2024 Annual Meeting of Shareholders Tuesday, April 30, 2024 | 10:00 a.m. ET www.virtualshareholdermeeting.com/BA2024

☐ |

Preliminary Proxy Statement |

☐ |

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

☒ |

Definitive Proxy Statement |

☐ |

Definitive Additional Materials |

☐ |

Soliciting Material Pursuant to §240.14a-12 |

☒ |

No fee required |

☐ |

Fee paid previously with preliminary materials. |

☐ |

Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 |

2024 Annual Meeting of Shareholders Tuesday, April 30, 2024 | 10:00 a.m. ET www.virtualshareholdermeeting.com/BA2024

Message from Our Independent Chair

|

|

To My Fellow Boeing Shareholders,

The months and years ahead are critically important for The Boeing Company to take the necessary steps to regain the trust lost in recent times, to get back on track and perform like the company we all know Boeing can and must be, every day. I recently accepted the role of independent Chair of the Board because I am acutely aware of how important this task is for the future of not just Boeing, but every single stakeholder who depends on us being successful. The world needs a healthy, safe, and successful Boeing. And that is what it is going to get.

I thank my fellow Board members for the privilege of serving in this role. I thank Dave Calhoun for his tireless work both as a member of the Board and as CEO. I thank Larry Kellner for his 13 years of remarkable dedication to the Company as a Board member and as its Chair. And, most important of all, I thank our employees for all their hard work and dedication, because without them we are nothing at all.

I promise that I personally, and we as a Board, will leave no stone unturned in our efforts to get this company to where it needs to be. And the work of renewal has already begun.

Now let me cover some important topics that are in full focus for all of us at Boeing.

Commitment to Safety. Safety is, of course, our top priority. While we have made progress in strengthening our safety management and quality control systems and processes in the last few years, recent events make it absolutely clear that we have more work to do and must improve every day. |

The Board is fully engaged and has worked with management to take immediate actions to continue strengthening our safety, quality and risk management systems. Among other steps, we brought in Admiral Kirkland Donald as an independent special advisor to Boeing President and CEO Dave Calhoun. Admiral Donald and his team of outside experts are conducting a thorough assessment of our Quality Management System for Commercial Airplanes, including quality programs and practices in our manufacturing facilities and its oversight of commercial supplier quality. His recommendations will be provided to Dave and to our Board’s Aerospace Safety Committee, which is comprised solely of independent directors. In addition, our teams have added additional inspections throughout the build process, we have opened our factories to 737 operators for additional oversight inspections, and are restructuring the approach and frequency of our sessions with teams to refocus and recommit on quality and compliance. As we navigate the year ahead, we will continue to work transparently with and follow the lead of our regulators.

Empowering our Employees. Our employees are the foundation of our success and the key to product safety. We believe a culture in which our employees are heard, trained and supported will produce safe and reliable airplanes. We remain determined to create a safe, innovative and inclusive culture. The safety of our employees in the workplace is a top priority and we are continually improving our practices and policies to strive to prevent workplace injuries. We support employees’ professional development through leadership trainings, tuition assistance and upskilling opportunities. We have a diverse workforce that is increasingly representative of the communities where we live and work.

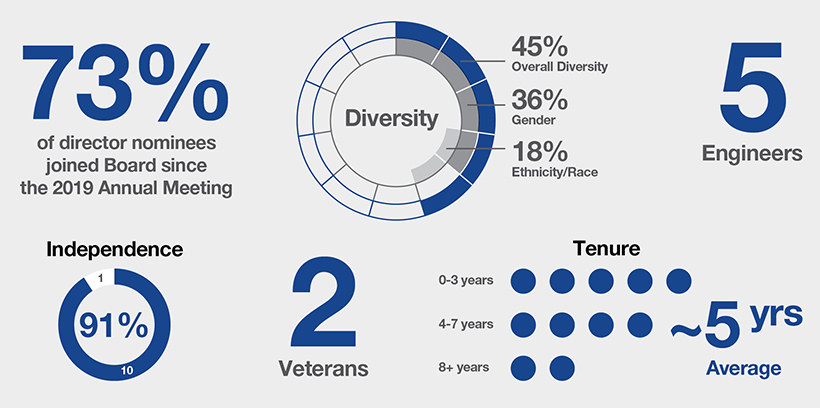

Maintaining a Highly Qualified and Skilled Board. Our Board is composed of highly qualified and dedicated directors who exhibit the right balance of skills and experiences to oversee our evolving business needs and strategic priorities. Our commitment to Board refreshment has resulted in adding directors with extensive safety, complex manufacturing, engineering and aerospace expertise. Since our 2019 annual meeting, we have added eight new directors, five of whom have engineering degrees. Our refreshment efforts have also resulted in a diverse Board (45% of nominees are diverse with respect to gender, race and/or ethnicity) that balances fresh perspectives with longer-tenured experience. I would like to extend my personal thanks to Ron Williams, who has reached the Board’s mandatory retirement age. We are grateful for his leadership and example over the years.

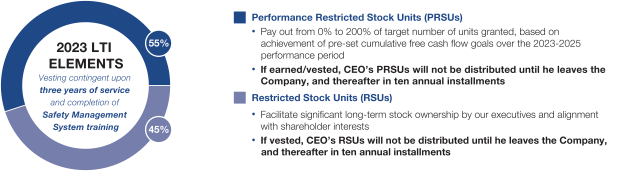

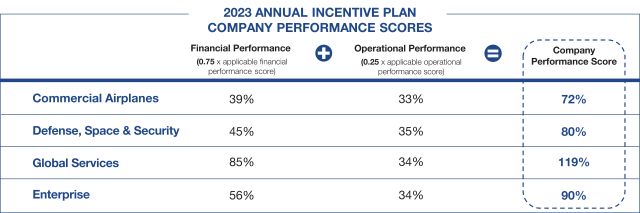

Aligning Compensation to Performance and Strategy. We are committed to maintaining a compensation program that ensures our executives are focused on building long-term, sustainable growth for our shareholders in a manner consistent with our core values. Over the past several years, we have implemented a number of changes that take into consideration shareholder feedback and the evolution of our business. For 2023, we refined our annual incentive plan design to adjust the balance between enterprise and business unit performance and shifted our long-term program to incorporate performance RSUs (weighted at 55% of long-term incentives) that only pay out if we achieve pre-established business goals. Following the Alaska Airlines accident, we made additional changes to our 2024 annual incentive plan and our long-term incentive program design to heighten focus on safety and quality metrics; for Commercial Airplanes, operational performance in these critical areas will be the primary driver of annual incentive payouts for 2024. These changes are described beginning on page 66.

Paving the Future of Sustainable Aerospace. Our focus on environmental sustainability is centered on our commitment to a sustainable aerospace future and we continue to make progress toward achieving the commercial aviation industry’s ambition to achieve net-zero carbon emissions for global civil aviation operations by 2050. We held our first Sustainable Aerospace Together Forum that convened global thought leaders and decision-makers across aviation, policy, energy and finance to discuss a path to achieving sustainable flight. Driven by our sustainability strategy, we made important progress over the past year to advance sustainable aviation fuel, accelerate fleet modernization, invest in operational efficiencies and develop new aviation technologies.

All of these items, in particular our compensation program, have been informed by shareholder feedback as part of our robust ongoing shareholder engagement program. Leading up to and following our 2023 annual meeting, we engaged with shareholders representing approximately 34% of our outstanding stock.

Above all, we remain committed to our core values of safety, quality, transparency and sustainability. While there is still considerable work ahead, the Board is confident we are on the right path with a clear focus on what needs to be accomplished.

Sincerely,

Steve Mollenkopf

Independent Chair of the Board

Notice of 2024 Annual Meeting of Shareholders

|

|

Time and Date 11:00 a.m. Eastern Time Friday, May 17, 2024

Place Virtual meeting at www.virtualshareholder meeting.com/BA2024

Record Date March 27, 2024

How to Vote See “Frequently Asked Questions” beginning on page 100 for additional information on how to vote

By Internet

Visit www.proxyvote.com

By Telephone

Call the telephone number

By Mail

Mark, sign, date and

|

Items of Business

1. Election of the 11 director nominees named in this proxy statement

2. Advisory vote on named executive officer compensation

3. Ratification of the appointment of Deloitte & Touche LLP as Boeing’s independent auditors for 2024

4. Five shareholder proposals contained in this proxy statement, if properly presented

Shareholders will also transact such other business as may properly come before the meeting and any postponement or adjournment thereof.

Your vote is important to us. We urge you to vote as soon as possible, even if you own only a few shares.

