UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ☒ |

Filed by a party other than the Registrant ☐ |

|

Check the appropriate box:

☐ |

|

Preliminary Proxy Statement |

☐ |

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

☒ |

|

Definitive Proxy Statement |

☐ |

|

Definitive Additional Materials |

☐ |

|

Soliciting Material under §240.14a-12 |

(Name of Registrant as Specified in its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check all boxes that apply):

☒ No fee required

☐ Fee paid previously with preliminary materials

☐ Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11

|

|

April 17, 2024

Dear TechTarget Stockholders:

You are cordially invited to attend the 2024 Annual Meeting of Stockholders of TechTarget, Inc. (the "Annual Meeting"), which will be held at 2:00 p.m., Eastern Daylight Time, on Tuesday, June 4, 2024, at our corporate headquarters located at 275 Grove Street, Newton, Massachusetts 02466.

As in prior years, we are using the "Notice and Access" method for providing our proxy materials to you via the Internet. As a result, we are mailing to our stockholders a Notice of Internet Availability of Proxy Materials ("Notice") instead of a paper copy of our Proxy Statement and our Annual Report on Form 10-K for the fiscal year ended December 31, 2023 ("Annual Report"). The Notice contains instructions on how to access both documents and vote online. The Notice also contains instructions on how each stockholder can receive a paper copy of our proxy materials, including this Proxy Statement, our Annual Report, and form of proxy. Using this distribution process conserves natural resources and reduces the costs of printing and distributing our proxy materials.

We hope that you will be able to attend, and participate in, the Annual Meeting. Whether or not you plan to attend, it is important that your shares be represented and voted at the Annual Meeting. As a stockholder of record, you may vote your shares by telephone, over the Internet, or by proxy card, and we hope you will vote as soon as possible.

On behalf of the Board of Directors, we thank you for your continued confidence, support, trust and ongoing interest in TechTarget, Inc.

Sincerely, |

|

|

|

|

|

|

|

|

GREG STRAKOSCH Executive Chairman |

|

MICHAEL COTOIA Chief Executive Officer |

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON JUNE 4, 2024

Notice is hereby given that all stockholders are cordially invited to attend the Annual Meeting of Stockholders of TechTarget, Inc., a Delaware corporation (the "Company"), to be held at 2:00 p.m., Eastern Daylight Time, on Tuesday, June 4, 2024 (the "Annual Meeting"), at our corporate headquarters located at 275 Grove Street, Newton, Massachusetts 02466. Stockholders will be asked to consider and act upon the following matters at the Annual Meeting:

Only holders of record of outstanding shares of the Company's common stock at the close of business on April 10, 2024 (the "Record Date") are entitled to notice of, and to vote at, the Annual Meeting and any adjournments or postponements thereof.

In accordance with the rules of the U.S. Securities and Exchange Commission, we will send a Notice of Internet Availability of Proxy Materials on or about April 17, 2024, and provide access to our proxy materials over the Internet, beginning on April 17, 2024, to the holders of record and beneficial owners of our capital stock as of the close of business on the Record Date.

Only stockholders, and persons holding proxies from stockholders, may attend the Annual Meeting. If your shares are registered in your name, you must bring a form of identification to attend the Annual Meeting in person. If your shares are held in the name of a broker, trust, bank, or other nominee, you must bring a proxy or letter from that broker, trust, bank, or other nominee that confirms that you are the beneficial owner of those shares.

Please note that the proxy statement relates solely to the Annual Meeting and does not contain information about our proposed strategic combination with Informa PLC's digital businesses and does not ask you to consider the Agreement and Plan of Merger (the "Transaction Agreement") or the transactions contemplated thereby. We do not intend to discuss the proposed strategic combination or the Transaction Agreement at the Annual Meeting. Instead, we will hold a separate, special meeting of stockholders on a future date to consider and approve the Transaction Agreement and the transactions contemplated thereby. At the appropriate time, we will send a separate package of proxy solicitation materials to our stockholders for the special meeting in connection with the proposed strategic combination.

By Order of the Board of Directors,

/s/ Charles D. Rennick

CHARLES D. RENNICK

Vice President, General Counsel

and Corporate Secretary

Newton, Massachusetts

April 17, 2024

TABLE OF CONTENTS

|

|

Page |

Questions and Answers about the Annual Meeting and Voting Procedures |

|

2 |

|

5 |

|

|

5 |

|

|

5 |

|

|

5 |

|

|

6 |

|

|

7 |

|

|

7 |

|

|

7 |

|

|

7 |

|

|

8 |

|

|

8 |

|

|

9 |

|

|

9 |

|

|

9 |

|

|

9 |

|

|

10 |

|

|

10 |

|

|

11 |

|

|

12 |

|

|

12 |

|

|

13 |

|

|

13 |

|

|

14 |

|

|

14 |

|

|

15 |

|

|

15 |

|

|

16 |

|

|

17 |

|

|

19 |

|

|

19 |

|

|

20 |

|

|

20 |

|

|

20 |

|

|

21 |

|

|

22 |

|

|

22 |

|

Employment Agreements and Potential Payments Upon Termination or Change of Control |

|

23 |

|

24 |

|

|

25 |

|

|

26 |

|

|

32 |

|

|

32 |

|

Security Ownership of Certain Beneficial Owners and Management |

|

32 |

|

34 |

|

|

34 |

|

|

34 |

|

|

35 |

|

|

35 |

|

Proposal No. 2: Ratification of Appointment of Independent Registered Public Accounting Firm |

|

36 |

|

36 |

|

Proposal No. 3: Advisory Vote to Approve Named Executive Compensation |

|

36 |

|

36 |

|

Stockholder Proposals for 2025 Annual Meeting of Stockholders |

|

36 |

|

37 |

|

|

37 |

|

|

37 |

i

PROXY STATEMENT

This Proxy Statement is furnished in connection with the solicitation by the Board of Directors (the "Board") of TechTarget, Inc. (the "Company," "TechTarget," "we," "us," or "our") of proxies to be voted at our 2024 Annual Meeting of Stockholders (the "Annual Meeting"), to be held at 2:00 p.m., Eastern Daylight Time, on Tuesday, June 4, 2024, at our corporate headquarters located at 275 Grove Street, Newton, Massachusetts 02466 or at any adjournments or postponements thereof. Stockholders of record of our common stock, $0.001 par value per share, as of the close of business on April 10, 2024 (the "Record Date") will be entitled to notice of, and to vote at, the Annual Meeting and any adjournments or postponements thereof. As of the Record Date, there were 28,548,634 shares of our common stock issued and outstanding and entitled to vote. Each share of common stock is entitled to one vote on any matter presented at the Annual Meeting. Directions to the Company's headquarters are available at: www.techtarget.com/contact-us/.

