Exhibit 99.1

| Contact: Tim Berryman Director – Investor Relations Medical Properties Trust, Inc. (205) 397-8589 tberryman@medicalpropertiestrust.com |

MEDICAL PROPERTIES TRUST, INC. ON PACE TO EXCEED ACQUISITION

TARGETS WITH $416 MILLION IN YEAR-TO-DATE COMMITMENTS FOR

NEW INVESTMENTS IN HOSPITAL REAL ESTATE

Continues Strong Growth in Per Share Normalized FFO of 8.0% (11.5% Before Non-cash Effect of Stronger Dollar) to $0.28

Birmingham, AL – May 7, 2015 – Medical Properties Trust, Inc. (the “Company” or “MPT”) (NYSE: MPW) today announced financial and operating results for the first quarter ended March 31, 2015.

FIRST QUARTER AND RECENT HIGHLIGHTS

| • | Achieved Normalized Funds from Operations (“FFO”) per diluted share of $0.28 in the first quarter, up 8.0% compared with $0.26 per diluted share in the first quarter of 2014; FFO was negatively impacted from foreign currency translation (non-cash impact) of $0.01 per share due to the dollar strengthening, absence of which Normalized FFO would have increased by 11.5% to $0.29 per share; |

| • | Invested $150 million for the acquisition of the real estate assets of two general acute care hospitals in the Kansas City area, and approximately $16 million for the acquisition of the real estate assets of an inpatient rehabilitation hospital in Weslaco, Texas; both investments will pay rent at a GAAP rate exceeding 10.0% with initial year cash yields between 8.5% and 9.0%; |

| • | Executed new agreements to acquire or develop and lease back $250 million in acute hospitals and free-standing emergency facilities to Adeptus Health at a GAAP yield exceeding 10.0% and at an initial year cash yield of approximately 9.0%; |

| • | Completed construction and commenced collection of rent from two Adeptus First Choice ER facilities in the first quarter; MPT is now receiving rent from 20 Adeptus facilities with 11 more under or nearing construction and 11 undergoing pre-construction diligence reviews; |

1

| • | Executed purchase agreements in April for 31 MEDIAN hospitals, commencing the period (generally 30 to 60 days) during which local governmental entities may elect (although not expected to do so) to acquire the purchase rights from MPT; |

| • | Issued 34.5 million shares of common stock at a public offering price of $14.50 for net proceeds of approximately $480 million to fund a portion of the acquisition of the previously announced MEDIAN sale-leaseback transactions; |

Included in the financial tables accompanying this press release is information about the Company’s assets and liabilities, net income and reconciliations of net income to FFO and Adjusted Funds from Operations (“AFFO”), all on a basis comparable to 2014 periods.

“During the first quarter, MPT built on last year’s record performance, capitalizing on the increasingly strong dynamics in the hospital real estate market,” said Edward K. Aldag, Jr., Chairman, President and CEO of Medical Properties Trust. “A confluence of positive factors is contributing to MPT’s significant growth, including increased capital needs among hospital operators and the growing acceptance of our sale/leaseback model from hospital operators and their equity owners and not-for-profit hospital systems.

“We expect another year of highly accretive acquisitions both domestically and internationally as our pipeline remains exceedingly strong. Our highly successful equity offering in the first quarter signaled the broadening of our shareholder base and, along with recently announced entries by other healthcare REITs and sophisticated capital sources into the markets for hospital real estate, indicates increased investor confidence in hospital real estate as a source of long-term stable cash flows with outstanding rent coverage. Overall, conditions remain highly favorable for continuing to create shareholder value in 2015 and beyond.”

OPERATING RESULTS

Normalized FFO for the first quarter increased 33% to $56.9 million compared with $42.7 million in the first quarter of 2014. Per share Normalized FFO increased 8% to $0.28 per diluted share in the first quarter compared with $0.26 per diluted share in the first quarter of 2014. During the first quarter, the U.S. dollar strengthened against the Euro by 10% on average compared to the fourth quarter of 2014; this negatively affected Normalized FFO (from the translation of our international operating results) by approximately $0.01 per share. Because MPT has no intention in the foreseeable future to convert euro-denominated cash flow to dollars this accounting does not impact the amount of cash available to pay euro-denominated expenses including interest and operating expenses or to acquire additional assets whose purchase prices are denominated in euros.

