EXHIBIT 99.1

Safe Harbor

PRESS RELEASE

|

|

| Contact Information:

Kite Realty Group Trust

Dan Sink, Chief Financial Officer

(317) 577-5609

dsink@kiterealty.com

|

Kite Realty Group Trust Reports

First Quarter 2011 Results

Highlights

|

·

|

Funds From Operations (FFO) was $0.10 per diluted common share for the first quarter of 2011.

|

|

·

|

33 new and renewal leases for 183,000 square feet were executed during the quarter for aggregate cash rent spreads of 5.8%.

|

|

·

|

Same Property NOI and leased percentage increased 1.0% and 1.9%, respectively.

|

|

·

|

Operating retail portfolio leased percentage improved year over year to 92.3% from 90.0%.

|

|

·

|

Executed a lease with Whole Foods to anchor the recently acquired Oleander Point Shopping Center in Wilmington, North Carolina.

|

Indianapolis, Ind., May 5, 2011 – Kite Realty Group Trust (NYSE: KRG) (the “Company”) today announced results for its first quarter ended March 31, 2011. Financial statements and exhibits attached to this release include results for the three months ended March 31, 2011 and 2010.

Financial and Operating Results

For the three months ended March 31, 2011, funds from operations (FFO), a widely accepted supplemental measure of REIT performance established by the National Association of Real Estate Investment Trusts, was $6.9 million, or $0.10 per diluted share, for the Kite Portfolio compared to $7.1 million, or $0.10 per diluted share, for the same period in the prior year. The Company’s allocable share of FFO was $6.1 million for the three months ended March 31, 2011 compared to $6.3 million for the same period in 2010.

Given the nature of the Company’s business as a real estate owner and operator, the Company believes that FFO is helpful to investors when measuring operating performance because it excludes various items included in net income that do not relate to or are not indicative of operating performance, such as gains or losses from sales of operating properties, and depreciation and amortization, which can make periodic and peer analyses of operating performance more difficult. The Company believes presenting FFO in this manner allows investors and other interested parties to form a more meaningful assessment of the Company’s operating results. A reconciliation of net income to FFO is included in the attached table.

Net loss attributable to Kite Realty Group Trust was $2.2 million for the first quarter of 2011 compared to a net loss in the prior year of $1.1 million. This change is primarily attributable to a $1.4 million dividend for the first quarter of 2011 on preferred shares issued in late 2010. The Company’s total revenue for the first quarter of 2011 was $24.4 million, down from $25.6 million for the same period in 2010. This decrease reflects a decline in construction volume of $1.9 million and reduced gains on land and outlot sales of $0.5 million. These decreases were partially offset by improvement in base rent and reimbursement revenue of $1.0 million due to higher occupancy levels.

John A. Kite, Kite Realty Group’s Chairman and Chief Executive Officer, said "We continued our operating and leasing momentum as we leased over 180,000 square feet and generated positive same property net operating income of 1.0%. The same property leased percentage also improved by almost 2.0%. We are on track to complete both in-process developments in the second half of 2011 and we continue to focus on the leasing of our other development projects."

Operating Portfolio

As of March 31, 2011, the Company owned interests in 52 retail operating properties totaling approximately 7.9 million square feet. The owned gross leasable area (“GLA”) in the Company’s retail operating portfolio was 92.3% leased as of March 31, 2011, compared to 92.2% leased as of the end of the prior quarter.

In addition, the Company owns four operating commercial properties totaling 581,400 square feet. As of March 31, 2011, the owned net rentable area of the commercial operating portfolio was 92.0% leased, compared to 94.8% at the end of the prior quarter. The combined retail and commercial operating portfolio leased percentage was 92.3% leased as of March 31, 2011, compared to 92.5% leased as of the end of the prior quarter.

On a same property basis, the leased percentage of 54 same store operating properties increased 1.9% to 92.4% at March 31, 2011 from 90.5% at March 31, 2010. Same property net operating income for these properties increased 1.0% in the first quarter of 2011 compared to the same period in the prior year.

Leasing Activities

During the first quarter of 2011, the Company executed a combined 33 new and renewal leases totaling approximately 183,000 square feet with aggregate cash rent spreads of 5.8%. New leases were signed with 21 tenants for approximately 115,400 square feet of GLA. These leases represent a 9.1% positive cash rent spread. A total of 12 leases for 67,600 square feet were renewed during the quarter. Nine of these renewals were completed at flat or positive rent spreads. Combined with three negative spread renewals, rental rates for all renewals decreased approximately 1.1%.

