Exhibit 10.1

LIMITED LIABILITY COMPANY AGREEMENT

OF

ECOS BIO-ART, LLC

A Delaware Limited Liability Company

This LIMITED LIABILITY COMPANY AGREEMENT (this "Agreement") of Ecos Bio-Art, LLC, a Delaware limited liability company (the "Company"), made effective as of December 19, 2016, is (a) adopted by the Managers (as defined below) and (b) agreed to by the Members (as defined below).

ARTICLE 1

CERTAIN DEFINITIONS

"Act" means the Delaware Limited Liability Company Act and any successor statute, as amended from time to time.

"Adjusted Capital Account Deficit" means, with respect to any Member, the deficit balance, if any, in the Capital Account maintained for such Member as of the end of each fiscal year of the Company after giving effect to the following adjustments:

(a) a credit to the Capital Account of any amounts which the Member is obligated to restore under this Agreement and the standards set forth in Treas. Reg. Sec. 1.704-(b)(ii)(c) or is deemed obligated to restore under Treas. Reg. Sec. 1.704-2(g)(1) (relating to partnership gains) and Treas. Reg. Sec. 1.704-2(i)(5) (relating to partnership nonrecourse debt minimum gain); and

(b) debits to the Capital Account of amounts equal to:

(i) all losses and deductions that, as of the end of the applicable fiscal year, are reasonably expected to be allocated to the Member in years subsequent to the applicable fiscal year under Code Sects. 704(e)(2) and 706(d) and under Treas. Reg. Sec. 1.751-1(b)(ii); and

(ii) distributions that are reasonably expected to be made to the applicable Member to the extent that such distributions exceed offsetting increases in the applicable Member's Capital Account that are reasonably expected to occur during (or prior to) the year in which such distributions are reasonably expected to be made.

Notwithstanding anything to the contrary contained herein, an Adjusted Capital Account Deficit shall be determined in accordance with Treas. Reg. Sec. 1.704-1(b)(2)(ii)(d) and shall be interpreted consistently with such Reg.

"Affiliate" of another Person means : (a) any entity or individual that directly or indirectly controls or holds the power to vote 10% or more of the outstanding voting securities of the Person in question; (b) any Person 10% or more of whose voting securities are directly or indirectly owned, controlled or held with power to vote, by such other Person; (c) any Person directly or indirectly controlling, controlled by, or under common control with such other Person; (d) any officer, director or partner of such other Person; and (e) if such other Person is an officer, director or partner, any company for which such Person acts in any such capacity.

"Agreed Value" of any Contributed Property means the fair market value of the property at the time of contribution as determined by the Managers and the contributing Member; provided, however, that the Agreed Value of any Property deemed contributed to the Company for federal income tax purposes upon termination and reconstitution thereof pursuant to Code Sec. 708 shall be determined in accordance with Section 3.5. Subject to Section 3.5, in the event that more than a single item of Property is contributed to the Company in a single or integrated transaction, the Managers shall use such method as it deems reasonable and appropriate to allocate the aggregate Agreed Value of Contributed Properties among each separate property in proportion to the respective fair market value of each such Property.

"Attorney" has the meaning given in Section 12.14.

"Book-Tax Disparity" concerning any item of Contributed Property or Revalued Property means, as of the date of any determination, the difference between the Carrying Value of such Contributed Property or Revalued Property and the adjusted basis thereof for federal income tax purposes as of such date. A Member's share of the Company's Book-Tax Disparities in all of the Company's Contributed Property and Revalued Property will be reflected by the difference between such Member's Capital Account balance, as maintained pursuant to Article 3, and the balance of such Member's Capital Account computed as if it had been maintained strictly in accordance with federal income tax accounting principles.

"Capital Account" has the meaning given that term in Section 3.5.

"Capital Contributions" means the total amount of capital contributed by a Member to the Company, as determined from time to time, which shall include cash contributions and the Net Agreed Value of any Contributed Property.

"Carrying Value" means:

(a) with respect to a Contributed Property, the Agreed Value of such Property reduced (but not below zero) by all depreciation, depletion (computed as a separate item of deduction), amortization and cost recovery deductions charged to the Members' Capital Accounts;

(b) with respect to a Revalued Property, the fair market value of such Property at the time of revaluation, as determined by the Managers in accordance with Section 3.7 below, reduced (but not below zero) by all depreciation, depletion, amortization and cost recovery deductions charged to the Members' Capital Accounts; and

2

(c) with respect to any other Company Property, the adjusted basis of such Property for federal income tax purposes, all as of the time of determination.

The Carrying Value of any Property shall be adjusted from time to time in accordance with Sections 3.7(a) and (b) of this Agreement.

"Certificate of Formation" or "Certificate" means the Certificate of Formation filed for the Company in accordance with the Act.

"Change of Control" means, with respect to any Person, the occurrence of any of the following events: (i) the sale or other disposition of a majority of the outstanding capital stock entitled to vote in the election of directors, or of other ownership interests entitled to participate in management and control, of such Person to a Person or group of Persons who are not Affiliates of such Party in a single transaction or series of related transactions; (ii) the sale or other disposition of all or substantially all of the operating assets of such Person to a Person or group of Persons who are not Affiliates of such Person in a single transaction or series of related transactions; or (iii) a merger, consolidation or other similar transaction the effect of which is substantially the same as a transaction described in clause (i) or (ii) above.

"Code" means the Internal Revenue Code of 1986 and any successor statute, as amended from time to time.

"Company Property" or "Property" means all properties, assets and rights of any type owned by the Company.

"Confidential Information" has the meaning given in Section 10.7.

"Contributed Property" means any property contributed to the Company at any time or from time to time. Once the Carrying Value of Contributed Property has been adjusted pursuant to Section 3.7 hereof, such property shall be deemed Revalued Property and shall no longer be deemed Contributed Property.

"Ecos" means Ecolocap Solutions, Inc., a Nevada corporation, and its Permitted Transferees.

"Equipment Purchase Agreement" means that certain Equipment Purchase Agreement between the Company and LRS, dated as of the date hereof, which is attached hereto as Exhibit C.

"Fair Market Value" means the price per Interest that could be obtained in an open sale of all the Membership Interests, valued as a whole on the basis of a sale of the Company in an arms' length sale between a willing buyer and a willing seller, assigning equal value to each Interest, adjusted for customary discounts for illiquidity, lack of marketability and minority interest. Fair Market Value shall be determined by an appraisal by an independent certified appraiser with experience valuing businesses in the Company's industry (a "Qualified Appraiser") pursuant to the following methodology: the buying party and the selling party shall

3

each select a Qualified Appraiser and such two Qualified Appraisers shall select a third Qualified Appraiser, and Fair Market Value will be the value reached by such third Qualified Appraiser. The determination of Fair Market Value by the Qualified Appraiser will be final and binding on the Company and all the Members. The selling party and the buying party shall each pay one half of the fees of the Qualified Appraiser. The Company and the Members shall provide reasonable cooperation with the Qualified Appraiser and the Qualified Appraiser will be allowed full access to the books, records, properties and employees of the Company.

"Indemnified Person" has the meaning given in Section 8.1.

"LRS" means Lakeshore Recycling Systems, LLC, a Delaware limited liability company and its Permitted Transferees, and their respective successors and assigns.

"Manager" means any Person elected as a Manager of the Company as provided in this Agreement, but does not include any Person who has ceased to be a Manager of the Company.

"Member" means each Person who acquires an Interest pursuant to this Agreement and each Person hereafter admitted to the Company as a Member as provided in this Agreement. The Members and their respective Interests are set forth on attached and incorporated Exhibit A.

"Member Minimum Gain" means with respect to each Member Nonrecourse Debt, the gain at any given time which would be realized by the Members if the Company disposed of the property encumbered by or otherwise subject to such Member Nonrecourse Debt for no consideration other than the full satisfaction of such Member Nonrecourse Debt. If the applicable property is subject to more than one liability, only that portion of the property's adjusted tax basis which is allocated to the applicable Member Nonrecourse Debt under the immediately succeeding sentence shall be used to compute Member Minimum Gain. The adjusted basis of Company Property subject to two or more liabilities of equal priority shall be allocated among such liabilities in proportion to their outstanding balances, and the adjusted basis of Company Property subject to two or more liabilities of unequal priority shall be allocated to the liabilities of subordinate priority only to the extent of the excess, if any, of the adjusted basis of such Property over the aggregate outstanding balance of all liabilities of superior priority. The priorities of any liability or any group of liabilities shall be determined by reference to all applicable facts and circumstances including, without limitation, all agreements by and between applicable creditors and all applicable corporate, commercial, bankruptcy and other laws. If a Book-Tax Disparity exists with respect to any Company Property, Member Minimum Gain shall be determined by using the Carrying Value instead of the adjusted tax basis of such property.

"Member Nonrecourse Debt" means any Nonrecourse Liability to the extent a Member or a Person who is related (as defined in Reg. Sec. 1.752-1(a)(3)) to a Member bears the economic risk of loss, as determined under Reg. Sec. 1.752-2, with respect to such liability. In the event that any Member (or a person related to any Member within the meaning of Reg. Sec. 1.752-1(a)(3)) bears the economic risk of loss for less than all of the outstanding balance of the Nonrecourse Liability, such Nonrecourse Liability shall be bifurcated in accordance with the principles of Reg. Sec. 1.752-2, and shall be treated as a Nonrecourse Liability to the extent that no Member (or related party) bears the economic risk of a loss, and as a Member Nonrecourse

4

Debt to the extent that the applicable Member (or related party) bears the economic risk of loss. Notwithstanding anything to the contrary contained herein, Member Nonrecourse Debt shall be determined in accordance with Reg. Sec. 1.704-2 as the same may be modified or supplemented from time to time.

"Member Nonrecourse Debt Deduction" means items of the Company's deductions, losses, and Code Sec. 705(a)(2)(B) expenditures (in each case computed based upon the Carrying Values of all Company assets if a Book-Tax Disparity exists with respect to such property) equal to the net increase, if any, in the amount of the aggregate Member Minimum Gain during any Company tax year ("Available Member Nonrecourse Debt Deductions "). If the net increase in the amount of Member Minimum Gain during any taxable year exceeds the Available Member Nonrecourse Debt Deductions, then the excess shall be carried over and treated as Member Minimum Gain of the applicable Member for the immediately succeeding taxable year and all taxable years thereafter until the cumulative Member Nonrecourse Debt Deductions for the applicable Member shall be equal to the sum of all net increases in Member Minimum Gain of the applicable Member for all Company years ending after the date of this Agreement. Generally, Member Nonrecourse Debt Deductions of the Company for a year will consist first of depreciation or cost recovery deductions with respect to property of the Company giving rise to the increase in Member Minimum Gain to the extent of such increase with any excess made up pro rata of all other items of deductions.

"Membership Interest" or "Interest" means the membership interest or interest of a Member in the Company, including the right to any and all benefits to which such Member may be entitled in accordance with this Agreement, and the obligations as provided in this Agreement and the Act.

"Minimum Gain" means, with respect to each Nonrecourse Liability of the Company, the gain (regardless of character) that would be realized by the Company if it disposed of the property encumbered by or subject to such Nonrecourse Liability for no consideration other than the full satisfaction of the Nonrecourse Liability. If property is subject to more than one liability, only that portion of the property's adjusted tax basis which is allocated to a Nonrecourse Liability under the immediately succeeding sentence shall be used to compute Minimum Gain. The adjusted basis of Company Property subject to two or more liabilities of equal priority shall be allocated among such liabilities in proportion to their outstanding balances, and the adjusted basis of Company Property subject to liabilities of unequal priority shall be allocated to the liabilities of subordinate priority only to the extent of the excess, if any, of the adjusted basis of such property over the aggregate outstanding balance of all liabilities of superior priority. The relative priorities of any liability or any group of liabilities shall be determined by reference to all applicable facts and circumstances including, without limitation, all agreements by and between applicable creditors and all applicable corporate, commercial, bankruptcy and other laws. If a Book-Tax Disparity exists with respect to any Company Property, the Minimum Gain shall be determined using the Carrying Value instead of the adjusted tax basis of the Property.