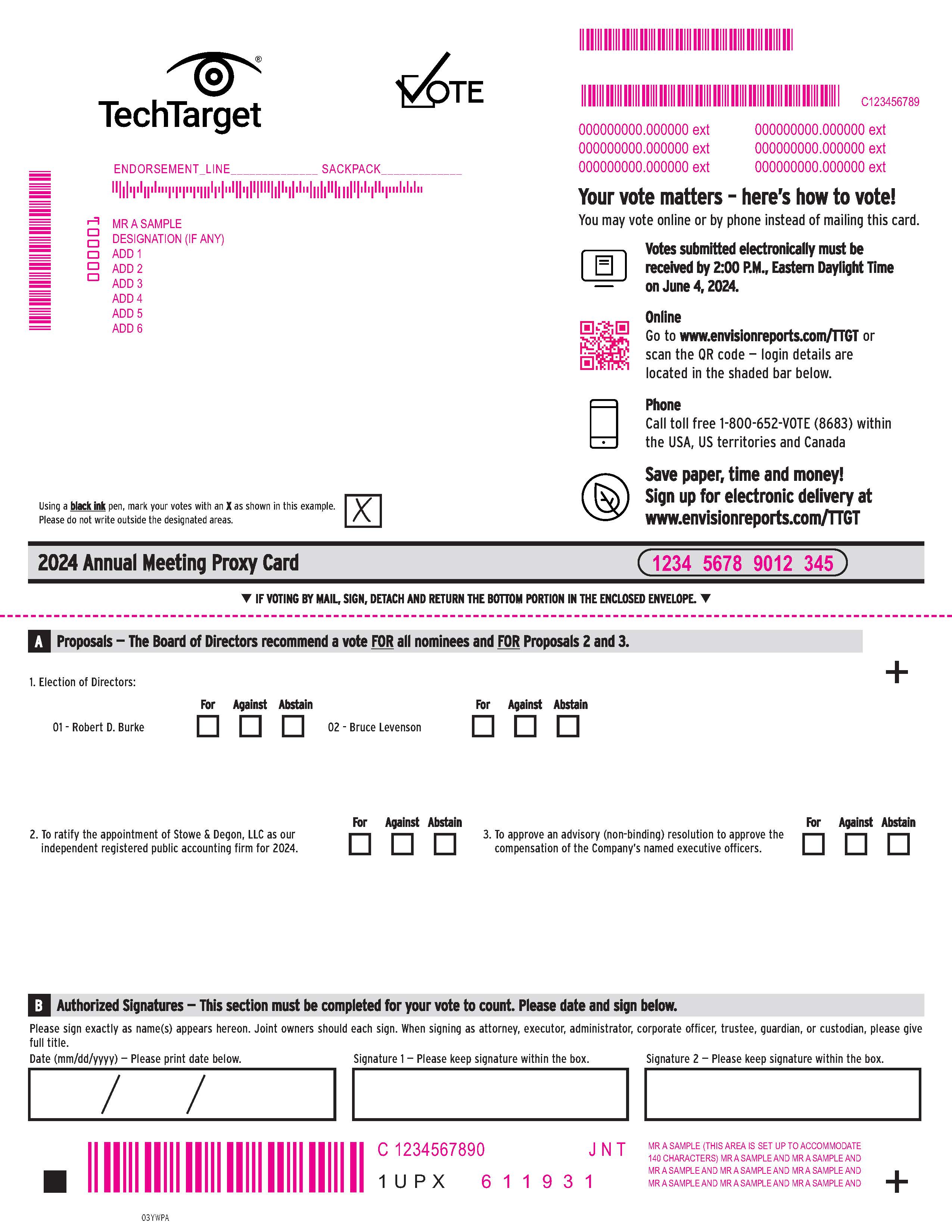

If proxies in the accompanying form are properly executed and returned, the shares of common stock represented thereby will be voted in the manner specified therein. If not otherwise specified, the shares of common stock represented by the proxies will be voted: (i) FOR the election of each of the Class II Directors (Proposal No. 1), (ii) FOR the ratification of Stowe & Degon, LLC as our independent registered public accounting firm (Proposal No. 2); (iii) FOR approval of an advisory (non-binding) resolution to approve the compensation of our named executive officers (Proposal No. 3), and (iv) in the discretion of the person or persons named in the Company's form of proxy, on any other proposals that may properly come before the Annual Meeting or any adjournment or postponements thereof. Any stockholder of record who has voted or otherwise submitted a proxy may revoke it at any time before it is voted by delivering written notice addressed to our Corporate Secretary (provided we receive your written notice before the Annual Meeting date), by submitting a duly executed proxy bearing a later date (provided we receive the later proxy card before the Annual Meeting date), by voting again over the telephone or the Internet prior to 2:00 p.m., Eastern Daylight Time, on June 4, 2024, or by attending and voting at the Annual Meeting. Mere attendance at the Annual Meeting of the person appointing a proxy does not revoke the appointment.

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE ANNUAL

MEETING OF STOCKHOLDERS TO BE HELD ON JUNE 4, 2024:

A copy of our Annual Report on Form 10-K (including the audited consolidated financial statements and schedules) for the fiscal year ended December 31, 2023 (the "Form 10-K"), as filed with the U.S. Securities and Exchange Commission, except for exhibits, will be furnished without charge to any stockholder upon written or oral request to: TechTarget, Inc., 275 Grove Street, Newton, Massachusetts 02466 Attention: Corporate Secretary, Telephone: (617) 431-9200. This Proxy Statement and the Form 10-K are also available through the Investor Relations portion of our website at www.techtarget.com. We include our website address in this proxy statement only as an inactive textual reference and do not intend it to be an active link to our website. The information on our website and the information contained or linked therein or otherwise connected thereto is not a part of or incorporated by reference into this proxy statement, regardless of any reference to such website in this proxy statement.

This Proxy Statement and the Form 10-K will be available for viewing, printing, and downloading on or about April 17, 2024 at www.edocumentview.com/TTGT.

TechTarget, Inc. | Proxy Statement for 2024 Annual Meeting of Stockholders |

1 |

QUESTIONS AND ANSWERS ABOUT THE ANNUAL MEETING AND VOTING PROCEDURES

You may only vote the shares of our common stock owned by you as of the close of business on April 10, 2024, which is the Record Date for the determination of stockholders entitled to notice of, and to vote at, the Annual Meeting. These shares include the following: (i) shares of common stock held directly in your name as the stockholder of record; and (ii) shares of common stock held for you, as the beneficial owner, through a broker, trust, bank, or other nominee.

Many of our stockholders hold their shares through a broker, trust, bank, or other nominee, rather than directly in their own names. As described below, there are some distinctions between shares held of record and those owned beneficially.

Stockholders of Record. If your shares are registered directly in your name with our transfer agent, Computershare, Inc., then you are considered, with respect to those shares, the stockholder of record. As the stockholder of record, you have the right to grant your voting proxy to the persons specified on the form of proxy or to vote at the Annual Meeting. The persons named in the form of proxy will vote the shares you own in accordance with your instructions on the proxy card you mail in, submit online, or provide by telephone. If you return the proxy card, but do not give any instructions on a particular matter described in this Proxy Statement, the persons named in the proxy card will vote the shares you own in accordance with the recommendations of our Board. Alternatively, you may vote through the Internet or by telephone by following the instructions on the proxy card.

Beneficial Owners. If your shares are held in a brokerage account, by a bank, trust, or other nominee, you are considered the beneficial owner of shares held in street name, and the proxy materials will be supplied to you by your broker, bank, trust, or other nominee who is considered, with respect to those shares, the stockholder of record. As the beneficial owner, you have the right to direct your broker, bank, trust, or other nominee how to vote. You are also invited to attend the Annual Meeting, but since you are not the stockholder of record, you may not vote these shares in person at the Annual Meeting unless you receive a proxy from your broker, bank, trust, or nominee. Your broker, bank, trust, or other nominee should have supplied a voting instruction card or link to online voting for you to use. If you wish to attend and vote at the Annual Meeting, please mark the box on the voting instruction card received from your broker, bank, trust, or other nominee and return it to the broker, bank, trust, or other nominee so that you receive a legal proxy to present at the Annual Meeting.

You may vote your shares by attending the Annual Meeting, by using the Internet or telephone, or (if you received hard copies of the proxy materials) by completing and returning the form of proxy by mail.

Voting in Person by Attending the Annual Meeting. You may vote shares held directly in your name as the stockholder of record in person at the Annual Meeting. If you choose to vote in person at the Annual Meeting, please bring the proxy card and proof of identification with you. You may vote shares that you beneficially own if you receive and present at the Annual Meeting a proxy from your broker or nominee, together with proof of identification. Even if you plan to attend the Annual Meeting, we recommend that you also submit your proxy as described below so that your vote will be counted if you later decide not to attend the Annual Meeting. For information on how to obtain directions to attend the annual meeting and vote in person, please contact our Corporate Secretary at 275 Grove Street, Newton, MA 02466, or call (617) 431-9200, or email investor@techtarget.com.

