Exhibit 99.1

Vermilion Energy Inc. | AIF for the year ended December 31, 2017 |

2017 ANNUAL INFORMATION FORM

For the year ended December 31, 2017

Dated February 28, 2018

Vermilion Energy Inc. | AIF for the year ended December 31, 2017 |

TABLE OF CONTENTS

| GLOSSARY OF TERMS | 4 |

| Conventions | 6 |

| Abbreviations | 6 |

| Conversion | 6 |

| SPECIAL NOTE REGARDING FORWARD LOOKING STATEMENTS | 7 |

| PRESENTATION OF OIL AND GAS RESERVES AND PRODUCTION INFORMATION | 9 |

| Contingent Resources | 9 |

| Prospective Resources | 10 |

| NON-GAAP MEASURES | 10 |

| VERMILION ENERGY INC. | 11 |

| General | 11 |

| Organizational Structure of the Company | 11 |

| DESCRIPTION OF THE BUSINESS | 12 |

| Operating Segments and Description of Properties | 12 |

| GENERAL DEVELOPMENT OF THE BUSINESS | 16 |

| Three Year History and Outlook | 16 |

| STATEMENT OF RESERVES DATA AND OTHER OIL AND GAS INFORMATION | 19 |

| Reserves and Future Net Revenue | 19 |

| Reconciliations of Changes in Reserves | 29 |

| Undeveloped Reserves | 37 |

| Timing of Initial Undeveloped Reserves Assignment | 37 |

| Future Development Costs | 38 |

| Oil and Gas Properties and Wells | 39 |

| Costs Incurred | 40 |

| Acreage | 40 |

| Exploration and Development Activities | 41 |

| Properties with No Attributed Reserves | 42 |

| Tax Information | 43 |

| Production Estimates | 44 |

| Production History | 45 |

| Marketing | 49 |

| DIRECTORS AND OFFICERS | 50 |

| Directors | 50 |

| Officers | 52 |

| DESCRIPTION OF CAPITAL STRUCTURE | 53 |

| Credit Ratings | 53 |

| Common Shares | 54 |

| Cash Dividends | 54 |

| Premium Dividend and Dividend Reinvestment Plan | 55 |

| Shareholder Rights Plan | 56 |

| MARKET FOR SECURITIES | 57 |

| AUDIT COMMITTEE MATTERS | 58 |

| Audit Committee Charter | 58 |

| Composition of the Audit Committee | 58 |

| External Audit Service Fees | 59 |

| CONFLICTS OF INTEREST | 59 |

| INTEREST OF MANAGEMENT AND OTHERS IN MATERIAL TRANSACTIONS | 59 |

| LEGAL PROCEEDINGS | 59 |

| MATERIAL CONTRACTS | 59 |

| INTERESTS OF EXPERTS | 59 |

| TRANSFER AGENT AND REGISTRAR | 60 |

Vermilion Energy Inc. | AIF for the year ended December 31, 2017 |

| RISK FACTORS | 60 |

| Reserve Estimates | 60 |

| Uncertainty of Contingent Resource Estimates | 60 |

| Uncertainty of Prospective Resource Estimates | 61 |

| Volatility of Oil and Natural Gas Prices | 61 |

| Reputational Risks Relating to Environmental Matters | 61 |

| Changes in Tax, Royalty and Other Government Incentive Program Legislation | 61 |

| Government Regulations | 61 |

| Political Events and Terrorist Attacks | 62 |

| Competition | 62 |

| International Operations and Future Geographical/Industry Expansion | 62 |

| Operational Matters | 62 |

| Hydraulic Fracturing | 63 |

| Reliance on Key Personnel, Management and Labour | 63 |

| Environmental Legislation | 63 |

| Discretionary Nature of Dividends | 64 |

| Debt Service | 64 |

| Depletion of Reserves | 65 |

| Net Asset Value | 65 |

| Volatility of Market Price of Common Shares | 65 |

| Variations in Interest Rates and Foreign Exchange Rates | 65 |

| Increase in Operating Costs or Decline in Production Level | 65 |

| Acquisition Assumptions | 66 |

| Failure to Realize Anticipated Benefits of Prior Acquisitions | 67 |

| Additional Financing | 67 |

| Potential Conflicts of Interest | 67 |

| Hedging Arrangements | 67 |

| Accounting Adjustments | 68 |

| Ineffective Internal Controls | 68 |

| Market Accessibility | 68 |

| Cost of New Technology | 68 |

| Cyber Security | 68 |

| ADDITIONAL INFORMATION | 69 |

| APPENDIX A | 70 |

| CONTINGENT RESOURCES | 70 |

| PROSPECTIVE RESOURCES | 75 |

| APPENDIX B | 81 |

| REPORT ON RESERVES DATA BY INDEPENDENT QUALIFIED RESERVES EVALUATOR OR AUDITOR (FORM 51-101F2) | 81 |

| REPORT ON CONTINGENT RESOURCES DATA AND PROSPECTIVE RESOURCES DATA BY INDEPENDENT QUALIFIED RESERVES EVALUATOR OR AUDITOR (FORM 51-101F2) | 82 |

| APPENDIX C | 84 |

| REPORT OF MANAGEMENT AND DIRECTORS ON RESERVES DATA AND OTHER INFORMATION (FORM 51-101F3) | 84 |

| APPENDIX D | 85 |

| TERMS OF REFERENCE FOR THE AUDIT COMMITTEE | 85 |

Vermilion Energy Inc. | AIF for the year ended December 31, 2017 |

GLOSSARY OF TERMS

In addition to terms defined elsewhere in this annual information form, the following are defined terms used in this annual information form:

“2003 Arrangement” means the plan of arrangement under the ABCA involving the Trust, Vermilion Resources Ltd., Clear Energy Inc. and Vermilion Acquisition Ltd., which was completed on January 22, 2003;

“ABCA” means the Business Corporations Act (Alberta), R.S.A. 2000, c. B-9, as amended, including the regulations promulgated thereunder;

“AIF” means this Annual Information Form and the appendices attached hereto;

“Affiliate” when used to indicate a relationship with a person or company, has the same meaning as set forth in the Securities Act (Alberta);

“Board of Directors” or “board” means the board of directors of Vermilion;

“CGUs” means cash generating units and based on management’s judgement, represents the lowest level at which there is identifiable cash inflows that are largely independent of the cash inflows of other groups of assets or properties;

“Common Shares” means a common share in the capital of the Company;

“Contingent Resources” are those quantities of petroleum estimated, as of a given date, to be potentially recoverable from known accumulations using established technology or technology under development, but which are not currently considered to be commercially recoverable due to one or more contingencies;

“Control” means, with respect to control of a body corporate by a person, the holding (other than by way of security) by or for the benefit of that person of securities of that body corporate to which are attached more than 50% of the votes that may be cast to elect directors of the body corporate (whether or not securities of any other class or classes shall or might be entitled to vote upon the happening of any event or contingency) provided that such votes, if exercised, are sufficient to elect a majority of the board of directors of the body corporate;

“Conversion Arrangement” means the plan of arrangement effected on September 1, 2010 under section 193 of the ABCA pursuant to which the Trust converted from an income trust to a corporate structure, and Unitholders exchanged their Trust Units for common shares of the Company on a one-for-one basis and holders of exchangeable shares of Vermilion Resources Ltd., previously a subsidiary of the company ("VRL"), received 1.89344 common shares for each exchangeable share held;

“Dividend” means a dividend paid by Vermilion in respect of the common shares, expressed as an amount per common share;

“Dividend Payment Date” means any date that Dividends are paid to Shareholders, generally being the 15th day of the calendar month following the determination of a Dividend Record Date;

“Dividend Record Date” means the the date on which a shareholder must hold the stock to receive the applicable dividend;

“GLJ” means GLJ Petroleum Consultants Ltd., independent petroleum engineering consultants of Calgary, Alberta;

“GLJ Report” means the independent engineering reserves evaluation of certain oil, NGL and natural gas interests of the Company prepared by GLJ dated February 1, 2018 and effective December 31, 2017;

“GLJ Resource Assessment” means the independent engineering resource evaluation prepared by GLJ to assess contingent and prospective resources across all of the Company’s key operating regions with an effective date of December 31, 2017;

“IFRS” means International Financial Reporting Standards or, alternatively, “GAAP”, as issued by the International Accounting Standards Board;

| 4 |

Vermilion Energy Inc. | AIF for the year ended December 31, 2017 |

“Income Tax Act” or “Tax Act” means the Income Tax Act (Canada), R.S.C. 1985, c. 1. (5th Supp.), as amended, including the regulations promulgated thereunder;

“Meeting” means the annual meeting of Shareholders of the Company to be held on April 26, 2018 (or, if adjourned, such other date on which the meeting is held);

“NYSE” means New York Stock Exchange;

“PRRT” means Petroleum Resource Rent Tax, a profit based tax levied on petroleum projects in Australia;

“Plan” means the Premium DividendTM and Dividend Reinvestment Plan of the Company dated effective February 27, 2015, as amended or supplemented from time to time;

“Prospective Resources” are those quantities of petroleum estimated, as of a given date, to be potentially recoverable from undiscovered accumulations by application of future development projects;

“Rights Plan” means the Shareholder Rights Plan of the Company;

“Shareholders” means holders from time to time of the Company’s common shares;

“Shareholder Rights Plan Agreement” means the Shareholder Rights Plan Agreement dated September 1, 2010 between the Company and Computershare Trust Company of Canada establishing the Rights Plan, as amended and restated as of May 1, 2013 and as amended or supplemented from time to time;

“Subsidiary” means, in relation to any person, any body corporate, partnership, joint venture, association or other entity of which more than 50% of the total voting power of common shares or units of ownership or beneficial interest entitled to vote in the election of directors (or members of a comparable governing body) is owned or controlled, directly or indirectly, by such person;

“TSX” means the Toronto Stock Exchange;

“Trust” means Vermilion Energy Trust, an unincorporated open-ended investment trust governed by the laws of the Province of Alberta that was dissolved and ceased to exist pursuant to the Conversion Arrangement;

“Trust Unit” means units in the capital of the Trust;

“Unitholders” means former unitholders of the Trust;

“Vermilion” or the “Company” means Vermilion Energy Inc. and where context allows, its consolidated business enterprise, except that a reference to “Vermilion” prior to the date of the Conversion Arrangement means the consolidated business enterprise of the Trust, unless otherwise indicated.

| 5 |

Vermilion Energy Inc. | AIF for the year ended December 31, 2017 |

Conventions

Unless otherwise indicated, references herein to "$" or "dollars" are to Canadian dollars. All financial information herein has been presented in Canadian dollars in accordance with IFRS.

