Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-K

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2013

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission file number: 1-33472

TechTarget, Inc.

(Exact name of Registrant as Specified in Its Charter)

| Delaware | 04-3483216 | |

| (State or Other Jurisdiction of Incorporation or Organization) |

(I.R.S. Employer Identification No.) | |

| 275 Grove Street Newton, Massachusetts |

02466 | |

| (Address of Principal Executive Offices) | (Zip Code) | |

Registrant’s telephone number, including area code: (617) 431-9200

Securities registered pursuant to Section 12(b) of the Exchange Act:

None.

Securities registered pursuant to Section 12(g) of the Exchange Act:

Common Stock, $0.001 Par Value

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Exchange Act. Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check One):

| Large Accelerated Filer | ¨ | Accelerated Filer | x | |||

| Non-Accelerated Filer | ¨ (Do not check if a smaller reporting company) | Smaller Reporting Company | ¨ | |||

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x

The aggregate market value of the registrant’s common stock held by non-affiliates of the registrant was approximately $89.4 million as of June 30, 2013 (based on a closing price of $4.47 per share as quoted by the Nasdaq Global Market as of such date). In determining the market value of non-affiliate common stock, shares of the registrant’s common stock beneficially owned by officers, directors and affiliates have been excluded. The determination of affiliate status is not necessarily a conclusive determination for other purposes.

The registrant had 32,629,660 shares of Common Stock, $0.001 par value per share, outstanding as of February 28, 2014.

DOCUMENTS INCORPORATED BY REFERENCE

Part III of this Annual Report incorporates by reference certain information from the registrant’s definitive proxy statement for the 2014 annual meeting of shareholders, which the registrant intends to file pursuant to Regulation 14A with the Securities and Exchange Commission not later than 120 days after the registrant’s fiscal year end of December 31, 2013.

Table of Contents

| PART I | ||||||

| Item 1. | 3 | |||||

| Item 1A. | 18 | |||||

| Item 1B. | 32 | |||||

| Item 2. | 32 | |||||

| Item 3. | 32 | |||||

| Item 4. | 32 | |||||

| PART II | ||||||

| Item 5. | 32 | |||||

| Item 6. | 35 | |||||

| Item 7. | Management’s Discussion and Analysis of Financial Condition and Results of Operations |

38 | ||||

| Item 7A. | 56 | |||||

| Item 8. | 57 | |||||

| Item 9. | Changes in and Disagreements with Accountants on Accounting and Financial Disclosure |

85 | ||||

| Item 9A. | 86 | |||||

| Item 9B. | 88 | |||||

| PART III | ||||||

| Item 10. | 88 | |||||

| Item 11. | 88 | |||||

| Item 12. | Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters |

88 | ||||

| Item 13. | Certain Relationships and Related Transactions, and Director Independence |

88 | ||||

| Item 14. | 88 | |||||

| PART IV | ||||||

| Item 15. | 88 | |||||

| 89 | ||||||

| 90 | ||||||

2

Table of Contents

This Annual Report on Form 10-K contains forward-looking statements that are based on the beliefs of management and assumptions made by and information currently available to them. The words “expect,” “anticipate,” “believe,” “may,” “estimate,” “intend” and similar expressions are intended to identify such forward-looking statements. Forward-looking statements involve risks, uncertainties and assumptions including those described in “Risk Factors,” which could cause our actual results to be materially different from results expressed or implied by such forward-looking statements.

Overview

TechTarget, Inc. (“we” or “the Company”) is a Delaware corporation incorporated on September 14, 1999. We are a leading provider of specialized online content and brand advertising that brings together buyers and sellers of corporate information technology (“IT”) products. We sell customized marketing programs that enable IT vendors to reach corporate IT decision makers who are actively researching specific IT purchases. We operate a network of over 150 websites, each of which focuses on a specific IT sector, such as storage, security or networking.

IT professionals rely on our websites for key decision support information tailored to their specific areas of responsibility. We complement our online offerings with targeted in-person events that enable advertisers to engage buyers directly at critical stages of their decision-making process for IT purchases. We work with our advertising customers to develop customized marketing programs, often providing them with multiple offerings in order to target their desired audience more effectively. Our service offerings address the lead generation, project opportunity information, and branding objectives of our advertising customers. The majority of our revenue for 2013, 2012 and 2011 was associated with lead generation advertising campaigns.

As IT professionals have become increasingly specialized, they have come to rely on our sector-specific websites to support purchasing decisions. Our content strategy enables IT professionals to navigate the complex and rapidly changing IT landscape where purchasing decisions can have significant financial and operational consequences. Our content strategy includes three primary sources which IT professionals use to assist them in their pre-purchase research: independent content provided by our professionals, vendor-generated content provided by our customers and user-generated (or peer-to-peer) content. As of December 31, 2013, we employed approximately 120 full-time editors who create original content tailored for specific audiences, which we complement with content through our association with outside industry experts. In addition to utilizing our independent content, registered members are able to conduct their pre-purchase research by accessing vendor content such as white papers, webcasts, videocasts, virtual events and podcasts, across our network of websites. Our network of websites also allows users to seamlessly interact and contribute content, which is highly valued by IT professionals during their research process.

We have a large and growing base of registered members, which totaled over 13.5 million as of December 31, 2013. The targeted nature of our user base enables IT vendors to reach a specialized audience efficiently because our content is highly segmented and aligned with the IT vendors’ specific products. Since our founding in 1999, we have developed a broad customer base. During 2013 we delivered advertising campaigns for approximately 1,200 customers. No customer represented 10% or more of total revenue during 2013. We generated revenues of approximately $88 million in 2013, down from approximately $100 million in 2012. Over the same period, our Adjusted EBITDA decreased from approximately $20 million in 2012 to approximately $9.4 million in 2013. Adjusted EBITDA represents net income (loss) before interest and other income (expense) net, provision for (benefit from) income taxes, depreciation and amortization, as further adjusted to exclude stock-based compensation and restructuring charges.

3

Table of Contents

Business Trends

The following discussion highlights key trends affecting our business.

| • | Macro-economic Conditions and Industry Trends. Because all of our customers are IT vendors, the success of our business is intrinsically linked to the health, and subject to market conditions, of the IT industry. In the twelve month period ended December 31, 2013, we saw continued weakness in the IT market. As a result, we have continued to see evidence that some IT vendors’ North American advertising budgets are being cut, which is negatively affecting our growth rate. Additionally, this deceleration has affected all segments of our customer base. As a result, until management is able to better determine if the decrease in spending by our customers is a temporary condition or a new level of spending, although we will continue to invest in growth areas, management will carefully control discretionary spending such as travel and entertainment, and the filling of new and replacement positions, in an effort to maintain profit margins and cash flow. |

| • | Customer Segments. In the three-month period ended December 31, 2013, our year-over-year revenue from our top 12 global customers increased by approximately 9%, our mid-sized customers (our next largest 100 customers) declined by approximately 11% and our smaller customers declined by approximately 3%. All three of our customer segments continue to report lower demand and customers delaying IT purchases, which is resulting in elongated purchase cycles. This translates into our customers being very cautious with their marketing expenditures. |

Available Information

Our website address is www.techtarget.com. We make our Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q and Current Reports on Form 8-K, and amendments to these reports, available free of charge through our website as soon as reasonably practicable after we electronically file such material with, or furnish such material to, the Securities and Exchange Commission (“SEC”). The SEC maintains an Internet website, at www.sec.gov, that contains reports, proxy and information statements and other information regarding issuers that are filed electronically. Our Code of Business Conduct and Ethics, and any amendments to our Code of Business Conduct and Ethics Corporate Governance Guidelines and Board Committee Charters, are also available on our website. We are not including the information contained on our website as part of, or incorporating it by reference into, this Annual Report on Form 10-K. The public may read and copy any materials that we file with the SEC at the SEC’s Public Reading Reference Room at 100 F Street NE, Washington, DC 20549, and the public may obtain information on the operation of the Public Reference Room by calling the SEC at 1-800-SEC-0330.

