Document

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington D.C. 20549

|

| |

x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

FOR THE FISCAL YEAR ENDED DECEMBER 31, 2017

OR

|

| |

¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission File Number: 000-51280

MORNINGSTAR, INC.

(Exact Name of Registrant as Specified in its Charter)

|

| | |

Illinois | | 36-3297908 |

(State or Other Jurisdiction of | | (I.R.S. Employer |

Incorporation or Organization) | | Identification Number) |

22 West Washington Street

Chicago, Illinois

60602

(Address of Principal Executive Offices)

(312) 696-6000

(Registrant's Telephone Number, Including Area Code)

Securities registered pursuant to Section 12(b) of the Act:

|

| | |

Title of Each Class | | Name of Each Exchange on Which Registered |

Common stock, no par value | | The Nasdaq Stock Market LLC |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the Registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes x No ¨

Indicate by check mark if the Registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No x

Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of Registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and "emerging growth company" in Rule 12b-2 of the Exchange Act.

(Check one):

|

| | | | | | |

Large accelerated filer x | Accelerated filer ¨ | | Non-accelerated filer ¨ | | Smaller reporting company ¨ | Emerging growth company o |

| | | (Do not check if a smaller reporting company) | | | |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Indicate by check mark whether the Registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x

The aggregate market value of shares of common stock held by non-affiliates of the Registrant as of June 30, 2017 was $1.4 billion. As of February 16, 2018, there were 42,498,136 shares of the Registrant's common stock, no par value, outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Certain parts of the Registrant's Definitive Proxy Statement for the 2018 Annual Meeting of Shareholders are incorporated into Part III of this Form 10-K.

Table of Contents

Part I

Item 1. Business

Overview

Morningstar, Inc. is a leading provider of independent investment research in North America, Europe, Australia, and Asia. The company offers an extensive line of products and services for individual investors, financial advisors, asset managers, retirement plan providers and sponsors, and institutional investors in the private capital markets.

We currently serve approximately 255,000 financial advisors, 1,500 asset management firms, 31 retirement plan providers, 285,000 retirement plan sponsors, and 11.9 million individual investors. We also provide data on the private capital markets to approximately 2,700 institutional clients.

Our data and research are core assets that we seek to leverage to build Morningstar's long-term value. Morningstar provides extensive data and research insights on a wide range of investment offerings, including managed investment products, publicly listed companies, fixed income securities, private capital markets, and real-time global market data.

We’ve been providing independent analyst research on mutual funds and other investment vehicles since the mid-1980s. We use this analyst research to provide a qualitative, forward-looking Morningstar Analyst Rating for funds. We now provide research reports and Morningstar Analyst Ratings for approximately 5,100 funds globally, including active, passive, multi-asset, ETF, and closed-end fund strategies. We also offer qualitative research and ratings on alternative funds, state-sponsored college savings plan portfolios, target-date funds, and ETFs. Our data and proprietary analytical tools such as the Morningstar Rating for mutual funds, which rates past performance based on risk- and cost-adjusted returns, and the Morningstar Style Box, which provides a visual summary of a mutual fund's underlying investment style, have become important tools that millions of investors and advisors use in making investment decisions. Other tools, such as the Ownership Zone, Sector Delta, and Market Barometer, allow investors to see how different investments work together to form a portfolio and to track its progress.

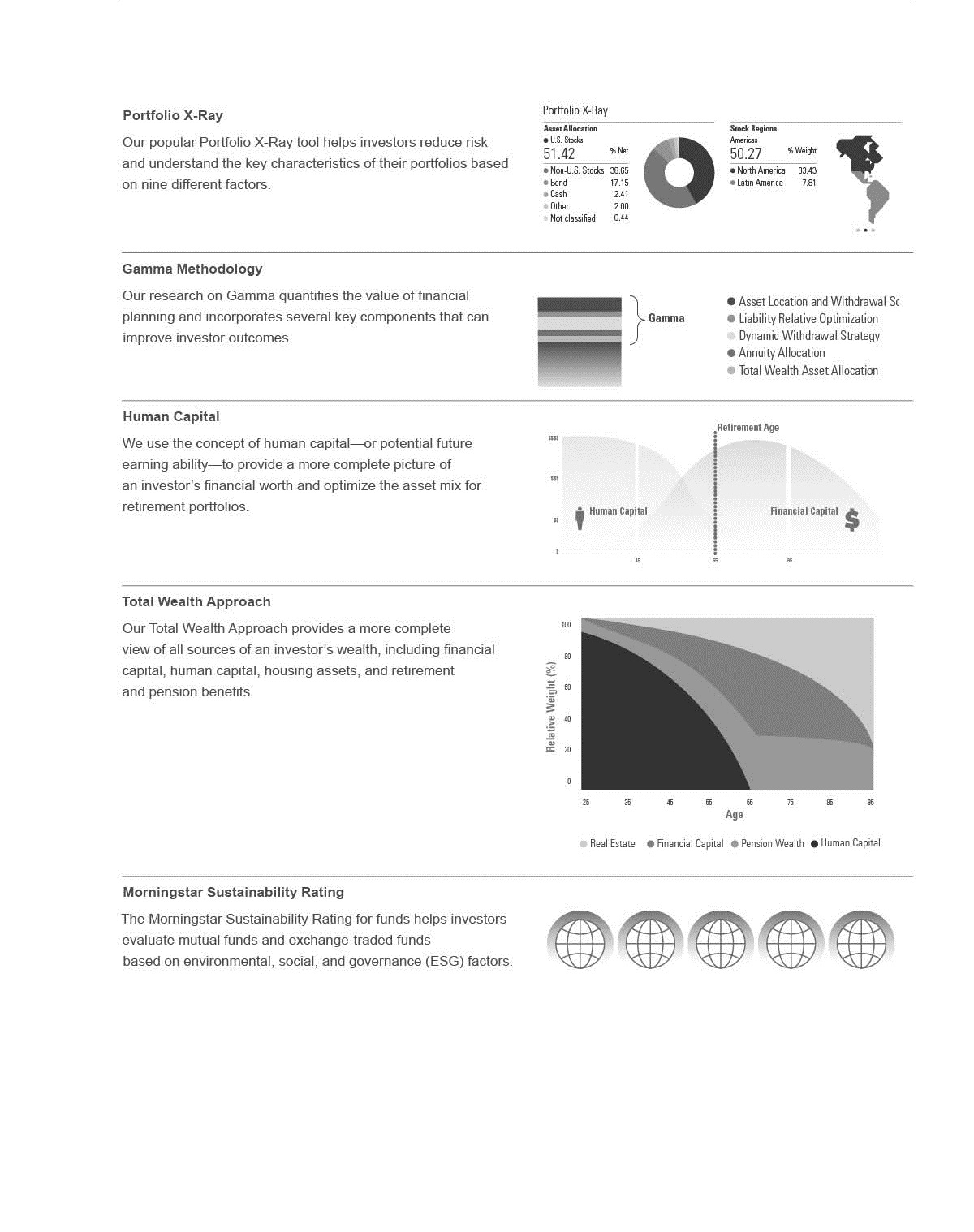

The Morningstar Sustainability Rating helps investors evaluate funds based on environmental, social, and governance (ESG) factors. Morningstar now provides Sustainability Ratings for approximately 36,000 investment vehicles. Sustainability ratings for mutual funds and ETFs encompass $21 trillion in assets under management, or more than half of fund assets globally.

As part of our research efforts on individual stocks, we popularized the concepts of economic moat, a measure of competitive advantage originally developed by Warren Buffett, and margin of safety, which reflects the size of the discount in a stock's price relative to its estimated value. The Morningstar Rating for stocks is based on the stock's current price relative to our analyst-generated fair value estimates, as well as the company's level of business risk and economic moat. Our analysts cover approximately 1,500 stocks using a consistent, proprietary methodology that focuses on fundamental analysis, competitive advantage assessment, and intrinsic value estimation.

In addition to our analyst-driven coverage, we provide quantitative ratings and reports for approximately 56,000 companies globally. These equity ratings draw on the fundamental research of our equity analyst team and provide a forward-looking statistical view of the valuation, competitive advantage, and level of uncertainty for stocks that are often under-followed by other research firms.

PitchBook, which we acquired in December 2016, provides venture capital and private equity firms, corporate development teams, investment banks, limited partners, lenders, law firms, and accounting firms with a robust, all-in-one workstation that focuses on private capital markets. Morningstar’s in-depth public company fundamental data and institutional equity research were integrated into the platform in 2017, allowing institutional investors to better capitalize on opportunities in both public and private markets.