Also during the quarter, 15 tenants commenced paying rent with annualized base rent of approximately $950,000.

Development and Acquisition Activities

In February, the Company acquired a 52,000 square foot neighborhood shopping center in Wilmington, North Carolina as a redevelopment opportunity. Whole Foods will replace former anchor Lowe’s Foods at the renamed Oleander Point. Construction at the center is currently scheduled to commence this summer, which would permit Whole Foods to open in the spring of 2012. Construction costs are anticipated to total approximately $5.0 million.

The Company also completed the acquisition of the remaining 40% interest in The Centre from its joint venture partners for a purchase price of $2.3 million. It assumed all leasing and management responsibilities for this 81,000 square foot retail property located in Carmel, Indiana. The Company intends to redevelop the existing center.

As of March 31, 2011, the Company owned interests in two in-process development projects that are expected to total approximately 260,700 owned square feet upon completion. The total estimated cost of these projects is approximately $68.2 million, of which approximately $56.5 million had been incurred as of March 31, 2011. The Company also has six properties in its redevelopment pipeline representing a projected total of approximately 625,000 of owned square feet with an estimated $37.2 million expected to be spent on redevelopment costs.

Financing Activities

During the quarter, the Company completed the following financing activities:

|

·

|

Entered into long-term financing on its International Speedway Square property located in Daytona, Florida. The $21 million loan has a 10-year term and carries a fixed interest rate of 5.77%. The net proceeds were used to pay down the Company’s line of credit.

|

|

·

|

Secured financing on land held for development at the intersection of Highways 951 and 41 in Naples, Florida. The $7.8 million loan has a 30 month term and carries a variable interest rate of LIBOR plus 300 basis points. The net proceeds were used to pay down the Company’s line of credit.

|

|

·

|

Extended the maturity date of a $3.5 million loan on a commercial asset leased to the State of Indiana. The loan has a new maturity date of February 2014 at a rate of LIBOR plus 325 basis points.

|

|

·

|

Reduced the loan balance on the unconsolidated Parkside Town Commons property to $20.2 million and extended the maturity date to August 2013 at an interest rate of LIBOR plus 275 basis points. The Company’s share of this loan balance is $8.1 million as of March 31, 2011.

|

Subsequent to the end of the quarter, the Company received commitments from a syndicate of banks for an amendment and restatement of its $200 million unsecured revolving credit facility. The amended and restated facility will have a term of three years with a one-year extension at the Company’s option. The banks’ commitments are subject to normal and customary due diligence and closing, which the Company expects to occur in the second quarter.

Distributions

On March 17, 2011, the Board of Trustees declared a quarterly common share cash distribution of $0.06 per common share for the quarter ended March 31, 2011 payable to shareholders of record as of April 6, 2011. This distribution was paid on April 13, 2011. The Board of Trustees anticipates declaring a quarterly cash distribution for the quarter ending June 30, 2011 later in the second quarter.

On May 3, 2011, the Board of Trustees declared a quarterly preferred share cash distribution of $0.515625 per preferred share covering the distribution period from March 2, 2011 to June 1, 2011 payable to shareholders of record as of May 18, 2011. This distribution will be paid on June 1, 2011.

FFO Guidance

The Company is reaffirming its FFO guidance for the year ending December 31, 2011 in a range of $0.40 to $0.45 per diluted share. Following is a reconciliation of estimated net loss per common share to estimated diluted FFO per share:

|

Guidance Range for 2011

|

Low

|

High

|

||||||

|

Net loss per diluted share

|

$ | (0.06 | ) | $ | (0.01 | ) | ||

|

Depreciation and amortization

|

0.46 | 0.46 | ||||||

|

FFO per diluted share

|

$ | 0.40 | $ | 0.45 | ||||

Earnings Conference Call

The Company will conduct a conference call to discuss its financial results on Friday, May 6th at 1:00 p.m. eastern time. A live webcast of the conference call will be available online on the Company’s website at www.kiterealty.com. The dial-in numbers are (866) 277-1181 for domestic callers and (617) 597-5358 for international callers (passcode 70368151). In addition, a telephonic replay of the call will be available until August 6, 2011. The replay dial-in telephone numbers are (888) 286-8010 for domestic callers and (617) 801-6888 for international callers (passcode 99213799).

