UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |

For the quarterly period ended | |

OR | |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |

For the transition period from to

Commission file number:

(Exact Name of Registrant as Specified in its Charter) |

| ||

(State of other jurisdiction of incorporation or organization) |

| (I.R.S. Employer Identification No.) |

|

|

|

|

| |

| ||

(Address of Principal Executive Offices) |

| (Zip Code) |

(

(Registrant’s Telephone Number, including Area Code)

Securities registered pursuant to Section 12(b) of the Act:

Title of Each Class | Trading Symbol(s) | Name of Each Exchange on Which Registered |

TBR | OTCQB TSX-V |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the past 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. ☒

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). ☒

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer”, “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act:

Large Accelerated Filer | ☐ | Accelerated Filer | ☐ |

☒ | Small Reporting Company | ||

|

| Emerging Growth Company |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the Registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act)

Number of shares of issuer’s common stock outstanding at February 13, 2024:

INDEX

2 |

| Table of Contents |

PART I — FINANCIAL INFORMATION

ITEM 1. CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED)

TIMBERLINE RESOURCES CORPORATION AND SUBSIDIARIES

Contents |

|

| Page |

|

|

|

FINANCIAL STATEMENTS (UNAUDITED): |

|

|

|

|

|

| F-2 | |

|

|

|

| F-3 | |

|

|

|

Condensed Consolidated statements of changes in stockholders’ equity |

| F-4 |

|

|

|

| F-5 | |

|

|

|

| F-6 - F-8 |

| F-1 |

| Table of Contents |

TIMBERLINE RESOURCES CORPORATION AND SUBSIDIARIES | ||||||||

CONDENSED CONSOLIDATED BALANCE SHEETS (UNAUDITED) | ||||||||

|

|

|

|

|

|

| ||

|

| December 31, 2023 |

|

| September 30, 2023 |

| ||

ASSETS |

|

|

|

|

|

| ||

CURRENT ASSETS: |

|

|

|

|

|

| ||

Cash |

| $ |

|

| $ |

| ||

Prepaid expenses and other current assets |

|

|

|

|

|

| ||

TOTAL CURRENT ASSETS |

|

|

|

|

|

| ||

|

|

|

|

|

|

|

|

|

Property, mineral rights, and equipment, net |

|

|

|

|

|

| ||

|

|

|

|

|

|

|

|

|

OTHER ASSETS: |

|

|

|

|

|

|

|

|

Reclamation bonds |

|

|

|

|

|

| ||

Deposits and other assets |

|

|

|

|

|

| ||

TOTAL OTHER ASSETS |

|

|

|

|

|

| ||

|

|

|

|

|

|

|

|

|

TOTAL ASSETS |

| $ |

|

| $ |

| ||

|

|

|

|

|

|

|

|

|

LIABILITIES AND STOCKHOLDERS' EQUITY |

|

|

|

|

|

|

|

|

CURRENT LIABILITIES: |

|

|

|

|

|

|

|

|

Accounts payable |

| $ |

|

| $ |

| ||

Accrued expenses |

|

|

|

|

|

| ||

Accrued payroll, benefits and taxes |

|

|

|

|

|

| ||

TOTAL CURRENT LIABILITIES |

|

|

|

|

|

| ||

|

|

|

|

|

|

|

|

|

LONG-TERM LIABILITIES: |

|

|

|

|

|

|

|

|

Asset retirement obligation |

|

|

|

|

|

| ||

TOTAL LONG-TERM LIABILITIES |

|

|

|

|

|

| ||

TOTAL LIABILITIES |

|

|

|

|

|

| ||

|

|

|

|

|

|

|

|

|

COMMITMENTS AND CONTINGENCIES (Note 6) |

|

|

|

|

|

| ||

|

|

|

|

|

|

|

|

|

STOCKHOLDERS' EQUITY: |

|

|

|

|

|

|

|

|

Preferred stock, $ |

|

|

|

|

|

| ||

Common stock, $ |

|

|

|

|

|

| ||

Additional paid-in capital |

|

|

|

|

|

| ||

Accumulated deficit |

|

| ( | ) |

|

| ( | ) |

TOTAL STOCKHOLDERS' EQUITY |

|

|

|

|

|

| ||

|

|

|

|

|

|

|

|

|

TOTAL LIABILITIES AND STOCKHOLDERS' EQUITY |

| $ |

|

| $ |

| ||

The accompanying notes are an integral part of these condensed consolidated financial statements.

| F-2 |

| Table of Contents |

TIMBERLINE RESOURCES CORPORATION AND SUBSIDIARIES CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS (UNAUDITED)

