Document

EMX Royalty Corporation

Annual Information Form

Year Ended December 31, 2023

Dated as at March 21, 2024

Suite 501 -543 Granville Street

Vancouver, British Columbia V6C 1X8

Canada

Tel: 604.688.6390

Fax: 604.688.1157

Email: info@EMXroyalty.com

Website: www.EMXroyalty.com

TABLE OF CONTENTS

Annual Information Form

(Expressed in U.S. Dollars, except where indicated)

Preliminary Notes

Date of Information

Unless otherwise indicated, all information contained in this Annual Information Form ("AIF") is as of December 31, 2023.

Currency and Exchange Rates

In this AIF, all references to "Canadian dollars" and to "C$" are to Canadian dollars, references to "U.S. dollars" and to "$" and "US$" are to United States dollars. The Bank of Canada noon buying rates for the purchase of one United States dollar using Canadian dollars were as follows for the indicated periods:

| | | | | | | | | | | |

| For the years ended December 31, |

| | 2023 | 2022 | 2021 |

| End of period | 1.3544 | 1.3544 | 1.2697 |

| High for the period | 1.3875 | 1.3856 | 1.2926 |

| Low for the period | 1.3128 | 1.2451 | 1.2046 |

| Average for the period | 1.3497 | 1.3013 | 1.2535 |

The Bank of Canada noon buying rate on March 21, 2024, for the purchase of one United States dollar using Canadian dollars was C$1.3525 (one Canadian dollar on that date equalled US$0.7394).

Glossary, Conversions, and Abbreviations

Glossary of Geological and Mining Terms

Alluvium: Loose detrital material deposited by running water.

Assay: a quantitative chemical analysis of an ore, mineral or concentrate to determine the amount of specific elements.

Breccia: a coarse-grained clastic rock, composed of broken rock fragments held together by a mineral cement or in a fine-grained matrix.

Carbonate replacement deposit: polymetallic deposits formed via the replacement of sedimentary, carbonate host rocks by metal-bearing hydrothermal fluids sourced from an intrusive body.

CIM: the Canadian Institute of Mining, Metallurgy and Petroleum.

CIM Definition Standards: the CIM Definition Standards on Mineral Resources and Mineral Reserves adopted by CIM Council, as amended.

Colluvium: an accumulation of unconsolidated sediments and rock fragments at the base of a slope.

Dacite: an igneous extrusive rock with a felsic (silica rich) chemical composition that is the extrusive equivalent of a granodiorite.

Doré: a mixture of predominantly gold and silver produced by a mine, usually in a bar form, before separation and refining into gold and silver by a refinery.

Epithermal: a hydrothermal mineral deposit formed within about 1 kilometer of the Earth's surface and in the temperature range of 50ºC to 200ºC.

Feasibility study is defined in the CIM Definition Standards as a comprehensive technical and economic study of the selected development option for a mineral project that includes appropriately detailed assessments of applicable Modifying Factors together with any other relevant operational factors and detailed financial analysis that are necessary to demonstrate, at the time of reporting, that extraction is reasonably justified (economically mineable). The results of the study may reasonably serve as the basis for a final decision by a proponent or financial institution to proceed with, or finance, the development of the project. The confidence level of the study will be higher than that of a pre-feasibility study.

| | | | | | | | | | | | | | | | | |

| TSX.V: EMX.V / NYSE: EMX | | | EMX ROYALTY CORPORATION | | 4 |

Annual Information Form

(Expressed in U.S. Dollars, except where indicated)

Ferricrete: hard crust or layer of sedimentary rock in soils that has been cemented by iron oxides.

Formation: a persistent body of igneous, sedimentary, or metamorphic rock, having easily recognizable boundaries that can be traced in the field without resorting to detailed paleontologic or petrologic analysis, and large enough to be represented on a geologic map as a practical or convenient unit for mapping and description.

Gossan: a weathered, oxidized surface zone overlying a sulfide deposit.

Greenschist facies: regional metamorphism formed under relatively low temperature (300 - 450°C) and pressure conditions.

High-sulfidation epithermal deposits: mineral deposits formed by acidic hydrothermal fluids with high sulfur fugacity, directly associated with a magmatic intrusion.

Hydrothermal: of or pertaining to hot water, to the action of hot water, or to the products of this action, such as a mineral deposit precipitated from a hot aqueous solution, with or without demonstrable association with igneous processes.

Indicated mineral resource: is defined in NI 43-101 as that part of a mineral resource for which quantity, grade or quality, densities, shape and physical characteristics are estimated with a level of sufficient confidence to allow the application of Modifying Factors in sufficient detail to support mine planning and evaluation of the economic viability of the deposit. The estimate is based on detailed and reliable exploration and test information gathered through appropriate techniques from locations such as outcrops, trenches, pits, workings and drill holes that are spaced closely enough for geological and grade continuity to be reasonably assumed.

Inferred mineral resource: is defined in NI 43-101 as that part of a mineral resource for which the quantity and grade or quality are estimated on the basis of limited geological evidence and sampling. Geological evidence is sufficient to imply, but not verified, geological and grade or quality continuity. The estimate is based on limited information and sampling gathered through appropriate techniques from locations such as outcrops, trenches, pits, workings and drill holes.

JORC Code: means the Australasian Code for Reporting of Exploration Results, Mineral Resources and Ore Reserves prepared by Joint Ore Reserves Committee of the Australasian Institute of Mining and Metallurgy, Australian Institute of Geoscientists and Minerals Council of Australia.

Kriging: a weighted, moving-average interpolation method in which the set of weights assigned to samples minimizes the estimation variance, which is computed as a function of the variogram model and locations of the samples relative to each other, and to the point or block being estimated.

Leach: to dissolve minerals or metals out of rock with chemicals.

Measured mineral resource: is defined in NI 43-101 as that part of a mineral resource for which quantity, grade or quality, densities, shape and physical characteristics are estimated with confidence sufficient to allow the application of Modifying Factors to support detailed mine planning and final evaluation of the economic viability of the deposit. The estimate is based on detailed and reliable exploration, sampling and testing information gathered through appropriate techniques from locations such as outcrops, trenches, pits, workings and drill holes that are spaced closely enough to confirm both geological and grade continuity.

Meta: a prefix that, when used with the name of a sedimentary or igneous rock, indicates that the rock has been metamorphosed.

Metamorphic rock: rock which has been changed from igneous or sedimentary rock through heat and pressure into a new form of rock.

Mineral reserve: is defined in NI 43-101 as the economically mineable part of a measured and/or indicated mineral resource. It includes diluting materials and allowances for losses, which may occur when the material is mined or extracted and is defined by studies at pre-feasibility or feasibility level, as appropriate that includes application of Modifying Factors. Such studies demonstrate that, at the time of reporting, extraction could be reasonably justified.

| | | | | | | | | | | | | | | | | |

| TSX.V: EMX.V / NYSE: EMX | | | EMX ROYALTY CORPORATION | | 5 |

Annual Information Form

(Expressed in U.S. Dollars, except where indicated)

Mineral resource: is defined in NI 43-101 as a concentration or occurrence of solid material in or on the Earth's crust in such form, grade or quality and quantity that there are reasonable prospects for economic extraction. The location, quantity, grade or quality, continuity and other geological characteristics of a mineral resource are known, estimated or interpreted from specific geological evidence and knowledge, including sampling.

Modifying Factors is defined in the CIM Definition Standards as considerations used to convert mineral resources to mineral reserves. These include, but are not restricted to, mining, processing, metallurgical, infrastructure, economic, marketing, legal, environmental, social and governmental factors.

Monzogranite: felsic, coarse-grained, intrusive igneous rock with subequal amounts of plagioclase and potassium feldspar.

Net smelter return royalty or NSR royalty: a type of royalty based on a percentage of the proceeds, net of smelting, refining and transportation costs and penalties, from the sale of metals extracted from concentrate and doré by the smelter or refinery.

NI 43-101: National Instrument 43-101 Standards of Disclosure for Mineral Projects of the Canadian Securities Administrators, which sets standards for all public disclosure made of scientific and technical information concerning mineral projects.

Oxide: a compound of ore that has been subjected to weathering and alteration as a result of exposure to oxygen for a long period of time.

PERC Code: means the Pan-European Code for Reporting of Exploration Results, Mineral Resources and Reserves prepared by the Pan-European Reserves and Resources Reporting Committee.

Phyllic alteration: Hydrothermal alteration often associated with porphyry systems which is characterized by sericite, quartz, and pyrite.

Porphyry: igneous rock consisting of large-grained crystals dispersed in a fine-grained matrix or ground mass.