Voting Without Attending the Annual Meeting. Whether you hold shares directly as the stockholder of record or as the beneficial owner in street name, you may direct your vote without attending the Annual Meeting. You may also do so by granting a proxy or, for shares held in street name, by submitting voting instructions to your broker or nominee. In most instances, you will be able to do this over the Internet, by telephone, or by mail. Please note that if you received a Notice of Internet Availability of Proxy Materials ("Notice"), then you may not vote your shares by filling out and returning the Notice. You must follow the instructions on the Notice to view materials and vote by using the Internet or telephone, or by requesting hard copy materials and a proxy card. If you choose to vote by proxy, the named proxies will vote your shares according to the directions you provide in the proxy, using the Internet or by telephone. If no directions are provided, except as otherwise indicated in this Proxy Statement, the shares will be voted, as recommended by the Board, FOR approval of Proposal No. 1, Proposal No. 2, and Proposal No. 3. Discretionary authority is provided in the proxy as to any matters not specifically referred to in the proxy. Our Board is not aware of any other matters that are likely to be brought before the Annual Meeting. If other matters are properly brought before the Annual Meeting, including a proposal to adjourn or postpone the Annual Meeting to permit the solicitation of additional proxies in the event that one or more proposals have not been approved by a sufficient number of votes at the time of the Annual Meeting, then the persons named in the proxy will vote on such matters in their own discretion. If you are a beneficial owner of common stock, please refer to the voting instruction card included by your broker, bank, trust, or other nominee for applicable voting procedures.

TechTarget, Inc. | Proxy Statement for 2024 Annual Meeting of Stockholders |

2 |

A proxy may be revoked by executing and delivering a later-dated proxy card before the Annual Meeting date, by voting again over the telephone or on the Internet prior to 2:00 p.m., Eastern Daylight Time, on June 4, 2024, by attending the Annual Meeting and voting, or by giving written notice revoking the proxy to our Corporate Secretary before it is exercised. Attendance at the Annual Meeting will not automatically revoke a stockholder's proxy. All written notices of revocation or other communications with respect to revocation of proxies should be addressed to TechTarget, Inc., 275 Grove Street, Newton, Massachusetts 02466, Attention: Corporate Secretary. If you own your shares in street name, then your bank or brokerage firm should provide you with appropriate instructions for changing your vote.

Holders of record of our common stock on April 10, 2024 are entitled to notice of, and to vote at, the Annual Meeting or any adjournment or postponement of the Annual Meeting. As of the Record Date, 28,548,634 shares of our common stock were issued and outstanding. The presence in person or by proxy of the holders of a majority of the outstanding shares of common stock entitled to vote at the Annual Meeting will constitute a quorum for the transaction of business at the Annual Meeting.

Each holder of common stock is entitled to one vote at the Annual Meeting on each matter to come before the Annual Meeting, including the election of each Director, for each share held by such stockholder as of the Record Date. Votes cast in person at the Annual Meeting or by proxy, Internet vote, or telephone vote will be tabulated by Computershare, Inc., the inspector of election appointed for the Annual Meeting, who will determine whether a quorum is present.

If you hold shares through a broker, bank, trust, or other nominee, generally the broker, bank, trust, or other nominee may, under limited circumstances, vote your shares if you do not return your proxy. Brokerage firms have discretionary authority to vote customers' unvoted shares only on "routine" matters. If you do not return a proxy to your brokerage firm to vote your shares, your brokerage firm may, on these certain limited matters, vote your shares. If your representative cannot vote your shares on a particular matter because it does not have discretionary voting authority, this is referred to as a "broker non-vote." We expect that brokers, banks, trusts and other nominees will have discretionary voting authority with respect to Proposal No. 2 (ratifying the appointment of our independent registered public accounting firm). We expect that brokers, banks, trusts and other nominees will not have discretionary voting authority with respect to the other proposals to be voted upon at the Annual Meeting and, without your instruction, will not be able to vote your shares on those proposals. Proxies reflecting broker non-votes (where a broker or nominee does not have discretionary authority to vote on a proposal) will be considered as present for purposes of determining whether a quorum is present, provided there is at least one discretionary matter to be voted on.

With respect to the election of Directors (Proposal No. 1), our Amended and Restated By-laws and Corporate Governance Guidelines state that to be elected in an uncontested election where a quorum is present, a Director Nominee shall be elected if the number of votes cast "for" such Director's election exceeds the number of votes cast "against" that Director's election by the shares present or represented by proxy at the Annual Meeting and entitled to vote on the election for directors. If the votes cast "against" a nominee's election exceed the votes cast "for" the nominee's election, the nominee will not be elected to the Board. However, under Delaware law, if a nominee that is an incumbent Director is not reelected to the Board, that incumbent Director will "hold over" in office as a Director until he or she is removed or until his or her successor is elected. Under our Corporate Governance Guidelines, in an uncontested election of Directors, each incumbent Director nominee must deliver to the Board a resignation that will become effective if such nominee does not receive the required vote and the Board determines to accept such resignation. Under our Corporate Governance Guidelines, the Nominating and Corporate Governance Committee evaluates the resignation and makes a recommendation to the Board on the action to be taken. With respect to Proposal No. 1, you may vote "FOR," "AGAINST," or "ABSTAIN" with respect to each nominee. If the shares you own are held in street name by a bank or brokerage firm, that bank or brokerage firm, as the record holder of your shares, is required to vote your shares according to your instructions. Abstentions and broker non-votes will not be counted as votes cast and accordingly, will have no effect on the outcome of this proposal.

The appointment of Stowe & Degon, LLC as our independent registered public accounting firm will be ratified if we receive the affirmative vote of a majority of the votes properly cast at the Annual Meeting. With respect to Proposal No. 2, you may vote "FOR," "AGAINST," or "ABSTAIN." If the shares you own are held in street name by a bank or brokerage firm, that bank or brokerage firm, as the record holder of your shares, is required to vote your shares according to your instructions.

TechTarget, Inc. | Proxy Statement for 2024 Annual Meeting of Stockholders |

3 |

If you do not instruct your bank or brokerage firm how to vote with respect to this proposal, your bank or brokerage firm may vote your shares or leave them unvoted resulting in a broker non-vote. Abstentions and broker non-votes will not be counted as votes cast and accordingly, will have no effect on the outcome of this proposal.

The affirmative vote of a majority of the votes properly cast at the Annual Meeting will be required for approval of the advisory (non-binding) resolution to approve the compensation of our named executive officers. With respect to Proposal No. 3, you may vote "FOR," "AGAINST" or "ABSTAIN." Abstentions and broker non-votes will not be counted as votes cast and accordingly, will have no effect on the outcome of this proposal.

This means that your shares are registered differently or are in more than one account. Please provide voting instructions for all of your shares.

Proxy cards, ballots and voting tabulations that identify individual stockholders are submitted, mailed, or returned to us and handled in a manner intended to protect your voting privacy. Your vote will not be disclosed except: (i) as needed to permit us to tabulate and certify the vote; (ii) as required by law; or (iii) in limited circumstances, such as a proxy contest in opposition to a Director candidate nominated by the Board. All comments written on the proxy card or elsewhere will be forwarded to management, but your identity will be kept confidential unless you ask that your name be disclosed.

We will publish the voting results on Form 8-K within four business days after the Annual Meeting. You can read or print a copy of that report by going to the Investor Relations portion of our website at www.techtarget.com or by going directly to the U.S. Securities and Exchange Commission ("SEC") website at www.sec.gov.

Recent Developments

On January 10, 2024, we entered into an Agreement and Plan of Merger (the "Transaction Agreement") with Informa and certain of our and their subsidiaries. Pursuant to the Transaction Agreement, we and Informa PLC ("Informa"), among other things, agreed to combine our businesses with the business of Informa Intrepid Holdings Inc. ("Informa Tech"), a wholly owned subsidiary of Informa which will own and operate Informa's digital businesses (Industry Dive, Omdia (including Canalys)), NetLine and certain of its digital media brands (e.g. Information Week, Light Reading, and AI Business), under a new publicly traded holding company ("New TechTarget"). Upon closing, among other things, Informa and its subsidiaries will collectively own 57% of the outstanding common stock of New TechTarget (on a fully diluted basis) and our former stockholders will own the remaining outstanding common stock of New TechTarget. Our former stockholders will also receive a pro rata share of an amount in cash equal to $350 million plus the amount of any EBITDA adjustment (as defined in the Transaction Agreement), which is estimated as of the date of the Transaction Agreement to be approximately $11.79 per share of our common stock. The various transactions set forth in the Transaction Agreement (the "proposed transaction") are expected to close in the second half of 2024, subject to satisfaction or waiver of certain customary conditions.

The Annual Meeting does not relate to the proposed transaction. We will hold a separate special meeting of stockholders to approve the proposed transaction and certain other matters related thereto.