Abbreviations

| Oil and Natural Gas Liquids | |

| bbl | barrel |

| Mbbl | thousand barrels |

| bbl/d | barrels per day |

| NGLs | natural gas liquids |

| Natural Gas | |

| Mcf | thousand cubic feet |

| MMcf | million cubic feet |

| Mcf/d | thousand cubic feet per day |

| MMcf/d | million cubic feet per day |

| MMBtu | million British Thermal Units |

| Other | |

| °API | An indication of the specific gravity of crude oil measured on the API (American Petroleum Institute) gravity scale. |

| Liquid petroleum with a specified gravity of 28 °API or higher is generally referred to as light crude oil. | |

| boe | barrel of oil equivalent |

| M$ | thousand dollars |

| MM$ | million dollars |

| Mboe | 1,000 barrels of oil equivalent |

| MMboe | million barrels of oil equivalent |

| WTI | West Texas Intermediate, the reference price paid in U.S. dollars at Cushing, Oklahoma for crude oil of standard grade. |

| TTF | the day-ahead price for natural gas in the Netherlands, quoted in MWh of natural gas, at the Title Transfer Facility Virtual Trading Point operated by Dutch TSO Gas Transport Services |

| NBP | the reference price paid for natural gas in the United Kingdom, quoted in pence per therm, at the National Balancing Point Virtual Trading Point operated by National Grid |

| AECO | the daily average benchmark price for natural gas at the AECO ‘C’ hub in southeast Alberta |

Conversion

The following table sets forth certain standard conversions from Standard Imperial Units to the International System of Units (or metric units).

| To Convert From | To | Multiply By |

| Mcf | Cubic metres | 28.174 |

| Cubic metres | Cubic feet | 35.494 |

| bbls | Cubic metres | 0.159 |

| Cubic metres | bbls oil | 6.290 |

| Feet | Metres | 0.305 |

| Metres | Feet | 3.281 |

| Miles | Kilometres | 1.609 |

| Kilometres | Miles | 0.621 |

| Acres | Hectares | 0.405 |

| Hectares | Acres | 2.471 |

| 6 |

Vermilion Energy Inc. | AIF for the year ended December 31, 2017 |

SPECIAL NOTE REGARDING FORWARD LOOKING STATEMENTS

Certain statements included or incorporated by reference in this annual information form may constitute forward looking statements or financial outlooks under applicable securities legislation. Such forward looking statements or information typically contain statements with words such as "anticipate", "believe", "expect", "plan", "intend", "estimate", "propose", or similar words suggesting future outcomes or statements regarding an outlook. Forward looking statements or information in this annual information form may include, but are not limited to:

| • | capital expenditures; |

| • | business strategies and objectives; |

| • | estimated reserve quantities and the discounted present value of future net cash flows from such reserves; |

| • | petroleum and natural gas sales; |

| • | future production levels (including the timing thereof) and rates of average annual production growth, estimated contingent and prospective resources; |

| • | exploration and development plans; |

| • | acquisition and disposition plans and the timing thereof; |

| • | operating and other expenses, including the payment of future dividends; |

| • | royalty and income tax rates; |

| • | the timing of regulatory proceedings and approvals; and |

| • | the estimate of Vermilion’s share of the expected natural gas production from the Corrib field. |

Such forward-looking statements or information are based on a number of assumptions all or any of which may prove to be incorrect. In addition to any other assumptions identified in this document, assumptions have been made regarding, among other things:

| • | the ability of the Company to obtain equipment, services and supplies in a timely manner to carry out its activities in Canada and internationally; |

| • | the ability of the Company to market crude oil, natural gas liquids and natural gas successfully to current and new customers; |

| • | the timing and costs of pipeline and storage facility construction and expansion and the ability to secure adequate product transportation; |

| • | the timely receipt of required regulatory approvals; |

| • | the ability of the Company to obtain financing on acceptable terms; |

| • | foreign currency exchange rates and interest rates; |

| • | future crude oil, natural gas liquids and natural gas prices; and |

| • | Management’s expectations relating to the timing and results of development activities. |

Although the Company believes that the expectations reflected in such forward looking statements or information are reasonable, undue reliance should not be placed on forward looking statements because the Company can give no assurance that such expectations will prove to be correct. Financial outlooks are provided for the purpose of understanding the Company’s financial strength and business objectives and the information may not be appropriate for other purposes. Forward looking statements or information are based on current expectations, estimates and projections that involve a number of risks and uncertainties which could cause actual results to differ materially from those anticipated by the Company and described in the forward looking statements or information. These risks and uncertainties include but are not limited to:

| • | the ability of management to execute its business plan; |

| • | the risks of the oil and gas industry, both domestically and internationally, such as operational risks in exploring for, developing and producing crude oil, natural gas liquids and natural gas; |

| • | risks and uncertainties involving geology of crude oil, natural gas liquids and natural gas deposits; |

| • | risks inherent in the Company's marketing operations, including credit risk; |

| • | the uncertainty of reserves estimates and reserves life and estimates of contingent resources and estimates of prospective resources and associated expenditures; |

| • | the uncertainty of estimates and projections relating to production, costs and expenses; |

| • | potential delays or changes in plans with respect to exploration or development projects or capital expenditures; |

| • | the Company's ability to enter into or renew leases on acceptable terms; |

| • | fluctuations in crude oil, natural gas liquids and natural gas prices, foreign currency exchange rates and interest rates; |

| • | health, safety and environmental risks; |

| 7 |

Vermilion Energy Inc. | AIF for the year ended December 31, 2017 |

| • | uncertainties as to the availability and cost of financing; |

| • | the ability of the Company to add production and reserves through exploration and development activities; |

| • | general economic and business conditions; |

| • | the possibility that government policies or laws may change or governmental approvals may be delayed or withheld; |

| • | uncertainty in amounts and timing of royalty payments; |

| • | risks associated with existing and potential future law suits and regulatory actions against the Company; and |

| • | other risks and uncertainties described elsewhere in this annual information form or in the Company's other filings with Canadian securities authorities. |

The forward-looking statements or information contained in this annual information form are made as of the date hereof and the Company undertakes no obligation to update publicly or revise any forward-looking statements or information, whether as a result of new information, future events or otherwise, unless required by applicable securities laws.

| 8 |

Vermilion Energy Inc. | AIF for the year ended December 31, 2017 |

PRESENTATION OF OIL AND GAS RESERVES AND PRODUCTION INFORMATION

All oil and natural gas reserve information contained in this annual information form is derived from the GLJ Report and has been prepared and presented in accordance with the Canadian Oil and Gas Evaluation Handbook (“COGEH”) and National Instrument 51-101 Standards of Disclosure for Oil and Gas Activities ("NI 51-101"). The actual oil and natural gas reserves and future production will be greater than or less than the estimates provided in this annual information form. The estimated future net revenue from the production of the disclosed oil and natural gas reserves does not represent the fair market value of these reserves.

Natural gas volumes have been converted on the basis of six thousand cubic feet of natural gas to one barrel of oil equivalent. Barrels of oil equivalent (“boe”) may be misleading, particularly if used in isolation. A boe conversion ratio of six thousand cubic feet of natural gas to one barrel of oil is based on an energy equivalency conversion method primarily applicable at the burner tip and does not represent a value equivalency at the wellhead.

Contingent Resources

"Contingent resources" are not, and should not be confused with, petroleum and natural gas reserves. "Contingent resources" are defined in COGEH as those quantities of petroleum estimated, as of a given date, to be potentially recoverable from known accumulations using established technology or technology under development, but which are not currently considered to be commercially recoverable due to one or more contingencies. Contingencies may include factors such as economic, legal, environmental, political and regulatory matters or a lack of markets. It is also appropriate to classify as contingent resource the estimated discovered recoverable quantities associated with a project in the early evaluation stage.

