Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2011

or

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission file number 1-442

THE BOEING COMPANY

(Exact name of registrant as specified in its charter)

| Delaware |

91-0425694 | |||

| State or other jurisdiction of incorporation or organization |

(I.R.S. Employer Identification No.) | |||

| 100 N. Riverside Plaza, Chicago, IL |

60606-1596 | |||

| (Address of principal executive offices) | (Zip Code) | |||

Registrant’s telephone number, including area code (312) 544-2000

Securities registered pursuant to Section 12(b) of the Act:

| Common Stock, $5 par value |

New York Stock Exchange | |||

| (Title of each class) | (Name of each exchange on which registered) |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes x No ¨

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§ 229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ¨

Indicate by check mark whether the registrant is a large accelerated filer, accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer x |

Accelerated filer ¨ | |

| Non-accelerated filer ¨ (Do not check if a smaller reporting company) |

Smaller reporting company ¨ |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x

As of June 30, 2011, there were 740,571,310 common shares outstanding held by nonaffiliates of the registrant, and the aggregate market value of the common shares (based upon the closing price of these shares on the New York Stock Exchange) was approximately $54.8 billion.

The number of shares of the registrant’s common stock outstanding as of February 1, 2012 was 745,720,763.

DOCUMENTS INCORPORATED BY REFERENCE

Part III incorporates information by reference to the registrant’s definitive proxy statement, to be filed with the Securities and Exchange Commission within 120 days after the close of the fiscal year ended December 31, 2011.

Table of Contents

THE BOEING COMPANY

For the Fiscal Year Ended December 31, 2011

Table of Contents

The Boeing Company, together with its subsidiaries (herein referred to as “Boeing,” the “Company,” “we,” “us,” “our”), is one of the world’s major aerospace firms.

We are organized based on the products and services we offer. We operate in five principal segments:

| · | Commercial Airplanes; |

| · | Our Boeing Defense, Space & Security (BDS) business comprises three segments: |

| · | Boeing Military Aircraft (BMA), |

| · | Network & Space Systems (N&SS) and |

| · | Global Services & Support (GS&S); and |

| · | Boeing Capital Corporation (BCC). |

Our Other segment includes the unallocated activities of Engineering, Operations & Technology (EO&T) and Shared Services Group (SSG), as well as intercompany guarantees provided to BCC. EO&T provides Boeing with technical and functional capabilities, including information technology, research and development, test and evaluation, technology strategy development, environmental remediation management and intellectual property management.

Commercial Airplanes Segment

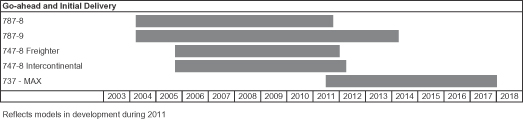

The Commercial Airplanes segment develops, produces and markets commercial jet aircraft and provides related support services, principally to the commercial airline industry worldwide. We are a leading producer of commercial aircraft and offer a family of commercial jetliners designed to meet a broad spectrum of passenger and cargo requirements of domestic and non-U.S. airlines. This family of commercial jet aircraft in production includes the 737 narrow-body model and the 747, 767, 777 and 787 wide-body models. Development continues on the 787-9 derivative. In the third quarter of 2011 we launched a variant of the 737 that will feature new more fuel efficient engines – the 737 MAX. The Commercial Airplanes segment also offers aviation services support, aircraft modifications, spares, training, maintenance documents and technical advice to commercial and government customers worldwide.

Boeing Defense, Space & Security

Our BDS operations principally involve research, development, production, modification and support of the following products and related systems: global strike systems, including fighters, bombers, combat rotorcraft systems, weapons and unmanned systems; global mobility systems, including transport and tanker aircraft, rotorcraft transport and tilt-rotor systems; airborne surveillance and reconnaissance aircraft, including command and control, battle management and airborne anti-submarine aircraft; network and tactical systems, including electronics and mission systems; information solutions including cybersecurity, secure mobile applications, analytics and secure infrastructure; strategic missile and defense systems; space and intelligence systems, including satellites and commercial satellite launching vehicles; and space exploration. BDS is committed to providing affordable, best-of-industry solutions and brings value to customers through its ability to solve the most complex problems utilizing expertise in large-scale systems integration, knowledge of legacy platforms and development of common network-enabled solutions across all customers’ domains. BDS’ primary customer is the United States Department of Defense (U.S. DoD) with 76% of BDS 2011 revenues being derived from this customer. Other significant revenues were derived from the National Aeronautics and Space Administration (NASA) and international defense markets, civil markets and commercial satellite markets. BDS consists of three capabilities-driven businesses: BMA, N&SS and

1

Table of Contents

GS&S. Additionally, the Phantom Works group is an integrated team that works with the three businesses via product development, rapid prototyping and customer engagement through experimentation and enterprise technology investment strategies.

Boeing Military Aircraft Segment

This segment is engaged in the research, development, production and modification of manned and unmanned military weapons systems for the global strike, mobility and surveillance and engagement markets as well as related services. Included in this segment are the A160 Hummingbird, AH-64 Apache, Airborne Early Warning and Control (AEW&C), CH-47 Chinook, C-17 Globemaster, EA-18G Growler Airborne Attack Electronic Aircraft, F/A-18E/F Super Hornet, F-15 Strike Eagle, F-22 Raptor, Harpoon, USAF KC-46A Tanker, KC-767 International Tanker, Joint Direct Attack Munition, P-8A Poseidon, India P-8I, ScanEagle, Small Diameter Bomb, T-45TS Goshawk and V-22 Osprey.

Network & Space Systems Segment

This segment is engaged in the research, development, production and modification of products and services to assist our customers in transforming their operations through the following capabilities: network integration, information and cyber applications, command, control, communications, computers, intelligence, surveillance and reconnaissance (C4ISR) space exploration and satellites. Included in this segment are the Airborne Laser, Brigade Combat Team Modernization (BCTM), Combat Survivor Evader Locator (CSEL), Crew Space Transportation-100, cyber and security programs, directed energy, Enhanced Medium Altitude Reconnaissance and Surveillance System (EMARSS), Family of Advanced Beyond Line-of-Sight Terminals (FAB-T), Future Rapid Effects System, Global Positioning System, Ground-based Midcourse Defense (GMD), High Energy Laser Technology Demonstrator, International Space Station, Joint Tactical Radio System (JTRS), satellite systems, SBInet, Space Launch System, space payloads, Space Shuttle and Wideband Global SATCOM.

Global Services & Support Segment

This segment is engaged in the operations, maintenance, training, upgrades and logistics support functions for military platforms and operations. Included in this segment are the following activities: Integrated Logistics on platforms including AEW&C, AH-64, AV-8B, C-17, CH-47, F-15, F/A-18, F-22, GMD Operations and Support (O&S), KC-767 International Tanker, P-8A, T-45 and V-22; Maintenance, Modifications and Upgrades on platforms including A-10, B-1, B-2, B-52, C-32, C-40, C-130, E-4B, E-6, KC-10, KC-135, QF-16, T-38 and VC-25; Training Systems and Services on platforms including AH-64, C-17, F-15, F-16, F/A-18, P-8A and T-45; and Defense and Government Services including the Infrastructure and Range Services, Log C2 and LogNEC programs.

Boeing Capital Corporation Segment

BCC facilitates, arranges, structures and provides selective financing solutions for our Commercial Airplanes customers. In the space and defense markets, BCC primarily arranges and structures financing solutions for our BDS government customers. BCC’s portfolio consists of equipment under operating leases, finance leases, notes and other receivables, assets held for sale or re-lease and investments.