Potassic alteration: Hydrothermal alteration often associated with porphyry systems which is characterized by potassium feldspar and secondary biotite.

Preliminary feasibility study or pre-feasibility study is defined in the CIM Definition Standards as a comprehensive study of a range of options for the technical and economic viability of a mineral project that has advanced to a stage where a preferred mining method, in the case of underground mining, or the pit configuration, in the case of an open pit, is established and an effective method of mineral processing is determined. It includes a financial analysis based on reasonable assumptions on the Modifying Factors and the evaluation of any other relevant factors which are sufficient for a qualified person, acting reasonably, to determine if all or part of the mineral resource may be converted to a mineral reserve at the time of reporting. Such a study is at a lower confidence level than a feasibility study.

Probable mineral reserve: is defined in NI 43-101 as the economically mineable part of an indicated, and in some circumstances, a measured mineral resource. The confidence in the Modifying Factors applying to a probable mineral reserve is lower than that applying to a proven mineral reserve. Probable mineral reserve estimates must be demonstrated to be economic, at the time of reporting, by at least a preliminary feasibility study.

Proven mineral reserve: is defined in NI 43-101 as the economically mineable part of a measured mineral resource. A proven mineral reserve implies a high degree of confidence in the Modifying Factors. Proven mineral reserve estimates must be demonstrated to be economic, at the time of reporting, by at least a preliminary feasibility study.

Pyroclastic: pertaining to clastic rock material formed by volcanic explosion or aerial expulsion from a volcanic vent; also, pertaining to rock texture of explosive origin.

Rhyodacite: fine-grained, extrusive igneous rock that is intermediate in composition between rhyolite and dacite; the extrusive equivalent to granodiorite.

Schist: a strongly foliated crystalline metamorphic rock, which readily splits into sheets or slabs as a result of the planar alignment of the constituent crystals. The constituent minerals are commonly specified (e.g. “quartz-muscovite-chlorite schist”).

SEDAR+: System for Electronic Document Analysis and Retrieval of the Canadian Securities Administrators +.

| | | | | | | | | | | | | | | | | |

| TSX.V: EMX.V / NYSE: EMX | | | EMX ROYALTY CORPORATION | | 6 |

Annual Information Form

(Expressed in U.S. Dollars, except where indicated)

Sericite: fine-grained white mica.

Silicification: the introduction of, or replacement by, silica, generally resulting in the formation of fine-grained quartz, chalcedony, or opal, which may fill pores and replace existing minerals.

Skarn: metamorphic rock formed by metasomatic replacement and alteration of carbonate-bearing country rocks by hydrothermal fluids adjacent to an intrusive body.

Strike: the direction, or course or bearing of a vein or rock formation measured on a level surface.

Strip (or stripping) ratio: the tonnage or volume of waste material that must be removed to allow the mining of one tonne of ore in an open pit.

Sulfides or sulphides: compounds of sulfur (or sulphur) with other metallic elements.

Supergene: near-surface enrichment process during which fluids leach metals, descend, and reprecipitate them.

Tailing: material rejected from a mill after the recoverable valuable minerals have been extracted.

Talus: an accumulation of coarse rock debris along the base of a cliff or slope.

Vein: sheet-like body of minerals formed by fracture filling or replacement of host rock.

Conversions

| | | | | | | | |

| Linear Measurements | | |

| | |

| 1 inch | = | 2.54 centimeters |

| 1 foot | = | 0.3048 meter |

| 1 yard | = | 0.9144 meter |

| 1 mile | = | 1.609 kilometers |

| | | | | | | | |

| Area Measurements | | |

| | |

| 1 acre | = | 0.4047 hectare |

| 1 hectare | = | 2.471 acres |

| 1 square mile | = | 640 acres or 259 hectares or 2.590 square kilometers |

| | | | | | | | |

| Units of Weight | | |

| | |

| 1 short ton | = | 2000 pounds or 0.893 long ton |

| 1 long ton | = | 2240 pounds or 1.12 short tons |

| 1 metric tonne | = | 2204.62 pounds or 1.1023 short tons |

| 1 pound (16 oz.) | = | 0.454 kilograms or 14.5833 troy ounces |

| 1 troy oz. | = | 31.1035 grams |

| 1 troy oz. per short ton | = | 34.2857 grams per metric ton |

| | | | | | | | | | | | | | | | | |

| TSX.V: EMX.V / NYSE: EMX | | | EMX ROYALTY CORPORATION | | 7 |

Annual Information Form

(Expressed in U.S. Dollars, except where indicated)

Analytical

| | | | | | | | | | | |

| Analytical | percent | grams per metric tonne | troy oz per short ton |

| 1% | 1% | 10,000 | 291.667 |

| 1 gram/tonne | 0.0001% | 1 | 0.029167 |

| 1 troy oz./short ton | 0.003429% | 34.2857 | 1 |

| 10 ppb | nil | 0.01 | 0.00029 |

| 100 ppm | 0.01 | 100 | 2.917 |

Temperature

| | | | | | | | |

| Degrees Fahrenheit | = | (°C x 1.8) + 32 |

| Degrees Celsius | = | (°F - 32) x 0.556 |

Frequently Used Abbreviations and Symbols

| | | | | |

| AAR | annual advance royalty |

| AgEq | silver equivalent |

| AMR | advance minimum royalty |

| Ag | silver |

| As | arsenic |

| Au | gold |

| °C | degrees Celsius (centigrade) |

| C.P.G. | Certified Professional Geologist |

| Co | cobalt |

| CRD | carbonate replacement deposit |

| CRM | certified reference materials |

| CSAMT | Controlled source audio-frequency magnetotellurics |

| Cu | copper |

| CuAS | acid-soluble copper |

| CuCNS | cyanide-soluble copper |

| CuT | total copper |

| Cu Tsol | total soluble copper |

| FS | feasibility study |

| g | gram(s) |

| g/t | grams per tonne |

| HS | high-sulfidation |

| JORC | Joint Ore Reserves Committee |

| JV | joint venture |

| km | kilometer |

| koz | thousand ounces |

| Ktonnes/kt | thousand tonnes |

| kV | kilovolts |

| lb | pounds |

| | | | | | | | | | | | | | | | | |

| TSX.V: EMX.V / NYSE: EMX | | | EMX ROYALTY CORPORATION | | 8 |

Annual Information Form

(Expressed in U.S. Dollars, except where indicated)

| | | | | |

| LOM | life of mine |

| l/s | liters per second |

| m | meter(s) |

| masl | meters above sea level |

| MD&A | Management's Discussion & Analysis |

| Mlb | million pounds |

| Mn | manganese |

| Mo | molybdenum |

| Moz | million ounces |

| Mt | million tonnes |

| Ni | nickel |

| NSR | net smelter returns |

| NVB | net value per block |

| OP | open pit |

| oz | troy ounce |

| Pb | lead |

| Pd | palladium |

| PEA | preliminary economic assessment |

| PFS | pre-feasibility study |

| PGE | platinum group element |

| ppb | parts per billion |

| ppm | parts per million |

| Pt | platinum |

| Q1, Q2, Q3, Q4 | first, second, third and fourth financial quarters |

| QA | quality assurance |

| QC | quality control |

| QP | Qualified Person |

| RC drilling | reverse circulation drilling |

| RMR | rock mass rating |

| ROM Pad | run of mine/mill pad |

| RQD | rock quality designation |

| T | tonnes |

| t | tons |

| tpa/ktpa | tonnes per annum, thousand tonnes per annum |

| tph | tonnes per hour |

| TSF | tailing storage facility |

| UG | underground |

| UTM | Universal Transverse Mercator System |

| VMS | volcanogenic massive sulfide |

| yd | yard |

| Zn | zinc |

| | | | | | | | | | | | | | | | | |

| TSX.V: EMX.V / NYSE: EMX | | | EMX ROYALTY CORPORATION | | 9 |

Annual Information Form

(Expressed in U.S. Dollars, except where indicated)

Forward-Looking Information

This AIF may contain “forward-looking statements” that reflect the Company's current expectations and projections about its future results. These forward-looking statements may include statements regarding perceived merit of properties, exploration results and budgets, mineral reserves and mineral resource estimates, work programs and proposed exploration, development and production activities, capital expenditures, operating costs, cash flow estimates, production estimates and similar statements relating to the economic viability of a project, timelines, strategic plans, completion of transactions, market prices for metals, future payments that the Company is to make or receive pursuant to agreements to which it is subject, future purchases of Common Shares pursuant to the Company’s normal course issuer bid, statement as to future payment of dividends, or other statements that are not statements of fact. These statements relate to analyses and other information that are based on forecasts of future results, estimates of amounts not yet determinable and assumptions of management. Statements concerning mineral resource or mineral reserve estimates may also be deemed to constitute “forward-looking statements” to the extent that they involve estimates of the mineralization that will be encountered if the property is developed.

