Document

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

(Mark One)

|

| |

x | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended June 30, 2018

OR

|

| |

¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from ____ to ____

Commission File Number 001-33351

_________________________________________________

NEUROMETRIX, INC.

(Exact name of registrant as specified in its charter)

|

| |

Delaware | 04-3308180 |

(State or other jurisdiction of | (I.R.S. Employer Identification No.) |

incorporation or organization) | |

| |

1000 Winter Street, Waltham, Massachusetts | 02451 |

(Address of principal executive offices) | (Zip Code) |

(781) 890-9989

(Registrant’s telephone number, including area code)

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

Yes x No ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See definition of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act (check one):

|

| | | |

Large accelerated filer ¨ | Accelerated filer ¨ | Non-accelerated filer ¨ | Smaller reporting company x |

| | (Do not check if a smaller reporting company) | |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes ¨ No x

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Yes ¨ No x

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate the number of shares outstanding of each of the issuer’s classes of common stock, as of the latest practicable date: 7,356,731 shares of common stock, par value $0.0001 per share, were outstanding as of July 13, 2018.

In addition, there were 454,781 warrants to purchase shares of the issuer's common stock listed under NUROW on the NASDAQ stock exchange outstanding as of July 13, 2018.

NeuroMetrix, Inc.

Form 10-Q

Quarterly Period Ended June 30, 2018

TABLE OF CONTENTS

|

| | |

| |

| | |

Item 1. | | |

| | |

| Balance Sheets as of June 30, 2018 (unaudited) and December 31, 2017 | |

| | |

| Statements of Operations (unaudited) for the Quarters and Six Months Ended June 30, 2018 and 2017 | |

| | |

| Statements of Cash Flows (unaudited) for the Six Months Ended June 30, 2018 and 2017 | |

| | |

| | |

| | |

Item 2. | | |

| | |

Item 3. | | |

| | |

Item 4. | | |

| | |

| |

| | |

Item 1. | | |

| | |

Item 1A. | | |

| | |

Item 2. | | |

| | |

Item 3. | | |

| | |

Item 4. | | |

| | |

Item 5. | | |

| | |

Item 6. | | |

| | |

| |

PART I – FINANCIAL INFORMATION

Item 1. Financial Statements

NeuroMetrix, Inc.

Balance Sheets

|

| | | | | | | |

| June 30, 2018 | | December 31, 2017 |

| (Unaudited) | | |

Assets | |

| | |

|

Current assets: | |

| | |

|

Cash and cash equivalents | $ | 7,108,915 |

| | $ | 4,043,681 |

|

Accounts receivable, net | 1,114,496 |

| | 1,049,329 |

|

Inventories | 2,424,178 |

| | 2,142,561 |

|

Prepaid expenses and other current assets | 691,835 |

| | 1,867,803 |

|

Total current assets | 11,339,424 |

| | 9,103,374 |

|

| | | |

Fixed assets, net | 430,669 |

| | 440,842 |

|

Other long-term assets | 38,127 |

| | 55,008 |

|

Total assets | $ | 11,808,220 |

| | $ | 9,599,224 |

|

| | | |

Liabilities and Stockholders’ Equity | |

| | |

|

Current liabilities: | |

| | |

|

| | | |

Accounts payable | $ | 799,785 |

| | $ | 733,305 |

|

Accrued expenses and compensation | 1,974,210 |

| | 2,362,124 |

|

Accrued product returns | 1,312,618 |

| | 666,375 |

|

Deferred revenue | — |

| | 820,031 |

|

Total current liabilities | 4,086,613 |

| | 4,581,835 |

|

| | | |

Total liabilities | 4,086,613 |

| | 4,581,835 |

|

| | | |

Commitments and contingencies (Note 6) |

|

| |

|

|

| | | |

Stockholders’ equity: | |

| | |

|

Preferred stock | — |

| | — |

|

Convertible preferred stock | 18 |

| | 30 |

|

Common stock, $0.0001 par value; 100,000,000 shares authorized at June 30, 2018 and December 31, 2017; 7,356,731 and 2,706,066 shares issued and outstanding at June 30, 2018 and December 31, 2017, respectively | 736 |

| | 271 |

|

Additional paid-in capital | 197,020,869 |

| | 196,355,142 |

|

Accumulated deficit | (189,300,016 | ) | | (191,338,054 | ) |

Total stockholders’ equity | 7,721,607 |

| | 5,017,389 |

|

Total liabilities and stockholders’ equity | $ | 11,808,220 |

| | $ | 9,599,224 |

|

The accompanying notes are an integral part of these interim financial statements.

NeuroMetrix, Inc.

Statements of Operations

(Unaudited)

|

| | | | | | | | | | | | | | | |

| Quarters Ended June 30, | | Six Months Ended June 30, |

| 2018 | | 2017 | | 2018 | | 2017 |

| | | | | | | |

Revenues | $ | 3,751,568 |

| | $ | 4,310,059 |

| | $ | 8,694,558 |

| | $ | 8,616,181 |

|

| | | | | | | |

Cost of revenues | 1,950,304 |

| | 2,639,402 |

| | 4,905,564 |

| | 5,337,004 |

|

| | | | | | | |

Gross profit | 1,801,264 |

| | 1,670,657 |

| | 3,788,994 |

| | 3,279,177 |

|

| | | | | | | |

Operating expenses: | |

| | |

| | |

| | |

|

Research and development | 1,616,863 |

| | 877,584 |

| | 2,896,427 |

| | 1,780,868 |

|

Sales and marketing | 2,200,852 |

| | 2,919,281 |

| | 4,705,593 |

| | 5,516,993 |

|

General and administrative | 1,170,634 |

| | 1,245,347 |

| | 2,974,777 |

| | 2,667,129 |

|

| | | | | | | |

Total operating expenses | 4,988,349 |

| | 5,042,212 |

| | 10,576,797 |

| | 9,964,990 |

|

| | | | | | | |

Loss from operations | (3,187,085 | ) | | (3,371,555 | ) | | (6,787,803 | ) | | (6,685,813 | ) |

| | | | | | | |

Other income: | | | | | | | |

Collaboration income | 3,749,999 |

| | — |

| | 8,505,704 |

| | — |

|

Other income | 11,014 |

| | 133,759 |

| | 22,279 |

| | 215,617 |

|

| | | | | | | |

Total other income | 3,761,013 |

| | 133,759 |

| | 8,527,983 |

| | 215,617 |

|

| | | | | | | |

Net income (loss) | 573,928 |

| | (3,237,796 | ) | | 1,740,180 |

| | (6,470,196 | ) |

| | | | | | | |

Net income (loss) applicable to common stockholders: |

| | | | | | | |

Deemed dividends attributable to preferred shareholders | — |

| | — |

| | — |

| | (4,041,682 | ) |

| | | | | | | |

Net income (loss) applicable to common stockholders | $ | 573,928 |

| | $ | (3,237,796 | ) | | $ | 1,740,180 |

| | $ | (10,511,878 | ) |

| | | | | | | |

Net income (loss) per common share applicable to common stockholders, | | | | | | | |

Basic | $ | 0.08 |

| | $ | (2.49 | ) | | $ | 0.25 |

| | $ | (9.12 | ) |

Diluted | $ | 0.04 |

| | $ | (2.49 | ) | | $ | 0.13 |

| | $ | (9.12 | ) |

The accompanying notes are an integral part of these interim financial statements.

NeuroMetrix, Inc.

