UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C.

20549

Form 20-F

(Mark One)

[ ] REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR (g) OF THE SECURITIES EXCHANGE ACT OF 1934

OR

[ X] ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2014

OR

[ ] TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

OR

[ ] SHELL COMPANY PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

Date of event requiring this shell company report __________________

Commission file number: 333-183376

Xtra-Gold Resources Corp.

(Exact name of Registrant

as specified in its charter)

not applicable

(Translation of Registrant’s name into

English)

British Virgin Islands

(Jurisdiction of incorporation

or organization)

357 Bay Street, Suite 902, Toronto, Ontario Canada, M5H 2T7

(Address of principal executive offices)

Paul Zyla, 416-366-4227 (telephone), 416-981-3055

(facsimile), 357 Bay Street, Suite 902, Toronto, Ontario Canada, M5H 2T7

(Name, Telephone, E-mail and/or Facsimile number and Address of Company

Contact Person)

Securities registered or to be registered pursuant to Section 12(b) of the Act.

| Title of each class | Name of each exchange on which registered |

| None | Not applicable |

Securities registered or to be registered pursuant to Section

12(g) of the Act.

None

(Title of Class)

Securities for which there is a reporting obligation pursuant to

Section 15(d) of the Act.

Common shares

(Title of Class)

- 1 -

Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered by the annual report.

| Title of each class | Outstanding at December 31, 2014 |

| Common shares | 45,811,417 |

Indicate by check mark if the registrant is a well-known

seasoned issuer, as defined in Rule 405 of the Securities Act.

[ ] Yes [ X]

No

If this report is an annual or transition report, indicate by

check mark if the registrant is not required to file reports pursuant to Section

13 or Section 15(d) of the Act.

[ ] Yes [ X] No

Indicate by check mark whether the registrant (1) has filed all

reports required to be filed by Section 13 or 15(d) of the Securities Exchange

Act of 1934 during the preceding 12 months (or for such shorter period that the

registrant was required to file such reports), and (2) has been subject to such

filing requirements for the past 90 days.

[ X] Yes [ ] No

Indicate by check mark whether the registrant has submitted

electronically and posted on its corporate web site, if any, every Interactive

Data File required to be submitted and posted pursuant to Rule 405 of Regulation

S-T (§232.405 of this chapter) during the preceding 12 months (or for such

shorter period that the registrant was required to submit and post such files).

[ X] Yes [ ] No

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer: See definition of “accelerated filer and large accelerated filer” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer [ ] | Accelerated filer [ ] | Non-accelerated filer [ X] |

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

| U.S. GAAP [ X] |

International Financial Reporting as issued by the [ ] |

Other [ ] |

|

International Accounting Standards Board |

If “Other” has been checked in response to the previous

question, indicate by check mark which financial statement item the registrant

has elected to follow.

[ ] Item 17 [ ] Item 18

If this is an annual report, indicate by check mark whether the

registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

[ ] Yes [ X] No

- 2 -

TABLE OF CONTENTS

PART I

- 3 -

- 4 -

GENERAL MATTERS

Use of Names

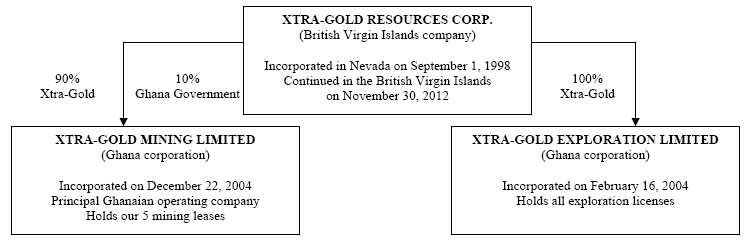

In this annual report filed on Form 20-F, the terms “Xtra-Gold”, “company”, “we”, and “our” refers to Xtra-Gold Resources Corp., a British Virgin Islands company, and our wholly-owned subsidiaries, Xtra-Gold Exploration Limited and Xtra Oil & Gas (Ghana) Limited and our 90% owned subsidiary, Xtra-Gold Mining Limited.

Currency

Unless otherwise specified, all dollar amounts in this annual report are expressed in United States dollars.

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

This annual report, including all exhibits hereto, contains forward-looking statements and forward-looking information. Forward-looking statements are with reference to our financial condition, results of operations, business prospects, plans, objectives, goals, strategies, future events, capital expenditure, and exploration and development efforts. Words such as “anticipates”, “expects”, “intends”, “plans”, “forecasts”, “projects”, “budgets”, “believes”, “seeks”, “estimates”, “could”, “might”, “should”, and similar expressions identify forward-looking statements. Although we believe that our plans, intentions and expectations reflected in these forward-looking statements are reasonable, we cannot be certain that these plans, intentions or expectations will be achieved. Actual results, performance or achievements could differ materially from those contemplated, expressed or implied by the forward-looking statements. These statements include comments regarding the establishment and estimates of mineral reserves and mineral resources, production, production commencement dates, productions costs, cash operating costs per ounce, total cash costs per ounce, grade, processing capacity, potential mine life, feasibility studies, development costs, capital and operating expenditures, exploration, the closing of certain transactions including acquisitions and offerings. All statements, other than statements of historical facts, included in this annual report, our other filings with the SEC and Canadian securities commissions and in news releases and public statements made by our officers, directors or representatives of our company, that address activities, events or developments that we expect or anticipate will or may occur in the future are forward-looking statements and forward-looking information.

The following, in addition to the factors described elsewhere in this annual report under “Risk Factors”, are among the factors that could cause actual results to differ materially from the forward-looking statements:

| • | our ability to continue as a going concern |

| • | unexpected changes in business and economic conditions; |

| • | significant increases or decreases in gold prices; |

| • | changes in interest rates and currency exchange rates; |

| • | unanticipated grade changes; |

| • | changes in metallurgy; |

| • | access and availability of materials, equipment, supplies, labor and supervision, power and water; |

| • | determination of mineral resources and mineral reserves; |

| • | availability of drill rigs; changes in project parameters; |

| • | costs and timing of development of new mineral reserves; results of current and future exploration activities; |

| • | results of pending and future feasibility studies; joint venture relationships; |

| • | political or economic instability, either globally or in the countries in which we operate; |

| • | local and community impacts and issues; |

| • | timing of receipt of government approvals; accidents and labor disputes; environmental costs and risks; and |

| • | competitive factors, including competition for property acquisitions; and availability of capital at reasonable rates or at all. |

With respect to any forward-looking statement that includes a statement of its underlying assumptions or bases, we believe such assumptions or bases to be reasonable and have formed them in good faith, assumed facts or bases almost always vary from actual results, and the differences between assumed facts or bases and actual results can be material depending on the circumstances. When, in any forward-looking statement, we express an expectation or belief as to future results, that expectation or belief is expressed in good faith and is believed to have a reasonable basis, but there can be no assurance that the stated expectation or belief will result or be achieved or accomplished.

- 5 -

All subsequent written and oral forward-looking statements attributable to us, or anyone acting on our behalf, are expressly qualified in their entirety by the cautionary statements. Except for our ongoing obligations to disclose material information under the Federal securities laws, we do not undertake any obligations to publicly release any revisions to any forward-looking statements to reflect events or circumstances after the date of this annual report or to reflect unanticipated events that may occur. These forward-looking statements speak only as of the date of this annual report and you should not rely on these statements without also considering the risks and uncertainties associated with these statements and our business.

