UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-21586

(Exact name of registrant as specified in charter)

120 East Liberty Drive, Suite 400

Wheaton, IL 60187

(Address of principal executive offices) (Zip code)

W. Scott Jardine, Esq.

First Trust Portfolios L.P.

120 East Liberty Drive, Suite 400

Wheaton, IL 60187

(Name and address of agent for service)

Registrant's telephone number, including area code: (630) 765-8000

Date of fiscal year end: December 31

Date of reporting period:

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget ("OMB") control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 100 F Street, NE, Washington, DC 20549. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Reports to Stockholders.

(a) The Report to Shareholders is attached herewith.

|

2

|

|

|

3

|

|

|

4

|

|

|

7

|

|

|

11

|

|

|

12

|

|

|

13

|

|

|

14

|

|

|

15

|

|

|

21

|

|

|

22

|

|

|

24

|

|

|

30

|

|

|

32

|

|

Fund Statistics

|

|

|

Symbol on New York Stock Exchange

|

FFA

|

|

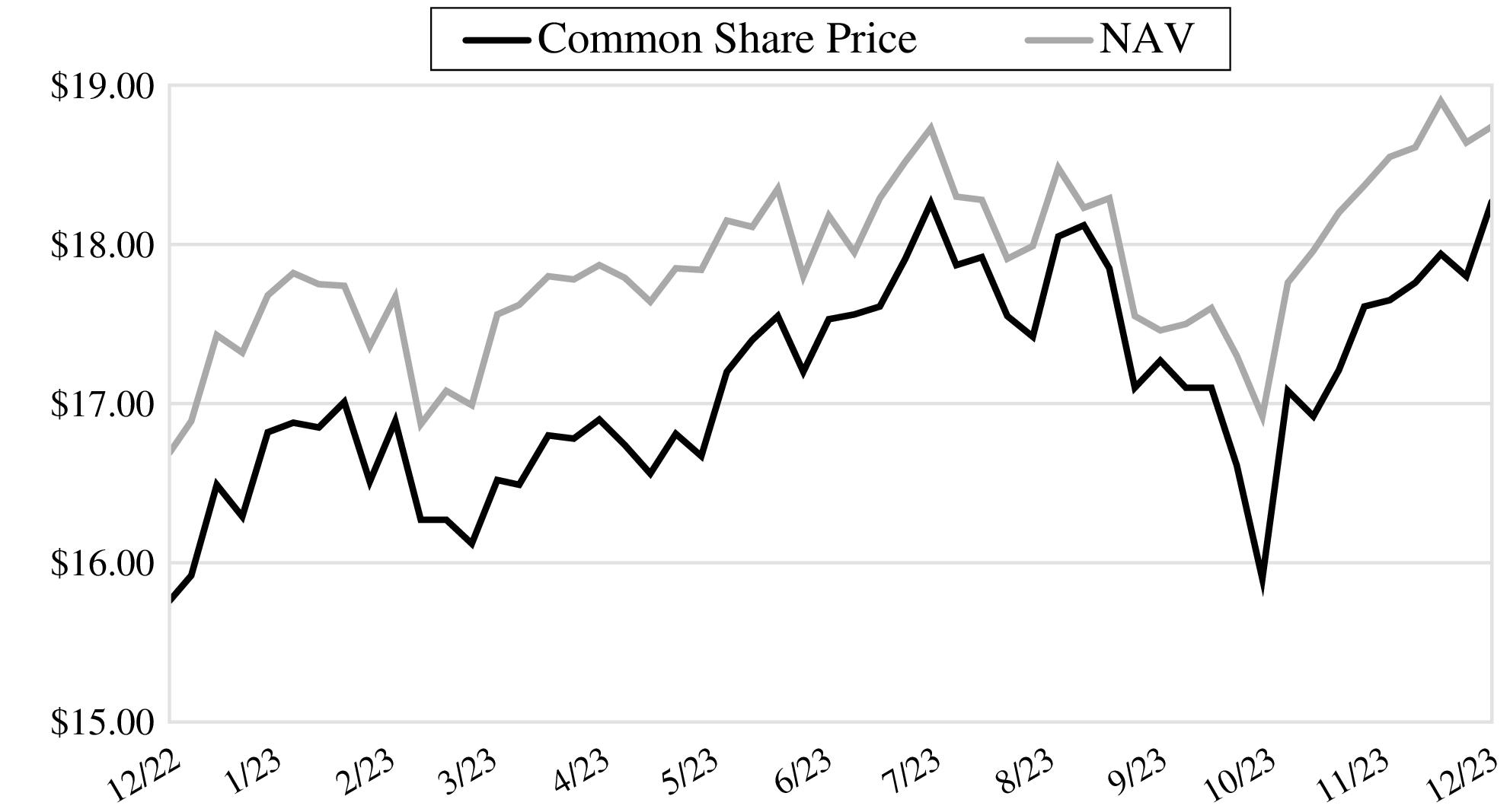

Common Share Price

|

$18.27

|

|

Common Share Net Asset Value (“NAV”)

|

$18.74

|

|

Premium (Discount) to NAV

|

(

)%

|

|

Net Assets Applicable to Common Shares

|

$374,568,902

|

|

Current Quarterly Distribution per Common Share(1)

|

$0.3150

|

|

Current Annualized Distribution per Common Share

|

$1.2600

|

|

Current Distribution Rate on Common Share Price(2)

|

6.90

%

|

|

Current Distribution Rate on NAV(2)