Statements of Cash Flows

(Unaudited)

|

| | | | | | | |

| Six Months Ended June 30, |

| 2018 | | 2017 |

Cash flows from operating activities: | |

| | |

|

Net income (loss) | $ | 1,740,180 |

| | $ | (6,470,196 | ) |

Adjustments to reconcile net income (loss) to net cash provided by (used in) operating activities: | |

| | |

|

Depreciation | 140,989 |

| | 126,254 |

|

Stock-based compensation | 371,917 |

| | 113,635 |

|

Change in fair value of warrant liability | — |

| | (208,153 | ) |

Changes in operating assets and liabilities: | |

| | |

|

Accounts receivable | 1,288,332 |

| | (245,786 | ) |

Inventories | (281,617 | ) | | (225,089 | ) |

Prepaid expenses and other current and long-term assets | 609,358 |

| | (53,464 | ) |

Accounts payable | 66,480 |

| | 24,160 |

|

Accrued expenses and compensation | (93,651 | ) | | 367,295 |

|

Accrued product returns | (645,938 | ) | | (71,388 | ) |

Deferred revenue | — |

| | 31,037 |

|

Net cash provided by (used in) operating activities | 3,196,050 |

| | (6,611,695 | ) |

| | | |

Cash flows from investing activities: | |

| | |

|

Purchases of fixed assets | (130,816 | ) | | (37,869 | ) |

Net cash used in investing activities | (130,816 | ) | | (37,869 | ) |

| | | |

Cash flows from financing activities: | |

| | |

|

Net proceeds from issuance of stock and warrants | — |

| | 6,312,378 |

|

Net cash provided by financing activities | — |

| | 6,312,378 |

|

| | | |

Net increase (decrease) in cash and cash equivalents | 3,065,234 |

| | (337,186 | ) |

Cash and cash equivalents, beginning of period | 4,043,681 |

| | 3,949,135 |

|

Cash and cash equivalents, end of period | $ | 7,108,915 |

| | $ | 3,611,949 |

|

Supplemental disclosure of cash flow information: | |

| | |

|

Change in fair value of warrant liability from repricing | $ | — |

| | $ | 244,611 |

|

Common stock issued to settle employee incentive compensation obligation | $ | 294,264 |

| | $ | — |

|

The accompanying notes are an integral part of these interim financial statements.

NeuroMetrix, Inc.

Notes to Unaudited Financial Statements

June 30, 2018

| |

1. | Business and Basis of Presentation |

Our Business-An Overview

NeuroMetrix, Inc., or the Company, is a commercial stage, innovation driven healthcare company combining bioelectrical and digital medicine to address chronic health conditions including chronic pain, sleep disorders, and diabetes. The Company’s lead product is Quell, an over-the-counter wearable therapeutic device for chronic pain. Quell is integrated into a digital health platform that helps patients optimize their therapy and decrease the impact of chronic pain on their quality of life. The Company also markets DPNCheck®, a rapid point-of-care test for diabetic neuropathy, which is the most common long-term complication of Type 2 diabetes. The Company maintains an active research effort and has several pipeline programs. The Company is located in Waltham, Massachusetts and was founded as a spinoff from the Harvard-MIT Division of Health Sciences and Technology in 1996.

In January 2018, the Company entered into a collaboration (the "Collaboration") with GlaxoSmithKline ("GSK"). The Collaboration set up a framework for the joint development of the next generation of Quell and the assignment of areas of marketing responsibility. The initial term of the Collaboration runs through 2020. Through June 30, 2018, GSK paid the Company $8.8 million upon entering the Collaboration and attainment of performance milestones, committed to future performance milestone payments totaling up to $17.7 million, and agreed to co-fund Quell development costs starting in 2019.

The accompanying financial statements have been prepared on a basis which assumes that the Company will continue as a going concern and which contemplates the realization of assets and satisfaction of liabilities and commitments in the normal course of business. In recent years, the Company has suffered recurring losses from operations and negative cash flows from operating activities. At June 30, 2018, the Company had an accumulated deficit of $189.3 million. The Company held cash and cash equivalents of $7.1 million as of June 30, 2018. The Company believes that these resources, together with the cash to be generated from expected product sales and the potential achievement of additional development milestones under the Collaboration with GSK, will be sufficient to meet its projected operating requirements into 2019. The Company continues to face significant challenges and uncertainties and, as a result, the Company’s available capital resources may be consumed more rapidly than currently expected due to (a) decreases in sales of the Company’s products and the uncertainty of future revenues; (b) delays in achieving Quell development milestones and related payments from GSK; (c) changes the Company may make to the business that affect ongoing operating expenses; (d) changes the Company may make in its business strategy; (e) regulatory developments or inquiries affecting the Company’s existing products and products under development; (f) changes the Company may make in its research and development spending plans; and (g) other items affecting the Company’s forecasted level of expenditures and use of cash resources. Accordingly, the Company may need to raise additional funds to support its operating and capital needs in 2019 and beyond. These factors raise substantial doubt about the Company’s ability to continue as a going concern for the one year period from the date of issuance of these financial statements. The financial statements do not include any adjustments that might result from the outcome of this uncertainty. The Company intends to obtain additional funding through public or private financing, collaborative arrangements with strategic partners, or through additional credit lines or other debt financing sources to increase the funds available to fund operations. However, the Company may not be able to secure such financing in a timely manner or on favorable terms, if at all. Furthermore, if the Company issues equity or debt securities to raise additional funds, its existing stockholders may experience dilution, and the new equity or debt securities may have rights, preferences and privileges senior to those of the Company’s existing stockholders. If the Company raises additional funds through collaboration, licensing or other similar arrangements, it may be necessary to relinquish valuable rights to its products or proprietary technologies, or grant licenses on terms that are not favorable to the Company. Without additional funds, the Company may be forced to delay, scale back or eliminate some of its sales and marketing efforts, research and development activities, or other operations and potentially delay product development in an effort to provide sufficient funds to continue its operations. If any of these events occurs, the Company’s ability to achieve its development and commercialization goals would be adversely affected.

Certain prior period amounts have been adjusted to reflect the Company's 1-for-8 reverse stock split effected May 11, 2017.

Unaudited Interim Financial Statements

The accompanying unaudited balance sheet as of June 30, 2018, unaudited statements of operations for the quarters and six months ended June 30, 2018 and 2017 and the unaudited statements of cash flows for the six months ended June 30, 2018 and 2017 have been prepared in accordance with accounting principles generally accepted in the United States of America for interim financial information and with the instructions to Form 10-Q and Article 8 of Regulation S-X. The accompanying balance sheet as of December 31, 2017 has been derived from audited financial statements prepared at that date, but does not include all disclosures required by accounting principles generally accepted in the United States of America. In the opinion of management, the financial statements include all normal and recurring adjustments considered necessary for a fair presentation of the Company’s financial position and operating results. Operating results for the quarter and six months ended June 30, 2018 are not necessarily indicative of the results that may be expected for the year ending December 31, 2018 or any other period. These financial statements and notes should be read in conjunction with the financial statements for the year ended December 31, 2017 included in the Company’s Annual Report on Form 10-K, as filed with the Securities and Exchange Commission, or the SEC, on February 8, 2018 (File No. 001-33351), or the Company’s 2017 Form 10-K.

Revenues

Revenues include product sales, net of estimated returns. Revenue is measured as the amount of consideration the Company expects to receive in exchange for product transferred. Revenue is recognized when contractual performance obligations have been satisfied and control of the product has been transferred to the customer. In most cases, the Company has a single product delivery performance obligation. Product returns are estimated based on historical data and evaluation of current information.

Accounting Standards Update (“ASU”) No. 2014-9, Revenue from Contracts with Customers (“ASU 2014-9”), is a comprehensive revenue recognition standard that superseded nearly all existing revenue recognition guidance. The Company adopted this standard effective January 1, 2018, using the modified retrospective method. Upon adoption, the Company discontinued revenue deferral under the sell-through model and commenced recording revenue upon delivery to distributors, net of estimated returns. Generally, the new standard results in earlier recognition of revenues.