| ||||||||

|

| Three months ended December 31, |

| |||||

|

| 2023 |

|

| 2022 |

| ||

|

|

|

|

|

|

| ||

OPERATING EXPENSES: |

|

|

|

|

|

| ||

Mineral exploration |

| $ |

|

| $ |

| ||

Salaries and benefits |

|

|

|

|

|

| ||

Professional fees |

|

|

|

|

|

| ||

Insurance expense |

|

|

|

|

|

| ||

Other general and administrative |

|

|

|

|

|

| ||

TOTAL OPERATING EXPENSES |

|

|

|

|

|

| ||

|

|

|

|

|

|

|

|

|

LOSS FROM OPERATIONS |

|

| ( | ) |

|

| ( | ) |

|

|

|

|

|

|

|

|

|

OTHER INCOME (EXPENSE): |

|

|

|

|

|

|

|

|

Foreign exchange gain (loss) |

|

| ( | ) |

|

|

| |

Interest expense – related party |

|

|

|

|

| ( | ) | |

Interest expense |

|

| ( | ) |

|

|

| |

Other income |

|

|

|

|

|

| ||

TOTAL OTHER INCOME (EXPENSE) |

|

| ( | ) |

|

| ( | ) |

|

|

|

|

|

|

|

|

|

LOSS BEFORE INCOME TAXES |

|

| ( | ) |

|

| ( | ) |

|

|

|

|

|

|

|

|

|

INCOME TAX PROVISION (BENEFIT) |

|

|

|

|

|

| ||

|

|

|

|

|

|

|

|

|

NET LOSS |

| $ | ( | ) |

| $ | ( | ) |

|

|

|

|

|

|

|

|

|

NET LOSS PER SHARE BASIC AND DILUTED |

| $ | ( | ) |

| $ | ( | ) |

|

|

|

|

|

|

|

|

|

WEIGHTED AVERAGE NUMBER OF COMMON SHARES OUTSTANDING, BASIC AND DILUTED |

|

|

|

|

|

| ||

The accompanying notes are an integral part of these condensed consolidated financial statements.

| F-3 |

| Table of Contents |

TIMBERLINE RESOURCES CORPORATION AND SUBSIDIARIES CONDENSED CONSOLIDATED STATEMENTS OF CHANGES IN STOCKHOLDERS' EQUITY (UNAUDITED) | ||||||||||||||||||||

|

| Common Stock |

|

| Additional Paid-in |

|

| Accumulated |

|

| Total Stockholders’ |

| ||||||||

|

| Shares |

|

| Amount |

|

| Capital |

|

| Deficit |

|

| Equity |

| |||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||

Balance, September 30, 2023 |

|

|

|

| $ |

|

| $ |

|

| $ | ( | ) |

| $ |

| ||||

Stock based compensation |

|

| - |

|

|

|

|

|

|

|

|

|

|

|

|

| ||||

Common stock issued for cash and warrants |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||

Net loss |

|

| - |

|

|

|

|

|

|

|

|

| ( | ) |

|

| ( | ) | ||

Balance December 31, 2023 |

|

|

|

| $ |

|

| $ |

|

| $ | ( | ) |

| $ |

| ||||

|

| Common Stock |

|

| Additional Paid-in |

|

| Accumulated |

|

| Total Stockholders’ |

| ||||||||

|

| Shares |

|

| Amount |

|

| Capital |

|

| Deficit |

|

| Equity |

| |||||

Balance, September 30, 2022 |

|

|

|

| $ |

|

| $ |

|

| $ | ( | ) |

| $ |

| ||||

Stock based compensation |

|

| - |

|

|

|

|

|

|

|

|

|

|

|

|

| ||||

Net loss |

|

| - |

|

|

|

|

|

|

|

|

| ( | ) |

|

| ( | ) | ||

Balance, December 31, 2022 |

|

|

|

| $ |

|

| $ |

|

| $ | ( | ) |

| $ |

| ||||

The accompanying notes are an integral part of these condensed consolidated financial statements.

| F-4 |

| Table of Contents |

TIMBERLINE RESOURCES CORPORATION AND SUBSIDIARIES CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS (UNAUDITED)

| ||||||||

|

| Three months Ended December 31, |

| |||||

|

| 2023 |

|

| 2022 |

| ||

CASH FLOWS FROM OPERATING ACTIVITIES: |

|

|

|

|

|

| ||

Net loss |

| $ | ( | ) |

| $ | ( | ) |

Adjustments to reconcile net loss to net cash used by operating activities: |

|

|

|

|

|

|

|

|

Stock-based compensation |

|

|

|

|

|

| ||

Accretion of asset retirement obligation |

|

|

|

|

|

| ||

Changes in assets and liabilities: |

|

|

|

|

|

|

|

|

Prepaid expenses and other current assets |

|

| ( | ) |

|

| ( | ) |

Deposits and other assets |

|

|

|

|

|

| ||

Accounts payable |

|

|

|

|

| ( | ) | |

Accrued expenses |

|

|

|

|

| ( | ) | |

Accrued interest – related party |

|

|

|

|

|

| ||

Accrued payroll, benefits and taxes |

|

|

|

|

| ( | ) | |

Net cash used by operating activities |

|

| ( | ) |

|

| ( | ) |

|

|

|

|

|

|

|

|

|

CASH FLOWS FROM INVESTING ACTIVITIES: |

|

|

|

|

|

|

|

|

Payments for mineral rights |

|

| ( | ) |

|

| ( | ) |

Purchase of mineral rights |

|

|

|

|

| ( | ) | |

Net cash used by investing activities |

|

| ( | ) |

|

| ( | ) |

|

|

|

|

|

|

|

|

|

CASH FLOWS FROM FINANCING ACTIVITIES: |

|

|

|

|

|

|

|

|

Proceeds from sale of common stock and warrants |

|

|

|

|

|

| ||

Net cash provided by financing activities |

|

|

|

|

|

| ||

|

|

|

|

|

|

|

|

|

Net increase (decrease) in cash and cash equivalents |

|

|

|

|

| ( | ) | |

|

|

|

|

|

|

|

|

|

CASH AT BEGINNING OF PERIOD |

|

|

|

|

|

| ||

|

|

|

|

|

|

|

|

|

CASH AT END OF PERIOD |

| $ |

|

| $ |

| ||

The accompanying notes are an integral part of these condensed consolidated financial statements.