Through our Morningstar Credit Ratings, LLC subsidiary, which is a Nationally Recognized Statistical Rating Organization (NRSRO), we provide new issue and surveillance ratings and analysis for commercial mortgage-backed securities (CMBS), residential mortgage-backed securities (RMBS), and other types of asset-backed securities. In 2017, the National Association of Insurance Commissioners (NAIC) extended Morningstar Credit Ratings’ designation on its NAIC Credit Rating Provider list to include financial institutions, brokers, and dealers, as well as corporate issuers. Morningstar Credit Ratings also announced the launch of its Real Estate Investment Trust (REIT) ratings initiative in 2017.

In our investment management business, we've developed in-depth advice on asset allocation, portfolio construction, and security selection to meet the needs of investors and professionals looking for integrated portfolio solutions. We’ve published research on "Gamma," an innovative measure that quantifies how much additional retirement income investors can generate by making better financial planning decisions. We use the concept of human capital-or potential future earning ability-to provide a more complete picture of an investor’s financial worth and optimize a portfolio’s asset mix.

We believe investors rely on these tools because they offer a useful framework for comparing potential investments and making decisions. Our independence and our history of innovation make us a trusted resource for investors.

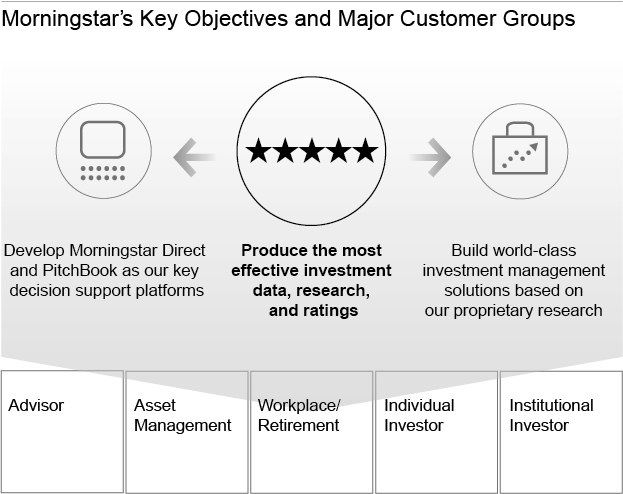

Strategy and Key Objectives

Our strategy is to widen our economic moat, or sustainable competitive advantage, and build shareholder value by focusing on our three key objectives, which we describe in more detail below.

1. Produce the most effective investment data, research, and ratings to help investors reach their financial goals.

We believe the quality and scope of our independent investment research offers a competitive advantage that would be difficult for competitors to replicate. Our goal is to leverage our proprietary research and intellectual property to help investors with both decision support (via Morningstar Direct and PitchBook) and outsourced investment management.

We’re focusing our research efforts on several different areas, as described below.

•Manager research (including mutual funds, ETFs, separate accounts, and other vehicles)

Our goal for manager research is to improve investor outcomes through ratings efficacy, coverage expansion, and innovation. Our analyst team qualitatively assesses thousands of managed investments using a structured and uniform approach. With the release of the Morningstar Quantitative Rating for Funds in the U.S., we have used machine-learning techniques to extend the qualitative Analyst Rating to thousands of funds that our analysts don’t cover. In addition, our analysts contribute to research and data innovations that we surface in the products and services we offer and oversee other ratings systems and tools that we offer to help investors make more-informed decisions when selecting securities, constructing portfolios, or measuring risk.

As of December 31, 2017, we had about 120 manager research analysts, including teams in North America, Europe, Australia, and Asia.

•Equity research

Our analysts follow a rigorous methodology that emphasizes a bottom-up, long-term, fundamentals-based valuation approach. We believe that our deep industry knowledge and Economic MoatTM Ratings, which identify sustainable competitive advantages, differentiate our equity research and help investors achieve better investment outcomes.

As of December 31, 2017, we had about 100 equity analysts globally, making us one of the largest providers of independent equity research.

•Credit ratings

Morningstar Credit Ratings, LLC, our credit ratings subsidiary, is a Nationally Recognized Statistical Rating Organization (NRSRO) that is focused on structured finance and credit ratings for corporate issuers and financial institutions. We bring transparency, unique perspectives, and superior client service to investors across the fixed-income markets.

As of December 31, 2017, we had about 100 credit analysts globally.

•Portfolio advice methodologies (including our research on Gamma and the Total Wealth Approach)

Over the past several years, we’ve developed new research tools that provide a more holistic approach to investing and asset allocation. Whereas traditional asset allocation methodologies focus solely on financial assets (such as stocks and bonds), we’ve developed methodologies that provide a more complete view of all sources of wealth, including financial capital, human capital, housing assets, and retirement and pension benefits.

2. Develop Morningstar Direct and PitchBook as our key decision support platforms.

In 2017, we continued to develop the next-generation version of Morningstar Direct, our institutional investment research platform.

The new software is designed to be more intuitive, elegant, and easy-to-use. It provides a more consistent, cohesive experience with a strong emphasis on Morningstar’s proprietary research and tools. We also improved the underlying technology, including a more streamlined development process for commonly used Morningstar capabilities such as portfolio management tools.

The new software is fully web-based, which eliminates the need for desktop software installations and allows immediate access to new features. It allows to us innovate more rapidly and more easily configure our software solutions to meet client needs. It also addresses the growing need for mobile-optimized capabilities to extend the desktop experience onto mobile devices.

Over the past several years, we've started migrating many of our core software capabilities to Morningstar Direct, which will serve as our main platform for clients seeking information to support the investment decisions they make on their own or to validate investment recommendations from another party. We're also continuing to expand the user base for Morningstar Direct by enhancing capabilities for our existing asset management clients and adding workflows for new types of clients, such as financial advisors.

The PitchBook Platform is an all-in-one web-based research and analysis workstation centered on the private capital markets, including venture capital, private equity, and mergers and acquisitions. The PitchBook Platform also offers a mobile application, Excel plug-in, Chrome extension and optional CRM integrations, all designed to help users source deals, raise funds, build buyer lists, create benchmarks, network, and more.

In 2017, we introduced several high-impact data and technology enhancements. Morningstar’s in-depth public company fundamental data and institutional equity research were integrated into the platform, which when combined with PitchBook’s best-in-class private market data, offers seamless access to cross-market insights, allowing institutional investors to better capitalize on opportunities in both public and private markets. We also doubled our private European company coverage.

In 2017, PitchBook also launched a new interface and user experience, creating a more scalable product and helping users quickly uncover trends and opportunities. For example, the new Chrome extension allows users to instantly view hard-to-find company data while browsing other web content, thereby creating efficiency and value for users in their research.

3. Build world-class investment management solutions based on our proprietary research.

We leverage our innovative, proprietary research by building world-class investment management solutions that help investors achieve better outcomes. Leveraging our existing capabilities, we create holistic solutions that help financial advisors, asset managers, and individual investors with portfolio construction, monitoring, security selection, and implementation.

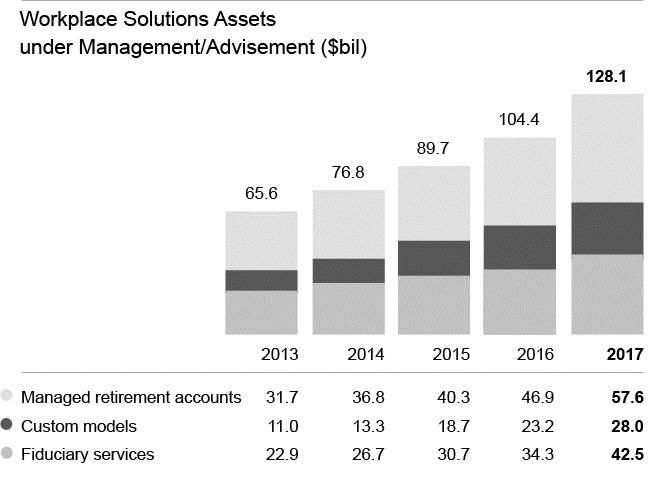

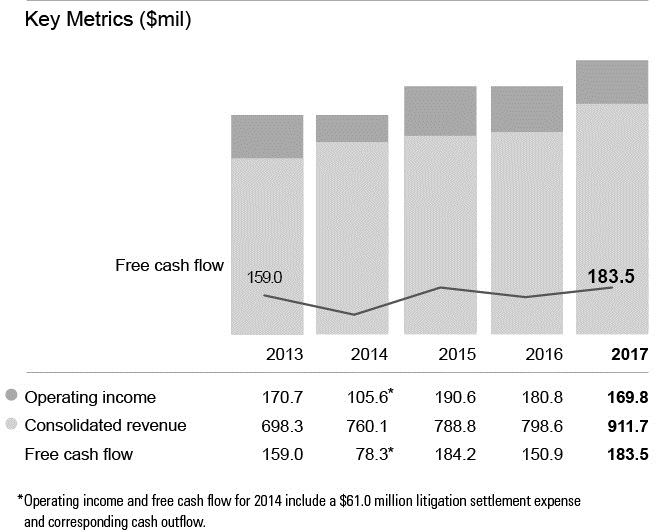

Our investment management solutions include Morningstar Managed Portfolios, which had $39.8 billion in assets under management and advisement as of December 31, 2017, and Workplace Solutions (formerly Retirement Solutions), which had a total of $128.1 billion in assets under management and advisement.