Adoption of ASU 2014-09 impacted the previously reported results for the quarter ended June 30, 2017 as follows:

|

| | | | | | | | | | | |

| As reported | | | | After adoption |

| Quarter Ended June 30, 2017 | | ASU 2014-09 Impact | | Quarter Ended June 30, 2017 |

Revenues | $ | 4,310,059 |

| | $ | 503,484 |

| | $ | 4,813,543 |

|

Cost of revenues | $ | 2,639,402 |

| | $ | 371,714 |

| | $ | 3,011,116 |

|

Gross profit | $ | 1,670,657 |

| | $ | 131,770 |

| | $ | 1,802,427 |

|

Net loss applicable to common stockholders | $ | (3,237,796 | ) | | $ | 131,770 |

| | $ | (3,106,026 | ) |

Net loss per common share applicable to common stockholders, basic and diluted | $ | (2.49 | ) | | $ | 0.10 |

| | $ | (2.39 | ) |

Adoption of ASU 2014-09 impacted the previously reported results for the six months ended June 30, 2017 as follows:

|

| | | | | | | | | | | |

| As reported | | | | After adoption |

| Six Months Ended June 30, 2017 | | ASU 2014-09 Impact | | Six Months Ended June 30, 2017 |

Revenues | $ | 8,616,181 |

| | $ | 511,138 |

| | $ | 9,127,319 |

|

Cost of revenues | $ | 5,337,004 |

| | $ | 397,743 |

| | $ | 5,734,747 |

|

Gross profit | $ | 3,279,177 |

| | $ | 113,395 |

| | $ | 3,392,572 |

|

Net loss applicable to common stockholders | $ | (10,511,878 | ) | | $ | 113,395 |

| | $ | (10,398,483 | ) |

Net loss per common share applicable to common stockholders, basic and diluted | $ | (9.12 | ) | | $ | 0.10 |

| | $ | (9.02 | ) |

Adoption of ASU 2014-09 impacted the previously reported balance sheet as of December 31, 2017 as follows:

|

| | | | | | | | | | | |

| As reported | | | | After adoption |

| December 31, 2017 | | ASU 2014-09

Impact | | December 31, 2017 |

| | | | | |

Accounts receivable, net | $ | 1,049,329 |

| | $ | 1,353,499 |

| | $ | 2,402,828 |

|

Prepaid expenses and other current assets | $ | 1,867,803 |

| | $ | (583,491 | ) | | $ | 1,284,312 |

|

Total current assets | $ | 9,103,374 |

| | $ | 770,008 |

| | $ | 9,873,382 |

|

| | | | | |

Accrued product returns | $ | 666,375 |

| | $ | 1,292,181 |

| | $ | 1,958,556 |

|

Deferred revenue | $ | 820,031 |

| | $ | (820,031 | ) | | $ | — |

|

Total current liabilities | $ | 4,581,835 |

| | $ | 472,150 |

| | $ | 5,053,985 |

|

| | | | | |

Accumulated deficit | $ | (191,338,054 | ) | | $ | 297,858 |

| | $ | (191,040,196 | ) |

Total stockholders’ equity | $ | 5,017,389 |

| | $ | 297,858 |

| | $ | 5,315,247 |

|

Accounts receivable are recorded net of the allowance for doubtful accounts which represents the Company’s best estimate of credit losses. Allowance for doubtful accounts was $25,000 as of June 30, 2018 and December 31, 2017.

Two customers accounted for 24% and 29% of total revenue for the quarter and six months ended June 30, 2018, respectively. One customer accounted for 16% of total revenue for the quarter and six months ended June 30, 2017. Customers that individually account for greater than 10% of accounts receivables totaled 64% and 66% of accounts receivables as of June 30, 2018 and December 31, 2017, respectively.

Collaboration

In January 2018, the Company entered into the Collaboration with GSK. The Company sold to GSK the rights to the Company’s Quell technology for markets outside of the United States, including certain patents and related assets, and agreed to complete development milestones for the next-generation Quell technology. The Company retained exclusive ownership of Quell technology in the U.S. market. GSK agreed to payments totaling up to $26.5 million, of which $5.0 million was paid at closing, $3.8 million was paid upon attainment of the first development milestone, and the balance will be due upon achievement of defined development and commercialization milestones. In addition, the parties agreed to jointly fund future Quell technology development during an initial period starting in 2019. The Company recognized Collaboration income net of costs, within Other income in the Statement of Operations of $3,749,999 and $8,505,704, for the quarter and six months ended June 30, 2018, respectively.

Stock-based Compensation

Total compensation cost related to non-vested awards not yet recognized at June 30, 2018 was $298,650. The total compensation costs are expected to be recognized over a weighted-average period of 2.3 years.

Use of Estimates

The preparation of financial statements in conformity with accounting principles generally accepted in the United States of America requires management to make significant estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenue and expenses during reporting periods. Actual results could differ from those estimates.

Reclassifications

Certain prior period amounts have been reclassified to conform to the current period presentation.

Recent Accounting Pronouncements

In February 2016, the Financial Accounting Standards Board (“FASB”) issued ASU No. 2016-2, Leases (Topic 842) (“ASU 2016-2”). ASU 2016-2 requires that lessees recognize virtually all of their leases on the balance sheet, by recording a right-of-use asset and lease liability. The provisions of this guidance are effective for annual periods beginning after December 31, 2018, and for interim periods therein. The Company is in the process of evaluating the new standard and assessing the impact, ASU 2016-2 will have on the Company’s financial statements and which adoption method will be used.

| |

2. | Comprehensive Income (Loss) |

For the quarters and six months ended June 30, 2018 and 2017, the Company had no components of other comprehensive income or loss other than net income (loss) itself.

| |

3. | Net Income (Loss) Per Common Share |

Basic and dilutive net income (loss) per common share were as follows:

|

| | | | | | | | | | | | | | | |

| Quarters Ended June 30, | | Six Months Ended June 30, |

| 2018 | | 2017 | | 2018 | | 2017 |

Net income (loss) applicable to common stockholders | $ | 573,928 |

| | $ | (3,237,796 | ) | | $ | 1,740,180 |

| | $ | (10,511,878 | ) |

| | | | | | | |

Weighted average number of common shares outstanding, basic | 7,330,479 |

| | 1,302,231 |

| | 6,839,778 |

| | 1,152,441 |

|

Dilutive convertible preferred stock | 6,584,674 |

| | — |

| | 6,980,585 |

| | — |

|

Weighted average number of common shares outstanding, dilutive | 13,915,153 |

| | 1,302,231 |

| | 13,820,363 |

| | 1,152,441 |

|

| | | | | | | |

Net income (loss) per common share applicable to common stockholders, basic | $ | 0.08 |

| | $ | (2.49 | ) | | $ | 0.25 |

| | $ | (9.12 | ) |

Net income (loss) per common share applicable to common stockholders, diluted | $ | 0.04 |

| | $ | (2.49 | ) | | $ | 0.13 |

| | $ | (9.12 | ) |

Shares underlying the following potentially dilutive weighted average number of common stock equivalents were excluded from the calculation of diluted net income (loss) per common share because their effect was anti-dilutive for each of the periods presented:

|

| | | | | | | | | | | |

| Quarters Ended June 30, | | Six Months Ended June 30, |

| 2018 | | 2017 | | 2018 | | 2017 |

Options | 466,025 |

| | 97,774 |

| | 401,778 |

| | 97,832 |

|

Warrants | 459,375 |

| | 4,845,186 |

| | 459,375 |

| | 4,619,920 |

|

Convertible preferred stock | — |

| | 3,883,251 |

| | — |

| | 3,042,295 |

|

Total | 925,400 |

| | 8,826,211 |

| | 861,153 |

| | 7,760,047 |

|

Inventories consist of the following:

|

| | | | | | | |

| June 30, 2018 | | December 31, 2017 |

Purchased components | $ | 1,481,398 |

| | $ | 505,293 |

|

Finished goods | 942,780 |

| | 1,637,268 |

|

| $ | 2,424,178 |

| | $ | 2,142,561 |

|

| |

5. | Accrued Expenses and Compensation |

Accrued expenses and compensation consist of the following:

|

| | | | | | | |

| June 30, 2018 | | December 31, 2017 |

Accrued compensation | $ | 534,467 |

| | $ | 786,184 |

|

Technology fees | 450,000 |

| | 450,000 |

|

Professional services | 320,000 |

| | 603,000 |

|

Advertising and promotion | 189,700 |

| | 127,361 |

|

Warranty reserve | 151,321 |

| | 160,800 |

|

Other | 328,722 |

| | 234,779 |

|

| $ | 1,974,210 |

| | $ | 2,362,124 |

|

| |

6. | Commitments and Contingencies |

Operating Lease

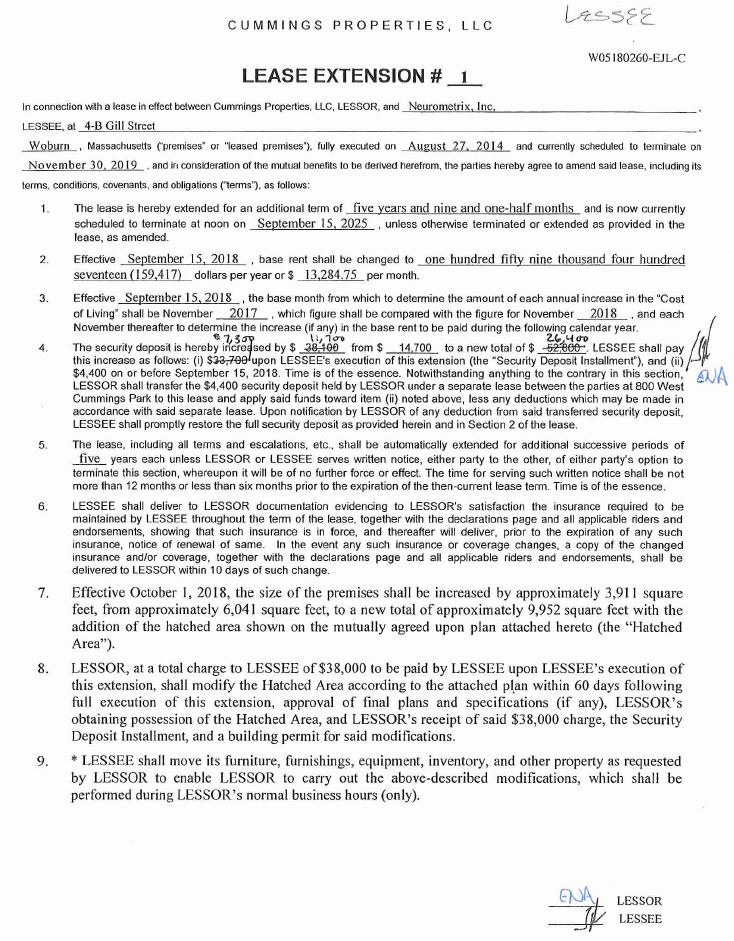

In June 2018, the Company extended the lease on its Woburn, Massachusetts manufacturing facilities (the “Woburn Lease”) through September 2025. As of September 2018, the Woburn Lease will have a monthly base rent of $13,285 and a 5-year extension option. In September 2014, the Company entered into a 7-year operating lease agreement with one 5-year extension option for its principal corporate office and product development location in Waltham, Massachusetts (the “Waltham Lease”). The term of the Waltham Lease commenced on February 20, 2015 and includes fixed payment obligations that escalate over the initial lease term. Average monthly base rent under the 7-year lease is $37,788.

| |

7. | Fair Value Measurements |

The following tables present information about the Company’s assets and liabilities that are measured at fair value on a recurring basis for the periods presented and indicates the fair value hierarchy of the valuation techniques it utilized to determine such fair value. In general, fair values determined by Level 1 inputs utilize quoted prices (unadjusted) in active markets for identical assets or liabilities. Fair values determined by Level 2 inputs utilize data points that are observable such as quoted prices, interest rates, and yield curves. Fair values determined by Level 3 inputs are unobservable data points for the asset or liability, and include situations where there is little, if any, market activity for the asset or liability.

|

| | | | | | | | | | | | | | | |

| | | Fair Value Measurements at June 30, 2018 Using |

| June 30, 2018 | | Quoted Prices in

Active Markets

for Identical

Assets (Level 1) | | Significant Other

Observable Inputs

(Level 2) | | Significant

Unobservable

Inputs

(Level 3) |

Assets: | |

| | |

| | |

| | |

|

Cash equivalents | $ | 4,728,828 |

| | $ | 4,728,828 |

| | $ | — |

| | $ | — |

|

Total | $ | 4,728,828 |

| | $ | 4,728,828 |

| | $ | — |

| | $ | — |

|

|

| | | | | | | | | | | | | | | |

| | | Fair Value Measurements at December 31, 2017 Using |

| December 31, 2017 | | Quoted Prices in

Active Markets

for Identical

Assets (Level 1) | | Significant Other

Observable Inputs

(Level 2) | | Significant

Unobservable

Inputs

(Level 3) |

Assets: | |

| | |

| | |

| | |

|

Cash equivalents | $ | 1,744,965 |

| | $ | 1,744,965 |

| | $ | — |

| | $ | — |

|

Total | $ | 1,744,965 |

| | $ | 1,744,965 |

| | $ | — |

| | $ | — |

|

The Company is party to a Loan and Security Agreement, as amended (the “Credit Facility”), with a bank. As of June 30, 2018, the Credit Facility permitted the Company to borrow up to $2.5 million on a revolving basis. The Credit Facility was amended most recently in January 2018, and expires in January 2019. Amounts borrowed under the Credit Facility will bear interest equal to the prime rate plus 0.5%. Any borrowings under the Credit Facility will be collateralized by the Company’s cash, accounts receivable, inventory, and equipment. The Credit Facility includes traditional lending and reporting covenants. These include certain financial covenants applicable to liquidity that are to be maintained by the Company. As of June 30, 2018, the Company was in compliance with these covenants and had not borrowed any funds under the Credit Facility. However, $226,731 of the amount under the Credit Facility is restricted to support letters of credit issued in favor of the Company's landlords. Consequently, the amount available for borrowing under the Credit Facility as of June 30, 2018 was approximately $2.3 million.

Preferred stock and convertible preferred stock consist of the following:

|

| | | | | | | |

| June 30, 2018 | | December 31, 2017 |

Preferred stock, $0.001 par value; 5,000,000 shares authorized at June 30, 2018 and December 31, 2017; no shares issued and outstanding at June 30, 2018 and December 31, 2017 | $ | — |

| | $ | — |

|

Series B convertible preferred stock, $0.001 par value; 147,000 shares designated at June 30, 2018 and December 31, 2017; 500 shares issued and outstanding at June 30, 2018 and December 31, 2017 | $ | 1 |

| | $ | 1 |

|

Series D convertible preferred stock, $0.001 par value; 21,300 shares designated at June 30, 2018 and December 31, 2017; 14,052.93 shares issued and outstanding at June 30, 2018 and December 31, 2017 | $ | 14 |

| | $ | 14 |

|

Series E convertible preferred stock, $0.001 par value; 7,000 shares designated at June 30, 2018 and December 31, 2017; 3,260.70 and 7,000 shares issued and outstanding at June 30, 2018 and December 31, 2017, respectively | $ | 3 |

| | $ | 7 |

|

Series F convertible preferred stock, $0.001 par value; 10,621 shares designated at June 30, 2018 and December 31, 2017; zero and 7,927.05 shares issued and outstanding at June 30, 2018 and December 31, 2017, respectively | $ | — |

| | $ | 8 |

|

2018 equity activity

In 2018, the Company issued shares of fully vested common stock in partial settlement of management incentive compensation. The 2018 issuance totaled 214,791 shares with a value of $294,264 reflecting the $1.37 closing price of the Company’s common stock as reported on the Nasdaq Capital Market on April 12, 2018.

During the six months ended June 30, 2018, 3,739.3 shares of the Series E Preferred Stock were converted into a total of 1,421,787 shares of Common Stock. As of June 30, 2018, 3,260.70 shares of Series E Preferred Stock remained outstanding.

During the six months ended June 30, 2018, 7,927.05 shares of the Series F Preferred Stock were converted into a total of 3,014,087 shares of Common Stock. As of June 30, 2018, zero shares of Series F Preferred Stock remained outstanding.