|

6.72

%

|

|

Performance

|

|

|

|

|

|

|

|

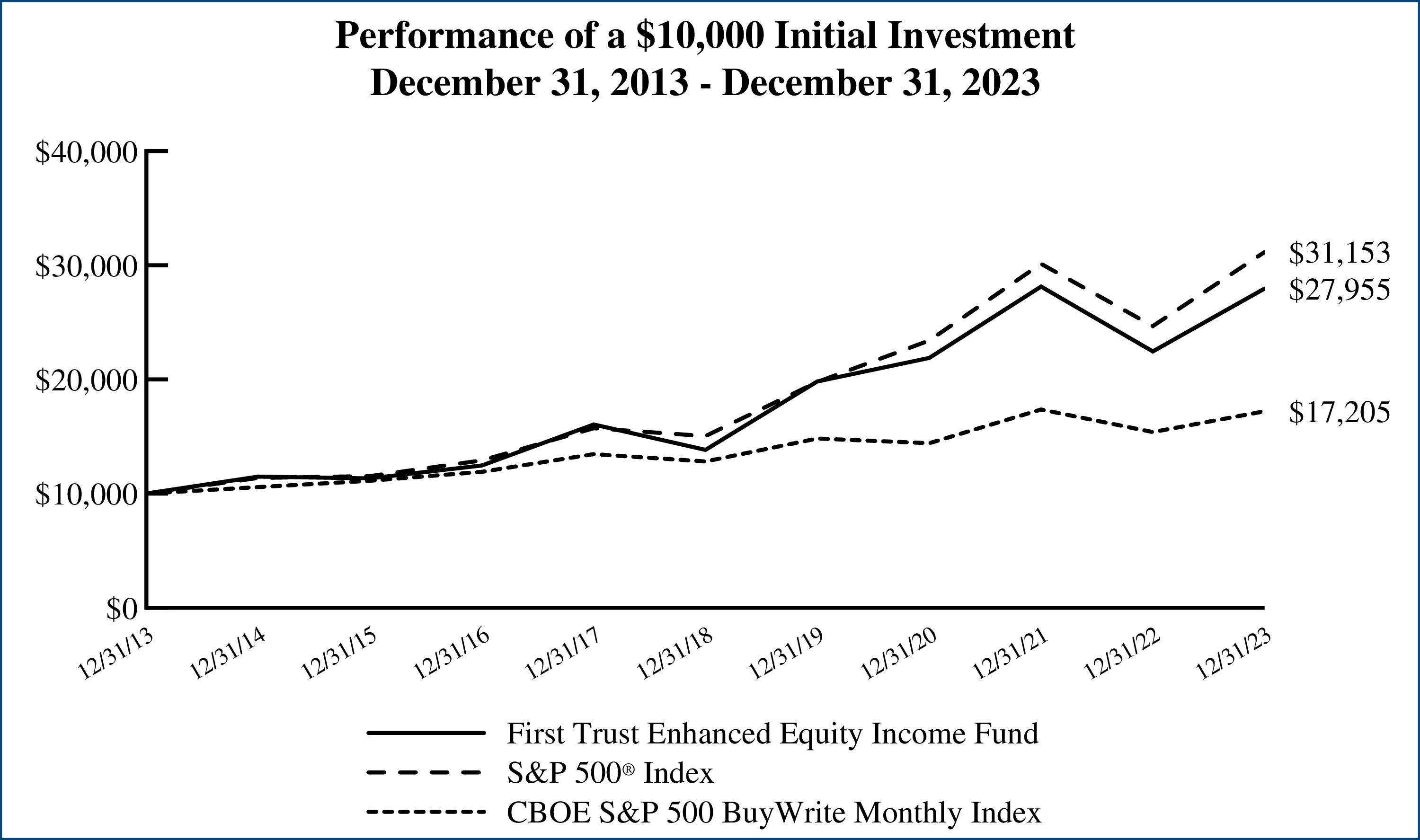

Average Annual Total Returns

|

||

|

|

1 Year Ended

12/31/23

|

5 Years Ended

12/31/23

|

10 Years Ended

12/31/23

|

Inception (8/26/04)

to 12/31/23

|

|

Fund Performance(3)

|

|

|

|

|

|

NAV

|

20.61

%

|

14.05

%

|

9.62

%

|

8.15

%

|

|

Market Value

|

24.53

%

|

15.12

%

|

10.83

%

|

7.75

%

|

|

Index Performance

|

|

|

|

|

|

S&P 500® Index

|

26.29

%

|

15.69

%

|

12.03

%

|

10.01

%

|

|

CBOE S&P 500 BuyWrite Monthly Index

|

11.82

%

|

6.08

%

|

5.58

%

|

5.30

%

|

|

Top Ten Holdings

|

% of Total

Investments

|

|

Microsoft Corp.

|

10.3%

|

|

Apple, Inc.

|

10.0

|

|

Alphabet, Inc., Class C

|

3.8

|

|

JPMorgan Chase & Co.

|

3.5

|

|

UnitedHealth Group, Inc.

|

2.4

|

|

Merck & Co., Inc.

|

2.2

|

|

AbbVie, Inc.

|

2.1

|

|

Coca-Cola (The) Co.

|

2.0

|

|

Arthur J. Gallagher & Co.

|

1.9

|

|

Danaher Corp.

|

1.9

|

|

Total

|

40.1%

|

|

Sector Allocation

|

% of Total

Investments

|

|

Information Technology

|

31.8%

|

|

Financials

|

14.0

|

|

Health Care

|

13.1

|

|

Consumer Discretionary

|

8.3

|

|

Communication Services

|

8.3

|

|

Consumer Staples

|

6.6

|

|

Industrials

|

6.0

|

|

Energy

|

4.2

|

|

Materials

|

3.1

|

|

Real Estate

|

2.5

|

|

Utilities

|

2.1

|

|

Total

|

100.0%

|

|

Fund Allocation

|

% of Net Assets

|

|

Common Stocks

|

97.7%

|

|

Common Stocks - Business Development Companies

|

1.2

|

|

Call Options Written

|

(0.2)

|

|

Net Other Assets and Liabilities

|

1.3

|

|

Total

|

100.0%

|

|

Performance Analysis

|

|

|

|

|

|

|

|

Average Annual Total Returns

|

||

|

|

1 Year Ended

12/31/23

|

5 Years Ended

12/31/23

|

10 Years Ended

12/31/23

|

Inception (8/26/04)

to 12/31/23

|

|

Fund Performance(1)

|

|

|

|

|

|

NAV

|

20.61

%

|

14.05

%

|

9.62

%

|

8.15

%

|

|

Market Value

|

24.53

%

|

15.12

%

|

10.83

%

|

7.75

%

|

|

Index Performance

|

|

|

|

|

|

S&P 500® Index

|

26.29

%

|

15.69

%

|

12.03

%

|

10.01

%

|

|

CBOE S&P 500 BuyWrite Monthly Index

|

11.82

%

|

6.08

%

|

5.58

%

|

5.30

%

|

|

Shares

|

Description

|

Value

|

|

COMMON STOCKS – 97.7%

|

||

|

|

Air Freight & Logistics – 1.4%

|

|

|

21,000

|

FedEx Corp. (a) (b)

|

$5,312,370

|

|

|

Automobiles – 0.7%

|

|

|

75,000

|

General Motors Co. (a) (b)

|

2,694,000

|

|

|

Banks – 6.3%

|

|

|

350,000

|

Huntington Bancshares, Inc. (a)

|

4,452,000

|

|

76,000

|

JPMorgan Chase & Co. (a)

|

12,927,600

|

|

17,500

|

PNC Financial Services Group (The), Inc. (a)

|

2,709,875

|

|

100,000

|

Truist Financial Corp.

|

3,692,000

|

|

|

|

23,781,475

|

|

|

Beverages – 3.2%

|

|

|

125,000

|

Coca-Cola (The) Co. (a)

|

7,366,250

|

|

18,500

|

Constellation Brands, Inc., Class A (a)

|

4,472,375

|

|

|

|

11,838,625

|

|

|

Biotechnology – 2.1%

|

|

|

51,000

|

AbbVie, Inc. (a)

|

7,903,470

|

|

|

Broadline Retail – 1.6%

|

|

|

40,500

|

Amazon.com, Inc. (a) (c)

|

6,153,570

|

|

|

Capital Markets – 2.3%

|

|

|

10,000

|

Goldman Sachs Group (The), Inc.

|

3,857,700

|

|

52,500

|

Morgan Stanley

|

4,895,625

|

|

|

|

8,753,325

|

|

|

Chemicals – 2.5%

|

|

|

15,000

|

Air Products and Chemicals, Inc.

|

4,107,000

|

|

16,500

|

Sherwin-Williams (The) Co. (a)

|

5,146,350

|

|

|

|

9,253,350

|

|

|

Communications Equipment – 1.6%

|

|

|

117,500

|

Cisco Systems, Inc. (a)

|

5,936,100

|

|

|

Consumer Staples Distribution & Retail – 1.7%

|

|

|

9,800

|

Costco Wholesale Corp. (b)

|

6,468,784

|

|

|

Diversified Telecommunication Services – 1.4%

|

|

|

112,500

|

AT&T, Inc. (a)

|

1,887,750

|

|

85,000

|

Verizon Communications, Inc. (a)

|

3,204,500

|

|

|

|

5,092,250

|

|

|

Electric Utilities – 2.0%

|

|

|

42,500

|

American Electric Power Co., Inc.

