UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

________________

FORM 10-K

(Mark One)

|

x |

|

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 OR |

|

o |

|

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Commission File No. 000-51134

________________

MMRGLOBAL, INC.

(Exact Name of Registrant as Specified in Its Charter)

|

Delaware |

|

33-0892797 |

|

(State or Other Jurisdiction of |

|

(I.R.S. Employer Identification No.) |

|

4401 Wilshire Blvd., Suite 200, |

|

90010 |

|

(Address of Principal Executive Offices) |

|

(Zip Code) |

(310) 476-7002

(Registrant's telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act: None

Securities registered pursuant to Section 12(g) of the Act: Common Stock, $.001 par value

________________

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15 (d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes

x No ¨Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See definitions of "large accelerated filer," "accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Exchange Act. (Check one):

|

Large accelerated filer ¨ |

Accelerated filer ¨ |

Non-accelerated filer ¨

|

Smaller reporting company x |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x

As of June 30, 2012, the last business day of the registrant's most recently completed second fiscal quarter, the aggregate market value of the registrant's common stock was $6,961,994 based on 409,529,064 shares issued and outstanding on such date and a closing sales price for the registrant's common stock of $0.017, as reported on the OTC BB on such date.

As of March 11, 2013, the registrant had 552,721,661 shares of common stock outstanding.

MMRGLOBAL, INC.

FORM 10-K ANNUAL REPORT

FOR THE YEAR ENDED DECEMBER 31, 2012

TABLE OF CONTENTS

|

Page |

||

|

PART I |

||

|

Item 1. |

2 |

|

|

Item 1A. |

35 |

|

|

Item 1B. |

41 |

|

|

Item 2. |

41 |

|

|

Item 3. |

42 |

|

|

Item 4. |

42 |

|

|

PART II |

||

|

Item 5. |

43 |

|

|

Item 6. |

44 |

|

|

Item 7. |

Management's Discussion and Analysis of Financial Condition and Results of Operations |

44 |

|

Item 7A. |

55 |

|

|

Item 8. |

55 |

|

|

Item 9. |

Changes in and Disagreements with Accountants on Accounting and Financial Disclosure |

55 |

|

Item 9A. |

55 |

|

|

Item 9B. |

56 |

|

|

PART III |

||

|

Item 10. |

56 |

|

|

Item 11. |

60 |

|

|

Item 12. |

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters |

65 |

|

Item 13. |

Certain Relationships and Related Transactions, and Director Independence |

66 |

|

Item 14. |

67 |

|

|

PART IV |

||

|

Item 15. |

68 |

|

|

72 |

||

1

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K contains certain forward-looking statements. The words "anticipate," "expect," "believe," "plan," "intend," "will" and similar expressions are intended to identify such statements. Although the forward-looking statements in this Annual Report on Form 10-K reflect the good faith judgment of our management. Such statements are subject to various risks and uncertainties, including but not limited to those discussed or incorporated by reference herein. Actual results and the timing of selected events may differ materially from those anticipated in these forward- looking statements. Except as required by applicable law, we disclaim any duty to update any forward-looking statement to reflect events or circumstances that occur after the date on which such statement is made. The forward-looking statements included herein are necessarily based on various assumptions and estimates and are inherently subject to various risks and uncertainties, including risks and uncertainties relating to the possible invalidity of the underlying assumptions and estimates and possible changes or developments in economic, business, industry, market, legal and regulatory circumstances and conditions and actions taken or omitted to be taken by third parties, including customers, suppliers, business partners and competitors and legislative, judicial and other governmental authorities and officials. Assumptions related to the foregoing involve judgments with respect to, among other things, future economic, competitive and market conditions and future business decisions, all of which are difficult or impossible to predict accurately and many of which are beyond our control, and are subject to various risks and uncertainties, including but not limited to those discussed or incorporated by reference herein. Actual results and the timing of selected events may differ materially from those anticipated in these forward-looking statements as a result of, among other things, future economic, competitive and market conditions and future business decisions, all of which are difficult or impossible to predict accurately and many of which are beyond our control.

ITEM 1. BUSINESS

Organizational History

MMRGlobal Inc. (referred to herein, unless otherwise indicated, as "MMR", the "Company," "we," "us," and "our") was originally incorporated as Favrille, Inc. ("Favrille") in Delaware in 2000, and since its inception and before the Merger (as defined below), operated under a different management team as a biopharmaceutical company focused on the development and commercialization of targeted immunotherapies for the treatment of cancer and other diseases of the immune system. In May 2008, Favrille's ongoing Phase 3 registration trial for our lead product candidate failed to show a statistically significant improvement in the treatment of patients with follicular B-cell non-Hodgkin's lymphoma, and accordingly, we determined to sell all of our equipment related to manufacturing of this product, as well as other personal property in an auction. On September 9, 2008, this auction was consummated and we received $3.2 million in net proceeds from the sale of the assets. With the disposition of all of our equipment and other personal property, we ceased to engage in any operations and became a "shell company" as such term is defined in Rule 12b-2 of the Exchange Act. Notwithstanding the sale of the assets, the current management team identified certain biotech patents and patient samples that the Company continues to hold and successfully license in the marketplace.

Agreement and Plan of Merger and Reorganization

On January 27, 2009, the Company, through MyMedicalRecords, Inc. ("MMR Inc."), what is now our wholly-owned operating subsidiary, conducted a reverse merger with Favrille. We refer to this transaction as the "Merger". Following the Merger, the holders of MMR Inc. equity prior to the Merger, on a fully diluted basis, owned or had the right to acquire approximately 60.3% of our equity, the holders of our equity prior to the Merger, on a fully diluted basis, owned approximately 33.2% of our equity, and certain beneficiaries under the Creditor Plan (which consist of our former officers and former directors and their affiliates) had the right to own up to approximately 6.5% of our equity. The Creditor Plan is described in Item 7 "Management's Discussion and Analysis of Financial Condition and Results of Operations" and filed as Exhibit 10.1 on our report on Form 8-K filed on November 13, 2008.

As a result of the Merger in January 2009, MMR Inc. became our wholly-owned subsidiary and its legal name became MyMedicalRecords, Inc. Although we are the legal acquirer, the Merger is accounted for as a reverse acquisition in accordance with U.S. generally accepted accounting principles, or GAAP. Under this method of accounting, Favrille was treated as the "acquired" company for financial reporting purposes. This determination was primarily based on: the fact that MMR Inc.'s former shareholders held a majority of the equity of the consolidated company, MMR Inc.'s operations comprise the ongoing operations of the consolidated entity, and MMR Inc.'s senior management and director designees assumed control of the consolidated company.