Financial and Other Business Information

See page 54 for the Summary of Business Segment Data and Note 22 to our Consolidated Financial Statements for financial information, including revenues and earnings from operations, for each of our business segments.

2

Table of Contents

Intellectual Property

We own numerous patents and have licenses for the use of patents owned by others, which relate to our products and their manufacture. In addition to owning a large portfolio of intellectual property, we also license intellectual property to and from third parties. For example, the U.S. government has licenses in our patents that are developed in performance of government contracts, and it may use or authorize others to use the inventions covered by such patents for government purposes. Unpatented research, development and engineering skills, as well as certain trademarks, trade secrets, and other intellectual property rights, also make an important contribution to our business. While our intellectual property rights in the aggregate are important to the operation of each of our businesses, we do not believe that our business would be materially affected by the expiration of any particular intellectual property right or termination of any particular intellectual property patent license agreement.

Non-U.S. Revenues

See Note 22 to our Consolidated Financial Statements for information regarding non-U.S. revenues.

Research and Development

Research and development expenditures involve experimentation, design, development and related test activities for defense systems, new and derivative jet aircraft including both commercial and military, advanced space and other company-sponsored product development. These are expensed as incurred including amounts allocable as reimbursable overhead costs on U.S. government contracts.

Our total research and development expense amounted to $3.9 billion, $4.1 billion and $6.5 billion in 2011, 2010 and 2009, respectively. Research and development expense in 2009 included $2.7 billion of production costs related to the first three flight test 787 aircraft that cannot be sold due to the inordinate amount of rework and unique and extensive modifications that would be made to the aircraft.

Research and development costs also include bid and proposal efforts related to government products and services, as well as costs incurred in excess of amounts estimated to be recoverable under cost-sharing research and development agreements. Bid and proposal costs were $332 million, $355 million and $343 million in 2011, 2010 and 2009, respectively.

Research and development highlights for each of the major business segments are discussed in more detail in Segment Results of Operations and Financial Condition on pages 23 – 38.

Employees

Total workforce level at December 31, 2011 was approximately 171,700.

3

Table of Contents

As of December 31, 2011, our principal collective bargaining agreements were with the following unions:

| Union | Percent of our Employees Represented |

Status of the Agreements with the Union | ||

| The International Association of Machinists and Aerospace Workers (IAM) | 20% | We have two major agreements; one expiring in January of 2015 and one in September of 2016. | ||

| The Society of Professional Engineering Employees in Aerospace (SPEEA) | 13% | We have two major agreements; one expiring in October of 2012 and one in December of 2013. | ||

| The United Automobile, Aerospace and Agricultural Implement Workers of America (UAW) | 2% | We have two major agreements; one expiring in October of 2014 and one in February of 2015. | ||

Competition

The commercial jet aircraft market and the airline industry remain extremely competitive. We face aggressive international competitors who are intent on increasing their market share, such as Airbus, Embraer and Bombardier, and other entrants from Russia, China and Japan. We are focused on improving our processes and continuing cost reduction efforts. We intend to continue to compete with other airplane manufacturers by providing customers with greater value products, services, and support. We continue to leverage our extensive customer support services network which includes aviation support, spares, training, maintenance documents and technical advice for airlines throughout the world to provide a higher level of customer satisfaction and productivity.

BDS faces strong competition in all market segments, primarily from Lockheed Martin Corporation, Northrop Grumman Corporation, Raytheon Company and General Dynamics Corporation. Non-U.S. companies such as BAE Systems and European Aeronautic Defence and Space Company (EADS), the parent of Airbus, continue to build a strategic presence in the U.S. market by strengthening their North American operations and partnering with U.S. defense companies. In addition, certain of our competitors have occasionally formed teams with other competitors to address specific customer requirements. BDS expects the trend of strong competition to continue into 2012 with many international firms attempting to increase their U.S. presence.

Regulatory Matters

Our businesses are heavily regulated in most of our markets. We deal with numerous U.S. government agencies and entities, including but not limited to all of the branches of the U.S. military, NASA, the Federal Aviation Administration (FAA) and the Department of Homeland Security. Similar government authorities exist in our international markets.

Government Contracts. The U.S. government, and other governments, may terminate any of our government contracts at their convenience, as well as for default, based on our failure to meet specified performance measurements. If any of our U.S. government contracts were to be terminated for convenience, we generally would be entitled to receive payment for work completed and allowable termination or cancellation costs. If any of our government contracts were to be terminated for default, generally the U.S. government would pay only for the work that has been accepted and can require us

4

Table of Contents

to pay the difference between the original contract price and the cost to re-procure the contract items, net of the work accepted from the original contract. The U.S. government can also hold us liable for damages resulting from the default.

Commercial Aircraft. In the United States, our commercial aircraft products are required to comply with FAA regulations governing production and quality systems, airworthiness and installation approvals, repair procedures and continuing operational safety. Internationally, similar requirements exist for airworthiness, installation and operational approvals. These requirements are generally administered by the national aviation authorities of each country and, in the case of Europe, coordinated by the European Joint Aviation Authorities.

Environmental. We are subject to various federal, state, local and non-U.S. laws and regulations relating to environmental protection, including the discharge, treatment, storage, disposal and remediation of hazardous substances and wastes. We continually assess our compliance status and management of environmental matters to ensure our operations are in substantial compliance with all applicable environmental laws and regulations. Operating and maintenance costs associated with environmental compliance and management of sites are a normal, recurring part of our operations. These costs often are allowable costs under our contracts with the U.S. government. It is reasonably possible that continued environmental compliance could have a material impact on our results of operations, financial condition or cash flows if more stringent clean-up standards are imposed, additional contamination is discovered and/or clean-up costs are higher than estimated.

A Potentially Responsible Party (PRP) has joint and several liability under existing U.S. environmental laws. Where we have been designated a PRP by the Environmental Protection Agency or a state environmental agency, we are potentially liable to the government or third parties for the full cost of remediating contamination at our facilities or former facilities or at third-party sites. If we were required to fully fund the remediation of a site, the statutory framework would allow us to pursue rights to contribution from other PRPs. For additional information relating to environmental contingencies, see Note 12 to our Consolidated Financial Statements.

International. Our international sales are subject to U.S. and non-U.S. governmental regulations and procurement policies and practices, including regulations relating to import-export control, investment, exchange controls and repatriation of earnings. International sales are also subject to varying currency, political and economic risks.

Raw Materials, Parts, and Subassemblies

We are highly dependent on the availability of essential materials, parts and subassemblies from our suppliers and subcontractors. The most important raw materials required for our aerospace products are aluminum (sheet, plate, forgings and extrusions), titanium (sheet, plate, forgings and extrusions) and composites (including carbon and boron). Although alternative sources generally exist for these raw materials, qualification of the sources could take one year or more. Many major components and product equipment items are procured or subcontracted on a sole-source basis with a number of companies.

Suppliers

We are dependent upon the ability of a large number of suppliers and subcontractors to meet performance specifications, quality standards and delivery schedules at our anticipated costs. While we maintain an extensive qualification and performance surveillance system to control risk associated with such reliance on third parties, failure of suppliers or subcontractors to meet commitments could

5

Table of Contents

adversely affect production schedules and program/contract profitability, thereby jeopardizing our ability to fulfill commitments to our customers. We are also dependent on the availability of energy sources, such as electricity, at affordable prices.

Seasonality

No material portion of our business is considered to be seasonal.

Executive Officers of the Registrant

See “Item 10. Directors, Executive Officers and Corporate Governance” in Part III.

Other Information

Boeing was originally incorporated in the State of Washington in 1916 and reincorporated in Delaware in 1934. Our principal executive offices are located at 100 N. Riverside Plaza, Chicago, Illinois 60606 and our telephone number is (312) 544-2000.

