|

Investment Company Act file number

|

811-21591

|

|||||

|

AMERICAN CENTURY ASSET ALLOCATION PORTFOLIOS, INC.

|

||||||

|

(Exact name of registrant as specified in charter)

|

||||||

|

4500 MAIN STREET, KANSAS CITY, MISSOURI

|

64111

|

|||||

|

(Address of principal executive offices)

|

(Zip Code)

|

|||||

|

CHARLES A. ETHERINGTON

4500 MAIN STREET, KANSAS CITY, MISSOURI 64111

|

||||||

|

(Name and address of agent for service)

|

||||||

|

Registrant’s telephone number, including area code:

|

816-531-5575

|

|||||

|

Date of fiscal year end:

|

07-31

|

|||||

|

Date of reporting period:

|

07-31-2011

|

|||||

|

|

LIVESTRONG® Income Portfolio

|

|

|

LIVESTRONG® 2015 Portfolio

|

|

|

LIVESTRONG® 2020 Portfolio

|

|

|

LIVESTRONG® 2025 Portfolio

|

|

|

LIVESTRONG® 2030 Portfolio

|

|

|

LIVESTRONG® 2035 Portfolio

|

|

|

LIVESTRONG® 2040 Portfolio

|

|

|

LIVESTRONG® 2045 Portfolio

|

|

|

LIVESTRONG® 2050 Portfolio

|

|

|

LIVESTRONG® 2055 Portfolio

|

|

President’s Letter

|

2

|

|

Independent Chairman’s Letter

|

3

|

|

Performance

|

4

|

|

Portfolio Commentary

|

20

|

|

Portfolio Characteristics

|

24

|

|

Shareholder Fee Examples

|

26

|

|

Schedule of Investments

|

33

|

|

Statement of Assets and Liabilities

|

38

|

|

Statement of Operations

|

42

|

|

Statement of Changes in Net Assets

|

46

|

|

Notes to Financial Statements

|

51

|

|

Financial Highlights

|

77

|

|

Report of Independent Registered Public Accounting Firm

|

127

|

|

Management

|

128

|

|

Approval of Management Agreements

|

131

|

|

Additional Information

|

136

|

|

Total Returns as of July 31, 2011

|

|||||

|

Average Annual Returns

|

|||||

|

Ticker

Symbol

|

1 year

|

5 years

|

Since

Inception

|

Inception

Date

|

|

|

LIVESTRONG Income Portfolio

|

|||||

|

Investor Class

|

ARTOX

|

11.87%

|

4.98%

|

5.21%

|

8/31/04

|

|

Russell 3000 Index

|

—

|

20.94%

|

2.89%

|

5.11%

|

—

|

|

Barclays Capital U.S. Aggregate Bond Index

|

—

|

4.44%

|

6.57%

|

5.35%

|

—

|

|

Institutional Class

|

ATTIX

|

12.20%

|

5.21%

|

5.43%

|

8/31/04

|

|

A Class(1)

No sales charge*

With sales charge*

|

ARTAX

|

11.60%

5.15%

|

4.72%

3.49%

|

4.95%

4.05%

|

8/31/04

|

|

C Class

|

ATTCX

|

10.87%

|

—

|

8.70%

|

3/1/10

|

|

R Class

|

ARSRX

|

11.33%

|

4.46%

|

4.68%

|

8/31/04

|

|

(1)

|

Prior to March 1, 2010, the A Class was referred to as the Advisor Class and did not have a front-end sales charge. Performance prior to that date has been restated to reflect this charge.

|

|

Total Returns as of July 31, 2011

|

|||||

|

Average Annual Returns

|

|||||

|

Ticker

Symbol

|

1 year

|

5 years

|

Since

Inception

|

Inception

Date

|

|

|

LIVESTRONG 2015 Portfolio

|

|||||

|

Investor Class

|

ARFIX

|

12.72%

|

5.01%

|

5.86%

|

8/31/04

|

|

Russell 3000 Index

|

—

|

20.94%

|

2.89%

|

5.11%

|

—

|

|

Barclays Capital U.S. Aggregate Bond Index

|

—

|

4.44%

|

6.57%

|

5.35%

|

—

|

|

Institutional Class

|

ARNIX

|

12.92%

|

5.23%

|

6.08%

|

8/31/04

|

|

A Class(1)

No sales charge*

With sales charge*

|

ARFAX

|

12.44%

5.94%

|

4.77%

3.53%

|

5.61%

4.71%

|

8/31/04

|

|

C Class

|

AFNCX

|

11.62%

|

—

|

9.30%

|

3/1/10

|

|

R Class

|

ARFRX

|

12.18%

|

4.49%

|

5.34%

|

8/31/04

|

|

(1)

|

Prior to March 1, 2010, the A Class was referred to as the Advisor Class and did not have a front-end sales charge. Performance prior to that date has been restated to reflect this charge.

|

|

Total Returns as of July 31, 2011

|

||||

|

Average

Annual Returns

|

||||

|

Ticker

Symbol

|

1 year

|

Since

Inception

|

Inception

Date

|

|

|

LIVESTRONG 2020 Portfolio

|

||||

|

Investor Class

|

ARBVX

|

13.66%

|

2.81%

|

5/30/08

|

|

Russell 3000 Index

|

—

|

20.94%

|

0.26%

|

—

|

|

Barclays Capital U.S.

Aggregate Bond Index

|

—

|

4.44%

|

6.61%

|

—

|

|

Institutional Class

|

ARBSX

|

13.88%

|

3.01%

|

5/30/08

|

|

A Class(1)

No sales charge*

With sales charge*

|

ARBMX

|

13.51%

6.94%

|

2.57%

0.67%

|

5/30/08

|

|

C Class

|

ARNCX

|

12.68%

|

9.97%

|

3/1/10

|

|

R Class

|

ARBRX

|

13.13%

|

2.30%

|

5/30/08

|

|

(1)

|

Prior to March 1, 2010, the A Class was referred to as the Advisor Class and did not have a front-end sales charge. Performance prior to that date has been restated to reflect this charge.

|

|

Total Returns as of July 31, 2011

|

|||||

|

Average Annual Returns

|

|||||

|

Ticker

Symbol

|

1 year

|

5 years

|

Since

Inception

|

Inception

Date

|

|

|

LIVESTRONG 2025 Portfolio

|

|||||

|

Investor Class

|

ARWIX

|

14.60%

|

4.88%

|

6.24%

|

8/31/04

|

|

Russell 3000 Index

|

—

|

20.94%

|

2.89%

|

5.11%

|

—

|

|

Barclays Capital U.S. Aggregate Bond Index

|

—

|

4.44%

|

6.57%

|

5.35%

|

—

|

|

Institutional Class

|

ARWFX

|

14.82%

|

5.07%

|

6.45%

|

8/31/04

|

|

A Class(1)

No sales charge*

With sales charge*

|

ARWAX

|

14.23%

7.64%

|

4.60%

3.37%

|

5.97%

5.07%

|

8/31/04

|

|

C Class

|

ARWCX

|

13.50%

|

—

|

10.52%

|

3/1/10

|

|

R Class

|

ARWRX

|

13.97%

|

4.34%

|

5.71%

|

8/31/04

|

|

(1)

|

Prior to March 1, 2010, the A Class was referred to as the Advisor Class and did not have a front-end sales charge. Performance prior to that date has been restated to reflect this charge.

|

|

Total Returns as of July 31, 2011

|

||||

|

Average

Annual Returns

|

||||

|

Ticker

Symbol

|

1 year

|

Since

Inception

|

Inception

Date

|

|

|

LIVESTRONG 2030 Portfolio

|

||||

|

Investor Class

|

ARCVX

|

15.41%

|

1.88%

|

5/30/08

|

|

Russell 3000 Index

|

—

|

20.94%

|

0.26%

|

—

|

|

Barclays Capital U.S.

Aggregate Bond Index

|

—

|

4.44%

|

6.61%

|

—

|

|

Institutional Class

|

ARCSX

|

15.62%

|

2.08%

|

5/30/08

|

|

A Class(1)

No sales charge*

With sales charge*

|

ARCMX

|

15.15%

8.58%

|

1.61%

-0.27%

|

5/30/08

|

|

C Class

|

ARWOX

|

14.18%

|

10.87%

|

3/1/10

|

|

R Class

|

ARCRX

|

14.88%

|

1.37%

|

5/30/08

|

|

(1)

|

Prior to March 1, 2010, the A Class was referred to as the Advisor Class and did not have a front-end sales charge. Performance prior to that date has been restated to reflect this charge.

|

|

Total Returns as of July 31, 2011

|

|||||

|

Average Annual Returns

|

|||||

|

Ticker

Symbol

|

1 year

|

5 years

|

Since

Inception

|

Inception

Date

|

|

|

LIVESTRONG 2035 Portfolio

|

|||||

|

Investor Class

|

ARYIX

|

16.44%

|

4.54%

|

6.42%

|

8/31/04

|

|

Russell 3000 Index

|

—

|

20.94%

|

2.89%

|

5.11%

|

—

|

|

Barclays Capital U.S. Aggregate Bond Index

|

—

|

4.44%

|

6.57%

|

5.35%

|

—

|

|

Institutional Class

|

ARLIX

|

16.75%

|

4.74%

|

6.64%

|

8/31/04

|

|

A Class(1)

No sales charge*

With sales charge*

|

ARYAX

|

16.17%

9.54%

|

4.28%

3.05%

|

6.15%

5.25%

|

8/31/04

|

|

C Class

|

ARLCX

|

15.25%

|

—

|

11.48%

|

3/1/10

|

|

R Class

|

ARYRX

|

15.80%

|

4.00%

|

5.89%

|

8/31/04

|

|

(1)

|

Prior to March 1, 2010, the A Class was referred to as the Advisor Class and did not have a front-end sales charge. Performance prior to that date has been restated to reflect this charge.

|

|

Total Returns as of July 31, 2011

|

||||

|

Average

Annual Returns

|

||||

|

Ticker

Symbol

|

1 year

|

Since

Inception

|

Inception

Date

|

|

|

LIVESTRONG 2040 Portfolio

|

||||

|

Investor Class

|

ARDVX

|

17.57%

|

1.55%

|

5/30/08

|

|

Russell 3000 Index

|

—

|

20.94%

|

0.26%

|

—

|

|

Barclays Capital U.S.