In addition, upon the closing of the Merger on January 27, 2009, MMR Inc. became our wholly-owned operating subsidiary and we ceased being a "shell company" as such term is defined in Rule 12b-2 of the Exchange Act.

2

On February 9, 2009, and in connection with the Merger, the Company changed its legal entity name from Favrille, Inc. to MMR Information Systems, Inc. Subsequently, on June 16, 2010, the Company changed its legal entity name to MMRGlobal, Inc., which we believe more accurately reflects the nature of our operations.

On March 8, 2011 we formed a subsidiary, which we named MMR Life Sciences Group, Inc., exclusively to maximize the value of our biotech assets including the Company's anti-CD20 antibodies and related FavId™/Specifid™ vaccine technologies identified by MMR Management as remaining assets from the Merger. As of this date, the assets have not been transferred to the subsidiary.

Our Business Subsequent to the Merger

As of the closing date of the Merger, we adopted MMR Inc.'s business of empowering consumers to manage their Personal Health Records ("PHR") and other important documents, whether paper-based or digital, and by doing so, to better control and organize their lives overall. Starting in 2005, MMR Inc. filed patents for a universal PHR that could be used by any person or any healthcare professional anywhere in the world regardless of the technology on the other end. The patents are entitled "Method and System for Providing Online Medical Records" and `"Method and System for Providing Online Records." Today, we provide patented secure online storage and document management solutions for Personal Health Records and other important documents such as insurance policies, deeds, driver's license, IDs, passports, estate planning documents, advance directives, photos, as well as legal and travel documents among others.

The Company expanded its operations and added a line of document storage and management solutions for healthcare professionals, designed to eliminate paper, allow them to operate without dramatically changing the way a medical office operates and allow them to store and share health records with their patients on a real-time basis.

We are also in the business of licensing our intellectual property which is comprised of biotech assets including patents, patient samples, anti-CD20 antibodies and other intellectual property as well as a portfolio of patents pertaining to health information technology. As a result of these licensing activities, we have signed Licensing Agreements for more than $40 million to date. More than $10 million of it pertains to biotech and $30 million to the Settlement and Patent License Agreement with Surgery Center Management, LLC, which is discussed in further detail in the "Customers" section.

Over the last seven years, these patents have been in the process of issuance and we now have patents issued, pending, and applied for in numerous countries around the world. As a result the Company has evolved from an operating business selling products and services to consumers and healthcare professionals to a company whose value proposition is based on a combination of factors including:

- A personal health records company specializing in storing medical records and other important documents for consumers and health care professionals

- A document imaging and management company for healthcare professionals

- A licensor of Biotech Intellectual Property based on a portfolio of biotech assets developed at a cost of more than 100 million dollars

- And a licensor of Health Information Technology patents and other Intellectual Property in numerous counties around the world

Business Overview

The following description of our business relates to our current business and operations.

We offer a suite of secure, online products that empower consumers and professionals alike to manage medical records and other important documents in their life and business, whether paper-based or digital. These online products include: (i) MyMedicalRecords.com, an online PHR secure system for the entire family including pets; (ii) MyEsafeDepositBox, an online secure document storage system; (iii) MMRPro, an integrated scanning and web-based document management solution for healthcare professionals; and (iv) private label PHR and MyEsafeDepositBox storage solutions.

In late 2009, we released our electronic document storage and management system for healthcare professionals, particularly small to mid-size physician practices and surgery centers that are still largely or entirely paper-based. Our professional solution, which we refer to as MMRPro, incorporates an integrated patient portal accessible through www.mmrpatientview.com in response to the need to provide patients with timely access to their medical records. In 2010 we added the MMR Stimulus Program to the MMRPro product offerings which helps healthcare professionals offset some of the cost involved in providing patients with copies of their personal health information when they sign up for a full-featured MyMedicalRecords account so that they can be stored in their online PHR. Videos on our products can be found at www.mmrtheatre.com. Television commercials on our products can be found at www.mmrontv.com.

3

Our health information technology patents became the focus of the Company's licensing and enforcement activities in 2012, having been granted five patents and two Notices of Allowance during the year by the United States Patent and Trademark Office ("USPTO") directed at a "Method and System for Providing Online Medical Records" and a "Method and System for Providing Online Records." The Company's health IT patent portfolio currently includes our U.S. patents (with a total of 177 claims), 17 pending U.S. patent applications (with hundreds of pending claims), six international patents including two in Australia with others in New Zealand, Singapore, Japan and Mexico, a Notice of Allowance received for our Canadian patent application in the first quarter of 2013, and seven other pending patent applications in foreign countries. These patents have the potential effect of enabling the Company to control a dominant marketplace position in personal healthcare, being well-positioned to benefit from the explosion in health IT both in the U.S. and globally. We also continue efforts to maximize the current and future value of the biotech assets acquired from Favrille, Inc. when the Merger was completed in January 2009. These assets include, but are not limited to, the exploitation and licensing of patents, data and samples from the Company's pre-Merger clinical vaccine trials, the FavId™/Specifid™ vaccine, and the anti-CD20 antibodies.

Products and Services

Our suite of secure, web-based products all are built on proprietary, patented and patent-pending technologies that allow users to easily store, organize, retrieve and share their protected health information and other data in a timely and secure manner from anywhere in the world.

Our consumer product, "MyMedicalRecords", is an easy-to-use, secure web-based PHR system, which allows documents, images and voice mail messages to be transmitted in and out of our system using a variety of methods, including fax, voice and file upload and doesn't need to rely on any specific Electronic Medical Records ("EMR") platform to maintain medical records. Using encryption technology, the system receives these files, as well as voice files, HL7, CCD and any other uploaded files including data exported from Telemedicine systems, which are all stored in the consumer's personal account secured by a unique user ID and multiple password combination. A notification is sent to up to five user e-mail addresses (including text-enabled cell and smartphones) whenever a new record is received. Users can then access their files via the Internet and take advantage of an intuitive, customized filing system that allows them to categorize, annotate and file their records for easy access, organization and retrieval. Users can also print, download, e-mail or fax their records from their account, giving our customers greater control over their own PHRs and other information, which they can share with healthcare providers and others as they move through the continuum of care.

