UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2013

or

| o | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from . to .

Commission File No. 1-32248

GRAMERCY PROPERTY TRUST INC.

(Exact name of registrant as specified in its charter)

| Maryland | 06-1722127 | |

| (State or other jurisdiction incorporation or organization) |

(I.R.S. Employer of Identification No.) |

521 5th Avenue, 30th Floor, New York, NY 10175

(Address of principal executive offices — zip code)

(212) 297-1000

(Registrant’s telephone number, including area code)

SECURITIES REGISTERED PURSUANT TO SECTION 12(b) OF THE ACT:

| Title of Each Class | Name of Each Exchange on Which Registered | |

| Common Stock, $0.001 Par Value Series A Cumulative Redeemable Preferred Stock, $0.001 Par Value |

New York Stock Exchange New York Stock Exchange |

SECURITIES REGISTERED PURSUANT TO SECTION 12(g) OF THE ACT: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.Yes o No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.Yes o No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.Yes x No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (Section 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).Yes x No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of the registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a small reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “small reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer o | Accelerated filer x | Non-accelerated filer o | Smaller reporting company o | |||

| (Do not check if a smaller reporting company) | ||||||

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).Yes o No x

As of March 14, 2014, there were 71,409,485 shares of the Registrant’s common stock outstanding. The aggregate market value of common stock held by non-affiliates of the registrant (55,372,672 shares) at June 30, 2013, was $249,177,024. The aggregate market value was calculated by using the closing price of the common stock as of that date on the New York Stock Exchange, which was $4.50 per share.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant’s Definitive Proxy Statement for its 2014 Annual Meeting of Stockholders expected to be filed within 120 days after the close of the registrant’s fiscal year are incorporated by reference into Part III of this Annual Report on Form 10-K.

GRAMERCY PROPERTY TRUST INC.

FORM 10-K

TABLE OF CONTENTS

10-K PART AND ITEM NO.

i

Part I

| ITEM 1. | BUSINESS |

General

Gramercy Property Trust Inc., or the “Company” or “Gramercy,” is a fully-integrated, self-managed commercial real estate investment company focused on acquiring and managing income-producing industrial and office properties net leased to high quality tenants in major markets throughout the United States. We also operate an asset management business that manages for third-parties, including our Bank of America Portfolio joint venture, commercial real estate assets.

Gramercy was founded in 2004 as a specialty finance Real Estate Investment Trust, or REIT, focused on originating and acquiring loans and securities related to commercial and multifamily properties. In July 2012, following a strategic review, our board of directors announced a repositioning of Gramercy as an equity REIT focused on acquiring and managing income producing net leased real estate. To reflect this transformation, in April 2013 we changed our name from Gramercy Capital Corp. to Gramercy Property Trust Inc. and changed our ticker symbol to “GPT” on the New York Stock Exchange.

As of December 31, 2013, we owned interests (either directly or through a joint venture) in 107 properties containing an aggregate of approximately 7.8 million rentable square feet.

Company Repositioning Milestones

We have achieved a number of important milestones since our board of directors elected to reposition our company as a REIT focused on acquiring and managing income producing net leased properties, including:

Sold Specialty Finance Business/Assets and Reduced Costs

| • | In March 2013, we sold our collateral management and sub-special servicing contracts for our three Collateralized Debt Obligations, or CDOs, disposed of certain non-core legacy assets and exited the commercial real estate finance business; and, |

| • | We downsized our New York City headquarters office, closed one satellite property management office, reduced employee headcount, rebid our professional consulting and insurance contracts and reduced annual run rate management, general and administrative expenses, or MG&A expenses. |

Raised Capital and Repaid Accrued Preferred Stock Dividends

| • | In September 2013, we entered into a $100.0 million senior secured credit facility which was increased to $150.0 million in February 2014; |

| • | In October 2013, we issued and sold 11.5 million shares of our common stock in a private placement at a price of $4.11 per share, resulting in total net proceeds to us of approximately $45.5 million; and, |

| • | In December 2013, our board of directors declared, and in January 2014 we paid in full, the accrued and unpaid dividends on our Cumulative Redeemable Preferred Stock, or Series A Preferred Stock, and began the timely payment of the quarterly preferred dividends beginning with the dividend due January 15, 2014, positioning us to re-commence dividends on our common stock. |

Assembled a High-Quality Net Leased Portfolio

As of December 31, 2013, we owned, directly or through joint ventures, a portfolio that consists of 107 industrial, office and specialty properties totaling approximately 7.8 million square feet. As of December 31, 2013, our portfolio has the following characteristics:

| • | 99.1% occupancy; |

| • | a weighted average remaining lease term of 11.7 years (based on annualized base rent); |

| • | 53.5% investment grade tenancy (includes subsidiaries of non-guarantor investment grade parent companies) (based on annualized base rent); |

1

| • | Industrial portfolio comprised of 4.2 million aggregate rentable square feet with an average base rent per square foot of $5.33; |

| • | Office portfolio comprised of 3.4 million aggregate rentable square feet with an average base rent per square foot of $9.53 (including the properties we own through joint ventures); |

| • | Specialty asset portfolio of three improved sites comprised of 186 acres of land and 256 thousand aggregate rentable square feet of building space that we lease to a car auction services company, a bus depot and a rental car company; and |

| • | Top five tenants by annualized base rent include: Bank of America, N.A. or Bank of America, guaranteed by Bank of America Corp. (31%); Adesa Texas, Inc., guaranteed by KAR Holdings, Inc. (11%); EF Transit, Inc., guaranteed by Monarch Beverage Co., Inc. (6%); AMCOR Rigid Plastics USA, Inc., guaranteed by Amcor Limited (6%); and Preferred Freezer Services of Hialeah, LLC, guaranteed by Preferred Freezer Services, LLC (5%). Our lease with Preferred Freezer Services of Hialeah, LLC starts upon completion of construction of the facility currently expected in the second quarter of 2014. |

Optimized Asset Management Business

| • | We executed or extended asset management contracts with third-party property owners, including our joint venture partners, resulting in an aggregate of $1.4 billion in assets under management at December 31, 2013; |

| • | During the year ended December 31, 2013, we generated $40.9 million in asset management revenue, including the collection of a $12.0 million out-performance fee (pre-tax) under our asset management agreement with an affiliate of KBS Real Estate Investment Trust, Inc., or KBS. |

Recent Developments

In January 2014, we paid in full the accrued and unpaid dividends on our Series A Preferred Stock and began the timely payment of the quarterly preferred dividends beginning with the dividend due January 15, 2014.

In February 2014, we acquired a 115 thousand square foot industrial property located in Des Plaines, Illinois, for a purchase price of approximately $6.3 million. The property is leased to one tenant through October 2025. In connection with the acquisition, we assumed a $2.7 million mortgage loan that matures in October 2020 and bears a fixed interest rate of 5.25%.

In February 2014, we exercised and the lenders approved the accordion feature to increase our $100.0 million senior credit facility to $150.0 million.

In March 2014, we announced that we will resume payment of a dividend to our common stockholders after a hiatus of more than five years. Our board of directors declared a quarterly dividend of $0.035 per common share for the first quarter of 2014, payable on April 15, 2014 to holders of record as of the close of business on March 31, 2014. We also announced that our board of directors declared the Series A Preferred Stock quarterly dividend payment in the amount of $0.50781 per share, for the period January 15, 2014, through and including April 14, 2014, payable on April 15, 2014 to holders of record as of the close of business on March 31, 2014.