This proxy statement is issued in connection with the solicitation of proxies by the Board of Directors of The Boeing Company for use at the 2024 Annual Meeting of Shareholders and at any adjournment or postponement thereof. On or about April 5, 2024, we will begin distributing print or electronic materials regarding the annual meeting to each shareholder entitled to vote at the meeting. Shares represented by a properly executed proxy will be voted in accordance with instructions provided by the shareholder.

By order of the Board of Directors,

John C. Demers Vice President, Assistant General Counsel and Corporate Secretary |

Important Notice regarding the availability of proxy materials for the Annual Meeting of Shareholders to be held on May 17, 2024: this Proxy Statement and the 2023 Annual Report are available at www.proxyvote.com.

Website references throughout this document are provided for convenience only, and the content on the referenced websites is not incorporated by reference into this document.

Table of Contents

| 1 | ||||

| 3 | ||||

| 4 | ||||

| 4 | ||||

| 5 | ||||

| 5 | ||||

| 5 | ||||

| 6 | ||||

| 7 | ||||

| 7 | ||||

| 8 | ||||

| 10 | ||||

| 10 | ||||

| 11 | ||||

| 11 | ||||

| 24 | ||||

| 24 | ||||

| 24 | ||||

| 25 | ||||

| 27 | ||||

| 31 | ||||

| 32 | ||||

| 34 | ||||

| 34 | ||||

| 35 | ||||

| 35 | ||||

| 36 | ||||

| 37 | ||||

| 38 | ||||

| 38 | ||||

| 38 | ||||

| 38 | ||||

| 41 | ||||

| 41 | ||||

| 41 | ||||

| APPROVE, ON AN ADVISORY BASIS, NAMED EXECUTIVE OFFICER COMPENSATION (ITEM 2) |

43 | |||

| 45 | ||||

| 46 | ||||

| 53 | ||||

| 56 | ||||

| 60 | ||||

| 62 | ||||

| 66 | ||||

| 67 | ||||

| 70 | ||||

| 70 | ||||

| 70 | ||||

| 72 | ||||

| 72 | ||||

| 74 | ||||

| 75 | ||||

| 76 | ||||

| 76 | ||||

| 77 | ||||

| 79 | ||||

| 81 | ||||

| 82 | ||||

| 85 | ||||

| 85 | ||||

| 86 | ||||

| 87 | ||||

| 87 | ||||

| 88 | ||||

| 88 | ||||

| 89 | ||||

| Shareholder Proposal – Review of China Business and ESG Commitments (Item 4) |

89 | |||

| 91 | ||||

| Shareholder Proposal – Racial and Gender Pay Gap Disclosure (Item 6) |

94 | |||

| Shareholder Proposal – Report on Risks Related to Diversity, Equity & Inclusion Efforts (Item 7) |

96 | |||

| Shareholder Proposal – Adoption of Value Chain Emission Reduction Target (Item 8) |

97 | |||

| 100 | ||||

| 100 | ||||

| 100 | ||||

| 104 | ||||

| A-1 | ||||

BUILDING TRUST THROUGH ACTION AND TRANSPARENCY

|

We are deeply sorry to our customers and their passengers for the disruption and serious concern caused by the January 5, 2024 Alaska Airlines Flight 1282 accident. We are committed to continuing to strengthen our culture of safety through continuous improvement, learning and innovation. Teammates from across the Company are taking an objective and collaborative approach to all aspects of product safety, quality, compliance and airworthiness. In all situations, every employee is empowered and encouraged to speak up if they have any safety or quality concern. We are dedicated to making daily progress and holding ourselves accountable to the highest standards.

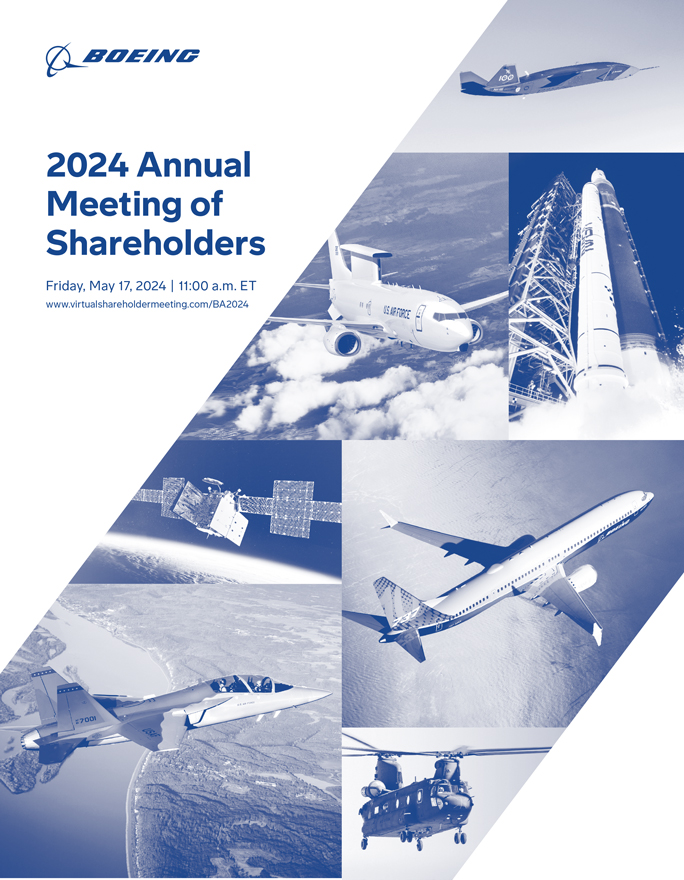

The Board and its Aerospace Safety Committee recognize the gravity of the situation and are actively engaged in overseeing the Company’s actions following the accident. The timeline to the left highlights some of the key actions the Board has taken in the 45 days immediately following the accident. While there is still more to do, this response reflects many of the enhancements to the Board’s oversight function that have been implemented in recent years, including by creating and then permanently establishing the Aerospace Safety Committee, as well as by adding highly-qualified and experienced directors with critical skills to oversee our business. Our directors collectively bring to boardroom discussions the perspectives of our airline customers, pilots, suppliers and engineers, as well as vast expertise in engineering, complex manufacturing, safety, highly-regulated industries, risk management and aerospace.

We have taken important steps in recent years to strengthen our Quality Management System’s (QMS) foundation and its layers of protection. However, the Alaska Airlines accident makes clear that we have more to do. To that end, we have taken immediate and comprehensive actions to strengthen quality assurance and controls across our factories, including:

• Conducting additional inspections throughout the build process. These checks provide one more layer of scrutiny on top of the thousands of inspections performed across each 737 airplane, and build on the reviews we have implemented to capture potential non-conformances. Since 2019, we have increased the number of Commercial Airplanes quality inspectors by 20% and we are making more investments in the Quality function.

• Appointed an independent and recognized safety and quality leader, Admiral Kirkland Donald, to complete a thorough and unimpeded assessment of our QMS and make recommendations to the Board’s Aerospace Safety Committee and our CEO.

• Required additional sessions for our teams to gather and refocus on the fundamentals of our QMS, take advantage of our expanded training programs and recommit to improving quality and compliance.

• Deployed a team to work alongside Spirit AeroSystems to complement the existing teammates on the ground. We are inspecting more than 50 points in Spirit’s build process and assessing their build plans against engineering specifications. Our team is also now inspecting Spirit’s installation of the mid-exit door plug and approving them before the fuselage section can be shipped to Boeing. |

|

1 |

|

2024 Proxy Statement |

BUILDING TRUST THROUGH ACTION AND TRANSPARENCY

| • | Enhanced quality focus through leadership changes including electing Stephanie F. Pope as the new leader of Commercial Airplanes, effective March 25, 2024, and the creation of a new position of Senior Vice President, Quality for Commercial Airplanes to lead quality control and quality assurance efforts, as well as the quality initiatives within our commercial airplanes business and the supply chain. |

| • | Opened our factories to 737 operators for additional oversight inspections to review our production and quality procedures. |

We make ourselves accountable for what happens on our factory floors and throughout our operations. That mindset was demonstrated in the actions and decisions taken in our executive compensation program. Our CEO, Mr. Calhoun, informed the Board in early February 2024 that he was declining to be considered for any annual incentive payout for 2023. The Board honored Mr. Calhoun’s request and approved a zero incentive payout for the year. For our other named executive officers, Mr. Calhoun recommended, and the Compensation Committee approved, individual performance scores that reflected their individual leadership efforts and the overall performance of the business unit or function they led during 2023; for our commercial airplanes and defense leaders, these scores resulted in significant reductions to their incentive payouts for the year. See page 62 for additional information.

