As filed with the Securities and Exchange Commission on March 16, 2022

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_______________

FORM

_______________

| [ | REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR (g) OF THE SECURITIES EXCHANGE ACT OF 1934 |

OR

| [ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 FOR THE FISCAL YEAR ENDED DECEMBER 31, 2021 |

OR

| [ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

OR

| [ | SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

GOL Linhas Aéreas Inteligentes S.A.

(Exact name of registrant as specified in its charter)

(Translation of registrant’s name into English)

_________________

The Federative Republic of

(Jurisdiction of incorporation or organization)

+55 11 5098-

Fax:

E-mail:

Federative Republic of

+

(Address of principal executive offices)

(Name, telephone, e-mail and/or facsimile number and address of company contact person)

___________________________________________

Securities registered or to be registered pursuant to Section 12(b) of the Act.

| Title of each class: | Trading symbol: | Name of each exchange on which registered: |

| Preferred Shares, without par value American Depositary Shares (as evidenced by American Depositary Receipts), each representing two Preferred Shares |

* |

New York Stock Exchange |

* Not for trading purposes, but only in connection with the trading on the New York Stock Exchange of American Depositary Shares representing those preferred shares.

___________________________________________

Securities registered or to be registered pursuant

to Section 12(g) of the Act:

None

___________________________________________

Securities for which there is a reporting obligation

pursuant to Section 15(d) of the Act:

None

___________________________________________

The number of outstanding shares of each class of stock of GOL Linhas Aéreas Inteligentes S.A. as of December 31, 2021:

Common Shares

Preferred Shares

Indicate

by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

If

this report is an annual or transition report, indicate by check mark if the registrant is not required to file pursuant to Section 13

or 15(d) of the Securities Exchange Act of 1934. Yes [_]

Note – Checking the box above will not relieve any registrant required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 from their obligations under those Sections.

Indicate

by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities

Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file

such reports), and (2) has been subject to such filing requirements for the past 90 days.

Indicate

by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405

of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant

was required to submit such files).

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or an emerging growth company. See definition of “large accelerated filer,” “accelerated filer” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Accelerated filer [_] | Non-accelerated filer [_] |

Emerging

growth company [

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards† provided pursuant to Section 13(a) of the Exchange Act. [_]

† The term “new or revised financial accounting standard” refers to any update issued by the Financial Accounting Standards Board to its Accounting Standards Codification after April 5, 2012.

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. [X]

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

| U.S. GAAP [_] | Board [ |

Other [_] |

If “Other” has been checked in response to the previous question, indicate by check mark which financial statement item the registrant has elected to follow.

Item 17 [_] Item 18 [_]

If

this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange

Act). Yes [_]

Table of Contents

Presentation of Financial and Other Data

The consolidated financial statements included in this annual report have been prepared in accordance with International Financial Reporting Standards, or IFRS, issued by the International Accounting Standards Board, or IASB, in reais.

We have translated some of the real amounts contained in this annual report into U.S. dollars. The rate used to translate such amounts in respect of the year ended December 31, 2021 was R$5.581 to US$1.00, which was the U.S. dollar selling rate as of December 31, 2021, as reported by the Brazilian Central Bank (Banco Central do Brasil), or the Central Bank. The U.S. dollar equivalent information presented in this annual report is provided solely for the convenience of investors and should not be construed as implying that the real amounts represent, or could have been or could be converted into, U.S. dollars at the above rate.

The consolidated financial statements included in this annual report have been prepared on a going concern basis of accounting, which contemplates continuity of operations, realization of assets and satisfaction of liabilities and commitments in the normal course of business. As such, the consolidated financial statements included in this annual report do not include any adjustments that might result from an inability to continue as a going concern. If we cannot continue as a going concern, adjustments to the carrying values and classification of our assets and liabilities and the reported amounts of income and expenses could be required and could be material. For more information, see “Item 5. Operating and Financial Review and Prospects—D. Trend Information.”

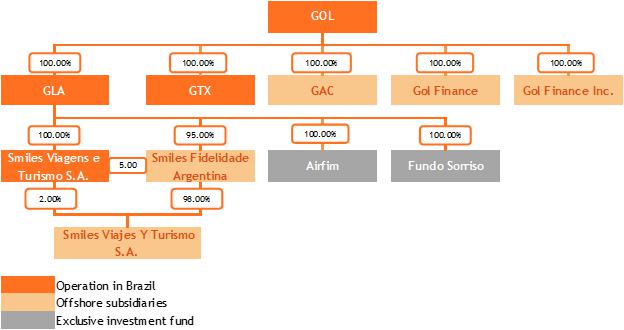

In this annual report, we use the terms “the registrant” and “GLAI”to refer to GOL Linhas Aéreas Inteligentes S.A., and “GOL”, “Company”, “we”, “us” and “our” to refer to the registrant and its consolidated subsidiaries together, except where the context requires otherwise. The term “GLA” refers to GOL Linhas Areas S.A., a wholly owned subsidiary of the registrant (formerly VRG Linhas Areas S.A., or VRG). References to “preferred shares”and “ ADSs” refer to non-voting preferred shares of the registrant and American depositary shares representing those preferred shares, respectively, except where the context requires otherwise.

The phrase “Brazilian government” refers to the federal government of the Federative Republic of Brazil. The term “Brazil” refers to the Federative Republic of Brazil. The terms “U.S. dollar” and “U.S. dollars” and the symbol “US$” refer to the legal currency of the United States. The terms “real” and “reais” and the symbol “R$” refer to the legal currency of Brazil. We make statements in this annual report about our competitive position and market share in, and the market size of, the Brazilian and international airline industries. We have made these statements on the basis of statistics and other information from third party sources, governmental agencies or industry or general publications that we believe are reliable. Although we have no reason to believe any of this information or these reports are inaccurate in any material respect, we have not independently verified the competitive position, market share and market size or market growth data provided by third parties or by industry or general publications. All industry and market data contained in this annual report are from the latest publicly available information.

Certain figures included in this annual report have been rounded. Accordingly, figures shown as totals in certain tables may not be an arithmetic sum of the figures that precede them.

This annual report is incorporated by reference into our registration statement on Form F-3, filed with the SEC on August 7, 2020.

This annual report contains terms relating to operating performance in the airline industry that are defined as follows:

“Aircraft utilization” represents the average number of block-hours operated per day per aircraft for the total aircraft fleet.

“ATK” refers to available ton kilometers and is a measure of total capacity, considering passenger and cargo.

“Available seat kilometers” or “ASK” represents the aircraft seating capacity multiplied by the number of kilometers flown.

“Average stage length” represents the average number of kilometers flown per flight.

“Block-hours” refers to the elapsed time between an aircraft’s leaving an airport gate and arriving at an airport gate.

| 1 |

“Load factor” represents the percentage of aircraft seating capacity that is actually utilized (calculated by dividing revenue passenger kilometers by available seat kilometers).

“Low-cost carrier” refers to airlines with a business model focused on a single fleet type, low-cost distribution channels and a highly efficient flight network.

“MRO” refers to maintenance, repair and operations.

“Net revenue per available seat kilometer” or “RASK” represents net revenue divided by available seat kilometers.

“Operating costs and expenses per available seat kilometer” or “CASK” represents operating costs and expenses divided by available seat kilometers, which is the generally accepted industry metric to measure operational cost efficiency.

“Operating costs and expenses excluding fuel expense per available seat kilometer” or “CASK ex-fuel” represents operating costs and expenses less fuel expense, divided by available seat kilometers.

“Passenger revenue per available seat kilometer” or “PRASK” represents passenger revenue divided by available seat kilometers.