General information about us can be found at www.boeing.com. The information contained on or connected to our web site is not incorporated by reference into this Annual Report on Form 10-K and should not be considered part of this or any other report filed with the Securities and Exchange Commission (SEC). Our Annual Report on Form 10-K, Quarterly Reports on Form 10-Q and Current Reports on Form 8-K, as well as any amendments to those reports, are available free of charge through our web site as soon as reasonably practicable after we file them with, or furnish them to, the SEC. These reports may also be obtained at the SEC’s public reference room at 100 F Street, N.E., Washington, DC 20549. The SEC also maintains a web site at www.sec.gov that contains reports, proxy statements and other information regarding SEC registrants, including Boeing.

Forward-Looking Statements

This report, as well as our Annual Report to Shareholders, quarterly reports, and other filings we make with the SEC, press releases and other written and oral communications, contains “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Words such as “may,” “should,” “expects,” “intends,” “projects,” “plans,” “believes,” “estimates,” “targets,” “anticipates” and similar expressions are used to identify these forward-looking statements. Examples of forward-looking statements include statements related to our future financial condition and operating results, as well as any other statement that does not directly relate to any historical or current fact.

Forward-looking statements are based on our current expectations and assumptions, which may not prove to be accurate. These statements are not guarantees and are subject to risks, uncertainties and changes in circumstances that are difficult to predict. Many factors, including those set forth in the “Risk Factors” section below could cause actual results to differ materially and adversely from these forward-looking statements. Any forward-looking statement speaks only as of the date on which it is made, and we assume no obligation to update or revise any forward-looking statement whether as a result of new information, future events or otherwise, except as required by law.

An investment in our common stock or debt securities involves risks and uncertainties and our actual results and future trends may differ materially from our past or projected future performance. We urge investors to consider carefully the risk factors described below in evaluating the information contained in this report.

6

Table of Contents

Our Commercial Airplanes business depends heavily on commercial airlines, and is subject to unique risks.

Market conditions have a significant impact on demand for our commercial aircraft. The commercial aircraft market is predominantly driven by long-term trends in airline passenger and cargo traffic. The principal factors underlying long-term traffic growth are sustained economic growth and political stability both in developed and emerging markets. Demand for our commercial aircraft is further influenced by airline profitability, availability of aircraft financing (including the industry’s ability to withstand the European sovereign debt crisis and other market developments), world trade policies, government-to-government relations, technological changes, price and other competitive factors, terrorism, epidemics and environmental regulations. Traditionally, the airline industry has been cyclical and very competitive and has experienced significant profit swings and constant challenges to be more cost competitive. Significant deterioration of the global economic environment or the financial health of the airline industry generally or of one or more of our major customers could result in fewer new orders for aircraft or could cause customers to seek to postpone or cancel contractual orders and/or payments to us, which could result in lower revenues, profitability and cash flows and a reduction in our contractual backlog. In addition, because our commercial aircraft backlog consists of aircraft scheduled for delivery over a period of several years, any of these industry or customer impacts could unexpectedly affect deliveries over a long period.

We enter into firm fixed-price aircraft sales contracts with indexed price escalation clauses which could subject us to losses if we have cost overruns or if increases in our costs exceed the applicable escalation rate. Commercial aircraft sales contracts are often entered into years before the aircraft are delivered. In order to account for economic fluctuations between the contract date and delivery date, aircraft pricing generally consists of a fixed amount as modified by an indexed price escalation formula. Our revenue estimates are based on current expectations with respect to these escalation formulas, but the actual escalation amounts are outside of our control. Escalation factors can fluctuate significantly from period to period. Changes in escalation amounts can significantly impact revenues and operating margins in our Commercial Airplanes business.

We derive a significant portion of our revenues from a limited number of commercial airlines. We can make no assurance that any customer will exercise purchase options, fulfill existing purchase commitments or purchase additional products or services from us after our contract with the customer ends. In addition, fleet decisions, airline consolidations or financial challenges involving any of our major commercial airline customers could significantly reduce our revenues and limit our opportunity to generate profits from those customers.

Our Commercial Airplanes business depends on our ability to develop new aircraft, achieve planned production rate increases across multiple programs and maintain a healthy production system.

The design and production of airplanes is complex and requires exotic materials, highly skilled employees and extensive coordination and integration with suppliers. As a result, our ability to deliver aircraft on time, satisfy contractual performance requirements and achieve or maintain, as applicable, program profitability is subject to significant risks. In addition, we are continuing to increase production rates for the 737, 747, 777 and 787 programs. These risks are increased by our simultaneous development of derivative aircraft, such as the 787-9 and the 737 MAX, the completion of design changes identified during flight testing into already-manufactured 747 and 787 aircraft, and our recent incorporation of a second 787 final assembly line into our production system.

If assembly line ramp-up efforts at any of our commercial aircraft assembly facilities are delayed or if our suppliers cannot timely deliver components to us at the rates necessary to achieve our planned rate increases, we may be unable to meet delivery schedules and the financial performance of one or

7

Table of Contents

more of our programs may suffer. Operational issues, including delays or defects in supplier components, the inability to efficiently and cost-effectively incorporate design changes into 787 and 747 production aircraft, and aircraft performance issues, could impact our ability to achieve our targeted production rates, and may result in aircraft delivery delays, higher production costs and/or lower program revenues. If we fail to deliver aircraft to our customers on time or meet contractual performance requirements, we could experience order cancellations or other significant financial exposures, or a reduction of the profitability of our Commercial Airplanes business.

Our BDS business could be adversely affected by changing acquisition priorities of the U.S. government, particularly the Department of Defense, including an increased emphasis on affordability.

The U.S. government participates in an increasingly wide variety of operations, including homeland defense, natural disasters, stabilization efforts, counterinsurgency and counterterrorism, that employ our products and services. The U.S. government, primarily operating through the U.S. DoD, continues to adjust its funding priorities in response to this changing threat environment. In addition, defense funding currently faces pressures due to the overall economic environment and competing budget priorities. Due to these pressures, the total U.S. DoD budget could decline. Any reduction in levels of U.S. DoD spending or cancellations or delays impacting existing contracts could have a significant impact on the operating results of our BDS business. We also expect that the U.S. DoD will continue to emphasize cost-cutting and other efficiency initiatives in its procurement processes. These initiatives will require us and our competitors to focus increasingly on long-term cost competitiveness and affordability when responding to proposals and/or pursuing development programs. If the priorities of the U.S. government change and/or we are unable to meet affordability targets, our BDS revenues and profitability could be negatively impacted.

We depend heavily on U.S. government contracts, which are subject to unique risks.

In 2011, 38% of our revenues were derived from U.S. government contracts. In addition to normal business risks, our contracts with the U.S. government are subject to unique risks, some of which are beyond our control.

The funding of U.S. government programs is subject to congressional appropriations. Many of the U.S. government programs in which we participate may last several years; however, initially these programs are normally funded yearly, with additional funds committed in later years as Congress makes additional appropriations. As a result, long-term government contracts and related orders are subject to modification, curtailment or termination, if appropriations for subsequent performance periods are not made, either due to changes in U.S. national security strategy and priorities or fiscal constraints. For example, the U.S. Army notified us of the termination for convenience of the BCTM System Development and Demonstration contract relating to Manned Ground Vehicles and associated systems and equipment. Similar further budgetary pressures could affect the funding for one or more of our existing programs. The termination or reduction of funding for U.S. government programs could result in a material adverse effect on our earnings, cash flow and financial position.

