Document

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2017

Commission file number 001-33961

HILL INTERNATIONAL, INC.

(Exact name of registrant as specified in its charter)

|

| | |

Delaware | | 20-0953973 |

State or other jurisdiction of incorporation or organization | | (I.R.S. Employer Identification No.) |

| | |

One Commerce Square | | |

2005 Market Street, 17th Floor | | |

Philadelphia, PA | | 19103 |

(Address of principal executive offices) | | (Zip Code) |

Registrant’s telephone number, including area code: (215) 309-7700

Securities registered pursuant to Section 12(b) of the Act:

|

| | |

Title of each class | | Name of each exchange on which registered |

Common Stock, $.0001 par value | | New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Exchange Act: None

Indicate by a check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes o No ý

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

Yes o No ý

Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months, and (2) has been subject to such filing requirements for the past 90 days. Yes o No ý

Indicate by a check mark whether the registrant has submitted electronically and posted on its corporate website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

Yes o No ý

Indicate by a check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act (Check one):

|

| | |

Large Accelerated Filer o | | Accelerated Filer x |

Non-Accelerated Filer o | | Smaller reporting company o |

| | Emerging growth company o |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes o No ý

The aggregate market value of shares of common stock held by non-affiliates on June 30, 2017 was approximately $270,716,337. As of August 28, 2018, there were 55,294,670 shares of the Registrant’s Common Stock outstanding.

HILL INTERNATIONAL, INC. AND SUBSIDIARIES

Index to Form 10-K

PART I

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This report contains “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995, and it is our intent that any such statements be protected by the safe harbor created thereby. Except for historical information, the matters set forth herein including, but not limited to, any projections of revenues, earnings, earnings before interest, taxes, depreciation and amortization (“EBITDA”), margin, profit improvement, cost savings or other financial items; any statements of belief, any statements concerning our plans, strategies and objectives for future operations; and any statements regarding future economic conditions or performance, are forward-looking statements.

These forward-looking statements are based on our current expectations, estimates and assumptions and are subject to certain risks and uncertainties. Although we believe that the expectations, estimates and assumptions reflected in our forward-looking statements are reasonable, actual results could differ materially from those projected or assumed in any of our forward-looking statements.

Forward-looking statements may concern, among other things:

| |

• | The markets for our services; |

| |

• | Projections of revenues and earnings, anticipated contractual obligations, funding requirements or other financial items; |

| |

• | Statements concerning our plans, strategies and objectives for future operations; and |

| |

• | Statements regarding future economic conditions or performance. |

Important factors that could cause our actual results to differ materially from estimates or projections contained in our forward-looking statements include:

| |

• | The risks set forth in Item 1A, “Risk Factors,” herein; |

| |

• | Unfavorable global economic conditions may adversely impact our business; |

| |

• | Our backlog, which is subject to unexpected adjustments and cancellations, may not be fully realized as revenue; |

| |

• | We may incur difficulties in implementing the profit improvement plan; |

| |

• | Our expenses may be higher than anticipated; |

| |

• | Modifications and termination of client contracts; |

| |

• | Control and operational issues pertaining to business activities that we conduct pursuant to joint ventures with other parties; |

| |

• | Difficulties we may incur in implementing our acquisition strategy; and |

| |

• | The need to retain and recruit key technical and management personnel. |

Other factors that may affect our business, financial position or results of operations include:

| |

• | Unexpected delays in collections from clients; |

| |

• | Risks related to our ability to obtain debt financing or otherwise raise capital to meet required working capital needs and to support potential future acquisition activities; |

| |

• | Risks related to international operations, including uncertain political and economic environments, acts of terrorism or war, potential incompatibilities with foreign joint venture partners, foreign currency fluctuations, civil disturbances and labor issues; and |

| |

• | Risks related to contracts with governmental entities, including the failure of applicable governing authorities to take necessary actions to secure or maintain funding for particular projects with us, the unilateral termination of contracts by the government and reimbursement obligations to the government for funds previously received. |

We do not intend, and undertake no obligation, to update any forward-looking statement. In accordance with the Reform Act, Item 1A of this Report entitled “Risk Factors” contains cautionary statements that accompany those forward-looking statements. You should carefully review such cautionary statements as they identify certain important factors that could cause actual results to differ materially from those in the forward-looking statements and from historical trends. Those cautionary statements are not exclusive and are in addition to other factors discussed elsewhere in this Form 10-K, in our other filings with the SEC or in materials incorporated therein by reference.

Item 1. Business.

General

Hill International, Inc., with approximately 2,900 professionals in more than 50 offices worldwide, provides project management, construction management and other consulting services primarily to the building, transportation, environmental, energy and industrial markets. The terms “Hill”, the “Company”, “we”, “us” and “our” refer to Hill International, Inc.

We compete for business based on a variety of factors such as technical capability, global resources, price, reputation and past experience, including client requirements for substantial experience in similar projects. We have developed significant long-standing relationships, which bring us repeat business and would be very difficult to replicate. We believe we have an excellent reputation for attracting and retaining professionals. In addition, we believe there are high barriers to entry for new competitors especially in the project management market.

Amounts throughout the remainder of this document are in thousands unless otherwise noted.

Our Strategy

Our strategy emphasizes the following key elements:

| |

• | Increase Revenues from Our Existing Clients. We have long-standing relationships with a number of public and private sector entities. Meeting our clients’ diverse needs in managing construction risk and generating repeat business from our clients to expand our project base is one of our key growth strategies. We accomplish this objective by providing a broad range of project management consulting services in a wide range of geographic areas that support our clients during every phase of a project, from concept through completion. We believe that nurturing our existing client relationships expands our project base through repeat business. |

| |

• | Capitalize Upon the Continued Spend in the Markets We Serve. We believe that the demand for project management services will grow with increasing construction and infrastructure spending in the markets we serve. We believe that our reputation and experience combined with our broad platform of service offerings will enable us to capitalize on increases in demand for our services. In addition, we strategically open new offices to expand into new geographic areas and we aggressively hire individuals with significant contacts to accelerate the growth of these new offices and to strengthen our presence in existing markets. |

| |

• | Strengthen Professional Resources. Our biggest asset is the people that work for Hill. We intend to continue spending significant time recruiting and retaining the best and the brightest to improve our competitive position. Our independent status has attracted top project management talent with varied industry experience. We believe maintaining and bolstering our team will enable us to continue to grow our business. |

| |

• | Control Our Costs and Expenses. The Company commenced a Profit Improvement Plan (“PIP”) in May 2017 following the sale of the Construction Claims Group. We initially identified gross, annualized pre-tax savings ranging from $27 million to $38 million. As a result of the reductions implemented to date, the gross savings through December 31, 2017 were approximately $8 million, with expected annual gross savings of approximately $32 million in 2018. We continue to seek additional cost savings opportunities and have substantially completed the PIP as of the third quarter of 2018. |

Reporting Segments

On December 20, 2016, we entered into a Stock Purchase Agreement to sell our Construction Claims Group, which is reported herein as discontinued operations. The transaction permitted us to strengthen our balance sheet and better focus on our project management business. See Note 2 to our consolidated financial statements for a description of the transaction.

The Company operates in a single reporting segment, known as the Project Management Group which provides fee-based construction management services to our clients, leveraging our construction expertise to identify potential trouble, difficulties and sources of delay on a construction project before they develop into costly problems. Our experienced professionals are capable of managing all phases of the construction process from concept through completion, including cost and budget controls, scheduling, estimating, expediting, inspection, contract administration and management of contractors, subcontractors and suppliers.

Our clients are typically billed a negotiated multiple of the actual direct cost of each professional assigned to a project and we are reimbursed for our out-of-pocket expenses. We believe our fee-based consulting has significant advantages over traditional general contractors. Specifically, because we do not assume project completion risk, our fee-based model eliminates many of the risks typically associated with providing “at risk” construction services.