Item 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations

You should read the following discussion of our financial condition and results of operations in conjunction with our financial statements and the accompanying notes to those financial statements included elsewhere in this Quarterly Report on Form 10-Q. This discussion contains forward-looking statements that involve risks and uncertainties. For a description of factors that may cause our actual results to differ materially from those anticipated in these forward-looking statements, please refer to the below section of this Quarterly Report on Form 10-Q titled “Cautionary Note Regarding Forward-Looking Statements.” Unless the context otherwise requires, all references to “we”, “us”, the “Company”, or “NeuroMetrix” in this Quarterly Report on Form 10-Q refer to NeuroMetrix, Inc.

Overview

NeuroMetrix is a commercial stage, innovation driven healthcare company combining bioelectrical and digital medicine to address chronic health conditions including chronic pain, sleep disorders, and diabetes. Our business is fully integrated with in-house capabilities spanning product development, manufacturing, regulatory affairs and compliance, sales and marketing, and customer support. We derive revenues from the sale of medical devices and after-market consumable products and accessories. Our products are sold in the United States and selected overseas markets, and are cleared by the U.S. Food and Drug Administration, or FDA, and regulators in foreign jurisdictions where appropriate. We have two principal product lines:

• Wearable neuro-stimulation therapeutic devices

• Point-of-care neuropathy diagnostic tests

Our core expertise in biomedical engineering has been refined over nearly two decades of designing, building and marketing medical devices that stimulate nerves and analyze nerve response for diagnostic and therapeutic purposes. We created the market for point-of-care nerve testing and were first to market with sophisticated, wearable technology for management of chronic pain. We have an experienced management team and Board of Directors.

Chronic pain is a significant public health problem. It is defined by the National Institutes of Health as any pain lasting more than 12 weeks, in contrast to acute pain, which is a normal bodily response to injury or trauma. Chronic pain conditions include painful diabetic neuropathy, or PDN, arthritis, fibromyalgia, sciatica, musculoskeletal pain, cancer pain and many others. Chronic pain may be triggered by an injury or there may be an ongoing cause such as disease or illness. There may also be no clear cause. Pain signals continue to be transmitted in the nervous system over extended periods of time often leading to other health problems. These can include fatigue, sleep disturbance, decreased appetite, and mood changes which cause difficulty in carrying out important activities and contributing to disability and despair. In general, chronic pain cannot be cured. Treatment of chronic pain is focused on reducing pain and improving function. The goal is effective pain management.

Chronic pain is widespread. It affects over 100 million adults in the United States and more than 1.5 billion people worldwide. The global market for pain management drugs and devices alone was valued at $35 billion in 2012. The estimated incremental impact of chronic pain on health care costs in the United States is over $250 billion per year and lost productivity is estimated to exceed $300 billion per year. Estimated out-of-pocket spending in the United States on chronic pain is $20 billion per year.

The most common approach to chronic pain is pain medication. This includes over-the-counter drugs (such as Advil and Motrin), and prescription drugs including anti-convulsants (such as Lyrica and Neurontin) and anti-depressants (such as Cymbalta and Elavil). Topical creams may also be used (such as Zostrix and Bengay). With severe pain, narcotic pain medications may be prescribed (such as codeine, fentanyl, morphine, and oxycodone). The approach to treatment is individualized, drug combinations may be employed, and the results are often hit or miss. Side effects and the potential for addiction are real and the risks are substantial.

Reflecting the difficulty in treating chronic pain, we believe that inadequate relief leads 25% to 50% of pain sufferers to turn to the over-the-counter market for supplements or alternatives to prescription pain medications. These include non-prescription medications, topical creams, lotions, electrical stimulators, dietary products, braces, sleeves, pads and other items. In total they account for over $4 billion in annual spending in the United States on pain relief products.

High frequency nerve stimulation is an established treatment for chronic pain supported by numerous clinical studies demonstrating efficacy. In simplified outline, the mechanism of action involves intensive nerve stimulation to activate the body’s central pain inhibition system resulting in widespread analgesia, or pain relief. The nerve stimulation activates brainstem

pain centers leading to the release of endogenous opioids that act primarily through the delta opioid receptor to reduce pain signal transmission through the central nervous system. This therapeutic approach is available through deep brain stimulation and through implantable spinal cord stimulation, both of which require surgery and have attendant risks. Non-invasive approaches to neuro-stimulation (transcutaneous electrical nerve stimulation, or TENS) have achieved limited efficacy in practice due to device limitations, ineffective dosing and low patient compliance.

Quell is our OTC wearable device for pain relief. Quell revenues for fiscal years 2017 and 2016 were approximately $12.4 million and $7.4 million, respectively. Quell revenues for the six months ended June 30, 2018 were approximately $5.5 million. In Q1 2018 we and GlaxoSmithKline (NYSE: GSK) entered a $26.5 million strategic collaboration to develop and market Quell technology with defined milestones. The parties also committed to co-fund development of Quell technology starting in 2019. Quell utilizes our patented 100% drug-free neuro-stimulation technology to provide relief from chronic pain, such as nerve pain due to diabetes, fibromyalgia, arthritic pain, and lower back and leg pain. This advanced wearable device is lightweight and can be worn during the day while active, and at night while sleeping. It has been cleared by the U.S. Food and Drug Administration (the “FDA”) for treatment of chronic intractable pain without a doctor’s prescription. Users of the device have the option of using their smartphones to control pain therapy and to track sleep, activity, gait and therapy parameters. Quell is distributed in North America via e-commerce, including the Company’s website (www.quellrelief.com) and Amazon, via direct response television including QVC, via retail merchandisers including Best Buy, CVS, and others and via health care professionals such as pain management physician practices and podiatry practices. Distribution is supported by television promotion to expand product awareness.

DPNCheck is our diagnostic test for peripheral neuropathies. DPNCheck revenues for fiscal years 2017 and 2016 were approximately $3.1 million, and $2.5 million, respectively. DPNCheck revenues for the six months ended June 30, 2018 were approximately $2.4 million. Our U.S. sales efforts focus on Medicare Advantage providers who assume financial responsibility and the associated risks for the health care costs of their patients. We believe that DPNCheck presents an attractive clinical case with early detection of neuropathy allowing for earlier clinical intervention to help mitigate the effects of neuropathy on both patient quality of life and cost of care. Also, the diagnosis and documentation of neuropathy provided by DPNCheck helps clarify the patient health profile which, in turn, may have a direct, positive effect on the Medicare Advantage premium received by the provider. DPNCheck is marketed in Japan by our distribution partner Fukuda Denshi; in China by OMRON Medical (Beijing) Ltd.; and in Mexico by Scienta Farma.

Our products consist of a medical device used in conjunction with a consumable electrode or biosensor. Other accessories and consumables are also available to customers. Our commercial objective is to build an installed base of active customer accounts that regularly order aftermarket products to meet their needs. We successfully implemented this model when we started our business with the NC-stat system and applied it to subsequent product generations including ADVANCE. Our more recently developed products, Quell and DPNCheck, conform to this model.

Results of Operations

Comparison of Quarters Ended June 30, 2018 and 2017

Revenues

The following table summarizes our revenues:

|

| | | | | | | | | | | | | | |

| Quarters Ended June 30, | | |

| 2018 | | 2017 | | Change | | % Change |

| (in thousands) | | |

Revenues | $ | 3,751.6 |

| | $ | 4,310.1 |

| | $ | (558.5 | ) | | (13.0 | )% |

Revenues include sales from Quell, DPNCheck and our legacy neurodiagnostic products. During the second quarter of 2018 total revenues decreased by approximately $0.6 million, or 13.0%, from the second quarter of 2017. Quell revenues of approximately $2.1 million, a decline of approximately $1.0 million or 31.9% from the comparable 2017 period, reflected our decision to defer certain advertising spending, which was reduced by 37.1% from the comparable 2017 quarter. We intend to utilize this deferred spending to support the product launch of the next generation of Quell in the second half of 2018. DPNCheck revenues of approximately $1.3 million increased by approximately $0.5 million, or 57.9% from the same period in 2017. Our legacy products contributed approximately $0.4 million in revenue for the second quarter of 2018, as compared to approximately $0.5 million in the second quarter of 2017.