The U.S. government may modify, curtail or terminate our contracts. The U.S. government may modify, curtail or terminate its contracts and subcontracts with us, without prior notice and at its convenience upon payment for work done and commitments made at the time of termination. In addition, if the U.S. government terminates a contract as a result of a default by us, we could be liable for additional costs, including reimbursement or damages. Modification, curtailment or termination of one or more of our major programs or contracts could have a material adverse effect on our results of operations and financial condition.

8

Table of Contents

Our contract costs are subject to audits by U.S. government agencies. U.S. government representatives may audit the costs we incur on our U.S. government contracts, including allocated indirect costs. Such audits could result in adjustments to our contract costs. Any costs found to be improperly allocated to a specific contract will not be reimbursed, and such costs already reimbursed must be refunded. We have recorded contract revenues based upon costs we expect to realize upon final audit. However, we do not know the outcome of any future audits and adjustments and we may be required to reduce our revenues or profits upon completion and final negotiation of audits. If any audit uncovers improper or illegal activities, we may be subject to civil and criminal penalties and administrative sanctions, including termination of contracts, forfeiture of profits, suspension of payments, fines and suspension or prohibition from doing business with the U.S. government.

Our business is subject to potential U.S. government inquiries and investigations. We are subject to certain U.S. government inquiries and investigations due to our participation in government contracts. Any such inquiry or investigation could potentially result in fines, financial penalties, or suspension or debarment from future business opportunities, which could have a material adverse effect on our results of operations and financial condition.

Our sales to the U.S. government are also subject to specific procurement regulations and other requirements. U.S government procurement requirements are customary in U.S. government contracts, and generally result in increased performance and compliance costs. These costs might increase in the future, reducing our margins, which could have a negative effect on our financial condition. For example, in late 2011 the U.S. DoD published new regulations with stringent requirements and criteria to increase Government oversight of six key business systems of all prime contractors: accounting, earned value management, purchasing, material management and accounting, government property management and cost estimating. These new requirements and criteria may increase our compliance costs, and failure to comply with these regulations could result in the withholding of payments and harm our reputation and ability to secure future U.S. government contracts. Beginning in 2014, we also will be required to allocate higher pension costs to U.S. government contracts due to new requirements scheduled to be effective in 2012. These requirements could have a negative effect on our financial condition if we are unable to recoup these costs.

We enter into fixed-price contracts which could subject us to losses if we have cost overruns.

Our BDS business generated approximately 60% of its 2011 revenues from fixed-price contracts. While firm fixed price contracts enable us to benefit from performance improvements, cost reductions and efficiencies, they also subject us to the risk of reduced margins or incurring losses if we are unable to achieve estimated costs and revenues. If our estimated costs exceed our estimated price, we recognize reach-forward losses which can significantly affect our reported results. The long term nature of many of our contracts makes the process of estimating costs and revenues on fixed-price contracts inherently risky. Fixed-price contracts often contain price incentives and penalties tied to performance which can be difficult to estimate and have significant impacts on margins. In addition, some of our contracts have specific provisions relating to cost, schedule and performance.

Fixed-price development contracts are generally subject to more uncertainty than fixed-price production contracts. Many of these development programs have highly complex designs. If we fail to meet the terms specified in those contracts, our sales price could be reduced. In addition, technical or quality issues that arise during development could lead to schedule delays and higher costs to complete, which could result in a material charge or otherwise adversely affect our financial condition. Examples of significant BDS fixed-price development contracts include AEW&C, the USAF KC-46A Tanker, India P-8I and commercial and military satellites.

9

Table of Contents

We enter into cost-type contracts which also carry risks.

Our BDS business generated approximately 40% of its 2011 revenues from cost-type contracting arrangements. Some of these are development programs that have complex design and technical challenges. These cost-type programs typically have award or incentive fees that are subject to uncertainty and may be earned over extended periods. In these cases the associated financial risks are primarily in reduced fees, lower profit rates or program cancellation if cost, schedule or technical performance issues arise. Programs whose contracts are primarily cost-type include GMD, BCTM, P-8A Poseidon, Proprietary programs, JTRS, FAB-T and the EA-18G Growler Airborne Attack Electronic Aircraft.

We enter into contracts that include in-orbit incentive payments that subject us to risks.

Contracts in the commercial satellite industry and certain government satellite contracts include in-orbit incentive payments. These in-orbit payments may be paid over time after final satellite acceptance or paid in full prior to final satellite acceptance. In both cases, the in-orbit incentive payment is at risk if the satellite does not perform to specifications for up to 15 years after acceptance. The net present value of in-orbit incentive fees we ultimately expect to realize is recognized as revenue in the construction period. If the satellite fails to meet contractual performance criteria, customers will not be obligated to continue making in-orbit payments and/or we may be required to provide refunds to the customer and incur significant charges.

Our ability to deliver products and services that satisfy customer requirements is heavily dependent on the performance of our subcontractors and suppliers, as well as on the availability of raw materials and other components.

We rely on other companies including subcontractors and suppliers to provide and produce raw materials, integrated components and sub-assemblies, and production commodities and to perform some of the services that we provide to our customers. If one or more of our suppliers or subcontractors experiences delivery delays or other performance problems, we may be unable to meet commitments to our customers. In addition, if one or more of the raw materials on which we depend (such as aluminum, titanium or composites) becomes unavailable or is available only at very high prices, we may be unable to deliver one or more of our products in a timely fashion or at budgeted costs. In some instances, we depend upon a single source of supply. Any service disruption from one of these suppliers, either due to circumstances beyond the supplier’s control or as a result of performance problems or financial difficulties, could have a material adverse effect on our ability to meet commitments to our customers or increase our operating costs.

We use estimates in accounting for many contracts and programs. Changes in our estimates could adversely affect our future financial results.

Contract and program accounting require judgment relative to assessing risks, estimating revenues and costs and making assumptions for schedule and technical issues. Due to the size and nature of many of our contracts and programs, the estimation of total revenues and cost at completion is complicated and subject to many variables. Assumptions have to be made regarding the length of time to complete the contract or program because costs also include expected increases in wages and employee benefits, material prices and allocated fixed costs. Incentives or penalties related to performance on contracts are considered in estimating sales and profit rates, and are recorded when there is sufficient information for us to assess anticipated performance. Suppliers’ assertions are also assessed and considered in estimating costs and profit rates. Estimates of award fees are also used in sales and profit rates based on actual and anticipated awards.

With respect to each of our commercial aircraft programs, inventoriable production costs (including overhead), program tooling and other non-recurring costs and routine warranty costs are accumulated

10

Table of Contents

and charged as cost of sales by program instead of by individual units or contracts. A program consists of the estimated number of units (accounting quantity) of a product to be produced in a continuing, long-term production effort for delivery under existing and anticipated contracts limited by the ability to make reasonably dependable estimates. To establish the relationship of sales to cost of sales, program accounting requires estimates of (a) the number of units to be produced and sold in a program, (b) the period over which the units can reasonably be expected to be produced and (c) the units’ expected sales prices, production costs, program tooling and other non-recurring costs, and routine warranty costs for the total program. Several factors determine accounting quantity, including firm orders, letters of intent from prospective customers and market studies. Changes to customer or model mix, production costs and rates, learning curve, escalation, costs of derivative aircraft, supplier performance, customer negotiations/settlements, supplier claims and/or certification issues can impact these estimates. Any such change in estimates relating to program accounting may adversely affect future financial performance.

Because of the significance of the judgments and estimation processes described above, it is likely that materially different sales and profit amounts could be recorded if we used different assumptions or if the underlying circumstances were to change. Changes in underlying assumptions, circumstances or estimates may adversely affect future period financial performance. For additional information on our accounting policies for recognizing sales and profits, see our discussion under “Management’s Discussion and Analysis – Critical Accounting Policies – Contract Accounting/Program Accounting” on pages 42 – 44 and Note 1 to our Consolidated Financial Statements on pages 55 – 56 of this Form 10-K.