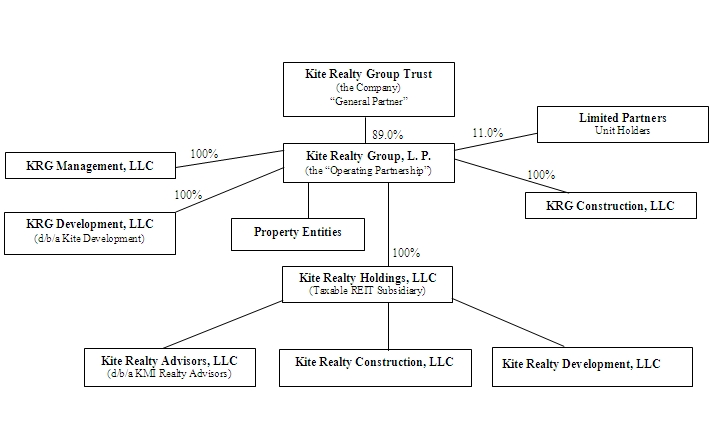

About Kite Realty Group Trust

Kite Realty Group Trust is a full-service, vertically integrated real estate investment trust engaged in the ownership, operation, management, leasing, acquisition, construction, redevelopment and development of neighborhood and community shopping centers in selected markets in the United States. At March 31, 2011, the Company owned interests in a portfolio of 62 operating and redevelopment properties totaling approximately 9.2 million square feet and an additional two properties currently under development totaling 0.5 million square feet.

Safe Harbor

This press release contains certain statements that are not historical fact and may constitute forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Such forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause the actual results of the Company to differ materially from historical results or from any results expressed or implied by such forward-looking statements, including, without limitation: national and local economic, business, real estate and other market conditions, particularly in light of the recent recession; financing risks, including the availability of and costs associated with sources of liquidity; the Company’s ability to refinance, or extend the maturity dates of, its indebtedness; the level and volatility of interest rates; the financial stability of tenants, including their ability to pay rent and the risk of tenant bankruptcies; the competitive environment in which the Company operates; acquisition, disposition, development and joint venture risks; property ownership and management risks; the Company’s ability to maintain its status as a real estate investment trust (“REIT”) for federal income tax purposes; potential environmental and other liabilities; impairment in the value of real estate property the Company owns; risks related to the geographical concentration of our properties in Indiana, Florida and Texas; and other factors affecting the real estate industry generally. The Company refers you the documents filed by the Company from time to time with the Securities and Exchange Commission, specifically the section titled “Risk Factors” in the Company’s Annual Report on Form 10-K for the year ended December 31, 2010, which discuss these and other factors that could adversely affect the Company’s results. The Company undertakes no obligation to publicly update or revise these forward-looking statements (including the FFO and net income estimates), whether as a result of new information, future events or otherwise.

Kite Realty Group Trust

Consolidated Balance Sheets

(Unaudited)

|

March 31,

2011

|

December 31,

2010

|

|||||||

|

Assets:

|

||||||||

|

Investment properties, at cost:

|

||||||||

|

Land

|

$ | 229,454,821 | $ | 228,707,073 | ||||

|

Land held for development

|

27,386,474 | 27,384,631 | ||||||

|

Buildings and improvements

|

790,204,170 | 780,038,034 | ||||||

|

Furniture, equipment and other

|

5,234,399 | 5,166,303 | ||||||

|

Construction in progress

|

163,586,816 | 158,636,747 | ||||||

| 1,215,866,680 | 1,199,932,788 | |||||||

|

Less: accumulated depreciation

|

(159,997,199 | ) | (152,083,936 | ) | ||||

| 1,055,869,481 | 1,047,848,852 | |||||||

|

Cash and cash equivalents

|

8,136,797 | 15,394,528 | ||||||

|

Tenant receivables, including accrued straight-line rent of $9,547,176 and $9,113,712, respectively, net of allowance for uncollectible accounts

|

17,884,508 | 18,204,215 | ||||||

|

Other receivables

|

4,194,074 | 5,484,277 | ||||||

|

Investments in unconsolidated entities, at equity

|

16,867,808 | 11,193,113 | ||||||

|

Escrow deposits

|

10,357,558 | 8,793,968 | ||||||

|

Deferred costs, net

|

25,260,550 | 24,207,046 | ||||||

|

Prepaid and other assets

|

1,924,312 | 1,656,746 | ||||||

|

Total Assets

|

$ | 1,140,495,088 | $ | 1,132,782,745 | ||||

|

Liabilities and Equity:

|

||||||||

|

Mortgage and other indebtedness

|

$ | 627,300,804 | $ | 610,926,613 | ||||

|

Accounts payable and accrued expenses

|

32,703,307 | 32,362,917 | ||||||

|

Deferred revenue and other liabilities

|

14,287,472 | 15,399,002 | ||||||

|

Total Liabilities

|

674,291,583 | 658,688,532 | ||||||

|

Commitments and contingencies

|

||||||||

|

Redeemable noncontrolling interests in the Operating Partnership

|

43,582,754 | 44,115,028 | ||||||

|

Equity:

|

||||||||

|

Kite Realty Group Trust Shareholders’ Equity:

|

||||||||

|

Preferred Shares, $.01 par value, 40,000,000 shares authorized, 2,800,000 shares issued and outstanding at March 31, 2011 and December 31, 2010, respectively

|

70,000,000 | 70,000,000 | ||||||

|

Common Shares, $.01 par value, 200,000,000 shares authorized 63,558,296 shares and 63,342,219 shares issued and outstanding at March 31, 2011 and December 31, 2010, respectively

|

635,583 | 633,422 | ||||||

|

Additional paid in capital

|

448,794,514 | 448,779,180 | ||||||

|

Accumulated other comprehensive loss

|

(1,708,751 | ) | (2,900,100 | ) | ||||

|

Accumulated deficit

|

(99,412,067 | ) | (93,447,581 | ) | ||||

|

Total Kite Realty Group Trust Shareholders’ Equity

|

418,309,279 | 423,064,921 | ||||||

|

Noncontrolling Interests

|

4,311,472 | 6,914,264 | ||||||

|

Total Equity

|

422,620,751 | 429,979,185 | ||||||

|

Total Liabilities and Equity

|

$ | 1,140,495,088 | $ | 1,132,782,745 | ||||

Kite Realty Group Trust

Consolidated Statements of Operations

For the Three Months Ended March 31, 2011 and 2010

(Unaudited)

|

Three Months Ended

March 31,

|

||||||||

|

2011

|

2010

|

|||||||

|

Revenue:

|

||||||||

|

Minimum rent

|

$ | 18,367,242 | $ | 17,735,211 | ||||

|

Tenant reimbursements

|

5,179,210 | 4,841,261 | ||||||

|

Other property related revenue

|

888,532 | 1,099,812 | ||||||

|

Construction and service fee revenue

|

10,038 | 1,879,350 | ||||||

|

Total revenue

|

24,445,022 | 25,555,634 | ||||||

|

Expenses:

|

||||||||

|

Property operating

|

4,910,012 | 4,574,352 | ||||||

|

Real estate taxes

|

3,312,944 | 3,376,314 | ||||||

|

Cost of construction and services

|

49,913 | 1,758,318 | ||||||

|

General, administrative, and other

|

1,848,452 | 1,375,970 | ||||||

|

Depreciation and amortization

|

9,176,873 | 8,544,855 | ||||||

|

Total expenses

|

19,298,194 | 19,629,809 | ||||||

|

Operating income

|

5,146,828 | 5,925,825 | ||||||

|

Interest expense

|

(5,901,625 | ) | (7,096,863 | ) | ||||

|

Income tax benefit (expense) of taxable REIT subsidiary

|

16,073 | (25,836 | ) | |||||

|

Loss from unconsolidated entities

|

(87,625 | ) | — | |||||

|

Other income

|

49,038 | 65,750 | ||||||

|

Consolidated net loss

|

(777,311 | ) | (1,131,124 | ) | ||||

|

Net loss attributable to noncontrolling interests

|

70,494 | 56,444 | ||||||

|

Dividends on preferred shares

|

(1,443,750 | ) | — | |||||

|

Net loss attributable to Kite Realty Group Trust

|

$ | (2,150,567 | ) | $ | (1,074,680 | ) | ||

|

Net loss per common share attributable to Kite Realty Group Trust common shareholders – basic and diluted

|

$ | (0.03 | ) | $ | (0.02 | ) | ||

|

Weighted average common shares outstanding – basic and diluated

|

63,448,048 | 63,121,498 | ||||||

|

Dividends declared per common share

|

$ | 0.0600 | $ | 0.0600 | ||||

Kite Realty Group Trust

Funds From Operations

For the Three Months Ended March 31, 2011 and 2010

(Unaudited)