The primary contingencies which currently prevent the classification of Vermilion’s contingent resource as reserves include but are not limited to:

| • | preparation of firm development plans, including determination of the specific scope and timing of projects; |

| • | project sanction; |

| • | access to capital markets; |

| • | shareholder and regulatory approvals as applicable; |

| • | access to required services and field development infrastructure; |

| • | oil and natural gas prices in Canada and internationally in jurisdictions in which Vermilion operates; |

| • | demonstration of economic viability; |

| • | future drilling program and testing results; |

| • | further reservoir delineation and studies; |

| • | facility design work; |

| • | corporate commitment; |

| • | development timing; |

| • | limitations to development based on adverse topography or other surface restrictions; and |

| • | the uncertainty regarding marketing and transportation of petroleum from development areas. |

There is no certainty that it will be commercially viable to produce any portion of the contingent resources or that Vermilion will produce any portion of the volumes currently classified as contingent resources. The estimates of contingent resources involve implied assessment, based on certain estimates and assumptions, that the contingent resources described exists in the quantities predicted or estimated and that the contingent resources can be profitably produced in the future. The net present value of the future net revenue from the contingent resources does not necessarily represent the fair market value of the contingent resources. Actual contingent resources (and any volumes that may be reclassified as reserves) and future production therefrom may be greater than or less than the estimates provided herein.

| 9 |

Vermilion Energy Inc. | AIF for the year ended December 31, 2017 |

Prospective Resources

“Prospective resources" are not, and should not be confused with, petroleum and natural gas reserves. "Prospective resources" are defined in COGEH as those quantities of petroleum estimated, as of a given date, to be potentially recoverable from undiscovered accumulations by application of future development projects.

There is no certainty that any portion of the prospective resources will be discovered. If discovered, there is no certainty that it will be commercially viable to produce any portion of the prospective resources or that Vermilion will produce any portion of the volumes currently classified as prospective resources. The estimates of prospective resources involve implied assessment, based on certain estimates and assumptions, that the resources described exists in the quantities predicted or estimated and that the resources can be profitably produced in the future. The net present value of the future net revenue from the prospective resources does not necessarily represent the fair market value of the prospective resources. The recovery and resources estimates provided herein are estimates only. Actual prospective resources (and any volumes that may be reclassified as reserves or contingent resources) and future production from such prospective resources may be greater than or less than the estimates provided herein.

NON-GAAP MEASURES

This annual information form includes non-GAAP measures as further described herein. Management of the Company believes these non-GAAP measures are a useful tool in analyzing operating performance. These measures do not have standardized meanings prescribed by GAAP and are not disclosed in Vermilion’s audited consolidated financial statements and, therefore, may not be comparable with the calculations of similar measures for other entities.

“Cash dividends per share” represents actual cash dividends paid per share by the Company during the relevant periods.

"Capital expenditures" represents the sum of drilling and development and exploration and evaluation. Vermilion considers capital expenditures to be a useful measure of our investment in our existing asset base. Capital expenditures are also referred to as E&D capital.

"Fund flows from operations" represents a measure of profit or loss in accordance with IFRS 8 “Operating Segments”. Vermilion analyzes fund flows from operations both on a consolidated basis and on a business unit basis in order to assess the contribution of each business unit to our ability to generate income necessary to pay dividends, repay debt, fund asset retirement obligations and make capital investments.

"Netbacks" represents a per boe and per mcf performance measures used in the analysis of operational activities. Vermilion assesses netbacks both on a consolidated basis and on a business unit basis in order to compare and assess the operational and financial performance of each business unit versus other business units and also versus third party crude oil and natural gas producers.

| 10 |

Vermilion Energy Inc. | AIF for the year ended December 31, 2017 |

VERMILION ENERGY INC.

General

Vermilion Energy Inc. is the successor to the Trust, following the completion of the Conversion Arrangement whereby the Trust converted from an income trust to a corporate structure by way of a court approved plan of arrangement under the ABCA on September 1, 2010.

As at December 31, 2017, Vermilion had 505 full time employees of which 172 employees were located in its Calgary head office, 55 employees in its Canadian field offices, 149 employees in France, 59 employees in the Netherlands, 31 employees in Australia, 9 employees in the United States, 24 employees in Germany, 5 employees in Hungary and 1 employee in Croatia.

Vermilion was incorporated on July 21, 2010 pursuant to the provisions of the ABCA for the purpose of facilitating the Conversion Arrangement. The registered and head office of Vermilion Energy Inc. is located at Suite 3500, 520 – 3rd Avenue S.W., Calgary, Alberta, T2P 0R3.

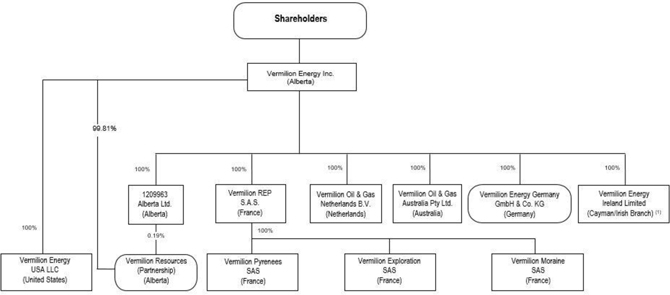

Organizational Structure of the Company

The following diagram shows the intercorporate relationships among the Company and each of its material subsidiaries, where each material subsidiary was incorporated or formed and the percentage of votes attaching to all voting securities of each material subsidiary beneficially owned directly or indirectly by Vermilion. Reference should be made to the appropriate sections of this annual information form for a complete description of the structure of the Company.

Note:

| (1) | Vermilion Energy Ireland Limited is the Irish Branch of a Cayman Islands incorporated company. |

| 11 |

Vermilion Energy Inc. | AIF for the year ended December 31, 2017 |

DESCRIPTION OF THE BUSINESS

Vermilion is an international energy producer that seeks to create value through the acquisition, exploration, development and optimization of producing properties in North America, Europe and Australia. Vermilion focuses on the exploitation of light oil and liquids-rich natural gas conventional resource plays in Canada and the United States, the exploration and development of high impact natural gas opportunities in the Netherlands and Germany, and oil drilling and workover programs in France and Australia. Vermilion currently holds an 18.5% non-operated working interest in the Corrib gas field in Ireland.

Vermilion's priorities are health and safety, the environment, and profitability, in that order. Nothing is more important to us than the safety of the public and those who work with us, and the protection of our natural surroundings. Vermilion has been recognized as a top decile performer amongst Canadian publicly listed companies in governance practices, as a Climate Leadership Level performer by the CDP (formerly the Carbon Disclosure Project), and a Best Workplace in the Great Place to Work® Institute's annual rankings in Canada, France, the Netherlands and Germany. Vermilion emphasizes strategic community investment in each of our operating areas.

Operating Segments and Description of Properties(1)

Vermilion has operations in three core areas: North America, Europe and Australia. Vermilion's business within these regions is managed at the country level through business units which form the basis of the Company's operating segments. These operating segments, as well as a description of the material oil and natural gas properties, facilities and installations in which Vermilion has an interest, are discussed below. For a discussion of the competitive conditions affecting Vermilion’s business, refer to "Competition" in the Risk Factors section of this AIF.

Canada Business Unit

Vermilion’s Canadian production is primarily focused in three areas of Alberta: West Pembina, Slave Lake and Central Alberta and in the Northgate Region of southeast Saskatchewan. Vermilion's main liquids rich gas producing asset is the Mannville condensate play in the West Pembina area. The Cardium light crude oil play in West Pembina is the main oil producing area, along with the Northgate and Slave Lake oil producing areas. Vermilion’s main natural gas producing areas are West Pembina and Central Alberta.

Vermilion holds an average 74% working interest in approximately 445,700 (330,900 net) acres of developed land, and an average 87% working interest in approximately 430,800 (376,400 net) acres of undeveloped land. Vermilion had 523 (375 net) producing natural gas wells and 639 (475 net) producing oil wells in Canada as at December 31, 2017.

Vermilion owns and operates three natural gas plants and has an ownership interest in six additional plants, resulting in combined gross natural gas processing capacity of over 80 MMcf/d. In addition, Vermilion has oil processing capacity of over 25,000 bbl/d through ten operated oil batteries including a 15,000 bbl/d oil battery in West Pembina.

For the year ended December 31, 2017, production in Canada averaged 97.9 MMcf/d of natural gas and 13,195 bbl/d of light crude oil, medium crude oil and NGLs. Sales of natural gas in 2017 were $83.5 million (2016 - $65.9 million) and sales from light crude oil, medium crude oil and NGLs were $247.3 million (2016 - $187.0 million).

During 2017, the majority of Vermilion's Canadian exploration and development expenditures were directed to our Mannville program with activity focused in the West Pembina and Ferrier areas of Alberta. During 2017 Vermilion drilled or participated in 24 (17.4 net) Mannville wells and production from the Mannville play increased by 42% as compared to 2016. Vermilion plans to drill 17 (13.8 net) Mannville wells in 2018. The Company also plans to drill or participate in five (4.2 net) Cardium wells and 21 (20.5 net) southeast Saskatchewan wells in 2018 as compared to seven (7.0 net) Cardium wells and 13 (11.1 net) southeast Saskatchewan wells in 2017. Vermilion expects that the Mannville, Cardium and southeast Saskatchewan assets will continue to support the Company's production growth.

The GLJ Report assigned 81,322 Mboe of total proved reserves and 139,209 Mboe of proved plus probable reserves to Vermilion's properties located in Canada as at December 31, 2017.

| 12 |

Vermilion Energy Inc. | AIF for the year ended December 31, 2017 |

France Business Unit

Vermilion entered France in 1997 and has completed three subsequent acquisitions. The Company is the largest oil producer in the country and represents approximately three-quarters of domestic oil production. Vermilion predominately produces oil in France and the Company's oil is priced with reference to Dated Brent.