Competition within our markets may reduce our future contracts and sales.

The markets in which we operate are highly competitive and one or more of our competitors may have more extensive or more specialized engineering, manufacturing and marketing capabilities than we do in some areas. In our Commercial Airplanes business, we anticipate increasing competition among non-U.S. aircraft manufacturers and service providers in one or more of our market segments. In our BDS business, we anticipate that the effects of defense industry consolidation and new priorities, including long-term cost competitiveness, of our U.S. DoD customer will intensify competition for many of our products and services. Furthermore, we are facing increased international competition and cross-border consolidation of competition. There can be no assurance that we will be able to compete successfully against our current or future competitors or that the competitive pressures we face will not result in reduced revenues and market share.

We derive a significant portion of our revenues from non-U.S. sales and are subject to the risks of doing business in other countries.

In 2011, non-U.S. customers accounted for approximately 50% of our revenues. We expect that non-U.S. sales will continue to account for a significant portion of our revenues for the foreseeable future. As a result, we are subject to risks of doing business internationally, including:

| · | changes in regulatory requirements; |

| · | domestic and international government policies, including requirements to expend a portion of program funds locally and governmental industrial cooperation or participation requirements; |

| · | fluctuations in international currency exchange rates; |

| · | volatility in international political and economic environments and changes in non-U.S. national priorities and budgets, which can lead to delays or fluctuations in orders; |

| · | the complexity and necessity of using non-U.S. representatives and consultants; |

11

Table of Contents

| · | the uncertainty of the ability of non-U.S. customers to finance purchases, including the availability of financing from the U.S. Export-Import Bank; |

| · | uncertainties and restrictions concerning the availability of funding credit or guarantees; |

| · | imposition of taxes, export controls, tariffs, embargoes and other trade restrictions; |

| · | the difficulty of management and operation of an enterprise spread over many countries; |

| · | compliance with a variety of international laws, as well as U.S. laws affecting the activities of U.S. companies abroad; and |

| · | economic and geopolitical developments and conditions. |

While the impact of these factors is difficult to predict, any one or more of these factors could adversely affect our operations in the future.

The outcome of litigation and of government inquiries and investigations involving our business is unpredictable and an adverse decision in any such matter could result in significant monetary payments and have a material effect on our financial position and results of operations.

We are involved in a number of litigation matters. These claims may divert financial and management resources that would otherwise be used to benefit our operations. No assurances can be given that the results of these matters will be favorable to us. An adverse resolution of any of these lawsuits could have a material impact on our financial position and results of operations. In addition, we are sometimes subject to government inquiries and investigations of our business due, among other things, to our business relationships with the U.S government, the heavily regulated nature of our industry, and in the case of environmental proceedings, our ownership of certain property. Any such inquiry or investigation could potentially result in an adverse ruling against us, which could result in significant monetary payments (including possible environmental remediation costs) and have a material impact on our financial position and operating results.

A significant portion of our and Boeing Capital Corporation’s customer financing portfolio is concentrated among certain customers based in the United States, and in certain types of Boeing aircraft, which exposes us to concentration risks.

A significant portion of our customer financing portfolio is concentrated among certain customers and in distinct geographic regions, particularly in the United States. Our portfolio is also concentrated by varying degrees across Boeing aircraft product types, most notably 717 aircraft. If one or more customers holding a significant portion of our portfolio assets experiences financial difficulties or otherwise defaults on or does not renew its leases with us at their expiration, and we are unable to redeploy the aircraft on reasonable terms, or if the types of aircraft that are concentrated in our portfolio suffer greater than expected declines in value, our earnings, cash flows and/or financial position could be materially adversely affected.

We may be unable to obtain debt to fund our operations and contractual commitments at competitive rates, on commercially reasonable terms or in sufficient amounts.

We depend, in part, upon the issuance of debt to fund our operations and contractual commitments. As of December 31, 2011, our airplane financing commitments totaled $15,866 million, as compared to $9,865 million as of December 31, 2010. If we require additional funding in order to fund outstanding financing commitments or meet other business requirements, our market liquidity may not be sufficient. A number of factors could cause us to incur increased borrowing costs and to have greater difficulty accessing public and private markets for debt. These factors include disruptions or declines in the

12

Table of Contents

global capital markets and/or a decline in our financial performance or outlook or credit ratings. The occurrence of any or all of these events may adversely affect our ability to fund our operations and contractual or financing commitments.

We may not realize the anticipated benefits of mergers, acquisitions, joint ventures/strategic alliances or divestitures.

As part of our business strategy, we may merge with or acquire businesses and/or form joint ventures and strategic alliances. Whether we realize the anticipated benefits from these acquisitions and related activities depends, in part, upon our ability to integrate the operations of the acquired business, the performance of the underlying product and service portfolio, the performance of the management team and other personnel of the acquired operations. Accordingly, our financial results could be adversely affected from unanticipated performance issues, legacy liabilities, transaction-related charges, amortization of expenses related to intangibles, charges for impairment of long-term assets, credit guarantees, partner performance and indemnifications. Consolidations of joint ventures could also impact our reported results of operations or financial position. While we believe that we have established appropriate and adequate procedures and processes to mitigate these risks, there is no assurance that these transactions will be successful. We also may make strategic divestitures from time to time. These transactions may result in continued financial involvement in the divested businesses, such as through guarantees or other financial arrangements, following the transaction. Nonperformance by those divested businesses could affect our future financial results through additional payment obligations, higher costs or asset write-downs.

Our insurance coverage may be inadequate to cover all significant risk exposures.

We are exposed to liabilities that are unique to the products and services we provide. While we maintain insurance for certain risks and, in some circumstances, we may receive indemnification from the U.S. government, insurance cannot be obtained to protect against all risks and liabilities. It is therefore possible that the amount of our insurance coverage may not cover all claims or liabilities, and we may be forced to bear substantial costs. For example, liabilities arising from the use of certain of our products, such as aircraft technologies, missile systems, border security systems, anti-terrorism technologies, and/or air traffic management systems may not be insurable on commercially reasonable terms. While many of these products are shielded from liability within the U.S. under the SAFETY Act provisions of the 2002 Homeland Security Act, no such protection is available outside the U.S., potentially resulting in significant liabilities. The amount of insurance coverage we are able to maintain may be inadequate to cover these or other claims or liabilities.

Business disruptions could seriously affect our future sales and financial condition or increase our costs and expenses.

Our business may be impacted by disruptions including threats to physical security, information technology or cyber-attacks or failures, damaging weather or other acts of nature and pandemics or other public health crises. Any of these disruptions could affect our internal operations or our ability to deliver products and services to our customers. Any significant production delays, or any destruction, manipulation or improper use of our data, information systems or networks could impact our sales, increase our expenses and/or have an adverse affect the reputation of Boeing and of our products and services.

13

Table of Contents

Some of our and our suppliers’ workforces are represented by labor unions, which may lead to work stoppages.

Approximately 63,000 employees, which constitute 37% of our total workforce, are union represented as of December 31, 2011. We experienced a work stoppage in 2008 when a labor strike halted commercial aircraft and certain BMA program production and we may experience additional work stoppages in the future, which could adversely affect our business. We cannot predict how stable our relationships, currently with 12 U.S. labor organizations and 7 non-U.S. labor organizations, will be or whether we will be able to meet the unions’ requirements without impacting our financial condition. The unions may also limit our flexibility in dealing with our workforce. Union actions at suppliers can also affect us. Work stoppages and instability in our union relationships could delay the production and/or development of our products, which could strain relationships with customers and cause a loss of revenues which would adversely affect our operations.

