EXHIBIT 99.1

ANNUAL INFORMATION FORM

FOR THE FINANCIAL YEAR ENDED DECEMBER 31, 2023

DATED MARCH 29, 2024

ANNUAL INFORMATION FORM

FOR THE FINANCIAL YEAR ENDED DECEMBER 31, 2023

TABLE OF CONTENTS

| PRELIMINARY NOTES |

| 3 |

|

| CORPORATE STRUCTURE |

| 7 |

|

| GENERAL DEVELOPMENT OF THE BUSINESS |

| 8 |

|

| DESCRIPTION OF THE BUSINESS |

| 12 |

|

| MINERAL RESERVE AND MINERAL RESOURCE ESTIMATES |

| 20 |

|

| MINERAL PROJECTS |

| 25 |

|

| MARKET FOR SECURITIES |

| 71 |

|

| DIRECTORS AND OFFICERS |

| 72 |

|

| CEASE TRADE ORDERS, BANKRUPTCIES, PENALTIES OR SANCTIONS |

| 77 |

|

| CONFLICT OF INTEREST |

| 78 |

|

| LEGAL PROCEEDINGS AND REGULATORY ACTIONS |

| 78 |

|

| INTEREST OF MANAGEMENT AND OTHERS IN MATERIAL TRANSACTIONS |

| 79 |

|

| TRANSFER AGENT AND REGISTRAR |

| 79 |

|

| MATERIAL CONTRACTS |

| 79 |

|

| INTEREST OF EXPERTS |

| 79 |

|

| AUDIT COMMITTEE INFORMATION |

| 81 |

|

| APPENDIX A DEFINITIONS, TECHNICAL TERMS, ABBREVIATIONS AND CONVERSION |

| 83 |

|

| Technical Abbreviations |

| 83 |

|

| APPENDIX B AUDIT COMMITTEE CHARTER |

| 93 |

|

| - 2 - |

PRELIMINARY NOTES

Effective Date of Information

All information in this annual information form (this “AIF”) of Americas Gold and Silver Corporation (“Americas Gold and Silver” or the “Company”) is as at December 31, 2023, unless otherwise indicated. This AIF is dated March 29, 2024.

Additional Information

Additional information is provided in the Company’s audited consolidated financial statements for the years ended December 31, 2023 and 2022 (the “2023 Annual Financial Statements”) dated March 28, 2024 and Management’s Discussion and Analysis dated March28, 2024 for the year ended December 31, 2023 (the “2023 Annual MD&A”), each of which has been filed on the Company’s profile on the System for Electronic Document Analysis and Retrieval (“SEDAR+”) (www.sedarplus.ca). Additional information, including directors’ and officers’ remuneration and indebtedness and information concerning the principal holders of the Company’s securities, and securities authorized for issuance under equity compensation plans, where applicable, will be contained in the Company’s Management Information Circular to be filed in connection with its upcoming annual meeting of shareholders for 2024 (the “2024 Circular”). This information, including the 2023 Annual MD&A and the 2023 Annual Financial Statements, and other additional information relating to the Company may be found in the Company's public filings with provincial securities regulatory authorities which can be found on the Company's profile on the SEDAR+ website at www.sedarplus.ca and with the U.S. Securities and Exchange Commission (the "SEC") on the Electronic Data-Gathering, Analysis and Retrieval ("EDGAR") website at www.sec.gov or, in the case of the 2024 Circular, will be made available in accordance with the time requirements of Canadian and U.S. securities laws.

Non-GAAP and Other Financial Measures

The Company has included certain non-GAAP and other financial measures, which the Company believes, that together with measures determined in accordance with IFRS, provide investors with an improved ability to evaluate the underlying performance of the Company. Non-GAAP financial measures do not have any standardized meaning prescribed under IFRS, and therefore they may not be comparable to similar non-GAAP and other financial performance measures employed by other companies. The data is intended to provide additional information and should not be considered in isolation or as a substitute for measures of performance prepared in accordance with IFRS.

Reconciliations and descriptions can be found under the heading “Non-GAAP and Other Financial Measures” of the 2023 MD&A, which section is incorporated by reference herein and is available on SEDAR+ at www.sedarplus.ca.

Interpretation and Definitions

A glossary of certain technical terms, abbreviations and measurement conversions is set forth in Appendix A.

***

| - 3 - |

Currency and Exchange Rate

Unless otherwise indicated, in this AIF all references to “dollar” or the use of the symbol “$” are to the United States dollar and all references to “C$” are to the Canadian dollar. The daily average exchange rate for Canadian dollars in terms of the United States dollar on December 31, 2023 and March 15, 2024 as reported by the Bank of Canada was 1.3226 and 1.3533, respectively. The daily average exchange rate for Canadian dollars in terms of the Mexican peso on December 31, 2023 and March 15, 2024 as reported by the Bank of Canada was 0.07818 and 0.08101, respectively.

| United States Dollars into Canadian Dollars | 2023 | 2022 | 2021 |

| Closing | 1.3226 | 1.3544 | 1.2678 |

| Average | 1.3497 | 1.3011 | 1.2535 |

| High | 1.3875 | 1.3856 | 1.2942 |

| Low | 1.3128 | 1.2451 | 1.2040 |

| Mexican Pesos into Canadian Dollars | 2023 | 2022 | 2021 |

| Closing | 0.07818 | 0.06949 | 0.06209 |

| Average | 0.07615 | 0.06471 | 0.06181 |

| High | 0.08122 | 0.07070 | 0.06477 |

| Low | 0.06949 | 0.06021 | 0.05856 |

Forward‐Looking Statements

Statements contained in this AIF of the Company that are not current or historical factual statements may constitute “forward-looking information” or “forward-looking statements” within the meaning of applicable Canadian and United States securities laws (“forward-looking statements”). These forward-looking statements are presented for the purpose of assisting the Company’s securityholders and prospective investors in understanding management’s views regarding those future outcomes and may not be appropriate for other purposes. When used in this AIF, the words “may”, “would”, “could”, “will”, “intend”, “plan”, “anticipate”, “believe”, “seek”, “propose”, “estimate”, “expect”, and similar expressions, as they relate to the Company, are intended to identify forward-looking statements. All such forward-looking statements are subject to important risks, uncertainties and assumptions. These statements are forward-looking because they are based on current expectations, estimates and assumptions. It is important to know that: (i) unless otherwise indicated, forward-looking statements in this AIF describe expectations as at the date hereof; and (ii) actual results and events could differ materially from those expressed or implied. Capitalized terms used but not defined in this “Forward-Looking Statements” section of this AIF shall have the meaning ascribed to such terms elsewhere in this AIF.

Specific forward-looking statements in this AIF include, but are not limited to: any objectives, expectations, intentions, plans, results, levels of activity, goals or achievements; estimates of mineral reserves and resources; the realization of mineral reserve estimates; the impairment of mining interests and non-producing properties; the timing and amount of estimated future production, production guidance, costs of production, capital expenditures, costs and timing of development; the success of exploration and development activities;; statements regarding the Galena Complex Recapitalization Plan, including with respect to underground development improvements, equipment procurement and the high-grade Phase II extension exploration drilling program and expected results thereof and completion of the shaft repair related to the Galena hoist project on its expected schedule and budget, and the realization of the anticipated benefits therefrom; Company’s Cosalá Operations, including expected production levels; the ability of the Company to target higher-grade silver ores at the Cosalá Operations; statements relating to the future financial condition, assets, liabilities (contingent or otherwise), business, operations or prospects of the Company; statements relating to the Company’s EC120 Project, including expected approvals, financing availability and capital expenditures required to develop such project and reach production thereat, expectations regarding the ability to rely in existing infrastructure, facilities, and equipment; material uncertainties that may impact the Company’s liquidity in the short term; changes in accounting policies not yet in effect; permitting timelines; government regulation of mining operations; environmental risks; labour relations, employee recruitment and retention, and pension funding and valuation; the timing and possible outcomes of pending disputes or litigation; negotiations or regulatory investigations; exchange rate fluctuations; cyclical or seasonal aspects of the Company’s business; the Company’s dividend policy; the suspension of certain operating metrics such as cash costs and all-in sustaining costs for Relief Canyon; the liquidity of the Company’s common shares; and other events or conditions that may occur in the future. Inherent in the forward-looking statements are known and unknown risks, uncertainties and other factors beyond the Company’s ability to control or predict what may cause the actual results, performance or achievements of the Company, or developments in the Company’s business or in its industry, to differ materially from the anticipated results, performance, achievements or developments expressed or implied by such forward-looking statements.