- 6 -

PART I

| Item 1 | Identity of Directors, Senior Management and Advisors |

This Form 20-F is being filed as an annual report under the Securities Exchange Act of 1934 and, as such, there is no requirement to provide any information under this item.

| Item 2 | Offer Statistics and Expected Timetable |

This Form 20-F is being filed as an annual report under the Securities Exchange Act of 1934 and, as such, there is no requirement to provide any information under this item.

| Item 3 | Key Information | |

| A. | Selected Financial Data | |

The following financial information has been extracted from our consolidated financial statements for the years indicated and is expressed in United States dollars. Our consolidated financial statements were prepared in accordance with U.S. generally accepted accounting principles (“U.S. GAAP”). The historical data included below and elsewhere in this annual report is not necessarily indicative of our future performance. The financial information should be read in conjunction with our consolidated financial statements and related notes included in this annual report and “Item 5. Operating and Financial Review and Prospects – A. Operating Results” and “B. Liquidity and Capital Resources” of this annual report.

In this annual report, all currency refers to United States Dollars (US$) unless indicated otherwise.

The following table summarizes information relating to the operations of Xtra-Gold for the last five fiscal years ended December 31.

For the Year Ended December 31

| 2014 | 2013 | 2012 | 2011 | 2010 | |

| $ | $ | $ | $ | $ | |

| Operating revenues | Nil | Nil | Nil | Nil | Nil |

| Consolidated loss and comprehensive loss for the year | (687,057) | (750,942) | (7,631,636) | (5,794,927) | (2,976,645) |

| Net loss and comprehensive loss attributable

to non-controlling interest |

6,842 |

8,849 |

466,378 |

470,170 |

(40,268) |

| Net loss and comprehensive loss attributable

to Xtra-Gold Resources Corp. |

(693,899) |

(742,093) |

(7,165,258) |

(5,324,757) |

(3,016,913) |

| Basic and diluted loss attributable to

common shareholders per common share |

(0.02) |

(0.02) |

(0.16) |

(0.12)) |

(0.09) |

| Total current assets | 1,124,733 | 1,717,195 | 2,692,522 | 7,374,906 | 10,350,617 |

| Total assets | 2,713,212 | 3,616,752 | 4,836,377 | 9,823,316 | 13,019,905 |

| Total current liabilities | 327,193 | 311,904 | 404,507 | 745,860 | 517,236 |

| Total liabilities | 327,193 | 515,299 | 931,491 | 917,255 | 672,631 |

| Working capital | 797,540 | 1,405,291 | 1,948,426 | 6,629,046 | 9,833,381 |

| Capital stock | 45,811 | 46,264 | 46,540 | 44,569 | 42,961 |

| Total shareholders’ equity | 2,386,019 | 3,101,453 | 3,904,866 | 8,906,061 | 12,347,274 |

| Total Xtra-Gold Resources Corp. shareholders’ equity | 3,360,935 | 4,083,211 | 4,877,795 | 9,412,592 | 12,383,635 |

| Dividends declared per share | Nil | Nil | Nil | Nil | Nil |

| Basic and diluted weighted average number of

common shares outstanding |

45,996,481 |

46,481,748 |

44,698,113 |

43,815,678 |

35,160,827 |

- 7 -

| B. |

Capitalization and Indebtedness |

This Form 20-F is being filed as an annual report under the Securities Exchange Act of 1934 and, as such, there is no requirement to provide any information under this item.

| C. |

Reasons for the Offer and Use of Proceeds |

This Form 20-F is being filed as an annual report under the Securities Exchange Act of 1934 and, as such, there is no requirement to provide any information under this item.

| D. |

Risk Factors |

The securities of our company are considered speculative due to the nature of our business and the present stage of our development. Only those persons who can bear the risk of the entire loss of their investment should participate. An investor should carefully consider the risks described below and the other information that we file with the Securities and Exchange Commission and with Canadian securities regulators before investing in our common shares. The risks described below are not the only ones faced. Additional risks that we are either unaware of, or we are aware of but we currently believe are immaterial, may become important factors that affect our business. If any of the following risks occur, or if others occur, our business, operating results and financial condition could be seriously harmed and the investor may lose all of their investment.

Risks Associated with our Company and our Operations

Our company is currently in the exploration stage with respect to all our projects. The chance of ever reaching the production stage at our projects is uncertain. Our company cannot predict whether we will successfully effectuate our company’s current business plan.

If our company does not obtain new financings, commencing from 2015, the amount of funds available to our company to pursue any further exploration activities at our projects will be reduced and our company’s plan of operations may be adversely affected.

Our company has relied on private placement financings and an initial public offering completed in Canada in November 2010 to fund our exploration programs, including our drilling programs at our Kibi project. Commencing from 2015, our company will continue to require additional financing to complete our plan of operations to carry out any further exploration activities on our projects. Any impairment in our company’s ability to raise additional funds through financings would reduce the available funds for such exploration activities, with the result that our company’s plan of operations may be adversely affected.

Substantial additional capital may be required commencing from 2015 to continue exploration activities at all of our projects. If our company cannot raise additional capital as needed, our ability to execute our business plan and fund our ongoing operations will be in jeopardy.

Commencing from 2015, our company may need to explore various financing alternatives to meet our projected costs and expenses. Our company cannot assure our shareholders that we will be able to obtain the necessary financing for our projects on favorable terms or at all. Additionally, if the actual costs to execute our company’s business plan are significantly higher than expected, our company may not have sufficient funds to cover these costs and we may not be able to obtain other sources of financing. The failure to obtain all necessary financing would prevent our company from executing our business plan and would impede our company’s ability to sustain operations or become profitable, and our company could be forced to cease our operations.

To date, we have not generated revenues from operations and our company will continue to incur operating losses and there is no guarantee that we will achieve operating profits.

Our company has incurred operating losses on an annual basis for a number of years, primarily arising out of the costs related to continued exploration and development of mineral resource properties, including costs written off on properties no longer being pursued by our company. As of December 31, 2014, our company had an accumulated deficit during the exploration stage of $26,247,372. It is anticipated that our company will continue to experience operating losses for fiscal 2015 and until our company discovers economically mineable mineralized material and successfully develops a mine. There can be no assurance that our company will ever achieve significant revenues or profitable operations.

Our auditors have raised substantial doubts as to our ability to continue as a going concern.

Our financial statements have been prepared assuming we will continue as a going concern. Since inception we have experienced recurring losses from operations, which losses have caused an accumulated deficit of approximately $26,247,372 as of December 31, 2014. These factors, among others, raise substantial doubt about our ability to continue as a going concern. Our financial statements do not include any adjustments that might result from the outcome of this uncertainty. We anticipate that we may continue to incur losses in future periods until we are successful in generating revenues which are significant enough to pay our expenses and fund our exploration efforts. There are no assurances that we will be able to raise our revenues to a level which supports profitable operations and provides sufficient funds to pay our obligations as they are incurred. If we are unable to meet those obligations, we could be forced to substantially curtail our operations and planned exploration efforts, which would have a material adverse effect on our business and operations in future periods.

- 8 -

Our company’s projects are in the exploration stage and may not result in the discovery of commercial bodies of mineralization which would result in our company discontinuing that project. Substantial expenditures are required to determine if a project has economically mineable mineralized material.

Our company’s projects are all in the exploration stage. Mineral exploration involves a high degree of risk and few properties which are explored are developed into producing mines. The exploration efforts of our company on our projects may not result in the discovery of commercial bodies of mineralization which would require our company to discontinue that project. Substantial expenditures are required to determine if a project has economically mineable mineralized material. It could take several years to establish proven and probable mineral reserves. Due to these uncertainties, there can be no assurance that current and future exploration programs will result in the discovery of mineral reserves.

Our company currently depends significantly on a limited number of projects.

Our company’s activities are currently focused on our Kibi project. Our company will as a consequence be exposed to some heightened degree of risk due to the lack of property diversification. Adverse changes or developments affecting our Kibi project would have a material and adverse effect on our company’s business, financial condition, results of operations and prospects.

Our company is subject to factors beyond our control which may impact our company’s title in our projects.