2

Corporate Structure

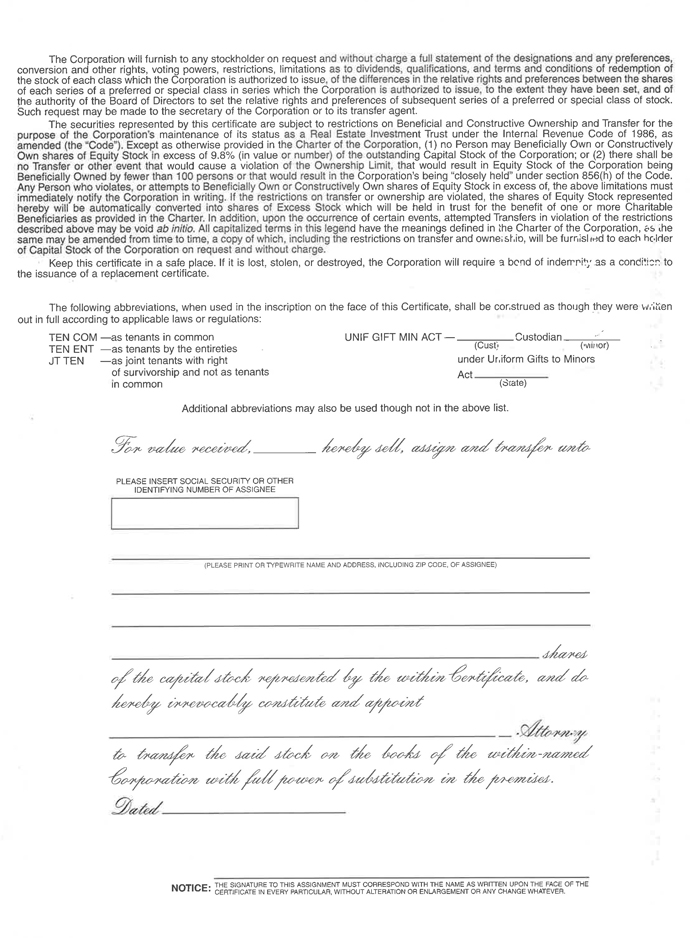

We were formed in April 2004 as a Maryland corporation and we completed our initial public offering in August 2004. We conduct substantially all of our operations through our operating partnership, GPT Property Trust LP, or our Operating Partnership. We are the sole general partner of our Operating Partnership. Our Operating Partnership conducts our commercial real estate investment business through various wholly-owned entities and our third party asset management business primarily through a wholly-owned TRS. The chart below summarizes the organizational structure of our entities as of December 31, 2013:

![[GRAPHIC MISSING]](v369233_chrt-flow.jpg)

We have elected to be taxed as a REIT under the Internal Revenue Code of 1986, as amended, or the Internal Revenue Code, and generally will not be subject to U.S. federal income taxes to the extent we distribute our taxable income, if any, to our stockholders. We have in the past established, and may in the future establish, TRSs, to effect various taxable transactions. Those TRSs would incur U.S. federal, state and local taxes on the taxable income from their activities.

Unless the context requires otherwise, all references to “Gramercy,” “the Company,” “we,” “our,” and “us” in this Annual Report on Form 10-K mean Gramercy Property Trust Inc., a Maryland corporation, and one or more of its subsidiaries, including our Operating Partnership.

Our Investment Strategy

We seek to acquire and manage a diversified portfolio of high quality net leased properties that generates stable, predictable cash flows and protects investor capital over a long investment horizon. We expect that these properties generally will be leased to a single tenant. Under a net lease, the tenant typically bears the responsibility for all property related expenses such as real estate taxes, insurance, and repair and maintenance costs. We believe this lease structure provides an owner cash flows over the term of the lease that are more stable and predictable than other forms of leases, and minimizes the ongoing capital expenditures often required with other property types.

We approach the net leased market as a value investor, looking to identify and acquire net leased properties that we believe offer attractive risk adjusted returns throughout market cycles. We focus primarily on industrial and office properties, where we believe attractive investment opportunities currently exist. We focus on acquiring assets in major markets where strong demographic and economic growth offer, in our view, a higher probability of producing long term rent growth and/or capital appreciation. Our goal is to grow our existing portfolio and become a pre-eminent owner of net leased commercial industrial and office properties in the United States.

We believe that within the net leased industry, industrial and office investments offer a fundamentally different opportunity from the market for net leased retail assets. Industrial and office assets tend to be heterogeneous, and valuation is frequently influenced by local real estate market conditions and tenant

3

preferences. In our view, the skillset required to properly underwrite industrial and office assets is specific to those assets and can be used to drive significant investment outperformance. We also believe that well-located industrial and office assets are better positioned to experience rent growth and asset price appreciation than single tenant retail assets in an inflationary environment.

Focus on Industrial Properties

Our strategy is to focus primarily on industrial properties and to pursue office properties on a more opportunistic basis. We believe industrial properties offer the most compelling risk adjusted returns in the net leased marketplace today. In our experience, industrial assets have more stable tenancy and a more direct and critical relationship to the tenant’s underlying operations. Industrial assets also have lower carrying costs when vacant, lower re-leasing costs to replace tenants and lower ongoing capital requirements during the period of ownership.

In our experience, net leased office — and specifically single tenant suburban office properties — can have contract rents that become very difficult to replicate at lease renewal. In addition, single tenant office properties can be difficult and costly to re-tenant and reconfigure as multi-tenant buildings. Office space also tends to be more generic, with weak links to the underlying operations making tenant switching costs very low for the tenants. We intend to pursue opportunistic net leased office transactions where we believe property specific factors and characteristics mitigate the above-referenced risks and the transaction offers compelling returns.

We do not plan to focus on net leased retail assets. We believe that there are many large, well-capitalized net leased REITs that currently focus on retail assets and we believe that the market for these assets is currently the most competitive within the overall net leased marketplace. In addition, retail leases typically have minimal rent increases, and many renewal options at fixed rents, which gives the tenant much of the benefit of any market or rent appreciation through an increase in the leasehold value of the asset. If specific opportunities arise or market conditions warrant, we may revisit this approach to net leased retail assets in the future.

Focus on Real Estate Fundamentals

We have observed that the net leased investing marketplace has evolved from a primarily credit-focused strategy with bond type net leased structures, very long lease terms, and bargain renewal options to one in which net leased investors face many of the same operational and market risks as other real estate investors. For this reason, we believe that real estate underwriting is an important aspect of our investment process. We believe that traditional real estate fundamentals will be the primary driver of investment performance in the net leased market for the foreseeable future, in contrast to the past practices where long lease terms and tenant credit quality were the primary drivers.

Target Industrial and Office Facilities

Target Markets with Attractive Characteristics — We plan to concentrate our investment activity in select target markets with the following characteristics: high quality infrastructure, diversified local economies with multiple economic drivers, strong demographics, pro-business local governments and high quality local labor pools. We believe that these markets offer a higher probability of producing long term rent growth and/or capital appreciation. As of December 31, 2013, approximately 85% of our portfolio (based on purchase price) is located in our target markets (based on purchase price).