“Revenue passenger kilometers” or “RPK” represents the number of kilometers flown by revenue passengers.

“Revenue passengers” represents the total number of paying passengers flown on all flight segments.

“Yield per passenger kilometer” or “yield” represents the average amount one passenger pays to fly one kilometer.

Cautionary Statements about Forward-Looking Statements

This annual report includes forward-looking statements, principally under the captions “Risk Factors,” “Operating and Financial Review and Prospects” and “Business Overview.” We have based these forward-looking statements largely on our current beliefs, expectations and projections about future events and financial trends affecting us. Many important factors, in addition to those discussed elsewhere in this annual report, could cause our actual results to differ substantially from those anticipated in our forward-looking statements, including, among others:

| · | general economic, political and business conditions in Brazil, South America and the Caribbean; |

| · | the effects of global financial markets and economic crises; |

| · | developments relating to, the economic, financial, political and health effects of, and our ability to timely and efficiently implement any measure necessary in response to, or to mitigate the impacts of, the COVID-19 global pandemic and government measures to address it; |

| · | management’s expectations and estimates concerning our financial performance and financing plans and programs; |

| · | our level of fixed obligations; |

| · | our capital expenditure plans; |

| · | our ability to obtain financing on acceptable terms; |

| · | our ability to service our indebtedness; |

| · | inflation and fluctuations in the exchange rate of the real; |

| · | changes to existing and future governmental regulations, including air traffic capacity controls; |

| · | fluctuations in crude oil prices and its effect on fuel costs, especially in light of the conflict between Russia and Ukraine; |

| · | increases in maintenance costs, insurance premiums and other operating expenses, including fuel costs, that we may not be able to adjust in our ticket prices; |

| 2 |

| · | changes in market prices, customer demand and preferences, and competitive conditions; |

| · | cyclical and seasonal fluctuations in our operating results; |

| · | defects or mechanical problems with our aircraft; |

| · | our ability to successfully implement our strategy; |

| · | developments in the Brazilian civil aviation infrastructure, including air traffic control, airspace and airport infrastructure; |

| · | future terrorism incidents, cyber-security threats, disease outbreaks or related occurrences affecting the airline industry; and |

| · | the risk factors discussed under the caption “Item 3. Key Information—D. Risk Factors” in this annual report. |

The words “believe,” “may,” “will,” “aim,” “estimate,” “continue,” “anticipate,” “intend,” “expect” and similar words are intended to identify forward-looking statements. Forward-looking statements include information concerning our possible or assumed results of operations, business strategies, financing plans, competitive position, industry environment, potential growth opportunities and the effects of regulation and of competition. Forward-looking statements are valid only as of the date they were made, and we undertake no obligation to update publicly or to revise any forward-looking statements after we distribute this annual report because of new information, events or other factors. In light of the risks and uncertainties described above, the forward-looking events and circumstances discussed in this annual report might not occur and are not guarantees of future performance.

PART I

ITEM 1. Identity of Directors, Senior Management and Advisers

Not applicable.

ITEM 2. Offer Statistics and Expected Timetable

Not applicable.

ITEM 3. Key Information

| A. | [Reserved] |

| B. | Capitalization and Indebtedness |

Not applicable.

| C. | Reasons for the Offer and Use of Proceeds |

Not applicable.

| D. | Risk Factors |

Investment in the ADSs involves a high degree of risk. You should carefully consider the risks described below, as well as the other information in this annual report, before making an investment decision regarding the ADSs. Our business, financial condition and results of operations could be materially and adversely affected by any of these risks. The trading price of the ADSs could decline due to any of these risks or other factors, and you may lose all or part of your investment. For purposes of this section, when we state that a risk, uncertainty or event may, could, would or will have an “adverse effect” on us or “adversely affect” us, we mean that the risk, uncertainty or event could have an adverse effect on our business, financial condition, results of operations, cash flow, prospects, reputation and/or the trading price of the ADSs, except as otherwise indicated.

| 3 |

Risks Relating to Brazil

The Brazilian government has exercised, and continues to exercise, significant influence over the Brazilian economy, and such involvement, along with general political and economic conditions, could adversely affect us.

The Brazilian government has frequently intervened in the Brazilian economy and has occasionally made drastic changes in policy and regulations. The Brazilian government’s actions to control inflation and in respect of other policies and regulations have involved, among other measures, increases in interest rates, changes in tax and social security policies, price controls, currency exchange and remittance controls, devaluations, capital controls and limits on imports. We may be adversely affected by changes in policy or regulations at the federal, state or municipal level involving factors such as:

| · | interest rates; |

| · | currency fluctuations; |

| · | monetary policies; |

| · | inflation; |

| · | liquidity of capital and lending markets; |

| · | tax and social security policies; |

| · | labor regulations; |

| · | energy and water shortages and rationing; and |

| · | other political, social and economic developments in or affecting Brazil. |

Uncertainty over whether the Brazilian government will implement changes in policy or regulation affecting these or other factors may contribute to economic uncertainty in Brazil and to heightened volatility in the Brazilian securities markets and securities issued abroad by Brazilian companies.

According to the Brazilian Institute of Geography and Statistics (Instituto Brasileiro de Geografia e Estatística), or the IBGE, Brazil’s gross domestic product, or GDP, grew by 1.1% in 2019, sharply contracted by 4.1% in 2020 due to global effects of developments relating to the COVID-19 pandemic and grew by 4.6% in 2021. Developments in the Brazilian economy may affect Brazil’s growth rates and, consequently, the use of our products and services and we have been, and will continue to be, affected by changes in the Brazilian GDP.

Political instability may adversely affect us.

Brazilian markets experienced heightened volatility in the last decade due to uncertainties deriving from the ongoing Lava Jato investigation, which is being conducted by the Federal Prosecutor’s Office, and its impact on the Brazilian economy and political environment. Numerous members of the Brazilian government and of the legislative branch, as well as senior officers of large state-owned and private companies have been convicted of political corruption of officials accepting bribes by means of kickbacks on contracts granted by the government to several infrastructure, oil and gas and construction companies.

The ultimate outcome of these investigations is uncertain, but they had an adverse impact on the image and reputation of the implicated companies, and on the general market perception of the Brazilian economy. The development of those unethical conduct cases has and may continue to adversely affect us.

In addition, the Brazilian economy is subject to the effects of uncertainty over political developments in Brazil. In 2022, Brazil will hold elections for President, senators, federal deputies and state deputies. The leading candidates in the Presidential race are incumbent Jair Bolsonaro and former President Luiz Inácio Lula da Silva, representing distinctly opposing political ideologies. Electoral uncertainty could lead to high volatility in Brazilian financial markets, and uncertainty regarding political developments and the policies the Brazilian federal government may adopt or alter may have material adverse effects on the macroeconomic environment in Brazil, as well as on businesses operating in Brazil, including ours.

| 4 |

Risks relating to the global economy may affect the perception of risk in emerging markets, which may adversely affect the Brazilian economy, including by means of oscillations in the capital markets and, consequently, us.

The market value of securities issued by Brazilian companies is influenced, to varying degrees, by the economic and market conditions of other countries, including the United States, European Union member countries and emerging economies. The reaction of investors to events in these countries may adversely affect the market value of the securities of Brazilian companies. Crises in the United States, the European Union or emerging markets may reduce investor interest in the securities of Brazilian companies, including securities issued by us.

In addition, the Brazilian economy is affected by international macroeconomic and market conditions, especially in the United States. Stock prices on the B3 S.A. – Brasil, Bolsa, Balcão, or the B3, for example, are highly affected by fluctuations in U.S. interest rates and by the behavior of the major U.S. stock exchanges. Any increase in interest rates in other countries, especially the United States, could reduce overall liquidity and investor interest in Brazilian capital markets.