Vermilion's main producing areas in France are located in the Aquitaine Basin which is southwest of Bordeaux, France and in the Paris Basin, located just east of Paris. Vermilion also holds exploration lands in the Alsace-Lorraine region. The three major fields in the Paris Basin area are Champotran, Neocomian and Chaunoy, and the two major fields in the Aquitaine Basin are Parentis and Cazaux. Vermilion operates 19 oil batteries and 15 single well batteries in the country. Given the legacy nature of these assets, the throughput capability of these batteries exceeds any projected future requirements. Vermilion holds an average 96% working interest in 218,100 (208,900 net) acres of developed land and 99% working interest in 383,000 (379,800 net) acres of undeveloped land in the Aquitaine and Paris Basins. Vermilion had 338 (332 net) producing oil wells and three (3.0 net) producing gas wells in France as at December 31, 2017.

For the year ended December 31, 2017, production in France averaged 11,085 bbl/d of light crude oil and medium crude oil. Sales from light crude oil and medium crude oil in 2017 were $268.1 million (2016 - $246.6 million) with no sales of natural gas (2016 - $0.3 million). Natural gas sales in France have decreased significantly since 2013 following the closure of a third party processing facility.

In 2017, Vermilion drilled six (6.0 net) wells in the Neocomian fields in the Paris basin, four (4.0 net) wells in the Champotran field and one (1.0 net) horizontal sidetrack well in the Vulaines field. In 2018, Vermilion intends to drill two (2.0 net) Neocomian wells and three (3.0 net) Champotran wells. The Company also intends to continue its ongoing program of workovers and optimizations. By continuing to develop its inventory in France, while minimizing declines through workovers and optimizations, Vermilion seeks to deliver moderate production growth from its French assets.

The GLJ Report assigned 42,093 Mboe of total proved reserves and 64,188 Mboe of proved plus probable reserves to Vermilion's properties located in France as at December 31, 2017.

Netherlands Business Unit

Vermilion entered the Netherlands in 2004 and is the country's second largest onshore natural gas producer (excluding state-owned energy company EBN). Vermilion's natural gas production in the Netherlands is priced off of the TTF index.

Vermilion's Netherlands assets consist of 24 onshore concessions and two offshore concessions. Production consists primarily of natural gas with a small amount of related condensate. Vermilion’s total land position in the Netherlands covers 1,455,800 (826,000 net) acres at an average 56% working interest, of which 95% is undeveloped. Vermilion had 56 (39 net) producing natural gas wells as at December 31, 2017.

For the year ended December 31, 2017, Vermilion's production in the Netherlands averaged 40.5 MMcf/d of natural gas and 90 bbl/d of NGLs. Sales in 2017 of natural gas were $106.2 million (2016 - $99.3 million) and sales from NGLs were $1.9 million (2016 - $1.4 million).

Vermilion drilled two (1.0 net) exploration wells in the Netherlands during 2017 and the Company expects to drill three (1.5 net) exploration wells in 2018. Vermilion expects that its inventory of potentially high-impact exploration and development opportunities in the Netherlands will continue to support the Company's production growth in the country.

The GLJ Report assigned 10,347 Mboe of total proved reserves and 17,863 Mboe of proved plus probable reserves to Vermilion's properties located in the Netherlands as at December 31, 2017.

Germany Business Unit

Vermilion entered Germany in 2014 with the acquisition of a 25% non-operated interest in natural gas producing assets. In December 2016, Vermilion completed an acquisition of oil and gas producing properties that provided Vermilion with its first operated position in the country. Vermilion holds a significant undeveloped land position in Germany as a result of a farm-in agreement the Company entered into in 2015. Vermilion's natural gas production in Germany is priced with reference to TTF and oil production is priced with reference to Dated Brent.

| 13 |

Vermilion Energy Inc. | AIF for the year ended December 31, 2017 |

Including the interests that were acquired in December 2016, Vermilion’s producing assets in Germany consist of operated and non-operated interests in seven natural gas fields and five oil fields. Prior to the December 2016 acquisition, Vermilion's producing assets in Germany consisted of a 25% non-operated interest in four natural gas fields. Vermilion had 135 (104 net) producing oil wells and 20 (7 net) producing natural gas wells as at December 31, 2017.

Vermilion holds a significant land position in northwest Germany comprised of 88,600 (32,600 net) developed acres and 2,787,000 (1,214,000 net) undeveloped acres. The Company also holds a 0.4% equity interest in Erdgas Munster GmbH ("EGM"), a joint venture created in 1959 to jointly transport, process, and market gas in northwest Germany. This transportation interest allows for our proportionate share of produced volumes to be processed, blended, and transported to designated gas consumers through the EGM network of approximately 2,000 kilometres of pipeline. Furthermore, the Company holds a 50% equity interest in Hannoversche Erdölleitung GmbH ("HEG"), a joint venture company created in 1959 that collects and transports oil through a 185 km network of infrastructure from the Hannover region to rail loading facilities in Hannover.

For the year ended December 31, 2017, production in Germany averaged 19.4 MMcf/d of natural gas and 1,060 bbl/d of crude oil. Sales of natural gas in 2017 were $45.1 million (2016 - $29.0 million) and sales from crude oil were $23.6 million (2016 - nil).

During 2017, Vermilion focused on workover and optimization opportunities on the assets acquired in December 2016. In 2018, the Company plans to continue to invest in optimization and other well work on the assets the Company acquired in December 2016 as well as prepare for the drilling of one (0.25 net) well in the Dümmersee-Uchte area which is expected to be drilled in 2019. Vermilion will also advance permitting, studies and other activities associated with the farm-in agreement signed in mid-2015.

The GLJ Report assigned 12,640 Mboe of total proved reserves and 24,496 Mboe of proved plus probable reserves to Vermilion's properties located in Germany as at December 31, 2017.

Ireland Business Unit

Vermilion acquired an 18.5% non-operating interest in the offshore Corrib gas field located off the northwest coast of Ireland in 2009. The asset is comprised of six offshore wells, an onshore natural gas processing facility and offshore and onshore pipeline segments. At the time of the acquisition, most of the key components of the project, with the exception of the onshore pipeline, were either complete or in the latter stages of development. In 2011, approvals and permissions were granted for the onshore gas pipeline and tunneling commenced in December 2012. In May 2014, Vermilion announced the completion of tunnel boring operations. In September 2015, the project operator, Shell E&P Ireland Limited, declared the project operationally ready for service. With the final regulatory consent received on December 29, 2015, gas began to flow from the Corrib project on December 30, 2015.

Production volumes at Corrib reached full plant capacity of approximately 65 mmcf/d (10,900 boe/d) net to Vermilion at the end of Q2 2016 following recertification activities associated with a third party gas distribution pipeline network.

On July 12, 2017 Vermilion and Canada Pension Plan Investment Board ("CPPIB") announced a strategic partnership in Corrib, whereby CPPIB will acquire Shell E&P Ireland Limited’s 45% interest in Corrib for total cash consideration of €830 million, subject to customary closing adjustments and future contingent value payments based on performance and realized pricing. At closing, Vermilion expects to assume operatorship of Corrib. In addition to operatorship, CPPIB plans to transfer a 1.5% working interest to Vermilion for €19.4 million ($28.4 million), before closing adjustments. Vermilion’s incremental 1.5% ownership of Corrib represents production of approximately 850 boe/d (100% gas). The acquisition has an effective date of January 1, 2017 and is anticipated to close in the first half of 2018.

For the year ended December 31, 2017, production in Ireland averaged 58.4 MMcf/d of natural gas. Sales of natural gas in 2017 were $153.3 million (2016 - $109.2 million).

The GLJ Report assigned 13,634 Mboe of total proved reserves and 22,199 Mboe of proved plus probable reserves to Vermilion's property located in Ireland as at December 31, 2017.

| 14 |

Vermilion Energy Inc. | AIF for the year ended December 31, 2017 |

Australia Business Unit

In 2005, Vermilion acquired a 60% operated interest in the Wandoo offshore oil field and related production assets, located on Western Australia's northwest shelf. In 2007, Vermilion acquired the remaining 40% interest in the asset. Production occurs from 18 well bores and five lateral sidetrack wells that are tied into two platforms, Wandoo 'A' and Wandoo 'B'. Wandoo 'B' is permanently manned, houses the required production facilities and incorporates 400,000 bbls of oil storage within the platform's concrete gravity structure. The Wandoo 'B' facilities are capable of processing 182,000 bbl/d of total fluid to separate the oil from produced water. Vermilion's land position in the Wandoo field is comprised of 59,600 acres (gross and net).

For the year ended December 31, 2017, Vermilion's production in Australia averaged 5,770 bbl/d of light crude oil and medium crude oil. Sales in 2017 from light crude oil and medium crude oil were $154.4 million (2016 - $136.8 million).

During 2015 and 2016, Vermilion drilled three wells in Australia and does not presently expect to drill any additional Australian wells until 2019. Vermilion expects to manage its Australian asset and related capital investment programs to maintain stable production levels of approximately 6,000 bbl/d.

The GLJ Report assigned 10,915 Mboe of total proved reserves and 15,565 Mboe of proved plus probable reserves to Vermilion's property located in Australia as at December 31, 2017.

United States Business Unit

Vermilion entered the United States in 2014. The Company's assets include 109,500 (97,200 net) acres of land in the Powder River basin of northeastern Wyoming, of which 95% is undeveloped. Vermilion had 13 (11 net) producing oil wells in the United States as at December 31, 2017.