Properties with Competitive Rents to Market — We target properties with contract rents that are at or below rents that are available in the market for similar properties as a way to reduce the volatility of cash flows that can occur upon the expiration of a lease. We specifically target properties where rents have been rolled down, post-financial crisis.

Properties with Long Lease Terms — We generally target properties that have between 5 and 20 years of non-cancelable lease terms. We believe that longer lease terms provide more stable cash flows, are less susceptible to changes in market conditions and require less capital expenditure to maintain tenancy.

Core Properties Acquired at Above Market Yields Due to Some Market Inefficiency — We seek opportunities to acquire core properties at attractive prices due to a mispricing of credit or real estate risk, or a misunderstanding of the nature of the investment that may limit the competitive environment.

4

Complex Legacy Net Leased Portfolios — We seek opportunities to acquire legacy net leased portfolios that through asset sales, lease restructurings and other value-add activities can be transformed into high quality net leased portfolios.

Target Mission Critical Non-Traditional Net Leased Properties

We target specialized properties that fall outside many traditional institutional investor parameters, but offer unique utility to a tenant or an industry and can therefore be acquired at attractive yields relative to the underlying risk. We look for properties that are difficult or costly to replicate due to a specific location, special zoning, unique physical attributes, below market rents or a significant tenant investment in the facility, all of which contribute to a higher probability of tenant renewals. Examples of specialized properties include cross-dock truck terminals, cold storage facilities, parking facilities, air-freight facilities, steel distribution facilities, properties with high parking requirements and other mission critical facilities. We purchase specialized corporate real estate if we believe the property is critical to the ongoing operations of the tenant and the profitable continuation of its business. We believe that the profitability of the operations and the relative difficulty in replicating or moving operations reflect the importance of the property to the tenant’s business.

Target Transactions Where We Have a Competitive Advantage

Individual Properties — We seek to acquire individual properties having a purchase price between $5 million and $30 million. We target properties of this size because we find in the current environment that there is less competition from larger institutions who generally look for larger properties and larger portfolios. We have an asset management team of significant scale that has significant experience negotiating, underwriting and acquiring these types of properties, which we believe gives us a competitive advantage over many local and regional investors that typically compete for these acquisitions.

Sale Leasebacks — We believe our management team is among the most experienced and well known in the sale and leaseback industry, with long-standing contacts and reputations among bankers, advisors and private equity firms. We believe that we can source and effectively compete on sale and leaseback transactions and believe that there will be an increasing number of such opportunities due to still extensive holdings of commercial real estate on corporate balance sheets, financial metrics which discourage such ownership and the relative attractiveness of the capital that we and others in the sale and leaseback industry can offer.

Build-to-Suits — Our management team has extensive experience in build-to-suit transactions whereby we provide construction funding for a property that we ultimately acquire. In a build-to-suit transaction, we generally pre-lease all or substantially all of the property to a single tenant under a long-term lease. We believe there is less competition for such investments due to investors’ relative lack of experience with such investments, the difficulties in obtaining inexpensive asset level financing and a lack of a mandate to make such investments.

Portfolios — We believe there may be opportunities to purchase portfolios of properties from existing owners who are either investor owners or corporations that occupy their properties. We believe that we will have the opportunity to purchase portfolios in exchange for cash, our common stock, units of limited partnership interest in the Operating Partnership or a combination thereof. The market for large portfolios is currently very competitive with many well-capitalized buyers actively bidding for these portfolios and we expect this market to remain competitive for the foreseeable future.

Target Investments that Maximize Growth Potential

Opportunities to Extend Leases through Expansions or Capital Investments — We focus on net leased investment properties where, in our view, there is the potential to invest incremental capital to accommodate a tenant’s business, extend lease terms and increase the value of a property. We believe these opportunities can generate attractive returns due to the nature of the relationship between the landlord and tenant.

Assets with Cycle-Low Rent Levels — We focus on industrial and office properties with rents that we believe are competitive with market rents. These rents have typically resulted in a lease-up of vacant space or a lease renewal completed following the financial crisis. We believe that the net leased marketplace does not properly differentiate and price these properties and that these investment opportunities can generate growth in income and residual value over time as the U.S. economy improves.

5

Long-term Appreciation Opportunities — We believe there are opportunities to acquire properties with longer term leases that provide current cash flow for the term of the lease and that, if correctly identified, have the potential upon lease expiration for a higher and better use that may provide capital appreciation over the long-run.

Focus on Risk Management

Underwrite and Structure Investments to Protect Downside and Preserve Cash Flows — We seek to invest in properties that have steady, predictable cash flow through: (a) long term, well-structured leases, (b) high leasehold value for tenants and (c) a high likelihood of renewal. We further seek to protect our investment by purchasing properties at prices at or below estimated replacement cost.

Utilize Portfolio Diversification — We seek to diversify our portfolio by property type, tenant credit, geography and tenant industry. As of December 31, 2013, our largest tenant was Bank of America, N.A., which accounted for approximately 31% of our annualized base rent revenue as of December 31, 2013. As we grow, we expect to further diversify our portfolio.

Utilize Moderate Leverage — We will target moderate consolidated leverage across our entire company of debt to market capitalization of approximately 50% to 55% through a combination of mortgage debt and corporate-level debt. We aspire to be an unsecured borrower; however, until we reach sufficient scale to obtain that goal, we will utilize a mix of secured debt and entity level borrowings.

Actively Manage the Portfolio to Maximize Tenant Retention and Minimize Vacancy — We believe there are opportunities within our portfolio to extend lease terms through property expansions or tenant improvement investments funded by us.

Leases

The following provides information regarding the various lease structures (including our lease with Preferred Freezer Services of Hialeah, LLC, which starts upon completion of construction of the facility currently expected in the second quarter of 2014) that we utilize in our operations.

Triple net lease. In our triple net leases, the tenant is responsible for all aspects of and costs related to the property and its operation during the lease term. The landlord may have responsibility under the lease to perform or pay for certain capital repairs or replacements to the roof, structure or certain building systems, such as heating and air conditioning and fire suppression. In some instances the tenant may reimburse the landlord for capital repairs or replacements on an amortized basis. The tenant may have the right to terminate the lease or abate rent due to a major casualty or condemnation affecting a significant portion of the property or due to the landlord’s failure to perform its obligations under the lease. Substantially all of our wholly owned industrial and specialty asset properties are leased pursuant to triple net leases.

Modified gross lease. In our modified gross leases, the landlord is responsible for some property related expenses during the lease term, but the cost of most of the expenses is passed through to the tenant for reimbursement to the landlord. The tenant may have the right to terminate the lease or abate rent due to a major casualty or condemnation affecting a significant portion of the property or due to the landlord’s failure to perform its obligations under the lease. Bank of America leases the Bank of America Portfolio properties pursuant to a modified gross lease.

Gross lease. In our gross leases, the landlord is responsible for all aspects of and costs related to the property and its operation during the lease term. The tenant may have the right to terminate the lease or abate rent due to a major casualty or condemnation affecting a significant portion of the property or due to the landlord’s failure to perform its obligations under the lease. As of December 31, 2013, gross leases in our portfolio represented approximately 1.0% of our total contractual base rent.