The Company is constantly in the process of evolving its products and adding new features that will facilitate connectivity with other systems such as Electronic Medical Records systems. The new features facilitate connectivity with any standalone EMR systems and other Electronic Medical Records systems, and laboratory reporting systems. Using an HL7 interface we will be able to populate data, such as a Continuity of Care Document, directly to the patient as well as lab test results, medication lists and other discrete data which will be directly deposited into the MyMedicalRecords PHR. At the option of the patient, the system will also be able to push PDFs from the patient's confidentially maintained files directly into an EMR or EHR. We believe this will increase adoption of our product by consumers, vendors and providers alike because we now are a true patient portal that shares electronic data.

We are currently selling our MyMedicalRecords PHR product direct to consumers, corporations as an employee benefit, physicians, small hospitals, surgery centers and other healthcare professionals including nursing associations and veterinarians, retail pharmacies, and to affinity organizations as a "value-added" service for their members or clients. We introduced a Prepaid Personal Health Record Card at the start of 2012 which the Company has been offering through healthcare professionals, home healthcare agencies and facilities, and patient advocates, and plans on offering it through retailers in the near future. We also sell to insurance companies and plan to sell through financial services organizations. The PHR is offered both via the MyMedicalRecords web site and as a private- labeled product. When sold to employers and/or affinity groups, the Company counts members as individuals who have received paid access to the MMR system through their employers benefit program or as a member benefit from a respective affinity group. The Company counts users as the individuals in that member group that activate and commence usage of their individual PHR account. In addition, the MyMedicalRecords PHR is an important component of the MMRPro professional document management and imaging system which we are selling to physician offices and other healthcare professionals (See section on "MMRPro").

Our "MyEsafeDepositBox" service is geared toward small businesses, the financial services, insurance and legal service industries. MyEsafeDepositBox is based on the same technology and architecture as our MyMedicalRecords PHR product. However, rather than focusing on storing medical records, MyEsafeDepositBox is designed to provide secure online storage for medical records and vital financial, legal and insurance documents such as wills and advance directives. MyEsafeDepositBox.com may be used as a virtual on line "safe" and could serve as an essential part of any household's or business's disaster preparedness plan.

4

Our MMRPro product provides physician offices with a powerful and cost-effective solution to the costly and time-consuming challenge of digitizing paper-based medical records, as well as providing doctors the ability to have access to those records through a private portal at MyMedicalRecordsMD.com (see MMRPro.com for more information). MMRPro also features an integrated e-Prescribe automated drug order entry system. It also automatically deploys records that patients can view and print out through a free patient portal, MMRPatientView.com. MMRPro also includes its own "Stimulus Program" that allows doctors the opportunity to earn administrative reimbursements when their patients upgrade from the free MMRPatientView.com portal to a full-featured, paid MyMedicalRecords PHR.

In developing and marketing our products and services, we plan to continue to take advantage of the burgeoning consumer health information market and health IT market for patients and healthcare professionals to leverage federal legislation, including the Health Information Technology for Economic and Clinical Health Act (HITECH) which is part of the American Reinvestment and Recovery Act of 2009 (ARRA). Additionally, we believe that the healthcare reform legislation passed by Congress and signed by the President into law in March 2010 (Patient Protection and Affordable Care Act) represents a significant behavioral shift in how consumers will manage their healthcare because of the requirement that most Americans have insurance starting in 2014. The U.S. Supreme Court, which had heard oral arguments challenging the law during the last week of March 2012, ultimately upheld the constitutionality of most all of the legislation in a ruling announced on June 28, 2012. As a result, key provisions such as the individual insurance mandate, Accountable Care Organizations ("ACOs"), and hospital readmission penalties quickly moved forward. We believe these reforms favorably impact the Company's health IT products and services. Even though the HITECH Act's meaningful use program incentivizing the national implementation of computerized medical records was separate from the 2010 reform bill, ACOs require coordinated care to improve outcomes and reduce costs, which further requires interoperable healthcare IT solutions. This is part and parcel of the transformation taking place in healthcare from a pay-for-service system to a pay-for-performance or outcomes-based healthcare model. In other words, under the Affordable Care Act, the Medicare Shared Savings program rewards physicians operating in ACOs and for keeping patients healthy in order to reduce costs. At the same time, as both government mandates and public and private employers are increasingly compelling individuals and families to take a more active role in better managing their healthcare, there is a prevailing consensus that patient portals and PHRs are necessary to achieve this.

Our MyMedicalRecords PHR product is designed to enable consumers to store their important medical records and data in one central and secure place where they can manage those records and control how they are accessed and shared. The market for the Company's products is significant. While every healthcare consumer in the U.S., as well as those in other countries, is a potential user of our MyMedicalRecords PHR product, we believe that the product has most appeal to these particular market niches:

- The chronically ill and their families who share information among many doctors; this "co-morbid population" represents a disproportionate share of U.S. healthcare costs;

- Physicians who are being required to provide patients with timely electronic access to their personal health information;

- Individuals with Health Savings Accounts who need to carefully manage their eligible expenses over the course of a year;

- Consumers with "senior" parents who, in their role as caregivers, want to be sure they have current medical information readily available to react quickly in case of parental illness;

- Consumers with newborns who will be able to build a complete medical file for the newborn, which can last the newborn's entire life;

- Employees who are forced to change doctors and other providers when their employer changes health insurance and who therefore need to manage the transfer of medical information to their new providers;

- Consumers who are concerned with having their PHRs and other important documents in a disaster or other emergency;

- Travelers and business people working overseas who want to ensure that they always have access to their medical records in the event of an emergency;

- Hospitals required to provide patients discharge summary and procedures electronically;

- Home healthcare professionals who want to use technology, particularly PHRs, to maintain and share patient records and support practical daily management issues;

- Wireless providers who are seeing smartphones increasingly used as a hub for remote patient monitoring devices that can export data to PHRs to improve coordination of care in the patient-centered medical home;

- Veterans and Medicare recipients who are using Blue Button to transfer their data into a comprehensive, portable and easy-to-use PHR;

- Corporations seeking to offer their employees a valuable benefit, e.g. companies implementing workforce wellness programs and those with expatriate employees would be particularly interested in our product;

- Pharmacists who are unable to spend more time counseling consumers due to time constraints and see PHRs as a way to help bridge the gap; and Government agencies, local, state and federal, who are seeking to provide a quick way to deploy a solution for helping families and businesses preserve their vital documents in the event of a man-made or natural disaster

5

Because of the similarity in functionality between our MyMedicalRecords PHR product and our MyEsafeDepositBox product, we market these products through some of the same channels. The crossover marketing strategy for our MyMedicalRecords PHR product and MyEsafeDepositBox product focuses primarily on the following channels:

- To corporate accounts, as an added employee benefit for their employees or bundled or co-branded with their product offerings to their customers;

- To insurance companies who are looking for a valuable benefit to provide risk and accident policyholders both in the United States and abroad;

- Through affinity groups (such as alumni organizations and other membership organizations) and discount health benefit membership groups to their members;

- To associations and organizations seeking our solution as an emergency preparedness tool;

- To charitable and critical illness organizations as ways to raise funds;

- To legal, accounting, mortgage, and other organizations that have the need to securely store and transmit documents to and from their clients; and

- Direct to consumers as a retail subscription product.