|

3,451,850

|

|

155,000

|

PPL Corp. (a)

|

4,200,500

|

|

|

|

7,652,350

|

|

|

Entertainment – 2.0%

|

|

|

90,000

|

Cinemark Holdings, Inc. (c)

|

1,268,100

|

|

15,000

|

Electronic Arts, Inc. (a)

|

2,052,150

|

|

200,000

|

Lions Gate Entertainment Corp., Class B (c)

|

2,038,000

|

|

14,000

|

Take-Two Interactive Software, Inc. (a) (c)

|

2,253,300

|

|

|

|

7,611,550

|

|

|

Financial Services – 0.4%

|

|

|

24,000

|

PayPal Holdings, Inc. (a) (c)

|

1,473,840

|

|

Shares

|

Description

|

Value

|

|

COMMON STOCKS (Continued)

|

||

|

|

Ground Transportation – 1.5%

|

|

|

70,000

|

Canadian Pacific Kansas City, Ltd.

|

$5,534,200

|

|

|

Health Care Equipment & Supplies – 0.8%

|

|

|

53,626

|

Boston Scientific Corp. (c)

|

3,100,119

|

|

|

Health Care Providers & Services – 2.4%

|

|

|

16,800

|

UnitedHealth Group, Inc. (a) (b)

|

8,844,696

|

|

|

Hotels, Restaurants & Leisure – 3.9%

|

|

|

68,000

|

Carnival Corp. (a) (b) (c)

|

1,260,720

|

|

10,000

|

Domino’s Pizza, Inc. (a)

|

4,122,300

|

|

90,000

|

Las Vegas Sands Corp. (a)

|

4,428,900

|

|

52,000

|

Restaurant Brands International, Inc.

|

4,062,760

|

|

31,500

|

Six Flags Entertainment Corp. (a) (c)

|

790,020

|

|

|

|

14,664,700

|

|

|

Industrial Conglomerates – 1.6%

|

|

|

29,000

|

Honeywell International, Inc. (a)

|

6,081,590

|

|

|

Insurance – 3.6%

|

|

|

31,500

|

Arthur J. Gallagher & Co. (a)

|

7,083,720

|

|

28,500

|

Chubb, Ltd.

|

6,441,000

|

|

|

|

13,524,720

|

|

|

Interactive Media & Services – 3.8%

|

|

|

100,000

|

Alphabet, Inc., Class C (a) (c)

|

14,093,000

|

|

|

IT Services – 1.4%

|

|

|

31,500

|

International Business Machines Corp. (a)

|

5,151,825

|

|

|

Life Sciences Tools & Services – 3.5%

|

|

|

29,800

|

Danaher Corp. (b)

|

6,893,932

|

|

12,000

|

Thermo Fisher Scientific, Inc. (a)

|

6,369,480

|

|

|

|

13,263,412

|

|

|

Machinery – 1.4%

|

|

|

18,000

|

Caterpillar, Inc. (b)

|

5,322,060

|

|

|

Metals & Mining – 0.6%

|

|

|

54,000

|

Freeport-McMoRan, Inc. (a)

|

2,298,780

|

|

|

Oil, Gas & Consumable Fuels – 4.2%

|

|

|

33,000

|

Diamondback Energy, Inc. (a)

|

5,117,640

|

|

50,000

|

Exxon Mobil Corp. (a)

|

4,999,000

|

|

39,000

|

Hess Corp. (a)

|

5,622,240

|

|

|

|

15,738,880

|

|

|

Pharmaceuticals – 4.2%

|

|

|

5,000

|

Eli Lilly & Co. (a) (b)

|

2,914,600

|

|

76,000

|

Merck & Co., Inc. (a)

|

8,285,520

|

|

22,000

|

Zoetis, Inc. (a)

|

4,342,140

|

|

|

|

15,542,260

|

|

|

Semiconductors & Semiconductor Equipment – 5.9%

|

|

|

5,000

|

Broadcom, Inc. (b)

|

5,581,250

|

|

119,000

|

Intel Corp. (a) (b)

|

5,979,750

|

|

47,000

|

Micron Technology, Inc. (b)

|

4,010,980

|

|

13,000

|

NVIDIA Corp. (a)

|

6,437,860

|

|

|

|

22,009,840

|

|

Shares

|

Description

|

Value

|

|

COMMON STOCKS (Continued)

|

||

|

|

Software – 12.7%

|

|

|

7,000

|

Adobe, Inc. (a) (c)

|

$4,176,200

|

|

101,300

|

Microsoft Corp. (a)

|

38,092,852

|

|

10,000

|

Synopsys, Inc. (a) (b) (c)

|

5,149,100

|

|

|

|

47,418,152

|

|

|

Specialized REITs – 2.5%

|

|

|

34,000

|

Crown Castle, Inc. (a)

|

3,916,460

|

|

107,000

|

Gaming and Leisure Properties, Inc. (a)

|

5,280,450

|

|

|

|

9,196,910

|

|

|

Technology Hardware, Storage & Peripherals – 9.9%

|

|

|

192,500

|

Apple, Inc. (a)

|

37,062,025

|

|

|

Textiles, Apparel & Luxury Goods – 2.0%

|

|

|

41,000

|

NIKE, Inc., Class B (a)

|

4,451,370

|

|

80,000

|

Tapestry, Inc.

|

2,944,800

|

|

|

|

7,396,170

|

|

|

Tobacco – 1.6%

|

|

|

64,000

|

Philip Morris International, Inc. (a)

|

6,021,120

|

|

|

Wireless Telecommunication Services – 1.0%

|

|

|

23,500

|

T-Mobile US, Inc. (a)

|

3,767,755

|

|

|

Total Common Stocks

|

365,957,273

|

|

|

(Cost $256,412,723)

|

|

|

COMMON STOCKS – BUSINESS DEVELOPMENT COMPANIES – 1.2%

|

||

|

|

Capital Markets – 1.2%

|

|

|

215,000

|

Ares Capital Corp. (a)

|

4,306,450

|

|

|

(Cost $3,728,891)

|

|

|

|

Total Investments – 98.9%

|

370,263,723

|

|

|

(Cost $260,141,614)

|

|

|

Number of

Contracts

|

Description

|

Notional

Amount

|

Exercise

Price

|

Expiration

Date

|

Value

|

|

WRITTEN OPTIONS – (0.2)%

|

|||||

|

|

Call Options Written – (0.2)%

|

|

|

|

|

|

(10

)

|

Broadcom, Inc.

|

$(1,116,250

)

|

$1,170.00

|

01/19/24

|

(7,900

)

|

|

(170

)

|

Carnival Corp.

|

(315,180

)

|

19.00

|

01/19/24

|

(9,010

)

|

|

(170

)

|

Carnival Corp.

|

(315,180

)

|

20.00

|

01/19/24

|

(3,910

)

|

|

(170

)

|

Carnival Corp.

|

(315,180

)

|

21.00

|

01/19/24

|

(1,870

)

|

|

(60

)

|

Caterpillar, Inc.