Escalations/Renewals. The properties in our wholly owned and joint venture portfolio may be subject to varying provisions regarding rent escalations and renewals. The properties within our Bank of America Portfolio typically have 1.5% rent increases every five years on 10-year lease terms and six tenant renewal options of five years each. Our remaining leases have rent escalation and renewal options that vary in amount and duration.

6

Our Competitive Strengths

We believe that we distinguish ourselves from other net leased companies through the following competitive strengths:

| • | Management Team with Extensive Specialized Net Lease Expertise |

| º | We are led by Gordon F. DuGan and Benjamin P. Harris, the former Chief Executive Officer and Head of US Investments of W.P. Carey & Co., or W.P. Carey, respectively, with a combined 35 years of real estate experience. |

| º | Our seven senior officers have an average of approximately 20 years of real estate experience. |

| • | Demonstrated Track Record |

| º | During his tenure at W.P. Carey as President from December 1999 to May 2004 and then CEO from May 2004 to July 2010, Mr. DuGan oversaw the growth of W.P. Carey’s assets under management from approximately $2 billion at December 31, 1999, to approximately $10 billion at June 30, 2010. |

| º | For the period July 1, 2012 to December 31, 2013, we have sourced and acquired (directly or in joint ventures) approximately $873 million in net leased investments. |

| º | For the period July 1, 2012 to December 31, 2013, we have marketed and sold for our company and third-parties 322 non-core properties for an aggregate gross sale price of approximately $905 million. |

| • | Focused and Disciplined Investment Strategy |

| º | We are uniquely focused on acquiring well positioned net leased industrial and office properties. |

| º | Our target markets consist of Metropolitan Statistical Areas, or MSA’s, that have strong demographics and business-friendly environments, among other things. |

| º | Our quantitative underwriting model allows us to evaluate opportunities from a risk/return perspective. |

| • | Strong, Long-Standing Industry Relationships |

| º | Members of our management team have cultivated relationships with various constituents in the net leased market for over two decades. |

| º | We believe our management team’s experience in the sale leaseback space may result in our receiving a “first-call” from numerous companies, advisors, brokers and private equity firms interested in possible sale leaseback transactions. |

| • | Full Service Asset Management Platform |

| º | We believe we have the in-house expertise and capability required to perform broad-scope asset management and construction management services for ourselves and for third parties, including our joint venture partners. |

| • | Ability to Move Fast |

| º | We believe we have established a reputation for closing transactions quickly and efficiently. |

| º | Our due diligence and closing group have extensive experience in closing transactions. |

| • | Stockholder-Aligned Compensation and Corporate Governance |

| º | We use individual and corporate annual performance metrics to measure executive performance when determining annual incentive compensation bonuses. |

| º | We maintain a policy that prohibits directors and officers from hedging, pledging or margining shares of our common stock. |

7

| º | Our stock ownership guidelines for our chief executive officer are based on a multiple of base salary. |

| º | Pursuant to Mr. DuGan’s employment contract, Mr. DuGan purchased from us 1.0 million shares of our common stock at market prices immediately prior to commencing employment as our Chief Executive Officer on July 1, 2012 using his personal funds without any reimbursement or other financial assistance from us. |

| º | Stock ownership guidelines for our non-employee directors are based on multiples of the annual retainer for our non-employee directors. |

| º | Our directors are elected annually. |

| º | We implemented majority voting in the election of directors. |

Our Investment Process

Sourcing and Initial Review

We utilize relationships with various real estate owners, real estate advisors and intermediaries, developers, investment and commercial banks, private equity sponsors, and other potential deal sources to identify a broad pipeline of investment opportunities. Our investment team actively reviews this pipeline and identifies a subset of properties that meet our investment criteria. Our initial review includes an evaluation of the credit of the tenant, the criticality of the property, an evaluation of the market and submarket where the property is located, the location, age, functionality and marketability of the property, the lease structure and how contract rents relate to rents for similar buildings in the submarket, the replacement cost for a similar asset, the expected returns and pricing, and other factors that go into the overall evaluation of the investment opportunity. Our management team actively looks to source proprietary investment opportunities that are not being generally marketed for sale.

Underwriting and Analysis

As part of a potential property acquisition, we evaluate the creditworthiness of the tenant and the tenant’s ability to generate sufficient cash flow to make payments to us pursuant to the lease. We evaluate each potential tenant for its creditworthiness, considering factors such as the tenant’s rating by a national credit rating agency, if any, management experience, industry position and fundamentals, operating history and capital structure. We may seek tenants who are small to middle-market businesses, many of which do not have publicly rated debt. We may also lease properties to large, publicly traded companies in order to diversify the overall credit quality of our tenant base. The creditworthiness of a tenant is determined on a tenant-by-tenant and case-by-case basis. Therefore, general standards for creditworthiness cannot be applied.

Due Diligence Review

We perform a due diligence review with respect to each potential property acquisition, such as evaluating the physical condition, evaluating compliance with zoning and site requirements, as well as completing an environmental site assessment in an attempt to determine potential environmental liabilities associated with a property prior to its acquisition, although there can be no assurance that hazardous substances or wastes (as defined by present or future federal or state laws or regulations) will not be discovered on the property after we acquire it.

We review the structural soundness of the improvements on the property and may engage a structural engineer to review all aspects of the structures in order to determine the longevity of each building on the property. This review normally also includes the components of each building, such as the roof, the electrical wiring, the heating and air-conditioning system, the plumbing, parking lot and various other aspects such as compliance with federal, state and local building codes.

8

We physically inspect the real estate and surrounding area as part of our process for determining the value of the real estate. Our due diligence is structured to assist us in determining the value of the property, which is based on, among other things, historical and projected operating results as well as the value of the real estate under the assumption that it was not rented to the current tenant. As part of this process, we may consider one or more of the following items:

| • | the comparable value of similar real estate in the same general area of the prospective property; |

| • | the comparable real estate rental rates for similar properties in the same area of the prospective property; |

| • | alternative property uses that may offer higher value; |

| • | the cost of replacing the property; and |

| • | any barriers to entry to construct competing properties. |

We may supplement our valuation with a real estate appraisal. When appropriate, we may also engage experts to undertake some or all of the due diligence efforts described above.

Credit Underwriting

As part of our investment process, we conduct a review of the tenant’s credit profile which may include a review of any or all of the following:

| • | the tenant’s and/or its affiliates’ historical financials; |

| • | the tenant’s and/or its affiliates’ industry and its competitive position; |

| • | the tenant’s and/or its affiliates’ business plan and financial projections; |

| • | the tenant’s and/or its affiliates’ capital structure; and |

| • | the tenant’ real estate and how a subject property fits into the tenant’s operations. |

We may also conduct interviews with management and owners of the tenant and/or its affiliates as a part of this process.

Investment policy

All real estate investments, dispositions and financings must be approved by a credit committee consisting of our most senior officers, including the affirmative approval of our chief executive officer. Real estate investments and dispositions at a loss (based on book value at the time of sale) having a transaction value greater than $20.0 million must also be approved by the investment committee of our board of directors. Our board of directors must approve all such transactions having a value greater than $50.0 million. Additionally, the investment committee must approve non-recourse financings greater than $20.0 million and our board of directors must approve all recourse financings, regardless of amount, and non-recourse financings greater than $50.0 million. For purposes of approval thresholds, joint ventures are calculated without regard for the joint venture structure and are calculated assuming we are acquiring 100% of the property or borrowing 100% of the financing.