TechTarget, Inc. | Proxy Statement for 2024 Annual Meeting of Stockholders |

4 |

PROPOSAL NO. 1:

ELECTION OF CLASS II DIRECTORS

Our Board of Directors

Our Board is divided into three classes, with one class being elected each year and members of each class holding office for a three-year term. Our Board is currently authorized to have, and we currently have, seven members. At the Annual Meeting, the Class II Directors will stand for election. None of our Directors are related to any other Director or to any of our executive officers. Information about each nominee, the Company's Class I and III Directors, and our executive officers, including their respective ages and positions, is included below and is current as of March 31, 2024.

Information about the Nominees

Our Board has nominated Robert D. Burke and Bruce Levenson for election as the Class II Directors, each to serve a three-year term until the 2027 Annual Meeting of Stockholders, or until their respective successors are elected and duly qualified. Each nominee is currently serving as a Director and has indicated that they are willing and able to serve as a Director, if elected. If a nominee should become unable or unwilling to serve, the proxies intend to vote for the replacement selected by the Nominating and Corporate Governance Committee of our Board.

Name |

|

Age |

|

|

Position |

|

Robert D. Burke |

|

|

69 |

|

|

Director |

Bruce Levenson |

|

|

74 |

|

|

Director |

Robert D. Burke. Mr. Burke has served as a Director since November 2012. Mr. Burke has over 40 years of experience in the technology industry with both private and public companies. Mr. Burke is currently the President of Mercatura, Inc., a consulting company, a position he has held since 2011. Prior thereto, Mr. Burke was most recently the President and Chief Executive Officer of Art Technology Group, Inc. ("ATG"), a leading e-commerce software provider, from 2002 to 2011. Before ATG, Mr. Burke was Chief Executive Officer of Quidnunc from 2000 to 2002 and President of ePresence Solutions from 1997 to 2000. Mr. Burke started his career as an Operating Systems Specialist at Digital Equipment Corporation and held a wide variety of roles in hardware and software infrastructure, software applications, consulting, and systems integration. Mr. Burke was previously a board member for Exa Corporation, a public company that develops, sells, and supports simulation software and services for vehicle manufacturers from 2014 to 2017. Mr. Burke has a B.S. in Physics from Eastern Michigan University. The Company believes that Mr. Burke's extensive experience as a leader of technology driven companies that are similar to the Company's target customers brings valuable strategic and industry-specific insight to the Board and can assist the Company as it implements its sales and marketing strategies.

Bruce Levenson. Mr. Levenson has served as a Director since February 2015 and, previously, from 2007 to 2012. Mr. Levenson is the co-founder of United Communications Group ("UCG"), a business information publisher, where he has worked since 1977. He also founded Oil Price Information Service, a private company that provides wholesale/rack and retail fuel prices for the refined products, renewable fuels, and natural gas and gas liquids industries and, with other partners, acquired GasBuddy, LLC, which owns a group of websites that offer a method for users to post and view retail gas prices, in 2013. He is currently a partner at UCG and GasBuddy, LLC, where he is involved in company strategy and acquisition efforts. Mr. Levenson is a former partner of LPF Atlanta LLC, which was the former majority owner of the Atlanta Hawks National Basketball Association franchise and owns the operating rights to the Philips Arena in Atlanta, Georgia. Mr. Levenson is also a former member of the Board of Governors of the National Hockey League. Mr. Levenson holds a B.A. from Washington University and a J.D. from American University. The Company believes that Mr. Levenson's career of over 40 years as a principal in a highly successful specialty publisher, UCG, provides the Board with valuable management and strategic experience in a core market the Company serves.

|

|

RECOMMENDATION OF THE |

The Board of Directors recommends that Stockholders vote "FOR" Proposal No. 1, the Election of Class II Directors. |

TechTarget, Inc. | Proxy Statement for 2024 Annual Meeting of Stockholders |

5 |

Directors Continuing in Office

Class III Directors (Term Expires at the 2025 Annual Meeting of Stockholders)

Perfecto Sanchez. Mr. Sanchez has served as a Director since January 2022. Mr. Sanchez is currently the co-founder and Chief Growth Officer of Equity Quotient ("EQ"), a technology platform that provides access to diversity data and advanced analytics to help companies measure their stakeholder impact, manage risk, and devise growth strategies as part of a broader environmental, social, and governance imperative. He is also the founder and Chief Executive Officer of Keep The Change, a for-purpose marketing consultancy he launched in 2014 and serves on the board of directors of Lifeway Foods, Inc. (Nasdaq: LWAY), a public company, since August 2022. He is also the co-founder of CHPTR, Inc., a tech memorialization company and mobile-first community, and a co-founder of EQ with Ms. Van Houten. He is currently an advisor to Build in Tulsa, a movement to build the infrastructure for Black multi-generational wealth creation, as well as an Advisor at International Crisis Group. He served as Chief Marketing Officer for Chloe's Soft Serve Fruit Co. from 2016 to 2018 where he helped double their distribution and brand awareness. Prior to that, from 2010 to 2015, he served in senior brand and portfolio strategy roles at The Dannon Company, Inc. (a subsidiary of Danone S.A.) and Kraft Foods, Inc. Mr. Sanchez holds a Bachelor of Math and Science from the United States Military Academy at West Point and is a decorated U.S. Army Veteran with two combat tours to Iraq. Mr. Sanchez brings to the Board his experience in managing complex projects and budgets, implementing portfolio, growth, and marketing strategies for global brands, as well as driving innovation and awareness through social impact initiatives.

Greg Strakosch. Mr. Strakosch has served as our Executive Chairman since May 2016. Prior thereto, he served as our Chief Executive Officer from our incorporation in September 1999 to May 2016 and as our Chairman from 2007 to May 2016. Prior to co-founding TechTarget, Mr. Strakosch was the President of the Technology Division of UCG, a business information publisher. Mr. Strakosch joined UCG in 1992 when it acquired Reliability Ratings, an information technology publishing company that he founded in 1989. Before Reliability Ratings, Mr. Strakosch spent six years at EMC Corporation, a provider of enterprise information storage systems. Mr. Strakosch holds a B.A. from Boston College. As one of the Company's two co-founders and our Executive Chairman, Mr. Strakosch is uniquely positioned to provide essential insight and guidance to the Board from an inside perspective and provide the Board with the benefit of his many years of experience and comprehensive knowledge of the information technology advertising business.

Class I Directors (Term Expires at the 2026 Annual Meeting of Stockholders)

Michael Cotoia. Mr. Cotoia has served as our Chief Executive Officer and a Director since May 2016. He has been employed by us since 2002, serving as our Chief Operating Officer from January 2012 to May 2016 and, prior to that, as Executive Vice President from 2010 to 2012 and in various other positions including as Senior Vice President and Vice President and Publisher, from 2002 to 2010. Prior to joining TechTarget, he was Director of Sales at SANZ, a national storage integrator, and he also held positions at EMC Corporation, a provider of enterprise information storage systems, and Deloitte, a provider of audit, consulting, financial, risk management, tax, and related services. Mr. Cotoia holds a B.S. from Babson College and is a CPA. Mr. Cotoia's history with the Company and experience in the IT advertising business provides the Board with specific knowledge of the Company's operations and a greater understanding of the Company's strategic opportunities.

Roger M. Marino. Mr. Marino has served as a Director since 2000. He is an active private investor in numerous companies including technology start-ups. Since 2001, Mr. Marino founded and has been associated with RMM Group LLC, a film production company, and RMM-P, an investment company. He also founded EMC Corporation, a provider of enterprise information storage systems, and retired as its president in 1992. He holds a B.S. from Northeastern University and is a member (Emeritus) of Northeastern University's Board of Trustees. Mr. Marino's extraordinary experience as an entrepreneur who co-founded and then served in various executive positions in a market-leading technology company provides the Board with both executive and sales experience from the perspective of the market in which virtually all of our customers operate.