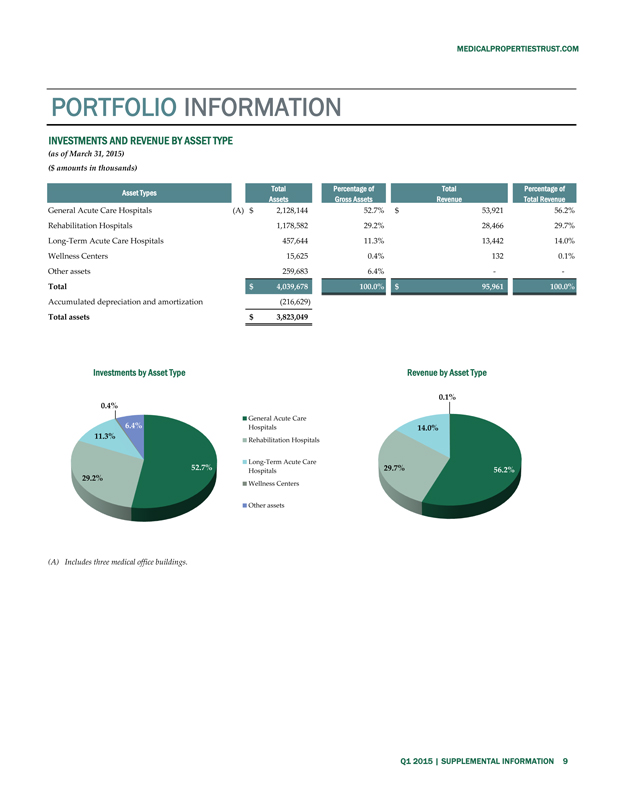

First quarter 2015 total revenues increased 31% to $96.0 million compared with $73.1 million for the first quarter of 2014.

Net income for the first quarter of 2015 was $35.9 million (or $0.17 per diluted share) up from net income of $7.2 million (or $0.04 per diluted share) in the first quarter of 2014, which included a previously disclosed loan impairment charge.

2

PORTFOLIO UPDATE AND OUTLOOK

Since the beginning of 2015, the Company has acquired two general acute care hospitals, St. Joseph Medical Center in Kansas City, Missouri and St. Mary’s Medical Center in Blue Springs, Missouri, for a total investment of $150 million and leased the facilities to Prime Healthcare. The leases are under a master lease agreement with Prime and have a 10-year initial term with two five-year extension options. The annual rent escalators are CPI-based with a floor.

In addition, the Company acquired an inpatient rehabilitation hospital in Weslaco, Texas for a total investment of approximately $16 million and leased the facility to Ernest Health. The lease falls under the master lease agreement with Ernest, which has a remaining 17-year fixed term and three five-year extension options. The annual rent escalators are CPI-based with a floor and a cap.

In April, the Company executed a new master lease agreement with Adeptus Health that provides for the acquisition and development of general acute care hospitals and free standing emergency facilities with an aggregate commitment of $250 million, bringing MPT’s expected investment in the preeminent leader in the rapidly growing emergency facility sector of acute treatment to $500 million. Much of the newly committed real estate funding will support Adeptus’ new strategy of creating localized ventures with leading hospital operators to build and operate clusters of facilities around jointly owned general acute hospitals. The new master lease includes provisions for double digit GAAP yields and uncapped annual inflation adjustments, along with a 15-year initial term and three five-year options to extend.

Early in the second quarter, the Company executed definitive agreements with affiliates of MEDIAN to purchase and lease back 31 hospitals and expects these properties to close during the next 30 to 60 days subject to expiration or waiver of previously described preemption rights; agreements for the acquisition of an additional four hospitals are expected to be executed during the second and third quarters. The Company has elected not to acquire five of the initially targeted 40 hospitals. The previously disclosed aggregate purchase price for the MEDIAN properties of €705 million remains unchanged.