Industry Background

The ongoing shift in the media business from traditional print and broad-based advertising (i.e. television, radio, etc.) to targeted online advertising has continued to grow. We believe the four major trends driving this shift continue to be:

| • | Targeted Content Channels Lead to Greater Efficiency for Advertisers. The desire of advertisers to reach customers efficiently has led to the development and proliferation of market-specific content channels throughout all forms of media. Targeted content channels increase advertising efficiency by enabling advertisers to market specifically to the audience they are trying to reach. Content providers are finding new ways, such as specialized cable television channels, magazines and events, to offer increasingly targeted content to their audience and advertisers. The Internet has enabled even more market-specific content offerings, and the proliferation of market-specific websites provides advertisers with efficient and targeted media to reach their customers. |

| • | The Internet Improves Advertisers’ Ability to Increase and Measure Return on Investment. Advertisers are increasingly focused on measuring and improving their return on investment (“ROI”). Before the advent of Internet-based marketing, there were limited tools for accurately measuring the |

4

Table of Contents

| results of marketing campaigns in a timely fashion. The Internet has enabled advertisers to track individual users and their responses to their marketing programs. With the appropriate technology, vendors now have the ability to assess and benchmark the efficacy of their online advertising campaigns cost-effectively and in real-time. As a result, advertisers are now increasingly demanding a measurable ROI across all forms of media. |

| • | Technology Marketers and Sales Organizations are Increasingly Using Audience Data to Drive Decisions. The increasing prevalence of online advertising and of marketing and sales automation systems means that advertisers have new opportunities to leverage data strategically in their workflow. In the business technology market in particular, advertisers are in the early stages of making use of data to help them determine prospect accounts that should be prioritized for marketing or sales follow-up. |

| • | The Internet is Increasingly Critical in Researching Large, Complex and Costly Purchases. The Internet has improved the efficiency and effectiveness of researching purchases. The vast quantity of information available on the Internet, together with search engines and directories that facilitate information discovery, enables potential purchasers to draw information from many sources, including independent experts, peers and vendors, in an efficient manner. These benefits are most apparent in the research of complex and costly purchases which require information from a variety of sources. By improving the efficiency of product research, the Internet enables potential purchasers to save significant time and review a wider range of product selections most effectively. |

Corporate IT Purchasing

The trends toward targeted content channels, increased focus on ROI by advertisers and Internet-based product research are evident in the corporate IT market. Over the past two decades, corporate IT purchases have grown in size and complexity. The corporate IT market is comprised of multiple, large sectors, such as storage, security and networking. Each of these sectors can, in turn, be further divided into sub-sectors that contain products addressing the areas of specialization within an enterprise’s IT environment. For example, within the multi-billion dollar storage sector, there are numerous sub-sectors such as storage area networks, storage management software and backup software. Furthermore, the products in each sub-sector may service entirely independent markets. For example, backup software for use in Windows® environments can be distinct from that designed for use in Linux® environments.

In view of the complexities, high cost and importance of IT decision-making, corporate IT purchasing decisions are increasingly being researched by teams of functional experts with specialized knowledge in their particular areas, rather than by one central IT professional, such as a chief information officer. The corporate IT purchasing process typically requires a lengthy sales cycle. The “sales cycle” is the sequence of stages that a typical customer goes through when deciding to purchase a product or service from a particular vendor. Key stages of a sales cycle typically consist of a customer recognizing or identifying a need; identifying possible solutions and vendors through research and evaluation; and finally, making a decision to purchase the product or service. Through various stages of this sales cycle, IT professionals rely upon multiple inputs from independent experts, peers and IT vendors. Although there is a vast amount of information available, the aggregation and validation of these inputs from various sources can be difficult and time-consuming.

The long sales cycle for corporate IT purchases, as well as the need for information support, requires substantial investment on the part of IT vendors, which drives the significant marketing expenditures in the corporate IT market. In addition, technology changes at an accelerated pace and there are often multiple solutions to a particular IT need. With each new product or product enhancement, IT vendors implement new advertising campaigns and IT professionals must research new technologies.

The Opportunity

Corporate IT professionals are demanding specialized websites and events tailored to the sub-sectors of IT solutions that they purchase. Prior to widespread Internet adoption, corporate IT buyers researching purchases relied largely on traditional IT media, consisting of broad print publications and large industry trade shows. As

5

Table of Contents

technology, vendors and IT professionals have all become much more specialized, the Internet has emerged as a preferred purchase research medium, a fact which has drastically reduced and improved research time.

IT advertisers seek high-ROI marketing platforms that provide access to the specific sectors of IT buyers that are aligned with the solutions the advertisers seek to sell. Traditional IT media companies with historically print-based revenue models service a large audience with broad content. This general approach minimizes the likelihood of a vendor reaching a buyer while he or she is actively researching the purchase of a solution that falls within the vendor’s particular market sector. Although the Internet offers advertisers a superior means to reach IT buyers while they are conducting research, the web properties operated by these traditional IT media companies offer online content and audiences that are in many cases derivative of their existing print efforts. Without a more targeted marketing platform oriented to IT professionals’ need for decision support for specialized IT purchases, traditional IT media companies have faced difficulty meeting the ROI needs of IT marketers.

Our Solution

Our specialized content strategy enables IT vendors to reach corporate IT professionals who are actively researching purchases in specific IT sectors. Our online network of websites is complemented by conferences, seminars and other in-person events. IT professionals rely on our platform for decision support information tailored to their specific purchasing needs. Our solution benefits from the following competitive advantages:

| • | Large and Growing Community of Registered Members. We have built a registered member database that contained detailed business information on over 13.5 million IT professionals as of December 31, 2013. We have collected detailed business and technology profiles with respect to our registered members, which allows us to provide these registered members with more specialized content and our advertisers with highly targeted audiences and sales leads. |

| • | Strong Advertiser Relationships. Since our founding in 1999, we have developed a broad base of customers comprised of some of the largest global enterprise IT vendors by providing hundreds of technology solutions for specific IT sectors. In 2013, we had approximately 1,200 technology vendor customers. |

| • | Substantial Experience in Online Media. We have over 14 years of experience in developing our online media content, with a focus on providing targeted information to IT professionals and a targeted audience to vendors. Our experience enables us to develop new online properties rapidly and to acquire and efficiently integrate select properties that further serve IT professionals. We have also developed an expertise in implementing integrated, targeted marketing campaigns designed to maximize the measurability of, and improvement in, ROI. |

