EXHIBIT 99.1

PRESS RELEASE

| Contact Information: | Investors/Media: |

| Kite Realty Group Trust | Kite Realty Group Trust |

| Dan Sink, Chief Financial Officer | Adam Basch, Investor Relations |

| (317) 577-5609 | (317) 578-5161 |

| dsink@kiterealty.com | abasch@kiterealty.com |

Kite Realty Group Trust Reports

Second Quarter 2013 Results

Indianapolis, Ind., August 1, 2013 – Kite Realty Group Trust (NYSE: KRG) (the “Company”) announced today its operating results for the three and six months ended June 30, 2013.

Financial Results

|

·

|

Funds from Operations, was $0.10 per diluted common share for the second quarter of 2013.

|

|

·

|

Revenue from Property Operations increased 28% in the second quarter over the same period of the prior year.

|

Funds from Operations

For the three months ended June 30, 2013, funds from operations (“FFO”) was $10.1 million, or $0.10 per diluted common share for the Kite Portfolio, compared to $7.5 million, or $0.10 per diluted common share in the same period of the prior year. As adjusted for certain one-time items, FFO for the three months ended June 30, 2013 was $10.1 million, or $0.10 per diluted common share for the Kite Portfolio, compared to $8.0 million, or $0.11 per diluted common share, in the same period of the prior year.

For the six months ended June 30, 2013, FFO was $21.5 million, or $0.24 per diluted common share for the Kite Portfolio, compared to $14.1 million, or $0.20 per diluted common share in the same period of the prior year. As adjusted for certain one-time items, FFO for the six months ended June 30, 2013 was $21.7 million, or $0.24 per diluted common share for the Kite Portfolio, compared to $15.9 million, or $0.22 per diluted common share, in the same period of the prior year.

John A. Kite, the Company’s Chairman and Chief Executive Officer, said "We made additional progress on our de-leveraging strategy by issuing equity and promptly deploying that capital into the acquisition of two quality assets in Indianapolis and Nashville. Our portfolio continues to perform very well with same property net operating income increasing 4.4% and cash rent spreads of 19.7%. We also substantially completed Rangeline Crossing, a quality redevelopment in Carmel, Indiana and transitioned this asset into the operating portfolio at 91.7% leased and we plan to complete several more developments before the end of 2013.”

Net Income (Loss)

Net loss attributable to common shareholders was $8.7 million for the second quarter of 2013, compared to net loss for the same period in the prior year of $2.7 million. The increase in loss between periods was the result of a previously disclosed $5.4 million non-cash impairment charge taken during the second quarter of 2013 relating to the Company’s Kedron Village property (further discussed below), a $4.0 million increase in depreciation, largely attributable to accelerated depreciation in connection with the Company’s redevelopment activities and the acquisitions of operating properties, and a $1.4 million increase in interest expense primarily due to the ceasing of interest capitalization on the transition to operating status of several development properties. Offsetting these were higher net operating income from property acquisitions and development properties of $4.6 million and higher net operating income of $0.6 million from fully operational properties during both periods.

The Company’s total revenue for the second quarter of 2013 was $31.0 million, a 28% increase over the same period in 2012, primarily due to a $3.3 million increase from properties acquired in 2012 and 2013 and a $1.7 million increase from the substantial completion of several development properties.

Net loss attributable to common shareholders was $8.8 million for the first six months of 2013 compared to a $2.7 million net loss in the same period of the prior year. This change consists of the previously disclosed $5.4 million impairment charge taken in the second quarter of 2013, a $6.6 million increase in depreciation, largely attributable to accelerated depreciation in connection with the Company’s redevelopment activities and the acquisitions of operating properties, a $2.2 million increase in interest expense primarily due to the transition to operating status of several development properties, and 2012 gains on sales of operating properties of $5.2 million. These were offset by higher net operating income from property acquisitions and development properties of $10.2 million and higher net operating income from same properties of $1.4 million in 2013, and a 2012 litigation charge of $1.3 million.