"Net Agreed Value" means, as follows:

5

(a) for Contributed Property, the Agreed Value of such property net of liabilities either assumed by the Company upon such contribution or to which such property is subject when contributed to the Company, as determined in accordance with Code Sec. 752; and

(b) for Property distributed to a Member, the Company's Carrying Value of such property at the time such Property is distributed, net of any indebtedness either assumed by such distributee Member upon such distribution or to which such Property is subject at the time of distribution, determined in accordance with Code Sec. 752.

"Net Cash Receipts" means, for any period, the gross cash proceeds from the Company's business (including any cash proceeds from the sale of Company Property outside the ordinary course of business or refinancing of indebtedness), less the portion thereof used to establish reasonable reserves in amounts determined by the Managers or to pay Company expenses, debt payments and capital expenditures. "Net Cash Receipts" shall not be reduced by depreciation, cost recovery, amortization or similar noncash deductions, and shall be increased by any reduction of reserves previously established by the Managers.

"Net LRS Output Sales" means gross output sales collected by the Company from sale of the Output by the Company derived from Systems sold to LRS, less the Company's cost of sales, which includes transportation, storage and any other direct expenses incurred by the Company in connection with the sale of such Output, and a reasonable allocation of electricity, rent, labor (including employee benefits), capital expenditures, city, state and local taxes, fees and permits, and any other overhead costs incurred by the Company, as determined by the Managers.

"Net Profit" means the sale price for the Systems less the cost of goods sold.

"Nonrecourse Liability" means a nonrecourse liability as defined in Reg. Sec. 1.704-

2(b)(3).

"Notice" has the meaning given in Section 12.2.

"Output" means output created by the System that is an organic fertilizer or other application that has resale value.

"Percentage Ownership" means the percentage participation of a Member in Profits and Losses and distributions determined by dividing the number of Membership Interests of such Member by the total number of Membership Interests owned by all Members. The Percentage Ownership of each Member is set forth on Exhibit A attached hereto and made a part hereof.

"Person" means any individual, corporation, trust, partnership, joint venture, limited liability company or other entity.

"Profits" and "Losses" mean, for each fiscal year, an amount equal to the Company's taxable income or loss for such year, determined in accordance with Code Sec. 703(a) (including all items required to be stated separately) with the following adjustments:

6

(a) any income exempt from federal income tax shall be included;

(b) any expenditures of the Company described in Code Sec. 705(a)(2)(B) (including expenditures treated as such pursuant to Reg. Sec. 1.704-1(b)(2)(iv)(i)) shall be subtracted;

(c) if any Company Property is revalued pursuant to Section 3.7, the amount of such adjustment shall be taken into account in determining gain or loss from the disposition of such Property;

(d) any items which are specially allocated pursuant to Section 4.3 shall not be taken into account in computing Profits or Losses;

(e) gain or loss resulting from any disposition of Company Property with respect to which gain or loss is recognized for federal income tax purposes shall be computed by reference to the Carrying Value of the Property disposed of, notwithstanding that the adjusted tax basis of such Property differs from its Carrying Value; and

(f) in the case of Property having a Book-Tax Disparity, in lieu of depreciation, amortization or other cost recovery deductions allowable under the Code ("Tax Depreciation"), there shall be taken into account for each Property a depreciation allowance which bears the same ratio to its initial Agreed Value (or, with respect to Revalued Property, its initial Carrying Value) as the Tax Depreciation for such year bears to the beginning adjusted tax basis of such Property.

"Regulatory Allocations" has the meaning given in Section 4.3.

"Related Party" means (a) any of the spouse, parents and descendants (whether natural or adopted) of a Member (collectively, "Relatives"), (ii) any custodian of a custodianship for and on behalf of one or more of such Relatives or a Member, (iii) any trustee of a trust or trusts solely for the benefit of a Member and/or one or more such Relatives of a Member, and (iv) any corporation, partnership, limited liability company or other entity more than 50% of the voting power of which is owned or controlled by a Member or a Related Party of a Member.

"Representative" means the legally appointed guardian of a mentally incapacitated Member, the conservator of a mentally incapacitated Member's assets or the legally appointed and qualified executor or personal representative of the estate of a deceased Member. In the event no such guardian, executor or personal representative is appointed, then the Representative shall mean the spouse of such incapacitated or deceased Member, or if such Member does not have a spouse or the spouse is not then living or is unable or unwilling to act, such Member's then living lineal descendants who are willing and capable of acting, one at a time in descending order of age but in no event younger than 21 years of age or, if none, such Member's then living lineal ancestors who are willing and capable of acting, one at a time and in ascending order of age.

"Revalued Property" means any Property which has had its Carrying Value adjusted in accordance with Section 3.7(a) or (b).