Any statements that express or involve discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, assumptions or future events or performance (often, but not always, identified by words or phrases such as “expects”, “anticipates”, “believes”, “plans”, “projects”, “estimates”, “assumes”, “intends”, “strategy,” “goals”, “objectives”, “potential”, “possible” or variations thereof or stating that certain actions, events, conditions or results “may”, “could”, “would”, “should”, “might” or “will” be taken, occur or be achieved, or the negative of any of these terms and similar expressions) are not statements of historical fact and may be forward-looking statements.

Forward-looking statements are based on a number of material assumptions, including those listed below, which could prove to be significantly incorrect:

•estimated production at any of the mineral properties in which the Company has a royalty, or other interest remains accurate;

•estimated capital costs, operating costs, production and economic returns remain accurate;

•estimated metal pricing, metallurgy, mineability, marketability and operating and capital costs, together with other assumptions underlying the Company's mineral resource and mineral reserve estimates, remains accurate;

•the expected ability of any of the properties in which the Company holds a royalty, or other interest to develop adequate infrastructure at a reasonable cost remains accurate;

•the Company and its counterparties will satisfy their obligations in accordance with the agreements that they are party to;

•the Company will continue to be able to fund or obtain funding for outstanding commitments;

•the Company will be able to source accretive royalties and royalty generation properties;

•that neither the Company nor any owner or operator of any of the properties in which the Company holds a royalty, or other interest will suffer significant impacts as a result of an epidemic or other natural disaster;

•that trading of the Common Shares will not be adversely affected by the differences in liquidity, settlement and clearing systems as a result of being listed on both the TSX-V and the NYSE American and will not be suspended;

•that the Company properly considered the application of applicable tax laws to its structure and operations and filed its tax returns and paid taxes in compliance with applicable tax laws;

•assumptions that all necessary permits and governmental approvals will be obtained;

•assumptions made in the interpretation of drill results, the geology, grade and continuity of the mineral deposits of any of the properties in which the Company holds a royalty or other interest remain accurate;

•expectations regarding demand for equipment, skilled labor and services needed for exploration and development of mineral properties in which the Company holds a royalty or other interest remain accurate; and

•the activities on any on the properties in which the Company holds a royalty, or other interest will not be adversely disrupted or impeded by development, operating or regulatory risks or any other government actions and will continue to operate in accordance with public statements.

| | | | | | | | | | | | | | | | | |

| TSX.V: EMX.V / NYSE: EMX | | | EMX ROYALTY CORPORATION | | 10 |

Annual Information Form

(Expressed in U.S. Dollars, except where indicated)

Forward-looking statements are subject to a variety of known and unknown risks, uncertainties and other factors that could cause actual events or results to differ from those reflected in the forward-looking statements, including, without limitation:

•uncertainty regarding the Company’s ability to continue as a going concern;

•risks associated with exploration, development, operating, expansion and improvement at the properties in which the Company holds a royalty interest;

•the risk that the Company may be unable to satisfy conditions under its property option agreements and earn an interest in the properties subject to such agreements;

•risks associated with fluctuations in the price of commodities;

•the absence of control over mining operations on the properties in which the Company holds a royalty interest and is dependent on third party operators to explore, develop and mine such properties ;

•risks associated with having to rely on the public disclosure and other information the Company receives from the owners and operators of the properties on which the Company holds a royalty interest as the basis for the Company’s analyses, forecasts and assessments relating to the Company’s business;

•risks relating to unknown defects and impairments in the Company’s royalty or other interests;

•risks related to the satisfaction of each party’s obligations in accordance with the terms of the Company’s royalty agreements, including the ability of the companies with which the Company has royalty agreements to perform their obligations under those agreements;

•the Company’s royalty and other interests may be subject to rights of other interest holders, including buy-down rights, pre-emptive rights, claw-back rights and the rights to dispose of property interests;

•risks related to the ability of any of the properties in which the Company holds a royalty, or other interest to commence production and generate material revenues and uncertainty that the Company will receive additional revenues from staged option payments, advanced annual royalty payments, management or operators fees and other sources;

•risks associated with EMX’s exploration partners being unable to obtain adequate financing to fund exploration and development activities;

•risks related to governmental regulation and permits, including environmental regulation;

•the risk that permits and governmental approvals necessary to develop and operate mines on the properties in which the Company holds a royalty, or other interest will not be available on a timely basis or at all;

•risks related to political uncertainty or instability in countries where the Company's mineral properties are located;

•risks of significant impacts on EMX or the properties on which EMX holds a royalty or other interests as a result of an epidemic or natural disaster;

•risks that the Company may not be able to obtain adequate financing when needed;

•volatility in the Company’s share price;

•uncertainties relating to the assumptions underlying the Company's mineral resource and mineral reserve estimates, such as metal pricing, metallurgy, mineability, marketability and operating and capital costs;

•risks associated with competition in the mineral royalty industry;

•risks related to the declaration, timing and payment of dividends;

•uncertainty related to title to the mineral properties of any of the properties in which the Company holds a royalty, or other interest;

•risks associated with fluctuations in prices of foreign currencies , including currency hedging arrangements or the lack thereof;

•unavailability of insurance for certain risks to which the Company may be subject;

| | | | | | | | | | | | | | | | | |

| TSX.V: EMX.V / NYSE: EMX | | | EMX ROYALTY CORPORATION | | 11 |

Annual Information Form

(Expressed in U.S. Dollars, except where indicated)

•environmental risks and hazards;

•risks related to global climate change and the impacts of legislation in responses thereto;

•the Company's dependence on, and need to attract and retain, qualified management and technical personnel;

•risks related to conflicts of interest of some of the directors of the Company;

•uncertainty as to the Company's PFIC status;

•risks related to regulatory and legal compliance and increased costs relating thereto;

•risks related to the adequacy of internal control over financial reporting;

•risks related to ensuring the security and safety of information systems, including cyber security risks;

•risks related to activist shareholders;

•risks related to reputational damage;

•uncertainty as to the outcome of potential litigation;

•mine operator and counterparty concentration risks;

•the Company’s dependence on receiving royalty and other payments from the owners or operators of its relevant royalty properties;

•indebtedness risks;

•risks related to royalties or other interest that permit cost deductions;

•risks associated with significant transactions;

•risks related to market events and general economic conditions;

•the Company’s interpretation of, or compliance with, or application of, tax laws and regulations or accounting policies and rules, being found to be incorrect or the tax impact to the Company’s business operations being materially different than currently contemplated;

•the inability to replace and expand mineral reserves, including anticipated timing of the commencement of production by certain mining operations from which the company holds a royalty or other interest;

•risks associated with violations of anti-corruption and anti-bribery laws;

•equity price risks related to the Company’s holding of long-term investments in other companies;

•risks associated with multiple listings of Common Shares on the TSX-V and the NYSE American and the possible suspension of trading of Common Shares;

•risks related to enforcing civil judgments obtained in Canada in other jurisdictions;

•risks related to environmental, social and governance related issues;

•lack of suitable supplies, infrastructure and employees to support the mining operations at the properties on which the Company holds a royalty or other interest;

•uncertainties related to indigenous rights with respect to the mineral properties; and

•risks associated with potential changes to mining legislation in Chile.

This list is not exhaustive of the factors that may affect any of the Company's forward-looking statements. Forward-looking statements are statements about the future and are inherently uncertain, and actual achievements of the Company or other future events or conditions may differ materially from those reflected in the forward-looking statements due to a variety of risks, uncertainties and other factors, including, without limitation, those referred to under the heading “Risks and Uncertainties” in the AIF (as defined below), which is incorporated by reference herein.

| | | | | | | | | | | | | | | | | |

| TSX.V: EMX.V / NYSE: EMX | | | EMX ROYALTY CORPORATION | | 12 |

Annual Information Form

(Expressed in U.S. Dollars, except where indicated)

The Company's forward-looking statements are based on the beliefs, expectations and opinions of management on the date the statements are made, and the Company does not assume any obligation to update forward-looking statements if circumstances or management's beliefs, expectations or opinions should change, except as required by law. For the reasons set forth above, investors should not place undue reliance on forward-looking statements.