| • | Proprietary Data on the Research Behavior of our Registered Members and Site Visitors. Through our Activity Intelligence™ product platform, we collect information on millions of interactions that our members and visitors, and the companies that they are associated with, have with the content on our websites and in our e-mails. Collection and analysis of this information allows us to increase the relevance of our informational offerings to our members and improves our advertisers’ ROI by allowing us to deliver more qualified prospects. |

| • | Significant Brand Recognition Among Advertisers and IT Professionals. Our brand is well-recognized by advertisers who value our integrated marketing capabilities and high-ROI advertising programs. At the same time, our sector-specific websites command brand recognition among IT professionals, who rely on these websites because of their specificity and depth of content. |

| • | Favorable Search Engine Rankings. Due to our long history of using a targeted approach toward online publishing, our network of websites has produced a large repository of archived content that allows us to appear on search result pages when users perform targeted searches on search engines such as Google. We are successful in attracting traffic from search engines, which, in turn, increases our registered membership. |

6

Table of Contents

| • | Proprietary Lead Management Technology. Our proprietary lead management technology enables IT vendors to prioritize and efficiently manage the leads we provide, improving the efficacy of their sales teams and optimizing the ROI on their marketing expenditures with us. |

Our solution increases efficiency for both IT professionals and IT vendors. It facilitates the ability of IT professionals to find specific information related to their purchase decisions, while enabling IT vendors to reach IT buyers who are actively researching specific solutions related to vendors’ products and services. Set forth below are several ways our solution benefits IT professionals and IT vendors:

Benefits to IT Professionals

| • | Provides Access to Integrated, Sector-Specific Content. Our websites provide IT professionals with sector-specific content from the three fundamental sources they value in researching IT purchasing decisions: industry experts, peers and vendors. Our independent staff of editors creates content specific to the sectors we serve and the key sub-sectors within them. This content is integrated with other content generated by our network of third-party industry experts, member-generated content and content from IT vendors. The reliability, breadth and depth, and accessibility of our content offering enable IT professionals to make more informed purchases. |

| • | Increases Efficiency of Purchasing Decisions. By accessing targeted and specialized information, IT professionals are able to research important purchasing decisions more effectively. Our integrated content offering minimizes the time spent searching for and evaluating content and maximizes the time available for consuming quality information. Furthermore, we provide this specialized, targeted content through a variety of media that together address critical stages of the purchase decision process. |

Benefits to IT Vendors

| • | Targets Active Buyers Efficiently. Our highly targeted content attracts specific, targeted audiences that are actively researching purchasing decisions. Using our registered member database and information we collect about their product interests, we are able to target further those registered members most likely to be of value to IT vendors. Advertising to a targeted audience already engaged in a potential buying decision minimizes advertiser expenditures on irrelevant audiences, increasing advertising efficiency. |

| • | Generates Measurable, High ROI. Our targeted online content offerings enable us to generate and collect valuable business information about each user and his or her technology preferences. As registered users access content, we are able to build a profile of their technology interests, and that of their company. When users access sponsored content, we are able to deliver both actionable leads and contextual intelligence to our advertisers. As a result, our advertisers are able to better prioritize and follow up with the qualified sales leads we send them, which improves the ROI on their advertising expenditures with us. |

| • | Generates and Prioritizes Qualified Sales Leads. Our IT vendors also use our detailed member database and integrated advertising campaigns to identify and market to the audience members they consider to have the highest potential value. Once the leads have been delivered, our proprietary lead management technology enables customers to categorize, prioritize and market more effectively to these leads. |

| • | Maximizes Awareness and Shortens the Sales Cycle. As a leading distributor of vendor-provided IT white papers, webcasts, videocasts, virtual events and podcasts, we offer IT vendors the opportunity to educate IT professionals during the research process, prior to any direct interaction with vendor salespeople. By distributing proprietary content and reaching their target audiences via our platform, IT vendors can educate audiences, demonstrate much of their product capabilities and proactively brand themselves as specific product leaders. As a result, an IT professional is more knowledgeable about the vendor’s specifications and product by the time he or she engages with the vendor. This reduces sales time and cost that would have been otherwise expended by the vendor’s direct sales force. |

7

Table of Contents

| • | Reaches IT Professionals at Critical Stages of the Purchase Decision Process. Because our content platform includes both online and event offerings, IT vendors can market to IT professionals at critical stages of the purchase decision process through multiple touch points. In addition to targeting IT professionals as they conduct purchase research on our website, IT vendors can have face-to-face interactions with qualified buyers seeking to finalize purchase decisions at our in-person events. |

Our Strategy

Our goal is to deliver superior performance by enhancing our position as a leading provider of specialized content that connects IT professionals with IT vendors in the sectors and sub-sectors that we serve. In order to achieve this goal, we intend to:

| • | Continue to Develop Our Content Platform and Service Offerings. We intend to continue to launch additional websites and develop our platform in order to capitalize on the ongoing shift from traditional broad-based media toward more focused online content that increases the efficiency of advertising spending. We intend to capture additional revenues from existing and new customers by continuing to develop our content and further segment it to deliver an increasingly specialized audience to the IT vendors who advertise across our media. We also intend to continue to deliver a highly engaged and growing audience to advertisers and to develop innovative marketing programs. |

| • | Expand into Complementary Sectors. We intend to complement our current offerings by continuing to expand our business in order to capitalize on strategic opportunities in existing, adjacent, or new sectors that we believe to be well-suited to our business model and core competencies. Based on our experience, we believe we are able to capitalize rapidly and cost-effectively on new market opportunities. |

| • | Continue to Expand Our International Presence. We intend to continue to expand our reach into our addressable market by increasing our presence in countries outside the United States. We have pursued this strategy by launching our own websites directed at the United Kingdom in 2008, at India and Spain in 2009, and at Singapore in 2012, as well as by acquiring control of our partners’ businesses in China and Australia in 2010, by acquiring the Computer Weekly and MicroScope online properties in the United Kingdom in 2011 and E-Magine Médias SAS, which we call LeMagIT, in France in 2012. In 2013, we launched websites in the German and Portuguese languages. We expect to further penetrate foreign markets by directly launching additional sector specific websites directed at these foreign locales and at additional international markets and, if deemed appropriate, making strategic acquisitions and investments in overseas entities. During 2013, approximately 28% of our revenues were derived from international geo-targeted campaigns, where our target audience is outside North America. We believe many of the current trends contributing to our domestic online revenue opportunity also are occurring in international markets and, therefore, present a future revenue opportunity. |

| • | Selectively Acquire or Partner with Complementary Businesses. We have used acquisitions in the past as a means of expanding our content and service offerings, web traffic and registered members. Historically, our acquisitions can be classified into three categories: content-rich blogs or other individually published sites, typically generating less than one million dollars in revenues; early stage revenue sites, typically generating between one and five million dollars in annual revenues; and later stage revenue sites, typically generating greater than five million dollars in annual revenues. We intend to continue to pursue selected acquisition or partnership opportunities in our core markets and in adjacent markets for products with similar characteristics. |

Platform & Content

Our integrated content platform consists of a network of websites that we complement with targeted in-person events. At critical stages of the purchase decision process, these content offerings meet IT professionals’ needs for expert, peer and IT vendor information and provide a platform on which IT vendors can launch targeted marketing campaigns that generate measurable, high ROI.