7

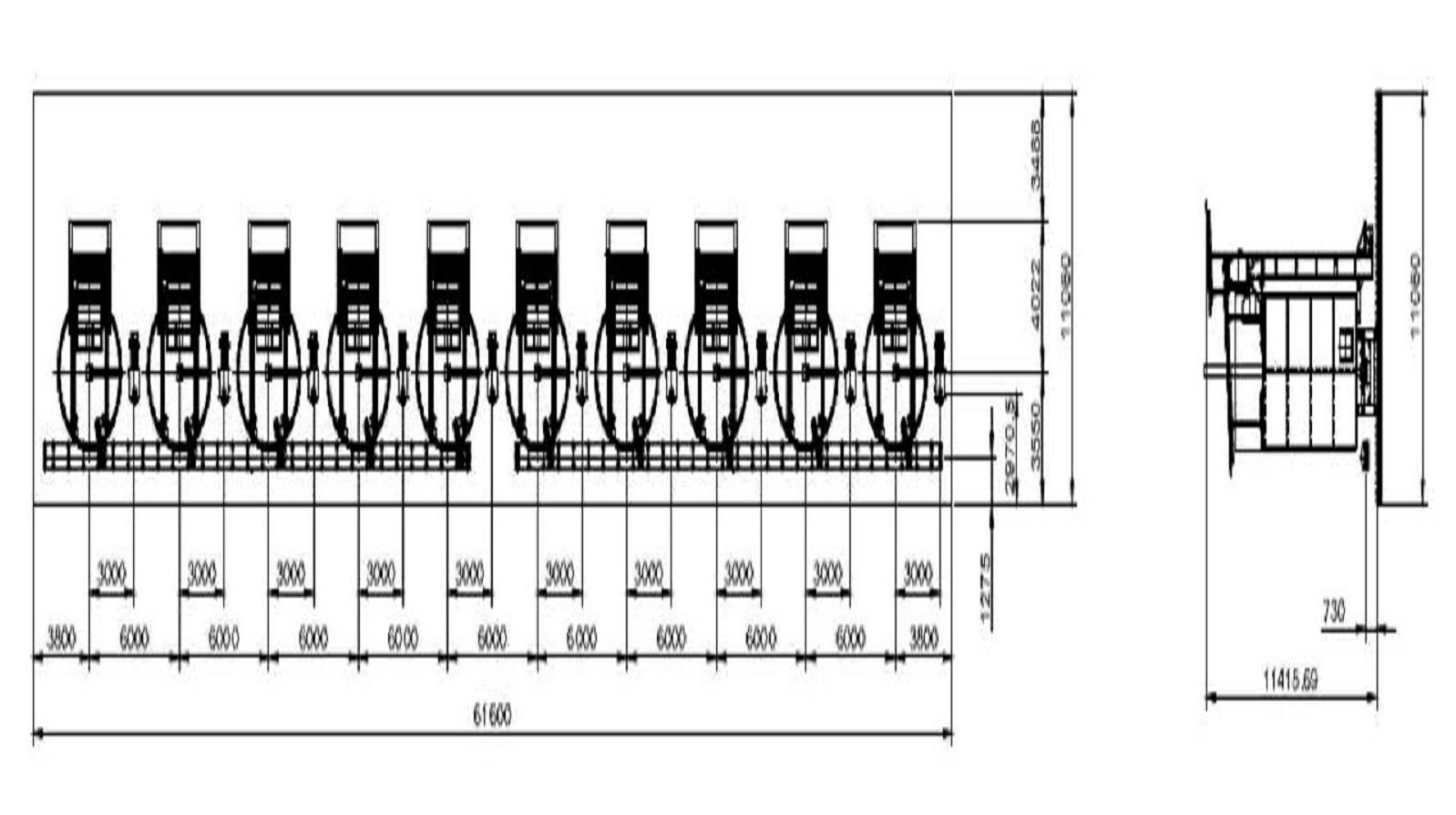

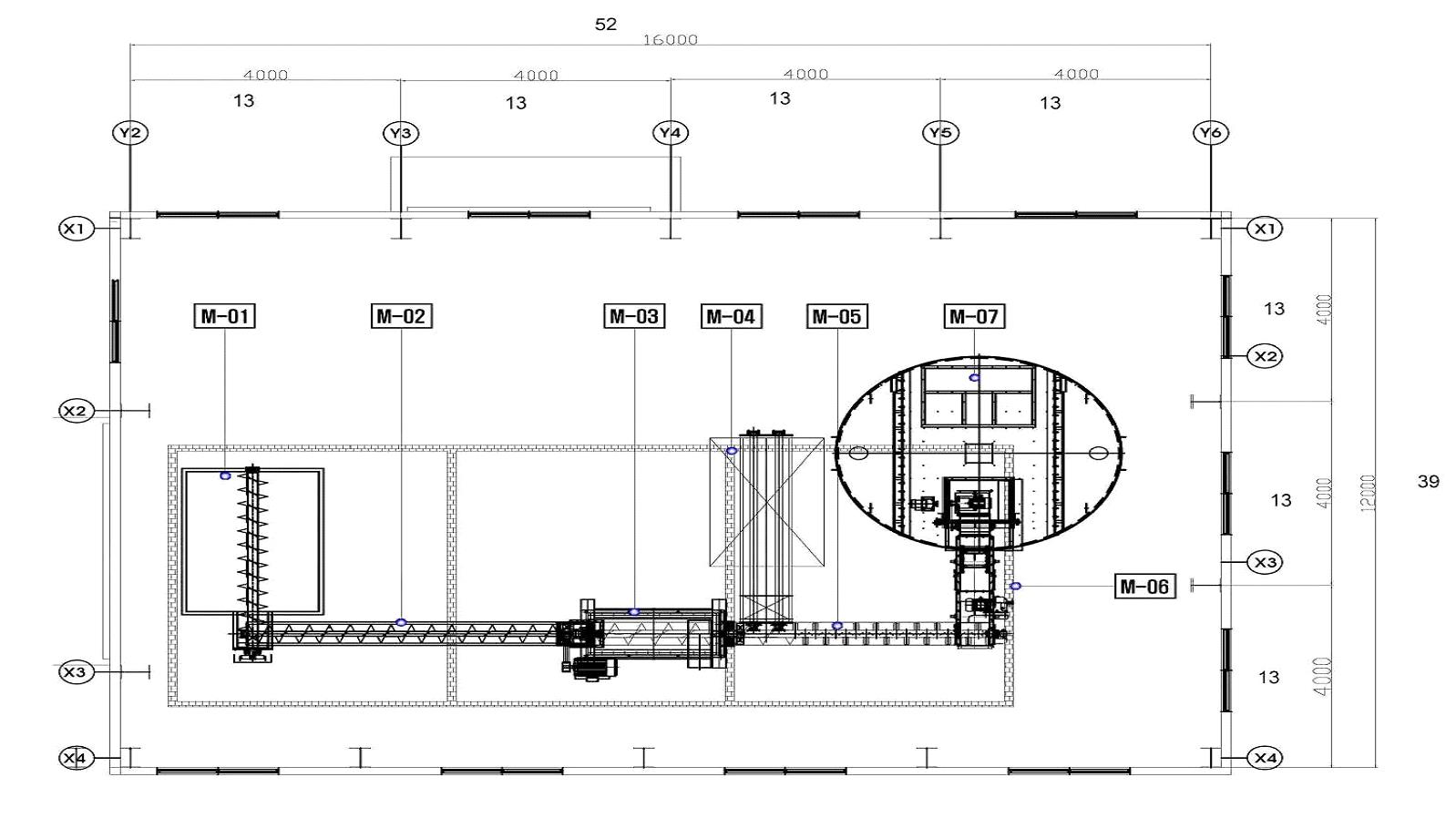

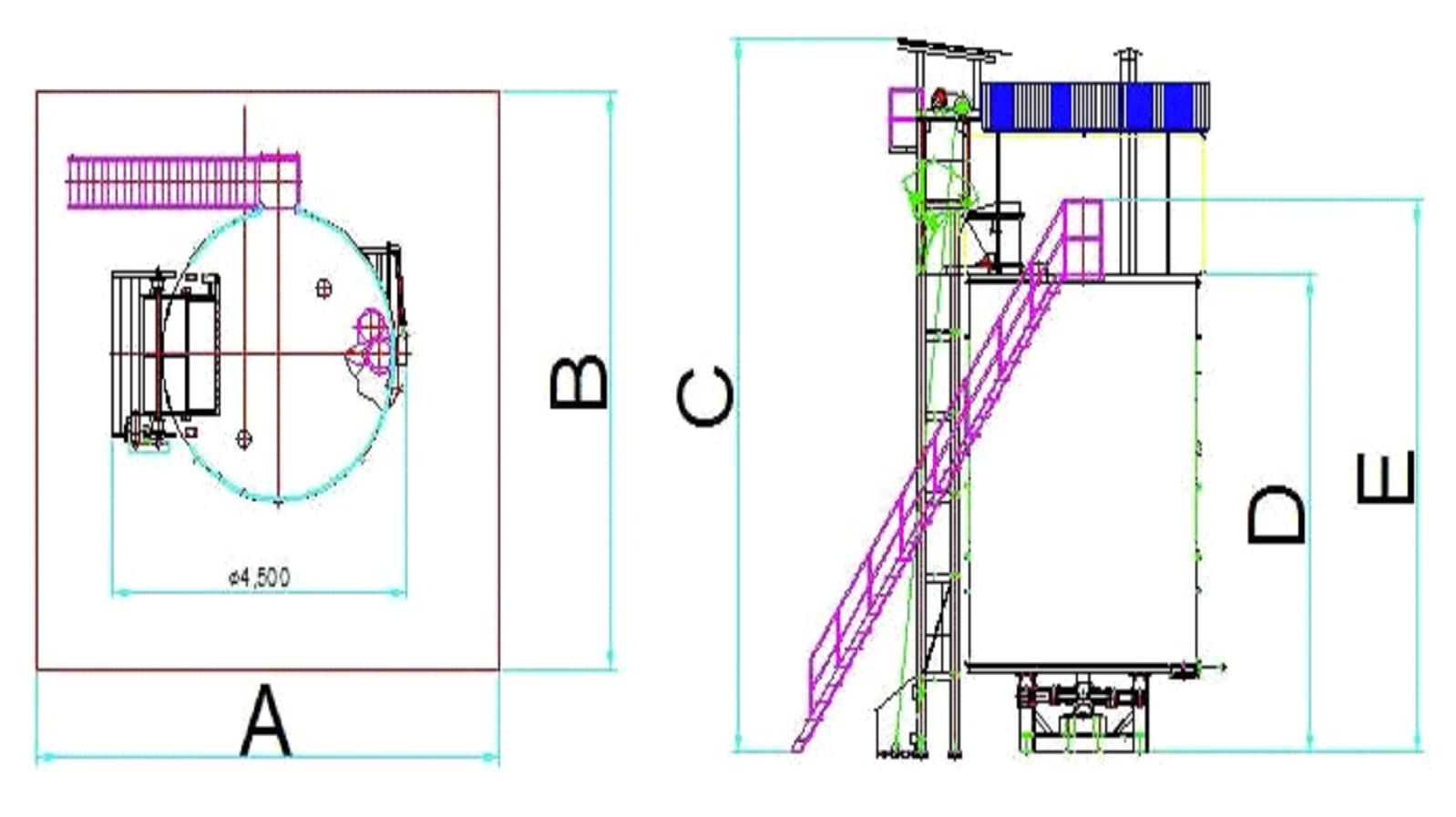

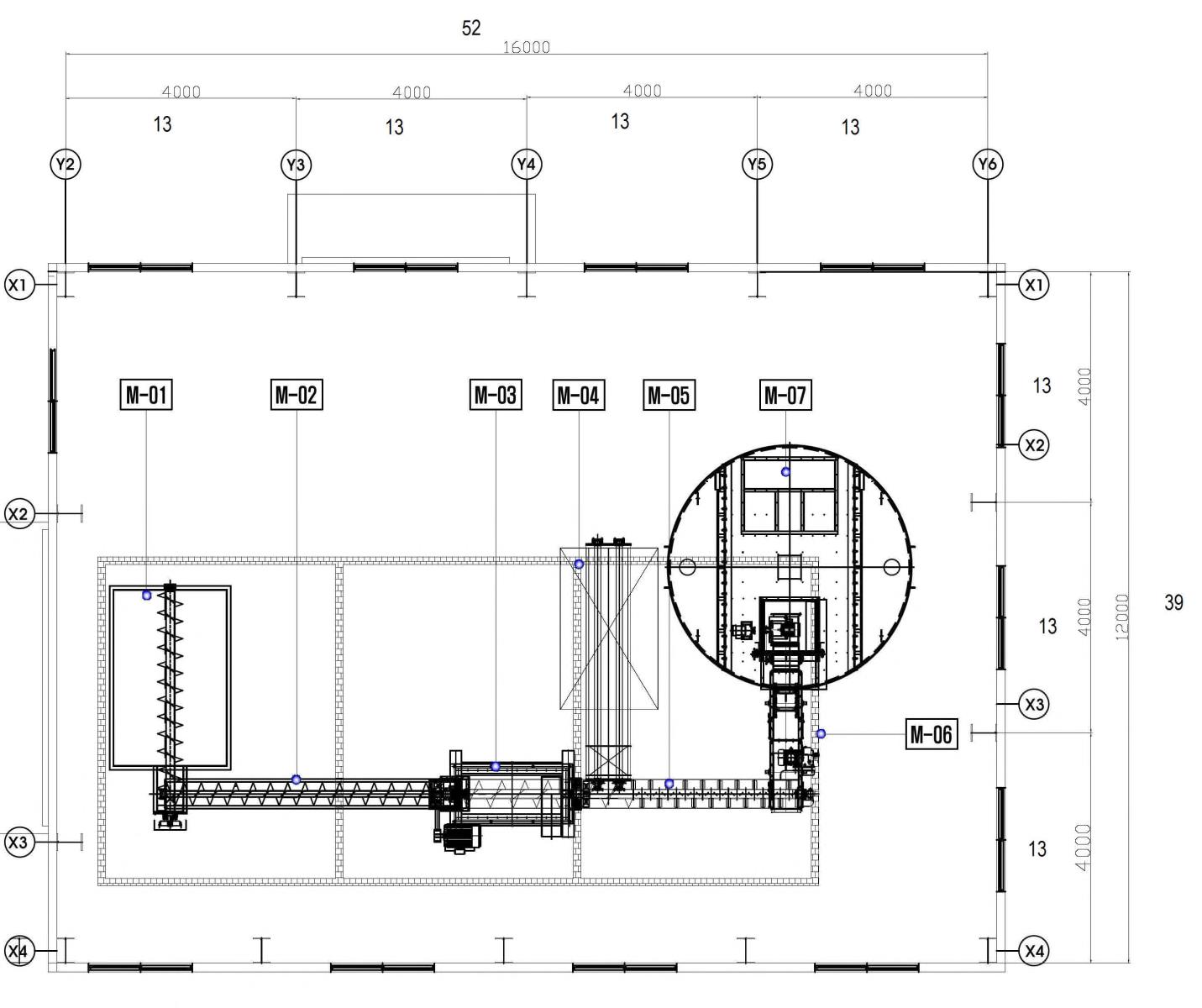

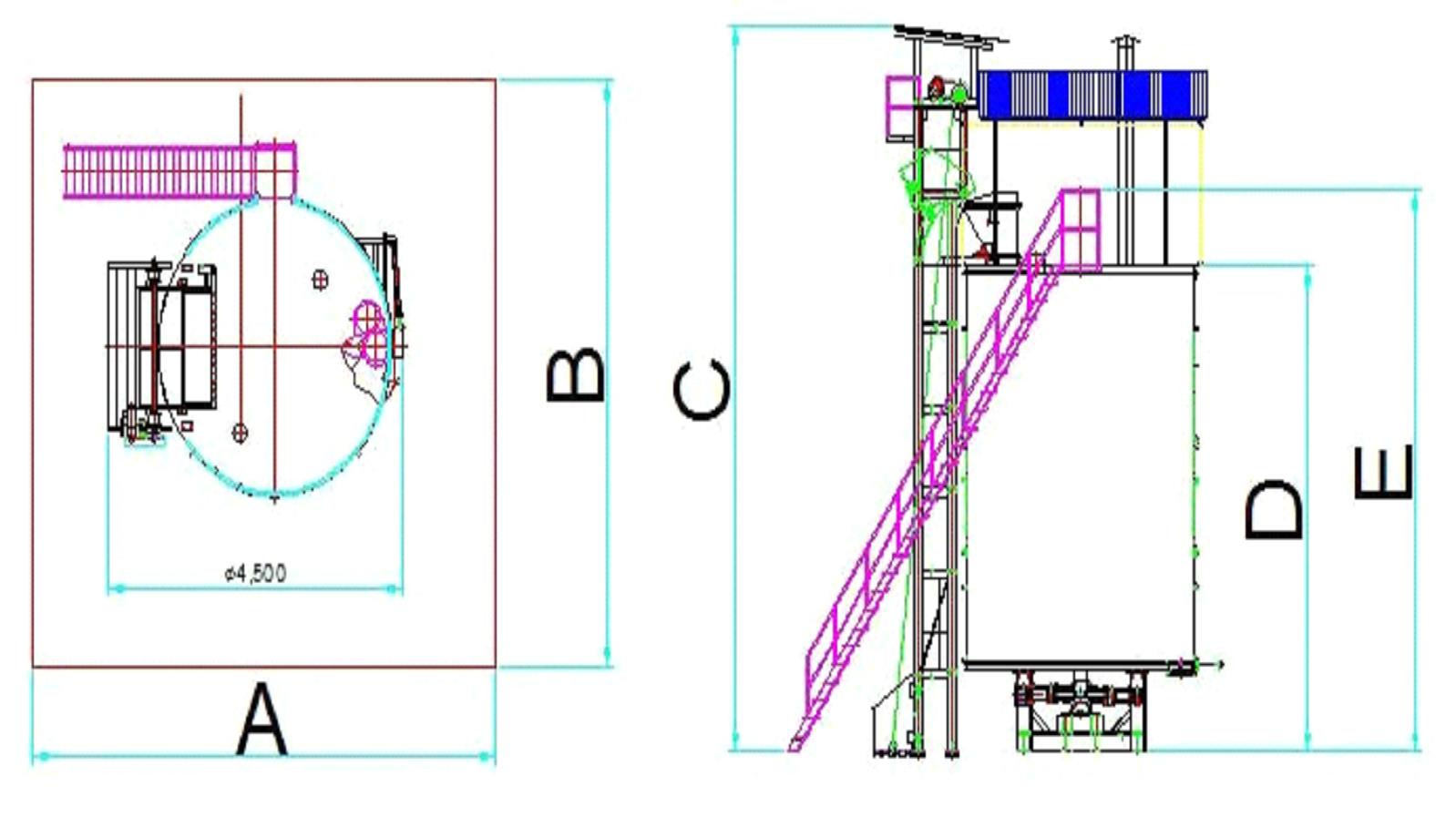

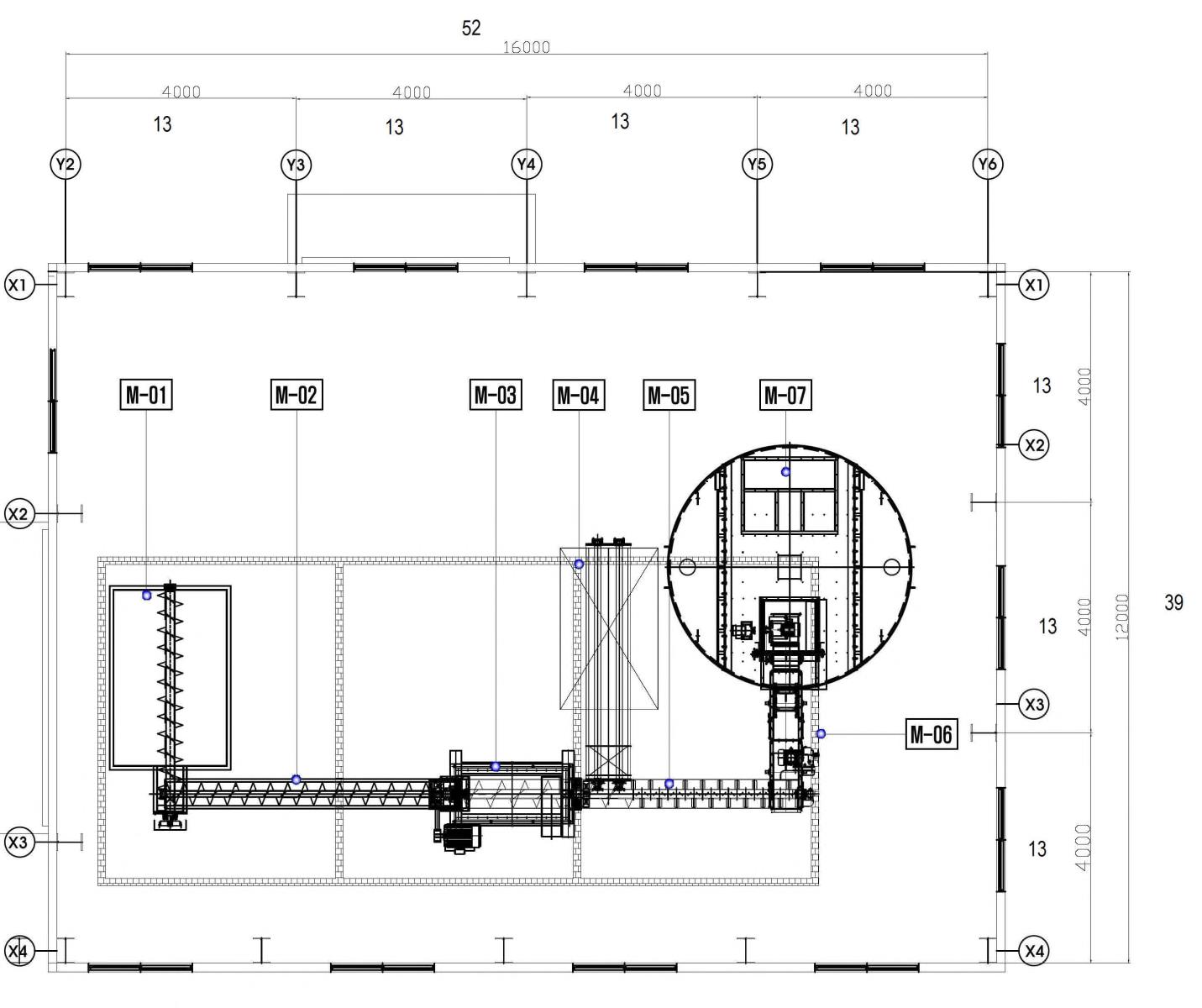