We also expect to expand the investment management solutions we offer through our index business. We currently offer more than 580 investment indexes that can be used for both benchmarking and product creation.

Major Customer Groups

Given the core capabilities discussed above, we're focusing on five primary customer groups:

| |

• | Advisor (including independent financial advisors as well as those affiliated with broker-dealers or other intermediaries); |

| |

• | Asset management (including fund companies, insurance companies, and other companies that build and manage portfolios of securities for their clients); |

| |

• | Workplace/retirement (including retirement plan providers and plan sponsors); |

| |

• | Individual investor; and |

Advisor

Financial advisors work with individual investors to help them reach their financial goals. This customer group includes independent advisors at registered investment advisor (RIA) firms, advisors affiliated with independent broker-dealers, dually registered advisors, and “captive” advisors who are employees of a broker-dealer. Such broker-dealers include wirehouses, regional broker-dealers, and banks. The advisor landscape is broad in both the United States, and in other parts of the world where we focus. The U.S. is our largest market, and in total, Cerulli Associates estimates there were approximately 313,000 financial advisors in the U.S. as of the end of 2017.

We believe our deep understanding of individual investors’ needs allows us to work with advisors to help them make more efficient use of their time and deliver better investment outcomes for their clients. Our advisor solutions also draw on Morningstar’s proprietary investment research methodologies and research insights.

We sell our advisor-related solutions both directly to independent financial advisors and through enterprise licenses, which allow financial advisors associated with the licensing firm to use our products.

We're expanding the range of services we offer to help financial advisors with all aspects of their daily workflow needs, including investment decision-making, portfolio construction, client monitoring and reporting, practice management, portfolio rebalancing that connects with custodial and trading interfaces, and financial planning. Because advisors are increasingly outsourcing investment management, we're continuing to enhance Morningstar Managed Portfolios to help advisors save time and reduce compliance risk.

Our main products for financial advisors are Morningstar Advisor Workstation (including Morningstar Office) and Morningstar Managed Portfolios.

Asset management

Asset management firms manage and distribute investment portfolios. We estimate that there are more than 3,000 asset management firms globally, ranging from large, global firms to firms with small fund lineups and operations in a single market or region. The asset management customer group includes individuals involved in sales, marketing, product development, and distribution, as well as investment management (often referred to as the “buy side”), which includes portfolio management and research.

Our asset management offerings help companies connect with their clients because of Morningstar’s strong brand presence with both financial advisors and individual investors. We offer a global reach and have earned investors’ trust in our unbiased approach, investor-centric mission, and thought leadership.

The key products we offer for asset management firms include Morningstar Direct, Morningstar Data, and Morningstar Indexes. For the buy side, key products include Morningstar Research, Morningstar Credit Ratings, Morningstar Data, and Morningstar Direct.

Workplace/retirement

In the U.S. workplace (also known as retirement) market, millions of investors are now charged with planning for their own retirement, mainly through self-directed retirement plans such as 401(k) plans in the United States. Assets in 401(k) plans totaled an estimated $5.6 trillion as of December 31, 2017, based on data from Cerulli Associates. In the wake of the financial crisis of 2008 and 2009, we believe individual investors, financial advisors, employers, and government organizations have all become more aware of the need for advice and guidance that helps individuals build assets for retirement and beyond.

Our retirement offerings help retirement plan participants of all ages plan and invest for retirement. We offer these services both through retirement plan providers (typically third-party asset management companies that provide administrative and record-keeping services) and directly to plan sponsors (employers that offer retirement plans to their employees).

Our main product offerings for the workplace/retirement customer group include retirement advice and managed accounts, fiduciary services, and custom models.

Individual investor

We offer products for individual investors who invest to build wealth and save for other goals, such as retirement or college tuition. A Gallup survey released in April 2017 found that approximately 54% of individuals in the United States invest in the stock market either directly or through mutual funds or self-directed retirement plans.

We design most of our products for individual investors who are actively involved in the investing process and want to take charge of their own investment decisions. We also reach individuals who want to learn more about investing or want to validate the advice they receive from brokers or financial advisors.

Our main product for individual investors is Morningstar.com, which includes both paid Premium Memberships and free content available to registered users and visitors. We also reach individual investors through investment newsletters, iPad and mobile applications, and through licensing our content to other websites, such as Yahoo Finance, MSN Money, and Google Finance.

Institutional investor

Through PitchBook Data, Inc. (PitchBook), which we acquired in December 2016, we reach approximately 2,700 investment and research firms and their service providers, including venture capital and private equity firms, corporate development teams, investment banks, limited partners, lenders, law firms, and accounting firms. These clients use PitchBook’s platform to access data, discover new connections, and conduct research on potential investment opportunities.

PitchBook covers the full lifecycle of venture capital, private equity, and mergers and acquisitions (M&A), including the limited partners, investment funds, and service providers involved. Our main product for this customer group is the PitchBook Platform, an all-in-one research and analysis workstation for sophisticated investment and business professionals.

Acquisitions and Divestitures

Since our founding in 1984, we've supported our organic growth by introducing new products and services and expanding our existing offerings. From 2006 through 2017, we also completed 30 acquisitions to support our growth objectives. In July 2017, we acquired a minority stake in Sustainalytics Holding B.V., an independent ESG and corporate governance research, ratings, and analysis firm supporting investors around the world with the development and implementation of responsible investment strategies. In June 2017, we sold HelloWallet.

For more information about our acquisitions, refer to Note 7 of the Notes to our Consolidated Financial Statements.

For more information about our investments in unconsolidated entities, refer to Note 9 of the Notes to our Consolidated Financial Statements. For more information about our divestiture, refer to Note 8 of the Notes to our Consolidated Financial Statements.

Major Products and Services

The section below describes some of our major products and services (ranked in order of size based on each product's 2017 revenue).

Morningstar Data

Morningstar Data gives institutions access to a full range of investment data spanning numerous investment databases, including real-time pricing and market data. We offer licenses and data feeds for our proprietary statistics, such as the Morningstar Style Box and Morningstar Rating, and a wide range of other data, including information on investment performance, risk, portfolios, operations data, fees and expenses, cash flows, and ownership. Institutions can use Morningstar Data in a variety of investor communications, including websites, print publications, and marketing fact sheets, as well as for internal research and product development.

We also offer Morningstar Data for equities, including financial statement data, consolidated industry statistics, stock ownership information, and proprietary Morningstar statistics.

In 2017, we added several new sets of data to our suite of offerings, including the expansion of our equity data, which added over 1,000 new data elements. We also advanced our fixed income capabilities, expanding portfolio level data and new analytics for funds. We’ve continued developing our data delivery platforms, including application programming interfaces (APIs), which allow for faster and more flexible client access to large groups of data files. We’ve expanded the number of data sets that are available through APIs and expanded the scope of data provided at the request of our clients.

Pricing for Morningstar Data is based on the number of investment vehicles covered, the amount of information provided for each security, the frequency of updates, the method of delivery, the size of the licensing firm, and the level of distribution.

Our main competitors for Morningstar Data include Activ Financial, Bloomberg, FactSet, Financial Express, Interactive Data, S&P Global, Thomson Reuters, and Xignite.

Morningstar Data is our largest product based on revenue and accounted for 17.9%, 19.0%, and 18.3% of our consolidated revenue in 2017, 2016, and 2015, respectively.