Although our company has obtained title opinions with respect to all of our projects and has taken other reasonable measures to ensure proper title to these projects, there is no guarantee that title to any of our projects will not be challenged or impugned. Third parties may have valid claims underlying portions of our company’s interests. Our projects may be subject to prior unregistered liens, agreements, transfers or claims and title may be affected by, among other things, undetected defects. In addition, our company may be unable to operate our projects as permitted or to enforce its rights with respect to our projects.

Our company’s activities are and will be subject to complex laws, significant government regulations and accounting standards that may delay or prevent operations at our projects and can adversely affect our company’s operating costs, the timing of the our company’s operations, ability to operate and financial results.

Business, exploration activities and any future development activities and mining operations are and will be subject to extensive Ghanaian, United States, Canadian, British Virgin Islands and other foreign, federal, state, territorial and local laws and regulations and also exploration, development, production, exports, taxes, labor standards, waste disposal, protection of the environment, reclamation, historic and cultural resource preservation, mine safety and occupational health, reporting and other matters, as well as accounting standards. Compliance with these laws, regulations and standards or the imposition of new such requirements could adversely affect our company’s operating and future development costs, the timing of our company’s operations, ability to operate and financial results. These laws and regulations governing various matters include:

| • | environmental protection; |

| • | management of natural resources; |

| • | exploration, development of mines, production and post-closure reclamation; |

| • | export and import controls and restrictions; |

| • | price controls; |

| • | taxation; |

| • | labor standards and occupational health and safety, including mine safety; |

| • | historic and cultural preservation; and |

| • | generally accepted accounting principles. |

- 9 -

The costs associated with compliance with these laws and regulations may be substantial and possible future laws and regulations, or more stringent enforcement of current laws and regulations by governmental authorities, could cause additional expense, capital expenditures, restrictions on or suspensions of our company’s operations and delays in the development of our projects. These laws and regulations may allow governmental authorities and private parties to bring lawsuits based upon damages to property and injury to persons resulting from the environmental, health and safety impacts of our company’s past and current operations, and could lead to the imposition of substantial fines, penalties or other civil or criminal sanctions. In addition, our company’s failure to comply strictly with applicable laws, regulations and local practices relating to permitting applications or reporting requirements could result in loss, reduction or expropriation of entitlements, or the imposition of additional local or foreign parties as joint venture partners. Any such loss, reduction, expropriation or imposition of partners could have a materially adverse effect on our company’s operations or business.

Our company may not be able to obtain, renew or continue to comply with all of the permits necessary to develop each of our projects which would force our company to discontinue development, if any, on that project.

Pursuant to Ghanaian law, if our company discovers economically mineable mineralized material, we must obtain various approvals, licenses or permits pertaining to environmental protection and use of water resources in connection with the development, if any, of our projects. In addition to requiring permits for the development of our mineral concessions where our projects are located, our company may need to obtain other permits and approvals during the life of our projects. Obtaining, renewing and continuing to comply with the necessary governmental permits and approvals can be a complex and time-consuming process. The failure to obtain or renew the necessary permits or licenses or continue to meet their requirements could delay future development and could increase the costs related to such activities.

The development of all of our company’s projects may be delayed due to delays in receiving regulatory permits and approvals, which could impede our company’s ability to develop our projects which, absent raising additional capital, could cause it to curtail or discontinue development, if any.

If our company discovers economically mineable mineralized material, our company may experience delays in developing our projects. The timing of development at our projects depends on many factors, some of which are beyond our control, including:

| • | taxation; |

| • | the timely issuance of permits; and |

| • | the acquisition of surface land and easement rights required to develop and operate our projects, (in particular, our company is required to acquire surface land through expropriation in connection with our mineral concessions). |

These delays could increase development costs of our projects, affect our company’s economic viability, or prevent our company from completing the development of our projects.

Our company’s activities are subject to environmental laws and regulations that may increase our company’s costs of doing business and may restrict our operations.

All of our company’s exploration activities in Ghana are subject to regulation by governmental agencies under various environmental laws. To the extent our company conducts exploration activities or undertakes new exploration or future mining activities in other foreign countries, our company will also be subject to environmental laws and regulations in those jurisdictions. These laws address emissions into the air, discharges into water, management of waste, management of hazardous substances, protection of natural resources, antiquities and endangered species, and reclamation of lands disturbed by mining operations. Environmental legislation in many countries is evolving and the trend has been towards stricter standards and enforcement, increased fines and penalties for non-compliance, more stringent environmental assessments of proposed projects and increasing responsibility for companies and their officers, directors and employees. Compliance with environmental laws and regulations may require significant capital outlays and may cause material changes or delays in our company’s intended activities. Our company cannot assure our shareholders that future changes in environmental regulations will not adversely affect our company’s business, and it is possible that future changes in these laws or regulations could have a significant adverse impact on some portion of our company’s business, causing our company to reevaluate those activities at that time.

In addition, our company may be exposed to potential environmental impacts during any full scale mining operation. At such time of commencement of full scale mining, if ever, our company plans to negotiate posting of a reclamation bond to quantify the reclamation costs. Our company anticipates that the dollar amount of reserves established for exposure to environmental liabilities will be $220,000, as to $150,000 for our Kwabeng project and $70,000 for our Pameng project, as estimated by the Environmental Protection Agency of Ghana, however, our company is currently unable to predict the ultimate cost of compliance or the extent of liability risks.

The undiscounted amount of cash flows, required over the estimated time of reclamation of the underlying assets, to settle the obligation, adjusted for inflation, is estimated at $96,395 (2013 - $220,000, 2012 - $220,000). The revised 2014 amount is expected to be settled within the current year to further development of the projects. The change in estimate was based on actual historical reclamation costs per acre of land and acres to be reclaimed. During the 2013 and 2012 years, obligation was calculated using a credit-adjusted risk free discount rate of 10% and an inflation rate of 2%. It is expected that this obligation will be funded from general Company resources at the time the costs are incurred. The Company has been required by the Ghanaian government to post a bond of US$221,322 which has been recorded in restricted cash.

- 10 -

During the year ended December 31, 2014, our company received environmental permits for our Banso and Muoso projects. These permits are subject to environmental bonds of $385,000 and $327,000 being posted within the year ended December 31, 2015. Should the bonds not be posted, our company could lose the permits. Our company is currently negotiating the final balance of the environmental bonds to be posted.

Our company is unable to predict the remediation costs for potential environmental liabilities.

The costs of remediation may exceed the provision that our company has made for such remediation by a material amount. Whenever a previously unrecognized remediation liability becomes known, or a previously estimated cost is increased, the amount of that liability or additional cost could adversely affect our company’s exploration activities and our financial condition.

There may be instances where certain events occur that our company is not insured against.

Our company maintains insurance policies to protect itself against certain risks related to its operations. This insurance is maintained in amounts that our company believes to be reasonable depending upon the circumstances surrounding each identified risk. However, our company may elect not to have insurance for certain risks because of the high premiums associated with insuring those risks or for various other reasons; in other cases, insurance may not be available for certain risks. Some concern always exists with respect to investments in parts of the world where civil unrest, war, nationalist movements, political violence or economic crisis are possible. These countries may also pose heightened risks of expropriation of assets, business interruption, increased taxation and a unilateral modification of concessions and contracts. Our company does not maintain insurance policies against political risk. Occurrence of events for which our company is not insured could adversely affect our company’s exploration activities and its financial condition.

Our company is subject to the potential of legal claims and the associated costs of defense and settlement.

Our company is subject to litigation risks. All industries, including the mining industry, are subject to legal claims, with and without merit. Defense and settlement costs of legal claims can be substantial, even with respect to claims that have no merit. Due to the inherent uncertainty of the litigation process, the resolution of any particular legal proceeding to which our company is or may become subject could have a material effect on its financial position, results of operations or our company’s project development operations.

Our company is subject to fluctuations in currency exchange rates, which could materially adversely affect our financial position.