8

Table of Contents

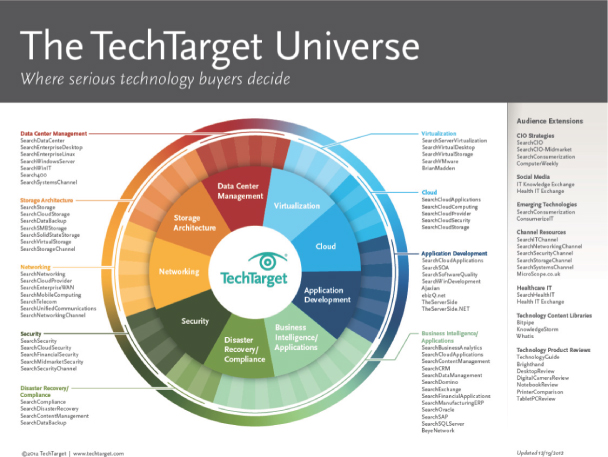

The diagram below provides a representation of the media services provided by our platform and our content offerings:

Media Groups

Based upon the logical clustering of our users’ respective job responsibilities and the marketing focus of the products being advertised by our customers, we currently categorize our content offerings across nine distinct media groups. Each of these media groups services a wide range of IT vendor sectors and sub-sectors and is driven by the key areas of IT professionals’ interests described below:

| • | Security. Every aspect of enterprise computing now depends on secure connectivity, data and applications. The security sector is constantly growing to adapt to new forms of threats and to secure new technologies such as mobile devices, wireless networks and virtualized systems (“cloud”). Compliance regulations, cloud computing adoption, and highly publicized identity and intellectual property thefts are driving interest and investment in increasingly sophisticated security solutions that supplement common “perimeter” security solutions such as firewalls and antivirus software. Our online properties in this sector, which include SearchSecurity.com, SearchCloudSecurity.com, SearchFinancialSecurity.com, and SearchMidMarketSecurity.com, offer navigable and structured guides on IT vendor and technology solutions in key sub-sectors such as network security, intrusion defense, identity management and authentication, data and application security, security-as-a-service, cloud security and security information management software. |

| • | Networking. Broadly defined, the networking market includes the hardware, software and services involved in the infrastructure and management of both Enterprise and Carrier voice and data networks. |

9

Table of Contents

| As new sub-sectors of networking have emerged and grown in importance, IT networking professionals have increasingly focused their investments in such technologies as VoIP, wireless and mobile computing, social networking and collaboration, application performance, data center fabrics, convergence, software-defined networking (“SDN”) and providing cloud services. Our online properties in this sector, which include SearchNetworking.com, SearchEnterpriseWAN.com, SearchUnifiedCommunications.com, SearchMobileComputing.com, SearchSDN.com and SearchTelecom.com, aim to address the specialized needs of these IT networking professionals by offering content targeted specifically to these emerging growth areas. |

| • | Storage. The storage sector consists of the market for disk storage systems and tape hardware and software that store and manage data. Growth is fueled by trends inherent in the industry, such as the ongoing need to maintain and supplement data stores, and by external factors, such as expanded compliance regulations and increased focus on disaster recovery solutions. Recent trends reflect an increased emphasis on solid state storage and cloud storage. At the same time, established storage sub-sectors, such as backup and Storage Area Networks (“SAN”s) have been invigorated by new technologies such as disk-based backup, continuous data protection and storage virtualization. Our online properties in this sector, which include SearchStorage.com, SearchDataBackup.com, SearchSMBStorage.com, SearchDisasterRecovery.com, SearchVirtualStorage.com, SearchCloudStorage.com, and SearchSolidStateStorage.com, address IT professionals seeking solutions in key sub-sectors such as fibre channel SANs, solid state storage, virtualization IP & iSCSI SANs, Network Attached Storage (“NAS”), backup hardware and software, and storage management software. The audience at our in-person Storage Decision conference is comprised almost exclusively of storage decision makers from within IT organizations. This event is supplemented by regional seminars on topics such as backup and disaster recovery. |

| • | Data Center and Virtualization Technologies. Data centers house the systems and components, such as servers, storage devices, routers and switches, utilized in large-scale, mission-critical computing environments. A variety of trends and new technologies have reinvigorated the data center as a priority among IT professionals. Technologies, such as blade servers, server virtualization and cloud computing, have driven renewed investment in data center-class computing solutions. Server consolidation is now a focus, driven by the decline in large-scale computing prices relative to distributed computing models. These trends have put pressure on existing data center infrastructure and are driving demand for solutions that address this. For example, the deployment of high-density servers has led to increased heat output and energy consumption in data centers. Power and cooling have thus become a significant cost in IT budgets, making data center energy efficiency a priority. Our key online properties in this sector provide targeted information on the IT vendors, technologies and solutions that serve these sub-sectors. Our properties in this sector include SearchDataCenter.com, covering disaster recovery, power and cooling, mainframe and UNIX® servers, systems management, and server consolidation; SearchEnterpriseLinux.com, focused on Linux migration and infrastructures; Search400.com, covering mid-range computing and SearchCloudComputing.com which covers private and public cloud infrastructure. SearchServerVirtualization.com covers the decision points and alternatives for implementing server virtualization, while SearchVMware.com focuses on managing and building out virtual environments on the most widely-installed server virtualization platform. |

We also cover servers, application and desktop solutions deployed in distributed computing environments. The dominant platform, Windows, no longer represents an offering of discrete operating systems but rather a diverse computing environment with its own areas of specialization around IT. As Windows servers have become more stable and scalable, they have taken share in data centers and currently represent one of the largest server sub-sectors. Given the breadth of the Windows market, we have segmented our Windows-focused media based on IT professionals’ infrastructure responsibilities and purchasing focus. Our online properties in this sector include SearchWindowsServer.com, covering servers, storage, and systems management; SearchDomino.com, SearchExchange.com and SearchWinIT.com, each targeted toward senior management for distributed computing environments. This network of sites provides resources and advice to IT professionals pursuing solutions related to

10

Table of Contents

such topics as Windows backup and storage, server consolidation, and upgrade planning. SearchEnterpriseDesktop.com, SearchVirtualDesktop.com and LabMice.net all focus on the deployment and management of end-user computing environments. SearchConsumerization.com covers the IT management issues surrounding the increasing deployment of personal technologies such as tablets and smartphones in the workplace. Combined with our two properties that focus on server virtualization, SearchDesktopVirtualization.com and BrianMadden.com, each focusing on desktop virtualization, gives us a comprehensive offering addressing the fast-growing area of virtualization technologies. Our online offerings in this sector are supplemented by in-person regional seminars. Our BriForum conferences focus on desktop virtualization and related technologies.