| - 4 - |

Some of the risks and other factors (some of which are beyond Americas Gold and Silver’s control) that could cause results to differ materially from those expressed in the forward-looking statements and information contained in this AIF include, but are not limited to: risks associated with market fluctuations in commodity prices; risks associated with generally elevated inflation; risks related to changing global economic conditions and market volatility, risks relating to geopolitical instability, political unrest, war, and other global conflicts may result in adverse effects on macroeconomic conditions, including volatility in financial markets, adverse changes in trade policies, inflation, supply chain disruptions, any or all of which may affect the Company’s results of operations and financial condition; the Company’s dependence on the success of its Cosalá Operations, including the San Rafael project, the Galena Complex and the Relief Canyon mines, which are exposed to operational risks and other risks, including certain development and exploration related risks, as applicable; risks related to mineral reserves and mineral resources, development and production and the Company’s ability to sustain or increase present production; risks related to global financial and economic conditions; risks related to government regulation and environmental compliance; risks related to mining property claims and titles, and surface rights and access; risks related to labour relations, disputes and/or disruptions, employee recruitment and retention and pension funding and valuation; some of the Company’s material properties are located in Mexico and are subject to changes in political and economic conditions and regulations in that country; risks associated with foreign operations; risks related to the Company’s relationship with the communities where it operates; risks related to actions by certain non-governmental organizations; substantially all of the Company’s assets are located outside of Canada, which could impact the enforcement of civil liabilities obtained in Canadian and U.S. courts; risks related to currency fluctuations that may adversely affect the financial condition of the Company; the Company may need additional capital in the future and may be unable to obtain it or to obtain it on favourable terms; risks associated with the Company’s outstanding debt and its ability to make scheduled payments of interest and principal thereon; risks associated with any hedging activities of the Company; risks associated with the Company’s business objectives; risks relating to mining and exploration activities and future mining operations; operational risks and hazards inherent in the mining industry; risks related to competition in the mining industry; risks relating to negative operating cash flows; risks relating to the possibility that the Company’s working capital requirements may be higher than anticipated and/or its revenue may be lower than anticipated over relevant periods; risks related to non-compliance with exchange listing standards, risks relating to climate change and the legislation governing it; cybersecurity risks; and risks and uncertainties surrounding the upcoming presidential elections in the United States and Mexico in 2024.

The list above is not exhaustive of the factors that may affect any of the Company’s forward-looking statements. Investors and others should carefully consider these and other factors and not place undue reliance on the forward-looking statements. The forward-looking statements contained in this AIF represent the Company’s views only as of the date such statements were made. Forward-looking statements contained in this AIF are based on management’s plans, estimates, projections, beliefs and opinions as at the time such statements were made and the assumptions related to these plans, estimates, projections, beliefs and opinions may change. Although forward-looking statements contained in this AIF are based on what management considers to be reasonable assumptions based on information currently available to it, there can be no assurances that actual events, performance or results will be consistent with these forward-looking statements, and management’s assumptions may prove to be incorrect. Some of the important risks and uncertainties that could affect forward-looking statements are described further in this AIF. The Company cannot guarantee future results, levels of activity, performance or achievements, should one or more of these risks and uncertainties materialize, or should underlying assumptions prove incorrect, the actual results or developments may differ materially from those contemplated by the forward-looking statements. The Company does not undertake to update any forward-looking statements, even if new information becomes available, as a result of future events or for any other reason, except to the extent required by applicable securities laws.

| - 5 - |

Cautionary Note to Investors in the United States Regarding Resources and Reserves

This AIF has been prepared in accordance with the requirements of the securities laws in effect in Canada, which differ from the requirements of United States securities laws. The Company’s mineral reserves and mineral resources have been calculated in accordance with National Instrument 43-101 – Standards of Disclosure for Mineral Projects (“NI 43-101”), as required by Canadian securities regulatory authorities. These standards differ from the requirements of the United States Securities and Exchange Commission (the “SEC”) that are applicable to domestic United States reporting companies. Accordingly, information in this AIF that describes the Company’s mineral reserves and mineral resources may not be comparable to information made public by United States companies subject to the SEC’s reporting and disclosure requirements.

***

| - 6 - |

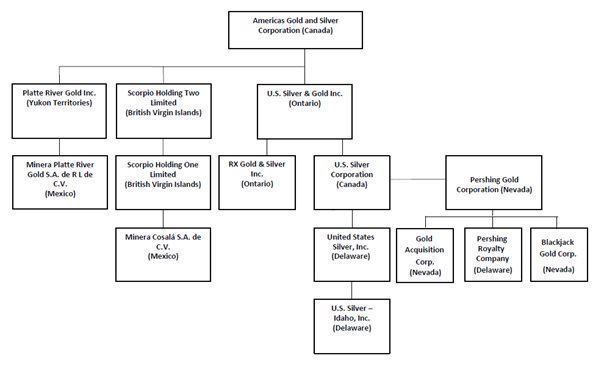

CORPORATE STRUCTURE

Name, Address and Incorporation

Americas Gold and Silver was incorporated as Scorpio Mining Corporation (“Scorpio Mining”) pursuant to articles of incorporation dated May 12, 1998, under the Canada Business Corporations Act with authorized share capital of an unlimited number of common shares (the “Common Shares”). On December 23, 2014, a merger of equals transaction between Scorpio Mining and U.S. Silver & Gold Inc. (“U.S. Silver”) was completed to combine their respective businesses by way of a plan of arrangement of U.S. Silver pursuant to section 182 of the Business Corporations Act (Ontario). Following the merger of equals, the combined company changed its name to Americas Silver Corporation (“Americas Silver”) by way of articles of amendment dated May 19, 2015. On April 3, 2019, Americas Silver completed its acquisition of Pershing Gold Corporation (“Pershing Gold”) pursuant to a plan of merger under Nevada law (the “Pershing Gold Transaction”). Following the completion of the Pershing Gold Transaction, the Company changed its name to “Americas Gold and Silver Corporation” pursuant to articles of amendment dated effective September 3, 2019. The Company’s principal and registered office is located at 145 King Street West, Suite 2870, Toronto, Ontario, Canada M5H 1J8.

The Company is a reporting issuer in each of the provinces of Canada. The Common Shares trade on the Toronto Stock Exchange (the “TSX”) under the symbol “USA” and on the NYSE American under the symbol “USAS”.

Inter‐Corporate Relationships

The organizational chart below indicates the inter-corporate relationships between the Company and its material subsidiaries (and includes their jurisdiction of organization) as of the date hereof. Unless otherwise indicated, all such subsidiaries are wholly owned.

| - 7 - |

GENERAL DEVELOPMENT OF THE BUSINESS

Overview

The Company is a precious metals producer with two operations in the world's leading silver mining regions: the Galena Complex in Idaho, U.S.A. and the Cosalá Operations in Sinaloa, Mexico. The Company owns the Relief Canyon mine (“Relief Canyon”) in Nevada, U.S.A. following a suspension of mining activities in August 2021.

In Idaho, U.S.A., the Company operates the 60%-owned producing Galena Complex (40% owned by Mr. Eric Sprott (“Sprott”)) whose primary assets are the operating Galena mine, the Coeur mine, and the contiguous Caladay development project in the Coeur d’Alene Mining District of the northern Idaho Silver Valley. The Galena Complex has recorded production of over 230 million ounces of silver along with associated by-product metals of copper and lead over a production history of more than sixty years. The Company entered into a joint venture agreement with Sprott effective October 1, 2019 for a 40% non-controlling interest of the Galena Complex. The continuing goal of the joint venture agreement is to position the Galena Complex to significantly grow resources, increase production, and reduce operating costs at the mine (the “Recapitalization Plan”).