Our company’s primary currency for operations is the United States dollar and, to a lesser extent, the “Cedi”, the Ghanaian currency. As at the date of this annual report, our company maintains most of its working capital in Canadian dollars. Our company converts its Canadian funds to foreign currencies as certain payment obligations become due. Accordingly, our company is subject to fluctuations in the rates of currency exchange between the Canadian dollar and these foreign currencies and these fluctuations, which are beyond our control, could materially affect our company’s financial position and results of operations. A significant portion of the operating costs of our projects are in Cedi. Our company obtains services and materials and supplies from providers in West Africa. The costs of goods and services could increase or decrease due to changes in the value of the Canadian dollar, the United States dollar, the Cedi or other currencies. Consequently, exploration and development of our projects could be more costly than anticipated.

Our company’s business is impacted by any instability and fluctuations in global financial systems.

The recent credit crisis and related instability in the global financial system, although somewhat abated, has had, and may continue to have, an impact on our company’s business and our company’s financial condition. Our company may face significant challenges if conditions in the financial markets do not continue to improve. Our company’s ability to access the capital markets may be severely restricted at a time when our company wishes or needs to access such markets, which could have a materially adverse impact on our company’s flexibility to react to changing economic and business conditions or carry on our operations.

Our company is subject to the effects that historically high inflation rate may have on its results.

Our company’s mineral properties are located in Ghana, which has historically experienced relatively high rates of inflation. High inflation rates in Ghana could cause the prices of materials obtained within Ghana to be slightly higher. As our company maintains our funds in U.S. and/or Canadian currency, the effect due to Ghanaian currency fluctuations is minimal.

The Government of Ghana has the right to increase its current ownership interest of 10% in our company’s subsidiary, Xtra-Gold Mining Limited (“XG Mining”), through which our company holds, among other things, its interest in our Kibi project and our other projects, for a consideration agreed upon by the parties or by arbitration and has a right of pre-emption to purchase all minerals produced by XG Mining. If the Government of Ghana were to exercise any of its rights, our company’s results of operations in future periods could be adversely impacted.

- 11 -

The Government of Ghana is granted a 10% free carried interest in all mining operations and has no obligation to contribute to development or operating expenses. The Government of Ghana currently has a 10% free carried interest in XG Mining, one of our Ghanaian subsidiaries that holds all of the mining leases securing our interest in all of the concessions where our projects are located. The Government of Ghana also has:

| • | the right to acquire an additional interest in XG Mining for a price to be determined by agreement or arbitration; |

| • |

the right to acquire a special share (as defined in the Minerals and Mining Act, 2006 (Act 703), as amended by the Minerals and Mining Act, 2010 (Act 794) (the “Mining Act (Ghana)”) in XG Mining at any time for such consideration as the Government of Ghana and XG Mining might agree; and |

| • | a right of pre-emption to purchase all minerals raised, won or obtained in Ghana. |

While our company is not aware of the Government of Ghana having ever exercised such right of pre-emption, our company cannot assure our shareholders that the Government of Ghana would not seek to exercise one or more of these rights which, if exercised, could have an adverse affect on our company’s results of operations in future periods. If the Government of Ghana should exercise its right to either acquire the additional interest in XG Mining or its right to acquire the special share, any profit that might otherwise be reported from XG Mining’s operations would be proportionally reduced in the same percentage as the minority interest attributable to the Government of Ghana in that subsidiary would be increased. If the Government of Ghana should exercise its right to purchase all gold and other minerals produced by XG Mining, the price it would pay may be lower than the price our company could sell the gold or other minerals for in transactions with third parties and it could result in a reduction in any revenues our company might otherwise report from XG Mining’s operations.

Our company currently relies on the continued services of key executives, including the directors of our company and a small number of highly skilled and experienced executives and personnel. The loss of their services may delay our company’s exploration activities or adversely affect our business and future operations.

Due to the relatively small size of our company, the loss of these persons or our company's inability to attract and retain additional highly skilled employees may lead to our company having to delay our exploration activities or adversely affect our business and future operations.

Our company may experience difficulty in engaging the services of qualified personnel in connection with our technical operations at our projects.

If the loss of any of our company’s key technical personnel occurs at any of our projects, our company may have difficulty finding qualified replacements. Our company’s inability to hire and retain the services of qualified persons for these positions in a timely manner could impede our company’s exploration activities at any of our projects which would have a material adverse effect on our company’s ability to conduct business.

Our company is subject to changes in political stability in West Africa.

Our company conducts exploration and development activities in Ghana, West Africa. Our company’s projects in Ghana may be subject to the effects of political changes, war and civil conflict, changes in government policy, lack of law enforcement and labor unrest and the creation of new laws. These changes (which may include new or modified taxes or other government levies as well as other legislation) may impact the profitability and viability of our properties. The effect of unrest and instability on political, social or economic conditions in Ghana could result in the impairment of exploration, development and mining operations. Any such changes are beyond the control of our company and may adversely affect our business.

In addition, local tribal authorities in West Africa exercise significant influence with respect to local land use, land labor and local security. From time to time, the Government of Ghana has intervened in the export of mineral concentrates in response to concerns about the validity of export rights and payment of duties. No assurances can be given that the co-operation of such authorities, if sought by our company, will be obtained, and if obtained, maintained.

The Government of Ghana also recently announced that it will be engaging companies to address the issue of dividend payment, exemptions and the mining sector fiscal regime, generally. As a result of these discussions, the Government of Ghana could amend the Mining Act (Ghana) or other regulations resulting in a material adverse impact on our company including increases in operating costs, capital expenditures or abandonment or delays in development of mining properties.

The mining industry is a competitive industry and our company may compete with larger, more established competitors for gold acquisition opportunities.

- 12 -

Significant and increasing competition exists for the limited number of gold acquisition opportunities available. As a result of this competition, some of which is with large established mining companies with substantial capabilities and greater financial and technical resources than our company, our company may be unable to acquire additional attractive mining properties on terms we consider acceptable.

The marketability of our company’s minerals may be influenced by various industry conditions.

The marketability of minerals, if any, which may be acquired or discovered by our company, will be affected by numerous factors beyond the control of our company. These factors include market fluctuations, the proximity and capacity of mineral markets and processing equipment and government regulations, including regulations relating to prices, taxes, royalties, land tenure and environmental protection. The exact effect of these factors cannot be accurately predicted, but the combination of these factors may result in our company not receiving an adequate return on invested capital. The probability of our company not receiving an adequate return on invested capital will be, to a significant extent, dependent upon the market price for gold. Gold prices fluctuate dramatically and are affected by numerous industry factors, such as interest rates, exchange rates, inflation or deflation, fluctuation in the value of the United States dollar and foreign currencies, global and regional supply and demand for precious metals, forward selling by producers, central bank sales and purchases of gold, production and cost levels in major gold producing regions and the political and economic conditions of major gold, copper or other mineral-producing countries throughout the world. Moreover, gold prices are also affected by macro-economic factors such as expectations for inflation, interest rates, currency exchange rates and global or regional political and economic situations. The current demand for, and supply of, gold affects gold prices, but not necessarily in the same manner as current demand and supply affect the prices of other commodities. The potential supply of gold consists of new gold mine production plus existing stocks of bullion and fabricated gold held by governments, financial institutions, industrial organizations and individuals. Since mine production in any single year constitutes a very small portion of the total potential supply of gold, normal variations in current production do not necessarily have a significant effect on the supply of gold or its price.

It may be difficult for our shareholders to enforce any judgment obtained in the United States against us or our officers or directors, which may limit the remedies otherwise available to our shareholders.