The Compensation Committee also took swift action to make significant design changes to our annual incentive metrics for 2024. These metrics will determine payouts not only for our executive officers but our entire executive team and over 110,000 of our employees around the world and across all three business units. These changes were informed by shareholder feedback and are intended to drive our collective performance towards achieving the challenging safety and quality goals set by the Compensation Committee for 2024. For our commercial airplanes business in particular, operational performance against pre-set metrics in the areas of product safety, quality and employee safety will be the primary driver of incentive plan outcomes for 2024, accounting for 60% of the payout score that will be determined in early 2025. More information on our 2024 annual incentive plan changes can be found on page 66.

In our long-term incentive program, the Compensation Committee determined that the value of executive officer awards would be reduced by the percentage decline in our stock price between January 5, 2024, the day of the Alaska Airlines accident, and the award grant date. This resulted in a 22% reduction in long-term incentive award values for our executive officer leadership team, including all of our named executive officers. These awards, which were issued in early March 2024, were granted 45% in restricted stock units and 55% in performance restricted stock units, which will pay out based on performance against three-year free cash flow goals and—new for 2024—pre-set operational metrics focused on quality and safety. More information on these decisions can be found on page 67.

Throughout this process, our independent Board Chair, Aerospace Safety Committee Chair and members of senior management have engaged with key stakeholders, including shareholders, customers, regulators and employees. We are committed to ensuring every Boeing airplane meets design specifications and the highest safety and quality standards, and doing everything we can to ensure our customers and their passengers can have complete confidence in Boeing airplanes.

|

2024 Proxy Statement |

|

2 |

|

SAFETY & QUALITY

Boeing is dedicated to its unwavering commitment to safety, quality, integrity and transparency. Our goal is to prevent accidents, injury or loss of life with our culture and actions rooted in safety. We continue to enhance oversight of our safety processes and procedures.

The Aerospace Safety Committee assists the Board in the oversight of the safety of company products and services. The Chief Aerospace Safety Office, which was established in 2021, has developed a comprehensive strategy to strengthen Boeing’s safety practices and culture and is collaborating with global regulators, airline operators and other industry stakeholders to improve the aerospace safety ecosystem.

The oversight mechanisms in place include formal lines of communication which ensure safety and potential safety issues are evaluated, discussed and addressed during Safety Reviews with business unit presidents, our Chief Engineer, functional and program leaders and members of the FAA. Nothing is more important at Boeing than safety—in the workplace and in the products we design, build and support.

| The Chief Aerospace Safety Office, with oversight by the Board of Directors and the Aerospace Safety Committee,

| ||||

|

Excellence in Engineering

|

Culture of Accountability |

Collaboration Within and Beyond the Industry

| ||

|

> Single integrated engineering organization, reporting to the Chief Engineer

> Online Engineering Handbook for onboarding, training and learning

> Standard method to capture, protect and share critical technical and engineering knowledge through Design Practices

> Technical Design Reviews focused on identifying risks and issues early in the design process

> Safety analytics platform, Boeing Safety Intelligence, delivers real-time insights from advanced modeling techniques and machine learning algorithms |

> Quality and safety metrics included in annual incentive plan

> Enterprise Safety Management System (SMS) for managing safety risks with processes to ensure issues or risks are escalated appropriately

> Confidential reporting channel, Speak Up, encouraging employees to report concerns

> Annual SMS training for all employees that focuses on the vital role each employee plays in speaking up about product safety issues and ideas

> Seek, Speak & Listen habits to build stronger teams, achieve better business outcomes and strengthen a culture of inclusion

> Annual Code of Conduct signing and recommitment remind all employees of the obligation to speak up and be a voice for others when something does not align with our values

> Digital learning platform provides a collaborative forum for sharing product safety information

> Weekly safety reviews of all safety and potential safety-related issues

> Dedicated Organization Designation Authorization (ODA) ombudsperson who serves as an additional channel for ODA unit members to raise concerns

|

> Annual Boeing Aviation Safety Conference with industry leaders to share knowledge, best practices and lessons learned

> Partner and advisor to commercial customers through trainings, workshops and onsite advisors

> Advanced training for pilots and mechanics, including competency-based training and assessment courses and experimental training

> Process to ensure fleet performance data is incorporated in design process

> Partnership with Embry-Riddle Aeronautical University for a research center to drive safety improvements throughout the industry | ||

|

3 |

|

2024 Proxy Statement |

SAFETY & QUALITY

Aerospace Safety and Quality

We invest in our people, systems, processes and infrastructure to deliver high-quality products and services that our customers expect and deserve. We continue to mature our enterprise Safety Management System (SMS), an integrating framework for managing safety risks. Recognized as an industry best practice, airlines around the world have been using SMS for nearly a decade, gathering data to evaluate systems, make decisions and investigate issues to support the safety of the fleet.

Our SMS collects and monitors data from multiple internal and external data sources — operational data from the global fleet, employee reporting, audit findings and design and manufacturing data — to identify and mitigate product safety risks. Acquiring data is the first step to risk mitigation. In 2023, we established SMS boards within program and functional organizations responsible for design, build and fleet support as part of a bottom-up approach in identifying and resolving potential safety risks. We also have expanded external safety data sources and jointly developed with the FAA machine learning algorithms to mine the tremendous amount of data to identify trends, patterns and safety risks proactively and predictively.

Following data collection, the SMS team and business partners apply industry-standard methods and tools to identify hazards, assess risk and develop mitigation actions. Ultimately, SMS brings data into the appropriate forums with people at the right level to make data-driven, risk-based decisions that result in safer products. It is a system of continuous improvement informed by existing data and ongoing development of increasingly better safety analytics.

Our Quality Management System (QMS) is based on AS9100, the internationally recognized standard for QMS in aerospace. Our QMS and SMS work together and are built into our organizational structure, policies, processes, procedures and resources. In addition to the comprehensive actions we have taken recently to strengthen quality assurance and controls across our factories, we have taken important steps in recent years to strengthen the foundation of our QMS and its layers of protection. For example, we updated more than 250 policies and procedures to improve alignment to regulatory requirements for product conformance, including a new procedure document that incorporates SMS-based risk assessment for inspection and test management. In 2023, we provided enhanced stamping and certification training to 62,000 mechanics and inspectors to emphasize their crucial role and underscore the importance of personal accountability. We also established a data sharing portal to provide key metrics and performance measures to the FAA to increase transparency and production oversight.

Employee Safety

Beyond product safety, employee safety plays a critical role in our safety strategy. Our Safety Guiding Principles are the foundation of workplace safety at Boeing. Each principle addresses a specific aspect of a healthy safety culture. Built around the concepts of safe decision-making and a commitment to protecting each other, our Safety Guiding Principles and our workplace safety program, Go4Zero, represent a holistic approach to prevent injuries at work and at home, stemming from the belief that every injury is preventable. By continually identifying areas where improvements can be made and measuring progress using industry standard approaches, our internal compliance requirements often exceed those standards set by government regulations. Every employee has the responsibility to make safety and quality top priorities. Through valuing human life and well-being above all else and acting accordingly, we will continue to foster an open culture where people are empowered and encouraged to speak up about any concerns with the assurance that they will be taken seriously.

|

2024 Proxy Statement |

|

4 |

|

PROXY SUMMARY

Voting Recommendations of the Board

| Item |

|

Recommendation | Page | |||

| 1. |

Elect 11 directors | FOR | 10 | |||

| 2. |

Approve, on an advisory basis, named executive officer compensation | FOR | 43 | |||

| 3. |

Ratify the appointment of Deloitte & Touche LLP as independent auditor | FOR | 85 | |||

| 4. |

Shareholder proposal – review of China business and ESG commitments | AGAINST | 89 | |||

| 5. |

Shareholder proposal – report on climate lobbying | AGAINST | 91 | |||

| 6. |

Shareholder proposal – racial and gender pay gap disclosure | AGAINST | 94 | |||

| 7. |

Shareholder proposal – report on risks related to diversity, equity & inclusion efforts | AGAINST | 96 | |||

| 8. |

Shareholder proposal – adoption of value chain emission reduction target | AGAINST | 97 | |||

Director Nominees

Our Board evaluates director candidates on an ongoing basis to maintain a proper balance and diversity of experience, tenure and perspectives. This commitment to constant improvement helps to ensure that our Board is consistently poised to defend our core values as well as advance our evolving business needs and strategic priorities. All nominees are incumbent directors.