Recent global developments relating to Russia’s invasion of Ukraine have generated uncertainty in global capital markets, and U.S. and European stock markets have seen increased price volatility. We cannot predict how these developments will evolve and whether or to what extent they may affect Brazilian capital markets and, consequently, us.

We cannot assure that Brazilian capital markets will be open to Brazilian companies and that financing costs will be favorable to Brazilian companies. Economic crises in Brazil or other emerging markets may reduce investor interest in securities of Brazilian companies, including securities issued by us. This may affect the liquidity and market price of the ADSs and our access to the Brazilian capital markets and financing on acceptable terms, which may adversely affect us.

Government efforts to combat inflation may hinder the growth of the Brazilian economy and materially and adversely affect us.

Historically, Brazil has experienced high inflation rates, which, together with actions taken by the Central Bank to curb inflation, have had significant adverse effects on the Brazilian economy. According to the IBGE, the annual rate of inflation in Brazil, as measured by the National Broad Consumer Price Index (Índice Nacional de Preços ao Consumidor Amplo), or IPCA, was 4.3%, 4.5% and 10.1% in 2019, 2020 and 2021, respectively.

The base interest rate for the Brazilian banking system is the Central Bank’s Special System for Settlement and Custody (Sistema Especial de Liquidação e Custódia) rate, or SELIC rate. The SELIC rate was repeatedly lowered from the October 2016 rate of 14.25% to 2.00% in August 2020 and has since steadily increased. As of December 31, 2019, 2020 and 2021, the SELIC rate was 4.5%, 2.0% and 9.25%, respectively. In February 2022, the SELIC rate was further increased to 10.75%.

Inflation and the Brazilian government’s measures to curb it, principally the Central Bank’s monetary policy, have had and may again have significant effects on the Brazilian economy and us, while tight monetary policies with high interest rates may restrict Brazil’s growth and the availability of credit, more lenient government and Central Bank policies and interest rate decreases may trigger increases in inflation, and, consequently, growth volatility and the need for sudden and significant interest rate increases, which could adversely affect us. In addition, we may not be able to adjust the fares we charge our customers to offset the effects of inflation on our cost structure.

Downgrades in Brazil’s credit rating could adversely affect our credit rating, the cost of our indebtedness and the trading price of securities issued by us.

Credit ratings affect investors’ perceptions of risk and, as a result, the yields required on indebtedness issuances in the financial markets. Rating agencies regularly evaluate Brazil and its sovereign ratings, taking into account a number of factors, including macroeconomic trends, fiscal and budgetary conditions, indebtedness and the prospect of change in these factors. Downgrades in Brazil’s credit rating can lead to downgrades in our credit rating and increase the cost of our indebtedness as investors may require a higher rate of return to compensate a perception of increased risk.

In January 2018, Standard & Poor’s downgraded Brazil’s credit rating to BB- with a stable outlook, which it changed to positive in December 2019 and back to stable in April 2020. Most recently, Standard & Poor’s reaffirmed its rating and outlook in June 2021. In February 2018, Fitch downgraded Brazil’s credit rating to BB- with a stable outlook, which it affirmed in May 2019. In May 2020, Fitch adjusted its outlook to negative, which it most recently reaffirmed in May 2021. Since April 2018, Moody’s has maintained Brazil’s credit rating at Ba2 with a stable outlook, which it most recently reaffirmed in December 2020.

| 5 |

Exchange rate instability may materially and adversely affect us.

The Brazilian currency has, during the last decades, experienced frequent and substantial variations in relation to the U.S. dollar and other foreign currencies. In 2019 and 2020, the real depreciated against the U.S. dollar and the U.S. dollar selling rate was R$4.031 per US$1.00 as of December 31, 2019 and R$5.197 per US$1.00 as of December 31, 2020, as reported by the Central Bank. In 2021, the real further depreciated against the U.S. dollar and, as of December 31, 2021, the U.S. dollar selling rate was R$5.581 per US$1.00. There can be no assurance that the real will not depreciate further against the U.S. dollar.

In 2021, 96.5% of our passenger revenue and other revenue were denominated in reais while 46.7% of our total operating costs and expenses were either denominated in or linked to U.S. dollars, such as fuel, aircraft and engine maintenance services and aircraft insurance. The market and resale value of the majority of our operating assets, our aircraft, is denominated in U.S. dollars. As of December 31, 2021, R$21,402.2 million, or 94.4%, of our indebtedness was denominated in U.S. dollars and we had a total of R$6,989.4 million in present value non-cancelable U.S. dollar denominated future lease payments.

Largely as a result of the conflict between Russia and Ukraine, Brent oil prices sharply increased from about US$75 per barrel at the end of 2021 to US$128 per barrel on March 8, 2022. It is possible that our U.S. dollar denominated operating expenses will further increase.

We are also required to maintain U.S. dollar denominated deposits and maintenance reserve deposits under the terms of some of our aircraft operating leases. We may incur substantial additional amounts of U.S. dollar denominated leases or financial obligations and U.S. dollar denominated indebtedness and we will be subject to fuel cost increases linked to the U.S. dollar. While in the past we have generally adjusted our fares in response to, and to alleviate the effect of, depreciation of the real against the U.S. dollar and increases in the price of jet fuel (which is priced in U.S. dollars) and have entered into hedging arrangements to protect us against the short-term effects of such developments, there can be no assurance that we will be able to continue to do so. However, unlike certain other expenses, we may not be able to defer significant amounts of our fuel costs and we will likely not be able to adjust fuel costs in our ticket prices.

Depreciation of the real against the U.S. dollar creates inflationary pressures in Brazil and causes increases in interest rates, which adversely affects the growth of the Brazilian economy as a whole, curtails access to foreign financial markets and may prompt government intervention, including recessionary governmental policies. Depreciation of the real against the U.S. dollar has also, as in the context of an economic slowdown, led to decreased consumer spending, deflationary pressures and reduced growth of the economy as a whole. Depreciation of the real also reduces the U.S. dollar value of distributions and dividends on the ADSs and the U.S. dollar equivalent of the market price of our preferred shares and, as a result, the ADSs. On the other hand, appreciation of the real against the U.S. dollar and other foreign currencies could lead to a deterioration of the Brazilian foreign exchange current accounts, as well as dampen export-driven growth. Depending on the circumstances, either depreciation or appreciation of the real could materially and adversely affect us.

Risks Relating to Us and the Brazilian Airline Industry

The airline industry is particularly sensitive to changes in macroeconomic conditions and adverse macroeconomic conditions, including as a result of developments relating to the COVID-19 global pandemic, have and may further materially and adversely affect the airline industry and us.

The airline industry in general, and the industry in Brazil in particular, are sensitive to changes in macroeconomic conditions. Unfavorable macroeconomic conditions in Brazil, a constrained credit market and increased business operating costs reduce spending on both leisure and business travel, as well as cargo transportation. Slowdowns in the Brazilian economy, such as the one faced in 2020 as a result of the COVID-19 global pandemic, adversely affect industries with significant spending in travel, including government, oil and gas, mining and construction, which affect the quality of demand, reducing the number of higher yield tickets we can sell. Unfavorable macroeconomic conditions, which, as of the date of this annual report, persist, may not be counterbalanced by our ability to raise fares to counteract increased fuel, labor and other costs. We cannot predict macroeconomic developments or their impact on us, including exchange rate volatility and increased fuel prices, especially in the context of the conflict between Russia and Ukraine and the Brazilian elections in 2022, but we expect to face inflationary pressures and sharply increased fuel prices in 2022. Especially because we may not be able to delay paying for significant amounts of our fuel costs and we will likely not be able to adjust fuel costs in our ticket prices, these price increases may materially and adversely affect us.

| 6 |

We cannot predict how the COVID-19 global pandemic will evolve, including novel variants of the virus or other infectious diseases, and affect demand for air travel in Brazil and, consequently, our results of operations and financial position. As demand for air travel recovers in the context of waning effects of the global pandemic, we may not be able to increase our number of flights and capacity fast enough to meet this increased demand as a result of the significant costs required to bring idle aircraft back into operation. Any such delay may lead our customers to seek alternatives and may adversely affect us.