In Sinaloa, Mexico, the Company operates the 100%-owned Cosalá Operations, which includes the San Rafael silver-zinc-lead mine (“San Rafael”), after declaring commercial production in December 2017. Prior to that time, it operated the Nuestra Señora silver-zinc-copper-lead mine after commissioning the Los Braceros processing facility and declaring commercial production in January 2009. The Cosalá area land holdings also host several other known precious metals and polymetallic deposits, past-producing mines, and development projects including the Zone 120 silver-copper deposit and the El Cajón silver-copper deposit. These properties are located in close proximity to the Los Braceros processing plant. The Company also owns a 100% interest in the San Felipe development project in Sonora, Mexico, which it acquired on October 8, 2020.

In Nevada, U.S.A., the Company has put the 100%-owned, Relief Canyon mine located in Pershing County into care and maintenance. The mine poured its first gold in February 2020 and declared commercial production in January 2021. Operations were suspended in August 2021 in order to resolve technical challenges related to the metallurgical characteristics of the deposit. The past-producing mine includes three historic open-pit mines, a crusher, ore conveying system, leach pads, and a refurbished heap-leach processing facility. The landholdings at Relief Canyon and the surrounding area cover over 11,700 hectares, providing the Company the potential to expand the Relief Canyon deposit and to explore for new discoveries close to existing processing infrastructure.

The Company’s mission is to profitably expand its precious metals production through the development of its own projects and consolidation of complementary projects. The Company is also focused on extending the mine life of its current assets through exploration and charting a path to profitability at the Galena Complex with the Recapitalization Plan. The Company will continue exploring and evaluating prospective areas accessible from existing infrastructure and the surface at the Galena Complex, and early-stage targets with an emphasis on the Cosalá District.

The Company’s management and Board of Directors (the “Board”) are comprised of senior mining executives who have extensive experience identifying, acquiring, developing, financing, and operating precious metals deposits globally.

| - 8 - |

Three Year History

Fiscal 2021

On January 11, 2021, the Company announced that Relief Canyon had declared commercial production effective that day with the sustained operation of the large radial stacker which satisfied the required stacking rates following first gold pour in February 2020.

On January 29, 2021, the Company completed a bought deal public offering of 10,253,128 Common Shares at a price of C$3.31 per share for aggregate gross proceeds of approximately $26.7 million (C$33.94 million), which included the partial exercise by the underwriters of the over-allotment option granted by the Company to the underwriters for the offering. The net proceeds were used for working capital purposes at Relief Canyon, development and exploration at the Galena Complex, care and maintenance at the Cosalá Operations, debt repayments, and working capital and other general corporate purposes.

On April 29, 2021, the Company issued a C$12.5 million secured convertible debentures to Royal Capital Management Corp. (“RoyCap”) due April 28, 2024 (the “Convertible Debentures”) with interest payable at 8% per annum, repayable at the Company’s option prior to maturity subject to payment of a redemption premium, and convertible into Common Shares at the holder’s option at a conversion price of C$3.35. The Convertible Debentures are secured by the Company’s interest in the Galena Complex and by shares of one of the Company’s Mexican subsidiaries. The net proceeds raised from the Convertible Debentures were used in connection with capital requirements relating to the reopening of the Cosalá Operations, repayment of shorter-term debt obligations, the ramp-up at Relief Canyon and for working capital purposes.

On November 12, 2021, the Company amended its existing Convertible Debentures by increasing the principal balance by C$6.3 million to a total principal balance of C$18.8 million, in addition to amending its conversion price of C$3.35 to C$1.48 (based on a 35% premium to the 5-day VWAP), and the terms of its retraction option from a retraction of C$0.3 million cumulative per month to a retraction of C$0.45 million cumulative per month. All other material terms of the Convertible Debentures remained unchanged. The net proceeds raised were used for the reopening of the Cosalá Operations and working capital purposes.

On May 17, 2021, the Company announced that because of the differences observed between the modelled (planned) and mined (actual) ore tonnage and the carbonaceous material identified in the early phases of the mine plan, an impairment charge of $55.6 million was taken in Q1-2021, reducing the carrying value of the Relief Canyon mineral interest, and property, plant, and equipment. An additional reduction of $23.0 million was taken to inventory in Q1-2021 because of the decreased recovery expected from gold ounces already placed on the leach pad.

On May 17, 2021, the Company announced it had entered into an at-the-market offering agreement (the “ATM Agreement”) with H.C. Wainwright & Co. LLC, acting as the lead agent, and Roth Capital Partners, LLC, as agent, pursuant to which the Company established an at-the-market equity program for aggregate gross proceeds to the Company of up to $50.0 million (the “ATM Program”). The ATM Program terminated on February 28, 2022, approximately 44.1 million Common Shares were sold pursuant to the ATM Program with an average price per share of approximately $1.01 for gross proceeds of approximately $44.4 million.

On July 7, 2021, the Company announced that it had signed an agreement with the federal Mexican Ministries of Economy, Interior and Labour committing along with certain union representatives to a reopening at the Cosalá Operations shut since early 2020 by the illegal blockade.

In July 2021, the Company was served with a statement of claim filed in the Ontario Superior Court of Justice to commence a proposed class action lawsuit against the Company and its Chief Executive Officer (the “Securities Action”). Pursuant to the Securities Action, the representative plaintiff sought damages of C$130 million in relation to the Company’s public disclosure concerning its Relief Canyon mine. The Company maintained that the complaint against it was unfounded and without merit. In November 2022 the Court found for the Company, that the plaintiff failed to present credible evidence to establish a reasonable possibility that the action could be resolved in the plaintiff’s favour and fully and finally dismissed the Securities Action.

On August 13, 2021, the Company and the Board of Directors temporarily suspended mining operations at Relief Canyon while continuing leaching operations and ongoing technical studies in order to prioritize capital for the Cosalá Operations re-opening and the Galena hoist replacement.

| - 9 - |

On September 8, 2021, the Company provided an updated Mineral Reserve and Resource statement as at June 30, 2021. With Phase 1 drilling of Galena’s Recapitalization Plan complete, there was a 38% increase in proven and probable silver mineral reserve at the Galena Complex from 12.0 million silver ounces to 16.6 million silver ounces year-over-year on a 100% basis. On a consolidated and attributable basis, estimated contained metal in the proven and probable mineral reserve (“P&P”) categories totalled 32.5 million ounces of silver, 139.9 million pounds of zinc, 114.3 million pounds of lead and 30.2 million pounds of copper. Estimated contained metal in the measured and indicated mineral resource (“M&I”) categories totalled 72.2 million ounces of silver, 584 thousand ounces of gold, 804.5 million pounds of zinc, 725.4 million pounds of lead and 34.4 million pounds of copper.

In December 2021 the Cosalá Operations resumed commercial production following the signing of an accord with a Mexican labour union signed by the Mexican Ministries of Economy, Interior and Labour in July 2021 and recalling workers in September 2021. The Los Braceros mill ramped up to nameplate production in December 2021. Concentrate shipments resumed with a return to revenue and cash flow generation in Q4-2021.

Fiscal 2022

On January 24, 2022, the Company hosted the official opening ceremony for the Cosalá Operations which was attended by the Mexican Minister of Economy, the Governor of the State of Sinaloa and the Cosalá Mayor.

During fiscal 2022, the Company closed quarterly non-brokered private placements with Sandstorm Gold Limited (“Sandstorm”) for total gross proceeds of $9.9 million through issuance of approximately 15.2 million of the Company’s common shares.

On September 13, 2022, the Company provided an updated Mineral Reserve and Resource statement as at June 30, 2022. At the Galena Complex, mineral reserves were successfully increased as part of the Phase 2 infill drill program. There was a 26% increase in proven and probable silver mineral reserve at the Galena Complex to approximately 4.3 million ounces year-over-year on a 100% basis. On a consolidated and attributable basis, estimated contained metal in the P&P mineral reserve categories totalled 6.5 million ounces of silver, 43.1 million pounds of zinc, 44.0 million pounds of lead and 1.1 million pounds of copper. Estimated contained metal in the M&I mineral resource categories totalled 15.9 million ounces of silver, 352 thousand ounces of gold, 83.3 million pounds of zinc, 113.0 million pounds of lead and 4.1 million pounds of copper.