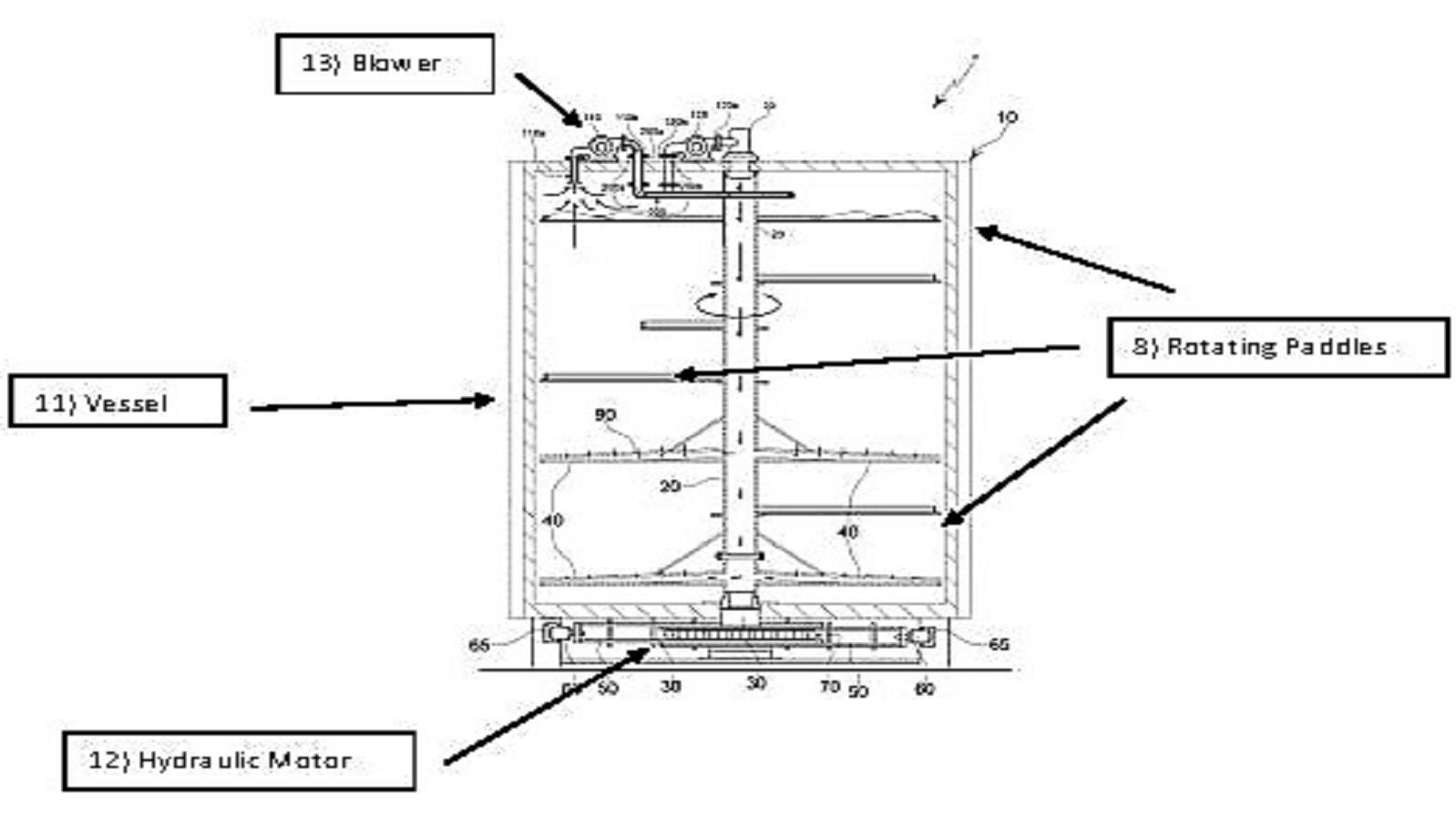

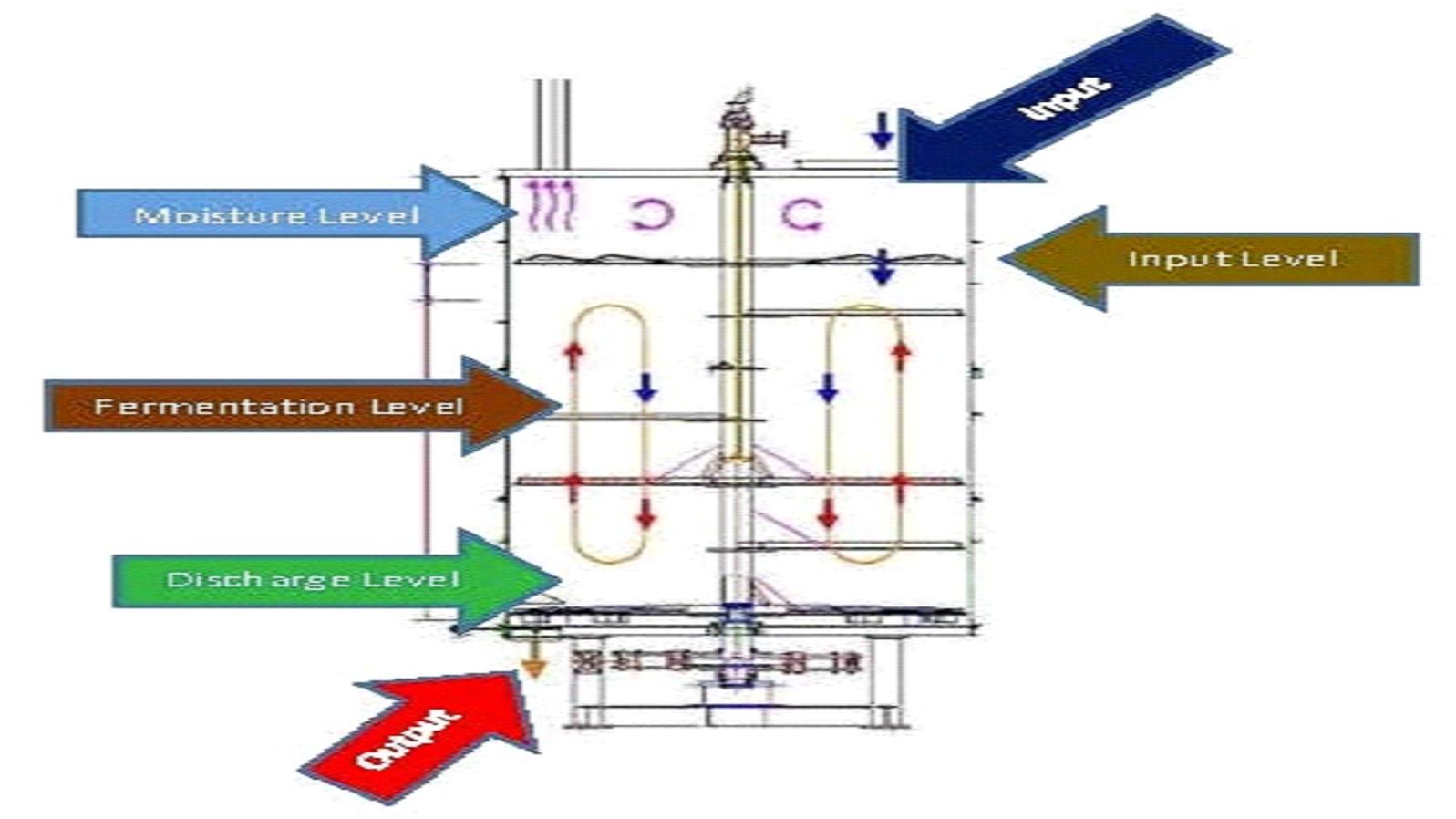

"System" means a biofermentation system which turns organic waste into a byproduct which can be processed into a high quality organic fertilizer, as described in further detail on Exhibit B attached hereto.