Our MMRPro product is an integrated, end-to-end service that gives physicians and other healthcare providers, an easy and cost- effective way to scan and digitize patient medical files, manage those files through a virtual patient chart and give patients up-to-date access to those records through an integrated patient portal. MMRPro is being marketed to:

- Physicians, particularly small group and sole practitioners who still do not have any way to digitize the paper in their offices and who do not want to invest the hundreds of thousands of dollars necessary to implement an Electronic Medical Record, or EMR, system;

- Other healthcare professionals such as dentists, veterinarians, and chiropractors;

- Community hospitals and other clinics which do not have the funds or technology resources to invest in an EMR system;

- Surgery centers and specialty clinics; and

- EMR and Electronic Health Records ("EHR") vendors who are looking for a way to bring a PHR into their systems without having to build their own import modules.

The Company was an Independent Software Vendor of Kodak until Kodak filed for bankruptcy protection on January 19, 2012. The Company has filed a claim in the United States Bankruptcy Court Southern District of New York for $827,818.74 in damages from development and other costs incurred building MMRPro with Kodak. The Company is still purchasing Kodak scanners for use in its MMRPro products and services. The machines are now being purchased through Kodak resellers. Because of the Kodak bankruptcy, the Company decided to identify secondary suppliers for scanners and software in support of MMRPro. As a result, the Company also announced that it is entering into an agreement with Fujitsu Computer Products of America, Inc. to provide hardware and software solutions to deploy its MMRPro professional products and services.

The Company was one of the first Integrated Service Providers on Google Health, which discontinued services effective January 2, 2012 but was allowing existing users to access and migrate their data up until January 1, 2013. However, in 2011, we signed an agreement with Microsoft® HealthVault® and are planning to integrate our services with their platform as demand for access to Healthvault® increases in the marketplace.

The Company has relied upon numerous consultants in its efforts to accelerate bringing to market its anti-CD20 monoclonal antibodies. Anti-CD20 antibodies are useful in treating B-Cell malignancies, including Non-Hodgkin's Lymphoma (NHL) and additional B-Cell mediated conditions such as rheumatoid arthritis. The Company understands the anti-CD20 antibody assets are potential candidates for the next generation of a Rituximab-type therapy. Rituximab is marketed under the trade name Rituxan® in the United States by Biogen Idec and Genentech (wholly owned member of the Roche Group) and under the name MabThera® by Roche in the rest of the world except Japan, where it is co-marketed by Chugai and Zenyaku Kogyo Co. Ltd. Rituxan® is one of the world's most successful monoclonal antibodies with reported sales of USD $7.1 billion in 2011. Rituxan is due to go off patent in 2015. Additionally, MMR acquired significant intellectual property assets from its 2009 reverse Merger with Favrille, Inc., that included data, patient samples and other intellectual property from the pre-Merger clinical trials of its FavId™/Specifid™ idiotype vaccine.

On December 22, 2010, the Company entered into a thirteen million dollar non-exclusive agreement with Celgene to license the use of the Company's clinical and scientific data related to targeted immunotherapies for cancer and other disease treatments to stimulate a patient's immune response and certain other confidential information. In consideration for the rights granted under the Agreement, Celgene agreed to pay the Company certain upfront fees and development milestones. When a milestone is reached it continues to automatically trigger a payment to MMR. The Company has already received $850,000 in milestone payments under such agreement.

6

2012 Business Developments

Overview:

Since its inception, MMR's health IT business has evolved from a development company, to a provider and reseller of Personal Health Records and document imaging and scanning systems (MMR Services), to a Licensor of MMR's intellectual property. Corroborating the value of protecting the Company's intellectual property, inventions and other IP by investing millions of dollars in the inventing and building of a global patent portfolio, a special report published by the Michael Bass Research Group on January 22, 2013 concluded that the range of value of the Company's U.S. patents could reach between $600 million to $1.1 billion in revenue (http://michaelbass.com/PDF/Patent_Valuation.pdf). This was based on what is described as conservative estimates based on a market projected to reach a GDP value of $19 billion. In line with this, developments in the industry during 2012 were positive for the Company as a provider of patented Personal Health Records because this marked the year PHRs moved to the center of health IT. The driving force was the release of the final rule for Stage 2 meaningful use on August 23, 2012 requiring online access for patients to their health information through an online portal or Personal Health Record. The Stage 2 meaningful use requirements for patient electronic access to their health information didn't build on so much as supersede Stage 1, where electronic copies of health information only needed to be provided upon request by the patient. Now, starting in January 2014, over 50% of an eligible professional's patients need to have access to their health information made available to them online, and this is expected to expand to over 90% with Stage 3 meaningful use requirements.

There are many factors affecting the growing popularity of PHRs, which include the web-based personal medical home, the move away from fee-for-service toward value-based or outcomes-based reimbursement, and the interest in web-based social networking and the Health 2.0 movement. MMR's vision from the start was to provide patients and families with an easy-to-use online system for accessing their medical records and other important documents and securely sharing them with all their healthcare providers using MMR's proprietary technology platform. Since our company began, we have made it our mission to ensure the patient shares in the electronic exchange of his or her health data along with their providers so they can make the informed decisions necessary to better manage their care and participate in cost savings that can accrue from timely access to information.

During 2012 and reaching into the future, the alignment of patient engagement with everything health IT is now everywhere in evidence. From the speeches and presentations of Dr. Farzad Mostashari, National Coordinator for Health Information Technology, to the blogs of technology experts and corporate CEOs, patient engagement has moved from being a component of meaningful use to becoming a core focus of government initiatives and a major strategy of healthcare organizations and employers, putting patient portals and PHRs on the map.