| • | CIO/IT Strategy. Our CIO/IT Strategy media group provides content targeted at Chief Information Officers (“CIOs”), and senior IT executives, enabling them to make informed IT purchases throughout the critical stages of the purchase decision process. CIOs’ areas of interest generally align with the major sectors of the IT market; however, CIOs increasingly are focused on the alignment between IT and their businesses’ operations. Data center consolidation, compliance, ITIL/IT service management, disaster recovery/business continuity, risk management and outsourcing (including software-as-a-service and cloud computing) have all drawn the attention of IT executives who need to understand the operational and strategic implications of these issues and technologies on their businesses. Accordingly, our targeted information resources for senior IT executives focus on ROI, implementation strategies, best practices and comparative assessment of vendor solutions related to these initiatives. Our online properties in this sector include SearchCIO.com, which provides CIOs in large enterprises with strategic information focused on critical purchasing decisions; and SearchCompliance.com, which provides advice on IT-focused regulations and standards to IT and business executives and other senior IT managers. The CIO/IT Strategy media group also includes online resources and events targeted to IT decision makers in prominent vertical industries. SearchHealthIT.com provides strategic IT purchasing information and advice to senior IT and clinical professionals in hospitals, medical centers, university health centers and other care delivery organizations, as well as organizations in the life sciences sector. |

| • | Business Applications and Analytics. Our Business Applications and Analytics media group focuses on mission critical software such as ERP, databases and business intelligence, content management enterprise resource planning, and customer facing applications such as CRM software for mid-sized and large companies. Because these applications are critical to the overall success of the businesses that use them, there is a high demand for specialized information by IT and business professionals involved in their purchase, implementation, and ongoing support. Our applications-focused properties in this sector include SearchCRM.com, SearchOracle.com, SearchSAP.com, SearchFinancialApplications.com and Search ManufacturingERP.com. These sites are leading online resources that provide this specialized information to support mission critical business applications such as customer relationship management (“CRM”), sales force automation, databases and ERP software. The information produced by these applications is seen as a corporate asset that is essential for gaining competitive advantage through informed, data-driven decisions that can help improve operational efficiency, enable business agility, and improve sales effectiveness and customer service. As a result, business intelligence and analytics have become pervasive as various organizations increasingly rely on mission critical information to optimize their businesses. Our sites BeyeNETWORK.com, SearchBusinessAnalytics.com, SearchDataManagement.com and SearchContentManagement.com, cover the business intelligence, data management, content management, and collaboration disciplines associated with such initiatives. SearchCloudApplications.com focuses on cloud-based or Software As A Service (“SAAS”) deployments of key business applications. |

| • | Application Architecture and Development. The application architecture and development sector is comprised of a broad landscape of tools and languages that enable developers, architects and project managers to build, customize and integrate software for their businesses. Our application architecture and development online properties focus on development in enterprise environments, the underlying languages such as .NET, Java and XML as well as related application development tools and integrated |

11

Table of Contents

| development environments (“IDEs”). Several trends have had a profound impact on this sector and are driving growth. The desire for business agility with more flexible and interoperable applications architecture continues to propel interest in Service-Oriented Architecture (“SOA”) and Business Process Management (“BPM”). Application integration, application testing and security, as well as AJAX and rich Internet applications are also key areas of continuing focus for vendors and developers. Our online properties in this sector include TheServerSide.com, which hosts independent communities of developers and architects; Ajaxian.com, which serves web developers of rich internet applications and SearchWinDevelopment.com, which serves Windows developers who use the .Net platform. SearchSoftwareQuality.com offers content focused on application testing and quality assurance while SearchSOA.com and eBizQ.net serve Architects, IT Managers and Line of Business Executives who are interested in building out service oriented architectures, BPM and working with related technologies. |

| • | Channel. Our Channel sites address the information needs of channel professionals—which we have classified as resellers, value added resellers, solution providers, systems integrators, service providers, managed service providers, and consultants—in the IT market. As IT professionals have become more specialized, IT vendors have actively sought resellers with specific expertise in the vendors’ sub-sectors. Like IT professionals, channel professionals require more focused technical content in order to operate successful businesses in the markets in which they compete. The resulting dynamics in the IT channel are well-suited to our integrated, targeted content strategy. Our online properties in this sector include SearchITChannel.com and SearchCloudProvider.com. In addition to these websites, TechTarget channel media is able to profile channel professionals accessing information on any website within the TechTarget Network. As channel professionals resell, service and support hardware, software and services from vendors in a particular IT sector, the key areas of focus tend to parallel those for the sub-sectors addressed by our IT-focused properties: for storage, backup, storage virtualization and network storage solutions such as fibre channel SANs, NAS, IP SANs; for security, intrusion defense, compliance and identity management; for networking, wireless, network security and VoIP; for systems, blade servers, consolidation and server virtualization. |

| • | TechnologyGuide.com. We operate a portfolio of Internet content sites that provide product reviews, price comparisons and user forums for technology products such as laptops, desktops and smartphones. Sites include NotebookReview.com™, Brighthand.com™ (covering smartphones), TabletPCReview.com™, PrinterComparison.com, DesktopReview.com, DigitalCameraReview.com and TechnologyGuide.com, which covers the personal technology segment as a whole. These sites represent an ideal complement to our enterprise-IT-focused TechTarget sites because IT professionals purchase a large volume of laptops, desktops, smartphones and mobile computing devices. Thus, these sites offer additional, complementary, in-depth content for our IT audience, as well as access for our advertisers to the broader audiences that visit these sites for information. |

User Generated Content and Vendor Content

ITKnowledgeExchange.com is a site devoted entirely to user generated content and represents our most concerted effort to date to facilitate peer-to-peer interaction amongst our users via blogs and a Q&A section. The site incorporates a number of important social media features, such as the use of tag-based navigation that allows users to self-classify content, and wiki-based Q&A functionality that allows them to collaborate with one another to respond to technical questions and product recommendations submitted by other users.

Bitpipe.com and KnowledgeStorm.com are sites that we operate and that host vendor-provided content such as white papers, software downloads, videocasts and webcasts. Maintaining centralized collections of this vendor content helps our users conduct pre-purchase research more easily and allows us to maximize the ability of this content to be found by search engines. We provide contextually relevant inclusion of vendor content from Bitpipe.com and KnowledgeStorm.com on the other sites in our network.

12

Table of Contents

Media Offerings

We use both online and event offerings to provide IT vendors with numerous touch points to reach key IT decision makers and to provide IT professionals with highly specialized content across multiple forms of media. We are experienced in assisting advertisers to develop custom advertising programs that maximize branding and ROI. The following is a description of the services we offer:

Online. Our network of websites forms the core of our content platform. Our websites provide IT professionals with comprehensive decision support information tailored to their specific areas of responsibility and purchasing decisions. Through our websites, we offer a variety of online media offerings to connect IT vendors to IT professionals. Our lead generation offerings allow IT vendors to maximize ROI by capturing qualified sales leads from the distribution and promotion of content to our audience of IT professionals. In August of 2011, we released a major upgrade to our Activity Intelligence platform. Beginning in 2012, all of our lead generation campaigns offer the Activity Intelligence Dashboard, a technology platform that gives our customers’ marketers and sales representatives a real-time view of their prospects, which includes insights on the research activities of technology buying teams, including at an account level. Lead generation offerings may also include an additional service, Nurture & Qualify (formerly called Nurture & Notify), which helps both technology marketers and their sales teams to identify highly active prospects, detect emerging projects, retarget interested buying teams, and accelerate engagement with specific accounts.