Global Business

We operate worldwide and currently have over 50 offices in over 25 countries. The following table sets forth the amount and percentage of our revenues by geographic region for each of the past three fiscal years:

Revenue by Geographic Region:

|

| | | | | | | | | | | | | | | | | | | | | |

| | 2017 | | 2016 | | 2015 |

United States | | $ | 227,581 |

| | 47.1 | % | | $ | 204,035 |

| | 39.5 | % | | $ | 187,399 |

| | 34.4 | % |

Latin America | | 11,772 |

| | 2.4 | % | | 18,775 |

| | 3.6 | % | | 26,350 |

| | 4.8 | % |

Europe | | 43,179 |

| | 8.9 | % | | 41,062 |

| | 8.0 | % | | 42,635 |

| | 7.8 | % |

Middle East | | 169,964 |

| | 35.1 | % | | 213,613 |

| | 41.4 | % | | 248,193 |

| | 45.6 | % |

Africa | | 23,100 |

| | 4.8 | % | | 24,037 |

| | 4.7 | % | | 23,935 |

| | 4.4 | % |

Asia/Pacific | | 8,140 |

| | 1.7 | % | | 14,490 |

| | 2.8 | % | | 16,248 |

| | 3.0 | % |

Total | | $ | 483,736 |

| | 100.0 | % | | $ | 516,012 |

| | 100.0 | % | | $ | 544,760 |

| | 100.0 | % |

Grow Organically and Through Selective Acquisitions

Over the years, our business has expanded through organic growth and the acquisition of a number of project management businesses.

Clients

Our clients consist primarily of the United States federal, state and local governments, other national governments, and the private sector. The following table sets forth our breakdown of revenue attributable to these categories of clients for for the years ended December 31, 2017, 2016 and 2015:

Revenue By Client Type

|

| | | | | | | | | | | | | | | | | | | | | |

| | 2017 | | 2016 | | 2015 |

U.S. federal government | | $ | 15,105 |

| | 3.1 | % | | $ | 12,050 |

| | 2.3 | % | | $ | 10,737 |

| | 2.0 | % |

U.S. state, regional and local governments | | 156,183 |

| | 32.3 | % | | 155,976 |

| | 30.2 | % | | 139,086 |

| | 25.5 | % |

Foreign governments | | 133,655 |

| | 27.6 | % | | 170,567 |

| | 33.1 | % | | 209,468 |

| | 38.5 | % |

Private sector | | 178,793 |

| | 37.0 | % | | 177,419 |

| | 34.4 | % | | 185,469 |

| | 34.0 | % |

Total | | $ | 483,736 |

| | 100.0 | % | | $ | 516,012 |

| | 100.0 | % | | $ | 544,760 |

| | 100.0 | % |

The following table sets forth the percentage of our revenue contributed by each of our five largest clients for the years ended December 31, 2017, 2016 and 2015:

|

| | | | | | | | | |

| | 2017 | | 2016 | | 2015 |

Largest client | | 6.0 | % | | 9.0 | % | | 8.0 | % |

2nd largest client | | 6.0 | % | | 5.0 | % | | 6.0 | % |

3rd largest client | | 4.0 | % | | 5.0 | % | | 5.0 | % |

4th largest client | | 3.0 | % | | 4.0 | % | | 4.0 | % |

5th largest client | | 3.0 | % | | 4.0 | % | | 3.0 | % |

Top 5 largest clients | | 22.0 | % | | 27.0 | % | | 26.0 | % |

Business Development

The process for acquiring business from each of our categories of clients is principally the same, by participating in a competitive request-for-proposal (“RFP”) process, with the primary difference among clients being that the process for public sector clients is significantly more formal and complex than for private sector clients as a result of government procurement rules and regulations that govern the public-sector process.

Although a significant factor in our business development consists of our standing in our industry, including existing relationships and reputation based on performance on completed projects, our marketing department undertakes a variety of activities in order to expand our exposure to potential new clients. These activities include media relations, advertising, promotions, market sector initiatives and maintaining our website and related web marketing. Media relations include placing articles that feature us and our personnel in trade publications and other media outlets. Our promotions include arranging speaking engagements for our personnel, participation in trade shows and other promotional activities. Market sector initiatives are designed to broaden our exposure to specific sectors of the construction industry by, for example, participating in or organizing industry seminars.

Doing business with governments is complex and requires the ability to comply with intricate regulations and satisfy periodic audits. We believe that the ability to understand these requirements and to successfully conduct business with government agencies is a barrier to entry for smaller, less experienced competitors. Most government contracts, including those with foreign governments, are subject to termination by the government, to government audits and to continued appropriations. For the year ended December 31, 2017, 2016 and 2015, revenue from U.S. and foreign government contracts represented approximately 63.0%, 65.6% and 66.0% of our total revenue, respectively.

We are required from time to time to obtain various permits, licenses and approvals in order to conduct our business in many of the jurisdictions where we operate. Our business of providing project management services is not subject to significant regulation by state, federal or foreign governments.

Contracts

The price provisions of our customer contracts can be grouped into three broad categories: cost-plus, time and materials, and fixed price. Cost-plus contracts provide for reimbursement of our costs and overhead plus a predetermined fee. Under some cost-plus

contracts, our fee may be based partially on quality, schedule and other performance factors. We also enter into contracts whereby we bill our clients monthly at hourly billing rates. The hourly billing rates are determined by contract terms. For governmental clients, the hourly rates are generally calculated as salary costs plus overhead costs plus a negotiated profit percentage. For commercial clients, the hourly rate can be taken from a standard fee schedule by staff classification or it can be at a discount from this schedule. In some cases, primarily for foreign work, a monthly rate is negotiated rather than an hourly rate. This monthly rate is a build-up of staffing costs plus overhead and profit.

Backlog

We believe a primary indicator of our future performance is our backlog of uncompleted projects under contract or awarded. Our backlog represents management’s estimate of the amount of contracts and awards in hand that we expect to result in future revenue. Our backlog is evaluated by management on a project-by-project basis and is reported for each period shown based upon the binding nature of the underlying contract, commitment or letter of intent, and other factors, including the economic, financial and regulatory viability of the project and the likelihood of the contract being extended, renewed or canceled.

Our backlog is important to us in anticipating and planning for our operational needs. Backlog is not a measure defined in U.S. generally accepted accounting principles ("U.S. GAAP"), and our methodology for determining backlog may not be comparable to the methodology used by other companies in determining their backlog.

Although backlog reflects business that we consider to be firm, cancellations or scope adjustments may occur. Further, substantially all of our contracts with our clients may be terminated at will, in which case the client would only be obligated to us for services provided through the termination date. Historically, the impact of terminations and modifications on our realization of revenue from our backlog has not been significant, however, in December 2016, one contract in the Middle East and one contract in Africa were cancelled. As a result, approximately $73,000 was excluded from our backlog at December 31, 2016. Furthermore, reductions of our backlog as a result of contract terminations and modifications may be offset by additions to the backlog.

We adjust backlog to reflect project cancellations, deferrals and revisions in scope and cost (both upward and downward) known at the reporting date. Future contract modifications or cancellations, however, may increase or reduce backlog and future revenue.