We expect stronger demand for our products and services given patient engagement requirements that need to be implemented by January 2014 under meaningful use to qualify for full payment under the HITECH Act's EHR Incentive Program, and the strength of our health IT patents. Back in 2005, we imagined a time when all Americans would be covered by health insurance, as most people are in most Western countries, and we brainstormed over what would patients and doctors need? Communication, obviously, in a way that tied together all of one's medical reports in one place, easily accessible in most all circumstances, and especially so in times of emergency, from an individual emergency to a widespread natural disaster like Hurricanes Katrina and Sandy. So we conceived of multiple ways this communication could connect and be interoperable with various entities and we filed hundreds of patents and claims to this effect.

It takes time for the U.S. patent office and those of other nations to evaluate and rule on new technology claims; yet since the end of 2011, the number of U.S. patent we have been granted went from three allowances granted by the United States Patent and Trademark Office at the end of 2011 to seven U.S. patents issued by January 8, 2013. Our patents, which involve inventions pertaining to Personal Health Records, Patient Portals and other Electronic Health Record Systems, are directed at a "Method and System for Providing Online Medical Records" and a "Method and System for Providing Online Records," and include U.S. Patent Nos. 8,117,045; 8,117,646; 8,121,855; 8,301,466; 8,321,240; 8,352,287; and 8,352,288. The MyMedicalRecords, Inc. patent portfolio also includes additional applications and continuation applications with more than 400 claims. As of this filing, and adding to our international patent portfolio, MMR was also issued a Mexican patent in April 2012 (#298478) and a Japanese patent in February 2013 (#5191895). In March 2013, the Company received a Notice of Allowance for its Canadian patent (Application No. 2,615,128), effectively giving us a dominant position throughout North America. MMR continues to have international patents issued, pending and applied for in numerous countries of commercial interest, including the United States, Australia, Singapore, New Zealand, Mexico, Japan, Canada, Hong Kong, South Korea, Israel and Europe.

7

In 2012, based on government regulations and the breadth of our foundational patents in health IT, we revitalized our efforts to monetize our intellectual property given requirements under the law pertaining to HIPAA, the HITECH Act and meaningful use. In addition to John Goodhue at McKee, Voorhees & Sease, the Company's patent prosecution counsel since the filing of MMR's first patent applications in 2005, on August 9, 2012, we announced that we had retained the law firm of Liner Grode Stein Yankelevitz Sunshine Regenstreif & Taylor LLP ("Liner"). Through Liner lead attorney Ted Ward, we began the process of contacting hospitals, physician group practices and vendors in an effort to educate them about MMR's portfolio of intellectual property. Our patent licensing activities increased significantly in the fourth quarter given the scope of the Company's patents to extend users to retail establishments that maintain Personal Health Records for customers and fill prescriptions online, and the Company began contacting organizations in an ever increasing number of healthcare verticals including large retail pharmacy chains providing Personal Health Record services to customers and nationwide lab services providers. The retail pharmacies and laboratories continue to be added to the list of hospitals, healthcare professionals and vendors the Company contacts regarding our health IT patents in an effort to create strategic business relationships and/or license the Company's patented technology. As a result, by the end of 2012, the Company had entered into licensing agreements with a laboratory reporting services vendor (4medica), a document management systems vendor providing services to more than 750 hospitals (Interbit Data), and an EMR/PHR provider (Healthcare Holdings Group, Inc. and Access My Records, Inc.).

Adding to our biotech intellectual property portfolio in 2012, the Company received additional patents by the Mexican Industrial Property Institute entitled "Antibodies and Methods for Making and Using Them" (Patent No. MX302058) and a "Method and Composition for Altering a B Cell Mediated Pathology" (Patent No. MX302477). The first patent has special significance because it represents an anti-CD20 monoclonal antibody patent which marks the first such approval for protection of the Company's specific antibodies that have particular utility in fighting cancers. Patents for the Company's antibodies are also pending in a number of additional countries including the United States, Australia, Brazil, Canada, China, Hong Kong, India, Europe, Japan and Korea. The second Mexican patent relates to methods of manufacturing compositions for B-cell vaccines used in the fight against lymphoma and potentially other forms of cancer. The manufacturing patent is similar to those manufacturing patents issued in the U.S., including U.S. Patent Nos. 8,114,404 and 8,113,486 issued in the first quarter of 2012, and Singapore, and is pending in various other countries of commercial interest. Subsequently, in January 2013, the Company announced approval of its European Union patent (European Patent No. 01979228.2) also directed at "Method and Composition for Altering a B Cell Mediated Pathology," protecting the manufacturing of our B-cell vaccines (which was under appeal in Europe for some time). This issued patent is currently undergoing the process of validating the patent in numerous countries of commercial interest including the United Kingdom, France, Germany, Switzerland, Spain, Italy, the Netherlands, Denmark, Sweden, Finland, Ireland and Belgium. All together, these patents represent a valuable addition to the Company's biotechnology portfolio acquired as a result of MMR's reverse merger with Favrille, Inc. in 2009. Favrille invested more than $100 million in research and development on its FavId™/Specifid™ vaccine trials and use of customized tumor cells to treat lymphoma patients and other technologies. MMR has continued to make progress in protecting the Company's IP, including its anti-CD20 antibodies, and seeks licensing agreements that include milestone payments such as the Company has with Celgene.

Although the Company continues to seek ways to maximize the value of its biotech assets through licensing and strategic business opportunities with universities and other biotech companies, it remains focused on its primary business, which is the development and distribution of the MyMedicalRecords Personal Health Record, MMRPro, and other related solutions in health IT. While we continue to protect and enforce our intellectual property, the Company had a very active year in new business in 2012. As the Company has discussed in past years, it takes more than 12 months and sometimes as long as two years for the Company to begin delivering its Personal Health Record products and services from the signing of an agreement with a customer. These programs and business initiatives are highlighted as follows:

- We started the year by showcasing the MyMedicalRecords PHR at the International Consumer Electronics Show ("CES") as part of the Alcatel-Lucent ng Connect Program, a multi-industry open innovation program comprised of over 190 members. MyMedicalRecords served as the Personal Health Record for the TeleConsult service concept, a self-care program encompassing remote monitoring of biometric data and access to a MyMedicalRecords PHR to store all the information for sharing among the patient and their medical team.

- Through our relationship with Alcatel-Lucent, we launched a Telemedicine reporting module inside the MyMedicalRecords PHR and are further working on identifying strategic partners to send medical information through our portal.