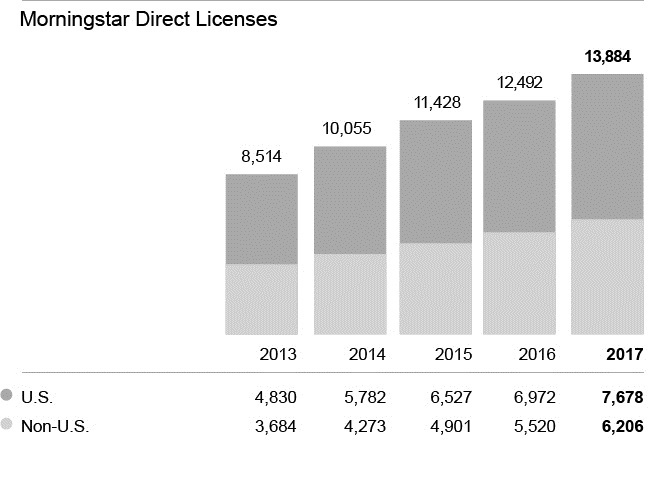

Morningstar Direct

Morningstar Direct is an institutional investment research platform that includes data and advanced analytical tools on the complete range of securities in Morningstar's global database, as well as privately held investments and data from third-party providers. It helps portfolio managers, investment consultants, financial product managers, wealth managers, and other professionals develop, select, and monitor investments. Users can create advanced performance comparisons and in-depth analyses of an investment's underlying investment style, as well as custom-branded reports and presentations.

In 2017, we further developed Morningstar Direct Cloud (the next-generation version of Morningstar Direct). These ongoing development efforts include rebuilding the platform to make it purely web-based and retooling existing capabilities to support users' daily workflow needs.

We also enhanced the data and research capabilities offered in Morningstar Direct during the year. For example, we expanded the Morningstar Sustainability Rating for funds, which helps investors evaluate mutual funds and ETFs based on how well the companies held in their portfolios are managing their environmental, social, and governance (ESG) risks and opportunities. We also introduced a new Global Risk Model into Direct Cloud, which helps investors understand and visualize the underlying factors that can drive the risk of a stock or portfolio and run scenario analysis to analyze returns.

Morningstar Direct's primary competitors are Bloomberg, eVestment Alliance, FactSet Research Systems, Thomson Reuters, and Zephyr Associates.

Morningstar Direct had approximately 13,900 licensed users worldwide as of December 31, 2017.

Pricing for Morningstar Direct is based on the number of licenses purchased. For clients in the United States, we generally charge an annual fee of $18,000 for the first user, $11,500 for the second user, and $9,800 for each additional user.

Morningstar Direct is our second-largest product based on revenue and accounted for 13.6%, 13.8%, and 12.9% of our consolidated revenue in 2017, 2016, and 2015, respectively.

Morningstar Investment Management

This product line includes several different offerings, including Morningstar Managed Portfolios, as well as services for institutional asset management, asset allocation, and manager selection.

Morningstar Managed Portfolios are widely available as strategist models on third-party managed account platforms and through a fee-based discretionary asset management service also known as a turn-key asset management program (TAMP). In the United States, we offer this service through Morningstar Investment Services LLC, a registered investment advisor, registered broker/dealer, member of the Financial Industry Regulatory Authority, Inc. (FINRA), and wholly owned subsidiary of Morningstar, Inc. Our portfolios are built using mutual funds, ETFs, and equities and tailored to meet specific investment time horizons, risk levels, and outcomes. We offer Morningstar Managed Portfolios mainly through fee-based independent financial advisors. These advisors are often affiliated with independent or insurance-related broker-dealers. Morningstar Managed Portfolios are also available in Australia, South Africa, and the United Kingdom.

We also provide other institutional asset management services for asset management firms, broker-dealers, and insurance providers, which we offer through a variety of registered entities in Australia, Canada, Dubai, France, Hong Kong, India, Japan, South Africa, the United Kingdom, and the United States. All of these entities are wholly owned or majority-owned subsidiaries of Morningstar, Inc., and are authorized to provide investment advisory services by the appropriate regulatory agency in their applicable jurisdictions.

These services include institutional asset management, asset allocation, and manager selection services, which are investment recommendations delivered as select lists, based on a process that draws on our rated universe and manager selection methodology.

In 2017, we continued migrating functionality to the new Morningstar Managed Portfolios website from our legacy platform. We also launched a new portfolio series, U.S. Real Return, as part of our outcome-based lineup. These diversified, multi-asset portfolios align their valuation-driven and best-ideas investment approach with the investors’ financial planning needs and goals.

We charge asset-based fees for Morningstar Managed Portfolios, which are typically based on the type of service (i.e., TAMP vs. strategist models) and the products contained within the portfolios. Fees for our mutual fund and ETF portfolios generally range from 20 to 40 basis points. We charge 40 to 55 basis points for Equity Portfolios, which are customizable stock portfolios based on Morningstar's proprietary equity research. We use third-party custodians for Morningstar Managed Portfolios and do not hold the assets in custody.

We base pricing for our other investment management services on the scope of work, our degree of investment discretion, and the level of service required. In the majority of our contracts, we receive asset-based fees, reflecting our work as a portfolio construction manager or subadvisor for multimanager portfolios.

For Morningstar Managed Portfolios offered through our TAMP, our primary competitors are AssetMark, Brinker Capital, and SEI Investments. Our primary strategist offering competitors are Blackrock, Vanguard, Envestnet PMC and Russell. We also compete with in-house research teams at independent broker-dealers who build proprietary portfolios for use on brokerage firm platforms, as well other registered investment advisors that provide investment strategies or models on these platforms. In our other investment management services, we compete with consulting firms such as Mercer, Callan, and Wilshire Associates, as well as various in-house providers of investment management services.

Morningstar Investment Management is our third-largest product based on revenue and made up 11.6%, 12.3%, and 12.5% of our consolidated revenue in 2017, 2016, and 2015, respectively.

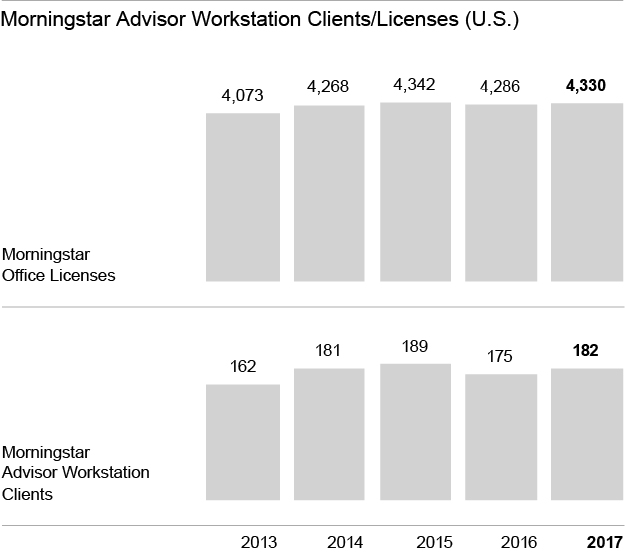

Morningstar Advisor Workstation

Morningstar Advisor Workstation, a web-based investment planning system, provides financial advisors with a comprehensive set of tools for conducting their core business-including investment research, planning, and presentations. It allows advisors to build and maintain a client portfolio database that can be fully integrated with the firm's back-office technology and resources. Moreover, it helps advisors create customized reports for client portfolios that combine different types of investments.

Morningstar Advisor Workstation is available in two versions: Morningstar Office for independent financial advisors and an enterprise version for financial advisors affiliated with larger firms. As of December 31, 2017, approximately 4,300 financial advisors in the United States were licensed to use Morningstar Office, and approximately 180 companies held licenses for the enterprise version of Morningstar Advisor Workstation.

In 2017, we continued to enhance integrations with several leading third-party platforms to help advisors with all aspects of their daily workflows. We advanced Morningstar Office CloudSM, our cloud-based practice and portfolio management platform for advisors. We also launched our Best Interest Scorecard, a solution designed to help advisors act as fiduciaries for their clients.

Pricing for Morningstar Advisor Workstation varies based on the number of users, as well as the number of databases licensed and level of functionality. We typically charge annual fees of about $3,500 per licensed user for a base configuration of Morningstar Advisor Workstation, but pricing varies significantly based on the scope of the license. We generally charge $8,000 per firm, on average, for an annual license for Morningstar Office. This average includes a mix of "per account" and "per seat" pricing for access. With the release of our cloud-based platform, we will be more focused on pricing on an account basis versus pricing per user.

Competitors for Morningstar Advisor Workstation and Morningstar Office include Black Diamond, Envestnet, Orion Advisor Services, S&P Global, and Thomson Reuters.