On October 20, 2022, the Company amended the Convertible Debentures by increasing the principal balance by C$7.0 million to a total outstanding principal of C$25.8 million, in addition to amending its interest rate of 8% per annum to 9.5% per annum, its conversion price of C$1.48 to C$1.00, and the terms to its retraction option retractable at a cumulative C$0.45 million per month to a cumulative C$0.5 million per month.

On November 30, 2022, the Company announced that the Galena Complex and its unionized workers ratified a new 3-year collective bargaining agreement effective November 17, 2022. Unionized workers at the Cosalá reviewed and ratified their collective bargaining agreement, effective May 1, 2022 with yearly and biannual reviews, as per the Mexican Labour Laws. This local union, which has been representing some Company’s unionized workers for a number of years, is different from the SMN Union that originated the 2020 illegal blockade at the Cosalá Operations. These agreements support continued stable operations during a period of forecasted production growth.

Fiscal 2023

On January 11, 2023, the Company provided a production update for the silver equivalent production noting that the silver equivalent production of 5.3 million ounces exceed the silver equivalent guidance range of 4.8-5.2 million ounces for the completed year 2022. It was also announced that the Galena Hoist had been put in place prior to year-end with shaft repairs to start following the completion of electrical work and commissioning. Further the instillation was completed as of the end of Q3.

On February 26, 2023 the Company and Sandstorm amended the April 3, 2019 Precious Metal Purchase Agreement to increase the advance payment payable to the Company by an additional $11 million. On April 12, 2023, the Company entered into a $4.0 million net smelter returns royalty agreement with Sandstorm to be repaid through a 2.5% royalty on attributable production from the Cosalá Operations and Galena Complex. The royalty reduces to 0.2% on attributable production from the Cosalá Operations and Galena Complex after the aggregate repayment of $4.0 million and may be eliminated thereafter with a buyout payment of $1.9 million.

| - 10 - |

On April 11, 2023, a tragic accident occurred at the Galena Complex resulting in a fatality. MSHA completed investigation in October 2023 and issued two citations relating to a fall of ground in a working area of the mine.

On June 21, 2023, the Company’s issued an additional secured convertible debenture to Delbrook Capital Advisors (“Delbrook”) under the Company’s existing convertible debenture, increasing the principal balance by C$8.0 million to a total of C$24.3 million outstanding at the end of the second quarter. The Company also amended the interest payable to 11% per annum, the conversion price to C$0.80, and extended the term of the maturity to July 1, 2024 with mutual option to extend by incremental calendar quarters up to April 28, 2025, among other terms. On October 30, 2023, the Company amended the convertible debenture held by Delbrook by increasing the principal by C$2.0 million with all other material terms unchanged. On November 13, 2023, the Company and Delbrook agreed to amend the terms of the existing 3,500,000 common share purchase warrants held by Delbrook and affiliates to amend the exercise price from C$0.80 per warrant to C$0.55 per Warrant. The warrants expire on June 21, 2026, and contain customary anti-dilution provisions, as well as customary blocker language regarding becoming a control person without required shareholder and TSX approvals. The convertible debenture’s outstanding balance was reduced to C$24.0 million as of December 31, 2023, through additional retractions of C$2.3 million settled through issuance of approximately 5.9 million of the Company’s common shares.

Sustainability Performance

In March 2021, the Company released its first sustainability report for the Cosalá Operations, “Working Towards Sustainability.” This report focused on the Company’s Environmental, Social, and Governance (“ESG”) strategy, management, policies, and performance at the Cosalá Operations between January 1, 2018, and January 31, 2020, highlighting overall the Company’s commitment to the mining industry in Mexico and to the Cosalá community in Sinaloa. The Company’s disclosure in this report was centered on the five key pillars of its corporate responsibility strategy, including governance and business ethics, our people, health and safety, environmental stewardship, and community involvement. The Company also affirmed its commitment to make sustainability reporting a key component of its ongoing sustainability program. In accordance with best practices, the report accounted for the Company’s fulfillment of its labour commitments, as well as the environmental, social, safety, and economic impacts in the community where the Cosalá Operations are located.

In June 2022, the second sustainability report for the Cosalá Operations, “Commitment to Sustainability” was released. The report stated that while there was limited information disclosed due to the illegal blockade which halted operations, it included information regarding the restarting of the operations and highlighted the support provided by the Mexican and Canadian governments along with the Company’s employees to reopen the operations at Cosalá. The report also focused on the Company’s ESG strategies and the reaffirmation of its commitment to continue working within a framework of responsible mining that contributes to the growth of the community through employment and local procurement.

As part of the Company’s commitment to make sustainability and its reporting a key component of its ongoing operations, the report covering the period from January 1, 2022 to December 31 2023 is expected to be provided this summer. In addition, this report is expected to include an introduction on the Galena Complex’s sustainability metrics and results.

Key highlights of the Company’s ESG performance at the Cosalá Operations and the full text of the sustainability reports are available on the Company’s website. The content of the Company’s website and information accessible through the website do not form part of this AIF.

***

| - 11 - |

DESCRIPTION OF THE BUSINESS

Summary

The Company is engaged in the evaluation, acquisition, exploration, development and operation of precious metals and polymetallic mineral properties, primarily those already producing or with the potential for near-term production. The Company’s geographic focus is the Western Hemisphere, particularly the United States and Mexico. The Company owns and operates the Cosalá Operations in Sinaloa, Mexico and manages the 60%‐owned Galena Complex in Idaho, U.S.A. The Company also owns the Relief Canyon mine in Nevada, U.S.A. and the San Felipe property in Sonora, Mexico.

Principal Product

The Company produces silver-bearing zinc and lead concentrates. The Company believes that because of the availability of alternate processing and commercialization options for its concentrates, it is not dependent on a particular purchaser with regard to the sale of its products.

Production

The Company operates the 60% owned Galena Complex located near the town of Wallace in the State of Idaho, U.S.A., and the 100%-owned Cosalá Operations located near the town of Cosalá in the State of Sinaloa, Mexico.

The Galena Complex produces a silver-lead concentrate. Ore mined at the Galena Complex is milled at the Galena mill. The Galena mill has an installed milling capacity of 630 tonnes-per-day. The 450 tonne-per-day capacity Coeur mill is currently on care and maintenance.

The high grade and “narrow vein” nature of the underground Galena Complex requires careful application of selective mining techniques such as overhand cut and fill. As well, the age and expanse of the underground infrastructure demands regular, ongoing maintenance. As such, production and operating costs will display a degree of variability depending on a number of timing and other factors. Substantial resources exist outside of the defined reserve, and exploration continues to develop resources and identify new areas of mineralization. A multi-year Recapitalization Plan began in mid-October 2019 and was concluded with the commissioning of the Galena Hoist in mid-2023. Other investments have included mine development, new equipment purchases and exploration to define and expand silver resources.

Ore at the Cosalá Operations is produced from the San Rafael mine and treated at the Los Braceros process plant. San Rafael is an underground silver-zinc-lead mine which entered commercial production in December 2017. The Los Braceros process plant, located 9 kilometers east southeast of the San Rafael mine, produces silver-bearing zinc and lead concentrates. The facility processes approximately 1,700 tonnes per day.

Commercial production at San Rafael was declared in 2017. An illegal blockade at the Cosalá Operations caused mining and processing to be suspended from Q1 2020 to Q4 2021 while the Company worked to resolve the issue. The Cosalá Operations produced continuously through 2022 and 2023.

