0001290900DEF 14AFALSE00012909002023-01-012023-12-310001290900cvgi:JamesR.RayMember2023-01-012023-12-31iso4217:USD0001290900cvgi:RobertR.GriffinMember2023-01-012023-12-310001290900cvgi:HaroldBevisMember2023-01-012023-12-310001290900cvgi:HaroldBevisMember2022-01-012022-12-310001290900cvgi:HaroldBevisMember2021-01-012021-12-310001290900cvgi:HaroldBevisMember2020-01-012020-12-310001290900cvgi:PatrickMillerMember2020-01-012020-12-3100012909002022-01-012022-12-3100012909002021-01-012021-12-3100012909002020-01-012020-12-3100012909002023-12-012023-12-3100012909002023-05-012023-12-3100012909002020-03-012020-12-3100012909002023-01-012023-05-3100012909002020-01-012020-03-310001290900cvgi:JamesR.RayMembercvgi:EquityAwardsGrantedDuringTheYearUnvestedMemberecd:PeoMember2023-01-012023-12-310001290900cvgi:EquityAwardsGrantedDuringTheYearUnvestedMemberecd:PeoMembercvgi:RobertR.GriffinMember2023-01-012023-12-310001290900cvgi:EquityAwardsGrantedDuringTheYearUnvestedMemberecd:PeoMembercvgi:HaroldBevisMember2023-01-012023-12-310001290900cvgi:EquityAwardsGrantedDuringTheYearUnvestedMemberecd:PeoMembercvgi:HaroldBevisMember2022-01-012022-12-310001290900cvgi:EquityAwardsGrantedDuringTheYearUnvestedMemberecd:PeoMembercvgi:HaroldBevisMember2021-01-012021-12-310001290900cvgi:EquityAwardsGrantedDuringTheYearUnvestedMemberecd:PeoMembercvgi:HaroldBevisMember2020-01-012020-12-310001290900cvgi:EquityAwardsGrantedDuringTheYearUnvestedMembercvgi:PatrickMillerMemberecd:PeoMember2020-01-012020-12-310001290900cvgi:JamesR.RayMembercvgi:EquityAwardsGrantedInPriorYearsUnvestedMemberecd:PeoMember2023-01-012023-12-310001290900cvgi:EquityAwardsGrantedInPriorYearsUnvestedMemberecd:PeoMembercvgi:RobertR.GriffinMember2023-01-012023-12-310001290900cvgi:EquityAwardsGrantedInPriorYearsUnvestedMemberecd:PeoMembercvgi:HaroldBevisMember2023-01-012023-12-310001290900cvgi:EquityAwardsGrantedInPriorYearsUnvestedMemberecd:PeoMembercvgi:HaroldBevisMember2022-01-012022-12-310001290900cvgi:EquityAwardsGrantedInPriorYearsUnvestedMemberecd:PeoMembercvgi:HaroldBevisMember2021-01-012021-12-310001290900cvgi:EquityAwardsGrantedInPriorYearsUnvestedMemberecd:PeoMembercvgi:HaroldBevisMember2020-01-012020-12-310001290900cvgi:EquityAwardsGrantedInPriorYearsUnvestedMembercvgi:PatrickMillerMemberecd:PeoMember2020-01-012020-12-310001290900cvgi:JamesR.RayMembercvgi:EquityAwardsGrantedDuringTheYearVestedMemberecd:PeoMember2023-01-012023-12-310001290900cvgi:EquityAwardsGrantedDuringTheYearVestedMemberecd:PeoMembercvgi:RobertR.GriffinMember2023-01-012023-12-310001290900cvgi:EquityAwardsGrantedDuringTheYearVestedMemberecd:PeoMembercvgi:HaroldBevisMember2023-01-012023-12-310001290900cvgi:EquityAwardsGrantedDuringTheYearVestedMemberecd:PeoMembercvgi:HaroldBevisMember2022-01-012022-12-310001290900cvgi:EquityAwardsGrantedDuringTheYearVestedMemberecd:PeoMembercvgi:HaroldBevisMember2021-01-012021-12-310001290900cvgi:EquityAwardsGrantedDuringTheYearVestedMemberecd:PeoMembercvgi:HaroldBevisMember2020-01-012020-12-310001290900cvgi:EquityAwardsGrantedDuringTheYearVestedMembercvgi:PatrickMillerMemberecd:PeoMember2020-01-012020-12-310001290900cvgi:JamesR.RayMembercvgi:EquityAwardsGrantedInPriorYearsVestedMemberecd:PeoMember2023-01-012023-12-310001290900cvgi:EquityAwardsGrantedInPriorYearsVestedMemberecd:PeoMembercvgi:RobertR.GriffinMember2023-01-012023-12-310001290900cvgi:EquityAwardsGrantedInPriorYearsVestedMemberecd:PeoMembercvgi:HaroldBevisMember2023-01-012023-12-310001290900cvgi:EquityAwardsGrantedInPriorYearsVestedMemberecd:PeoMembercvgi:HaroldBevisMember2022-01-012022-12-310001290900cvgi:EquityAwardsGrantedInPriorYearsVestedMemberecd:PeoMembercvgi:HaroldBevisMember2021-01-012021-12-310001290900cvgi:EquityAwardsGrantedInPriorYearsVestedMemberecd:PeoMembercvgi:HaroldBevisMember2020-01-012020-12-310001290900cvgi:EquityAwardsGrantedInPriorYearsVestedMembercvgi:PatrickMillerMemberecd:PeoMember2020-01-012020-12-310001290900cvgi:JamesR.RayMembercvgi:EquityAwardsThatFailedToMeetVestingConditionsMemberecd:PeoMember2023-01-012023-12-310001290900cvgi:EquityAwardsThatFailedToMeetVestingConditionsMemberecd:PeoMembercvgi:RobertR.GriffinMember2023-01-012023-12-310001290900cvgi:EquityAwardsThatFailedToMeetVestingConditionsMemberecd:PeoMembercvgi:HaroldBevisMember2023-01-012023-12-310001290900cvgi:EquityAwardsThatFailedToMeetVestingConditionsMemberecd:PeoMembercvgi:HaroldBevisMember2022-01-012022-12-310001290900cvgi:EquityAwardsThatFailedToMeetVestingConditionsMemberecd:PeoMembercvgi:HaroldBevisMember2021-01-012021-12-310001290900cvgi:EquityAwardsThatFailedToMeetVestingConditionsMemberecd:PeoMembercvgi:HaroldBevisMember2020-01-012020-12-310001290900cvgi:EquityAwardsThatFailedToMeetVestingConditionsMembercvgi:PatrickMillerMemberecd:PeoMember2020-01-012020-12-310001290900cvgi:JamesR.RayMembercvgi:EquityAwardsEquityAwardModificationsExcessFairValueMemberecd:PeoMember2023-01-012023-12-310001290900cvgi:EquityAwardsEquityAwardModificationsExcessFairValueMemberecd:PeoMembercvgi:RobertR.GriffinMember2023-01-012023-12-310001290900cvgi:EquityAwardsEquityAwardModificationsExcessFairValueMemberecd:PeoMembercvgi:HaroldBevisMember2023-01-012023-12-310001290900cvgi:EquityAwardsEquityAwardModificationsExcessFairValueMemberecd:PeoMembercvgi:HaroldBevisMember2022-01-012022-12-310001290900cvgi:EquityAwardsEquityAwardModificationsExcessFairValueMemberecd:PeoMembercvgi:HaroldBevisMember2021-01-012021-12-310001290900cvgi:EquityAwardsEquityAwardModificationsExcessFairValueMemberecd:PeoMembercvgi:HaroldBevisMember2020-01-012020-12-310001290900cvgi:EquityAwardsEquityAwardModificationsExcessFairValueMembercvgi:PatrickMillerMemberecd:PeoMember2020-01-012020-12-310001290900cvgi:EquityAwardsGrantedDuringTheYearUnvestedMemberecd:NonPeoNeoMember2023-01-012023-12-310001290900cvgi:EquityAwardsGrantedDuringTheYearUnvestedMemberecd:NonPeoNeoMember2022-01-012022-12-310001290900cvgi:EquityAwardsGrantedDuringTheYearUnvestedMemberecd:NonPeoNeoMember2021-01-012021-12-310001290900cvgi:EquityAwardsGrantedDuringTheYearUnvestedMemberecd:NonPeoNeoMember2020-01-012020-12-310001290900ecd:NonPeoNeoMembercvgi:EquityAwardsGrantedInPriorYearsUnvestedMember2023-01-012023-12-310001290900ecd:NonPeoNeoMembercvgi:EquityAwardsGrantedInPriorYearsUnvestedMember2022-01-012022-12-310001290900ecd:NonPeoNeoMembercvgi:EquityAwardsGrantedInPriorYearsUnvestedMember2021-01-012021-12-310001290900ecd:NonPeoNeoMembercvgi:EquityAwardsGrantedInPriorYearsUnvestedMember2020-01-012020-12-310001290900cvgi:EquityAwardsGrantedDuringTheYearVestedMemberecd:NonPeoNeoMember2023-01-012023-12-310001290900cvgi:EquityAwardsGrantedDuringTheYearVestedMemberecd:NonPeoNeoMember2022-01-012022-12-310001290900cvgi:EquityAwardsGrantedDuringTheYearVestedMemberecd:NonPeoNeoMember2021-01-012021-12-310001290900cvgi:EquityAwardsGrantedDuringTheYearVestedMemberecd:NonPeoNeoMember2020-01-012020-12-310001290900ecd:NonPeoNeoMembercvgi:EquityAwardsGrantedInPriorYearsVestedMember2023-01-012023-12-310001290900ecd:NonPeoNeoMembercvgi:EquityAwardsGrantedInPriorYearsVestedMember2022-01-012022-12-310001290900ecd:NonPeoNeoMembercvgi:EquityAwardsGrantedInPriorYearsVestedMember2021-01-012021-12-310001290900ecd:NonPeoNeoMembercvgi:EquityAwardsGrantedInPriorYearsVestedMember2020-01-012020-12-310001290900ecd:NonPeoNeoMembercvgi:EquityAwardsThatFailedToMeetVestingConditionsMember2023-01-012023-12-310001290900ecd:NonPeoNeoMembercvgi:EquityAwardsThatFailedToMeetVestingConditionsMember2022-01-012022-12-310001290900ecd:NonPeoNeoMembercvgi:EquityAwardsThatFailedToMeetVestingConditionsMember2021-01-012021-12-310001290900ecd:NonPeoNeoMembercvgi:EquityAwardsThatFailedToMeetVestingConditionsMember2020-01-012020-12-310001290900cvgi:EquityAwardsEquityAwardModificationsExcessFairValueMemberecd:NonPeoNeoMember2023-01-012023-12-310001290900cvgi:EquityAwardsEquityAwardModificationsExcessFairValueMemberecd:NonPeoNeoMember2022-01-012022-12-310001290900cvgi:EquityAwardsEquityAwardModificationsExcessFairValueMemberecd:NonPeoNeoMember2021-01-012021-12-310001290900cvgi:EquityAwardsEquityAwardModificationsExcessFairValueMemberecd:NonPeoNeoMember2020-01-012020-12-31000129090012023-01-012023-12-31000129090022023-01-012023-12-31000129090032023-01-012023-12-31000129090042023-01-012023-12-31000129090052023-01-012023-12-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant x Filed by a Party other than the Registrant ¨

Check the appropriate box:

| | | | | | | | |

| ¨ | | Preliminary Proxy Statement |

| |

| ¨ | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| |

| x | | Definitive Proxy Statement |

| |

| ¨ | | Definitive Additional Materials |

| |

| ¨ | | Soliciting Material under §240.14a-12 |

COMMERCIAL VEHICLE GROUP, INC.

(Name of registrant as specified in its charter)

(Name of person(s) filing proxy statement, if other than the registrant)

Payment of Filing Fee (Check the appropriate box):

| | | | | | | | | | | | | | |

| x | | No fee required. |

| |

| | | |

| ¨ | | Fee paid previously with preliminary materials. |

| ¨ | | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 |

2024

Proxy Statement

Notice of Annual Meeting of Stockholders

CVG

TABLE OF CONTENTS

Page | | | | | |

| |

| |

| |

| |

| |

| 8 |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| 15 |

| 22 |

| 28 |

| 31 |

| 32 |

Proposal 2 – Advisory Vote to Approve Compensation of Our Named Executive Officers | 33 |

| 33 |

| 34 |

| 34 |

| 34 |

| 35 |

| 37 |

| 37 |

| 38 |

| 40 |

| 40 |

| 52 |

| 54 |

| 55 |

| 56 |

| 57 |

| 58 |

FORWARD-LOOKING STATEMENTS AND NON-GAAP FINANCIAL MEASURES

Some of the information we provide in this proxy statement is forward-looking and therefore could change over time to reflect changes in the environment in which CVG operates, or other future changes. For details on uncertainties that may cause our actual results to be materially different than those expressed in our forward-looking statements, see our SEC filings, including our Form 10-K, which is available on our website and at SEC.gov. We do not undertake to update our forward-looking statements.

For Reconciliation of GAAP to Non-GAAP financial measures disclosed in this proxy statement, reference is also made to Exhibit 99.1 to Company's current report on Form 8-K (File No. 001-34365), filed on March 4, 2024.

Notice of Annual Meeting of Stockholders

This year’s Annual Meeting of Stockholders (“Annual Meeting”) will be conducted exclusively online without an option for physical attendance. You will be able to participate in the virtual meeting online, vote your shares electronically, and submit questions during the meeting by visiting www.virtualshareholdermeeting.com/CVGI2024.

| | | | | | | | |

| Date | | Thursday, May 16, 2024 |

| Time | | 1:00 p.m. Eastern Time |

| Virtual Meeting | | This year’s meeting is a virtual stockholder meeting at www.virtualshareholdermeeting.com/CVGI2024. You will need the 16-digit control number that is printed in the box marked by the arrow on your proxy card to enter the Annual Meeting. We recommend that you log in at least 15 minutes before the meeting to ensure you are logged in when the meeting starts. The Company has endeavored to provide stockholders attending the Annual Meeting with the same rights and opportunities to participate as they would at an in-person meeting. |

| Record Date | | March 18, 2024. Only stockholders of record at the close of business on the record date are entitled to receive notice of, and to vote at, the Annual Meeting. |

| Proxy Voting | | Make your vote count. Please vote your shares promptly to ensure the presence of a quorum during the Annual Meeting. Voting your shares now via the Internet, by telephone, or by signing, dating, and returning the enclosed proxy card or voting instruction form will save the expense of additional solicitation. If you wish to vote by mail, we have enclosed an addressed envelope with postage prepaid if mailed in the United States. Submitting your proxy now will not prevent you from voting your shares during the Annual Meeting, as your proxy is revocable at your option. We are requesting your vote to: |

| Items of Business | | (1)To elect seven director nominees named in the accompanying Proxy Statement to hold office until the 2025 Annual Meeting of Stockholders;

(2)To approve, on a non-binding advisory basis, the compensation of the Company's named executive officers; (3)To ratify the appointment of KPMG LLP as the independent registered public accounting firm of the Company, for the fiscal year ending December 31, 2024; and

(4)To transact such other business as may properly come before the meeting or any adjournment or postponement. |

| Meeting Details | | See “Proxy Summary” and “Other Matters” for details. |

Important notice regarding the availability of proxy materials for the Annual Meeting to be held on May 16, 2024: The Notice of Annual Meeting of Stockholders, the accompanying proxy statement and our 2023 Annual Report to Stockholders are available at www.cvgrp.com/proxy and www.proxyvote.com. These proxy materials are first being sent or made available to stockholders commencing on or about April 18, 2024.

By Order of the Board of Directors,

Aneezal H. Mohamed

Chief Legal Officer, Compliance Officer and Secretary

April 18, 2024

Proxy Summary

This summary highlights certain information contained elsewhere in our proxy statement. This summary does not contain all the information that you should consider, and you should carefully read the entire proxy statement and our 2023 Annual Report to Stockholders before voting. The Notice of Annual Meeting of Stockholders, the accompanying proxy statement and our 2023 Annual Report to Stockholders are available at www.cvgrp.com/proxy and www.proxyvote.com and are first being sent or made available to stockholders commencing on or about April 18, 2024.

About Us

Commercial Vehicle Group, Inc. and its subsidiaries, is a global provider of systems, assemblies and components to the global commercial vehicle market, the electric vehicle market, and the industrial automation markets. We deliver real solutions to complex design, engineering and manufacturing problems while creating positive change for our customers, industries, and communities we serve. References herein to the "Company", "CVG", "we", "our", or "us" refer to Commercial Vehicle Group, Inc. and its subsidiaries.

We have manufacturing operations in the United States, Mexico, China, United Kingdom, Czech Republic, Ukraine, Morocco, Thailand, India and Australia. Our products are primarily sold in North America, Europe, and the Asia-Pacific region.

We primarily manufacture customized products to meet the requirements of our customers. We believe our products are used by a majority of the North American Commercial Truck manufacturers, many construction vehicle original equipment manufacturers ("OEMs"), parts and service dealers, distributors, as well as top e-commerce retailers.

Governance and Board Highlights

| | | | | |

6 of our 7 director nominees are independent Independent, non-executive Chairman of the Board Ongoing Board refreshment: two new experienced directors added in the last 12 months Over 40% of our director nominees are gender or racially diverse Director nominees with diverse business experiences, backgrounds and expertise in a wide range of fields | Significant Board engagement on strategy and capital deployment Board monitors corporate culture Directors interact with key talent through Board discussions and planned one-on-one sessions Well-developed Board and individual director evaluation process Annual election of directors |

Board Changes in 2023

Mr. Harold C. Bevis resigned from his role as President and Chief Executive Officer and Board member effective May 19, 2023.

Mr. Robert C. Griffin, our Chairman of the Board was elected the interim President and Chief Executive Officer as of May 19, 2023 and served in the interim role until December 20, 2023. During the time Mr. Griffin served as the interim President and Chief Executive Officer, he was not an independent Director.

Mr. James R. Ray, an independent Director, was elected President and Chief Executive Officer effective December 20, 2023, where upon, he remained as a Director, but ceased being an independent Director.

On August 14, 2023, Mr. Roger L. Fix, a Director since June 2014, informed the Company that he will be retiring from the Board without standing for re-election at the 2024 Annual Meeting of Stockholders, effective the date of the 2024 Annual Meeting of Stockholders.

On September 26, 2023, the Board elected Ms. Melanie K. Cook as an independent Director.

On December 8, 2023, the Board elected Mr. William C. Johnson as an independent Director.

director evaluation process (page 24) Annual election of directors with majority voting Director service on other public company boards is limited to three or just their own board if a director is an executive of another public company

Our 2024 Board Nominees

| | | | | | | | |

7 Nominees | | |

| | |

------Years of Service on Board of Directors------ | Robert C. Griffin | James R. Ray |

2 4 1 0-2 years 3-10 years 11-18 years

| Chairman of the Board Retired Head of Investment Banking, Americas, Barclays Retired member of the Executive Committee for the Montgomery Division of Banc of America Securities Age: 76 Director since 2005 Independent | President and Chief Executive Officer Retired President, Engineered Fastening, Stanley Black & Decker, Inc. Age: 60 Director since 2020

|

----------------Nominee Ages (years)---------------- | | |

4 2 1 50-60 61-65 66-76

Average age is 60 years | | |

| | |

| Melanie K. Cook | Ruth Gratzke |

| Retired Chief Operating Officer of GE Appliances Age: 51 Director since 2023 Independent Committees: A, C | President and Chief Executive Officer, Siemens Industry, Inc. Age: 53 Director since 2021 Independent Committees: A, N

|

|

|

| | | | | | | | |

| -----------------Skills and Experience----------------- | | |

Griffin Ray Cook Gratzke Johnson Nauman Rancourt | | |

Executive Leadership ü ü ü ü ü ü ü |

Strategic Management ü ü ü ü ü ü ü |

Finance/ Accounting ü ü ü ü ü ü ü |

Operations ü ü ü ü ü ü ü | William C. Johnson | J. Michael Nauman |

International ü ü ü ü ü ü | Chief Executive Officer, Avail Infrastructure Solutions Age: 60 Director since 2023 Independent Committees: C, N | Retired President, Chief Executive Officer and Board Member of Brady Corporation Age: 61 Director since 2021 Independent Committees: A, C, N |

M&A ü ü ü ü ü ü ü |

Legal/Risk/ ü ü ü ü ü ü ü Governance | | |

| | |

| | |

-----------Gender and Racially Diversity-------------

43% | | |

| Wayne M. Rancourt | |

| Retired Executive Vice President, Chief Financial Officer & Treasurer of Boise Cascade Company Age: 61 Director since 2016 Independent Committees: A, C | |

| A: Audit C: Compensation N: Nominating, Governance and Sustainability |

Virtual Annual Meeting of Stockholders

ime and Date Wednesday, November 4, 2020 10:00 a.m. Eastern Time Place Virtual Meeting www.virtualshareholdermeeting.com/CAH2020 Record Date September 8, 2020

This year’s Annual Meeting will be conducted exclusively online without an option for physical attendance. We believe that hosting a virtual meeting will enable greater stockholder attendance and participation from any location around the world. You will be able to participate in the virtual Annual Meeting online, vote your shares electronically, and submit questions during the meeting by visiting www.virtualshareholdermeeting.com/CVGI2024 and entering the 16-digit control number included in the Notice of Internet Availability of Proxy Materials, voting instruction form or proxy card that was sent to you with this proxy statement.

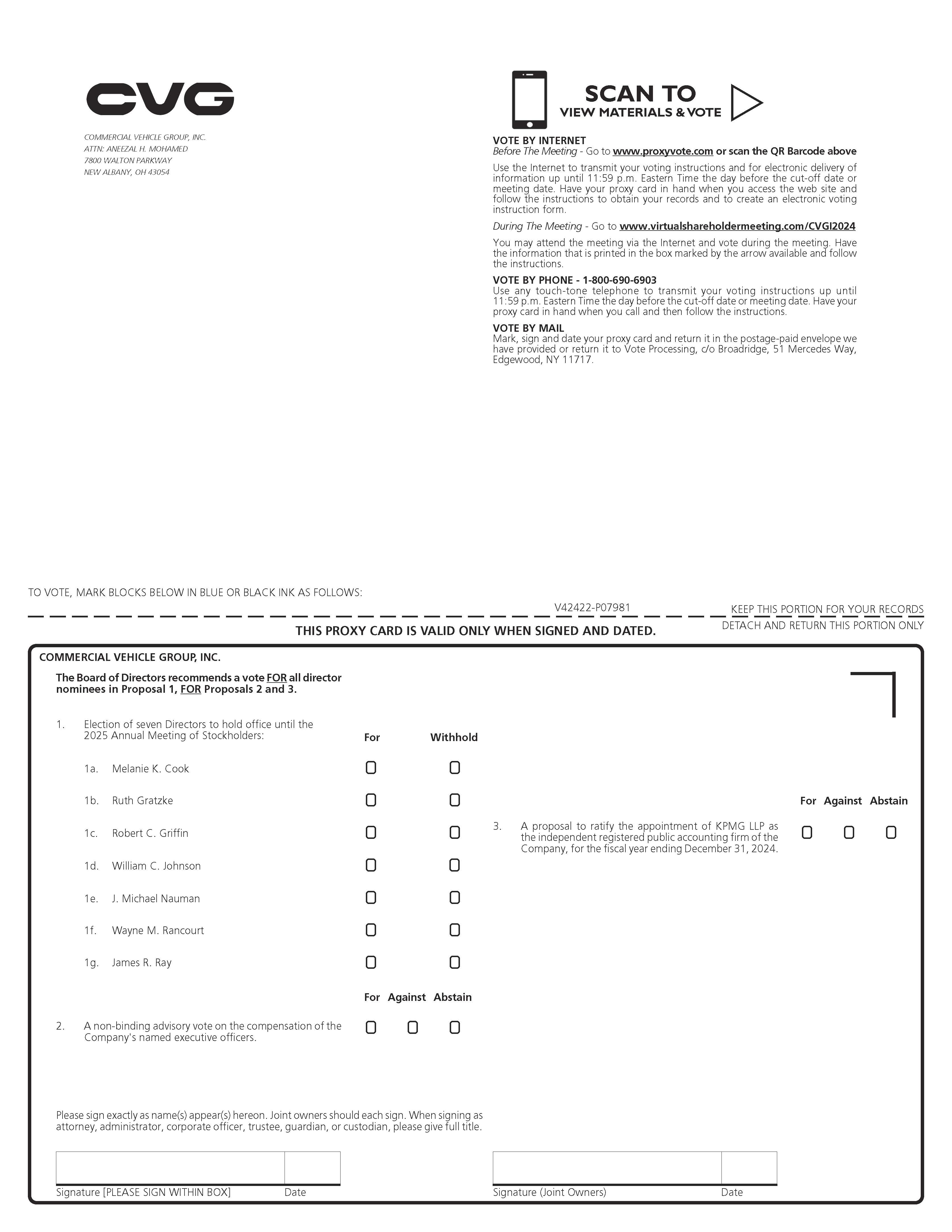

Roadmap to Voting Matters

Stockholders will be asked to vote on the following proposals at the Annual Meeting:

| | | | | | | | |

| Proposal | Board Recommendation | Page Reference |

Proposal 1: To elect seven director nominees named in this Proxy Statement to hold office until the 2025 Annual Meeting of Stockholders | FOR each director nominee | 14 |

Proposal 2: To vote on a non-binding advisory proposal on the compensation of the named executive officers | FOR | 33 |

Proposal 3: To ratify the appointment of KPMG LLP as the independent registered public accounting firm of the Company for the fiscal year ending December 31, 2024 | FOR | 34 |

How to Vote in Advance of the Annual Meeting

You can vote on matters presented at the Annual Meeting in four ways:

1) You can vote by filling out, signing and dating your proxy card and returning it in the enclosed envelope, OR

2) You can vote over the Internet, OR

3) You can vote by telephone, OR

4) You can attend the virtual Annual Meeting and vote online during the Annual Meeting.

If you properly fill out your proxy card and send it to us, or submit your proxy over the Internet or by telephone, in each case, prior to the Annual Meeting, your shares will be voted at the Annual Meeting as you have directed. If you do not specify a choice on your properly submitted proxy, the shares represented by your proxy card will be voted FOR the election of all nominees named in this proxy statement, FOR the approval, on a non-binding advisory basis, of the compensation of our named executive officers as disclosed in this proxy statement, and FOR the ratification of the appointment of KPMG LLP as our independent registered public accounting firm for the year ending December 31, 2024.

You can submit a proxy by Internet by logging onto www.proxyvote.com and following the instructions.

You can submit a proxy by telephone by dialing 1-800-690-6903 and following the instructions.

To vote your shares during the Annual Meeting, click on the vote button provided on the screen and follow the instructions provided. If you encounter any difficulties accessing the virtual meeting during the check-in or meeting time, please call the technical support number that will be posted on the log in page. Stockholders may submit questions during the Annual Meeting on the Annual Meeting website. More information regarding the question and answer process, including the number and types of questions permitted, and how questions will be recognized and answered, will be available in the meeting rules of conduct, which will be posted on the Annual Meeting website prior to the meeting.Internet Visit 24/7 www.proxyvote.com Telephone Call the toll-free number 1-800-690-6903 within the United States, U.S. territories or Canada and follow the instructions provided by the recorded message Mail Mark, sign and date your proxy card and return it by mail in the enclosed postage-paid envelope

Questions and Answers About Voting

Q Who can attend the meeting?

A All stockholders as of the record date, or their duly appointed proxies, may attend the virtual meeting by entering the 16-digit control number that is printed in the box marked by the arrow on your proxy card.

Please note that if you hold your shares in “street name” (that is, beneficially through a broker or other nominee), you must obtain a proxy from your financial institution and use the 16-digit control number that is printed in the box marked by the arrow on your proxy card to enter the Annual Meeting.

Q If my shares are held in “street name” by my broker, will my broker vote my shares for me?

A If you hold shares beneficially in street name, in order to ensure your shares are voted, you must provide voting instructions to your broker. If you do not provide timely voting instructions to your broker, whether your shares can be voted by such person depends on the type of item being considered for vote. Your broker will have the discretion to vote your shares on “routine” matters, but your broker will be able to vote your shares on “non-routine” matters only if you provide instructions on how to vote. Therefore, you should follow the directions provided by your broker regarding instructions to vote your shares. The ratification of KPMG LLP as our independent registered public accounting firm for 2024 is the only routine matter on which your broker will have discretionary voting authority. All other matters to be voted on at the Annual Meeting are “non-routine” and thus non-discretionary for voting purposes.

Q Can I change my vote or revoke my proxy after I have mailed my proxy card?

A Yes, you can revoke your proxy at any time before your proxy is voted at the Annual Meeting. You can do this in one of three ways:

•First, you can send a written notice to CVG's Chief Legal Officer, Compliance Officer and Secretary at our headquarters stating that you would like to revoke your proxy.

•Second, you can complete and submit a later dated proxy.

•Third, you can attend the virtual Annual Meeting and vote online during the Annual Meeting.

Simply attending the meeting, however, will not revoke your proxy unless you properly vote at the Annual Meeting or specifically request that your prior proxy be revoked by delivering a written notice to the Chief Legal Officer, Compliance Officer and Secretary at our headquarters stating that you would like to revoke your proxy. If you have instructed a broker to vote your shares, you must follow the directions you received from your broker to revoke your proxy.

Q How are votes counted?

A Stockholders of record of our common stock as of the close of business on March 18, 2024 are entitled to vote at the annual meeting. As of March 18, 2024, there were 33,885,223 shares of common stock outstanding. The presence in person or by proxy of a majority of the outstanding shares of common stock will constitute a quorum for the transaction of business. Each share of common stock is entitled to one vote on each matter to come before the Annual Meeting. Under Delaware law, if you have returned a valid proxy or attend the meeting in person, but abstain from voting, your shares will nevertheless be treated as present and entitled to vote. Your shares, therefore, will be counted in determining the existence of a quorum. Abstentions will have no effect on the outcome of the vote on the election of directors and will count as a vote against the other proposals. Under Delaware law, “broker non-votes,” as defined later in this proxy statement, are also counted for purposes of determining whether a quorum is present. Broker non-votes will have no effect on the outcome of any proposal to be voted on at the Annual Meeting.

Q How are proxies being solicited and who pays for the solicitation of proxies?

A Initially, we will solicit proxies by mail. Our directors, officers and employees may also solicit proxies in person or by telephone without additional compensation. We will pay all expenses of solicitation of proxies.

Q Can I access this proxy statement and the Company’s 2023 Annual Report on Form 10-K electronically?

A The proxy statement and our 2023 Annual Report on Form 10-K are available through the investor page on our website at www.cvgrp.com/proxy and through the Broadridge Proxy Vote website at www.proxyvote.com.

Voting and Revocability of Proxies

When proxies are properly dated, executed and returned, the shares they represent will be voted as directed by the stockholder on all matters properly coming before the Annual Meeting.

Where specific choices are not indicated on a valid proxy, the shares represented by such proxies received will be voted:

1. FOR the election of the nominees for directors named in this proxy statement;

2. FOR the approval, on a non-binding advisory basis, of the compensation of our named executive officers as disclosed in this proxy statement;

3. FOR the ratification of the appointment of KPMG LLP as independent registered public accounting firm for fiscal 2024.

In addition, if other matters are properly brought before the Annual Meeting and we do not have notice of these matters within a reasonable time prior to the Annual Meeting, all proxies will be voted in accordance with the discretion of the persons appointed as proxies in the proxy card. If for any reason any of the nominees is not available as a candidate for director, the persons named as proxy holder will have the discretion to vote for such other candidate or candidates as may be nominated by the Board of Directors.

Returning your completed proxy will not prevent you from voting online during the Annual Meeting should you be present and desire to do so; provided that if you have instructed a broker to vote your shares, you must follow the directions you received from your broker to change your vote. In addition, your proxy may be revoked at any time prior to its exercise either by giving written notice to our Chief Legal Officer, Compliance Officer and Secretary prior to the Annual Meeting, by submission of a later-dated proxy or attending the virtual Annual Meeting online and voting during the Annual Meeting.

At the Annual Meeting, the inspector of election will determine the presence of a quorum and will tabulate the results of the stockholders’ voting. The presence of a quorum is required to transact the business proposed to be transacted at the Annual Meeting. The presence in person or by proxy of holders of a majority of the outstanding shares of common stock entitled to vote will constitute the necessary quorum for any business to be transacted at the Annual Meeting. In accordance with the General Corporation Law of the State of Delaware (the “DGCL”), properly executed proxies marked “abstain,” as well as proxies held in street name by brokers for which the beneficial owner does not provide voting instructions on non-routine matters (“broker non-votes”), will be considered “present” for the purposes of determining whether a quorum has been achieved at the Annual Meeting.

The seven nominees for director will be elected by a plurality of the votes present in person or represented by proxy at the Annual Meeting and entitled to vote in the election of directors, meaning that the persons receiving the greatest number of "for" votes cast at the Annual Meeting in person or by proxy, up to the total number of directors to be elected at the Annual Meeting, will be elected. Consequently, any shares of common stock present in person or by proxy at the Annual Meeting but not voted for any reason, including abstentions and broker non-votes, have no impact in the election of directors, except to the extent that the failure to vote for an individual may result in another individual receiving a larger number or percentage of votes. The affirmative vote of the holders of a majority of the shares of common stock present in person or represented by proxy at the Annual Meeting and entitled to vote thereon is required for all other matters. Stockholders have no right to cumulative voting as to any matter, including the election of directors.

Record Date and Share Ownership

Only stockholders of record of the common stock on our books at the close of business on March 18, 2024 will be entitled to vote at the Annual Meeting. On that date, we had 33,885,223 shares of common stock outstanding. A list of our stockholders will be open to the examination of any stockholders, for any purpose germane to the meeting, at our headquarters, located at 7800 Walton Parkway, New Albany, Ohio 43054, for a period of ten (10) days prior to the meeting; however, please contact Aneezal Mohamed at (614) 289-0326 or by email at Aneezal.Mohamed@cvgrp.com to coordinate your review. Each share of common stock entitles the holder thereof to one vote on all matters submitted to stockholders.

Corporate Governance

Proposal 1 —

Election of Directors

Our Board currently has eight members including Roger L. Fix who has announced his resignation from the Board effective as of this Annual Meeting. The Board has nominated seven nominees -- James R. Ray, Melanie K. Cook, Ruth Gratzke, Robert C. Griffin, William C. Johnson, J. Michael Nauman and Wayne M. Rancourt -- for election as directors at the Annual Meeting, and such nominees will, if elected, serve for a term expiring at the annual meeting of stockholders in 2025.

Each of the director nominees has agreed to be named in this proxy statement, to serve as director if elected and has been nominated by the Board, following a recommendation by the Nominating, Governance & Sustainability Committee (the "NG&S Committee"). All seven nominees currently serve as directors of the Company. In the event any nominee is unable or unwilling to serve as a director at the time of the Annual Meeting (which is not anticipated), the persons named on the enclosed proxy card as proxy holders will have the discretion to vote for such other candidate or candidates as may be nominated by the Board of Directors. The seven persons receiving the highest number of FOR votes of shares present in person or represented by proxy at the Annual Meeting and entitled to vote in the election of directors will be elected. A vote to “WITHHOLD” on the election of directors and broker non-votes will have no effect on the outcome of the election of directors.

Recommendation of the Board

| | | | | |

| The Board recommends that you vote FOR the election of the nominees listed on pages 15 through 21. |

Board Membership Criteria: What we look for

The NG&S Committee has used, over the last few years, a formal process to identify potential candidates for nomination as directors. In the formal process, the NG&S Committee has retained an executive search firm to identify potential candidates for consideration by the NG&S Committee and the Board. Generally, candidates have significant business experience. The NG&S Committee considers properly submitted stockholder recommendations for candidates for the Board. The NG&S Committee has established criteria that identify desirable experience for prospective Board members, including experience as an officer in a public or substantial private company, breadth of knowledge about issues affecting CVG or our industry, expertise in finance, logistics, manufacturing, law, human resources or marketing. While the NG&S Committee does not have a formal diversity policy with respect to nominees, the NG&S Committee shares our commitment to an inclusive culture and endorses equal opportunity principles and practices that support these values. Accordingly, the NG&S Committee may consider whether a potential nominee, if elected, assists in achieving a mix of Board members that represent a diversity of background and experience. The NG&S Committee believes that the backgrounds and qualifications of its directors, as a group, should provide a broad mix of experience, knowledge and abilities that will allow the Board to fulfill its responsibilities. The NG&S Committee is committed to nondiscrimination in its selection practices and makes decisions solely on the basis of skills, qualifications and experience. Personal attributes for prospective Board members include integrity and sound ethical character, absence of legal or regulatory impediments, absence of conflicts of interest, demonstrated track record of achievement, ability to act in an oversight capacity, appreciation for the issues confronting a public company, adequate time to devote to the Board and its committees and willingness to assume broad fiduciary responsibilities on behalf of all stockholders. The NG&S Committee considers a director’s past attendance record, participation and contribution to the Board in considering whether to recommend the reelection of such director.

Our Director Nominees

The Board seeks members that possess the experience, skills and diverse backgrounds to perform effectively in overseeing our current and evolving business and strategic direction and to properly perform the Board’s oversight responsibilities. All director nominees bring to the Board a wealth of executive leadership experience derived from their diverse professional backgrounds and areas of expertise. As a group, they have business acumen, global business experience and financial expertise, as well as public company board experience. In addition, three of the seven director nominees are gender or ethnically diverse. Each director nominee has sound judgment and integrity and is able to commit sufficient time and attention to the activities of the Board. All director nominees other than our Chief Executive Officer are independent.

| | | | | | | | | | | |

Age 76 Director since 2005 Independent Director | | Robert C. Griffin |

Chairman of the Board of CVG Head of Investment Banking, Americas, Barclays (retired) |

Background |

Robert C. Griffin has served as a Director since July 2005, and was elected Chairman in 2019, and served as Interim President and CEO from May 2023 through December 2023. Mr. Griffin’s career spanned over 25 years in the financial sector until he retired from Barclays Capital, where from June 2000 to March 2002 he was Head of Investment Banking, Americas and a member of the Management Committee. Prior to joining Barclays Capital, Mr. Griffin was a member of the Executive Committee for the Montgomery Division of Banc of America Securities and held a number of positions with Bank of America, including Group Executive Vice President and Head of Global Debt Capital Raising and as a Senior Management Council Member. Since 2005, he has served on a number of boards, both public and private, including during the last five years, the board of Builders FirstSource, Inc. (ending in 2019). |

Qualifications |

Mr. Griffin has a broad understanding of the financial and investment world. He has over sixteen years of experience in senior and executive management positions with large corporations which included responsibility for determining and executing successful strategies. Mr. Griffin has also served as Chairman of the Board of Directors of another public company, been on numerous committees of each company where he has served as a Director and brings a depth of knowledge about corporate governance from those roles to his service on the Board of Commercial Vehicle Group. Mr. Griffin earned a Master of Business Administration degree from Northwestern University and a Bachelor of Science degree in Finance from Miami University. |

| | | | | | | | | | | | | | | | | | | | |

Age 60 President and Chief Executive Officer Director since March 2020

| | James R. Ray |

| President and Chief Executive Officer of CVG |

Background |

Mr. Ray has served as President and Chief Executive Officer since December 2023 and as a Director since March 2020. He also currently serves as an Independent Director on the Board of Spirit AeroSystems, Inc. In addition to his Board roles, Mr. Ray has provided consulting services to Fortune 100 companies and private equity portfolio companies. Until November 2020, he served as President, Engineered Fastening at Stanley Black & Decker, Inc. where he held various global industrial P&L and operational leadership roles since 2013. Prior to Stanley Black & Decker, Mr. Ray spent more than 25 years in global P&L and engineering leadership roles at TE Connectivity, Delphi and GM. |

Qualifications |

Mr. Ray brings extensive expertise in electronics and electrical engineering within global industrial and automotive operations which is closely aligned with CVG’s long-term growth strategy. Mr. Ray earned a Master of Science degree in Manufacturing Management from Kettering University and a Bachelor of Science degree in Electrical and Electronics Engineering from Howard University. |

| | | | | | | | | | | |

Age 51 Director since October 2023 Board Committees: Audit Committee; and Compensation Committee Independent Director | | Melanie K. Cook |

| Chief Operating Officer, GE Appliances (retired) |

Background |

Melanie K. Cook joined as Director in October 2023 and she serves on the Audit and Compensation committees of the Board. Ms. Cook brings a wealth of leadership, operating experience and expertise in a multitude of business areas. She was Chief Operating Officer at GE Appliances from 2017 until her retirement in 2021. In that executive position, Melanie was responsible for full operations leadership for the multi-billion-dollar revenue business covering 15,000 employees globally. |

Qualifications |

| Ms. Cook's nearly 30 years of global experience includes business unit leadership roles with full P&L responsibility, product lifecycle management, digitization, end-to-end supply chain, global sourcing, and finance/audit across multiple industries globally. Melanie has been an independent Director of Badger Meter, Inc. since February 2022, where she serves on the Audit and Compliance Committee of the Board. She holds a Bachelor of Science in Business Administration, with a specialty in Decision and Information Sciences from the University of Florida. |

| | | | |

| | | | | | | | | | | |

Age 52 Director since 2021 Board Committees: Audit Committee; and Nominating, Governance and Sustainability Committee Independent Director | | Ruth Gratzke |

| President and Chief Executive Officer of Siemens Industry, Inc. |

Background |

Ruth Gratzke has served as a Director since July 2021 and she serves on the Audit and Nominating, Governance and Sustainability committees of the Board. Ms. Gratzke has served as President & CEO, Siemens Industry, Inc., an industrial manufacturing company, and as President of Siemens Smart Infrastructure, United States, Siemens AG, since 2020, after rejoining the company in 2019. From 2017 to 2019, Ms. Gratzke was Divisional Vice President, Power Systems at Hubbell Incorporated, an international manufacturer of quality electrical, lighting and power solutions, and from 2014 to 2017, Ms. Gratzke was General Manager and Global Product Line Lead, Industrial Breakers, Power Components at General Electric Company. Prior to joining GE, Ms. Gratzke held a number of general management positions at Siemens AG over a period of 19 years. |

Qualifications |

| Ms. Gratzke brings more than 25 years of commercial experienced and expertise on a multitude of topics including business development, industrial manufacturing operations, strategic planning, project management and international business operations. Ms. Gratzke earned her Master of Science degree in Electric Engineering from University of Erlangen-Nuremberg (Germany). |

| | | | |

| | | | | | | | | | | |

Age 60 Director since 2023 Board Committees: Compensation Committee; and Nominating, Governance and Sustainability Committee Independent Director | | William C. Johnson |

| Chief Executive Officer of Avail Infrastructure Solutions |

Background |

William C. Johnson has served as a Director since December 2023 and he serves on the Compensation and Nominating, Governance and Sustainability committees of the Board. Since October 2022, Mr. Johnson has served as CEO and a member of the Board of Directors of Avail Infrastructure Solutions. From October 2018 to July 2022, Mr. Johnson served as the President and CEO of Welbilt, Inc. (WBT), and from July 2016 to June 2018, he served President and CEO and COO of Chart Industries, Inc. Prior to that he held multiple roles of increasing responsibility at Dover Refrigeration and Food Equipment, Hillphoenix, ABB and ESAB. |

Qualifications |

Mr. Johnson brings tremendous leadership experience to the CVG Board. He has served as the CEO of several public, private, and sponsor-backed companies in the industrial and manufacturing space. His proven record of success across various executive roles speaks to his exceptional capabilities. Mr. Johnson holds a bachelor's degree in ceramic engineering from Alfred University and an MBA from Rollins College. He started his professional career as a nuclear engineer in the U.S. Navy aboard the submarine USS Stonewall Jackson. |

| | | | |

| | | | | | | | | | | |

Age 61

Director since 2021 Board Committees: Audit Committee; Compensation Committee; and Nominating, Governance and Sustainability Committee Independent Director | | J. Michael Nauman |

| President, Chief Executive Officer & Board Member of Brady Corporation (retired) |

Background |

J. Michael Nauman has served as a Director since June 2021 and serves on the Audit, Compensation and Nominating, Governance and Sustainability committees of the Board. Mr. Nauman served on Brady Corporation’s Board of Directors and as the President and CEO of Brady Corporation, a developer and manufacturer of specialty products, technical equipment, and services for identifying components used in workplaces, from 2014 until 2022. Prior to joining Brady Corporation, Mr. Nauman spent 20 years at Molex Incorporated, where he led global businesses in the automotive, data communications, industrial, medical, military/aerospace and mobile sectors. In 2007, he became Molex's Senior Vice President leading its Global Integrated Products Division and was named Executive Vice President in 2009. Before joining Molex in 1994, Mr. Nauman was a tax accountant and auditor with Arthur Andersen and Controller and then President of Ohio Associated Enterprises, Inc. |

Qualifications |

| Mr. Nauman brings more than 35 years of experience in commercial and operational leadership, strategy development, restructuring, and mergers and acquisitions. He is a board member of the Little Rock Museum of Discovery, the Quapaw Area Council of the Boy Scouts of America, and the Anthony School Board of Trustees. He holds a bachelor of science degree in management from Case Western Reserve University. Mr. Nauman is a certified public accountant and chartered global management accountant. |

| | | | |

| | | | | | | | | | | |

Age 61 Director since 2016 Board Committees: Audit Committee; and Compensation Committee Independent Director | | Wayne M. Rancourt |

| Executive Vice President, Chief Financial Officer & Treasurer of Boise Cascade Company (retired) |

Background |

Wayne M. Rancourt has served as a Director since July 2016 and serves on Audit and Compensation committees of the Board. In May 2021, Mr. Rancourt retired as Executive Vice President, Chief Financial Officer & Treasurer of Boise Cascade Company, a $5.5 billion in revenues North American based manufacturing and distribution company. He served in that role beginning in August 2009. Mr. Rancourt has over 30 years of experience in various finance roles including chief financial officer, treasurer, investor relations, strategic planning, as well as internal audit. |

Qualifications |

| Mr. Rancourt brings strong financial expertise to the Board through his experience in various finance roles. He has over 30 years of experience in senior and executive management positions in the finance field which includes responsibility for determining and executing successful strategies. Mr. Rancourt received a Bachelor of Science degree in Accounting from Central Washington University. |

| | | | |

Director Skills Matrix

Our director nominees possess relevant skills and experience that contribute to a well-functioning Board that effectively oversees our strategy and management.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Director Nominee Skills and Experience | | Griffin | | Ray | | Cook | | Gratzke | | Johnson | | Nauman | | Rancourt |

| Executive Leadership | | ü | | ü | | ü | | ü | | ü | | ü | | ü |

| Strategic Management | | ü | | ü | | ü | | ü | | ü | | ü | | ü |

| Finance/Accounting | | ü | | ü | | ü | | ü | | ü | | ü | | ü |

| Operations | | ü | | ü | | ü | | ü | | ü | | ü | | ü |

| International | | ü | | ü | | ü | | ü | | ü | | ü | | |

| M&A | | ü | | ü | | ü | | ü | | ü | | ü | | ü |

| Legal/Risk/Governance | | ü | | ü | | ü | | ü | | ü | | ü | | ü |

Our Board’s Composition and Structure

Our Board Leadership Structure

The Board has determined that Ms. Cook and Ms. Gratzke and Messrs. Griffin, Johnson, Rancourt and Nauman are independent directors, as independence is defined in Rule 5605(a)(2) of the Nasdaq Stock Market (“Nasdaq”) Marketplace Rules. The Board has not adopted categorical standards in making its determination of independence and instead relies on standards set forth in the Nasdaq Marketplace Rules. In making this determination, the Board considered all provisions of the definition in the standards set forth in the Nasdaq Marketplace Rules. Each member of the Audit Committee of the Board meets the heightened independence standards required for audit committee members under the Nasdaq Marketplace Rules and Rule 10A-3 under the Securities Exchange Act of 1934, as amended (the “Exchange Act”).

Our Board structure provides for an independent, non-executive Chairman whose principal responsibility to our Company is leading the Board, thereby allowing our President and CEO to focus on running our Company, except that from May - December 2023, our Chairman also served as the interim President and CEO. We believe that this structure is optimal at this time as it allows the President and CEO to more readily devote his attention and energy to the challenges of managing the business while the Chairman facilitates board activities and the flow of information between management and the Board.

Our Board currently has seven independent members and one non-independent member, our President and CEO. As previously disclosed, Mr. Fix announced his resignation from the Board effective as of this Annual Meeting. Collectively, these individuals offer decades of relevant industry expertise, executive management experience and governance expertise. A number of our independent board members also serve, or have served, as members of senior management or as directors of other public companies. We have three board committees consisting entirely of independent directors, each of which is chaired by a different director. We believe the independence of all but our President and CEO and background of the individuals who comprise our Board, along with the oversight of a non-executive Chairman, offers our Company and our stockholders diverse leadership and governance experience, including manufacturing, transportation, distribution, logistics, and finance.

Our independent directors hold regularly scheduled meetings in executive session, at which only independent directors and the Chief Legal Officer are present. As provided in our NG&S Committee charter, in the absence of the Chairman of the Board, the Chairman of the NG&S Committee serves as chairman of the meetings of the independent directors in executive session. Stockholders and third parties may communicate with our independent directors through the Chairman of the NG&S Committee, c/o Aneezal H. Mohamed, Chief Legal Officer, Compliance Officer and Secretary, Commercial Vehicle Group, Inc., 7800 Walton Parkway, New Albany, Ohio 43054. During 2023, our independent directors met in executive session five times. As of the date of this proxy statement, our independent directors have met in executive session two times in 2024.

Board Diversity

In identifying and evaluating candidates for the Board, the NG&S Committee considers the diversity of the Board, including diversity of skills, experience and backgrounds. We believe that our Board nominees reflect an appropriate mix of skills, experience and backgrounds and strike the right balance of longer serving and newer directors.

| | |

Gender and Racial Diversity 43% |

In August 2021, the SEC approved a Nasdaq Stock Market proposal to adopt new listing rules relating to board diversity and disclosure. As approved by the SEC, the new Nasdaq listing rules require all Nasdaq listed companies to disclose consistent, transparent diversity statistics regarding their boards of directors. The rules also require most Nasdaq listed companies to have, or explain why they do not have, at least two diverse directors, including one who self-identifies as female and one who self-identifies as either an under-represented minority or LGBTQ+. In this regard, Ms. Cook and Ms. Gratzke are female and Mr. Ray is African-American. Accordingly, the Company is in compliance with Nasdaq’s diversity requirement. The Board Diversity Matrix below presents the Board’s diversity statistics in the format prescribed by the Nasdaq rules.

| | | | | | | | | | | | | | |

Board Diversity Matrix (as of March 18, 2024) |

| Total Number of Directors | 8 |

| Female | Male1 | Non-Binary | Did Not Disclose Gender |

| Part I: Gender Identity | | | | |

| Directors | 2 | 6 | 0 | |

| Part II: Demographic Background | | | | |

| African American or Black | | 1 | | |

| Alaskan Native or Native American | | | | |

| Asian | | | | |

| Hispanic or Latinx | | | | |

| Native Hawaiian or Pacific Islander | | | | |

| White | 2 | 5 | | |

| Two or More Races or Ethnicities | | | | |

| LGBTQ+ | | | | |

| Did Not Disclose Demographic Background | | | | |

1Mr. Fix is included in this table, but he has announced his retirement from the Board, effective as of the Annual Meeting, and is not standing for re-election.

Director Attendance

The Board held four regular quarterly meetings and three telephonic meetings during fiscal year 2023. The Board has three standing committees: the Audit Committee, the Compensation Committee and the Nominating, Governance & Sustainability Committee. Each director is expected to attend each meeting of the Board and those committees on which he or she serves. In addition to meetings, the Board and its committees review and act upon matters through written consent actions. All of the directors who were serving on the Board in 2023 attended greater than 75% of the meetings of the Board and committees on which they served. The Board has a policy that members of the Board are encouraged to attend annual meetings of stockholders. All of the directors who were then serving on the Board attended the 2023 Annual Meeting of Stockholders.

| | |

2023 Director Attendance Greater than 75% |

Board Committees

The Board has an Audit Committee, a Nominating, Governance & Sustainability Committee and a Compensation Committee. Each member of these committees is independent under our Corporate Governance Guidelines and under applicable committee independence rules.

The charter for each of these committees is available on our website at www.cvgrp.com. This information also is available in print (free of charge) to any stockholder who requests it from our Investor Relations department.

| | | | | |

| Audit Committee |

Members: Wayne M. Rancourt (Chair) Melanie K. Cook Ruth Gratzke J. Michael Nauman

Meetings in fiscal 2023: 8

| The Audit Committee’s primary duties are: • The appointment, retention and oversight of the work of the independent registered public accounting firm engaged for the purpose of preparing and issuing an audit report; • Reviewing the independence of the independent registered public accounting firm and taking, or recommending that our Board take, appropriate action to oversee their independence; • Approving, in advance, all audit and non-audit services to be performed by the independent registered public accounting firm; • Overseeing our accounting and financial reporting processes and the audits of our financial statements; • Establishing procedures for the receipt, retention and treatment of complaints received by the Company regarding accounting, internal control or auditing matters and the confidential, anonymous submission by our employees of concerns regarding questionable accounting or auditing matters; • Determining compensation of the independent registered public accounting firm, compensation of advisors hired by the Audit Committee and ordinary administrative expenses; • Reviewing and approving the internal audit plan annually; • Reviewing and assessing the adequacy of its formal written charter on an annual basis; • Engaging independent counsel and other advisors as the Audit Committee deems necessary; and • Such other matters that are designated by the Audit Committee charter or our Board. Each of Ms. Cook and Messrs. Rancourt and Nauman qualify as an “audit committee financial expert” as such term is defined in Item 407(d)(5) of Regulation S-K under the Exchange Act.

|

| | |

| Nominating, Governance and Sustainability Committee |

| | | | | |

Members: J. Michael Nauman (Chair) Roger L. Fix* Ruth Gratzke William Johnson Meetings in fiscal 2023: 4

*Retiring effective this Annual Meeting | The Nominating, Governance & Sustainability Committee’s primary duties are: • Recommending to our Board for selection, nominees for election to our Board; • Making recommendations to our Board regarding the size and composition of the Board, committee structure and makeup, and retirement procedures affecting Board members; • Leading the Board in an annual self-evaluation process, including the self-evaluation of each Board committee, and report its conclusions and any recommendations to the Board; • Monitoring our performance in meeting our obligations of fairness in internal and external matters and our principles of corporate governance; • Monitoring the Company’s ESG programs and initiatives; and • Such other matters that are designated by the NG&S Committee charter or our Board. The NG&S Committee will consider as potential nominees individuals for board membership properly recommended by stockholders. Recommendations concerning individuals proposed for consideration should be addressed to the NG&S Committee, c/o Aneezal H. Mohamed, Chief Legal Officer, Compliance Officer and Secretary, Commercial Vehicle Group, Inc., 7800 Walton Parkway, New Albany, Ohio 43054. Each recommendation should include a personal biography of the suggested nominee, an indication of the background or experience that qualifies the person for consideration, and a statement that the person has agreed to serve if nominated and elected. Stockholders who themselves wish to effectively nominate a person for election to the Board, as contrasted with recommending a potential nominee to the NG&S Committee for its consideration, are required to comply with the advance notice and other requirements set forth in our by-laws and described below under "Submission of Stockholders' Proposals and Additional Information."

|

| | | | | |

Members: Roger L. Fix (Chair)* Melanie K. Cook William C. Johnson J. Michael Nauman Wayne M. Rancourt Meetings in fiscal 2023: 6

*Retiring effective this Annual Meeting | The Compensation Committee’s primary duties are: • Reviewing the performance of the President and CEO on an annual basis; • Reviewing and determining the compensation of the President and CEO and all other executive officers; • Reviewing our compensation policies and programs to ensure they are aligned with corporate objectives; • Overseeing the design and administration of our equity-based and incentive compensation plans, including the Commercial Vehicle Group, Inc. 2020 Equity Incentive Plan (the “2020 Equity Incentive Plan”), and the Amended and Restated Commercial Vehicle Group, Inc. 2014 Equity Incentive Plan (the “2014 Equity Incentive Plan”); • Reviewing and discussing with management the Compensation Discussion and Analysis section of this proxy statement and recommending to the Board whether the Compensation Discussion and Analysis should be included in our annual proxy statement; • Reviewing and assessing risks associated with the Company’s compensation policies and practices; • Reviewing and considering the results of the most recent say-on-pay vote in evaluating and determining executive compensation; and • Such other matters that are designated by the Compensation Committee charter or our Board. The Compensation Discussion and Analysis, which begins on page 40, discusses how the Compensation Committee makes compensation-related decisions regarding our named executive officers. |

Compensation Committee Interaction with Compensation Consultants

During 2023, the Compensation Committee engaged Meridian Compensation Partners, LLC (“Meridian”), an executive compensation consulting firm. Meridian has been serving in an advisory capacity since August 2016 to assist with the Compensation Committee’s review of the compensation programs for our executive officers, non-employee directors and various aspects of this proxy statement. The Compensation Committee continues to retain Meridian in an advisory capacity relating to executive compensation, including the review of this proxy statement. Although the Compensation Committee retains Meridian with Meridian reporting directly to the Chair of the Compensation Committee, Meridian interacts directly with our executive officers when necessary and appropriate. Meridian’s advisory services included providing industry and compensation peer group benchmark data and presenting compensation plan design alternatives to the Compensation Committee for consideration. The Compensation Committee considered and assessed all factors specified under the applicable Nasdaq Marketplace Rules with respect to advisor independence and determined that Meridian was an independent executive compensation firm whose scope of work is limited to research and advisory services related to executive compensation, including the review of this proxy statement. Based on this review, we are not aware of any conflict of interest that has been raised by the work performed by Meridian.

Compensation Committee Interaction with Management

Certain of our officers, including but not limited to, our President and CEO, Chief Financial Officer, Chief Legal Officer, and Chief Human Resources Officer, may from time to time attend Compensation Committee meetings when executive compensation, company performance, team performance, individual performance or other matters are discussed and evaluated by Compensation Committee members, except when their respective compensation or performance is discussed. The executive officers are asked for their insights, ideas and recommendations on executive compensation matters during these meetings or at other times, and also provide updates on financial performance, corporate development activities, industry status and other factors that the Compensation Committee may consider when making decisions regarding our executive compensation programs.

Mr. James R. Ray, was elected President and Chief Executive Officer effective December 20, 2023. The Chairman of the Board and Chairman of the Compensation Committee met with our President and CEO in the first quarter of 2024 to discuss his 100-day performance.

Our Board’s Primary Role and Responsibilities and Processes

Our Board’s Primary Role and Responsibilities

Our Corporate Governance Guidelines provide that our Board serves as the representative of, and acts on behalf of, all the stockholders of CVG. In that regard, some primary functions of the Board include:

● reviewing, evaluating and, where appropriate, approving our major business strategies, capital deployment and

long-term plans and reviewing our performance;

● planning for and approving management succession; and

● overseeing our policies and procedures for assessing and managing compliance and risk.

The Role of the Board in Risk Oversight

As provided in our Audit Committee Charter, the Audit Committee is primarily responsible for overseeing our risk management processes on behalf of the full Board. The Audit Committee reviews and provides oversight regarding our risk management policies with respect to our business strategy, capital strength and overall risk tolerance. On a periodic basis, the Audit Committee evaluates and discusses with management, with management having consulted outside advisors, our risk assessment practices, including the internal system to review operational risks, procedures for investment and trading, and safeguards to ensure compliance with procedures. The Audit Committee reports regularly to the full Board about these matters. The Audit Committee and the full Board consider our risk profile and focus on the most significant risk factors facing us as they seek to ensure that material risks are identified and appropriate risk mitigation measures are implemented. The Audit Committee and the full Board work with management to oversee the application of risk management policies and protocols, including controls over cash and investments, currency exposures and interest rate and commodities risks.

Communication with the Board

Stockholders and other interested parties may communicate with the Board, including the independent directors, as a group or with individual directors, by sending written communications to the directors c/o Aneezal H. Mohamed, Chief Legal Officer, Compliance Officer and Secretary, Commercial Vehicle Group, Inc., 7800 Walton Parkway, New Albany, Ohio 43054. All such communications will be forwarded to the appropriate directors.

Environmental, Social & Governance Responsibility

CVG is committed to operating in an ethical and sustainable manner that benefits all our stakeholders including investors, customers, employees and the communities we serve. The Board has the ultimate responsibility for risk oversight and oversees a Company-wide approach to risk management of ESG issues through each of the Compensation and NG&S committees. Management provides each of the Compensation and NG&S committees with periodic updates on the Company’s ESG programs and initiatives. We have established company-wide environmental, human rights, and labor rights policies that outline the Company’s standards for all business operations. More information on these policies can be found on our website under the caption “About Us – CVG Policies,” including highlights of our ongoing Environmental, Social and Governance efforts related to safety, quality, environmental, community engagement and corporate governance. In March 2023, the Company issued its first ESG report (the "ESG Report") which is available on the Company website at www.cvgrp.com. The ESG Report shall not be deemed incorporated by reference by any general statement incorporating by reference this proxy statement into any filing under the Securities Act of 1933, as amended (the “Securities Act”) or under the Exchange Act, except to the extent that we specifically incorporate this information by reference, and shall not be deemed filed under the Securities Act or the Exchange Act.

Code of Conduct

The Board has adopted a Code of Conduct that applies to the Company’s directors, officers and employees. A copy of the Code of Conduct is posted on our website at www.cvgrp.com. If we waive any provision of our Code of Conduct for our Board or our executive officers or make material changes to our Code of Conduct, we will disclose that fact on our website within four business days.

Insider Trading Policy

We adopted a corporate policy regarding insider trading and Section 16 reporting that applies to our directors, executive officers and employees. This policy prohibits trading in our common stock under certain circumstances, including while in possession of material, non-public information about us. A copy of the Insider Trading Policy is posted on our website at www.cvgrp.com.

Clawback Policy on Incentive Compensation and Other Equity Grants Upon the Material Restatement of Financial Statements

Our Board has adopted a clawback policy (the "Clawback Policy") stating that, in the event the Company is required to prepare an accounting restatement of the Company’s financial statements due to material non-compliance with any financial reporting requirement under the federal securities laws (including any such correction that is material to the previously issued financial statements, or that would result in a material misstatement if the error were corrected in the current period or left uncorrected in the current period), the Company will recover on a reasonably prompt basis the amount of any incentive-based compensation received by a covered executive during the recovery period that exceeds the amount that otherwise would have been received had it been determined based on the restated financial statements. A copy of the Clawback Policy is posted on our website at www.cvgrp.com.

Board Policy on Stockholder Rights Plans

The Board has adopted a policy on stockholder rights plans. Pursuant to the policy, our Board will seek and obtain prior stockholder approval of any new stockholder rights plan, unless a majority of the independent directors, in the exercise of their fiduciary duties, deem it to be in our best interests and in the best interests of our stockholders to adopt a stockholder rights plan without the delay in adoption that would arise from obtaining stockholder approval. If the Board so adopts a stockholder rights plan without obtaining prior stockholder approval, the Board will submit the stockholder rights plan to the stockholders for ratification and approval within one year of the Board’s adoption of the plan, or else the stockholder rights plan will automatically expire, without being renewed or replaced, on the first anniversary of the adoption of the stockholder rights plan by the Board. If presented by the Board for stockholder approval at a meeting of the stockholders and not approved by the stockholders, the plan will expire upon the certification of the voting results of such stockholders meeting.

A copy of our policy on stockholder rights plan is posted on our website at www.cvgrp.com.

Board Leadership

The following changes became effective in 2023. Harold C. Bevis resigned from his role as President and Chief Executive Officer and Board member effective May 19, 2023.

Robert C. Griffin, our Chairman of the Board was elected the interim President and Chief Executive Officer as of May 19, 2023 and served in the interim role until December 20, 2023. During the time Mr. Griffin served as the interim President and Chief Executive Officer, he was not an independent Director.

James R. Ray, an independent Director, was elected President and Chief Executive Officer effective December 20, 2023, where upon, he remained as a Director, but ceased being an independent Director.

On August 14, 2023, Roger L. Fix, a Director since June 2014, informed the Company that he will be retiring from the Board without standing for re-election at the 2024 Annual Meeting of Stockholders, effective the date of the 2024 Annual Meeting of Stockholders.

On September 26, 2023, the Board elected Melanie K. Cook as an independent Director.

On December 8, 2023, the Board elected William C. Johnson as an independent Director.

Director Compensation

Overview

We pay our non-employee directors an annual retainer of $75,000. We pay annual chair fees of $65,000 to the Chairman of the Board, $20,000 to the Audit Committee Chair, $15,000 to the Compensation Committee Chair and $10,000 to the NG&S Committee Chair.

We also compensate our non-employee directors through an annual grant of restricted stock to the value of $110,000 and in May 2023, we granted 13,716 shares of restricted stock to each non-employee director calculated based on the average closing price for twenty (20) trading days prior to the grant date of May 11, 2023 or $8.02. All such restricted stock grants made to our non-employee directors in 2023 cliff vest on the first to occur of May 11, 2024 or the 2024 Annual Meeting. With respect to Ms. Cook, who was elected to the Board on September 26, 2023, she was granted 13,654 restricted shares valued at $110,000 on September 29, 2023 based on the average closing price of $8.06 for twenty (20) trading days prior to the grant date. With respect to Mr. Johnson, who was elected to the Board on December 8, 2023, he was granted 16,830 restricted shares valued at $110,000 on December 14, 2023 based on the average closing price of $6.54 for twenty (20) trading days prior to the grant date. We also reimburse all directors for reasonable expenses incurred in attending Board and committee meetings.

Based on the result of the compensation benchmarking performed by the Committee’s compensation consultant, Meridian, against the Company’s peer group, the non-employee directors' compensation was adjusted, effective January 1, 2024, as follows: the annual retainer was increased to $85,000 per year; the value of annual grant of restricted stock was increased to $120,000 (with the grant following this Annual Meeting); the annual Board chair fees was increased to $80,000; and all committee chair fees remained unchanged.

The table below describes the compensation paid to non-employee directors in 2023.

2023 Director Compensation

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Name | | Fees Earned or Paid in Cash

($) | | Stock Awards

($) (1)(2) | | Option Awards ($) | | Non-Equity Incentive Plan Compensation ($) | | Change in Pension Value and Nonqualified Deferred Compensation Earnings

($) | | All Other Compensation

($) | | Total ($) |

| Robert C. Griffin | | 140,000.00 | | | 134,416.80 | | | — | | | — | | | — | | | — | | | 274,417.00 | |

| Wayne M. Rancourt | | 95,000.00 | | | 134,416.80 | | | — | | | — | | | — | | | — | | | 229,417.00 | |

| Roger L. Fix | | 90,000.00 | | | 134,416.80 | | | — | | | — | | | — | | | — | | | 224,417.00 | |

| James Ray | | 128,858.70 | | | 134,416.80 | | | — | | | — | | | — | | | — | | | 263,276.00 | |

| Ruth Gratzke | | 75,000.00 | | | 134,416.80 | | | — | | | — | | | — | | | — | | | 209,417.00 | |

| J. Michael Nauman | | 75,000.00 | | | 134,416.80 | | | — | | | — | | | — | | | — | | | 209,417.00 | |

| Melanie K. Cook | | 18,750.00 | | | 105,955.04 | | | — | | | — | | | — | | | — | | | 124,705.00 | |

| William C. Johnson | | 18,750.00 | | | 117,978.30 | | | — | | | — | | | — | | | — | | | 136,728.00 | |

| | | | | |

| (1) | Represents the aggregate value of the restricted stock based on the closing price of $9.80 on May 11, 2023, the grant date for all non-employee directors except for grants to Ms. Cook who was elected to the Board on September 26, 2023 and Mr. Johnson who was elected to the Board on December 8, 2023 . The 2023 awards for the non-employee directors, except to Ms. Cook and Mr. Johnson, was based on the average closing price for twenty (20) trading days prior to the grant date of May 11, 2023, or $8.02. The award made to Ms. Cook was based on the average closing price for twenty (20) trading days prior to the grant date of September 29, 2023, or $8.06; and the award made to Mr. Johnson was based on the average closing price for twenty (20) trading days prior to the grant date of December 14, 2023, or $6.54. |

| (2) | The aggregate number of shares of unvested restricted stock held by each of our non-employee directors,except for Ms. Cook and Mr. Johnson, as of December 31, 2023 was 13,716 shares, and with respect to each of Ms. Cook and Mr. Johnson, was 13,654 and 16,830, respectively. |

Related Person Transactions Policy and Process

Our management monitors related party transactions for potential conflicts of interest situations on an ongoing basis. Under the Nasdaq Marketplace Rules, we are required to conduct a review of all related party transactions for potential conflict of interest situations on an ongoing basis, and all such transactions must be reviewed and approved by our Audit Committee or another independent body of the Board. Related parties means our directors, officers, 5% stockholders or the immediate family members of any of the foregoing. Our Code of Conduct provides that no director or executive officer may represent the interests of any party other than the Company (including personal interests) in any material transaction in which we and another party are involved.

Proposal 2 –

Advisory Vote to Approve the Compensation of Our Named Executive Officers

In accordance with Section 14A of the Securities Exchange Act of 1934 (the “Exchange Act”), we are asking our stockholders to approve, on a non-binding advisory basis, the compensation of our named executive officers, as disclosed in the Compensation Discussion and Analysis, the Summary Compensation Table and the related compensation tables, notes and narrative in this proxy statement.

We urge stockholders to read the Compensation Discussion and Analysis beginning on page 40 of this proxy statement, which describes in more detail how our executive compensation program operates and is designed to achieve our compensation objectives, as well as the Summary Compensation Table and related compensation tables, notes and narrative appearing on pages 52 through 60, which provide detailed information on the compensation of our named executive officers.

Although this advisory vote is not binding on the Board, the Board and the Compensation Committee will review and consider the voting results when evaluating our executive compensation program.

The Board has adopted a policy providing for annual say-on-pay advisory votes. Accordingly, unless the Board modifies its policy on the frequency of future say-on-pay advisory votes, we expect that the next say-on-pay advisory vote will be held at our 2025 Annual Meeting of Stockholders.

The approval of the resolution to approve, on a non-binding, advisory basis, the compensation of our named executive officers requires the affirmative vote of the holders of a majority of the shares of common stock present in person or represented by proxy at the Annual Meeting and entitled to vote thereon. Abstentions will count as a vote against the proposal and broker non-votes will have no effect on the outcome of the vote.

Recommendation of the Board

| | | | | |