Morningstar Advisor Workstation is our fourth-largest product based on revenue and made up 9.6%, 10.3%, and 10.3% of our consolidated revenue in 2017, 2016, and 2015, respectively.

Workplace Solutions

This product line includes several different offerings, including retirement advice and managed accounts, fiduciary services and custom models.

Our advice and managed accounts program, delivered primarily through Morningstar Retirement Manager, helps retirement plan participants with their retirement goals. As part of this service, we deliver personalized recommendations for a target savings goal, a recommended contribution rate to help achieve that goal, a portfolio mix based on risk tolerance, and specific investment recommendations. Participants can build their own portfolios based on our recommendations or elect to have their accounts managed by us through our managed retirement account offering. We also offer Advisor Managed Accounts, a program that allows financial advisors to specify the portfolios that are used in an employer's managed account offering. We do not hold assets in custody for the managed retirement accounts we provide.

In our fiduciary services offering, we work with retirement plan providers and sponsors to help them meet their fiduciary obligations by selecting and monitoring a broad range of diversified plan options. With our custom models, we work with retirement plan providers to design solutions for their investment lineups, including target maturity models and risk-based models.

We also serve as a non-discretionary subadvisor and index provider for the Morningstar Lifetime Allocation Funds, a series of target-date collective investment trust funds (CITs) offered by UBS Asset Management to retirement plan sponsors. Retirement plan sponsors can select a conservative, moderate, or growth version of the funds based on the needs of participants in the plan.

In 2017, we further redesigned the user interface of Retirement Manager and transitioned many of our provider clients to the new version.

Pricing for Workplace Solutions depends on several different factors, including the level of services offered (including whether the services involve acting as a fiduciary under the Employee Retirement Income Security Act, or ERISA), the number of participants, the level of systems integration required, and the availability of competing products.

Our main competitors for Workplace Solutions are Financial Engines and Guided Choice as well as companies that provide automated investment advice, such as Betterment and Wealthfront. For the Lifetime Allocation Funds, we compete with other providers of target-date funds, such as Vanguard, Fidelity, and T. Rowe Price.

Workplace Solutions is our fifth-largest product based on revenue and made up 8.1% of revenue in 2017, compared with 8.9% in 2016 and 8.4% in 2015.

PitchBook Data

PitchBook Data, Inc., which Morningstar acquired in December 2016, provides data, research, and technology covering the private capital markets, including venture capital, private equity, and M&A. PitchBook's main product is the PitchBook Platform, an all-in-one research and analysis workstation for sophisticated investment and research professionals. Close to 14,000 professionals use this software to source deals, raise funds, build buyer lists, create benchmarks, network, and more. To accommodate their diverse needs, the platform offers advanced search functionality, a fully customizable dashboard and email alerts that help users discover and monitor relevant information.

PitchBook also offers a mobile application, Excel plug-in, data feeds, and flexible, à la carte data solutions that allow clients to access a variety of data points on demand.

In 2017, we integrated Morningstar’s in-depth fundamental data and equity research into PitchBook and we now provide comprehensive data coverage and information for publicly traded companies worldwide. PitchBook also significantly expanded its European data sets, doubling private European company coverage to over 340,000 companies. We also launched a new interface for the platform, creating a more scalable and intuitive product to enhance the user experience.

PitchBook's main competitors are CB Insights, Dow Jones VentureSource, Prequin, S&P Capital IQ, and Thomson Reuters.

Pricing for the PitchBook Platform is based on the number of seats, with the standard base license generally priced at $32,500 for the first five seats, and pricing for additional seats generally priced at $6,500 per user, with customized prices for large enterprises, boutiques, and startup firms.

PitchBook is our sixth-largest product based on revenue and made up 7% of revenue in 2017, compared with 0.5% in 2016. Because the PitchBook acquisition closed in December, PitchBook contributed approximately one month of revenue in 2016.

Morningstar.com

Our largest website, Morningstar.com, helps individual investors discover, evaluate, and monitor stocks and funds; build and monitor portfolios; and monitor the markets. Revenue is generated from paid memberships through Morningstar Premium and Internet advertising sales, which respectively made up approximately 53% and 47% of Morningstar.com’s total revenue in 2017.

Our Morningstar Premium offering is focused on bringing clarity and confidence to investment decisions. Members have access to proprietary Morningstar research, ratings, data and tools, including analyst reports, portfolio management tools (such as Portfolio X-Ray), and premium stock and fund screeners.

We currently offer Premium Membership services in Australia, Canada, Italy, the United Kingdom, and the United States.

In 2017, we continued to build out and optimize our redesigned site. The site features a new user interface focused on helping individual investors select and monitor investments. We plan to complete the rollout of the new site during 2018, including a new fund report page and new portfolio and screener experiences.

Morningstar.com primarily competes with The Motley Fool, Seeking Alpha, TheStreet.com, and Yahoo! Finance, as well as other finance and brokerage sites.

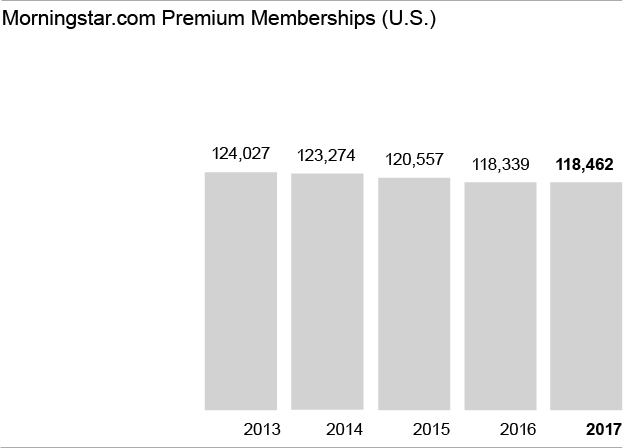

As of December 31, 2017, Morningstar.com had about 11.9 million registered free members worldwide. We also had approximately 118,000 paid Premium members in the United States plus an additional 11,000 Premium members across other global markets. We currently charge $23.95 for a monthly subscription, $199 for an annual subscription, $339 for a two-year subscription, and $439 for a three-year subscription for Morningstar.com's Premium Membership service.

Morningstar Enterprise Components

Morningstar Enterprise Components is a set of tools and capabilities that help institutional clients build customized websites or enhance their existing solutions. We offer a series of API components, editorial content, and reports that investment firms can license to build or enhance their websites for financial advisors and individual investors. We also offer licenses for investment research, editorial content, and portfolio analysis and comparison tools that allow users to drill down into the underlying data when researching a potential investment.

In 2017, we continued to roll out the new Morningstar Developer platform, now known as Morningstar as a Service, which provides clients with direct access to our tools, components, data, calculation engines, and APIs. The site empowers clients by giving them the flexibility to develop their own solutions using Morningstar components.

For Enterprise Components, our primary competitors include Factset, Financial Express, Interactive Data Corporation, Markit on Demand, and Thomson Reuters.

Pricing for Enterprise Components consists of both ongoing license fees and one-time development fees and depends on the solution being offered, the number of users and level of distribution, and the amount of client integration involved.

Morningstar Research

We offer Morningstar Research, including Equity Research and Manager Research, through Morningstar Research Services LLC and a variety of other subsidiaries outside the United States. We offer Equity Research to institutional investors who use it to supplement their own research, as well as to broker-dealers who provide our research to their affiliated financial advisors or individual investor clients. Our Manager Research services help institutional investors and manager research due diligence teams evaluate funds, investment strategies, and asset management firms.

During 2017, we continued to evolve our manager research solutions, which help wealth management firms evaluate managed investments and perform due diligence on the products they offer to clients. We also progressed our Morningstar Quantitative Rating, a forward-looking rating assigned by a model that is designed to estimate what the Morningstar Analyst Rating would be on managed products not covered by our manager research analysts.

Our Equity Research services compete with CFRA Research (formerly S&P Capital IQ Equity Research) and Zack's Investment Research, as well as sell-side firms, internal providers, and smaller boutique firms. Our Manager Research services mainly compete with Mercer, Willis Towers Watson, and Wilshire Associates.

Pricing for Morningstar Research varies based on the level of distribution, the type of investors who are using our research, the number of securities or investment strategies covered, the amount of custom coverage and client support required, and the length of the contract term.

Morningstar Credit Ratings

Morningstar Credit Ratings, LLC is an NRSRO that provides timely new issue and surveillance ratings and analysis for structured credits, as well as operational risk assessment services. We provide ratings on a broad range of structured finance securities, including commercial mortgage-backed securities, residential mortgage-backed securities, single-family rental securities, and asset-backed securities. We also provide ratings for corporate issuers and financial institutions.