| F-5 |

| Table of Contents |

TIMBERLINE RESOURCES CORPORATION AND SUBSIDIARIES NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS December 31, 2023 (Unaudited) |

NOTE 1 – ORGANIZATION AND DESCRIPTION OF BUSINESS:

Timberline Resources Corporation (“Timberline” or “the Company) was incorporated in August of 1968 under the laws of the State of Idaho as Silver Crystal Mines, Inc., for the purpose of exploring for precious metal deposits and advancing them to production. In 2008, the Company reincorporated into the State of Delaware, pursuant to a merger agreement approved by its shareholders.

NOTE 2 – SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES:

a. Basis of Presentation and Going Concern – The unaudited condensed consolidated financial statements have been prepared by the Company in accordance with accounting principles generally accepted in the United States of America (“GAAP”) for interim financial information, as well as the instructions to Form 10-Q. Accordingly, they do not include all of the information and footnotes required by GAAP for complete financial statements. In the opinion of the Company’s management, all adjustments (consisting of only normal recurring accruals) considered necessary for a fair statement of the interim condensed consolidated financial statements have been included. Operating results for the three-month period ended December 31, 2023 are not necessarily indicative of the results that may be expected for the fiscal year ending September 30, 2024.

For further information refer to the consolidated financial statements and footnotes thereto in the Company’s Annual Report on Form 10-K/A for the year ended September 30, 2023.

The accompanying condensed consolidated financial statements have been prepared under the assumption that the Company will continue as a going concern. The Company has incurred losses since its inception. The Company does not have sufficient cash to fund normal operations and meet all of its obligations for the next 12 months without raising additional funds. However, we are an exploration company with exploration programs that require significant cash expenditures. A significant drilling program, such are those we have planned, can result in depletion of cash and return us to a position of insufficient cash to support normal operations for 12 months. The Company currently has no historical recurring source of revenue, and its ability to continue as a going concern is dependent on its ability to raise equity and/or debt capital to fund future exploration and working capital requirements, or the Company’s ability to profitably execute its business plan. The Company’s plans for the long-term return to and continuation as a going concern include financing its future operations through sales of common stock, Company assets and/or debt and the eventual profitable exploitation of its mining properties. While the Company has been successful in the past in obtaining financing, there is no assurance that it will be able to obtain adequate financing in the future or that such financing will be on terms acceptable to the Company. These factors raise substantial doubt about the Company’s ability to continue as a going concern. The condensed consolidated financial statements do not include any adjustments that might be necessary should the Company be unable to continue as a going concern. If the going concern basis were not appropriate for these condensed consolidated financial statements, adjustments would be necessary in the carrying value of assets and liabilities, the reported expenses and the balance sheet classifications used.

b. New Accounting Pronouncements – In August 2023, the Financial Accounting Standards Board issued Accounting Standards Update (“ASU”) 2023-05, Business Combinations - Joint Venture Formations (Subtopic 805-60): Recognition and Initial Measurement, which clarifies the business combination accounting for joint venture formations. The amendments in the ASU seek to reduce diversity in practice that has resulted from a lack of authoritative guidance regarding the accounting for the formation of joint ventures in separate financial statements. The amendments also seek to clarify the initial measurement of joint venture net assets, including businesses contributed to a joint venture. The guidance is applicable to all entities involved in the formation of a joint venture. The amendments are effective for all joint venture formations with a formation date on or after January 1, 2025. Early adoption and retrospective application of the amendments are permitted. We do not expect adoption of the new guidance to have a material impact on our consolidated financial statements and disclosures.

In November 2023, the Financial Accounting Standards Board (“FASB”) issued Accounting Standards Update 2023-07 (“ASU 2023-07”), Segment Reporting (Topic 280): Improvements to Reportable Segment Disclosures, amending reportable segment disclosure requirements to include disclosure of incremental segment information on an annual and interim basis. Among the disclosure enhancements are new disclosures regarding significant segment expenses that are regularly provided to the chief operating decision-maker and included within each reported measure of segment profit or loss, as well as other segment items bridging segment revenue to each reported measure of segment profit or loss. The amendments in ASU 2023-07 are effective for fiscal years beginning after December 15, 2023, and for interim periods within fiscal years beginning after December 15, 2024, and are applied retrospectively. Early adoption is permitted. We are currently evaluating the impact of this update on our consolidated financial statements and disclosures.

| F-6 |

| Table of Contents |

TIMBERLINE RESOURCES CORPORATION AND SUBSIDIARIES NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS December 31, 2023 (Unaudited) |

In December 2023, the FASB issued Accounting Standards Update 2023-09 (“ASU 2023-09”), Income Taxes (Topic 740): Improvement to Income Tax Disclosures, amending income tax disclosure requirements for the effective tax rate reconciliation and income taxes paid. The amendments in ASU 2023-09 are effective for fiscal years beginning after December 15, 2024, and are applied prospectively. Early adoption and retrospective application of the amendments are permitted. We are currently evaluating the impact of this update on our consolidated financial statements and disclosures.