We generally intend to hold the investment properties we acquire for an extended period. However, circumstances might arise which could result in the early sale of some properties. We also may acquire a portfolio of properties with the intention of holding only a core group of properties and disposing of the remainder of the portfolio in single or multiple sales. The determination of whether a particular property should be sold or otherwise disposed of will be made after consideration of all relevant factors, including prevailing economic conditions, with a view to achieving maximum capital appreciation. The selling price of a property will depend on many of the same factors identified above with respect to our investment process for acquisitions.

We may use TRSs to acquire or hold property, including assets that may not be deemed to be REIT-qualified assets. Taxes paid by such entity will reduce the cash available to us to fund our continuing operations and cash available for distributions to our stockholders.

9

Some of our investments have been made and may continue to be made through joint ventures that permit us to own interests in larger properties or portfolios without restricting the diversity of our portfolio. We will not enter into a joint venture to make an investment that we would not otherwise purchase on our own under our existing investment policies. We currently have investments in two joint ventures. As of December 31, 2013, this included (i) a 50% interest in a 75 property portfolio referred to as the Bank of America Portfolio and (ii) a 25% interest in a fee interest in 200 Franklin Square Drive, Somerset New Jersey which is 100% net leased to Philips Holdings, USA Inc., a wholly-owned subsidiary of Royal Philips Electronics, through December 2021, or Philips HQ JV.

Use of Leverage

In addition to cash on hand and cash from operations, we anticipate using funds from various sources to finance our acquisitions and operations, including public and private equity issuances, bank credit facilities, term loans, property-level mortgage debt, operating partnership units and other sources that may become available from time to time. We believe that moderate leverage is prudent and generally target a debt to market capitalization ratio of 50% – 55% across our entire portfolio. We may encumber certain properties with higher leverage while keeping other properties unencumbered or pledged as part of various corporate level borrowings. We aspire over time to become an investment grade rated, unsecured borrower. However, until we reach sufficient scale to obtain that goal, we will utilize a mix of secured debt and entity level borrowing.

We expect that any property-level mortgage borrowings will be structured as non-recourse to us, with limited exceptions that would trigger recourse to us only upon the occurrence of certain fraud, misconduct, environmental, bankruptcy or similar events.

We have a $150.0 million senior secured revolving credit facility with an initial term expiring September 4, 2015, with an option for a one-year extension. The credit facility included a $50.0 million accordion feature, which we exercised in February 2014, that allowed us to increase borrowing capacity from $100 million when we entered into the agreement in September 2013 to $150.0 million. The credit facility is fully guaranteed by Gramercy and certain subsidiaries and is secured by first priority mortgages on designated properties, or the “Borrowing Base”, as defined under the agreement. Availability under the credit facility is limited to the lesser of $150.0 million or 60% of the value of the Borrowing Base. We intend to use credit facilities and other entity level borrowings in the future as a part of our overall capital structure.

Our organizational documents do not limit the amount or percentage of indebtedness that we may incur. The amount of leverage we will deploy for particular investments will depend on an assessment of a variety of factors, which may include the availability and cost of financing the assets, the creditworthiness of our tenants, the health of the U.S. economy and commercial mortgage markets, our outlook for the level, slope and volatility of interest rates, and the overall quality of the properties that secure the indebtedness. We can provide no assurance that financing will be available on terms acceptable to us or at all.

Asset and Property Management

In addition to net leased investing, we also operate a commercial real estate management business for third-parties. As of December 31, 2013, this business, which operates under the name Gramercy Asset Management, managed approximately $1.4 billion of commercial properties leased primarily to regulated financial institutions and affiliated users throughout the United States. We manage properties for companies including KBS, Garrison Investment Group, L.P., or Garrison, through their investment in the Bank of America Portfolio Joint Venture, and Oak Tree Capital Management, L.P.

We have an integrated asset management platform within Gramercy Asset Management to consolidate responsibility for, and control over, leasing, lease administration, property management, operations, construction management, tenant relationship management and property accounting. To the extent that we provide asset management services for third-party property owners, we provide such services in consultation with and at the direction of such owners.

In December 2013, one of our wholly owned TRSs extended an Amended Restated Asset Management Services Agreement, or Management Agreement, with KBS. As part of the execution of the Management Agreement, KBS made a $12.0 million payment to our TRS in satisfaction of the profit participation provisions under the pre-amended Management Agreement. In addition, the Management Agreement provides

10

for a base management fee of $7.5 million per year as well as certain other fees as provided therein. The term of the Management Agreement will continue to December 31, 2016 (with a one year extension option exercisable by KBS), unless earlier terminated as therein provided, and also provides incentive fees in the form of profit participation ranging from 10% – 30% of incentive profits earned on sales.

Commercial Real Estate Finance

In March 2013, we disposed of our Gramercy Finance segment, and exited the commercial real estate finance business. Our commercial real estate finance business invested in and managed a diversified portfolio of real estate loans, including whole loans, bridge loans, subordinate interests in whole loans, mezzanine loans, Commercial Mortgage-backed securities, or CMBS, and preferred equity involving commercial properties throughout the United States, and which held interests in real estate properties acquired through foreclosures. The disposal was completed pursuant to a sale and purchase agreement to transfer the collateral management and sub-special servicing agreements for our three CDOs to CWCapital Investments LLC, or CWCapital, for proceeds of $6.3 million in cash, after expenses. We retained our noninvestment grade subordinate bonds, preferred shares and ordinary shares, or the Retained CDO Bonds, in the CDOs, which may allow us to recoup additional proceeds over the remaining life of the CDOs based upon resolution of underlying assets within the CDOs. However, there is no guarantee that we will realize any proceeds from the Retained CDO Bonds or what the timing of these proceeds might be. On March 15, 2013, we deconsolidated the assets and liabilities of Gramercy Finance from our Consolidated Financial Statements and recognized a gain on the disposal of $389.1 million within discontinued operations. The carrying value of the Retained CDO Bonds was $6.8 million as of December 31, 2013.

In addition to our Retained CDO Bonds, we expect to receive additional cash proceeds for past CDO servicing advances when specific assets within the CDOs are liquidated. We received reimbursements of $6.1 million during the year ended December 31, 2013, and the carrying value of the receivable for servicing advance reimbursements as of December 31, 2013 is $8.8 million. We do not anticipate receiving a substantial portion of the remaining CDO servicing advance reimbursements until the second half of 2014.

Hedging Activities

We may use a variety of commonly used derivative instruments that are considered conventional, or “plain vanilla” derivatives, including interest rate swaps, caps, collars and floors, in our risk management strategy to limit the effects of changes in interest rates on our operations. We may from time to time use derivative instruments in connection with the private placement of equity.

Our hedging strategy consists of entering into interest rate swap and interest rate cap contracts. The value of our derivatives may fluctuate over time in response to changing market conditions, and will tend to change inversely with the value of the risk in our liabilities that we intend to hedge. Hedges are sometimes ineffective because the correlation between changes in value of the underlying investment and the derivative instrument is less than was expected when the hedging transaction was undertaken. We continuously monitor the effectiveness of our hedging strategies and we have retained the services of an outside financial services firm with expertise in the use of derivative instruments to advise us on our overall hedging strategy, to effect hedging trades, and to provide the appropriate designation and accounting of all hedging activities from a GAAP and tax accounting and reporting perspective.