For the year ended December 31, 2017, Vermilion’s production in the United States averaged 716 bbl/d of light crude oil, medium crude oil and NGLs and 0.4 MMcf/d of natural gas. Sales from all commodities in 2017 were $15.4 million (2016 - $7.3 million).

During 2017, Vermilion continued work on its early stage Turner Sand development in the Powder River Basin, drilling and completing three (3.0 net) wells. In 2018, Vermilion expects to drill five (5.0 net) wells in this play.

The GLJ Report assigned 5,613 Mboe of total proved reserves and 14,970 Mboe of proved plus probable reserves to Vermilion's properties located in the United States.

Central and Eastern Europe ("CEE") Business Unit

Vermilion has established a CEE Business unit with a head office in Budapest, Hungary. The CEE business unit is responsible for business development in the CEE, including managing the exploration and development opportunities associated with the Company's land holdings in Hungary, Slovakia and Croatia.

At present, the CEE business unit does not have any production or revenues.

Vermilion's land position in the CEE consists of 652,800 (652,800 net) acres in Hungary, 184,600 (92,300 net) acres in Slovakia and 2.35 million (2.35 million net) acres in Croatia. Currently, Vermilion's entire land position in the CEE is undeveloped.

Vermilion plans to drill its first well (1.0 net) in the South Battonya license of Hungary in 2018.

| (1) | The production numbers stated refer to Vermilion's working interest share before deduction of Crown, freehold and other royalties. Reserve amounts are gross reserves, stated before deduction of royalties, as at December 31, 2017, based on forecast costs and price assumptions as evaluated in the GLJ Report. |

| 15 |

Vermilion Energy Inc. | AIF for the year ended December 31, 2017 |

GENERAL DEVELOPMENT OF THE BUSINESS

Three Year History and Outlook

The following describes the development of Vermilion's business over the last three completed financial years. None of the acquisitions described below constituted a “significant acquisition” within the meaning of applicable securities laws.

2015

Vermilion achieved record annual production of 54,922 boe/d representing an increase of 11% as compared to 2014. Full-year average production was within 0.1% of guidance as strong production results from other business units largely offset the production shortfall related to regulatory delays at Corrib.

Vermilion maintained its dividend at $0.215 per month throughout 2015. In February 2015, Vermilion announced the implementation of a Premium DividendTM Component of the Dividend Reinvestment Plan as a short term measure to maintain the Company’s financial strength. The Premium DividendTM component allowed Vermilion to preserve financial flexibility by providing ongoing access to a modest amount of low-cost equity capital. Under the Premium DividendTM component, shares were issued at 3.5% discount to average market price and participating shareholders received a premium cash payment equal to 101.5% of dividends.

In 2015, Vermilion entered into a farm-in agreement in northwest Germany. The farm-in provided Vermilion with participating interest in 18 onshore exploration licenses, comprising approximately 850,000 net undeveloped acres in the North German Basin, in exchange for carrying 50% of the farmor's costs associated with the drilling and testing of six net exploration wells over the following five years. The agreement also granted Vermilion operatorship during the exploration phase for 11 of the 18 licenses as well as access to key data spanning the farm-in assets.

On December 29, 2015 Vermilion announced that Shell E&P Ireland Limited, operator of the Corrib project, received the final remaining consent required for production from the office of Ireland's Minister for Communications, Energy and Natural Resources. Following this, natural gas began to flow from the Corrib gas project in Ireland on December 30, 2015.

Vermilion continued to prioritize preserving the strength of its balance sheet and increase its financial flexibility in response to the continued weak commodity price environment. Total exploration and development ("E&D") investment for 2015 totalled $487 million, representing a nearly 30% decrease from the prior year. Vermilion continued to focus on reducing costs through our company-wide Profitability Enhancement Program ("PEP"), and the Company increased its credit facility capacity by $500 million during the year to $2.0 billion while also extending the term to May 2019.

2016

Vermilion achieved record annual production of 63,526 boe/d representing an increase of 16% as compared to 2015. The increase was attributable to a full-year of Corrib production and organic growth in the Netherlands.

The commodity price environment continued to be extremely challenging during 2016. WTI averaged US$43.32/bbl for the year and reached an intra-year, monthly average low of US$30.62/bbl in February 2016. To support its balance sheet and dividend in the prevailing price environment, the Company continued to focus on further improving capital efficiencies as well as achieving cost reductions through PEP. Accordingly, in January 2016, Vermilion announced a $285 million E&D capital budget for 2016 representing a 42% decrease from 2015. As commodity prices continued to weaken during Q1 2016, in February 2016 Vermilion announced a further reduction in its 2016 E&D capital budget to $235 million. In August 2016, Vermilion modestly increased its E&D capital expenditure guidance for 2016 to $240 million. E&D capital expenditures for 2016 totaled $242.4 million, representing decreases from 2015 and 2014 of 50% and 65%, respectively.

Vermilion maintained its dividend at $0.215 per month throughout 2016. In addition, the Company began prorating the Premium DividendTM Component of the Dividend Reinvestment Plan starting in 2016. The Premium DividendTM Component of the Dividend Reinvestment Plan was implemented by Vermilion in 2015 as a short term measure to preserve the Company’s financial flexibility by providing access to a modest amount of low-cost equity capital. As a result of the continued strength in the Company's business associated with cost reductions, capital efficiency improvements and the expectation of a more stable commodity price environment, Vermilion began prorating the Premium DividendTM Component of the Dividend Reinvestment Plan by 25% commencing with the October 2016 dividend.

| 16 |

Vermilion Energy Inc. | AIF for the year ended December 31, 2017 |

Vermilion repaid the $225 million of 6.5% Senior Unsecured Notes that came due on February 10, 2016 with funds from its credit facility. While the Company assessed opportunities to diversify its debt structure, the credit facility represented the Company’s most cost-effective method of borrowing.

Effective March 1, 2016, Mr. Lorenzo Donadeo retired as Chief Executive Officer of Vermilion and became Chair of the Board of Directors. Mr. Anthony Marino, previously the Company's President and Chief Operating Officer, assumed the role of President and CEO. Mr. Larry Macdonald, previously the Board of Director's Chair, assumed the newly created role of Lead Independent Director.

In December 2016, Vermilion closed an acquisition of producing oil and gas properties in Germany from Engie E&P Deutschland GmbH (previously known as GDF Suez S.A.) for total consideration of $45.6 million, net of acquired product inventory. The acquisition comprised operated and non-operated interests in five oil and three natural gas producing fields, along with an operated interest in one exploration license. Vermilion assumed operatorship of six of the eight producing fields, with the other fields operated by ExxonMobil Production Deutschland ("EMPG") and Deutsche Erdoel AG ("DEA"). Production from the acquired assets was approximately 2,000 boe/d in 2016. The acquisition provided Vermilion with its first operated producing properties in Germany, and advanced the Company’s objective of developing a material business unit in the country.

In June 2016, the Republic of Croatia ratified the grant of four exploration blocks to Vermilion. The exploration blocks consisted of approximately 2.35 million gross acres (100% working interest), with a substantial portion of the acreage located near existing crude oil and natural gas fields in northeast Croatia. The initial five-year exploration period consists of two phases with an option to relinquish the blocks following the initial three-year phase. In December 2016, Vermilion entered into a farm-in agreement in Slovakia with NAFTA, Slovakia's dominant exploration and production company. The farm-in agreement grants Vermilion a 50% working interest to jointly explore 183,000 gross acres on an existing license. The primary term of the farm-in agreement is five years.

Vermilion was awarded a position on CDP's 2016 Climate "A" List. CDP (formerly Carbon Disclosure Project) is a London-based not-for-profit organization that administers a global environmental disclosure system that assists in the measurement and management of corporate environmental impacts. Only 193 companies globally achieved Climate "A" List recognition in 2016 and Vermilion was one of only five oil and gas companies in the world, and the only North American energy company, on the 2016 Climate "A" List. Vermilion has voluntarily reported emissions data to CDP for each year since 2012, recognizing the importance of measuring and understanding the Company’s environmental impact.

2017

Vermilion achieved record annual production of 68,021 boe/d representing an increase of 7% as compared to 2016. Production growth in Canada, the US, Ireland and Germany more than offset lower production in France, Netherlands and Australia. Permitting delays significantly reduced Netherlands production volumes in 2017, while an unplanned 31-day downtime period at Corrib late in Q3 and early Q4 2017 reduced annual production by approximately 900 boe/d.

Vermilion maintained its dividend at $0.215 per month throughout 2017. Additionally, as the Company's business continued its strong performance and with the prospect of a more stable commodity price environment, Vermilion continued the proration of the Premium DividendTM Component of the Dividend Reinvestment Plan, which commenced in 2016, throughout the year. The Company discontinued the Premium DividendTM Component beginning with the July 2017 dividend payment.

In March 2017, Vermilion issued US$300 million aggregate principal amount of eight-year senior unsecured notes bearing interest at a rate of 5.625% per annum. This issuance was completed by way of a private offering and represented Vermilion's first issuance in the US debt markets. The issuance of US dollar denominated debt provides a partial natural hedge against our largely US dollar denominated revenue streams.