| Name | Director Since |

Independent |

Professional Background | Engineering Degree |

Board Committees | |||||

| Robert A. Bradway |

2016 | ✓ | Chairman & CEO, Amgen |

|

Finance, GPP | |||||

| David L. Calhoun |

2009 |

|

President & CEO, Boeing |

|

— | |||||

| Lynne M. Doughtie |

2021 | ✓ | Former U.S. Chairman & CEO, KPMG |

|

Audit, Comp. | |||||

| David L. Gitlin |

2022 | ✓ | Chairman & CEO, Carrier Global |

|

ASC, Finance | |||||

| Lynn J. Good |

2015 | ✓ | Chair & CEO, Duke Energy |

|

Audit, Comp. | |||||

| Stayce D. Harris |

2021 | ✓ | Former United Airlines Pilot; Former Inspector General, U.S. Air Force |

✓ | ASC, Audit, SP | |||||

| Akhil Johri |

2020 | ✓ | Former EVP & CFO, United Technologies |

|

Audit, Finance | |||||

| David L. Joyce |

2021 | ✓ | Former President & CEO, GE Aviation; Former Vice Chair, General Electric | ✓ | ASC, Comp., SP | |||||

| Steven M. Mollenkopf* |

2020 | ✓ | Former CEO, Qualcomm | ✓ | Comp., GPP, SP | |||||

| John M. Richardson |

2019 | ✓ | 31st Chief of Naval Operations; Former Director of Naval Nuclear Propulsion Program, U.S. Navy | ✓ | ASC, Finance, SP | |||||

| Sabrina Soussan |

2023 | ✓ | Chairman and CEO, SUEZ SA | ✓ | Audit, Finance | |||||

* Independent Chair ASC = Aerospace Safety Committee Comp. = Compensation Committee GPP = Governance & Public Policy Committee SP = Special Programs Committee

|

5 |

|

2024 Proxy Statement |

PROXY SUMMARY

Highlights of the composition of our director nominees:

| 5 of 11 | 9 of 11 | 5 of 11 | ~5 years | 8 of 11 | 9 of 11 | 7 of 11 | ||||||||

| In-Depth Aerospace Expertise |

Engineering/ Technology |

Diverse with Respect to Gender, Race or Ethnicity |

Average Tenure |

Safety Expertise |

Highly Regulated Industry Experience |

Complex Expertise | ||||||||

Governance Highlights

| Board Structure and Independence | ✓ Independent Board Chair required by By-Laws and Corporate Governance Principles (page 24) ✓ Average director nominee tenure of 5 years ✓ Balanced and diverse group of independent Board nominees with 73% of the director nominees joining the Board after the 2019 annual meeting ✓ 10 of 11 director nominees, and all committee members, are independent ✓ Executive sessions of independent directors conducted after every regular Board meeting | |

| Board Oversight | ✓ Robust succession planning process for senior leadership positions, including in-depth meetings between individual directors and senior executives other than the CEO (page 35) ✓ Extensive Board oversight of key strategic, operational and compliance risks, with an intense focus on risks related to safety and quality, succession planning, development programs, human capital, cybersecurity and sustainability (page 32) ✓ Board involvement in strategy development, including safety initiatives and efforts to reduce emissions in our production facilities and enhance workforce diversity ✓ Regular visits to Boeing production sites by each director (page 36) ✓ Board oversight of global ethics and compliance efforts, corporate culture, political advocacy, public policy, sustainability, equity, diversity and inclusion, and charitable contributions | |

| Strong Corporate Governance Practices | ✓ Active shareholder engagement throughout the year with actions taken in response to such feedback (page 25) ✓ Comprehensive annual evaluations of the Board, each of the committees, and individual directors (page 37), led by the Board Chair and Governance & Public Policy Committee Chair ✓ Robust Board refreshment process focused on expertise, diversity and evolving Company priorities, resulting in strategic Board turnover ✓ Limits on director service on outside boards (page 10) ✓ Average aggregate meeting attendance exceeded 99% in 2023 (page 31) ✓ Directors required to hold all equity-based compensation until they leave the Board (page 41) ✓ Mandatory director retirement policy (page 38) ✓ Director orientation and continuing education programs for all directors (page 36) ✓ Board and committees may hire outside advisors independently of management ✓ Published second annual Political Advocacy Report in 2024, highlighting advocacy priorities, trade association contributions of $25,000 or more, lobbying efforts, U.S. climate policy development, global advocacy, Boeing Political Action Committee contributions and oversight (page 34) ✓ Detailed disclosures in Sustainability Report and Global Equity, Diversity & Inclusion Report ✓ Codes of conduct for all employees and directors (page 38) ✓ Code of Basic Working Conditions and Human Rights, reflecting our commitment to the protection and advancement of human rights worldwide | |

| Shareholder Rights | ✓ Proxy access right for shareholders seeking to nominate directors (page 104) ✓ Majority voting for all directors, each of whom is elected for a one-year term and is subject to a resignation policy in the event he or she fails to receive a majority vote ✓ No supermajority voting requirements ✓ Shareholder right to call special meetings ✓ No poison pill and any future poison pill must be submitted to shareholders | |

|

2024 Proxy Statement |

|

6 |

|

PROXY SUMMARY

Leadership Changes

On March 25, 2024, we announced that David Calhoun plans to step down as our President and Chief Executive Officer at the end of the year, and that Stephanie Pope was elected to the position of President and Chief Executive Officer of Commercial Airplanes effective as of the date of announcement, in connection with Stanley Deal’s upcoming retirement. Ms. Pope will also continue to serve as Executive Vice President and Chief Operating Officer. We also announced that Larry Kellner has decided not to stand for re-election to the Board at the annual meeting and that the Board has elected Steve Mollenkopf to succeed Mr. Kellner as independent Chair of the Board, effective March 24, 2024. Under the leadership of Mr. Mollenkopf, the Governance & Public Policy Committee and the Board will conduct a thorough succession process for a Chief Executive Officer to succeed Mr. Calhoun.

Executive Compensation

| • | Significant portion of pay for senior leaders is at risk and directly linked to individual and Company performance – approximately 90% of target named executive officer, or NEO, average pay in 2023 was variable or at risk; |

| • | Annual incentive pay program featuring multiple performance metrics at each of the Company, business unit and individual levels targeted to driving strong financial performance, critical improvements in safety and quality operational performance, and measurable progress towards climate and equity, diversity and inclusion goals; |

| • | Long-term incentives for senior executives that facilitate long-term stock ownership and alignment between interests of management and shareholders; |

| • | Clawback policy permits the recoupment of past incentive pay from executive officers in the event of instances of misconduct or certain types of negligent conduct, in addition to and even absent a restatement of financial results, including where such conduct has compromised the safety of our products or services; |

| • | Continued focus on safety as a component in determining annual incentive payouts for executive officers, including formal consultation between the Aerospace Safety and Compensation Committees on identifying appropriate safety-related metrics for incentive program design and evaluating individual executive performance with respect to safety; |

| • | No accelerated vesting of equity awards in connection with a change in control; |

| • | Prohibition against pledging or hedging Boeing stock by directors or executive officers; |

| • | Rigorous stock holding and ownership requirements for executive officers, including requiring our CEO to hold shares acquired through exercise of stock options until post-termination; |

| • | Provisions in CEO long-term incentive award agreements delaying distribution of vested awards until separation from the Company and thereafter in ten annual installments; and |

| • | No change in control arrangements or (except where required by non-U.S. law) employment agreements. |

Principal Components of NEO 2023 Total Target Compensation

For detailed information about our executive compensation program, see “Compensation Discussion and Analysis” beginning on page 45.

|

7 |

|

2024 Proxy Statement |

PROXY SUMMARY

Sustainability

Boeing is committed to protecting, connecting and exploring our world and beyond, safely and sustainably. Our commitment to sustainability is rooted in our company values, our strategy and our stakeholders’ expectations, and encompasses our focus on environmental stewardship, social progress and inclusion, and values-based, transparent governance. We have defined 11 sustainability priorities based on our core values as well as the interests of our diverse stakeholders, including customers, current and future employees, regulators, suppliers, shareholders and communities around the world. Boeing supports both the objectives of the Paris Agreement and the commercial aviation industry’s ambition to achieve net-zero carbon emissions for global civil aviation operations by 2050. For information on the Board’s oversight of sustainability matters, see “Sustainability Governance” on page 34.