Christina Van Houten. Ms. Van Houten has served as a Director since August 2019. She is currently the co-founder and Chief Executive Officer of EQ. Prior to co-founding EQ with Mr. Sanchez, Ms. Van Houten served in various roles at Mimecast Limited ("Mimecast"), a global provider of cloud cyber resilience solutions for corporate data and email, including as advisor to the Chief Executive Officer and as Chief Strategy Officer, from April 2018 to May 2022. Prior to joining Mimecast, from 2014 to 2018, Ms. Van Houten was Senior Vice President, Marketing Strategy & Product Management, at Infor Global Solutions, an enterprise software company that provides comprehensive business solutions. She served as Vice President, Industry Solution and Strategy, at Infor, from 2011 to 2014. She was Vice President of Strategy and Solutions at IBM Netezza from 2010 to 2011. Prior to that, from 2005 to 2010, she served in senior roles at Oracle Corporation. Ms. Van Houten holds an MBA from the Booth School of Business at the University of Chicago, and a B.A. degree from Georgetown University. Ms. Van Houten's experience in marketing strategy and career with some of the world's largest firms provides the Board with invaluable business insight and expertise in overall sales and marketing strategies.

TechTarget, Inc. | Proxy Statement for 2024 Annual Meeting of Stockholders |

6 |

Information about Directors and Committee Membership

Name |

|

Age |

|

|

Audit |

|

Compensation |

|

Nominating and Corporate Governance |

|

Robert D. Burke(1) |

|

|

69 |

|

|

Chair |

|

Member |

|

— |

Michael Cotoia(2) |

|

|

52 |

|

|

— |

|

— |

|

— |

Bruce Levenson(3) |

|

|

74 |

|

|

Member |

|

Member |

|

Chair |

Roger M. Marino |

|

|

85 |

|

|

— |

|

Chair |

|

Member |

Perfecto Sanchez |

|

|

40 |

|

|

— |

|

— |

|

Member |

Greg Strakosch(4) |

|

|

61 |

|

|

— |

|

— |

|

— |

Christina Van Houten |

|

|

57 |

|

|

Member |

|

— |

|

Member |

Board Leadership Structure

Mr. Cotoia became our Chief Executive Officer ("CEO") and Mr. Strakosch became our Executive Chairman in May 2016. The Board continues to believe that this leadership structure, which separates the Executive Chairman and CEO roles, remains appropriate. As Executive Chairman, Mr. Strakosch not only remains involved in long-term strategy, investor relations, and other key business areas critical to our continued growth and success, but he also continues to assist and advise Mr. Cotoia. As CEO, Mr. Cotoia is responsible for the general management and operation of the business and guiding and overseeing the Company's senior executives. Mr. Cotoia's in-depth knowledge of the Company's business, industry, and operations also provides him with a strong understanding of the vision and strategic direction of our Company. The Board believes that the structure of a separate Executive Chairman and CEO, together with a Lead Independent Director having the duties described below, is in the best interest of the Company's stockholders and harmonizes the various responsibilities, experiences, and independent perspectives important to furthering the Company's strategic vision for growth, while also addressing the governance needs and oversight responsibilities of our Board. To strengthen independent oversight, the Board has adopted a number of governance practices, including (i) a clearly defined Lead Independent Director role (as detailed below) and (ii) executive sessions of the independent Directors. However, the Board recognizes that no single leadership model is right for all companies at all times and that depending on the circumstances, other leadership models, such as an independent Chairman of the Board, might be appropriate. Accordingly, the Board periodically reviews its leadership structure.

Lead Independent Director

Bruce Levenson, an independent Director who serves as a Member of the Audit and Compensation Committees and as the Chair of the Nominating and Corporate Governance Committee, was selected by the Board again this year to serve as the Lead Independent Director. Mr. Levenson has been selected for this position each year since 2016. The Lead Independent Director has the responsibility of presiding at all executive sessions of the Board, consulting with both the Executive Chairman and the CEO on Board and committee meeting agendas, monitoring communications from stockholders and other interested parties, meeting with any Director not adequately performing such Director's duties as a member of the Board or any committee thereof, acting as the principal liaison between management and the non-employee Directors, including maintaining frequent contact with both the Executive Chairman and the CEO and advising them on the efficacy of the Board meetings, and facilitating teamwork and communication between the non-employee Directors and management, as well as additional ancillary responsibilities. Additionally, the Lead Independent Director may represent the Board in any communications with stockholders and other stakeholders and also may provide input on the design of the Board itself.

Information about Other Executive Officers

Included in the table below is the name, age, and position of each executive officer of the Company, as of March 31, 2024, other than Messrs. Strakosch and Cotoia, for whom such information is provided above. No executive officer is related to another executive officer or Director.

Name |

|

Age |

|

|

Principal Occupation/Position Held with the Company |

|

Don Hawk |

|

|

52 |

|

|

Executive Director, Product Innovation |

Rebecca Kitchens |

|

|

46 |

|

|

President |

Steven Niemiec |

|

|

43 |

|

|

Chief Operating Officer and Chief Revenue Officer |

Daniel T. Noreck |

|

|

52 |

|

|

Chief Financial Officer and Treasurer |

Don Hawk. Mr. Hawk has served as our Executive Director, Product Innovation since January 2012. Prior to that, Mr. Hawk served as our President from our incorporation in September 1999 to 2012. Prior to co-founding TechTarget, Mr. Hawk was a Director of New Media Products for the Technology Division of UCG from 1997 to 1999. Prior to joining UCG, Mr. Hawk

TechTarget, Inc. | Proxy Statement for 2024 Annual Meeting of Stockholders |

7 |

was the Director of Electronic Business Development for Telecommunications Reports International, Inc., a telecommunications publishing company. Mr. Hawk holds a B.A. and an M.A. from George Washington University.

Rebecca Kitchens. Ms. Kitchens has served as our President since January 2023. Prior to that, she served as an Executive Vice President & Publisher of the Company, from January 2021, which entailed leading several business units tied to our content and audience marketing efforts, as well as overseeing the Company's Enterprise Strategy Group division, an IT analyst, research, validation, and strategy unit that provides market intelligence and actionable insight to the global IT community, as well as overseeing several other business units. Ms. Kitchens has also previously served as Senior Vice President, Market Development from October 2017 to January 2021, Senior Vice President & Group Publisher from May 2012 to October 2017, and Vice President of Global Accounts from September 2010 to May 2012. Ms. Kitchens holds a B.S. from Fairfield University.

Steven Niemiec. Mr. Niemiec has served as our Chief Operating Officer and Chief Revenue Officer since January 2023. Prior to that, Mr. Niemiec served as the Company's first Chief Revenue Officer, from January 2021, overseeing the Company's Sales, Customer Success, and Sales Operations groups. Mr. Niemiec began his career with the Company as an Account Manager and worked his way up to progressively more senior positions including serving as Senior Vice President, Global Sales from June 2013 to January 2021 and Vice President & General Manager from January 2011 to June 2013. Mr. Niemiec holds a B.S. from Providence College.

Daniel T. Noreck. Mr. Noreck has served as our Chief Financial Officer and Treasurer since December 2016. Since April 2021, he has also served as a director and chair of the audit committee of Capital Properties, Inc., a publicly traded property leasing company in Providence, Rhode Island. From September 2010 to December 2016, he served as Chief Financial Officer and Treasurer of Providence and Worcester Railroad Company, a publicly traded regional short line railroad with operations in Connecticut, Massachusetts, New York, and Rhode Island. Prior to that, Mr. Noreck was a Senior Audit Manager at Lefkowitz, Garfinkel, Champi & DeRienzo P.C. in Providence, Rhode Island from July 2003 to September 2010. Mr. Noreck holds a B.S. from the University of Massachusetts, Dartmouth and is a CPA and a chartered global management accountant.

INFORMATION ABOUT CORPORATE GOVERNANCE

Our Board believes that good corporate governance is important to ensure that we are managed for the long-term benefit of our stockholders. This section describes the key corporate governance guidelines and practices that we have adopted. The charters governing the Audit Committee, the Compensation Committee, and the Nominating and Corporate Governance Committee, the Code of Business Conduct and Ethics, and our Corporate Governance Guidelines are posted on the corporate governance section of our investor relations website located at investor.techtarget.com. Additionally, you may request a copy of these governance documents, without charge, by writing to TechTarget, Inc., 275 Grove Street, Newton, Massachusetts 02466, Attention: Corporate Secretary.