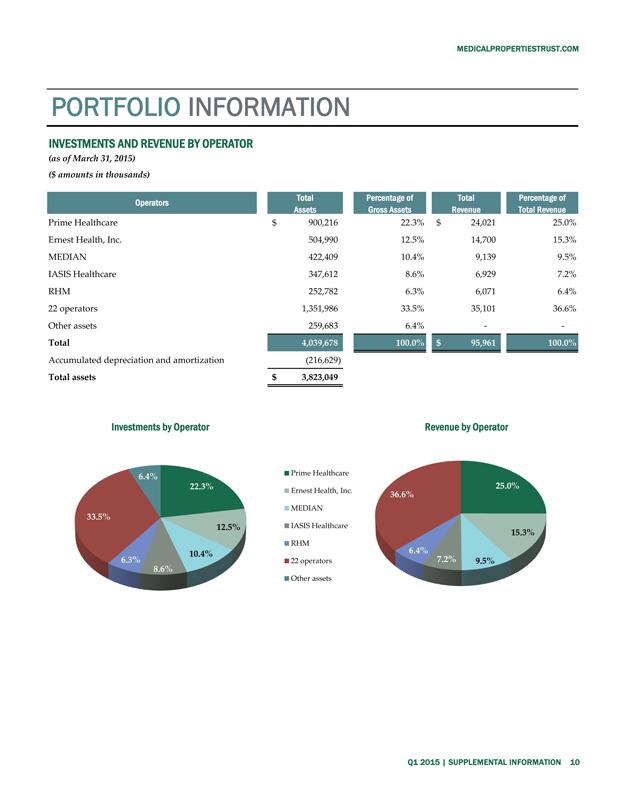

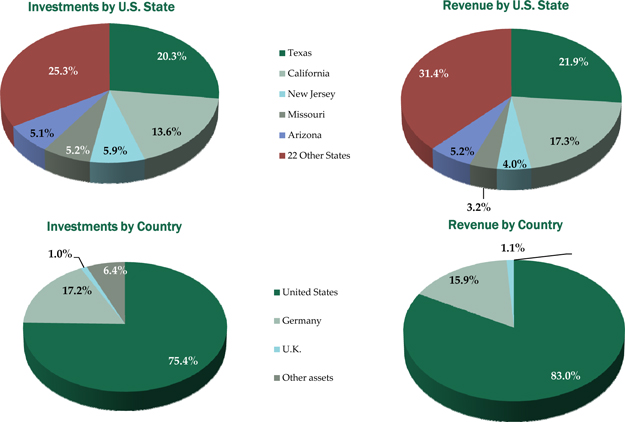

As of March 31, 2015, the Company had total real estate and related investments of approximately $3.8 billion consisting of 141 properties in 27 states and in Germany and the United Kingdom. The properties are leased to or mortgaged by 27 hospital operating companies. Including completion of development commitments and the pending MEDIAN acquisitions, the Company projects total real estate and related investments of approximately $4.5 billion comprising more than 176 healthcare properties when achieved.

Based solely on the completed acquisitions, development projects currently ongoing, which does not include the new $250 million commitment to Adeptus, and the completion of the MEDIAN sale leaseback transactions, per share Normalized FFO is expected to range between approximately $1.22 and $1.28 on an annual run-rate basis. In addition, MPT expects to continue to invest in similarly accretive hospital real estate in 2015; however, any impact on FFO from such investments and the financing thereof is not included in the annual run rate provided herein.

3

These estimates do not include the effects, if any, of real estate operating costs, litigation costs, debt refinancing costs, acquisition costs, currency exchange rate movements, interest rate hedging activities, write-offs of straight-line rent or other non-recurring or unplanned transactions. These estimates will change when the Company acquires or sells assets, market interest rates change, debt is refinanced, new shares are issued, additional debt is incurred, other operating expenses vary, income from investments in tenant operations vary from expectations, or existing leases do not perform in accordance with their terms.

CONFERENCE CALL AND WEBCAST

The Company has scheduled a conference call and webcast for Thursday, May 7, 2015 at 11:00 a.m. Eastern Time to present the Company’s financial and operating results for the quarter ended March 31, 2015. The dial-in numbers for the conference call are 877-546-5020 (U.S.) and 857-244-7552 (international); both numbers require passcode 33154467. The conference call will also be available via webcast in the Investor Relations’ section of the Company’s website, www.medicalpropertiestrust.com.

A telephone and webcast replay of the call will be available beginning shortly after the call’s completion through May 21, 2015. Dial-in numbers for the replay are 888-286-8010 and 617-801-6888 for U.S. and International callers, respectively. The replay passcode for both U.S. and international callers is 75057881.

