☐ |

Preliminary Proxy Statement |

☐ |

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

☒ |

Definitive Proxy Statement |

☐ |

Definitive Additional Materials |

☐ |

Soliciting Material Pursuant to §240.14a-12 |

☒ |

No fee required |

☐ |

Fee paid previously with preliminary materials. |

☐ |

Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 |

Message from Our Chair

To My Fellow Boeing Shareholders,

|

|

In 2022, we continued to make significant progress in ensuring that our culture, processes and systems always meet the highest standards. Despite difficult macroeconomic factors, we are overcoming the challenges of recent years, de-risking our business, and restoring the operational and financial strength you expect from Boeing. For example, we achieved our goal of generating positive free cash flow in 2022, and demand remains strong as we look to continue to improve operational performance and work to hold ourselves to the highest standards of safety, quality, and transparency.

Safety remains paramount and we have taken actions across Boeing to strengthen our safety culture further and to meet our obligations to those who depend on the safety of our products. Among other steps, we have matured our enterprise-wide Safety Management System, continued to enhance our Quality Management System, and issued our first Chief Aerospace Safety Officer Report to ensure continued transparency in our safety-related efforts.

Another key focus area in 2022 was supporting the safety and well-being of our teammates impacted by the war in Ukraine. Boeing and its employees, with a boost from |

the Boeing Gift Match Program, provided over $3 million in humanitarian assistance in 2022 to Ukraine. We have also seen generous Boeing families in Poland and throughout the region willingly open their homes to our displaced teammates. As a global company with a long legacy of advancing human freedom, Boeing has continuously navigated challenging and shifting geopolitical dynamics, using our values as guiding principles.

As we approach our Annual Meeting, I would like to update you on some other areas our Board has focused on in the last year:

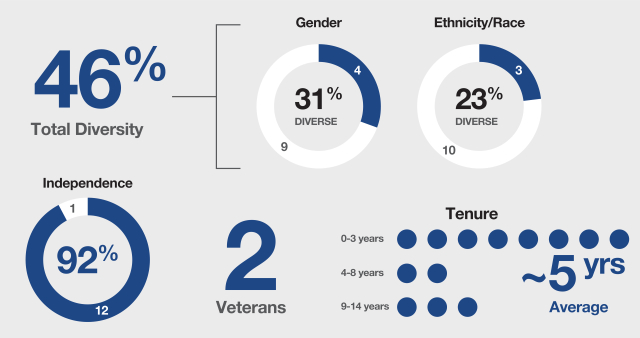

Highly Skilled and Experienced Board. Our Board has worked closely with management to help rebuild our company over the past few years. We have focused on adding directors with a wide range of experience, particularly with in-depth expertise in aerospace, safety, engineering/technology and complex manufacturing. Since the 2019 Annual Meeting, we have added seven independent directors including, most recently, David Gitlin in June 2022. Mr. Gitlin currently serves as Chair and CEO of Carrier and brings to the Board more than 20 years of aerospace industry experience. In addition, we are pleased that Sabrina Soussan, Chairman and CEO of Suez SA, has agreed to be nominated for election to the Board at this year’s meeting, and would bring to the Board an international perspective and extensive experience in areas of heavy manufacturing, cybersecurity, digitalization, environmental sustainability, product safety and human capital management. Our robust refreshment efforts also reflect our commitment to equity, diversity and inclusion; we are particularly proud that 46% of our director nominees are diverse with respect to gender, race and/or ethnicity.

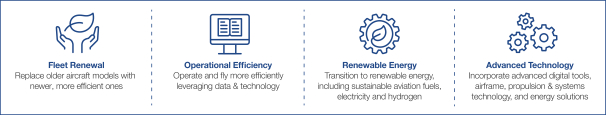

Sustainable Aerospace Together. Our commitment to sustainability is rooted in our core values and our stakeholders’ expectations. In June 2022, we released our second annual Sustainability Report, which further defines the Company’s sustainability goals and includes key metrics to measure progress of our core enterprise priorities. The aerospace industry and our company face significant climate change-driven risks that underscore the need to decarbonize for sustained long-term growth. We are focused on sustainable aerospace and we continue to invest across our four pillars of fleet renewal, operational efficiency, renewable energy and advanced technology to help meet industry-wide goals. We also remain dedicated to supporting the safety and well-being of our employees and investing in the communities where our employees live and work.

Continued Commitment to Equity, Diversity and Inclusion. At Boeing, our goal is to address representation gaps and strengthen equity, diversity and inclusion so that all team members feel supported and inspired. In 2021, we established a set of near-term aspirations to achieve by 2025 and introduced the Seek, Speak & Listen habits to build stronger teams and achieve better business outcomes. Over the past year, we have seen the value that inclusion brings to Boeing as we continue to advance these commitments. Our second annual Global Equity, Diversity & Inclusion Report shares our progress against these aspirations as well as new diversity data.

Track Record of Engagement and Responsiveness. Building trust and delivering sustainable, long-term value requires regular dialogue with our shareholders. Over the past year, we continued to build on our robust shareholder engagement program and discussed with investors topics including our business strategy and priorities, the Board’s recent refreshment efforts and director skill sets, our executive compensation program, our focus on sustainability and climate action, and our equity, diversity and inclusion strategy. On behalf of the Board, I joined members of management in many of these shareholder engagement meetings. The input from these conversations informed recent actions such as enhancements to the compensation program to include goals on climate and equity, diversity and inclusion. Furthermore, in response to a Board-supported shareholder proposal, we described how we compare against the criteria of the Net Zero Indicator in our 2022 Sustainability Report.

On behalf of the Board, we remain committed to serving our shareholders through building long-term value for the Company consistent with our core values. As always, we thank you for your continued confidence and trust in Boeing as we embark on this next chapter.

Sincerely,

Lawrence W. Kellner

Independent Chair of the Board

The Boeing Company

Notice of 2023 Annual Meeting of Shareholders

| Time and Date 11:00 a.m. Eastern Time Tuesday, April 18, 2023

Place Virtual meeting at www.virtualshareholder meeting.com/BA2023

Record Date February 17, 2023

How to Vote See page 91 for additional information on how to vote

Visit www.proxyvote.com to vote online

Call the telephone number on your proxy card, voting instruction form or notice

Mark, sign, date and return each proxy card or voting instruction form |

Items of Business

1. Election of the 13 director nominees named in this proxy statement

2. Advisory vote on named executive officer compensation

3. Advisory vote on the frequency of future advisory votes on named executive officer compensation

4. Approval of The Boeing Company 2023 Incentive Stock Plan

5. Ratification of the appointment of Deloitte & Touche LLP as Boeing’s independent auditors for 2023

6. Four shareholder proposals contained in this proxy statement, if properly presented

Shareholders will also transact such other business as may properly come before the meeting and any postponement or adjournment thereof.

Your vote is important to us. We urge you to vote as soon as possible, even if you own only a few shares.

This proxy statement is issued in connection with the solicitation of proxies by the Board of Directors of The Boeing Company for use at the 2023 Annual Meeting of Shareholders and at any adjournment or postponement thereof. On or about March 3, 2023, we will begin distributing print or electronic materials regarding the annual meeting to each shareholder entitled to vote at the meeting. Shares represented by a properly executed proxy will be voted in accordance with instructions provided by the shareholder.

By order of the Board of Directors,

John C. Demers Vice President, Assistant General Counsel and Corporate Secretary |

Important Notice regarding the availability of proxy materials for the Annual Meeting of Shareholders to be held on April 18, 2023: this Proxy Statement and the 2022 Annual Report are available at www.proxyvote.com.

Websites throughout this proxy statement are provided for reference only. Websites referred to herein are not incorporated by reference into this proxy statement.

