) No Governmental Review. Buyer understands that no United States federal or state agency or any other government or governmental agency has passed on or made any recommendation or endorsement of the Common Shares or the fairness or suitability of the investment in the Common Shares nor have such authorities passed upon or endorsed the merits of the offering or sale of the Common Shares.

| 3 |

(g) Transfer or Resale. Buyer understands that: (i) the Common Shares have not been and are not being registered under the 1933 Act or any state securities laws, and may not be offered for sale, sold, assigned or transferred unless (A) subsequently registered thereunder, (B) Buyer shall have delivered to the Company (if requested by the Company) an opinion of counsel to Buyer, in a form reasonably acceptable to the Company, to the effect that the applicable Common Shares to be sold, assigned or transferred may be sold, assigned or transferred pursuant to an exemption from such registration, or (C) Buyer provides the Company with reasonable assurance that the applicable Common Shares can be sold, assigned or transferred pursuant to Rule 144 or Rule 144A promulgated under the 1933 Act (or a successor rule thereto) (collectively, “Rule 144”); (ii) any sale of Common Shares made in reliance on Rule 144 may be made only in accordance with the terms of Rule 144, and further, if Rule 144 is not applicable, any resale of Common Shares under circumstances in which the seller (or the Person through whom the sale is made) may be deemed to be an underwriter (as that term is defined in the 1933 Act) may require compliance with some other exemption under the 1933 Act or the rules and regulations of the SEC promulgated thereunder; and (iii) neither the Company nor any other Person is under any obligation to register the Common Shares under the 1933 Act or any state securities laws or to comply with the terms and conditions of any exemption thereunder.

(h) Validity; Enforcement. This Agreement has been duly and validly authorized, executed and delivered by Buyer and constitutes the legal, valid and binding obligations of Buyer enforceable against Buyer in accordance with its terms, except as such enforceability may be limited by general principles of equity or applicable bankruptcy, insolvency, reorganization, moratorium, liquidation and other similar laws relating to, or affecting generally, the enforcement of applicable creditors’ rights and remedies.

(i) No Conflicts. The execution, delivery and performance by Buyer of this Agreement and the consummation by Buyer of the transactions contemplated hereby will not (i) conflict with, or constitute a default (or an event which with notice or lapse of time or both would become a default) under, or give to others any rights of termination, amendment, acceleration or cancellation of, any agreement, indenture or instrument to which Buyer is a party, or (ii) result in a violation of any law, rule, regulation, order, judgment or decree (including U.S. federal and state securities laws and any non-U.S. laws) applicable to Buyer, except in the case of clauses (i) and (ii) above, for such conflicts, defaults, rights or violations which would not, individually or in the aggregate, reasonably be expected to have a material adverse effect on the ability of Buyer to perform its obligations hereunder.

(k) OFAC. Buyer is not (i) a Person included in the Specially Designated Nationals and Blocked Persons lists, as published from time to time by the U.S. Office of Foreign Assets Control (“OFAC”), (ii) currently subject to any U.S. economic sanctions administered by OFAC, (iii) to Buyer’s knowledge, a Person with whom the Company is prohibited from dealing or otherwise engaging in any transaction by any anti-money laundering laws or anti-terrorism laws, including the USA Patriot Act of 2001 and the Executive Order 13224 of September 23, 2001 entitled, “Blocking Property and Prohibiting Transactions With Persons Who Commit, Threaten to Commit, or Support Terrorism” (66 Fed. Reg. 49079 (2001)), (iv) to Buyer’s knowledge, a Person covered by or subject to (or is resident, organized or otherwise located in any country that is covered by or subject to) sanctions under the International Emergency Economic Powers Act, the Trading with the Enemy Act or any other applicable laws imposing economic sanctions against or prohibiting transacting business with, for or on behalf of any country, region or individual pursuant to United States law or United Nations resolution, or (v) to Buyer’s knowledge, named on any applicable list of known suspected terrorists, terrorist organizations or of other sanctioned Persons issued by any governmental authority of any jurisdiction in which the Company has conducted or is conducting business.

| 4 |

3. REPRESENTATIONS AND WARRANTIES OF THE COMPANY.

The Company represents and warrants to the Buyer that:

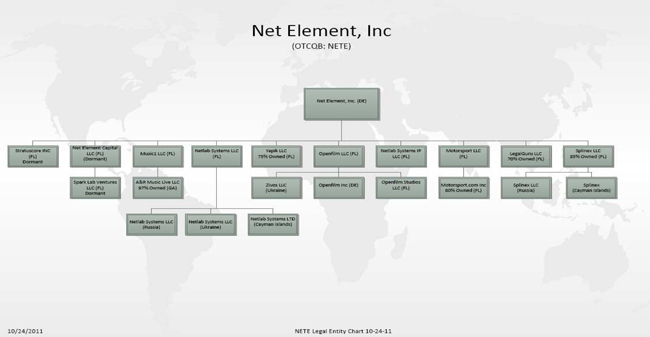

(a) Organization and Standing. Each of the Company and each of its Subsidiaries (as defined below) is duly organized, validly existing and in good standing under the laws of the jurisdiction of their respective incorporation, organization or formation. Each of the Company and each of its Subsidiaries has full corporate power and authority and all necessary government approvals to own, lease and operate its respective properties and assets and to conduct its respective businesses as presently conducted. Each of the Company and each of its Subsidiaries is duly qualified to do business as a foreign corporation or other entity and is in good standing in each jurisdiction where the character of the properties owned, leased or operated by it or the nature of its respective business makes such qualification necessary, except that where any such failure has not had, or could not reasonably be expected to have a material adverse effect on the business, assets, condition (financial or otherwise), results of operations or prospects of the Company and its Subsidiaries, taken as a whole (a “Material Adverse Effect”). Other than the Persons set forth on Schedule 3(a), the Company has no Subsidiaries. “Subsidiaries” means any Person in which the Company, directly or indirectly, (I) owns any of the outstanding capital stock or holds any equity or similar interest of such Person or (II) controls or operates all or any part of the business, operations or administration of such Person, and each of the foregoing, is individually referred to herein as a “Subsidiary.”