The Company’s supplemental information package for the current period will also be available on the Company’s website under the “Investor Relations” section.

About Medical Properties Trust, Inc.

Medical Properties Trust, Inc. is a Birmingham, Alabama based self-advised real estate investment trust formed to capitalize on the changing trends in healthcare delivery by acquiring and developing net-leased healthcare facilities. MPT’s financing model allows hospitals and other healthcare facilities to unlock the value of their underlying real estate in order to fund facility improvements, technology upgrades, staff additions and new construction. Facilities include acute care hospitals, inpatient rehabilitation hospitals, long-term acute care hospitals, and other medical and surgical facilities. For more information, please visit the Company’s website at www.medicalpropertiestrust.com.

The statements in this press release that are forward looking are based on current expectations and actual results or future events may differ materially. Words such as “expects,” “believes,” “anticipates,” “intends,” “will,” “should” and variations of such words and similar expressions are intended to identify such forward-looking statements. Forward-looking statements involve known and unknown risks, uncertainties and other factors that may cause the actual results of the Company or future events to differ materially from those expressed in or underlying such forward-looking statements, including without limitation: the satisfaction of all conditions to, and the timely closing (if at all) of the MEDIAN sale-leaseback transactions; the Company financing of the transactions described herein; the capacity of MEDIAN and the Company’s other

4

tenants to meet the terms of their agreements; Normalized FFO per share; expected payout ratio, the amount of acquisitions of healthcare real estate, if any; capital markets conditions, the repayment of debt arrangements; statements concerning the additional income to the Company as a result of ownership interests in certain hospital operations and the timing of such income; the payment of future dividends, if any; completion of additional debt arrangement, and additional investments; national and international economic, business, real estate and other market conditions; the competitive environment in which the Company operates; the execution of the Company’s business plan; financing risks; the Company’s ability to maintain its status as a REIT for federal income tax purposes; acquisition and development risks; potential environmental and other liabilities; and other factors affecting the real estate industry generally or healthcare real estate in particular. For further discussion of the factors that could affect outcomes, please refer to the “Risk factors” section of the Company’s Annual Report on Form 10-K for the year ended December 31, 2014, and as updated by the Company’s subsequently filed Quarterly Reports on Form 10-Q and other SEC filings. Except as otherwise required by the federal securities laws, the Company undertakes no obligation to update the information in this press release.

# # #

5

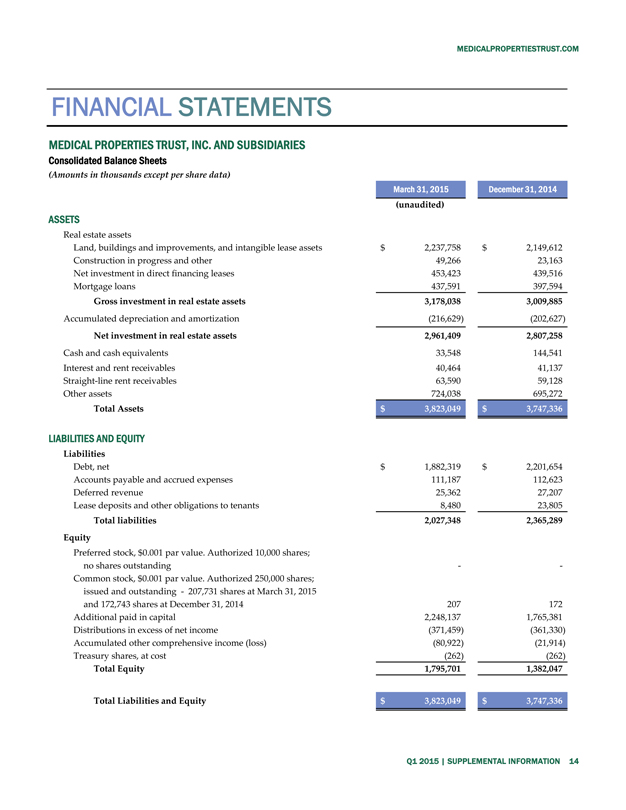

MEDICAL PROPERTIES TRUST, INC. AND SUBSIDIARIES

Consolidated Balance Sheets

| (Amounts in thousands, except for per share data) | March 31, 2015 | December 31, 2014 | ||||||