Other accounting standards that have been issued or proposed by FASB that do not require adoption until a future date are not expected to have a material impact on the consolidated financial statements upon adoption.

c. Principles of Consolidation – The condensed consolidated financial statements include the accounts of the Company and its wholly owned subsidiaries, BH Minerals USA, Inc.; Wolfpack Gold (Nevada) Corp.; Staccato Gold Resources, Ltd.; Lookout Mountain LLC, and Talapoosa Development Corp., after elimination of intercompany accounts and transactions.

d. Net Income (Loss) per Share – Basic earnings per share (“EPS”) is computed as net income (loss) available to common shareholders divided by the weighted-average number of common shares outstanding for the period. Diluted EPS reflects the potential dilution that could occur from common shares issuable through stock options, warrants, and other convertible securities.

The dilutive effect of outstanding securities as of December 31, 2023 and 2022 is as follows:

|

| December 31, 2023 |

|

| December 31, 2022 |

| ||

Stock options |

|

|

|

|

|

| ||

Warrants |

|

|

|

|

|

| ||

Total potential dilution |

|

|

|

|

|

| ||

At December 31, 2023 and 2022, the effect of the Company’s common stock equivalents would have been anti-dilutive.

NOTE 3 – PROPERTY, MINERAL RIGHTS, AND EQUIPMENT:

The following is a summary of property, mineral rights, and equipment and accumulated depreciation at December 31, 2023 and September 30, 2023, respectively:

|

| Expected Useful Lives (years) |

|

| December 31, 2023 |

|

| September 30, 2023 |

| |||

|

|

|

|

|

|

|

|

|

| |||

Mineral rights – Eureka |

|

| - |

|

| $ |

|

| $ |

| ||

Mineral rights – Seven Troughs, New York Canyon and other |

|

| - |

|

|

|

|

|

|

| ||

ARO Asset |

|

|

|

|

|

|

|

|

|

| ||

Total mineral rights |

|

|

|

|

|

|

|

|

|

| ||

|

|

|

|

|

|

|

|

|

|

|

|

|

Equipment and vehicles |

|

|

|

|

|

|

|

| ||||

Office equipment and furniture |

|

|

|

|

|

|

|

| ||||

Land |

|

| - |

|

|

|

|

|

|

| ||

Total property and equipment |

|

|

|

|

|

|

|

|

|

| ||

Less accumulated depreciation |

|

|

|

|

|

| ( | ) |

|

| ( | ) |

Property, mineral rights, and equipment, net |

|

|

|

|

| $ |

|

| $ |

| ||

Mineral rights at Eureka increased by $

| F-7 |

| Table of Contents |

TIMBERLINE RESOURCES CORPORATION AND SUBSIDIARIES NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS December 31, 2023 (Unaudited) |

NOTE 4 – COMMON STOCK, WARRANTS AND PREFERRED STOCK:

On December 28, 2023, the Company closed a non-brokered private placement to accredited investors at a price of $

During the quarter ended December 31, 2023,

At December 31, 2023, the Company has a total of

NOTE 5 – STOCK-BASED AWARDS:

On

The following is a summary of options issued and outstanding:

|

| Options |

|

| Weighted Average Exercise Price |

| ||

Outstanding at September 30, 2022 |

|

|

|

|

|

| ||

Granted |

|

| - |

|

|

| - |

|

Expired |

|

| ( | ) |

|

| ( | ) |

Outstanding at September 30, 2023 |

|

|

|

| $ |

| ||

Granted |

|

| - |

|

|

|

| |

Expired |

|

| - |

|

|

|

| |

Outstanding at December 31, 2023 |

|

|

|

|

|

| ||

Outstanding and exercisable at December 31, 2022 |

|

|

|

| $ |

| ||

Weighted average remaining contractual term (years) |

|

|

|

|

|

|

| |

The aggregate of options exercisable as of December 31, 2023 had no intrinsic value, based on the closing price of $

NOTE 6 – COMMITMENTS AND CONTINGENCIES:

The Company has the following commitments and contingencies:

Mineral Exploration

A portion of the Company’s mining claims on the Company’s properties are subject to lease and option agreements including advance minimum royalty payments, with various terms, obligations, and royalties payable in certain circumstances.

The Company pays federal and county claim maintenance fees on unpatented claims that are included in the Company’s mineral exploration properties. Should the Company continue to explore all of the Company’s mineral properties, it estimates annual fees to total $

| F-8 |

| Table of Contents |

ITEM 2. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS.

As used in herein, the terms “Timberline,” the “Company,” “we,” “us,” and “our” refer to Timberline Resources Corporation.