Unfavorable macroeconomic conditions, a significant decline in demand for air travel or continued instability of the credit and capital markets could also result in pressure on our indebtedness costs, operating results and financial condition and would affect our growth and investment plans. These factors could also adversely affect our ability to obtain financing on acceptable terms and liquidity generally.

Substantial fluctuations in fuel costs would harm us.

International and local fuel prices are subject to high volatility depending on multiple factors, including geopolitical issues and supply and demand. The price of West Texas Intermediate crude oil, a benchmark widely used for crude oil prices that is measured in barrels and quoted in U.S. dollars, affects our fuel costs and constitutes a significant portion of our total operating costs and expenses. The average price per barrel of West Texas Intermediate crude oil was US$57.04, US$39.13 and US$67.34, in 2019, 2020 and 2021, respectively, according to New York Mercantile Exchange – NYMEX data. The average price for 2020 reflects the low prices in the first half of 2020. By year-end 2021, the price per barrel of West Texas Intermediate crude oil was US$75.21. Fuel costs represented 34%, 28% and 23% of our total operating costs and expenses in 2019, 2020 and 2021, respectively.

Because Russia is one of the world’s largest oil exporters, we expect recent global developments relating to Russia’s invasion of Ukraine, and resulting export restrictions, will likely lead to decreased global supply and increased fuel prices, which effects could be more acute if the participants of the Organization of the Petroleum Exporting Countries – OPEC decide not to, or are unable to, increase their supply production.

Substantially all of our fuel is supplied by one source, Petrobras Distribuidora S.A., or Petrobras Distribuidora, and we depend on them to supply fuel at the times and in the quantities that we require. As such, we are exposed to significant supplier risk, which may materially and adversely affect us. See “Item 4. Information on the Company—B. Business Overview—Airline Business—Fuel.”

We may not be able to maintain adequate liquidity and our cash flows from operations and financings may not be sufficient to meet our current obligations.

Our liquidity, cash flows from operations and financings have been and may be adversely affected by exchange rates, fuel prices and the impact of adverse economic conditions in Brazil on the demand for air travel. As of December 31, 2020, our total indebtedness was R$17,561.2 million, as compared to R$22,663.0 million as of December 31, 2021, which increase was mainly due to depreciation of the real in 2021. The average maturity of our loans and financing, excluding our perpetual notes, was 3.3 and 3.4 years as of December 31, 2020 and 2021, respectively. We have no significant indebtedness maturing until 2024, but, as of December 31, 2021, we had negative working capital of R$8,393.8 million.

We have taken numerous measures to protect our operations and liquidity in response to the significantly reduced demand for air travel caused by the COVID-19 pandemic, including adjusting and reducing our flight network, significantly reducing fixed and variable costs, deferring certain lease obligations and rolling over and extending certain debt. We cannot guarantee that our cash preservation and cost reduction initiatives will be sufficient to preserve our liquidity or that creditors will continue to cooperate with us.

Certain of our indebtedness agreements contain covenants that require the maintenance of specified financial ratios. Our ability to meet these financial ratios and other restrictive covenants may be affected by events beyond our control and we cannot assure that we will meet those ratios. Failure to comply with any of these covenants or payment obligations under our finance and lease obligations could result in an event of default under these agreements and others, as a result of cross default provisions. If we were unable to comply with our indebtedness covenants, we need to seek waivers from our creditors. We cannot guarantee that we will be successful in complying with our covenants or in obtaining or renewing any waivers.

Since the beginning of the global pandemic, we have repeatedly deferred and not been paying in full our lease obligations and many other suppliers, which have generally been cooperating with us under deferrals and amendments to our outstanding agreements. However, we do not know whether or for how much longer our counterparties will continue to cooperate with us.

Our financial statements as of and for the years ended December 31, 2019, 2020 and 2021 contain a going concern emphasis, due in significant part to our negative working capital and more recently to the substantial decline in demand for air travel as a result of the effects of developments relating to the COVID-19 pandemic and the actions taken by the Brazilian government to address it, which are largely out of our control.

The consolidated financial statements included in this annual report have been prepared on a going concern basis of accounting, which contemplates continuity of operations, realization of assets and satisfaction of liabilities and commitments in the normal course of business. However, we currently operate with a significantly negative working capital, most recently because of the drop in worldwide demand for air travel caused by the COVID-19 pandemic that affected the entire airline industry, and the travel restrictions that were placed by numerous countries, including Brazil, and there is significant uncertainty about our ability to continue as a going concern. Our independent registered public accounting firms in each of 2019, 2020 and 2021, in their reports on our consolidated financial statements as of and for the years ended December 31, 2019, 2020 and 2021, expressed substantial doubt regarding our ability to continue as a going concern.

| 7 |

We rely on one manufacturer for our aircraft and engines and any negative developments relating to Boeing 737 MAX aircraft would materially and adversely affect us.

One of the key elements of our business strategy and a key element of the low-cost carrier business model is to reduce costs by operating a standardized aircraft fleet. After extensive research and analysis, we chose the 737-700/800 Next Generation aircraft manufactured by The Boeing Company, or Boeing, which we are now, on an accelerated basis, replacing with Boeing 737 MAX aircraft, and 56-7B engines manufactured by CFM International, or CFM. We expect to continue to rely on Boeing and CFM for the foreseeable future and delivery and operation of the Boeing 737 MAX aircraft are crucial to our strategy and fleet modernization initiatives.

We derive benefits from a fleet comprised of a standardized type of aircraft while still having the flexibility to match the capacity and range of the aircraft to the demands of each route. If we had to lease or purchase aircraft of another manufacturer, we could lose these benefits. We cannot assure you that any such replacement aircraft would have the same operating advantages as the Boeing aircraft or that we could lease or purchase engines that would be as reliable and efficient as the CFM engines. In addition, replacement aircraft may require additional training of our pilots and crew, as well as our maintenance staff, and could materially affect our operations and require us to make significant unexpected expenditures. Our operations could also be disrupted by the failure or inability of Boeing or CFM to provide sufficient parts or related support services on a timely basis.

Following two accidents involving Boeing 737 MAX aircraft, regulators grounded the aircraft in March 2019. The FAA and ANAC lifted the grounding and we reinitiated operations of the 737 MAX in November 2020. Further, Boeing suspended MAX deliveries following the groundings and temporarily ceased to manufacture new MAX aircraft. Because Boeing no longer manufactures versions of the 737 other than the 737 MAX family of aircraft and our operations have been designed around the single fleet model, if there is any future grounding of the MAX aircraft or if there are additional delays in delivery of our ordered aircraft, we may face increased maintenance costs on our aircraft, experience operational disruptions and decreases in customer ratings, be unable to realize our expected fuel cost efficiencies, incur increased aircraft lease costs and risk facing a shortage of available aircraft, which may limit our growth plans and the execution of our long-term strategy.