In 2017, we expanded our research and ratings, most notably in asset-backed securities, which had a positive impact on financial performance.

Our business competes with several other firms, including DBRS, Fitch, Kroll Bond Ratings, Moody’s, and S&P Global Ratings.

We charge annual fees for our subscription-based CMBS surveillance software and data services, which are paid for by the user. Pricing for these services varies depending on the solution and the level of access within a client organization. For new-issue ratings, we charge one-time fees to the issuer based on the type of security, the size of the transaction, and the complexity of the issue. In addition to the initial rating fee, clients pay annual surveillance fees that continue until the securities mature.

Morningstar Indexes

We offer an extensive set of investment indexes that can be used to benchmark the market and create investment products, including indexes that track the global equity markets, sector, and investment style; strategic beta indexes; dividend indexes; active equity indexes based on Morningstar’s equity research; bond indexes; commodity indexes; hedge fund indexes; asset allocation indexes; and a family of sustainability indexes.

In 2017, we globalized our strategic beta indexes, which included a family of dividend-based indexes and moat-focused indexes that draw upon our proprietary research. We also further developed our Global Sustainability Indexes, which incorporate environmental, social and governance factors into the investment process.

We expanded the Morningstar Open Indexes Project, offering asset managers and other firms the ability to benchmark their investments against more than 100 Morningstar global equity indexes for free. The goal of the project is to lower benchmarking costs for the industry and improve outcomes for investors in response to the escalating cost of market-cap-weighted equity indexes. Participants receive price return, total return, net return, and month-end constituent data for indexes included in the project.

We currently license Morningstar Indexes to numerous institutions that offer ETFs and exchange-traded notes based on the indexes. Firms license Morningstar Indexes for both product creation (where we typically receive the greater of a minimum fee or basis points tied to assets under management) and data licensing (where we typically receive annual licensing fees). In both cases, our pricing varies based on the level of distribution, the type of user, and the specific indexes licensed.

Major competitors for Morningstar Indexes include FTSE Russell, MSCI, and S&P Dow Jones Indices (offered through S&P Global).

International Operations

We conduct our business operations outside of the United States through wholly owned or majority-owned operating subsidiaries based in each of the following 26 countries: Australia, Brazil, Canada, Chile, Denmark, France, Germany, India, Italy, Japan, Luxembourg, Mexico, the Netherlands, New Zealand, Norway, People's Republic of China (both Hong Kong and the mainland), Singapore, South Africa, South Korea, Spain, Sweden, Switzerland, Taiwan, Thailand, United Arab Emirates, and the United Kingdom. See Note 5 of the Notes to our Consolidated Financial Statements for additional information concerning revenue from customers and long-lived assets from our business operations outside the United States.

Intellectual Property and Other Proprietary Rights

We treat our brand name and logo, product names, databases and related content, software, technology, know-how, and the like as proprietary. We seek to protect this intellectual property by using: (i) trademark, copyright, patent and trade secrets laws; (ii) licensing and nondisclosure agreements; and (iii) other security and related technical measures designed to restrict unauthorized access and use. For example, we generally provide our intellectual property to third parties through the use of standard licensing agreements, which define the extent and duration of any third-party usage rights and provide for our continued ownership in any intellectual property furnished.

Because of the value of our brand name and logo, we generally seek to register one or both of them as trademarks in all relevant international classes in any jurisdiction in which we have business offices or significant operations. We have registered the Morningstar name and/or logo in approximately 50 jurisdictions, including the European Union, and currently have registrations pending in several others. In some jurisdictions, we may also choose to register one or more product names.

“Morningstar” and the Morningstar logo are both registered marks of Morningstar in the United States. The table below includes some of the trademarks and service marks referenced in this report:

|

| | |

Morningstar® Advisor Workstation SM | | Morningstar® Portfolio X-Ray® |

Morningstar Analyst Rating TM | | Morningstar Rating™ |

Morningstar® ByAllAccounts® | | Morningstar® Retirement Manager SM |

Morningstar® Data | | Morningstar® Stewardship Grade SM |

Morningstar Direct SM | | Morningstar Style Box™ |

Morningstar® Enterprise Components SM | | Morningstar Sustainability Rating™ |

Morningstar® Managed Portfolios SM | | Morningstar.com® |

Morningstar Market Barometer SM | | PitchBook® |

Morningstar Office SM | | |

In addition to trademark registrations, we currently hold several patents in the United States, including a recently issued patent for a coordinate-based document processing system and several patents held by our wholly owned subsidiary, Morningstar Investment Management LLC, for lifetime asset allocation and asset allocation with annuities.

License Agreements

We license our products and related intellectual property to our customers, generally for a fee. As a rule, we use our standard agreement forms and we do not provide our products and services to customers or other users without having an agreement in place.

We maintain licensing agreements with most of our larger Morningstar operating companies around the world to allow them to access and use our intellectual property, including, without limitation, our products, trademarks, databases and content, technology, and know-how. We put these agreements in place to allow our operating companies to both market standard Morningstar products and services in their operating territories and to develop and sell territory-specific variants of those products under the Morningstar name in their specific territories.

In the ordinary course of our business, we obtain and use intellectual property from a wide variety of sources, including licensing it from third-party providers, developing it internally, and gathering it through publicly available sources (e.g., regulatory filings).

Seasonality

We believe our business has a minimal amount of seasonality. Some of our smaller products, such as our annual investment conference in Chicago, generate the majority of their revenue in the first or second quarter of the year. We sell most of our products with subscription or license terms of at least one year, though, and we recognize revenue ratably over the term of each subscription or license agreement. This tends to offset most of the seasonality in our business.

We believe market movements generally have more influence on our performance than seasonality. The revenue we earn from asset-based fees depends on the value of assets on which we provide advisory services, and the size of our asset base can increase or decrease along with trends in market performance.

Largest Customer

In 2017, our largest customer accounted for less than 2% of our consolidated revenue.

Competitive Landscape

The economic and financial information industry includes a few large firms as well as numerous smaller companies, including startup firms. Some of our main competitors include Bloomberg, S&P Global, and Thomson Reuters. These companies have financial resources that are significantly greater than ours. We also compete with a variety of other companies in specific areas of our business. We discuss some of the key competitors in each area in the Major Products and Services section of this report.

We believe the most important competitive factors in our industry are brand and reputation, data accuracy and quality, technology, breadth of data coverage, quality of investment research and analytics, design, product reliability, and value of the products and services provided.

Research and Development

A key aspect of our growth strategy is to expand our investment research capabilities and enhance our existing products and services. We strive to adopt new technology that can improve our products and services. As a general practice, we manage our own websites and build our own software rather than relying on outside vendors. This allows us to control our technology development and better manage costs, enabling us to respond quickly to market changes and to meet customer needs efficiently. As of December 31, 2017, our technology team consisted of approximately 1,310 programmers and technology and infrastructure professionals.

Government Regulation

United States

Investment advisory and broker-dealer businesses are subject to extensive regulation in the United States at both the federal and state level, as well as by self-regulatory organizations. Financial services companies are among the nation's most extensively regulated. The SEC is responsible for enforcing the federal securities laws and oversees federally registered investment advisors and broker-dealers.

Three of our subsidiaries, Morningstar Investment Management LLC, Morningstar Investment Services LLC, and Morningstar Research Services LLC, are registered as investment advisors with the SEC under the Investment Advisers Act of 1940 (Advisers Act). As registered investment advisors, these companies are subject to the requirements and regulations of the Advisers Act. These requirements relate to, among other things, record-keeping, reporting, and standards of care, as well as general anti-fraud prohibitions. As registered investment advisors, these subsidiaries are subject to on-site examination by the SEC.

In addition, in cases where these subsidiaries provide investment advisory services to retirement plans and their participants, they may be acting as fiduciaries under the Employee Retirement Income Security Act of 1974 (ERISA). As fiduciaries under ERISA, they have duties of loyalty and prudence, as well as duties to diversify investments and to follow plan documents to comply with the applicable portions of ERISA.

Morningstar Investment Services is a broker-dealer registered under the Securities Exchange Act of 1934 (Exchange Act) and a member of FINRA. The regulation of broker-dealers has, to a large extent, been delegated by the federal securities laws to self-regulatory organizations, including FINRA. Subject to approval by the SEC, FINRA adopts rules that govern its members. FINRA and the SEC conduct periodic examinations of the brokerage operations of Morningstar Investment Services.