Table of Contents

| 1 | ||||

| 1 | ||||

| 1 | ||||

| 2 | ||||

| 2 | ||||

| 3 | ||||

| 4 | ||||

| 5 | ||||

| 5 | ||||

| 6 | ||||

| 6 | ||||

| 8 | ||||

| 15 | ||||

| 15 | ||||

| 15 | ||||

| 16 | ||||

| 17 | ||||

| 20 | ||||

| 21 | ||||

| 21 | ||||

| 22 | ||||

| 22 | ||||

| 22 | ||||

| 24 | ||||

| 24 | ||||

| 24 | ||||

| 24 | ||||

| 27 | ||||

| 27 | ||||

| 28 | ||||

| 30 | ||||

| 31 | ||||

| 32 | ||||

| APPROVE, ON AN ADVISORY BASIS, NAMED EXECUTIVE OFFICER COMPENSATION (ITEM 2) |

34 | |||

| 35 | ||||

| 36 | ||||

| 36 | ||||

| 39 | ||||

| 41 | ||||

| 42 | ||||

| 46 | ||||

| 50 | ||||

| 51 | ||||

| 52 | ||||

| 53 | ||||

| 54 | ||||

| 54 | ||||

| 55 | ||||

| 56 | ||||

| 56 | ||||

| 57 | ||||

| 59 | ||||

| 60 | ||||

| 61 | ||||

| 62 | ||||

| 63 | ||||

| 66 | ||||

| 67 | ||||

| APPROVE THE BOEING COMPANY 2023 INCENTIVE STOCK PLAN (ITEM 4) |

71 | |||

| 72 | ||||

| 72 | ||||

| 75 | ||||

| 76 | ||||

| 77 | ||||

| 77 | ||||

| 78 | ||||

| 78 | ||||

| 79 | ||||

| 80 | ||||

| 80 | ||||

| 81 | ||||

| 81 | ||||

| 82 | ||||

| 82 | ||||

| Shareholder Proposal – Report on Lobbying Activities (Item 7) |

83 | |||

| 85 | ||||

| 87 | ||||

| 90 | ||||

| 90 | ||||

| 90 | ||||

| 94 | ||||

| A-1 | ||||

PROXY SUMMARY

Voting Recommendations of the Board

| Item | Description | Recommendation | Page | |||

| 1 |

Elect 13 directors | FOR | 5 | |||

| 2 |

Approve, on an advisory basis, named executive officer compensation | FOR | 34 | |||

| 3

|

Recommend, on an advisory basis, the frequency of future advisory votes on named executive officer compensation | EVERY YEAR

|

35

| |||

| 4 |

Approve The Boeing Company 2023 Incentive Stock Plan | FOR | 71 | |||

| 5 |

Ratify the appointment of Deloitte & Touche LLP as independent auditor | FOR | 78 | |||

| 6 |

Shareholder proposal – China report | AGAINST | 82 | |||

| 7 |

Shareholder proposal – report on lobbying activities | AGAINST | 83 | |||

| 8 |

Shareholder proposal – report on climate lobbying | AGAINST | 85 | |||

| 9 |

Shareholder proposal – pay equity disclosure | AGAINST | 87 | |||

Director Nominees

Our Board evaluates director candidates on an ongoing basis to maintain a proper balance and diversity of experience, tenure and perspectives. This commitment to constant improvement helps to ensure that our Board is consistently poised to defend our core values as well as advance our evolving business needs and strategic priorities.

| Name | Age | Director Since |

Professional Background | Board Committees | ||||||||

|

Robert A. Bradway

|

|

60

|

|

|

2016

|

|

Chairman & CEO, Amgen

|

Finance,

Governance & Public Policy | ||||

|

David L. Calhoun |

|

65 |

|

|

2009 |

|

President & CEO, Boeing |

— | ||||

|

Lynne M. Doughtie |

|

60 |

|

|

2021 |

|

Former U.S. Chairman & CEO, KPMG |

Audit, Finance | ||||

|

David L. Gitlin |

|

53 |

|

|

2022 |

|

Chairman & CEO, Carrier Global |

Aerospace Safety, Finance | ||||

|

Lynn J. Good |

|

63 |

|

|

2015 |

|

Chairman, President & CEO, Duke Energy |

Audit, Compensation | ||||

|

Stayce D. Harris

|

|

63

|

|

|

2021

|

|

Former United Airlines Pilot;

Former Inspector General, U.S. Air Force |

Aerospace Safety, Audit,

Special Programs | ||||

|

Akhil Johri |

|

61 |

|

|

2020 |

|

Former EVP & CFO, United Technologies |

Audit, Finance | ||||

|

David L. Joyce

|

|

66

|

|

|

2021

|

|

Former President & CEO, GE Aviation;

Former Vice Chair, General Electric |

Aerospace Safety, Compensation,

Special Programs | ||||

|

Lawrence W. Kellner*

|

|

64

|

|

|

2011

|

|

Former Chairman & CEO, Continental Airlines

|

Aerospace Safety,

Governance & Public Policy | ||||

|

Steven M. Mollenkopf |

|

54 |

|

|

2020 |

|

Former CEO, Qualcomm |

Compensation, Governance & Public Policy,

Special Programs | ||||

|

John M. Richardson |

|

62 |

|

|

2019 |

|

31st Chief of Naval Operations; Former Director of Naval Nuclear Propulsion Program, U.S. Navy

|

Aerospace Safety, Finance, Special Programs

| ||||

|

Sabrina Soussan |

|

53 |

|

|

— |

|

Chairman and CEO, Suez SA |

Audit, Finance# | ||||

|

Ronald A. Williams

|

|

73

|

|

|

2010

|

|

Former Chairman, President & CEO, Aetna

|

Compensation, Governance & Public Policy | ||||

| * | Independent Chair of the Board |

| # | Subject to, and effective upon, her election at the annual meeting |

|

2023 Proxy Statement |

|

1 |

|

PROXY SUMMARY

Shareholder Outreach

We meet with shareholders throughout the year to ensure that the Board and management are focused on, and responsive to, investor priorities and concerns. For additional information, see “Shareholder Outreach” on page 16.

Governance Highlights

| Board Structure and Independence | ✓ Independent Board Chair required by our By-Laws and Corporate Governance Principles (page 15) ✓ Average director nominee tenure of 5 years ✓ Balanced and diverse group of independent Board nominees, most with tenure of fewer than three years (page 7) ✓ 12 of 13 director nominees, and all committee members, are independent ✓ Executive sessions of independent directors conducted after every regularly scheduled Board meeting | |

| Board Oversight | ✓ Robust succession planning process for senior leadership positions, including in-depth meetings between individual directors and senior executives other than the CEO ✓ Extensive Board oversight of key strategic, operational and compliance risks, with a sharpened focus on risks related to safety and quality, cybersecurity, and climate change (page 20) ✓ Significant Board involvement in strategy development, such as efforts to reduce emissions in our production facilities and enhance workforce diversity ✓ Regular visits to Boeing production sites by each director ✓ Board oversight of global ethics and compliance efforts, corporate culture, political advocacy, public policy, sustainability, equity, diversity and inclusion, and charitable contributions | |

| Strong Corporate Governance Practices | ✓ Active shareholder engagement throughout the year (page 16) ✓ Comprehensive annual evaluations of the Board, each of the committees, and individual directors (page 21), led by the Board Chair and GPP Committee Chair ✓ 100% attendance at all Board and committee meetings during 2022 (page 21) ✓ Robust Board refreshment process focused on diversity, expertise, and evolving Company priorities, resulting in strategic Board turnover ✓ Limits on director service on outside boards (page 5) ✓ Publicly disclosed policies and practices regarding political advocacy, including disclosure of trade association contributions of $25,000 or more in response to shareholder feedback (see www.boeing.com/company/key-orgs/government-operations/#/political) ✓ Directors required to hold all equity-based compensation until they leave the Board ✓ Mandatory director retirement policy (page 24) ✓ Board and committees may hire outside advisors independently of management ✓ Annual Sustainability Report and Global Equity, Diversity & Inclusion Report outline our commitment to environmental, social and governance matters ✓ Rigorous codes of conduct for all employees and directors ✓ Publicly disclosed Code of Basic Working Conditions and Human Rights, reflecting our commitment to the protection and advancement of human rights worldwide | |

| Shareholder Rights | ✓ Proxy access right for shareholders seeking to nominate directors (page 94) ✓ Majority voting for all directors, each of whom is elected for a one-year term and is subject to a resignation policy in the event he or she fails to receive a majority vote ✓ No supermajority voting requirements ✓ Shareholder right to call special meetings ✓ No poison pill and any future poison pill must be submitted to shareholders | |