***

| - 12 - |

Consolidated Results and Developments

| Fiscal Year Ended December 31 |

| 2023 |

|

| 2022 |

|

|

| 20211,5 |

| ||

| Revenues ($ M) |

| $ | 89.6 |

|

| $ | 85.0 |

|

| $ | 45.0 |

|

| Net Loss ($ M) |

|

| (38.2 | ) |

|

| (45.2 | ) |

|

| (160.6 | ) |

| Comprehensive Loss ($ M) |

|

| (39.0 | ) |

|

| (38.6 | ) |

|

| (159.8 | ) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net Loss per Common Share - Basic and Diluted |

| $ | (0.16 | ) |

| $ | (0.23 | ) |

| $ | (1.11 | ) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Silver Produced (oz) |

|

| 2,043,053 |

|

|

| 1,308,201 |

|

|

| 61,001 |

|

| Zinc Produced (lbs) |

|

| 34,084,119 |

|

|

| 39,319,795 |

|

|

| 4,164,185 |

|

| Lead Produced (lbs) |

|

| 20,539,540 |

|

|

| 24,606,674 |

|

|

| 1,672,806 |

|

| Cost of Sales/Ag Eq Oz Produced ($/oz)2,3,4 |

| $ | 12.87 |

|

| $ | 9.89 |

|

| $ | 7.47 |

|

| Cash Cost/Ag Oz Produced ($/oz)2,3,4 |

| $ | 13.21 |

|

| $ | 0.77 |

|

| $ | (18.53 | ) |

| All-In Sustaining Cost/Ag Oz Produced ($/oz)2,3,4 |

| $ | 20.44 |

|

| $ | 9.64 |

|

| $ | (14.67 | ) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Cash ($ M) |

| $ | 2.1 |

|

| $ | 2.0 |

|

| $ | 2.9 |

|

| Receivables ($ M) |

|

| 9.5 |

|

|

| 11.6 |

|

|

| 8.2 |

|

| Inventories ($ M) |

|

| 8.7 |

|

|

| 8.8 |

|

|

| 17.9 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Property, Plant and Equipment ($ M) |

| $ | 153.1 |

|

| $ | 161.3 |

|

| $ | 177.9 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Current Assets ($ M) |

| $ | 23.0 |

|

| $ | 25.4 |

|

| $ | 23.5 |

|

| Current Liabilities ($ M) |

|

| 61.2 |

|

|

| 42.1 |

|

|

| 45.6 |

|

| Working Capital ($ M) |

|

| (38.2 | ) |

|

| (16.7 | ) |

|

| (22.1 | ) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total Assets ($ M) |

| $ | 180.5 |

|

| $ | 190.8 |

|

| $ | 213.4 |

|

| Total Liabilities ($ M) |

|

| 108.3 |

|

|

| 92.2 |

|

|

| 109.6 |

|

| Total Equity ($ M) |

|

| 72.2 |

|

|

| 98.6 |

|

|

| 103.8 |

|

| 1 | Consolidated production results exclude the Galena Complex after Q3-2019 due to the Recapitalization Plan, and are nil from Q2-2020 to Q3-2021 due to the Cosalá Operations being placed under care and maintenance effective February 2020 as a result of the illegal blockade. |

| 2 | Throughout this AIF, consolidated production results and consolidated operating metrics are based on the attributable ownership percentage of each operating segment (100% Cosalá Operations and 60% Galena Complex). |

| 3 | Cost per ounce measurements during fiscal 2021 were based on operating results starting from December 1, 2021 following return to nameplate production of the Cosalá Operations. Throughout this AIF, all other production results from the Cosalá Operations during fiscal 2021 were determined based on total production during the year. |

| 4 | This is a supplementary or non-GAAP financial measure or ratio. See “Non-GAAP and Other Financial Measures” section in the Company’s 2023 Annual MD&A. |

| 5 | Certain fiscal 2021 amounts were adjusted through changes in accounting policies. See “Accounting Standards and Pronouncements” in the Company’s 2023 Annual MD&A. |

Consolidated attributable silver production during 2023 increased by 56% compared to 2022. Consolidated attributable silver equivalent production during 2023 decreased by 13% compared to 2022 due to higher silver prices and lower zinc prices in 2023 compared to 2022 as the Company uses realized quarterly prices in its calculations. These price changes negatively impacted the silver equivalent production calculation by approximately 0.9 million ounces in 2023 relative to 2022.

| - 13 - |

Despite the increase in silver production, 2023 production was impacted by a 17-day maintenance shutdown of the Cosalá Operations tailings facility in February in order to perform remedial work on a decant tunnel as part of the long-term environmental plan at the operations, and various mill outages totalling 14 days during Q3-2023 due to heavy rain and tailings work. Production at the Galena Complex was negatively impacted early in Q3-2023 by a planned 5-day electrical shutdown at the Galena Complex to allow necessary hoist switchgear upgrades. Towards the end of Q3-2023, the Galana Complex was unable to maintain targeted ore production due to unavailability of mine mobile equipment. The availability issue was resolved and provided the Company with the strongest consolidated production quarter of the year in Q4-2023.

Revenue of $89.6 million for the year ended December 31, 2023 was higher than revenue of $85.0 million for the year ended December 31, 2022. Higher revenue from the Galena Complex was recognized from higher silver production and higher realized silver price during the year, offset by lower revenue from the Cosalá Operations due to lower base metal production and lower realized zinc price during the year. The average realized silver, zinc, and lead prices increased by 8%, decreased by 24%, and decreased by 1%, respectively, from 2022 to 2023. The average realized silver price of $23.44/oz. for 2023 (2022 – $21.69/oz.) is comparable to the average London silver spot price of $23.39/oz. for 2023 (2022 – $21.75/oz.).

The Company recorded a net loss of $38.62 million for the year ended December 31, 2023 compared to a net loss of $45.2 million for the year ended December 31, 2022. The decrease in net loss was primarily attributable to higher net revenue, higher foreign exchange gain, lower impairment to property, plant and equipment at Relief Canyon, and higher income tax recovery, offset in part by higher cost of sales, higher interest and financing expense, higher loss on fair value of metals contract liability, and prior year’s gain on government loan forgiveness. See the Company’s 2023 Annual MD&A for further details.

| - 14 - |

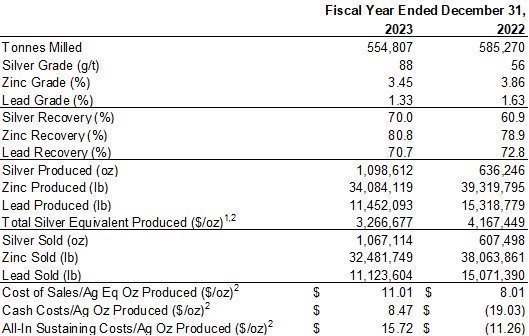

Cosalá Operations

| 1 | Throughout this AIF, silver equivalent production was calculated based on all metals production at average realized silver, zinc, and lead prices during each respective period. |

| 2 | This is a supplementary or non-GAAP financial measure or ratio. See “Non-GAAP and Other Financial Measures” section of the Company’s 2023 Annual MD&A. |

The Cosalá Operations increased silver production in 2023 by 73% to approximately 1.1 million ounces of silver compared to approximately 0.6 million ounces of silver in 2022 as the Company focused on higher grade silver areas given the higher silver prices and lower zinc prices. However, as a result, production of base metals decreased to 34.1 million pounds of zinc and 11.5 million pounds of lead in 2023, compared to 39.3 million pounds of zinc, and 15.3 million pounds of lead in 2022. Production was negatively impacted by a total of 31 days due to a 17-day maintenance shutdown of the Cosalá Operations tailings facility in February in order to perform remedial work on a decant tunnel as part of the long-term environmental plan at the operations, and various mill outages totalling 14 days during Q3-2023 due to heavy rain and tailings work.