"Transfer" means, with respect to an Interest, a sale, assignment, gift or any other disposition, whether voluntary, involuntary or by operation of law.

"Treasury Regulations," "Treas. Reg." or "Reg." means the income tax regulations promulgated under the Code as amended from time to time (including corresponding provisions of succeeding regulations).

"Unrealized Gain" attributable to any item of Company Property means, as of any date of determination, the excess, if any, of (a) the fair market value of such Property (as determined under Section 3.7 hereof) as of such date, over (b) the Carrying Value of such Property as of such date (prior to any adjustment to be made pursuant to Section 3.7 as of such date).

"Unrealized Loss" attributable to any item of Company Property means, as of any date of determination, the excess, if any, of (a) the Carrying Value of such Property as of such date (prior to any adjustment to be made pursuant to Section 3.7 as of such date), over (b) the fair market value of such Property (as determined under Section 3.7) as of such date.

ARTICLE 2

ORGANIZATION

2.1 Organization. The Company has been organized as a Delaware limited liability company under and pursuant to the Act and the issuance of Certificate of Formation for the Company by the Secretary of State of Delaware. The rights and obligations of the Members are as set forth in the Act except as this Agreement expressly provides otherwise.

2.2 Name. The name of the Company is "ECOS Bio-Art, LLC" and all Company business must be conducted in that name or such other name the Managers may select from time to time and which is in compliance with all applicable laws.

2.3 Registered Office and Registered Agent and Principal Office. The registered office of the Company required by the Act to be maintained in the State of Delaware is the office of the initial registered agent named in the Certificate or such other office as the Managers may designate from time to time in the manner provided by law. The registered agent of the Company in the State of Delaware is the initial registered agent named in the Certificate or such other Person or Persons as the Managers may designate from time to time. The principal office of the Company may be at such place as the Managers may designate from time to time.

2.4 Purposes. The purpose of the Company is to conduct any lawful business whatsoever that may be conducted by limited liability companies pursuant to the Act, including, initially, marketing, distributing, reselling and/or leasing the Systems to LRS and other customers of the Company and marketing, distributing and selling Output, and any and all activities related thereto (the "Initial Purpose").

8

2.5 Foreign Qualification. The Managers may not permit the Company to engage in any business outside the State of Delaware unless and until the Company has complied with the requirements necessary to qualify the Company as a foreign limited liability company in the jurisdiction in which the Company conducts business.

2.6 Term. The Company commenced on the date of issuance of its Certificate of Formation and has a perpetual term and will continue until it is dissolved in accordance with either the provisions of this Agreement or the Act.

2.7 Recapitalization, Acquisitions, Restructuring and Mergers. The Company may participate in or be a party to any recapitalization, acquisition, restructuring or merger in accordance with and as allowed by the Act.

2.8 Entity Declaration. The Company is not a general partnership or a limited partnership or a joint venture, and no Member or Manager should be considered a partner or joint venturer of or with any other Member or Manager, for any purposes other than for federal and state tax purposes, and this Agreement shall not be construed otherwise.

ARTICLE 3

CAPITAL CONTRIBUTIONS AND CAPITAL ACCOUNTS

3.1 Capital Contributions. Ecos will contribute to the Company the Net Profit resulting from the sale of the first eight (8) Systems to LRS pursuant to the Equipment Purchase Agreement promptly after receipt. The Members have made initial Capital Contributions to the Company in the amounts reflected on Exhibit A.

3.2 Subsequent Contributions. No Member shall be obligated to make any Capital Contributions to the Company other than the initial Capital Contributions referred to in Section 3.1.

3.3 Return of Capital Contributions. Except as expressly provided herein, no Member shall be entitled to the return of any part of its Capital Contributions or to be paid interest in respect of either its Capital Account or its Capital Contributions. Any unrepaid Capital Contribution is not a liability of the Company or of any Member or Manager.

3.4 Loans by Managers and Members. Any Manager or Member may, but is not obligated to, loan to the Company such sums as the Managers determine to be appropriate for the conduct of the Company's business, upon terms and for such maturities as the Managers determine are commercially reasonable.

3.5 Capital Accounts. A separate capital account ("Capital Account") will be maintained for each Member in accordance with Reg. Sec. 1.704-1(b)(2)(iv). Subject to the requirements of Reg. Sec. 1.704-1(b)(2)(iv):

(a) the Company will credit each Member's Capital Account with: (i) all cash contributions of such Member to the Company; (ii) the Net Agreed Value of Contributed Property; (iii) such Member's share of the Company's Profits; (iv) the amount of any liabilities of the Company assumed by such Member (other than liabilities included in the netting process of subsection (b)(ii) below or increases in the Member's share of the Company's liabilities determined in accordance with the provisions of Code Sec. 752); and (v) the amount of any basis increase in Company Property attributable to investment credit recapture allocated to such Member; and

9

(b) the Company will debit each Member's Capital Account for: (i) distributions of cash to such Member; (ii) the Net Agreed Value of Company Property distributed to such Member; (iii) such Member's share of the Company's Losses (including expenditures which can neither be capitalized nor deducted for tax purposes, organization and syndication expenses not subject to amortization, and loss on sale or disposition of Company Property, whether or not disallowed under the rules of Code Sec. 267 or Sec. 707, but excluding losses or deductions described in Reg. Sec. 1.704- 1(b)(4)(i) or (iii)); (iv) the amount of any liabilities of such Member assumed by the Company (other than liabilities already included in the netting process of subsection (a)(ii) above or decreases in the Member's share of the Company's liabilities determined in accordance with the provisions of Code Sec. 752); and (v) the amount of any basis decrease in Company Property attributable to investment credit recapture allocated to such Member.

3.6 Capital Accounts Upon Sale or Exchange of Membership Interests. Upon the sale or exchange of an Interest, the following shall apply: (i) if such sale or exchange causes a termination of the Company in accordance with Code Sec. 708(b)(1)(B), the Company's Property shall be deemed to have been distributed to the Members in a liquidation of the Company and to have been recontributed to a new Company, and the Capital Accounts of the Members shall be redetermined in accordance with Section 3.7; or (ii) if such sale or exchange does not cause a termination of the Company in accordance with Code Sec. 708(b)(1)(B), the Capital Account of the selling or exchanging Member will be transferred to the transferee on a pro rata basis.

3.7 Revaluation of Capital Accounts Upon Occurrence of Certain Events.

(a) Contributions. In accordance with the provisions of Reg. Sec. 1.704-1(b)(2)(iv)(f) if, after the initial capital is contributed pursuant to Section 3.1, money or property in other than a de minimis amount is contributed to the Company in exchange for an Interest, the Capital Accounts of the Members and Carrying Values of all the Company's Property (determined immediately prior to such issuance) shall be adjusted to reflect the Unrealized Gain or Unrealized Loss attributable to each such Company Property as if such Unrealized Gain or Unrealized Loss had been recognized on a sale of each such item of Company Property immediately prior to such issuance and had been allocated to the Members in accordance with Article 4. In determining the Unrealized Gain or Unrealized Loss, the fair market value of Company Property shall be as determined by the Managers.

(b) Distributions. In accordance with the provisions of Reg. Sec. 1.704-1(b)(2)(iv)(f), if money or Company Property in other than a de minimis amount is distributed (including any deemed distribution under Section 3.6(i)) to a Member in

10

exchange for all or part of an Interest, the Capital Accounts of the Members and the Carrying Values of all the Company's Property (determined immediately prior to such distribution) shall be adjusted to reflect the Unrealized Gain or Unrealized Loss attributable to each item of Company Property as if such Unrealized Gain or Unrealized Loss had been recognized on a sale of each such item of Company Property immediately prior to such distribution and had been allocated to the Members in accordance with Article 4. In determining the Unrealized Gain or Unrealized Loss, the fair market value of the distributed Property shall be as determined by the Managers.

(c) Liquidation. If the Company is liquidated within the meaning of Treas. Reg. Sec. 1.704-1(b)(2)(ii)(g), the Carrying Values of all of the Company's Property (determined immediately prior to the liquidation) shall be adjusted to reflect the Unrealized Gain or Unrealized Loss attributable to each Company Property as if the Unrealized Gain or Unrealized Loss had been recognized on a sale of each such item of Company Property immediately prior to such liquidation. In determining the Unrealized Gain or Unrealized Loss, the fair market value of the Company Property shall be determined by the Managers.

(d) Services. In accordance with the provisions of Treas. Reg. Sec. 1.704-1(b)(2)(iv)(f), if the Company grants an Interest (other than a de minimis Interest) as consideration for the performance of services to or for the benefit of the Company, the Carrying Values of all the Company's Property (determined immediately prior to such issuance) shall be adjusted to reflect the Unrealized Gain or Unrealized Loss attributable to each such Company Property as if such Unrealized Gain or Unrealized Loss had been recognized on a sale of each such item of Company Property immediately prior to such issuance. In determining the Unrealized Gain or Unrealized Loss, the fair market value of Company Property shall be as determined by the Managers.

(e) Other Adjustments. The Carrying Values of Company Property shall be increased or decreased to reflect any adjustments to the adjusted basis of such assets pursuant to Code Section 734(b) or Section 743(b), but only to the extent that such adjustments are taken into account in determining Capital Accounts pursuant to (i) Treas. Reg. Sec. 1.704-1(b)(2)(iv)(m); and (ii) subparagraph (g) of the definition of Profits and Losses hereof, provided, however, that Carrying Value shall not be adjusted pursuant to this subparagraph to the extent the Managers determine that an adjustment pursuant to Sections 3.7(a), (b), (c) or (d) is necessary or appropriate in connection with the transaction that would otherwise result an adjustment pursuant to this subsection I.

(f) Managers Discretion. The adjustments pursuant to subsections (a), (b) or (d) above shall be made only if the Managers reasonably determine that such adjustments are necessary or appropriate to reflect the relative economic interests of the Members in the Company.

11

ARTICLE 4

ALLOCATIONS AND DISTRIBUTIONS

4.1 Allocation of Profits. After giving effect to the special allocations set forth in Section 4.3, Profits for each fiscal year shall be allocated among the Members as follows:

(a) All Profits resulting from any Net LRS Output Sales (i) sixty percent (60%) to LRS, and (ii) forty percent (40%) to Ecos;

(b) All other Profits, if any, to the Members, in accordance with their Percentage Ownerships.

4.2 Allocation of Losses. After giving effect to the special allocations set forth in Section 4.3, Losses for each fiscal year shall be allocated among the Members:

(a) All Losses resulting from any Net LRS Output Sales, (i) sixty percent (60%) to LRS, and (ii) forty percent (40%) to Ecos;

(b) All other Profits, if any, to the Members, in accordance with their Percentage Ownerships.

(c) The Losses allocated pursuant to Sections 4.2(a)-(b) shall not exceed the maximum amount of Losses that can be so allocated without causing any Member to have an Adjusted Capital Account Deficit at the end of any fiscal year. In the event some but not all of the Members would have an Adjusted Capital Account Deficit as a consequence of an allocation of Losses pursuant to such Sections, the limitations set forth in this Section 4.2(d) shall be applied on a Member-by-Member basis so as to allocate the maximum permissible loss to each Member under the Treasury Regulations.