|

2 |

|

2023 Proxy Statement |

PROXY SUMMARY

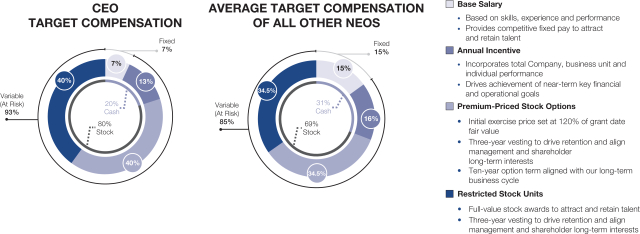

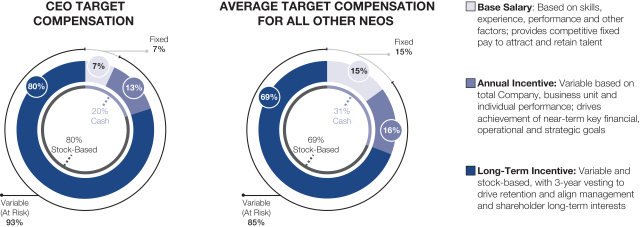

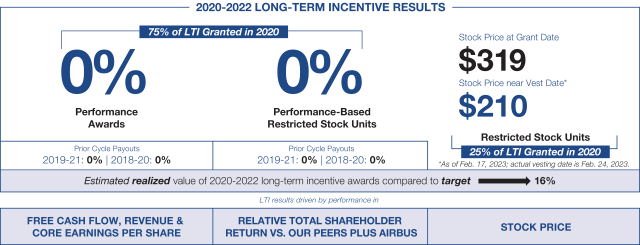

Executive Compensation

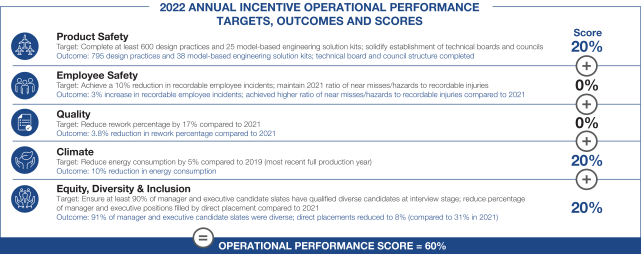

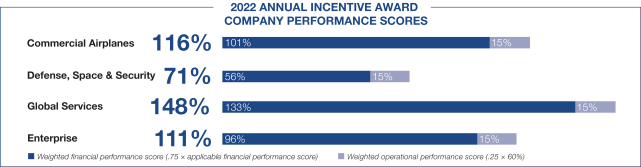

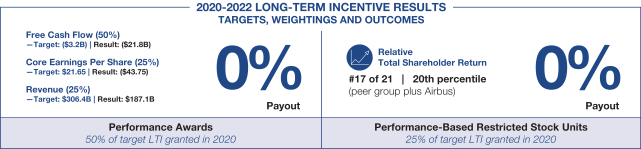

| • | No performance award or performance-based restricted stock unit payouts for the 2020-2022 performance period |

| • | Robust clawback policy permits the recoupment of past incentive pay from executive officers in the event of instances of misconduct or certain types of negligent conduct, even absent a restatement of financial results, including where such conduct has compromised the safety of our products or services |

| • | Continued focus on safety as a component in determining annual incentive payouts for executive officers, including formal consultation between the Aerospace Safety and Compensation Committees on identifying appropriate safety-related metrics for incentive program design and evaluating individual executive performance with respect to safety |

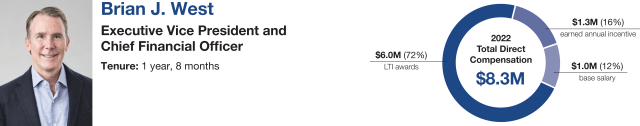

| • | Approximately 87% of average target named executive officer, or NEO, pay in 2022 was variable or at risk |

| • | Annual incentive pay program featuring multiple performance metrics at each of the Company, business unit and individual levels targeted to driving strong financial performance as well as concrete improvements in product safety, employee safety, quality, climate, and equity, diversity and inclusion |

| • | Long-term incentives for senior executives that facilitate long-term stock ownership and alignment between interests of management and shareholders |

| • | No accelerated vesting of equity awards in connection with a change in control |

| • | Prohibition against pledging or hedging Boeing stock by directors or executive officers |

| • | Rigorous stock holding and ownership requirements for executive officers, including requiring our CEO to hold shares acquired under long-term incentive awards until post-termination |

| • | No change in control arrangements or (except where required by non-U.S. law) employment agreements |

Principal Components of NEO 2022 Total Target Compensation

For detailed information about our executive compensation program, see “Compensation Discussion and Analysis” beginning on page 36.

|

2023 Proxy Statement |

|

3 |

|

PROXY SUMMARY

Sustainability

Boeing is committed to protecting, connecting and exploring our world and beyond, safely and sustainably. Our commitment to sustainability is rooted in our company values, our strategy and our stakeholders’ expectations, and encompasses our focus on environmental stewardship, social progress and inclusion, and values-based, transparent governance. We have organized our sustainability efforts around four key pillars: People, Products & Services, Operations and Communities. We have defined 11 sustainability priorities based on our core values as well as the interests of our diverse portfolio of stakeholders, including customers, current and future employees, regulators, suppliers, investors, and communities around the world. Boeing supports both the objectives of the Paris Agreement and the commercial aviation industry’s ambition to achieve net-zero carbon emissions for global civil aviation operations by 2050.

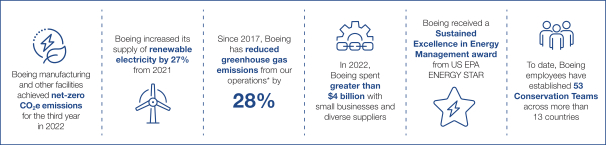

In 2022, Boeing advanced its sustainability goals through the following:

| • | Published our first Chief Aerospace Safety Officer Report |

| • | Invested to create and launch Cascade, a data modeling and visualization tool that supports the global civil aviation industry’s goal of achieving net-zero emissions by 2050 |

| • | Maintained net-zero greenhouse gas (GHG) emissions from manufacturing, other facilities and company travel |

| • | Celebrated the ten-year investment in Boeing’s ecoDemonstrator program and completed a second round of testing with NASA to evaluate the emissions produced from sustainable aviation fuels (SAF) |

| • | Increased our supply of renewable electricity by 27% from 2021 |

| • | Purchased two million gallons of SAF for commercial operations |

| • | Became the aviation sector “champion” for the First Movers Coalition |

| • | Announced plans to open a new Boeing Research and Technology center in Japan focused on sustainability |

| • | Shared 2025 goal progress in our 2022 Global Equity, Diversity & Inclusion (GEDI) Report and also publicly shared our EEO-1 report |

| • | Completed $10 million in energy efficiency and other conservation initiatives to reduce GHG emissions and water consumption |

| • | Shared key metrics to measure progress against our six 2030 goals |

For additional information, see “Sustainability” beginning on page 27.

|

4 |

|

2023 Proxy Statement |

ELECTION OF DIRECTORS (ITEM 1)

| PROPOSAL SUMMARY

Shareholders are being asked to elect the 13 director nominees under “Director Nominees” beginning on page 8 to serve until the 2024 Annual Meeting of Shareholders. |

|

The Board recommends that you vote FOR each of the 13 director nominees. |

Director Qualification Criteria

The Governance & Public Policy Committee, or GPP Committee, is responsible for identifying and assessing potential candidates and recommending nominees for the Board’s approval. The GPP Committee assesses the qualifications of incumbent directors and other candidates for nomination on an ongoing basis, including with respect to the following key factors:

| • | Experience. The GPP Committee considers each candidate’s experience and leadership record in areas such as aerospace, engineering, manufacturing, safety, risk management, software, operations, finance, marketing, sustainability, human capital management, international business and affairs, government and public policy. |

| • | Industry Expertise. The GPP Committee ensures that a number of directors possess aerospace and/or defense industry, as well as technology, expertise. This broad industry expertise allows the Board to assess Company performance and provide strategic guidance with respect to each of our principal businesses. |

| • | Diversity. The Board is deeply committed to a membership profile that demonstrates diversity with respect to gender, race/ethnicity, background, experience, skills and perspectives. |

| • | Safety. The Board is committed to safety as a core value of the Company—both with respect to our aerospace products and services and our employees in the workplace. One manifestation of this commitment is ensuring that the Board includes members with a wide range of experience in areas where safety is paramount. |

| • | Outside Board Memberships. Directors are expected to ensure that other commitments, including outside board memberships, do not interfere with their responsibilities as Boeing directors. Consequently, directors may not serve on more than three public company boards in addition to Boeing (one, if the director is a public company CEO). The GPP Committee reviews directors’ outside commitments to ensure that all directors are able to devote sufficient time to Boeing. If a director, solely through service on for-profit boards previously approved by the GPP Committee, exceeds the public company limits set forth above, such director shall commit to reduce the number of such directorships in order to fall within such limits within 12 months. |

| • | Independence. In addition to any regulatory limitations with respect to independence, the GPP Committee also considers other positions the director holds or has held, and evaluates each nominee with respect to Boeing’s publicly disclosed Director Independence Standards, the New York Stock Exchange, or NYSE, director independence standards and any potential conflicts of interest. |

| • | Professional Reputation. As set forth in our Corporate Governance Principles, our directors are expected to have a reputation for personal and professional integrity, honesty and adherence to the highest ethical standards. |

| • | Length of Service. The Board believes that regular refreshment of the Board is critical for us to gain fresh perspectives and maintain our position as a global aerospace leader. At the same time, with decades-long product cycles and lengthy development periods, we also benefit from directors with extensive Boeing experience. As a result, the GPP Committee’s strategy is to maintain a balance among directors of short, medium and longer tenures. |

| • | Regulatory Compliance. All director nominees must satisfy regulatory requirements for Board service, including those with respect to any committee on which such director would be asked to serve. |

| • | Prior Contributions to the Board. When evaluating the candidacy of an incumbent director, the Board also considers the director’s ongoing contributions to the Board, including attendance and participation at meetings and ongoing relevance of their skills and experience, as well as the results of both formal and informal evaluations provided by fellow directors. |

|

2023 Proxy Statement |

|

5 |

|

ELECTION OF DIRECTORS (ITEM 1)