The Company’s total revenue for the six months ended June 30, 2013 was $63.1 million, a 29% increase over the same period in 2012, mainly due to properties acquired in 2012 and 2013 and the transition of development properties to operating status. In addition, the Company had higher gains on land sales of $4.8 million for the six months ended June 30, 2013 over the same period in 2012.

Portfolio Operations

|

·

|

The Company’s total portfolio was 95.4% leased at June 30, 2013, an increase of 240 basis points over the same period of the prior year.

|

|

·

|

Shop leased percentage increased to 84.5% from 80.6% as of June 30, 2012.

|

|

·

|

Same Property Net Operating Income for the second quarter of 2013 increased 4.4% over the same period of the prior year.

|

|

·

|

The Company generated aggregate new and renewal leasing spreads of 19.7% on spaces vacant less than 12 months.

|

|

·

|

38 new and renewal leases were executed during the second quarter totaling 106,340 square feet.

|

As of June 30, 2013, the Company owned interests in 63 retail properties totaling approximately 9.9 square feet. The owned gross leasable area (“GLA”) in the Company’s retail operating portfolio was 95.4% leased as of June 30, 2013, compared to 93.0% leased as of June 30, 2012. The owned net rentable area of the Company’s commercial properties was 95.2% leased as of June 30, 2013.

On a same property basis, the leased percentage of the 49 operating properties increased to 95.1% at June 30, 2013 from 92.8% at June 30, 2012. Same property net operating income for these properties increased 4.4% in the second quarter of 2013 compared to the same period in the prior year.

Investments in Properties

|

·

|

Acquired Cool Springs Market in Nashville, Tennessee, and Castleton Crossing in Indianapolis, Indiana for a total purchase price of $76.6 million.

|

|

·

|

Substantially completed the redevelopment of Rangeline Crossing and transitioned it to the operating portfolio.

|

Acquisitions

During the second quarter, the Company acquired Cool Springs Market, a 224,000 square foot center located in Nashville, Tennessee. Cool Springs Market is 95.8% leased and is anchored by Dick’s Sporting Goods, Marshall’s, JoAnn Fabrics, Staples, and a non-owned Kroger. The purchase price, exclusive of closing costs, was $37.6 million.

The Company also acquired Castleton Crossing, a 278,000 square foot center located in Indianapolis, Indiana. Castleton Crossing is 100% leased and is anchored by TJ Maxx, HomeGoods, Burlington Coat Factory and Shoe Carnival. The purchase price, exclusive of closing costs, was $39.0 million.

Dispositions

As previously disclosed, on July 2, 2013, the lender on the Company’s Kedron Village operating property non-recourse loan initiated foreclosure proceedings and acquired title to the property. The Company performed an evaluation of the property’s fair value as of June 30, 2013. In this evaluation, which was caused by the reduction in the asset’s expected holding period, the undiscounted cash flows of the property were insufficient to recover the book value of the asset and, accordingly, as required by accounting rules, the Company recognized a non-cash impairment charge of $5.4 million during the second quarter of 2013 to write down the asset to its fair value. In the third quarter of 2013, upon the lender’s acquiring title to the property, the Company expects to recognize an associated $1.5 million non-cash gain from the extinguishment of the debt on the property. The Company also expects to reverse an accrual of default interest and other interest of approximately $1.1 million in the third quarter of 2013.

Development

As of June 30, 2013, the Company owned interests in four development projects under construction that were in the aggregate 76.6% pre-leased or committed. The total estimated cost of these projects is approximately $263.5 million, of which approximately $186.1 million had been incurred as of June 30, 2013. During the second quarter, the Company also commenced preliminary site work at Phase II of Parkside Town Commons. This 278,000 square foot phase is 58% pre-leased or committed and will be anchored by Frank Theatres, Golf Galaxy and Field & Stream.