These instruments are used to hedge as much of the interest rate risk as we determine is in the best interest of our stockholders, given the cost of such hedges. To the extent that we enter into a hedging contract to reduce interest rate risk on indebtedness incurred to acquire or carry real estate assets, any income that we derive from the contract is not considered income for purposes of the REIT 95% gross income test and is either non-qualifying for the 75% gross income test (hedges entered into prior to August 1, 2008), or is not considered income for purposes of the 75% gross income test (hedges entered into after July 31, 2008). This change in character for the 75% gross income test was included in the Housing and Economic Recovery Act of 2008. We can elect to bear a level of interest rate risk that could otherwise be hedged when we believe, based on all relevant facts, that bearing such risk is advisable.

11

Equity Capital Policies

Subject to applicable law and our charter, our board of directors has the authority, without further stockholder approval, to issue additional authorized common stock and preferred stock or otherwise raise capital, including through the issuance of senior securities, in any manner and on the terms and for the consideration it deems appropriate.

We may, under certain circumstances, repurchase our common or preferred stock in private transactions with our stockholders if those purchases are approved by our board of directors and are in accordance with our charter. Our board of directors has no present intention of causing us to repurchase any shares, and any action would only be taken in conformity with applicable federal and state laws and the applicable requirements for qualifying as a REIT, for so long as our board of directors concludes that we should remain a qualified REIT.

Future Revisions in Policies and Strategies

If our board of directors determines that additional funding is required, we may raise such funds through additional offerings of equity or debt securities or the retention of cash flow (subject to REIT distribution requirements) or a combination of these methods. In the event that our board of directors decides to raise additional equity capital, it has the authority, without obtaining stockholder approval, to issue additional common stock or preferred stock in any manner and on such terms and for such consideration as it deems appropriate, at any time. Our investment guidelines and our portfolio and leverage are periodically reviewed by our board of directors.

Competition

The market for acquiring well-positioned net leased properties is currently very competitive and likely to remain very competitive for the foreseeable future. We compete for net leased real estate with a variety of other potential purchasers, including other public and private real estate investment companies, some of which have greater financial or other resources than we do. We also compete for tenants with other net leased property owners. Deteriorating investment opportunities in a highly competitive marketplace may negatively impact our pace of acquisitions, the prices we pay for the properties we acquire and our results from operations.

Although we believe that we are positioned to compete effectively in each facet of our business, there is considerable competition in our market sector and there can be no assurance that we will compete effectively or that we will not encounter increased competition in the future that could limit our ability to conduct our business effectively.

Compliance With The Americans With Disabilities Act of 1990

Properties that we acquire, and the properties underlying our investments, are required to meet federal requirements related to access and use by disabled persons as a result of the Americans with Disabilities Act of 1990, or the Americans with Disabilities Act. In addition, a number of additional federal, state and local laws may require modifications to any properties we purchase, or may restrict further renovations of our properties, with respect to access by disabled persons. Noncompliance with these laws or regulations could result in the imposition of fines or an award of damages to private litigants. Additional legislation could impose additional financial obligations or restrictions with respect to access by disabled persons. If required changes involve greater expenditures than we currently anticipate, or if the changes must be made on a more accelerated basis, our ability to make distributions could be adversely affected.

Other Information

Our corporate offices are located in midtown Manhattan at 521 Fifth Avenue, 30th Floor, New York, New York 10175. We also have regional offices in Jenkintown, Pennsylvania, and St. Louis, Missouri. We can be contacted at (212) 297-1000. We maintain a website at www.gptreit.com. Our reference to our website is intended to be an inactive textual reference only. On our website, you can obtain, free of charge, a copy of our annual report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, and amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Securities Exchange

12

Act of 1934, as amended, or the Exchange Act, as soon as practicable after we file such material electronically with, or furnish it to, the Securities and Exchange Commission, or the SEC. We have also made available on our website our audit committee charter, compensation committee charter, nominating and corporate governance committee charter, code of business conduct and ethics and corporate governance principles. Information on, or accessible through, our website is not part of, and is not incorporated into, this report. You can also read and copy materials we file with the SEC at its Public Reference Room at 100 F Street, NE, Washington, DC 20549 (1-800-SEC-0330). The SEC maintains an Internet site (www.sec.gov) that contains reports, proxy and information statements, and other information regarding the issuers that file electronically with the SEC.

Industry Segments

As of December 31, 2013, we have two reportable operating segments: Investments/Corporate and Asset Management. The reportable segments were determined based on the management approach, which looks to our internal organizational structure. These two lines of business require different support infrastructures.

The Investments/Corporate segment includes all of our activities related to investment and ownership of commercial properties net leased to high quality tenants throughout the United States. The Investments/Corporate segment generates revenues from rental revenues from properties that we own.

The Asset Management segment includes substantially all of our activities related to third-party asset and property management of commercial. The Asset Management segment generates revenues from fee income related to the Management Agreement with third parties and from our Bank of America Portfolio joint venture.

In March 2013, we disposed of the Finance segment, which was classified as held-for-sale and included in discontinued operations at December 31, 2013. The Finance segment included all of our activities related to origination, acquisition and portfolio management of whole loans, bridge loans, subordinate interests in whole loans, mezzanine loans, preferred equity, CMBS and other real estate related securities.

Segment revenue and profit information is presented in Note 18 to the consolidated financial statements.

Employees

As of December 31, 2013, we had 83 employees. Our employees are not represented by a collective bargaining agreement.

Corporate Governance and Internet Address; Where Readers Can Find Additional Information

We emphasize the importance of professional business conduct and ethics through our corporate governance initiatives. Our board of directors consists of a majority of independent directors; the Audit, Nominating and Corporate Governance, and Compensation Committees of our board of directors are composed exclusively of independent directors. We have adopted corporate governance guidelines and a code of business conduct and ethics.

We file annual, quarterly and current reports, proxy statements and other information required by the Exchange Act with the SEC. Readers may read and copy any document that we file at the SEC’s Public Reference Room located at 100 F Street, N.E., Washington, D.C. 20549, U.S.A. Please call the SEC at 1-800-SEC-0330 for further information on the Public Reference Room. Our SEC filings are also available to the public from the SEC’s internet site at www.sec.gov. Copies of these reports, proxy statements and other information can also be inspected at the offices of the New York Stock Exchange, Inc., 20 Broad Street, New York, New York 10005.

Our internet site is www.gptreit.com. Our reference to our website is intended to be an inactive textual reference only. We make available free of charge through our internet site our annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, proxy statements and Forms 3, 4 and 5 filed on behalf of directors and executive officers and any amendments to those reports filed or furnished pursuant to the Exchange Act as soon as reasonably practicable after we electronically file such material with, or furnish it to, the SEC. Also posted on our website in the “Investor Relations — Corporate Governance” section are charters for our Audit Committee, Compensation Committee and Nominating and Corporate Governance

13

Committee as well as our Corporate Governance Guidelines and our Code of Business Conduct and Ethics governing our directors, officers and employees. Information on, or accessible through, our website is not a part of, and is not incorporated into, this report.