Our reliance on single suppliers for our aircraft and engines means that any of these developments relating to Boeing 737 MAX aircraft or CFM engines would materially and adversely affect us.

| 8 |

Changes to the Brazilian civil aviation regulatory framework, including rules regarding slot distribution, fare restrictions and fees associated with civil aviation, may adversely affect us.

Brazilian aviation authorities monitor and influence the developments in Brazil’s airline market. For example, airport services are regulated by ANAC and, in many cases, still managed by the Brazilian Airport Infrastructure Company (Empresa Brasileira de Infraestrutura Aeroportuária), or INFRAERO, a government-owned corporation. ANAC’s policies, as well as those of other aviation supervisory authorities, including relating to new routes and flight frequencies, may adversely affect us. ANAC considers operating history and efficiency (on-time performance and regularity) as the main criteria for the allocation of slots. Under its rules, on-time performance and regularity are assessed twice per year, following the International Air Transport Association, or IATA, summer and winter calendars, between April and September and between October and March. The minimum regularity performance target for each series of slots in a season is 90% at Congonhas (São Paulo) and 80% for Guarulhos (São Paulo), Santos Dumont (Rio de Janeiro) and Recife. The on-time performance, since 2018, is measured through the method of statistical tendency that compares the performance of all airlines for each airport. Airlines forfeit slots used below the minimum criteria in a season. Forfeited slots are redistributed first to new entrants, which includes airlines that operate fewer than five slots in the affected airport in the given weekday, and are subsequently returned to the slots database and redistributed according to regulations.

In 2020 and 2021, ANAC waived slots regularity targets in the context of the COVID-19 pandemic. By the end of 2021, airlines, including GOL, shared their comments on ANAC’s slots distribution policy, which comments are, as of the date of this annual report, under ANAC’s review and consideration.

As of the date of this annual report, there are plans to privatize two of the most important airports for our operations: Congonhas (São Paulo) and Santos Dumont (Rio de Janeiro). We cannot foresee how these privatizations will affect our operations. In addition, we cannot foresee changes to the Brazilian civil aviation regulatory framework, which could increase our costs, change the competitive dynamics of our industry and adversely affect us, including as discussed in “—We operate in a highly competitive industry.”

Technical and operational problems in the Brazilian civil aviation infrastructure, including air traffic control systems, airspace and airport infrastructure, may adversely affect us.

We depend on improvements in the coordination and development of Brazilian airspace control and airport infrastructure, which continue to require substantial improvements and government investments.

If the measures taken and investments made by the Brazilian government and regulatory authorities do not prove sufficient or effective, air traffic control, airspace management and sector coordination difficulties might reoccur or worsen, which may adversely affect us.

Slots at Congonhas airport in São Paulo, the most important airport for our operations and the busiest one in Brazil, are fully utilized on weekdays. The Santos Dumont airport in Rio de Janeiro, a highly utilized airport with half-hourly shuttle flights between São Paulo and Rio de Janeiro, also has certain slot restrictions. Several other Brazilian airports, including the Brasília, Campinas, Salvador, Confins and São Paulo (Guarulhos) international airports, have limited the number of slots per day due to infrastructural limitations at these airports. Any condition that would prevent or delay our access to airports or routes that are vital to our strategy or our inability to maintain our existing slots, and obtain additional slots, may adversely affect us. In addition, we cannot assure that any investments will be made by the Brazilian government in the Brazilian aviation infrastructure (by expanding additional or developing new airports) to permit our growth.

We have significant recurring aircraft expenses, and we will incur significantly more fixed costs that could hinder our ability to meet our strategic goals.

We have significant costs, relating primarily to leases for our aircraft and engines. As of the date of this annual report, we have significant accumulated lease obligations that were deferred in the context of the COVID-19 global pandemic. In addition, as of December 31, 2021, we had aircraft purchase commitments with Boeing for an aggregate present value of R$21,947.8 million (US$3,932.9 million) for deliveries through 2026. Our accelerated return of Boeing 737 Next Generation aircraft as part of our fleet renewal plan also requires significant cash expenditures. We expect that we will incur additional fixed obligations and indebtedness as we take delivery of the new aircraft and other equipment to implement our strategy.

These significant fixed payment obligations:

| · | could limit our ability to obtain additional financing to support expansion plans and for working capital and other purposes; |

| 9 |

| · | divert substantial cash flows from our operations to service our fixed obligations under aircraft operating leases and aircraft purchase commitments; |

| · | if interest rates increase, require us to incur significantly more lease or interest expense than we currently do; and |

| · | could limit our ability to react to changes in our business, the airline industry and general economic conditions. |

Our ability to make scheduled payments on our fixed obligations will depend on our operating performance and cash flow, which will in turn depend on prevailing macroeconomic and political conditions and financial, competitive, regulatory, business and other factors, many of which are beyond our control. In addition, our ability to raise our fares to compensate for an increase in our fixed costs may be limited by competition and regulatory factors.

We operate in a highly competitive industry.

We face intense competition on all routes we operate from existing scheduled airlines, charter airlines and potential new entrants in our market. Competition from other airlines has a relatively greater impact on us when compared to our competitors because we have a greater proportion of flights connecting Brazil’s busiest airports, where competition is more intense. In contrast, some of our competitors have a greater proportion of flights connecting less busy airports, where there is little or no competition. In addition, we cannot foresee how the recent financial distress of our main competitors will affect the competitive landscape.

The Brazilian airline industry also faces competition from ground transportation alternatives, such as interstate buses. In addition, the Brazilian government and regulators could give preference to new entrants and existing competitors when granting new and current slots in Brazilian airports in order to promote competition.

Existing and potential competitors have in the past and may again undercut our fares or increase capacity on their routes in an effort to increase their market share of business traffic (high value-added customers). In any such event, we cannot assure you that our level of fares or passenger traffic would not be adversely affected.

Changes in the Brazilian and global airline industry framework may adversely affect us.

As a result of the competitive environment, there may be further changes in the Brazilian and global airline industry, whether by means of acquisitions, joint ventures, partnerships or strategic alliances. We cannot predict the effects of further consolidation on the industry. For example, in May 2020, LATAM Airlines Group and Avianca Holdings S.A., the two largest Latin American airlines, filed for bankruptcy protection under Chapter 11 of the U.S. Bankruptcy Code, with the latter emerging from bankruptcy proceedings in December 2021. Consolidation in the airline industry and changes in international alliances will continue to affect the competitive landscape in the industry and may result in the formation of airlines and alliances with greater financial resources, more extensive global networks and lower cost structures than we can obtain.

We rely on complex systems and technology and any operational or security inadequacy or interruption could materially and adversely affect us.

In the ordinary course of our business, our systems and technology require ongoing modification and refinements, which can to be expensive to implement and may divert management’s attention from other matters. In addition, our operations could be adversely affected, or we could face regulatory penalties, if we were unable to timely or effectively modify our systems as necessary.

We have occasionally experienced system interruptions and delays that make our websites and services unavailable or slow to respond, which could prevent us from efficiently processing customer transactions or providing services. This could reduce our net revenue and the attractiveness of our services. Our computer and communications systems and operations could be damaged or interrupted by catastrophic events such as fires, floods, earthquakes, power loss, computer and telecommunications failures, acts of war or terrorism, computer viruses, cybersecurity breaches and similar events or disruptions. Any of these events could cause system interruptions, delays and loss of critical data, and could prevent us from processing customer transactions or providing services, which could make our business and services less attractive and subject us to liability. Any of these events could damage our reputation and be expensive to remedy.

| 10 |

In August 2021, we switched our passenger service system to Sabre, which is one of the most used by airlines. The transition during the second half of 2021 resulted in issues with our website useability and customers’ ability to book flights. We cannot assure you we will not face additional issues deriving from our passenger service system or other technology.