The majority of our directors and officers are residents of countries other than the United States and all or a substantial portion of such persons’ assets are located outside the United States. As a result, it may be difficult or impossible for our shareholders to:

| • | effect service of process on our directors or officers, or |

| • |

enforce any United States judgment they receive against us or our officers or directors in a foreign court, or including judgments predicated upon the securities laws of the United States or any state thereof. In addition, there is uncertainty as to whether foreign courts would be competent to hear original actions brought in such foreign court against us or such persons predicated upon the securities laws of the United States or any state thereof. Consequently, you may be effectively prevented from pursuing remedies under U.S. federal securities laws against us or our officers and directors. The foregoing risks also apply to those experts identified in this Annual Report that are not residents of the United States. |

Risks Relating to our Common Shares

Broker-dealers may be discouraged from effecting transactions in our common shares because they are considered a penny stock and are subject to the penny stock rules.

Rules 15g-1 through 15g-9 promulgated under the Exchange Act impose sales practice and disclosure requirements on certain brokers-dealers who engage in certain transactions involving a “penny stock”. Subject to certain exceptions, a penny stock generally includes any equity security not listed on a stock exchange that has a market price of less than $5.00 per share. Our common shares have traded below $5.00 per share throughout its trading history.

A broker-dealer selling penny stock to anyone other than an established customer or “accredited investor”, generally, an individual with net worth in excess of $1,000,000 or an annual income exceeding $200,000, or $300,000 together with his or her spouse, must make a special suitability determination for the purchaser and must receive the purchaser‘s written consent to the transaction prior to sale, unless the broker-dealer or the transaction is otherwise exempt. In addition, the penny stock regulations require the broker-dealer to deliver, prior to any transaction involving a penny stock, a disclosure schedule prepared by the United States Securities and Exchange Commission relating to the penny stock market, unless the broker-dealer or the transaction is otherwise exempt. A broker-dealer is also required to disclose commissions payable to the broker-dealer and the registered representative and current quotations for the securities. Finally, a broker-dealer is required to send monthly statements disclosing recent price information with respect to the penny stock held in a customer‘s account and information with respect to the limited market in penny stocks. The additional sales practice and disclosure requirements imposed upon broker-dealers may discourage broker-dealers from effecting transactions in our common shares, which could severely limit the market liquidity of our common shares and impede the sale of our common shares in the secondary market.

- 13 -

The price of our common shares is likely to be highly volatile and possibly illiquid, which could cause the value of investments to decline.

The market price of our common shares may be highly volatile and possibly illiquid. Our shareholders may not be able to resell their common shares following periods of volatility because of the market’s adverse reaction to volatility. Factors that could cause such volatility may include, among other things:

| • | actual or anticipated fluctuations in our quarterly operating results; |

| • | large purchases or sales of our common shares; |

| • | additions or departures of key personnel; |

| • | investor perception of our company’s business prospects; |

| • | conditions or trends in other industry related companies; |

| • | changes in the market valuations of publicly traded companies in general and other industry-related companies; and |

| • | world-wide political, economic and financial conditions. |

The markets for our common shares is limited.

There is currently only a limited trading market for our common shares. Our common shares trade on the OTC Bulletin Board under the symbol “XTGRF” which is a limited market in comparison to the NASDAQ Global Market, the NYSE MKT LLC and other national securities exchanges. Our securities are also listed on the Toronto Stock Exchange (the “TSX”) under the trading symbol “XTG”. The market for our securities on the TSX only commenced in November 2010 and, to date, trading has been limited. There is no assurance that the market for our common shares on the OTC Bulletin Board or the TSX will develop into active trading markets.

In connection with future stock offerings, the value of our company’s common shares may become diluted as more of our common shares are issued and outstanding.

Our company may undertake in the future additional offerings of our common shares or of securities convertible into our common shares. The increase in the number of our common shares issued and outstanding and the possibility of sales of such common shares may depress the price of our common shares. In addition, as a result of such additional common shares, the voting power of our company’s existing shareholders will be diluted.

We are authorized to issue an unlimited number of shares without prior shareholder consent which will be dilutive to our shareholders.

Xtra-Gold is authorized to issue an unlimited number of no par value common shares of a single class which may be issued by our Board of Directors without further action or approval of our shareholders. While our Board of Directors is required to fulfill its fiduciary obligation in connection with the issuance of such shares, the shares may be issued in transaction with which not all shareholders agree, and the issuance of such shares will cause dilution to the ownership interest of our company’s shareholders.

We have never paid cash dividends on our common shares.

We have never paid dividends on our common shares and do not presently intend to pay cash dividends on our common shares. Any future decisions as to the payment of dividends will be at the discretion of our Board of Directors, subject to applicable law.

Risks Related to our Company Post Continuation

In November 2012, as a result of the adoption by our shareholders of certain resolutions, at a special meeting of shareholders held on November 16, 2012 and a plan of conversion (the “Plan of Conversion”) under Chapter 92A of the Nevada Revised Statutes filed with the Nevada Secretary of State and the subsequent filing of a memorandum of association and articles of association (the “Memorandum and Articles”) with the Registrar of Corporate Affairs in the British Virgin Islands (the “BVI”), both of which were filed on November 30, 2012, we changed the jurisdiction of incorporation of our company from Nevada to the BVI (the “Continuation”).

- 14 -

We will still be treated as a U.S. corporation and taxed on our worldwide income after the Continuation.

The Continuation of our company from Nevada to the BVI was for corporate purposes a migration from Nevada to the BVI. Transactions whereby a U.S. corporation migrates to a foreign jurisdiction are considered by the United States Congress to be a potential abuse of the U.S. tax rules because after the migration the foreign entity is not subject to U.S. tax on its worldwide income. As a result, Section 7874(b) of the Code was enacted in 2004 to address this potential abuse. Section 7874(b) of the Code provides generally that a corporation that migrates from the United States will still remain subject to U.S. tax on its worldwide income unless the migrating entity has substantial business activities in the foreign country in which it is migrating when compared to its total business activities.

Section 7874(b) of the Code applies to the migration of our company from Nevada to the BVI, causing our company to be subject to United States federal income taxation on our worldwide income because our company does not have substantial business activities in the BVI when compared to its total business activities. Our administrative functions and our business operations are primarily located outside of the BVI. Substantially, all of our shareholders reside outside of the BVI and historically most of our funds have been raised outside of the BVI. Accordingly, we believe that our company will continue to be treated as a U.S. domestic corporation under Section 7874 of the Code after the Continuation.

Moreover, while we believe we have addressed the material U.S. federal income tax considerations as to the exchange of the shares of common stock of our company, as a Nevada company for shares of our company, as a BVI company pursuant to the Continuation, we cannot assure Holders that we have addressed the material U.S. federal income tax consequences to persons who may be subject to special provisions of the U.S. federal income tax law based on their individual circumstances. Holders should review the discussion under “Material United Federal Tax Consequences” in its entirety, including the definitions of “U.S. Holder” and “Non-U.S. Holder” described therein.

Under the BVI Business Companies Act, 2004 (the “BVI Act”), the number of shareholder votes required to approve certain fundamental matters, including amendments to our articles and business combination transactions, may be less than under Nevada law with the result that these transactions may more easily be approved under the BVI Act than under Nevada law.

Under the BVI Act, shareholder approval by resolution, being a majority approval, is required to approve certain fundamental changes, including amendments to our articles and mergers, which are the equivalent of mergers under Nevada law. Under the BVI Act, the majority approval is determined based upon those shareholders present at the meeting and entitled to vote on the fundamental change. While majority approval is required, the number of shares required may be significantly less than 50% of the outstanding share capital, which is the requirement under Nevada law, due to the fact that the quorum requirement for shareholders meetings is only two individuals present in person, each of whom is a stockholder or a proxyholder entitled to vote at a meeting.

Pursuant to the Memorandum and Articles of our company, our shareholders will have greater rights of dissent, with the result that dissenting shareholders may impede our ability to make fundamental corporate changes or increase the cost to us of making these changes.