- In January and February, we launched our Prepaid Personal Health Record card, first introducing it at the CES show followed by a full launch at the Healthcare Information and Management Systems Society (HIMSS) Conference and Exhibition in Las Vegas. The Company also showcased its signature Prepaid PHR card on its new apps for handheld devices and tablets.

- At HIMSS 2012, we also demonstrated our new software developed with Interbit Data that allows hospitals and other clinical facilities to use a Meaningful Use certified solution to make health information available to patients using the MMRPatientView portal. The MMR-Interbit Data module is certified for meaningful use with MEDITECH EMR systems, and the Company believes that it can also work with virtually any EMR platform. (In January of 2013, Interbit Data, under a Non-Exclusive Patent and License Agreement with MyMedicalRecords, Inc., started selling the solution and also the MyMedicalRecords PHR to more than 750 hospitals utilizing Interbit's NetDelivery secure software solution and our patented technologies.)

8

- With strategic development partner UST Global, we are connecting MMR to UST Global's certified EMR solutions. The Company has been working with UST Global to sell our products and services to GE, Safeway and Wal-Mart. As part of the relationship, the CEO of UST Global invested $200,000 in the Company.

- On February 2, 2012, the Company announced that pursuant to the terms of the December 9, 2011 Settlement and Patent License Agreement with Surgery Center Management, LLC ("SCM"), we had filed suit to collect the initial payment of $5 million, due on December 23, 2011, along with an application to the court for a Right To Attach Order and Order For Issuance of Writ of Attachment. Pursuant to the terms of the Agreement, the remaining $25 million is due in annual payments of $5 million each, starting November 15, 2012. At this time $10 million is past due and owing. For a detailed explanation about this agreement please see the Customers section below.

- MMR and VisiInc PLC in Australia signed an agreement in February to license MMR's Australian patents for a "Method and System for Providing Online Medical Records" for use in MMR and Visi™ consumer and professional health IT products and services. The agreement calls for minimum performance royalty guarantees of nearly $1 million. The agreement also called for VisiInc to start selling the services in Australia starting June 1, 2012.

- Also in February, we announced that Spalding Surgical Center of Beverly Hills achieved its goal of going paperless using MMRPro. Two months later, the Company announced it was following up on our install of MMRPro at Peninsula Ambulatory Surgical Center in Bayonne, New Jersey managed by Regent Surgical Health with signed agreements for additional MMRPro systems at the Regent- managed ASC in Fort Myers, Florida, and New Brunswick, New Jersey. Regent, a leading surgery center management and development company, currently manages more than 20 facilities nationwide.

- In April, MMR announced an agreement with Vida Senior Resource, Inc. to launch a private-branded MyMedicalRecords PHR to 50,000 patients in Vida's nationwide organization of certified owned and operated home care services agencies. That same month, MMR showcased its home health and senior care programs at the Visiting Nurse Associations of America's (VNAA) Annual meeting and began working with visiting nurses and patient advocates to sell MyMedicalRecords.com through providers of home and community-based healthcare.

- Also in April, the Company announced that China Joint Venture partner Unis-Tonghe Technology (Zhengzhou) Co., Ltd. will work with Alcatel-Lucent (ALU) to collaborate and participate in the launch of MMR's Personal Health Record products and services in China.

- In May, we announced the Company had entered into an amended services agreement with E-Mail Frequency, whose clients include AmeriDoc™ and National Benefit Builders, Inc., to offer the Company's MyMedicalRecords Personal Health Record products and services exclusively to a consortium of wholesale affinity and employee benefit Telemedicine providers starting in July. The agreement calls for E-mail Frequency to offer embedded PHRs to more than one million wholesale benefit recipients in the first year of service.

- As a result of our entrance into the patient advocate, home health, and senior care channels, the Company announced in May that we had signed reseller agreements with two nationally known Patient Advocate Organizations, Premier Health Advocates and Patient- Advocate.com, for sales of MyMedicalRecords.

- In June, MMRGlobal and Fujitsu Computer Products of America, Inc. jointly announced a business arrangement to assist physicians in smaller practices to digitize patient records using our MMRPro system integrated with the Fujitsu ScanSnap N1800 Network Scanner. Utilizing a proprietary interface created by DocuFi™, this is being marketed as a low-cost solution that enables providers the ability to digitize, store, manage and share medical records without making the significant investment required while transitioning to a full-blown EMR system.

- In June, after nearly three years of development, the Company jointly announced with 4medica that the modules which enable physicians to receive and send faxes from inside an EMR were being deployed. MMR's EMR/EHR Fax Communications Gateway is incorporated in 4medica's Certified for Meaningful Use Integrated Electronic Health Record (4medica iEHR®), which enables hospitals, physicians, labs and health information exchanges (HIEs) to aggregate laboratory, imaging, pathology, e-prescribing and inpatient data from multiple sources into a single patient-centric record.

- Also as previously reported, we continue to work with 4medica to integrate our PHR with laboratory reporting services which is used by tens of thousands of doctors nationwide. Once this information is available, information will be put directly into subscribers' accounts and users will be able to view their lab report results in binary format, meaning they will also be able to chart and graph the data.

9

- In July, we announced the exciting news that we had received our official 30-year business license from the Chinese government to operate the Unis Tonghe MMR International Health Management Service Co., Ltd. Joint Venture. Though we had been installing early stage EMR systems in three hospitals in Henan Province during the application and registration process of responding to requests from the Chinese Government, this signifies that the JV is officially licensed with the government and is now approved to operate and generate revenue through 2042.

- Also internationally, the Company announced it sold MMRPro to a physician group practice in the Philippines, which is being used to make presentations to the Government and other private physician practices and hospitals.

- In July, we announced the recent launch of our Personal Touch Concierge Service, a well-received enhanced service offering designed to simplify the process of setting up a MyMedicalRecords.com account. With the assistance of a credentialed health professional, members are provided the equivalent of a Personal Assistant authorized to collect and organize their medical records and populate them in their PHR. Personal Touch is being marketed as a packaged offering and also as an upsell to MMR's existing base of members along with affinity users from membership organizations.

- As reported in the third quarter, we signed an agreement with VisiInc PLC for the sale of a minimum of 1,275 MMRPro systems through a large reseller of medical products and services to healthcare professionals. The Company believes this represents a $17 million pipeline from MMRPro. At the end of September, we had delivered the first 25 MMRPRo systems, with the agreement obligating VisiInc to purchase a minimum of 50 MMRPro systems by the first quarter of 2013. Under the multi-year agreement, which calls for quarterly minimum purchases of MMRPro over 40 months, MMRPro is being bundled with other Visi products and marketed as VISI- MMRPro through the Seagate VAR and OEM channels. This includes a syndicate of Seagate VARs, as well as through the Burkhart Dental channel, as part of a Seagate/Visi/MMR/Via3 product bundle.