|

(1,774,020

)

|

310.00

|

01/19/24

|

(8,460

)

|

|

(20

)

|

Costco Wholesale Corp.

|

(1,320,160

)

|

605.00

|

01/19/24

|

(117,900

)

|

|

(50

)

|

Danaher Corp.

|

(1,156,700

)

|

240.00

|

01/19/24

|

(11,500

)

|

|

(15

)

|

Eli Lilly & Co.

|

(874,380

)

|

610.00

|

01/19/24

|

(7,200

)

|

|

(40

)

|

FedEx Corp.

|

(1,011,880

)

|

300.00

|

01/19/24

|

(440

)

|

|

(250

)

|

General Motors Co.

|

(898,000

)

|

35.00

|

01/19/24

|

(36,750

)

|

|

(400

)

|

Intel Corp.

|

(2,010,000

)

|

50.00

|

01/19/24

|

(65,600

)

|

|

(100

)

|

Micron Technology, Inc.

|

(853,400

)

|

85.00

|

01/19/24

|

(24,300

)

|

|

(100

)

|

Micron Technology, Inc.

|

(853,400

)

|

90.00

|

01/19/24

|

(6,300

)

|

|

(50

)

|

S&P 500® Index (d)

|

(23,849,150

)

|

4,875.00

|

01/19/24

|

(66,900

)

|

|

(200

)

|

S&P 500® Index (d)

|

(95,396,600

)

|

4,900.00

|

01/19/24

|

(158,000

)

|

|

(250

)

|

S&P 500® Index (d)

|

(119,245,750

)

|

4,925.00

|

01/19/24

|

(135,000

)

|

|

(25

)

|

Synopsys, Inc.

|

(1,287,275

)

|

590.00

|

01/19/24

|

(2,062

)

|

|

Number of

Contracts

|

Description

|

Notional

Amount

|

Exercise

Price

|

Expiration

Date

|

Value

|

|

WRITTEN OPTIONS (Continued)

|

|||||

|

|

Call Options Written (Continued)

|

|

|

|

|

|

(40

)

|

UnitedHealth Group, Inc.

|

$(2,105,880

)

|

$570.00

|

01/19/24

|

$(2,680

)

|

|

|

Total Written Options

|

(665,782

)

|

|||

|

|

(Premiums received $614,098)

|

|

|

|

|

|

|

Net Other Assets and Liabilities – 1.3%

|

4,970,961

|

|

|

Net Assets – 100.0%

|

$374,568,902

|

|

(a)

|

All or a portion of these securities are pledged to cover index call options written. At December 31, 2023, the segregated

value of

these securities amounts to $240,644,643.

|

|

(b)

|

All or a portion of this security’s position represents cover for outstanding options written.

|

|

(c)

|

Non-income producing security.

|

|

(d)

|

Call options on securities indices were written on a portion of the common stock positions that were not used to cover call

options

written on individual equity securities held in the Fund’s portfolio.

|

|

ASSETS TABLE

|

||||

|

|

Total

Value at

12/31/2023

|

Level 1

Quoted

Prices

|

Level 2

Significant

Observable

Inputs

|

Level 3

Significant

Unobservable

Inputs

|

|

Common Stocks*

|

$365,957,273

|

$365,957,273

|

$—

|

$—

|

|

Common Stocks - Business Development Companies*

|

4,306,450

|

4,306,450

|

—

|

—

|

|

Total Investments

|

$370,263,723

|

$370,263,723

|

$—

|

$—

|

|

|

||||

|

LIABILITIES TABLE

|

||||

|

|

Total

Value at

12/31/2023

|

Level 1

Quoted

Prices

|

Level 2

Significant

Observable

Inputs

|

Level 3

Significant

Unobservable

Inputs

|

|

Written Options

|

$(665,782

)

|

$(663,720

)

|

$(2,062

)

|

$—

|

|

*

|

See Portfolio of Investments for industry breakout.

|

|

ASSETS:

|

|

|

Investments, at value

|

$370,263,723

|

|

Cash

|

4,289,101

|

|

Receivables:

|

|

|

Investment securities sold

|

4,450,024

|

|

Dividends

|

540,661

|

|

Reclaims

|

2,860

|

|

Prepaid expenses

|

2,851

|

|

Total Assets

|

379,549,220

|

|

LIABILITIES:

|

|

|

Options contracts written, at value

|

665,782

|

|

Payables:

|

|

|

Investment securities purchased

|

3,872,289

|

|

Investment advisory fees

|

317,847

|

|

Audit and tax fees

|

47,784

|

|

Shareholder reporting fees

|

31,606

|

|

Custodian fees

|

17,738

|

|

Administrative fees

|

17,107

|

|

Legal fees

|

5,148

|

|

Transfer agent fees

|

1,645

|

|

Financial reporting fees

|

771

|

|

Trustees’ fees and expenses

|

56

|

|

Other liabilities

|

2,545

|

|

Total Liabilities

|

4,980,318

|

|

NET ASSETS

|

$374,568,902

|

|

NET ASSETS consist of:

|

|

|

Paid-in capital

|

$263,987,224

|

|

Par value

|

199,881

|

|

Accumulated distributable earnings (loss)

|

110,381,797

|

|

NET ASSETS

|

$374,568,902

|

|

NET ASSET VALUE, per Common Share (par value $0.01 per Common Share)

|

$18.74

|

|

Number of

|

|

|

Investments, at cost

|

$260,141,614

|

|

Premiums received on options contracts written

|

$614,098

|

|

INVESTMENT INCOME:

|

|

|

|

Dividends

|

$6,930,773

|

|

|

Interest

|

145,492

|

|

|

Foreign withholding tax

|

(26,976

)

|

|

|

Other

|

6,941

|

|

|

Total investment income

|

7,056,230

|

|

|

EXPENSES:

|

|

|

|

Investment advisory fees

|

3,570,398

|

|

|

Administrative fees

|

160,901

|

|

|

Legal fees

|

130,712

|

|

|

Shareholder reporting fees

|

110,109

|

|

|

Audit and tax fees

|

55,247

|

|

|

Custodian fees

|

26,343

|

|

|

Listing expense

|

23,768

|

|

|

Trustees’ fees and expenses

|

20,387

|

|

|

Transfer agent fees

|

18,559

|

|

|

Financial reporting fees

|

9,250

|

|

|

Other

|

18,919

|

|

|

Total expenses

|

4,144,593

|

|

|

NET INVESTMENT INCOME (LOSS)

|

2,911,637

|

|

|

NET REALIZED AND UNREALIZED GAIN (LOSS):

|

|

|

|

Net realized gain (loss) on:

|

|

|

|

Investments

|

29,432,236

|

|

|

Written options contracts

|

(4,508,052

)

|

|

|

Foreign currency transactions

|

32

|

|

|

Net realized gain (loss)

|

24,924,216

|

|

|

Net change in unrealized appreciation (depreciation) on:

|

|

|

|

Investments

|

38,392,943

|

|

|

Written options contracts

|

6,767

|

|

|

Foreign currency translation

|

(58

)

|

|

|

Net change in unrealized appreciation (depreciation)

|

38,399,652

|

|

|

NET REALIZED AND UNREALIZED GAIN (LOSS)