Aggregate Bond Index

|

—

|

4.44%

|

6.61%

|

—

|

|

Institutional Class

|

ARDSX

|

17.78%

|

1.75%

|

5/30/08

|

|

A Class(1)

No sales charge*

With sales charge*

|

ARDMX

|

17.29%

10.56%

|

1.31%

-0.56%

|

5/30/08

|

|

C Class

|

ARNOX

|

16.46%

|

12.09%

|

3/1/10

|

|

R Class

|

ARDRX

|

17.03%

|

1.04%

|

5/30/08

|

|

(1)

|

Prior to March 1, 2010, the A Class was referred to as the Advisor Class and did not have a front-end sales charge. Performance prior to that date has been restated to reflect this charge.

|

|

Total Returns as of July 31, 2011

|

|||||

|

Average Annual Returns

|

|||||

|

Ticker

Symbol

|

1 year

|

5 years

|

Since

Inception

|

Inception

Date

|

|

|

LIVESTRONG 2045 Portfolio

|

|||||

|

Investor Class

|

AROIX

|

17.98%

|

4.35%

|

6.48%

|

8/31/04

|

|

Russell 3000 Index

|

—

|

20.94%

|

2.89%

|

5.11%

|

—

|

|

Barclays Capital U.S. Aggregate Bond Index

|

—

|

4.44%

|

6.57%

|

5.35%

|

—

|

|

Institutional Class

|

AOOIX

|

18.10%

|

4.54%

|

6.68%

|

8/31/04

|

|

A Class(1)

No sales charge*

With sales charge*

|

AROAX

|

17.63%

10.85%

|

4.08%

2.85%

|

6.20%

5.30%

|

8/31/04

|

|

C Class

|

AROCX

|

16.68%

|

—

|

12.32%

|

3/1/10

|

|

R Class

|

ARORX

|

17.35%

|

3.82%

|

5.95%

|

8/31/04

|

|

(1)

|

Prior to March 1, 2010, the A Class was referred to as the Advisor Class and did not have a front-end sales charge. Performance prior to that date has been restated to reflect this charge.

|

|

Total Returns as of July 31, 2011

|

||||

|

Average

Annual Returns

|

||||

|

Ticker

Symbol

|

1 year

|

Since

Inception

|

Inception

Date

|

|

|

LIVESTRONG 2050 Portfolio

|

||||

|

Investor Class

|

ARFVX

|

18.35%

|

0.64%

|

5/30/08

|

|

Russell 3000 Index

|

—

|

20.94%

|

0.26%

|

—

|

|

Barclays Capital U.S.

Aggregate Bond Index

|

—

|

4.44%

|

6.61%

|

—

|

|

Institutional Class

|

ARFSX

|

18.69%

|

0.87%

|

5/30/08

|

|

A Class(1)

No sales charge*

With sales charge*

|

ARFMX

|

18.08%

11.35%

|

0.40%

-1.45%

|

5/30/08

|

|

C Class

|

ARFDX

|

17.23%

|

12.54%

|

3/1/10

|

|

R Class

|

ARFWX

|

17.80%

|

0.17%

|

5/30/08

|

|

(1)

|

Prior to March 1, 2010, the A Class was referred to as the Advisor Class and did not have a front-end sales charge. Performance prior to that date has been restated to reflect this charge.

|

|

Total Returns as of July 31, 2011

|

|||

|

Ticker Symbol

|

Since Inception(1)

|

Inception Date

|

|

|

LIVESTRONG 2055 Portfolio

|

|||

|

Investor Class

|

AREVX

|

-0.80%

|

3/31/11

|

|

Russell 3000 Index

|

—

|

-2.32%

|

—

|

|

Barclays Capital U.S.

Aggregate Bond Index

|

—

|

3.91%

|

—

|

|

Institutional Class

|

ARENX

|

-0.80%

|

3/31/11

|

|

A Class

No sales charge*

With sales charge*

|

AREMX

|

-0.90%

-6.60%

|

3/31/11

|

|

C Class

No sales charge*

With sales charge*

|

AREFX

|

-1.20%

-2.19%

|

3/31/11

|

|

R Class

|

AREOX

|

-1.00%

|

3/31/11

|

|

(1)

|

Total returns for periods less than one year are not annualized.

