Document

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-K

|

| |

þ | Annual Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 |

or

|

| |

¨ | Transition report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 |

|

| | |

For the fiscal year ended December 31, 2017 | | Commission file number: 001-34365 |

COMMERCIAL VEHICLE GROUP, INC.

(Exact name of Registrant as specified in its charter)

|

| | |

Delaware | | 41-1990662 |

(State of Incorporation) | | (I.R.S. Employer Identification No.) |

| |

7800 Walton Parkway | | 43054 |

New Albany, Ohio | | (Zip Code) |

(Address of Principal Executive Offices) | | |

Registrant’s telephone number, including area code:

(614) 289-5360

Securities registered pursuant to Section 12(b) of the Act:

|

| | |

Title of Each Class | | Name of exchange on which registered |

Common Stock, par value $.01 per share | | The NASDAQ Global Select Market |

Securities registered pursuant to Section 12(g) of the Act:

None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No þ

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Schedule 15(d) of the Act. Yes ¨ No þ

Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes þ No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes þ No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of Registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer,” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

Large accelerated filer ¨ Accelerated filer þ Non-accelerated filer ¨ Smaller reporting company ¨

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No þ

The aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the price at which the common equity was last sold on June 30, 2017, was $251,131,448.

As of March 12, 2018, 31,004,524 shares of Common Stock of the Registrant were outstanding.

Documents Incorporated by Reference

Information required by Items 10, 11, 12, 13 and 14 of Part III of this Annual Report on Form 10-K is incorporated by reference from the Registrant’s Proxy Statement for its annual meeting to be held May 17, 2018 (the “2018 Proxy Statement”).

COMMERCIAL VEHICLE GROUP, INC.

Annual Report on Form 10-K

Table of Contents

|

| | |

| | Page |

PART I | |

Item 1. | | |

Item 1A. | | |

Item 1B. | | |

Item 2. | | |

Item 3. | | |

Item 4. | | |

| |

PART II | |

Item 5. | | |

Item 6. | | |

Item 7. | | |

Item 7A. | | |

Item 8. | | |

Item 9. | | |

Item 9A. | | |

Item 9B. | | |

| |

PART III | |

Item 10. | | |

Item 11. | | |

Item 12. | | |

Item 13. | | |

Item 14. | | |

| |

PART IV | |

Item 15. | | |

| |

CERTAIN DEFINITIONS

All references in this Annual Report on Form 10-K to the “Company”, “Commercial Vehicle Group”, “CVG”, “we”,“us”, and “our” refer to Commercial Vehicle Group, Inc. and its consolidated subsidiaries (unless the context otherwise requires).

FORWARD-LOOKING INFORMATION

This Annual Report on Form 10-K contains forward-looking statements within the meaning of Section 21E of the Securities Exchange Act of 1934, as amended. For this purpose, any statements contained herein that are not statements of historical fact, including without limitation, certain statements under “Item 1 - Business” and “Item 7 - Management’s Discussion and Analysis of Financial Condition and Results of Operations” and located elsewhere herein regarding industry outlook, financial covenant compliance, anticipated effects of acquisitions, production of new products, plans for capital expenditures and our results of operations or financial position and liquidity, may be deemed to be forward-looking statements. Without limiting the foregoing, the words “believe”, “anticipate”, “plan”, “expect”, “intend”, “will”, “should”, “could”, “would”, “project”, “continue”, “likely”, and similar expressions, as they relate to us, are intended to identify forward-looking statements. The important factors discussed in “Item 1A - Risk Factors”, among others, could cause actual results to differ materially from those indicated by forward-looking statements made herein and presented elsewhere by management from time to time. Such forward-looking statements represent management’s current expectations and are inherently uncertain. Investors are warned that actual results may differ from management’s expectations. Additionally, various economic and competitive factors could cause actual results to differ materially from those discussed in such forward-looking statements, including, but not limited to, factors which are outside our control, such as risks relating to (i) general economic or business conditions affecting the markets in which we serve; (ii) our ability to develop or successfully introduce new products; (iii) risks associated with conducting business in foreign countries and currencies; (iv) increased competition in the medium- and heavy-duty, construction, agriculture, aftermarket, military, bus and other markets; (v) our failure to complete or successfully integrate additional strategic acquisitions; (vi) the impact of changes in governmental regulations on our customers or on our business; (vii) the loss of business from a major customer or the discontinuation of particular commercial vehicle platforms; (viii) our ability to obtain future financing due to changes in the lending markets or our financial position and (ix) our ability to comply with the financial covenants in our revolving credit facility and term loan facility. All subsequent written and oral forward-looking statements attributable to us or persons acting on our behalf are expressly qualified in their entirety by such cautionary statements.

PART I

COMPANY OVERVIEW

Commercial Vehicle Group, Inc. (and its subsidiaries) is a leading supplier of a full range of cab related products and systems for the global commercial vehicle market, including the medium- and heavy-duty truck (“MD/HD Truck”) market, the medium- and heavy-construction vehicle market, and the military, bus, agriculture, specialty transportation, mining, industrial equipment and off-road recreational markets.

We have manufacturing operations in the United States, Mexico, United Kingdom, Czech Republic, Ukraine, China, India and Australia. Our products are primarily sold in North America, Europe, and the Asia-Pacific region.

Our products include seats and seating systems ("Seats"); trim systems and components ("Trim"); cab structures, sleeper boxes, body panels and structural components; mirrors, wipers and controls; and electric wire harness and panel assemblies designed for applications in commercial and other vehicles.

We are differentiated from automotive industry suppliers by our ability to manufacture low volume, customized products on a sequenced basis to meet the requirements of our customers. We believe our products are used by a majority of the North American MD/HD Truck and certain leading global construction and agriculture original equipment manufacturers (“OEMs”), which we believe creates an opportunity to cross-sell our products.

Our Long-term Strategy and Strategic Footprint

Refer to Item 7, Management's Discussion and Analysis of Financial Condition and Results of Operations.

SEGMENTS

Operating segments are defined as components of an enterprise that are evaluated regularly by the Company’s chief operating decision maker (“CODM”), which is our President and Chief Executive Officer. The Company has two reportable segments: the Global Truck and Bus Segment (“GTB Segment”) and the Global Construction and Agriculture Segment (“GCA Segment”). Each of these segments consists of a number of manufacturing facilities. Certain of our facilities manufacture and sell products through both of our segments. Each manufacturing facility that sells products through both segments is reflected in the financial results of the segment that has the greatest amount of revenues from that manufacturing facility. Our segments are more specifically described below.

The GTB Segment manufactures and sells the following products:

| |

• | Seats, Trim, sleeper boxes, cab structures, structural components and body panels. These products are sold primarily to the MD/HD Truck markets in North America; |

| |

• | Seats to the truck and bus markets in Asia-Pacific and Europe; |

| |

• | Mirrors and wiper systems to the truck, bus, agriculture, construction, rail and military markets in North America; |

| |

• | Trim to the recreational and specialty vehicle markets in North America; and |

| |

• | Aftermarket seats and components in North America. |

The GCA Segment manufactures and sells the following products:

| |

• | Wire harness assemblies and Seats for construction, agricultural, industrial, automotive, mining and military industries in North America, Europe and Asia-Pacific; |

| |

• | Seats to the truck and bus markets in Asia-Pacific and Europe; |

| |

• | Wiper systems to the construction and agriculture markets in Europe; |

| |

• | Office seating in Europe and Asia-Pacific; and |

| |

• | Aftermarket seats and components in Europe and Asia-Pacific. |

See Note 9 of the Notes to Consolidated Finance Statements under Item 8 Financial Statements and Supplementary Data for financial information presented by segment for each of the three years ended December 31, 2017, 2016 and 2015, including information on sales and long-lived assets by geographic area.

GLOBAL TRUCK AND BUS SEGMENT OVERVIEW

Global Truck and Bus Segment Products

Set forth below is a brief description of our products manufactured in the GTB Segment and their applications.

Seats and Seating Systems. We design, engineer and produce Seats for MD/HD Truck and bus applications. For the most part, our Seats are fully-assembled and ready for installation when they are delivered to the OEM. We offer a wide range of seats that include mechanical and air suspension seats, static seats, bus seats and military seats. As a result of our product design and product technology, we believe we are a leader in designing seats with convenience and safety features. Our Seats are designed to achieve a high level of operator comfort by adding a wide range of manual and power features such as lumbar support, cushion and back bolsters, and leg and thigh support. Our Seats are built to meet customer requirements in low volumes and produced in numerous feature combinations to form a full-range product line with a wide level of price points. We also manufacture seats, and parts and components for the aftermarket.

Trim Systems and Components. We design, engineer and produce Trim for MD/HD Truck, and recreational and specialty vehicle applications. Our Trim products are used mostly for interior cabs of commercial vehicles as well as exterior components for commercial recreational and specialty vehicles. Our Trim products are designed to provide a comfortable and durable interior along with a variety of functional and safety features for the vehicle occupant. The wide variety of features that can be selected makes Trim a complex and specialized product category. Set forth below is a brief description of our principal products in the Trim category:

Trim Products. Our trim products include door panels and other interior trim panels. Specific components include vinyl or cloth-covered appliqués ranging from a traditional cut and sew approach to a contemporary molded styling theme, armrests, map pocket compartments, and sound-reducing insulation.

Instrument Panels. We produce and assemble instrument panels that can be integrated with the rest of the interior trim. The instrument panel is a complex system of coverings and foam, plastic and metal parts designed to house various components and act as a safety device for the vehicle occupant.

Headliners/Wall Panels. Headliners and wall panels consist of a substrate and a finished interior layer made of fabrics and other materials. While headliners and wall panels are an important contributor to interior aesthetics, they also provide insulation from road noise and can serve as carriers for a variety of other components, such as visors, overhead consoles, grab handles, coat hooks, electrical wiring, speakers, lighting and other electronic and electrical products.

Storage Systems. Our modular storage units and custom cabinetry are designed to improve comfort and optimize space for the operator. These storage systems are designed to be integrated with the interior trim.

Floor Covering Systems. We have an extensive and comprehensive portfolio of floor covering systems and dash insulators. Carpet flooring systems generally consist of tufted or non-woven carpet with a thermoplastic backcoating. Non-carpeted flooring systems, used primarily in commercial and fleet vehicles, offer improved wear and maintenance characteristics.

Sleeper Bunks. We offer a wide array of design choices for upper and lower sleeper bunks for heavy-duty trucks. All parts of our sleeper bunks can be integrated to match the rest of the interior trim.

Grab Handles and Armrests. Our grab handles and armrests are designed and engineered with specific attention to aesthetics, ergonomics and strength.

Privacy Curtains. We produce privacy curtains for use in sleeper cabs.

Plastics Decorating and Finishing. We offer customers a wide variety of cost-effective finishes in paint, ultra violet, hard coating and customized industrial hydrographic films (simulated appearance of wood grain, carbon fiber, brushed metal, marbles, camouflage and custom patterns), paints and other interior and exterior finishes.

Cab Structures, Sleeper Boxes, Body Panels and Structural Components. We design, engineer and produce complete cab structures, sleeper boxes, body panels and structural components for MD/HD Trucks. Set forth below is a brief description of our principal products in this category:

Cab Structures. We design, manufacture and assemble complete cab structures. Our cab structures, which are manufactured from both steel and aluminum, are delivered fully assembled and primed for paint.

Sleeper Boxes. We design, manufacture and assemble sleeper boxes that can be part of the overall cab structure or standalone assemblies depending on the customer application.

Bumper Fascias and Fender Liners. We design and manufacture durable, lightweight bumper fascias and fender liners.

Body Panels and Structural Components. We produce a wide range of both steel and aluminum large exterior body panels and structural components for use in production of cab structures and sleeper boxes.

Mirrors, Wipers and Technical Controls. We design, engineer and produce a variety of mirrors, wipers and controls used in commercial vehicles. Set forth below is a brief description of our principal products in this category:

Mirrors. We offer a range of round, rectangular, motorized and heated mirrors and related hardware, including brackets, braces and side bars. We have introduced both road and outside temperature devices that can be mounted on the cab, integrated into the mirror face and the vehicle’s dashboard through our RoadWatch™ family of products.

Windshield Wiper Systems. We offer application-specific windshield wiper systems and individual windshield wiper components.

Controls. We offer a range of controls and control systems for window lifts, door locks and electric switch products.

Global Truck and Bus Segment Raw Materials and Suppliers

A description of the principal raw materials we utilize in our GTB Segment’s principal product categories is set forth below:

| |

• | Seats and Seating Systems. The principal raw materials used in our Seats include steel, resin-based products and foam products and are generally readily available and obtained from multiple suppliers under various supply agreements. Leather, vinyl, fabric and certain components are also purchased from multiple suppliers. |

| |

• | Trim Systems and Components. The principal raw materials used in our Trim are resin and chemical products, foam, vinyl and fabric which are formed and assembled into end products. These raw materials are generally readily available from multiple suppliers. |

| |

• | Cab Structures, Sleeper Boxes, Body Panels and Structural Components. The principal raw materials and components used in our cab structures, sleeper boxes, body panels and structural components are steel and aluminum. These raw materials are generally readily available and obtained from multiple suppliers. |

| |

• | Mirrors, Wipers and Controls. The principal raw materials used to manufacture our mirrors, wipers and controls are steel, stainless steel, aluminum and rubber, which are generally readily available and obtained from multiple suppliers. We also purchase sub-assembled products, such as motors, for our wiper systems and mirrors. |

Global Truck and Bus Segment Customers

The following is a summary of the GTB Segment’s significant revenues (figures are shown as a percentage of total GTB Segment revenue) by end market for each of the three years ended December 31:

|

| | | | | |

| 2017 | | 2016 | | 2015 |

Medium- and Heavy-duty Truck OEMs | 64% | | 62% | | 70% |

Aftermarket and OE Service | 19 | | 18 | | 15 |

Bus OEMs | 7 | | 8 | | 6 |

Construction OEMs | 2 | | 2 | | 2 |

Other | 8 | | 10 | | 7 |

Total | 100% | | 100% | | 100% |

We believe we are a successful long-term supplier because of our comprehensive product offerings, leading brand names and product innovation. Our principal customers include A.B. Volvo, Daimler Trucks, PACCAR and Navistar, constituting a combined total of 74%, 73% and 79% of GTB Segment revenue for the years ended December 31, 2017, 2016 and 2015, respectively.

Our European and Asia-Pacific operations collectively contributed approximately 6%, 6% and 4% of the GTB Segment’s revenues for the years ended December 31, 2017, 2016 and 2015, respectively.

Global Truck and Bus Industry

Commercial Vehicle Market Overview. Commercial vehicles are used in a wide variety of end markets, including local and long-haul commercial trucking, bus, construction, mining, agricultural, military, industrial, municipal, off-road recreation and specialty vehicle markets. The commercial vehicle supply industry can generally be separated into two categories: (1) sales to OEMs, in which products are sold in relatively large quantities directly for use by OEMs in new commercial and construction vehicles; and (2) aftermarket sales, in which products are sold as replacements to a wide range of original equipment service organizations, wholesalers, retailers and installers. In the OEM market, suppliers are generally divided into tiers - “Tier 1” suppliers

that provide products directly to OEMs, and “Tier 2” and “Tier 3” suppliers that sell products principally to other suppliers for integration into those suppliers’ own product offerings. We are generally a Tier I supplier.

Our largest end market, the North American commercial truck industry, is supplied by medium- and heavy-duty commercial vehicle suppliers, as well as automotive suppliers. The commercial vehicle supplier industry is fragmented and comprised of several large companies and many smaller companies. In addition, the commercial vehicle supplier industry is characterized by relatively low production volumes and can have considerable barriers to entry, including the following: (1) specific technical and manufacturing requirements, (2) high transition costs to shift production to new suppliers, (3) just-in-time delivery requirements and (4) strong brand name recognition. Foreign competition is growing with the globalization of the world economy.

Although OEM demand for our products is directly correlated with new vehicle production, suppliers like us can grow by increasing sales through the cross selling and bundling of products, further penetrating existing customers’ businesses, gaining new customers, expanding into new geographic markets, developing new content in our products to meet changing customer needs and by increasing aftermarket sales. We believe that companies with a global presence, advanced technology, engineering and manufacturing and support capabilities, such as our company, are well positioned to take advantage of these opportunities.

North American Commercial Truck Market. Purchasers of commercial trucks include fleet operators, owner operators, governmental agencies and industrial end users. Commercial vehicles used for local and long-haul commercial trucking are generally classified by gross vehicle weight. Class 8 vehicles are trucks with gross vehicle weight in excess of 33,000 lbs. and Classes 5 through 7 vehicles are trucks with gross vehicle weight from 16,001 lbs. to 33,000 lbs. The following table shows production levels (in thousands of units) of commercial vehicles used for local and long-haul commercial trucking from 2013 through 2017 in North America:

|

| | | | | | | | | |

| 2013 | | 2014 | | 2015 | | 2016 | | 2017 |

Class 8 trucks | 246 | | 297 | | 323 | | 228 | | 256 |

Class 5-7 trucks | 201 | | 226 | | 237 | | 233 | | 249 |

Source: ACT N.A. (February 2018).

The following describes the major markets within the commercial vehicle market in which the GTB Segment competes:

Class 8 Truck Market. The global Class 8 ("Class 8" or "heavy-duty") truck manufacturing market is concentrated in three primary regions: North America, Europe and Asia-Pacific. The global Class 8 truck market is localized in nature due to the following factors: (1) the prohibitive costs of shipping components from one region to another, (2) the high degree of customization to meet the region-specific demands of end-users, and (3) the ability to meet just-in-time delivery requirements. According to ACT Research, four companies represented approximately 98% of North American Class 8 truck production in 2017. The percentages of Class 8 production represented by Daimler, PACCAR, A.B. Volvo, and Navistar were approximately 41%, 30%, 15%, and 12%, respectively, in 2017. We supply products to all of these OEMs.

New Class 8 truck demand has historically been cyclical and is particularly sensitive to economic factors that generate a significant portion of the freight tonnage hauled by commercial vehicles.

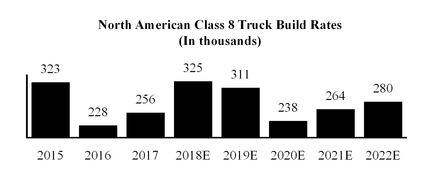

The following table illustrates North American Class 8 truck build for the years 2015 to 2022:

“E” — Estimated

Source: ACT (February 2018).

Class 5-7 Truck Market. North American Class 5-7 ("Class 5-7" or "medium-duty") includes recreational vehicles, buses and medium-duty trucks. We primarily participate in the Class 6 and 7 medium-duty truck market. The medium-duty market is influenced

by overall economic conditions but has historically been less cyclical than the North American Class 8 truck market, with highs and lows generally not as pronounced as the Class 8 truck market. As the North American truck fleet companies move to a distribution center model, requiring less long-haul freight vehicles, the demand for medium-duty trucks may increase.

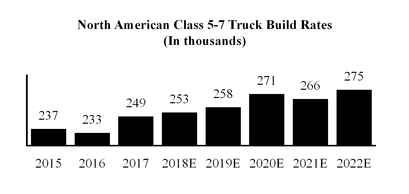

The following table illustrates the North American Class 5-7 truck build for the years 2015 through 2022:

“E” — Estimated

Source: ACT (February 2018).

We believe the following factors are primarily responsible for driving the North American Class 8 truck market:

Economic Conditions. The North American truck industry is directly influenced by overall economic conditions and consumer spending. Since heavy-duty truck OEMs supply the fleet operators, their production levels generally reflect the demand for freight and the fleet operators' access to capital.

Truck Replacement Cycle and Fleet Aging. The average age of the U.S. Class 8 truck population is approximately 11.3 years in 2017. The average fleet age tends to run in cycles as freight companies permit their truck fleets to age during periods of lagging demand and then replenish those fleets during periods of increasing demand. As truck fleets age, maintenance costs typically increase. Freight companies evaluate the economics between repair and replacement as well as the potential to utilize more cost-effective technology in vehicles. The chart below illustrates the approximate average age of the U.S. Class 8 truck population:

“E” — Estimated

Source: ACT (February 2018).

Commercial Truck Aftermarket. The GTB Segment sells aftermarket products primarily in North America. Demand for aftermarket products is driven by the quality of OEM parts, the number of vehicles in operation, the average age of the vehicle fleet, the content and value per vehicle, vehicle usage and the average useful life of vehicle parts. Aftermarket sales tend to be at a higher margin. The recurring nature of aftermarket revenue can be expected to provide some insulation to the overall cyclical nature of the industry as it tends to provide a more stable stream of revenues. Brand equity and the extent of a company’s distribution network also contribute to the level of aftermarket sales. We believe CVG has a widely recognized brand portfolio and participates in most retail sales channels including Original Equipment Dealer networks and independent distributors.

GLOBAL CONSTRUCTION AND AGRICULTURE SEGMENT OVERVIEW

Global Construction and Agriculture Segment Products

Set forth below is a brief description of our products manufactured in the GCA Segment and their applications.

Electric Wire Harnesses and Panel Assemblies. We produce a wide range of electric wire harnesses and electrical distribution systems, and related assemblies. Set forth below is a brief description of our principal products in this category:

Electric Wire Harnesses. We offer a broad range of electric wire harness assemblies that function as the primary electric current carrying devices used to provide electrical interconnections for gauges, lights, control functions, power circuits, powertrain and transmission sensors, emissions systems and other electronic applications on commercial vehicles. Our wire harnesses are customized to fit specific end-user requirements, and can be complex. We provide our wire harnesses for a variety of commercial and other vehicles.

Panel Assemblies. We assemble integrated components such as panel assemblies and cabinets that are installed in a vehicle or unit of equipment and may be integrated with our wire harness assemblies. These components provide the user control over multiple operational functions and features.

Seats and Seating Systems. We design, engineer and produce Seats predominately for the construction, agriculture and military markets. For the most part, our Seats are fully-assembled and ready for installation when they are delivered to the OEM. We offer a wide range of Seats that include mechanical and air suspension seats and static seats, as well as seat frames. As a result of our product design and product technology, we believe we are a leader in designing seats with convenience and enhanced safety features. Our Seats are designed to achieve a high level of operator comfort by adding a range of manual and power features such as lumbar support, cushion and back bolsters and leg and thigh support. Our Seats are built to meet customer requirements in low volumes and produced in numerous feature combinations to form a full-range product line with a wide level of price points. We also manufacture seats, parts and components for the aftermarket.

Office Seating. We design, engineer and produce office seating products. Our office chair was developed as a result of our experience supplying seats for the heavy-duty truck, agricultural and construction industries and is fully adjustable to achieve a high comfort level. Our office chairs are designed to suit different office environments including heavy usage environments, such as emergency services, call centers, reception areas, studios and general office environments.

Wipers Systems. We design, engineer and produce a variety of wipers used in commercial vehicles. We offer application-specific windshield wiper systems and individual windshield wiper components.

Global Construction and Agriculture Segment Raw Materials and Suppliers

A description of the principal raw materials we utilize in GCA Segment’s principal product categories is set forth below:

| |

• | Electric Wire Harnesses and Panel Assemblies. The principal raw materials used to manufacture our electric wire harnesses are wire and cable, connectors, terminals, switches, relays and various covering techniques involving braided yarn, braided copper, slit and non-slit conduit and molded foam. These raw materials are obtained from multiple suppliers and are generally available, although we have experienced and continue to experience a shortage of certain of these raw materials. |

| |

• | Seats and Seating Systems. The principal raw materials used in our seating systems include steel, die-cast aluminum, resin-based products and foam products and are generally readily available and obtained from multiple suppliers under various supply agreements. Leather, vinyl, fabric and certain other components are also readily available to be purchased from multiple suppliers under supply agreements. |

| |

• | Wiper Systems. The principal raw materials used to manufacture our wipers are steel, stainless steel and rubber, which are generally readily available and obtained from multiple suppliers. We also purchase sub-assembled products such as motors for our wiper systems. |

Global Construction and Agriculture Segment’s Customers

The following is a summary of the GCA Segment’s significant revenues (figures are shown as a percentage of total GCA Segment revenue) by end market based for each of the three years ended December 31:

|

| | | | | | | | |

| 2017 | | 2016 | | 2015 |

Construction | 52 | % | | 47 | % | | 52 | % |

Automotive | 13 |

| | 14 |

| | 14 |

|

Aftermarket and OE Service | 12 |

| | 16 |

| | 16 |

|

Truck | 8 |

| | 8 |

| | 5 |

|

Military | 5 |

| | 5 |

| | 3 |

|

Agriculture | 3 |

| | 3 |

| | 3 |

|

Other | 7 |

| | 7 |

| | 7 |

|

Total | 100 | % | | 100 | % | | 100 | % |

We believe we are a successful long-term supplier because of our comprehensive product offerings and product innovation services. Our principal customers include Caterpillar and John Deere, constituting a combined total of 36%, 33% and 37% of GCA Segment revenue for the years ended December 31, 2017, 2016 and 2015, respectively.

Our European and Asia-Pacific operations collectively contributed approximately 62%, 63% and 57% of our revenues for the years ended December 31, 2017, 2016 and 2015, respectively.

Global Construction and Agriculture Industry

Commercial Construction Vehicle Market. New vehicle demand in the global construction equipment market generally follows certain economic conditions including GDP, infrastructure investment, housing starts, business investment, oil and energy investment and industrial production around the world. Within the construction market, there are two classes of construction equipment markets: the medium and heavy construction equipment market (weighing over 12 metric tons) and the light construction equipment market (weighing below 12 metric tons). Our construction equipment products are primarily used in the medium and heavy construction equipment markets, with a growing emphasis on light and utility machines. The platforms that we generally participate in include: cranes, pavers, planers & profilers, dozers, loaders, graders, haulers, tractors, excavators, backhoes, material handling and compactors. Demand in the medium and heavy construction equipment market is typically related to the level of larger-scale infrastructure development projects such as highways, dams, harbors, hospitals, airports and industrial development as well as activity in the mining, forestry and other raw material based industries.

Purchasers of medium and heavy construction equipment include construction companies, municipalities, local governments, rental fleet owners, quarrying and mining companies and forestry related industries. Purchasers of light construction equipment include contractors, rental fleet owners, landscapers, logistics companies and farmers. In the medium and heavy construction equipment market, we primarily supply OEMs with our wire harness and seating products.

Agricultural Equipment Market. We market most of our products for small, medium and large agricultural equipment across a spectrum of machines including tractors, sprayers, bailers, farm telehandler equipment and harvesters. Sales and production of these vehicles can be influenced by rising or falling farm commodity prices, land values, profitability, and other factors such as increased mechanization in emerging economies and new uses for crop materials such as biofuels and other factors. In the medium to longer term, a combination of factors create the need for more productive agricultural equipment, such as: (1) population growth, (2) an evolving sophistication of dietary habits, and (3) constraints on arable land and other macroeconomic and demographic factors.

Military Equipment Market. We supply products for heavy- and medium-payload tactical trucks that are used by various military customers. Military equipment production is particularly sensitive to political and governmental budgetary considerations.

OUR CONSOLIDATED OPERATIONS

Competitive Strengths

Generally, the barriers to entry in our industries include investment, specific engineering requirements, transition costs for OEMs to shift production to new suppliers, just-in-time delivery requirements and brand name recognition. Our competitive strengths include the following:

Market Positions and Brands. We believe we have a strong market position supplying Seats and a good market position supplying Trim products to the North American MD/HD Truck market. Our market position in the North American MD/HD Truck market leads us to believe we have processes in place to design, manufacture and introduce products that meet customers’ expectations in that market. We also believe we are competitive as a global supplier of construction vehicle Seats. Our major product brands

include CVG™, Sprague Devices®, Moto Mirror®, RoadWatch®, KAB Seating™, National Seating™, Bostrom Seating®, Stratos™ and FinishTEK™.

Comprehensive Cab Product and Cab System Solutions. We manufacture a broad base of products utilized in the interior and the exterior of commercial vehicle cabs. We believe the breadth of our product offerings provide us with a potential opportunity for further customer penetration through cross-selling initiatives and by bundling our products to provide complete system solutions.

End-User Focused Product Innovation. Commercial vehicle OEMs focus on interior and exterior product design features that better serve the vehicle operator and therefore seek suppliers that can provide product innovation. Accordingly, we have engineering, and research and development capabilities to assist OEMs in meeting those needs. We believe this helps us secure content on new as well as current platforms and models.

Flexible Manufacturing Capabilities. Because commercial vehicle OEMs permit their customers to select from an extensive menu of cab options, our end users frequently request modified products in low volumes within a limited time frame. We can leverage our flexible manufacturing capabilities to provide low volume, customized products to meet styling, cost and just-in-time delivery requirements. We manufacture or assemble our products at facilities in North America, Europe and in the Asia-Pacific region.

Global Capabilities. We have sales, engineering, manufacturing and assembly capabilities in North America, Europe and the Asia-Pacific region that provide a high level of service to our customers who manufacture and sell their products on a global basis.

Relationships with Leading Customers and Major North American Fleets. We have comprehensive product offerings, brand names and product features that enable us to be a global supplier to many of the leading MD/HD Truck, construction and specialty commercial vehicle manufacturers such as PACCAR, Caterpillar, Volvo/Mack, Navistar, Daimler Trucks, John Deere, Oshkosh Corporation, Komatsu and Škoda (part of the Volkswagen Group). In addition, we maintain relationships with the major MD/HD Truck fleet organizations that are end-users of our products such as Schneider National, Werner, Walmart, FedEx and JB Hunt.

Management Team. We believe that our management team has substantial knowledge of our customer needs and expertise in critical operational areas, and has a demonstrated ability to manage costs, improve processes and expand revenue through product, market, geography and customer diversification.

Research and Development

Our research and development capabilities offer quality and technologically advanced products to our customers at competitive prices. We offer industrial engineering, product design, specialized simulation and testing and evaluation services that are necessary in today’s global markets. Our capabilities in acoustics, thermal efficiency, benchmarking, multi-axis durability, biomechanics, comfort, prototyping and process prove-out allow us to provide complete integrated solutions for the end-user.

We engage in global engineering, and research and development activities that improve the reliability, performance and cost-effectiveness of our existing products and support the design and development and testing of new products for existing and new applications. We have test and validation engineering centers in North America, Europe and Asia. We have developed a global engineering support center in India to provide a cost-effective global engineering resource to all of our seat facilities.

We believe we are staffed with experienced engineers and have equipment and technology to support early design involvement that results in products that timely meet or exceed the customer’s design and performance requirements, and are more efficient to manufacture. Our ability to support our products and customers with extensive involvement enhances our position for bidding on such business. We work aggressively to ensure that our quality and delivery metrics distinguish us from our competitors.

Generally, we work with our customers’ engineering and development teams at the beginning of the concept design process for new components and assemblies and systems, or the re-engineering process for existing components and assemblies, in order to leverage production efficiency and quality. Our customers are continuously searching for advanced products while maintaining cost, quality and performance deliverables.

Research and development costs for the years ended December 31, 2017, 2016 and 2015 totaled $7.7 million, $7.0 million and $7.4 million, respectively.

Intellectual Property

Our principal intellectual property consists of product and process technology U.S. and foreign patents, trade secrets, trademarks and copyrights. Although our intellectual property is important to our business operations and in the aggregate constitutes a valuable asset, we do not believe that any single patent, trade secret, trademark or copyright, or group of patents, trade secrets, trademarks or copyrights is critical to the success of our business. Our policy is to seek statutory protection for all significant intellectual property embodied in patents, trademarks and copyrights.

Our major brands include CVG™, Sprague Devices®, Moto Mirror®, RoadWatch®, KAB Seating™, National Seating™, Bostrom Seating®, Stratos™ and FinishTEK™. We believe that our brands are valuable, but that our business is not dependent on any one brand. We own U.S. federal trademark registrations for several of our products.

Manufacturing Processes

A description of the manufacturing processes we utilize for each of our principal product categories is set forth below:

| |

• | Seats and Seating Systems. Our Seats utilize a variety of manufacturing techniques whereby foam and various other components along with fabric, vinyl or leather are affixed to an underlying seat frame. We also manufacture and assemble seat frames. |

| |

• | Trim Systems and Components. Our Trim capabilities include injection molding, low-pressure injection molding, urethane molding and foaming processes, compression molding, heavy-gauge thermoforming and vacuum forming as well as various cutting, sewing, trimming and finishing methods. |

| |

• | Cab Structures, Sleeper Boxes, Body Panels and Structural Components. We utilize a wide range of manufacturing processes to produce our cab structures, sleeper boxes, body panels and structural components and utilize robotic and manual welding techniques in the assembly of these products. We have facilities with large capacity, fully automated E-coat paint priming systems thereby allowing us to provide our customers with a paint-ready cab product. Due to their high cost, full body E-coat systems, such as ours, are rarely found outside of the manufacturing operations of the major OEMs. |

| |

• | Mirrors, Wipers and Controls. We manufacture our mirrors, wipers and controls utilizing a variety of manufacturing processes and techniques. Our mirrors, wipers and controls are primarily assembled utilizing semi-automatic work cells, electronically tested and then packaged. |

| |

• | Electric Wire Harnesses and Panel Assemblies. We utilize several manufacturing techniques to produce our electric wire harnesses and panel assemblies. Our processes, manual and automated, are designed to produce a wide range of wire harnesses and panel assemblies in short time frames. Our wire harnesses and panel assemblies are electronically and hand tested. |

We have a broad array of processes to enable us to meet our OEM customers’ styling and cost requirements. The vehicle cab is the most significant and appealing aspect to the operator of the vehicle; each commercial vehicle OEM therefore has unique requirements as to feel, appearance and features.

The end markets for our products can be highly specialized and our customers frequently request modified products in low volumes within an expedited delivery timeframe. As a result, we primarily utilize flexible manufacturing cells at our production facilities. Manufacturing cells are clusters of individual manufacturing operations and work stations. This provides flexibility by allowing efficient changes to the number of operations each operator performs. When compared to the more traditional, less flexible assembly line process, cell manufacturing allows us to better maintain our product output consistent with our OEM customers’ requirements and minimize the level of inventory.

When an end-user buys a commercial vehicle, the end-user may specify the seat and other features for that vehicle. Because our Seats are unique, our manufacturing facilities have significant complexity which we manage by building in sequence. We build our Seats as orders are received, and the Seats are delivered to our customer’s rack in the sequence in which vehicles come down the assembly line. We have systems in place that allow us to provide complete customized interior kits in boxes that are delivered in sequence. Sequencing reduces our cost of production because it eliminates warehousing costs and reduces waste and obsolescence, offsetting any increased labor costs. Several of our manufacturing facilities are strategically located near our customers’ assembly plants, which facilitates this process and minimizes shipping costs.

We employ just-in-time manufacturing and sourcing in our operations to meet customer requirements for faster deliveries and to minimize our need to carry significant inventory levels. We utilize material systems to manage inventory levels and, in certain locations, we have inventory delivered as often as two times per day from a nearby facility based on the previous day’s order, which reduces the need to carry excess inventory at our facilities.

Within our cyclical industries, we strive to maintain a certain portion of temporary labor to improve our ability to flex our costs and throughput as required by fluctuating customer demand. We engage our core employees to assist in making our processes efficient.

Seasonality

OEMs close their production facilities around holidays or when demand drops, reducing work days. Our cost structure, to the extent it is variable, provides us with some flexibility during these periods.

Our Supply Agreements

Our supply agreements generally provide for fixed pricing but do not require us to purchase any specified quantities. Normally we do not carry inventories of raw materials or finished products in excess of those reasonably required to meet production and shipping schedules, as well as service requirements. Steel, aluminum, petroleum-based products, copper, resin, foam, fabrics, wire and wire components comprise the most significant portion of our raw material costs. We typically purchase steel, copper and petroleum-based products at market prices that are fixed over varying periods of time. Due to the volatility in pricing over the last several years, we use methods such as market index pricing and competitive bidding to assist in reducing our overall cost. We strive to align our customer pricing and material costs to minimize the impact of steel, copper and petrochemical price fluctuations. Certain component purchases and suppliers are directed by our customers, so we generally will pass through directly to the customer any cost changes from these components. We generally are not dependent on a single supplier or limited group of suppliers for our raw materials.

Our Customer Contracts

Our OEM customers generally source business to us pursuant to written contracts, purchase orders or other firm commitments (“Commercial Arrangements”) with terms of price, quality, technology and delivery. Awarded business generally covers the supply of all or a portion of a customer’s production and service requirements for a particular product program rather than the supply of a specific quantity of products. In general, these Commercial Arrangements provide that the customer can terminate them if we do not meet specified quality, delivery and cost requirements. Although these Commercial Arrangements may be terminated at any time by our customers (but not by us), such terminations have historically been minimal and have not had a material impact on our results of operations. Because we produce products for a broad cross section of vehicle models, we are not overly reliant on any one vehicle model.

Our Commercial Arrangements with our OEM customers may provide for an annual prospective productivity cost reduction. These productivity cost reductions are generally calculated on an annual basis as a percentage of the previous year’s purchases by each customer. Historically, most of these cost reductions have been offset by internal cost reductions and through the assistance of our supply base, although no assurances can be given that we will be able to achieve such reductions in the future. The cost reduction is achieved through engineering changes, material cost reductions, logistics savings, reductions in packaging cost, labor efficiencies and other productivity actions.

Our sales and marketing efforts are designed to create customer awareness of our engineering, design and manufacturing capabilities. Our sales and marketing staff work closely with our design and engineering personnel to prepare the materials used for bidding on new business, as well as to provide a consistent interface between us and our key customers. We have sales and marketing personnel located in every major region in which we operate. From time to time, we participate in industry trade shows and advertise in industry publications.

Our principal customers for our aftermarket sales include OEM dealers and independent wholesale or retail distributors. Our sales and marketing efforts are focused on support of these two distribution chains, as well as participation in industry trade shows and direct contact with major fleets.

Competition

Within each of our principal product categories we compete with a variety of independent suppliers and with OEMs’ in-house operations, primarily on the basis of price, breadth of product offerings, product quality, technical expertise, development capability, product delivery and product service. A summary of our primary competitors is set forth below:

Seats and Seating Systems. We believe we have a strong market position supplying Seats to the North American MD/HD Truck market. Our primary competitors in the North American commercial vehicle market include Sears Manufacturing Company, Isringhausen, Grammer AG and Seats, Inc. Our primary competitors in the European commercial vehicle market include Grammer AG and Isringhausen; and in the Asia-Pacific region include Isrihuatai and Tiancheng (in China); and Harita and Pinnacle (in India).

Trim Systems and Components. We believe we have a good position supplying Trim products to the North American MD/HD Truck market. We face competition from a number of different competitors with respect to each of our trim system products and components. Our primary competitors are ConMet, International Automotive Components, Superior, Blachford Ltd. and Grupo Antolin.

Cab Structures, Sleeper Boxes, Body Panels and Structural Components. We are a supplier of cab structural components, cab structures, sleeper boxes and body panels to the North American MD/HD Truck market. Our primary competitors in this category are Magna, International Equipment Solutions (formerly Crenlo), Worthington Industries (formerly Angus Palm), McLaughlin Body Company and Defiance Metal Products.

Mirrors, Wipers and Controls. We are a supplier of wiper systems and mirrors to the North American MD/HD Truck market. We also sell wiper systems to the construction and agriculture market in Europe. We face competition from various competitors in this category. Our principal competitors for mirrors are Hadley, Retrac, and Lang-Mekra and our principal competitors for wiper systems are Doga, Wexco, Trico and Valeo.

Electric Wire Harnesses and Panel Assemblies. We supply a wide range of electric wire harnesses and panel assemblies used in various commercial and other vehicles. Our primary competitors for wire harnesses include large diversified suppliers such as Delphi Automotive PLC, Leoni, Nexans SA, Motherson-Sumi, St. Clair and Electrical Components International as well as many smaller companies.

Backlog

Our customers may place annual blanket purchase orders that do not obligate them to purchase any specific or minimum amount of products from us until a release is issued by the customer under the blanket purchase order. Releases are typically placed 30 to 90 days prior to required delivery and may be canceled at any time within agreed terms. We do not believe that our backlog of expected product sales covered by firm purchase orders is a meaningful indicator of future sales since orders may be rescheduled or canceled.

Employees

As of December 31, 2017, we had approximately 8,250 permanent employees, of whom approximately 14% were salaried and the remainder were hourly. As of December 31, 2017, approximately 56% of the employees in our North American operations were unionized, with the majority of union-represented personnel based in Mexico. On January 24, 2017, workers in our Shadyside, Ohio facility ratified a Closure Effects Agreement between Mayflower Vehicle Systems, LLC and the United Steel, Paper and Forestry, Rubber, Manufacturing and Energy, Allied Industrial and Service Workers International Union and its affiliated Local Union 9419. Production ceased in that facility in July 2017 and no hourly employees remained in the facility as of year-end. Approximately 64% of our European, Asian and Australian operations were represented by shop steward committees.

We did not experience any material strikes, lockouts or work stoppages during 2017 and consider our relationship with our employees to be satisfactory. On an as-needed basis during peak periods we utilize contract and temporary employees. During periods of weak demand, we respond to reduced volumes through flexible scheduling, furloughs and/or reductions in force as necessary.

Environmental Matters

We are subject to foreign, federal, state and local laws and regulations governing the protection of the environment and occupational health and safety, including laws regulating air emissions, wastewater discharges, and the generation, storage, handling, use and transportation of hazardous materials; the emission and discharge of hazardous materials into the soil, ground or air; and the health and safety of our colleagues. We are also required to obtain permits from governmental authorities for certain of our operations. We cannot give assurances that we are, or have been, in complete compliance with such environmental and safety laws, regulations and permits. If we violate or fail to comply with these laws, regulations or permits, we could be fined or otherwise sanctioned by regulators. In some instances, such a fine or sanction could have a material adverse effect on us. We are also subject to laws imposing liability for the cleanup of contaminated property. Under these laws, we could be held liable for costs and damages relating to contamination at our past or present facilities and at third-party sites to which we sent waste containing hazardous substances. The amount of such liability could be material.

Certain of our operations generate hazardous substances and wastes. If a release of such substances or wastes occurs at or from our properties, or at or from any offsite disposal location to which substances or wastes from our current or former operations were taken, or if contamination is discovered at any of our current or former properties, we may be held liable for the cost of cleanup and for any other response by governmental authorities or private parties, together with any associated fines, penalties or damages. In most jurisdictions, this liability would arise whether or not we had complied with environmental laws governing the handling of hazardous substances or wastes.

Government Regulations

New emissions regulations were approved in 2016 by US regulators impacting MD/HD Truck manufacturers. The regulations require manufacturers to cut greenhouse gas emissions by 25 percent by 2027. Other countries are implementing clean air measures to reduce air pollution. For example, China's Ministry of Environment implemented new standards applicable during 2017 for Stage V vehicles, including light gasoline-powered vehicles, diesel-powered passenger vehicles and heavy diesel-powered vehicles manufactured and sold in China.

Under a California law known as Proposition 65, if the state has determined that a substance causes cancer or harms human reproduction, a warning must appear on any product sold in the state that exposes consumers to that substance. The state maintains lists of these substances and periodically adds other substances to them. Certain of our products may be subject to Proposition 65 and therefore cause us to have to provide warnings on the products in California because it does not provide for any generally applicable quantitative threshold below which the presence of a listed substance is exempt from the warning requirement. Consequently, the detection of even a trace amount of a listed substance can subject an affected product to the requirement of a warning label.

To the extent that current or future governmental regulation has a negative impact on the demand for commercial vehicles, our business, financial condition or results of operations could be adversely affected.

AVAILABLE INFORMATION

We maintain a website on the Internet at www.cvgrp.com. We make available free of charge through our website, by way of a hyperlink to a third-party Securities Exchange Commission (SEC) filing website, our Annual Reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and amendments to those reports electronically filed or furnished pursuant to Section 13(a) or 15(d) of the Exchange Act of 1934. Such information is available as soon as such reports are filed with the SEC. Additionally, our Code of Ethics may be accessed within the Investor Relations section of our website. Information found on our website is not part of this Annual Report on Form 10-K or any other report filed with the SEC.

EXECUTIVE OFFICERS OF REGISTRANT

The following table sets forth certain information with respect to our executive officers as of March 12, 2018:

|

| | | |

Name | Age | | Principal Position(s) |

Patrick E. Miller | 50 | | President, Chief Executive Officer, Director |

C. Timothy Trenary | 61 | | Executive Vice President and Chief Financial Officer |

Greg R. Boese | 61 | | Senior Vice President and Managing Director of Global Truck and Bus |

Dale M. McKillop | 60 | | Senior Vice President and Managing Director of Global Truck and Bus |

The following biographies describe the business experience of our executive officers:

Patrick E. Miller has served as President and Chief Executive Officer and Director since November 2015. Mr. Miller, who most recently was President of the Company’s Global Truck & Bus Segment, has been with the Company since 2005. During this time, he served in the capacity of Senior Vice President & General Manager of Aftermarket; Senior Vice President of Global Purchasing; Vice President of Global Sales; Vice President & General Manager of North American Truck and Vice President & General Manager of Structures. Prior to joining the Company, Mr. Miller held engineering, sales, and operational leadership positions with Hayes Lemmerz International, Alcoa, Inc. and ArvinMeritor. He holds a Bachelor of Science in Industrial Engineering from Purdue University and a Masters of Business Administration from the Harvard University Graduate School of Business.

C. Timothy Trenary has served as Executive Vice President and Chief Financial Officer since October 2013. Mr. Trenary served as Executive Vice President and Chief Financial Officer of ProBuild Holdings LLC, a privately held North American supplier of building materials, from 2010 to 2013. Prior to that, Mr. Trenary served as Senior Vice President & Chief Financial Officer of EMCON Technologies Holdings Limited, a privately held global automotive parts supplier, from 2008 to 2010; and as Vice President and Chief Financial Officer of DURA Automotive Systems, Inc., a publicly held global automotive parts supplier, from 2007 to 2008. He holds a Bachelor of Accounting with Honors from Michigan State University and a Masters of Business Administration with Honors from the University of Detroit Mercy. Mr. Trenary is a certified public accountant with registered status in Michigan.

Greg R. Boese was promoted to Senior Vice President and Managing Director of Global Truck and Bus in February 2016. Mr. Boese, who most recently was Vice President of Product Line Management for Global Truck and Bus Seating, has been with the Company since 2005 when he joined the Company with the acquisition of Mayflower Vehicle Systems. Mr. Boese started his

tenure with Mayflower Vehicle Systems in 1995 and held positions of increasing responsibility including Vice President of Sales and Marketing. Prior to joining Mayflower Vehicle Systems, Mr. Boese held various senior leadership positions in sales, marketing, and operational management with a division of Masco Industries. He holds a Bachelor of Science degree in Business Management from Tri State University, Angola, Indiana.

Dale M. McKillop was promoted to Senior Vice President and Managing Director of Global Truck and Bus in February 2016. Mr. McKillop, who most recently was Vice President and General Manager of the Company’s Global Truck & Bus Trim and Structures division, has been with the Company since 2005 when he joined the Company with the acquisition of Mayflower Vehicle Systems. Mr. McKillop has held positions of increasing responsibility with the company including Managing Director - Structures and Aftermarket, Managing Director - Structures, Director of Operations Trim and Structures, and Plant Manager. Prior to joining Mayflower Vehicle Systems, Mr. McKillop held engineering positions with Pullman Standard from 1978 to 1982. Mr. McKillop holds a Bachelor of Science degree in Business Administration from Gardner Webb University.

You should carefully consider the risks described below before making an investment decision. These are not the only risks we face.

If any of these risks and uncertainties were to actually occur, our business, financial condition or results of operations could be materially and adversely affected. In such case, the trading price of our common stock could decline and you may lose all or part of your investment.

Our results of operations could be materially and adversely affected by downturns in the U.S. and global economy which are naturally accompanied by related declines in freight tonnage hauled and in infrastructure development and other construction projects.

Our results of operations are directly impacted by changes in the U.S. and global economic conditions which are accompanied by related declines in freight tonnage hauled in infrastructure development and other construction projects because, among other things:

| |

• | Demand for our MD/HD truck products is generally dependent on the number of new MD/HD truck commercial vehicles manufactured in North America. Historically, the demand for MD/HD truck commercial vehicles has declined during periods of weakness in the North American economy. |

| |

• | Demand for our construction products is also dependent on the overall vehicle demand for new commercial vehicles in the global construction equipment market. |

| |

• | Demand in the medium and heavy construction vehicle market, which is the market in which our GCA products are primarily used, is typically related to the level of larger-scale infrastructure development projects. |

| |

• | Demand in the light construction equipment market is typically related to certain economic conditions such as the level of housing construction and other smaller-scale developments and projects. |

If we experience periods of low demand for our products in the future, it could have a negative impact on our revenues, operating results and financial position.

Volatility and cyclicality in the commercial vehicle market could adversely affect us.

Our profitability depends in part on the varying conditions in the commercial vehicle market. This market is subject to considerable volatility as it moves in response to cycles in the overall business environment and is particularly sensitive to the industrial sector of the economy, which generates a significant portion of the freight tonnage hauled. Sales of commercial vehicles have historically been cyclical, with demand affected by such economic factors as industrial production, construction levels, demand for consumer durable goods, interest rates and fuel costs.

Historically, general weakness in the global economy, but especially the North American economy, and corresponding decline in the need for commercial vehicles has contributed to a downturn in commercial vehicle production. Demand for commercial vehicles depends to some extent on economic and other conditions in a given market and the introduction of new vehicles and technologies. The yearly demand for commercial vehicles may increase or decrease more than overall gross domestic product in markets we serve. Downturns historically have had a material adverse effect on our business. If unit production of commercial vehicles declines in the future it may materially and adversely affect our business and results of operations. Conversely, upswings in the global economy may result in a sharp acceleration in commercial vehicle production. A sharp acceleration in commercial vehicle production may adversely affect our ability to convert the incremental revenue into operating income efficiently.

Our operating results, revenues and expenses may fluctuate significantly from quarter-to-quarter or year-to-year, which could have an adverse effect on the market price of our common stock.

Our operating results, revenues and expenses have in the past varied and may in the future vary significantly from quarter-to-quarter or year-to-year. These fluctuations could have an adverse effect on the market price of our common stock.

Our operating results may fluctuate as a result of these and other events and factors:

| |

• | the size, timing, volume and execution of significant orders and shipments; |

| |

• | changes in the terms of our sales contracts; |

| |

• | the timing of new product announcements by us and our competitors; |

| |

• | changes in our pricing policies or those of our competitors; |

| |

• | market acceptance of new and enhanced products; |

| |

• | announcement of technological innovations or new products by us or our competitors; |

| |

• | the length of our sales cycles; |

| |

• | conditions in the commercial vehicle industry; |

| |

• | changes in our operating expenses; |

| |

• | new business acquisitions; |

| |

• | uncertainty in geographic regions; |

| |

• | currency and interest rate fluctuations; |

| |

• | uncertainty with respect to the North American Free Trade Agreement; |

We base our operating expense budgets in large part on expected revenue trends. However, certain of our expenses are relatively fixed and as such we may be unable to adjust expenses quickly enough to offset any unexpected revenue shortfall. Accordingly, any significant change in revenue may cause significant variation in operating results in any quarter or year.

It is possible that in one or more future quarters or years, our operating results may be below the expectations of public market analysts and investors and may result in changes in analysts’ estimates. In such events, the trading price of our common stock may be adversely affected.

In the past, companies that have experienced volatility in the market price of their stock have been the subject of securities class action litigation. If we become involved in securities class action litigation in the future, it could result in substantial costs and diversion of management attention and resources, thus harming our business.

Our common stock has historically had a low trading volume and, as a result, any sale of a significant number of shares may depress the trading price of our stock; shareholders may be unable to sell their shares above the purchase price.

Our common stock is traded on the NASDAQ Global Select Market under the symbol “CVGI.” The trading volume of our common stock has historically been limited as compared to common stock of a seasoned issuer that has a large and steady volume of trading activity that will generally support continuous sales without an adverse effect on share prices. Because of the limited trading volume, holders of our securities may not be able to sell quickly any significant number of such shares, and any attempted sale of a large number of our shares may have a material adverse impact on the price of our common stock. Additionally, because of the limited number of shares being traded, the price per share is subject to volatility and may continue to be subject to rapid price swings in the future that may result in shareholders’ inability to sell their common stock at or above purchase price.

We incur restructuring and impairment charges periodically as we continue to evaluate our portfolio of assets and identify opportunities to restructure our business in an effort to optimize our cost structure.

As we continue to evaluate our manufacturing footprint to improve our cost structure and remove excess, underperforming assets, or assets that no longer fit our goals, we incur restructuring charges periodically to close facilities, such as, lease termination charges, severance charges and impairment charges of leasehold improvements and/or machinery and equipment.

Also, if we decide to close or consolidate facilities, we may face execution risks which could adversely affect our ability to serve our customers and could lead to loss of business adversely affecting our business, results of operations and financial condition.

We may be unable to successfully implement our business strategy and, as a result, our businesses and financial position and results of operations could be materially and adversely affected.

Our ability to achieve our business and financial objectives is subject to a variety of factors, many of which are beyond our control. For example, we may not be successful in implementing our strategy if unforeseen factors emerge diminishing the expected growth in the commercial vehicle markets we supply, or we experience increased pressure on our margins. In addition, we may not succeed in integrating strategic acquisitions, and our pursuit of additional strategic acquisitions may lead to resource constraints, which could have a negative impact on our ability to meet customers’ demands, thereby adversely affecting our relationships with those customers. As a result of such business or competitive factors, we may decide to alter or discontinue aspects of our business strategy and may adopt alternative or additional strategies. Any failure to successfully implement our business strategy could materially and adversely affect our business, results of operations and growth potential.

We are subject to certain risks associated with our foreign operations.

We have operations in the United Kingdom, Czech Republic, Ukraine, Belgium, China, Australia, Mexico and India, which accounted in the aggregate for approximately 26%, 25% and 23% of our total revenues for the years ended December 31, 2017, 2016 and 2015, respectively. There are certain risks inherent in our international business activities including, but not limited to:

| |

• | the difficulty of enforcing agreements and collecting receivables through certain foreign legal systems; |

| |

• | foreign customers, who may have longer payment cycles than customers in the U.S.; |

| |

• | material foreign currency exchange rate fluctuations affecting our ability to match revenue received with costs paid in the same currency; |

| |

• | tax rates in certain foreign countries, which may exceed those in the U.S., withholding requirements or the imposition of tariffs, exchange controls or other restrictions, including restrictions on repatriation, on foreign earnings; |

| |

• | intellectual property protection difficulties; |

| |

• | general economic and political conditions, along with major differences in business culture and practices, including the challenges of dealing with business practices that may impact the company’s compliance efforts, in countries where we operate; |

| |

• | exposure to local social unrest, including any resultant acts of war, terrorism or similar events; |

| |

• | the difficulties associated with managing a large organization spread throughout various countries; and |

| |

• | complications in complying with a variety of laws and regulations related to doing business with and in foreign countries, some of which may conflict with U.S. law or may be vague or difficult to comply with. |

Additionally, our international business activities are also subject to risks arising from violations of U.S. laws such as the U.S. Foreign Corrupt Practices Act and similar anti-bribery laws in other jurisdictions, and various export control and trade embargo laws and regulations, including those which may require licenses or other authorizations for transactions relating to certain countries and/or with certain individuals identified by the U.S. government. If we fail to comply with applicable laws and regulations, we could suffer civil and criminal penalties that could materially and adversely affect our results of operations and financial condition.

As we continue to expand our business on a global basis, we are increasingly exposed to these risks. Our success will be dependent, in part, on our ability to anticipate and effectively manage these and other risks associated with foreign operations. These and other factors may have a material adverse effect on our international operations, business, financial condition and results of operations.

Significant changes to international trade regulations could adversely affect our results of operations.

Our business benefits from current free trade agreements and other duty preference programs, including the North American Free Trade Agreement (“NAFTA”). The Trump Administration has indicated that it may propose significant changes with respect to a variety of issues, including NAFTA, other international trade agreements, import and export regulations, and tariffs and customs duties, which have increased uncertainty regarding the future of existing international trade regulations. The imposition of tariffs on the products we manufacture and sell could have a material and adverse impact on our business, financial condition and results of operations. Additionally, if the Trump Administration or Congress takes action to withdraw from or materially modify NAFTA, our business, financial condition and results of operations could be adversely affected.

We have invested substantial resources in markets where we expect growth and we may be unable to timely alter our strategies should such expectations not be realized.

Our future growth is dependent in part on our making the right investments at the right time to support product development and manufacturing capacity in areas where we can support our customer base. We have identified the Asia-Pacific region, specifically China and India, as key markets likely to experience substantial growth in our market share, and accordingly have made and expect to continue to make substantial investments, both directly and through participation in various partnerships and joint ventures, in numerous manufacturing operations, technical centers and other infrastructure to support anticipated growth in those regions. If

we are unable to maintain, deepen existing and develop additional customer relationships in these regions, we may not only fail to realize expected rates of return on our existing investments, but we may incur losses on such investments and be unable to timely redeploy the invested capital to take advantage of other markets, potentially resulting in lost market share to our competitors. We cannot guarantee that we will be successful in leveraging our capabilities into new markets and thus, in meeting the needs of these new customers and competing favorably in these new markets. Our results will also suffer if these regions do not grow as quickly as we anticipate.

We may be unable to complete strategic acquisitions or we may encounter unforeseen difficulties in integrating acquisitions.