Corporate Governance Guidelines

Our Board has adopted Corporate Governance Guidelines ("Guidelines") to assist in the exercise of its duties and responsibilities and to serve our best interests and those of our stockholders. The Guidelines, which establish a framework for the conduct of the business of the Board, provide, among other things:

These and other matters are described in more detail in the Guidelines themselves and below.

TechTarget, Inc. | Proxy Statement for 2024 Annual Meeting of Stockholders |

8 |

Director Diversity Information

Set forth below is information concerning the gender and demographic background of each of the current Directors of the Company, as self-identified and reported by each Director. This information is being provided in accordance with the corporate governance rules of Nasdaq and each of the categories listed in the below table has the meaning as it is used in Nasdaq Rule 5605(f).

Board Diversity Matrix (As of March 31, 2024) |

||||

Total Number of Directors |

7 |

|||

Part I: Gender Identity |

Female |

Male |

Non-binary |

Did not disclose gender |

Directors |

1 |

6 |

— |

— |

Part II: Demographic Background |

||||

African American or Black |

— |

— |

— |

— |

Alaskan Native or Native American |

— |

— |

— |

— |

Asian |

— |

— |

— |

— |

Hispanic or Latinx |

— |

— |

— |

— |

Native Hawaiian or Pacific Islander |

— |

— |

— |

— |

White |

1 |

5 |

— |

— |

Two or More Races or Ethnicities |

— |

1 |

— |

— |

LGBTQ+ |

— |

|||

Did Not Disclose Demographic Background |

— |

|||

Prohibitions on Hedging and Pledging

The Company's Insider Trading and Public Communication Policy restricts hedging and pledging of TechTarget stock. This policy prohibits TechTarget Directors, officers, and employees from engaging in any of the following types of transactions with respect to TechTarget stock: short sales; purchases or sales of puts, calls or other derivative securities; and purchases of financial instruments or other transactions that hedge or offset any decrease in the market value of TechTarget stock (including swaps, forwards, options and futures). This policy also prohibits TechTarget Directors, officers, and employees from pledging TechTarget stock except in certain limited circumstances.

Board Determination of Independence

To assist it in making independence determinations, the Board has adopted independence standards, which include the standards required by Nasdaq for independent directors. Applicable Nasdaq rules require a majority of a listed company’s board of directors to be comprised of independent directors. Under applicable Nasdaq rules, a director will only qualify as an "independent director" if they can satisfy certain bright line tests set forth in such rules. In addition, Nasdaq rules require that, subject to specified exceptions, each member of a listed company's audit, compensation and nominating and governance committees be an independent director and, in the case of each member of the audit committee, satisfy the independence criteria set forth in Rule 10A-3 under the Securities Exchange Act of 1934, as amended, (the "Exchange Act"), and, in the case of each member of the compensation committee, satisfy the independence criteria set forth in Rule 10C-1 under the Exchange Act. The Board must also determine that the director does not have a relationship that would interfere with the exercise of independent judgment in carrying out the responsibilities of a director. In the course of determining the independence of each non-employee Director under applicable Nasdaq rules, our Board, among other things, considers relationships that each non-employee director has with the Company and the annual amount of TechTarget sales to, or purchases from, any company where a non-employee director or their family member serves as an executive officer. The Board considers all the relevant facts and circumstances surrounding such sales or purchases.

Our Board has determined that each of Mr. Burke, Mr. Levenson, Mr. Marino, Mr. Sanchez, and Ms. Van Houten, is "independent" as the term is defined by Nasdaq standards and that none of these Directors has a relationship that would interfere with the exercise of their independent judgment in carrying out the responsibilities of a Director. Messrs. Strakosch and Cotoia are not deemed to be independent Directors under these rules because they are our Executive Chairman and CEO, respectively. Other than the payments by the Company reported in the "Director Compensation" section of this Proxy Statement, none of our Directors have received, or will receive, any compensation, nor have they entered into any "golden leash" arrangements in connection with their service on our Board.

Board Meetings and Attendance

Each Director is expected to attend regularly scheduled Board meetings and to participate in special or other Board meetings. During 2023, our Board held 11 meetings. Each Director attended at least 75% of (i) the total number of meetings of the Board held and (ii) the total number of meetings held by all committees on which he or she served during 2023.

TechTarget, Inc. | Proxy Statement for 2024 Annual Meeting of Stockholders |

9 |

Director Attendance at Annual Meeting of Stockholders

Our Guidelines provide that Directors are encouraged to attend our Annual Meeting. In 2023, four of our seven Directors participated in the Annual Meeting either in person or by telephone.

Board Committees

Our Board has established Audit, Compensation, and Nominating and Corporate Governance committees. Each committee operates under a separate charter adopted by our Board. The committee charters are posted on the corporate governance section of our investor relations website located at investor.techtarget.com. Our Board has determined that all of the members of each of the Board's three standing committees are independent as defined under applicable Nasdaq listing standards as well as, in the case of all members of the Audit Committee, the independence requirements contemplated by Rule 10A-3 under the Exchange Act and, in the case of all members of the Compensation Committee, the additional independence requirements set forth in Rule 10C-1 of the Exchange Act.

Audit Committee. Our Audit Committee is comprised of Robert D. Burke, the Chair of the Committee, Bruce Levenson, and Christina Van Houten. Mr. Burke serves as our "audit committee financial expert" as defined in applicable SEC rules. The Audit Committee's responsibilities, as set forth in its Charter, include:

In accordance with its charter and subject to applicable law, the Audit Committee may establish and delegate authority to one or more subcommittees consisting of one or more of its members, when the Audit Committee deems it appropriate to do so in order to carry out its responsibilities. The Audit Committee has delegated limited authority to the Chair of the Audit Committee to pre-approve any audit and permitted non-audit services and discuss certain required matters with the independent auditor. The Audit Committee met six times in 2023.

Compensation Committee. Our Compensation Committee is comprised of Roger M. Marino, the Chair of the Committee, Bruce Levenson, and Robert D. Burke. The Compensation Committee's responsibilities include:

TechTarget, Inc. | Proxy Statement for 2024 Annual Meeting of Stockholders |

10 |

The Compensation Committee met four times in 2023. In accordance with its charter and subject to applicable law, the Compensation Committee may establish and delegate authority to one or more subcommittees consisting of one or more of its members, when the Compensation Committee deems it appropriate to do so in order to carry out its responsibilities. The Compensation Committee has delegated limited authority to executive officers, from time to time, including with respect to administrative tasks under the Company's 2022 Employee Stock Purchase Plan. The processes and procedures followed by our Compensation Committee in considering and determining executive and Director compensation are described below under the headings "Executive Compensation" and "Director Compensation."

Nominating and Corporate Governance Committee. Our Nominating and Corporate Governance Committee is comprised of Bruce Levenson, the Chair of the Committee, Roger M. Marino, Perfecto Sanchez, and Christina G. Van Houten. The Nominating and Corporate Governance Committee's responsibilities include:

The Nominating and Corporate Governance Committee met two times in 2023. The processes and procedures followed by our Nominating and Corporate Governance Committee in identifying and evaluating Director candidates are described below under the heading "Director Nomination Process."

Director Nomination Process

The process followed by the Nominating and Corporate Governance Committee to identify and evaluate Director candidates includes meeting, from time to time, to evaluate biographical information and background material relating to potential candidates, interviewing selected candidates, and recommending prospective candidates for the Board's consideration and review. Generally, the Committee identifies candidates through the personal, business and organizational contacts of the Directors and management.