Upon adoption of the new revenue recognition standard ASU 2014-9, we discontinued revenue deferral under the sell-through model and commenced recording revenue upon delivery to distributors, net of estimated returns. Generally, the new standard results in earlier recognition of revenues. Had the accounting principles of ASU 2014-9 been applied in the second quarter of 2017 revenues would have been $0.5 million greater than the $4.3 million previously reported.

Cost of Revenues and Gross Profit

The following table summarizes our cost of revenues and gross profit:

|

| | | | | | | | | | | | | | |

| Quarters Ended June 30, | | |

| 2018 | | 2017 | | Change | | % Change |

| (in thousands) | | |

Cost of revenues | $ | 1,950.3 |

| | $ | 2,639.4 |

| | $ | (689.1 | ) | | (26.1 | )% |

| | | | | | | |

Gross profit | $ | 1,801.3 |

| | $ | 1,670.7 |

| | $ | 130.6 |

| | 7.8 | % |

Our cost of revenues decreased approximately $0.7 million, or 26.1% to approximately $2.0 million in the second quarter of 2018 from approximately $2.6 million in the comparable period in 2017. The gross profit rate increased to 48.0% in the second quarter of 2018 from 38.8% in the prior year. This reflected strengthening Quell margins due to favorable product mix as well as heavier weighting of higher margin DPNCheck revenue.

Operating Expenses

The following table summarizes our operating expenses:

|

| | | | | | | | | | | | | | |

| Quarters Ended June 30, | | |

| 2018 | | 2017 | | Change | | % Change |

| (in thousands) | | |

Operating expenses: | |

| | |

| | |

| | |

|

Research and development | $ | 1,616.9 |

| | $ | 877.6 |

| | $ | 739.3 |

| | 84.2 | % |

Sales and marketing | 2,200.9 |

| | 2,919.3 |

| | (718.4 | ) | | (24.6 | )% |

General and administrative | 1,170.6 |

| | 1,245.3 |

| | (74.7 | ) | | (6.0 | )% |

Total operating expenses | $ | 4,988.4 |

| | $ | 5,042.2 |

| | $ | (53.8 | ) | | (1.1 | )% |

Research and Development

Research and development expenses for the quarters ended June 30, 2018 and 2017 were approximately $1.6 million and $0.9 million, respectively. The increase of approximately $0.7 million encompasses a $0.5 million increase in development spending on the next generation of Quell as well as costs to support the GSK Collaboration.

Sales and Marketing

Sales and marketing expenses were approximately $2.2 million and $2.9 million for the quarters ended June 30, 2018 and 2017, respectively. The spending reflected a decrease of approximately $0.7 million, or 37.1%, in promotional spending.

General and Administrative

General and administrative expenses were flat at approximately $1.2 million for the quarters ended June 30, 2018 and 2017. The small decrease of less than $0.1 million reflected a decrease in professional services expenses.

Collaboration income

|

| | | | | | | | | | | | | | |

| Quarters Ended June 30, | | |

| 2018 | | 2017 | | Change | | % Change |

| (in thousands) | | |

| | | | | | | |

Collaboration income | $ | 3,750.0 |

| | $ | — |

| | $ | 3,750.0 |

| | 100.0 | % |

In January 2018, we entered into a collaboration (the "Collaboration") with GlaxoSmithKline ("GSK") in which we sold to GSK rights to our Quell technology for markets outside of the United States, including certain patents and related assets, and agreed to complete development milestones for the next-generation Quell technology. We retained exclusive ownership of Quell technology in the U.S. market. GSK agreed to payments totaling up to $26.5 million, of which $5.0 million was paid at closing and the balance due upon achievement of defined development and commercialization milestones. In addition, the parties agreed to jointly fund future Quell technology development during an initial period starting in 2019. Upon attainment of a development milestone, the Company recorded Collaboration income of $3.7 million, net of costs, for the quarter ended June 30, 2018.

Other income

|

| | | | | | | | | | | | | | |

| Quarters Ended June 30, | | |

| 2018 | | 2017 | | Change | | % Change |

| (in thousands) | | |

| |

| | |

| | |

| | |

|

Other income | $ | 11.0 |

| | $ | 133.8 |

| | $ | (122.8 | ) | | (91.8 | )% |

Other income includes interest income and warrant liability fair value changes.

Net income (loss) per common share applicable to common stockholders, basic and diluted

The net income (loss) per common share applicable to common stockholders, basic and diluted, was $0.08 and $0.04, respectively, for the quarter ended June 30, 2018 and $(2.49), both basic and diluted for the quarter ended June 30, 2017. Weighted average shares outstanding used in computing per share amounts are included in Note 3 to the Financial Statements.

Comparison of Six Months Ended June 30, 2018 and 2017

Revenues

The following table summarizes our revenues:

|

| | | | | | | | | | | | | | |

| Six Months Ended June 30, | | |

| 2018 | | 2017 | | Change | | % Change |

| (in thousands) | | |

Revenues | $ | 8,694.6 |

| | $ | 8,616.2 |

| | $ | 78.4 |

| | 0.9 | % |

Revenues include sales from Quell, DPNCheck and our legacy neurodiagnostic products. During the first six months of 2018 total revenues increased by approximately $0.1 million, or 0.9%, from the first six months of 2017. Quell revenues of approximately $5.5 million, a decline of approximately $0.6 million or 9.5% from the comparable 2017 period, reflected our decision to defer certain advertising spending, which was reduced by 23.0% from the comparable 2017 quarter. We intend to utilize this deferred spending to support the product launch of the next generation of Quell in the second half of 2018. DPNCheck revenues of approximately $2.4 million increased approximately $0.8 million, or 50.5%, over the same period in 2017. Our legacy products contributed approximately $0.8 million in revenue for the first six months of 2018, as compared to approximately $0.9 million in the same period in 2017.

Upon adoption of the new revenue recognition standard ASU 2014-9, we discontinued revenue deferral under the sell-through model and commenced recording revenue upon delivery to distributors, net of estimated returns. Generally, the new standard results in earlier recognition of revenues. Had the accounting principles of ASU 2014-9 been applied in the first six months of 2017 revenues would have been $0.5 million greater than the $8.6 million previously reported.

Cost of Revenues and Gross Profit

The following table summarizes our cost of revenues and gross profit:

|

| | | | | | | | | | | | | | |

| Six Months Ended June 30, | | |

| 2018 | | 2017 | | Change | | % Change |

| (in thousands) | | |

Cost of revenues | $ | 4,905.6 |

| | $ | 5,337.0 |

| | $ | (431.4 | ) | | (8.1 | )% |

| | | | | | | |

Gross profit | $ | 3,789.0 |

| | $ | 3,279.2 |

| | $ | 509.8 |

| | 15.5 | % |

Our cost of revenues of approximately $4.9 million decreased $0.4 million, or 8.1%, from $5.3 million in the comparable period in 2017. The gross profit rate increased to 43.6% in the first six months of 2018 from 38.1% in the first six months of 2017. Gross profit rates improved for both Quell and DPNCheck.

.

Operating Expenses

The following table summarizes our operating expenses:

|

| | | | | | | | | | | | | | |

| Six Months Ended June 30, | | |

| 2018 | | 2017 | | Change | | % Change |

| (in thousands) | | |

Operating expenses: | |

| | |

| | |

| | |

|

Research and development | $ | 2,896.4 |

| | $ | 1,780.9 |

| | $ | 1,115.5 |

| | 62.6 | % |

Sales and marketing | 4,705.6 |

| | 5,517.0 |

| | (811.4 | ) | | (14.7 | )% |

General and administrative | 2,974.8 |

| | 2,667.1 |

| | 307.7 |

| | 11.5 | % |

Total operating expenses | $ | 10,576.8 |

| | $ | 9,965.0 |

| | $ | 611.8 |

| | 6.1 | % |

Research and Development

Research and development expenses for the six months ended June 30, 2018 and 2017 were approximately $2.9 million and $1.8 million, respectively. The increase of approximately $1.1 million encompasses an $0.8 million increase in Quell development spending and a $0.2 million increase in personnel costs.