4.3 Special Allocations. Items of income, gain, loss and deduction will be allocated in accordance with the provisions of this Section 4.3 without regard to the allocation provisions contained in Sections 4.1 and 4.2, in the following order:

(a) Minimum Gain Chargeback. Notwithstanding any other provision of this Article 4, if there is a net decrease in Minimum Gain during any Company fiscal year, each Member shall be specially allocated items of Company income and gain for such year (and, if necessary, subsequent years) in an amount equal to such Member's share of the net decrease in Minimum Gain, determined in accordance with Reg. Sec. 1.704-2(g). Allocations pursuant to the previous sentence shall be made in proportion to the respective amounts required to be allocated to each Member pursuant thereto. The items to be so allocated shall be determined in accordance with Reg. Sec. 1.704-2(f)(6) and (j)(2). This Section 4.3(a) is intended to comply with the minimum gain chargeback requirement in Reg. Sec. 1.704-2(f) and shall be interpreted consistently therewith.

(b) Member Minimum Gain Chargeback. Notwithstanding any other provision of this Article 4 except Section 4.3(a), if there is a net decrease in Member Minimum Gain attributable to a Member Nonrecourse Debt during any Company fiscal

12

year, each Member who has a share of the Member Minimum Gain attributable to such Member Nonrecourse Debt, determined in accordance with Reg. Sec. 1.704-2(i)(5), shall be specially allocated items of Company income and gain for such year (and, if necessary, subsequent years) in an amount equal to such Member's share of the net decrease in Member Minimum Gain attributable to such Member Nonrecourse Debt, determined in accordance with Reg. Sec. 1.704-2(i)(4). Allocations pursuant to the previous sentence shall be made in proportion to the respective amounts required to be allocated to the Members pursuant thereto. The items to be so allocated shall be determined in accordance with Reg. Sec. 1.704-2(i)(4) and (j)(2). This Section 4.3(b) is intended to comply with the minimum gain chargeback requirement in Treas. Reg. Sec. 1.704-2(i)(4) and shall be interpreted consistently therewith.

(c) Qualified Income Offset. If any Member's Capital Account is unexpectedly adjusted for, or such Member is unexpectedly allocated or there is unexpectedly distributed to such Member any item described in Reg. Sec. 1.704-1(b)(2)(ii)(d)(4)-(6), and such treatment creates or increases a Member's Adjusted Capital Account Deficit, then without regard to the allocation provisions provided in Sections 4.1 and 4.2, the Company shall allocate to such Member items of Company income and gain (consisting of a pro rata portion of each item of Company income, including gross income, and gain for such year) in an amount and manner sufficient to eliminate such Adjusted Capital Account Deficit as quickly as possible; provided that an allocation pursuant to this Section 4.3(c) shall be made only if and to the extent that the Member would have an Adjusted Capital Account Deficit after all other allocations provided for in this Article 4 have been tentatively made as if this Section 4.3(c) were not in this Agreement.

(d) Gross Income Allocation. In the event that a Member has a deficit Capital Account at the end of any Company fiscal year which is in excess of the sum of (i) the amount the Member is obligated to restore pursuant to any provision of this Agreement, and (ii) the amount the Member is deemed to be obligated to restore pursuant to Reg. Secs. 1.704-2(g) and (i)(5), the Member shall be specially allocated items of Company income and gain in the amount of such excess as quickly as possible, provided that an allocation pursuant to this Section 4.3(d) shall be made if and to the extent that the Member would have a deficit Capital Account in excess of such sum after all other allocations provided for in this Article 4 have been tentatively made as if this Section 4.3(d) were not in this Agreement.

(e) Nonrecourse Deductions. Nonrecourse Deductions, if any, for any fiscal year shall be allocated to the Members in accordance with their Percentage Ownerships.

(f) Member Nonrecourse Debt Deductions. Any Member Nonrecourse Debt Deductions for any fiscal year shall be allocated to the Member who bears the risk of loss with respect to the liability to which such Member Nonrecourse Debt Deductions are attributable in accordance with Reg. Sec. 1.704-2(i).

13

(g) Unrecaptured Section 1250 Gain. For purposes of determining the amount of unrecaptured Section 1250 gain allocable to each Member, a Member's share of depreciation is determined in accordance with Reg. Sec. 1.1245-1I, so that the unrecaptured Section 1250 gain is allocated to the Members who received the depreciation deductions.

(h) Curative Allocations. The allocations set forth in Section 4.2(b) and Sections 4.3(a) through 4.3(g) ("Regulatory Allocations") are intended to comply with certain requirements of Reg. Sec. 1.704-1(b). Notwithstanding any other provision of Article 4 (other than the Regulatory Allocations), the Regulatory Allocations shall be taken into account in allocating other profits, losses and items of income, gain, loss and deduction among the Members so that, to the extent possible, the net amount of such allocations of other profits, losses and other items and the Regulatory Allocations to each Member shall be equal to the amount that would have been allocated if the Regulatory Allocations had not occurred.

(i) Code Section 704I Allocations. In accordance with Code Sec. 704I, income, gain, loss and deduction concerning any Contributed Property shall, solely for tax purposes, be allocated among the Members to take account of any variation between the adjusted tax basis of such property and the Net Agreed Value of such property upon contribution. If the value of any Company Property is adjusted under Section 3.7 of this Agreement, subsequent allocations of income, gain, loss and deduction with respect to such asset shall take account of any variation between the adjusted tax basis of such asset for federal income tax purposes and its Carrying Value in the same manner as under Code Sec. 704I. Allocations under this Section 4.3(i) are solely for purposes of federal income taxes and will not affect or be taken into account in computing any Member's Capital Account.

4.4 Other Allocation Rules.

(a) In the event Members are admitted to the Company on different dates, the Profits or Losses allocated to the Members for each such fiscal year during which Members are so admitted shall be allocated among the Members in proportion to the number and class of Interests each holds from time to time during such fiscal year in accordance with Code Sec. 706, using any convention permitted by law and selected by the Managers.

(b) Solely for purposes of determining a Member's proportionate share of the Company's "excess nonrecourse liabilities" within the meaning of Reg. Sec. 1.752-3(a)(3), and solely for such purpose, the Member's Percentage Ownership in the Company is specified to be his applicable interest.

(c) Except as otherwise provided in this Agreement, all items of Company income, gain, loss, deduction and any other allocations not otherwise provided for shall be divided among the Members in the same proportions as they share Profits or Losses, as the case may be, for the year.

14

4.5 Allocations Concerning Transferred Interests. Unless the Code requires otherwise, any Profits or Losses allocable to an Interest which has been transferred during any year shall be allocated among the Persons who were holders of such Interest during such year by taking into account their varying interests during such taxable year in accordance with Code Sec. 706(d) and using any convention selected by the Managers.

4.6 Distributions of Net Cash Receipts.

(a) Except as otherwise provided in Section 11.3, Net Cash Receipts resulting from Net LRS Output Sales shall be distributed from time to time as determined by the Managers as follows: (i) sixty percent (60%) to LRS; and (ii) forty percent (40%) to Ecos;

(b) Except as otherwise provided in Section 11.3, Net Cash Receipts except for those distributed in accordance with Section 4.6(a), if any, shall be distributed from time to time as determined by the Managers to the Members in proportion to their respective Percentage Ownerships.

4.7 Tax Distributions. To the extent permitted by the Company's lender(s), if any, and to the extent Net Cash Receipts are available for distribution, the Managers shall cause the Company to distribute sufficient cash to enable Members to pay federal and state income taxes arising from the Company's Profits allocated to the Members during a Fiscal Year in an amount equal to the Company's Profits allocated to each Member for such Fiscal Year times the highest marginal Federal and Delaware state income tax rates for such year (a "Tax Distribution"). Such distribution shall be paid with respect to a Fiscal Year of the Company within ninety (90) days after the end of such Fiscal Year or at such earlier times and in such amounts as determined in good faith by the Managers to be appropriate to enable the Members to pay estimated income tax liabilities. Tax Distributions shall be treated as advance distributions of amounts otherwise distributed pursuant to Section 4.6(b).

ARTICLE 5

MEMBERSHIP; DISPOSITIONS OF INTERESTS

5.1 Representations and Warranties. Each Member hereby represents and warrants to the Company and to each other Members that:

(a) Organization and Authority Matters. (i) If that Member is a corporation, limited liability company, partnership, trust, or other entity, it is duly organized, validly existing, and in good standing under the law of the state of its organization and is duly qualified and (if applicable) in good standing as a foreign entity in the jurisdiction of its principal place of business (if not organized therein); (ii) the Member has full corporate, limited liability company, partnership, trust, or other applicable power and authority to execute and agree to this Agreement and to perform its obligations hereunder and all necessary actions by the board of directors, shareholders, managers, members, partners, trustees, beneficiaries, or other Persons necessary for the due authorization, execution, delivery, and performance of this Agreement by that Member have been duly taken; (iii) the Member has duly executed and delivered this Agreement; and (iv) the Member's

15

authorization, execution, delivery, and performance of this Agreement does not conflict with (A) any law, rule or court order applicable to that Member, (B) that Member's articles of incorporation, bylaws, partnership agreement, agreement or certificate of organization, or (C) any other agreement or arrangement to which that Member is a party or by which it is bound.

(b) Investment Matters. (i) The Member is acquiring his Interest for his own account for investment and not with a view to the resale, distribution or fractionalization thereof; (ii) the Member is an accredited investors as such term is defined in Regulation D under the Securities Act of 1933; (iii) the Member has, alone or together with his purchaser representatives, such knowledge and experience in financial matters that he is capable of evaluating the relative risks and merits of this investment; (iv) the Member has adequate means of providing for his current needs and personal contingencies and has no need for liquidity in this investment and is able to bear the economic risk of this investment for an indefinite period of time; (v) all documents and records requested by the Member have been delivered or made available to him and the Member's investment decision is based upon his own investigation and analysis and not the representations or inducements of any Manager or Member; (vi) the Member understands that the Interests have not been, and will not be, registered under the Securities Act of 1933 in reliance upon applicable exemptions from registration; and (vii) the Member under that there are substantial restrictions on the transferability of the Interests under the Securities Act of 1933 and state securities laws and under this Agreement and further understands that for the foreseeable future, there will be no public market for the Interests and the Company is under no obligation to register the Interests under the Securities Act of 1933 at some future date.

5.2 Restrictions on Transfer of Membership Interests.

(a) No Transfers. Except as otherwise specifically provided in this Agreement, the parties have agreed that it is not desirable that any of the Membership Interests be sold or transferred because the Members desire to provide for continuity of membership and management of the Company. No Member may Transfer an Interest in the Company except in accordance with Sections 5.3 or 5.4. Any attempted Transfer of an Interest, or any part thereof, without compliance with this Agreement shall be, and is hereby declared, null and void ab initio. The Members agree that the foregoing transfer restriction is intended to permit the harmonious operation of the Company's business, is reasonable in view of the Company's purpose and the relationship of the Members, and may be specifically enforced by the Company, the Managers and each Member.

(b) Effectiveness of Assignment. Any Transfer of Membership Interests must be made by a written instrument. No Transfer will be effective unless it is specifically permitted under this Section 5.2 and:

(i) the transferor delivers to the Managers an opinion of counsel in form and substance satisfactory to counsel designated by the Managers that

16

neither the Transfer nor any offering in connection therewith violates any provision of any federal or state securities law;

(ii) the transferee executes a statement that he is acquiring such Interest or such part thereof for his own account for investment and not with a view to distribution, fractionalization or resale thereof;

(iii) the Company receives a favorable opinion of the Company's legal counsel that such Transfer would not result in the termination of the Company (within the meaning of Section 708(b) of the Code) or termination of its status as a partnership under the Code; and

(iv) the Company receives a transfer fee sufficient to cover all expenses in connection with the transfer, including but not limited to legal fees incurred in connection with the legal opinions referred to in Section 5.2(b)(iii).