This discussion and analysis contains forward-looking statements that involve known or unknown risks, uncertainties and other factors that may cause the actual results, performance, or achievements of the Company to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements. Except for historical information, the matters set forth herein, which are forward-looking statements, involve certain risks and uncertainties that could cause actual results to differ. Potential risks and uncertainties include, but are not limited to, unexpected changes in business and economic conditions; significant increases or decreases in gold prices; changes in interest and currency exchange rates; unanticipated grade changes; metallurgy, processing, access, availability of materials, equipment, supplies and water; results of current and future exploration and production activities; local and community impacts and issues; timing of receipt and maintenance of government approvals; accidents and labor disputes; environmental costs and risks; competitive factors, including competition for property acquisitions; and availability of external financing at reasonable rates or at all, and those set forth under the heading “Risk Factors” in our Form 10-K/A filed with the United States Securities and Exchange Commission (the “SEC”) on January 17, 2024. Forward- looking statements can be identified by terminology such as “may,” “will,” “should,” “expects,” “intends,” “plans,” “anticipates,” “believes,” “estimates,” “predicts,” “potential,” “continues” or the negative of these terms or other comparable terminology. Although the Company believes that the expectations reflected in the forward-looking statements are reasonable, it cannot guarantee future results, levels of activity, performance or achievements. Forward-looking statements are made based on management’s beliefs, estimates, and opinions on the date the statements are made, and the Company undertakes no obligation to update such forward-looking statements if these beliefs, estimates, and opinions should change, except as required by law.

This discussion and analysis should be read in conjunction with the accompanying unaudited consolidated financial statements and related notes. The discussion and analysis of the financial condition and results of operations are based upon the unaudited condensed consolidated financial statements, which have been prepared in accordance with accounting principles generally accepted in the United States of America. The preparation of financial statements in conformity with accounting principles generally accepted in the United States of America requires the Company to make estimates and assumptions that affect the reported amounts of assets and liabilities, disclosure of any contingent liabilities at the financial statement date and reported amounts of revenue and expenses during the reporting period. On an on-going basis the Company reviews its estimates and assumptions. The estimates were based on historical experience and other assumptions that the Company believes to be reasonable under the circumstances. Actual results are likely to differ from those estimates under different assumptions or conditions, but the Company does not believe such differences will materially affect our condensed consolidated financial position or results of operations. Critical accounting policies, the policies the Company believes are most important to the presentation of its consolidated financial statements and require the most difficult, subjective and complex judgments are outlined below in “Critical Accounting Policies” and have not changed significantly.

Corporate Overview

We are a mineral exploration business and, if and when we establish mineral reserves, a development company. Mineral exploration is essentially a research activity that does not produce a product. Successful exploration often results in increased project value that can be realized through the optioning or selling of the claimed site to larger companies. We acquire properties which we believe have potential to host economic concentrations of minerals, particularly gold and silver. These acquisitions have and may take the form of unpatented mining claims on federal land, or leasing claims on private property owned by others. An unpatented mining claim is an interest that can be acquired in the mineral rights on open lands of the federally owned public domain. Claims are staked in accordance with the Mining Law of 1872, recorded with the federal government pursuant to laws and regulations established by the Bureau of Land Management (the Federal agency that administers America’s public lands), that grant the holder of the claim a possessory interest in the mineral rights, subject to the paramount title of the United States.

We perform geological work to identify specific drill targets on the properties, and then collect subsurface samples by drilling to confirm the presence of mineralization (the presence of economic minerals in a specific area or geological formation). We may enter into option and joint venture agreements with other companies to fund further exploration and/or development work. It is our plan to focus on assembling a high-quality group of gold and silver exploration prospects using the experience and contacts of the management group. By such prospects, we mean properties that may have been previously identified by third parties, including prior owners such as exploration companies, as mineral prospects with potential for economic mineralization. Often these properties have been sampled, mapped and sometimes drilled, usually with indefinite results. Accordingly, such acquired projects will either have some prior exploration history or will have strong similarity to a recognized geologic ore deposit model. We place geographic emphasis on the western United States, and Nevada in particular.

| 3 |

| Table of Contents |

SPECIAL NOTE TO READERS: Lookout Mountain is a material property as defined by Regulation S-K Subpart 1300 (S-K 1300) issued by the Security and Exchange Commission (SEC). All other properties described in this Annual Report are immaterial under S-K 1300.

The Eureka Project, includes the Lookout Mountain Property and the historical Lookout Mountain and Windfall Mines in a total property position of approximately 28 square miles (72 square kilometers). The Lookout Mountain mineral resource estimate was reported in compliance with Canadian NI 43-101 in an Updated Technical Report on the Lookout Mountain Project by Mine Development Associates, Effective March 1, 2013, filed on SEDAR April 12, 2013:

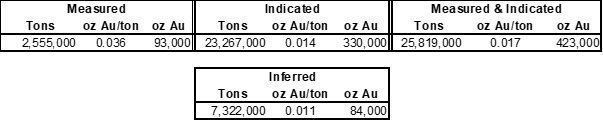

During the 2023 fiscal year, RESPEC Company LLC completed a mineral resource estimate and an initial Technical Report Summary (TRS) for the Lookout Mountain gold deposit. The TRS and mineral resource disclosure is a requirement of S-K 1300, which governs US mining projects. The updated mineral resource estimate is summarized in Table 1. The resource estimate has been constrained by optimized open pits utilizing revenue and cost inputs as summarized in the Notes to Table 1 below:

Table 1. Updated Lookout Mountain Project Gold Resources

Notes:

| · | The Mineral Resources are comprised of oxidized model blocks that lie within optimized pits at a cutoff grade of 0.005 oz Au/ton plus unoxidized blocks within the optimized pits at a 0.055 oz Au/ton cutoff. |

| · | Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability. |

| · | The Mineral Resources are potentially amenable to open pit mining methods and are therefore constrained by optimized pits created using a gold price of US$1,800/oz, a throughput rate of 10,000 tons/day, assumed metallurgical recoveries of 80% for heap-leaching of oxidized materials and 86% for toll milling of unoxidized materials, a mining cost of US$2.50/ton, heap-leaching processing cost of $3.60/ton, toll milling cost of $80.00/ton, general and administrative costs of $0.83/ton processed, a reclamation cost of $0.25/ton processed, refining cost of $3.00/oz Au produced, and an NSR royalty of 3.5%. This study does not constitute an Initial Assessment under S-K 1300. |

| · | The effective date of the resource estimate is December 31, 2022. |

| · | Rounding may result in apparent discrepancies between tons, grade, and contained metal content. |

| · | The Technical Report Summary is authored by Steven Osterberg, PhD, PG (Timberline’s qualified person) and RESPEC Company LLC of Reno, Nevada |

Complete descriptions, data and analysis of the Company’s mineral interests, together with graphs, tables and diagrams, can be viewed in our fiscal 2023 annual report dated December 31, 2023, as amended, originally filed with the Securities and Exchange Commission on January 2, 2024.

Detailed maps and mineral resources estimates for the Eureka Project, the 2023 Technical Report Summary and other technical reports and information on the Company’s projects may be viewed at http://timberlineresources.co.

Summary of the exploration activities for the three months ended December 31, 2023:

During the three months ended December 31, 2023, Management’s efforts were directed toward securing additional financing to advance the mineral rights owned by the Company, in which it was successful in the short term. Additional funds will be required to perform planned exploration programs on the Company’s properties, but the funds required to support the administration and operating activities of the Company in the interim period until long-term financing can be obtained, were secured with a cash infusion of $630,000 to the Company as a result of selling common shares and warrants in a private placement transaction.

| 4 |

| Table of Contents |

Exploration Plans and Budgets

Our exploration focus during fiscal 2024 will continue to be on the Eureka Project. Our financial and human resources will be dedicated to the advancement of the Lookout Mountain, Water Well, New York Canyon, and other targets across the property. The results of our drilling, mapping, geochemical and geophysical work completed during fiscal years 2020 through 2022 exploration seasons significantly advanced our understanding of the overall geologic setting of the Eureka Project, highlighting several areas with potential for significant gold mineralization. Our most significant advances during this period were the strong drill results announced in FY 2022, the acquisition of patented claims in New York Canyon, surface sampling results for silver and gold in New York Canyon, and the growing potential of carbonate replacement silver-lead-zinc deposits (CRD) on the Eureka Project and more broadly in the district. During fiscal year 2023, management conducted extensive analysis of historical data, newer geophysical and geological data, and district geology to advance integrated targets for CRD silver-lead-zinc and Carlin-type gold exploration. This work will serve as a guide for our fiscal 2024 exploration plan.

Execution of any 2024 exploration activities will be contingent upon our ability to secure additional financing prior to the exploration season. Our preliminary exploration budget for fiscal 2024 is expected to exceed $3.0 million, funded largely by additional financing activities as we enter into the new 2024 calendar year. Details of the exploration plan for fiscal 2024 will follow anticipated financing successes, which will determine the nature and extent of an exploration program.

Results of Operations for the three months ended December 31, 2023 and 2022

Consolidated Results

(US$) |

| Three Months Ended December 31, |

| |||||

|

| 2023 |

|

| 2022 |

| ||

Exploration expenses: |

|

|

|

|

|

| ||

Eureka |

| $ | 19,919 |

|

| $ | 442,037 |

|

Other exploration properties |

|

| 39,328 |

|

|

| 80,606 |

|

Total exploration expenditures |

|

| 59,247 |

|

|

| 522,643 |

|

Non-cash expenses: |

|

|

|

|

|

|

|

|

Stock option expenses |

|

| 3,669 |

|

|

| 51,708 |

|

Depreciation, amortization and accretion |

|

| 1,800 |

|

|

| 1,715 |

|

Total non-cash expenses |

|

| 5,469 |

|

|

| 53,423 |

|

Professional fees expenses |

|

| 59,462 |

|

|

| 62,859 |

|

Insurance expenses |

|

| 13,967 |

|

|

| 44,528 |

|

Salaries and benefits expenses |

|

| 74,021 |

|

|

| 60,456 |

|

Interest and other (income) expense |

|

| 408 |

|

|

| 11,447 |

|

Other general and administrative expenses |

|

| 19,713 |

|

|

| 126,187 |

|

Net loss |

| $ | 232,287 |

|

| $ | 881,543 |

|

Our consolidated net loss for the three months ended December 31, 2023 was $232,287, compared to a consolidated net loss of $881,543 for the three months ended December 31, 2022. The decrease in net loss is largely due to the significant decrease in exploration expenses, stock option expenses and other general and administrative expenses as a result of our intentional scale-back of operating activities during management’s efforts to raise funds for operations.

Subject to adequate funding in 2024, we expect to continue to incur exploration expenses for the advancement of our Eureka Project.

Financial Condition and Liquidity

At December 31, 2023, we had assets of $15,260,543, consisting of cash in the amount of $541,493; property, mineral rights and equipment of $14,173,178, net of depreciation, reclamation bonds of $528,643, and prepaid expenses, deposits and other assets in the amount of $17,229.