Unauthorized access to or release or violation of our or our business partners’ systems and data could materially and adversely affect us.

We are subject to a broad range of cyber threats, including attacks, with varying levels of sophistication. These cyber threats are related to the confidentiality, availability and integrity of our systems and data, including our customers’ and business partners’ confidential, classified or personal information. In addition, because we have access to certain information technology systems of certain of our business partners, our systems may be subject to attacks aimed at accessing, tampering with or exposing our business partners’ systems and their data.

In addition, certain of our business partners, including our suppliers, have broad access to certain of our confidential and strategic information. Many of these business partners face similar security threats and any attacks on their systems could result in unauthorized access to our systems or data. Any unauthorized access to, or release or violation of our systems and data, whether directly or through cyberattacks or similar breaches affecting our business partners, could materially and adversely affect us, including subjecting us to regulatory scrutiny and fines.

We rely on maintaining a high daily aircraft utilization rate to increase our revenues and reduce our costs.

One of the key elements of our business strategy and an important element of the low-cost carrier business model is to maintain a high daily aircraft utilization rate, which we measured as 9.6 block hours per day in 2020 and 10.0 block hours per day in 2021. High daily aircraft utilization, which we were not able to maintain during the COVID-19 global pandemic, generally allows us to generate more revenue from our aircraft and dilute our fixed costs, and is achieved in part by operating with quick turnaround times at airports so we can fly more hours on average in a day. Our rate of aircraft utilization could be adversely affected by a number of different factors that are beyond our control, including, among others, air traffic and airport congestion, adverse weather conditions and delays by third-party service providers relating to matters such as fueling and ground handling.

We may be adversely affected by events out of our control, including accidents and pandemics.

Accidents or incidents involving our aircraft could result in significant claims by injured passengers and others, as well as significant costs related to the repair or replacement of damaged aircraft and temporary or permanent loss from service. We are required by ANAC and lessors of our aircraft under our operating lease agreements to carry liability insurance. Although we believe we maintain liability insurance in amounts and of the type generally consistent with industry practice, the amount of such coverage may not be adequate and we may be forced to bear substantial losses in the event of an accident. Substantial claims resulting from an accident in excess of our related insurance coverage would harm us. Any accidents or incidents involving our or any other Boeing 737 Next Generation or Boeing 737-8 MAX aircraft or the aircraft of any major airline have and may again cause negative public perceptions about us, and, consequently, adversely affect us.

Our controlling shareholders have the ability to direct our business and affairs and their interests could conflict with yours.

Our controlling shareholders have the power to, among other things, elect a majority of our directors and determine the outcome of any action requiring shareholder approval, including transactions with related parties, corporate reorganizations and dispositions and the timing and payment of any dividends. The chairman of our board of directors, Constantino de Oliveira Junior, has since our inception been the fundamental figure of our company, and has directed our company initially as its chief executive officer, and, since 2012, as the chairman of our board of directors. As of December 31, 2021, the Constantino family, which indirectly controls us, held 57.0% of the economic interest in us. A difference in economic exposure may intensify conflicts of interests between our controlling shareholders and you. See “Item 9. The Offer and Listing—C. Markets—Corporate Governance Practices.”

| 11 |

Risks Relating to the ADSs and Our Preferred Shares

The relative volatility and illiquidity of the Brazilian securities markets, and securities issued by airlines in particular, may substantially limit your ability to sell the preferred shares underlying the ADSs at the price and time you desire.

Investing in securities that trade in emerging markets, such as Brazil, often involves greater risk than investing in securities of issuers in the United States, and such investments are generally considered to be more speculative in nature. The Brazilian securities market is substantially smaller, less liquid, more concentrated and can be more volatile than major securities markets in the United States. Accordingly, although you are entitled to withdraw the preferred shares underlying the ADSs from the depositary at any time, your ability to sell the preferred shares underlying the ADSs at a price and time at which you wish to do so may be substantially limited. There is also significantly greater concentration in the Brazilian securities market than in major securities markets in the United States. As of December 31, 2021, the ten largest companies in terms of market capitalization represented 52.0% of the aggregate market capitalization of the B3.

The trading prices of shares of companies in the worldwide airline industry are relatively volatile and investors’ perception of the market value of the ADSs and preferred shares may be adversely affected by volatility and decreases in their trading prices.

Holders of the ADSs and our preferred shares may not receive any dividends.

According to our bylaws, we must pay our shareholders at least 25.0% of our annual net income as dividends, as determined and adjusted under Brazilian corporate law. Our adjusted net income may be capitalized, used to absorb losses or otherwise appropriated as allowed under Brazilian corporate law and may not be available to be paid as dividends. We may not pay dividends to our shareholders in any particular fiscal year if our board of directors determines that such distributions would be inadvisable in view of our financial condition. In the past five fiscal years, we did not distribute dividends.

If you surrender your ADSs and withdraw preferred shares, you risk losing the ability to remit foreign currency abroad and certain Brazilian tax advantages.

As an ADS holder, you benefit from the electronic foreign capital registration obtained by the custodian for our preferred shares underlying the ADSs in Brazil, which permits the custodian to convert dividends and other distributions with respect to the preferred shares into non-Brazilian currency and remit the proceeds abroad. If you surrender your ADSs and withdraw preferred shares, you will be entitled to continue to rely on the custodian’s electronic foreign capital registration for only five business days from the date of withdrawal. Thereafter, upon the disposition of or distributions relating to the preferred shares, you will not be able to remit non-Brazilian currency abroad unless you obtain your own electronic foreign capital registration.

If you attempt to obtain your own electronic foreign capital registration, you will incur expenses and may suffer delays in the application process, which could delay your ability to receive dividends or distributions relating to our preferred shares or the return of your capital in a timely manner.

Holders of the ADSs may be unable to exercise preemptive rights with respect to our preferred shares.

We may not be able to offer our preferred shares to U.S. holders of the ADSs pursuant to preemptive rights granted to holders of our preferred shares in connection with any future issuance of our preferred shares, unless a registration statement under the U.S. Securities Act of 1933, or the Securities Act, is effective with respect to such preferred shares and preemptive rights, or an exemption from the registration requirements of the Securities Act is available. We are not obligated to file a registration statement relating to preemptive rights with respect to our preferred shares, and we cannot assure you that we will file any such registration statement. If such a registration statement is not filed and an exemption from registration does not exist, the depositary bank will attempt to sell the preemptive rights, and you will be entitled to receive the proceeds of such sale. However, these preemptive rights will expire if the depositary does not sell them, and U.S. holders of the ADSs will not realize any value from grants of such preemptive rights.

| 12 |

ITEM 4. Information on the Company

| A. | History and Development of the Company |

Overview

GOL is Brazil’s largest domestic airline by market share, one of the largest low-cost carriers globally and the leading low-cost carrier in South America. We pioneered the low-cost carrier model in South America and believe we offer the best product and customer experience to business and leisure passengers. As a result of our experienced management, we believe we have built a resilient airline capable of maintaining sustainable competitive advantages throughout the business cycle.

Our strategy and business model allow us to adapt our supply to fluctuations in demand. Since our inception in 2001, we have had a strategic focus on sustainability and have been preparing ourselves to successfully operate in highly competitive business environments. Since the beginning of the COVID-19 pandemic, we have been working proactively with our stakeholders to further strengthen our position as the #1 airline in Brazil.