During the second quarter, the Company substantially completed its Rangeline Crossing redevelopment in Carmel, Indiana and transitioned it to the operating portfolio. Rangeline Crossing was 91.7% leased as of June 30, 2013. The Company’s primary anchor Earth Fare had a very successful opening at the end of June.

Redevelopment

As of June 30, 2013, the Company owned two redevelopment properties under construction that were in the aggregate 88% pre-leased or committed. Four Corner Square, in Seattle, Washington is substantially complete and is anchored by Walgreens, Grocery Outlet and Do it Best Hardware. Construction commenced during the quarter on LA Fitness at Bolton Plaza, in Jacksonville, Florida. This tenant will anchor the center along with Academy Sports and Outdoors.

Capital Markets Results

|

·

|

Issued 15,525,000 common shares at $6.55 per share for net proceeds of $97.2 million which were used to fund acquisitions and redevelopment costs and repay borrowings.

|

During the quarter, the Company completed a public offering of 15,525,000 common shares at a price of $6.55 per share, which generated net proceeds to the Company of approximately $97.2 million. The Company used $76.6 million of the net proceeds to fund the acquisitions of Cool Springs Market and Castleton Crossing. The remainder of the net proceeds was used to fund certain redevelopment costs and to pay down the Company’s revolving line of credit.

Distributions

On June 17, 2013, the Board of Trustees declared a quarterly common share cash distribution of $0.06 per common share for the quarter ended June 30, 2013 payable to shareholders of record as of July 5, 2013. This distribution was paid on July 12, 2013. The Board of Trustees anticipates declaring a quarterly cash distribution for the quarter ending September 30, 2013 later in the third quarter.

2013 Earnings Guidance

The Company is modifying its as adjusted FFO guidance range for the year ending December 31, 2013 to be within a range of $0.45 to $0.48 per diluted common share from its previous guidance of $0.44 to $0.48 per diluted common share. The expected third quarter gain on debt extinguishment is reflected as a reduction of FFO in the earnings guidance. The Company also revised its net income guidance to be a net loss within a range of $(0.09) to $(0.12) per diluted common share.

Following is a reconciliation of the range of 2013 estimated net loss per diluted common share to estimated FFO and as adjusted FFO per diluted common share:

|

Guidance Range for 2013

|

Low

|

High

|

||||||

|

Net loss per diluted common share

|

$ | (0.12 | ) | $ | (0.09 | ) | ||

|

Depreciation and amortization

|

0.53 | 0.53 | ||||||

|

Impairment charge

|

0.06 | 0.06 | ||||||

|

FFO per diluted common share

|

0.47 | 0.50 | ||||||

|

Gain on debt extinguishment

|

(0.02 | ) | (0.02 | ) | ||||

|

FFO per diluted common share, as adjusted

|

$ | 0.45 | $ | 0.48 | ||||

Non-GAAP Financial Measures

Given the nature of the Company’s business as a real estate owner and operator, the Company believes that FFO and FFO, as adjusted, are helpful to investors when measuring operating performance because they exclude various items included in net income or loss that do not relate to or are not indicative of operating performance, such as gains or losses from sales and impairments of operating properties, and depreciation and amortization, which can make periodic and peer analyses of operating performance more difficult. For informational purposes, we have also provided FFO adjusted for the litigation charge recorded in the first quarter of 2012 and the write-off of deferred financing costs in the first quarter of 2013 and second quarter of 2012. We believe this supplemental information provides a meaningful measure of our operating performance. The Company believes presenting FFO in this manner allows investors and other interested parties to form a more meaningful assessment of the Company’s operating results. A reconciliation of net income to FFO and adjusted FFO are included in the attached table.

The Company believes that NOI is helpful to investors as a measure of its operating performance because it excludes various items included in net income that do not relate to or are not indicative of its operating performance, such as depreciation and amortization, interest expense, and impairment, if any. The Company believes that same property NOI is helpful to investors as a measure of its operating performance because it includes only the NOI of properties that have been owned for the full period presented, which eliminates disparities in net income due to the redevelopment, acquisition or disposition of properties during the particular period presented, and thus provides a more consistent metric for the comparison of the Company's properties. Same property NOI should not, however, be considered as alternatives to net income (calculated in accordance with GAAP) as indicators of the Company's financial performance.