The following tables show our backlog by geographic region:

|

| | | | | | | | | | | | | | |

| | Total Backlog | | 12-Month Backlog |

As of December 31, 2017 | | |

| | |

| | |

| | |

|

United States | | $ | 449,621 |

| | 53.2 | % | | $ | 116,975 |

| | 37.5 | % |

Latin America | | 13,350 |

| | 1.6 | % | | 8,789 |

| | 2.8 | % |

Europe | | 45,446 |

| | 5.4 | % | | 29,887 |

| | 9.6 | % |

Middle East | | 250,956 |

| | 29.6 | % | | 126,965 |

| | 40.6 | % |

Africa | | 67,491 |

| | 8.0 | % | | 23,111 |

| | 7.4 | % |

Asia/Pacific | | 18,935 |

| | 2.2 | % | | 6,500 |

| | 2.1 | % |

Total | | $ | 845,799 |

| | 100.0 | % | | $ | 312,227 |

| | 100.0 | % |

|

| | | | | | | | | | | | | | |

| | Total Backlog | | 12-Month Backlog |

As of December 31, 2016 | | |

| | |

| | |

| | |

|

United States | | $ | 459,000 |

| | 54.6 | % | | 141,000 |

| | 41.7 | % |

Latin America | | 10,000 |

| | 1.2 | % | | 8,000 |

| | 2.4 | % |

Europe | | 38,225 |

| | 4.5 | % | | 26,091 |

| | 7.7 | % |

Middle East | | 284,028 |

| | 33.7 | % | | 133,030 |

| | 39.4 | % |

Africa | | 42,000 |

| | 5.0 | % | | 22,000 |

| | 6.5 | % |

Asia/Pacific | | 8,000 |

| | 1.0 | % | | 8,000 |

| | 2.3 | % |

Total | | $ | 841,253 |

| | 100.0 | % | | $ | 338,121 |

| | 100.0 | % |

At December 31, 2017, our backlog was $845,799, compared to approximately $841,253 at December 31, 2016. Our net bookings during December 2017 of $488,283 equates to a book-to-bill ratio of 100.9%. We estimate that approximately $312,227 or 36.9% of the backlog at December 31, 2017 will be recognized during our 2018 fiscal year.

Competition

The project management industry is highly competitive. We compete for contracts, primarily on the basis of technical capability, with numerous entities, including other construction management companies, design or engineering firms, general contractors, management consulting firms and other entities. Compared to us, many of these competitors are larger, well-established companies that have broader geographic scope and greater financial and other resources. During 2017, some of our largest project management competitors included: AECOM, ARCADIS N.V., Jacobs Engineering Group, Inc., WSP Parsons Brinckerhoff, Inc., Parsons Corp. and Turner Construction Co.

Insurance

We maintain insurance covering general and professional liability, involving bodily injury and property damage. We have historically enjoyed a favorable loss ratio in all lines of insurance and our management considers our present limits of liability, deductibles and reserves to be adequate. We endeavor to reduce or eliminate risk through the use of quality assurance/control, risk management, workplace safety and similar methods to eliminate or reduce the risk of losses on a project.

Management

We are led by an experienced management team with significant experience in the construction industry. Additional information about our executive officers follows.

Executive Officers

|

| | | | | |

Name | | Age | | Position |

Paul J. Evans | | 50 |

| | Interim Chief Executive Officer |

Raouf S. Ghali | | 57 |

| | President and Chief Operating Officer |

Michael V. Griffin | | 65 |

| | Regional President, Americas |

William H. Dengler, Jr. | | 52 |

| | Executive Vice President and General Counsel |

Marco A. Martinez | | 52 |

| | Senior Vice President and Interim Chief Financial Officer |

Abdo E. Kardous | | 59 |

| | Regional President, Middle East |

J. Charles Levergood | | 57 |

| | Senior Vice President of Business Development, Americas |

PAUL J. EVANS has been our Interim Chief Executive Officer since May 2017, and has been a member of our Board of Directors since August 2016. Over the course of his 25-year-plus career, Mr. Evans has held several leadership positions including Vice President, Chief Financial Officer and Treasurer of MYR Group; Chief Executive Officer of Conex Energy Corporation; Treasurer and Corporate Officer of Northwestern Energy; Vice President — Structured Finance, Valuation and Treasury Operations at Duke Energy North America; and Executive Director — Project Finance at NRG Energy. Mr. Evans is also a veteran of the U.S. Army. He holds a BBA from Stephen F. Austin State University and a Masters in international management from Thunderbird School of Global Management.

RAOUF S. GHALI has been our President and a member of our Board of Directors since August 2016 and our Chief Operating Officer since January 2015. Prior to that, he was President of our Project Management Group (International) from January 2005 to January 2015, Senior Vice President in charge of project management operations in Europe, North Africa and the Middle East from 2001 to 2004, and Vice President from 1993 to 2001. Prior to joining us, he worked for Walt Disney Imagineering from 1988 to 1993. Mr. Ghali earned both a B.S. in business administration and economics and an M.S. in business organizational management from the University of LaVerne.

MICHAEL V. GRIFFIN has been our Regional President, Americas since September 2017. Mr. Griffin started his career with Hill in 1981. Prior to joining us, Mr. Griffin worked for the City of Philadelphia in the Department of Public Property. He has more than 40 years of construction industry experience and has managed or overseen the delivery of a wide variety of technically complex facilities and projects. He has proven expertise in the planning, design and construction of major building, transportation and heavy civil construction projects. He earned both a B.S. and a M.S. in civil engineering from Villanova University, and a MBA in finance from La Salle University. He is a registered Professional Engineer in Pennsylvania, New Jersey, New York and Maryland.

WILLIAM H. DENGLER, JR. has been our Executive Vice President and General Counsel since August 2016. Mr. Dengler was previously Senior Vice President from 2007 to 2016, Vice President and General Counsel from 2002 to 2007, and Corporate Counsel from 2001 to 2002. Mr. Dengler also serves as corporate secretary to Hill and its subsidiaries. Prior to joining Hill, Mr. Dengler served as Assistant Counsel to former New Jersey Governors Donald DiFrancesco and Christine Todd Whitman from 1999 to 2001. Mr. Dengler earned his B.A. in political science from McDaniel College and his J.D. from Rutgers University School of Law at Camden. He is licensed to practice law in New Jersey, as well as before the U.S. Court of Appeals for the Third Circuit and the U.S. Supreme Court.

MARCO A. MARTINEZ has been our Senior Vice President and Interim Chief Financial Officer since November 2017. Mr. Martinez has over 27 years of financial and operational leadership experience including serving as Senior Vice President and Chief Financial Officer of Pernix Group and Vice President and Chief Financial Officer and Treasurer, Vice President of Contract Performance of MYR Group. Mr. Martinez earned both a BBA in accounting and a M.S. in finance from Loyola University, Chicago.

ABDO E. KARDOUS assumed the post of Regional President, Middle East in April 2018. Abdo joined Hill in 1997 as part of the Grand Mosque team, was promoted to Vice President in our Dubai office, and then named SVP Middle East. He was key to establishing Hill’s presence across the Gulf Cooperation Council before serving as Hill’s Senior Vice President and Managing Director for the Asia/Pacific Region. Abdo is a member of both the Chartered Institute of Building (CIOB) and Association for Project Management (API), and has recently served on the Advisory Board of the Chicago based Council of Tall Buildings and Urban Habitat (CTBUH). He holds a B.S., Magna Cum Laude, in Civil Engineering, from the University of Maryland and an M.S. in Civil Engineering from the University of California, Berkley. Abdo brings more than 30 years of experience to the Middle East region, with expertise in the design, procurement, construction, and delivery of multi-billion-dollar projects in the residential, hospitality, energy, infrastructure, and marine sectors, among others. He was also named Hill Internationals' Project Manager of the Year in 2001.

J CHARLES LEVERGOOD "Chuck" is our Senior Vice President of Business Development, Americas. Chuck brings 32 years of experience in strategic business development, marketing and sales, consulting services, and construction management for multi-billion-dollar pursuits. Prior to joining Hill, he worked for 13 years at Jacobs Engineering Group in a variety of positions, most recently as Vice President of Mega Sales and Global Strategy for Jacobs’ Global Buildings and Infrastructure group. Chuck also served as Vice President with Parsons Brinckerhoff and earlier as Director of Marketing with HNTB. Chuck earned his B.S.C.E. in Civil Engineering from Bucknell University and his M.S.C.E. in Civil Engineering from Purdue University. He is a registered professional engineer in Indiana, Maryland, Virginia, and the District of Columbia.