| (Unaudited) | ||||||||

| Assets |

||||||||

| Real estate assets |

||||||||

| Land, buildings and improvements, and intangible lease assets |

$ | 2,237,758 | $ | 2,149,612 | ||||

| Construction in progress and other |

49,266 | 23,163 | ||||||

| Net investment in direct financing leases |

453,423 | 439,516 | ||||||

| Mortgage loans |

437,591 | 397,594 | ||||||

|

|

|

|

|

|||||

| Gross investment in real estate assets |

3,178,038 | 3,009,885 | ||||||

| Accumulated depreciation and amortization |

(216,629 | ) | (202,627 | ) | ||||

|

|

|

|

|

|||||

| Net investment in real estate assets |

2,961,409 | 2,807,258 | ||||||

| Cash and cash equivalents |

33,548 | 144,541 | ||||||

| Interest and rent receivables |

40,464 | 41,137 | ||||||

| Straight-line rent receivables |

63,590 | 59,128 | ||||||

| Other assets |

724,038 | 695,272 | ||||||

|

|

|

|

|

|||||

| Total Assets |

$ | 3,823,049 | $ | 3,747,336 | ||||

|

|

|

|

|

|||||

| Liabilities and Equity |

||||||||

| Liabilities |

||||||||

| Debt, net |

$ | 1,882,319 | $ | 2,201,654 | ||||

| Accounts payable and accrued expenses |

111,187 | 112,623 | ||||||

| Deferred revenue |

25,362 | 27,207 | ||||||

| Lease deposits and other obligations to tenants |

8,480 | 23,805 | ||||||

|

|

|

|

|

|||||

| Total Liabilities |

2,027,348 | 2,365,289 | ||||||

| Equity |

||||||||

| Preferred stock, $0.001 par value. Authorized 10,000 shares; no shares outstanding |

— | — | ||||||

| Common stock, $0.001 par value. Authorized 250,000 shares; issued and outstanding - 207,731 shares at March 31, 2015 and 172,743 shares at December 31, 2014 |

207 | 172 | ||||||

| Additional paid in capital |

2,248,137 | 1,765,381 | ||||||

| Distributions in excess of net income |

(371,459 | ) | (361,330 | ) | ||||

| Accumulated other comprehensive loss |

(80,922 | ) | (21,914 | ) | ||||

| Treasury shares, at cost |

(262 | ) | (262 | ) | ||||

|

|

|

|

|

|||||

| Total Equity |

1,795,701 | 1,382,047 | ||||||

|

|

|

|

|

|||||

| Total Liabilities and Equity |

$ | 3,823,049 | $ | 3,747,336 | ||||

|

|

|

|

|

|||||

MEDICAL PROPERTIES TRUST, INC. AND SUBSIDIARIES

Consolidated Statements of Income

(Unaudited)