On December 31, 2023, we had total liabilities of $421,381 and total assets of $15,260,543. This compares to total liabilities of $358,095 and total assets of $14,795,875 on September 30, 2023. As of December 31, 2023, our liabilities consist of $145,840 for asset retirement obligations, and $275,541 of trade payables and accrued liabilities. Of these liabilities, $275,541 are due within twelve months. The liabilities compared to September 30, 2023 have increased, due to increased trade payables, accrued payroll, benefits and taxes, and accrued liabilities during the three months ended December 31, 2023.

| 5 |

| Table of Contents |

On December 31, 2023, we had working capital of $281,981 and stockholders’ equity of $14,839,162 compared to negative working capital of $107,701 and stockholders’ equity of $14,437,780 for the year ended September 30, 2023. Working capital experienced a favorable change due to the increase in available cash from a completed private placement financing during the three months ended December 31, 2023.

During the three months ended December 31, 2023, we used cash from operating activities of $168,731, compared to cash used of $1,453,507 for the three months ended December 31, 2022. The use of cash from operating activities results primarily from the net loss of $232,287 for the three-month period ended December 31, 2023 compared to net loss of $881,543 for the quarter ended December 31, 2023. Changes to the net loss for the comparative periods are described above.

During the three-month period ended December 31, 2023, cash of $18,000 was used by investment activities, compared with cash of $28,933 used for the three-month period ended December 31, 2022. During the quarter ended December 31, 2023, we paid $18,000 for mineral rights, compared to $28,933 paid for mineral rights for the quarter ended December 31, 2022.

During the three-month period ended December 31, 2023, cash of $630,000 was provided by financing activities compared to $nil for the quarter ended December 31, 2022.

Going Concern:

The audit opinion and notes that accompany our consolidated financial statements for the year ended September 30, 2023 disclose a ‘going concern’ qualification to our ability to continue in business. These consolidated financial statements have been prepared on the basis that the Company is a going concern, which contemplates the realization of our assets and the settlement of our liabilities in the normal course of our operations. Disruptions in the credit and financial markets over the past several years have had a material adverse impact on a number of financial institutions and investors and have limited access to capital and credit for many companies. In addition, commodity prices and mining equities have seen significant volatility which increases the risk to precious metal investors. Market disruptions and alternative investment options, among other things, make it more difficult for us to obtain, or increase our cost of obtaining, capital and financing for our operations. Our access to additional capital may not be available on terms acceptable to us or at all. If we are unable to obtain financing through equity investments, we will seek multiple solutions including, but not limited to, asset sales, corporate transactions, credit facilities or debenture issuances in order to continue as a going concern.

At December 31, 2023, we had working capital of $281,981. We had $275,541 outstanding in current liabilities and a cash balance of $541,493. As of the date of this report on Form 10-Q, we do not have sufficient cash to meet our normal operating commitments for the next 12 months without additional financing. Therefore, we expect to be required to engage in financial transactions to increase our cash balance or decrease our cash obligations in the near term. However, we are an exploration company with exploration programs that require significant cash expenditures. A significant drilling program, such as that we have executed in prior years, can result in depletion of cash and would be prohibitive unless we can secure sufficient cash to support normal operations for the following 12 months.

The condensed consolidated financial statements do not include any adjustments that might be necessary should we be unable to continue as a going concern. We believe that the going concern condition cannot be removed with confidence until the Company has entered into a business climate where funding of its activities is more assured. If the going concern basis were not appropriate for these financial statements, adjustments would be necessary in the carrying value of assets and liabilities, the reported expenses and the balance sheet classifications used.

We plan, as funding allows, to follow up on our positive drill results on our Eureka Project. Subject to available capital, we may continue prudent exploration programs on our material exploration properties and/or fund some exploratory activities on early-stage properties.

We will require additional funding and/or reductions in exploration and administrative expenditures in future periods. Given current economic conditions, we cannot provide assurance that necessary financing transactions will be available on terms acceptable to us, or at all. Without additional financing, we would have to curtail our exploration and other expenditures while we seek alternative funding arrangements to provide sufficient capital to meet our ongoing, non-discretionary expenditures, and maintain our primary mineral properties. If we cannot obtain sufficient additional financing, we may be unable to make required property payments on a timely basis and be forced to return some or all of our leased or optioned properties to the underlying owners.

| 6 |

| Table of Contents |

Financing Activities

On December 28, 2023, we closed a non-brokered private placement to accredited investors at a price of $0.04 per unit. Units consist of one share of common stock and one series P warrant share. We issued 15,750,000 common shares and a like number of warrants for cash proceeds of $630,000. The warrants have a term of four years and are exercisable at $0.06 per common share.

Subsequent Events

None.

Off-Balance Sheet Arrangements

We do not have any off-balance sheet arrangements that are reasonably likely to have a current or future effect on our financial condition, revenues, results of operations, liquidity or capital expenditures.

Critical Accounting Policies and Estimates

There have been no significant changes to the critical accounting policies and estimates disclosed in Management’s Discussion and Analysis of Financial Condition and Results of Operation in our 2023 Form 10-K/A.

ITEM 3. QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK

Not applicable.