Founding

GOL was founded in 2000 and initiated operations in 2001, when entrepreneur Constantino de Oliveira Junior pioneered the low-cost carrier concept in Brazil. Constantino de Oliveira Junior has been key to GOL’s success, first as chief executive officer and, since 2012, as chairman of our board of directors. He continues to be the leading figure at GOL, both in helping set strategic direction and in his close supervision of and daily interaction with senior management. As of December 31, 2021, the Constantino family, which indirectly controls us, held 57.0% of the economic interest in us. Our corporate governance practices include a board of nine directors, with a majority of independent directors, a highly experienced executive management team and an independent audit committee.

GOL Effect

From our launch in 2001 until today, we have been a major driver behind passenger growth in Brazil. Between 2001 and 2019, Brazil’s domestic passenger market grew 3.2x, from 30.8 million passengers in 2001 to 95.3 million in 2019. Brazil’s international passenger market increased 4.1x, from 3.8 million passengers in 2001 to 9.1 million passengers in 2019, excluding international carriers.

Much of this growth can be directly attributed to GOL and our low-cost carrier model. Our passenger market share in the domestic air transportation market, as measured by RPKs, increased from 5% in 2001 to 38% in 2019, and was 38% and 32% in 2020 and 2021, respectively. We have transported more than 500 million passengers since we began our operations.

Importance of Air Transportation in Brazil

Brazil is geographically similar in size to the continental United States and, according to IATA’s 2018 data, Brazil is the sixth largest domestic airline market in the world, after the United States, China, India, Indonesia and Japan. Brazilian domestic air passenger demand grew 0.8% in 2019. While demand for passenger air travel declined globally in 2020 as a result of developments relating to the COVID-19 pandemic, it has been gradually recovering since mid-2021.

Competitive Strengths

We believe we are one of the most sustainable Latin American carriers, based on our unique business model and competitive strengths:

| · | Lowest Cost and Strongest Operating Margins: |

| o | Since inception, we have had the lowest operating costs of any Brazilian airline, with a CASK ex-fuel of R$21.07 cents in 2020 and R$31.87 cents in 2021, and we have one of the lowest cost models among airlines globally. |

| 13 |

| o | We have had for many years one of the highest EBITDA margins among our Latin American peers. |

| o | Our fleet of Boeing 737 aircraft provides operational advantages that make it optimally suited for our low-cost carrier model. |

| · | Flexible, Single Fleet Type: |

| o | Our single fleet strategy provides significant operational flexibility. In 2019, we had best in class aircraft utilization, with 12.3 block hours per day, one of the highest in the world. Our aircraft financings are structured for maximum operational flexibility, and, as of December 31, 2021, we leased 100% of our aircraft from global operating lessors. During the COVID-19 pandemic, we were able to maintain our high block hours at 9.6 in 2020 and 10.0 in 2021, due to the reduction in our operating fleet. We retain full optionality to extend leases or return aircraft at maturity, providing significant flexibility in managing our fleet size. |

| o | As of December 31, 2021, our total fleet comprised 135 Boeing 737 aircraft, of which 112 were Next Generation aircraft and 23 were MAX aircraft – all under operating leases, which provided us with important operational flexibility in 2020 and 2021 in light of sharply reduced and then gradually increasing demand for air travel. We have accelerated our fleet transformation plan in order for MAX aircraft to comprise 50% of our total fleet by 2024. As part of this plan, in August 2021, we entered into purchase agreements for 28 additional MAX aircraft to replace Next Generation aircraft. Of these 28 new aircraft, ten will be purchased under finance leases, which represents our return to finance leased aircraft since 2013. We believe the addition of finance leased aircraft presents an opportunity to optimize our capital structure and the financial sustainability of our fleet management. |

| o | We had an average operating fleet of 10.7 aircraft in 2021, representing 97.3% and 108.1% of our average operating fleet in 2020 and 2019, respectively. |

| o | Our ability to rapidly and efficiently adjust to increasing demand for air travel in the second half of 2021 further evidenced the benefits and flexibility granted by our single fleet type. In addition, in light of a steep increase in the number of reported COVID-19 cases deriving from the Omicron variant in late 2021 and early 2022, as a result of which our peers cancelled more than 1,500 flights, we experienced only a minimal impact and almost no cancellations because we were able to efficiently reallocate pilots and crew that are necessarily familiar with all of our aircraft of the same fleet type. |

| o | Since 2001, we have forged a deep relationship with Boeing, allowing us to obtain favorable terms for the pricing and delivery of aircraft. Attractive pricing, together with our financing strategy, allow us to create significant value in our aircraft acquisitions. |

| · | Highest Load Factors and Passenger Capacity: Our load factor has been best-in-class in Brazil for many years. Even during the peaks of the pandemic, in April and May 2020 and in February and March 2021, with a largely reduced fleet and flight network, we reported load factors above 75%. In 2020, although our total demand decreased 51.9%, as compared to 2019, we were the only airline in Brazil that kept our average load factor at 80.0%, due to our fleet size flexibility. In 2021, in the context of recovering demand as compared to 2020, we increased our average load factor by 1.9 percentage points. Our single fleet model and proactive fleet management increased our fleet flexibility, which allowed us to follow varying demand levels for flights without meaningfully impacting our load factors. |

| · | Dominant Market Position in Key Airports: We are the largest player in two of the ten busiest airports in Brazil, with an average market share in 2021 of 42.9%, and we were the leading airline in 23.3% of the 30 largest airports in Brazil in 2021, which together represented 92.9% of Brazilian domestic passenger air traffic. Our acquisition of Brazilian domestic airline MAP Linhas Aéreas will further boost our ability to service these important, slot-constrained airports in Brazil. |

| · | Meaningful ESG Track Record and Initiatives: Since 2010, we have prepared annual sustainability reports based on Global Reporting Initiative guidelines, an international standard for reporting environmental, social and economic performance. By adopting these parameters and providing related data to the public, we are reinforcing our accountability with various stakeholders through added transparency and credibility. Among our initiatives are our voluntary adherence, since 2016, to the carbon pricing leadership coalition, which is a global initiative to price carbon emissions, as well as multiple campaigns and associations dedicated to promoting best ESG practices both in the airline industry and generally. From 2017 to 2019, we had the lowest indicator of CO2 emissions by capacity (measured as metric tons of CO2/ASK) among the main global airlines. Our ESG strategy is directly linked to our fleet plan as our accelerated fleet transformation to Boeing 737 MAX aircraft is a key component of our goal to reach carbon neutrality by 2050. Boeing 737 MAX aircraft consume 15% less fuel and produce 16% fewer carbon emissions and 40% less noise than the Boeing 737 Next Generation aircraft that we are replacing. The 23,000 flight hours that we have flown so far with Boeing 737 MAX aircraft since 2019 through 2021 have saved 9.7 million liters of jet fuel and emitted 24,300 fewer tons of greenhouse gas emissions. In addition, we maintain social initiatives relating to our workforce, customer satisfaction and safety, as well as governance initiatives through leadership, committees, policies and shareholder meetings. |

| 14 |

| · | Highest Ranking in Customer Service: We have made a significant investment in our product offering, including features such as loyalty program integration, onboard service, onboard entertainment and comfortable seats, among others. We believe we offer more complete products and services than any other leading global low-cost carrier, allowing us to capture the largest portion of premium business and economy leisure customers. Both groups of customers value the experience we offer, allowing us to extract higher yields and a leading share of customer wallet. We are a leader in technology development and digital solutions, enabling us to offer the best passenger experience, with a Net Promoter Score of 36 in 2021. |