|

|

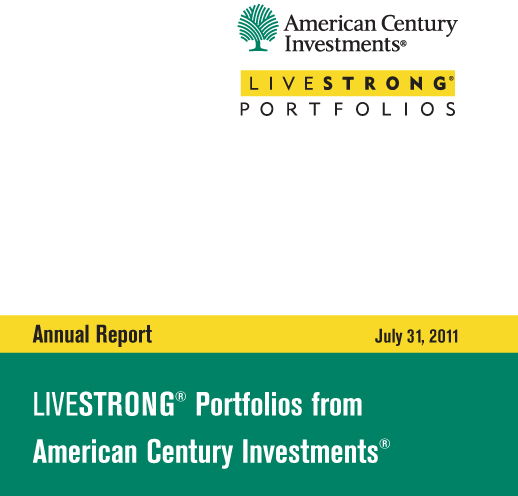

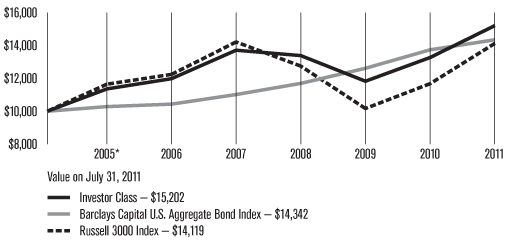

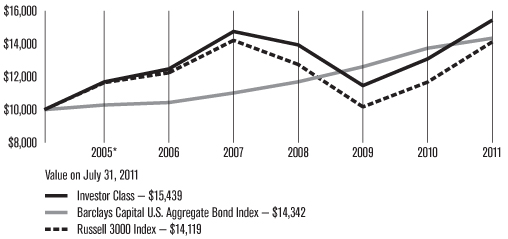

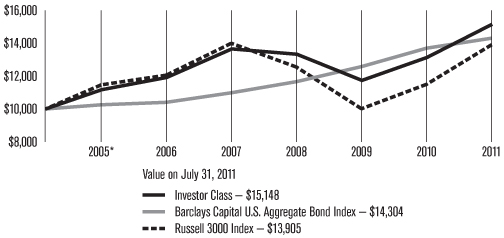

Growth of $10,000 Over Life of LIVESTRONG Income Portfolio — Investor Class

|

|

$10,000 investment made August 31, 2004

|

|

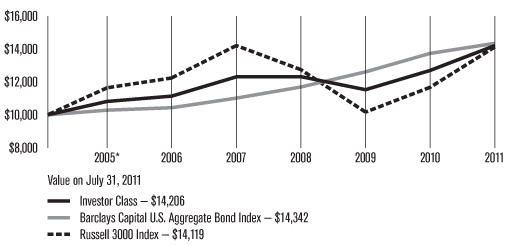

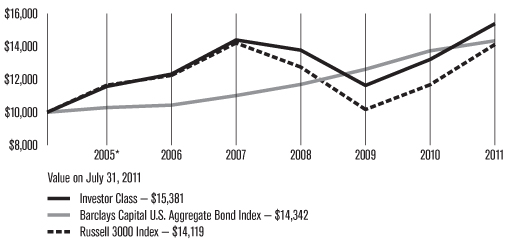

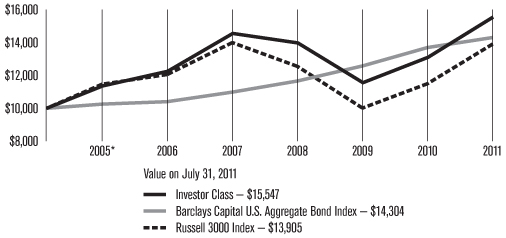

Growth of $10,000 Over Life of LIVESTRONG 2015 Portfolio — Investor Class

|

|

$10,000 investment made August 31, 2004

|

|

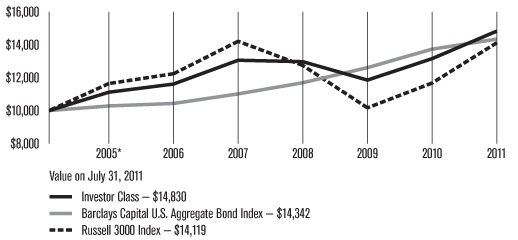

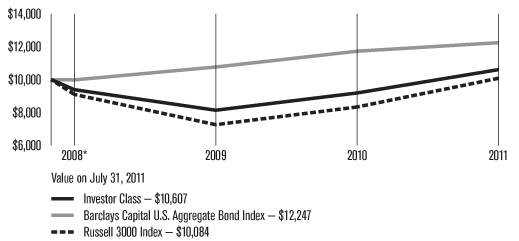

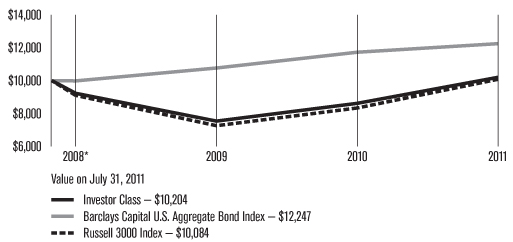

Growth of $10,000 Over Life of LIVESTRONG 2020 Portfolio — Investor Class

|

|

$10,000 investment made May 30, 2008

|

|

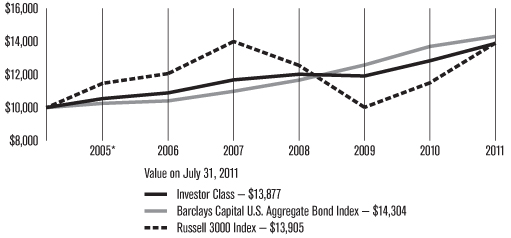

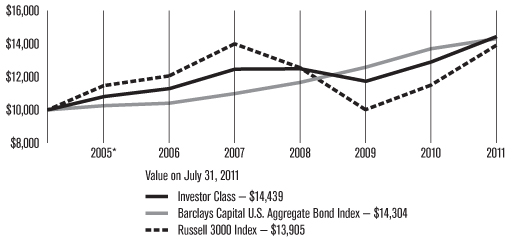

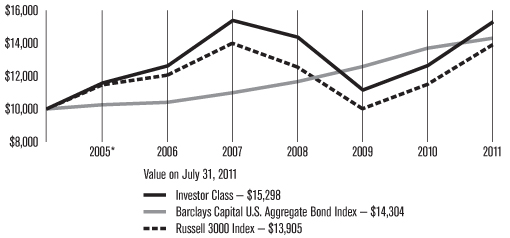

Growth of $10,000 Over Life of LIVESTRONG 2025 Portfolio — Investor Class

|

|

$10,000 investment made August 31, 2004

|

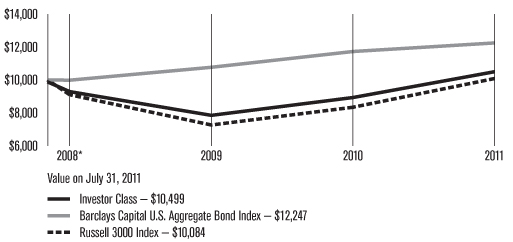

Data presented reflect past performance. Past performance is no guarantee of future results. Current performance may be higher or lower than the performance shown. Investment return and principal value will fluctuate, and redemption value may be more or less than original cost. To obtain performance data current to the most recent month end, please call 1-800-345-2021 or visit americancentury.com. The performance of LIVESTRONG Portfolios is dependent on the performance of their underlying American Century Investments funds, and will assume the risks associated with these funds. The risks will vary according to each LIVESTRONG Portfolio’s asset allocation, and a fund with a later target date is expected to be more volatile than one with an earlier target date. International investing involves special risks, such as political instability and currency fluctuations. Investing in emerging markets may accentuate these risks. As interest rates rise, bond values will decline.

|

Growth of $10,000 Over Life of LIVESTRONG 2030 Portfolio — Investor Class

|

|

$10,000 investment made May 30, 2008

|

|

Growth of $10,000 Over Life of LIVESTRONG 2035 Portfolio — Investor Class

|

|

$10,000 investment made August 31, 2004

|

*From 8/31/04, the Investor Class’s inception date. Not annualized.

|

Growth of $10,000 Over Life of LIVESTRONG 2040 Portfolio — Investor Class

|

|

$10,000 investment made May 30, 2008

|

|

Growth of $10,000 Over Life of LIVESTRONG 2045 Portfolio — Investor Class

|

|

$10,000 investment made August 31, 2004

|

|

Growth of $10,000 Over Life of LIVESTRONG 2050 Portfolio — Investor Class

|

|

$10,000 investment made May 30, 2008

|

*From 5/30/08, the Investor Class’s inception date. Not annualized.

|

Total Annual Fund Operating Expenses

|

|||||

|

Investor Class

|

Institutional Class

|

A Class

|

C Class

|

R Class

|

|

|

LIVESTRONG Income Portfolio

|

0.76%

|

0.56%

|

1.01%

|

1.76%

|

1.26%

|

|

LIVESTRONG 2015 Portfolio

|

0.79%

|

0.59%

|

1.04%

|

1.79%

|

1.29%

|

|

LIVESTRONG 2020 Portfolio

|

0.82%

|

0.62%

|

1.07%

|

1.82%

|

1.32%

|

|

LIVESTRONG 2025 Portfolio

|

0.84%

|

0.64%

|

1.09%

|

1.84%

|

1.34%

|

|

LIVESTRONG 2030 Portfolio

|

0.87%

|

0.67%

|

1.12%

|

1.87%

|

1.37%

|

|

LIVESTRONG 2035 Portfolio

|

0.90%

|

0.70%

|

1.15%

|

1.90%

|

1.40%

|

|

LIVESTRONG 2040 Portfolio

|

0.93%

|

0.73%

|

1.18%

|

1.93%

|

1.43%

|

|

LIVESTRONG 2045 Portfolio

|

0.95%

|

0.75%

|

1.20%

|

1.95%

|

1.45%

|

|

LIVESTRONG 2050 Portfolio

|

0.97%

|

0.77%

|

1.22%

|

1.97%

|

1.47%

|

|

LIVESTRONG 2055 Portfolio

|

0.95%

|

0.75%

|

1.20%

|

1.95%

|

1.45%

|

|

Market Index Total Returns

|

||||

|

For the 12 months ended July 31, 2011

|

||||

|

U.S. Stocks

|

||||

|

Russell 1000 Index (Large-Cap)

|

20.68 | % | ||

|

Russell Midcap Index

|

24.51 | % | ||

|

Russell 2000 Index (Small-Cap)

|

23.92 | % | ||

|

International Stocks

|

||||

|

MSCI EAFE (Europe, Australasia, Far East) Index

|

17.17 | % | ||

|

MSCI Emerging Markets Index

|

17.45 | % | ||

|

U.S. Fixed Income

|

||||

|

Barclays Capital U.S. Aggregate Bond Index

|

4.44 | % | ||

|

Barclays Capital U.S. Corporate High-Yield Bond Index

|

12.95 | % | ||

|

Barclays Capital U.S. Treasury Inflation Protected Securities (TIPS) Index

|

11.79 | % | ||

|

Barclays Capital U.S. Corporate Bond Index (investment-grade)

|

6.87 | % | ||

|

Barclays Capital U.S. MBS Index (mortgage-backed securities)

|

3.85 | % | ||

|

Barclays Capital U.S. Treasury Bond Index

|

3.39 | % | ||

|

International Bonds

|

||||

|

Barclays Capital Global Treasury Bond Index, ex-U.S.

|

11.75 | % | ||

|

Portfolio Characteristics

|

|

Underlying Fund Allocations(1) as a % of net assets as of July 31, 2011

|

||||||||||||||||||||

|

LIVESTRONG

Income

Portfolio

|

LIVESTRONG

2015

Portfolio

|

LIVESTRONG

2020

Portfolio

|

LIVESTRONG

2025

Portfolio

|

LIVESTRONG

2030

Portfolio

|

||||||||||||||||

|

Equity

|

||||||||||||||||||||

|

NT Equity

Growth Fund

|

12.8 | % | 12.4 | % | 12.2 | % | 12.0 | % | 12.3 | % | ||||||||||

|

NT Growth Fund

|

6.4 | % | 7.2 | % | 8.5 | % | 9.9 | % | 11.8 | % | ||||||||||

|

NT Large Company

Value Fund

|

10.8 | % | 10.8 | % | 11.0 | % | 11.5 | % | 12.1 | % | ||||||||||

|

NT Mid Cap

Value Fund

|

3.9 | % | 4.4 | % | 5.1 | % | 5.4 | % | 5.2 | % | ||||||||||

|

NT Small

Company Fund

|

1.9 | % | 1.9 | % | 2.1 | % | 2.8 | % | 3.8 | % | ||||||||||

|

NT VistaSM Fund

|

2.4 | % | 3.1 | % | 4.0 | % | 4.6 | % | 5.0 | % | ||||||||||

|

Real Estate Fund

|

1.0 | % | 1.2 | % | 1.4 | % | 1.7 | % | 1.9 | % | ||||||||||

|

NT Emerging

Markets Fund

|

— | 0.9 | % | 1.9 | % | 2.6 | % | 3.1 | % | |||||||||||

|

NT International

Growth Fund

|

4.9 | % | 5.6 | % | 6.5 | % | 7.8 | % | 9.2 | % | ||||||||||

|

Total Equity

|

44.1 | % | 47.5 | % | 52.7 | % | 58.3 | % | 64.4 | % | ||||||||||

|

Fixed Income

|

||||||||||||||||||||

|

High-Yield Fund

|

3.9 | % | 3.7 | % | 3.5 | % | 3.3 | % | 3.0 | % | ||||||||||

|

Inflation-Adjusted

Bond Fund

|

7.8 | % | 7.6 | % | 7.3 | % | 6.8 | % | 6.0 | % | ||||||||||

|

NT Diversified

Bond Fund

|

27.0 | % | 26.4 | % | 25.3 | % | 23.2 | % | 20.7 | % | ||||||||||

|

International

Bond Fund

|

7.1 | % | 6.5 | % | 5.4 | % | 3.3 | % | 0.8 | % | ||||||||||

|

Total Fixed Income

|

45.8 | % | 44.2 | % | 41.5 | % | 36.6 | % | 30.5 | % | ||||||||||

|

Premium Money

Market Fund

|

10.1 | % | 8.3 | % | 5.8 | % | 5.1 | % | 5.1 | % | ||||||||||

|

Other Assets

and Liabilities

|

— | (2) | — | (2) | — | (2) | — | (2) | — | (2) | ||||||||||

|

(1)

|

Institutional Class, except Premium Money Market Fund Investor Class.