Environmental Matters

The properties we own and will acquire are subject to various federal, state and local environmental laws. Under these laws, courts and government agencies have the authority to require us, as owner of a contaminated property, to clean up the property, even if we did not know of or were not responsible for the contamination. These laws also apply to persons who owned a property at the time it became contaminated, and therefore it is possible we could incur these costs even after we sell some of our properties. In addition to the costs of cleanup, environmental contamination can affect the value of a property and, therefore, an owner’s ability to borrow using the property as collateral or to sell the property. Under applicable environmental laws, courts and government agencies also have the authority to require that a person who sent waste to a waste disposal facility, such as a landfill or an incinerator, pay for the clean-up of that facility if it becomes contaminated and threatens human health or the environment.

Furthermore, various court decisions have established that third parties may recover damages for injury caused by property contamination. For instance, a person exposed to asbestos at one of our properties may seek to recover damages if he or she suffers injury from the asbestos. Lastly, some of these environmental laws restrict the use of a property or place conditions on various activities. An example would be laws that require a business using chemicals to manage them carefully and to notify local officials that the chemicals are being used.

We could be responsible for any of the costs discussed above. The costs to clean up a contaminated property, to defend against a claim, or to comply with environmental laws could be material and could adversely affect the funds available for distribution to our stockholders.

We generally obtain “Phase I environmental site assessments,” or “ESAs,” on each property prior to acquiring it. However, these ESAs may not reveal all environmental costs that might have a material adverse effect on our business, assets, results of operations or liquidity and may not identify all potential environmental liabilities. Additionally, our leases generally require our tenants to conduct their operations at our properties in compliance with applicable federal, state and local environmental laws, to promptly notify us of the occurrence of any environmental contaminations or similar issues and to indemnify us against claims resulting from their failure to so act. However, there can be no assurance that our tenants will notify us as required, or further, have funds or assets at the time indemnification is sought that are sufficient to properly indemnify us against any such claims.

While we purchase many of our properties on an “as is” basis, our purchase contracts for such properties contain an environmental contingency clause, which permits us to reject a property because of any environmental hazard at such property. However, we do acquire properties which may have asbestos abatement requirements, for which we set aside appropriate reserves.

We believe that our portfolio is in compliance in all material respects with all federal and state regulations regarding hazardous or toxic substances and other environmental matters.

Insurance

We carry commercial liability and all risk property insurance, including where required, flood, earthquake, wind and terrorism coverage, on substantially all of the properties that we own. For certain net leased properties, however, we rely on our tenant’s insurance and do not maintain separate coverage. We continue to monitor the state of the insurance market and the scope and costs of specialty coverage, including flood, earthquake, wind and terrorism. We cannot anticipate what coverage will be available on commercially reasonable terms in future policy years. We believe that the insured limits are appropriate given the relative risk of loss, the cost of the coverage and industry practice.

14

| ITEM 1A. | RISK FACTORS |

Risks Related to Our Business and Investments

Our future growth will depend upon our ability to acquire and lease properties in a competitive real estate business.

Our future growth will depend, in large part, upon our ability to acquire and lease properties. In order to grow we need to continue to acquire and finance investment properties and sell non-core properties. The acquisition and sale of investment properties is subject to competitive pressures from many market participants and we expect strong competition from other REITs, businesses, individuals, fiduciary accounts and plans, as well as other entities engaged in real estate investment and financing. Many of these competitors are larger than we are and have access to greater financial resources. Such competition may limit our ability to acquire properties and grow or may result in a higher cost to us for properties we wish to purchase.

If we cannot obtain additional capital, our ability to make acquisitions and lease properties will be limited. We are subject to risks associated with debt and capital stock issuances, and such issuances may have consequences to holders of our common and preferred stock.

Our ability to make acquisitions and lease properties will depend, in large part, upon our ability to raise additional capital. If we were to raise additional capital through the issuance of equity securities, we could dilute the interests of holders of our common stock. Our Board may authorize the issuance of additional classes or series of preferred stock which may have rights that could dilute, or otherwise adversely affect, the interest of holders of our common stock.

We intend to incur additional indebtedness in the future, which may include an additional corporate credit facility. Such indebtedness could also have other important consequences to holders of the notes and holders of our common and preferred stock, including subjecting us to covenants restricting our operating flexibility, increasing our vulnerability to general adverse economic and industry conditions, limiting our ability to obtain additional financing to fund future working capital, capital expenditures and other general corporate requirements, requiring the use of a portion of our cash flow from operations for the payment of principal and interest on our indebtedness, thereby reducing our ability to use our cash flow to fund working capital, acquisitions, capital expenditures and general corporate requirements, and limiting our flexibility in planning for, or reacting to, changes in our business and our industry.

The competitive pressures we face as a result of operating in a highly competitive market could have a material adverse effect on our business, financial condition, liquidity and results of operations.

We face significant competition with respect to our acquisition and origination of assets from many other companies, including other REITs, insurance companies, private investment funds, hedge funds, specialty finance companies and other investors. Some competitors may have a lower cost of funds and access to funding sources that are not available to us. In addition, some of our competitors may have higher risk tolerances or different risk assessments, which could allow them to consider a wider variety of investments and establish more relationships than us. Furthermore, there is significant competition on a national, regional and local level with respect to property management services and in commercial real estate services generally, and we are subject to competition from large national and multi-national firms as well as local or regional firms that offer similar services to ours. Some of our competitors may have greater financial and operational resources, larger customer bases, and more established relationships with their customers and suppliers than we do. The competitive pressures we face, if not effectively managed, may have a material adverse effect on our business, financial condition, liquidity and results of operations.

Also, as a result of this competition, we may not be able to take advantage of attractive origination and investment opportunities and therefore may not be able to identify and pursue opportunities that are consistent with our objectives. Competition may limit the number of suitable investment opportunities offered to us. It may also result in higher prices, lower yields and a narrower spread of yields over our borrowing costs, making it more difficult for us to acquire new investments on attractive terms. In addition, competition for desirable investments could delay our investment in desirable assets, which may in turn reduce our earnings per share and negatively affect our ability to declare and make distributions to our stockholders.

15

We are dependent on key personnel whose continued service is not guaranteed.

We rely on a small number of persons who comprise our existing senior management team and our Board to implement our business and investment strategies. While we have entered into employment and/or retention agreements with certain members of our senior management team, they may nevertheless cease to provide services to us at any time.

The loss of services of any of our key management personnel or directors or significant numbers of other employees, or our inability to recruit and retain qualified personnel or directors in the future, could have an adverse effect on our business.

Quarterly results may fluctuate and may not be indicative of future quarterly performance.

Our quarterly operating results could fluctuate; therefore, you should not rely on past quarterly results to be indicative of our performance in future quarters. Factors that could cause quarterly operating results to fluctuate include, among others, variations in our investment origination volume, impairments, the degree to which we encounter competition in our markets, tenant defaults and delinquencies and general economic conditions.

We are required to make a number of judgments in applying accounting policies, and different estimates and assumptions in the application of these policies could result in changes to our reporting of financial condition and results of operations.

Various estimates are used in the preparation of our financial statements, including estimates related to asset and liability valuations (or potential impairments) and various receivables. Often these estimates require the use of market data values which may be difficult to assess, as well as estimates of future performance or receivables collectability which may be difficult to accurately predict. While we have identified those accounting policies that are considered critical and have procedures in place to facilitate the associated judgments, different assumptions in the application of these policies could result in material changes to our financial condition and results of operations.