More information about the Company including its recent financial reports is available on SEDAR+ at www.sedarplus.ca. The Company's Annual Report on Form 40-F, including the recent financial reports, is available on the Electronic Data, Gathering, Analysis, and Retrieval (“EDGAR”) database of the United States Securities and Exchange Commission’s (“SEC”) at www.sec.gov and on the Company's website at www.EMXroyalty.com.

Cautionary Notes Regarding Mineral Reserve and Resource Estimates

This AIF has been prepared in accordance with the requirements of Canadian securities laws in effect in Canada, which differ from the requirements of U.S. securities laws. Unless otherwise indicated, all mineral resource and mineral reserve estimates included in this AIF have been disclosed by the Company in accordance with NI 43-101 and the CIM Definition Standards based on information prepared by the current or previous owners or operators of the relevant properties (as and to the extent indicated by them). NI 43-101 is a rule developed by the Canadian securities regulatory authorities which establishes standards for all public disclosure an issuer makes of scientific and technical information concerning mineral projects.

Historical Estimates. An historical estimate is defined by NI 43-101 as “an estimate of the quantity, grade, or metal or mineral content of a deposit that an issuer has not verified as a current mineral resource or mineral reserve, and which was prepared before the issuer acquiring, or entering into an agreement to acquire, an interest in the property that contains the deposit”. NI 43-101 permits disclosure of an historical estimate that does not comply with NI 43-101 using the historical terminology if, among other things, the disclosure: (a) identifies the source and date of the historical estimate; (b) comments on the relevance and reliability of the historical estimate; (c) states whether the historical estimate uses categories other than those prescribed by NI 43-101; and (d) includes any more recent estimates or data available.

Mineral Resource and Reserve Disclosures According to an Acceptable Foreign Code. Under NI 43-101, “Acceptable Foreign Code” means the JORC Code, the PERC Code, the SAMREC Code, SEC Industry Guide 7 (now Regulation S-K 1300 as defined below), the Certification Code, or any other code, generally accepted in a foreign jurisdiction, that defines mineral resources and mineral reserves in a manner that is consistent with mineral resource and mineral reserve definitions and categories set out in sections 1.2 and 1.3 of NI 43-101..

NI 43-101 permits an issuer to make disclosure and file a technical report that uses mineral resource and mineral reserve categories of an Acceptable Foreign Code in certain circumstances, if the issuer includes in the technical report a reconciliation of any material differences between the mineral resource and mineral reserve categories used and the categories set out in sections 1.2 and 1.3 of NI 43-101.

As such, in addition to NI 43-101, certain estimates referenced in this AIF have been prepared in accordance with the JORC Code or the PERC Code (as such terms are defined in NI 43-101), which differ from the requirements of NI 43-101 and U.S. securities laws. Accordingly, information containing descriptions of the Company's mineral properties may not be comparable to similar information made public by Canadian or U.S. reporting companies. For more information, see “Reconciliation to CIM Definitions” below.

Reconciliation to CIM Definitions. In this AIF, EMX has disclosed current mineral reserve and mineral resource estimates as well as certain historical estimates covering royalty properties that are not based on CIM Definition Standards, but are based on Acceptable Foreign Code or in reliance on the “historical estimates” provisions of NI 43-101. In each case, the estimates reported in this AIF are based on estimates disclosed by the relevant property owner or operator, without reference to the underlying data used to calculate the estimates. Accordingly, EMX is not able to definitively reconcile these estimates with that of CIM Definition Standards.

However, with respect to the Acceptable Foreign Codes used in this AIF, EMX believes that while the CIM Definition Standards are not identical to those of the JORC Code or the PERC Code, the mineral resource and mineral reserve definitions and categories are substantively the same as the CIM definitions mandated in NI 43-101 and will typically result in reporting of substantially similar mineral reserve and mineral resource estimates.

| | | | | | | | | | | | | | | | | |

| TSX.V: EMX.V / NYSE: EMX | | | EMX ROYALTY CORPORATION | | 13 |

Annual Information Form

(Expressed in U.S. Dollars, except where indicated)

With respect to the “historical estimates”, the prescribed disclosure is included in this AIF in the relevant property descriptions or in Appendix “B”, as applicable.

With respect to United States investors, there are two important provisos to this assertion, being (i) SEC Industry Guide 7, which has been replaced by Regulation S-K 1300 effective as of January 1, 2021, prohibited the reporting of mineral resources, and only permitted reporting of mineral reserves, and (ii) it is now generally accepted practice that the SEC expects to see metals prices based on historical three year average prices, while each of CIM and the other JORC Code or the PERC Code permits the author of a mineral resource or mineral reserve estimate to use his or her discretion to establish reasonable assumed metal prices.

Technical and Third-Party Information

Except where otherwise stated herein, the disclosure in this AIF relating to properties and operations on the properties in respect of which EMX holds royalty or other similar interests, including under the headings “General Development of the Business”, “Mineral Properties“, “Technical Information“, Appendix A and Appendix B is based on information publicly disclosed by the owners or operators of these properties and other information and data available in the public domain as at December 31, 2023 (except where stated otherwise) and none of this information has been independently verified EMX.

As a royalty holder, EMX frequently has limited, if any, access to properties included in its royalty asset portfolio. Additionally, EMX may from time to time receive information from the owners and operators of the properties, which the Company is not permitted to disclose to the public. EMX is dependent on operators of the properties and their qualified persons for information, or on publicly available information, to prepare disclosure pertaining to properties and operations on the properties for which EMX holds royalty interests. EMX generally has limited or no ability to independently verify such information. Although EMX does not have any knowledge that such information may not be accurate, there can be no assurance that such third party information is complete or accurate.

The assumptions and methodologies underpinning estimates of mineral resources and mineral reserves on a property, and the classification of mineralization in categories of measured, indicated and inferred and proven and probable within the estimates of mineral resources and mineral reserves, respectively, and the assumptions and methodologies employed in proposed mining and recovery processes and production plans, were made by owners or operators and their qualified persons. EMX generally has limited or no ability to independently verify such information. EMX has not verified, and is not in a position to verify, the accuracy, completeness or fairness of such third-party information and refers the reader to the public reports filed by the operators for information regarding the properties in which EMX holds a royalty or similar interest. Although EMX does not believe that such information is inaccurate or incomplete in any material respect, there can be no assurance that such third-party information is complete or accurate. For the avoidance of doubt, nothing stated in this paragraph operates to relieve the Company from liability for any misrepresentation contained in this AIF under applicable Canadian securities laws.

Some information publicly reported by operators may relate to a larger property than the area covered by EMX’s royalty or other similar interest. EMX’s royalty or other similar interests in certain cases cover less than 100% and sometimes only a portion of the publicly reported mineral reserves, mineral resources and production of a property. In addition, numerical information presented in this AIF which has been derived from information publicly disclosed by owners or operators may have been rounded by EMX and, therefore, there may be some inconsistencies between the numerical information presented in this AIF and the information publicly disclosed by owners and operators.