Board Refreshment

The Board is committed to adding new members with compatible skill sets and fresh perspectives. Since the 2019 Annual Meeting, eight independent directors have left the Board and seven have been added as part of the Board’s refreshment efforts. These seven directors bring significant experience in aerospace, safety, engineering, cyber/software, risk oversight, audit, supply chain management and finance. Mr. Gitlin, who joined the Board in 2022, was recommended to the GPP Committee by an incumbent independent director. Ms. Soussan, who is a new director nominee, was referred to the GPP Committee by an independent search firm. Meanwhile, the GPP Committee continues to seek highly qualified director candidates in furtherance of the Board’s ongoing refreshment strategy. By identifying and electing directors with safety-related experience, expertise in areas such as aerospace/aviation, risk management, software development, engineering, sustainability and finance, and diverse backgrounds and perspectives, the Board seeks to continue to fulfill its oversight responsibilities and uphold Boeing’s core values, all while enabling Boeing to achieve its evolving strategic imperatives. As part of the Board’s commitment to diversity, 46% of our director nominees, including the chairs of the Audit, Compensation and GPP Committees, are diverse with respect to gender and/or race/ethnicity.

Board Composition

Skills and Experience of Director Nominees

| Skills and Experience | BRADWAY | CALHOUN | DOUGHTIE | GITLIN | GOOD | HARRIS | JOHRI | JOYCE | KELLNER | MOLLENKOPF | RICHARDSON | SOUSSAN | WILLIAMS | |||||||||||||

| In-Depth Aerospace Expertise Substantial knowledge of aerospace enables enhanced oversight of product development and sharpens focus on safety and quality |

|

✓

|

|

✓

|

|

✓

|

✓

|

✓

|

✓

|

|

|

|

| |||||||||||||

| Engineering/Technology Leadership Experience in precision engineering or in leading teams working on cutting-edge technologies enables sharpened oversight of the design, development and testing of complex aerospace products, services and systems |

✓ | ✓ |

|

✓ | ✓ | ✓ |

|

✓ | ✓ | ✓ | ✓ | ✓ |

| |||||||||||||

| Complex Manufacturing Expertise Understanding of complex manufacturing allows directors to critically evaluate our operations and product development |

✓

|

✓

|

|

✓

|

|

|

✓

|

✓

|

|

✓

|

|

✓

|

| |||||||||||||

| Safety Expertise in establishing and overseeing safety processes and procedures drives our ability to support our core value of safety in all that we do |

✓

|

✓

|

|

✓

|

✓

|

✓

|

|

✓

|

✓

|

|

✓

|

✓

|

| |||||||||||||

| Risk Management Experience assessing and managing risks enables directors to effectively oversee and mitigate the most significant risks facing Boeing |

✓

|

✓

|

✓

|

✓

|

✓

|

✓

|

✓

|

✓

|

✓

|

✓

|

✓

|

✓

|

✓

| |||||||||||||

| Highly Regulated Industry Experience Familiarity with highly regulated industries enables directors to advise on complex interactions with regulators and ensure that Boeing’s products and services meet the expectations of various stakeholders |

✓ | ✓ | ✓ | ✓ | ✓ |

|

✓ | ✓ | ✓ |

|

|

✓ | ✓ | |||||||||||||

| Current or Former CEO of a Large Company Experience in the chief executive role at large companies enhances the Board’s ability to evaluate and advise our CEO as well as oversee corporate strategy, values, and culture |

✓ | ✓ | ✓ | ✓ | ✓ |

|

|

|

✓ | ✓ |

|

✓ | ✓ | |||||||||||||

|

6 |

|

2023 Proxy Statement |

ELECTION OF DIRECTORS (ITEM 1)

| Skills and Experience | BRADWAY | CALHOUN | DOUGHTIE | GITLIN | GOOD | HARRIS | JOHRI | JOYCE | KELLNER | MOLLENKOPF | RICHARDSON | SOUSSAN | WILLIAMS | |||||||||||||

| Climate Change Experience in climate change risk management strategies and other climate-related issues enables enhanced Board oversight of environmental policies, strategies and priorities for a sustainable aerospace future |

✓ | ✓ |

|

✓ | ✓ |

|

|

|

✓ |

|

|

✓ |

| |||||||||||||

| Fortune 500 Board Experience Service on other large, public company boards provides directors with similar oversight experience |

✓ | ✓ |

|

✓ | ✓ |

|

✓ |

|

✓ | ✓ | ✓ |

|

✓ | |||||||||||||

| International Leadership Experience managing global relationships and engaging with international stakeholders supports the Board’s oversight of key risks involving our global customer and supply bases and our challenges managing global compliance systems |

✓ | ✓ | ✓ | ✓ |

|

|

✓ | ✓ | ✓ | ✓ | ✓ | ✓ |

| |||||||||||||

| Senior Leadership Experience Leadership experience facilitates effective oversight of management and sharpens the Board’s succession planning process |

✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | |||||||||||||

| Senior U.S. Government/Military Experience Experience in large-scale military operations, strategy development, international relations, and/or defense contracting enhances oversight of global defense strategy and relations with key customers |

|

|

|

|

|

✓ |

|

|

|

|

✓ |

|

| |||||||||||||

| Former Fortune 500 CFO Demonstrated experience with large-scale financial decision-making enables enhanced Board deliberations regarding capital allocation, long-term strategy, and regulatory compliance |

✓ |

|

|

|

✓ |

|

✓ |

|

✓ |

|

|

|

| |||||||||||||

Data reflect 2023 director nominees

|

2023 Proxy Statement |

|

7 |

|

ELECTION OF DIRECTORS (ITEM 1)

Director Nominees

| Robert A. Bradway | ||||

|

Chairman and CEO, Amgen Inc.

Boeing director since: 2016

Committees: Finance (Chair); Governance & Public Policy

Independent: Yes

Age: 60

Other current public directorships:

• Amgen Inc.

|

Skills and Qualifications

Mr. Bradway brings to the Board critical skills in the areas of high technology, product development, financial oversight, product safety and risk management. His experience as a senior executive in the biotechnology industry, including as Chief Executive Officer, Chief Operating Officer and Chief Financial Officer of Amgen, provides him with an extensive understanding of the strategic considerations and challenges associated with meeting the requirements of numerous safety and regulatory compliance regimes around the world. At Amgen, Mr. Bradway has also overseen a number of sustainability initiatives, such as Amgen’s 2027 Environmental Sustainability Plan to reduce Amgen’s environmental footprint as well as coordinating its overall environment, social and governance strategy. In addition, he previously served as a director of Norfolk Southern Corporation, one of the nation’s largest railroad transportation companies, where virtually every aspect of operations is heavily regulated and subject to strict safety-related oversight. In recognition of Mr. Bradway’s experience in corporate finance, risk management and executive leadership, the Board elected him to serve as Chair of the Finance Committee.

Professional highlights:

• Chairman and CEO, Amgen Inc. (Chairman 2013-present; CEO 2012-present)

• President and COO, Amgen Inc. (2010-2012)

• Executive Vice President and CFO, Amgen Inc. (2007-2010)

|

| David L. Calhoun | ||||

|

President and CEO, The Boeing Company

Boeing director since: 2009

Committees: None

Independent: No

Age: 64

Other current public directorships:

• Caterpillar Inc.