|

|

(2)

|

Category is less than 0.05% of total net assets.

|

|

Underlying Fund Allocations(1) as a % of net assets as of July 31, 2011

|

||||||||||||||||||||

|

LIVESTRONG

2035

Portfolio

|

LIVESTRONG

2040

Portfolio

|

LIVESTRONG

2045

Portfolio

|

LIVESTRONG

2050

Portfolio

|

LIVESTRONG

2055

Portfolio

|

||||||||||||||||

|

Equity

|

||||||||||||||||||||

|

NT Equity

Growth Fund

|

12.8 | % | 13.9 | % | 14.5 | % | 15.0 | % | 15.2 | % | ||||||||||

|

NT Growth Fund

|

13.0 | % | 13.9 | % | 14.6 | % | 15.0 | % | 15.2 | % | ||||||||||

|

NT Large Company

Value Fund

|

13.0 | % | 14.1 | % | 14.8 | % | 15.3 | % | 15.4 | % | ||||||||||

|

NT Mid Cap

Value Fund

|

5.9 | % | 6.9 | % | 7.2 | % | 7.5 | % | 7.4 | % | ||||||||||

|

NT Small

Company Fund

|

4.0 | % | 3.9 | % | 4.1 | % | 4.7 | % | 5.0 | % | ||||||||||

|

NT VistaSM Fund

|

5.9 | % | 6.9 | % | 7.2 | % | 7.4 | % | 7.5 | % | ||||||||||

|

Real Estate Fund

|

2.2 | % | 2.4 | % | 2.7 | % | 2.9 | % | 3.0 | % | ||||||||||

|

NT Emerging

Markets Fund

|

4.0 | % | 5.0 | % | 5.9 | % | 6.4 | % | 6.5 | % | ||||||||||

|

NT International

Growth Fund

|

9.9 | % | 10.1 | % | 10.1 | % | 9.6 | % | 9.5 | % | ||||||||||

|

Total Equity

|

70.7 | % | 77.1 | % | 81.1 | % | 83.8 | % | 84.7 | % | ||||||||||

|

Fixed Income

|

||||||||||||||||||||

|

High-Yield Fund

|

2.5 | % | 2.1 | % | 1.9 | % | 1.6 | % | 1.5 | % | ||||||||||

|

Inflation-Adjusted

Bond Fund

|

5.3 | % | 4.4 | % | 3.8 | % | 3.2 | % | 3.1 | % | ||||||||||

|

NT Diversified

Bond Fund

|

18.2 | % | 15.6 | % | 13.2 | % | 11.4 | % | 10.7 | % | ||||||||||

|

Total Fixed Income

|

26.0 | % | 22.1 | % | 18.9 | % | 16.2 | % | 15.3 | % | ||||||||||

|

Premium Money

Market Fund

|

3.3 | % | 0.8 | % | — | — | — | |||||||||||||

|

Other Assets

and Liabilities

|

— | (2) | — | (2) | — | (2) | — | (2) | — | (2) | ||||||||||

|

(1)

|

Institutional Class, except Premium Money Market Fund Investor Class.

|

|

(2)

|

Category is less than 0.05% of total net assets.

|

|

Beginning

Account

Value

2/1/11

|

Ending

Account

Value

7/31/11

|

Expenses

Paid During

Period(1)

2/1/11 –

7/31/11

|

Annualized

Expense

Ratio(1)

|

Effective

Expenses

Paid During

Period(2)

2/1/11 –

7/31/11

|

Effective

Annualized

Expense

Ratio(2)

|

|

|

LIVESTRONG Income Portfolio

|

||||||

|

Actual

|

||||||

|

Investor Class

|

$1,000

|

$1,033.30

|

$1.06

|

0.21%

|

$3.83

|

0.76%

|

|

Institutional Class

|

$1,000

|

$1,034.20

|

$0.05

|

0.01%

|

$2.82

|

0.56%

|

|

A Class

|

$1,000

|

$1,032.10

|

$2.32

|

0.46%

|

$5.09

|

1.01%

|

|

C Class

|

$1,000

|

$1,028.40

|

$6.09

|

1.21%

|

$8.85

|

1.76%

|

|

R Class

|

$1,000

|

$1,030.90

|

$3.58

|

0.71%

|

$6.34

|

1.26%

|

|

Hypothetical

|

||||||

|

Investor Class

|

$1,000

|

$1,023.75

|

$1.05

|

0.21%

|

$3.81

|

0.76%

|

|

Institutional Class

|

$1,000

|

$1,024.74

|

$0.05

|

0.01%

|

$2.81

|

0.56%

|

|

A Class

|

$1,000

|

$1,022.51

|

$2.31

|

0.46%

|

$5.06

|

1.01%

|

|

C Class

|

$1,000

|

$1,018.79

|

$6.06

|

1.21%

|

$8.80

|

1.76%

|

|

R Class

|

$1,000

|

$1,021.27

|

$3.56

|

0.71%

|

$6.31

|

1.26%

|

|

LIVESTRONG 2015 Portfolio

|

||||||

|

Actual

|

||||||

|

Investor Class

|

$1,000

|

$1,033.00

|

$1.06

|

0.21%

|

$3.93

|

0.78%

|

|

Institutional Class

|

$1,000

|

$1,033.90

|

$0.05

|

0.01%

|

$2.92

|

0.58%

|

|

A Class

|

$1,000

|

$1,032.20

|

$2.32

|

0.46%

|

$5.19

|

1.03%

|

|

C Class

|

$1,000

|

$1,028.70

|

$6.09

|

1.21%

|

$8.95

|

1.78%

|

|

R Class

|

$1,000

|

$1,030.40

|

$3.57

|

0.71%

|

$6.44

|

1.28%

|

|

Hypothetical

|

||||||

|

Investor Class

|

$1,000

|

$1,023.75

|

$1.05

|

0.21%

|

$3.91

|

0.78%

|

|

Institutional Class

|

$1,000

|

$1,024.74

|

$0.05

|

0.01%

|

$2.91

|

0.58%

|

|

A Class

|

$1,000

|

$1,022.51

|

$2.31

|

0.46%

|

$5.16

|

1.03%

|

|

C Class

|

$1,000

|

$1,018.79

|

$6.06

|

1.21%

|

$8.90

|

1.78%

|

|

R Class

|

$1,000

|

$1,021.27

|

$3.56

|

0.71%

|

$6.41

|

1.28%

|

|

(1)

|

Expenses are equal to the class’s annualized expense ratio listed in the table above, multiplied by the average account value over the period, multiplied by 181, the number of days in the most recent fiscal half-year, divided by 365, to reflect the one-half year period. The fees and expenses of the underlying American Century Investments funds in which the fund invests are not included in the class’s annualized expense ratio.

|

|

(2)

|

Effective expenses reflect the sum of expenses borne directly by the class plus the fund’s pro rata share of the weighted average expense ratio of the underlying funds in which it invests. The effective annualized expense ratio combines the class’s annualized expense ratio and the annualized weighted average expense ratio of the underlying funds. The annualized weighted average expense ratio of the underlying funds for the one-half year period reflects the actual expense ratio of each underlying fund from its most recent shareholder report, annualized and weighted for the fund’s relative average investment therein during the period.

|

|

Beginning

Account

Value

2/1/11

|

Ending

Account

Value

7/31/11

|

Expenses

Paid During

Period(1)

2/1/11 –

7/31/11

|

Annualized

Expense

Ratio(1)

|

Effective

Expenses

Paid During

Period(2)