Our lead generation offerings may also include the syndication of the following:

| • | White Papers. White papers are technical documents created by IT vendors to describe business or technical problems which are addressed by the vendors’ products or services. As part of a lead generation campaign, we post white papers on our relevant websites and our users receive targeted promotions about these content assets. Prior to viewing white papers, our registered members and visitors supply their corporate contact information and agree to receive further information from the vendor. The corporate contact and other qualification information for these leads are supplied to the vendor in real time through our proprietary lead management software. |

| • | Webcasts, Podcasts, Videocasts and Virtual Trade Shows. Webcasts, podcasts, videocasts, virtual trade shows and similar content bring informational sessions directly to attendees’ desktops and mobile devices. As is the case with white papers, our users supply their corporate contact and qualification information to the webcast, podcast, virtual trade show or videocast sponsor when they view or download the content. Sponsorship includes access to the registrant information and visibility before, during and after the event. |

Our branding offerings provide IT vendors exposure to targeted audiences of IT professionals actively researching information related to their products and services and include display advertising and custom offerings. Display advertising can be purchased on specific websites within our network and against specific technology segments. These offerings give IT vendors the ability to increase their brand awareness to highly specialized IT sectors.

Our other offerings include the following:

| • | Custom Content Creation. In support of our advertisers’ lead generation programs, we will sometimes create white papers, case studies, webcasts, or videos to our customers’ specifications through our Custom Media team. These content assets are then promoted to our audience in the context of the advertisers’ lead generation programs. Our custom offerings allow customers to have content or entire microsites created that focus on topics related to their marketing objectives and include promotion of these vehicles to our users. |

| • | Content Sponsorships. IT vendors pay us to sponsor editorially created content vehicles on specific technology topics, such as “e-Zines,” “e-Books,” and “e-Guides.” In some cases, these vehicles are supported by multiple sponsors in a single segment, with the registrant information provided to all |

13

Table of Contents

| participating sponsors. Because these offerings are editorially driven, advertisers get the benefit of association with independently created content, and access to qualified sales leads that are researching the topic. |

| • | List Rentals. We also offer IT vendors the ability to message relevant registered members on topics related to their interests. IT vendors can rent our e-mail and postal lists of registered members using specific criteria such as company size, geography or job title. |

| • | Third Party Revenue Sharing Arrangements. We have arrangements with certain third parties, including for the licensing of our online content, for the renting of our database of opted-in e-mail subscribers and for which advertising from customers of certain third parties is made available to our website visitors. In each of these arrangements we are paid a share of the resulting revenue. |

| • | IT Deal Alert. IT Deal Alert™ is a suite of services for advertisers that leverages the detailed purchase intent data we collect about end-user IT organizations. Through proprietary scoring methodologies, we use this data to help advertisers identify and prioritize accounts whose content consumption around specific IT topics indicates that they are “in-market” for a particular product or service. We also use the data directly to identify and further profile accounts’ upcoming purchase plans. Based on this information, we provide advertisers with detailed “Qualified Sales Opportunities” that profile specific in-progress purchase projects, including information on scope and purchase considerations. |

Events. Our in-person events bring together IT professionals to hear from industry experts and to talk to IT vendors about key topics of interest in the sectors we serve. Most of our media groups operate revenue generating events. The majority of our events are free to IT professionals and are sponsored by IT vendors. Attendees are pre-screened based on event-specific criteria such as sector-specific budget size, company size, or job title. We offer three types of events: multi-day conferences, single-day seminars and custom events. Multi-day conferences provide independent expert content for our attendees and allow vendors to purchase exhibit space and other sponsorship offerings that enable interaction with the attendees. We also hold single-day seminars on various topics in major cities. These seminars provide independent content on key sub-topics in the sectors we serve, are free to qualified attendees, and offer multiple vendors the ability to interact with specific, targeted audiences actively focused on buying decisions. Our custom events differ from our seminars in that they are exclusively sponsored by a single IT vendor, and the content is driven primarily by the sole sponsor.

Customers

We market to IT vendors targeting a specific audience within an IT sector or sub-sector. We maintain multiple points of contact with our customers in order to provide support throughout a given organization and during critical stages of the sales cycle. As a result, individual customers often run multiple advertising programs with us in order to reach discrete portions of our targeted audience. Our services are generally delivered under short-term contracts that run for the length of a given advertising program, typically less than six months. Since our founding in 1999, we have developed a broad customer base that now comprises approximately 1,200 active advertisers. During 2013, no single customer represented 10% or more of total revenue.

Sales and Marketing

Since our inception in 1999, we have maintained an internal direct sales department that works closely with existing and potential customers to develop customized marketing programs that provide highly targeted access to IT professionals. We organize the sales force by the sector-specific media groups that we operate and have a global accounts team that works with our largest advertisers. We believe that our sector-specific sales organization and integrated approach to our service offerings allows our sales personnel to develop a high level of expertise in the specific sectors they cover and to create effective marketing programs tailored to the customer’s specific objectives. As of December 31, 2013, our sales and marketing staff consisted of approximately 285 people. The majority of our sales staff is located in our Newton, Massachusetts headquarters and our offices in San Francisco, California and London, England.

14

Table of Contents

We pursue a variety of marketing initiatives designed to support our sales activities by building awareness of our brand to IT vendors and positioning ourselves as a “thought leader” in ROI-based marketing. These initiatives include purchasing online and event sponsorships in media vehicles that target the technology advertising market, as well as engaging in direct communications with the database of advertising contacts we have built since inception. Examples of our direct communications include selected e-mail updates on new product launches and initiatives. We also produce in-person events, videocasts and white papers for technology marketers where we provide information on the latest best practices in the field of online marketing. Additionally, we publish a blog for marketers which we use as a thought leadership vehicle to promote our ideas and viewpoints on a myriad of online subjects.

Online User Acquisition

Our primary source of traffic to our websites is through non-paid traffic sources, such as our existing registered member base and organic search engine traffic. Organic search engine traffic is also the primary source of new registered members for our sites. Because our sites focus on specific sectors of the IT market, our content is highly targeted and is an effective means for attracting search engine traffic and resulting members. We also make user-focused marketing expenditures designed to supplement our non-paid traffic and registered members. We employ a variety of online marketing vehicles such as keyword advertising on the major search engines and targeted list rentals of opt-in e-mail subscribers from a variety of targeted media sources.

Technological Infrastructure

We have developed an expandable operations infrastructure using hardware and software systems from established IT vendors to maintain our websites and online offerings. Our system hardware is co-located at an offsite data center. All of the critical components of the system are redundant, allowing us to withstand unexpected component failure and to undergo maintenance and upgrades. Our infrastructure is scalable, enabling us to make additions that fit into the existing environment as our system requirements grow based on traffic and member growth. Our critical data is copied daily to backup tapes, which are sent to an off-site storage facility. We maintain a quality assurance process to monitor constantly our servers, processes and network connectivity. We have implemented these various redundancies and backup systems in order to minimize the risk associated with damage from fire, power loss, telecommunications failure, break-ins, computer viruses and other events beyond our control. We believe that continued development of our technological infrastructure is critical to our success. We have made, and expect to continue to make, technological improvements in this infrastructure to improve our ability to service our users and customers.