In April 2017, Vermilion extended the term of its credit facility with its banking syndicate to May 2021. Following a review of the Company's projected liquidity requirements and the receipt of proceeds from the US debt issuance, Vermilion elected to request a reduction in the total facility amount to $1.4 billion from $2.0 billion.

| 17 |

Vermilion Energy Inc. | AIF for the year ended December 31, 2017 |

In July 2017, Vermilion and Canada Pension Plan Investment Board ("CPPIB") announced a strategic partnership in Corrib, whereby CPPIB will acquire Shell E&P Ireland Limited’s 45% interest in Corrib for total cash consideration of €830 million, subject to customary closing adjustments and future contingent value payments based on performance and realized pricing. At closing, Vermilion expects to assume operatorship of Corrib. In addition to operatorship, CPPIB plans to transfer a 1.5% working interest to Vermilion for €19.4 million ($28.4 million), before closing adjustments. Vermilion’s incremental 1.5% ownership of Corrib represents production of approximately 850 boe/d (100% gas). The acquisition has an effective date of January 1, 2017 and is anticipated to close in the first half of 2018.

In December 2017, we were awarded a license for the Békéssámson concession for a 4-year term in Hungary. Located adjacent to our existing South Battonya concession in southeast Hungary, the Békéssámson concession covers 330,700 net acres (100% working interest) and more than doubles the size of our total land position in the country. We plan to drill our first well (1.0 net) in the South Battonya concession in Hungary in 2018.

Vermilion continued to be recognized for its commitment and leadership on environmental, social and governance matters in 2017. The Company received a top quartile ranking for our industry sector in RobecoSAM’s annual Corporate Sustainability Assessment (“CSA”). The CSA analyzes sustainability performance across economic, environmental, governance and social criteria, and is the basis of the Dow Jones Sustainability Indices. The RobecoSAM assessment follows earlier recognition of Vermilion’s sustainability performance, including being named to the CDP Climate Leadership Level (A-) as a global leader in environmental stewardship, and receipt of the French government’s Circular Economy Award for Industrial and Regional Ecology for our geothermal energy partnership in Parentis. Vermilion was also ranked 13th by Corporate Knights on the Future 40 Responsible Corporate Leaders in Canada list. This marks the fourth year in a row that Vermilion has been recognized by Corporate Knights as one of Canada's top sustainability performers. Vermilion’s MSCI ESG (Environment, Social and Governance) rating increased from BBB to A for 2017 and our Governance Metrics score ranked in the 90th percentile globally.

Outlook

Vermilion's business model continues to allow for flexibility in response to volatile commodity prices and regulatory changes, as demonstrated in 2017 through the Company’s response to various permitting delays in the Netherlands to reallocate capital to other business units. Vermilion intends to maintain a low level of financial leverage and continue to fund dividends and E&D capital investment from internally generated fund flows from operations. Consistent with these objectives, in October 2017 Vermilion announced an E&D capital budget for 2018 of $315 million with corresponding production guidance of between 74,500-76,500 boe/d. In January 2018, after announcing an acquisition of a private southeast Saskatchewan light oil producer, Vermilion increased its 2018 E&D guidance to $325 million and production guidance to between 75,000-77,500 boe/d. Based on the current commodity price strip, Vermilion expects to fully fund 2018 E&D capital investment and cash dividends from fund flows from operations, with surplus cash generation primarily directed to debt reduction.

TM denotes trademark of Canaccord Genuity Capital Corporation.

| 18 |

Vermilion Energy Inc. | AIF for the year ended December 31, 2017 |

STATEMENT OF RESERVES DATA AND OTHER OIL AND GAS INFORMATION

Reserves and Future Net Revenue

The following is a summary of the oil and natural gas reserves and the value of future net revenue of Vermilion as evaluated by GLJ in a report dated February 1, 2018 with an effective date of December 31, 2017. Pricing used in the forecast price evaluations is set forth in the notes to the tables.

Reserves and other oil and gas information contained in this section is effective December 31, 2017 unless otherwise stated.

All evaluations of future net revenue set forth in the tables below are stated after overriding and lessor royalties, Crown royalties, freehold royalties, mineral taxes, direct lifting costs, normal allocated overhead and future capital investments, including abandonment and reclamation obligations. Future net revenues estimated by the GLJ Report do not represent the fair market value of the reserves. Other assumptions relating to the costs, prices for future production and other matters are included in the GLJ Report. There is no assurance that the future price and cost assumptions used in the GLJ Report will prove accurate and variances could be material.

Reserves for Australia, Canada, France, Germany, Ireland, the Netherlands and United States are established using deterministic methodology. Total proved reserves are established at the 90 percent probability (P90) level. There is a 90 percent probability that the actual reserves recovered will be equal to or greater than the P90 reserves. Total proved plus probable reserves are established at the 50 percent probability (P50) level. There is a 50 percent probability that the actual reserves recovered will be equal to or greater than the P50 reserves.

The Report on Reserves Data by Independent Qualified Reserves Evaluator in Form 51-101F2 and the Report of Management and Directors on Oil and Gas Disclosure in Form 51-101F3 are contained in Schedules "B" and "C", respectively.

The following tables provide reserves data and a breakdown of future net revenue by component and product type using forecast prices and costs. For Canada, the tables following include Alberta Gas Cost Allowance.

The following tables may not total due to rounding.

| 19 |

Vermilion Energy Inc. | AIF for the year ended December 31, 2017 |

Oil and Gas Reserves - Based on Forecast Prices and Costs (1)

| Light

Crude Oil & Medium Crude Oil |

Heavy Oil | Tight Oil | Conventional Natural Gas | |||||

| Gross (2) | Net (2) | Gross (2) | Net (2) | Gross (2) | Net (2) | Gross (2) | Net (2) | |

| (Mbbl) | (Mbbl) | (Mbbl) | (Mbbl) | (Mbbl) | (Mbbl) | (MMcf) | (MMcf) | |

| Proved Developed Producing (3) (5) (6) | ||||||||

| Australia | 9,065 | 9,065 | — | — | — | — | — | — |

| Canada | 11,148 | 10,219 | — | — | — | — | 139,772 | 128,023 |

| France | 35,944 | 33,265 | — | — | — | — | 8,619 | 7,939 |

| Germany | 5,008 | 4,880 | — | — | — | — | 29,791 | 26,881 |

| Ireland | — | — | — | — | — | — | 81,803 | 81,803 |

| Netherlands | — | — | — | — | — | — | 37,296 | 24,721 |

| United States | 982 | 782 | — | — | — | — | 1,071 | 854 |

| Total Proved Developed Producing | 62,147 | 58,211 | — | — | — | — | 298,352 | 270,221 |

| Shale Gas | Coal Bed Methane | Natural Gas Liquids | BOE | |||||

| Gross (2) | Net (2) | Gross (2) | Net (2) | Gross (2) | Net (2) | Gross (2) | Net (2) | |

| (MMcf) | (MMcf) | (MMcf) | (MMcf) | (Mbbl) | (Mbbl) | (Mboe) | (Mboe) | |

| Proved Developed Producing (3) (5) (6) | ||||||||

| Australia | — | — | — | — | — | — | 9,065 | 9,065 |

| Canada | 60 | 56 | 2,330 | 2,153 | 11,215 | 9,102 | 46,057 | 41,026 |

| France | — | — | — | — | — | — | 37,381 | 34,588 |

| Germany | — | — | — | — | — | — | 9,973 | 9,360 |

| Ireland | — | — | — | — | — | — | 13,634 | 13,634 |

| Netherlands | — | — | — | — | 137 | 90 | 6,353 | 4,210 |

| United States | — | — | — | — | 147 | 117 | 1,308 | 1,041 |

| Total Proved Developed Producing | 60 | 56 | 2,330 | 2,153 | 11,499 | 9,309 | 123,771 | 112,924 |

| Light

Crude Oil & Medium Crude Oil |

Heavy Oil | Tight Oil | Conventional Natural Gas | |||||

| Gross (2) | Net (2) | Gross (2) | Net (2) | Gross (2) | Net (2) | Gross (2) | Net (2) | |

| (Mbbl) | (Mbbl) | (Mbbl) | (Mbbl) | (Mbbl) | (Mbbl) | (MMcf) | (MMcf) | |

| Proved Developed Non-Producing (3) (5) (7) | ||||||||

| Australia | 350 | 350 | — | — | — | — | ||

| Canada | 878 | 768 | — | — | — | — | 9,420 | 8,489 |

| France | 562 | 492 | — | — | — | — | — | — |

| Germany | 539 | 521 | — | — | — | — | 8,959 | 8,156 |

| Ireland | — | — | — | — | — | — | — | — |

| Netherlands | — | — | — | — | — | — | 21,010 | 20,482 |

| United States | — | — | — | — | — | — | — | — |

| Total Proved Developed Non-Producing | 2,329 | 2,131 | — | — | — | — | 39,389 | 37,127 |

| Shale Gas | Coal Bed Methane | Natural Gas Liquids | BOE | |||||

| Gross (2) | Net (2) | Gross (2) | Net (2) | Gross (2) | Net (2) | Gross (2) | Net (2) | |

| (MMcf) | (MMcf) | (MMcf) | (MMcf) | (Mbbl) | (Mbbl) | (Mboe) | (Mboe) | |

| Proved Developed Non-Producing (3) (5) (7) | ||||||||

| Australia | — | — | — | — | — | — | 350 | 350 |

| Canada | 1,079 | 1,025 | 2,360 | 2,200 | 410 | 309 | 3,431 | 3,029 |

| France | — | — | — | — | — | — | 562 | 492 |

| Germany | — | — | — | — | — | — | 2,032 | 1,880 |

| Ireland | — | — | — | — | — | — | — | — |

| Netherlands | — | — | — | — | 56 | 54 | 3,558 | 3,468 |

| United States | — | — | — | — | — | — | — | — |

| Total Proved Developed Non-Producing | 1,079 | 1,025 | 2,360 | 2,200 | 466 | 363 | 9,933 | 9,219 |