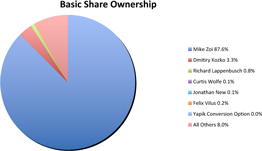

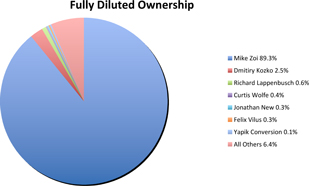

(b) Capital Stock of the Company. As of the date hereof, the Company has authorized capital stock consisting of 2,500,000,000 shares of Common Stock, of which 747,674,446 shares are issued and outstanding, and 100,000,000 shares of preferred stock, $.001 par value, of which no shares are issued and outstanding. As of such date, 149,970,000 shares of the Company’s capital stock were reserved for issuance upon the exercise of outstanding stock options. All of the issued and outstanding shares of capital stock of the Company and of each of its Subsidiaries have been duly authorized and validly issued, are fully paid and non-assessable, and are free of preemptive rights. The Company has 6,250,000 treasury shares. Except as set forth on Schedule 3(b)(i) attached hereto, the Company owns all of the outstanding capital stock, membership interests, partnership interests or other equity interests in its Subsidiaries. Except as set forth on Schedule 3(b)(ii) attached hereto, neither the Company nor any Subsidiary has outstanding any subscriptions, options, warrants, or other rights to purchase, or securities or other obligations convertible into or exchangeable for, or contracts, commitments, agreements, arrangements, or understandings, to issue, any shares of its capital stock, membership interests or other securities. Schedule 3(b)(ii) hereto sets forth the number of (i) warrants to purchase shares of the Common Stock and (ii) options to purchase and securities convertible into shares of the Common Stock. “Common Stock” means (i) the Company’s shares of common stock, $.001 par value per share, and (ii) any capital stock into which such common stock shall have been changed or any share capital resulting from a reclassification of such common stock.

| 5 |

(c) No Violation. The execution, delivery and performance of the Transaction Documents by the Company and the consummation by the Company of the transactions contemplated hereby and thereby (including, without limitation, the issuance of the Common Shares) will not violate (with or without the giving of notice or the lapse of time or both), conflict with, or result in any violation of or default under (i) any provision or restriction of the Company’s certificate of incorporation, as amended and as in effect on the date hereof (the “Certificate of Incorporation”) (including, without limitation, any certificates of designation contained therein), the Company’s bylaws, as amended and as in effect on the date hereof (the “Bylaws”) or other organizational documents of the Company or any of its Subsidiaries, (ii) any agreement, indenture or other instrument to which the Company or any Subsidiary is a party or may be bound or (iii) any shareholders’ agreement, voting trust, proxy or other similar agreement to which the Company or any of its Subsidiaries is a party or may be bound. The execution, delivery and performance of the Transaction Documents by the Company and the consummation by the Company of the transactions contemplated hereby and thereby will not (A) violate any judgment, decree, order or award of any court, governmental body or other authority to which the Company is subject or (B) violate any statute, regulation, ordinance or code of any foreign, federal, state or local government or other governmental department or agency.

(d) Legal Compliance. Each of the Company and its Subsidiaries is in material compliance with, and the respective businesses of the Company and its Subsidiaries are being conducted in compliance with, all applicable laws, orders and permits which are necessary to conduct the businesses now operated by them, and, neither the Company nor any of its Subsidiaries has received written notice of any litigation alleging any failure to so comply, except in each case such as could not reasonably be expected to have, individually or in the aggregate, a Material Adverse Effect. The material permits under which the Company and its Subsidiaries are operating or bound (i) constitute all material permits used or required in the conduct of the respective businesses of the Company and its Subsidiaries as presently conducted and (ii) are in full force and effect, except in each case as could not reasonably be expected to have, individually or in the aggregate, a Material Adverse Effect.

(e) Material Contracts. Except as set forth in Schedule 3(e) attached hereto, neither the Company nor any of its Subsidiaries is in default, and no event has occurred which, with due notice or lapse of time or both, would constitute such a default under, any material contract, agreement, instrument, commitment and other arrangement to which the Company or any Subsidiary is a party or otherwise relating to or affecting any of their respective assets, including, without limitation, employment, severance or consulting agreements, loan, credit or security agreements, joint venture agreements and license and distribution agreements, except in each case such as could not reasonably be expected to have, individually or in the aggregate, a Material Adverse Effect.

(f) Reports and Financial Statements.

(i) Except as set forth in Schedule 3(f)(i) attached hereto, the Company has filed with the SEC true and complete copies of all reports, schedules, forms, statements and any definitive proxy or information statements required to be filed by the Company pursuant to the Securities Exchange Act of 1934, as amended (the “1934 Act”), since January 1, 2011 (the “SEC Filings”), each of which has complied in all material respects with the 1934 Act and the rules and regulations promulgated thereunder, as in effect on the date so filed, except to the extent updated, amended, restated or corrected by a subsequent SEC Filing filed or furnished to the SEC by the Company and in either case, publicly available prior to the date hereof. None of the SEC Filings (including, any financial statements or schedules included or incorporated by reference therein) contained when filed any untrue statement of a material fact or omitted to state a material fact required to be stated therein or necessary to make the statements therein, in light of the circumstances under which they were made, not misleading, except to the extent updated, amended, restated or corrected by a subsequent SEC Filing.

| 6 |

(ii) Except to the extent updated, amended, restated or corrected by a subsequent SEC Filing, all of the financial statements included in the SEC Filings, in each case, including any related notes thereto, as filed with the SEC (those filed with the SEC are collectively referred to as the “Financial Statements”), have been prepared in accordance with generally accepted accounting principles (“GAAP”) applied on a consistent basis throughout the periods involved (except as may be indicated in the notes thereto or, in the case of the unaudited statements, as may be permitted by Form 10-Q of the SEC and subject, in the case of the unaudited statements, to normal, year-end audit adjustments which could not reasonably be expected to have, individually or in the aggregate, a Material Adverse Effect). (i) The consolidated balance sheets (including the related notes) included in the Financial Statements (if applicable, as updated, amended, restated or corrected in a subsequent SEC Filing) fairly present, in all material respects, the consolidated financial position of the Company and its consolidated Subsidiaries at the respective dates thereof, and (ii) the consolidated statements of operations, stockholders’ equity (in the audited financial statements of the Company) and cash flows (in each case, including the related notes) included in the Financial Statements (if applicable, as updated, amended, restated or corrected in a subsequent SEC Filing) fairly present, in all material respects, the consolidated statements of operations, stockholders’ equity (in the audited financial statements of the Company) and cash flows of the Company and its consolidated Subsidiaries for the periods indicated, subject, in the case of the unaudited statements, to normal, year-end audit adjustments which could not reasonably be expected to be material in the aggregate.

(iii) The Company has designed and maintains a system of “internal control over financial reporting” (as defined in Rules 13a-15(f) and 15d-15(f) of the 1934 Act). However, as described in Item 9A of the Company’s Transition Report, as amended, on Form 10-KT/A for the period ended December 31, 2010, the Company’s management has identified material weaknesses in the Company’s internal control over financial reporting, which have not been fully remediated as of the date of this Agreement.

(iv) Subject to the disclosure set forth in the Company’s latest filed Form 10-Q with the SEC regarding the Company’s disclosure controls and procedures (as defined in Rule 13a-15(e) and Rule 15d-15(e) promulgated under the 1934 Act), the management of the Company has (i) implemented disclosure controls and procedures that comply in all material respects with the requirements of the 1934 Act, and (ii) has disclosed, based on its most recent evaluation of internal control over financial reporting (as defined in Rule 13a-15(f) promulgated under the 1934 Act), to the Company’s outside auditors and the board of directors of the Company (A) all significant deficiencies and material weaknesses in the design or operation of internal control over financial reporting which are reasonably likely to adversely affect the Company’s ability to record, process, summarize and report financial information and (B) any fraud, whether or not material, that involves management or other employees who have a significant role in the Company’s internal control over financial reporting. Neither the Company nor any of its consolidated Subsidiaries has any liabilities or obligations of any kind whatsoever, whether or not accrued and whether or not contingent or absolute, that are material to the Company and its consolidated Subsidiaries, taken as a whole, other than (i) liabilities or obligations disclosed or provided for in the consolidated financial statements of the Company and its consolidated subsidiaries as of June 30, 2011, including the notes thereto, contained in the SEC Filings, (ii) liabilities or obligations incurred in the ordinary course of business consistent with past practice since July 1, 2011, (iii) liabilities or obligations disclosed in SEC Filings since July 1, 2011, and (iv) other liabilities or obligations that were not, or could not reasonably be expected to be, material and adverse to the businesses of the Company and its consolidated Subsidiaries, taken as a whole.

| 7 |

(g) Broker’s Fees. Neither the Company nor any of its officers or directors has retained or authorized any investment banker, broker, finder or other intermediary to act on behalf of the Company or incurred any liability for any banker’s, broker’s or finder’s fees or commissions in connection with the transactions contemplated by this Agreement.