Earnings Conference Call

The Company will conduct a conference call to discuss its financial results on Friday, August 2nd at 1:00 p.m. eastern time. A live webcast of the conference call will be available online on the Company’s corporate website at www.kiterealty.com. The dial-in numbers are (866) 318-8619 for domestic callers and (617) 399-5138 for international callers (passcode 13283470). In addition, a telephonic replay of the call will be available until November 2, 2013. The replay dial-in telephone numbers are (888) 286-8010 for domestic callers and (617) 801-6888 for international callers (passcode 96265416).

About Kite Realty Group Trust

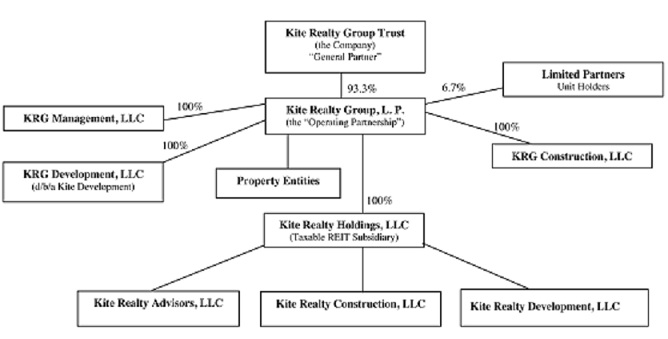

Kite Realty Group Trust is a full-service, vertically integrated real estate investment trust engaged in the ownership, operation, management, leasing, acquisition, construction, redevelopment and development of neighborhood and community shopping centers in selected markets in the United States. At June 30, 2013, the Company owned interests in a portfolio of 63 operating and redevelopment properties totaling approximately 9.9 million square feet and four properties currently under development totaling 1.4 million square feet.

Safe Harbor

This press release contains certain statements that are not historical fact and may constitute forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Such forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause the actual results of the Company to differ materially from historical results or from any results expressed or implied by such forward-looking statements, including, without limitation: national and local economic, business, real estate and other market conditions, particularly in light of the recent slowing of growth in the U.S. economy; financing risks, including the availability of and costs associated with sources of liquidity; the Company’s ability to refinance, or extend the maturity dates of, its indebtedness; the level and volatility of interest rates; the financial stability of tenants, including their ability to pay rent and the risk of tenant bankruptcies; the competitive environment in which the Company operates; acquisition, disposition, development and joint venture risks; property ownership and management risks; the Company’s ability to maintain its status as a real estate investment trust (“REIT”) for federal income tax purposes; potential environmental and other liabilities; impairment in the value of real estate property the Company owns; risks related to the geographical concentration of our properties in Indiana, Florida, Texas and North Carolina; and other factors affecting the real estate industry generally. The Company refers you the documents filed by the Company from time to time with the Securities and Exchange Commission, specifically the section titled “Risk Factors” in the Company’s Annual Report on Form 10-K for the year ended December 31, 2012, which discuss these and other factors that could adversely affect the Company’s results. The Company undertakes no obligation to publicly update or revise these forward-looking statements (including the FFO and net income estimates), whether as a result of new information, future events or otherwise.

###

Kite Realty Group Trust

Consolidated Balance Sheets

(Unaudited)

|

June 30,

2013

|

December 31,

2012

|

|||||||

|

Assets:

|

||||||||

|

Investment properties, at cost:

|

||||||||

|

Land

|

$ | 290,310,938 | $ | 239,690,837 | ||||

|

Land held for development

|

56,473,896 | 34,878,300 | ||||||

|

Buildings and improvements

|

1,074,813,451 | 892,508,729 | ||||||

|

Furniture, equipment and other

|

5,087,218 | 4,419,918 | ||||||

|

Construction in progress

|

106,106,571 | 223,135,354 | ||||||

| 1,532,792,074 | 1,394,633,138 | |||||||

|

Less: accumulated depreciation

|

(217,345,797 | ) | (194,297,531 | ) | ||||

| 1,315,446,277 | 1,200,335,607 | |||||||

|

Cash and cash equivalents

|

13,098,358 | 12,482,701 | ||||||

|

Tenant receivables, including accrued straight-line rent of $13,362,690 and $12,189,449, respectively, net of allowance for uncollectible accounts

|

20,829,417 | 21,210,754 | ||||||

|

Other receivables

|

6,727,213 | 4,946,219 | ||||||

|

Investments in unconsolidated entities, at equity

|

14,421 | 15,522 | ||||||

|

Escrow deposits

|

11,585,942 | 12,960,488 | ||||||

|

Deferred costs, net

|

40,180,270 | 34,536,474 | ||||||

|

Prepaid and other assets

|

5,204,811 | 2,169,140 | ||||||

|

Total Assets

|

$ | 1,413,086,709 | $ | 1,288,656,905 | ||||

|

Liabilities and Equity:

|

||||||||

|

Mortgage and other indebtedness

|

$ | 747,489,021 | $ | 699,908,768 | ||||

|

Accounts payable and accrued expenses

|

47,971,675 | 54,187,172 | ||||||

|

Deferred revenue and other liabilities

|

18,837,470 | 20,269,501 | ||||||

|

Total Liabilities

|

814,298,166 | 774,365,441 | ||||||

|

Commitments and contingencies

|

||||||||

|

Redeemable noncontrolling interests in the Operating Partnership

|

40,813,315 | 37,669,803 | ||||||

|

Equity:

|

||||||||

|

Kite Realty Group Trust Shareholders’ Equity:

|

||||||||

|

Preferred Shares, $.01 par value, 40,000,000 shares authorized, 4,100,000 shares issued and outstanding, respectively

|

102,500,000 | 102,500,000 | ||||||

|

Common Shares, $.01 par value, 200,000,000 shares authorized 93,749,091 shares and 77,728,697 shares issued and outstanding, respectively

|

937,491 | 777,287 | ||||||

|

Additional paid in capital

|

607,323,319 | 513,111,877 | ||||||

|

Accumulated other comprehensive income

|

804,784 | (5,258,543 | ) | |||||

|

Accumulated deficit

|

(157,132,020 | ) | (138,044,264 | ) | ||||

|

Total Kite Realty Group Trust Shareholders’ Equity

|

554,433,574 | 473,086,357 | ||||||

|

Noncontrolling Interests

|

3,541,654 | 3,535,304 | ||||||

|

Total Equity

|

557,975,228 | 476,621,661 | ||||||

|

Total Liabilities and Equity

|

$ | 1,413,086,709 | $ | 1,288,656,905 | ||||

Kite Realty Group Trust

Consolidated Statements of Operations

For the Three and Six Months Ended June 30, 2013 and 2012

(Unaudited)

|

Three Months Ended June 30,

|

Six Months Ended June 30,

|

|||||||||||||||

|

2013

|

2012

|

2013

|

2012

|

|||||||||||||

|

Revenue:

|

||||||||||||||||

|

Minimum rent

|

$ | 23,544,978 | $ | 18,761,604 | $ | 44,899,762 | $ | 37,223,051 | ||||||||

|

Tenant reimbursements

|

5,709,268 | 4,541,108 | 11,421,800 | 9,650,782 | ||||||||||||

|

Other property related revenue

|

1,730,470 | 863,847 | 6,736,270 | 2,082,727 | ||||||||||||

|

Total revenue

|

30,984,716 | 24,166,559 | 63,057,832 | 48,956,560 | ||||||||||||

|

Expenses:

|

||||||||||||||||

|

Property operating

|

5,185,362 | 4,098,793 | 10,455,617 | 8,592,644 | ||||||||||||

|

Real estate taxes

|

3,556,993 | 3,028,677 | 7,175,128 | 6,542,740 | ||||||||||||

|

General, administrative, and other

|

1,815,940 | 1,792,472 | 3,957,553 | 3,614,177 | ||||||||||||

|

Acquisition costs

|

236,613 | 70,933 | 413,512 | 70,933 | ||||||||||||

|

Litigation charge

|

— | — | — | 1,289,446 | ||||||||||||

|

Impairment charge

|

5,371,428 | — | 5,371,428 | — | ||||||||||||

|

Depreciation and amortization

|

14,175,797 | 10,211,245 | 25,929,354 | 19,360,081 | ||||||||||||

|

Total expenses

|

30,342,133 | 19,202,120 | 53,302,592 | 39,470,021 | ||||||||||||

|

Operating income

|

642,583 | 4,964,439 | 9,755,240 | 9,486,539 | ||||||||||||

|

Interest expense

|

(7,752,529 | ) | (6,303,413 | ) | (14,884,304 | ) | (12,682,630 | ) | ||||||||

|

Income tax (expense)/benefit of taxable REIT subsidiary

|

(104,833 | ) | 30,174 | (75,881 | ) | (7,390 | ) | |||||||||

|

Other (expense)/income

|

(39,034 | ) | 20,703 | 7,901 | (1,655 | ) | ||||||||||

|

(Loss) income from continuing operations

|

(7,253,813 | ) | (1,288,097 | ) | (5,197,044 | ) | (3,205,136 | ) | ||||||||

|

Discontinued operations:

|

||||||||||||||||

|

Income from operations

|

— | 319,348 | — | 728,156 | ||||||||||||

|

Gain on sale of operating property, net of tax expense

|

— | 93,891 | — | 5,245,880 | ||||||||||||

|

Income from discontinued operations

|

— | 413,239 | — | 5,974,036 | ||||||||||||

|

Consolidated net (loss) income

|

(7,253,813 | ) | (874,858 | ) | (5,197,044 | ) | 2,768,900 | |||||||||

|

Net loss (income) attributable to noncontrolling interests

|

661,009 | 271,221 | 636,154 | (1,825,799 | ) | |||||||||||

|

Net (loss) income attributable to Kite Realty Group Trust

|

(6,592,804 | ) | (603,637 | ) | (4,560,890 | ) | 943,102 | |||||||||

|

Dividends on preferred shares

|

(2,114,063 | ) | (2,114,063 | ) | (4,228,125 | ) | (3,691,876 | ) | ||||||||

|

Net loss attributable to common shareholders

|

$ | (8,706,867 | ) | $ | (2,717,700 | ) | $ | (8,789,015 | ) | $ | (2,748,774 | ) | ||||

|

Net (loss) income per common share attributable to Kite Realty Group Trust common shareholders – basic and diluted

|

||||||||||||||||

|

Loss from continuing operations attributable to common shareholders

|

$ | (0.10 | ) | $ | (0.05 | ) | $ | (0.10 | ) | $ | (0.10 | ) | ||||

|

Income from discontinued operations attributable to common shareholders

|

0.00 | 0.01 | 0.00 | 0.06 | ||||||||||||

|

Net loss attributable to common shareholders

|

$ | (0.10 | ) | $ | (0.04 | ) | $ | (0.10 | ) | $ | (0.04 | ) | ||||

|

Weighted average common shares outstanding – basic and diluted

|

91,066,817 | 64,014,187 | 84,486,979 | 63,864,040 | ||||||||||||

|

Dividends declared per common share

|

$ | 0.06 | $ | 0.06 | $ | 0.12 | $ | 0.12 | ||||||||

|

Loss attributable to Kite Realty Group Trust common shareholders

|

||||||||||||||||

|

Loss from continuing operations

|

$ | (8,706,867 | ) | $ | (3,086,101 | ) | $ | (8,789,015 | ) | $ | (6,214,744 | ) | ||||

|

Income from discontinued operations

|

— | 368,401 | — | 3,465,970 | ||||||||||||

|

Net loss attributable to Kite Realty Group Trust common shareholders

|

$ | (8,706,867 | ) | $ | (2,717,700 | ) | $ | (8,789,015 | ) | $ | (2,748,774 | ) | ||||

