1. General information |

12 Months Ended |

|---|---|

Dec. 31, 2018 | |

| General Information | |

| General information | 1. General information

Gol Linhas Aéreas Inteligentes S.A. (the “Company” or “GLAI”) is a publicly-listed company incorporated on March 12, 2004, under the Brazilian Corporate Law. According to the Bylaws, the Company’s main purpose is to exercise control of GOL Linhas Aéreas S.A. (“GLA”), formerly denominated VRG Linhas Aéreas S.A., or its successor, and, through its subsidiaries or associates, also explore:

· the regular and non-regular flight transportation services of passengers, cargo and mail, domestically or internationally, according to the concessions granted by the regulator; · other activities in relation to flight transportation services of passengers, cargo and mail; · services to maintain and repair its own or third-party’s aircraft, engines and parts; · airplane hangar services; · the development of other activities related or ancillary to flight transportation and other above-mentioned activities; · development of loyalty programs; and · holding shares in other companies’ capital stock, as a shareholder, partner or member.

The Company’s shares are traded on B3 S.A. - Brasil, Bolsa, Balcão (“B3”) and on the New York Stock Exchange (“NYSE”). The Company adopted Level 2 Differentiated Corporate Governance Practices from the B3 and is included in the Special Corporate Governance Stock Index (“IGC”) and the Special Tag Along Stock Index (“ITAG”), which were created for companies committed to apply differentiated corporate governance practices.

The Company’s corporate address is located at Praça Comandante Linneu Gomes, s/n, concierge 3, building 24, Jardim Aeroporto, São Paulo, Brazil.

1.1. Capital structure and net working capital

As of December 31, 2018, the Company’s deficit of shareholders’ equity totaled R$4,505,351 (R$3,088,521 as of December 31, 2017) and a had negative net working capital of R$3,889,721 (R$2,424,622 as of December 31, 2017). Both positions are mainly due to the depreciation of the Brazilian Real against the U.S. dollar (“US$”) over the difference between assets and liabilities, in 2015 and 2018 of 47.0% and 17.1%, respectively. The net working capital was also impacted by the payment terms with suppliers and increase in the volume of suppliers - forfaiting operations.

GLA is highly sensitive to the economy and also to the U.S. dollar, as approximately 50% of its costs are denominated in U.S. dollar and GLA’s capacity to adjust ticket prices charged to its clients in order to offset the U.S. dollar appreciation is dependent on capacity (offer) and ticket prices practiced by the competitors.

The Company implemented several initiatives to adjust its fleet size to the economy growth and match seat supply to demand, in order to maintain a high load factor, reduce costs and adjust its capital structure.

At the end of 2017, the Company executed initiatives to restructure its statement of financial position, consisting of lengthening of maturity terms and reducing the financial cost of its debt structure, as a result of an issuance of Senior Notes on December 11, 2017, which raised US$500 million, at interest rates of 7.1% per year, partially used to amortize debts with average interest rates of 9.8% per year.

In October 2018, the Company concluded the refinancing of the debentures issued by GLA, fully amortizing the amount of R$1,025,000 and issuing a new series of non-convertible, unsecured debentures in the amount of R$887,500, thus reducing net debt by R$137,500. The new debentures were issued with interest at 120.0% of the Interbank Deposit Certificate (“CDI”) rate, a significant reduction in relation to the amortized debt, at 132.0% of the CDI rate. This operation decrease the leverage of the Company’s statement of financial position and adjusted GLA’s operating cash flow generation with the amortizing of its liabilities.

The Company will continue strengthening its balance sheet management and results in order to guarantee sustainability, including the corporate reorganization described in Note 1.3. Management understands that the business plan prepared, presented and approved by the Board of Directors on January 17, 2019, shows strong elements to continue as going concern.