| 20 |

Vermilion Energy Inc. | AIF for the year ended December 31, 2017 |

| Light

Crude Oil & Medium Crude Oil |

Heavy Oil | Tight Oil | Conventional Natural Gas | |||||

| Gross (2) | Net (2) | Gross (2) | Net (2) | Gross (2) | Net (2) | Gross (2) | Net (2) | |

| (Mbbl) | (Mbbl) | (Mbbl) | (Mbbl) | (Mbbl) | (Mbbl) | (MMcf) | (MMcf) | |

| Proved Undeveloped (3) (8) | ||||||||

| Australia | 1,500 | 1,500 | — | — | — | — | — | — |

| Canada | 7,634 | 6,929 | — | — | — | — | 91,104 | 83,603 |

| France | 4,140 | 3,767 | — | — | — | — | 64 | 64 |

| Germany | 241 | 235 | — | — | — | — | 2,361 | 1,939 |

| Ireland | — | — | — | — | — | — | — | — |

| Netherlands | — | — | — | — | — | — | 2,620 | 2,620 |

| United States | 3,300 | 2,693 | — | — | — | — | 3,309 | 2,700 |

| Total Proved Undeveloped | 16,815 | 15,124 | — | — | — | — | 99,458 | 90,926 |

| Shale Gas | Coal Bed Methane | Natural Gas Liquids | BOE | |||||

| Gross (2) | Net (2) | Gross (2) | Net (2) | Gross (2) | Net (2) | Gross (2) | Net (2) | |

| (MMcf) | (MMcf) | (MMcf) | (MMcf) | (Mbbl) | (Mbbl) | (Mboe) | (Mboe) | |

| Proved Undeveloped (3) (8) | ||||||||

| Australia | — | — | — | — | — | — | 1,500 | 1,500 |

| Canada | — | — | 2,023 | 1,849 | 8,679 | 7,689 | 31,834 | 28,860 |

| France | — | — | — | — | — | — | 4,151 | 3,778 |

| Germany | — | — | — | — | — | — | 635 | 558 |

| Ireland | — | — | — | — | — | — | — | — |

| Netherlands | — | — | — | — | — | — | 437 | 437 |

| United States | — | — | — | — | 454 | 370 | 4,306 | 3,513 |

| Total Proved Undeveloped | — | — | 2,023 | 1,849 | 9,133 | 8,059 | 42,863 | 38,646 |

| Light

Crude Oil & Medium Crude Oil |

Heavy Oil | Tight Oil | Conventional Natural Gas | |||||

| Gross (2) | Net (2) | Gross (2) | Net (2) | Gross (2) | Net (2) | Gross (2) | Net (2) | |

| (Mbbl) | (Mbbl) | (Mbbl) | (Mbbl) | (Mbbl) | (Mbbl) | (MMcf) | (MMcf) | |

| Proved (3) | ||||||||

| Australia | 10,915 | 10,915 | — | — | — | — | — | — |

| Canada | 19,660 | 17,916 | — | — | — | — | 240,296 | 220,115 |

| France | 40,646 | 37,524 | — | — | — | — | 8,683 | 8,003 |

| Germany | 5,788 | 5,636 | — | — | — | — | 41,111 | 36,976 |

| Ireland | — | — | — | — | — | — | 81,803 | 81,803 |

| Netherlands | — | — | — | — | — | — | 60,926 | 47,823 |

| United States | 4,282 | 3,475 | — | — | — | — | 4,380 | 3,554 |

| Total Proved | 81,291 | 75,466 | — | — | — | — | 437,199 | 398,274 |

| Shale Gas | Coal Bed Methane | Natural Gas Liquids | BOE | |||||

| Gross (2) | Net (2) | Gross (2) | Net (2) | Gross (2) | Net (2) | Gross (2) | Net (2) | |

| (MMcf) | (MMcf) | (MMcf) | (MMcf) | (Mbbl) | (Mbbl) | (Mboe) | (Mboe) | |

| Proved (3) | ||||||||

| Australia | — | — | — | — | — | — | 10,915 | 10,915 |

| Canada | 1,139 | 1,081 | 6,713 | 6,202 | 20,304 | 17,100 | 81,322 | 72,916 |

| France | — | — | — | — | — | — | 42,093 | 38,858 |

| Germany | — | — | — | — | — | — | 12,640 | 11,799 |

| Ireland | — | — | — | — | — | — | 13,634 | 13,634 |

| Netherlands | — | — | — | — | 193 | 144 | 10,347 | 8,115 |

| United States | — | — | — | — | 601 | 487 | 5,613 | 4,554 |

| Total Proved | 1,139 | 1,081 | 6,713 | 6,202 | 21,098 | 17,731 | 176,564 | 160,791 |

| 21 |

Vermilion Energy Inc. | AIF for the year ended December 31, 2017 |

| Light

Crude Oil & Medium Crude Oil |

Heavy Oil | Tight Oil | Conventional Natural Gas | |||||

| Gross (2) | Net (2) | Gross (2) | Net (2) | Gross (2) | Net (2) | Gross (2) | Net (2) | |

| (Mbbl) | (Mbbl) | (Mbbl) | (Mbbl) | (Mbbl) | (Mbbl) | (MMcf) | (MMcf) | |

| Probable (4) | ||||||||

| Australia | 4,650 | 4,650 | — | — | — | — | — | — |

| Canada | 12,885 | 11,417 | — | — | — | — | 181,055 | 164,336 |

| France | 21,786 | 20,115 | — | — | — | — | 1,854 | 1,769 |

| Germany | 3,000 | 2,931 | — | — | — | — | 53,134 | 47,092 |

| Ireland | — | — | — | — | — | — | 51,389 | 51,389 |

| Netherlands | — | — | — | — | — | — | 44,380 | 35,383 |

| United States | 7,073 | 5,827 | — | — | — | — | 7,520 | 6,194 |

| Total Probable | 49,394 | 44,940 | — | — | — | — | 339,332 | 306,163 |

| Shale Gas | Coal Bed Methane | Natural Gas Liquids | BOE | |||||

| Gross (2) | Net (2) | Gross (2) | Net (2) | Gross (2) | Net (2) | Gross (2) | Net (2) | |

| (MMcf) | (MMcf) | (MMcf) | (MMcf) | (Mbbl) | (Mbbl) | (Mboe) | (Mboe) | |

| Probable (4) | ||||||||

| Australia | — | — | — | — | — | — | 4,650 | 4,650 |

| Canada | 214 | 203 | 3,053 | 2,846 | 14,282 | 12,186 | 57,887 | 51,501 |

| France | — | — | — | — | — | — | 22,095 | 20,410 |

| Germany | — | — | — | — | — | — | 11,856 | 10,780 |

| Ireland | — | — | — | — | — | — | 8,565 | 8,565 |

| Netherlands | — | — | — | — | 119 | 90 | 7,516 | 5,987 |

| United States | — | — | — | — | 1,031 | 849 | 9,357 | 7,708 |

| Total Probable | 214 | 203 | 3,053 | 2,846 | 15,432 | 13,125 | 121,926 | 109,601 |

| Light

Crude Oil & Medium Crude Oil |

Heavy Oil | Tight Oil | Conventional Natural Gas | |||||

| Gross (2) | Net (2) | Gross (2) | Net (2) | Gross (2) | Net (2) | Gross (2) | Net (2) | |

| (Mbbl) | (Mbbl) | (Mbbl) | (Mbbl) | (Mbbl) | (Mbbl) | (MMcf) | (MMcf) | |

| Proved Plus Probable (3) (4) | ||||||||

| Australia | 15,565 | 15,565 | — | — | — | — | — | — |

| Canada | 32,545 | 29,333 | — | — | — | — | 421,351 | 384,451 |

| France | 62,432 | 57,639 | — | — | — | — | 10,537 | 9,772 |

| Germany | 8,788 | 8,567 | — | — | — | — | 94,245 | 84,068 |

| Ireland | — | — | — | — | — | — | 133,192 | 133,192 |

| Netherlands | — | — | — | — | — | — | 105,306 | 83,206 |

| United States | 11,355 | 9,302 | — | — | — | — | 11,900 | 9,748 |

| Total Proved Plus Probable | 130,685 | 120,406 | — | — | — | — | 776,531 | 704,437 |

| Shale Gas | Coal Bed Methane | Natural Gas Liquids | BOE | |||||

| Gross (2) | Net (2) | Gross (2) | Net (2) | Gross (2) | Net (2) | Gross (2) | Net (2) | |

| (MMcf) | (MMcf) | (MMcf) | (MMcf) | (Mbbl) | (Mbbl) | (Mboe) | (Mboe) | |

| Proved Plus Probable (3) (4) | ||||||||

| Australia | — | — | — | — | — | — | 15,565 | 15,565 |

| Canada | 1,353 | 1,284 | 9,766 | 9,048 | 34,586 | 29,286 | 139,209 | 124,416 |

| France | — | — | — | — | — | — | 64,188 | 59,268 |

| Germany | — | — | — | — | — | — | 24,496 | 22,578 |

| Ireland | — | — | — | — | — | — | 22,199 | 22,199 |

| Netherlands | — | — | — | — | 312 | 234 | 17,863 | 14,102 |

| United States | — | — | — | — | 1,632 | 1,336 | 14,970 | 12,263 |

| Total Proved Plus Probable | 1,353 | 1,284 | 9,766 | 9,048 | 36,530 | 30,856 | 298,490 | 270,391 |