| · | Best Route Network and Global Partnerships: We have a highly integrated network, operating the most flights at Brazil’s busiest airports. Before the COVID-19 pandemic commenced in Brazil, we were, in 2019, the largest Brazilian airline with over 36 million annual passengers transported and a domestic market share of 38%, as measured by RPKs, and we have since then been able to further improve our competitive market position. We operate the leading Brazilian airline loyalty program, with 19.3 million members as of December 31, 2021. We have entered into 13 codeshare agreements, 14 frequent flyer agreements and 38 interline agreements, allowing our customers to connect seamlessly to 179 airports around the world. In September 2021, we announced the expansion of our commercial cooperation with American Airlines, the leading provider of air service between the United States and Brazil, through an exclusive codeshare agreement for three years that has strengthened the relationship between the two airlines. |

| · | Domestic Market Focus: Our network of flights has always been focused on national and regional routes within South America and Brazil, which are returning to normal levels of traffic faster than inter-continental routes prioritized by our Brazilian competitors. We have benefitted from the competitive dynamic that has led to certain competitors pursuing credit restructuring and Chapter 11 bankruptcy procedures, which have decreased the supply of flights in the market. In addition, as recovery in the demand for international air travel lags behind domestic air travel, we are particularly well-positioned to take advantage of the recovery in Brazilian passenger air travel. |

| · | Leading Loyalty Program: Our loyalty program Smiles is one of the largest coalition loyalty programs in Brazil, with 19.3 million members as of December 31, 2021. Our Smiles business model is based on a pure coalition loyalty program comprising a single platform for accumulating and redeeming miles through a broad network of commercial and financial partners. Our Smiles business provides us with significant revenues derived from the redemption and expiration of miles. In addition, Smiles provides an incentive for customer air travel bookings, thereby boosting ticket sales and our number of repeat customers. |

| · | Leading Cargo Business: We are Brazil’s third largest cargo airline with a 29.4% market share in 2021 as measured by ATKs, and our cargo revenues increased 14.3% in 2021, as compared to 2020, representing 4.6% of our gross revenue in 2021. Through GOLLOG, we generate cargo revenue through the use of cargo space on regularly scheduled passenger aircraft. Our cargo business has grown at higher rates than our passenger travel business, in large part because we count with an excellent and diversified base of clients in the B2B segment and e-commerce markets, and are well-positioned to support this market’s expected growth as we forge and strengthen our client relationships. We are committed to delivering quality logistics solutions and believe our cargo business will be an increasingly important contributor to our financial performance. |

| 15 |

| · | Leading MRO Service Provider: In 2019, we launched GOL Aerotech, our business unit dedicated to providing MRO services, including to third parties. We have 15 years of experience providing maintenance, preventive maintenance and modifications on our aircraft. GOL Aerotech represents an important cost saving source for us as we are able to rely on local workforce instead of relying on other maintenance providers that would expose us to exchange rate variations and higher market pricing. Our local maintenance services also reduce our repair and logistics costs, as well as engine off-time and replacement time, and support our sustainability efforts as we do not have to transport aircraft to third-party maintenance facilities. We have expanded our MRO services to other airlines and what began as a cost-saving initiative has become a revenue generating opportunity. As of the date of this annual report, we have three maintenance units (Confins, Brasília and Congonhas) and continue to seek expansion opportunities for our GOL Aerotech business. |

| · | GOLLabs: In 2018, we created GOLLabs, our innovation business dedicated to researching and developing new technologies and services to generate new revenues and reduce costs, including by optimizing our pricing and route strategies and enhancing our customer experience through initiatives such as face recognition technology to facilitate check-in and boarding procedures, media streaming partnerships to provide enhanced entertainment options and a customer service platform through mobile chat applications, among others. GOLLabs is responsible for the entire lifecycle of the development of an innovative concept, including market testing and analytics and implementation and training, and plays a key role in creating value in our other business lines. |

Throughout the pandemic, we maintained steady liquidity by optimizing our capital structure. We entered into discussions with key suppliers to reduce our costs and adjust them to our revised network and fleet profiles. We were able to make significant adjustments to our working capital by extending our payment terms and managing other current assets and liabilities.

We were also able to raise new financing to continue to pay down short term maturities, while terming out the average maturity of our debt profile. In May and September 2021, we issued US$300.0 million and US$150.0 million in aggregate principal amount of additional 8.00% senior secured notes due 2026, respectively. In addition, in October 2021, we extended the amortization schedule of our debentures to October 2024. For further information on these financings, see note 16 to our audited consolidated financial statements included elsewhere in this annual report.

In addition, in 2021, we increased our equity capital by R$420.7 million from our controlling shareholder-led capital increase and by R$606.8 million from our merger of Smiles Fidelidade S.A., or Smiles, our loyalty program subsidiary.

We have been managing our business since the beginning of the pandemic, by matching cash inflows with outflows in an efficient manner. As of December 31, 2021, we had approximately R$1.7 billion in total liquidity and, including financeable amounts of deposits and unencumbered assets, our potential liquidity sources reached approximately R$3.1 billion. We will continue to seek to manage our negative working capital of R$8.4 billion, as of December 31, 2021, by reducing costs and rolling over and deferring short-term obligations with our suppliers and counterparties, most of which have been supportive of GOL during the course of the pandemic. For further information, see “Item 3. Key Information—D. Risk Factors—Risks Relating to Us and the Brazilian Airline Industry—We may not be able to maintain adequate liquidity and our cash flows from operations and financings may not be sufficient to meet our current obligations.”

| 16 |

Operating Data Highlights

The following tables set forth our main operating performance indicators as of the dates and for the periods presented:

|

December 31, | |||

|

2019 |

2020 |

2021 | |

| Operating aircraft at year end | 130 | 127 | 132 |

| Total aircraft at year end | 137 | 127 | 135 |

| Revenue passengers carried (in thousands)(1) | 36,445 | 16,701 | 18,848 |

| RPKs (in millions)(1) | 41,863 | 20,128 | 22,237 |

| ASKs (in millions)(1) | 51,065 | 25,144 | 27,132 |

| Load factor | 82.0% | 80.1% | 82.0% |

| Aircraft utilization (block hours per day) | 12.3 | 9.6 | 10.0 |

| Average fare (R$) | 359 | 345 | 357 |

| Passenger revenue yield per RPK (R$ cents) | 31.2 | 28.7 | 30.9 |

| PRASK (R$ cents) | 25.6 | 23.0 | 25.4 |

| RASK (R$ cents) | 27.2 | 25.3 | 27.4 |

| CASK (R$ cents) | 23.0 | 29.1 | 41.5 |

| CASK ex-fuel (R$ cents) | 15.1 | 21.1 | 31.8 |

| Adjusted CASK (R$ cents)(2) | 22.3 | 25.4 | 33.5 |

| Adjusted CASK ex-fuel (R$ cents)(2) | 14.4 | 17.4 | 23.8 |

| Departures | 259,377 | 124,528 | 133,902 |

| Departures per day | 711 | 340 | 367 |

| Average stage length (kilometers) | 1,114 | 1,152 | 1,137 |

| Active full-time equivalent employees at year end | 16,113 | 13,899 | 13,969 |

| Fuel liters consumed (in millions) | 1,475 | 722 | 751 |

| Average fuel expense per liter (R$) | 2.79 | 2.55 | 3.51 |

_____________

| (1) | Source: National Civil Aviation Agency (Agência Nacional de Aviação Civil), or ANAC. |

| (2) | We calculate adjusted CASK as CASK excluding non-recurring results, net and expenses related to fleet and labor idleness. |

Recent Developments

On January 3, 2022, the Brazilian Antitrust Authority (Conselho Administrativo de Defesa Econômica – CADE) approved our acquisition of Brazilian domestic airline MAP Linhas Aéreas, which acquisition we announced in June 2021. This acquisition is part of our expanding Brazilian domestic air travel services and will support us in taking advantage of the recovery in Brazilian domestic air travel.