Significant changes in discount rates, actual investment return on pension assets and other factors could reduce our earnings, equity, and increase pension contributions in future periods.

The actuarial assumptions underlying the income or expense we record for our pension and other postretirement benefit plans reflect assumptions relating to financial market and other economic conditions, such as the discount rate, the expected long-term rate of return on plan assets and expected future medical inflation. Changes to these assumptions and differences between projected and actual performance can have a significant effect on our annual pension and other post retirement costs and/or result in a significant change to Shareholders’ equity. For U.S. government contracts, we must allocate pension costs to individual contracts based on U.S. Cost Accounting Standards which can also affect contract profitability. For a discussion regarding how our financial statements can be affected by pension and other postretirement plan accounting policies, see “Management’s Discussion and Analysis—Critical Accounting Policies—Postretirement Plans” on pages 45 – 46 of this Form 10-K. Although GAAP expense and pension or other postretirement contributions are not directly related, the key economic factors that affect GAAP expense would also likely affect the amount of cash or common stock we would contribute to our plans. Potential pension contributions include both mandatory amounts required under federal law Employee Retirement Income Security Act (ERISA) and discretionary contributions to improve the plans’ funded status.

Our operations expose us to the risk of material environmental liabilities.

We are subject to various federal, state, local and non-U.S. laws and regulations related to environmental protection, including the discharge, treatment, storage, disposal and remediation of hazardous substances and wastes. We could incur substantial costs, including cleanup costs, fines and civil or criminal sanctions, as well as third-party claims for property damage or personal injury, if we were to violate or become liable under environmental laws or regulations. In some cases, we may be subject to such costs due to environmental impacts attributable to our current or past manufacturing operations or the operations of companies we have acquired. In other cases, we may become subject to such costs due to an indemnification agreement between us and a third party relating to such environmental liabilities. In addition, new laws and regulations, more stringent enforcement of existing laws and regulations, the discovery of previously unknown contamination or the imposition of new remediation requirements could result in additional costs. For additional information relating to environmental contingencies, see Note 12 to our Consolidated Financial Statements.

Unauthorized access to our or our customers’ information and systems could negatively impact our business.

We face certain security threats, including threats to the confidentiality, availability and integrity of our data and systems. We maintain an extensive network of technical security controls, policy enforcement mechanisms and monitoring systems in order to address these threats. While these measures are

14

Table of Contents

designed to prevent, detect and respond to unauthorized activity in our systems, certain types of attacks could result in significant financial losses and/or reputational harm. In addition, we manage information technology systems for certain customers. Many of these customers face similar security threats. If we cannot prevent the unauthorized access, release and/or corruption of our customers’ confidential, classified or personally identifiable information, our reputation could be damaged, and/or we could face financial losses.

Item 1B. Unresolved Staff Comments

Not Applicable.

We occupied approximately 85 million square feet of floor space on December 31, 2011 for manufacturing, warehousing, engineering, administration and other productive uses, of which approximately 96% was located in the United States.

The following table provides a summary of the floor space by business as of December 31, 2011:

| (Square feet in thousands) | Owned | Leased | Government Owned* |

Total | ||||||||||||

| Commercial Airplanes |

36,071 | 5,231 | 41,302 | |||||||||||||

| Boeing Defense, Space & Security |

30,221 | 8,432 | 157 | 38,810 | ||||||||||||

| Other** |

3,542 | 1,122 | 4,664 | |||||||||||||

| Total |

69,834 | 14,785 | 157 | 84,776 | ||||||||||||

|

|

||||||||||||||||

| * | Excludes rent-free space furnished by U.S. government landlord of 695 square feet. |

| ** | Other includes BCC; EO&T; SSG; and our Corporate Headquarters. |

At December 31, 2011, our segments occupied facilities at the following major locations that occupied in excess of 78 million square feet of floor space:

| · | Commercial Airplanes – Greater Seattle, WA; North Charleston, SC; Greater Los Angeles, CA; Portland, OR; Australia; and Canada |

| · | Boeing Defense, Space & Security – Greater Los Angeles, CA; Greater Seattle, WA; Greater St. Louis, MO; Philadelphia, PA; San Antonio, TX; Huntsville, AL; Mesa, AZ; Wichita, KS; Houston, TX; and Greater Washington, DC |

| · | Other – Chicago, IL and Greater Seattle, WA |

Most runways and taxiways that we use are located on airport properties owned by others and are used jointly with others. Our rights to use such facilities are provided for under long-term leases with municipal, county or other government authorities. In addition, the U.S. government furnishes us certain office space, installations and equipment at U.S. government bases for use in connection with various contract activities.

We believe that our major properties are adequate for our present needs and, as supplemented by planned improvements and construction, expect them to remain adequate for the foreseeable future.

Currently, we are involved in a number of legal proceedings. For a discussion of contingencies related to legal proceedings, see Note 21 to our Consolidated Financial Statements, which is hereby incorporated by reference.

15

Table of Contents

On April 20, 2011, the National Labor Relations Board (NLRB) issued a complaint regarding our decision to build a 787 final assembly plant in North Charleston, South Carolina. On December 8, 2011 the IAM requested that its charge be withdrawn, and on December 9, 2011 the NLRB withdrew the charge and dismissed the complaint.

Item 4. Mine Safety Disclosures

Not applicable.

16

Table of Contents

PART II

Item 5. Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities

The principal market for our common stock is the New York Stock Exchange where it trades under the symbol BA. As of February 1, 2012, there were 204,705 shareholders of record. Additional information required by this item is incorporated by reference from Note 23 to our Consolidated Financial Statements.

Issuer Purchases of Equity Securities

The following table provides information about purchases we made during the quarter ended December 31, 2011 of equity securities that are registered by us pursuant to Section 12 of the Exchange Act:

(Dollars in millions, except per share data)

| (a) | (b) | (c) | (d) | |||||||||||

| Total Number of Shares Purchased(1) |

Average Price Paid per Share |

Total Number of Shares Purchased as Part of Publicly Announced Plans or Programs |

Approximate Dollar Value of Shares That May Yet be Purchased Under the Plans or Programs(2) |

|||||||||||

| 10/1/2011 thru 10/31/2011 |

42,399 | $ | 60.21 | $ | 3,610 | |||||||||

| 11/1/2011 thru 11/30/2011 |

2,331 | 64.64 | 3,610 | |||||||||||

| 12/1/2011 thru 12/31/2011 |

1,851 | 70.62 | 3,610 | |||||||||||

| Total |

46,581 | $ | 60.85 | |||||||||||

|

|

||||||||||||||

| (1) | We purchased an aggregate of 46,474 shares transferred to us from employees in satisfaction of minimum tax withholding obligations associated with the vesting of restricted stock units during the period. In addition, we purchased an aggregate of 107 shares in swap transactions. |

| (2) | On October 29, 2007, the Board approved the repurchase of up to $7 billion of common stock (the Program). Unless terminated earlier by a Board resolution, the Program will expire when we have used all authorized funds for repurchase. |