Recent prior directorships:

• Gates Industrial Corporation plc

• Nielsen Holdings plc

|

Skills and Qualifications

Mr. Calhoun brings a diverse skill set to the Board, including deep and long-standing aviation industry experience as Boeing’s President and Chief Executive Officer, former Boeing Chair of the Board and independent Lead Director, and a multi-year tenure as the leader of GE’s transportation and aircraft engines businesses. He also brings experience leading businesses through periods of change, having led Nielsen’s transformation into a leading global information and measurement company. In addition, Mr. Calhoun brings to Boeing strong leadership and valuable insight and perspective on a wide array of strategic and business matters, stemming from his vast executive, management and operational experience at Blackstone, as well as at Nielsen and GE. Furthermore, Mr. Calhoun served as chair of Caterpillar’s Public Policy and Governance Committee, which oversees the company’s environmental, health and safety activities, including with respect to climate and sustainability. Mr. Calhoun’s significant global aerospace, manufacturing and high-technology industry expertise, as well as leadership experience on the boards of Caterpillar and Gates Industrial Corporation, position him well to serve on the Board and lead Boeing as President and Chief Executive Officer.

Professional highlights:

• President and CEO, The Boeing Company (2020-present)

• Senior Managing Director and Head of Private Equity Portfolio Operations, The Blackstone Group (2014-2020)

• Chairman and CEO, Nielsen Holdings plc (Chairman 2014-2016; CEO 2010-2014)

• Chairman and CEO, The Nielsen Company B.V. (2006-2014)

• Vice Chairman, General Electric Company; President and CEO, GE Infrastructure (2005-2006)

• President and CEO, GE Transportation (aircraft engines and rail) (2003-2005)

• President and CEO, GE Aircraft Engines (2000-2003)

|

|

8 |

|

2023 Proxy Statement |

ELECTION OF DIRECTORS (ITEM 1)

|

Lynne M. Doughtie | ||||||

|

Former U.S. Chairman and CEO, KPMG

Boeing director since: 2021

Committees: Audit; Finance

Independent: Yes

Age: 60

Other current public directorships:

• Workday, Inc.

|

Skills and Qualifications

Ms. Doughtie brings insights and expertise from her extensive experience in the accounting profession and executive experience leading a Big Four public accounting firm. She began her career in KPMG’s audit practice in 1985 and held various national, regional and global leadership roles, including lead partner for several of KPMG’s major clients. Ms. Doughtie has had significant exposure to issues facing complex, global companies and has expertise in risk management, internal controls, culture change and regulatory compliance. Ms. Doughtie also previously served on the boards of Catalyst, Inc. and Chief Executives for Corporate Purpose and has been recognized for her leadership in inclusion and diversity and values leadership. Ms. Doughtie’s financial expertise, executive leadership experience, risk management and regulatory skills, and experience driving culture change bring significant value to the Board.

Professional highlights:

• U.S. Chairman and CEO, KPMG (2015-2020)

• Vice Chair of Advisory Practice, KPMG (2011-2015)

| |||||

|

David L. Gitlin | ||||||

|

Chairman and CEO, Carrier Global Corporation

Boeing director since: 2022

Committees: Aerospace Safety; Finance

Independent: Yes

Age: 53

Other current public directorships:

• Carrier Global Corporation

|

Skills and Qualifications

Mr. Gitlin, the most recent addition to the Board, has extensive senior-level experience in the aerospace industry as well as in manufacturing, safety and sustainable innovation. As Chairman and CEO of Carrier, Mr. Gitlin oversees a world leader in heating, air conditioning and refrigeration solutions, which is committed to cost-effective climate mitigation strategies in both its products and operations. Prior to joining Carrier, Mr. Gitlin was President and COO of Collins Aerospace and President of UTC Aerospace Systems. In these roles, as well as in prior leadership roles at Hamilton Sundstrand, Mr. Gitlin developed extensive expertise in aerospace safety (including the development and manufacture of aircraft engines and power systems), manufacturing and operational excellence. As a result, he brings to our Board unique perspectives on aerospace safety, aerospace supplier management and manufacturing in a highly regulated environment. In recognition of Mr. Gitlin’s record of achievement in these disciplines, the Board has appointed him to the Aerospace Safety Committee.

Professional highlights:

• Chairman and CEO, Carrier Global Corporation (2021-present)

• President and CEO, Carrier Global Corporation (2020-2021)

• President and CEO of Carrier, United Technologies Corporation (2019-2020)

• President and COO of Collins Aerospace Systems, United Technologies Corporation (2018-2019)

• President of UTC Aerospace Systems, United Technologies Corporation (2015-2018)

| |||||

|

2023 Proxy Statement |

|

9 |

|

ELECTION OF DIRECTORS (ITEM 1)

|

Lynn J. Good |

||||

|

Chairman, President and CEO, Duke Energy Corporation

Boeing director since: 2015

Committees: Compensation (Chair); Audit

Independent: Yes

Age: 63

Other current public directorships:

• Duke Energy Corporation

|

Skills and Qualifications

Ms. Good brings to the Board substantial experience in executive leadership, safety, corporate governance, financial management and accounting, as well as operational expertise in a highly regulated, capital-intensive industry. Ms. Good’s record as Chief Executive Officer and Chairman of Duke Energy, one of the nation’s largest grid and generation operators, enables her to advise management on a wide range of strategic, financial, sustainability and governance matters, including the challenges associated with safety performance, large-scale capital projects, transformative technologies and crisis management. Ms. Good leads the integration of Duke Energy’s climate strategy into the company’s business strategy, through investing in carbon-free technology, modernizing its gas and electric infrastructure and expanding and integrating efficiency and demand management systems. Ms. Good also has vast financial management experience, gained principally from her prior service as Chief Financial Officer and Treasurer of Duke Energy. Ms. Good also has extensive capital markets proficiency, significant merger and restructuring experience and accounting and auditing skills earned from nearly 30 years as a Certified Public Accountant and 11 years as an audit partner at Arthur Andersen LLP and Deloitte & Touche LLP. Ms. Good also serves as chair of the Institute of Nuclear Power Operations, a not-for-profit organization responsible for promoting the highest levels of safety and reliability in nuclear plant operations. Ms. Good earned Bachelor of Science degrees in systems analysis and accounting from Miami University.

Professional highlights:

• Chairman, President and CEO, Duke Energy Corporation (Chairman 2016-present; President and CEO 2013-present)

• Vice Chairman, Duke Energy Corporation (2013-2016)

• Executive Vice President and CFO, Duke Energy Corporation (2009-2013)

|

|

Stayce D. Harris | ||||

|

Former United Airlines Pilot; Former

Boeing director since: 2021

Committees: Aerospace Safety;

Independent: Yes

Age: 63

Other current public directorships:

• BlackRock Fixed-Income Funds

Recent prior directorships:

• KULR Technology Group, Inc. |

Skills and Qualifications

Lieutenant General Harris brings extensive aerospace and aviation experience to the Board. General Harris is an experienced Boeing 747 pilot, with over 10,000 flight hours safely transporting passengers and cargo worldwide in the Boeing 747, 757, 767 and 777 aircraft for United Airlines before her retirement in 2020. Her extensive experience as a pilot, together with her deep knowledge of safety protocols and flight procedures, adds to the Board’s expertise in aviation safety and provides hands-on familiarity with pilots’ and crew interaction with complex aerospace systems, including in particular Boeing aircraft. Before retiring from the Air Force in 2019, she was a United States Air Force Reserve Lieutenant General, serving in several senior roles, including most recently as Inspector General of the Air Force and, before that, the Assistant Vice Chief of Staff of the Air Force. General Harris was the first African American woman to command an Air Force operational flying squadron, wing and numbered Air Force. Her military and aviation expertise, extensive leadership experience, and demonstrated record of leading teams with honor and integrity as paramount values all bring significant value to the Board. General Harris’ prior experiences also bring to the Board an extensive background and expertise in audit and cybersecurity matters. General Harris earned a Bachelor of Science degree in industrial and systems engineering from the University of Southern California and a Master of Aviation Management degree from Embry-Riddle Aeronautical University. She also has a certificate in cybersecurity oversight from Carnegie Mellon University.

Professional highlights:

• Inspector General, U.S. Air Force (2017-2019)

• Assistant Vice Chief of Staff and Director Air Staff, U.S. Air Force (2016-2017)

• Commander, 22nd Air Force (2014-2016)

• 747 Pilot, United Airlines (1990-2020 with military leave of absence 2014-2019)

• Senior Strategist/Air Force Reserve Advisor to Commander, Air Mobility Command and 18th Air Force (2012-2014)

• Senior Strategist/Air Force Reserve Advisor to Commander, U.S. Africa Command on Reserve Matters (2010-2012)

| |||||

|

10 |

|

2023 Proxy Statement |

ELECTION OF DIRECTORS (ITEM 1)

|

Akhil Johri | ||||

|

Former Executive Vice President and

Boeing director since: 2020

Committees: Audit (Chair); Finance

Independent: Yes

Age: 61

Other current public directorships:

• Cardinal Health Inc. |

Skills and Qualifications

Mr. Johri brings to the Board extensive aerospace industry expertise from his more than 30 years at United Technologies, as well as critical skills developed while serving as Chief Financial Officer at multiple Fortune 500 companies. These skills enable Mr. Johri to provide critical insights to the Board in areas as diverse as financial strategy, strategic operations, the dynamics of managing a complex, global supply chain, articulating corporate strategy to investors and other stakeholders and mitigating risks associated with the development of new products and services at a large industrial manufacturer. Mr. Johri also brings to the Board unique insights relating to his senior leadership experience at United Technologies, a major supplier to aerospace companies like Boeing. In addition, as an independent director and audit committee member at Cardinal Health, Mr. Johri brings to the Board experience in risk oversight and corporate governance of a large company in a highly regulated industry. In recognition of Mr. Johri’s extensive experience in corporate finance and strategic matters, the Board elected him to serve as Chair of the Audit Committee. Mr. Johri is a graduate of the Indian Institute of Management, Ahmedabad, and is a Chartered Accountant.