In evaluating prospective Director candidates, the Committee may consider all facts and circumstances that it deems appropriate or advisable, including, among other things, the skills of the prospective Director candidate, his or her depth and breadth of business experience or other background characteristics, his or her independence, and the needs of our Board. Certain criteria are set forth in our Guidelines and include the candidate's integrity, business acumen, knowledge of the Company's business and industry, and experience. The Committee does not assign specific weights to particular criteria, although it does consider the following minimum qualifications:

TechTarget, Inc. | Proxy Statement for 2024 Annual Meeting of Stockholders |

11 |

The Board may also consider other qualities such as an understanding of, or experience in, online media, finance, and/or marketing as well as leadership experience within public companies. Our Board believes that the backgrounds and qualifications of its Directors, considered as a group, provide a composite mix of experience, knowledge, and abilities that allows our Board to fulfill its responsibilities. In addition to the foregoing factors, the Committee may also consider diversity in its evaluation of candidates for Board membership. The Board believes that diversity with respect to viewpoint, skills, and experience is an important factor in Board composition. The Committee ensures that diversity considerations are discussed in connection with each potential nominee, as well as on a periodic basis, in connection with the composition of the Board as a whole. Stockholders may recommend individuals to the Nominating and Corporate Governance Committee for consideration as potential Director candidates by submitting their names, together with appropriate biographical information and background materials, and a statement as to whether the stockholder or group of stockholders making the recommendation has beneficially owned more than 5% of our common stock for at least a year as of the date such recommendation is made, to TechTarget, Inc., 275 Grove Street, Newton, Massachusetts 02466, Attn: Corporate Secretary. Assuming that appropriate biographical and background material has been provided in a timely manner, the Nominating and Corporate Governance Committee will evaluate stockholder-recommended candidates by following substantially the same process, and applying substantially the same criteria, as it follows for candidates submitted by others. If the Board determines to nominate a stockholder-recommended candidate and recommends his or her election, then his or her name will be included in the Company's proxy statement for the next annual meeting assuming the nominee consents to such inclusion.

Communications with Directors

Our Board will give appropriate attention to written communications that are submitted by stockholders, and will respond if, and as, appropriate. The Executive Chairman is primarily responsible for monitoring and responding to communications from stockholders and other interested parties and for providing copies to our other Directors or to the individual Director so designated on a periodic basis, as he considers appropriate. Unless any communication is marked confidential and is addressed to a particular Board member, the Executive Chairman, prior to forwarding any correspondence, will review such correspondence and, in his discretion, will not forward items if they are deemed to be of a commercial, irrelevant, or frivolous nature or otherwise inappropriate for consideration by our Board. Interested parties may send written communications to our Board at the following address: TechTarget, Inc., 275 Grove Street, Newton, Massachusetts 02466, Attention: Executive Chairman of the Board, or to the attention of an individual Director.

The Board's Role in Risk Oversight

While management is responsible for designing and implementing the Company's overall risk management process, including controls and administration, the Board and its committees are primarily responsible for oversight of the Company's risk management. As such, the Board considers and discusses with management current and emerging risks and other issues that may present particular risks to the Company in the short-term, intermediate-term, or long-term. These risks include those involving acquisitions, competition, customer demands, economic conditions, planning, strategy, finance, sales and marketing, products, information technology and cybersecurity, facilities and operations, and legal and regulatory compliance issues. Management periodically reports to the Board and its committees on these risks, including with the assistance of outside advisors as appropriate. Additionally, the Board relies on the Audit Committee to regularly review certain risks that may be material to the Company, including issues related to financial risks and exposures, particularly financial reporting, tax, accounting, financial disclosures, internal control over financial reporting, financial policies, investment guidelines, and credit and liquidity matters and as otherwise disclosed in the Company's quarterly and annual reports filed with the SEC. In terms of cybersecurity oversight, in particular, our Audit Committee receives reports on the results of independent testing of aspects of the operations of our cybersecurity program and the supporting control framework and our Privacy and Security Executive Taskforce, which oversees an IT Security Team that is responsible for leading company-wide cybersecurity efforts, meets periodically to, among other things, review global trends in privacy, security, and compliance, identify key projects and resource needs, and review operational privacy and security statistics and metrics. The Board believes that this approach provides appropriate checks and balances against undue risk taking. We believe that our leadership structure supports the risk oversight function of the Board. Having two members of management, specifically our Executive Chairman and our CEO, serving on the Board, facilitates open communication between the Company's management team and Directors relating to risk and helps ensure that these risks are appropriately assessed, managed, and mitigated.

Compensation Risks. The Board relies on the Compensation Committee to evaluate the Company's compensation programs to ensure that they do not create undue risk-taking in attempting to achieve Company goals. To assist the Compensation Committee in its evaluation in 2023, management conducted a risk analysis of the structure of the Company's compensation policies and practices, including the design and metrics of its performance-based compensation programs, and reported the results to the Compensation Committee. Management analyzed each plan generally as well as each performance goal under each plan, in conjunction with the business process or processes involved in attaining the performance goal. Management considered any mitigating factors, including internal controls designed to prevent fraud or

TechTarget, Inc. | Proxy Statement for 2024 Annual Meeting of Stockholders |

12 |

manipulation of business processes and operations, in its evaluation. For example, there is an inherent risk of manipulation in the recognition of revenue and the pricing and processing of orders in the Company's business. In order to mitigate these risks, the Company has established numerous processes and controls regarding pricing, revenue recognition, accounts receivable, order processing, and expenses, including independent reviews of the various components of revenue and expense, and a multidisciplinary contracts management process that has multiple approval and signatory levels, and seeks to prevent any deviation from or circumvention of the processes and controls. In addition to the numerous internal controls which require multidisciplinary review, the Company's independent registered public accounting firm also reviews the interim financial statements included in our quarterly reports on Form 10-Q and audits the Company's annual financial statements. Management presented its analysis to the Compensation Committee in April 2024. Based on the analysis, the Committee concluded that the Company's performance-based compensation plans did not create risks that would be reasonably likely to have a material adverse effect on the Company.

Compensation Clawback. In October 2023, our Board adopted a written Compensation Recovery Policy ("Clawback Policy") addressing the recoupment of incentive-based compensation from current or former covered officers to ensure compliance with the requirements of Nasdaq Listing Rule 5608, which implements Rule 10D-1 under the Exchange Act. Under the Clawback Policy, the Company will recover any erroneously awarded incentive-based compensation from current or former executive officers subject to the Clawback Policy that was received within the applicable recovery period. The Compensation Committee of the Board has the discretion to make all decisions under this policy. Our 2017 Stock Option and Incentive Plan, as amended, also provides that any award made to a participant under the plan will be bound by any clawback policy that the Company has in effect or may adopt in the future.

Code of Business Conduct and Ethics

We have adopted a written Code of Business Conduct and Ethics ("Code") that applies to our Directors, officers and employees, including our principal executive officer, principal financial officer, principal accounting officer or controller, and persons performing similar functions. We have posted the Code on the corporate governance section of our investor relations website located at investor.techtarget.com. In addition, we will disclose on our website any amendments to, or waivers granted to, any Director or executive officer from, any provision of the Code.

We strive to attract diverse and exceptional candidates and help support their career growth once they become employees. Once hired, we ensure that employees are rewarded, recognized and engaged based on their contributions. We also emphasize employee internal mobility opportunities through our performance evaluation and career development efforts to drive professional development. Our goal is a long-term, upward-bound career at TechTarget for every employee, which we believe will assist our retention efforts. We are also dedicated to fostering a collaborative culture among our workforce, creating an environment that is safe, respectful, fair and inclusive of everyone, and promoting diversity, equity and inclusion inside and outside of our business. We accomplish this with the strong culture that we have built over the past 20+ years and through the efforts of our active culture committees: TechTarget Diversity, Equity & Inclusion, Health & Fitness at TechTarget, and TechTarget Gives. Each committee has a distinct mission, but all look to cultivate leadership skills, develop best business practices, encourage knowledge sharing, give back to the community, and provide personal growth and development opportunities while allowing for a wide range of perspectives and experiences.

TechTarget, Inc. | Proxy Statement for 2024 Annual Meeting of Stockholders |

13 |

DIRECTOR COMPENSATION

Directors who are also employees receive no compensation for their service as a Director. All non-employee Directors received the following compensation in 2023: (i) a base annual retainer of $20,000; (ii) a fee of $1,500 for attendance at each Board meeting; (iii) a fee of $1,000 for attendance at each Committee meeting; and (iv) an annual grant of options to purchase, at the fair market value on the date of grant, 5,000 shares of our common stock, which options are exercisable on the first anniversary of the date of grant or the business day prior to the Company's next annual meeting, if earlier. New non-employee Directors receive an initial grant of 2,500 options upon the commencement of service with the Company and must serve on the Board for at least six months to be eligible to receive the annual grant of options to purchase 5,000 shares of common stock.