17

Table of Contents

Item 6. Selected Financial Data

Five-Year Summary (Unaudited)

| (Dollars in millions, except per share data) | 2011 | 2010 | 2009 | 2008 | 2007 | |||||||||||||||

| Operations |

||||||||||||||||||||

| Revenues: |

||||||||||||||||||||

| Commercial Airplanes |

$ | 36,171 | $ | 31,834 | $ | 34,051 | $ | 28,263 | $ | 33,386 | ||||||||||

| Boeing Defense, Space & Security:(1) |

||||||||||||||||||||

| Boeing Military Aircraft |

14,947 | 14,238 | 14,304 | 13,445 | 13,545 | |||||||||||||||

| Network & Space Systems |

8,673 | 9,455 | 10,877 | 11,346 | 11,481 | |||||||||||||||

| Global Services & Support |

8,356 | 8,250 | 8,480 | 7,256 | 7,026 | |||||||||||||||

| Total Boeing Defense, Space & Security |

31,976 | 31,943 | 33,661 | 32,047 | 32,052 | |||||||||||||||

| Boeing Capital Corporation |

532 | 639 | 660 | 703 | 815 | |||||||||||||||

| Other segment |

138 | 138 | 165 | 567 | 308 | |||||||||||||||

| Unallocated items and eliminations |

(82 | ) | (248 | ) | (256 | ) | (671 | ) | (174 | ) | ||||||||||

| Total revenues |

$ | 68,735 | $ | 64,306 | $ | 68,281 | $ | 60,909 | $ | 66,387 | ||||||||||

|

|

||||||||||||||||||||

| General and administrative expense |

3,408 | 3,644 | 3,364 | 3,084 | 3,531 | |||||||||||||||

| Research and development expense |

3,918 | 4,121 | 6,506 | 3,768 | 3,850 | |||||||||||||||

| Other income/(loss), net |

47 | 52 | (26 | ) | 247 | 484 | ||||||||||||||

| Net earnings from continuing operations |

$ | 4,011 | $ | 3,311 | $ | 1,335 | $ | 2,654 | $ | 4,058 | ||||||||||

| Net gain/(loss) on disposal of discontinued operations, net of tax |

7 | (4 | ) | (23 | ) | 18 | 16 | |||||||||||||

| Net earnings |

$ | 4,018 | $ | 3,307 | $ | 1,312 | $ | 2,672 | $ | 4,074 | ||||||||||

| Basic earnings per share from continuing operations |

5.38 | 4.50 | 1.89 | 3.68 | 5.36 | |||||||||||||||

| Diluted earnings per share from continuing operations |

5.33 | 4.46 | 1.87 | 3.65 | 5.26 | |||||||||||||||

| Cash dividends declared |

$ | 1,263 | $ | 1,245 | $ | 1,233 | $ | 1,187 | $ | 1,129 | ||||||||||

| Per share |

1.70 | 1.68 | 1.68 | 1.62 | 1.45 | |||||||||||||||

| Additions to Property, plant and equipment |

1,713 | 1,125 | 1,186 | 1,674 | 1,731 | |||||||||||||||

| Depreciation of Property, plant and equipment |

1,119 | 1,096 | 1,066 | 1,013 | 978 | |||||||||||||||

| Employee salaries and wages |

17,008 | 15,709 | 15,424 | 15,559 | 14,852 | |||||||||||||||

| Year-end workforce |

171,700 | 160,500 | 157,100 | 162,200 | 159,300 | |||||||||||||||

| Financial position at December 31 |

||||||||||||||||||||

| Total assets |

$ | 79,986 | $ | 68,565 | $ | 62,053 | $ | 53,779 | $ | 58,986 | ||||||||||

| Working capital |

8,536 | 5,177 | 2,392 | (4,809 | ) | (4,184 | ) | |||||||||||||

| Property, plant and equipment, net |

9,313 | 8,931 | 8,784 | 8,762 | 8,265 | |||||||||||||||

| Cash and cash equivalents |

10,049 | 5,359 | 9,215 | 3,268 | 7,042 | |||||||||||||||

| Short-term and other investments |

1,223 | 5,158 | 2,008 | 11 | 2,266 | |||||||||||||||

| Total debt |

12,371 | 12,421 | 12,924 | 7,512 | 8,217 | |||||||||||||||

| Customer financing assets |

4,772 | 4,680 | 5,834 | 6,282 | 7,105 | |||||||||||||||

| Shareholders’ equity(2) |

3,515 | 2,766 | 2,128 | (1,294 | ) | 9,004 | ||||||||||||||

| Per share |

4.72 | 3.76 | 2.93 | (1.85 | ) | 12.22 | ||||||||||||||

| Common shares outstanding (in millions)(3) |

744.7 | 735.3 | 726.3 | 698.1 | 736.7 | |||||||||||||||

| Contractual Backlog: |

||||||||||||||||||||

| Commercial Airplanes |

$ | 293,303 | $ | 255,591 | $ | 250,476 | $ | 278,575 | $ | 255,176 | ||||||||||

| Boeing Defense, Space & Security:(1) |

||||||||||||||||||||

| Boeing Military Aircraft |

24,085 | 25,094 | 26,354 | 25,802 | 23,027 | |||||||||||||||

| Network & Space Systems |

9,056 | 9,586 | 7,746 | 8,868 | 9,207 | |||||||||||||||

| Global Services & Support |

13,213 | 13,684 | 11,924 | 10,615 | 9,554 | |||||||||||||||

| Total Boeing Defense, Space & Security |

46,354 | 48,364 | 46,024 | 45,285 | 41,788 | |||||||||||||||

| Total contractual backlog |

$ | 339,657 | $ | 303,955 | $ | 296,500 | $ | 323,860 | $ | 296,964 | ||||||||||

|

|

||||||||||||||||||||

Cash dividends have been paid on common stock every year since 1942.

| (1) | Effective January 1, 2010, certain programs were realigned between BDS segments. Prior years have been recast for segment realignments. |

| (2) | Shareholders’ equity excludes noncontrolling interest. Prior year amounts have been adjusted to conform to this presentation. |

| (3) | Represents actual number of shares outstanding as of December 31 and excludes treasury shares and the outstanding shares held by the ShareValue Trust, which was terminated in July 2010. |

18

Table of Contents

Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations

Consolidated Results of Operations and Financial Condition

Overview

We are a global market leader in design, development, manufacture, sale and support of commercial jetliners, military aircraft, satellites, missile defense, human space flight and launch systems and services. We are one of the two major manufacturers of 100+ seat airplanes for the worldwide commercial airline industry and one of the largest defense contractors in the U.S. While our principal operations are in the U.S., we conduct operations in many countries and rely on an extensive network of international partners, key suppliers and subcontractors.

Our strategy is centered on successful execution in healthy core businesses – Commercial Airplanes and Boeing Defense, Space & Security (BDS) – supplemented and supported by Boeing Capital Corporation (BCC). Taken together, these core businesses have historically generated substantial earnings and cash flow that permit us to invest in new products and services. We focus on producing the products and providing the services that the market demands and we price our products and services to provide a fair return for our shareholders while continuing to find new ways to improve efficiency and quality. Commercial Airplanes is committed to being the leader in commercial aviation by offering airplanes and services that deliver superior design, efficiency and value to customers around the world. BDS integrates its resources in defense, intelligence, communications, security and space to deliver capability-driven solutions to its customers at reduced costs. Our strategy is to leverage our core businesses to capture key next-generation programs while expanding our presence in adjacent and international markets, underscored by an intense focus on growth and productivity. Our strategy also benefits as the cyclicality of commercial and defense markets often offset. BCC delivers value by supporting our business units and managing overall financing exposure.

Consolidated Results of Operations

Revenues

(Dollars in millions)

| Years ended December 31, | 2011 | 2010 | 2009 | |||||||||

| Commercial Airplanes |

$ | 36,171 | $ | 31,834 | $ | 34,051 | ||||||

| Boeing Defense, Space & Security |

31,976 | 31,943 | 33,661 | |||||||||

| Boeing Capital Corporation |

532 | 639 | 660 | |||||||||

| Other segment |

138 | 138 | 165 | |||||||||

| Unallocated items and eliminations |

(82 | ) | (248 | ) | (256 | ) | ||||||

| Total |

$ | 68,735 | $ | 64,306 | $ | 68,281 | ||||||

|

|

||||||||||||

Revenues in 2011 increased by $4,429 million or 7% compared with 2010. Commercial Airplanes revenues increased by $4,337 million due to higher new airplane deliveries, including the impact of entry into service of the 787-8 and 747-8 Freighter, favorable new airplane delivery mix and higher commercial aviation services revenues. BDS revenues increased by $33 million primarily due to higher revenues in the Boeing Military Aircraft (BMA) and Global Services & Support (GS&S) segments, partially offset by lower revenues in the Network & Space Systems (N&SS) segment.