In 2023, Boeing advanced its sustainability goals as follows:

| Safety & Quality

|

• Renewed our Safety Promise to prioritize workplace safety during the 10-year anniversary of Go4Zero

• Introduced a digital learning platform for employees to reflect, learn and apply product safety lessons to their work

• Conducted product safety training for more than 160,000 employees

• Enhanced stamping and certification training for 62,000 mechanics and inspectors

• Updated more than 250 policies and procedures to improve alignment to regulatory requirements for product conformance | |

| People

|

• Increased overall representation of women and racial/ethnic minorities compared to last year

• Expanded industry-leading tuition assistance and provided access to the Bright Horizons EdAssist Education Network, in addition to over 300 Boeing partner schools already available

• Added 10 new chapters around the world to Boeing’s nine Business Resource Groups

• Approximately 3,800 employees from 33 countries are part of the Inclusion Ambassador Network, a group that meets monthly to learn together, adopt new inclusion tools, share insights and commit to taking action

• Received 22 external awards and recognition from organizations such as Fair360, Disability:IN, Human Rights Campaign and Bloomberg Gender-Equality Index | |

| Climate & Environment

|

• Convened energy, finance, policy and aviation sectors at our first global Sustainable Aerospace Together Forum, where we launched the public version of the Cascade Climate Impact Model, a tool that allows stakeholders to make informed decisions about how to reach the commercial aviation industry’s net-zero 2050 ambition

• Partnered with customers, suppliers, producers and regulators globally to advance sustainable aviation fuel (SAF) and expanded global efforts to scale-up SAF by doubling Boeing’s SAF procurement in 2023 to 5.6 million gallons for commercial operations

• Provided technical expertise on the first 100% SAF flight across the Atlantic on a commercial jetliner – a Boeing 787 Dreamliner

• Launched a SAF Dashboard capable of tracking and projecting expected SAF production over the next decade

• Maintained net-zero emissions at manufacturing sites and other facilities (Scope 1 and Scope 2) by expanding conservation and renewable energy use while securing third-party-verified offsets for the remaining greenhouse gas (GHG) emissions

• Co-led industry efforts via the International Association for Engineering Geology and the Environment (IAEG) to develop a voluntary industrywide approach to supplier ESG assessment and education

• Reduced GHG emissions from Boeing operations* by 33% (against 2017 base levels)

• Increased Boeing’s supply of renewable electricity by 14% from 2022 | |

| Community Impact

|

• Donated $191 million and contributed 477,000 volunteer hours to charitable causes, from Boeing and its employees

• Provided more than $17 million to support 440 veterans organizations globally, including $13.1 million to support the military-to-civilian transition process and recovery and rehabilitation programs for veterans and their families

• Contributed $7.4 million in support of environmental programs

• Contributed to more than 13,500 community partners globally

• Committed $3.6 million in emergency assistance, including $500,000 from the Boeing Charitable Trust to support recovery efforts in Hawaii after the devastating wildfires | |

| * | Greenhouse gas (GHG) emissions from our operations represent GHG emissions from energy (electricity and natural gas) consumption at Boeing’s Core Metric Sites. Core Metric Sites represent the majority (70%) of Boeing’s GHG footprint from operations. This is an absolute reduction in GHG emissions; no normalization has been applied. |

|

2024 Proxy Statement |

|

8 |

|

PROXY SUMMARY

We are committed to high standards of ethical, lawful, responsible and sustainable procurement of goods and services. Our contractual relationships with suppliers, including our consultants and contract labor, require adherence to our standards. Our supply chain organizations are responsible for evaluating and establishing all new supplier relationships and monitoring performance of our suppliers. We have policies and practices designed to enforce the standards set forth in our Code of Basic Working Conditions and Human Rights. We also expect similar behaviors from our suppliers, which we articulate in our Supplier Code of Conduct.

| Helpful Resources:

• Corporate Governance, visit www.boeing.com/company/general-info/corporate-governance

• Sustainability Report, visit www.boeing.com/sustainability

• Global Equity, Diversity & Inclusion Report, visit www.boeing.com/sustainability/diversity-and-inclusion

• Chief Aerospace Officer Report, visit www.boeing.com/sustainability/our-principles/caso-report

• Safety, visit www.boeing.com/safety

• Quality, visit www.boeing.com/quality

• Community Engagement, visit www.boeing.com/sustainability/community-engagement

• Supplier Code of Conduct, visit www.boeingsuppliers.com/become.html#/expectations

• Code of Basic Working Conditions and Human Rights, visit www.boeing.com/sustainability/human-rights

• Political Advocacy Report, visit www.boeing.com/company/key-orgs/government-operations |

|

9 |

|

2024 Proxy Statement |

ELECTION OF DIRECTORS (ITEM 1)

|

PROPOSAL SUMMARY

Shareholders are being asked to elect the 11 director nominees under “Director Nominees” beginning on page 11 to serve until the 2025 Annual Meeting of Shareholders.

|

|

The Board recommends that you vote FOR each of the 11 director nominees. |

Director Qualification Criteria

The Governance & Public Policy Committee, or GPP Committee, is responsible for identifying and assessing potential candidates and recommending nominees for the Board’s approval. The GPP Committee assesses the qualifications of incumbent directors and other candidates for nomination on an ongoing basis, including with respect to the following key factors:

| • | Experience. The GPP Committee considers each candidate’s experience and leadership record in areas that include aerospace, engineering, manufacturing, safety, risk management, software, operations, finance, marketing, sustainability, human capital management, international business and affairs, government and public policy. |

| • | Industry Expertise. The GPP Committee ensures that a number of directors possess aerospace and/or defense industry, as well as technology expertise. This broad industry expertise allows the Board to assess Company performance and provide strategic guidance with respect to each of our principal businesses. |

| • | Safety. The Board is committed to safety as a core value of the Company—both with respect to our aerospace products and services and our employees in the workplace. One manifestation of this commitment is ensuring that the Board includes members with a wide range of experience in areas where safety is paramount. |

| • | Diversity. The Board is deeply committed to a membership profile that demonstrates diversity with respect to gender, race/ethnicity, background, experience, skills and perspectives. |

| • | Outside Board Memberships. Directors are expected to ensure that other commitments, including outside board memberships, do not interfere with their responsibilities as Boeing directors. Consequently, directors may not serve on more than three public company boards in addition to Boeing (one, if the director is a public company CEO). The GPP Committee reviews directors’ outside commitments to ensure that all directors are able to devote sufficient time to Boeing. If a director, solely through service on for-profit boards previously approved by the GPP Committee, exceeds the public company limits set forth above, such director shall commit to reduce the number of such directorships in order to fall within such limits within 12 months. |

| • | Independence. In addition to any regulatory limitations with respect to independence, the GPP Committee also considers other positions the director holds or has held, and evaluates each nominee with respect to Boeing’s publicly disclosed Director Independence Standards, the New York Stock Exchange (NYSE), director independence standards and any potential conflicts of interest. |

| • | Professional Reputation. As set forth in our Corporate Governance Principles, our directors are expected to have a reputation for personal and professional integrity, honesty and adherence to the highest ethical standards. |

| • | Length of Service. The Board believes that regular refreshment of the Board is critical for us to gain fresh perspectives and maintain our position as a global aerospace leader. At the same time, with decades-long product cycles and lengthy development periods, we also benefit from directors with extensive Boeing experience. As a result, the GPP Committee’s strategy is to maintain a balance among directors of short, medium and longer tenures. |

| • | Regulatory Compliance. All director nominees must satisfy NYSE and Securities and Exchange Commission, or SEC, requirements for Board service, including those with respect to any committee on which such director would be asked to serve. |

| • | Prior Contributions to the Board. When evaluating the candidacy of an incumbent director, the Board also considers the director’s ongoing contributions to the Board, including attendance and participation at meetings and ongoing relevance of their skills and experience, as well as the results of both formal and informal evaluations provided by fellow directors. |

|

2024 Proxy Statement |

|

10 |

|

ELECTION OF DIRECTORS (ITEM 1)

Board Refreshment

The Board is committed to adding new members with complementary skill sets and fresh perspectives. Since the 2019 annual meeting, eight independent directors have been added as part of the Board’s refreshment efforts, five of whom have engineering degrees. These directors collectively bring significant experience in aerospace, safety, engineering/technology, complex manufacturing, cybersecurity, risk oversight, audit, supply chain management and finance. Meanwhile, the GPP Committee continues to seek highly qualified director candidates in furtherance of the Board’s ongoing refreshment strategy. By identifying and electing directors with safety-related experience, expertise in areas such as aerospace/aviation, risk management, engineering, software development, sustainability and finance, as well as diverse backgrounds and perspectives, the Board seeks to continue to fulfill its oversight responsibilities and uphold Boeing’s core values, while enabling Boeing to achieve its evolving strategic imperatives. As part of the Board’s commitment to diversity, 45% of our director nominees and the current chairs of the Audit, Compensation and GPP Committees are diverse with respect to gender and/or race/ethnicity.