We utilize, and intend to continue to utilize, leverage which may limit our financial flexibility in the future.

We make acquisitions and operate our business in part through the utilization of leverage pursuant to loan agreements with various financial institutions. These loan agreements contain financial covenants that restrict our operations. These financial covenants, as well as any future financial covenants we may enter into through further loan agreements, could inhibit our financial flexibility in the future and prevent distributions to stockholders.

We may incur losses as a result of ineffective risk management processes and strategies.

We seek to monitor and control our risk exposure through a risk and control framework encompassing a variety of separate but complementary financial, credit, operational, compliance and legal reporting systems, internal controls, management review processes and other mechanisms. While we employ a broad and diversified set of risk monitoring and risk mitigation techniques, those techniques and the judgments that accompany their application cannot anticipate every economic and financial outcome or the specifics and timing of such outcomes. Thus, we may, in the course of our activities, incur losses due to these risks.

We are highly dependent on information systems and third parties, and systems failures could significantly disrupt our business, which may, in turn, negatively affect the market price of our common stock and our ability to make distributions to our stockholders.

Our business is highly dependent on communications and information systems, some of which are provided by third parties. Any failure or interruption of our systems could cause delays or other problems, which could have a material adverse effect on our operating results and negatively affect the market price of our common stock and our ability to make distributions to our stockholders.

Lack of diversification in number of investments increases our dependence on individual investments.

We own a 50% interest in a joint venture with Garrison in which nearly 100% of the properties in the portfolio are leased to Bank of America. The cash flow generated from these properties represents a significant

16

portion of our rental income. If Bank of America defaults or is otherwise unable to perform under its lease obligations, it would negatively impact our cash flows and overall financial condition. Additionally, because Bank of America operates in the financial services industry, any disruptions in the financial markets or downturns in the financial services industry could cause us to experience higher rates of lease default or terminations than we otherwise would if our tenant base was more diversified.

If we acquire other property interests that are similarly large in relation to our overall size, our portfolio could become even more concentrated, increasing the risk of loss to stockholders if a default or other problem arises. Alternatively, property sales may reduce the aggregate amount of our property investment portfolio in value or number. As a result, our portfolio could become concentrated in larger assets, thereby reducing the benefits of diversification by geography, property type, tenancy or other measures.

We may never reach sufficient size to achieve diversity in our portfolio.

We are presently a comparatively small net leased company with a limited number of warehouse and industrial properties and a proportionally large investment in the Bank of America Portfolio, resulting in a portfolio that lacks geographic and tenant diversity. While we intend to endeavor to grow and diversify our portfolio through additional property acquisitions, we may never reach a significant size to achieve true portfolio diversity.

We expect to lease a significant portion of our real estate to middle-market businesses which may be more susceptible to adverse market conditions.

We expect that a substantial number of our properties will be leased to middle-market businesses that generally have less financial and other resources than larger businesses. Middle-market companies are more likely to be adversely affected by a downturn in their respective businesses or in the regional, national or international economy. As such, negative market conditions affecting existing or potential middle-market tenants, or the industries in which they operate, could materially adversely affect our financial condition and results of operations.

We may be adversely affected by unfavorable economic changes in geographic areas where our properties are concentrated.

Adverse conditions in the areas where our properties are located (including business layoffs or downsizing, industry slowdowns, changing demographics and other factors) and local real estate conditions (such as oversupply of, or reduced demand for, office, industrial or retail properties) may have an adverse effect on the value of our properties. A material decline in the demand or the ability of tenants to pay rent for office, industrial or retail space in these geographic areas may result in a material decline in our cash available for distribution to our stockholders.

We may not be able to relet or renew leases at the properties held by us on terms favorable to us or at all.

We are subject to risks that upon expiration or earlier termination of the leases for space located at our properties the space may not be relet or, if relet, the terms of the renewal or reletting (including the costs of required renovations or concessions to tenants) may be less favorable than current lease terms. Any of these situations may result in extended periods where there is a significant decline in revenues or no revenues generated by a property. If we are unable to relet or renew leases for all or substantially all of the spaces at these properties, if the rental rates upon such renewal or reletting are significantly lower than expected, if our reserves for these purposes prove inadequate, or if we are required to make significant renovations or concessions to tenants as part of the renewal or reletting process, we will experience a reduction in net income and may be required to reduce or eliminate distributions to our stockholders.

The bankruptcy, insolvency or diminished creditworthiness of our tenants under their leases or delays by our tenants in making rental payments could seriously harm our operating results and financial condition.

We lease our properties to tenants, and we receive rents from our tenants during the terms of their respective leases. A tenant’s ability to pay rent is often initially determined by the creditworthiness of the tenant. However, if a tenant’s credit deteriorates, the tenant may default on its obligations under its lease and

17

the tenant may also become bankrupt. The bankruptcy or insolvency of our tenants or other failure to pay is likely to adversely affect the income produced by our real estate investments. Any bankruptcy filings by or relating to one of our tenants could bar us from collecting pre-bankruptcy debts from that tenant or its property, unless we receive an order permitting us to do so from the bankruptcy court. A tenant bankruptcy could delay our efforts to collect past due balances under the relevant leases, and could ultimately preclude full collection of these sums. If a tenant files for bankruptcy, we may not be able to evict the tenant solely because of such bankruptcy or failure to pay. A court, however, may authorize a tenant to reject and terminate its lease with us. In such a case, our claim against the tenant for unpaid, future rent would be subject to a statutory cap that might be substantially less than the remaining rent owed under the lease. In addition, certain amounts paid to us within 90 days prior to the tenant’s bankruptcy filing could be required to be returned to the tenant’s bankruptcy estate. In any event, it is highly unlikely that a bankrupt or insolvent tenant would pay in full amounts it owes us under its lease. In other circumstances, where a tenant’s financial condition has become impaired, we may agree to partially or wholly terminate the lease in advance of the termination date in consideration for a lease termination fee that is likely less than the agreed rental amount. If a lease is rejected by a tenant in bankruptcy, we would have only a general unsecured claim for damages. Any unsecured claim we hold against a bankrupt entity may be paid only to the extent that funds are available and only in the same percentage as is paid to all other holders of unsecured claims. We may recover substantially less than the full value of any unsecured claims, which would harm our financial condition.

Certain of our properties, including a substantial majority of those in our Bank of America Portfolio joint venture, are leased to banks that are not eligible to be debtors under the federal bankruptcy code, but would be subject to the liquidation and insolvency provisions of applicable banking laws and regulations. If the Federal Deposit Insurance Corporation were appointed as receiver of a banking tenant because of a tenant’s insolvency, we would become an unsecured creditor of the tenant and be entitled to share with the other unsecured non-depositor creditors in the tenant’s assets on an equal basis after payment to the depositors of their claims. In this event, we may recover substantially less than the full value of any unsecured claims, which could have a material adverse effect on our operating results and financial condition, as well as our ability to make distributions to our stockholders at historical levels or at all.

If a sale leaseback transaction is re-characterized in a tenant’s bankruptcy proceeding, our financial condition could be adversely affected.

We may enter into sale leaseback transactions, whereby we would purchase and then lease a property back to the seller. In the event of the bankruptcy of a tenant, a transaction structured as a sale leaseback may be re-characterized as either a financing or a joint venture, either of which outcomes could adversely affect our financial condition and cash flow.