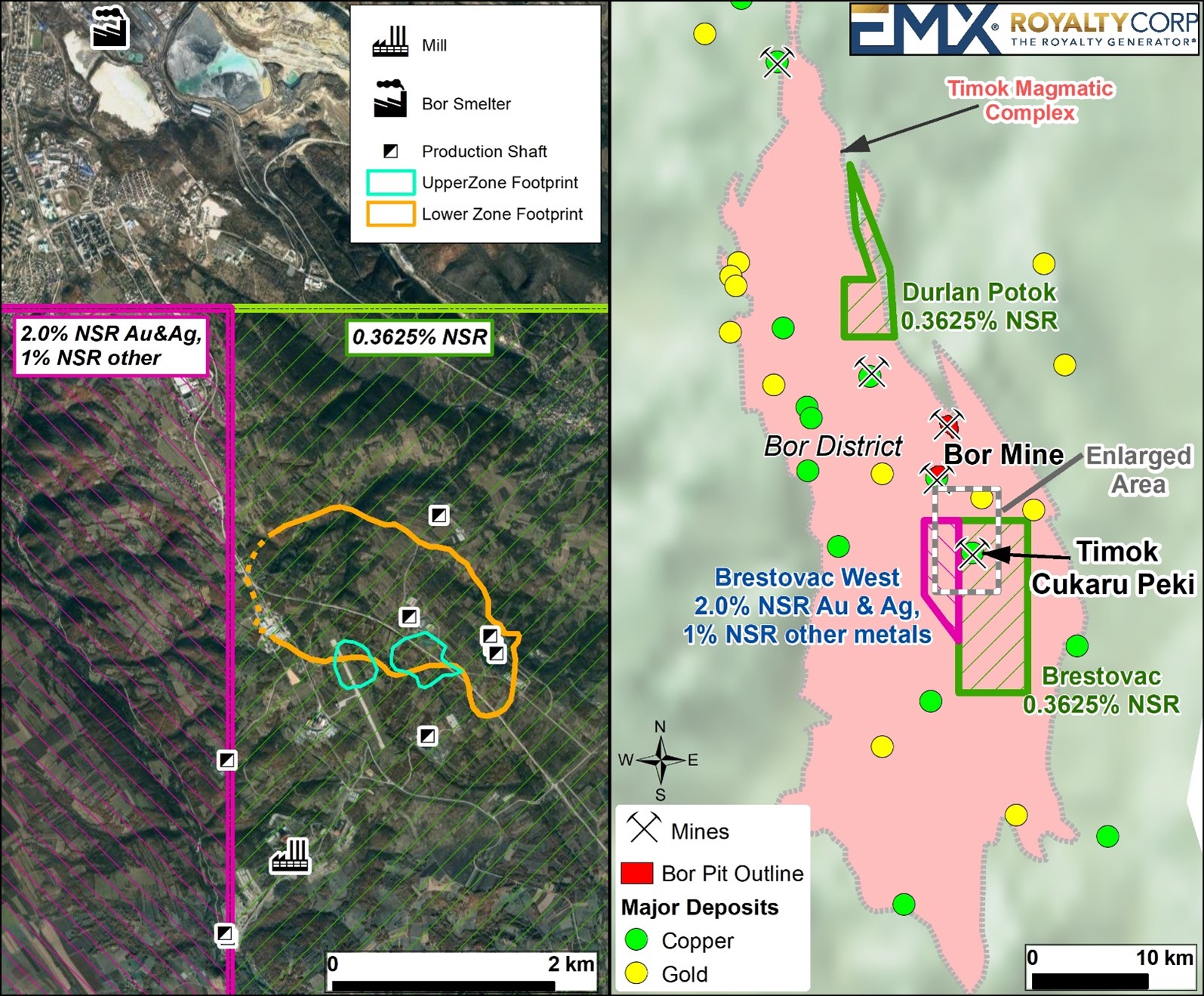

As of the date of this AIF, EMX considers its interests in the Gediktepe Mine in Türkiye, the Timok Project in Serbia and the Caserones Mine in Chile to be its only material mineral properties for the purposes of NI 43-101. EMX will continue to assess the materiality of its assets as new assets are acquired or assets progress through stages of development into production. Information contained in this AIF with respect to each of the Gediktepe Mine in Türkiye, the Timok Project in Serbia and the Caserones Mine in Chile has been prepared in accordance with the exemption set forth in section 9.2 of NI 43-101.

Unless otherwise noted the disclosure contained in this AIF of a scientific and technical nature for the:

1.Gediktepe Mine is based on the information in the technical report entitled “Gediktepe Project - Balıkesir Province, Türkiye NI 43-101 Royalty Technical Report” dated March 21, 2022 and with an effective date of February 1, 2022, prepared by DAMA Engineering Inc. (the “Gediktepe Technical Report“) which technical report was prepared for, and filed under EMX’s SEDAR+ profile on March 31, 2022.

| | | | | | | | | | | | | | | | | |

| TSX.V: EMX.V / NYSE: EMX | | | EMX ROYALTY CORPORATION | | 14 |

Annual Information Form

(Expressed in U.S. Dollars, except where indicated)

2.Timok Project is based on the information in the technical report entitled “NI 43-101 Technical Report - Timok Copper-Gold Project Royalty, Serbia” dated March 25, 2022 and with an effective date of December 31, 2020, prepared by Mineral Resource Management LLC (the “Timok Technical Report”) which technical report was prepared for, and filed under EMX’s SEDAR+ profile on March 31, 2022.

3.Caserones Mine is based on: (i) the technical report entitled “NI 43-101 Technical Report on the Caserones Mining Operation Caserones Project Atacama Region, Chile” dated July 13, 2023 and with an effective date of December 31, 2022 (the “Caserones Technical Report”) which technical report was prepared for, and filed under, Lundin Mining Corporation’s (“Lundin”) SEDAR+ profile on July 13, 2023; (ii) the annual information form of Lundin dated February 21, 2024 and filed under Lundin’s SEDAR+ profile on February 21, 2024 (the “Lundin AIF”); (iii) the news release of Lundin dated February 8, 2024 and filed under Lundin’s SEDAR+ profile on February 8, 2024 (the “Lundin February Release”); and (iv) the news release of Lundin dated January 14, 2024 and filed under Lundin’s SEDAR+ profile on January 14, 2024 (the “Lundin January Release”).

Except as explicitly stated herein, none of the foregoing reports, documents, filings or other documents are deemed to be incorporated by reference into this AIF.

All scientific and technical information in this AIF has been reviewed and approved by the following Qualified Persons, as such term is defined pursuant to NI 43-101, as follows:

1.For information related to properties located in North America and Latin America, other than Caserones Mine, under the sections entitled “General Development of the Business” and “Mineral Properties”, for the list of Royalty Assets contained in Appendix A, for the summaries ’’of mineral reserves, historical mineral reserves, mineral resources, and historical mineral resources for EMX’s Royalty Assets contained in Appendix B, other than the Caserones Mine and Timok Project, and for all other scientific and technical information not covered by any other named expert in this section related to North America and Latin America: Michael P. Sheehan, CPG, an employee of the Company and a Qualified Person;

2.For information related to properties located in Europe, Türkiye, and Australia under the sections entitled “General Development of the Business” and “Mineral Properties”, for the summaries of the historical mineral reserves and historical mineral resources for the Timok Project contained in Appendix B and for all other scientific and technical information not covered by any other named expert in this section related to Europe, Türkiye and Australia: Eric P. Jensen, CPG, an employee of the Company and a Qualified Person;

3.For information related to Gedikepte Mine under the heading “Technical Information – Gediktepe”: DAMA's Mustafa Atalay, CPG, Senior Geologist; Metin Alemdar, MIMMM, Senior Mining and Mineral Processing Engineer; Selim Yilmaz, MIMMM, Senior Mining and Mineral Processing Engineer; and Arif Umutcan Gelisen, MIMMM, Senior Mining and Mineral Processing Engineer, independent Qualified Persons and authors of the Gediktepe Technical Report;

4.For information related to the Timok Project under the section entitled “Technical Information – Timok”: Kevin Francis, SME RM, a Qualified Person; and

5.For information related to the Caserones Mine under the section entitled “Technical Information – Caserones”, for information related to the Caserones Mine under the sections entitled “General Development of the Business” and “Mineral Properties” and for the summaries of mineral reserves and mineral resources for the Caserones Mine contained in Appendix B: Mark Ramirez, SME RM, a consultant of the Company and a Qualified Person.

Cautionary Notes to United States Investors

Regulation S-K 1300 Replacement of SEC Industry Guide 7. Mining disclosure under U.S. securities law was previously required to comply with SEC Industry Guide 7 (“SEC Industry Guide 7”) under the United States Securities Exchange Act of 1934, as amended. The SEC has adopted final rules, effective February 25, 2019, to replace SEC Industry Guide 7 with new mining disclosure rules under sub-part 1300 of Regulation S-K of the U.S. Securities Act (“Regulation S-K 1300”). As a foreign private issuer that is eligible to file reports with the SEC pursuant to the multi-jurisdictional disclosure system adopted by the securities regulatory authorities in Canada and the United States, the Company is not required to provide disclosure on its mineral properties under the Regulation S-K 1300 and instead provides disclosure under NI 43-101 and the CIM Definition Standards.

| | | | | | | | | | | | | | | | | |

| TSX.V: EMX.V / NYSE: EMX | | | EMX ROYALTY CORPORATION | | 15 |

Annual Information Form

(Expressed in U.S. Dollars, except where indicated)

Accordingly, mineral reserve and mineral resource information contained in this AIF and the documents incorporated by reference herein and therein may not be comparable to similar information disclosed by U.S. reporting companies.

Under Regulation S-K 1300, the SEC recognizes estimates of “Measured Mineral Resources”, “Indicated Mineral Resources” and “Inferred Mineral Resources”. In addition, the SEC has amended its definitions of “Proven Mineral Reserves” and “Probable Mineral Reserves” to be substantially similar to international standards. Readers are cautioned that despite efforts to harmonize U.S. mining disclosure rules with NI 43-101 and other international requirements, there are differences between the terms and definitions used in Regulation S-K 1300 and mining terms defined in the CIM Definition Standards, which definitions have been adopted by NI 43-101, and there is no assurance that any mineral reserves or mineral resources that an owner or operator may report as “proven mineral reserves”, “probable mineral reserves”, “measured mineral resources”, “indicated mineral resources” and “inferred mineral resources” under NI 43-101 would be the same had the owner or operator prepared the mineral reserve or mineral resource estimates under the standards of Regulation S-K 1300.