The Managers may elect to waive the requirements of the opinions of counsel set forth in subsection (iii) and the transfer fee set forth in subsection (iv) in their sole discretion. The Transfer by a Member of all or part of his Interest shall become effective on the first day of the calendar month immediately succeeding the month in which all of the requirements of this Section 5.2 have been met. All distributions prior to the effective date shall be made to the transferor, and all distributions made thereafter shall be made to the transferee.

(c) Requirements for Admission. No transferee of Membership Interests, including a Related Party (as defined herein), shall have the right to become a Member unless and until the Transfer becomes effective in accordance with Section 5.2(b) and all of the following conditions are satisfied:

(i) A duly executed and acknowledged written instrument of transfer approved by the Managers has been filed with the Company setting forth (A) the intention of the transferee to be admitted as a Member; (B) the notice address of the transferee; and (C) the number of Membership Interests transferred by the transferor to the transferee;

(ii) The transferor and transferee execute and acknowledge, and cause such other Persons to execute and acknowledge, such other instruments and provide such other evidence as the Managers may reasonably deem necessary or desirable to effect such admission, including without limitation: (A) the written acceptance and adoption by the transferee of the provisions of this Agreement, including a representation and warranty that the representations and warranties in Section 5.1 are true and correct with respect to the transferee; (B) the transferee's completion of a purchaser qualification questionnaire which will enable counsel for the Company to determine whether such proposed substitution is consistent with the requirements of a private placement exemption from registration under the Securities Act of 1933 and relevant state law; and (C) the transferee's

17

completion, if applicable, of an acknowledgment of the use of a purchaser representative, and such representative's completion of a purchaser representative questionnaire which will enable counsel for the Company to determine whether such proposed substitution is consistent with the requirements of a private placement exemption from registration under the Securities Act of 1933 and relevant state law;

(iii) The admission is approved by the Managers and the Members; and

(iv) A fee has been paid to the Company sufficient to cover all expenses in connection with the admission, subject to the Managers' right to waive these fees in its sole discretion.

(d) Rights of Mere Assignees. If a transferee of an Interest is not admitted as a Member, it shall be entitled to receive the allocations and distributions attributable to the transferred Interest, but it shall not be entitled to inspect the Company's books and records, receive an accounting of Company financial affairs or otherwise take part in the Company's business or exercise the rights of a Member under this Agreement.

5.3 Permitted Transfers. Notwithstanding anything to the contrary contained in this Agreement, Membership Interests may be Transferred (a "Permitted Transfer") in the case of Transfers by a Member or a Permitted Transferee (as herein defined) to the Representative of such Member, to the Company, or to a Related Party (each such transferee, a "Permitted Transferee").

5.4 Right of First Refusal.

(a) If a Member desires to sell any Interests in a bona fide arm's length sale to a third party purchaser (other than in a Permitted Transfer), such Member shall deliver a written notice (an "Offer Notice") to the Managers and the other Members. The Offer Notice shall disclose in reasonable detail the identity of the proposed transferee(s) (including all parties holding controlling interests in such proposed transferee), the proposed amount of Interests to be transferred and the terms and conditions of the proposed sale and shall include a true and correct copy of the written offer to purchase Interests received by the transferring Member.

(b) The delivery by the transferring Member of the Offer Notice shall create an option in favor of the non-transferring Members to purchase the Interests specified in the Offer Notice, which option may be exercised in accordance with, and will be subject to the terms set forth below in this Section 5.4(b). The non-transferring Members may elect to purchase all of the Interests subject to the option granted by this Section 5.4, by delivering written notice of such election to the Managers and the Member whose Interests are the subject of the option within 15 days following the delivery of the Officer Notice (such 15-day period being referred to herein as the "Members Election Period"). If the exercising Members elect to purchase more Interests than are subject to the option, each purchasing Member shall be entitled to purchase its pro rata share of such Interests

18

based upon their relative Percentage Ownerships and any remaining Interests will be allocated among the Members desiring to purchase them based upon such Members' relative Percentage Ownerships.

(c) Notwithstanding anything to the contrary herein, no exercise of any option granted under this Section 5.4, will be effective unless the Members, collectively, have elected to purchase all (but not less than all) of the Interests subject to the option.

(d) In the case of an option under this Section 5.4, the purchase price for the Membership Interests and the payment terms therefore will be those set forth in the Offer Notice. Purchasers of Interests under this Section 5.4 are entitled to receive customary representations and warranties as to ownership, title, authority to sell and the like from the selling Member regarding the subject Interests and to receive such other documents as may be reasonably necessary to effect the purchase of the Interests.

(e) If the Members do not exercise their option to purchase all of the Interests specified in the Offer Notice by the expiration of the Member Election Period, the transferring Member may, within sixty (60) days following the expiration of the Member Election Period, sell the Interests specified in the Offer Notice to the party or parties named therein at a price no less than the price specified in the Offer Notice and otherwise on terms and conditions no more favorable to the transferee than those offered in the Offer Notice. Any Interests not transferred within such sixty (60) day period shall be again subject to the provisions of this Section 5.4 with respect to any subsequent Transfer.

5.5 Sale by a Majority Interest.

(a) Tag Along Rights. If the right of first refusal in Section 5.4 is not exercised with respect to a Transfer described in an Offer Notice, which relates to the sale of Membership Interests representing holders of greater than 50% of the outstanding Membership Interests of the Company in a transaction or series of related transactions (a "Majority Sale"), all other Members will have the option to sell their Membership Interests in the transaction described in the Offer Notice as additional selling Members, on identical terms and conditions, by delivering a written notice thereof to the Offering Member(s) within 30 days after delivery of the Offer Notice. Each other Member may Transfer up to the Percentage Ownership of Interests then owned by such other Member as the Percentage Ownership of Membership Interests to be sold by the Offering Member(s) in the transaction bears to the aggregate number of Membership Interests then owned by the Offering Member; provided, however, that if the transferee refuses to purchase all of such Membership Interests, the number of Membership Interests to be sold in the transaction shall be reduced pro-rata (in proportion to the total number of Membership Interests initially sought to be sold by the Offering Member(s) and the other Members) to the extent necessary to consummate the transaction.

(b) Drag-Along Rights. If the right of first refusal in Section 5.4 is not exercised with respect to a Transfer described in an Offer Notice, which relates to a Majority Sale, then the Offering Member(s) may within 30 days from delivery of the

19

Offer Notice, by written notice to the other Members, require that all of the other Members sell all of their Membership Interests in the transaction described in the Offer Notice on identical terms and conditions as set forth in the Offer Notice. The other Members must so sell their Membership Interests and take all other desirable actions reasonably requested by the Offering Member(s) in connection with the sale described in the Offer Notice.

5.6 Preemptive Rights on Subsequent Issuances.

(a) Each Member shall have a preemptive right to purchase all or any portion of its pro rata share of any Equity Securities (as hereinafter defined) that the Company may from time to time, propose to issue and sell after the date of this Agreement. A Member's pro rata share is equal to the amount of such Equity Securities so that the Member maintains its then current Percentage Interest in the Company, on a fully diluted basis. The term "Equity Securities" means any Membership Interests, any other security convertible into Membership Interests or any warrant, option or other right to purchase any such security.

(b) The Managers shall give each Member notice of its intention, describing the Equity Securities, the price and the terms and conditions upon which the Company proposes to issue the Equity Securities. Each Member shall have 15 days from the receipt of such notice to agree to purchase all or any portion of its pro rata share of the Equity Securities for the price and upon the terms and conditions specified in the notice by giving written notice to the Company and therein the quantity of Equity Securities to be purchased.

(c) After the end of the 15-day period specified in subsection (b) above, the Company shall have 180 days thereafter to sell the Equity Securities in respect of which the Member's rights were not exercised at a price and terms and conditions no more favorable to the purchaser thereof than specified in the Company's notice pursuant to subsection (a). If the Company has not sold such Equity Securities within such 180-day period, the Company shall not thereafter issue or sell any Equity Securities without first offering such securities to the Members in the manner provided above.

5.7 LRS' Ownership. The following issuances shall not be subject to the preemptive rights set forth in Section 5.6 above.

(a) For each System purchased by LRS under the Equipment Purchase Agreement after the Initial System is purchased, LRS shall automatically be issued additional Membership Interests at no additional cost to LRS and with no required additional Capital Contribution such that LRS' Percentage Ownership shall automatically increase by 5%, until such time as LRS has purchased eight (8) Systems. The Managers shall amend Exhibit A to reflect such increases.

(b) Upon the later to occur of (i) such time as LRS has purchased all eight Systems from the Company under the Equipment Purchase Agreement and (ii) two years

20

from the date of this Agreement (the "Controlling Interest Date"), LRS shall have the option, in its sole discretion, for a period of one hundred eighty (180) days after the Controlling Interest Date, to purchase additional Equity Securities from the Company to increase LRS' Percentage Ownership to fifty-one percent (51%) (a "Controlling Interest"). The purchase price for such Equity Securities shall be the Fair Market Value as of the date the option is excercised.

5.8 LRS Option to Purchase.

(a) Notwithstanding anything to the contrary set forth in this Article 5, in the event of a Change of Control of Ecos, LRS shall have the option, exercisable within 60 days following the Change of Control, to purchase all, but not less than all, of the Membership Interests owned by Ecos. The aggregate price (the "Purchase Price") paid by LRS to Ecos for the Member's Membership Interests will be equal to the Fair Market Value of such Membership Interests as of the date of the event that gave rise to such option.

(b) The closing of the sale and purchase of the Membership Interests (the "Closing") will take place at the Company's principal office. The Closing will take place no later than ninety (90) days after the date LRS gives notice of its election to purchase the Membership Interests. The Purchase Price shall be paid by LRS in cash at Closing.

(c) At the Closing (i) LRS and Ecos will execute and deliver to each other the various documents necessary to effectuate the sale and purchase of the Membership Interests, (ii) Ecos will deliver to LRS good and marketable title to the Membership Interests, free and clear of all liens, claims and encumbrances, and (iii) the Managers appointed by Ecos will deliver to the Company their resignations as Managers the Company.

5.9 Interests in Member. A Member that is not a natural person may not cause or permit an ownership interest, direct or indirect, in itself to be disposed of if, after the disposition: the Company would be considered to have terminated within the meaning of Code Sec. 708.

5.10 Information. In addition to the other rights specifically set forth in this Agreement, each Member is entitled to all information to which that Member is entitled to have access pursuant to the Act under the circumstances and subject to the conditions therein stated.

5.11 Liability to Third Parties. No Member or Manager shall, by virtue of its or his status as a Member or Manager or its or his ownership of an Interest, be liable for the debts, obligations or liabilities of the Company, including but not limited to a judgment decree or order of a court.

5.12 Withdrawal. A Member does not have the right to withdraw from the Company as a Member. The Company is not obligated to purchase the Membership Interest (or any part thereof) of a Member who becomes dissociated from the Company. A dissociated Member will continue to have the same distributional interest it had before the dissociation.

21

5.13 Lack of Authority. No Member (other than a Manager or an officer appointed by the Managers) has the authority or power to act for or on behalf of the Company, to do any act that would be binding on the Company, or to incur any expenditure on behalf of the Company.