- In November, our wholly owned subsidiary, MMR Life Sciences Group, made plans to exploit our pipeline of biotech assets by facilitating a partnership or other joint venture with a privately held biotech company that has completed its Phase 2 clinical trials and is in the process of beginning Phase 3. The Company has held talks with several privately held biotech companies who are finding it difficult to get the funding necessary to commence Phase 3 trials. As a result, they are looking at options to go public by reverse merger or a Form 10 Registration Statement.

- As a result of our initiative to actively pursue licensing arrangements based on MMR's health IT patents, we started seeing results in November when we agreed to the terms of patent license agreements with EMR and PHR vendors including Healthcare Holdings, Group, Inc. and Access My Records, Inc. and began making licensed services available to more than 30,000 physician accounts belonging to 4medica. The Company also began the process of licensing our patented PHR technologies and other intellectual property with strategic technology partner, Nihilent Technologies, to hospital networks, purchasing syndicates and trade associations representing thousands of hospitals, clinics and other healthcare providers in Illinois, Arizona, New Jersey Louisiana and Pennsylvania.

- Following our third quarter financial statements reporting that MMR and VisiInc had entered into an agreement to sell 1,275 patented MMRPro systems, our two companies jointly announced in December that the bundled VISI-MMRPro systems were in the process of being shipped and installed to Burkhart Dental. Burkhart is the first major account to install the VISI-MMRPro bundled solution, which is being sold through its network of more than 24,000 dental practice clients across the U.S. Although our agreement is based on selling exclusively to the dental channel, Visi has subsequently requested exclusive rights to include, legal, accounting and other verticals. As a result, the Company believes the number of units may increase.

Many of the programs the Company launched during 2012 are expected to achieve their targets throughout the next year. For example, consumers will be able to purchase our Prepaid Personal Health Record card nationwide. The programs we are creating for Vida Senior Resource are requiring significant lead time, training and testing to deploy and we anticipate that these will show results in 2013, along with other verticals in our Rapid Revenue Program that we launched in April. Because the program focuses specifically on sales to mass merchandisers including pharmacies and medical supply companies, home healthcare agencies and assisted living facilities, we believe our efforts will be further supported by our sixth health IT patent that was allowed in December 2012 because it potentially affects retail establishments that maintain Personal Health Records or patient portals for customers and fill prescriptions online and service providers who offer web-based portals for consumer access to personal health information. The growth in Telemedicine is also expected to fuel the value of the Company's IP. So, for example, because Telemedicine portals require connectivity to the patient, this gives MMR the opportunity to increase revenue by offering a combined Alcatel-Lucent platform with MMR's patented PHR through organizations and employers with direct connection to the doctor and wellness management tools. We also plan to provide automated data exchange with Blue Button sites offered by the VA and at Medicare.gov. This is in addition to our own branded MyBlueButton.com portal launched in April 2011. The Company is also beginning to see a trend toward providing Personal Health Records for animals and through relationships with horse owners and Dancing Paws, founded by MMRGlobal's CEO, we intend to sell our PHR into the $5 billion U.S. pet market.

10

Additionally, we will continue to use social media to build greater awareness for our products and services. In 2012, we increased utilization of social media (YouTube, Facebook, Twitter) to enhance brand loyalty for our MyMedicalRecords PHR and connect with a greater number of potential users. The Facebook advertising campaign that we have been running delivered 20.7 million impressions in just one month. In the fourth quarter, the Company also rolled out an affiliate marketing program, in which marketing partners such as list publishers and health-related websites will be offered the ability to bring the Personal Health Record to their customers on a "Per Acquisition" basis, which means MMR only pays them if the Company received a paid subscription. This program will give MMR the ability to put its marketing message in front of millions of new viewers, in a targeted way, without having to pay cost of advertising upfront.

Even though we are competing with companies that spend hundreds of millions of dollars in the health IT market, we have managed to spend a fraction of that amount and still enjoy strategic partnerships and sales and licensing agreements designed to generate revenues with companies such as UST Global, 4medica, Alcatel-Lucent and ng Connect, our China Joint Venture Partner Unis-Tonghe Technology (Zhengzhou) Co., Ltd., Australian licensee VisiInc PLC, E-mail Frequency, Fujitsu Computer Products of America, Inc., Interbit Data, Vida Senior Resource, Inc., and healthcare providers and surgery centers across the United States. We believe that our PHR is the most robust and comprehensive product in the market and we feel confident that the patents surrounding our products and services will prove to have tremendous potential.

Our Products

MyMedicalRecords - An Online Personal Health Record

Our MyMedicalRecords PHR product, principally accessible at

www.mymedicalrecords.com, delivers an easy-to-use, web-based medical records and health information storage, retrieval and management system for use by consumers and healthcare professionals. Built on our patented technologies, the MyMedicalRecords PHR product allows for paper-based medical records such as lab reports, radiology reports, MRI reports and progress notes to be transmitted via fax or file upload to a secure mailbox that is created when a user enrolls in the service. Our MyMedicalRecords PHR product is designed to allow a user to fax his or her health records or other vital documents into a personal MyMedicalRecords PHR account via a dedicated telephone number, which we refer to as the user's "Lifeline." This unique telephone number is assigned to the user upon enrollment. A user can also upload digital files, such as x-rays, scans or other medical images, as well as other vital documents into his or her account directly from a personal computer through any Internet browser. In addition, the MyMedicalRecords PHR accepts voice messages.Our MyMedicalRecords PHR product is bilingual in English and Spanish and allows users to store and segregate information for up to 10 family members in a single account. It is a patient-controlled PHR that provides portability for the user, which means our MyMedicalRecords PHR can stay with the individual through changes in doctors, jobs and insurers.