ITEM 4. CONTROLS AND PROCEDURES

Conclusions of Management Regarding Effectiveness of Disclosure Controls and Procedures

At the end of the period covered by this Quarterly Report on Form 10-Q, an evaluation was carried out under the supervision of and with the participation of our management, including the Principal Executive Officer and the Principal Financial Officer of the effectiveness of the design and operations of our disclosure controls and procedures (as defined in Rule 13a – 15(e) and Rule 15d – 15(e) under the Exchange Act) as of the end of the period covered by this report. Based upon that evaluation, it was concluded that our disclosure controls were effective as of the end of the period covered by this report, to ensure that: (i) information required to be disclosed by the Company in the reports that it files under the Exchange Act is recorded, processed, summarized, and reported within required time periods specified by the Securities & Exchange Commission rules and forms, and (ii) material information required to be disclosed in reports filed under the Exchange Act is accumulated and communicated to our management, including our Chief Executive Officer and Chief Accounting Officer, as appropriate, to allow for accurate and timely decision regarding required disclosure.

Internal Control over Financial Reporting

Our management is responsible for establishing and maintaining adequate internal control over financial reporting. This internal control system has been designed to provide reasonable assurance to the Company’s management and Board of Directors regarding the preparation and fair statement of the Company’s published financial statements.

All internal control systems, no matter how well designed, have inherent limitations. Therefore, even those systems determined to be effective can provide only reasonable assurance with respect to financial statement preparation and presentation.

Our management has assessed the effectiveness of the Company’s internal control over financial reporting as of December 31, 2023. To make this assessment, we used the criteria for effective internal control over financial reporting described in Internal Control-Integrated Framework (2013), issued by the Committee of Sponsoring Organizations of the Treadway Commission. Based on our assessment, we believe that, as of December 31, 2023, the Company’s internal control over financial reporting is effective.

Changes in Internal Control over Financial Reporting

There was no material change in internal control over financial reporting in the quarter ended December 31, 2023.

| 7 |

| Table of Contents |

PART II — OTHER INFORMATION

ITEM 1. LEGAL PROCEEDINGS.

We are not aware of any material pending litigation or of any proceedings known to be contemplated by governmental authorities which are, or would be, likely to have a material adverse effect upon us or our operations, taken as a whole. No director, officer or affiliate of Timberline and no owner of record or beneficial owner of more than 5% of our securities or any associate of any such director, officer or security holder is a party adverse to Timberline or has a material interest adverse to Timberline in reference to any currently pending litigation.

ITEM 1A. RISK FACTORS

There have been no material changes from the risk factors as previously disclosed in our Annual Report on Form 10-K/A for the year ended September 30, 2023, which was filed with the SEC on January 17, 2024.

ITEM 2. UNREGISTERED SALES OF EQUITY SECURITIES AND USE OF PROCEEDS.

On December 28, 2023, we closed a non-brokered private placement to accredited investors at a price of $0.04 per unit. Units consist of one share of common stock and one series P warrant share. We issued 15,750,000 common shares and a like number of warrants for cash proceeds of $630,000. The warrants have a term of four years and are exercisable at $0.06 per common share.

ITEM 3. DEFAULTS UPON SENIOR SECURITIES.

None.

ITEM 4. MINE SAFETY DISCLOSURES

We consider health, safety and environmental stewardship to be a core value for the Company.

Pursuant to Section 1503(a) of the Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010, issuers that are operators, or that have a subsidiary that is an operator, of a coal or other mine in the United States are required to disclose in their periodic reports filed with the SEC information regarding specified health and safety violations, orders and citations, related assessments and legal actions, and mining-related fatalities with respect to mining operations and properties in the United States that are subject to regulation by the Federal Mine Safety and Health Administration (“MSHA”) under the Federal Mine Safety and Health Act of 1977 (the “Mine Act”). During the quarter ended December 31, 2023, our U.S. exploration properties were not subject to regulation by the MSHA under the Mine Act.

ITEM 5. OTHER INFORMATION

None.

| 8 |

| Table of Contents |

ITEM 6. EXHIBITS.

| ||

| ||

| ||

| ||

| ||

| ||

| ||

| ||

| ||

| ||

101.INS* |

| XBRL Instance Document |

101.SCH* |

| XBRL Taxonomy Extension Schema Document |

101.CAL* |

| XBRL Taxonomy Extension Calculation Linkbase Document |

101.DEF* |

| XBRL Taxonomy Extension Definition Linkbase Document |

101.LAB* |

| XBRL Taxonomy Extension Label Linkbase Document |

101.PRE* |

| XBRL Taxonomy Extension Presentation Linkbase Document |

* - Filed herewith

| 9 |

| Table of Contents |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the Company has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| TIMBERLINE RESOURCES CORPORATION |

| |

|

|

|

|

| By: | /s/ Patrick Highsmith |

|

|

| Patrick Highsmith |

|

|

| President and Chief Executive Officer |

|

|

| (Principal Executive Officer) |

|

|

|

|

|

| Date: February 13, 2023 |

| |

|

|

|

|

| By: | /s/ Ted R. Sharp |

|

|

| Ted R. Sharp |

|

|

| Chief Financial Officer |

|

|

| (Principal Financial and Accounting Officer) |

|

|

|

|

|

| Date: February 13, 2023 |

| |

| 10 |