Kite Realty Group Trust

Funds From Operations

For the Three and Six Months Ended June 30, 2013 and 2012

(Unaudited)

|

Three Months Ended June 30,

|

Six Months Ended June 30,

|

|||||||||||||||

|

2013

|

2012

|

2013

|

2012

|

|||||||||||||

|

Consolidated net (loss) income

|

$ | (7,253,813 | ) | $ | (874,858 | ) | $ | (5,197,044 | ) | $ | 2,768,900 | |||||

|

Less dividends on preferred shares

|

(2,114,063 | ) | (2,114,063 | ) | (4,228,125 | ) | (3,691,876 | ) | ||||||||

|

Less net income attributable to noncontrolling interests in properties

|

(29,795 | ) | (49,644 | ) | (61,772 | ) | (76,414 | ) | ||||||||

|

Less gain on sale of operating properties, net of tax expense

|

— | (93,891 | ) | — | (5,245,880 | ) | ||||||||||

|

Add impairment charge

|

5,371,428 | — | 5,371,428 | — | ||||||||||||

|

Add depreciation and amortization, net of noncontrolling interests

|

14,078,521 | 10,607,051 | 25,639,803 | 20,324,359 | ||||||||||||

|

Funds From Operations of the Kite Portfolio1

|

10,052,278 | 7,474,595 | 21,524,290 | 14,079,089 | ||||||||||||

|

Less redeemable noncontrolling interests in Funds From Operations

|

(673,452 | ) | (798,279 | ) | (1,583,477 | ) | (1,524,773 | ) | ||||||||

|

Funds From Operations allocable to the Company1

|

$ | 9,378,826 | $ | 6,676,316 | $ | 19,940,813 | $ | 12,554,316 | ||||||||

|

Basic and Diluted FFO per share of the Kite Portfolio

|

$ | 0.10 | $ | 0.10 | $ | 0.24 | $ | 0.20 | ||||||||

|

Funds From Operations of the Kite Portfolio

|

$ | 10,052,278 | $ | 7,474,595 | $ | 21,524,290 | $ | 14,079,089 | ||||||||

|

Add back: litigation charge

|

— | — | — | 1,289,446 | ||||||||||||

|

Add back: accelerated amortization of deferred financing fees

|

— | 500,028 | 171,572 | 500,028 | ||||||||||||

|

Funds From Operations of the Kite Portfolio, as adjusted

|

$ | 10,052,278 | $ | 7,974,623 | $ | 21,695,862 | $ | 15,868,563 | ||||||||

|

Basic and Diluted FFO per share of the Kite Portfolio, as adjusted

|

$ | 0.10 | $ | 0.11 | $ | 0.24 | $ | 0.22 | ||||||||

|

Basic weighted average Common Shares outstanding

|

91,066,817 | 64,014,187 | 84,486,979 | 63,864,040 | ||||||||||||

|

Diluted weighted average Common Shares outstanding

|

91,391,141 | 64,341,342 | 84,801,949 | 64,191,292 | ||||||||||||

|

Basic weighted average Common Shares and Units outstanding

|

97,799,238 | 71,845,223 | 91,221,006 | 71,699,582 | ||||||||||||

|

Diluted weighted average Common Shares and Units outstanding

|

98,123,563 | 72,172,379 | 91,535,976 | 72,026,834 | ||||||||||||

|

____________________

|

|

|

1

|

“Funds From Operations of the Kite Portfolio” measures 100% of the operating performance of the Operating Partnership’s real estate properties in which the Company owns an interest. “Funds From Operations allocable to the Company” reflects a reduction for the redeemable noncontrolling weighted average diluted interest in the Operating Partnership.