Employees

At June 30, 2018, we had 2,856 professionals. Of these professionals, 2,731 worked in our Project Management Group and 125 worked in our Corporate office. Our personnel included 2,430 full-time employees, 106 part-time employees, 233 independent external contractors and 87 external contractors provided by third-party agencies. We are not a party to any collective bargaining agreements.

Access to Company Information

We electronically file our Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K and all amendments to those reports with the United States Securities and Exchange Commission (the “SEC”). The public may read and copy any of the reports that are filed with the SEC at the SEC’s Public Reference Room at 100 F Street, N.E., Washington, DC 20549. The public may obtain information on the operation of the Public Reference Room by calling the SEC at (800) SEC-0330. The SEC maintains an Internet site at www.sec.gov that contains periodic reports, proxy statements, information statements and other information regarding issuers that file electronically.

We make available, free of charge, through our website or by responding to requests addressed to our Legal Department, our Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K and all amendments to those reports filed by us with the SEC pursuant to Sections 13(a) and 15(d) of the Securities Exchange Act, as amended. These reports are available as soon as practicable after such material is filed with or furnished to the SEC. Our primary website is www.hillintl.com. We post the charters for our audit, compensation and governance and nominating committees, corporate governance principles and code of ethics in the “Investors” section of our website. The information contained on our website, or on other websites linked to our website, is not part of this document.

Item 1A. Risk Factors.

Our business involves a number of risks and uncertainties, some of which are beyond our control. The risks and uncertainties described below could individually or collectively have a material adverse effect on our business, financial condition, results of operations and cash flows. While these are not the only risks and uncertainties we face, we believe that the more significant risks and uncertainties are as follows:

Risks Affecting the Business

Acts of terrorism, political, governmental and social upheaval and threats of armed conflicts in or around various areas in which we operate could limit or disrupt markets and our operations, including disruptions resulting from the evacuation of personnel, cancellation of contracts or the loss of personnel.

Acts of terrorism, political, governmental and social upheaval and threats of armed conflicts in or around various areas in which we operate could limit or disrupt markets and our operations, including disruptions resulting from the evacuation of personnel, cancellation of contracts or the loss of personnel, and may affect timing and collectability of our accounts receivable. Such events may cause further disruption to financial and commercial markets and may generate greater political and economic instability in some of the geographic areas in which we operate.

We may be unable to collect amounts owed to us, which could have a material adverse effect on our liquidity, results of operations and financial condition.

Accounts receivable represent the largest asset on our balance sheet. While we take steps to evaluate and manage the credit risks relating to our clients, economic downturns or other events can adversely affect the markets we serve and our clients ability to pay, which could reduce our ability to collect all amounts due from clients. If our clients delay in paying or fail to pay us a significant amount of our outstanding receivables, it could have a material adverse effect on our liquidity, results of operations, and financial condition.

Our business is sensitive to oil and gas prices, and fluctuations in oil and gas prices may negatively affect our business.

Historically, oil and natural gas prices have been volatile and are subject to fluctuations in response to changes in supply and demand, market uncertainty and a variety of additional factors that are beyond our control. Significant drops in oil or gas prices have led, and could lead to further slowdowns, in construction in oil and gas producing regions, which has had and could continue to have a material adverse effect on our business, results of operations, financial condition and cash flows.

Unfavorable global economic conditions could adversely affect our business, liquidity and financial results.

The markets that we serve are subject to fluctuation based on general global economic conditions and other factors. Unfavorable global economic conditions could adversely affect our business and results of operations, primarily by limiting our access to credit and disrupting our clients’ businesses. The reduction in financial institutions’ willingness or ability to lend has increased the cost of capital and reduced the availability of credit. Although we currently believe that the financial institutions with which we do business will be able to fulfill their commitments to us, there is no assurance that those institutions will be able or willing to continue to do so, which could have a material adverse impact on our business. Changes in general market conditions in the locations where we work may adversely affect our clients’ level of spending, ability to obtain financing, and ability to make timely payments to us for our services, which could require us to increase our allowance for doubtful accounts, negatively impact our days sales outstanding, results of operations and liquidity.

We may be unable to win new contract awards if we cannot provide clients with letters of credit, bonds or other forms of guarantees.

In certain international regions, primarily the Middle East, it is industry practice for clients to require letters of credit, bonds, bank guarantees or other forms of guarantees. These letters of credit, bonds or guarantees indemnify our clients if we fail to perform our obligations under our contracts. We currently have relationships with various domestic and international banking institutions to assist us in providing clients with letters of credit or guarantees. In the event there are limitations in worldwide banking capacity, we may find it difficult to find sufficient bonding capacity to meet our future bonding needs. Failure to provide credit enhancements on terms required by a client may result in our inability to compete or win a project.

International operations and doing business with foreign governments expose us to legal, political, operational and economic risks in different countries and currency exchange rate fluctuations could adversely affect our financial results.

There are risks inherent in doing business internationally, including:

| |

• | Lack of developed legal systems to enforce contractual rights; |

| |

• | Foreign governments may assert sovereign or other immunity if we seek to assert our contractual rights thus depriving us of any ability to seek redress against them; |

| |

• | Greater difficulties in managing and staffing foreign operations; |

| |

• | Differences in employment laws and practices which could expose us to liabilities for payroll taxes, pensions and other expenses; |

| |

• | Inadequate or failed internal controls, processes, people, and systems associated with foreign operations; |

| |

• | Increased logistical complexity; |

| |

• | Increased selling, general and administrative expenses associated with managing a larger and more global business; |

| |

• | Greater risk of uncollectible accounts and longer collection cycles; |

| |

• | Currency exchange rate fluctuations; |

| |

• | Restrictions on the transfer of cash from certain foreign countries; |

| |

• | Imposition of governmental controls; |

| |

• | Political and economic instability; |

| |

• | Changes in U.S. and other national government policies affecting the markets for our services and our ability to do business with certain foreign governments or their political leaders; |

| |

• | Conflict between U.S. and non-U.S. law; |

| |

• | Changes in regulatory practices, tariffs and taxes; |

| |

• | Less established bankruptcy and insolvency procedures; |

| |

• | Potential non-compliance with a wide variety of non-U.S. laws and regulations; and |

| |

• | General economic, political and civil conditions in these foreign markets. |

Any of these and other factors could have a material adverse effect on our business, results of operations, financial condition or cash flows.

We operate in many different jurisdictions and we could be adversely affected by any violations of the U.S. Foreign Corrupt Practices Act or similar worldwide and local anti-corruption laws.

The U.S. Foreign Corrupt Practices Act, the U.K. Bribery Act and similar worldwide and local anti-corruption laws in other jurisdictions, generally prohibit companies and their intermediaries from making improper payments to officials for the purpose of obtaining or retaining business. Our internal policies mandate compliance with these anti-corruption laws. The policies also are applicable to agents through which we do business in certain non-U.S. jurisdictions. We operate in many parts of the world that have experienced governmental corruption to some degree, and in certain circumstances, strict compliance with anti-corruption laws may conflict with local customs and practices. Despite our training and compliance programs, we cannot assure you that our internal control policies and procedures always will protect us from improper or criminal acts committed by our employees or agents. Our continued expansion outside the U.S., including in developing countries, could increase the risk of such violations in the future. Violations of these laws, or allegations of such violations, could disrupt our business, subject us to fines, penalties and restrictions and otherwise result in a material adverse effect on our results of operations or financial condition. All of our acquired businesses are subject to our internal policies. However, because our internal policies are more restrictive than some local laws or customs where we operate, we may be at an increased risk for violations while we train our new employees to comply with our internal policies and procedures.