Inferred Mineral Resources. U.S. investors are cautioned that “inferred mineral resources” have a lower level of confidence than that applying to “indicated mineral resources” and cannot be directly converted to a “mineral reserve”. Qualified persons have determined that it is reasonably expected that the majority of the reported “inferred mineral resources” could be upgraded to “indicated mineral resources” with continued exploration. Under Canadian rules, “inferred mineral resources” may not form the basis of feasibility or pre-feasibility studies except in rare cases. Investors are cautioned not to assume that all or any part of an “inferred mineral resource” exists or is economically or legally mineable.

Corporate Structure

Name, Address and Incorporation

EMX Royalty Corporation (the “Company” or “EMX”) is a British Columbia company incorporated in Alberta on May 13, 1996 as Marchwell Capital Corp. and continued into British Columbia on September 21, 2004 and became subject to the Business Corporations Act (British Columbia).

On November 24, 2003, Marchwell underwent a reverse take-over by Southern European Exploration Ltd., which was incorporated in the Yukon Territory on August 21, 2001. On November 23, 2003, Marchwell changed its name to Eurasian Minerals Inc. On July 19, 2017, Eurasian changed its name to EMX Royalty Corporation to better reflect its business.

EMX is a reporting company under the securities legislation of British Columbia and Alberta. Its common shares without par value (“Common Shares”) are listed on the TSX Venture Exchange (“TSX-V”), and the NYSE American Exchange (“NYSE American”) under the symbol “EMX”, and also trade on the Frankfurt Stock Exchange under the symbol “6E9”.

The Company's corporate office is located at Suite 501, 543 Granville Street, Vancouver, British Columbia V6C 1X8, Canada and its telephone number is 604-688-6390. The Company's registered and records offices are located Suite 2200 HSBC Building, 885 West Georgia Street, Vancouver, British Columbia, Canada V6C 3E8.

The Company's technical office is located at 10001 W. Titan Road, Littleton, Colorado 80125, United States of America, and its telephone number is 303-973-8585.

Inter-corporate Relationships

A majority of the Company's business is carried on through its various subsidiaries. The following table illustrates the Company's material subsidiaries, including their respective jurisdiction of incorporation and the percentage of votes attaching to all voting securities of each subsidiary that are beneficially owned, controlled or directed, directly or indirectly, by the Company:

| | | | | | | | | | | | | | | | | |

| TSX.V: EMX.V / NYSE: EMX | | | EMX ROYALTY CORPORATION | | 16 |

Annual Information Form

(Expressed in U.S. Dollars, except where indicated)

| | | | | | | | | | | |

| Name | Place of Incorporation | | Ownership Percentage |

| Bullion Monarch Mining, Inc | Utah, USA | | 100 | % |

| EMX (USA) Services Corp. | Nevada, USA | | 100 | % |

| Bronco Creek Exploration Inc. | Arizona, USA | | 100 | % |

| EMX - NSW1 PTY LTD. | Australia | | 100 | % |

| EMX Broken Hill PTY LTD. | Australia | | 100 | % |

| Eurasia Madencilik Ltd. Sirketi | Türkiye | | 100 | % |

| Eurasian Royalty Madencilik Anonim Sirketi | Türkiye | | 100 | % |

| EMX Morocco Corp. | Morocco | | 100 | % |

| EMX Scandinavia AB | Sweden | | 100 | % |

| Viad Royalties AB | Sweden | | 100 | % |

| EMX Finland OY | Finland | | 100 | % |

| EMX Norwegian Services AS | Norway | | 100 | % |

| EMX Chile SpA | Chile | | 100 | % |

| Minera Tercero SpA | Chile | | 50 | % |

Description of the Business

Overview

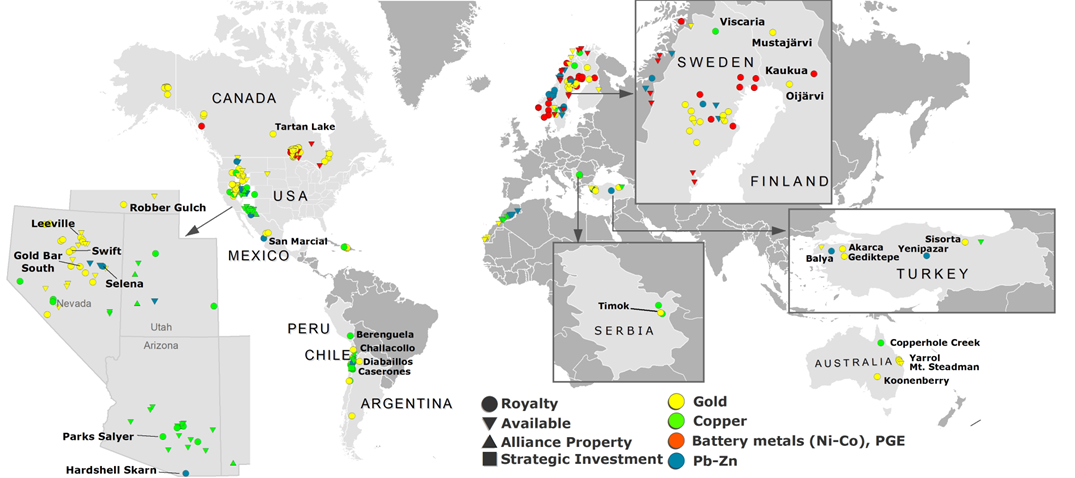

EMX Royalty Corporation is in the business of organically generating royalties derived from a portfolio of mineral property interests. The Company augments royalty generation with royalty acquisitions and strategic investments. EMX's royalty and mineral property portfolio consists of 282 properties in North America, Europe, Türkiye, Latin America, Morocco and Australia. The Company's portfolio is comprised of the following:

| | | | | |

| Producing Royalties | 6 |

| Advanced Royalties | 11 |

| Exploration Royalties | 149 |

| Royalty Generation Properties | 116 |

Strategy

EMX's strategy is to provide our shareholders and other stakeholders exposure to exploration success and commodity upside through successful implementation of our royalty business. The Company believes in having a strong, balanced exposure to precious and base metals with an emphasis on gold and copper. The three key components of the Company's business strategy are summarized as:

•Royalty Generation and Project Evaluation. EMX's 20-year track record of successful exploration initiatives has developed into an avenue to organically generate mineral property royalty interests. The strategy is to leverage in-country geologic expertise to acquire prospective properties on open ground, and to build value through low-cost work programs and targeting. These properties are sold or optioned to partner companies for retained royalty interests, advance minimum royalty ("AMR") payments and annual advance royalty ("AAR") payments, project milestone payments, and other consideration that may include equity interests. Pre-production payments provide early-stage cash flows to EMX, while the operating companies build value through exploration and development. EMX participates in project upside optionality at no additional cost, with the potential for future royalty payments upon the commencement of production.

•Royalty Acquisition. The purchase of royalty interests allows EMX to acquire assets that range from producing mines to development projects. In conjunction with the acquisition of producing and pre-production royalties in the base metals, precious metals, and battery metals sectors, the Company will also consider other cash flowing royalty acquisition opportunities including the energy sector.

| | | | | | | | | | | | | | | | | |

| TSX.V: EMX.V / NYSE: EMX | | | EMX ROYALTY CORPORATION | | 17 |

Annual Information Form

(Expressed in U.S. Dollars, except where indicated)

•Strategic Investment. An important complement to EMX's royalty generation and royalty acquisition initiatives comes primarily from strategic equity investments in companies with what EMX considers to be under-valued mineral assets that have upside exploration or development potential. Exit strategies can include equity sales, royalty positions, or a combination of both.

EMX has a combination of producing royalties, advanced royalty projects and early-stage exploration royalty properties providing shareholder's exposure to immediate cash flow, near-term development of mines, and long-term exposure to class leading discoveries. Unlike other royalty companies, EMX has focused a significant portion of its expertise and capital toward organically generating royalties. We believe putting people on the ground generating ideas and partnering with major and junior companies is where EMX can generate the highest return for our shareholders. This diversified approach towards the royalty business provides a foundation for supporting EMX's growth and increasing shareholder value over the long term.