(h) Litigation. Except as set forth on Schedule 3(h) attached hereto, there is no action, suit, proceeding, inquiry or investigation before or by any court, public board, government agency, self-regulatory organization or body pending or, to the knowledge of the Company, threatened against or affecting the Company or any of its Subsidiaries, the Common Stock or any of the Company’s or Subsidiaries’ officers or directors in their capacities as such, that could reasonably be expected to have, individually or in the aggregate, a Material Adverse Effect.

(i) Bankruptcy. Neither the Company nor any of its Subsidiaries has taken any steps to seek protection pursuant to any bankruptcy law nor does the Company or any of its Subsidiaries have (i) any knowledge or reason to believe that any creditors of the Company or any of its Subsidiaries intend to initiate involuntary bankruptcy proceedings with respect to the Company or any of its Subsidiaries or (ii) any actual knowledge of any fact which would reasonably lead a creditor to initiate involuntary bankruptcy proceedings with respect to the Company or any of its Subsidiaries.

(j) Actions in the Ordinary Course of Business. Except as disclosed in the SEC Filings and except for an aggregate of $100,785 which has been advanced to the Company by Mike Zoi or one or more entities controlled by him to fund continuing operations of the Company, since January 1, 2011, neither the Company nor any of its Subsidiaries (i) has taken any action or entered into any material transaction, other than contemplated hereby, outside the ordinary and usual course of business; (ii) has borrowed any money or become contingently liable for any obligation or liability of another outside the ordinary and usual course of business; (iii) has failed to pay any of its uncontested debts and obligations as they become due; (iv) has incurred any debt, liability, or obligation of any nature to any party, except for obligations arising from the purchase of goods or the rendition of services in the ordinary and usual course of business; (v) has failed to use its best efforts to preserve its business organization intact, to keep available the services of its employees and independent contractors, or to preserve its relationships with its customers, suppliers, and others with which it deals; (vi) has sold, transferred, leased, or encumbered any of its assets or properties outside the ordinary and usual course of business; (vii) has waived any material right, (viii) has written off any assets or properties; or (ix) has hired any employees or, other than decreasing in 2011 and then increasing later in 2011 the compensation of certain employees of the Company, increased the compensation of any employees outside the ordinary and usual course of business.

| 8 |

(k) No Prohibited Payments. Neither the Company nor any of its Subsidiaries nor any officer, director, employee, independent contractor, or agent, acting on behalf of the Company or any of its Subsidiaries, has at any time (i) made any contributions to any candidate for political office in violation of law or failed to disclose fully any contributions to any candidate for political office in accordance with any applicable statute, rule, regulation, or ordinance requiring such disclosure, (ii) made any payment to any local, state, federal, or foreign governmental officer or official, or other Person charged with similar public or quasi-public duties, other than payments required or allowed by applicable law, (iii) made any payment outside the ordinary course of business to any purchasing or selling agent or Person charged with similar duties of any entity to which the Company or any of its Subsidiaries sells products or renders services or from which the Company or any of its Subsidiaries buys products or services for the purpose of influencing such agent or Person to buy products or services from or sell products or services to the Company or any of its Subsidiaries, or (iv) engaged in any transaction, maintained any bank account, or used any corporate funds, except for transactions, bank accounts, and funds that have been and are reflected in the normally maintained books and records of the Company or any of its Subsidiaries.

(l) Authorization; Enforcement; Validity. The Company has the requisite power and authority to enter into and perform its obligations under this Agreement and the other Transaction Documents and to issue the Common Shares in accordance with the terms hereof and thereof. The execution and delivery of this Agreement and the other Transaction Documents by the Company and the consummation by the Company of the transactions contemplated hereby and thereby (including, without limitation, the issuance of the Common Shares) have been duly authorized by the Company’s board of directors and (other than any filings as may be required by the SEC or any state securities agencies) no further filing, consent or authorization is required by the Company, its board of directors or its stockholders or other governing body. This Agreement has been, and the other Transaction Documents will be prior to the Closing, duly executed and delivered by the Company, and each constitutes the legal, valid and binding obligations of the Company, enforceable against the Company in accordance with its respective terms, except as such enforceability may be limited by general principles of equity or applicable bankruptcy, insolvency, reorganization, moratorium, liquidation or similar laws relating to, or affecting generally, the enforcement of applicable creditors’ rights and remedies and except as rights to indemnification and to contribution may be limited by federal or state securities law.

| 9 |

(m) Consents. The Company is not required to obtain any consent from, authorization or order of, or make any filing or registration with (other than any filings as may be required by the SEC or any state securities agencies), any court, governmental agency or any regulatory or self-regulatory agency or any other Person in order for it to execute, deliver or perform any of its obligations under, or contemplated by, the Transaction Documents, in each case, in accordance with the terms hereof or thereof. All consents, authorizations, orders, filings and registrations which the Company is required to obtain at or prior to the Closing have been obtained or effected on or prior to the Closing Date, and neither the Company nor any of its Subsidiaries are aware of any facts or circumstances which might prevent the Company from obtaining or effecting any of the registration, application or filings contemplated by the Transaction Documents. The Company is not in violation of the requirements of the Principal Market (as defined below) and has no knowledge of any facts or circumstances which could reasonably lead to delisting or suspension of the Common Stock in the foreseeable future. There has not been, and to the knowledge of the Company, there is not pending or contemplated, any investigation by the SEC involving the Company, any of its Subsidiaries or any current of former director or officer of the Company or any of its Subsidiaries.

(o) Issuance of Common Shares. The issuance of the Common Shares is duly authorized and, upon issuance in accordance with the terms of the Transaction Documents, will be validly issued, fully paid and non-assessable and free from all preemptive or similar rights, taxes, liens, charges and other encumbrances with respect to the issue thereof. Subject to the accuracy of the representations and warranties of the Buyer in this Agreement, the offer and issuance by the Company of the Common Shares is exempt from registration under the 1933 Act.

(p) Acknowledgment Regarding Buyer’s Purchase of Common Shares. The Company acknowledges and agrees that Buyer is acting solely in the capacity of an arm’s length purchaser with respect to the Transaction Documents and the transactions contemplated hereby and thereby. The Company further acknowledges that Buyer is not acting as a financial advisor or fiduciary of the Company or any of its Subsidiaries (or in any similar capacity) with respect to the Transaction Documents and the transactions contemplated hereby and thereby, and any advice given by Buyer or any of its representatives or agents in connection with the Transaction Documents and the transactions contemplated hereby and thereby is merely incidental to Buyer’s purchase of the Common Shares. The Company further represents to Buyer that the Company’s decision to enter into the Transaction Documents has been based solely on the independent evaluation by the Company and its representatives.