Cash costs per silver ounce increased during the year to $8.47 per ounce from $(19.03) per ounce in 2022 due primarily to the lower price of zinc combined with lower base metal production, and the devaluation of the U.S. dollar relative to the Mexican peso. Mining began in the transition zone between the San Rafael Upper Zone and Zone 120 in late 2023 with the Company expecting to realize an increase in silver production in the near term due the higher-grade silver areas in the Upper Zone and the transition zone.

| - 15 - |

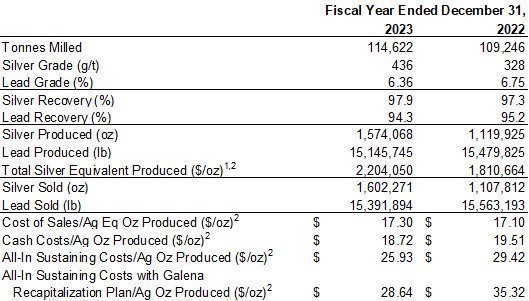

Galena Complex

| 1 | Throughout this AIF, silver equivalent production was calculated based on all metals production at average realized silver, zinc, and lead prices during each respective period. |

| 2 | This is a supplementary or non-GAAP financial measure or ratio. See “Non-GAAP and Other Financial Measures” section of the Company’s 2023 Annual MD&A. |

The Company announced the strategic Joint Venture Agreement with Sprott in September 2019 to recapitalize the mining operations at the Galena Complex. The goal of the joint venture is to position the Galena Complex to significantly grow resources, increase production, and reduce operating costs at the mine. The strategic 60/40 joint venture has allowed the Company to take positive action: to advance development, modernize infrastructure, purchase new mining equipment, and define and expand silver resources.

The Galena Complex increased silver production by 41% in 2023, producing approximately 1.6 million ounces of silver and 15.1 million pounds of lead. The increase in silver production highlights the continuing benefit and further potential of increased production following completion of the Galena Recapitalization Plan which includes rehabilitation of the Galena shaft. The operation was able to produce over 40% more silver ounces in 2023 compared to 2022 despite the challenges encountered with the Galena Shaft Repair project and the associated lower than planned ore and waste hoisting capacity. The increase in production was driven by the successful mining of high-grade silver-copper stopes. The Galena Shaft Repair project is expected to recommence in Q3-2024 and will be completed by Moran Mining & Tunneling. In Q4-2023, the Galena Complex undertook some critical shaft rehab work on the Coeur Shaft to increase total skipping capacity and ensure that critical waste development above 3700 Level is possible which will open up new high grade stope areas. During H1-2024, the Galena Complex anticipates bringing two new stope areas online which will increase the mine’s mining rate and result in providing critical incremental cash flow which will be directed to the Galena Shaft Repair project. Cash costs decreased to $18.72 per ounce silver in 2023 from $19.51 per ounce silver in 2022 with a similar decrease in all-in sustaining costs due to the increase silver production.

| - 16 - |

The Company began mining high-grade silver ore from the 3700 Level in mid-December 2022 and started development on the 4300 Level to access the Upper 360 Complex reserves area. The 4300 Level mining front will increase the number of producing stopes and boost production throughput to coincide with the completion of the Galena hoist project. The Company is focused on finishing the remaining shaft repair work. The shaft was fully inspected with a LIDAR survey scan showing less than a few hundred feet of the shaft requiring more extensive repair. The Galena hoist will increase hoisting capacity at the Galena Complex, support plans to increase production and improve operational flexibility. Cash costs per ounce at the Galena Complex are also anticipated to decrease with the completion of the Galena hoist replacement as the benefits of economies of scale on the existing cost base with higher grade silver ore are realized.

Employees

As at December 31, 2023, the Company had the following number of employees:

|

Galena Complex

|

Cosalá Operations

| Relief Canyon |

Corporate

|

Total

| |

| Salary | 45 | 114 | 3 | 11 | 173 |

| Hourly | 210 | 231 | 8 | 0 | 449 |

| Total | 255 | 345 | 11 | 11 | 622 |

*Some workers at the Galena Complex and Cosalá Operations are covered by collective bargaining agreements. See “Changes to Contracts and Economic Dependence” also see “Risk Factors – Labour Relations, Employee Recruitment, Retention and Pension Funding”.

In addition, the Company, from time to time, employs outside contractors on a fee‐for‐service basis.

Specialized Skill and Knowledge

Various aspects of the Company’s business require specialized skills and knowledge. Such skills and knowledge include the areas of geology, drilling, metallurgy, engineering, logistical planning and implementation of programs as well as finance and accounting and legal/regulatory compliance. While competitive conditions exist in the industry, the Company has been able to locate and retain employees and consultants with such skills and believes it will continue to be able to do so in the foreseeable future. See “Risk Factors – Labour Relations, Employee Recruitment, Retention and Pension Funding”.

Competitive Conditions

Competition in the mineral exploration industry is intense. The Company competes with other mining companies, many of which have significant financial resources and technical facilities for the acquisition and development of, and production from, mineral interests, as well as for the recruitment and retention of qualified employees and consultants. The ability of the Company to acquire viable mineral properties in the future will depend not only on its ability to develop its present properties, but also on its ability to select and acquire suitable producing properties or prospects for development or mineral exploration.

Business Cycles

The mining business is highly cyclical. The marketability of minerals and mineral concentrates is also affected by global economic cycles. The ultimate economic viability of the Company’s projects is related and sensitive to the market price of gold and silver as well the market price of by‐products such as zinc, lead and copper. Metal prices fluctuate widely and are affected by numerous factors such as global supply, demand, inflation, exchange rates, interest rates, forward selling by producers, central bank sales and purchases, production, global or regional political, economic or financial situations and other factors beyond the control of the Company.

| - 17 - |

Changes to Contracts and Economic Dependence

The Company’s cash flow is dependent on delivery of its ore concentrate to market. The Company’s contracts with the concentrate purchasers provide for provisional payments based on periodic deliveries. The Company may sell its concentrate to a metal trader while it is at the smelter in order to help manage its cash flow. The Company has not had any problems collecting payments from concentrate purchasers in a reliable and timely manner and expects no such difficulties in the foreseeable future. However, this cash flow is dependent on continued mine production which can be subject to interruption for various reasons including fluctuations in metal prices and concentrate shipment difficulties. Additionally, unforeseen cessation in smelter provider capabilities could severely impact the Company’s capital resources. Although the Company sells its concentrate to a limited number of customers, it is not economically dependent upon any one customer as there are other markets throughout the world for the Company’s concentrate.

Environmental Protection

The Company’s mining, exploration and development activities are subject to various federal, state and municipal laws and regulations relating to the protection of the environment, including requirements for closure and reclamation of mining properties. In all jurisdictions where the Company operates, specific statutory and regulatory requirements and standards must be met throughout the exploration, development and operations stages of a mining property with regard to matters including water quality, air quality, wildlife protection, solid and hazardous waste management and disposal, noise, land use and reclamation. Changes in any applicable governmental regulations to which the Company is subject or inconsistent application of these regulations, may adversely affect its operations. Failure to comply with any condition set out in any required permit or with applicable regulatory requirements may result in the Company being unable to continue to carry out its activities. The impact of these requirements cannot accurately be predicted.

Management estimates costs associated with reclamation of mining properties as well as remediation costs for inactive properties. The Company uses assumptions about future costs, including inflation, prices, mineral processing recovery rates, production levels and capital and reclamation costs. Such assumptions are based on the Company’s current mining plan and the best available information for making such estimates. Details and quantification of the Company’s reclamation and closure costs are discussed in the 2023 Annual Financial Statements (see “Note 4 – Significant Accounting Judgments and Estimates – Decommissioning Provision”) and the 2023 Annual MD&A (see “Significant Accounting Judgements and Estimates – Decommissioning Provision”). See also “Risk Factors – Government Regulation and Environmental Compliance”.

The Company is focused on strengthening monitoring, controls and disclosure of environmental issues that affect employees and the surrounding communities. Through proactive public engagement, the Company continues to gain a better understanding of the concerns of area-wide citizens and regulators and continues to work collaboratively to identify the most reasonable and cost-effective measures to address the most pressing concerns.

Foreign Operations

As of the date hereof, substantially all of the Company’s long-term assets, comprising its mineral properties, are located in Mexico and the United States.

| - 18 - |

Tax Considerations

With current operations in the United States and Mexico, the Company is subject to the tax considerations of those jurisdictions. Certain changes to United States and Mexican tax laws affect the Company. See “Risk Factors – Tax Considerations” and “Note 23 – Income Taxes” of the Company’s 2023 Annual Financial Statements

It cannot be predicted whether, when, in what form, or with what effective dates, new tax laws may be enacted, or regulations and rulings may be enacted, promulgated or issued under existing or new tax laws, which could result in an increase in the Company’s or investors’ tax liability or require changes in the manner in which the Company operates in order to minimize or mitigate any adverse effects of changes in tax law or in the interpretation thereof.