Pursuant to our Memorandum and Articles, our shareholders will have the right to dissent when we amend our articles to change any provisions restricting or constraining the issue, transfer or ownership of shares of that class. Our shareholders will also have dissenters’ rights when we propose to amend our articles to add, change or remove any restrictions on our business or businesses that we may carry on, merge (other than a vertical short-form merger with a wholly-owned subsidiary), continue to another jurisdiction, sell, lease or exchange all or substantially all of our property, or carry out a going private or squeeze-out transaction. The exercise by shareholders of their dissent and appraisal rights when we attempt to complete any of these fundamental changes could impede our ability to make fundamental corporate changes or increase the cost to us of making these changes.

The stock price of our common shares may be volatile. In addition, demand in the United States for our common shares may be decreased by the change in domicile.

The market price of our common shares may be subject to significant fluctuations in response to variations in results of operations and other factors. Developments affecting the mining industry generally, including general economic conditions and government regulation, could also have a significant impact on the market price for our common shares. In addition, the stock market has experienced a high level of price and volume volatility. Market prices for the stock of many similar companies have experienced wide fluctuations which have not necessarily been related to the operating performance of such companies. These broad market fluctuations, which are beyond our control, could have a material adverse effect on the market price of our common shares. We cannot predict what effect, if any, the Continuation will have on the market price prevailing from time to time or the liquidity of our common shares. The change in domicile may decrease the demand for our common shares in the United States. The decrease may not be offset by increased demand for our common shares in the BVI.

- 15 -

As a reporting issuer under Section 15(d) of the Exchange Act, we file more limited reports with the SEC than do companies who are registered under Section 12(g) of the Exchange Act. As we have elected “foreign private issuer” status following our Continuation into the BVI, our reporting obligations under U.S. securities laws is more limited than if we had remained a domestic issuer. This lack of transparency may make it more difficult for investors in our securities to make informed investment decisions.

While we are subject to Section 15(d) of the Exchange Act, we do not have a class of securities registered under Section 12(g) of the Exchange Act. Consequently, we file more limited reports with the SEC than do companies whose shares are registered under Section 12(g). For example, as a company reporting under Section 15(d) of the Exchange Act, we are not subject to the SEC’s proxy rules and our officers, directors and principal shareholders are not required to file reports under Section 16(a) of the Exchange Act, and such persons are not subject to the short-swing profit rules of Section 16(b) of the Exchange Act.

Following our Continuation into the BVI, we have qualified as a foreign private issuer under U.S. securities laws and we have elected foreign private issuer status. While we will remain subject to limited reporting obligations under U.S. federal securities law, as a foreign private issuer:

| • |

we are not required to file quarterly reports on Form 10-Q with the SEC; although since our securities are listed on the TSX we are a reporting issuer in Canada and subject to the rules of the Canadian securities administrators (the “CSA”) which includes the applicable provincial securities commissions in the provinces of British Columbia, Alberta and Ontario, we will file quarterly reports containing unaudited interim financial statements and MD&A with the CSA via SEDAR (System for Electronic Delivery of Analysis and Retrieval) and, in accordance with SEC rules, post copies of such reports on our website; |

| • |

we are not be required to file current reports on Form 8-K; although we are required to file current reports on Form 6-K but for less mandatory items than are required under Form 8-K, and since our securities are listed on the TSX and subject to the rules of the CSA, we will file material change reports with the CSA via SEDAR and, under SEC rules, post copies of such reports on our website; |

| • |

our officers, directors and principal shareholders are not subject to Section 16 of the Exchange Act, which otherwise requires them to file ownership reports with the SEC and subjects them to “short-swing” profit liability; |

| • |

we are not subject to the SEC’s proxy rules; and |

| • |

we are not subject to the provisions of Regulation FD which is designed to prevent selective disclosure of material information. |

While we believe that the disclosure requirements of the TSX and the CSA, and SEC regulations applicable to foreign private issuers, will collectively provide transparency to the investment community and allow informed investment decisions to be made by investors in our securities, there is no assurance that the reduced transparency afforded to foreign private issuers will not also reduce the information available to investors and make investment decisions in our securities more difficult.

| Item 4 | Information on Xtra-Gold | |

| A. | History and Development of Xtra-Gold | |

On November 30, 2012, we completed the Continuation to the BVI which resulted in the change of the jurisdiction of incorporation of our company from Nevada to the BVI.

| B. |

Business Overview |

We are engaged in the exploration of gold properties exclusively in Ghana, West Africa in the search for mineral deposits and mineral reserves which could be economically and legally extracted or produced. Our exploration activities include the review of existing data, grid establishment, geological mapping, geophysical surveying, trenching and pitting to test the areas of anomalous soil samples and reverse circulation (RC) and/or diamond drilling to test targets followed by infill drilling, if successful, to define a mineral reserve.

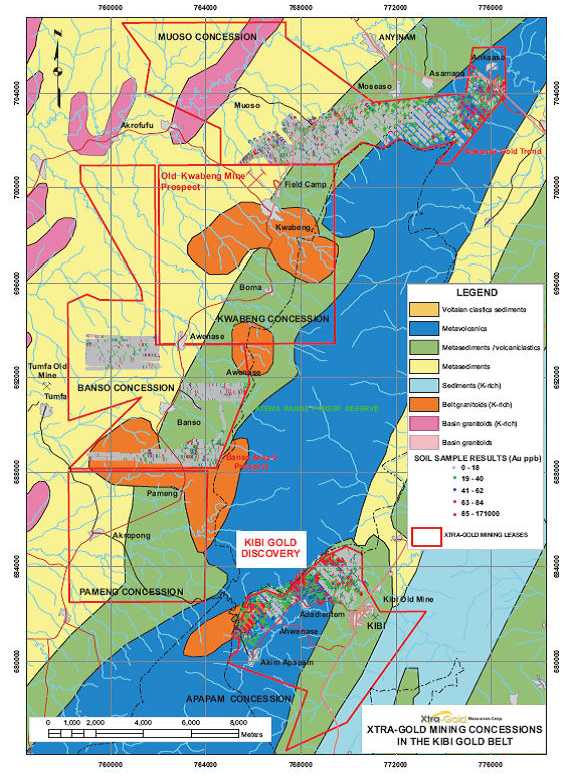

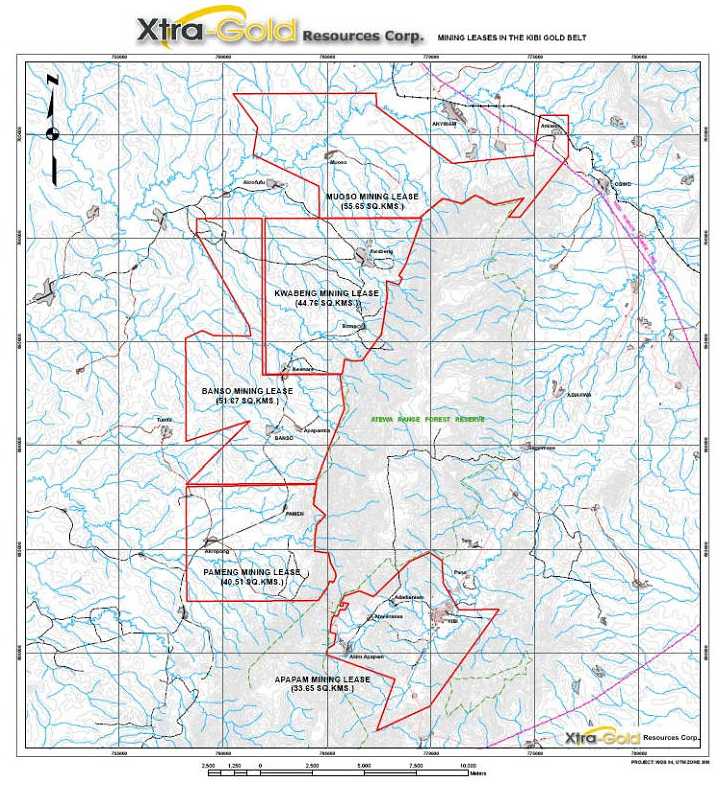

Our mining portfolio currently consists of 225.87 square kilometers comprised of 33.65 square kilometers for our Kibi project, 51.67 square kilometers for our Banso project, 55.28 square kilometers for our Muoso project, 44.76 square kilometers for our Kwabeng project, and 40.51 square kilometers for our Pameng project, or 55,873 acres, pursuant to the leased areas set forth in our mining leases.