(q) No General Solicitation; No Integrated Offering. Neither the Company, nor any of its Subsidiaries or affiliates, nor any Person acting on its or their behalf, has engaged in any form of general solicitation or general advertising (within the meaning of Regulation D) in connection with the offer or sale of the Common Shares. None of the Company, its Subsidiaries or any of their affiliates, nor any Person acting on their behalf has, directly or indirectly, made any offers or sales of any security or solicited any offers to buy any security, under circumstances that would require registration of the issuance of any of the Common Shares under the 1933 Act, whether through integration with prior offerings or otherwise, or cause this offering of the Common Shares to require approval of stockholders of the Company under any applicable stockholder approval provisions, including, without limitation, under the rules and regulations of any exchange or automated quotation system on which any of the securities of the Company are listed or designated for quotation. None of the Company, its Subsidiaries, their affiliates nor any Person acting on their behalf will take any action or steps that would require registration of the issuance of any of the Common Shares under the 1933 Act or cause the offering of any of the Common Shares to be integrated with other offerings of securities of the Company.

| 10 |

(r) Application of Takeover Protections; Rights Agreement. The Company and its board of directors have taken all necessary action, if any, in order to render inapplicable any control share acquisition, interested stockholder, business combination, poison pill (including, without limitation, any distribution under a rights agreement) or other similar anti-takeover provision under the Certificate of Incorporation, Bylaws or other organizational documents or the laws of the jurisdiction of its incorporation or otherwise which is or could become applicable to Buyer as a result of the transactions contemplated by this Agreement, including, without limitation, the Company’s issuance of the Common Shares and Buyer’s ownership of the Common Shares. The Company and its board of directors have taken all necessary action, if any, in order to render inapplicable any stockholder rights plan or similar arrangement relating to accumulations of beneficial ownership of shares of Common Stock or a change in control of the Company or any of its Subsidiaries.

(s) Investment Company Status. The Company is not, and upon consummation of the sale of the Common Shares will not be, an “investment company,” an affiliate of an “investment company,” a company controlled by an “investment company” or an “affiliated person” of, or “promoter” or “principal underwriter” for, an “investment company” as such terms are defined in the Investment Company Act of 1940, as amended.

(t) Manipulation of Price. Neither the Company nor any of its Subsidiaries has, and, to the knowledge of the Company, no Person acting on their behalf has, directly or indirectly, (i) taken any action designed to cause or to result in the stabilization or manipulation of the price of any security of the Company or any of its Subsidiaries to facilitate the sale or resale of any of the Common Shares, (ii) sold, bid for, purchased, or paid any compensation for soliciting purchases of, any of the Common Shares, or (iii) paid or agreed to pay to any Person any compensation for soliciting another to purchase any other securities of the Company or any of its Subsidiaries.

(u) Transfer Taxes. On the Closing Date, all stock transfer or other taxes (other than income or similar taxes), if any, which are required to be paid in connection with the issuance and sale of the Common Shares to Buyer hereunder will be, or will have been, fully paid or provided for by the Company, and all laws imposing such taxes, if any, will be or will have been complied with.

(v) OFAC. Neither the Company or any of its Subsidiaries, nor, to the Company’s actual knowledge, is any affiliate, principal, director, officer, employee of, or any Person acting on behalf of or controlled by, the Company or any of its Subsidiaries, (i) a Person included in the Specially Designated Nationals and Blocked Persons lists, as published from time to time by OFAC, (ii) currently subject to any U.S. economic sanctions administered by OFAC, (iii) to the Company’s knowledge, a Person with whom the Buyer is prohibited from dealing or otherwise engaging in any transaction by any anti-money laundering laws or anti-terrorism laws, including the USA Patriot Act of 2001 and the Executive Order 13224 of September 23, 2001 entitled, “Blocking Property and Prohibiting Transactions With Persons Who Commit, Threaten to Commit, or Support Terrorism” (66 Fed. Reg. 49079 (2001)), (iv) to the Company’s knowledge, a Person covered by or subject to (or is resident, organized or otherwise located in any country that is covered by or subject to) sanctions under the International Emergency Economic Powers Act, the Trading with the Enemy Act or any other applicable laws imposing economic sanctions against or prohibiting transacting business with, for or on behalf of any country, region or individual pursuant to United States law or United Nations resolution, or (v) to the Company’s knowledge, named on any applicable list of known suspected terrorists, terrorist organizations or of other sanctioned Persons issued by any governmental authority of any jurisdiction in which the Buyer has conducted or is conducting business.

| 11 |

The Company acknowledges and agrees that Buyer is not making, and has not made, any representations or warranties with respect to the transactions contemplated hereby other than those specifically set forth in Section 2.

4. COVENANTS.

(a) Best Efforts. Buyer shall use its best efforts to timely satisfy each of the conditions to be satisfied by it as provided in Section 6 of this Agreement. The Company shall use its best efforts to timely satisfy each of the conditions to be satisfied by it as provided in Section 7

of this Agreement.

(b) Form D and Blue Sky. The Company shall file a Form D with respect to the Common Shares as required under Regulation D and to provide a copy thereof to Buyer promptly after such filing. The Company shall, on or before the Closing Date, take such action as the Company shall reasonably determine is necessary in order to obtain an exemption for, or to, qualify the Common Shares for sale to the Buyer at the Closing pursuant to this Agreement under applicable securities or “Blue Sky” laws of the states of the United States (or to obtain an exemption from such qualification), and shall provide evidence of any such action so taken to the Buyer on or prior to the Closing Date. Without limiting any other obligation of the Company under this Agreement, the Company shall timely make all filings and reports relating to the offer and sale of the Common Shares required under all applicable securities laws (including, without limitation, all applicable federal securities laws and all applicable “Blue Sky” laws), and the Company shall comply with all applicable foreign, federal, state and local laws, statutes, rules, regulations and the like relating to the offering and sale of the Common Shares to the Buyer.

(c) Reporting Status. Until the first date after the Closing Date on which the Buyer no longer holds any of the Common Shares (the “Reporting Period”), the Company shall timely file all reports required to be filed with the SEC pursuant to the 1934 Act, and the Company shall not terminate its status as an issuer required to file reports under the 1934 Act even if the 1934 Act or the rules and regulations thereunder would no longer require such filings or would otherwise permit such termination.

(d) Use of Proceeds. The Company shall use the proceeds from the sale of the Common Shares hereunder solely for general working capital purposes.

(e) Listing. The Company shall promptly secure the listing or designation for quotation (as the case may be) of all of the Common Shares upon each national securities exchange and automated quotation system, if any, upon which the Common Stock is then listed or designated for quotation (as the case may be) (subject to official notice of issuance) (but in no event later than the Closing Date) and shall maintain such listing or designation for quotation (as the case may be) of all the Common Shares from time to time issuable under the terms of the Transaction Documents on such national securities exchange or automated quotation system. The Company shall maintain the Common Stock’s listing or designation for quotation (as the case may be) on the OTCQB (the “Principal Market”), the OTCQX, the OTC Bulletin Board, The New York Stock Exchange, the NYSE Amex, the Nasdaq Global Select Market, the Nasdaq Global Market or the Nasdaq Capital Market (each, an “Eligible Market”). Neither the Company nor any of its Subsidiaries shall take any action which could be reasonably expected to result in the delisting or suspension of the Common Stock on an Eligible Market. The Company shall pay all fees and expenses in connection with satisfying its obligations under this Section 4(e).

| 12 |

(f) Fees. The Company shall be responsible for the payment of any placement agent’s fees, financial advisory fees, or broker’s commissions (other than for Persons engaged by Buyer, which Buyer acknowledges there are no such Persons) relating to or arising out of the transactions contemplated hereby, if any. The Company shall pay, and hold Buyer harmless against, any liability, loss or expense (including, without limitation, reasonable attorneys’ fees and out-of-pocket expenses) arising in connection with any claim relating to any such payment. Except as provided for herein, each party to this Agreement shall bear its own fees, costs and expenses in connection with the transactions contemplated by this Agreement.

(g) Pledge of Common Shares. Notwithstanding anything to the contrary contained in this Agreement (but subject to any limitations imposed by applicable securities laws), the Company acknowledges and agrees that the Common Shares may be pledged by Buyer in connection with a bona fide margin agreement or other loan or financing arrangement that is secured by the Common Shares. The pledge of Common Shares shall not be deemed to be a transfer, sale or assignment of the Common Shares hereunder, and if Buyer effects a pledge of Common Shares, Buyer shall not be required to provide the Company with any notice thereof or otherwise make any delivery to the Company pursuant to this Agreement or any other Transaction Document. The Company hereby agrees to execute and deliver such documentation as a pledgee of the Common Shares may reasonably request in connection with a pledge of the Common Shares to such pledgee by Buyer.

(h) Disclosure of Transactions and Other Material Information. The Company shall, on or before 8:30 a.m., New York time, on the fourth (4th) Business Day after the date of this Agreement, file a Current Report on Form 8-K describing all the material terms of the transactions contemplated by the Transaction Documents in the form required by the 1934 Act and attaching all the material Transaction Documents (including, without limitation, this Agreement (and all schedules to this Agreement)) (including all attachments, the “8-K Filing”). Except for the 8-K Filing, neither the Company, its Subsidiaries nor Buyer shall issue any press releases or any other public statements with respect to the transactions contemplated hereby; provided, however, the Company shall be entitled, without the prior approval of Buyer, to make any press release or other public disclosure with respect to such transactions in substantial conformity with the 8-K Filing, provided that Buyer shall be consulted by the Company in connection with any such press release or other public statement prior to its release).

(i) Conduct of Business. The business of the Company and its Subsidiaries shall not be conducted in violation of any law, ordinance or regulation of any governmental entity, except where such violations would not result, either individually or in the aggregate, in a Material Adverse Effect.

| 13 |

(j) Variable Rate Transaction. From the date hereof through the first date after the Closing Date on which the Buyer, together with Buyer’s Affiliates, cease to have “beneficial ownership” (as determined under Section 13(d) of the 1934 Act and the rules and regulations thereunder) greater than five percent (5%) of the Common Stock, the Company and each Subsidiary shall be prohibited from effecting or entering into an agreement to effect any Subsequent Placement (as defined below) involving a Variable Rate Transaction. “Variable Rate Transaction” means a transaction in which the Company or any Subsidiary (i) issues or sells any Convertible Securities either (A) at a conversion, exercise or exchange rate or other price that is based upon and/or varies with the trading prices of, or quotations for, the shares of Common Stock at any time after the initial issuance of such Convertible Securities, or (B) with a conversion, exercise or exchange price that is subject to being reset at some future date after the initial issuance of such Convertible Securities or upon the occurrence of specified or contingent events directly or indirectly related to the business of the Company or the market for the Common Stock, other than pursuant to a customary “weighted average” anti-dilution provision or (ii) enters into any agreement (including, without limitation, an “equity line of credit” which has non-customary or disproportionately dilutive provisions or an “at-the-market offering”) whereby the Company or any Subsidiary may sell securities at a future determined price (other than standard and customary “preemptive” or “participation” rights). Buyer shall be entitled to obtain injunctive relief against the Company and its Subsidiaries to preclude any such issuance, which remedy shall be in addition to any right to collect damages.

(k) Participation Right. From the date hereof through the first date after the Closing Date on which the Buyer, together with Buyer’s Affiliates, cease to have “beneficial ownership” (as determined under Section 13(d) of the 1934 Act and the rules and regulations thereunder) of greater than five percent (5%) of the Common Stock, neither the Company nor any of its Subsidiaries shall, directly or indirectly, issue, offer, sell, grant any option or right to purchase, or otherwise dispose of (or announce any issuance, offer, sale, grant of any option or right to purchase or other disposition of) any equity security or any equity-linked or related security (including, without limitation, any “equity security” (as that term is defined under Rule 405 promulgated under the 1933 Act), any Convertible Securities (as defined below), any preferred stock or any purchase rights (any such issuance, offer, sale, grant, disposition or announcement is referred to as a “Subsequent Placement”) unless the Company shall have first complied with this Section 4(k). Buyer may elect, in its sole and absolute discretion, to assign its rights under the Section 4(k) to an Affiliate of Buyer, provided that such Affiliate shall be an “accredited investor” as that term is defined in Rule 501(a) of Regulation D and shall execute an instrument in form and substance reasonably acceptable to the Company pursuant to which such Affiliate joins in and agrees to be bound by the provisions of this Section 4(k).

(i) At least five (5) Business Days prior to each proposed or intended Subsequent Placement, the Company shall deliver to Buyer an irrevocable written notice (the “Offer Notice”) of such proposed or intended issuance or sale or exchange (the “Offer”) of the securities being offered (the “Offered Securities”) in such Subsequent Placement, which Offer Notice shall (w) identify and describe the Offered Securities, (x) describe the price and other terms upon which they are to be issued, sold or exchanged, and the number or amount of the Offered Securities to be issued, sold or exchanged, (y) identify the Persons (if known) to which or with which the Offered Securities are to be offered, issued, sold or exchanged and (z) offer to issue and sell to or exchange with Buyer (or Buyer’s Affiliate) in accordance with the terms of the Offer 100% of the Offered Securities.

| 14 |

(ii) To accept an Offer, in whole or in part, Buyer must deliver a written notice to the Company prior to the end of the fifth (5th) Business Day after the Company’s delivery to Buyer of the applicable Offer Notice (the “Offer Period”), setting forth all or any portion of the Offered Securities that Buyer elects to purchase (the “Notice of Acceptance”). Notwithstanding the foregoing, if the Company desires to modify or amend the terms and conditions of the Offer prior to the expiration of the Offer Period, the Company may deliver to Buyer a new Offer Notice and the Offer Period shall expire on the fifth (5th) Business Day after the Company’s delivery to Buyer of such new Offer Notice.

(iii) The Company shall have thirty (30) days from the expiration of the Offer Period above (i) to offer, issue, sell or exchange all or any part of such Offered Securities as to which a Notice of Acceptance has not been given by Buyer (the “Refused Securities”) pursuant to a definitive agreement(s) (the “Subsequent Placement Agreement”), but only to the offerees described in the Offer Notice (if so described therein) and only upon terms and conditions (including, without limitation, unit prices and interest rates) that are not more favorable to the acquiring Person or Persons or less favorable to the Company than those set forth in the Offer Notice and (ii) to publicly announce, if required by applicable law, (a) the execution of such Subsequent Placement Agreement, and (b) either (x) the consummation of the transactions contemplated by such Subsequent Placement Agreement or (y) the termination of such Subsequent Placement Agreement, which shall be filed with the SEC on a Current Report on Form 8-K with such Subsequent Placement Agreement and any documents contemplated therein filed as exhibits thereto.

(iv) In the event the Company shall propose to sell less than all the Refused Securities (any such sale to be in the manner and on the terms specified in Section 4(k)(iii) above), then Buyer may, at its sole option and in its sole discretion, reduce the number or amount of the Offered Securities specified in its Notice of Acceptance to an amount that shall be not less than the number or amount of the Offered Securities that Buyer elected to purchase pursuant to Section 4(k)(ii) above multiplied by a fraction, (i) the numerator of which shall be the number or amount of Offered Securities the Company actually proposes to issue, sell or exchange and (ii) the denominator of which shall be the original amount of the Offered Securities. In the event that Buyer so elects to reduce the number or amount of Offered Securities specified in its Notice of Acceptance, the Company may not issue, sell or exchange more than the reduced number or amount of the Offered Securities unless and until such securities have again been offered to the Buyer in accordance with Section 4(k)(i) above.

(v) Upon the closing of the issuance, sale or exchange of all or less than all of the Refused Securities, Buyer shall acquire from the Company, and the Company shall issue to Buyer, the number or amount of Offered Securities specified in its Notice of Acceptance. The purchase by Buyer of any Offered Securities is subject in all cases to the preparation, execution and delivery by the Company and Buyer of a separate purchase agreement relating to such Offered Securities reasonably satisfactory in form and substance to Buyer and its counsel.

| 15 |

(vi) Any Offered Securities not acquired by Buyer or other Persons in accordance with this Section 4(k) may not be issued, sold or exchanged until they are again offered to Buyer under the procedures specified in this Agreement.

(vii) The Company and Buyer agree that if Buyer elects to participate in the Offer, neither the Subsequent Placement Agreement with respect to such Offer nor any other transaction documents related thereto (collectively, the “Subsequent Placement Documents”) shall include any term or provision whereby Buyer shall be required to agree to any restrictions on trading as to any securities of the Company or be required to consent to any amendment to or termination of, or grant any waiver, release or the like under or in connection with, any agreement previously entered into with the Company or any instrument received from the Company.

(viii) Notwithstanding anything to the contrary in this Section 4(k) and unless otherwise agreed to by Buyer, the Company shall either confirm in writing to Buyer that the transaction with respect to the Subsequent Placement has been abandoned or shall publicly disclose, if required by applicable law, its intention to issue the Offered Securities, in either case in such a manner such that Buyer will not be in possession of any material, non-public information, by the fifth (5th) Business Day following delivery of the Offer Notice. If by such fifth (5th) Business Day, no public disclosure regarding a transaction with respect to the Offered Securities has been made, and no notice regarding the abandonment of such transaction has been received by Buyer, such transaction shall be deemed to have been abandoned and Buyer shall not be in possession of any material, non-public information with respect to the Company or any of its Subsidiaries. Should the Company decide to pursue such transaction with respect to the Offered Securities, the Company shall provide Buyer with another Offer Notice in accordance with, and subject to, the terms of this Section 4(k) and Buyer will again have the right of participation set forth in this Section 4(k).

| 16 |

(ix) The restrictions contained in this Section 4(k) shall not apply in connection with the issuance of any Excluded Securities (as defined below). “Excluded Securities” means, collectively, (A) shares of Common Stock or options to purchase Common Stock to directors, officers, employees or consultants (provided that, (1) any such consultant may not be an Affiliate of either Mike Zoi or TGR Capital, LLC, may not be an officer, director or employee of the Company, and may not be providing, directly or indirectly, any capital to the Company, and (2) such shares or options must be issued or granted pursuant to a written, arms’ length agreement between the consultant and the Company in connection with bona fide services provided to the Company by such consultant) of the Company in their capacity as such pursuant to an Approved Share Plan (as defined below); and (B) shares of Common Stock issued upon the conversion or exercise of Convertible Securities (other than options to purchase Common Stock issued pursuant to an Approved Share Plan that are covered by clause (A) above) issued prior to the date of this Agreement, provided that the conversion or exercise (as the case may be) of any such Convertible Security is made solely pursuant to the conversion or exercise (as the case may be) provisions of such Convertible Security that were in effect on the date immediately prior to the date of this Agreement, the conversion or exercise price of any such Convertible Securities (other than options to purchase Common Stock issued pursuant to an Approved Share Plan that are covered by clause (A) above) is not lowered, none of such Convertible Securities are (other than options to purchase Common Stock issued pursuant to an Approved Share Plan that are covered by clause (A) above) (nor is any provision of any such Convertible Securities) amended or waived in any manner (whether by the Company or the holder thereof) to increase the number of shares issuable thereunder and none of the terms or conditions of any such Convertible Securities (other than options to purchase Common Stock issued pursuant to an Approved Share Plan that are covered by clause (A) above) are otherwise materially changed or waived (whether by the Company or the holder thereof) in any manner that adversely affects the Buyer. “Approved Share Plan” means any employee benefit plan which has been approved by the board of directors of the Company prior to or subsequent to the date hereof pursuant to which shares of Common Stock and options to purchase Common Stock may be issued to any employee, officer, director or consultant (provided that, (1) any such consultant may not be an Affiliate of either Mike Zoi or TGR Capital, LLC, may not be an officer, director or employee of the Company, and may not be providing, directly or indirectly, any capital to the Company), and (2) such shares or options must be issued or granted pursuant to a written, arms’ length agreement between the consultant and the Company in connection with bona fide services provided to the Company by such consultant) for services provided to the Company in their capacity as such. “Convertible Securities” means any capital stock or other security of the Company or any of its Subsidiaries that is, or may be, at any time and under any circumstances directly or indirectly convertible into, exercisable or exchangeable for, or which otherwise entitles the holder thereof to acquire, any capital stock or other security of the Company (including, without limitation, Common Stock) or any of its Subsidiaries.

(l) Passive Foreign Investment Company. The Company shall conduct its business in such a manner as will ensure that the Company will not be deemed to constitute a passive foreign investment company within the meaning of Section 1297 of the U.S. Internal Revenue Code of 1986, as amended.