| For the Three Months Ended | ||||||||

| March 31, 2015 | March 31, 2014 | |||||||

| (Amounts in thousands, except for per share data) | ||||||||

| Revenues |

||||||||

| Rent billed |

$ | 53,100 | $ | 42,957 | ||||

| Straight-line rent |

4,728 | 2,148 | ||||||

| Income from direct financing leases |

12,555 | 12,215 | ||||||

| Interest and fee income |

25,578 | 15,769 | ||||||

|

|

|

|

|

|||||

| Total revenues |

95,961 | 73,089 | ||||||

| Expenses |

||||||||

| Real estate depreciation and amortization |

14,756 | 13,690 | ||||||

| Impairment charges |

— | 20,496 | ||||||

| Property-related |

351 | 738 | ||||||

| Acquisition expenses |

6,239 | 512 | ||||||

| General and administrative |

10,905 | 8,959 | ||||||

|

|

|

|

|

|||||

| Total operating expenses |

32,251 | 44,395 | ||||||

|

|

|

|

|

|||||

| Operating income |

63,710 | 28,694 | ||||||

| Interest and other income (expense) |

(27,359 | ) | (21,442 | ) | ||||

| Income tax (expense) benefit |

(375 | ) | 57 | |||||

|

|

|

|

|

|||||

| Income from continuing operations |

35,976 | 7,309 | ||||||

| Income (loss) from discontinued operations |

— | (2 | ) | |||||

|

|

|

|

|

|||||

| Net income |

35,976 | 7,307 | ||||||

| Net income attributable to non-controlling interests |

(79 | ) | (66 | ) | ||||

|

|

|

|

|

|||||

| Net income attributable to MPT common stockholders |

$ | 35,897 | $ | 7,241 | ||||

|

|

|

|

|

|||||

| Earnings per common share - basic: |

||||||||

| Income from continuing operations |

$ | 0.18 | $ | 0.04 | ||||

| Income from discontinued operations |

— | — | ||||||

|

|

|

|

|

|||||

| Net income attributable to MPT common stockholders |

$ | 0.18 | $ | 0.04 | ||||

|

|

|

|

|

|||||

| Earnings per common share - diluted: |

||||||||

| Income from continuing operations |

$ | 0.17 | $ | 0.04 | ||||

| Income from discontinued operations |

— | — | ||||||

|

|

|

|

|

|||||

| Net income attributable to MPT common stockholders |

$ | 0.17 | $ | 0.04 | ||||

|

|

|

|

|

|||||

| Dividends declared per common share |

$ | 0.22 | $ | 0.21 | ||||

| Weighted average shares outstanding - basic |

202,958 | 163,973 | ||||||

| Weighted average shares outstanding - diluted |

203,615 | 164,549 | ||||||

MEDICAL PROPERTIES TRUST, INC. AND SUBSIDIARIES

Reconciliation of Net Income to Funds From Operations

(Unaudited)

| For the Three Months Ended | ||||||||

| March 31, 2015 | March 31, 2014 | |||||||

| (Amounts in thousands, except per share data) | ||||||||

| FFO information: |

||||||||

| Net income attributable to MPT common stockholders |

$ | 35,897 | $ | 7,241 | ||||

| Participating securities’ share in earnings |

(266 | ) | (209 | ) | ||||

|

|

|

|

|

|||||

| Net income, less participating securities’ share in earnings |

$ | 35,631 | $ | 7,032 | ||||

| Depreciation and amortization |

14,756 | 13,690 | ||||||

|

|

|

|

|

|||||

| Funds from operations |

$ | 50,387 | $ | 20,722 | ||||

| Write-off of straight line rent |

— | 950 | ||||||

| Impairment charges |

— | 20,496 | ||||||

| Acquisition costs |

6,239 | 512 | ||||||

| Unutilized financing fees / debt refinancing costs |

238 | — | ||||||

|

|

|

|

|

|||||

| Normalized funds from operations |

$ | 56,864 | $ | 42,680 | ||||

| Share-based compensation |

2,603 | 2,043 | ||||||

| Debt costs amortization |

1,377 | 1,049 | ||||||

| Additional rent received in advance (A) |

(300 | ) | (300 | ) | ||||

| Straight-line rent revenue and other |

(6,332 | ) | (4,703 | ) | ||||

|

|

|

|

|

|||||

| Adjusted funds from operations |

$ | 54,212 | $ | 40,769 | ||||

|

|

|

|

|

|||||

| Per diluted share data: |

||||||||

| Net income, less participating securities’ share in earnings |

$ | 0.17 | $ | 0.04 | ||||

| Depreciation and amortization |

0.08 | 0.09 | ||||||

|

|

|

|

|

|||||

| Funds from operations |

$ | 0.25 | $ | 0.13 | ||||

| Write-off of straight line rent |

— | 0.01 | ||||||

| Impairment charges |

— | 0.12 | ||||||

| Acquisition costs |

0.03 | — | ||||||

| Unutilized financing fees / debt refinancing costs |

— | — | ||||||

|

|

|

|

|

|||||

| Normalized funds from operations |

$ | 0.28 | $ | 0.26 | ||||

| Share-based compensation |

0.01 | 0.01 | ||||||

| Debt costs amortization |

0.01 | 0.01 | ||||||

| Additional rent received in advance (A) |

— | — | ||||||

| Straight-line rent revenue and other |

(0.03 | ) | (0.03 | ) | ||||

|

|

|

|

|

|||||

| Adjusted funds from operations |

$ | 0.27 | $ | 0.25 | ||||

|

|

|

|

|

|||||

| (A) | Represents additional rent from one tenant in advance of when we can recognize as revenue for accounting purposes. This additional rent is being recorded to revenue on a straight-line basis over the lease life. |