Each non-employee Director also receives, on an annual basis, the following retainer amounts for committee service: each member of the Audit Committee: $5,000; each member of the Compensation Committee: $2,500; and each member of the Nominating and Corporate Governance Committee: $2,500. In addition to the retainers for committee service, each committee chairperson also receives the following annual retainers: Chair of the Audit Committee: $10,000; Chair of the Compensation Committee: $5,000; and Chair of the Nominating and Corporate Governance Committee: $5,000. Directors are also reimbursed for actual out-of-pocket expenses incurred in attending any meetings. The Company's compensation policy is to pay non-employee Directors their retainers in advance in December for the next fiscal year and to pay meeting fees in arrears in August for the period from January to July and in December for the period from August to December. Non-employee Directors shall be entitled to retain their retainers if they cease to be a non-employee Director or serve on a Committee or as a Committee Chair.

In accordance with the terms of our non-employee Director compensation program described above, which is reviewed and approved annually by the Compensation Committee, Directors receive Restricted Stock Units ("RSUs") as payment for their retainers and meeting attendance fees under our 2017 Stock Option and Incentive Plan, as amended. These RSUs are valued at the fair market value on the date of grant and are fully vested upon grant.

In the event that we add additional non-employee Directors to our Board, we may grant additional amounts of equity compensation based on the available benchmarking data for directors of comparable companies as well as other relevant factors, such as that person's experience in our industry, unique skills and knowledge, and the extent to which we expect that person will serve on and/or chair any committees.

Fiscal 2023 Director Compensation

The following table details the compensation for 2023 of our non-employee Directors:

Name |

|

Fees earned or paid($) |

|

|

Stock |

|

|

Option |

|

|

Total($) |

|

||||

Robert D. Burke |

|

|

— |

|

|

|

63,042 |

|

|

|

182,300 |

|

|

|

245,342 |

|

Bruce Levenson |

|

|

— |

|

|

|

61,011 |

|

|

|

182,300 |

|

|

|

243,311 |

|

Roger M. Marino |

|

|

— |

|

|

|

51,039 |

|

|

|

182,300 |

|

|

|

233,339 |

|

Perfecto Sanchez |

|

|

— |

|

|

|

41,056 |

|

|

|

182,300 |

|

|

|

223,356 |

|

Christina G. Van Houten |

|

|

— |

|

|

|

52,039 |

|

|

|

182,300 |

|

|

|

234,339 |

|

TechTarget, Inc. | Proxy Statement for 2024 Annual Meeting of Stockholders |

14 |

EXECUTIVE COMPENSATION

Compensation Discussion and Analysis

This Compensation Discussion and Analysis describes our executive compensation programs for our principal executive officer, our principal financial officer, and our other three executive officers for 2023 (collectively, the "named executive officers") who were:

Overview and Compensation Philosophy. The primary objectives of our Compensation Committee and our Board with respect to executive compensation are to attract, retain, and motivate executives who make important contributions to the achievement of our business goals, and to align the incentives of our executives with the creation of long-term value for our stockholders. The Compensation Committee implements and maintains compensation plans in order to enhance the likelihood that we will achieve these objectives. Our executive compensation program is designed to attract and retain those individuals with the skills necessary for us to achieve our long-term business goals, to motivate and reward individuals who perform at or above the levels that we expect, and to link a portion of each executive officer's compensation to the achievement of our business objectives. It is also designed to reinforce a sense of ownership, urgency, and overall entrepreneurial spirit. Further, our executive compensation program is designed in a manner that we believe aligns the interests of our executive officers with those of our stockholders by providing a portion of our executive officers' compensation through equity-based awards.

Compensation Committee. Our current executive compensation policies and objectives were developed and implemented by our Compensation Committee which, throughout 2023, consisted of all independent Directors. The Compensation Committee reviews and approves compensation for our executive officers with input from both our Executive Chairman and CEO. Mr. Strakosch and Mr. Cotoia make recommendations to the Committee, from time to time, regarding the compensation of the Company's executive officers based in part upon the periodic benchmarking exercise described in the "Equity Incentive Compensation and Other Benefits — Benchmarking of Compensation and Equity" section below. Neither Mr. Strakosch nor Mr. Cotoia plays any role in determining his own salary, bonus, or equity compensation. Our Compensation Committee annually reviews our executive compensation program to assess whether the program adequately incentives, motivates, and compensates our executive officers. In addition to addressing cash compensation for our executive officers, which includes base salary and annual bonus plan and targets, our Compensation Committee reviews and approves equity grants to executive officers and employees who are not executive officers.

Elements of Executive Compensation. Our executive compensation consists of the following elements: (i) base salary; (ii) annual bonus; (iii) equity incentive compensation; and (iv) compensation through employee benefit plans. We view these elements of compensation as related but distinct. Although our Compensation Committee reviews total compensation, we generally do not believe that significant compensation derived from one element of compensation should necessarily negate or reduce compensation from other elements. We assess the appropriate level for each compensation component based on our view of internal fairness and consistency and other considerations we deem relevant, such as the executives’ equity ownership position. We may also, from time to time, review executive compensation levels at other companies with which we compete. For 2023, our overall mix of executive compensation continued to include a balance of cash and non-cash compensation, taking into consideration existing long-term equity awards.

Base Salary. Base salaries are used to recognize the experience, skills, knowledge, and responsibilities required of all our employees, including our executives. Base salaries for our executives typically have been set in our offer letter to the executive at the outset of employment. None of our executives are currently party to an employment agreement that provides for automatic or scheduled increases in base salary. We set base salary compensation for our executive officers at a level we believe enables us to retain and motivate and, as needed, hire individuals in a competitive environment, so that our executive officers will contribute to our overall business goals and success. We may also consider the base salary compensation that is payable by companies that we believe to be our competitors and by other comparable private and public companies with which we believe we generally compete for executives. The Compensation Committee reviews base salaries periodically, most recently in late 2023, and adjusts them from time to time as appropriate after taking into account an individual's responsibilities, performance, skills specific to our business, industry experience, as well as the limited benchmarking referenced above and described in the "Equity Incentive Compensation and Other Benefits — Benchmarking of Compensation and Equity" section below. Excluding Ms. Kitchens and Mr. Niemiec, who became executive officers effective January 1, 2023, in 2023 the annual base salary for Mr. Strakosch and Mr. Cotoia remained the same as in 2022. The Board approved, effective January 1, 2023, a $75,000 increase to the annual base salary for Mr. Noreck, with a new base salary of $300,000 per year.

TechTarget, Inc. | Proxy Statement for 2024 Annual Meeting of Stockholders |

15 |

Executive Incentive Bonus Plan

Plan Performance Metrics and Individual Goals. The Compensation Committee designed our 2023 Executive Incentive Bonus Plan (the "2023 Bonus Plan") in a manner that it believed would focus and motivate our management to achieve key company financial and strategic objectives and reward our executive officers for achievement of these measures of operating performance. In December 2022, our Board approved the 2023 Bonus Plan performance metrics. As in prior years, the Compensation Committee concluded that "Revenue" (as defined by Generally Accepted Accounting Principles ("GAAP")), Adjusted Earnings Before Interest, Taxes, Depreciation, and Amortization ("Adjusted EBITDA"), and an operating metric based on the percentage of customer contracts with terms longer than 270 days ("Longer-Term Contracts") were the appropriate measurements of our performance with respect to the 2023 Bonus Plan. Adjusted EBITDA is a non-GAAP financial measure defined as earnings before net interest, other income and expense such as asset impairment (including expenses related to the induced conversion of our 2025 convertible notes), income taxes, depreciation and amortization, as further adjusted to include the impact of the fair value adjustments to contingent consideration and acquired unearned revenue and to exclude stock-based compensation and other one-time charges, such as costs related to acquisitions or reduction in forces expenses, if any. The Compensation Committee included the Longer-Term Contract metric, coupled with the Revenue and Adjusted EBITDA metrics, because it felt this metric would continue to align our executive incentive compensation with the Company's goal of moving towards providing our customers our purchase-intent data and other services under Longer-Term Contracts. Payment of a bonus under the 2023 Bonus Plan was based on either the attainment of the Revenue and/or Adjusted EBITDA performance goals or attainment of the Longer-Term Contract performance goal. Payments under our bonus plan are made each year before March 15, based on the achievement of the prior year's performance goals measured at the end of each fiscal year.