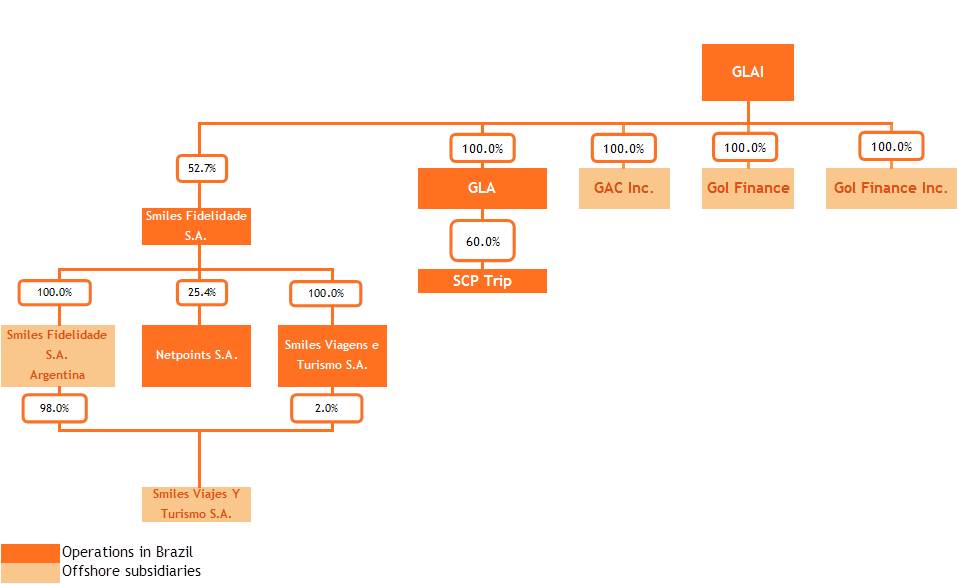

1.2. Ownership structure

The ownership structure of the Company and its subsidiaries as of December 31, 2018 is as follows:

As of November 7 and 20, 2018, through the subsidiary Smiles Fidelidade S.A. (“Smiles Fidelidade” previously denominated Webjet Participações S.A. before the change in its corporate name occurred on July 1st, 2017), the entity and subsidiary, Smiles Fidelidade S.A.( “Smiles Fidelidade Argentina”) and Smiles Viajes Y Turismo S.A. (“Smiles Viagens Argentina”) were respectively established, both headquartered in Buenos Aires, Argentina, with the purpose of promoting the operations of the Smiles Program and airline ticket sales in that country.

The Company was a direct parent company of Gol Dominicana Lineas Aereas SAS (“Gol Dominicana”) until September 14, 2018.

On August 10, 2017, the subsidiary Smiles Fidelidade acquired all the shares of Smiles Viagens e Turismo S.A. (“Smiles Viagens”), whose main purpose is to provide travel arrangement services, including the booking or sale of airline tickets, accommodations and vacation packages, among others. Smiles Viagens began its operations in January 2018.

1.3. Corporate reorganization plan - 2018

On October 14, 2018, the Company announced to the market a corporate reorganization comprising the intention to (i) not renew our services agreement with Smiles beyond its current expiration in 2032 and (ii) merge Smiles into GLA. Smiles has established an independent committee that will evaluate the terms of a potential transaction, if any. The Company cannot foresee if, when or on which terms a transaction may result from its negotiations with Smiles’ independent committee. Any transaction would be subject to approval by shareholders of the Company and Smiles, as well as regulatory approvals.

1.4. Corporate reorganization - 2017

On July 1, 2017, due to change in the organizational structure, and to generate tax savings from the use of tax losses carryforward, the Company approved a corporate restructuring through the merger of Smiles S.A. and Smiles Fidelidade S.A.. As a result of the merger, Smiles S.A. was dissolved and all its assets, rights and obligations were transferred to Smiles Fidelidade S.A., pursuant to articles 224, 225, 227 and 264 of the Brazilian Corporate Law.

1.5. Compliance program

Since 2016, the Company has taken several steps to strengthen and expand its internal control and compliance programs, including:

· hiring specialized companies in order to evaluate risks and review internal controls regarding frauds and corruptions; · integration of the risks functions, compliance and the internal controls through the Executive Board of Corporate Risks, Compliance and Internal Controls, reporting directly to the Company’s president, and independent access to the Board of Directors and the Statutory Audit Committee; · monitoring transactions involving politically exposed persons; · enhancement of its procedures of supervision of the execution of contracted services; · updating its procurement policies and flow of contracts management; · revising the code of ethics, manual of conduct and several compliance policies, including the mandatory training.

The senior management is constantly reinforcing to its employees, customers and suppliers its commitment to continue improving its internal control and compliance programs.

As previously disclosed in the financial statements for the year ended December 31, 2017, the Company entered into an agreement with the Brazilian Federal Public Ministry (the “Agreement”), under which the Company agreed to pay R$12.0 million in fines and make improvements to its compliance program along with the Federal Public Ministry on not to raise any charges related to activities that are the subject to the Agreement, in addition, the Company paid R$4.2 million in fines to the Brazilian tax authorities.

The Company voluntarily informed the U.S. Department of Justice (“DOJ”), the Securities and Exchange Commission (“SEC”) and the Brazilian Securities Commission (“CVM”) of the external independent investigation hired by the Company and the Agreement. The external independent investigation was concluded in April 2017. It revealed that certain immaterial payments were made to politically exposed persons. None of our current employees, representatives or members of our board or Management was knowledgeable of any illegal purpose behind any of the identified transactions or of any illicit benefit to the Company arising from the investigated transactions.

The Company reported the conclusions of the investigation to the relevant authorities and will keep them informed of the developments regarding this issue, as well as monitoring the analyses initiated by these bodies. These authorities may impose fines and possibly other sanctions to the Company. |