2/1/11 –

7/31/11

|

Effective

Annualized

Expense

Ratio(2)

|

|

|

LIVESTRONG 2020 Portfolio

|

||||||

|

Actual

|

||||||

|

Investor Class

|

$1,000

|

$1,032.90

|

$1.06

|

0.21%

|

$4.08

|

0.81%

|

|

Institutional Class

|

$1,000

|

$1,033.90

|

$0.05

|

0.01%

|

$3.08

|

0.61%

|

|

A Class

|

$1,000

|

$1,032.90

|

$2.32

|

0.46%

|

$5.34

|

1.06%

|

|

C Class

|

$1,000

|

$1,028.90

|

$6.09

|

1.21%

|

$9.11

|

1.81%

|

|

R Class

|

$1,000

|

$1,030.90

|

$3.58

|

0.71%

|

$6.60

|

1.31%

|

|

Hypothetical

|

||||||

|

Investor Class

|

$1,000

|

$1,023.75

|

$1.05

|

0.21%

|

$4.06

|

0.81%

|

|

Institutional Class

|

$1,000

|

$1,024.74

|

$0.05

|

0.01%

|

$3.06

|

0.61%

|

|

A Class

|

$1,000

|

$1,022.51

|

$2.31

|

0.46%

|

$5.31

|

1.06%

|

|

C Class

|

$1,000

|

$1,018.79

|

$6.06

|

1.21%

|

$9.05

|

1.81%

|

|

R Class

|

$1,000

|

$1,021.27

|

$3.56

|

0.71%

|

$6.56

|

1.31%

|

|

LIVESTRONG 2025 Portfolio

|

||||||

|

Actual

|

||||||

|

Investor Class

|

$1,000

|

$1,031.50

|

$1.06

|

0.21%

|

$4.18

|

0.83%

|

|

Institutional Class

|

$1,000

|

$1,032.30

|

$0.05

|

0.01%

|

$3.17

|

0.63%

|

|

A Class

|

$1,000

|

$1,029.80

|

$2.32

|

0.46%

|

$5.44

|

1.08%

|

|

C Class

|

$1,000

|

$1,027.20

|

$6.08

|

1.21%

|

$9.20

|

1.83%

|

|

R Class

|

$1,000

|

$1,028.90

|

$3.57

|

0.71%

|

$6.69

|

1.33%

|

|

Hypothetical

|

||||||

|

Investor Class

|

$1,000

|

$1,023.75

|

$1.05

|

0.21%

|

$4.16

|

0.83%

|

|

Institutional Class

|

$1,000

|

$1,024.74

|

$0.05

|

0.01%

|

$3.16

|

0.63%

|

|

A Class

|

$1,000

|

$1,022.51

|

$2.31

|

0.46%

|

$5.41

|

1.08%

|

|

C Class

|

$1,000

|

$1,018.79

|

$6.06

|

1.21%

|

$9.15

|

1.83%

|

|

R Class

|

$1,000

|

$1,021.27

|

$3.56

|

0.71%

|

$6.66

|

1.33%

|

|

(1)

|

Expenses are equal to the class’s annualized expense ratio listed in the table above, multiplied by the average account value over the period, multiplied by 181, the number of days in the most recent fiscal half-year, divided by 365, to reflect the one-half year period. The fees and expenses of the underlying American Century Investments funds in which the fund invests are not included in the class’s annualized expense ratio.

|

|

(2)

|

Effective expenses reflect the sum of expenses borne directly by the class plus the fund’s pro rata share of the weighted average expense ratio of the underlying funds in which it invests. The effective annualized expense ratio combines the class’s annualized expense ratio and the annualized weighted average expense ratio of the underlying funds. The annualized weighted average expense ratio of the underlying funds for the one-half year period reflects the actual expense ratio of each underlying fund from its most recent shareholder report, annualized and weighted for the fund’s relative average investment therein during the period.

|

|

Beginning

Account

Value

2/1/11

|

Ending

Account

Value

7/31/11

|

Expenses

Paid During

Period(1)

2/1/11 –

7/31/11

|

Annualized

Expense

Ratio(1)

|

Effective

Expenses

Paid During

Period(2)

2/1/11 –

7/31/11

|

Effective

Annualized

Expense

Ratio(2)

|

|

|

LIVESTRONG 2030 Portfolio

|

||||||

|

Actual

|

||||||

|

Investor Class

|

$1,000

|

$1,029.40

|

$1.06

|

0.21%

|

$4.33

|

0.86%

|

|

Institutional Class

|

$1,000

|

$1,031.40

|

$0.05

|

0.01%

|

$3.32

|

0.66%

|

|

A Class

|

$1,000

|

$1,028.40

|

$2.31

|

0.46%

|

$5.58

|

1.11%

|

|

C Class

|

$1,000

|

$1,024.30

|

$6.07

|

1.21%

|

$9.34

|

1.86%

|

|

R Class

|

$1,000

|

$1,027.40

|

$3.57

|

0.71%

|

$6.84

|

1.36%

|

|

Hypothetical

|

||||||

|

Investor Class

|

$1,000

|

$1,023.75

|

$1.05

|

0.21%

|

$4.31

|

0.86%

|

|

Institutional Class

|

$1,000

|

$1,024.74

|

$0.05

|

0.01%

|

$3.31

|

0.66%

|

|

A Class

|

$1,000

|

$1,022.51

|

$2.31

|

0.46%

|

$5.56

|

1.11%

|

|

C Class

|

$1,000

|

$1,018.79

|

$6.06

|

1.21%

|

$9.30

|

1.86%

|

|

R Class

|

$1,000

|

$1,021.27

|

$3.56

|

0.71%

|

$6.80

|

1.36%

|

|

LIVESTRONG 2035 Portfolio

|

||||||

|

Actual

|

||||||

|

Investor Class

|

$1,000

|

$1,028.80

|

$1.06

|

0.21%

|

$4.48

|

0.89%

|

|

Institutional Class

|

$1,000

|

$1,030.40

|

$0.05

|

0.01%

|

$3.47

|

0.69%

|

|

A Class

|

$1,000

|

$1,028.00

|

$2.31

|

0.46%

|

$5.73

|

1.14%

|

|

C Class

|

$1,000

|

$1,023.00

|

$6.07

|

1.21%

|

$9.48

|

1.89%

|

|

R Class

|

$1,000

|

$1,026.30

|

$3.57

|

0.71%

|

$6.98

|

1.39%

|

|

Hypothetical

|

||||||

|

Investor Class

|

$1,000

|

$1,023.75

|

$1.05

|

0.21%

|

$4.46

|

0.89%

|

|

Institutional Class

|

$1,000

|

$1,024.74

|

$0.05

|

0.01%

|

$3.46

|

0.69%

|

|

A Class

|

$1,000

|

$1,022.51

|

$2.31

|

0.46%

|

$5.71

|

1.14%

|

|

C Class

|

$1,000

|

$1,018.79

|

$6.06

|

1.21%

|

$9.44

|

1.89%

|

|

R Class

|

$1,000

|

$1,021.27

|

$3.56

|

0.71%

|

$6.95

|

1.39%

|

|

(1)

|

Expenses are equal to the class’s annualized expense ratio listed in the table above, multiplied by the average account value over the period, multiplied by 181, the number of days in the most recent fiscal half-year, divided by 365, to reflect the one-half year period. The fees and expenses of the underlying American Century Investments funds in which the fund invests are not included in the class’s annualized expense ratio.

|

|

(2)

|

Effective expenses reflect the sum of expenses borne directly by the class plus the fund’s pro rata share of the weighted average expense ratio of the underlying funds in which it invests. The effective annualized expense ratio combines the class’s annualized expense ratio and the annualized weighted average expense ratio of the underlying funds. The annualized weighted average expense ratio of the underlying funds for the one-half year period reflects the actual expense ratio of each underlying fund from its most recent shareholder report, annualized and weighted for the fund’s relative average investment therein during the period.

|

|

Beginning

Account

Value

2/1/11

|

Ending

Account

Value

7/31/11

|

Expenses

Paid During

Period(1)

2/1/11 –

7/31/11

|

Annualized

Expense

Ratio(1)

|

Effective

Expenses

Paid During

Period(2)

2/1/11 –

7/31/11

|

Effective

Annualized

Expense

Ratio(2)

|

|

|

LIVESTRONG 2040 Portfolio

|

||||||

|

Actual

|

||||||

|

Investor Class

|

$1,000

|

$1,027.40

|

$1.06

|

0.21%

|

$4.62

|

0.92%

|

|

Institutional Class

|

$1,000

|

$1,028.50

|

$0.05

|

0.01%

|

$3.62

|

0.72%

|

|

A Class

|

$1,000

|

$1,026.40

|

$2.31

|

0.46%

|

$5.88

|

1.17%

|

|

C Class

|

$1,000

|

$1,023.40

|

$6.07

|

1.21%

|

$9.63

|

1.92%

|

|

R Class

|

$1,000

|

$1,025.40

|

$3.57

|

0.71%

|

$7.13

|

1.42%

|

|

Hypothetical

|

||||||

|

Investor Class

|

$1,000

|

$1,023.75

|

$1.05

|

0.21%

|

$4.61

|

0.92%

|

|

Institutional Class

|

$1,000

|

$1,024.74

|

$0.05

|

0.01%

|

$3.61

|

0.72%

|

|

A Class

|

$1,000

|

$1,022.51

|

$2.31

|

0.46%

|

$5.86

|

1.17%

|

|

C Class

|

$1,000

|

$1,018.79

|

$6.06

|

1.21%

|

$9.59

|

1.92%

|

|

R Class

|

$1,000

|

$1,021.27

|

$3.56

|

0.71%

|

$7.10

|

1.42%

|

|

LIVESTRONG 2045 Portfolio

|

||||||

|

Actual

|

||||||

|

Investor Class

|

$1,000

|

$1,027.80

|

$1.06

|

0.21%

|

$4.73

|

0.94%

|

|

Institutional Class

|

$1,000

|

$1,028.60

|

$0.05

|

0.01%

|

$3.72

|

0.74%

|

|

A Class

|

$1,000

|

$1,026.10

|

$2.31

|

0.46%

|

$5.98

|

1.19%

|

|

C Class

|

$1,000

|

$1,022.00

|

$6.07

|

1.21%

|

$9.73

|

1.94%

|

|

R Class

|

$1,000

|

$1,024.50

|

$3.56

|

0.71%

|

$7.23

|

1.44%

|

|

Hypothetical

|

||||||

|

Investor Class

|

$1,000

|

$1,023.75

|

$1.05

|

0.21%

|

$4.71

|

0.94%

|

|

Institutional Class

|

$1,000

|

$1,024.74

|

$0.05

|

0.01%

|

$3.71

|

0.74%

|

|

A Class

|

$1,000

|

$1,022.51

|

$2.31

|

0.46%

|

$5.96

|

1.19%

|

|

C Class

|

$1,000

|

$1,018.79

|

$6.06

|

1.21%

|

$9.69

|

1.94%

|

|

R Class

|

$1,000

|

$1,021.27

|

$3.56

|

0.71%

|

$7.20

|

1.44%

|

|

(1)