| 22 |

Vermilion Energy Inc. | AIF for the year ended December 31, 2017 |

Notes:

| (1) | The pricing assumptions used in the GLJ Report with respect to net present value of future net revenue (forecast) as well as the inflation rates used for operating and capital costs are set forth below. See “Forecast Prices used in Estimates”. The NGL price is an aggregate of the individual natural gas liquids prices used in the Total Proved plus Probable evaluation. GLJ is an independent qualified reserves evaluator appointed pursuant to NI 51-101. |

| (2) | "Gross Reserves" are Vermilion's working interest (operating or non-operating) share before deduction of royalties and without including any royalty interests of Vermilion. "Net Reserves" are Vermilion's working interest (operating or non-operating) share after deduction of royalty obligations, plus Vermilion's royalty interests in reserves. |

| (3) | "Proved" reserves are those reserves that can be estimated with a high degree of certainty to be recoverable. It is likely that the actual remaining quantities recovered will exceed the estimated proved reserves. |

| (4) | "Probable" reserves are those additional reserves that are less certain to be recovered than proved reserves. It is equally likely that the actual remaining quantities recovered will be greater or less than the sum of the estimated proved plus probable reserves. |

| (5) | "Developed" reserves are those reserves that are expected to be recovered from existing wells and installed facilities or, if facilities have not been installed, that would involve a low expenditure (e.g. when compared to the cost of drilling a well) to put the reserves on production. |

| (6) | "Developed Producing" reserves are those reserves that are expected to be recovered from completion intervals open at the time of the estimate. These reserves may be currently producing or, if shut-in, they must have previously been on production, and the date of resumption of production must be known with reasonable certainty. |

| (7) | "Developed Non-Producing" reserves are those reserves that either have not been on production, or have previously been on production, but are shut in, and the date of resumption of production is unknown. |

| (8) | "Undeveloped" reserves are those reserves expected to be recovered from known accumulations where a significant expenditure (for example, when compared to the cost of drilling a well) is required to render them capable of production. They must fully meet the requirements of the reserves classification (proved, probable, possible) to which they are assigned. |

| 23 |

Vermilion Energy Inc. | AIF for the year ended December 31, 2017 |

Net Present Value of Future Net Revenue - Based on Forecast Prices and Costs (1)

|

Before Deducting Future Income Taxes Discounted At | After Deducting Future Income Taxes Discounted At | ||||||||

| (M$) | 0% | 5% | 10% | 15% | 20% | 0% | 5% | 10% | 15% | 20% |

| Proved Developed Producing (2) (4) (5) | ||||||||||

| Australia | (17,017) | 90,880 | 132,474 | 146,048 | 147,713 | 77,180 | 124,390 | 136,979 | 136,121 | 130,383 |

| Canada | 929,867 | 770,860 | 647,843 | 559,708 | 494,964 | 929,867 | 770,860 | 647,843 | 559,708 | 494,964 |

| France | 1,791,774 | 1,315,070 | 1,030,403 | 849,032 | 725,407 | 1,473,144 | 1,091,894 | 858,839 | 708,168 | 604,390 |

| Germany | 276,577 | 249,619 | 206,965 | 174,876 | 151,703 | 276,578 | 249,619 | 206,965 | 174,876 | 151,703 |

| Ireland | 389,204 | 376,115 | 346,327 | 316,408 | 290,143 | 389,204 | 376,115 | 346,327 | 316,408 | 290,143 |

| Netherlands | 48,794 | 60,781 | 66,245 | 68,260 | 68,404 | 48,793 | 60,781 | 66,245 | 68,260 | 68,404 |

| United States | 44,617 | 34,550 | 28,272 | 24,106 | 21,170 | 44,619 | 34,550 | 28,272 | 24,106 | 21,170 |

| Total Proved Developed Producing | 3,463,816 | 2,897,875 | 2,458,529 | 2,138,438 | 1,899,504 | 3,239,385 | 2,708,209 | 2,291,470 | 1,987,647 | 1,761,157 |

| Proved Developed Non-Producing (2) (4) (6) | ||||||||||

| Australia | 28,079 | 24,122 | 20,869 | 18,180 | 15,942 | 28,079 | 24,122 | 20,869 | 18,180 | 15,942 |

| Canada | 60,804 | 42,405 | 32,416 | 26,238 | 22,048 | 60,804 | 42,405 | 32,417 | 26,238 | 22,048 |

| France | 10,082 | 8,113 | 6,095 | 4,559 | 3,438 | 6,848 | 5,499 | 3,953 | 2,763 | 1,896 |

| Germany | 49,825 | 37,600 | 27,510 | 20,411 | 15,501 | 32,059 | 29,369 | 23,502 | 18,374 | 14,426 |

| Ireland | — | — | — | — | — | — | — | — | — | — |

| Netherlands | 70,140 | 70,244 | 67,599 | 63,916 | 59,989 | 53,099 | 54,167 | 52,375 | 49,452 | 46,205 |

| United States | — | — | — | — | — | — | — | — | — | — |

| Total Proved Developed Non-Producing | 218,930 | 182,484 | 154,489 | 133,304 | 116,918 | 180,889 | 155,562 | 133,116 | 115,007 | 100,517 |

| Proved Undeveloped (2) (7) | ||||||||||

| Australia | 54,981 | 43,263 | 34,175 | 27,105 | 21,564 | 25,101 | 18,532 | 13,890 | 10,524 | 8,032 |

| Canada | 524,830 | 354,396 | 246,584 | 175,252 | 126,009 | 397,236 | 281,016 | 202,741 | 148,193 | 108,836 |

| France | 177,851 | 128,923 | 96,156 | 73,638 | 57,592 | 127,650 | 88,876 | 63,091 | 45,660 | 33,460 |

| Germany | 17,161 | 11,696 | 8,012 | 5,495 | 3,737 | 12,154 | 8,910 | 6,412 | 4,551 | 3,166 |

| Ireland | — | — | — | — | — | — | — | — | — | — |

| Netherlands | 10,559 | 8,825 | 7,405 | 6,255 | 5,323 | 7,921 | 6,405 | 5,174 | 4,189 | 3,401 |

| United States | 110,911 | 64,500 | 39,231 | 24,394 | 15,111 | 105,425 | 62,306 | 38,295 | 23,973 | 14,912 |

| Total Proved Undeveloped | 896,293 | 611,603 | 431,563 | 312,139 | 229,336 | 675,487 | 466,045 | 329,603 | 237,090 | 171,807 |

| Proved (2) | ||||||||||

| Australia | 66,043 | 158,265 | 187,518 | 191,333 | 185,219 | 130,360 | 167,044 | 171,738 | 164,825 | 154,357 |

| Canada | 1,515,501 | 1,167,661 | 926,843 | 761,198 | 643,021 | 1,387,907 | 1,094,281 | 883,001 | 734,139 | 625,848 |

| France | 1,979,707 | 1,452,106 | 1,132,654 | 927,229 | 786,437 | 1,607,642 | 1,186,269 | 925,883 | 756,591 | 639,746 |

| Germany | 343,563 | 298,915 | 242,487 | 200,782 | 170,941 | 320,791 | 287,898 | 236,879 | 197,801 | 169,295 |

| Ireland | 389,204 | 376,115 | 346,327 | 316,408 | 290,143 | 389,204 | 376,115 | 346,327 | 316,408 | 290,143 |

| Netherlands | 129,493 | 139,850 | 141,249 | 138,431 | 133,716 | 109,813 | 121,353 | 123,794 | 121,901 | 118,010 |

| United States | 155,528 | 99,050 | 67,503 | 48,500 | 36,281 | 150,044 | 96,856 | 66,567 | 48,079 | 36,082 |

| Total Proved | 4,579,039 | 3,691,962 | 3,044,581 | 2,583,881 | 2,245,758 | 4,095,761 | 3,329,816 | 2,754,189 | 2,339,744 | 2,033,481 |

| Probable (3) | ||||||||||

| Australia | 154,459 | 149,732 | 125,619 | 102,719 | 84,652 | 93,591 | 88,478 | 72,912 | 58,670 | 47,633 |

| Canada | 1,363,584 | 814,347 | 539,091 | 384,014 | 288,722 | 1,003,602 | 592,655 | 390,429 | 278,355 | 210,521 |

| France | 1,200,008 | 673,205 | 431,159 | 299,927 | 219,972 | 879,913 | 477,377 | 292,831 | 193,985 | 134,663 |

| Germany | 414,585 | 244,149 | 151,416 | 100,767 | 70,641 | 293,314 | 172,157 | 104,603 | 68,306 | 47,063 |

| Ireland | 350,695 | 246,321 | 182,785 | 141,844 | 114,117 | 350,695 | 246,321 | 182,785 | 141,844 | 114,117 |

| Netherlands | 197,136 | 167,242 | 141,871 | 121,179 | 104,496 | 130,277 | 108,388 | 89,527 | 74,196 | 61,980 |

| United States | 353,649 | 198,078 | 124,603 | 84,897 | 61,103 | 278,493 | 157,846 | 100,547 | 69,404 | 50,591 |

| Total Probable | 4,034,116 | 2,493,074 | 1,696,544 | 1,235,347 | 943,703 | 3,029,885 | 1,843,222 | 1,233,634 | 884,760 | 666,568 |

| 24 |