Professional highlights:

• Operating Advisor, Clayton, Dubilier & Rice (2021-present)

• Special Advisor to the Chairman and CEO, United Technologies Corporation (2019-2020)

• Executive Vice President and CFO, United Technologies Corporation (2015-2019)

• CFO, Pall Corporation (2013-2014)

• Vice President, Finance and CFO, UTC Propulsion and Aerospace Systems, United Technologies Corporation (2011-2013)

• Vice President, Financial Planning and Investor Relations, United Technologies Corporation (2009-2011)

| |||||

|

David L. Joyce | ||||

|

Former President and CEO, GE Aviation; Former Vice Chair, General Electric Company

Boeing director since: 2021

Committees: Aerospace Safety (Chair); Compensation; Special Programs

Independent: Yes

Age: 66

Other current public directorships: • None

|

Skills and Qualifications

Mr. Joyce brings to the Board vast aerospace, engineering and manufacturing expertise, as well as a demonstrated track record of safety leadership and operational excellence. He developed his in-depth knowledge of the challenges and opportunities facing the aerospace industry at General Electric Company. Mr. Joyce has 40 years of experience at GE Aviation including 12 years of service as President and CEO and four years as Vice Chairman of GE. He began his GE career as a product engineer, spending more than a decade designing and building engines for both military and commercial customers. Mr. Joyce is recognized for his proficiency in product development, product management and product support founded on an industry-leading safety management system and ever more efficient products. Mr. Joyce is a member of the National Academy of Engineering and earned both bachelor of science and master’s degrees in mechanical engineering from Michigan State University and a master’s degree in business finance from Xavier University.

Professional highlights:

• Senior Advisor, AE Industrial Partners, LP (2023)

• Chairman, AE Industrial Partners HorizonX (2023)

• Non-Executive Chair, GE Aviation (2020)

• President and CEO, GE Aviation (2008-2020)

• Vice Chair, General Electric Company (2016-2020)

| |||||

|

2023 Proxy Statement |

|

11 |

|

ELECTION OF DIRECTORS (ITEM 1)

|

Lawrence W. Kellner Chair of the Board | ||||

|

Former Chairman and CEO, Continental Airlines, Inc.

Boeing director since: 2011; Independent Chair of the Board (2019-present)

Committees: Chair of the Board; Aerospace Safety; Governance & Public Policy

Independent: Yes

Age: 64

Other current public directorships:

• ExxonMobil

Recent prior directorships:

• Marriott International, Inc.

• Sabre Corporation

|

Skills and Qualifications

Mr. Kellner brings to the Board extensive airline industry experience developed during his 14 years of service in key leadership positions at Continental Airlines, including Chairman, Chief Executive Officer, Chief Financial Officer and Chief Operating Officer. Mr. Kellner possesses a deep understanding of strategic planning, customer requirements including with respect to products that improve fuel efficiency and reduce emissions, operational management, and sustainable aviation fuels in the airline industry. As CEO of Continental Airlines, Mr. Kellner led a highly regulated global airline committed to safety through strong training programs, as well as coordination and integration among pilots, civil aviation authorities and other internal and external stakeholders. He also has deep experience in successfully navigating numerous safety and regulatory compliance regimes around the world. In addition, Mr. Kellner has detailed finance and accounting knowledge gained principally from his experience as Chief Financial Officer at Continental Airlines and American Savings Bank. Mr. Kellner also brings to the Board corporate governance expertise from his past service as lead director of Marriott, chairman of Sabre, and on the boards of other Fortune 500 companies. As a result of his leadership experience in the airline industry, his record of independent leadership at Boeing and his distinguished service on other corporate boards, the Board elected Mr. Kellner to serve as Chair of the Board.

Professional highlights:

• President, Emerald Creek Group, LLC (2010-present)

• Chairman and CEO, Continental Airlines, Inc. (2004-2009)

• President and COO, Continental Airlines, Inc. (2003-2004)

| |||||

|

Steven M. Mollenkopf | ||||

|

Former CEO, Qualcomm Incorporated

Boeing director since: 2020

Committees: Compensation; Governance & Public Policy; Special Programs

Independent: Yes

Age: 54

Other current public directorships:

• None

Recent prior directorships:

• General Electric Company

• Qualcomm Incorporated

|

Skills and Qualifications

Mr. Mollenkopf’s experience as the Chief Executive Officer and Chief Operating Officer of Qualcomm, an engineering-driven, high-technology manufacturing company, enables him to bring critical insights to the Board in areas such as engineering leadership, risk management, leading a complex business with a global reach and oversight of large-scale efforts to develop and test new technologies. A long-time engineer who started with Qualcomm over 25 years ago, Mr. Mollenkopf also possesses expertise and direct leadership experience in precision engineering, project management, manufacturing, quality control and designing testing regimes for complex systems. Mr. Mollenkopf is a published IEEE (Institute of Electrical and Electronics Engineers) author and an inventor on 38 patents in areas such as power estimation and measurement, multi-standard transmitters and wireless communication transceiver technology. He holds a bachelor’s degree in electrical engineering from Virginia Tech and a master’s degree in electrical engineering from the University of Michigan.

Professional highlights:

• Special Advisor, Consello Group (2022-present)

• Special Advisor, Qualcomm Incorporated (2021-2022)

• CEO, Qualcomm Incorporated (2014-2021)

• CEO-elect and President, Qualcomm Incorporated (2013-2014)

• President and COO, Qualcomm Incorporated (2011-2013)

| |||||

|

12 |

|

2023 Proxy Statement |

ELECTION OF DIRECTORS (ITEM 1)

|

John M. Richardson | ||||

|

31st Chief of Naval Operations; Former Director of the Naval Nuclear Propulsion Program, U.S. Navy

Boeing director since: 2019

Committees: Special Programs (Chair); Aerospace Safety; Finance

Independent: Yes

Age: 62

Other current public directorships:

• BWX Technologies, Inc.

• Constellation Energy Corporation

Recent prior directorships:

• The Exelon Corporation

|

Skills and Qualifications

Admiral Richardson brings deep expertise in safety, regulation and oversight of complex, high-risk systems, as well as extensive crisis management and national security experience. During his 37 years of service in the U.S. Navy, Admiral Richardson served as the Director of the Naval Nuclear Propulsion Program, a joint activity of the Navy and Department of Energy, serving the Navy and as Deputy Administrator in the National Nuclear Security Administration. In this capacity, he exercised all responsibilities, including applicable regulatory compliance, over related facilities, radiological controls, environmental safety and health matters, as well as selection, training and assignment of personnel supporting over 100 nuclear power plants operating on nuclear-powered warships around the world. Operationally, Admiral Richardson brings extensive experience managing operations of a diverse team on a global basis. He commanded the submarine USS Honolulu and served as naval aide to the President of the United States. As Chief of Naval Operations, he was responsible for the management of 600,000 sailors and civilians, 290 warships and over 2,000 aircraft worldwide. As a result of his safety and operational knowledge, the Board elected Admiral Richardson to the Aerospace Safety Committee, as well as Chair of the Special Programs Committee. At Constellation Energy Corporation, Admiral Richardson is a member of the Risk Committee as well as the Nuclear Oversight Committee, where he has oversight over a number of sustainability issues related to the company’s nuclear facilities and operations. He earned a Bachelor of Science degree in physics from the U.S. Naval Academy, a master’s degree in electrical engineering from the Massachusetts Institute of Technology and Woods Hole Oceanographic Institution and a master’s degree in national security strategy from the National War College.

Professional highlights:

• 31st Chief of Naval Operations, U.S. Navy (2015-2019)

• Director of the Naval Nuclear Propulsion Program, U.S. Navy (2012-2015)

| |||||

|

Sabrina Soussan | ||||

|

Chairman and CEO, Suez SA

Boeing director since: N/A

Committees: Audit; Finance*

Independent: Yes

Age: 53

Other current public directorships:

• ITT Inc.