5. REGISTER; TRANSFER AGENT INSTRUCTIONS; LEGEND.

(a) Register. The Company shall maintain or cause to be maintained at its principal executive offices (or such other office or agency of the Company as it may designate to Buyer), a register for its Common Stock in which the Company or its agent shall record the name and address of the Person in whose name the Common Shares have been issued (including the name and address of each assignee and transferee) and the number of Common Shares held by such Person. The Company shall keep the register open and available at all times during business hours for inspection of Buyer or its legal representatives.

| 17 |

(b) Transfer Agent Instructions. The Company shall issue irrevocable instructions to its transfer agent and any subsequent transfer agent (the “Irrevocable Transfer Agent Instructions”) to issue one or more certificates or credit shares to the applicable balance accounts at The Depository Trust Company (“DTC”), registered in the name of Buyer or its respective nominee(s), for the Common Shares in such amounts as specified from time to time by Buyer to the Company upon delivery of the Common Shares. The Company represents and warrants that no instructions other than the Irrevocable Transfer Agent Instructions referred to in this Section 5(b), instructions to include a standard 1933 Act restrictive securities legend as contemplated by Section 5(c) and stop transfer instructions to give effect to Section 2(h) hereof, will be given by the Company to its transfer agent with respect to the Common Shares, and that the Common Shares shall otherwise be freely transferable on the books and records of the Company, as applicable, to the extent provided in this Agreement and the other Transaction Documents. If Buyer effects a sale, assignment or transfer of the Common Shares in accordance with Section 2(h), subject to Buyer and his broker providing customary certificates and other documentation in connection with such sale, assignment or transfer, the Company shall permit the sale, assignment or transfer (as applicable) and shall promptly instruct its transfer agent to issue one or more certificates or credit shares to the applicable balance accounts at DTC in such name and in such denominations as specified by Buyer to effect such sale, transfer or assignment (as applicable). In the event that such sale, assignment or transfer involves Common Shares sold, assigned or transferred pursuant to an effective registration statement or in compliance with Rule 144, the transfer agent shall issue such shares to Buyer or such assignee or transferee (as the case may be) without any restrictive legend in accordance with Section 5(d) below. The Company acknowledges that a breach by it of its obligations hereunder will cause irreparable harm to Buyer. Accordingly, the Company acknowledges that the remedy at law for a breach of its obligations under this Section 5(b) will be inadequate and agrees, in the event of a breach or threatened breach by the Company of the provisions of this Section 5(b), that Buyer shall be entitled, in addition to all other available remedies, to an order and/or injunction restraining any breach and requiring immediate issuance and transfer, without the necessity of showing economic loss and without any bond or other security being required. If required by the Company’s transfer agent, the Company shall cause its counsel to issue a legal opinion to the Company’s transfer agent in connection with the sale, assignment or transfer of the Common Shares. Any fees (with respect to the transfer agent, counsel to the Company or otherwise) associated with the issuance of such opinion or the removal of any such legend shall be borne by the Company.

(c) Legends. Buyer understands that the Common Shares will be issued pursuant to an exemption from registration or qualification under the 1933 Act and applicable state securities laws, and except as set forth below, the Common Shares shall bear any legend as required by the “blue sky” laws of any state and a restrictive legend in substantially the following form (and a stop-transfer order may be placed against transfer of such stock certificates):

THE SHARES REPRESENTED BY THIS CERTIFICATE HAVE NOT BEEN REGISTERED UNDER THE SECURITIES ACT OF 1933, AS AMENDED. THE SHARES HAVE BEEN ACQUIRED FOR INVESTMENT AND MAY NOT BE OFFERED, SOLD OR OTHERWISE TRANSFERRED IN THE ABSENCE OF AN EFFECTIVE REGISTRATION STATEMENT WITH RESPECT TO THE SHARES OR AN EXEMPTION FROM THE REGISTRATION REQUIREMENTS OF SAID ACT THAT IS THEN APPLICABLE TO THE SHARES, AS TO WHICH A PRIOR OPINION OF COUNSEL MAY BE REQUIRED BY THE ISSUER OR THE TRANSFER AGENT.

| 18 |

(d) Removal of Legends. Certificates evidencing Common Shares shall not be required to contain the legend set forth in Section 5(c) above or any other legend (i) if such Common Shares are being sold pursuant to an effective registration statement under the 1933 Act covering the resale of the Common Shares, (ii) following the sale of Common Shares pursuant to Rule 144 (provided that Buyer shall deliver a customary "144 rep letter" to the Company in connection with each sale of Common Shares pursuant to Rule 144), (iii) if the Common Shares are eligible to be sold, assigned or transferred under Rule 144 (provided that such Common Shares are eligible to be sold without any restriction or limitation on the amount of securities to be sold or the manner of sale pursuant to Rule 144 and Buyer provides the Company with reasonable assurances that the Common Shares are so eligible), (iv) in connection with a sale, assignment or other transfer (other than under Rule 144), provided that Buyer provides the Company with an opinion of counsel to Buyer, in a generally acceptable form, to the effect that such sale, assignment or transfer of the Common Shares may be made without registration under the applicable requirements of the 1933 Act or (v) if such legend is not required under applicable requirements of the 1933 Act (including, without limitation, controlling judicial interpretations and pronouncements issued by the SEC and its staff). If a legend is not required pursuant to the foregoing, the Company shall no later than two (2) Business Days following the delivery by Buyer to the Company or the transfer agent (with notice to the Company) of a legended certificate representing the Common Shares (endorsed or with stock powers attached, signatures medallion guaranteed, and otherwise in form necessary to affect the reissuance and/or transfer, if applicable), together with any other deliveries from Buyer as may be required pursuant to this Section 5(d), as directed by Buyer, either: (A) provided that the Company’s transfer agent is participating in the DTC Fast Automated Securities Transfer Program, credit the aggregate number of Common Shares to which Buyer shall be entitled to Buyer’s or its designee’s balance account with DTC through its Deposit/Withdrawal at Custodian system or (B) if the Company’s transfer agent is not participating in the DTC Fast Automated Securities Transfer Program, issue and deliver (via reputable overnight courier) to Buyer, a certificate representing the Common Shares that is free from all restrictive and other legends, registered in the name of Buyer or its designee.

6. CONDITIONS TO THE COMPANY’S OBLIGATION TO SELL.

(a) The obligation of the Company hereunder to issue and sell the Common Shares to Buyer at the Closing is subject to the satisfaction, at or before the Closing Date, of each of the following conditions, provided that these conditions are for the Company’s sole benefit and may be waived by the Company at any time in its sole discretion by providing Buyer with prior written notice thereof:

(i) Buyer shall have delivered to the Company the Purchase Price for the Common Shares being purchased by Buyer at the Closing by wire transfer of immediately available funds pursuant to the wire instructions provided by the Company.

(ii) Buyer shall deliver to the Company a duly completed and executed Internal Revenue Service Form W-8BEN or other appropriate Form W-8.

| 19 |

(iii) The representations and warranties of Buyer shall be true and correct in all material respects as of the date when made and as of the Closing Date as though originally made at that time (except for representations and warranties that speak as of a specific date, which shall be true and correct as of such date), and Buyer shall have performed, satisfied and complied in all material respects with the covenants, agreements and conditions required by this Agreement to be performed, satisfied or complied with by Buyer at or prior to the Closing Date.