Broker-dealers are subject to regulations that cover all aspects of the securities business, including sales, capital structure, record-keeping, and the conduct of directors, officers, and employees. Violation of applicable regulations can result in the revocation of a broker-dealer license, the imposition of censures or fines, and the suspension or expulsion of a firm or its officers or employees. As a registered broker-dealer, Morningstar Investment Services is subject to certain net capital requirements under the Exchange Act. These requirements are designed to regulate the financial soundness and liquidity of broker-dealers.

Morningstar Credit Ratings, LLC is registered with the SEC as a Nationally Recognized Statistical Rating Organization (NRSRO) specializing in rating structured finance investments, corporate credit issuers, and financial institutions. As an NRSRO, Morningstar Credit Ratings is subject to certain requirements and regulations under the Exchange Act. These requirements relate to, among other things, record-keeping, reporting, governance, and conflicts of interest. As part of its NRSRO registration, Morningstar Credit Ratings is subject to annual examination by the SEC.

Australia

Our subsidiaries that provide financial information services and advice in Australia, Morningstar Australasia Pty Limited and Morningstar Investment Management Australia Ltd., are registered under an Australian Financial Services license and are subject to oversight by the Australian Securities and Investments Commission (ASIC). This license requires them to, among other things, maintain positive net asset levels and sufficient cash resources to cover three months of expenses and to comply with the audit requirements of the ASIC.

United Kingdom

Morningstar Investment Management Europe Limited is authorized and regulated by the Financial Conduct Authority (FCA) to provide advisory services in the United Kingdom. As an authorized firm, Morningstar Investment Management Europe Limited is subject to the requirements and regulations of the FCA. Such requirements relate to, among other things, financial reporting and other reporting obligations, record-keeping, and cross-border requirements.

In addition, our index business, as a non-European Union administrator of indexes, will be seeking recognition from the FCA under EU benchmark regulations that have recently become effective to administer indexes in the EU. Morningstar Investment Management Europe Limited will act as our legal representative for this purpose in the EU. Compliance with these regulations will require us to, among other things, comply with the IOSCO Principles for Financial Benchmarks and related certification requirements.

Other Regions

We have a variety of other entities (including in Canada, France, Hong Kong, India, Japan, Korea, and South Africa) that are registered with their respective regulatory bodies; however, the amount of business conducted by these entities related to the registration is relatively small.

Additional legislation and regulations, including those relating to the activities of investment advisors and broker-dealers, changes in rules imposed by the SEC or other U.S. or non-U.S. regulatory authorities and self-regulatory organizations, or changes in the interpretation or enforcement of existing laws and rules may adversely affect our business and profitability.

Employees

We had 4,920 employees globally as of December 31, 2017, including approximately 1,050 data analysts, 80 designers, 460 investment analysts (including consulting and quantitative research analysts), 1,310 programmers and technology staff, and 530 sales and marketing professionals. Our U.S.-based employees are not represented by any unions, and we have never experienced a walkout or strike.

Executive Officers

As of March 1, 2018, we had nine executive officers. The table below summarizes information about each of these officers.

|

| | | | |

Name | | Age | | Position |

Joe Mansueto | | 61 | | Executive Chairman |

Kunal Kapoor | | 42 | | Chief Executive Officer |

Jason Dubinsky | | 44 | | Chief Financial Officer |

Bevin Desmond | | 51 | | Head of Talent and Culture |

Danny Dunn | | 42 | | Chief Revenue Officer |

Haywood Kelly | | 49 | | Head of Global Research |

Pat Maloney | | 60 | | General Counsel |

Daniel Needham | | 39 | | President and Chief Investment Officer, Investment Management |

Tricia Rothschild | | 51 | | Chief Product Officer |

Joe Mansueto

Joe Mansueto founded Morningstar in 1984 and became executive chairman in 2017. He has served as chairman of the board since the company's inception. He served as our chief executive officer from 1984 to 1996 and again from 2000 to 2016.

Under Joe’s leadership, Morningstar has been named twice to Fortune magazine’s “100 Best Companies to Work For” list, in 2011 and 2012. The Chicago Tribune recognized Morningstar as one of the top 100 workplaces in the Chicago area in 2010, 2011, and 2012, and Crain’s Chicago Business listed Morningstar in its Fast Fifty feature in 2007, 2008, 2009, and 2011. Morningstar won the 2010 AIGA Chicago Chapter Corporate Design Leadership Award, which recognizes forward-thinking organizations that have advanced design by promoting it as a meaningful business policy.

In December 2016, InvestmentNews named Joe to its list of 20 Icons & Innovators. MutualFundWire.com recognized Joe as one of the 10 most influential individuals in the mutual fund industry in 2015, and he was the recipient of PLANSPONSOR’s Lifetime Achievement Award in 2013. In 2010, Joe received the Tiburon CEO Summit award, MutualFundWire.com named him ninth on its list of the 100 Most Influential People of the year, and Chicago magazine listed Joe among its top 40 Chicago pioneers over the past four decades. In 2007, SmartMoney magazine recognized him in the “SmartMoney Power 30,” its annual list of the 30 most powerful forces in business and finance. He received the Distinguished Entrepreneurial Alumnus Award from the University of Chicago Booth School of Business in 2000.

Joe holds a bachelor's degree in business administration from The University of Chicago and a master's degree in business administration from The University of Chicago Booth School of Business.

Kunal Kapoor

Kunal Kapoor is chief executive officer of Morningstar and a member of our board of directors. Before assuming his current role in 2017, he served as president, responsible for product development and innovation, sales and marketing, and driving strategic prioritization across the firm.

Before becoming president in 2015, Kunal was head of global products and client solutions. Kunal became head of our global client solutions group in 2013 and took on additional responsibility for the products group in February 2014. For part of 2013, he was president of our Data Division, and from 2010 until 2012, he was president of Equity and Market Data/Software. In 2009 and 2010, he was president of Individual Software. Kunal joined Morningstar in 1997.

He holds a bachelor's degree in economics and environmental policy from Monmouth College and a master's degree in business administration from The University of Chicago Booth School of Business. He also holds the Chartered Financial Analyst (CFA) designation.

Jason Dubinsky

Jason Dubinsky is chief financial officer for Morningstar, responsible for controllership, tax, treasury, internal audit, financial planning and analysis, and investor relations.

Before joining Morningstar in 2017, Jason served as senior vice president and chief financial officer of planning and central operations for Walgreens Boots Alliance, Inc., where he was responsible for accounting and shared service functions for Walgreens' U.S. operations and led the financial planning and analysis function for the global business. Prior to the merger of Walgreens and Alliance Boots in 2014, he was Walgreens' vice president of finance and treasurer, with responsibility for business unit finance, treasury operations, risk management, and investor relations. Before joining Walgreens in 2009, he served as vice president of investment banking at Goldman Sachs and Lehman Brothers, where he led mergers and acquisitions and corporate finance activity for clients across various industries.

Jason holds a bachelor's degree in business administration from the University of Michigan and a master’s degree in business administration from New York University's Stern School of Business.

Bevin Desmond

Bevin Desmond is head of talent and culture, a role she has held since 2010. She is responsible for overseeing talent and culture for all of Morningstar’s global operations. Previously, she was head of global markets from 2010 to 2017 and head of international operations from 2001 until 2010. She joined Morningstar in 1993.

Bevin holds a bachelor's degree in psychology from St. Mary's College.

Danny Dunn

Danny Dunn is chief revenue officer for Morningstar. He is responsible for sales philosophy, strategy, and execution in order to drive revenue growth.

Before joining Morningstar in 2016, Danny was vice president of the Midwest enterprise unit for IBM, a global information technology firm. He was responsible for marketing, strategy, sales, channels, and customer service for the complete IBM portfolio, including Cloud, Software, Services, Systems, and IBM Credit, LLC in the region. Prior to that, he was regional director for IBM's Chicago enterprise unit in 2013 and 2014, territory director for IBM's Wisconsin business unit from 2011 until June 2013, and territory sales leader for IBM Global Services from 2009 until July 2011. Before joining IBM in 2007, he led sales, account management, and client service at Neology, a software and technology consulting division of SmithBucklin Corporation.

Danny holds a bachelor’s degree from the University of Vermont and a master’s degree in business administration, with concentrations in marketing, strategy, and managerial economics, from the Kellogg School of Management at Northwestern University.