|

Expenses are equal to the class’s annualized expense ratio listed in the table above, multiplied by the average account value over the period, multiplied by 181, the number of days in the most recent fiscal half-year, divided by 365, to reflect the one-half year period. The fees and expenses of the underlying American Century Investments funds in which the fund invests are not included in the class’s annualized expense ratio.

|

|

(2)

|

Effective expenses reflect the sum of expenses borne directly by the class plus the fund’s pro rata share of the weighted average expense ratio of the underlying funds in which it invests. The effective annualized expense ratio combines the class’s annualized expense ratio and the annualized weighted average expense ratio of the underlying funds. The annualized weighted average expense ratio of the underlying funds for the one-half year period reflects the actual expense ratio of each underlying fund from its most recent shareholder report, annualized and weighted for the fund’s relative average investment therein during the period.

|

|

Beginning

Account

Value

2/1/11

|

Ending

Account

Value

7/31/11

|

Expenses

Paid During

Period(1)

2/1/11 –

7/31/11

|

Annualized

Expense

Ratio(1)

|

Effective

Expenses

Paid During

Period(2)

2/1/11 –

7/31/11

|

Effective

Annualized

Expense

Ratio(2)

|

|

|

LIVESTRONG 2050 Portfolio

|

||||||

|

Actual

|

||||||

|

Investor Class

|

$1,000

|

$1,027.00

|

$1.06

|

0.21%

|

$4.77

|

0.95%

|

|

Institutional Class

|

$1,000

|

$1,028.00

|

$0.05

|

0.01%

|

$3.77

|

0.75%

|

|

A Class

|

$1,000

|

$1,026.00

|

$2.31

|

0.46%

|

$6.03

|

1.20%

|

|

C Class

|

$1,000

|

$1,022.80

|

$6.07

|

1.21%

|

$9.78

|

1.95%

|

|

R Class

|

$1,000

|

$1,024.90

|

$3.56

|

0.71%

|

$7.28

|

1.45%

|

|

Hypothetical

|

||||||

|

Investor Class

|

$1,000

|

$1,023.75

|

$1.05

|

0.21%

|

$4.76

|

0.95%

|

|

Institutional Class

|

$1,000

|

$1,024.74

|

$0.05

|

0.01%

|

$3.76

|

0.75%

|

|

A Class

|

$1,000

|

$1,022.51

|

$2.31

|

0.46%

|

$6.01

|

1.20%

|

|

C Class

|

$1,000

|

$1,018.79

|

$6.06

|

1.21%

|

$9.74

|

1.95%

|

|

R Class

|

$1,000

|

$1,021.27

|

$3.56

|

0.71%

|

$7.25

|

1.45%

|

|

(1)

|

Expenses are equal to the class’s annualized expense ratio listed in the table above, multiplied by the average account value over the period, multiplied by 181, the number of days in the most recent fiscal half-year, divided by 365, to reflect the one-half year period. The fees and expenses of the underlying American Century Investments funds in which the fund invests are not included in the class’s annualized expense ratio.

|

|

(2)

|

Effective expenses reflect the sum of expenses borne directly by the class plus the fund’s pro rata share of the weighted average expense ratio of the underlying funds in which it invests. The effective annualized expense ratio combines the class’s annualized expense ratio and the annualized weighted average expense ratio of the underlying funds. The annualized weighted average expense ratio of the underlying funds for the one-half year period reflects the actual expense ratio of each underlying fund from its most recent shareholder report, annualized and weighted for the fund’s relative average investment therein during the period.

|

|

Beginning

Account

Value

2/1/11

|

Ending

Account

Value

7/31/11

|

Expenses

Paid During

Period(1)

2/1/11 –

7/31/11

|

Annualized

Expense

Ratio(1)

|

Effective

Expenses

Paid During

Period(2)

2/1/11 –

7/31/11

|

Effective

Annualized

Expense

Ratio(2)

|

|

|

LIVESTRONG 2055 Portfolio

|

||||||

|

Actual

|

||||||

|

Investor Class

|

$1,000

|

$992.00(3)

|

$0.67(4)

|

0.20%

|

$3.13(4)

|

0.94%

|

|

Institutional Class

|

$1,000

|

$992.00(3)

|

$0.00(4)

|

0.00%(5)

|

$2.46(4)

|

0.74%

|

|

A Class

|

$1,000

|

$991.00(3)

|

$1.50(4)

|

0.45%

|

$3.96(4)

|

1.19%

|

|

C Class

|

$1,000

|

$988.00(3)

|

$3.99(4)

|

1.20%

|

$6.45(4)

|

1.94%

|

|

R Class

|

$1,000

|

$990.00(3)

|

$2.33(4)

|

0.70%

|

$4.79(4)

|

1.44%

|

|

Hypothetical

|

||||||

|

Investor Class

|

$1,000

|

$1,023.80(6)

|

$1.00(6)

|

0.20%

|

$4.71(6)

|

0.94%

|

|

Institutional Class

|

$1,000

|

$1,024.79(6)

|

$0.00(6)

|

0.00%(5)

|

$3.71(6)

|

0.74%

|

|

A Class

|

$1,000

|

$1,022.56(6)

|

$2.26(6)

|

0.45%

|

$5.96(6)

|

1.19%

|

|

C Class

|

$1,000

|

$1,018.84(6)

|

$6.01(6)

|

1.20%

|

$9.69(6)

|

1.94%

|

|

R Class

|

$1,000

|

$1,021.32(6)

|

$3.51(6)

|

0.70%

|

$7.20(6)

|

1.44%

|

|

(1)

|

Expenses are equal to the class’s annualized expense ratio listed in the table above, multiplied by the average account value over the period, multiplied by 181, the number of days in the most recent fiscal half-year, divided by 365, to reflect the one-half year period. The fees and expenses of the underlying American Century Investments funds in which the fund invests are not included in the class’s annualized expense ratio.

|

|

(2)

|

Effective expenses reflect the sum of expenses borne directly by the class plus the fund’s pro rata share of the weighted average expense ratio of the underlying funds in which it invests. The effective annualized expense ratio combines the class’s annualized expense ratio and the annualized weighted average expense ratio of the underlying funds. The annualized weighted average expense ratio of the underlying funds for the one-half year period reflects the actual expense ratio of each underlying fund from its most recent shareholder report, annualized and weighted for the fund’s relative average investment therein during the period.

|

|

(3)

|

Ending account value based on actual return from March 31, 2011 (fund inception) through July 31, 2011.

|

|

(4)

|

Expenses are equal to the class’s annualized expense ratio listed in the table above, multiplied by the average account value over the period, multiplied by 122, the number of days in the period from March 31, 2011 (fund inception) through July 31, 2011, divided by 365, to reflect the period. Had the class been available for the full period, the expenses paid during the period would have been higher.

|

|

(5)

|

Other expenses, which include the fees and expenses of the fund’s independent directors and its legal counsel, as well as interest, did not exceed 0.005%.

|

|

(6)

|

Ending account value and expenses paid during period assumes the class had been available throughout the entire period and are calculated using the class’s annualized expense ratio listed in the table above.