- 16 -

Our interests in our projects are held by our Ghanaian subsidiary, XG Mining, through mining leases granted by the Government of Ghana and registered to XG Mining for leased areas located within and upon concessions in Ghana. A concession is a grant of a tract of land made by a government or other controlling authority in exchange for an agreement that the land will be used for a specific purpose. The mining lease areas for our projects total approximately 226 square kilometers and are located at the northern extremity of the Kibi Gold Belt which is a greenstone belt, as defined in all the geological publications in Ghana, and is one of the four main greenstone belts located in Ghana.

Development of our Business During 2014

As at the date of this annual report, we have the following five projects all of which are in the exploration stage.

| • |

Kibi Project. Our Kibi project is located on the Apapam concession and is our only material project. This project encompasses the Zone 2 – Zone 3 – Zone 4 gold system consisting of an over 5.5 kilometer long mineralized trend delineated from gold-in-soil anomalies, geophysical interpretations, trenching and drilling along the northwest margin of the Apapam concession and the recently discovered Zone 5 auriferous shear system spatially associated with a 1.8 kilometer long gold-in- soil anomaly lying at the northeast extremity of the concession. | |

|

Exploration activities on this project from January 1 to December 31, 2014, being the fiscal year for which this annual report is being filed, was limited to Zone 5 reconnaissance geology / prospecting with 144 rock composite chip samples collected and geological - geophysical modelling geared towards drill target selection. | ||

|

With a view to conserving our company’s working capital, management decided to scale back the exploration planned for this project during the fiscal year. | ||

|

See “Kibi Project – Prior Exploration by Xtra-Gold” for exploration activities conducted by our company during the two years preceding the fiscal year. | ||

|

As at the date of this annual report, during 2015, we plan to conduct: | ||

| • |

an exploration program consisting of additional outcrop stripping / trenching followed by detailed geological mapping and channel sampling to further investigate the auriferous occurrences discovered by the latest prospecting efforts and to further define the strike-extensions of the known gold-bearing shear zones; | |

| • |

prospecting / reconnaissance geology of the additional prospective IP/Resistivity targets present along the 2.2 km long Zone 5 grid is also planned; and | |

| • |

a drill program of approximately 2,000 to 3,000 meters at an estimated cost of $300,000 to $500,000. | |

| Kwabeng Project. Our Kwabeng project is located on the Kwabeng concession. During the fiscal year for which this annual report is being filed, we conducted geological compilation, prospecting and reconnaissance geology to identify and/or further advance grassroots targets on this project. During the fiscal year, we announced: | ||

| • | prospecting and sampling results for the Bomaa prospect (May 2014). | |

|

See “Kwabeng Project – 2014 Exploration Program” for the details and results of this exploration work. In connection with the two years preceding the fiscal year, we did not conduct any exploration activities at this project in 2012. See “Kwabeng Project – 2013 Exploration Program” for the details and results of the exploration work conducted in 2013. | ||

|

As at the date of this annual report, during 2015, we plan to conduct an exploration program consisting of: | ||

| • |

ongoing geological compilation, prospecting, soil geochemical sampling, and scout trenching to identify and/or further advance grassroots targets. | |

|

We commenced placer gold recovery operations at our Kwabeng project in late March 2013 and during the fiscal year, we recovered 1,159 ounces of placer gold and sold 1,159 ounces for net proceeds of $411,152. As at the date of this annual report, during 2015, we plan to continue placer gold recovery operations at this project. | ||

|

Pameng Project. Our Pameng project is located on the Pameng concession. During the fiscal year for which this annual report is being filed, we conducted geological compilation, prospecting, reconnaissance geology and soil geochemical sampling, to identify and/or further advance grassroots targets on this project as follows: | ||

| • |

soil geochemical sampling was completed on two grids with a total of approximately 80.5 line-km cross-lines established at 200 meter spacing and 2,853 soil samples collected at 25 meter station spacing. A total of 202 rock composite chip samples were collected as part of a prospecting program focusing on the ground proofing of geophysical and structural geology targets. With a view to conserving our company’s working capital, management decided to postpone the laboratory analyses of the soil and rock samples for the fiscal year. | |

- 17 -

| In connection with the two years preceding the fiscal year, we did not conduct any exploration activities at this project. As of the date of this annual report, during 2015, we plan to conduct an exploration program consisting of: | ||

| • | ongoing geological compilation, prospecting, soil geochemical sampling, and scout trenching to identify and/or further advance grassroots targets. | |

|

As at the date of this annual report, for the fiscal year, we have estimated $180,000 for the cost to conduct the exploration programs noted above at our Kibi, Kwabeng and Pameng projects. | |

| • |

Banso Project. Our Banso project is located on the Banso concession. During the fiscal year, we did not conduct any exploration activities on this project. See “Banso Project – Exploration Activities by Buccaneer Gold Corp. in 2012 and 2013” for exploration activities conducted on this project during the two years preceding the fiscal year. As at the date of this annual report, we have not planned to conduct any exploration activities at this project during the next 12 months, however, we may consider doing so at a later date. |

| • |

Muoso Project. Our Muoso project is located on the Muoso concession. During the fiscal year, we did not conduct any exploration activities on this project. See “Muoso Project - Exploration Activities by Buccaneer Gold Corp. in 2012 and 2013” for exploration activities conducted on this project during the two years preceding the fiscal year. As at the date of this annual report, we have not planned to conduct any exploration activities at this project during the next 12 months, however, we may consider doing so at a later date. |

In connection with the Banso and Muoso projects, our company entered into an agreement in January 2011 with Buccaneer Gold Corp. (formerly Verbina Resources Inc.), a mineral resource company listed on the TSX Venture Exchange (the “TSXV”). This agreement set forth the terms and conditions for which Buccaneer Gold Corp. could acquire an undivided 55% interest in our company’s 90% interest in the minerals rights for these projects. As part of the criteria for Buccaneer Gold Corp. to earn the 55% interest, this company was required to incur $4.5 million in exploration expenditures over a five year period which commenced in February 2011. For clarity purposes, these expenditures can be incurred for exploration work conducted on either or both of these projects. In April 2013, Buccaneer Gold Corp. ceased all exploration activities at these projects to conserve capital due to market conditions. We granted Buccaneer Gold Corp. a two year extension to complete its obligation to incur the $4.5 million in exploration expenditures. As at the date of this annual report, we continue to support Buccaneer Gold Corp. and expect their exploration efforts at these projects will restart when the junior exploration market improves. In addition to the foregoing, Buccaneer Gold Corp. has also acquired a 55% interest in the alluvial rights relating to the Banso and Muoso projects by making a payment of $50,000 to our company.

As of the date of this annual report, we have:

| • | received gross proceeds of $10,795,193 from our recovery of placer gold operations at our Kwabeng, Pameng and Kibi projects since we commenced these operations; |

| • | have achieved losses since inception; |

| • | have minimal operations, and |

| • | relied upon the sale of our securities and the proceeds derived from our recovery of placer gold operations to fund our operations. |

Principal Capital Expenditures/Divestitures over the last Three Fiscal Years

Our company has not had any principal capital expenditures or divestitures over the last three fiscal years.

- 18 -

| C. |

Organizational Structure |

The following organization chart sets forth our significant subsidiaries.

| D. |

Property, Plants and Equipment |

Technical Information

The hardrock, lode gold exploration technical information relating to our mineral properties contained in this annual report on Form 20-F is based upon information prepared by or the preparation of which was supervised by Yves Clement, P.Geo., our Vice-President, Exploration.