Revenues in 2010 decreased by $3,975 million or 6% compared with 2009. Commercial Airplanes revenues decreased by $2,217 million due to lower 777 deliveries primarily resulting from a production rate change from 7 to 5 per month beginning in June 2010 and no deliveries on the 747 program due

19

Table of Contents

to the transition from the 747-400 to the 747-8. These were partially offset by increases in commercial aviation services business. BDS revenues decreased by $1,718 million primarily due to lower revenues in the N&SS segment.

Earnings From Operations

The following table summarizes our earnings/(loss) from operations:

(Dollars in millions)

| Years ended December 31, | 2011 | 2010 | 2009 | |||||||||

| Commercial Airplanes |

$ | 3,495 | $ | 3,006 | $ | (583 | ) | |||||

| Boeing Defense, Space & Security |

3,158 | 2,875 | 3,298 | |||||||||

| Boeing Capital Corporation |

125 | 152 | 126 | |||||||||

| Other segment |

54 | (327 | ) | (151 | ) | |||||||

| Unallocated items and eliminations |

(988 | ) | (735 | ) | (594 | ) | ||||||

| Total |

$ | 5,844 | $ | 4,971 | $ | 2,096 | ||||||

|

|

||||||||||||

Operating earnings in 2011 increased by $873 million compared with 2010. Commercial Airplanes earnings increased by $489 million, primarily due to higher revenues and a reduction in research and development costs, partially offset by increases in period costs associated with business growth. BDS earnings increased by $283 million compared with 2010 due to higher earnings in the BMA and GS&S segments, partially offset by lower earnings in the N&SS segment. Other segment earnings increased by $381 million primarily due to a $241 million reduction in the allowance for losses on receivables during 2011. Unallocated items and eliminations in 2011 reduced earnings by $253 million compared with 2010 primarily due to higher pension and postretirement costs.

Operating earnings in 2010 increased by $2,875 million compared with 2009. Commercial Airplanes earnings increased by $3,589 million, primarily due to $2,693 million of costs related to the first three 787 flight test aircraft included in research and development expense in 2009 and the 2009 reach-forward losses on the 747 program of $1,352 million. BDS earnings decreased by $423 million compared with 2009 due to lower margins in the BMA segment and lower revenues in the N&SS segment. Other segment earnings decreased by $176 million primarily due to $119 million in intercompany guarantees related to aircraft impairment charges and reduced aircraft collateral values.

The most significant items included in Unallocated items and eliminations are shown in the following table:

(Dollars in millions)

| Years ended December 31, | 2011 | 2010 | 2009 | |||||||||

| Share-based plans |

$ | (83 | ) | $ | (136 | ) | $ | (189 | ) | |||

| Deferred compensation |

(61 | ) | (112 | ) | (158 | ) | ||||||

| Pension |

(269 | ) | 54 | 110 | ||||||||

| Postretirement |

(248 | ) | (59 | ) | (93 | ) | ||||||

| Eliminations and other |

(327 | ) | (482 | ) | (264 | ) | ||||||

| Total |

$ | (988 | ) | $ | (735 | ) | $ | (594 | ) | |||

|

|

||||||||||||

Share-based plans expense decreased by $53 million in both 2011 and 2010 primarily due to the expiration of the ShareValue trust at June 30, 2010.

Deferred compensation expense decreased by $51 million and $46 million in 2011 and 2010. The year over year changes in deferred compensation expense are primarily driven by changes in our stock price and broad stock market conditions.

20

Table of Contents

Eliminations and other unallocated items expense decreased by $155 million in 2011 and increased by $218 million in 2010 primarily due to timing of intercompany expense allocations and elimination of profit on intercompany items. 2010 expense also includes a $55 million charitable contribution.

Unallocated pension and other postretirement expense represents the difference between costs recognized under Generally Accepted Accounting Principles in the United States of America (GAAP) in the consolidated financial statements and federal cost accounting standards required to be utilized by our business segments for U.S. government contracting purposes. We recorded net periodic benefit cost related to pensions and other postretirement benefits of $3,127 million, $1,864 million and $1,816 million in 2011, 2010, and 2009, respectively. The increase in net periodic benefit costs related to pensions and other postretirement benefits is primarily due to higher amortization of actuarial losses and higher service costs driven by lower discount rates. Not all net periodic benefit cost is recognized in earnings in the period incurred because it is allocated to production as product costs and a portion remains in inventory at the end of the reporting period. A portion of pension and other postretirement expense is recorded in the business segments and the remainder is included in unallocated pension and other postretirement expense. The unallocated expense in 2011 includes $161 million of additional expense recorded during the third quarter due to an adjustment primarily related to prior years’ accumulated postretirement benefit obligations. See the discussion of the postretirement liabilities in Note 15 to our Consolidated Financial Statements. Earnings from operations included the following amounts allocated to business segments and Other unallocated items and eliminations.

| (Dollars in millions) | Pension | Other Postretirement Benefits |

||||||||||||||||||||||

| Years ended December 31, | 2011 | 2010 | 2009 | 2011 | 2010 | 2009 | ||||||||||||||||||

| Allocated to business segments |

$ | (1,379 | ) | $ | (1,155 | ) | $ | (989 | ) | $ | (444 | ) | $ | (421 | ) | $ | (522 | ) | ||||||

| Other unallocated items and eliminations |

(269 | ) | 54 | 110 | (248 | ) | (59 | ) | (93 | ) | ||||||||||||||

| Total |

$ | (1,648 | ) | $ | (1,101 | ) | $ | (879 | ) | $ | (692 | ) | $ | (480 | ) | $ | (615 | ) | ||||||

|

|

||||||||||||||||||||||||

Other Earnings Items

(Dollars in millions)

| Years ended December 31, | 2011 | 2010 | 2009 | |||||||||

| Earnings from operations |

$ | 5,844 | $ | 4,971 | $ | 2,096 | ||||||

| Other income/(expense), net |

47 | 52 | (26 | ) | ||||||||

| Interest and debt expense |

(498 | ) | (516 | ) | (339 | ) | ||||||

| Earnings before income taxes |

5,393 | 4,507 | 1,731 | |||||||||

| Income tax expense |

(1,382 | ) | (1,196 | ) | (396 | ) | ||||||

| Net earnings from continuing operations |

$ | 4,011 | $ | 3,311 | $ | 1,335 | ||||||

|

|

||||||||||||

Other income decreased by $5 million in 2011 due to lower interest rates. The increase of $78 million in 2010 was driven by investment income on higher cash and investment balances. Interest and debt expense decreased by $18 million in 2011 due to the replacement of debt at lower interest rates. The increase of $177 million in 2010 was due to debt issued in 2009.

Our effective income tax rate was 25.6%, 26.5% and 22.9% for the years ended December 31, 2011, 2010 and 2009, respectively. Our effective tax rate was lower in 2011 than in 2010 primarily due to an income tax charge of $150 million recorded during the first quarter of 2010 as a result of the Patient Protection and Affordable Care Act, as modified by the Health Care and Education Reconciliation Act of 2010. During 2011, our effective tax rate was reduced by 7.4% due to a tax benefit of $397 million

21

Table of Contents