Our business sometimes requires our employees to travel to and work in high security risk countries, which may result in employee injury, repatriation costs or other unforeseen costs.

Many of our employees often travel to and work in high security risk countries around the world that are undergoing or that may undergo political, social and economic upheavals resulting in war, civil unrest, criminal activity or acts of terrorism. For example, we have had and expect to continue to have significant projects in the Middle East and Africa. As a result, we may be subject to costs related to employee injury, repatriation or other unforeseen circumstances. Further, circumstances in these countries could make it difficult or impossible to attract and retain qualified employees, which could have a material adverse effect on our operations.

We depend on government contracts for a significant portion of our revenue. Our inability to win profitable government contracts could harm our operations and adversely affect our net earnings.

Our inability to win profitable government contracts could harm our operations and adversely affect our net earnings. Government contracts are typically awarded through a heavily regulated procurement process. Some government contracts are awarded to multiple competitors, causing increases in overall competition and pricing pressure. In turn, the competition and pricing pressure may require us to make sustained post-award efforts to reduce costs under these contracts. If we are not successful in reducing the amount of costs, our profitability on these contracts may be negatively impacted. In addition, some of our federal government contracts require U.S. government security clearances. If we or certain of our personnel were to lose these security clearances, our ability to continue performance of these contracts or to win new contracts requiring such clearances may be negatively impacted.

We depend on long-term government contracts, many of which are funded on an annual basis. If appropriations are not made in subsequent years of a multiple-year contract, we will not realize all of our potential revenue and profit from that project.

Most government contracts are subject to the continuing availability of legislative appropriation. Legislatures typically appropriate funds for a given program on a year-by-year basis, even though contract performance may take more than one year. As a result, at the beginning of a program, the related contract is only partially funded, and additional funding is normally committed only as appropriations are made in each subsequent fiscal year. These appropriations and the timing of payment of appropriated amounts may be influenced by, among other things, the state of the economy, budgetary and other political issues affecting the particular government and its appropriations process, competing priorities for appropriation, the timing and amount of tax receipts and the overall level of government expenditures. If appropriations are not made in subsequent years on government contracts, then we will not realize all of our potential revenue and profit from those contracts.

We depend on contracts that may be terminated by our clients on short notice, which may adversely impact our ability to recognize all of our potential revenue and profit from the projects.

Substantially all of our contracts are subject to termination by the client either at its convenience or upon our default. If one of our clients terminates a contract at its convenience, then we typically are able to recover only costs incurred or committed, settlement expenses and profit on work completed prior to termination, which could prevent us from recognizing all of our potential revenue and profit from that contract. If one of our clients terminates the contract due to our default, we could be liable for excess costs incurred by the client in re-procuring services from another source, as well as other costs.

Our contracts with governmental agencies are subject to audit, which could result in adjustments to reimbursable contract costs or, if we are charged with wrongdoing, possible temporary or permanent suspension from participating in government programs.

Our books and records are subject to audit by the various governmental agencies we serve and by their representatives. These audits can result in adjustments to reimbursable contract costs and allocated overhead. In addition, if as a result of an audit, we or one of our subsidiaries is charged with wrongdoing or the government agency determines that we or one of our subsidiaries is otherwise no longer eligible for federal contracts, then we or, as applicable, that subsidiary, could be temporarily suspended or, in the event of convictions or civil judgments, could be prohibited from bidding on and receiving future government contracts for a period of time. Furthermore, as a United States government contractor, we are subject to increased risk of investigations, criminal prosecution, civil fraud, whistleblower lawsuits and other legal actions and liabilities, the results of which could have a material adverse effect on our operations.

We submit change orders to our clients for work we perform beyond the scope of some of our contracts. If our clients do not approve these change orders, our net earnings could be adversely impacted.

We submit change orders under some of our contracts, typically for payment for work performed beyond the initial contractual requirements. The clients may not approve or may contest these change orders and we cannot assure you that these claims will be approved in whole, in part or at all. If these claims are not approved, our net earnings could be adversely impacted.

Our backlog of uncompleted projects under contract or awarded is subject to unexpected adjustments and cancellations, including the amount, if any, of future appropriations by the applicable contracting governmental agency, and it may not be indicative of our future revenue and profits.

The inability to obtain financing or governmental approvals, changes in economic or market conditions or other unforeseen events, such as terrorist acts or natural disasters, could lead to us not realizing any revenue under some or all of these contracts. We cannot assure you that the backlog attributed to any of our uncompleted projects under contract will be realized as revenue or, if realized, will result in profits.

Many projects may remain in our backlog for an extended period of time because of the size or long-term nature of the contract. In addition, from time to time projects are scaled back or cancelled. These types of backlog reductions adversely affect the revenue and profit that we ultimately receive. Included in our backlog is the maximum amount of all indefinite delivery/indefinite quantity (“ID/IQ”), or task order, contracts, or a lesser amount if we do not reasonably expect to be issued task orders for the maximum amount of such contracts. A significant amount of our backlog is derived from ID/IQ contracts and we cannot provide any assurance that we will in fact be awarded the maximum amount of such contracts.

Our dependence on subcontractors, partners and specialists could adversely affect our business.

We rely on third-party subcontractors as well as third-party strategic partners and specialists to complete our projects. To the extent that we cannot engage such subcontractors, partners or specialists or cannot engage them on a competitive basis, our ability to complete a project in a timely fashion or at a profit may be impaired. If we are unable to engage appropriate strategic partners or specialists in some instances, we could lose the ability to win some contracts. In addition, if a subcontractor or specialist is unable to deliver its services according to the negotiated terms for any reason, including the deterioration of its financial condition or over-commitment of its resources, we may be required to purchase the services from another source at a higher price. This may reduce the profit to be realized or result in a loss on a project for which the services were needed.

If our partners fail to perform their contractual obligations on a project, we could be exposed to legal liability, loss of reputation or reduced profits.

We sometimes enter into joint venture agreements and other contractual arrangements with outside partners to jointly bid on and execute a particular project. The success of these joint projects depends on the satisfactory performance of the contractual obligations of both our partners and us. If any of our partners fails to satisfactorily perform its contractual obligations, we may be required to make additional investments and provide additional services to complete the project. If we are unable to adequately address our partner’s performance issues, then our client could terminate the joint project, exposing us to legal liability, loss of reputation or reduced profits.

The project management business is highly competitive and if we fail to compete effectively, we may miss new business opportunities or lose existing clients and our revenues may decline.

The project management industry is highly competitive. We compete for contracts, primarily based on technical capability, with numerous entities, including other construction management companies, design or engineering firms, general contractors, management consulting firms and other entities. Compared to us, many of these competitors are larger, well-established companies that have broader geographic scope and greater financial and other resources. If we cannot compete effectively with our competitors, or if the costs of competing, including the costs of retaining and hiring professionals, become too expensive, our revenue growth and financial results may differ materially from our expectations.

We have acquired and may continue to acquire businesses as strategic opportunities arise and may be unable to realize the anticipated benefits of those acquisitions, or if we are unable to take advantage of strategic acquisition situations, our ability to expand our business may be slowed or curtailed.

In the past, we have acquired companies related to the project management business and we may continue to expand and diversify our operations with additional acquisitions as strategic opportunities arise. If the competition for acquisitions increases, or if the cost of acquiring businesses or assets becomes too expensive, the number of suitable acquisition opportunities may decline, the cost of making an acquisition may increase or we may be forced to agree to less advantageous acquisition terms for the companies that we are able to acquire. Alternatively, at the time an acquisition opportunity presents itself, internal and external pressures (including, but not limited to, borrowing capacity under our credit facilities or the availability of alternative financing), may cause us to be unable to pursue or complete an acquisition. Our ability to grow our business, particularly through acquisitions, may depend on our ability to raise capital by selling equity or debt securities or obtaining additional debt financing. There can be no assurance that we will be able to obtain financing when we need it or on terms acceptable to us.