|

63,323,868

|

|

|

NET INCREASE (DECREASE) IN NET ASSETS RESULTING FROM OPERATIONS

|

$66,235,505

|

|

|

|

Year

Ended

12/31/2023

|

Year

Ended

12/31/2022

|

|

OPERATIONS:

|

|

|

|

Net investment income (loss)

|

$2,911,637

|

$2,929,934

|

|

Net realized gain (loss)

|

24,924,216

|

18,412,142

|

|

Net change in unrealized appreciation (depreciation)

|

38,399,652

|

(89,978,856

)

|

|

Net increase (decrease) in net assets resulting from operations

|

66,235,505

|

(68,636,780

)

|

|

DISTRIBUTIONS TO SHAREHOLDERS FROM:

|

|

|

|

Investment operations

|

(25,184,987

)

|

(25,183,334

)

|

|

CAPITAL TRANSACTIONS:

|

|

|

|

Proceeds from Common Shares reinvested

|

—

|

105,150

|

|

Net increase (decrease) in net assets resulting from capital transactions

|

—

|

105,150

|

|

Total increase (decrease) in net assets

|

41,050,518

|

(93,714,964

)

|

|

NET ASSETS:

|

|

|

|

Beginning of period

|

333,518,384

|

427,233,348

|

|

End of period

|

$374,568,902

|

$333,518,384

|

|

CAPITAL TRANSACTIONS were as follows:

|

|

|

|

Common Shares at beginning of period

|

19,988,085

|

19,982,838

|

|

Common Shares issued as reinvestment under the Dividend Reinvestment Plan

|

—

|

5,247

|

|

Common Shares at end of period

|

19,988,085

|

19,988,085

|

|

|

Year Ended December 31,

|

||||

|

2023

|

2022

|

2021

|

2020

|

2019

|

|

|

Net asset value, beginning of period

|

$16.69

|

$21.38

|

$18.29

|

$16.92

|

$13.89

|

|

Income from investment operations:

|

|

|

|

|

|

|

Net investment income (loss)

|

0.15

(a)

|

0.15

|

0.07

|

0.12

|

0.17

|

|

Net realized and unrealized gain (loss)

|

3.16

|

(3.58

)

|

4.28

(b)

|

2.39

|

4.00

|

|

Total from investment operations

|

3.31

|

(3.43

)

|

4.35

|

2.51

|

4.17

|

|

Distributions paid to shareholders from:

|

|

|

|

|

|

|

Net investment income

|

(0.29

)

|

—

|

(0.18

)

|

(0.08

)

|

(0.14

)

|

|

Net realized gain

|

(0.97

)

|

(1.26

)

|

(1.08

)

|

(1.06

)

|

(1.00

)

|

|

Total distributions paid to Common Shareholders

|

(1.26

)

|

(1.26

)

|

(1.26

)

|

(1.14

)

|

(1.14

)

|

|

Net asset value, end of period

|

$

|

$16.69

|

$21.38

|

$18.29

|

$16.92

|

|

Market value, end of period

|

$

|

$15.76

|

$21.29

|

$17.62

|

$17.25

|

|

Total return based on net asset value (c)

|

20.61

%

|

(15.84

)%

|

24.38

%(b)

|

16.84

%

|

30.78

%

|

|

Total return based on market value (c)

|

24.53

%

|

(20.19

)%

|

28.56

%

|

10.41

%

|

43.34

%

|

|

Ratios to average net assets/supplemental data:

|

|

|

|

|

|

|

Net assets, end of period (in 000’s)

|

$374,569

|

$333,518

|

$427,233

|

$365,432

|

$338,198

|

|

Ratio of total expenses to average net assets

|

1.16

%

|

1.13

%

|

1.12

%

|

1.15

%

|

1.14

%

|

|

Ratio of net investment income (loss) to average net assets

|

0.82

%

|

0.81

%

|

0.39

%

|

0.77

%

|

1.08

%

|

|

Portfolio turnover rate

|

26

%

|

21

%

|

14

%

|

20

%

|

37

%

|

|

(a)

|

Based on average shares outstanding.

|

|

(b)

|

The Fund received a reimbursement from Chartwell in the amount of $17,250, which represents less than $0.01 per share. Since

the Fund was reimbursed, there was no effect on the Fund’s total return.

|

|

(c)

|

Total return is based on the combination of reinvested dividend, capital gain and return of capital distributions, if any,

at prices

obtained by the Dividend Reinvestment Plan, and changes in net asset value per share for net asset value returns and changes

in

Common Share Price for market value returns. Total returns do not reflect sales load and are not annualized for periods of

less

than one year. Past performance is not indicative of future results.

|

|

Distributions paid from:

|

2023

|

2022

|

|

Ordinary income

|

$7,101,632

|

$132,172

|

|

Capital gains

|

18,083,355

|

25,051,162

|

|

Return of capital

|

—

|

—

|

|

Undistributed ordinary income

|

$—

|

|

Undistributed capital gains

|

—

|

|

Total undistributed earnings

|

—

|

|

Accumulated capital and other losses

|

5,503,943

|

|

Net unrealized appreciation (depreciation)

|

104,877,854

|

|

Total accumulated earnings (losses)

|

110,381,797

|

|

Other

|

—

|

|

Paid-in capital

|

264,187,105

|

|

Total net assets

|

$374,568,902

|

|

Tax Cost

|

Gross

Unrealized

Appreciation

|

Gross

Unrealized

(Depreciation)

|

Net Unrealized

Appreciation

(Depreciation)

|

|

$264,720,058

|

$121,089,815

|

$(16,211,932)

|

$104,877,883

|

|

|

|

Asset Derivatives

|

Liability Derivatives

|

||

|

Derivative

Instrument

|

Risk

Exposure

|

Statement of Assets and

Liabilities Location

|

Value

|

Statement of Assets and

Liabilities Location

|

Value

|

|

Written Options

|

Equity Risk

|

—

|

$—

|

Options written, at value

|

$665,782

|

|

Statement of Operations Location

|

|

|

Equity Risk Exposure

|

|

|

Net realized gain (loss) on written options contracts

|

$(4,508,052

)

|

|

Net change in unrealized appreciation (depreciation) on written options contracts

|

6,767

|

|

NOT FDIC INSURED

|

NOT BANK GUARANTEED

|

MAY LOSE VALUE

|

|

Name, Year of Birth and

Position with the Fund

|

Term of Office

and Year First

Elected or

Appointed(1)

|

Principal Occupations

During Past 5 Years

|

Number of

Portfolios in

the First Trust

Fund Complex

Overseen by

Trustee

|

Other Trusteeships or

Directorships Held by

Trustee During Past 5 Years

|

|

INDEPENDENT TRUSTEES

|

||||

|

Richard E. Erickson, Trustee

(1951)

|

• Three Year

Term

• Since Fund

Inception

|

Retired; Physician, Edward-Elmhurst

Medical Group (2021 to September

2023); Physician and Officer,

Wheaton Orthopedics (1990 to 2021)

|

257

|

None

|

|

Thomas R. Kadlec, Trustee

(1957)

|

• Three Year

Term

• Since Fund

Inception

|

Retired; President, ADM Investor

Services, Inc. (Futures Commission

Merchant) (2010 to July 2022)