|

|

Shares

|

Value

|

|||||||

|

LIVESTRONG Income Portfolio

|

||||||||

|

Mutual Funds(1) — 100.0%

|

||||||||

|

DOMESTIC EQUITY FUNDS — 39.2%

|

||||||||

|

NT Equity Growth Fund Institutional Class

|

3,809,560 | $38,133,698 | ||||||

|

NT Growth Fund Institutional Class

|

1,547,706 | 19,052,255 | ||||||

|

NT Large Company Value Fund Institutional Class

|

3,811,026 | 32,317,497 | ||||||

|

NT Mid Cap Value Fund Institutional Class

|

1,141,255 | 11,640,797 | ||||||

|

NT Small Company Fund Institutional Class

|

656,316 | 5,808,397 | ||||||

|

NT Vista Fund Institutional Class(2)

|

676,274 | 7,317,287 | ||||||

|

Real Estate Fund Institutional Class

|

142,599 | 2,973,193 | ||||||

| 117,243,124 | ||||||||

|

DOMESTIC FIXED INCOME FUNDS — 38.7%

|

||||||||

|

High-Yield Fund Institutional Class

|

1,865,156 | 11,489,363 | ||||||

|

Inflation-Adjusted Bond Fund Institutional Class

|

1,839,721 | 23,382,848 | ||||||

|

NT Diversified Bond Fund Institutional Class

|

7,438,053 | 80,777,257 | ||||||

| 115,649,468 | ||||||||

|

MONEY MARKET FUNDS — 10.1%

|

||||||||

|

Premium Money Market Fund Investor Class

|

30,139,926 | 30,139,926 | ||||||

|

INTERNATIONAL FIXED INCOME FUNDS — 7.1%

|

||||||||

|

International Bond Fund Institutional Class

|

1,415,907 | 21,224,449 | ||||||

|

INTERNATIONAL EQUITY FUNDS — 4.9%

|

||||||||

|

NT International Growth Fund Institutional Class

|

1,444,074 | 14,787,321 | ||||||

|

TOTAL INVESTMENT SECURITIES — 100.0% (Cost $253,659,212)

|

299,044,288 | |||||||

|

OTHER ASSETS AND LIABILITIES(3)

|

— | |||||||

|

TOTAL NET ASSETS — 100.0%

|

$299,044,288 | |||||||

|

(1)

|

Investments are funds within the American Century Investments family of funds, of which certain funds may be deemed to be under common control because of the same board of directors.

|

|

(2)

|

Non-Income producing.

|

|

(3)

|

Category is less than 0.05% of total net assets.

|

|

Shares

|

Value

|

|||||||

|

LIVESTRONG 2015 Portfolio

|

||||||||

|

Mutual Funds(1) — 100.0%

|

||||||||

|

DOMESTIC EQUITY FUNDS — 41.0%

|

||||||||

|

NT Equity Growth Fund Institutional Class

|

9,141,749 | $91,508,910 | ||||||

|

NT Growth Fund Institutional Class

|

4,325,052 | 53,241,385 | ||||||

|

NT Large Company Value Fund Institutional Class

|

9,352,451 | 79,308,787 | ||||||

|

NT Mid Cap Value Fund Institutional Class

|

3,137,879 | 32,006,362 | ||||||

|

NT Small Company Fund Institutional Class

|

1,574,723 | 13,936,298 | ||||||

|

NT Vista Fund Institutional Class(2)

|

2,078,971 | 22,494,461 | ||||||

|

Real Estate Fund Institutional Class

|

420,418 | 8,765,721 | ||||||

| 301,261,924 | ||||||||

|

DOMESTIC FIXED INCOME FUNDS — 37.7%

|

||||||||

|

High-Yield Fund Institutional Class

|

4,444,513 | 27,378,203 | ||||||

|

Inflation-Adjusted Bond Fund Institutional Class

|

4,430,842 | 56,315,996 | ||||||

|

NT Diversified Bond Fund Institutional Class

|

17,850,926 | 193,861,059 | ||||||

| 277,555,258 | ||||||||

|

MONEY MARKET FUNDS — 8.3%

|

||||||||

|

Premium Money Market Fund Investor Class

|

61,073,697 | 61,073,697 | ||||||

|

INTERNATIONAL EQUITY FUNDS — 6.5%

|

||||||||

|

NT Emerging Markets Fund Institutional Class(2)

|

609,882 | 6,714,804 | ||||||

|

NT International Growth Fund Institutional Class

|

4,034,890 | 41,317,276 | ||||||

| 48,032,080 | ||||||||

|

INTERNATIONAL FIXED INCOME FUNDS — 6.5%

|

||||||||

|

International Bond Fund Institutional Class

|

3,174,979 | 47,592,937 | ||||||

|

TOTAL INVESTMENT SECURITIES — 100.0% (Cost $641,550,913)

|

735,515,896 | |||||||

|

OTHER ASSETS AND LIABILITIES(3)

|

— | |||||||

|

TOTAL NET ASSETS — 100.0%

|

$735,515,896 | |||||||

|

(1)

|

Investments are funds within the American Century Investments family of funds, of which certain funds may be deemed to be under common control because of the same board of directors.

|

|

(2)

|

Non-income producing.

|

|

(3)

|

Category is less than 0.05% of total net assets.

|

|

Shares

|

Value

|

|||||||

|

LIVESTRONG 2020 Portfolio

|

||||||||

|

Mutual Funds(1) — 100.0%

|

||||||||

|

DOMESTIC EQUITY FUNDS — 44.3%

|

||||||||

|

NT Equity Growth Fund Institutional Class

|

5,291,922 | $52,972,136 | ||||||

|

NT Growth Fund Institutional Class

|

2,988,657 | 36,790,370 | ||||||

|

NT Large Company Value Fund Institutional Class

|

5,669,354 | 48,076,121 | ||||||

|

NT Mid Cap Value Fund Institutional Class

|

2,188,104 | 22,318,660 | ||||||

|

NT Small Company Fund Institutional Class

|

1,012,997 | 8,965,027 | ||||||

|

NT Vista Fund Institutional Class(2)

|

1,620,383 | 17,532,548 | ||||||

|

Real Estate Fund Institutional Class

|

298,974 | 6,233,611 | ||||||

| 192,888,473 | ||||||||

|

DOMESTIC FIXED INCOME FUNDS — 36.1%

|

||||||||

|

High-Yield Fund Institutional Class

|

2,516,284 | 15,500,310 | ||||||

|

Inflation-Adjusted Bond Fund Institutional Class

|

2,488,738 | 31,631,860 | ||||||

|

NT Diversified Bond Fund Institutional Class

|

10,138,888 | 110,108,320 | ||||||

| 157,240,490 | ||||||||

|

INTERNATIONAL EQUITY FUNDS — 8.4%

|

||||||||

|

NT Emerging Markets Fund Institutional Class(2)

|

742,812 | 8,178,357 | ||||||

|

NT International Growth Fund Institutional Class

|

2,787,782 | 28,546,882 | ||||||

| 36,725,239 | ||||||||

|

MONEY MARKET FUNDS — 5.8%

|

||||||||

|

Premium Money Market Fund Investor Class

|

25,265,656 | 25,265,656 | ||||||

|

INTERNATIONAL FIXED INCOME FUNDS — 5.4%

|

||||||||

|

International Bond Fund Institutional Class

|

1,568,846 | 23,517,008 | ||||||

|

TOTAL INVESTMENT SECURITIES — 100.0% (Cost $378,100,524)

|

435,636,866 | |||||||

|

OTHER ASSETS AND LIABILITIES(3)

|

— | |||||||

|

TOTAL NET ASSETS — 100.0%

|

$435,636,866 | |||||||

|

(1)

|

Investments are funds within the American Century Investments family of funds, of which certain funds may be deemed to be under common control because of the same board of directors.

|

|

(2)

|

Non-income producing.

|

|

(3)

|

Category is less than 0.05% of total net assets.

|

|

Shares

|

Value

|

|||||||

|

LIVESTRONG 2025 Portfolio

|

||||||||

|

Mutual Funds(1) — 100.0%

|

||||||||

|

DOMESTIC EQUITY FUNDS — 47.9%

|

||||||||

|

NT Equity Growth Fund Institutional Class

|

12,208,924 | $122,211,331 | ||||||

|

NT Growth Fund Institutional Class

|

8,138,978 | 100,190,820 | ||||||

|

NT Large Company Value Fund Institutional Class

|

13,743,641 | 116,546,073 | ||||||

|

NT Mid Cap Value Fund Institutional Class

|

5,352,697 | 54,597,509 | ||||||

|

NT Small Company Fund Institutional Class

|

3,228,528 | 28,572,477 | ||||||

|

NT Vista Fund Institutional Class(2)

|

4,367,045 | 47,251,421 | ||||||

|

Real Estate Fund Institutional Class

|

825,558 | 17,212,874 | ||||||

| 486,582,505 | ||||||||

|

DOMESTIC FIXED INCOME FUNDS — 33.3%

|

||||||||

|

High-Yield Fund Institutional Class

|

5,482,852 | 33,774,366 | ||||||

|

Inflation-Adjusted Bond Fund Institutional Class

|

5,404,546 | 68,691,782 | ||||||

|

NT Diversified Bond Fund Institutional Class

|

21,697,686 | 235,636,872 | ||||||

| 338,103,020 | ||||||||

|

INTERNATIONAL EQUITY FUNDS — 10.4%

|

||||||||

|

NT Emerging Markets Fund Institutional Class(2)

|

2,383,190 | 26,238,923 | ||||||

|

NT International Growth Fund Institutional Class

|

7,785,848 | 79,727,082 | ||||||

| 105,966,005 | ||||||||

|

MONEY MARKET FUNDS — 5.1%

|

||||||||

|

Premium Money Market Fund Investor Class

|

51,475,048 | 51,475,048 | ||||||

|

INTERNATIONAL FIXED INCOME FUNDS — 3.3%

|

||||||||

|

International Bond Fund Institutional Class

|

2,248,422 | 33,703,848 | ||||||

|

TOTAL INVESTMENT SECURITIES — 100.0% (Cost $876,593,179)

|

1,015,830,426 | |||||||

|

OTHER ASSETS AND LIABILITIES(3)

|

— | |||||||

|

TOTAL NET ASSETS — 100.0%

|

$1,015,830,426 | |||||||

|

(1)

|

Investments are funds within the American Century Investments family of funds, of which certain funds may be deemed to be under common control because of the same board of directors.