In addition, managing the growth of our operations will require us to continually increase and improve our operational, financial and human resources management and our internal systems and controls. If we are unable to manage growth effectively or to successfully integrate acquisitions or if we are unable to grow organically, that could have a material adverse effect on our business.

Systems and information technology interruption and breaches in data security could adversely impact our ability to operate and our operating results.

We are heavily reliant on computer, information and communications technology and related systems in order to properly operate. From time to time, we experience system interruptions and delays. In the event we are unable to regularly deploy software and hardware, effectively upgrade our systems and network infrastructure and take other steps to improve the efficiency and effectiveness of our systems, the operation of such systems could be interrupted or delayed, or our data security could be breached. In addition, our computer and communications systems and operations could be damaged or interrupted by natural disasters, power loss, telecommunications failures, acts of war or terrorism, acts of God, computer viruses, physical or electronic security breaches. Any of these or other events could cause system interruptions, delays and loss of critical data including private data. While we have taken steps to address these concerns by implementing sophisticated network security, training and internal control measures, there can be no assurance that a system failure or loss or data security breach will not materially adversely affect our business, financial condition and operating results.

Risks Related to Ownership of Our Common Stock

We have identified material weaknesses in our internal control over financial reporting and determined that our disclosure controls and procedures were not effective which could, if not remediated, result in additional material misstatements in our financial statements.

Our management is responsible for establishing and maintaining adequate disclosure controls and procedures and internal control over our financial reporting, as defined in Rules 13a-15(e) and 13a-15(f), respectively, under the Securities Exchange Act of 1934, as amended. As disclosed in Item 9A of this Annual Report on Form 10-K, management has identified several material weaknesses in our internal control over financial reporting and has determined that our disclosure controls and procedures were not effective. A material weakness is defined as a deficiency, or combination of significant deficiencies, in internal control over financial reporting, such that there is a more than a remote likelihood that a material misstatement of our annual or interim financial statements will not be prevented or detected on a timely basis. As a result of these material weaknesses, our management concluded that the Company did not maintain effective disclosure controls and procedures and internal control over financial reporting as of December 31, 2017.

We have developed and have begun to implement a remediation plan designed to address these material weaknesses in internal control over financial reporting and ineffective disclosure controls and procedures. If our remedial measures are insufficient, or if additional material weaknesses or significant deficiencies in our internal controls are discovered or occur in the future, our consolidated financial statements may contain material misstatements and we could be required to restate our financial results, which could materially and adversely affect our business and results of operations or financial condition, restrict our ability to access the capital markets, require us to expend significant resources to correct the weaknesses or deficiencies, subject us to fines, penalties or judgments, harm our reputation or otherwise cause a decline in investor confidence.

The NYSE has suspended trading of our common stock and may delist our common stock from trading on its exchange, which could limit investors’ ability to make transactions in our common stock and subject us to additional trading restrictions.

On August 13, 2018, the NYSE announced the suspension of trading of our common stock due to non-compliance with Section 802.01E of the NYSE’s Listed Company Manual and announced that it was initiating proceedings to delist our common stock. As a result of the suspension, our common stock began trading on August 14, 2018 under the symbol “HILI” on the OTC Pink, which is operated by OTC Markets Group Inc. The Company has filed a Request for Review (the “Review Request”) to a Committee of the Board of Directors of NYSE Regulation (the “Committee”) with respect to the NYSE’s determination to initiate delisting proceedings. The Company expects that the Committee will hold a hearing on the Review Request on or after 25 business days from the date of filing the Review Request. While the Company expects to be current with its filings on or before the NYSE’s hearing date, we cannot assure you that our common stock will resume trading on the NYSE in the future. If the NYSE delists our common stock from listing on its exchange and we are not able to list our common stock on another national securities exchange, we expect our common stock would continue to be quoted on an over-the-counter market, such as the OTC Pink. If this were to continue, we could face significant material adverse consequences, including:

| |

• | a limited availability of market quotations for our common stock; |

| |

• | reduced liquidity for our common stock; |

| |

• | a determination that our common stock is a “penny stock” which will require brokers trading in our common stock to adhere to more stringent rules and possibly result in a reduced level of trading activity in the secondary trading market for our securities; |

| |

• | a limited amount of news and analyst coverage; and |

| |

• | a decreased ability to issue additional securities or obtain additional financing in the future. |

Future sales of our common and preferred stock may depress the price of our common stock.

As of August 28, 2018, there were 55,294,670 shares of our common stock outstanding. An additional 6,075,246 shares of our common stock may be issued upon the exercise of options held by employees, management and directors. We also have the authority, as determined by our Board of Directors, to issue up to 1,000,000 shares of preferred stock and additional options to purchase 2,077,459 shares of our common stock without stockholder approval. Future issuances or sales of our common stock could have an adverse effect on the market price of our common stock.

Because we have no current plans to pay cash dividends on our common stock, you may not receive any return on investment unless you sell your common stock for a price greater than that which you paid for it.

We may retain future earnings, if any, for future operations, expansion and debt repayment and have no current plans to pay any cash dividends. Any decision to declare and pay dividends in the future will be made at the discretion of our Board of Directors and will depend on, among other things, our results of operations, financial condition, cash requirements, contractual restrictions and other factors that our Board of Directors may deem relevant. In addition, our ability to pay dividends is limited by covenants of our Secured Credit Facilities and may be limited by future indebtedness incurred by our subsidiaries or us. As a result, you may not receive any return on an investment in our common stock unless you sell our common stock for a price greater than that which you paid for it.

We are able to issue shares of preferred stock with greater rights than our common stock.

Our Board of Directors is authorized to issue one or more series of preferred stock from time to time without any action on the part of our stockholders. Our Board of Directors also has the power, without stockholder approval, to set the terms of any such series of preferred stock that may be issued, including voting rights, dividend rights and preferences over our common stock with respect to dividends and other terms. If we issue preferred stock in the future that has a preference over our common stock with respect to the payment of dividends or other terms, or if we issue preferred stock with voting rights that dilute the voting power of our common stock, the rights of holders of our common stock or the market price of our common stock could be adversely affected.

Provisions in our organizational documents and Delaware law could discourage potential acquisition proposals, could delay or prevent a change in control of the Company that our stockholders may consider favorable and could adversely affect the market value of our common stock.

Provisions in our organizational documents and Delaware law could discourage potential acquisition proposals, could delay or prevent a change in control of the Company that our stockholders may consider favorable and could adversely affect the market value of our common stock. Our amended and restated certificate of incorporation and amended and restated bylaws include provisions that:

| |

• | Our Board of Directors is expressly authorized to make, alter or repeal our bylaws; |

| |

• | Our Board of Directors is divided into three classes of service with staggered three-year terms. This means that only one class of directors will be elected at each annual meeting of stockholders, with the other classes continuing for the remainder of their respective terms; |

| |

• | Our Board of Directors is authorized to issue preferred stock without stockholder approval; |

| |

• | Only our Board of Directors, our Chairman of the Board, our Chief Executive Officer or the holders of not less than 25% of our outstanding common stock and entitled to vote may call a special meeting of stockholders; |

| |

• | Our bylaws require advance notice for stockholder proposals and director nominations; |

| |

• | Our bylaws limit the removal of directors and the filling of director vacancies; and |

| |

• | We will indemnify officers and directors against losses that may incur in connection with investigations and legal proceedings resulting from their services to us, which may include services in connection with takeover defense measures. |

These provisions may make it more difficult for stockholders to take specific corporate actions and could have the effect of delaying or preventing a change in control of the Company.