|

- -

Kite Realty Group Trust

Same Property Net Operating Income

For the Three and Six Months Ended June 30, 2013 and 2012

(Unaudited)

|

Three Months Ended June 30,

|

Six Months Ended June 30,

|

|||||||||||||||

|

2013

|

2012

|

% Change

|

2013

|

2012

|

% Change

|

|||||||||||

|

Number of properties at period end1

|

49

|

49

|

49

|

49

|

||||||||||||

|

Leased percentage at period-end

|

95.1%

|

92.8%

|

95.1%

|

92.8%

|

||||||||||||

|

Minimum rent

|

$

|

17,633,006

|

$

|

17,178,711

|

$

|

35,107,606

|

$

|

33,926,051

|

||||||||

|

Tenant recoveries

|

5,078,728

|

4,755,695

|

10,478,837

|

9,547,536

|

||||||||||||

|

Other income

|

402,407

|

470,575

|

1,125,782

|

1,178,311

|

||||||||||||

|

23,114,141

|

22,404,981

|

46,712,225

|

44,651,898

|

|||||||||||||

|

Property operating expenses

|

4,583,017

|

4,510,754

|

9,748,301

|

9,144,759

|

||||||||||||

|

Real estate taxes

|

3,300,589

|

3,311,039

|

6,677,569

|

6,612,263

|

||||||||||||

|

7,883,606

|

7,821,793

|

16,425,870

|

15,757,022

|

|||||||||||||

|

Net operating income – same properties (49 properties)2

|

15,230,535

|

14,583,188

|

4.4

|

%

|

30,286,355

|

28,894,876

|

4.8

|

%

|

||||||||

|

Reconciliation to Most Directly Comparable GAAP Measure:

|

||||||||||||||||

|

Net operating income – same properties

|

$

|

15,230,535

|

$

|

14,583,188

|

$

|

30,286,355

|

$

|

28,894,876

|

||||||||

|

Net operating income – non-same activity

|

7,011,826

|

2,455,901

|

15,140,733

|

4,926,300

|

||||||||||||

|

Other (expense) income, net

|

(143,867

|

)

|

50,877

|

(67,981

|

)

|

(9,045

|

)

|

|||||||||

|

General, administrative and acquisition expenses

|

(2,052,553

|

)

|

(1,863,405

|

)

|

(4,371,065

|

)

|

(3,685,111

|

)

|

||||||||

|

Litigation charge

|

—

|

—

|

—

|

(1,289,446

|

)

|

|||||||||||

|

Impairment charge

|

(5,371,428

|

)

|

—

|

(5,371,428

|

)

|

-

|

||||||||||

|

Depreciation expense

|

(14,175,797

|

)

|

(10,211,245

|

)

|

(25,929,354

|

)

|

(19,360,081

|

)

|

||||||||

|

Interest expense

|

(7,752,529

|

)

|

(6,303,413

|

)

|

(14,884,304

|

)

|

(12,682,630

|

)

|

||||||||

|

Discontinued operations

|

—

|

319,348

|

—

|

728,158

|

||||||||||||

|

Gain on sale of operating properties

|

—

|

93,891

|

—

|

5,245,880

|

||||||||||||

|

Net loss (income) attributable to noncontrolling interests

|

661,009

|

271,221

|

636,154

|

(1,825,799

|

)

|

|||||||||||

|

Dividends on preferred shares

|

(2,114,063

|

)

|

(2,114,063

|

)

|

(4,228,125

|

)

|

(3,691,876

|

)

|

||||||||

|

Net loss attributable to common shareholders

|

$

|

(8,706,867

|

)

|

$

|

(2,717,700

|

)

|

$

|

(8,789,015

|

)

|

$

|

(2,748,774

|

)

|

||||

|

____________________

|

|

|

1

|

Same Property analysis excludes operating properties in redevelopment.

|

|

2

|

Excludes net gains from outlot sales, straight-line rent and amortization of lease intangibles, bad debt expense, and lease termination fees.

|