***

| - 19 - |

MINERAL RESERVE AND MINERAL RESOURCE ESTIMATES

Americas Gold and Silver’s Mineral Reserves and Mineral Resources have been estimated as at December 31, 2023 in accordance with definitions adopted by the Canadian Institute of Mining, Metallurgy and Petroleum and incorporated into NI 43-101. See “Glossary of Technical Terms”. The previously stated Mineral Reserves and Mineral Resources estimated as at June 30, 2022 have been depleted to reflect the portion of the Mineral Reserves and Mineral Resources extracted through December 31, 2023.

2023 production details are provided under “Description of the Business – Production” and in the 2023 Annual Financial Statements and the 2023 Annual MD&A.

For further detail regarding the extent to which estimates of Mineral Reserves and Mineral Resources may be materially affected by external factors, including metallurgical, environmental, permitting, title and other risks and relevant issues, please refer to “Risk Factors – Mineral Reserves and Resources, Development and Production”.

***

| - 20 - |

| Attributable Proven and Probable Mineral Reserves - December 31, 2023 |

|

|

|

|

|

|

|

|

| |||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||||||||||||||

| Silver Mineral Reserves |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||||||||||||||

|

|

| Proven |

|

|

|

|

|

|

|

| Probable |

|

|

|

|

|

|

|

| Proven and Probable |

| |||||||||||||||

|

|

| Tonnes |

|

| Grade |

|

| Ounces |

|

| Tonnes |

|

| Grade |

|

| Ounces |

|

| Tonnes |

|

| Grade |

|

| Ounces |

| |||||||||

| Property |

| (kt) |

|

| (g/t) |

|

| (koz) |

|

| (kt) |

|

| (g/t) |

|

| (koz) |

|

| (kt) |

|

| (g/t) |

|

| (koz) |

| |||||||||

| Galena - Ag-Pb (60%) |

|

| 115 |

|

|

| 252 |

|

|

| 936 |

|

|

| 421 |

|

|

| 255 |

|

|

| 3,456 |

|

|

| 536 |

|

|

| 255 |

|

|

| 4,392 |

|

| Galena - Ag-Cu (60%) |

|

| 54 |

|

|

| 552 |

|

|

| 956 |

|

|

| 246 |

|

|

| 676 |

|

|

| 5,349 |

|

|

| 300 |

|

|

| 654 |

|

|

| 6,305 |

|

| Galena Subtotal (60%) |

|

| 169 |

|

|

| 348 |

|

|

| 1,892 |

|

|

| 667 |

|

|

| 411 |

|

|

| 8,805 |

|

|

| 836 |

|

|

| 398 |

|

|

| 10,696 |

|

| San Rafael |

|

| 501 |

|

|

| 200 |

|

|

| 3,229 |

|

|

| 697 |

|

|

| 118 |

|

|

| 2,645 |

|

|

| 1,198 |

|

|

| 153 |

|

|

| 5,874 |

|

| El Caj n |

|

| - |

|

|

| - |

|

|

| - |

|

|

| 788 |

|

|

| 157 |

|

|

| 3,983 |

|

|

| 788 |

|

|

| 157 |

|

|

| 3,983 |

|

| Zone 120 |

|

| - |

|

|

| - |

|

|

| - |

|

|

| 2,041 |

|

|

| 165 |

|

|

| 10,835 |

|

|

| 2,041 |

|

|

| 165 |

|

|

| 10,835 |

|

| Cosal Subtotal |

|

| 501 |

|

|

| 200 |

|

|

| 3,229 |

|

|

| 3,526 |

|

|

| 154 |

|

|

| 17,463 |

|

|

| 4,027 |

|

|

| 160 |

|

|

| 20,692 |

|

| Total Silver |

|

| 670 |

|

|

| 238 |

|

|

| 5,121 |

|

|

| 4,193 |

|

|

| 195 |

|

|

| 26,267 |

|

|

| 4,863 |

|

|

| 201 |

|

|

| 31,388 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Zinc Mineral Reserves |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Proven |

|

|

|

|

|

|

|

|

|

| Probable |

|

|

|

|

|

|

|

|

|

| Proven and Probable |

| |||||||||||

|

|

| Tonnes |

|

| Grade |

|

| Pounds |

|

| Tonnes |

|

| Grade |

|

| Pounds |

|

| Tonnes |

|

| Grade |

|

| Pounds |

| |||||||||

| Property |

| (kt) |

|

| (%) |

|

| (Mlbs) |

|

| (kt) |

|

| (%) |

|

| (Mlbs) |

|

| (kt) |

|

| (%) |

|

| (Mlbs) |

| |||||||||

| San Rafael Subtotal |

|

| 501 |

|

|

| 2.07 |

|

|

| 22.9 |

|

|

| 697 |

|

|

| 2.67 |

|

|

| 41.0 |

|

|

| 1,198 |

|

|

| 2.42 |

|

|

| 63.9 |

|

| Total Zinc |

|

| 501 |

|

|

| 2.07 |

|

|

| 22.9 |

|

|

| 697 |

|

|

| 2.67 |

|

|

| 41.0 |

|

|

| 1,198 |

|

|

| 2.42 |

|

|

| 63.9 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Lead Mineral Reserves |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Proven |

|

|

|

|

|

|

|

|

|

| Probable |

|

|

|

|

|

|

|

|

|

| Proven and Probable |

| |||||||||||

|

|

| Tonnes |

|

| Grade |

|

| Pounds |

|

| Tonnes |

|

| Grade |

|

| Pounds |

|

| Tonnes |

|

| Grade |

|

| Pounds |

| |||||||||

| Property |

| (kt) |

|

| (%) |

|

| (Mlbs) |

|

| (kt) |

|

| (%) |

|

| (Mlbs) |

|

| (kt) |

|

| (%) |

|

| (Mlbs) |

| |||||||||

| Galena Subtotal (60%) |

|

| 115 |

|

|

| 7.91 |

|

|

| 20.1 |

|

|

| 421 |

|

|

| 6.83 |

|

|

| 63.4 |

|

|

| 536 |

|

|

| 7.07 |

|

|

| 83.6 |

|

| San Rafael Subtotal |

|

| 501 |

|

|

| 0.69 |

|

|

| 7.7 |

|

|

| 697 |

|

|

| 0.87 |

|

|

| 13.4 |

|

|

| 1,198 |

|

|

| 0.80 |

|

|

| 21.0 |

|

| Total Lead |

|

| 617 |

|

|

| 2.05 |

|

|

| 27.8 |

|

|

| 1,117 |

|

|

| 3.12 |

|

|

| 76.8 |

|

|

| 1,734 |

|

|

| 2.74 |

|

|

| 104.6 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Copper Mineral Reserves |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Proven |