Recent prior directorships:

• Schaeffler AG

* Subject to, and effective upon, her election at the annual meeting

|

Skills and Qualifications

Ms. Soussan would bring to the Board unique perspectives from her multiple CEO roles following a career of over 20 years at Siemens AG. With extensive international leadership experience, she would also bring a fresh non-U.S. perspective to our Board. In her current role, Ms. Soussan serves as Chairman and CEO of Suez SA, a French-based utility company specializing in water and waste management, where climate change is a key focus area. In addition to her role at Suez SA, Ms. Soussan has extensive experience as an engineer and a senior leader in heavy manufacturing, transportation, automotive industry, building technologies and security access control systems, cybersecurity, digitalization, environmental sustainability, product safety and human capital management. During her lengthy career at Siemens AG, she also held multiple leadership positions as Division CEO, Business Unit CEO and as an engineer in areas such as transportation, automation, and energy management. Ms. Soussan earned a master’s degree in mechanical and aeronautical engineering from the École Nationale Supérieure de Mécanique et d’Aérotechnique and an MBA from I.A.E. Poitiers and University of Dublin, Ireland.

Professional highlights:

• Chairman and CEO, SUEZ SA (2022-present)

• CEO, Dormakaba Holding AG (2021)

• co-CEO, Siemens Mobility, Siemens AG (2017-2020) • Business Unit CEO, High Speed, Commuter Trains, Locomotives, Metro and Light Rail, Mobility Division, Siemens AG (2015-2017)

• Vice President and Head of Commuter and Regional Trains, Mobility Division, Siemens AG (2013-2015)

• Vice President, Head of Business Segment, Sustainability and Energy Management, Building Automation Business Unit, Siemens Building Technologies (2011-2013)

• Head of Marketing and Global Account Management, Building Automation Business Unit, Siemens Building Technologies (2009-2011)

| |||||

|

2023 Proxy Statement |

|

13 |

|

ELECTION OF DIRECTORS (ITEM 1)

|

Ronald A. Williams | ||||

|

Former Chairman, President and CEO, Aetna Inc.

Boeing director since: 2010

Committees: Governance & Public Policy (Chair); Compensation

Independent: Yes

Age: 73

Other current public directorships:

• agilon health, inc.

• Warby Parker Inc.

Recent prior directorships:

• American Express Company

• Johnson & Johnson

|

Skills and Qualifications

Mr. Williams brings to the Board significant strategic, leadership, operations and management experience from his tenure at Aetna, including as Chairman and Chief Executive Officer. With more than 25 years of experience in the health care industry, Mr. Williams provides valuable insight into health insurance and employee benefits best practices, as well as the many related areas associated with managing the requirements of companies in industries with large numbers of employees in U.S. and non-U.S. locations. Mr. Williams also brings experience in significant corporate transformations from his time at Aetna. As co-founder and director and chairman of the agilon health board, Mr. Williams is responsible for overseeing the company’s overall ESG strategy and the company released its inaugural ESG report in August 2022, outlining its enterprise-wide ESG actions, programs and investments. In addition, his service as lead director and chair of the risk committee of American Express has enhanced his expertise in risk management at large, global companies. Mr. Williams’ executive leadership and experience in corporate governance matters at Aetna and through his service on other boards of directors enable him to serve a crucial role as Chair of the Governance & Public Policy Committee and as a member of the Compensation Committee.

Professional highlights:

• Chairman and CEO, RW2 Enterprises, LLC (privately-held) (2011-present)

• Chairman, President and CEO, Aetna Inc. (Chairman 2006-2011; President 2002-2007; CEO 2006-2010)

• Executive Vice President and Chief of Health Operations, Aetna Inc. (2001-2002)

| |||||

|

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS A VOTE FOR EACH OF THESE NOMINEES. | ||||

|

14 |

|

2023 Proxy Statement |

CORPORATE GOVERNANCE

Our Board has adopted a set of Corporate Governance Principles to assist the Board in the exercise of its responsibilities and, along with Boeing’s Certificate of Incorporation and By-Laws and charters of the committees of the Board, provide an effective framework for Boeing’s governance. The Corporate Governance Principles cover topics such as board composition, responsibilities and operations, and is subject to review and modification by the Board from time to time in its discretion and in accordance with relevant regulatory and listing requirements. Additionally, the Board has adopted a Code of Ethical Business Conduct to focus the Board and each director on areas of ethical risk, provide guidance to help them continue to effectively recognize and deal with ethical issues, enhance existing mechanisms to continue the reporting of unethical conduct, and help to continue to foster and sustain a culture of honesty and accountability. We also separately have a code of conduct that applies to all employees. Our corporate governance materials, including our Corporate Governance Principles, the charters of each of the Board’s standing committees, our Director Independence Standards, and our codes of conduct for directors and employees, are available at www.boeing.com/company/general-info/corporate-governance.page. The GPP Committee reviews our governance practices and policies on an ongoing basis and, when appropriate, proposes modifications to the Board. Meanwhile, we continue to engage with shareholders, customers, suppliers and other stakeholders to ensure that our governance practices evolve with our business and the future of aerospace.

Leadership Structure

Our By-Laws and Corporate Governance Principles require that the Chair of the Board be independent. Under this leadership structure, the independent members of the Board, based on the recommendation of the GPP Committee, elect a Chair on an annual basis from among the independent directors. The Board believes that this leadership structure allows our CEO to focus on executing our strategic imperatives, enhancing our operational stability, sharpening our focus on our core values of safety, quality, integrity and sustainability, and increasing transparency with our stakeholders. Meanwhile, in his capacity as independent Chair of the Board, Mr. Kellner can focus on leading the Board, ensuring that it provides strong oversight of management and that all directors are well-positioned to discharge their duties appropriately. Mr. Kellner also engages regularly with shareholders, providing shareholders with additional insight into the priorities of our independent directors while also deepening the independent directors’ understanding of shareholder priorities.

Director Independence

Board Independence

Our Corporate Governance Principles require that at least 75% of the Board satisfy the NYSE criteria for independence. For a director to be considered independent, the Board must determine, after consideration of all relevant facts and circumstances, that such director has no material relationship with Boeing other than as a director, either directly or as a partner, shareholder or executive officer of another entity that has a relationship with Boeing. In addition, the Board has adopted Director Independence Standards to assist the Board in its assessment of director independence. These standards are designed to supplement the requirements of the NYSE listing standards. If a director or nominee has a relationship with Boeing that is not addressed in the Director Independence Standards, the members of the Board who have already been determined to be independent consider all relevant facts and circumstances and determine whether the relationship is material.

The Board has reviewed all direct and indirect relationships between Boeing and each of our director nominees, and has determined that all of our director nominees, other than Mr. Calhoun, are independent. Accordingly, 92% of our director nominees are independent.

Committee Independence

All members of the Aerospace Safety, Audit, Compensation and GPP Committees must be independent, both under the Director Independence Standards and pursuant to any regulatory requirements. The Board has determined that all members of these committees satisfy all applicable independence requirements.

|

2023 Proxy Statement |

|

15 |

|

CORPORATE GOVERNANCE

Shareholder Outreach

Boeing has long believed that the delivery of sustainable, long-term value requires regular dialogue with, and accountability to, our shareholders. As a result, our management team participates in numerous investor meetings throughout the year to discuss our business and strategic priorities. Our core shareholder engagement team includes senior members of our investor relations, corporate governance and sustainability teams, supplemented by our Chair or other directors, as appropriate. These meetings include in-person, telephone and webcast engagements, as well as investor conferences and tours of Boeing facilities. During 2022, we also conducted our first formal investor conference since 2018, during which members of our leadership team publicly discussed our strategic priorities and presented our vision for Boeing’s future.

| FALL ENGAGEMENT | PROXY STATEMENT | |||

| Solicit and receive feedback from shareholders on governance practices and trends, board composition, executive compensation, sustainability, human capital management and other shareholder priorities |

|

Board reviews shareholder feedback and uses information gathered from fall engagement to, when appropriate, enhance disclosures and revise governance practices, executive compensation program, sustainability practices or other programs and policies

| ||

|

| |||

| ANNUAL MEETING | SPRING ENGAGEMENT | |||

| Receive and publish voting results from the annual meeting which help shape our ongoing improvements and developments in governance practices, executive compensation, sustainability and other shareholder interest areas

|

|

Engage in additional outreach with shareholders to provide updates on changes made in response to shareholder feedback and to address management and shareholder proposals, as well as other topics of interest | ||

|

|

During 2022, we discussed many topics, including:

• Boeing’s business structure, strategy and culture;

• our focus on quality and operational stability, including with respect to the 787 program;

• our progress toward the safe return to service of the 737 MAX;

• execution on development programs in both our defense and commercial businesses;

• the Board’s continued refreshment with four new directors since 2021 and seven since the 2019 annual meeting;

• our sustainability priorities and environmental goals;

• our equity, diversity and inclusion aspirations; and

• our executive compensation program. | |

The institutional shareholders with whom we interact each year represent holdings both large and small. We believe that discussions with a broad range of institutional shareholders help ensure that the Board and management understand our shareholders’ priorities and work to address them effectively. The Board incorporates feedback from these conversations, as well as the results of management and shareholder proposals voted on at our shareholders’ meetings, into its deliberations on a wide variety of matters.