ARTICLE 6

COMPANY MANAGEMENT

6.1 Management of Company. Except as otherwise provided for herein or by non- waivable provisions of the Act, the Managers shall have full and complete authority, power and discretion to manage and control the business, affairs and properties of the Company, to make all decisions regarding those matters and to perform any and all other acts or activities customary or incident to the management of the Company's business. Subject to the other provisions of this Agreement, the Managers shall have the authority to exercise all the powers and privileges granted by the Act or this Agreement, together with any powers incidental thereto, so far as such powers are necessary or convenient to the conduct, promotion or attainment of the business, trade, purposes or activities of the Company, and to take any other action not prohibited under the Act or other applicable law. Except as otherwise expressly set forth herein, the Members, as such, shall have no authority to act for the Company or to exercise any of the powers of the Act. The Managers may delegate certain of their duties to officers or agents as set forth in Section 6.11.

6.2 Number and Tenure of Managers.

(a) There shall be seven (7) Managers of the Company. The number of Managers may be increased or decreased only by amendment to this Agreement in accordance with Article 9. A Manager need not be a Member of the Company or resident of Delaware.

(b) Initially, Ecos shall have the right to appoint four (4) managers and LRS shall have the right to appoint three (3) Managers. Initially, Ecos appoints James Kwak, Jeung Kwak, Michael Siegal and Kathy Kwak. Initially, LRS appoints Alan Handley, Rich Golf and Jerry Golf. Each Manager shall hold office until his successor shall be elected as set forth in this Section 6.2(b), or until his earlier death, resignation or removal as a Manager or until such Person is unable to continue to serve as a Manager. Upon the death, resignation or removal of a Manager, or the inability of a Manager to serve, the Member who appointed such Manager will have the right to appoint a successor Manager.

(c) In the event that LRS exercises its right to purchase Equity Securities constituting a Controlling Interest as set forth in Section 5.7(b), Ecos will have the right to appoint three (3) Managers and LRS will have the right to appoint four (4) Managers. Each Manager shall hold office until his successor shall be elected as set forth in this Section 6.2(c), or until his earlier death, resignation or removal as a Manager or until such Person is unable to continue to serve as a Manager. Upon the death, resignation or removal of a Manager, or the inability of a Manager to serve, the Member who appointed such Manager will have the right to appoint a successor Manager.

(c) Any Manager may resign at any time upon written notice to the Members. A Manager may be removed for any reason at any time by the Member who appointed such Manager. Removal of a Manager who is also an employee of the Company, will be without prejudice to the contract rights, if any, of the Person so removed.

6.3 Manner of Acting. For purposes of any and all votes, decisions, actions, approvals and other acts to be taken by the Managers with respect to the Company, each Manager shall be entitled to one vote upon each such matter. Except as set forth in Section 6.4 or where otherwise expressly stated in this Agreement, for purposes of any and all votes, decisions, actions, approvals and other acts to be taken by the Managers with respect to the Company, the affirmative vote of a majority of the votes entitled to be cast by all Managers at a meeting at which all Managers were present and voting shall be required to constitute an act of the Managers.

6.4 The affirmative vote of (a) a majority of the Managers appointed by LRS and (b) a majority of the Managers appointed by Ecos shall be required to approve the Company's taking any of the actions ("Major Decisions") set forth below:

(i) The recapitalization, reorganization, merger, or consolidation of the Company;

(ii) The sale, exchange or other disposition of all, or substantially all of the assets of the Company as part of a single transaction or plan, or series of related transactions;

(iii) The liquidation or dissolution of the Company;

(iv) The pledge, hypothecation or encumbrance of any ownership interest in or to the Company or of any asset of the Company, or the refinance of any indebtedness secured by any asset of the Company;

(v) The addition of any Member to the Company;

(vi) The approval of any Transfer in accordance with Section 5.2;

(vii) The issuance or sale of additional Membership Interests or other Equity Securities or the request for or acceptance of, any additional Capital Contributions from any Member;

(viii) The borrowing, acceptance or approval of any loan from any owner, member, manager or other Person to the Company;

(ix) The approval of any contract, agreement, transaction or series of related transactions involving an amount in excess of $50,000.00 in connection with or relating to the Company;

22

(x) Entering into or modifying any agreement with any material customer of the Company, or otherwise modifying the Company's relationship with any material customer;

(xi) The commencement of any voluntary bankruptcy or insolvency proceeding or the consent to the appointment of a receiver for or in connection with the Company, or any of the assets thereof;

(xii) Approval of the Company's annual budget or modifications thereto;

(xiii) Making any distributions to any Member in excess of Tax Distributions;

(xiv) Making any modifications to the Company's Initial Purpose, or taking any actions that are inconsistent with the Company's Initial Purpose;

(xv) Hiring or terminating any officer or executive level employee of the Company, establishing or modifying compensation arrangements with such persons, and entering into any employment agreements with such persons;

(xvi) Entering into any contracts, agreements or other arrangements with any Affiliated Parties, and

(xvii) Agreeing in writing to take any of the actions set forth in items (i) through (xvi) above.

6.5 Meetings. Meetings of the Managers may be called by or at the request of any Manager. The person or persons authorized to call the meeting of the Managers may fix any place as the place for holding the meeting of the Managers.

6.6 Notice. Notice of any meeting of the Managers shall be sent to all Managers and shall be given no fewer than 10 days and no more than 30 days prior to the date of the meeting. Notices shall be delivered in the manner set forth in Section 12.2. The attendance of a Manager at any meeting shall constitute a waiver of notice of such meeting, except where a Manager attends a meeting for the express purpose of objecting to the transaction of any business because the meeting is not lawfully called or convened. Neither the business to be transacted at, nor the purpose of, any meeting of the Managers need be specified in the notice or waiver of notice of such meeting.

6.7 Action Without Meeting. Unless specifically prohibited by the Certificate, any action required to be taken at a meeting of the Managers, or any other action which may be taken at a meeting of the Managers, may be taken without a meeting if a consent in writing, setting forth the action so taken, shall be signed by all of the Managers.

6.8 Telephonic Meetings. The Managers may participate in and act at any meeting of Managers through the use of a conference telephone or other communications equipment by

23

means of which all persons participating in the meeting can hear each other. Participation in such meeting shall constitute attendance and presence in person at the meeting of the person or persons so participating.

6.9 Management Fees; Expense Reimbursement. The Managers will not receive compensation for their services as Managers. However, the Managers shall be entitled to be reimbursed for out-of-pocket costs and expenses incurred in the course of their service hereunder.

6.10 Conflicts of Interest. Each Manager need not devote full time to the Company's business, but shall devote such time as it, in his discretion, deems necessary to manage the Company's affairs in an efficient manner. Subject to the other express provisions of this Agreement or any other agreement to which any Member or Manager is a party, and any nonwaivable provisions in the Act, each Manager, Member and officer of the Company at any time and from time to time may engage in and possess interests in other business ventures of any and every type and description, independently or with others, with no obligation to offer to the Company or any other Manager, Member or officer the right to participate therein. Subject to the limitations set forth herein, the Company may transact business with any Manager, Member, officer or Affiliate thereof ("Affiliated Parties") provided the terms of those transactions are no less favorable than those the Company could obtain from unrelated third parties and/or those transactions are specifically contemplated by this Agreement

6.11 Officers. The Managers may, by resolution, designate one or more individuals as officers or agents of the Company. No officer or agent need be a Manager, Member or resident of Delaware. Vacancies may be filled or new offices created and filled by resolution of the Managers. Any officer or agent elected or appointed by the Managers may be removed by the Managers whenever in their judgment the best interests of the Company would be served; provided, however, such removal shall be without prejudice to the contract rights, if any, of the Person so removed. Each officer or agent shall have such duties and authority and may be assigned by the Managers from time to time.

ARTICLE 7

MEETINGS OF MEMBERS

7.1 Meetings. Meetings of the Members may be called by any Manager or by Members holding not less than 20% of the outstanding Membership Interests. The meeting shall be held at the principal place of business of the Company or as designated in the notice or waivers of notice of the meeting.

7.2 Notice. Notice of any meeting of the Members shall be given no fewer than 10 days and no more than 30 days prior to the date of the meeting. Notices shall be delivered in the manner set forth in Section 12.2 and shall specify the purpose or purposes for which the meeting is called. The attendance of a Member at any meeting shall constitute a waiver of notice of such meeting, except where a Member attends a meeting for the express purpose of objecting to the transaction of any business because the meeting is not lawfully called or convened.

24

7.3 Manner of Acting. The unanimous vote of all Members entitled to vote on an action shall be required to constitute the act of the Members.

7.4 Action Without Meeting. Unless specifically prohibited by the Certificate, any action required to be taken at a meeting of the Members or any other action which may be taken at a meeting of the Members, may be taken without a meeting if a consent in writing, setting forth the action so taken, shall be signed by Members holding Membership Interests entitled to not less than the minimum number of votes that would be necessary to authorize or take such action at a meeting at which all of the Members entitled to vote thereon were present and voting. Prompt notice of the taking of the action without a meeting by less than unanimous consent shall be given in writing to those Membership who were entitled to vote but did not consent in writing.

7.5 Telephonic Meetings. The Members may participate in and act at any meeting of Members through the use of a conference telephone or other communications equipment by means of which all persons participating in the meeting can hear each other. Participation in such meeting shall constitute attendance and presence in person at the meeting of the person or persons so participating.

7.6 Proxies. Each Member entitled to vote at a meeting of Members or to express consent or dissent to action in writing without a meeting may authorize another Person or Persons to act for him by proxy. Such proxy shall be deposited with the Managers not less than 48 hours before a meeting is held or action is taken, but no proxy shall be valid after eleven months from the date of its execution, unless otherwise provided in the proxy.

7.7 Voting of Membership Interests. Each outstanding Membership Interest shall be entitled to one vote upon each matter submitted to a vote of the holders thereof.

ARTICLE 8

INDEMNIFICATION

8.1 Right To Indemnification.

(a) Indemnification. To the fullest extent permitted by the Act, the Company shall indemnify, defend and hold harmless each Person (an "Indemnified Person") who was or is made a party or is threatened to be made a party to or is involved in any threatened, pending or completed action, suit or proceeding, whether civil, criminal, administrative, arbitrative or investigative (including, without limitation, an action by or in the right of the Company), or any appeal in such a proceeding or any inquiry or investigation that could lead to such a proceeding, by reason of the fact that he, or a Person of whom he is the personal representative, is or was an officer, Manager or Member of the Company, or is or was serving as a director, member, manager, officer, partner, venturer, proprietor, trustee, employee or agent of another limited liability company, corporation, partnership, joint venture, trust, sole proprietorship, employee benefit plan or other enterprise, that is or was a Manager or Member, from and against any liabilities, expenses (including, without limitation, attorneys' fees and expenses and any other costs and expenses incurred in connection with defending such action, suit or

25

proceeding), judgments, penalties, fines and amounts paid in settlement actually and reasonably incurred by such Indemnified Person in connection with such proceeding; provided that the Person acted in good faith and in a manner the Person reasonably believed to be in or not opposed to the best interests of the Company, and, with respect to any criminal action or proceeding, had no reasonable cause to believe the Person's actions conduct was unlawful.

(b) Advance Payment. Expenses (including, without limitation, attorneys' fees and expenses) incurred by an Indemnified Person in defending a civil, criminal, administrative or investigative action, suit or proceeding shall be paid by the Company in advance of the final disposition of such action, suit or proceeding; provided, however, that the payment of such expenses incurred in advance of the final disposition of a proceeding shall be made only upon delivery to the Company of a written affirmation by such Indemnified Person of his good faith belief that he has met the standard of conduct necessary for indemnification under this Article 8 and a written undertaking, by or on behalf of such Person, to repay all amounts so advanced if it shall ultimately be determined that such Person is not entitled to be indemnified under this Article 8 or otherwise.