Competition

We compete for potential advertisers with a number of different types of companies, including: broad-based media outlets, such as television, newspapers and business periodicals that are designed to reach a wide audience; general purpose portals and search engines; and offline and online offerings of media companies that produce content specifically for IT professionals. The market for advertisers is highly competitive, and in each of the sectors we serve as well as across the services we offer, our primary competitors are the media companies that produce content specifically for IT professionals. Our primary competitors for advertisers, each of which possess substantial resources to compete, are United Business Media, QuinStreet, International Data Group, and CBS Interactive/ CNet. In the online market we generally compete on the basis of target audience, quality and uniqueness of information content, ease of use of our websites for IT professionals, and the quality and quantity of sales leads generated for advertisers. Our events generally compete on the basis of the quality and integrity of our content offerings, the quality of our attendees, and the ability to provide events that meet the needs of particular sector segments. As with the competition for advertisers, we compete for the users who comprise our target audiences primarily with the media companies that produce content specifically for IT professionals such as United Business Media, QuinStreet, International Data Group, and CBS Interactive/CNet.

15

Table of Contents

Although only approximately 26% of our revenues for the twelve months ended December 31, 2013 were derived from advertisers located outside of the United States, as we continue to expand internationally we expect to compete with many of the competitors mentioned above, as well as with established media companies based in particular countries or geographical regions. This international expansion has included commencing operations of websites for the United Kingdom in 2008, India and Spain in 2009, China in 2010, Australia in 2011, Singapore in 2012, Germany and Brazil in 2013; by acquiring the Computer Weekly and MicroScope properties from Reed Business Information Limited in the United Kingdom in April 2011; and, in December 2012, by acquiring LeMagIT, a strategic partner in France. See Note 13 for further information regarding revenues and long-lived assets by geographic area.

User Privacy

We gather in-depth business information about our registered members who consent to provide us such information through one or more of the online registration forms displayed on our websites, as well as through tracking certain behavioral activity of users on our sites. We post applicable privacy policies on our websites so that our users can access and understand the terms and conditions applicable to the collection and use of information we collect from them. Our privacy policies also disclose the types of information we gather, how we use it, and how a user can correct or change this information. Further, our privacy policies explain the circumstances under which we share this information and with whom. Users who register for our websites have the option of indicating specific areas of interest in which they are willing to receive offers via e-mail or postal mail; these offers contain content created either by us or our third-party IT vendor customers. To protect our disclosures and obligations to our users, we impose constraints that are generally consistent with our privacy policies on the customers to whom we provide user data. Additionally, when we provide lists to third parties, including to our advertiser customers, it is under contractual terms that are generally consistent with our obligations to our privacy policies and with applicable laws and regulations.

Consumer Protection Regulation

General. Advertising and promotional activities presented to visitors on our websites are subject to federal and state consumer protection laws that regulate unfair and deceptive practices. We are also subject to various other federal and state consumer protection laws, including the ones described below.

CAN-SPAM Act. The Controlling the Assault of Non-Solicited Pornography and Marketing Act of 2003, (the “CAN-SPAM Act”), became effective on January 1, 2004. The CAN-SPAM Act regulates commercial e-mails and provides a right on the part of the recipient to request the sender to stop sending messages, and establishes penalties for the sending of e-mail messages that are intended to deceive the recipient as to source or content. Under the CAN-SPAM Act, senders of commercial e-mails (and other persons who initiate those e-mails) are required to make sure that those e-mails do not contain false or misleading transmission information. Commercial e-mails are required to include a valid return e-mail address and other subject heading information so that the sender and the Internet location from which the message has been sent are accurately identified. Recipients must be furnished with an electronic method of informing the sender of the recipient’s decision not to receive further commercial e-mails. In addition, the e-mail must include a postal address of the sender and notice that the e-mail is an advertisement. The CAN-SPAM Act may apply to the e-newsletters that our websites distribute to registered members and to some of our other commercial e-mail communications. However, on May 12, 2008, the U.S. Federal Trade Commission (the “FTC”) issued additional regulations related to the CAN-SPAM Act, including interpretations of such act that indicate that e-newsletters, such as those we distribute to our registered members, will be exempt from most of the provisions of the CAN-SPAM Act. At this time, we are applying the applicable CAN-SPAM requirements to e-newsletters and all other e-mail communications, and believe that our e-mail practices comply with the requirements of the CAN-SPAM Act.

Other Consumer Protection Regulation. The FTC and many state attorneys general are applying federal and state consumer protection laws to require that the online collection, use and dissemination of data, and the

16

Table of Contents

presentation of Web site content, comply with certain standards for notice, choice, security and access. Courts may also adopt these developing standards. In many cases, the specific limitations imposed by these standards are subject to interpretation by courts and other governmental authorities. In addition, on December 20, 2007, the FTC published for public comment proposed principles to address consumer privacy issues that may arise from so-called “behavioral targeting” (i.e. the tracking of a user’s online activities in order to deliver advertising tailored to his or her interests) and to encourage industry self-regulation for public content. On February 12, 2009, following public comment, the FTC released a Staff Report with its revised principles for self-regulation of behavioral targeting. Although the FTC excluded from the principles both “first-party” behavioral advertising and contextual advertising (each being the types of behavioral targeting activities in which we are currently primarily engaged), with respect to other types of behavioral targeting that include the storage of more, and potentially sensitive, data or that collects information outside of the “traditional Web site context” (such as through a mobile device or by an ISP), the FTC has stated that it will continue to evaluate self-regulatory programs. Further, through a preliminary Staff Report published on December 1, 2010, the FTC indicated that it is considering regulations regarding behavioral targeting which may include implementation of a more rigorous opt-in regime. An opt-in policy would prohibit businesses from collecting and using information obtained through behavioral targeting activities from individuals who have not voluntarily consented. A few states have also introduced legislation that, if enacted, would restrict or prohibit behavioral advertising within the state. In the absence of a federal law pre-empting their enforcement, such state legislation would likely have the practical effect of regulating behavioral advertising nationwide because of the difficulties behind implementing state-specific policies or identifying the location of a particular consumer.

We believe that we are in compliance with applicable consumer protection laws, but a determination by a state or federal agency or court that any of our practices do not meet these standards could create liability to us, result in adverse publicity and negatively affect our businesses. Further, changes to existing regulations or laws or the passage of new regulations or laws such as the federal and state proposed legislation described above could also require us to incur additional costs and restrict our business operations.

In addition, several foreign governmental bodies, including the European Union, the United Kingdom and Canada have regulations dealing with the collection and use of personal information obtained from their citizens, some of which we may be subject to as a result of the expansion of our business internationally. Regulations in these territories have focused on the collection, use, disclosure and security of information that may be used to identify or that actually identifies an individual, such as an e-mail address or a name. Further, within the European Union, certain member state data protection authorities regard IP addresses as personal information, and legislation adopted recently in the European Union requires informed consent for the placement of a cookie on a user device. We believe that we are in compliance with the regulations that apply to us; however, such laws may be modified and new laws may be enacted in the future.