Location of Operations

Except for the land upon which our field camp is located in Kwabeng, Ghana, we do not own any real property. We own the mineral rights on our projects located in the Kibi Gold Belt where all of our exploration activities are currently conducted. Mining leases granted by the Government of Ghana and registered to our Ghanaian subsidiary, XG Mining, grant us the right to operate at our Kibi, Kwabeng, Pameng, Banso and Muoso projects and are described elsewhere in this annual report.

We currently conduct limited administrative activities from our corporate office located at Suite 902, 357 Bay Street, Toronto, Ontario, M5H 2T7, Canada, where we have leased 881 square feet for a five year term commencing on November 1, 2012 and expiring on October 31, 2017, at approximately $3,161 (CAD$3,667) per month.

As of the date of this annual report, our technical and administrative activities are conducted at our field camp. We do not pay any rent as we own our field camp.

- 19 -

Map of Projects and Operations

The map below shows the locations of our Kibi, Kwabeng, Pameng, Banso and Muoso projects all of which are described in further detail in this annual report.

Xtra-Gold Mining

Concessions Located in the Kibi Gold Belt

- 20 -

Xtra-Gold

Mining Leases Located in the Kibi Gold Belt

- 21 -

Overview of Projects

All of our mineral exploration projects are currently at an early stage of evaluation. As at the date of this annual report, no mineralized material or mineral reserve estimates have been made at any of our projects.

Except for the following exploration activities which we have planned for 2015: at our Kibi project:

| • |

an exploration program consisting of additional outcrop stripping / trenching followed by detailed geological mapping and channel sampling to further investigate the auriferous occurrences discovered by the latest prospecting efforts and to further define the strike-extensions of the known gold-bearing shear zones; |

| • |

prospecting / reconnaissance geology of the additional prospective IP/Resistivity targets present along the 2.2 km long Zone 5 grid is also planned; and |

| • | a drill program of approximately 2,000 to 3,000 meters at an estimated cost of $300,000 to $500,000; |

at our Kwabeng project:

| • | ongoing geological compilation, prospecting, soil geochemical sampling, and scout trenching to identify and/or further advance grassroots targets; and |

| • | the continuation of placer gold recovery operations at this project; and |

at our Pameng project:

| • | ongoing geological compilation, prospecting, soil geochemical sampling, and scout trenching to identify and/or further advance grassroots targets; |

there are no exploration activities currently being conducted on our other projects or have any such activities been planned for the next 12 months, however, we may consider doing so at a later date.

Title to Properties

We hold 30-year mining leases expiring on July 26, 2019 on our Kwabeng and Pameng concessions, a 7-year mining lease on our Apapam concession expiring on December 17, 2015, a 14-year mining lease on our Banso concession expiring on January 5, 2025 and a 13-year mining lease on our Muoso concession expiring on January 5, 2024.

Recovery of Placer Gold

In July 2010, we entered into agreements with independent Ghanaian contract miners to recover placer gold and produce the mineralized material from our Kibi and Pameng projects and an agreement with Ravenclaw Mining Limited, a Swiss company (see footnote 8 following the compensation table under “Compensation – Directors and Senior Management Compensation Table”), to assist in overseeing the contract miners to limit our involvement in the placer gold recovery operations from July 2010 through December 2011 and enable our company to focus on lode gold exploration activities (see “Kibi Project – Recovery and Sale of Placer Gold” and “Pameng Project – Recovery and Sale of Placer Gold” for further details). There was no placer gold recovery operations carried out at these projects during 2012 through to the end of the fiscal year.

As of the date of this annual report, we have resumed placer gold recovery operations at our Kwabeng project and have engaged Ravenclaw Mining Limited to assist us (see “Kwabeng Project – Resumption of Placer Gold Recovery Operations at our Kwabeng Project” for further details). During 2010 through 2012, we did not conduct any placer gold recovery operations at our Kwabeng project. During 2013 and the fiscal year, we conducted placer gold recovery operations at our Kwabeng project (see “Kwabeng Project - Recovery and Sale of Placer Gold” for further details).

VTEM Survey

In 2011, an airborne Versatile Time-domain Electromagnetic (“VTEM”), Magnetic and Radiometric survey (the “VTEM survey”) was completed by our company on our projects which are all located in the Kibi Gold Belt and encompassed approximately 4,000 line-kilometers at 200 meter line spacing, with approximately 490 line-kilometers of detail 100 meter line spacing coverage over our core Kibi project mining lease area. The VTEM system is renowned for its superior penetration depth of greater than 400 meters, low base frequency for enhanced penetration in conductive ground cover and high spatial resolution which permits the spotting of drill targets directly off the airborne anomalies. The primary purpose of the VTEM survey was to delineate auriferous graphitic or sulphidic shears but resistivity-depth data may also help further define and/or identify the granitoid bodies hosting the Kibi project mineralization In addition to helping map lithological contacts, including the gold prospective granitoid bodies, the aeromagnetic survey will permit the detection of low-magnetic domains possibly reflecting demagnetization resulting from intense gold-related hydrothermal alteration. The radiometric survey may also help further define and/or identify the gold-hosting granitoid bodies.

- 22 -

The VTEM data was incorporated into the geological compilation following our receipt of the final survey interpretation data from Geotech Airborne Limited (see “Technical Reports - Interpretation Report of VTEM Survey” below for further details). This integrated survey, in combination with previous soil geochemistry and reconnaissance geology surveys will help further delineate known gold occurrences outside Zone 2 of the Kibi project, and evaluate the remainder of the Apapam mining lease area for the hosting of granitoid-hosted and Ashanti style shear zone gold mineralization. Similarly, the VTEM survey will help further define the extent and regional controls of the gold-bearing structures discovered to date by scout trenching on the Ankaase Gold Trend, located on the Muoso concession, and Banso Area No. 3 gold-in-soil anomalies; with the objective of guiding follow-up trenching designed to outline high priority, cost effective drill targets.

Technical Reports

Interpretation Report of VTEM Survey

In August 2011, Geotech Airborne Limited provided our company with a report setting forth its interpretation of approximately 4,027 line kilometers of electromagnetic, magnetic and radiometric data for gold exploration in our Kibi project area.

The airborne geophysical datasets display a complex signal largely dominated by NE-SW to NNE-SSW structures that are interpreted as shear zones and graphitic sediments. Metasediments, metavolcanics and granitoids units have been delineated from their geophysical (magnetic, electromagnetic and radiometric) characteristics. The electromagnetic anomaly picks show elongated patterns of conductors located in NE-SW to NNE-SSW trending areas interpreted as graphitic layers within the interpreted shear zone and graphitic sediments.

The available geological and geophysical data was interpreted in terms of gold potential within the area of interest. The geophysical interpretation used the genetic model for stockworks/silicification gold emplacement and the genetic model of granitoid gold emplacement. A total of 38 targets were delineated and ranked according to a priority level for ground follow-up. Geotech Airborne Limited suggested that these targets should be further investigated in the field using geology and geochemistry before planning a drilling program.

Modified Gold Deportment Study

In October 2011, SGS South Africa (Pty) Ltd. provided our company with a mineralogical report relating to mineralogical test work consisting of a modified gold deportment study to characterize the gold, in two samples, to recommend a process route to maximize gold recoveries. Approximately 10 kilograms of sample G478923 sulphide material (drill core) and 10 kilograms of composite oxide (saprolite) material were utilized for the test work. The composite oxide sample was created by SGS South Africa (Pty) Ltd. from trench samples that were crushed and combined. The mineralogical test work included metallurgical and mineralogical tests and was done in conjunction with gravity test work conducted by the Metallurgical Section of SGS South Africa (Pty) Ltd. This report outlined the methodology as to how the different tests were conducted, the results of the test work, conclusions and recommendations.