|

257

|

Director, National Futures

Association and ADMIS

Singapore Ltd.; Formerly,

Director of ADM Investor

Services, Inc., ADM Investor

Services International,

ADMIS Hong Kong Ltd., and

Futures Industry Association

|

|

Denise M. Keefe, Trustee

(1964)

|

• Three Year

Term

• Since 2021

|

Executive Vice President, Advocate

Aurora Health and President,

Advocate Aurora Continuing Health

Division (Integrated Healthcare

System)

|

257

|

Director and Board Chair of

Advocate Home Health

Services, Advocate Home

Care Products and Advocate

Hospice; Director and Board

Chair of Aurora At Home

(since 2018); Director of

Advocate Physician Partners

Accountable Care

Organization; Director of

RML Long Term Acute Care

Hospitals; Director of Senior

Helpers (since 2021); and

Director of MobileHelp

(since 2022)

|

|

Robert F. Keith, Trustee

(1956)

|

• Three Year

Term

• Since June

2006

|

President, Hibs Enterprises (Financial

and Management Consulting)

|

257

|

Formerly, Director of Trust

Company of Illinois

|

|

Niel B. Nielson, Trustee

(1954)

|

• Three Year

Term

• Since Fund

Inception

|

Senior Advisor (2018 to Present),

Managing Director and Chief

Operating Officer (2015 to 2018),

Pelita Harapan Educational

Foundation (Educational Products and

Services)

|

257

|

None

|

|

Name, Year of Birth and

Position with the Fund

|

Term of Office

and Year First

Elected or

Appointed(1)

|

Principal Occupations

During Past 5 Years

|

Number of

Portfolios in

the First Trust

Fund Complex

Overseen by

Trustee

|

Other Trusteeships or

Directorships Held by

Trustee During Past 5 Years

|

|

INDEPENDENT TRUSTEES

|

||||

|

Bronwyn Wright, Trustee

(1971)

|

• Three Year

Term

• Since 2023

|

Independent Director to a number of

Irish collective investment funds

(2009 to Present); Various roles at

international affiliates of Citibank

(1994 to 2009), including Managing

Director, Citibank Europe plc and

Head of Securities and Fund Services,

Citi Ireland (2007 to 2009)

|

233

|

None

|

|

INTERESTED TRUSTEE

|

||||

|

James A. Bowen(2), Trustee and

Chairman of the Board

(1955)

|

• Three Year

Term

• Since Fund

Inception

|

Chief Executive Officer, First Trust

Advisors L.P. and First Trust

Portfolios L.P.; Chairman of the

Board of Directors, BondWave LLC

(Software Development Company)

and Stonebridge Advisors LLC

(Investment Advisor)

|

257

|

None

|

|

Name and Year of Birth

|

Position and Offices

with Fund

|

Term of Office

and Length of

Service

|

Principal Occupations

During Past 5 Years

|

|

OFFICERS(3)

|

|||

|

James M. Dykas

(1966)

|

President and Chief

Executive Officer

|

• Indefinite Term

• Since 2016

|

Managing Director and Chief Financial Officer, First Trust

Advisors L.P. and First Trust Portfolios L.P.; Chief Financial

Officer, BondWave LLC (Software Development Company) and

Stonebridge Advisors LLC (Investment Advisor)

|

|

Derek D. Maltbie

(1972)

|

Treasurer, Chief Financial

Officer and Chief

Accounting Officer

|

• Indefinite Term

• Since 2023

|

Senior Vice President, First Trust Advisors L.P. and First Trust

Portfolios L.P., July 2021 to Present. Previously, Vice President,

First Trust Advisors L.P. and First Trust Portfolios L.P., 2014 to

2021.

|

|

W. Scott Jardine

(1960)

|

Secretary and Chief Legal

Officer

|

• Indefinite Term

• Since Fund

Inception

|

General Counsel, First Trust Advisors L.P. and First Trust

Portfolios L.P.; Secretary and General Counsel, BondWave LLC;

Secretary, Stonebridge Advisors LLC

|

|

Daniel J. Lindquist

(1970)

|

Vice President

|

• Indefinite Term

• Since December

2005

|

Managing Director, First Trust Advisors L.P. and First Trust

Portfolios L.P.

|

|

Kristi A. Maher

(1966)

|

Chief Compliance Officer

and Assistant Secretary

|

• Indefinite Term

• Chief

Compliance

Officer Since

January 2011

• Assistant

Secretary Since

Fund Inception

|

Deputy General Counsel, First Trust Advisors L.P. and First Trust

Portfolios L.P.

|

(b) Not applicable.

Item 2. Code of Ethics.

| (a) | The registrant, as of the end of the period covered by this report, has adopted a code of ethics that applies to the registrant’s principal executive officer, principal financial officer, principal accounting officer or controller, or persons performing similar functions, regardless of whether these individuals are employed by the registrant or a third party. |

| (c) | There have been no amendments, during the period covered by this report, to a provision of the code of ethics that applies to the registrant’s principal executive officer, principal financial officer, principal accounting officer or controller, or persons performing similar functions, regardless of whether these individuals are employed by the registrant or a third party, and that relates to any element of the code of ethics description. |

| (d) | The registrant has not granted any waivers, including an implicit waiver, from a provision of the code of ethics that applies to the registrant’s principal executive officer, principal financial officer, principal accounting officer or controller, or persons performing similar functions, regardless of whether these individuals are employed by the registrant or a third party, that relates to one or more of the items set forth in paragraph (b) of this item’s instructions. |

| (e) | Not applicable. |

| (f) | A copy of the code of ethics that applies to the registrant’s principal executive officer, principal financial officer, principal accounting officer or controller is filed as an exhibit pursuant to Item 13(a)(1). |

Item 3. Audit Committee Financial Expert.

As of the end of the period covered by the report, the registrant’s board of trustees has determined that Thomas R. Kadlec, Robert F. Keith and Bronwyn Wright are qualified to serve as audit committee financial experts serving on its audit committee and that each of them is “independent,” as defined by Item 3 of Form N-CSR.

Item 4. Principal Accountant Fees and Services.

(a) Audit Fees (Registrant) — The aggregate fees billed for each of the last two fiscal years for professional services rendered by the principal accountant for the audit of the registrant’s annual financial statements or services that are normally provided by the accountant in connection with statutory and regulatory filings or engagements were $40,000 for 2022 and $40,000 for 2023.

(b) Audit-Related Fees (Registrant) — The aggregate fees billed in each of the last two fiscal years, for assurance and related services by the principal accountant that are reasonably related to the performance of the audit of the registrant’s financial statements and are not reported under paragraph (a) of this Item were $0 for 2022 and $0 for 2023.

Audit-Related Fees (Investment Advisor) — The aggregate fees billed in each of the last two fiscal years of the registrant for assurance and related services by the principal accountant that are reasonably related to the performance of the audit of the registrant’s financial statements and are not reported under paragraph (a) of this Item were $0 for 2022 and $0 for 2023.

(c) Tax Fees (Registrant) — The aggregate fees billed in each of the last two fiscal years for professional services rendered by the principal accountant for tax compliance, tax advice, and tax planning to the registrant were $16,250 for 2022 and $21,094 for 2023. These fees were for tax consultation and/or tax return preparation and professional services rendered for PFIC (Passive Foreign Investment Company) Identification Services.