|

|

|

|

|

|

|

|

|

| Probable |

|

|

|

|

|

|

|

|

|

| Proven and Probable |

| |||||||||||

|

|

| Tonnes |

|

| Grade |

|

| Pounds |

|

| Tonnes |

|

| Grade |

|

| Pounds |

|

| Tonnes |

|

| Grade |

|

| Pounds |

| |||||||||

| Property |

| (kt) |

|

| (%) |

|

| (Mlbs) |

|

| (kt) |

|

| (%) |

|

| (Mlbs) |

|

| (kt) |

|

| (%) |

|

| (Mlbs) |

| |||||||||

| Galena Subtotal (60%) |

|

| 54 |

|

|

| 0.61 |

|

|

| 0.7 |

|

|

| 246 |

|

|

| 0.73 |

|

|

| 4.0 | 0 |

|

| 300 |

|

|

| 0.71 |

|

|

| 4.7 |

|

| El Caj n |

|

| - |

|

|

| - |

|

|

| - |

|

|

| 788 |

|

|

| 0.49 |

|

|

| 8.5 | 0 |

|

| 788 |

|

|

| 0.49 |

|

|

| 8.5 |

|

| Zone 120 |

|

| - |

|

|

| - |

|

|

| - |

|

|

| 2,041 |

|

|

| 0.41 |

|

|

| 18.5 | 0 |

|

| 2,041 |

|

|

| 0.41 |

|

|

| 18.5 |

|

| Cosal Subtotal |

|

| - |

|

|

| - |

|

|

| - |

|

|

| 2,829 |

|

|

| 0.43 |

|

|

| 27.1 | 0 |

|

| 2,829 |

|

|

| 0.43 |

|

|

| 27.1 |

|

| Total Copper |

|

| 54 |

|

|

| 0.61 |

|

|

| 0.7 |

|

|

| 3,075 |

|

|

| 0.46 |

|

|

| 31.0 | 0 |

|

| 3,129 |

|

|

| 0.46 |

|

|

| 31.7 |

|

| - 21 - |

| Attributable Measured and Indicated Mineral Resources - December 31, 2023 |

|

|

|

|

|

|

| |||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||||||||||||||

| Gold Mineral Resources - Exclusive of Mineral Reserves |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||||||||||

|

|

| Measured |

|

| Indicated |

|

| Measured and Indicated |

| |||||||||||||||||||||||||||

|

|

| Tonnes |

|

| Grade |

|

| Ounces |

|

| Tonnes |

|

| Grade |

|

| Ounces |

|

| Tonnes |

|

| Grade |

|

| Ounces |

| |||||||||

| Property |

| (kt) |

|

| (g/t) |

|

| (koz) |

|

| (kt) |

|

| (g/t) |

|

| (koz) |

|

| (kt) |

|

| (g/t) |

|

| (koz) |

| |||||||||

| Relief Canyon Subtotal |

|

| 12,177 |

|

|

| 0.90 |

|

|

| 352 |

|

|

| 10,431 |

|

|

| 0.66 |

|

|

| 220 |

|

|

| 22,608 |

|

|

| 0.79 |

|

|

| 572 |

|

| Total Gold |

|

| 12,177 |

|

|

| 0.90 |

|

|

| 352 |

|

|

| 10,431 |

|

|

| 0.66 |

|

|

| 220 |

|

|

| 22,608 |

|

|

| 0.79 |

|

|

| 572 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Silver Mineral Resources - Exclusive of Mineral Reserves |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||||

|

|

| Measured |

|

|

| Indicated |

|

|

| Measured and Indicated | ||||||||||||||||||||||||||

|

|

| Tonnes |

|

| Grade |

|

| Ounces |

|

| Tonnes |

|

| Grade |

|

| Ounces |

|

| Tonnes |

|

| Grade |

|

| Ounces |

| |||||||||

| Property |

| (kt) |

|

| (g/t) |

|

| (koz) |

|

| (kt) |

|

| (g/t) |

|

| (koz) |

|

| (kt) |

|

| (g/t) |

|

| (koz) |

| |||||||||

| Relief Canyon Subtotal |

|

| 12,177 |

|

|

| 3.4 |

|

|

| 1346.3 |

|

|

| 10,431 |

|

|

| 0.6 |

|

|

| 210 |

|

|

| 22,608 |

|

|

| 2.1 |

|

|

| 1,556 |

|

| Galena - Ag-Pb (60%) |

|

| 417 |

|

|

| 317 |

|

| 4259 |

|

|

| 2,058 |

|

|

| 326 |

|

|

| 21,589 |

|

|

| 2,475 |

|

|

| 325 |

|

|

| 25,849 |

| |

| Galena - Ag-Cu (60%) |

|

| 199 |

|

|

| 690 |

|

| 4410 |

|

|

| 639 |

|

|

| 664 |

|

|

| 13,643 |

|

|

| 838 |

|

|

| 670 |

|

|

| 18,054 |

| |

| Galena Subtotal (60%) |

|

| 616 |

|

|

| 438 |

|

| 8670 |

|

|

| 2,697 |

|

|

| 406 |

|

|

| 35,233 |

|

|

| 3,313 |

|

|

| 412 |

|

|

| 43,902 |

| |

| San Rafael |

|

| 1,453 |

|

|

| 87 |

|

| 4083 |

|

|

| 2,201 |

|

|

| 68 |

|

|

| 4,833 |

|

|

| 3,654 |

|

|

| 76 |

|

|

| 8,916 |

| |

| Nuestra Se ora |

|

| 257 |

|

|

| 85 |

|

|

| 700 |

|

|

| 1,879 |

|

|

| 89 |

|

|

| 5,379 |

|

|

| 2,136 |

|

|

| 89 |

|

|

| 6,079 |

|

| El Caj n |

|

| - |

|

|

| - |

|

|

| - |

|

|

| 299 |

|

|

| 131 |

|

|

| 1,263 |

|

|

| 299 |

|

|

| 131 |

|

|

| 1,263 |

|

| Zone 120 |

|

| - |

|

|

| - |

|

|

| - |

|

|

| 1,470 |

|

|

| 114 |

|

|

| 5,394 |

|

|

| 1,470 |

|

|

| 114 |

|

|

| 5,394 |

|

| Cosal Subtotal |

|

| 1,710 |

|

|

| 87 |

|

| 4783 |

|

|

| 5,849 |

|

|

| 90 |

|

|

| 16,868 |

|

|

| 7,558 |

|

|

| 89 |

|

|

| 21,651 |

| |

| San Felipe Subtotal |

|

| - |

|

|

| - |

|

|

|

|

|

|

| 4,677 |

|

|

| 61 |

|

|

| 9,115 |

|

|

| 4,677 |

|

|

| 61 |

|

|

| 9,115 |

|

| Total Silver |

|

| 14,503 |

|

|

| 32 |

|

|

| 14799 |

|

|

| 23,654 |

|

|

| 81 |

|

|

| 61,426 |

|

|

| 38,157 |

|

|

| 62 |

|

|

| 76,225 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Zinc Mineral Resources - Exclusive of Mineral Reserves |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||

|

|

| Measured |

|

|

| Indicated |

|

|

| Measured and Indicated | ||||||||||||||||||||||||||

|

|

| Tonnes |

|

| Grade |

|

| Pounds |

|

| Tonnes |

|

| Grade |

|

| Pounds |

|

| Tonnes |

|

| Grade |

|

| Pounds |

| |||||||||

| Property |

| (kt) |

|

| (%) |

|

| (Mlbs) |

|

| (kt) |

|

| (%) |

|

| (Mlbs) |

|

| (kt) |

|

| (%) |

|

| (Mlbs) |

| |||||||||

| San Rafael |

|

| 1,453 |

|

|

| 2.22 |

|

|

| 71.1 |

|

|

| 2,201 |

|

|

| 2.00 |

|

|

| 96.8 |

|

|

| 3,654 | 0 |

|

| 2.08 |

|

|

| 167.9 |

|

| Nuestra Se ora |

|

| 257 |

|

|

| 1.76 |

|

|

| 10.0 |

|

|

| 1,879 |

|

|

| 1.74 |

|

|

| 71.9 |

|

|

| 2,136 | 0 |

|

| 1.74 |

|

|

| 81.9 |

|

| Cosal Subtotal |

|

| 1,710 |

|

|

| 2.15 |

|

|

| 81.1 |

|

|

| 4,080 |

|

|

| 1.88 |

|

|

| 168.7 |

|

|

| 5,790 | 0 |

|

| 1.96 |

|

|

| 249.8 |

|

| San Felipe Subtotal |

|

| - |

|

|

| - |

|

|

| - |

|

|

| 4,677 |

|

|

| 5.43 |

|

|

| 560.1 |

|

|

| 4,677 | 0 |

|

| 5.43 |

|

|

| 560.1 |

|

| Total Zinc |

|

| 1,710 |

|

|

| 2.15 |

|

|

| 81.1 |

|

|

| 8,757 |

|

|

| 3.78 |

|

|

| 728.9 |

|

|

| 10,467 | 0 |

|

| 3.51 |

|

|

| 810.0 |

|

|

|