We also use multiple communication channels to interact with our retail shareholders. These include our annual report and periodic updates to our website and/or various social media outlets, as well as our annual Sustainability Report and annual Global Equity, Diversity & Inclusion Report. In addition, we provide multiple channels on our website for shareholders to raise concerns directly with members of our Board and/or management.

Our Board has a consistent record of discussing and acting upon shareholder feedback. Recent Board discussions have addressed shareholder feedback on a variety of topics, including Board refreshment, shareholder proposals,

|

16 |

|

2023 Proxy Statement |

CORPORATE GOVERNANCE

executive compensation, sustainability and human capital management and political advocacy, often resulting in changes to our policies and practices as well as guiding the focus of future discussions in the boardroom. In 2021, we published our first Sustainability Report and publicly disclosed our workplace diversity data, including our consolidated EEO-1 report. In our second annual Sustainability Report, we also disclosed how we compare against the Net Zero Indicator criteria in response to a Board-supported shareholder proposal that received majority support. Recognizing the continued importance of transparency with respect to political advocacy, we continue to publicly describe the Board and GPP Committee’s enhanced oversight role, our political action committee processes and governance, and our political contributions guidelines, as well as disclose our direct lobbying activities and our annual trade association contributions of greater than $25,000.

Board Committees

The Board has six standing committees, each of which operates under a Board-approved charter. The Chair of each committee reviews and discusses the agendas and materials for meetings with senior management in advance of distribution to the other committee members, and reports to the Board on topics reviewed and actions taken at each committee meeting. The table below sets forth the current membership of each of the standing committees, the independence of each director and the number of meetings each committee held in 2022. Subject to her election at the annual meeting, Ms. Soussan will serve on the Audit and Finance Committees.

| Independent Director |

Aerospace Safety Committee |

Audit Committee |

Compensation Committee |

Finance Committee |

GPP Committee |

Special Programs Committee | ||||||||

| Number of Meetings in 2022 |

— | 6 | 11 | 7 | 6 | 6 | 3 | |||||||

|

Robert A. Bradway |

✓ |

— |

— |

— |

|

|

— | |||||||

|

David L. Calhoun |

— |

— |

— |

— |

— |

— |

— | |||||||

|

Lynne M. Doughtie

|

✓ |

— |

|

— |

|

— |

— | |||||||

|

David L. Gitlin |

✓ |

|

— |

— |

|

— |

— | |||||||

|

Lynn J. Good

|

✓ |

— |

|

|

— |

— |

— | |||||||

|

Stayce D. Harris |

✓ |

|

|

— |

— |

— |

| |||||||

|

Akhil Johri

|

✓ |

— |

|

— |

|

— |

— | |||||||

|

David L. Joyce |

✓ |

|

— |

|

— |

— |

| |||||||

|

Lawrence W. Kellner

|

✓ |

|

— |

— |

— |

|

— | |||||||

|

Steven M. Mollenkopf |

✓ |

— |

— |

|

— |

|

| |||||||

|

John M. Richardson |

✓ |

|

— |

— |

|

— |

| |||||||

|

Ronald A. Williams |

✓ |

— |

— |

|

— |

|

— | |||||||

|

|

|

|

|

Aerospace Safety Committee

The Aerospace Safety Committee is responsible for directly overseeing our engineering, design, development, manufacture, production, operations, maintenance and delivery activities, in order to ensure the safety of our commercial, defense, space and other aerospace products and services.

In order to fulfill this responsibility, the Aerospace Safety Committee provides direct oversight of:

| • | safety-related policies and processes; |

| • | certification activities; |

| • | our Safety Management System; |

| • | policies and processes for engaging with and supporting the regulatory oversight of the FAA, the Department of Defense, the National Aeronautics and Space Administration, and non-U.S. commercial, defense and space aviation safety regulators; |

|

2023 Proxy Statement |

|

17 |

|

CORPORATE GOVERNANCE

| • | participation in and support of accident investigations conducted by the National Transportation Safety Board and other domestic and international investigatory authorities, including our responses to material findings and conclusions of such investigations; |

| • | pilot training programs and services; and |

| • | cybersecurity with respect to our aerospace products. |

In addition, the Aerospace Safety Committee consults with the Compensation Committee in connection with the safety review portion of individual executive performance evaluations, as well as in connection with identifying incentive plan metrics that are best suited to drive safety improvements and ensure overall product safety. Each meeting of the Aerospace Safety Committee includes updates on significant safety issues, including significant safety events that have occurred, as well as information sufficient to understand management’s judgment in developing new safety policies and procedures, or in addressing significant safety events. The Board also regularly receives and discusses reporting from management, including the Chief Aerospace Safety Officer, regarding the performance of Boeing’s Safety Management System and other significant safety initiatives. The Aerospace Safety Committee is composed entirely of independent directors.

Audit Committee

The Audit Committee oversees our independent auditor and accounting and internal control matters. Its principal responsibilities include oversight of:

| • | the integrity of our financial statements; |

| • | our internal control environment and compliance with legal and regulatory requirements; |

| • | our independent auditor’s qualifications and independence; |

| • | our processes for assessing key strategic, operational and compliance risks; |

| • | the performance of our internal audit function; and |

| • | the performance of our independent auditor. |

At each meeting, representatives of Deloitte & Touche LLP, our independent registered public accounting firm, are present to review accounting, control, auditing and financial reporting matters. In addition, the Audit Committee meets in executive session after every meeting with representatives of Deloitte & Touche LLP, our independent auditors, and also meets regularly in executive session with one or more of the following members of Company management:

| • | Executive Vice President and Chief Financial Officer; |

| • | Senior Vice President, Controller; |

| • | Chief Legal Officer and Executive Vice President, Global Compliance; |

| • | Vice President and Chief Compliance Officer; and |

| • | Vice President, Corporate Audit. |

The Audit Committee also oversees key strategic, operational and compliance risks on behalf of the Board, including those set forth under “Audit Committee Risk Oversight” on page 20. The Audit Committee also prepares the Audit Committee Report included on page 79. The Audit Committee is composed entirely of directors who satisfy NYSE director independence standards and our Director Independence Standards, as well as additional independence standards applicable to audit committee members established pursuant to applicable law. The Board has determined that each Audit Committee member is financially literate as defined by NYSE listing standards and that Mses. Doughtie and Good and Mr. Johri qualify as audit committee financial experts as defined by the rules of the Securities and Exchange Commission, or SEC.

Compensation Committee

The Compensation Committee oversees our executive and equity compensation programs. The Compensation Committee is composed entirely of directors who satisfy NYSE director independence standards and our Director Independence Standards, as well as additional independence standards applicable to compensation committee members established pursuant to applicable law. Additional information about the Compensation Committee, including a more detailed list of its principal responsibilities, is set forth under “How Executive Compensation is Determined” on page 39. In addition, certain of the Compensation Committee’s risk oversight responsibilities are set forth under “Compensation Committee Risk Oversight” on page 20.

|

18 |

|

2023 Proxy Statement |

CORPORATE GOVERNANCE

Finance Committee

The Finance Committee’s principal responsibilities include reviewing and, where appropriate, making recommendations to the Board with respect to:

| • | our funding plans and the funding plans of our subsidiaries; |

| • | our significant financial exposures, contingent liabilities and major insurance programs; |

| • | proposed dividend actions, stock splits and repurchases and issuances of debt or equity securities; |

| • | strategic plans and transactions, including mergers, acquisitions and divestitures, as well as joint ventures and other equity investments; |

| • | customer financing activities; |

| • | our credit agreements and short-term investment policies; and |

| • | employee benefit plan trust investment policies, administration and performance. |

In addition, the Finance Committee has key risk oversight responsibilities that are described under “Finance Committee Risk Oversight” on page 20. The Finance Committee is composed entirely of independent directors.

Governance & Public Policy Committee

The GPP Committee’s principal responsibilities include: