UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

(Mark One)

x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2017

OR

o | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to .

Commission File Number: 001-32269

EXTRA SPACE STORAGE INC.

(Exact name of registrant as specified in its charter)

Maryland | 20-1076777 | |

(State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) | |

2795 East Cottonwood Parkway, Suite 300

Salt Lake City, Utah 84121

(Address of principal executive offices and zip code)

Registrant’s telephone number, including area code: (801) 365-4600

Securities Registered Pursuant to Section 12(b) of the Act:

Title of Each Class | Name of exchange on which registered | |

Common Stock, $0.01 par value | New York Stock Exchange, Inc. | |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes x No ¨

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment of this Form 10-K. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and "emerging growth company" in Rule 12b-2 of the Exchange Act.

Large accelerated filer | x | Accelerated filer | o | |||

Non-accelerated filer | o (Do not check if a smaller reporting company) | Smaller reporting company | o | |||

Emerging growth company | o | |||||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x.

The aggregate market value of the common stock held by non-affiliates of the registrant was $9,468,562,974 based upon the closing price on the New York Stock Exchange on June 30, 2017, the last business day of the registrant’s most recently completed second fiscal quarter. This calculation does not reflect a determination that persons whose shares are excluded from the computation are affiliates for any other purpose.

The number of shares outstanding of the registrant’s common stock, $0.01 par value per share, as of February 21, 2018 was 126,037,528.

Documents Incorporated by Reference

Portions of the registrant’s definitive proxy statement to be issued in connection with the registrant’s annual stockholders’ meeting to be held in 2018 are incorporated by reference into Part III of this Annual Report on Form 10-K.

Extra Space Storage Inc.

Annual Report on Form 10-K

For the Year Ended December 31, 2017

Table of Contents

Item 1. | ||

Item 1A. | ||

Item 1B. | ||

Item 2. | ||

Item 3. | ||

Item 4. | ||

Item 5. | ||

Item 6. | ||

Item 7. | ||

Item 7A. | ||

Item 8. | ||

Item 9. | ||

Item 9A. | ||

Item 9B. | ||

Item 10. | ||

Item 11. | ||

Item 12. | ||

Item 13. | ||

Item 14. | ||

Item 15. | ||

2

Statements Regarding Forward-Looking Information

Certain information set forth in this report contains “forward-looking statements” within the meaning of the federal securities laws. Forward-looking statements include statements concerning our plans, objectives, goals, strategies, future events, future revenues or performance, capital expenditures, financing needs, plans or intentions relating to acquisitions and other information that is not historical information. In some cases, forward-looking statements can be identified by terminology such as “believes,” “expects,” “estimates,” “may,” “will,” “should,” “anticipates,” or “intends” or the negative of such terms or other comparable terminology, or by discussions of strategy. We may also make additional forward-looking statements from time to time. All such subsequent forward-looking statements, whether written or oral, by us or on our behalf, are also expressly qualified by these cautionary statements.

All forward-looking statements, including without limitation, management’s examination of historical operating trends and estimates of future earnings, are based upon our current expectations and various assumptions. Our expectations, beliefs and projections are expressed in good faith and we believe there is a reasonable basis for them, but there can be no assurance that management’s expectations, beliefs and projections will result or be achieved. All forward-looking statements apply only as of the date made. We undertake no obligation to publicly update or revise forward-looking statements which may be made to reflect events or circumstances after the date made or to reflect the occurrence of unanticipated events.

There are a number of risks and uncertainties that could cause our actual results to differ materially from the forward-looking statements contained in or contemplated by this report. Any forward-looking statements should be considered in light of the risks referenced in “Part I. Item 1A. Risk Factors” below. Such factors include, but are not limited to:

• | adverse changes in general economic conditions, the real estate industry and in the markets in which we operate; |

• | failure to close pending acquisitions and developments on expected terms, or at all; |

• | the effect of competition from new and existing stores or other storage alternatives, which could cause rents and occupancy rates to decline; |

• | potential liability for uninsured losses and environmental contamination; |

• | the impact of the regulatory environment as well as national, state, and local laws and regulations including, without limitation, those governing real estate investment trusts (“REITs”), tenant reinsurance and other aspects of our business, which could adversely affect our results; |

• | disruptions in credit and financial markets and resulting difficulties in raising capital or obtaining credit at reasonable rates or at all, which could impede our ability to grow; |

• | increased interest rates; |

• | reductions in asset valuations and related impairment charges; |

• | our lack of sole decision-making authority with respect to our joint venture investments; |

• | the effect of recent or future changes to U.S. tax laws; |

• | the failure to maintain our REIT status for U.S. federal income tax purposes; and |

• | economic uncertainty due to the impact of natural disasters, war or terrorism, which could adversely affect our business plan. |

The forward-looking statements are based on our beliefs, assumptions and expectations of our future performance, taking into account all information currently available to us. These beliefs, assumptions and expectations are subject to risks and uncertainties and can change as a result of many possible events or factors, not all of which are known to us. If a change occurs, our business, financial condition, liquidity and results of operations may vary materially from those expressed in our forward-looking statements. You should carefully consider these risks before you make an investment decision with respect to our securities.

We disclaim any duty or obligation to update or revise any forward-looking statements set forth in this Annual Report on Form 10-K to reflect new information, future events or otherwise.

3

PART I

Item 1. Business

General

Extra Space Storage Inc. (“we,” “our,” “us” or the “Company”) is a fully integrated, self-administered and self-managed real estate investment trust (“REIT”) formed as a Maryland corporation on April 30, 2004, to own, operate, manage, acquire, develop and redevelop self-storage properties (“stores”). We closed our initial public offering (“IPO”) on August 17, 2004. Our common stock is traded on the New York Stock Exchange under the symbol “EXR.”

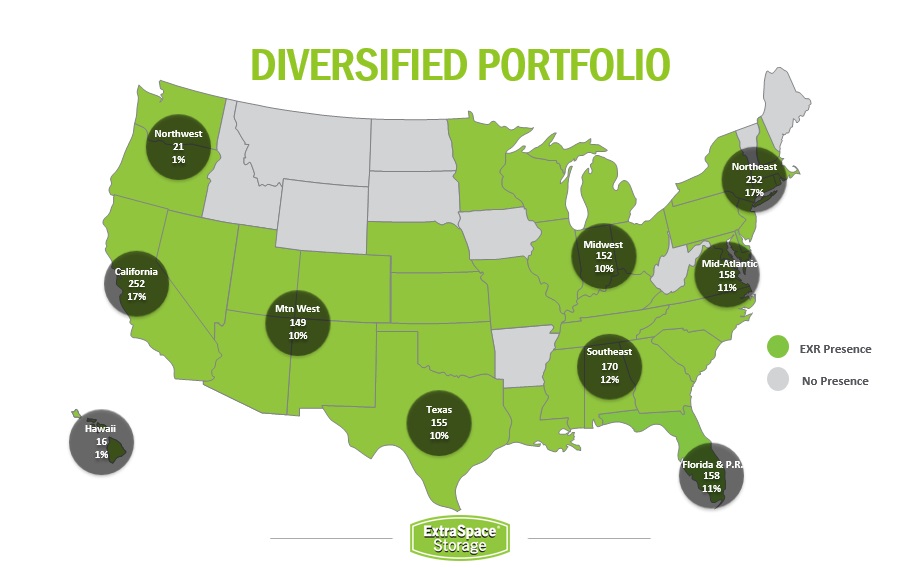

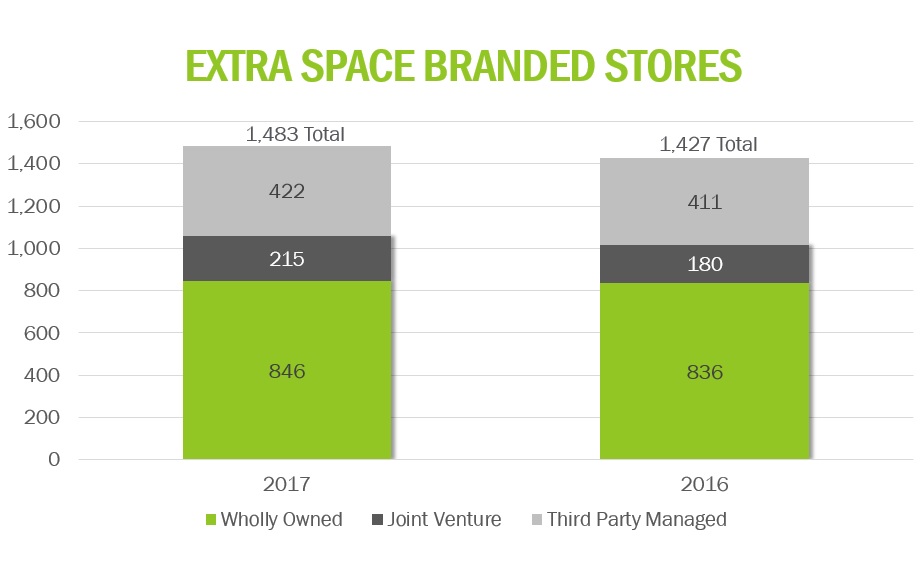

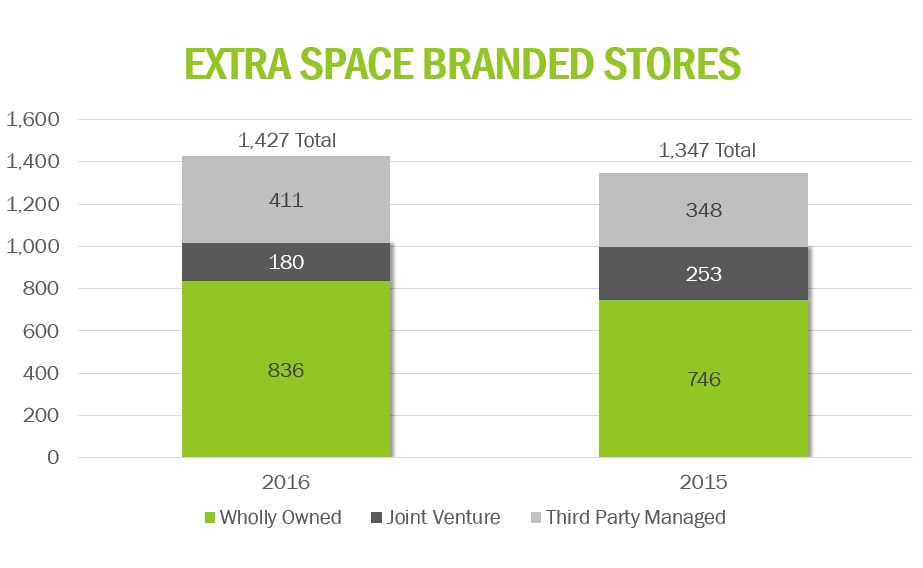

We were formed to continue the business of Extra Space Storage LLC and its subsidiaries, which had engaged in the self-storage business since 1977. These companies were reorganized after the consummation of our IPO and various formation transactions. As of December 31, 2017 we owned and/or operated 1,483 stores in 39 states, Washington, D.C. and Puerto Rico, comprising approximately 112 million square feet of net rentable space in approximately 1,020,000 units.

We operate in two distinct segments: (1) self-storage operations; and (2) tenant reinsurance. Our self-storage operations activities include rental operations of wholly-owned stores. Tenant reinsurance activities include the reinsurance of risks relating to the loss of goods stored by tenants in the Company’s stores. We previously reported our financial statements in three segments, but based on operational changes and the way our management reviews company performance, we realigned our financial statements into two reportable segments. For more information and comparative financial and other information on our reportable business segments, refer to the segment information footnote in the notes to the consolidated financial statements in Item 8 of this Form 10-K.

Substantially all of our business is conducted through Extra Space Storage LP (the “Operating Partnership”). Our primary assets are general partner and limited partner interests in the Operating Partnership. This structure is commonly referred to as an umbrella partnership REIT, or UPREIT. We have elected to be taxed as a REIT under the Internal Revenue Code of 1986, as amended (the “Internal Revenue Code”). To the extent we continue to qualify as a REIT we will not be subject to U.S. Federal tax, with certain exceptions, on our net taxable income that is distributed to our stockholders.

We file our annual report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, and all amendments to those reports with the Securities and Exchange Commission (the “SEC”). You may obtain copies of these documents by visiting the SEC’s Public Reference Room at 100 F Street, N.E., Washington, D.C. 20549, by calling the SEC at 1-800-SEC-0330 or by accessing the SEC’s website at www.sec.gov. In addition, as soon as reasonably practicable after such materials are furnished to the SEC, we make copies of these documents available to the public free of charge through our website at www.extraspace.com, or by contacting our Secretary at our principal offices, which are located at 2795 East Cottonwood Parkway, Suite 300, Salt Lake City, Utah 84121, telephone number (801) 365-4600.

Management

Members of our executive management team have significant experience in all aspects of the self-storage industry. Our executive management team and their years of industry experience are as follows: Joseph D. Margolis, Chief Executive Officer, 13 years; Scott Stubbs, Executive Vice President and Chief Financial Officer, 17 years; Samrat Sondhi, Executive Vice President and Chief Operating Officer, 14 years; Gwyn McNeal, Executive Vice President and Chief Legal Officer, 12 years; James Overturf, Executive Vice President and Chief Marketing Officer, 19 years; and Kenneth M. Woolley, Executive Chairman, 39 years.

Our executive management team and board of directors have an ownership position in the Company with executive officers and directors owning approximately 4,059,669 shares or 3.2% of our outstanding common stock as of February 21, 2018.

Industry & Competition

Stores offer month-to-month rental of storage space for personal or business use. Tenants typically rent fully enclosed spaces that vary in size and typically range from 5 feet by 5 feet to 20 feet by 20 feet, with an interior height of 8 feet to 12 feet. Tenants have responsibility for moving their items into and out of their units. Stores generally have on-site managers who supervise and run the day-to-day operations, providing tenants with assistance as needed.

4

Self-storage provides a convenient way for individuals and businesses to store their possessions due to life changes, or simply because of a need for storage space. The mix of residential tenants using a store is determined by a store’s local demographics and often includes people who are experiencing life changes such as downsizing their living space or others who are not yet settled into a permanent residence. Items that tenants place in self-storage are typically furniture, household items and appliances. Commercial tenants tend to include small business owners who require easy and frequent access to their goods, records, inventory or storage for seasonal goods.

Our research has shown that tenants choose a store based primarily on the convenience of the site to their home or business, making high-density, high-traffic population centers ideal locations for stores. A store’s price, perceived security, cleanliness, and the general professionalism of the site managers and staff are also contributing factors to a site’s ability to successfully secure rentals. Although most stores are leased to tenants on a month-to-month basis, tenants tend to continue their leases for extended periods of time.

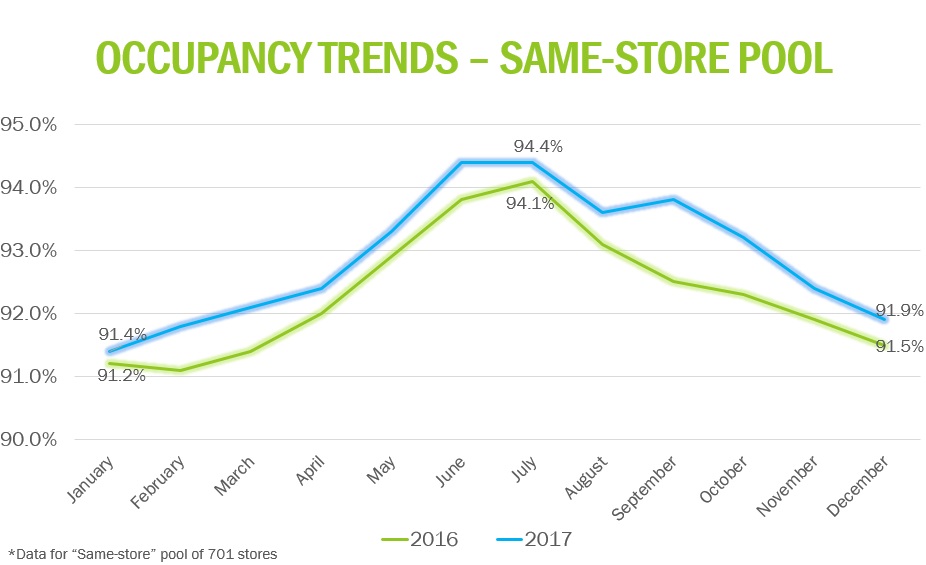

The self-storage business is subject to seasonal fluctuations. A greater portion of revenues and profits are realized from May through September. Historically, our highest level of occupancy has been at the end of July, while our lowest level of occupancy has been in late February and early March.

Since inception in the early 1970’s, the self-storage industry has experienced significant growth. The self-storage industry has also seen increases in occupancy over the past several years. According to the Self-Storage Almanac (the “Almanac”), in 2012, the national average physical occupancy rate was 85.0% of net rentable square feet, compared to an average physical occupancy rate of 92.8% in 2017.

The industry is also characterized by fragmented ownership. According to the Almanac, as of the end of 2017, the top ten self-storage companies in the United States operated approximately 15.8% of the total U.S. stores, and the top 50 self-storage companies operated approximately 19.2% of the total U.S. stores. We believe this fragmentation will contribute to continued consolidation at some level in the future.

Recently we have encountered competition when we have sought to acquire existing operating stores, especially for brokered portfolios. Competitive bidding practices have been commonplace between both public and private entities, and this will likely continue. We believe that we are well positioned to compete for acquisitions.

We are the second largest self-storage operator in the United States. We are one of five public self-storage REITs along with CubeSmart, National Storage Affiliates, Life Storage and Public Storage.

Long-Term Growth and Investment Strategies

Our primary business objectives are to maximize cash flow available for distribution to our stockholders and to achieve sustainable long-term growth in cash flow per share in order to maximize long-term stockholder value both at acceptable levels of risk. We continue to evaluate a range of growth initiatives and opportunities. Our primary strategies include the following:

Maximize the performance of our stores through strategic, efficient and proactive management

We pursue revenue-generating and expense-minimizing opportunities in our operations. Our revenue management team seeks to maximize revenue by responding to changing market conditions through our advanced technology systems' ability to provide real-time, interactive rental rate and discount management. Our size allows us greater ability than the majority of our competitors to implement more effective online marketing programs, which we believe will attract more customers to our stores at a lower net cost.

We continually analyze our portfolio to look for long-term value-enhancing opportunities. We proactively redevelop properties to add units or modify existing unit mix to better meet the demand in a given market and to maximize revenue. We also redevelop properties to reduce their effective useful age, increase visual appeal, enhance security and to improve brand consistency across the portfolio.

Acquire self storage stores

Our acquisitions team continues to pursue the acquisition of multi-store portfolios and single stores that we believe can provide stockholder value. We have established a reputation as a reliable, ethical buyer, which we believe enhances our ability to negotiate and close acquisitions. In addition, we believe our status as an UPREIT enables flexibility when structuring deals. We remain a disciplined buyer and only execute acquisitions that we believe will strengthen our portfolio and increase stockholder value.

5

In addition to the pursuit of stabilized stores, we also develop stores from the ground up and provide the construction capital. We also purchase stores at the completion of construction from third party developers, who build to our specifications. These stores purchased at completion of construction (a "Certificate of Occupancy store"), create additional long term value for our stockholders. We are typically able to acquire these assets at a lower price than a stabilized store, and expect greater long term returns on these stores on average. However, in the short term, these acquisitions cause dilution to our earnings during the two-to-four year period required to lease up the Certificate of Occupancy stores. We expect that this trend will continue in 2018 as we continue to acquire Certificate of Occupancy stores.

Expand our management business

Our management business enables us to generate increased revenues through management fees as well as expand our geographic footprint, data sophistication and scale with little capital investment. We believe this expanded footprint enables us to reduce our operating costs through economies of scale. In addition, we see our management business as a future acquisition pipeline. We pursue strategic relationships with owners whose stores would enhance our portfolio in the event an opportunity arises to acquire such stores.

Financing of Our Long-Term Growth Strategies

Acquisition and Development Financing

As a REIT, we are required to distribute at least 90% of our REIT taxable income to our stockholders. Consequently, we require access to additional sources of capital to fund our growth. We expect to maintain a flexible approach to financing growth. We plan to finance future acquisitions through a diverse capital optimization strategy which includes but is not limited to: cash generated from operations, borrowings under our revolving lines of credit (the "Credit Lines"), secured and unsecured financing, equity offerings, joint ventures and sale of properties.

Credit Lines - We have two credit lines which we primarily use as short term bridge financing until we obtain longer-term financing through either debt or equity. As of December 31, 2017, our Credit Lines had available capacity of $600.0 million, of which $506.0 million was undrawn.

Secured and Unsecured Debt - Historically, we have primarily used traditional secured mortgage loans to finance store acquisitions and development efforts. More recently, we obtained unsecured bank term loans and issued unsecured private placement bonds. We will continue to utilize a combination of secured and unsecured financing for future store acquisitions and development. As of December 31, 2017, we had $2.8 billion of secured notes payable and $1.7 billion of unsecured notes payable outstanding compared to $2.9 billion secured notes payable and $1.0 billion unsecured notes payable outstanding as of December 31, 2016.

Equity - We have an active "at the market" (ATM) program for selling stock. We sell stock under the ATM program from time to time to raise capital when we believe conditions are advantageous. During the year ended December 31, 2016, we issued 1,381,300 shares of common stock through our ATM program and received proceeds of approximately $123.4 million. No shares were issued under the ATM program during the year ended December 31, 2017.

We view equity interests in our Operating Partnership as a potential source of capital that can also provide attractive tax planning opportunities to sellers of real estate. We issue common and preferred Operating Partnership units to sellers in certain acquisitions. Common Operating Partnership units receive distributions equal to the dividends on common stock, while preferred Operating Partnership units receive distributions at various negotiated rates. We may issue additional units in the future when circumstances are favorable.

Joint Venture Financing - As of December 31, 2017, we owned 215 of our stores through joint ventures with third parties. Our joint venture partners typically provide most of the equity capital required for the acquisition of stores owned in these joint ventures. Most joint venture agreements include buy-sell rights, as well as rights of first offer in connection with the sale of stores by the joint venture. We generally manage the day-to-day operations of the stores owned in these joint ventures and have the right to participate in major decisions relating to sales of stores or financings by the applicable joint venture.

6

Sale of Properties - We have not historically sold a high volume of stores, as we generally believe we are able to optimize the cash flow from stores through continued operations. However, we may sell more stores or interests in stores in the future in response to changing economic, financial or investment conditions. For the years ended December 31, 2017 and 2016, we sold 36 stores into a joint venture and nine stores to an outside party, respectively, for approximately $295.0 million and $30.3 million.

Regulation

Generally, stores are subject to various laws, ordinances and regulations, including regulations relating to lien sale rights and procedures and the Americans with Disabilities Act of 1990. Changes in any of these laws or regulations, as well as changes in laws, such as the Comprehensive Environmental Response and Compensation Liability Act, which increase the potential liability for environmental conditions or circumstances existing or created by tenants or others on stores, or laws affecting development, construction, operation, upkeep, safety and taxation may result in significant unanticipated expenditures, loss of stores or other impairments to operations, which would adversely affect our financial position, results of operations or cash flows. In addition, noncompliance with any of these laws, ordinances or regulations could result in the imposition of fines or an award of damages to private litigants and also could require substantial capital expenditures to ensure compliance.

Insurance activities are subject to state insurance laws and regulations as determined by the particular insurance commissioner for each state in accordance with the McCarran-Ferguson Act, and are subject to the Gramm-Leach-Bliley Act and the privacy regulations promulgated by the Federal Trade Commission pursuant thereto. Store management activities may be subject to state real estate brokerage laws and regulations as determined by the particular real estate commission for each state. Changes in any of the laws governing our conduct could have an adverse impact on our ability to conduct our business or could materially affect our financial position, results of operations or cash flows.

Employees

As of December 31, 2017, we had 3,380 employees and believe our relationship with our employees is good. Our employees are not represented by a collective bargaining agreement.

Item 1A. Risk Factors

An investment in our securities involves various risks. All investors should carefully consider the following risk factors in conjunction with the other information contained in this Annual Report before trading in our securities. If any of the events set forth in the following risks actually occur, our business, operating results, prospects and financial condition could be harmed.

Our performance is subject to risks associated with real estate investments. We are a real estate company that derives our income from the operation of our stores. There are a number of factors that may adversely affect the income that our stores generate, including the following:

Risks Related to Our Stores and Operations

Adverse economic or other conditions in the markets in which we do business could negatively affect our occupancy levels and rental rates and therefore our operating results.

Our revenues and net operating income can be negatively impacted by general economic factors that lead to a reduction in demand for rental space in the markets in which we operate.

If we are unable to promptly re-let our units or if the rates upon such re-letting are significantly lower than expected, our business and results of operations would be adversely affected.

Virtually all of our leases are on a month-to-month basis. Any delay in re-letting units as vacancies arise would reduce our revenues and harm our operating results. In addition, lower than expected rental rates upon re-letting could adversely affect our revenues and impede our growth.

7

Uninsured losses or losses in excess of our insurance coverage could adversely affect our financial condition and our cash flow.

We maintain comprehensive property and casualty insurance policies, including liability, fire, flood, earthquake, wind (as we deem necessary or as required by our lenders), umbrella coverage and rental loss insurance with respect to our stores. Certain types of losses, however, may be either uninsurable, not economically insurable, or coverage may be excluded on certain policies, such as losses due to earthquakes, hurricanes, tornadoes, riots, acts of war, terrorism, or social engineering. Should an uninsured loss occur, we could lose both our investment in and anticipated profits and cash flow from a store. In addition, if any such loss is insured, we may be required to pay significant amounts on any claim for recovery of such a loss prior to our insurer being obligated to reimburse us for the loss, or the amount of the loss may exceed our coverage for the loss. As a result, our operating results may be adversely affected.

Legal disputes, settlement and defense costs could have an adverse effect on our operating results.

From time to time we have to make monetary settlements or defend actions or arbitration (including class actions) to resolve tenant, employment-related or other claims and disputes. Settling any such liabilities could negatively impact our operating results and cash available for distribution to stockholders, and could also adversely affect our ability to sell, lease, operate or encumber affected properties.

Our tenant reinsurance business is subject to significant governmental regulation, which may adversely affect our results.

Our tenant reinsurance business is subject to significant governmental regulation. The regulatory authorities generally have broad discretion to grant, renew and revoke licenses and approvals, to promulgate, interpret and implement regulations, and to evaluate compliance with regulations through periodic examinations, audits and investigations of the affairs of insurance providers. As a result of regulatory or private action in any jurisdiction, we may be temporarily or permanently suspended from continuing some or all of our reinsurance activities, or otherwise fined or penalized or suffer an adverse judgment, which could adversely affect our business and results of operations.

Environmental compliance costs and liabilities associated with operating our stores may adversely affect our results of operations.

Under various U.S. federal, state and local laws, ordinances and regulations, a current or previous owner, developer or operator of real estate may be liable for the costs of removal or remediation of certain hazardous or toxic substances, which could be substantial. Such laws often impose liability without regard to whether the owner or operator knew of, or was responsible for, the release or presence of such hazardous substances. From time to time, we may acquire properties, or interests in properties, with known adverse environmental conditions for which we believe that the environmental liabilities associated with these conditions are quantifiable and that the acquisition will yield a superior risk-adjusted return.

Costs associated with complying with the Americans with Disabilities Act of 1990 may result in unanticipated expenses.

Under the ADA, places of public accommodation are required to meet certain federal requirements related to access and use by disabled persons. A number of additional U.S. federal, state and local laws may also require modifications to our stores, or restrict certain further renovations of the stores, with respect to access thereto by disabled persons. If one or more of our stores is not in compliance with the ADA or other legislation, then we would be required to incur additional costs to bring the facility into compliance.

There is significant competition among self-storage operators and from other storage alternatives.

Competition in the local markets in which many of our stores are located is significant and has affected our occupancy levels, rental rates and operating expenses. Development of self-storage facilities has increased in recent years, which has intensified competition, and we expect it will continue to do so as newly developed facilities are opened. Development of self-storage facilities by other operators could continue to increase in the future. Actions by our competitors may decrease or prevent increases in our occupancy and rental rates, while increasing our operating expenses, which could adversely affect our business and results of operations.

We may not be successful in identifying and consummating suitable acquisitions that meet our criteria, which may impede our growth.

Our ability to expand through acquisitions is integral to our business strategy and requires us to identify suitable acquisition candidates or investment opportunities that meet our criteria and are compatible with our growth strategy. We may not be successful in identifying suitable stores or other assets that meet our acquisition criteria or in consummating acquisitions

8

or investments on satisfactory terms or at all. Failure to identify or consummate acquisitions will slow our growth, which could in turn adversely affect our stock price.

Our ability to acquire stores on favorable terms and successfully integrate and operate them may be constrained by the following significant risks

• | competition from local investors and other real estate investors with significant capital, including other publicly-traded REITs and institutional investment funds; |

• | competition from other potential acquirers may significantly increase the purchase price which could reduce our profitability; |

• | the inability to achieve satisfactory completion of due diligence investigations and other customary closing conditions; and |

• | we may acquire stores subject to liabilities without any recourse, or with only limited recourse, with respect to unknown liabilities such as liabilities for clean-up of undisclosed environmental contamination, claims by persons dealing with the former owners of the stores and claims for indemnification by general partners, directors, officers and others indemnified by the former owners of the stores. |

We rely on information technology in our operations, and any material failure, inadequacy, interruption or security failure of that technology could harm our business.

We rely on information technology networks and systems, including the Internet, to process, transmit and store electronic information, and to manage or support a variety of business processes, including financial transactions and records, personally identifiable information, and tenant and lease data. We purchase some of our information technology from vendors, on whom our systems depend. We rely on commercially available systems, software, tools and monitoring to provide security for processing, transmission and storage of confidential tenant and other sensitive information. Although we have taken steps to protect the security of our information systems and the data maintained in those systems, it is possible that our safety and security measures will not be able to prevent the systems’ improper functioning or damage, or the improper access or disclosure of personally identifiable information such as in the event of cyber-attacks. Security breaches, including physical or electronic break-ins, computer viruses, attacks by hackers and similar breaches, can create system disruptions, shutdowns or unauthorized disclosure of confidential information. While, to date, we have not experienced a security breach, this risk has generally increased as the number, intensity and sophistication of such breaches and attempted breaches from around the world have increased. Any failure to maintain proper function, security and availability of our information systems could interrupt our operations, damage our reputation, divert significant management attention and resources to remedy any damages that result, subject us to liability claims or regulatory penalties and have a material adverse effect on our business and results of operations.

Risks Related to Our Organization and Structure

Conflicts of interest could arise as a result of our relationship with our Operating Partnership.

Conflicts of interest could arise in the future as a result of the relationships between us and our affiliates, and our Operating Partnership or any partner thereof. Our directors and officers have duties to our Company under applicable Maryland law in connection with their management of our Company. At the same time, we, through our wholly-owned subsidiary, have fiduciary duties, as a general partner, to our Operating Partnership and to the limited partners under Delaware law in connection with the management of our Operating Partnership. Our duties, through our wholly-owned subsidiary, as a general partner to our Operating Partnership and its partners may come into conflict with the duties of our directors and officers to our Company. The partnership agreement of our Operating Partnership does not require us to resolve such conflicts in favor of either our Company or the limited partners in our Operating Partnership. Unless otherwise provided for in the relevant partnership agreement, Delaware law generally requires a general partner of a Delaware limited partnership to adhere to fiduciary duty standards under which it owes its limited partners the highest duties of good faith, fairness, and loyalty and which generally prohibit such general partner from taking any action or engaging in any transaction as to which it has a conflict of interest.

Additionally, the partnership agreement expressly limits our liability by providing that neither we, our direct wholly-owned Massachusetts business trust subsidiary, as the general partner of the Operating Partnership, nor any of our or their trustees, directors or officers, will be liable or accountable in damages to our Operating Partnership, the limited partners or assignees for errors in judgment, mistakes of fact or law or for any act or omission if we, or such trustee, director or officer, acted in good faith. In addition, our Operating Partnership is required to indemnify us, our affiliates and each of our respective trustees, officers, directors, employees and agents to the fullest extent permitted by applicable law against any and all losses, claims, damages, liabilities (whether joint or several), expenses (including, without limitation, attorneys’ fees and other legal fees and expenses), judgments, fines, settlements and other amounts arising from any and all claims, demands, actions, suits or

9

proceedings, civil, criminal, administrative or investigative, that relate to the operations of the Operating Partnership, provided that our Operating Partnership will not indemnify for (1) willful misconduct or a knowing violation of the law, (2) any transaction for which such person received an improper personal benefit in violation or breach of any provision of the partnership agreement, or (3) in the case of a criminal proceeding, the person had reasonable cause to believe the act or omission was unlawful.

The provisions of Delaware law that allow the common law fiduciary duties of a general partner to be modified by a partnership agreement have not been resolved in a court of law, and we have not obtained an opinion of counsel covering the provisions set forth in the partnership agreement that purport to waive or restrict our fiduciary duties that would be in effect under common law were it not for the partnership agreement.

Our joint venture investments could be adversely affected by our lack of sole decision-making authority.

As of December 31, 2017, we held interests in 215 operating stores through joint ventures. Some of these arrangements could be adversely affected by our lack of sole decision-making authority, our reliance on co-venturers financial conditions and disputes between us and our co-venturers. We expect to continue our joint venture strategy by entering into more joint ventures for the purpose of developing new stores and acquiring existing stores. In such event, we would not be in a position to exercise sole decision-making authority regarding the property, partnership, joint venture or other entity. The decision-making authority regarding the stores we currently hold through joint ventures is either vested exclusively with our joint venture partners, is subject to a majority vote of the joint venture partners or is equally shared by us and the joint venture partners. In addition, investments in partnerships, joint ventures or other entities may, under certain circumstances, involve risks not present were a third party not involved, including the possibility that partners or co-venturers might become bankrupt or fail to fund their share of required capital contributions. Partners or co-venturers may have economic or other business interests or goals which are inconsistent with our business interests or goals, and may be in a position to take actions contrary to our policies or objectives. Such investments may also have the potential risk of impasses on decisions, such as a sale, because neither we nor the partner or co-venturer would have full control over the partnership or joint venture. Disputes between us and partners or co-venturers may result in litigation or arbitration that would increase our expenses and prevent our officers and/or directors from focusing their time and efforts on our business. Consequently, actions by or disputes with partners or co-venturers might result in subjecting stores owned by the partnership or joint venture to additional risk. In addition, we may in certain circumstances be liable for the actions of our third-party partners or co-venturers, which could harm our financial condition.

Certain provisions of Maryland law and our organizational documents, including the stock ownership limit imposed by our charter, may inhibit market activity in our stock and could prevent or delay a change in control transaction.

Our charter, subject to certain exceptions, authorizes our directors to take such actions as are necessary and desirable to preserve our qualification as a REIT and to limit any person to actual or constructive ownership of no more than 7.0% (by value or by number of shares, whichever is more restrictive) of our outstanding common stock or 7.0% (by value or by number of shares, whichever is more restrictive) of our outstanding capital stock. Our board of directors, in its sole discretion, may exempt a proposed transferee from the ownership limit. However, our board of directors may not grant an exemption from the ownership limit to any proposed transferee whose ownership could jeopardize our qualification as a REIT. These restrictions on ownership will not apply if our board of directors determines that it is no longer in our best interests to attempt to qualify, or to continue to qualify, as a REIT. The ownership limit may delay or impede a transaction or a change of control that might involve a premium price for our securities or otherwise be in the best interests of our stockholders. Different ownership limits apply to the family of Kenneth M. Woolley, certain of his affiliates, family members and estates and trusts formed for the benefit of the foregoing; to Spencer F. Kirk, certain of his affiliates, family members and estates and trusts formed for the benefit of the foregoing; and to certain designated investment entities as defined in our charter.

Our board of directors has the power to issue additional shares of our stock in a manner that may not be in the best interest of our stockholders.

Our charter authorizes our board of directors to issue additional authorized but unissued shares of common stock or preferred stock and to increase the aggregate number of authorized shares or the number of shares of any class or series without stockholder approval. In addition, our board of directors may classify or reclassify any unissued shares of common stock or preferred stock and set the preferences, rights and other terms of the classified or reclassified shares. Our board of directors could issue additional shares of our common stock or establish a series of preferred stock that could have the effect of delaying, deferring or preventing a change in control or other transaction that might involve a premium price for our securities or otherwise not be in the best interests of our stockholders.

10

Our rights and the rights of our stockholders to take action against our directors and officers are limited.

Maryland law provides that a director or officer has no liability in that capacity if he or she performs his or her duties in good faith, in a manner he or she reasonably believes to be in our best interests and with the care that an ordinarily prudent person in a like position would use under similar circumstances. In addition, our charter eliminates our directors’ and officers’ liability to us and our stockholders for money damages except for liability resulting from actual receipt of an improper benefit in money, property or services or active and deliberate dishonesty established by a final judgment and which is material to the cause of action. Our bylaws require us to indemnify our directors and officers for liability resulting from actions taken by them in those capacities to the maximum extent permitted by Maryland law. As a result, we and our stockholders may have more limited rights against our directors and officers than might otherwise exist under common law. In addition, we may be obligated to fund the defense costs incurred by our directors and officers.

Risks Related to Our Debt Financings

Disruptions in the financial markets could affect our ability to obtain debt financing on reasonable terms and have other adverse effects on us.

Uncertainty in the credit markets may negatively impact our ability to access additional debt financing or to refinance existing debt maturities on favorable terms (or at all), which may negatively affect our ability to make acquisitions and fund development projects. A downturn in the credit markets may cause us to seek alternative sources of potentially less attractive financing, and may require us to adjust our business plan accordingly. In addition, these factors may make it more difficult for us to sell stores or may adversely affect the price we receive for stores that we do sell, as prospective buyers may experience increased costs of debt financing or difficulties in obtaining debt financing.

Required payments of principal and interest on borrowings may leave us with insufficient cash to operate our stores or to pay the distributions currently contemplated or necessary to maintain our qualification as a REIT and may expose us to the risk of default under our debt obligations.

As of December 31, 2017, we had approximately $4.6 billion of outstanding indebtedness. We may incur additional debt in connection with future acquisitions and development. We may borrow under our Credit Lines or borrow new funds to finance these future stores. Additionally, we do not anticipate that our internally generated cash flow will be adequate to repay our existing indebtedness upon maturity and, therefore, we expect to repay our indebtedness through refinancings and equity and/or debt offerings. Further, we may need to borrow funds in order to make cash distributions to maintain our qualification as a REIT or to make our expected distributions. To qualify as a REIT, we generally must distribute to our stockholders at least 90% of our net taxable income each year, excluding net capital gains, and we are subject to U.S. federal corporate income tax to the extent that we distribute less than 100% of our net taxable income each year.

If we are required to utilize our Credit Lines for purposes other than acquisition activity, this will reduce the amount available for acquisitions and could slow our growth. Therefore, our level of debt and the limitations imposed on us by our debt agreements could have significant adverse consequences, including the following:

• | our cash flow may be insufficient to meet our required principal and interest payments; |

• | we may be unable to borrow additional funds as needed or on favorable terms, including to make acquisitions or to continue to make distributions required to maintain our qualification as a REIT; |

• | we may be unable to refinance our indebtedness at maturity or the refinancing terms may be less favorable than the terms of our original indebtedness; |

• | because a portion of our debt bears interest at variable rates, an increase in interest rates could materially increase our interest expense; |

• | we may be forced to dispose of one or more of our stores, possibly on disadvantageous terms; |

• | after debt service, the amount available for cash distributions to our stockholders is reduced; |

• | we may experience increased vulnerability to economic and industry downturns, reducing our ability to respond to changing business and economic conditions; |

• | we may default on our obligations and the lenders or mortgagees may foreclose on our stores that secure their loans and receive an assignment of rents and leases and/or enforce our guarantees; |

• | we may violate restrictive covenants in our loan documents, which would entitle the lenders to accelerate our debt obligations; and |

• | our default under any one of our mortgage loans with cross-default or cross-collateralization provisions could result in a default on other indebtedness or result in the foreclosures of other stores. |

11

Increases in interest rates may increase our interest expense and adversely affect our cash flow and our ability to service

our indebtedness and make cash distributions to our stockholders.

As of December 31, 2017, we had approximately $4.6 billion of debt outstanding, of which approximately $1.2 billion, or 25.3% was subject to variable interest rates (excluding debt with interest rate swaps). This variable rate debt had a weighted average interest rate of approximately 3.1% per annum. Increases in interest rates on this variable rate debt would increase our interest expense, which could harm our cash flow and our ability to pay cash distributions.

Failure to hedge effectively against interest rate changes may adversely affect our results of operations.

In certain cases we may seek to manage our exposure to interest rate volatility by using interest rate hedging arrangements. Hedging involves risks, such as the risk that the counterparty may fail to honor its obligations under an arrangement. Failure to hedge effectively against interest rate changes may adversely affect our financial condition, results of operations and ability to make cash distributions to our stockholders.

Risks Related to Qualification and Operation as a REIT

Dividends payable by REITs may be taxed at higher rates.

Dividends payable by REITs may be taxed at higher rates than dividends of non-REIT corporations. The maximum U.S. federal income tax rate for qualified dividends paid by domestic non-REIT corporations to U.S. stockholders that are individuals, trust or estates is generally 20%. Dividends paid by REITs to such stockholders are generally not eligible for that rate, but under the 2017 Tax Legislation (defined below), such stockholders may deduct up to 20% of ordinary dividends from a REIT for taxable years beginning after December 31, 2017 and before January 1, 2026. Although this deduction reduces the effective tax rate applicable to certain dividends paid by REITs, such tax rate may still higher than the tax rate applicable to regular corporate qualified dividends. This may cause investors to view REIT investments as less attractive than investments in non-REIT corporations, which in turn may adversely affect the value of stock of REITs, including our stock. In addition, the relative attractiveness of real estate in general may be adversely affected by the favorable tax treatment given to corporate dividends, which could negatively affect the value of our stores.

Possible legislative or other actions affecting REITs could adversely affect our stockholders.

The rules dealing with U.S. federal income taxation are constantly under review by persons involved in the legislative process and by the IRS and the U.S. Department of the Treasury. Changes to the tax laws, with or without retroactive application, could adversely affect our investors or us in ways we cannot predict. New legislation, Treasury Regulations, administrative interpretations or court decisions could significantly and negatively affect our ability to qualify as a REIT, the U.S. federal income tax consequences of such qualification, or the U.S. federal income tax consequences of an investment in us. Also, the law relating to the tax treatment of other entities, or an investment in other entities, could change, making an investment in such other entities more attractive relative to an investment in a REIT.

Recently enacted U.S. tax legislation (the “2017 Tax Legislation”) has significantly changed the U.S. federal income taxation of U.S. businesses and their owners, including REITs and their stockholders. Changes made by the 2017 Tax Legislation that could affect us and our stockholders include:

• | permanently eliminating the progressive corporate tax rate structure, which previously imposed a maximum corporate tax rate of 35%, and replacing it with a corporate tax rate of 21%; |

• | permitting a deduction for certain pass-through business income, including dividends received by our stockholders from us that are not designated by us as capital gain dividends or qualified dividend income, which will allow individuals, trusts and estates to deduct up to 20% of such amounts for taxable years beginning after December 31, 2017 and before January 1, 2026; |

• | reducing the highest rate of withholding with respect to our distributions to non-U.S. stockholders that are treated as attributable to gains from the sale or exchange of U.S. real property interests from 35% to 21%; |

• | limiting our deduction for net operating losses arising in taxable years beginning after December 31, 2017 to 80% of REIT taxable income (determined without regard to the dividends paid deduction); |

• | generally limiting the deduction for net business interest expense in excess of 30% of a business’s “adjusted taxable income,” except for taxpayers that engage in certain real estate businesses (including most equity REITs) and elect out of this rule (provided that such electing taxpayers must use an alternative depreciation system with longer depreciation periods); and |

• | eliminating the corporate alternative minimum tax. |

12

Many of these changes are effective immediately, without any transition periods or grandfathering for existing transactions. The legislation is unclear in many respects and could be subject to potential amendments and technical corrections, as well as interpretations and implementing regulations by the Treasury and IRS, any of which could lessen or increase the impact of the legislation. In addition, it is unclear how these U.S. federal income tax changes will affect state and local taxation, which often uses federal taxable income as a starting point for computing state and local tax liabilities. While some of the changes made by the tax legislation may adversely affect us in one or more reporting periods and prospectively, other changes may be beneficial on a going forward basis. We are continuing to work with our tax advisors to determine the full impact that the recent federal tax reform legislation, which we refer to herein as the 2017 Tax Legislations, as a whole will have on us.

Our failure to qualify as a REIT would have significant adverse consequences to us and the value of our stock.

We believe we operate in a manner that allows us to qualify as a REIT for U.S. federal income tax purposes under the Internal Revenue Code. If we fail to qualify as a REIT or lose our qualification as a REIT at any time, we will face serious tax consequences that would substantially reduce the funds available for distribution for each of the years involved because:

• | we would not be allowed a deduction for distributions to stockholders in computing our taxable income and would be subject to U.S. federal corporate income tax on our income; |

• | we also could be subject to the U.S. Federal alternative minimum income tax for taxable years prior to 2018 and possibly increased state and local taxes; and |

• | unless we are entitled to relief under applicable statutory provisions, we could not elect to be taxed as a REIT for four taxable years following a year during which we were disqualified. |

In addition, if we fail to qualify as a REIT, we will not be required to make distributions to stockholders, and all distributions to stockholders will be subject to tax as regular corporate dividends to the extent of our current and accumulated earnings and profits. This means that our U.S. individual stockholders would be taxed on our dividends at capital gains rates, and our U.S. corporate stockholders would be entitled to the dividends received deduction with respect to such dividends, subject, in each case, to applicable limitations under the Internal Revenue Code. If we fail to qualify as a REIT for U.S. federal income tax purposes and are able to avail ourselves of one or more of the relief provisions under the Internal Revenue Code in order to maintain our REIT status, we may nevertheless be required to pay penalty taxes of $50,000 or more for each such failure. As a result of all these factors, our failure to qualify as a REIT also could impair our ability to expand our business and raise capital, and could adversely affect the value of our securities.

Qualification as a REIT involves the application of highly technical and complex Internal Revenue Code provisions for which there are only limited judicial and administrative interpretations. The complexity of these provisions and of the applicable Treasury regulations that have been promulgated under the Internal Revenue Code is greater in the case of a REIT that, like us, holds its assets through a partnership. The determination of various factual matters and circumstances not entirely within our control may affect our ability to qualify as a REIT. In order to qualify as a REIT, we must satisfy a number of requirements, including requirements regarding the composition of our assets, the sources of our gross income and the owners of our stock. Our ability to satisfy the asset tests depends upon our analysis of the fair market value of our assets, some of which are not susceptible to precise determination, and for which we will not obtain independent appraisals. Our ability to satisfy the income tests depends on the sources and amounts of our gross income, which we may not be able to control. Also, we must make distributions to stockholders aggregating annually at least 90% of our net taxable income, excluding capital gains, and we will be subject to U.S. federal corporate income tax to the extent we distribute less than 100% of our net taxable income including capital gains. In addition, legislation, new regulations, administrative interpretations or court decisions may adversely affect our investors, our ability to qualify as a REIT for U.S. federal income tax purposes or the desirability of an investment in a REIT relative to other investments. Although we believe that we have been organized and have operated in a manner that is intended to allow us to qualify for taxation as a REIT, we can give no assurance that we have qualified or will continue to qualify as a REIT for tax purposes. We have not requested and do not plan to request a ruling from the Internal Revenue Service regarding our qualification as a REIT.

13

We will pay some taxes, reducing cash available for stockholders.

Even though we qualify as a REIT for U.S. federal income tax purposes, we will be required to pay some U.S. federal, state and local taxes on our income and property. Extra Space Management, Inc. manages stores for our joint ventures and stores owned by third parties. We, jointly with Extra Space Management, Inc., elected to treat Extra Space Management, Inc. as a taxable REIT subsidiary (“TRS”) of our Company for U.S. federal income tax purposes. A TRS is a fully taxable corporation, and may be limited in its ability to deduct interest payments made to us. ESM Reinsurance Limited, a wholly-owned subsidiary of Extra Space Management, Inc., generates income from insurance premiums that are subject to U.S. federal income tax and state insurance premiums tax, and pays certain insurance royalties to us. In addition, we will be subject to a 100% penalty tax on certain amounts if the economic arrangements among our tenants, our TRS and us are not comparable to similar arrangements among unrelated parties. Also, if we sell property as a dealer (i.e., to customers in the ordinary course of our trade or business), we will be subject to a 100% penalty tax on any gain arising from such sales. While we do not intend to sell stores as a dealer, the IRS could take a contrary position. To the extent that we are, or our TRS is, required to pay U.S. federal, state or local taxes, we will have less cash available for distribution to stockholders.

Item 1B. Unresolved Staff Comments

None.

Item 2. Properties

As of December 31, 2017, we owned or had ownership interests in 1,061 operating stores. Of these stores, 846 are wholly-owned, one is in a consolidated joint venture, and 214 are in joint ventures. In addition, we managed an additional 422 stores for third parties bringing the total number of stores which we own and/or manage to 1,483. These stores are located in 39 states, Washington, D.C. and Puerto Rico. The majority of our stores are clustered around large population centers. The clustering of assets around these population centers enables us to reduce our operating costs through economies of scale. Our acquisitions have given us an increased scale in many core markets as well as a foothold in many markets where we had no previous presence.

As of December 31, 2017, approximately 835,000 tenants were leasing storage units at the operating stores that we own and/or manage, primarily on a month-to-month basis, providing the flexibility to increase rental rates over time as market conditions permit. Existing tenants generally receive rate increases at least annually, for which no direct correlation has been drawn to our vacancy trends. Although leases are short-term in duration, the typical tenant tends to remain at our stores for an extended period of time. For stores that were stabilized as of December 31, 2017, the average length of stay was approximately 14.6 months.

The average annual rent per square foot for our existing customers at stabilized stores, net of discounts and bad debt, was $15.98 for the year ended December 31, 2017, compared to $15.30 for the year ended December 31, 2016. Average annual rent per square foot for new leases was $16.77 for the year ended December 31, 2017, compared to $15.96 for the year ended December 31, 2016. The average discounts, as a percentage of rental revenues, during these periods were 3.9% and 3.6%, respectively.

Our store portfolio is made up of different types of construction and building configurations. Most often sites are what we consider “hybrid” facilities, a mix of both drive-up buildings and multi-floor buildings. We have a number of multi-floor buildings with elevator access only, and a number of facilities featuring ground-floor access only.

The following table presents additional information regarding net rentable square feet and the number of stores by state.

As of December 31, 2017 | ||||||||||||||||

REIT Owned | JV Owned | Managed | Total | |||||||||||||

Location | Property Count | Net Rentable Square Feet | Property Count | Net Rentable Square Feet | Property Count | Net Rentable Square Feet | Property Count | Net Rentable Square Feet | ||||||||

Alabama | 8 | 557,887 | 1 | 75,286 | 9 | 468,712 | 18 | 1,101,885 | ||||||||

Arizona | 22 | 1,536,086 | 8 | 554,487 | 6 | 420,836 | 36 | 2,511,409 | ||||||||

California | 145 | 11,423,633 | 53 | 3,752,368 | 54 | 5,072,892 | 252 | 20,248,893 | ||||||||

Colorado | 13 | 853,150 | 3 | 247,030 | 16 | 1,142,138 | 32 | 2,242,318 | ||||||||

Connecticut | 7 | 524,606 | 6 | 485,336 | 3 | 218,206 | 16 | 1,228,148 | ||||||||

Delaware | — | — | 1 | 76,765 | — | — | 1 | 76,765 | ||||||||

Florida | 82 | 6,273,792 | 17 | 1,333,795 | 51 | 3,775,872 | 150 | 11,383,459 | ||||||||

Georgia | 55 | 4,221,218 | 3 | 275,370 | 13 | 928,430 | 71 | 5,425,018 | ||||||||

Hawaii | 9 | 603,380 | — | — | 7 | 403,633 | 16 | 1,007,013 | ||||||||

Illinois | 31 | 2,395,802 | 4 | 288,168 | 18 | 1,108,036 | 53 | 3,792,006 | ||||||||

Indiana | 15 | 943,492 | 1 | 57,010 | 7 | 486,709 | 23 | 1,487,211 | ||||||||

Kansas | 1 | 49,999 | 2 | 108,770 | 1 | 70,480 | 4 | 229,249 | ||||||||

Kentucky | 10 | 767,624 | 2 | 111,342 | 5 | 359,304 | 17 | 1,238,270 | ||||||||

Louisiana | 2 | 150,355 | — | — | 1 | 133,810 | 3 | 284,165 | ||||||||

Maryland | 32 | 2,558,639 | 7 | 530,788 | 20 | 1,346,381 | 59 | 4,435,808 | ||||||||

Massachusetts | 41 | 2,558,305 | 11 | 663,963 | 3 | 200,511 | 55 | 3,422,779 | ||||||||

Michigan | 6 | 477,254 | 5 | 396,484 | — | — | 11 | 873,738 | ||||||||

Minnesota | 1 | 74,550 | — | — | 5 | 325,475 | 6 | 400,025 | ||||||||

Mississippi | 3 | 217,442 | — | — | 4 | 258,690 | 7 | 476,132 | ||||||||

Missouri | 5 | 331,836 | 2 | 119,575 | 5 | 301,578 | 12 | 752,989 | ||||||||

Nebraska | — | — | — | — | 2 | 90,742 | 2 | 90,742 | ||||||||

Nevada | 14 | 1,038,922 | 4 | 472,911 | 7 | 840,292 | 25 | 2,352,125 | ||||||||

New Hampshire | 2 | 135,932 | 2 | 83,685 | 4 | 145,280 | 8 | 364,897 | ||||||||

New Jersey | 55 | 4,341,854 | 19 | 1,415,395 | 8 | 624,589 | 82 | 6,381,838 | ||||||||

New Mexico | 10 | 643,186 | 4 | 242,503 | 4 | 326,294 | 18 | 1,211,983 | ||||||||

New York | 22 | 1,638,327 | 12 | 930,426 | 14 | 725,050 | 48 | 3,293,803 | ||||||||

North Carolina | 16 | 1,088,452 | — | — | 15 | 1,038,417 | 31 | 2,126,869 | ||||||||

Ohio | 16 | 1,217,275 | 6 | 415,728 | 2 | 111,419 | 24 | 1,744,422 | ||||||||

Oklahoma | — | — | — | — | 16 | 1,336,611 | 16 | 1,336,611 | ||||||||

Oregon | 6 | 399,292 | 2 | 138,275 | 3 | 183,795 | 11 | 721,362 | ||||||||

Pennsylvania | 16 | 1,203,819 | 7 | 505,496 | 17 | 1,203,508 | 40 | 2,912,823 | ||||||||

Rhode Island | 2 | 131,021 | — | — | 1 | 84,665 | 3 | 215,686 | ||||||||

South Carolina | 23 | 1,741,038 | 1 | 85,486 | 9 | 666,943 | 33 | 2,493,467 | ||||||||

Tennessee | 17 | 1,423,749 | 12 | 802,555 | 9 | 654,935 | 38 | 2,881,239 | ||||||||

Texas | 97 | 8,323,425 | 11 | 767,115 | 47 | 3,699,803 | 155 | 12,790,343 | ||||||||

Utah | 10 | 706,215 | — | — | 6 | 444,536 | 16 | 1,150,751 | ||||||||

Virginia | 44 | 3,515,299 | 7 | 513,857 | 13 | 937,276 | 64 | 4,966,432 | ||||||||

Washington | 8 | 591,349 | — | — | 2 | 145,839 | 10 | 737,188 | ||||||||

Washington, DC | 1 | 99,589 | 1 | 104,382 | 1 | 73,237 | 3 | 277,208 | ||||||||

Wisconsin | — | — | — | — | 6 | 562,695 | 6 | 562,695 | ||||||||

Puerto Rico | — | — | — | — | 8 | 900,440 | 8 | 900,440 | ||||||||

Totals | 847 | 64,757,794 | 214 | 15,554,351 | 422 | 31,818,059 | 1,483 | 112,130,204 | ||||||||

14

Item 3. Legal Proceedings

We are involved in various legal proceedings and are subject to various claims and complaints arising in the ordinary course of business. Because litigation is inherently unpredictable, the outcome of these matters cannot presently be determined with any degree of certainty. In accordance with applicable accounting guidance, management establishes an accrued liability for litigation when those matters present loss contingencies that are both probable and reasonably estimable. In such cases, there may be an exposure to loss in excess of any amounts accrued. The estimated loss, if any, is based upon currently available information and is subject to significant judgment, a variety of assumptions, and known and unknown uncertainties. We could in the future incur judgments or enter into settlements of claims that could have a material adverse effect on our results of operations in any particular period, notwithstanding the fact that we are currently vigorously defending any legal proceedings against us. For more information on our legal accruals, refer to the Commitments and Contingencies footnote in the notes to the consolidated financial statements in Item 8 of this Form 10-K.

Item 4. Mine Safety Disclosures

Not Applicable.

PART II

Item 5. Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities

Market Information

Our common stock has been traded on the New York Stock Exchange (“NYSE”) under the symbol “EXR” since our IPO on August 17, 2004. Prior to that time there was no public market for our common stock.

The following table presents, for the periods indicated, the high and low sales price for our common stock as reported by the NYSE and the per share dividends declared:

2017 | 2016 | ||||||||||||||||||||||

Range | Dividends Declared | Range | Dividends Declared | ||||||||||||||||||||

Quarter | High | Low | High | Low | |||||||||||||||||||

1st | $ | 79.82 | $ | 71.64 | $ | 0.78 | $ | 93.46 | $ | 78.42 | $ | 0.59 | |||||||||||

2nd | $ | 80.80 | $ | 71.79 | $ | 0.78 | $ | 94.04 | $ | 84.95 | $ | 0.78 | |||||||||||

3rd | $ | 82.25 | $ | 74.13 | $ | 0.78 | $ | 94.38 | $ | 76.17 | $ | 0.78 | |||||||||||

4th | $ | 87.86 | $ | 78.70 | $ | 0.78 | $ | 77.66 | $ | 68.78 | $ | 0.78 | |||||||||||

On February 21, 2018, the closing price of our common stock as reported by the NYSE was $81.50. At February 21, 2018, we had 423 holders of record of our common stock. Certain shares of the Company are held in “street” name and accordingly, the number of beneficial owners of such shares is not known or included in the foregoing number.

Holders of shares of common stock are entitled to receive distributions when declared by our board of directors out of any assets legally available for that purpose. As a REIT, we are required to distribute at least 90% of our “REIT taxable income,” which is generally equivalent to our net taxable ordinary income, determined without regard to the deduction for dividends paid to our stockholders, annually in order to maintain our REIT qualification for U.S. federal income tax purposes. We have historically made regular quarterly distributions to our stockholders.

Information about our equity compensation plans is incorporated by reference in Item 12 of Part III of this Annual Report on Form 10-K.

15

Issuer Purchases of Equity Securities

In November 2017, our board of directors authorized a three-year share repurchase program to allow the Company to acquire shares in aggregate up to $400.0 million. The Company expects to acquire shares through open market or privately negotiated transactions. There have been no repurchases since the inception of this plan.

Unregistered Sales of Equity Securities

On December 28, 2017, our Operating Partnership issued 64,708 common OP units ("OP Units")in connection with the acquisition of one store in Florida. The store was acquired in exchange for the OP Units, valued at $5.6 million, and approximately $4.9 million in cash.

On December 6, 2017, our Operating Partnership issued 174,020 Series D-2 Preferred Units in connection with a joint venture's acquisition of one store in New York. We acquired an ownership interest in the store from the issuance of Preferred D-2 Units that was then contributed to the joint venture as an equity contribution. The OP Units were valued at $4.3 million.

The terms of the common and preferred OP Units are governed by the Operating Partnership’s Fourth Amended and Restated Agreement of Limited Partnership. The OP Units will be redeemable, at the option of the holders following the expiration of a lock-up period of at least one year from the date of issuance. The redemption obligation may be satisfied, at our option, in cash or shares of our common stock.

The OP Units were issued in private placements in reliance on Section 4(a)(2) of the Securities Act of 1933, as amended, and the rules and regulations promulgated thereunder.

All other unregistered sales of equity securities during the year ended December 31, 2017 have previously been disclosed in filings with the SEC.

Item 6. Selected Financial Data

The following table presents selected financial data and should be read in conjunction with the financial statements and notes thereto included in Item 8, “Financial Statements and Supplementary Data” and Item 7, “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in this Form 10-K (amounts in thousands, except share and per share data).

For the Year Ended December 31, | |||||||||||||||||||

2017 | 2016 | 2015 | 2014 | 2013 | |||||||||||||||

Operating Data: | |||||||||||||||||||

Total revenues | $ | 1,105,009 | $ | 991,875 | $ | 782,270 | $ | 647,155 | $ | 520,613 | |||||||||

Income from operations (1) | $ | 541,605 | $ | 449,838 | $ | 294,656 | $ | 278,468 | $ | 213,483 | |||||||||

Earnings per share basic | $ | 3.79 | $ | 2.92 | $ | 1.58 | $ | 1.54 | $ | 1.54 | |||||||||

Earnings per share diluted | $ | 3.76 | $ | 2.91 | $ | 1.56 | $ | 1.53 | $ | 1.53 | |||||||||

Cash dividends paid per common share | $ | 3.12 | $ | 2.93 | $ | 2.24 | $ | 1.81 | $ | 1.45 | |||||||||

Other Data: | |||||||||||||||||||

Acquisitions - wholly owned | $ | 627,462 | $ | 1,086,645 | $ | 1,606,509 | $ | 563,670 | $ | 704,449 | |||||||||

Acquisitions - investment in joint ventures | 15,094 | 34,199 | 21,529 | — | — | ||||||||||||||

Total | $ | 642,556 | $ | 1,120,844 | $ | 1,628,038 | $ | 563,670 | $ | 704,449 | |||||||||

16

As of December 31, | |||||||||||||||||||

2017 | 2016 | 2015 | 2014 | 2013 | |||||||||||||||

Balance Sheet Data | |||||||||||||||||||

Total assets | $ | 7,455,137 | $ | 7,091,446 | $ | 6,071,407 | $ | 4,381,987 | $ | 3,977,140 | |||||||||

Total notes payable, notes payable to trusts, exchangeable senior notes and revolving lines of credit, net (2) | $ | 4,554,217 | $ | 4,306,223 | $ | 3,535,621 | $ | 2,349,764 | $ | 1,946,647 | |||||||||

Noncontrolling interests | $ | 373,056 | $ | 351,274 | $ | 283,527 | $ | 174,558 | $ | 173,425 | |||||||||

Total stockholders' equity | $ | 2,350,751 | $ | 2,244,892 | $ | 2,089,077 | $ | 1,737,425 | $ | 1,758,470 | |||||||||

Other Data | |||||||||||||||||||

Net cash provided by operating activities | $ | 597,375 | $ | 539,263 | $ | 367,329 | $ | 337,581 | $ | 271,259 | |||||||||

Net cash used in investing activities | $ | (369,556 | ) | $ | (1,032,035 | ) | $ | (1,625,664 | ) | $ | (564,948 | ) | $ | (366,976 | ) | ||||

Net cash provided by (used in) financing activities | $ | (215,994 | ) | $ | 460,831 | $ | 1,286,471 | $ | 148,307 | $ | 191,655 | ||||||||

(1) | The adoption of FASB ASU 2017-01 on January 1, 2017, has resulted in a decrease in acquisition related costs as the Company’s acquisition of operating stores are considered asset acquisitions rather than business combinations. |

(2) | In connection with our adoption of Financial Accounting Standards Board (“FASB”) ASU 2015-3, "Simplifying the Presentation of Debt Issuance Costs," in fiscal year 2016, debt issuance costs, with the exception of those related to our revolving credit facility, have been reclassified from other assets to a reduction of the carrying amount of the related debt liability. Prior year amounts have been reclassified to conform to the current period’s presentation. |

Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations

The following discussion should be read in conjunction with the financial statements and notes thereto appearing elsewhere in this report. We make statements in this section that are forward-looking statements within the meaning of the federal securities laws. For a complete discussion of forward-looking statements, see the section in this Form 10-K entitled “Statements Regarding Forward-Looking Information.” Certain risk factors may cause actual results, performance or achievements to differ materially from those expressed or implied by the following discussion. For a discussion of such risk factors, see the section in this Form 10-K entitled “Risk Factors.” Amounts in thousands, except share and per share data.

OVERVIEW

We are a fully integrated, self-administered and self-managed real estate investment trust (“REIT”), formed to own, operate, manage, acquire, develop and redevelop self-storage properties (“stores”). We derive substantially all of our revenues from our two segments: storage operations and tenant reinsurance. Primary sources of revenue for our storage operations segment include rents received from tenants under leases at each of our wholly-owned stores. Our operating results depend materially on our ability to lease available self-storage units, to actively manage unit rental rates, and on the ability of our tenants to make required rental payments. Consequently, management spends a significant portion of their time maximizing cash flows from our diverse portfolio of stores. Revenue from our tenant reinsurance segment consists of insurance revenues from the reinsurance of risks relating to the loss of goods stored by tenants in the Company's stores. Our segment presentation has changed from the prior year, and all applicable information has been reclassified to conform to the current year's segment presentation.

Our stores are generally situated in highly visible locations clustered around large population centers. These areas enjoy above average population growth and income levels. The clustering of our assets around these population centers enables us to reduce our operating costs through economies of scale. To maximize the performance of our stores, we employ industry-leading revenue management systems. Developed by our management team, these systems enable us to analyze, set and adjust rental rates in real time across our portfolio in order to respond to changing market conditions. We believe our systems and processes allow us to more pro-actively manage revenues.