Specialized Skill and Knowledge

All aspects of EMX's business require specialized skills and knowledge. Such skills and knowledge include the areas of geology, finance, accounting and law.

Competitive Conditions

Competition in the mineral exploration and royalty industry is intense. EMX competes with other companies, many of which have greater financial resources and technical facilities, for the acquisition and exploration of royalty and mineral property interests, as well as for the recruitment and retention of qualified employees and consultants.

Raw Materials (Components)

Other than water and electrical or mechanical power - all of which are readily available on or near its properties - EMX does not require any raw materials with which to carry out its business.

Intangible Property

EMX does not have any need for nor does it use any brand names, circulation lists, patents, copyrights, trademarks, franchises, licenses, software (other than commercially available software), subscription lists or other intellectual property in its business.

Business Cycle & Seasonality

EMX's business model is diversified in order to address impacts from commodity prices and business cycles, however, its business is not seasonal.

Economic Dependence

EMX's business is not substantially dependent on any contract such as a contract to sell the major part of its products or services or to purchase the major part of its requirements for goods, services or raw materials, or on any franchise or license or other agreement to use a patent, formula, trade secret, process or trade name upon which its business depends.

Renegotiation or Termination of Contracts

It is not expected that EMX's business will be affected in the current financial year by the renegotiation or termination of contracts or sub-contracts.

Environmental Protection

All phases of EMX's exploration are subject to environmental regulation in the various jurisdictions in which it operates.

Environmental legislation is evolving in a manner which requires stricter standards and enforcement, increased fines and penalties for non-compliance, more stringent environmental assessments of proposed projects and a heightened degree of responsibility for companies and their officers, directors and employees. While manageable, EMX expects this evolution (which affects most mineral exploration and royalty companies) might result in increased costs. Although EMX does not operate any mining assets, we believe we can make a positive impact by investing in streams and royalties on mines and projects where we believe environmental, social and governance (“ESG”) is well managed by our counterparties. ESG is a key filter and gating item,

| | | | | | | | | | | | | | | | | |

| TSX.V: EMX.V / NYSE: EMX | | | EMX ROYALTY CORPORATION | | 18 |

Annual Information Form

(Expressed in U.S. Dollars, except where indicated)

and EMX's investment due diligence process includes an extensive assessment of counterparties’ ESG and health and safety management practices and local stakeholder engagement in addition to a review of geology, exploration, mineral reserve and mineral resource modelling, mine design and scheduling, geotechnics, mineral processing, tailings, permitting and legal, regulatory, tax and financial considerations.

Employees

At its financial year ended December 31, 2023, EMX had 46 employees and consultants working at various locations throughout the world.

Foreign Operations

EMX's mineral property interests are located in the North America, Fennoscandia, Australia, and Latin America, as well as in areas traditionally considered to be risky from a political or economic perspective, including Serbia, Türkiye, and Haiti. See “Risks and Uncertainties – Foreign Countries and Political Risks”

Those operations are subject to regulation (and changes thereto) in those jurisdictions with respect to land tenure, productions, export controls, taxation, environmental legislation, land and water use, local indigenous peoples’ interests, mine safety and expropriation of property. Although EMX, as a royalty interest holder, is not responsible for ensuring compliance with these laws and regulations, failure by the operators to comply with applicable laws, regulations and permits could result in injunctive action, orders to suspend or cease operations, damages and civil and criminal penalties on the operators, all of which could have a material adverse effect on the results of the operations and financial condition of EMX.

Bankruptcy Reorganizations

There has not been any voluntary or involuntary bankruptcy, receivership or similar proceedings against EMX within the three most recently completed financial years or the current financial year.

Material Reorganizations

Except as disclosed under the heading “General Development of the Business – Three Year History”, there has not been any material reorganization of EMX or its subsidiaries within the three most recently completed financial years or the current financial year.

Social or Environmental Policies

EMX has implemented various social policies that are fundamental to its operations, such as policies regarding its relationship with the communities where the Company operates.

EMX is committed to the implementation of a comprehensive Health, Safety, Environment, Labor and Community Policy and Stakeholder Engagement Strategy (the “Policies”). EMX ensures these Policies are made known to all its managers, staff, contractors and exploration and joint venture partners, and that the requirements contained therein are adequately planned, resourced implemented and monitored wherever EMX is actively managing the project and where EMX has obtained a formal commitment from its exploration and joint venture partners to adopt the same Policies.

Environmental Policy

The Company believes that good environmental management at every project it manages, whether in the exploration phase, feasibility stage, project construction or mine site operation, requires proactive health and safety procedures, transparent interaction with local communities and implementation of prudent expenditures and business performance standards that constitutes the foundation for successful exploration and subsequent development if the results warrant it.

EMX will develop and implement appropriate standard operating procedures for different stages of its ground technical surveys, prospecting and evaluation and development work which procedures will be designed to meet all applicable environmental requirements and best environmental practices in the mineral exploration industry.

| | | | | | | | | | | | | | | | | |

| TSX.V: EMX.V / NYSE: EMX | | | EMX ROYALTY CORPORATION | | 19 |

Annual Information Form

(Expressed in U.S. Dollars, except where indicated)

Community Relations, Communication and Notification Policy

Proactive interaction with the stakeholders on whom the Company's exploration and development programs may impact is considered an important part of the long-term investment that the Company is planning in its exploration programs in North America, Türkiye, Europe, Haiti, Australia, and Latin America.

•EMX recognizes that from the inception of exploration activities or a new field work program, and as the exploration project progresses towards development, it will be important to:

•communicate and proactively engage with all local communities and other stakeholders that may be affected by its exploration programs;

•inform and obtain a consensus with the full range of stakeholders that may be impacted upon by exploration, evaluation and development; and

•identify any vulnerable or marginalized groups within the affected communities (e.g., women, elders or handicapped) and ensure they are also reached by above information disclosure and consultation activities.

In these respects, EMX will work actively and transparently with governmental authorities, other elected parties, non-governmental organizations, and the communities themselves to ensure that the communities are aware of the activities of the Company, and that the impact and benefits of such activities are a benefit to the communities.

When detailed or advanced exploration activities, including drilling, evaluation and other such programs, are implemented, the Company will endeavor to identify how the impacts of such work on communities can best be managed, and how benefits can best be provided to communities through its activities. This will be undertaken in consultation with the affected communities.

Labour, Health and Safety Policy

The health and safety of its employees, contractors, affected communities and any other role players that may participate and be affected by the activities of EMX are crucial to the long-term success of the Company.

The Company will establish and maintain a constructive work-management relationship, promote the fair treatment, non-discrimination, and equal opportunity of workers in accordance with Performance Standards 2, Labor and Working Conditions of the International Finance Corporation, a member of the World Bank Group.

Every effort will be made through training, regular reviews and briefings, and other procedures to ensure that best practice labour, health and safety and good international industry practices are implemented and maintained by EMX, including prompt and in-depth accident and incident investigation and the implementation of the conclusions thereof. The Company will take measures to prevent any child labour or forced labour.

The Company's aim is at all times to achieve zero lost-time injuries and fatalities.

Development Stage Environmental and Social Management Policy

EMX will communicate and consult with local communities and stakeholders with a view to fostering mutual understanding and shared benefits through the promotion and maintenance of open and constructive dialogue and working relationships.

Risks and Uncertainties

Investment in the Common Shares involves a significant degree of risk and should be considered speculative due to the nature of EMX's business and the present stage of its development. Prospective investors should carefully review the following factors together with other information contained in this AIF before making an investment decision.

Going Concern Risks

As at December 31, 2023, the Company had a working capital deficit of $2,270,000 (December 31, 2022 - working capital of $31,562,000). As such, the consolidated financial statements of the Company contain a note that indicates the existence of a material uncertainty that raises substantial doubts about the Company’s ability to continue as a going concern. The Company’s ability to continue as a going concern is dependent on its ability to generate profitable earnings, receive continued financial

| | | | | | | | | | | | | | | | | |

| TSX.V: EMX.V / NYSE: EMX | | | EMX ROYALTY CORPORATION | | 20 |

Annual Information Form

(Expressed in U.S. Dollars, except where indicated)

support from strategic shareholders, complete additional financing and/or refinance its existing debt. While the Company expects to continue to successfully execute its financing plans, including raising funds through the issuance of equity and/or obtaining new debt or refinancing the existing senior secured credit facility, there can be no assurances that future equity financing, debt or debt refinancing alternatives will be available on acceptable terms to the Company or at all. Failure to generate profitable earnings or obtain such additional financing could result in the Company becoming unable to carry out its business objectives, and cast doubt as to the Company’s ability to continue as a going concern. Should the Company be unable to continue as a going concern, realization of assets and settlement of liabilities in other than the normal course of business may be at amount materially different than the Company’s estimates.