|

Three Months Ended

March 31,

|

||||||||

|

2011

|

2010

|

|||||||

|

Consolidated net loss

|

$ | (777,311 | ) | $ | (1,131,124 | ) | ||

|

Less dividends on preferred shares

|

(1,443,750 | ) | — | |||||

|

Less net income attributable to noncontrolling interests in properties

|

(16,586 | ) | (79,089 | ) | ||||

|

Add depreciation and amortization of consolidated entities, net of noncontrolling interests

|

9,014,386 | 8,322,513 | ||||||

|

Add depreciation and amortization of unconsolidated entities

|

83,200 | — | ||||||

|

Funds From Operations of the Operating Partnership1

|

6,859,939 | 7,112,300 | ||||||

|

Less redeemable noncontrolling interests in Funds From Operations

|

(754,593 | ) | (796,578 | ) | ||||

|

Funds From Operations allocable to the Company1

|

$ | 6,105,346 | $ | 6,315,722 | ||||

|

Basic FFO per share of the Operating Partnership

|

$ | 0.10 | $ | 0.10 | ||||

|

Diluted FFO per share of the Operating Partnership

|

$ | 0.10 | $ | 0.10 | ||||

|

Basic weighted average Common Shares outstanding

|

63,448,048 | 63,121,498 | ||||||

|

Diluted weighted average Common Shares outstanding

|

63,763,668 | 63,137,031 | ||||||

|

Basic weighted average Common Shares and Units outstanding

|

71,303,746 | 71,095,552 | ||||||

|

Diluted weighted average Common Shares and Units outstanding

|

71,619,366 | 71,291,084 | ||||||

|

____________________

|

|

|

1

|

“Funds From Operations of the Operating Partnership” measures 100% of the operating performance of the Operating Partnership’s real estate properties and construction and service subsidiaries in which the Company owns an interest. “Funds From Operations allocable to the Company” reflects a reduction for the redeemable noncontrolling weighted average diluted interest in the Operating Partnership.

|

Kite Realty Group Trust

Same Property Net Operating Income

For the Three Months Ended March 31, 2011 and 2010

(Unaudited)

|

Three Months Ended March 31,

|

||||||||||||

|

2011

|

2010

|

%

Change

|

||||||||||

|

Number of properties at period end1

|

54 | 54 | ||||||||||

|

Leased percentage at period end

|

92.4 | % | 90.5 | % | ||||||||

|

Minimum rent

|

$ | 16,412,069 | $ | 16,388,214 | ||||||||

|

Tenant recoveries

|

4,513,604 | 4,542,846 | ||||||||||

|

Other income

|

104,272 | 64,992 | ||||||||||

| 21,029,945 | 20,996,052 | |||||||||||

|

Property operating expenses

|

4,531,410 | 4,357,777 | ||||||||||

|

Real estate taxes

|

2,762,161 | 3,038,768 | ||||||||||

| 7,293,571 | 7,396,545 | |||||||||||

|

Net operating income – same properties (54 properties)2

|

$ | 13,736,374 | $ | 13,599,507 | 1.0% | |||||||

|

Reconciliation to Most Directly Comparable GAAP Measure:

|

||||||||||||

|

Net operating income – same properties

|

$ | 13,736,374 | $ | 13,599,507 | ||||||||

|

Other income (expense), net

|

(14,443,191 | ) | (14,674,187 | ) | ||||||||

|

Dividends on preferred shares

|

(1,443,750 | ) | — | |||||||||

|

Net loss

|

$ | (2,150,567 | ) | $ | (1,074,680 | ) | ||||||

|

____________________

|

|

|

1

|

Same Property analysis excludes Courthouse Shadows, Four Corner Square, Rivers Edge, The Centre and Bolton Plaza properties as the Company pursues redevelopment of these properties.

|

|

2

|

Same Property net operating income is considered a non-GAAP measure because it excludes net gains from outlot sales, write offs of straight-line rent and lease intangibles, bad debt expense and related recoveries, lease termination fees and significant prior year expense recoveries and adjustments, if any.

|

The Company believes that Net Operating Income is helpful to investors as a measure of its operating performance because it excludes various items included in net income that do not relate to or are not indicative of its operating performance, such as depreciation and amortization, interest expense, and impairment, if any. The Company believes that Same Property NOI is helpful to investors as a measure of its operating performance because it includes only the NOI of properties that have been owned for the full period presented, which eliminates disparities in net income due to the redevelopment, acquisition or disposition of properties during the particular period presented, and thus provides a more consistent metric for the comparison of the Company's properties. NOI and Same Property NOI should not, however, be considered as alternatives to net income (calculated in accordance with GAAP) as indicators of the Company's financial performance