Intellectual Property

We regard our copyrights, domain names, trademarks, trade secrets and similar intellectual property as important to our success, and we rely upon copyright, trademark and trade secrets laws, as well as confidentiality agreements with our employees and others, and protective contractual provisions to protect the proprietary technologies and content that we have developed. We pursue the registration of our material trademarks in the United States and elsewhere. Currently, our TechTarget trademark and logo, as well as the KnowledgeStorm and certain other marks and logos are registered federally in the United States and selected foreign jurisdictions and we have applied for U.S. and foreign registrations for various other marks. In addition, we have registered over 1,500 domain names that are or may be relevant to our business, including “www.techtarget.com,” “www.knowledgestorm.com,” “www.bitpipe.com,” “www.technologyguide.com” and those leveraging the “search” prefix used in the branding of many of our websites. We also incorporate a number of third-party software products into our technology platform pursuant to relevant licenses. Some of this software is proprietary and some is open source. We use third-party software to maintain and enhance, among other things, the content generation, delivery, and support our technology infrastructure. We are not substantially dependent upon these

17

Table of Contents

third-party software licenses, and we believe the licensed software is generally replaceable, by either licensing or purchasing similar software from another vendor or building the software functions ourselves.

Employees

As of December 31, 2013, we had 639 employees. Other than a small number of employees in the United Kingdom and France, none of our current employees is represented by a labor union or is the subject of a collective bargaining agreement.

The following discussion highlights certain risks that may affect future operating results and share price. These are the risks and uncertainties we believe are most important for our existing and potential stockholders to consider. Additional risks and uncertainties not presently known to us, which we currently deem immaterial or which are similar to those faced by other companies in our industry or business in general, may also impair our business operations. If any of the following risks or uncertainties actually occurs, our business, financial condition and operating results would likely suffer.

Risks Relating to Our Business

Because we depend on our ability to generate revenues from the sale of advertising campaigns, fluctuations in advertising spending could have an adverse effect on our operating results.

The primary source of our revenues is the sale of advertising campaigns to our customers. Our advertising revenues accounted for the majority of our total revenues for the twelve months ended December 31, 2013. We believe that advertising spending on the Internet, as in traditional media, fluctuates significantly as a result of a variety of factors, many of which are outside of our control. These factors include:

| • | variations in expenditures by advertisers due to budgetary constraints; |

| • | the cancellation or delay of projects by advertisers; |

| • | the cyclical and discretionary nature of advertising spending; |

| • | general economic conditions, as well as economic conditions specific to the Internet and online and offline media industry; and |

| • | the occurrence of extraordinary events, such as natural disasters and international or domestic political and economic unrest. |

Because all of our customers are in the IT industry, our revenues are subject to characteristics of the IT industry that can affect advertising spending by IT vendors.

The IT industry is characterized by, among other things, volatile quarterly results, uneven sales patterns, short product life cycles, rapid technological developments and frequent new product introductions and enhancements. As a result, our customers’ advertising budgets, which are often viewed as discretionary expenditures, may increase or decrease significantly over a short period of time. In addition, the advertising budgets of our customers may fluctuate as a result of:

| • | weakness in corporate IT spending, resulting in a decline in IT advertising spending – the Company has, in fact, seen continued weakness in corporate IT spending and that trend may continue; |

| • | increased concentration in the IT industry as a result of consolidations, leading to a decrease in the number of current and prospective customers, as well as an overall reduction in advertising; |

| • | reduced spending by combined entities following such consolidations; |

18

Table of Contents

| • | the timing of advertising campaigns around new product introductions and initiatives; and |

| • | economic conditions specific to the IT industry. |

The general economic, business or industry conditions may adversely affect the business of the Company, as well as our ability to forecast financial results.

The domestic and international economies have continued to experience ongoing instability and inconsistent, unpredictable growth. This period of instability has been magnified by factors including changes in the availability of credit, volatile business and consumer confidence and continuing high unemployment. These and other macro-economic conditions have contributed to unpredictable changes in the global economy and expectations of future global economic growth. If the economic climate in the U.S. and abroad remains as it is or deteriorates, our customers or potential customers could reduce or delay their purchases of our offerings, which would adversely impact our revenues and our ability to sell our offerings, collect customer receivables and, ultimately, our profitability. Additionally, future economic conditions continue to have a high degree of inherent uncertainty. As a result, it continues to be difficult to estimate the level of growth or contraction for the economy as a whole, as well as for the various sectors of the economy, such as the IT market. Because all components of our budgeting and forecasting are dependent upon estimates of growth or contraction in the IT market and demand for our offerings, the prevailing economic uncertainties continue to render accurate estimates of future income and expenditures very difficult to make. We cannot predict the duration of current economic conditions or the duration or strength of an economic recovery, worldwide in the IT industry or in any of the different segments of the IT industry. Further adverse changes may occur as a result of global, domestic or regional economic conditions, changing consumer confidence, unemployment, declines in stock markets, or other factors affecting economic conditions generally. These changes may negatively affect the sales of our offerings, increase exposure to losses from bad debts, increase the cost and decrease the availability of financing, or increase the risk of loss on investments. Any recent growth the Company has experienced internationally would be negatively affected by any future global downturn.

Lingering effects of financial market instability and continued uncertain conditions in the United States and global economies have in the past and could in the future adversely affect our revenues and operating results.

We believe that the lingering effects of the instability affecting the financial markets and any further deterioration in the current business climate within the United States and/or certain other geographic regions in which we do business have had, and could continue to have, a negative impact on our revenue growth and operating results. Because all of our clients are in the IT industry, the success of our business is intrinsically linked to the health, and subject to market conditions, of the IT industry, and regional, domestic and global economic conditions. In turn, many of our customers have reassessed and will, for the foreseeable future, be likely to continue to scrutinize their spending on advertising campaigns. Prior market downturns in the IT industry have resulted in declines in advertising spending, which can cause longer sales cycles, deferral or delay of purchases by IT vendors and generally reduced expenditures for advertising and related services. Our revenues and profitability depend on the overall demand for advertising services from our customers. We believe that demand for our offerings has been in the past, and could be in the future, disproportionately affected by fluctuations, disruptions, instability or downturns in the economy and the IT industry, which may cause customers and potential customers to exit the industry or delay, cancel or reduce any planned expenditures for our advertising offerings. Furthermore, competitors have and may continue to respond to market conditions by lowering prices and attempting to lure away our customers and prospects to lower cost offerings. In addition, any slowdown in the formation of new IT companies, or decline in the growth of existing IT companies, may cause a decline in demand for our offerings.

19

Table of Contents

Our quarterly operating results are subject to fluctuations, and these fluctuations may adversely affect the trading price of our common stock.

We have experienced fluctuations in our quarterly revenues and operating results. Our quarterly revenues and operating results may fluctuate from quarter to quarter due to a number of factors, many of which are outside of our control. In addition to the factors described elsewhere in this “Risk Factors” section, these factors include:

| • | the spending priorities and advertising budget cycles of specific advertisers; |