Tax Fees (Investment Advisor) — The aggregate fees billed in each of the last two fiscal years of the registrant for professional services rendered by the principal accountant for tax compliance, tax advice, and tax planning to the registrant’s advisor were $0 for 2022 and $0 for 2023.

(d) All Other Fees (Registrant) — The aggregate fees billed in each of the last two fiscal years for products and services provided by the principal accountant to the registrant, other than the services reported in paragraphs (a) through (c) of this Item were $0 for 2022 and $0 for 2023.

All Other Fees (Investment Advisor) — The aggregate fees billed in each of the last two fiscal years for products and services provided by the principal accountant to the registrant’s investment advisor, other than services reported in paragraphs (a) through (c) of this Item were $0 for 2022 and $0 for 2023.

| (e)(1) | Disclose the audit committee’s pre-approval policies and procedures described in paragraph (c)(7) of Rule 2-01 of Regulation S-X. |

Pursuant to its charter and its Audit and Non-Audit Services Pre-Approval Policy, the Audit Committee (the “Committee”) is responsible for the pre-approval of all audit services and permitted non-audit services (including the fees and terms thereof) to be performed for the registrant by its independent auditors. The Chairman of the Committee is authorized to give such pre-approvals on behalf of the Committee up to $25,000 and report any such pre-approval to the full Committee.

The Committee is also responsible for the pre-approval of the independent auditor’s engagements for non-audit services with the registrant’s advisor (not including a sub-advisor whose role is primarily portfolio management and is sub-contracted or overseen by another investment advisor) and any entity controlling, controlled by or under common control with the investment advisor that provides ongoing services to the registrant, if the engagement relates directly to the operations and financial reporting of the registrant, subject to the de minimis exceptions for non-audit services described in Rule 2-01 of Regulation S-X. If the independent auditor has provided non-audit services to the registrant’s advisor (other than any sub-advisor whose role is primarily portfolio management and is sub-contracted with or overseen by another investment advisor) and any entity controlling, controlled by or under common control with the investment advisor that provides ongoing services to the registrant that were not pre-approved pursuant to its policies, the Committee will consider whether the provision of such non-audit services is compatible with the auditor’s independence.

| (e)(2) | The percentage of services described in each of paragraphs (b) through (d) for the registrant and the registrant’s investment advisor of this Item that were approved by the audit committee pursuant to the pre-approval exceptions included in paragraph (c)(7)(i)(c) or paragraph (c)(7)(ii) of Rule 2-01 of Regulation S-X are as follows: |

(b) 0%

(c) 0%

(d) 0%

| (f) | The percentage of hours expended on the principal accountant’s engagement to audit the registrant’s financial statements for the most recent fiscal year that were attributed to work performed by persons other than the principal accountant’s full-time, permanent employees was less than fifty percent. |

| (g) | The aggregate non-audit fees billed by the registrant’s accountant for services rendered to the registrant, and rendered to the registrant’s investment advisor (not including any sub-advisor whose role is primarily portfolio management and is subcontracted with or overseen by another investment advisor), and any entity controlling, controlled by, or under common control with the advisor that provides ongoing services to the registrant for 2022 were $16,250 and $0 for the Registrant and the registrant’s investment advisor, respectively, and for 2023 were $21,094 and $44,000, for the registrant and the registrant’s investment advisor, respectively. |

| (h) | The registrant’s audit committee of its Board of Trustees determined that the provision of non-audit services that were rendered to the registrant’s investment advisor (not including any sub-advisor whose role is primarily portfolio management and is subcontracted with or overseen by another investment advisor), and any entity controlling, controlled by, or under common control with the investment advisor that provides ongoing services to the registrant that were not pre-approved pursuant to paragraph (c)(7)(ii) of Rule 2-01 of Regulation S-X is compatible with maintaining the principal accountant’s independence. |

| (i) | Not applicable. |

| (j) | Not applicable. |

Item 5. Audit Committee of Listed Registrants.

| (a) | The registrant has a separately designated audit committee consisting of all the independent trustees of the registrant. The members of the audit committee are: Thomas R. Kadlec, Niel B. Nielson, Denise M. Keefe, Richard E. Erickson,Robert F. Keith and Bronwyn Wright. |

Item 6. Investments.

| (a) | Schedule of Investments in securities of unaffiliated issuers as of the close of the reporting period is included as part of the report to shareholders filed under Item 1 of this form. |

| (b) | Not applicable. |

Item 7. Disclosure of Proxy Voting Policies and Procedures for Closed-End Management Investment Companies.

A description of the policies and procedures used to vote proxies on behalf of the Fund is attached as an exhibit.

Item 8. Portfolio Managers of Closed-End Management Investment Companies.

| (a)(1) | Identification of Portfolio Manager(s) or Management Team Members and Description of Role of Portfolio Manager(s) or Management Team Members |

Information provided as of December 31, 2023

Chartwell Investment Partners, LLC (“Chartwell”), a wholly owned subsidiary of TriState Capital Holdings, Inc., is a research-based equity and fixed-income manager with a disciplined, team-oriented investment process. The Chartwell Portfolio Management Team consists of the following:

Douglas W. Kugler, CFA

Principal, Senior Portfolio Manager

Mr. Kugler is a Senior Portfolio Manager on Chartwell’s large-cap equity portfolio management team and has over 25 years of investment industry experience. His areas of focus include the Consumer Discretionary, Energy, Industrials, Materials and Technology sectors of the market. He has been a portfolio manager for the Fund since 2007. From 1993 to 2003, he held several positions at Morgan Stanley Investment Management (Miller Anderson & Sherrerd) the last of which was Senior Associate and Analyst for the Large Cap Value team. Mr. Kugler is a member of the CFA (Chartered Financial Analysts) Institute and the CFA Society of Philadelphia. He holds the Chartered Financial Analyst designation. Mr. Kugler earned a Bachelor’s degree in Accounting from the University of Delaware.

Jeffrey D. Bilsky,

Portfolio Manager

Jeffrey D. Bilsky, is a Portfolio Manager on Chartwell's equity investment team managing the Dividend Value Strategy and has over 17 years of investment industry experience. His areas of focus include the Energy, Utilities, Information Technology and Staples sectors of the market. He is also a member of the Brokerage Committee. Prior to joining Chartwell, Jeff was employed at Cruiser Capital, where he served as a Research Analyst. Previously, he was a Vice President in Institutional Sales and Trading at Hudson Securities. Earlier in his career, Mr. Bilskey worked at Bank of America as an Analyst in Institutional Sales and Trading.