Haywood Kelly

Haywood Kelly is head of global research for Morningstar and oversees our global fund, equity, and credit research and data operations. Before taking on his current role in January 2014, he was head of equity and credit research since 2009 and took on additional responsibility for equity data in 2013. Haywood joined Morningstar in 1991.

He holds a bachelor’s degree in economics from The University of Chicago, where he graduated as a member of Phi Beta Kappa. He also holds the CFA designation.

Pat Maloney

Pat Maloney is general counsel for Morningstar. He is responsible for directing Morningstar’s legal department and managing its relationships with outside counsel. He also oversees Morningstar’s compliance department.

Before joining Morningstar in June 2016, Pat was a partner at Sheppard Mullin Richter & Hampton LLP from July 2012 through April 2016 in the firm’s corporate and securities practice. Previously, he was a partner at K&L Gates LLP and its legacy predecessor firm, Bell, Boyd & Lloyd LLP. Early in his career, he was an associate with the New York law firm of Dewey Ballantine and an Assistant General Counsel with the Prudential Insurance Company of America.

Pat holds a bachelor’s degree with honors from The University of Chicago and a juris doctor degree with honors from The University of Chicago Law School. He is admitted to practice law in Illinois and New York.

Daniel Needham

Daniel Needham is president and chief investment officer (CIO) of Morningstar Investment Management and is responsible for building world-class investment management solutions based on our proprietary research. Before taking on his current role in February 2015, he served as CIO for Morningstar Investment Management, and was previously managing director and CIO for Morningstar Investment Management’s Asia-Pacific Operations. He joined our company when Morningstar acquired Intech Pty Ltd (now Ibbotson Associates Australia) in 2009, where he served as chief investment officer. Before joining Intech in 2002, Daniel worked for Zurich Financial Services in Sydney.

He holds a bachelor's degree in commerce with a major in finance and economics from the University of Sydney. He also holds the CFA designation.

Tricia Rothschild

Tricia Rothschild is chief product officer for Morningstar. She is responsible for product strategy, innovation, development, and execution for the solutions delivered to clients.

Before taking on her current role in January 2017, Tricia was head of global advisor solutions for Morningstar, setting the strategic direction for our wealth management and online brokerage business and overseeing priorities for this customer group. From September 2012 until February 2013, Tricia was senior vice president of advisor software for Morningstar. Previously, she served as senior vice president for Morningstar's equity research business and held a variety of research and product management roles after joining Morningstar in 1993.

Tricia holds a bachelor’s degree from Northwestern University and a master’s degree in Russian and Central European economics from Indiana University. She also holds the CFA designation.

Company Information

We were incorporated in Illinois on May 16, 1984. Our corporate headquarters are located at 22 West Washington Street, Chicago, Illinois, 60602.

We maintain a website at http://www.morningstar.com/company. Our annual report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, and amendments to any of these documents are available free of charge on this site as soon as reasonably practicable after the reports are filed with or furnished to the SEC. We also post quarterly press releases on our financial results and other documents containing additional information related to our company on this site. We provide this website and the information contained in or connected to it for informational purposes only. That information is not part of this Annual Report on Form 10-K.

Item 1A. Risk Factors

You should carefully consider the risks described below and all of the other information included in this Form 10-K when deciding whether to invest in our common stock or otherwise evaluating our business. If any of the following risks materialize, our business, financial condition, or operating results could suffer. In this case, the trading price of our common stock could decline, and you may lose all or part of your investment.

Our investment management operations may subject us to liability for any losses that result from a breach of our fiduciary duties.

Three of our subsidiaries, Morningstar Investment Management LLC, Morningstar Investment Services LLC, and Morningstar Research Services LLC, are registered as investment advisors with the SEC under the Investment Advisers Act of 1940, as amended. As registered investment advisors, these companies are subject to the requirements and regulations of the Advisers Act. These requirements relate to, among other things, record-keeping, reporting, and standards of care, as well as general anti-fraud prohibitions. As registered investment advisors, these subsidiaries are subject to on-site examination by the SEC.

In addition, in cases where these subsidiaries provide investment advisory services to retirement plans and their participants, they may be acting as fiduciaries under the Employee Retirement Income Security Act of 1974. As fiduciaries under ERISA, they have obligations to act in the best interest of their clients. They also have duties of loyalty and prudence, as well as duties to diversify investments and to follow plan documents to comply with the applicable portions of ERISA.

Our subsidiaries outside the United States that have investment advisory operations are subject to similar requirements.

We may face liabilities for actual or claimed breaches of our fiduciary duties, particularly in areas where we provide retirement advice and managed retirement accounts. In some of our retirement contracts, we act as an ERISA fiduciary by, for example, selecting and monitoring a broad range of diversified plan options. We also provide a managed account service for retirement plan participants who elect to have their accounts managed by our programs. Such activities have been the subject of increasing class action litigation in recent years. For example, in 2017, a participant in a pension plan filed a putative class action proceeding against us alleging that we, together with other defendant parties, violated the Racketeer Influenced and Corrupt Organizations Act by allegedly engaging in actions to steer plan participants into high-cost investments that pay unwarranted fees to the defendants. We are vigorously contesting this proceeding, which is described in more detail in Item 3 of this Form 10-K under Legal Proceedings. As of December 31, 2017, we had $57.6 billion in assets under management in our managed retirement accounts. We could face substantial liabilities related to our management of these assets.

We rely on automated investment technology for our retirement advice and managed retirement accounts services. The Wealth Forecasting Engine is our core advice and managed accounts engine that determines appropriate asset allocations for retirement plan participants and assigns individuals to portfolios. We also rely on automated portfolio construction tools. Problems could arise if these programs assigned retirement plan participants to the wrong portfolios, particularly if we failed to detect program errors over an extended period. Clients may take legal action against us for an actual or claimed breach of a fiduciary duty. If we make an error, we may be subject to potentially large liabilities for make-whole payments and/or litigation. We cannot quantify the potential size of these liabilities with any level of precision.

In addition, we may face other legal liabilities based on the quality and outcome of our investment advisory recommendations, even in the absence of an actual or claimed breach of fiduciary duty, or based on our investment management fees and expenses. In total, we provided investment advisory and management services on approximately $195 billion in assets as of December 31, 2017. We could face substantial liabilities related to our work on these assets.

Failing to maintain and protect our brand, independence, and reputation may harm our business. Our reputation and business may also be harmed by allegations made about possible conflicts of interest or by other negative publicity or media reports.

We believe independence is at the core of our business, and our reputation is our greatest corporate asset. We rely on our reputation for integrity and high-caliber products and services. Any failure to uphold our high ethical standards and ensure that our customers have a consistently positive experience with us could damage our reputation as an objective, honest, and credible source for investment research and information. Allegations of improper conduct, whether the ultimate outcome is favorable or unfavorable to us, as well as any negative publicity or media reports about Morningstar, whether valid or not, may harm our reputation and damage our business. For instance, in October 2017, The Wall Street Journal ran an article critical of our fund star and analyst ratings. We publicly and comprehensively disputed the assertions made in the article, but the publication of such an article illustrates the risks of negative publicity to our business.

We provide ratings, analyst research, and investment recommendations on mutual funds and other investment products offered by our institutional clients. We also provide investment advisory and investment management services. In some cases, we make investment recommendations (such as Select Lists) within the framework of client constraints. While we don’t charge asset management firms for their products to be rated, we do charge licensing fees for the use of our ratings. We also receive payments from issuers for our new-issue ratings on various types of asset-backed securities and corporate bond issues. These payments may create the perception that our ratings, research, and recommendations are not impartial.

This perception may undermine the confidence of our customers and potential customers in our reputation as a provider of independent research. Any such loss of confidence or damage to our reputation could hurt our business.

Our reputation may also be harmed by factors outside of our control, such as news reports about our clients or adverse publicity about certain investment products. Our reputation could also suffer if we fail to produce competitive performance in our investment management offerings.

Failing to differentiate our products and continuously create innovative, proprietary research tools may harm our competitive position and business results.

We attribute much of our company's success over the past 34 years to our ability to develop innovative, proprietary research tools, such as the Morningstar Rating, Morningstar Style Box, Ownership Zone, and Portfolio X-Ray. More recently, we’ve developed unique concepts and tools such as the Wealth Forecasting Engine, Gamma, Total Wealth Approach, and Best Interest Scorecard. We believe these innovations set us apart because most of our competitors focus on providing data or software rather than creating their own proprietary research frameworks. We also believe our ability to develop innovative, proprietary research tools is at the core of what drives Morningstar’s value for all of our customer groups.