Director Nominees

| Key Skills and Qualifications |

|

|

|

|

|

|

|

|

|

|

| |||||||||||

| In-Depth Aerospace Expertise Substantial knowledge of aerospace enables enhanced oversight of product development and sharpens focus on safety and quality |

|

✓

|

|

✓

|

|

✓

|

✓

|

✓

|

|

|

| |||||||||||

| Engineering/Technology Leadership Experience in precision engineering or in leading teams working on cutting-edge technologies facilitates sharpened oversight of the design, quality, development and testing of complex aerospace products, services and systems |

✓ | ✓ |

|

✓ | ✓ | ✓ |

|

✓ | ✓ | ✓ | ✓ | |||||||||||

| Complex Manufacturing Expertise Understanding of complex manufacturing allows directors to critically evaluate our operations and product development |

✓

|

✓

|

|

✓

|

|

|

✓

|

✓

|

✓

|

|

✓

| |||||||||||

| Safety Expertise in establishing and overseeing safety processes and procedures drives our ability to support our core value of safety in all that we do |

✓

|

✓

|

|

✓

|

✓

|

✓

|

|

✓

|

|

✓

|

✓

| |||||||||||

| Risk Management Experience assessing and managing risks enables directors to effectively oversee, identify, manage and mitigate the most significant risks facing Boeing |

✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | |||||||||||

| Highly Regulated Industry Experience Familiarity with highly regulated industries enables directors to advise on complex interactions with regulators and ensure that Boeing’s products and services meet the requirements and expectations of various stakeholders |

✓ | ✓ | ✓ | ✓ | ✓ |

|

✓ | ✓ |

|

✓ | ✓ | |||||||||||

| Cybersecurity/Digitalization Experience in data privacy and cybersecurity supports our business in enhancing internal operations, contributing to the Board’s effective oversight of cyber-safety, and furthering the Company’s digital transformation efforts |

|

|

|

|

✓ | ✓ |

|

|

|

✓ | ✓ | |||||||||||

| CEO of a Large Company Experience in the chief executive role at large companies enhances the Board’s ability to evaluate and advise our CEO as well as oversee corporate strategy, values and culture |

✓ | ✓ | ✓ | ✓ | ✓ |

|

|

|

✓ |

|

✓ | |||||||||||

| Senior Leadership Experience Leadership experience in core management areas facilitates effective oversight of management, sharpens the Board’s succession planning process and oversight of human capital, and provides a practical understanding of complex organizations like Boeing |

✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | |||||||||||

|

11 |

|

2024 Proxy Statement |

ELECTION OF DIRECTORS (ITEM 1)

| Key Skills and Qualifications |

|

|

|

|

|

|

|

|

|

|

| |||||||||||

| Climate Change Experience in climate change risk management strategies and other climate-related issues enables enhanced Board oversight of environmental policies, strategies and priorities for a sustainable aerospace future |

✓ | ✓ |

|

✓ | ✓ |

|

|

|

|

|

✓ | |||||||||||

| Human Capital Management Experience overseeing the development and implementation of human capital strategy, leadership development and culture throughout a large or global workforce, helping to ensure a successful framework for the attraction, development and retention of employees with diverse skills and backgrounds |

✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | |||||||||||

| Fortune 500 Board Experience Service on other large, public company boards provides directors with similar oversight experience |

✓ | ✓ |

|

✓ | ✓ |

|

✓ |

|

✓ | ✓ |

| |||||||||||

| International Leadership and Global Relationships Experience managing global relationships and engaging with international stakeholders supports the Board’s oversight of key risks involving our global customer and supply bases and challenges managing global compliance systems |

✓ | ✓ | ✓ | ✓ |

|

|

✓ | ✓ | ✓ | ✓ | ✓ | |||||||||||

| Senior U.S. Government/Military Experience Experience in large-scale military operations, strategy development, international relations and/or defense contracting enhances oversight of global defense strategy and relations with key customers |

|

|

|

|

|

✓ |

|

|

|

✓ |

| |||||||||||

| Fortune 500 CFO Demonstrated experience with large-scale financial decision-making, including understanding of financial reporting processes, enables sophisticated Board deliberations regarding capital allocation, long-term strategy and regulatory compliance, and helps ensure accurate financial reporting and robust controls |

✓ |

|

|

|

✓ |

|

✓ |

|

|

|

| |||||||||||

|

2024 Proxy Statement |

|

12 |

|

ELECTION OF DIRECTORS (ITEM 1)

|

Chairman and CEO, Amgen Inc. |

Robert A. Bradway

Boeing director since: 2016

Committees: • Finance (Chair) • Governance & Public Policy

Independent: Yes

Age: 61

|

Other current public directorships: • Amgen Inc. | ||

| Professional highlights: • Chairman and CEO, Amgen Inc. (Chairman 2013-present; CEO 2012-present) • President and COO, Amgen Inc. (2010-2012) • Executive Vice President and CFO, Amgen Inc. (2007-2010)

| ||||

|

Mr. Bradway brings to the Board critical skills in the areas of high technology, product development, financial oversight, product safety and risk management. His experience as a senior executive in the biotechnology industry, including as Chief Executive Officer, Chief Operating Officer and Chief Financial Officer of Amgen, provides him with an extensive understanding of the strategic considerations and challenges associated with meeting the requirements of numerous safety and regulatory compliance regimes around the world. At Amgen, Mr. Bradway has also overseen a number of sustainability initiatives. In addition, he previously served as a director of Norfolk Southern Corporation, one of the nation’s largest railroad transportation companies, where virtually every aspect of operations is heavily regulated and subject to strict safety-related oversight. In recognition of Mr. Bradway’s experience in corporate finance, risk management and executive leadership, the Board elected him to serve as Chair of the Finance Committee.

|

Key skills and qualifications:

Engineering/Technology Leadership

Complex Manufacturing Expertise

Safety

Risk Management

Highly Regulated Industry Experience

CEO of a Large Company

Senior Leadership Experience

Climate Change

Human Capital Management

Fortune 500 Board Experience

International Leadership and Global Relationships

Fortune 500 CFO

|

|

13 |

|

2024 Proxy Statement |

ELECTION OF DIRECTORS (ITEM 1)

|

President and CEO, The Boeing Company |

David L. Calhoun

Boeing director since: 2009

Committees: None

Independent: No

Age: 66

|

Other current public directorships: • Caterpillar Inc.

Recent prior directorships: • Gates Industrial Corporation plc | ||

| Professional highlights: • President and CEO, The Boeing Company (2020-present) • Senior Managing Director and Head of Private Equity Portfolio Operations, The Blackstone Group (2014-2020) • Chairman and CEO, Nielsen Holdings plc (Chairman 2014-2016; CEO 2010-2014) • Chairman and CEO, The Nielsen Company B.V. (2006-2014) • Vice Chairman, General Electric Company; President and CEO, GE Infrastructure (2005-2006) • President and CEO, GE Transportation (aircraft engines and rail) (2003-2005) • President and CEO, GE Aircraft Engines (2000-2003) | ||||

|

Mr. Calhoun brings a diverse skill set to the Board, including deep and long-standing aviation industry experience as Boeing’s President and Chief Executive Officer, former Boeing Chair of the Board and independent Lead Director, and a multi-year tenure as the leader of GE’s transportation and aircraft engines businesses. He has experience leading businesses through periods of change, having led Nielsen’s transformation into a leading global information and measurement company. In addition, Mr. Calhoun brings to Boeing strong leadership and valuable insight and perspective on a wide array of strategic and business matters, stemming from his vast executive, management and operational experience at Blackstone, as well as at Nielsen and GE. Furthermore, Mr. Calhoun served as chair of Caterpillar’s Public Policy and Governance Committee, which oversees the company’s environmental, health and safety activities, including with respect to climate and sustainability. Mr. Calhoun’s significant global aerospace, complex manufacturing and high-technology industry expertise, as well as leadership experience on the boards of Caterpillar and Gates Industrial Corporation, position him well to serve on the Board and lead Boeing as President and Chief Executive Officer.

|

Key skills and qualifications:

In-Depth Aerospace Expertise

Engineering/Technology Leadership

Complex Manufacturing Expertise

Safety

Risk Management

Highly Regulated Industry Experience

CEO of a Large Company

Senior Leadership Experience

Climate Change

Human Capital Management

Fortune 500 Board Experience

International Leadership and Global Relationships

|

|

2024 Proxy Statement |

|

14 |

|

ELECTION OF DIRECTORS (ITEM 1)

|

Former U.S. Chairman and CEO, KPMG |

Lynne M. Doughtie

Boeing director since: 2021

Committees: • Audit • Compensation

Independent: Yes

Age: 61

|

Other current public directorships: • Workday, Inc. | ||

| Professional highlights: • U.S. Chairman and CEO, KPMG (2015-2020) • Vice Chair of Advisory Practice, KPMG (2011-2015) | ||||

|

Ms. Doughtie brings insights and expertise from her extensive experience in the accounting profession and executive experience leading a Big Four public accounting firm. She began her career in KPMG’s audit practice in 1985 and held various national, regional and global leadership roles, including serving as lead partner for several of KPMG’s major clients. Ms. Doughtie has had significant exposure to issues facing complex, global companies across industries and has deep expertise in risk management, internal controls, culture change and regulatory compliance. Ms. Doughtie also previously served on the boards of Catalyst, Inc. and Chief Executives for Corporate Purpose and has been recognized for her leadership in inclusion and diversity and values leadership. Ms. Doughtie’s financial expertise, executive leadership experience, risk management and regulatory skills, and experience driving culture change bring significant value to the Board.

|

Key skills and qualifications:

Risk Management

Highly Regulated Industry Experience

CEO of a Large Company

Senior Leadership Experience

Human Capital Management

International Leadership and Global Relationships

|

|

15 |

|

2024 Proxy Statement |

ELECTION OF DIRECTORS (ITEM 1)

|

Chairman and CEO, Carrier Global Corporation |

David L. Gitlin

Boeing director since: 2022

Committees: • Aerospace Safety • Finance

Independent: Yes

Age: 54 |

Other current public directorships: • Carrier Global Corporation | ||

|

Professional highlights: • Chairman and CEO, Carrier Global Corporation (2021-present) • President and CEO, Carrier Global Corporation (2020-2021) • President and CEO of Carrier, United Technologies Corporation (2019-2020) • President and COO of Collins Aerospace Systems, United Technologies Corporation (2018-2019) • President of UTC Aerospace Systems, United Technologies Corporation (2015-2018) | ||||

|

Mr. Gitlin has extensive senior-level experience in the aerospace industry as well as in manufacturing, safety and sustainable innovation. As Chairman and CEO of Carrier, Mr. Gitlin oversees a world leader in heating, air conditioning and refrigeration solutions, which is committed to cost-effective climate mitigation strategies in both its products and operations. Prior to joining Carrier, Mr. Gitlin was President and COO of Collins Aerospace and President of UTC Aerospace Systems. In these roles, as well as in prior leadership roles at Hamilton Sundstrand, Mr. Gitlin developed extensive expertise in aerospace safety (including the development and manufacture of aircraft engines and power systems), manufacturing and operational excellence. As a result, he brings to our Board unique perspectives on aerospace safety, aerospace supplier management and manufacturing in a highly regulated environment. In recognition of Mr. Gitlin’s record of achievement in these disciplines, the Board has appointed him to the Aerospace Safety Committee.

|

Key skills and qualifications:

In-Depth Aerospace Expertise

Engineering/Technology Leadership

Complex Manufacturing Expertise

Safety

Risk Management

Highly Regulated Industry Experience

CEO of a Large Company

Senior Leadership Experience

Climate Change

Human Capital Management

Fortune 500 Board Experience

International Leadership and Global Relationships

|

|

2024 Proxy Statement |

|

16 |

|

ELECTION OF DIRECTORS (ITEM 1)

|

Chair and CEO, Duke Energy Corporation |

Lynn J. Good

Boeing director since: 2015

Committees: • Compensation (Chair) • Audit

Independent: Yes

Age: 64

|

Other current public directorships: • Duke Energy Corporation | ||

| Professional highlights: • Chair and CEO, Duke Energy Corporation (Chair 2016-present; CEO 2013-present) • President, Duke Energy Corporation (2013-2024) • Vice Chair, Duke Energy Corporation (2013-2016) • Executive Vice President and CFO, Duke Energy Corporation (2009-2013)

| ||||

|

Ms. Good brings to the Board substantial experience in executive leadership, safety, corporate governance, financial management and accounting, as well as operational expertise and cybersecurity in a highly regulated, capital-intensive industry. Ms. Good’s record as Chief Executive Officer and Chair of Duke Energy, one of the nation’s largest grid and generation operators, enables her to advise management on a wide range of strategic, financial, sustainability and governance matters, including the challenges associated with safety performance, large-scale capital projects, transformative technologies and crisis management. Ms. Good leads the integration of Duke Energy’s climate strategy into the company’s business strategy, through investing in carbon-free technology, modernizing its gas and electric infrastructure and expanding and integrating efficiency and demand management systems. Ms. Good also has vast financial management experience, gained principally from her prior service as Chief Financial Officer and Treasurer of Duke Energy. Ms. Good also has extensive capital markets proficiency, significant merger and restructuring experience and accounting and auditing skills earned from nearly 30 years as a Certified Public Accountant and 11 years as an audit partner at Arthur Andersen LLP and Deloitte & Touche LLP. Ms. Good also serves as past-chair of the Institute of Nuclear Power Operations, a not-for-profit organization responsible for promoting the highest levels of safety and reliability in nuclear plant operations. Ms. Good earned Bachelor of Science degrees in systems analysis and accounting from Miami University.

|

Key skills and qualifications:

Engineering/Technology Leadership

Safety

Risk Management

Highly Regulated Industry Experience

Cybersecurity/Digitalization

CEO of a Large Company

Senior Leadership Experience

Climate Change

Human Capital Management

Fortune 500 Board Experience

Fortune 500 CFO

|

|

17 |

|

2024 Proxy Statement |

ELECTION OF DIRECTORS (ITEM 1)

|

Former United Airlines Pilot; Former Inspector General, U.S. Air Force |

Stayce D. Harris

Boeing director since: 2021

Committees: • Aerospace Safety • Audit • Special Programs

Independent: Yes

Age: 64

|

Other current public directorships: • BlackRock Fixed-Income Funds

Recent prior directorships: • KULR Technology Group, Inc. | ||

| Professional highlights: • Inspector General, U.S. Air Force (2017-2019) • Assistant Vice Chief of Staff and Director Air Staff, U.S. Air Force (2016-2017) • Commander, 22nd Air Force (2014-2016) • 747 Pilot, United Airlines (1990-2020 with military leave of absence 2014-2019) • Senior Strategist/Air Force Reserve Advisor to Commander, Air Mobility Command and 18th Air Force (2012-2014) • Senior Strategist/Air Force Reserve Advisor to Commander, U.S. Africa Command on Reserve Matters (2010-2012) | ||||

|

Lieutenant General Harris brings extensive aerospace and aviation experience to the Board. General Harris is an experienced Boeing 747 pilot, with over 10,000 flight hours safely transporting passengers and cargo worldwide in the Boeing 747, 757, 767 and 777 aircraft for United Airlines before her retirement in 2020. Her extensive experience as a pilot, together with her deep knowledge of safety protocols and flight procedures, adds to the Board’s expertise in aviation safety and provides hands-on familiarity with pilots’ and crew interaction with complex aerospace systems, including in particular Boeing aircraft. Before retiring from the Air Force in 2019, she was a United States Air Force Reserve Lieutenant General, serving in several senior roles, including most recently as Inspector General of the Air Force and, before that, the Assistant Vice Chief of Staff of the Air Force. General Harris was the first African American woman to command an Air Force operational flying squadron, wing and numbered Air Force. Her military and aviation expertise, extensive leadership experience and demonstrated record of leading teams with honor and integrity as paramount values all bring significant value to the Board. General Harris’ prior experiences also bring to the Board an extensive background and expertise in audit and cybersecurity matters. General Harris earned a Bachelor of Science degree in industrial and systems engineering from the University of Southern California and a Master of Aviation Management degree from Embry-Riddle Aeronautical University. She also has a certificate in cybersecurity oversight from Carnegie Mellon University. As a result of her extensive cybersecurity expertise, General Harris is the Board’s primary cybersecurity expert who participates in multiple deep dives and engages regularly with management on cyber-related topics.

|

Key skills and qualifications:

In-Depth Aerospace Expertise

Engineering/Technology Leadership

Safety

Risk Management

Cybersecurity/Digitalization

Senior Leadership Experience

Human Capital Management

Senior U.S. Government/Military Experience

|

|

2024 Proxy Statement |

|

18 |

|

ELECTION OF DIRECTORS (ITEM 1)

|

Former Executive Vice President and CFO, United Technologies Corporation |

Akhil Johri

Boeing director since: 2020

Committees: • Audit (Chair) • Finance

Independent: Yes

Age: 62

|

Other current public directorships: • Cardinal Health Inc. | ||

| Professional highlights: • Operating Advisor, Clayton, Dubilier & Rice (2021-present) • Special Advisor to the Chairman and CEO, United Technologies Corporation (2019-2020) • Executive Vice President and CFO, United Technologies Corporation (2015-2019) • CFO, Pall Corporation (2013-2014) • Vice President, Finance and CFO, UTC Propulsion and Aerospace Systems, United Technologies Corporation (2011-2013) • Vice President, Financial Planning and Investor Relations, United Technologies Corporation (2009-2011) | ||||

|

Mr. Johri brings to the Board extensive aerospace industry expertise from his more than 30 years at United Technologies, as well as critical skills in areas of financial reporting, internal controls and risk management developed while serving as Chief Financial Officer at multiple Fortune 500 companies. These skills enable Mr. Johri to provide critical insights to the Board in areas as diverse as financial strategy, strategic operations, the dynamics of managing a complex, global supply chain, articulating corporate strategy to investors and other stakeholders and mitigating risks associated with the development of new products and services at a large industrial manufacturer. Mr. Johri also brings to the Board unique insights relating to his senior leadership experience at United Technologies, a major supplier to aerospace companies like Boeing. In addition, as an independent director and audit committee member at Cardinal Health, Mr. Johri brings to the Board experience in risk oversight and corporate governance of a large company in a highly regulated industry. In recognition of Mr. Johri’s extensive experience in corporate finance and strategic matters, the Board elected him to serve as Chair of the Audit Committee. Mr. Johri is a graduate of the Indian Institute of Management, Ahmedabad, and is a Chartered Accountant.

|

Key skills and qualifications:

In-Depth Aerospace Expertise

Complex Manufacturing Expertise

Risk Management

Highly Regulated Industry Experience

Senior Leadership Experience

Human Capital Management

Fortune 500 Board Experience

International Leadership and Global Relationships

Fortune 500 CFO

|

|

19 |

|

2024 Proxy Statement |

ELECTION OF DIRECTORS (ITEM 1)

|

Former President and CEO, GE Aviation; Former Vice Chair, General Electric Company |

David L. Joyce

Boeing director since: 2021

Committees: • Aerospace Safety (Chair) • Compensation • Special Programs

Independent: Yes

Age: 67

|

Other current public directorships: • None | ||

| Professional highlights: • Senior Advisor, AE Industrial Partners, LP (2023-present) • Chairman, AE Industrial Partners HorizonX (2023-present) • Non-Executive Chair, GE Aviation (2020) • President and CEO, GE Aviation (2008-2020) • Vice Chair, General Electric Company (2016-2020) | ||||

|

Mr. Joyce brings to the Board vast aerospace, engineering and manufacturing expertise, as well as a demonstrated track record of safety leadership and operational excellence. He developed his in-depth knowledge of the challenges and opportunities facing the aerospace industry at General Electric Company. Mr. Joyce has 40 years of experience at GE Aviation including 12 years of service as President and CEO and four years as Vice Chair of GE. He began his GE career as a product engineer, spending more than a decade designing and building engines for both military and commercial customers. Mr. Joyce is recognized for his proficiency in product development, product management and product support founded on an industry-leading safety management system and ever more efficient products. Mr. Joyce is a member of the National Academy of Engineering and earned both bachelor of science and master’s degrees in mechanical engineering from Michigan State University and a master’s degree in business finance from Xavier University.

|

Key skills and qualifications:

In-Depth Aerospace Expertise

Engineering/Technology Leadership

Complex Manufacturing Expertise

Safety

Risk Management

Highly Regulated Industry Experience

Senior Leadership Experience

Human Capital Management

International Leadership and Global Relationships

|

|

2024 Proxy Statement |

|

20 |

|

ELECTION OF DIRECTORS (ITEM 1)

|

Former CEO, Qualcomm |

Steven M. Mollenkopf Chair of the Board

Boeing director since: 2020; Independent Chair of the Board (2024-present)

Committees: • Compensation • Governance & Public Policy • Special Programs

Independent: Yes

Age: 55

|

Other current public directorships: • Dell Technologies Inc.

Recent prior directorships: • Qualcomm Incorporated | ||

|

Professional highlights: • Special Advisor, Consello Group (2022-present) • Special Advisor, Qualcomm Incorporated (2021-2022) • CEO, Qualcomm Incorporated (2014-2021) • CEO-elect and President, Qualcomm Incorporated (2013-2014) • President and COO, Qualcomm Incorporated (2011-2013)

| ||||

|

Mr. Mollenkopf’s experience as the Chief Executive Officer and Chief Operating Officer of Qualcomm, an engineering-driven, high-technology manufacturing company, enables him to bring critical insights to the Board in areas such as engineering leadership, risk management, leading a complex business with a global reach and oversight of large-scale efforts to develop and test new technologies. A long-time engineer who started with Qualcomm over 25 years ago, Mr. Mollenkopf also possesses expertise and direct leadership experience in precision engineering, project management, manufacturing, quality control and designing testing regimes for complex systems. Mr. Mollenkopf is a published IEEE (Institute of Electrical and Electronics Engineers) author and an inventor on 38 patents. He holds a bachelor’s degree in electrical engineering from Virginia Tech and a master’s degree in electrical engineering from the University of Michigan. As a result of his complex manufacturing expertise, his engineering background and his record of independent leadership at Boeing, on March 24, 2024, the Board elected Mr. Mollenkopf to serve as independent Chair of the Board.

|

Key skills and qualifications:

Engineering/Technology Leadership

Complex Manufacturing Expertise

Risk Management

CEO of a Large Company

Senior Leadership Experience

Human Capital Management

Fortune 500 Board Experience

International Leadership and Global Relationships

|

|

21 |

|

2024 Proxy Statement |

ELECTION OF DIRECTORS (ITEM 1)

|

31st Chief of Naval Operations; Former Director of the Naval Nuclear Propulsion Program, U.S. Navy |

John M. Richardson

Boeing director since: 2019

Committees: • Special Programs (Chair) • Aerospace Safety • Finance

Independent: Yes

Age: 63 |

Other current public directorships: • BWX Technologies, Inc. • Constellation Energy Corporation

Recent prior directorships: • The Exelon Corporation | ||

|

Professional highlights: • 31st Chief of Naval Operations, U.S. Navy (2015-2019) • Director of the Naval Nuclear Propulsion Program, U.S. Navy (2012-2015)

| ||||

|

Admiral Richardson brings deep expertise in safety, regulation, cybersecurity and oversight of complex, high-risk systems, as well as extensive crisis management and national security experience. During his 37 years of service in the U.S. Navy, Admiral Richardson served as the Director of the Naval Nuclear Propulsion Program, a joint activity of the Navy and Department of Energy, serving the Navy and as Deputy Administrator in the National Nuclear Security Administration. In this capacity, he exercised all responsibilities, including applicable regulatory compliance over related facilities, radiological controls, environmental safety and health matters, oversight of cybersecurity issues, as well as selection, training and assignment of personnel supporting over 100 nuclear power plants operating on nuclear-powered warships around the world. Operationally, Admiral Richardson brings extensive experience managing operations of a diverse team on a global basis. He commanded the submarine USS Honolulu and served as naval aide to the President of the United States. As Chief of Naval Operations, he was responsible for the management of 600,000 sailors and civilians, 290 warships and over 2,000 aircraft worldwide. As a result of his safety and operational knowledge, the Board elected Admiral Richardson to the Aerospace Safety Committee, as well as Chair of the Special Programs Committee. At Constellation Energy Corporation, Admiral Richardson is a member of the Risk Committee as well as the Nuclear Oversight Committee, where he has oversight over a number of sustainability issues related to the company’s nuclear facilities and operations. He earned a Bachelor of Science degree in physics from the U.S. Naval Academy, a master’s degree in electrical engineering from the Massachusetts Institute of Technology and Woods Hole Oceanographic Institution and a master’s degree in national security strategy from the National War College. Admiral Richardson is a member of the National Academy of Engineering.

|

Key skills and qualifications:

Engineering/Technology Leadership

Safety

Risk Management

Highly Regulated Industry Experience

Cybersecurity/Digitalization

Senior Leadership Experience

Human Capital Management

Fortune 500 Board Experience

International Leadership and Global Relationships

Senior U.S. Government/Military Experience

|

|

2024 Proxy Statement |

|

22 |

|

ELECTION OF DIRECTORS (ITEM 1)

|

Chairman and CEO, SUEZ SA |

Sabrina Soussan

Boeing director since: 2023

Committees: • Audit • Finance

Independent: Yes

Age: 54

|

Other current public directorships: • None

Recent prior directorships: • ITT Inc. • Schaeffler AG | ||

|