The investment team for the First Trust Enhanced Equity Income Fund consists of two portfolio managers with an average of 29 years of investment experience. All team members (portfolio managers and analysts) conduct fundamental research and meet with company management. Purchase and sale decisions are discussed among the team members, however, final decision-making responsibility rests with Mr. Kugler. In addition, while each team member may be consulted on any options transactions involving the portfolio, Mr. Kugler has full responsibility for decisions involving the options program.

| (a)(2) | Other Accounts Managed by Portfolio Manager(s) or Management Team Member and Potential Conflicts of Interest |

Information provided as of December 31, 2023

Other Accounts Managed by Portfolio Manager(s) or Management Team Member

| Name of Portfolio Manager or Team Member | Type of Accounts* | Total # of Accounts Managed | Total Assets | # of Accounts Managed for which Advisory Fee is Based on Performance | Total Assets for which Advisory Fee is Based on Performance |

| 1. Douglas W. Kugler | Registered Investment Companies: | 0 | $0 | 0 | $0 |

| Other Pooled Investment Vehicles: | 1 | $1.6M | 0 | $0 | |

| Other Accounts: | 19 | $505M | 0 | $0 | |

| 2. Jeffrey D. Bilsky | Registered Investment Companies: | 1 | $22.0M | 0 | $0 |

| Other Pooled Investment Vehicles: | 1 | $1.6 | 0 | $0 | |

| Other Accounts: | 19 | $505M | 0 | $0 |

Potential Conflicts of Interests

The portfolio managers manage other accounts for Chartwell including institutional portfolios of similar investment styles. None of these portfolio managers manage any hedge funds nor any accounts with performance-based fees. When registered funds and investment accounts are managed side-by-side, firm personnel must strictly follow the policies and procedures outlined in our Trade Allocation Policy to ensure that accounts are treated in a fair and equitable manner, and that no client or account is favored over another. When registered funds and investment accounts are trading under the same investment product, and thus trading the same securities, shares are allocated on a pro-rata basis based on market value, and all portfolios obtain the same average price.

On a monthly basis, a member of our Finance team, oversees the performance calculation process handled in Operations, and completes a spreadsheet of monthly portfolio returns by client. The Finance Officer provides this spreadsheet to the CEO, COO, CCO and various investment personnel for their review. Any performance dispersion noted by anyone on the distribution list is investigated whereby the Finance Officer reviews the underlying transactional detail, holdings & security weightings by portfolio. This monthly process ensures that all portfolios that are managed under the same investment product are treated fairly and traded in accordance with firm policy.

(a)(3) Compensation Structure of Portfolio Manager(s) or Management Team Members

Information provided as of December 31, 2023

The compensation paid to a Chartwell portfolio manager and analyst consists of base salary, annual bonus, ownership distribution, and an annual profit-sharing contribution to the firm’s retirement plan.

A portfolio manager’s and analyst’s base salary is determined by Chartwell’s Compensation Committee and is reviewed at least annually. A portfolio manager’s and analyst’s experience, historical performance, and role in firm or product team management are the primary considerations in determining the base salary. Industry benchmarking is utilized by the Compensation Committee on an annual basis.

Annual bonuses are determined by the Compensation Committee based on revenue sharing. Since strategy revenue is highly correlated with long-term performance, teams can earn a proportion of strategy revenue with the residual over salaries distributable as annual bonuses. Performance tests relative to the appropriate benchmark and peer group rankings can enhance this revenue share. Additional factors used to determine the annual bonus include the portfolio manager’s contribution as an analyst, product team management, and contribution to the strategic planning and development of the investment group as well as the firm.

Fund performance is compared to a combination of outperforming either the S&P 500 or BXM and the ranking of performance compared to the peer group as reported to the FFA board.

For employee retention purposes, part of the annual bonus for key employees is deferred for a period of 3 year.s

(a)(4) Disclosure of Securities Ownership

Information provided as of December 31, 2023:

|

Name

of Portfolio Manager or |

Dollar

Range of Fund Shares Beneficially Owned | |

| Douglas W. Kugler | $100,001-500,000 | |

| Jeffrey D. Bilsky | None |

| (b) | Not applicable. |

Item 9. Purchases of Equity Securities by Closed-End Management Investment Company and Affiliated Purchasers.

Not applicable.

Item 10. Submission of Matters to a Vote of Security Holders.

There have been no material changes to the procedures by which the shareholders may recommend nominees to the registrant’s board of directors, where those changes were implemented after the registrant last provided disclosure in response to the requirements of Item 407(c)(2)(iv) of Regulation S-K (17 CFR 229.407) (as required by Item 22(b)(15) of Schedule 14A (17 CFR 240.14a-101)), or this Item.

Item 11. Controls and Procedures.

| (a) | The registrant’s principal executive and principal financial officers, or persons performing similar functions, have concluded that the registrant’s disclosure controls and procedures (as defined in Rule 30a-3(c) under the Investment Company Act of 1940, as amended (the “1940 Act”) (17 CFR 270.30a-3(c))) are effective, as of a date within 90 days of the filing date of the report that includes the disclosure required by this paragraph, based on their evaluation of these controls and procedures required by Rule 30a-3(b) under the 1940 Act (17 CFR 270.30a-3(b)) and Rules 13a-15(b) or 15d-15(b) under the Securities Exchange Act of 1934, as amended (17 CFR 240.13a-15(b) or 240.15d-15(b)). |

| (b) | There were no changes in the registrant’s internal control over financial reporting (as defined in Rule 30a-3(d) under the 1940 Act (17 CFR 270.30a-3(d)) that occurred during the period covered by this report that has materially affected, or is reasonably likely to materially affect, the registrant’s internal control over financial reporting. |

Item 12. Disclosure of Securities Lending Activities for Closed-end Management Investment Companies.

| (a) | Not applicable. |

| (b) | Not applicable. |

Item [18]. Recovery of Erroneously Awarded Compensation.

Not applicable.

Item 14. Exhibits.

| (a)(1) | Code of ethics, or any amendment thereto, that is the subject of disclosure required by Item 2 is attached hereto. |

| (a)(2) | Certifications pursuant to Rule 30a-2(a) under the 1940 Act and Section 302 of the Sarbanes-Oxley Act of 2002 are attached hereto. |

| (a)(3) | Not applicable. |

| (b) | Certifications pursuant to Rule 30a-2(b) under the 1940 Act and Section 906 of the Sarbanes- Oxley Act of 2002 are attached hereto. |

| (c) | to the registrant’s common shareholders in accordance with the order under Section 6(c) of the 1940 Act granting an exemption from Section 19(b) of the 1940 Act and Rule 19a-l under the 1940 Act, dated March 24, 2010.(1) |

| (1) | The Fund received exemptive relief from the Securities and Exchange Commission which permits the Fund to make periodic distributions of long-term capital gains as frequently as monthly each taxable year. The relief is conditioned, in part, on an undertaking by the Fund to make the disclosures to the holders of the Fund’s common shares, in addition to the information required by Section 19(a) of the 1940 Act and Rule 19a-1 thereunder. The Fund is likewise obligated to file with the SEC the information contained in any such notice to shareholders. In that regard, attached as an exhibit to this filing is a copy of such notice made during the period. |

| (d) | Disclosure of Proxy Voting Policies and Procedures for Closed-End Management Investment Companies required by Item 7 is attached hereto. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| (registrant) | First Trust Enhanced Equity Income Fund |

| By (Signature and Title)* | /s/ James M. Dykas | |

| James M. Dykas, President and Chief Executive Officer (principal executive officer) |

| Date: | March 14, 2024 |

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, this report has been signed below by the following persons on behalf of the registrant and in the capacities and on the dates indicated.

| By (Signature and Title)* | /s/ James M. Dykas | |

| James M. Dykas, President and Chief Executive Officer (principal executive officer) |

| Date: | March 14, 2024 |

| By (Signature and Title)* | /s/ Derek D. Maltbie | |

| Derek D. Maltbie, Treasurer, Chief Financial Officer and Chief Accounting Officer (principal financial officer) |

| Date: | March 14, 2024 |

* Print the name and title of each signing officer under his or her signature.