In addition, Section 203 of the Delaware General Corporation Law imposes certain restrictions on mergers and other business combinations between the Company and any holder of 15% or more of our outstanding common stock. This provision is applicable to Hill and may have an anti-takeover effect that may delay, defer or prevent a tender offer or takeover attempt that a stockholder might consider in the stockholder’s best interest. In general, Section 203 could delay for three years and impose conditions upon “business combinations” between an “interested shareholder” and Hill, unless prior approval by our Board of Directors is given. The term “business combination” is defined broadly to include mergers, asset sales and other transactions resulting in financial benefit to a stockholder. An “interested shareholder,” in general, would be a person who, together with affiliates and associates, owns or within three years did own, 15% or more of a corporation’s voting stock.

A small group of stockholders owns a large quantity of our common stock, thereby potentially exerting significant influence over the Company.

As of December 31, 2017, Irvin E. Richter, David L. Richter and other members of the Richter family beneficially owned approximately 16.3% of our common stock. This concentration of ownership could significantly influence matters requiring stockholder approval and could delay, deter or prevent a change in control of the Company or other business combinations that might otherwise be beneficial to our other stockholders. Accordingly, this concentration of ownership may impact the market price of our common stock. In addition, the interest of our significant stockholders may not always coincide with the interest of the Company’s other stockholders. In deciding how to vote on such matters, they may be influenced by interests that conflict with our other stockholders.

Item 1B. Unresolved Staff Comments.

None.

Item 2. Properties.

Our executive and certain operating offices are currently located at One Commerce Square, 2005 Market Street, 17th Floor, Philadelphia, Pennsylvania 19103. We lease all of our office space and do not own any real property. The telephone number at our executive office is (215) 309-7700. In addition to our executive offices, we have approximately 80 operating leases for office facilities throughout the world.

Our principal worldwide office locations and the geographic regions in which we reflect their operations are:

|

| | | | |

United States | | Europe | | Middle East |

Baltimore, MD | | Amsterdam, Netherlands | | Abu Dhabi, UAE |

Boston, MA | | Athens, Greece | | Doha, Qatar |

Cleveland, OH | | Belgrade, Serbia | | Dubai, UAE |

Columbus, OH | | Bucharest, Romania | | Jeddah, Saudi Arabia |

Houston, TX | | Dusseldorf, Germany | | Manama, Bahrain |

Irvine, CA | | Frankfurt, Germany | | Muscat, Oman |

Irving, TX | | Istanbul, Turkey | | Riyadh, Saudi Arabia |

Jacksonville, FL | | Lisbon, Portugal | | |

Miami, FL | | London, UK | | Africa |

Mission Viejo, CA | | Madrid, Spain | | Algiers, Algeria |

New York, NY | | Pristina, Kosovo | | Cairo, Egypt |

Ontario, CA | | Warsaw, Poland | | Casablanca, Morocco |

Orlando, FL | | Wroclaw, Poland | | |

Philadelphia, PA (Headquarters) | | | | Asia/Pacific |

Phoenix, AZ | | Latin America | | Astana City, Kazakhstan |

Pittsburgh, PA | | Bogota, Colombia | | Gurgaon, India |

San Francisco, CA | | Mexico City, Mexico | | Hong Kong, China |

San Jose, CA | | Sao Paulo, Brazil | | |

Seattle, WA | | | | |

Spokane, WA | | | | |

Toledo, OH | | | | |

Woodbridge, NJ | | | | |

Washington, DC | | | | |

Item 3. Legal Proceedings.

General Litigation

From time to time, the Company is a defendant or plaintiff in various legal proceedings which arise in the normal course of business. As such, the Company is required to assess the likelihood of any adverse outcomes to these proceedings as well as potential ranges of probable losses. A determination of the amount of the provision required for these commitments and contingencies, if any, which would be charged to earnings, is made after careful analysis of each proceeding. The provision may change in the future due to new developments or changes in circumstances. Changes in the provision could increase or decrease the Company’s earnings in the period the changes are made. It is the opinion of management, after consultation with legal counsel, that the ultimate resolution of these proceedings will not have a material adverse effect on the Company’s financial condition, results of operations or cash flows.

In 2013, M.A. Angeliades, Inc. (“Plaintiff”) filed a complaint with the Supreme Court of New York against the Company and the New York City Department of Design and Construction (“DDC”) regarding payment of approximately $8,771 for work performed as a subcontractor to the Company plus interest and other costs. On October 5, 2015, pursuant to a settlement agreement, Hill paid Plaintiff approximately $2,596, including interest amounting to $1,056, of which $448 had been previously accrued and $608 was charged to expense for the year ended December 31, 2015. The Plaintiff resolved its remaining issues regarding change orders and compensation for delay with DDC. On January 16, 2016, Plaintiff filed a Motion to amend its complaint against the Company claiming that the amounts paid by the Company do not reconcile with the amounts Plaintiff believes the Company received from DDC despite DDC’s records reflecting the same amount as the Company’s. On August 8, 2016, the Plaintiff’s Motion was granted and the parties resolved the matter and entered into a confidential settlement and general release on August 17, 2018. The settlement was accrued for and reflected in the Company's balance sheet and the statement of operations as of and for the year ended December 31, 2017.

Knowles Limited (“Knowles”), a subsidiary of the Company’s Construction Claims Group, is a party to an arbitration proceeding instituted on July 8, 2014 in which Knowles claimed that it was entitled to payment for services rendered to Celtic Bioenergy Limited (“Celtic”). The arbitrator decided in favor of Knowles. The arbitrator’s award was appealed by Celtic to the U.K. High Court of Justice, Queen’s Bench Division, Technology and Construction Court (“Court”). On March 16, 2017, the Court (1) determined that certain relevant facts had been deliberately withheld from the arbitrator by an employee of Knowles and (2) remitted the challenged parts of the arbitrator’s award back to the arbitrator to consider the award in possession of the full facts. The Company is evaluating the impact of the judgment of the Court.

Item 4. Mine Safety Disclosures.

Not applicable.

PART II

Item 5. Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities.

Market Information

Our common stock has historically been traded on the New York Stock Exchange (“NYSE”) under the trading symbol “HIL.” On August 13, 2018, the NYSE suspended the trading of our common stock and commenced proceedings to delist our common stock due to our failure to be current in our periodic reporting obligations with the SEC. As a result, on August 14, 2018, our common stock commenced trading on the OTC Pink Marketplace under the symbol “HILI”. The following table includes the range of high and low trading prices for our common stock as reported on the NYSE for the periods presented.

|

| | | | | | | | |

| | Price Range |

| | High | | Low |

2017 | | |

| | |

|

Fourth Quarter | | $ | 5.70 |

| | $ | 4.75 |

|

Third Quarter | | 5.70 |

| | 4.25 |

|

Second Quarter | | 5.30 |

| | 3.70 |

|

First Quarter | | 5.70 |

| | 3.85 |

|

| | | | |

2016 | | |

| | |

|

Fourth Quarter | | $ | 4.62 |

| | $ | 1.95 |

|

Third Quarter | | 4.64 |

| | 3.96 |

|

Second Quarter | | 4.68 |

| | 3.20 |

|

First Quarter | | 4.07 |

| | 2.62 |

|

Stockholders

As of December 31, 2017, there were approximately 80 holders of record of our common stock. However, a single record stockholder account may represent multiple beneficial owners, including owners of shares in street name accounts. There are approximately 2,400 beneficial owners of our common stock.

Dividends

We have not paid any dividends on our common stock. The payment of dividends in the future will be contingent upon our earnings, if any, capital requirements and general financial condition of our business. Our Secured Credit Facilities currently limit the payment of dividends.