Sales and Marketing

Sales and marketing expenses were approximately $4.7 million and $5.5 million for the six months ended June 30, 2018 and 2017, respectively, reflecting a decrease of approximately $0.8 million, or 23.0%, in promotional spending.

General and Administrative

General and administrative expenses were approximately $3.0 million and $2.7 million for the six months ended June 30, 2018 and 2017, respectively. The increase of approximately $0.3 million reflects additional spending of $0.2 million in professional services expense and $0.2 million in stock-based compensation.

Collaboration income

|

| | | | | | | | | | | | | | |

| Six Months Ended June 30, | | |

| 2018 | | 2017 | | Change | | % Change |

| (in thousands) | | |

| | | | | | | |

Collaboration income | $ | 8,505.7 |

| | $ | — |

| | $ | 8,505.7 |

| | 100.0 | % |

In January 2018, we entered the Collaboration with GSK in which we sold to GSK rights to our Quell technology for markets outside of the United States, including certain patents and related assets, and agreed to complete development milestones for the next-generation Quell technology. We retained exclusive ownership of Quell technology in the U.S. market. GSK agreed to payments totaling up to $26.5 million of which $5.0 million was paid at closing and the balance due upon achievement of defined development and commercialization milestones. In addition, the parties agreed to jointly fund future Quell technology development during an initial period starting in 2019. Upon sale of rights to our Quell technology for markets outside of the United States and attainment of a development milestone, the Company recorded Collaboration income of $8.5 million, net of costs, for the six months ended June 30, 2018.

Other income

|

| | | | | | | | | | | | | | |

| Six Months Ended June 30, | | |

| 2018 | | 2017 | | Change | | % Change |

| (in thousands) | | |

| |

| | |

| | |

| | |

|

Other income | $ | 22.3 |

| | $ | 215.6 |

| | $ | (193.3 | ) | | (89.7 | )% |

Other income includes interest income and warrant liability fair value changes. The change in fair value of warrant liability was zero and $0.2 million for the six months ended June 30, 2018 and 2017, respectively.

Net income (loss) per common share applicable to common stockholders, basic and diluted

The net income (loss) per common share applicable to common stockholders, basic and diluted, was $0.25 and $0.13, respectively, for the six months ended June 30, 2018 and $(9.12), both basic and diluted for the six months ended June 30, 2017. Weighted average shares outstanding used in computing per share amounts are included in Note 3 to the Financial Statements. In the six months ended June 30, 2017, per share amounts reflected a deemed dividend attributable to preferred stockholders of $4.0 million, or $(3.51) per share, related to our Q1 2017 equity offering; plus our net loss of $6.5 million, or $(5.61) per share.

Liquidity and Capital Resources

Our principal source of liquidity is our cash resources which, as of June 30, 2018, totaled $7.1 million. Funding for our operations largely depends on the success of our commercial products for chronic pain and neuropathy, and on milestone achievement under the GSK Collaboration. A low level of market interest in Quell or DPNCheck, a decline in our consumables sales, unanticipated increases in our operating costs, or unanticipated setbacks toward the achievement of the GSK milestones would have an adverse effect on our liquidity and cash. The following table sets forth information relating to our cash resources:

|

| | | | | | | | | | | | | | |

| June 30, 2018 | | December 31, 2017 | | Change | | % Change |

| ($ in thousands) | | |

| | | | | | | |

Cash and cash equivalents | $ | 7,108.9 |

| | $ | 4,043.7 |

| | $ | 3,065.2 |

| | 75.8 | % |

The Company is party to a Loan and Security Agreement with a bank. As of June 30, 2018 this credit facility permitted the Company to borrow up to $2.5 million on a revolving basis. Amounts borrowed under the credit facility will bear interest equal to the prime rate plus 0.5% and will be collateralized by our cash, accounts receivable, inventory, and equipment. The credit facility also includes traditional lending and reporting covenants. As of June 30, 2018, we were in compliance with these covenants.

During the six months ended June 30, 2018, cash and cash equivalents increased by $3.1 million reflecting proceeds the GSK Collaboration funding offset by net cash usage from business operations.

In managing working capital, we focus on two important financial measurements as presented below:

|

| | | | | |

| Quarters Ended June 30, | | Year Ended

December 31, |

| 2018 | | 2017 | | 2017 |

| | | | | |

Days sales outstanding (days) | 32 | | 32 | | 37 |

Inventory turnover rate (times per year) | 3.6 | | 7.8 | | 6.5 |

Days sales outstanding reflect customer payment terms which vary from payment on order to 60 days from invoice date. The lower inventory turnover rate in the quarter ended June 30, 2018 reflects the combined effects of reduced Quell shipments and inventory build in anticipation of the new Quell product launch.

The following sets forth information relating to sources and uses of our cash:

|

| | | | | | | |

| Six Months Ended June 30, |

| 2018 | | 2017 |

| (in thousands) |

Net cash used in operating activities (excluding collaboration income) | $ | (5,309.6 | ) | | $ | (6,611.7 | ) |

Net cash provided by collaboration income | 8,505.7 |

| | — |

|

Net cash provided by (used in) operating activities | $ | 3,196.1 |

| | $ | (6,611.7 | ) |

Net cash used in investing activities | $ | (130.8 | ) | | $ | (37.9 | ) |

Net cash provided by financing activities | $ | — |

| | $ | 6,312.4 |

|

Our operating activities, excluding collaboration income, consumed $5.3 million of cash for the six months ended June 30, 2018, which reflected our operating net loss of $6.8 million. The operating loss includes non-cash stock compensation expense of approximately $0.4 million. In addition, operating activities included decreases in accounts receivable of $1.3 million and in prepaid expenses and other current and long-term assets of $0.6 million, partially offset by decreases in accrued product returns of $0.6 million.

We held cash and cash equivalents of $7.1 million as of June 30, 2018. We believe that these resources, together with the cash to be generated from expected product sales and the potential achievement of development milestones under the Collaboration will be sufficient to meet our projected operating requirements into 2019. We continue to face significant challenges and uncertainties and, as a result, our available capital resources may be consumed more rapidly than currently expected due to (a) decreases in sales of our products; (b) delays in achieving Quell development milestones and related payments from GSK; (c) changes we may make to the business that affect ongoing operating expenses; (d) changes we may make in our business strategy; (e) regulatory developments or inquiries affecting our existing products and products under development; (f) changes we may make in our research and development spending plans; and (g) other items affecting our forecasted level of expenditures and use of cash resources. Accordingly, we may need to raise additional funds to support our operating and capital needs in 2019 and beyond. These factors raise substantial doubt about our ability to continue as a going concern for the one year period from the date of issuance of these financial statements. The financial statements do not include any adjustments that might result from the outcome of this uncertainty. We may attempt to obtain additional funding through public or private financing, collaborative arrangements with strategic partners, or through additional credit lines or other debt financing sources. However, we may not be able to secure such financing in a timely manner or on favorable terms, if at all. We filed a shelf registration statement on Form S-3 with the U.S. Securities and Exchange Commission (the "SEC") covering shares of our common stock and other securities for sale, giving us the opportunity to raise funding when needed or otherwise considered appropriate at prices and on terms to be determined at the time of any such offerings. However, pursuant to applicable SEC rules, our ability to sell shares under the shelf registration statement, during any 12-month period, is limited to an amount less than or equal to one-third of the aggregate market value of our common stock held by non-affiliates. If we raise additional funds by issuing equity or debt securities, either through the sale of securities pursuant to a registration statement or by other means, our existing stockholders may experience dilution, and the new equity or debt securities may have rights, preferences and privileges senior to those of our existing stockholders. If we raise additional funds through collaboration, licensing or other similar arrangements, it may be necessary to relinquish valuable rights to our potential products or proprietary technologies, or grant licenses on terms that are not favorable to us. Without additional funds, we may be forced to delay, scale back or eliminate some of our sales and marketing efforts, research and development activities, or other operations and potentially delay product development in an effort to provide sufficient funds to continue our operations. If any of these events occurs, our ability to achieve our development and commercialization goals would be adversely affected.