|

|

(2)

|

Non-income producing.

|

|

(3)

|

Category is less than 0.05% of total net assets.

|

|

Shares

|

Value

|

|||||||

|

LIVESTRONG 2030 Portfolio

|

||||||||

|

Mutual Funds(1) — 100.0%

|

||||||||

|

DOMESTIC EQUITY FUNDS — 52.1%

|

||||||||

|

NT Equity Growth Fund Institutional Class

|

4,576,108 | $45,806,844 | ||||||

|

NT Growth Fund Institutional Class

|

3,575,184 | 44,010,509 | ||||||

|

NT Large Company Value Fund Institutional Class

|

5,302,532 | 44,965,472 | ||||||

|

NT Mid Cap Value Fund Institutional Class

|

1,884,291 | 19,219,768 | ||||||

|

NT Small Company Fund Institutional Class

|

1,610,307 | 14,251,220 | ||||||

|

NT Vista Fund Institutional Class(2)

|

1,724,400 | 18,658,012 | ||||||

|

Real Estate Fund Institutional Class

|

343,442 | 7,160,772 | ||||||

| 194,072,597 | ||||||||

|

DOMESTIC FIXED INCOME FUNDS — 29.7%

|

||||||||

|

High-Yield Fund Institutional Class

|

1,808,624 | 11,141,124 | ||||||

|

Inflation-Adjusted Bond Fund Institutional Class

|

1,761,582 | 22,389,710 | ||||||

|

NT Diversified Bond Fund Institutional Class

|

7,112,661 | 77,243,497 | ||||||

| 110,774,331 | ||||||||

|

INTERNATIONAL EQUITY FUNDS — 12.3%

|

||||||||

|

NT Emerging Markets Fund Institutional Class(2)

|

1,049,109 | 11,550,686 | ||||||

|

NT International Growth Fund Institutional Class

|

3,364,661 | 34,454,123 | ||||||

| 46,004,809 | ||||||||

|

MONEY MARKET FUNDS — 5.1%

|

||||||||

|

Premium Money Market Fund Investor Class

|

18,896,501 | 18,896,501 | ||||||

|

INTERNATIONAL FIXED INCOME FUNDS — 0.8%

|

||||||||

|

International Bond Fund Institutional Class

|

188,699 | 2,828,601 | ||||||

|

TOTAL INVESTMENT SECURITIES — 100.0% (Cost $318,643,600)

|

372,576,839 | |||||||

|

OTHER ASSETS AND LIABILITIES(3)

|

— | |||||||

|

TOTAL NET ASSETS — 100.0%

|

$372,576,839 | |||||||

|

(1)

|

Investments are funds within the American Century Investments family of funds, of which certain funds may be deemed to be under common control because of the same board of directors.

|

|

(2)

|

Non-income producing.

|

|

(3)

|

Category is less than 0.05% of total net assets.

|

|

Shares

|

Value

|

|||||||

|

LIVESTRONG 2035 Portfolio

|

||||||||

|

Mutual Funds(1) — 100.0%

|

||||||||

|

DOMESTIC EQUITY FUNDS — 56.8%

|

||||||||

|

NT Equity Growth Fund Institutional Class

|

8,709,549 | $87,182,582 | ||||||

|

NT Growth Fund Institutional Class

|

7,145,093 | 87,956,096 | ||||||

|

NT Large Company Value Fund Institutional Class

|

10,354,278 | 87,804,275 | ||||||

|

NT Mid Cap Value Fund Institutional Class

|

3,924,103 | 40,025,846 | ||||||

|

NT Small Company Fund Institutional Class

|

3,084,092 | 27,294,217 | ||||||

|

NT Vista Fund Institutional Class(2)

|

3,697,733 | 40,009,474 | ||||||

|

Real Estate Fund Institutional Class

|

708,485 | 14,771,911 | ||||||

| 385,044,401 | ||||||||

|

DOMESTIC FIXED INCOME FUNDS — 26.0%

|

||||||||

|

High-Yield Fund Institutional Class

|

2,782,415 | 17,139,674 | ||||||

|

Inflation-Adjusted Bond Fund Institutional Class

|

2,797,469 | 35,555,827 | ||||||

|

NT Diversified Bond Fund Institutional Class

|

11,340,729 | 123,160,314 | ||||||

| 175,855,815 | ||||||||

|

INTERNATIONAL EQUITY FUNDS — 13.9%

|

||||||||

|

NT Emerging Markets Fund Institutional Class(2)

|

2,487,174 | 27,383,792 | ||||||

|

NT International Growth Fund Institutional Class

|

6,548,853 | 67,060,260 | ||||||

| 94,444,052 | ||||||||

|

MONEY MARKET FUNDS — 3.3%

|

||||||||

|

Premium Money Market Fund Investor Class

|

22,327,721 | 22,327,721 | ||||||

|

TOTAL INVESTMENT SECURITIES — 100.0% (Cost $583,488,679)

|

677,671,989 | |||||||

|

OTHER ASSETS AND LIABILITIES(3)

|

47,570 | |||||||

|

TOTAL NET ASSETS — 100.0%

|

$677,719,559 | |||||||

|

(1)

|

Investments are funds within the American Century Investments family of funds, of which certain funds may be deemed to be under common control because of the same board of directors.

|

|

(2)

|

Non-income producing.

|

|

(3)

|

Category is less than 0.05% of total net assets.

|

|

Shares

|

Value

|

|||||||

|

LIVESTRONG 2040 Portfolio

|

||||||||

|

Mutual Funds(1) — 100.0%

|

||||||||

|

DOMESTIC EQUITY FUNDS — 62.0%

|

||||||||

|

NT Equity Growth Fund Institutional Class

|

2,942,545 | $29,454,876 | ||||||

|

NT Growth Fund Institutional Class

|

2,395,813 | 29,492,453 | ||||||

|

NT Large Company Value Fund Institutional Class

|

3,511,373 | 29,776,445 | ||||||

|

NT Mid Cap Value Fund Institutional Class

|

1,433,027 | 14,616,874 | ||||||

|

NT Small Company Fund Institutional Class

|

931,595 | 8,244,613 | ||||||

|

NT Vista Fund Institutional Class(2)

|

1,345,207 | 14,555,138 | ||||||

|

Real Estate Fund Institutional Class

|

244,192 | 5,091,408 | ||||||

| 131,231,807 | ||||||||

|

DOMESTIC FIXED INCOME FUNDS — 22.1%

|

||||||||

|

High-Yield Fund Institutional Class

|

733,674 | 4,519,431 | ||||||

|

Inflation-Adjusted Bond Fund Institutional Class

|

728,615 | 9,260,700 | ||||||

|

NT Diversified Bond Fund Institutional Class

|

3,040,141 | 33,015,928 | ||||||

| 46,796,059 | ||||||||

|

INTERNATIONAL EQUITY FUNDS — 15.1%

|

||||||||

|

NT Emerging Markets Fund Institutional Class(2)

|

949,917 | 10,458,591 | ||||||

|

NT International Growth Fund Institutional Class

|

2,090,083 | 21,402,449 | ||||||

| 31,861,040 | ||||||||

|

MONEY MARKET FUNDS — 0.8%

|

||||||||

|

Premium Money Market Fund Investor Class

|

1,607,613 | 1,607,613 | ||||||

|

TOTAL INVESTMENT SECURITIES — 100.0% (Cost $181,278,276)

|

211,496,519 | |||||||

|

OTHER ASSETS AND LIABILITIES(3)

|

275 | |||||||

|

TOTAL NET ASSETS — 100.0%

|

$211,496,794 | |||||||

|

(1)

|

Investments are funds within the American Century Investments family of funds, of which certain funds may be deemed to be under common control because of the same board of directors.

|

|

(2)

|

Non-income producing.

|

|

(3)

|

Category is less than 0.05% of total net assets.

|

|

Shares

|

Value

|

|||||||

|

LIVESTRONG 2045 Portfolio

|

||||||||

|

Mutual Funds(1) — 100.0%

|

||||||||

|

DOMESTIC EQUITY FUNDS — 65.1%

|

||||||||

|

NT Equity Growth Fund Institutional Class

|

5,994,389 | $60,003,832 | ||||||

|

NT Growth Fund Institutional Class

|

4,902,948 | 60,355,293 | ||||||

|

NT Large Company Value Fund Institutional Class

|

7,185,959 | 60,936,934 | ||||||

|

NT Mid Cap Value Fund Institutional Class

|

2,904,380 | 29,624,672 | ||||||

|

NT Small Company Fund Institutional Class

|

1,927,123 | 17,055,041 | ||||||

|

NT Vista Fund Institutional Class(2)

|

2,727,233 | 29,508,663 | ||||||

|

Real Estate Fund Institutional Class

|

535,859 | 11,172,655 | ||||||

| 268,657,090 | ||||||||

|

DOMESTIC FIXED INCOME FUNDS — 18.9%

|

||||||||

|

High-Yield Fund Institutional Class

|

1,260,918 | 7,767,254 | ||||||

|