Securities Authorized for Issuance under Equity Compensation Plans

The table setting forth this information is included in Part III — Item 12 of this Form 10-K. Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters.

Recent Sales of Unregistered Securities

None.

Performance Graph

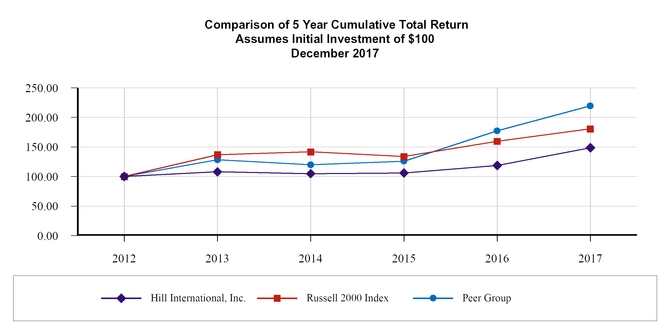

The performance graph and table below compare the cumulative total return of our common stock for the period from December 31, 2012 to December 31, 2017 with the comparable cumulative total returns of the Russell 2000 Index (of which the Company was a component stock) and a peer group which consists of the following eight companies: AECOM (ACM), Fluor Corporation (FLR), Granite Construction Incorporated (GVA), Jacobs Engineering Group Inc. (JEC), KBR, Inc. (KBR), NV5 Global, Inc. (NVEE), Tutor Perini Corporation (TPC), and Tetra Tech, Inc. (TTEK).

|

| | | | | | | | | | | | | | | | | | | | | | | | |

| | 2012 | | 2013 | | 2014 | | 2015 | | 2016 | | 2017 |

Hill International, Inc. | | $ | 100.00 |

| | $ | 107.91 |

| | $ | 104.91 |

| | $ | 106.00 |

| | $ | 118.81 |

| | $ | 148.79 |

|

Russell 2000 Index | | 100.00 |

| | 136.92 |

| | 141.74 |

| | 133.66 |

| | 159.65 |

| | 180.60 |

|

Peer Group | | 100.00 |

| | 128.24 |

| | 119.82 |

| | 126.03 |

| | 177.30 |

| | 219.52 |

|

Item 6. Selected Financial Data.

The following is selected financial data from our audited consolidated financial statements for each of the last five years. This data should be read in conjunction with our consolidated financial statements (and related notes) appearing in Item 8 of this report and with Item 7, “Management’s Discussion and Analysis of Financial Condition and Results of Operations.” On May 5, 2017, the sale of the Construction Claims Group was finalized, which is reported as discontinued operations for each year presented. See Note 2 - "Discontinued Operations" to our consolidated financial statements for additional information. The data presented below is in thousands, except for (loss) earnings per share data.

|

| | | | | | | | | | | | | | | | | | | | |

| | Years Ended December 31, |

| | 2017 | | 2016 | | 2015 | | 2014 | | 2013 |

Income Statement Data: | | |

| | |

| | |

| | |

| | |

|

Revenue | | $ | 483,736 |

| | $ | 516,012 |

| | $ | 544,760 |

| | $ | 489,348 |

| | $ | 452,602 |

|

Direct expenses | | 336,883 |

| | 358,943 |

| | 373,544 |

| | 322,733 |

| | 303,918 |

|

Gross profit | | 146,853 |

| | 157,069 |

| | 171,216 |

| | 166,615 |

| | 148,684 |

|

Selling, general and administrative expenses | | 151,186 |

| | 170,682 |

| | 172,649 |

| | 146,265 |

| | 125,672 |

|

Share of (profit) loss of equity method affiliates | | (3,777 | ) | | 37 |

| | 237 |

| | — |

| | — |

|

Operating profit (loss) | | (556 | ) | | (13,650 | ) | | (1,670 | ) | | 20,350 |

| | 23,012 |

|

Interest and related financing fees, net | | 3,031 |

| | 2,355 |

| | 3,611 |

| | 3,099 |

| | 4,522 |

|

(Loss) earnings before income taxes | | (3,587 | ) | | (16,005 | ) | | (5,281 | ) | | 17,251 |

| | 18,490 |

|

Income tax expense | | 3,103 |

| | 5,955 |

| | 5,833 |

| | 9,997 |

| | 6,650 |

|

(Loss) earnings from continuing operations | | (6,690 | ) | | (21,960 | ) | | (11,114 | ) | | 7,254 |

| | 11,840 |

|

Discontinued Operations: | | | | | | | | | | |

Loss from discontinued operations | | (14,479 | ) | | (11,776 | ) | | (2,564 | ) | | (18,627 | ) | | (9,512 | ) |

Gain on disposal of discontinued operations , net of tax | | 48,713 |

| | — |

| | — |

| | — |

| | — |

|

Total gain (loss) from discontinued operations | | 34,234 |

| | (11,776 | ) | | (2,564 | ) | | (18,627 | ) | | (9,512 | ) |

| | | | | | | | | | |

Net earnings (loss) | | 27,544 |

| | (33,736 | ) | | (13,678 | ) | | (11,373 | ) | | 2,328 |

|

Less: net earnings - noncontrolling interests | | 178 |

| | 76 |

| | 823 |

| | 1,304 |

| | 2,271 |

|

Net earnings (loss) attributable to Hill International, Inc. | | $ | 27,366 |

| | $ | (33,812 | ) | | $ | (14,501 | ) | | $ | (12,677 | ) | | $ | 57 |

|

| | | | | |

|

| | | | |

Basic (loss) earnings per common share from continuing operations | | $ | (0.13 | ) | | $ | (0.43 | ) | | $ | (0.24 | ) | | $ | 0.13 |

| | $ | 0.24 |

|

Basic loss per common share from discontinued operations | | (0.28 | ) | | (0.22 | ) | | (0.05 | ) | | (0.42 | ) | | (0.24 | ) |

Basic gain on disposal of discontinued operation, net of tax | | 0.93 |

| | — |

| | — |

| | — |

| | — |

|

Basic earnings (loss) per common share - Hill International, Inc. | | $ | 0.52 |

| | $ | (0.65 | ) | | $ | (0.29 | ) | | $ | (0.29 | ) | | $ | — |

|

Basic weighted average common shares outstanding | | 52,175 |

| | 51,724 |

| | 50,874 |

| | 44,370 |

| | 39,098 |

|

Diluted (loss) earnings per common share from continuing operations | | $ | (0.13 | ) | | $ | (0.43 | ) | | $ | (0.24 | ) | | $ | 0.13 |

| | $ | 0.24 |

|

Diluted loss per common share from discontinued operations | | (0.28 | ) | | (0.22 | ) | | (0.05 | ) | | (0.42 | ) | | (0.24 | ) |

Diluted gain on disposal of discontinued operation, net of tax | | 0.93 |

| | — |

| | — |

| | — |

| | — |

|

Diluted earnings (loss) per common share - Hill International, Inc. | | $ | 0.52 |

| | $ | (0.65 | ) | | $ | (0.29 | ) | | $ | (0.29 | ) | | $ | — |

|

Diluted weighted average common shares outstanding | | 52,175 |

| | 51,724 |

| | 50,874 |

| | 44,370 |

| | 39,098 |

|

|

| | | | | | | | | | | | | | | | | | | | |

| | Years Ended December 31, |

| | 2017 | | 2016 | | 2015 | | 2014 | | 2013 |

Discontinued Operations Data (1): | | |

| | |

| | |

| | |

| | |

|

Revenue | | $ | 62,149 |

| | $ | 169,252 |

| | $ | 168,029 |

| | $ | 153,839 |

| | $ | 124,164 |

|

Operating (loss) profit | | (4,975 | ) | | 3,970 |

| | 10,753 |

| | 9,842 |

| | 10,399 |

|

Interest and related financing fees, net | | 8,858 |