Off-Balance Sheet Arrangements, Contractual Obligation and Contingent Liabilities and Commitments

As of June 30, 2018, we did not have any off-balance sheet financing arrangements.

See Note 6, Commitments and Contingencies, of our Notes to Unaudited Financial Statements for information regarding commitments and contingencies.

Recent Accounting Pronouncements

In February 2016, the Financial Accounting Standards Board (“FASB”) issued Accounting Standards Update No. 2016-2, Leases (Topic 842) (“ASU 2016-2”). ASU 2016-2 requires that lessees recognize virtually all of their leases on the balance sheet, by recording a right-of-use asset and lease liability. The provisions of this guidance are effective for annual periods beginning after December 31, 2018, and for interim periods therein. The Company is in the process of evaluating the new standard and assessing the impact, ASU 2016-2 will have on the Company’s financial statements and which adoption method will be used.

Cautionary Note Regarding Forward-Looking Statements

The statements contained in this Quarterly Report on Form 10-Q, including under the section titled “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and other sections of this Quarterly Report, include forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, or the Exchange Act, including, without limitation, statements regarding our or our management’s expectations, hopes, beliefs, intentions or strategies regarding the future, such as our estimates regarding anticipated operating losses, future revenues and projected expenses; our expectations regarding achievement of milestones under the GSK Collaboration; our future liquidity and our expectations regarding our needs for and ability to raise additional capital; our ability to manage our expenses effectively; our belief that there are unmet needs for the management of chronic pain and in the diagnosis and treatment of diabetic neuropathy; our expectations surrounding Quell and DPNCheck; our expected timing and our plans to develop and commercialize our products; our ability to meet our proposed timelines for the commercial availability of our products; our ability to obtain and maintain regulatory approval of our existing products and any future products we may develop; regulatory and legislative developments in the United States and foreign countries; the performance of our third-party manufacturers; our ability to obtain and maintain intellectual property protection for our products; the successful development of our sales and marketing capabilities; the size and growth of the potential markets for our products and our ability to serve those markets; our estimate of our customer returns of our products; the rate and degree of market acceptance of any future products; our reliance on key scientific management or personnel; and other factors discussed elsewhere in this Quarterly Report on Form 10-Q. The words “believe,” “may,” “will,” “estimate,” “continue,” “anticipate,” “intend,” “expect,” “plan” and similar expressions may identify forward-looking statements, but the absence of these words does not mean that a statement is not forward-looking. The forward-looking statements contained in this quarterly report are based on our current expectations and beliefs concerning future developments and their potential effects on us. There can be no assurance that future developments affecting us will be those that we have anticipated. These forward-looking statements involve a number of risks, uncertainties (some of which are beyond our control) or other assumptions that may cause actual results or performance to be materially different from those expressed or implied by these forward-looking statements. These risks and uncertainties include, but are not limited to, those factors described in the section titled “Risk Factors” in our Annual Report on Form 10-K. Should one or more of these risks or uncertainties materialize, or should any of our assumptions prove incorrect, actual results may vary from those projected in these forward-looking statements. We undertake no obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as may be required under applicable securities laws.

Item 3. Quantitative and Qualitative Disclosures About Market Risk

We do not use derivative financial instruments in our investment portfolio and have no foreign exchange contracts. Our financial instruments consist of cash and cash equivalents. We consider investments that, when purchased, have a remaining maturity of 90 days or less to be cash equivalents. The primary objectives of our investment strategy are to preserve principal, maintain proper liquidity to meet operating needs, and maximize yields. To minimize our exposure to an adverse shift in interest rates, we invest mainly in cash equivalents and short-term investments with a maturity of twelve months or less and maintain an average maturity of twelve months or less. We do not believe that a notional or hypothetical 10% change in interest rate percentages would have a material impact on the fair value of our investment portfolio or our interest income.

Item 4. Controls and Procedures

(a) Evaluation of Disclosure Controls and Procedures. Our principal executive officer and principal financial officer, after evaluating the effectiveness of our disclosure controls and procedures (as defined in Exchange Act Rules 13a-15(e) and 15d-15(e)) as of June 30, 2018, have concluded that, based on such evaluation, our disclosure controls and procedures were effective to ensure that information required to be disclosed by us in the reports that we file or submit under the Exchange Act is recorded, processed, summarized and reported, within the time periods specified in the SEC’s rules and forms, and is accumulated and communicated to our management, including our principal executive and principal financial officers, or persons performing similar functions, as appropriate to allow timely decisions regarding required disclosure.

(b) Changes in Internal Controls. There were no changes in our internal control over financial reporting, identified in connection with the evaluation of such internal control that occurred during the quarter ended June 30, 2018 that have materially affected, or are reasonably likely to materially affect, our internal control over financial reporting.

PART II – OTHER INFORMATION

Item 1. Legal Proceedings

While we are not currently a party to any material legal proceedings, we could become subject to legal proceedings in the ordinary course of business. We do not expect any such potential items to have a significant impact on our financial position.

Item 1A. Risk Factors

There have been no material changes in the risk factors described in “Item 1A. Risk Factors” of our Annual Report on Form 10-K for the year ended December 31, 2017.

Item 2. Unregistered Sales of Equity Securities and Use of Proceeds

None.

Item 3. Defaults Upon Senior Securities

None.

Item 4. Mine Safety Disclosures

Not applicable.

Item 5. Other Information

In 2017 the Company received a Civil Investigative Demand (“CID”) from the United States Federal Trade Commission (“FTC”). The CID requests information in connection with an FTC review for compliance of the Company’s representations about Quell with Sections 5 and 12 of the FTC Act. The Company is in the process of producing documents and information in response to the CID. To the knowledge of the Company, no complaint has been filed against the Company; however, no assurance can be given as to the timing or outcome of the investigation.

The Company intends to repurchase, from time to time, warrants to purchase its common stock that are traded on Nasdaq under the symbol NUROW. The Company may expend up to $25,000 in making these purchases on Nasdaq from time to time. Through June 30, 2018, the Company spent $2,391 to repurchase 38,506 warrants to purchase its common stock.

Item 6. Exhibits

See the Exhibit Index on the page immediately preceding the exhibits for a list of exhibits filed as part of this quarterly report, which Exhibit Index is incorporated herein by this reference.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

|

| | |

| | NEUROMETRIX, INC. |

| |

July 19, 2018 | /s/ | SHAI N. GOZANI, M.D., PH. D. |

| | Shai N. Gozani, M.D., Ph. D. |

| | Chairman, President and Chief Executive Officer |

| |

July 19, 2018 | /s/ | THOMAS T. HIGGINS |

| | Thomas T. Higgins |

| | Senior Vice President, Chief Financial Officer and Treasurer |

EXHIBIT INDEX

|

| | |

Exhibit No. | | Description |

| | |

| | Lease Extension #1 dated June 14, 2018, between Cummings Properties, LLC and NeuroMetrix, Inc. |

| | |

| | Certification of Principal Executive Officer Under Rule 13a-14(a) of the Securities Exchange Act of 1934, as amended, and pursuant to Section 302(a) of the Sarbanes-Oxley Act of 2002. Filed herewith. |

| | |

| | Certification of Principal Financial Officer Required Under Rule 13a-14(a) or Rule 15d-14(a) of the Securities Exchange Act of 1934, as amended, and pursuant to Section 302 of the Sarbanes-Oxley Act of 2002. Filed herewith. |

| | |

| | Certification of Principal Executive Officer and Principal Financial Officer Required Under Rule 13a-14(a) or Rule 15d-14(a) of the Securities Exchange Act of 1934, as amended, and 18 U.S.C. Section 1350. Furnished herewith. |

| | |

101 | | The following materials from the Company’s Quarterly Report on Form 10-Q for the quarter ended June 30, 2018, formatted in XBRL (eXtensible Business Reporting Language): (i) Balance Sheets at June 30, 2018 and December 31, 2017, (ii) Statements of Operations for the quarters and six months ended June 30, 2018 and 2017, (iii) Statements of Cash Flows for the six months ended June 30, 2018 and 2017, and (iv) Notes to Financial Statements. |

| |