Mineral Property Exploration Risks

The business of mineral exploration and extraction involves a high degree of risk. Few properties that are explored ultimately become producing mines. Certain operating risks include ensuring ownership of and access to mineral properties by confirmation that royalty agreements, option agreements, claims and leases are in good standing and obtaining permits for exploration activities, mine development, and mining operations.

The properties on which the Company holds a royalty or other interest are subject to all of the hazards and risks normally encountered in the exploration, development and production of metals, including weather related events, unusual and unexpected geology formations, seismic activity, rock bursts, cave-ins, pit-wall failures, tailings dam breaches or failures, flooding, environmental hazards and the discharge of toxic chemicals, explosions and other conditions involved in the drilling, blasting, storage and removal of material, any of which could result in damage to, or destruction of, mines and other producing facilities, damage to property, injury or loss of life, environmental damage, work stoppages, delays in production, increased production costs and possible legal liability. Milling operations, waste rock dumps and tailings impoundments are subject to hazards such as equipment failure, or breaches in or the failure of retaining dams around tailings disposal areas and may be subject to ground movements or deteriorating ground conditions, or extraordinary weather events that may result in structure instability, or impoundment overflow, requiring that deposition activities be suspended. The tailings storage facility infrastructure, including pipelines, pumps, liners, etc. may fail or rupture. Should any of these risks or hazards affect a property on which the Company has a royalty or other interest, it may (i) result in an environmental release or environmental pollution and liability; (ii) cause the cost of development or production to increase to a point where it would no longer be economic to produce, (iii) result in a write down or write-off of the carrying value of one or more projects, (iv) cause extended interruption to the business, including delays or stoppage of mining or processing, (v) result in the destruction of properties, processing facilities or third party facilities necessary to the operations, (vi) cause personal injury or death and related legal liability, (vii) result in regulatory fines and penalties, revocation or suspension of permits or licenses; or (viii) result in the loss of insurance coverage. The occurrence of any of above-mentioned risks or hazards could result in an interruption or suspension of operation of the Mining Operations and have a material adverse effect on the Company and the trading price of the Company's securities as well as the Company's reputation.

The exploration for, development, mining and processing of mineral deposits involves significant risks which even a combination of careful evaluation, experience and knowledge may not eliminate. While the discovery of an ore body may result in substantial rewards, few properties which are explored are ultimately developed into producing mines. Major expenditures may be required to locate and establish mineral reserves to develop metallurgical processes and to construct mining and processing facilities at a particular site. It is impossible to ensure that the exploration or development programs planned by the owners or operators will result in profitable commercial mining operations. Whether a mineral deposit will be commercially viable depends on a number of factors, some of which are: cash costs associated with extraction and processing, the particular attributes of the deposit, such as size, grade and proximity to infrastructure; metal prices which are highly cyclical; government regulations, including regulations relating to prices, taxes, royalties, land tenure, land use, importing and exporting of minerals and environmental protection; and political stability. The exact effect of these factors cannot be accurately predicted, and the combination of these factors may result in one or more of the properties not receiving an adequate return on invested capital. Accordingly, there can be no assurance the properties on which the Company has a royalty or other interest which are not currently in production will be brought into a state of commercial production.

Conditions to be Satisfied Under Certain Agreements

EMX is currently earning an interest in some of its properties through option agreements and acquisition of title to the properties is only completed when the option conditions have been met. These conditions generally include making property payments, incurring exploration expenditures on the properties and can include the satisfactory completion of pre-feasibility or other studies. If the Company does not satisfactorily complete these option conditions in the time frame laid out in the option

| | | | | | | | | | | | | | | | | |

| TSX.V: EMX.V / NYSE: EMX | | | EMX ROYALTY CORPORATION | | 21 |

Annual Information Form

(Expressed in U.S. Dollars, except where indicated)

agreements, the Company's title to the related property will not vest and the Company will have to write-off any previously capitalized costs related to that property.

Markets

The market prices for precious, base, and other metals can be volatile and there is no assurance that a profitable market will exist for a production decision to be made or for the ultimate sale of the metals even if commercial quantities of precious and other metals are discovered or are being mined, respectively.

No Control over Mining Operations

The Company is not directly involved in the ownership or operation of mines and has no contractual rights relating to the operation or development of any property on which it has a royalty or other interest. The operation of the properties in which EMX holds an interest is generally determined by third-party property owners and operators, and EMX has no or limited decision-making power as to how these properties are operated, and the operators’ failure to perform could affect revenue generated by EMX.

The Company will not be entitled to any material compensation if any of the operations do not meet their forecasted gold or other production targets in any specified period or if the operations shut down or discontinue their operations on a temporary or permanent basis. The properties may not commence commercial production within the time frames anticipated, if at all, or they may not meet ramp-up targets or complete expansion plans, and there can be no assurance that the gold or other production from such operations will ultimately meet forecasts or targets. At any time, any of the operators of the mining operations or their successors may decide to suspend or discontinue operations or may sell or relinquish operations, which may result in royalties or other monies not being paid or obligated to be paid to the Company.

The Company is subject to the risk that the any property or operation may shut down on a temporary or permanent basis due to issues including but not limited to economic conditions, lack of financial capital, flooding, fire, weather related events, mechanical malfunctions, community or social related issues, social unrest, the failure to receive permits or having existing permits revoked, collapse of mining infrastructure including tailings ponds, nationalization or expropriation of property and other risks. These issues are common in the mining industry and can occur frequently. There is a risk that the carrying values of the Company's assets may not be recoverable if the mining companies operating the counterparty cannot raise additional finances to continue to develop those assets. The exact effect of these factors cannot be accurately predicted, and the combination of these factors may result in the property or operation becoming uneconomic resulting in their shutdown and closure.

Reliance on Third Party Reporting

The Company relies on public disclosure and other information regarding the properties or operations it receives from the owners, operators and independent experts of such properties or operations, and certain of such information is included in this document. Such information is necessarily imprecise because it depends upon the judgment of the individuals who operate the properties or operations as well as those who review and assess the geological and engineering information. In addition, the Company must rely on the accuracy and timeliness of the public disclosure and other information it receives from the owners and operators of the properties or operations, and uses such information in its analyses, forecasts and assessments relating to its own business and to prepare its disclosure with respect to the royalties. If the information provided by such third parties to the Company contains material inaccuracies or omissions, the Company's disclosure may be inaccurate and its ability to accurately forecast or achieve its stated objectives may be materially impaired, which may have a material adverse effect on the Company. In addition, some royalties or other interests may be subject to confidentiality arrangements which govern the disclosure of information with regard to the applicable interest and, as such, the Company may not be in a position to publicly disclose non-public information with respect to certain royalties or other interests. The limited access to data and disclosure regarding the operations of the properties in which EMX has an interest, may restrict the Company’s ability to enhance its performance which may result in a material and adverse effect on EMX’s profitability, results of operations and financial

| | | | | | | | | | | | | | | | | |

| TSX.V: EMX.V / NYSE: EMX | | | EMX ROYALTY CORPORATION | | 22 |

Annual Information Form

(Expressed in U.S. Dollars, except where indicated)

condition. Although EMX attempts to obtain these rights when entering into new agreement, or amending existing agreements, there is no assurance that EMX’s efforts will be successful.

Unknown Defects or Impairments in EMX's Royalty or Other Interests

Unknown defects in or disputes relating to the royalty and other interests EMX holds or acquires, including defects in the chain or title to any of the properties underlying EMX’s royalty or other interests, may prevent EMX from realizing the anticipated benefits from its royalty and other interests and could have a material adverse effect on EMX's business, results of operations, cash flows and financial condition. It is also possible that material changes could occur that may adversely affect management's estimate of the carrying value of EMX's royalty and other interests and could result in impairment charges. While EMX seeks to confirm the existence, validity, enforceability, terms and geographic extent of the royalty and other interests EMX acquires, and the title of any properties underlying EMX’s royalty and other interests, there can be no assurance that disputes over these and other matters will not arise. Confirming these matters, as well as the title to a mining property on which EMX holds or seeks to acquire a royalty or other interest, is a complex matter, and is subject to the application of the laws of each jurisdiction, to the particular circumstances of each parcel of a mining property and to the documents reflecting the royalty or other interest. To the extent an owner or operator does not have title to the property underlying any of EMX’s royalty and other interests, it may be required to cease operations or transfer operational control to another party.