7. CONDITIONS TO BUYER’S OBLIGATION TO PURCHASE.

(a) The obligation of Buyer hereunder to purchase the Common Shares at the Closing is subject to the satisfaction, at or before the Closing Date, of each of the following conditions, provided that these conditions are for Buyer’s sole benefit and may be waived by Buyer at any time in its sole discretion by providing the Company with prior written notice thereof:

(i) The Company shall have duly executed and delivered to Buyer (A) each of the other Transaction Documents and (B) the Common Shares at the Closing pursuant to this Agreement.

(ii) Buyer shall have received the opinion of Curtis Wolfe, the Company’s corporate counsel, dated as of the Closing Date, in the form reasonably acceptable to Buyer.

(iii) The Company shall have delivered to Buyer a copy of the Irrevocable Transfer Agent Instructions, in the form reasonably acceptable to Buyer, which instructions shall have been delivered to the Company’s transfer agent.

(iv) The Company shall have delivered to Buyer a certificate, in the form acceptable to Buyer, executed by the Secretary of the Company and dated as of the Closing Date, as to (i) the resolutions consistent with Section 3(d) as adopted by the Company’s board of directors in a form reasonably acceptable to Buyer, (ii) the Certificate of Incorporation and (iii) the Bylaws, each as in effect at the Closing.

(v) Each and every representation and warranty of the Company shall be true and correct as of the date when made and as of the Closing Date as though originally made at that time (except for representations and warranties that speak as of a specific date, which shall be true and correct as of such date) and the Company shall have performed, satisfied and complied in all respects with the covenants, agreements and conditions required to be performed, satisfied or complied with by the Company at or prior to the Closing Date.

(vi) The Common Stock (I) shall be designated for quotation or listed on the Principal Market and (II) shall not have been suspended, as of the Closing Date, by the SEC or the Principal Market from trading on the Principal Market nor shall suspension by the SEC or the Principal Market have been threatened, as of the Closing Date, either (A) in writing by the SEC or the Principal Market or (B) by falling below the minimum maintenance requirements (if any)of the Principal Market.

| 20 |

(vii) The Company shall have obtained all governmental, regulatory or third party consents and approvals, if any, necessary for the sale of the Common Shares, including without limitation, those required by the Principal Market.

(viii) No statute, rule, regulation, executive order, decree, ruling or injunction shall have been enacted, entered, promulgated or endorsed by any court or governmental authority of competent jurisdiction that prohibits the consummation of any of the transactions contemplated by the Transaction Documents.

(ix) Since the date of execution of this Agreement, no event or series of events shall have occurred that reasonably would have or result in a Material Adverse Effect.

(x) The Company shall have obtained approval of the Principal Market to list or designate for quotation (as the case may be) the Common Shares, if any approval is required to obtain such listing or designation.

(xi) The Company shall have delivered to Buyer such other documents, instruments or certificates relating to the transactions contemplated by this Agreement as Buyer or its counsel may reasonably request.

8. TERMINATION.

In the event that the Closing shall not have occurred within ten (10) days after the date hereof, then Buyer shall have the right to terminate this Agreement at any time on or after the close of business on such date without liability of Buyer to the Company; provided, however, the right to terminate this Agreement under this Section 8 shall not be available to Buyer if the failure of the transactions contemplated by this Agreement to have been consummated by such date is the result of Buyer’s breach of this Agreement. Nothing contained in this Section 8 shall be deemed to release any party from any liability for any breach by such party of the terms and provisions of this Agreement or the other Transaction Documents or to impair the right of any party to compel specific performance by any other party of its obligations under this Agreement or the other Transaction Documents.

9. MISCELLANEOUS.

(a) Governing Law; Jurisdiction; Jury Trial. All questions concerning the construction, validity, enforcement and interpretation of this Agreement shall be governed by the internal laws of the State of Delaware, without giving effect to any choice of law or conflict of law provision or rule (whether of the State of Delaware or any other jurisdictions) that would cause the application of the laws of any jurisdictions other than the State of Delaware. Each party hereby irrevocably submits to the exclusive jurisdiction of the state and federal courts sitting in The City of Wilmington, Delaware, for the adjudication of any dispute hereunder or in connection herewith or with any transaction contemplated hereby or discussed herein, and hereby irrevocably waives, and agrees not to assert in any suit, action or proceeding, any claim that it is not personally subject to the jurisdiction of any such court, that such suit, action or proceeding is brought in an inconvenient forum or that the venue of such suit, action or proceeding is improper. Each party hereby irrevocably waives personal service of process and consents to process being served in any such suit, action or proceeding by mailing a copy thereof to such party at the address for such notices to it under this Agreement and agrees that such service shall constitute good and sufficient service of process and notice thereof. Nothing contained herein shall be deemed to limit in any way any right to serve process in any manner permitted by law. Nothing contained herein shall be deemed or operate to preclude Buyer from bringing suit or taking other legal action against the Company in any other jurisdiction to collect on the Company’s obligations to Buyer or to enforce a judgment or other court ruling in favor of Buyer. EACH PARTY HEREBY IRREVOCABLY WAIVES ANY RIGHT IT MAY HAVE TO, AND AGREES NOT TO REQUEST, A JURY TRIAL FOR THE ADJUDICATION OF ANY DISPUTE HEREUNDER OR IN CONNECTION WITH OR ARISING OUT OF THIS AGREEMENT OR ANY TRANSACTION CONTEMPLATED HEREBY.

| 21 |

(b) Counterparts. This Agreement may be executed in two or more counterparts, all of which shall be considered one and the same agreement and shall become effective when counterparts have been signed by each party and delivered to the other party. In the event that any signature is delivered by facsimile transmission or by an e-mail which contains a portable document format (.pdf) file of an executed signature page, such signature page shall create a valid and binding obligation of the party executing (or on whose behalf such signature is executed) with the same force and effect as if such signature page were an original thereof.

(c) Headings; Gender. The headings of this Agreement are for convenience of reference and shall not form part of, or affect the interpretation of, this Agreement. Unless the context clearly indicates otherwise, each pronoun herein shall be deemed to include the masculine, feminine, neuter, singular and plural forms thereof. The terms “including,” “includes,” “include” and words of like import shall be construed broadly as if followed by the words “without limitation.” The terms “herein,” “hereunder,” “hereof” and words of like import refer to this entire Agreement instead of just the provision in which they are found.

(d) Severability. If any provision of this Agreement is prohibited by law or otherwise determined to be invalid or unenforceable by a court of competent jurisdiction, the provision that would otherwise be prohibited, invalid or unenforceable shall be deemed amended to apply to the broadest extent that it would be valid and enforceable, and the invalidity or unenforceability of such provision shall not affect the validity of the remaining provisions of this Agreement so long as this Agreement as so modified continues to express, without material change, the original intentions of the parties as to the subject matter hereof and the prohibited nature, invalidity or unenforceability of the provision(s) in question does not substantially impair the respective expectations or reciprocal obligations of the parties or the practical realization of the benefits that would otherwise be conferred upon the parties. The parties will endeavor in good faith negotiations to replace the prohibited, invalid or unenforceable provision(s) with a valid provision(s), the effect of which comes as close as possible to that of the prohibited, invalid or unenforceable provision(s).

| 22 |