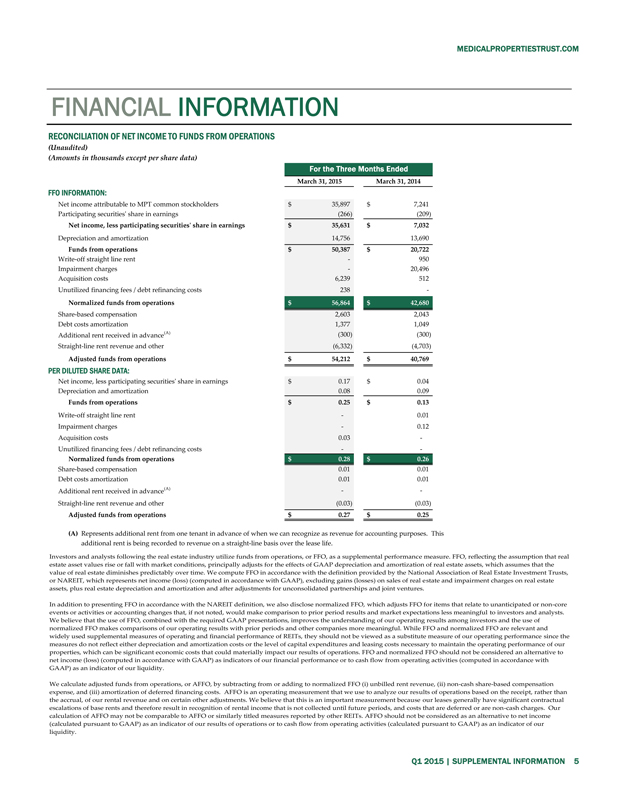

Investors and analysts following the real estate industry utilize funds from operations, or FFO, as a supplemental performance measure. FFO, reflecting the assumption that real estate asset values rise or fall with market conditions, principally adjusts for the effects of GAAP depreciation and amortization of real estate assets, which assumes that the value of real estate diminishes predictably over time. We compute FFO in accordance with the definition provided by the National Association of Real Estate Investment Trusts, or NAREIT, which represents net income (loss) (computed in accordance with GAAP), excluding gains (losses) on sales of real estate and impairment charges on real estate assets, plus real estate depreciation and amortization and after adjustments for unconsolidated partnerships and joint ventures.

In addition to presenting FFO in accordance with the NAREIT definition, we also disclose normalized FFO,which adjusts FFO for items that relate to unanticipated or non-core events or activities or accounting changes that, if not noted, would make comparison to prior period results and market expectations less meaningful to investors and analysts. We believe that the use of FFO, combined with the required GAAP presentations, improves the understanding of our operating results among investors and the use of normalized FFO makes comparisons of our operating results with prior periods and other companies more meaningful. While FFO and normalized FFO are relevant and widely used supplemental measures of operating and financial performance of REITs, they should not be viewed as a substitute measure of our operating performance since the measures do not reflect either depreciation and amortization costs or the level of capital expenditures and leasing costs necessary to maintain the operating performance of our properties, which can be significant economic costs that could materially impact our results of operations. FFO and normalized FFO should not be considered an alternative to net income (loss) (computed in accordance with GAAP) as indicators of our financial performance or to cash flow from operating activities (computed in accordance with GAAP) as an indicator of our liquidity.

We calculate adjusted funds from operations, or AFFO, by subtracting from or adding to normalized FFO (i) unbilled rent revenue, (ii) non-cash share-based compensation expense, and (iii) amortization of deferred financing costs. AFFO is an operating measurement that we use to analyze our results of operations based on the receipt, rather than the accrual, of our rental revenue and on certain other adjustments. We believe that this is an important measurement because our leases generally have significant contractual escalations of base rents and therefore result in recognition of rental income that is not collected until future periods, and costs that are deferred or are non-cash charges. Our calculation of AFFO may not be comparable to AFFO or similarly titled measures reported by other REITs. AFFO should not be considered as an alternative to net income (calculated pursuant to GAAP) as an indicator of our results of operations or to cash flow from operating activities (calculated pursuant to GAAP) as an indicator of our liquidity.