Through an Internet-based solution, the MyMedicalRecords PHR takes advantage of the one piece of equipment still being used in virtually every doctor's office: a fax machine. Healthcare providers can transmit documents to a patient's MyMedicalRecords PHR mailbox without making any changes to existing patient or practice management software. Our MyMedicalRecords PHR product can be used to provide secure storage for a variety of important confidential records, including:

- Patient charts, notes, and medical histories;

- Vaccination and immunization records;

- Lab reports and test results, including any images (or, if offered by a laboratory, links that the user can use to access the laboratory's stored images);

- Copies of prescription orders;

- X-ray results and images (either the actual images or, if offered by a radiology provider, links that the user can use to access the provider's stored images);

- EKG results and images (either the actual images or, if offered by an imaging provider, links that the user can use to access the provider's stored images);

- Birth certificates, living wills, healthcare powers of attorney and advance directives;

- Lab report and pharmacy records through 4medica; and

- Telemedicine data through Alcatel-Lucent ng Connect

In addition, users can store important legal, insurance and financial documents, as well as copies of identification documents such as passports and driver's license in their MyMedicalRecords PHR account.

11

The MyMedicalRecords.com Personal Health Record allows patients to store and manage their records

and share information with providers, as they move along the continuum of care.

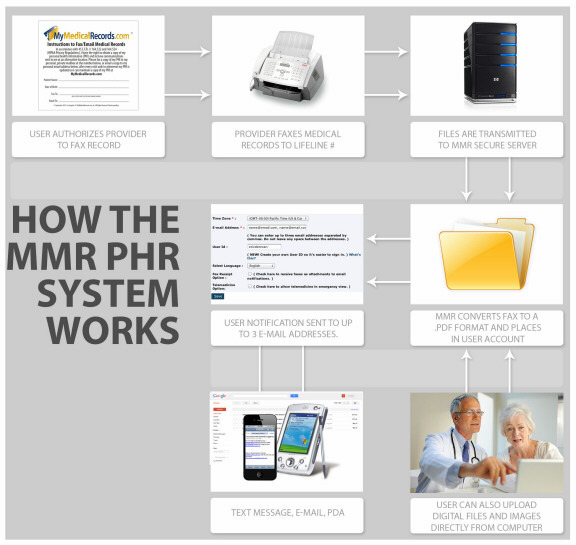

How it Works

Most providers, regardless of size, continue to rely on fax to move medical records. In fact the average physician receives more than 1,000 faxed pages per month even if they have an EMR or other electronic system. We have based our service on the efficient and effective conversion of faxed documents, uploaded documents, voice files and, more recently, telemedicine, pharmacy and laboratory data. We convert fax into encrypted Portable Document Format, or PDF files using proprietary patented technology. Users are then able to annotate and file these records using a simple, intuitive, online document management system. At the same time, users can upload records into their account and organize them using the same file management system as is used for faxed documents. Records can be shared by downloading and sending them from the user's e-mail or transmitted using the system's integrated outbound fax capability.

12

- Upon enrollment, we send every user a Welcome Kit containing a set of authorization stickers to be placed on their medical files at the doctors' offices that authorizes doctors to fax information into the MyMedicalRecords PHR, as well as a sticker for the back of a driver's license, which contains a special Physician Emergency Login password that will allow access to user information in the event of a medical emergency.

- When our MyMedicalRecords PHR system receives a document by fax transmission, it converts it into a PDF file and, using secure File Transfer Protocol transmission, or FTP, deposits it in the user's account on a secure server.

- When a faxed record or voice mail is received via the user's personal Lifeline number, our MyMedicalRecords PHR system sends a notification message to up to five e-mail addresses (including smartphones or tablets) provided by the user to inform the user that a new document or voice message has arrived in his or her account.

- The user then accesses the web site, www.mymedicalrecords.com, and logs in using their unique ID (Lifeline number or a User ID that they create) and password. Users are able to view their faxed records using any PDF reader software, which can be downloaded from the Internet free of charge.

- Our MyMedicalRecords PHR product allows users to store, organize, and sort records by doctor, date, type of medical record, and, in the event multiple family members have enrolled in the service, by family member. Users also can annotate their filed records with free-form notes and then use a search feature to find any record containing a specific word or phrase.

- The user can also upload images, such as x-rays or EKG results directly into his or her MyMedicalRecords PHR account and can view these images using an Internet browser or other graphics software. Health information stored in the user's MyMedicalRecords PHR account can also be printed, downloaded and e-mailed from the user's e-mail so the user can easily share it with any provider who may be involved in the treatment of his or her medical condition.

- Users also have the ability to fax records out of their MyMedicalRecords PHR account using an integrated Internet fax service. This feature gives users the ability to easily share information with multiple providers with the privacy of web-based faxing that doesn't require them to print out documents and then place them in a physical fax machine. This feature also transforms the PHR into a proprietary integrated fax messaging service, which the Company believes provides a significant competitive advantage over other PHRs.

We sell our MyMedicalRecords PHR product direct to consumers on a monthly and annual subscription basis. We use the Internet as a distribution channel where consumers can enroll in our service online. Current direct to consumer pricing for our MyMedicalRecords PHR product for a family that permits storing information for up to 10 people is $99.95 for an annual subscription or $9.95 for a monthly subscription when purchased over the Internet. We also occasionally offer free trials and discounted pricing as a way to incentivize consumer acceptance of our MyMedicalRecords PHR product. The retail price point may be different than what the product is being sold for on the Internet.

We also offer a value-added service to our MyMedicalRecords PHR which we call Personal Touch. When a user enrolls in Personal Touch, their records are collected by a health professional, who then organizes them and places them into their PHR. Personal Touch is sold as an additional service and charged separately from the basic MyMedicalRecords Personal Health Record service.

For special key account programs, such as healthcare providers that would like to make the service available to patients, corporations who want to offer the service as a benefit to employees, insurance companies who offer this to policyholders, or affinity groups and other organizations who want to offer the service to their members, we provide different access-based pricing plans, which vary based on the number of people in the organization and the expected use of the product across the organization's members. For large corporate or key accounts, we co-brand or private label our site.

13

Additional Product Features

Our MyMedicalRecords PHR product offers users multiple ways to enter and maintain their personal medical information, including by fax, voice, digital file upload and online annotations as well as through customized web service links. We believe our patented integrated capability makes our MyMedicalRecords PHR product easier to use and more accessible to potential customers and healthcare professionals. This gives us a unique competitive advantage in the marketplace and creates a barrier to competitive entry. In addition to the core document conversion, storage and retrieval capabilities, our MyMedicalRecords PHR product provides a layer of useful, value-added interactive tools to help users better manage their personal and/or their families' medical records. These tools include:

- Integration with Electronic Medical Record Systems and Laboratory Reporting Services.

We are integrating our PHR with laboratory reporting services and Electronic Medical Record systems, beginning with 4medica, which is used by tens of thousands of doctors nationwide, through the creation of a HL7 messaging interface scheduled to be completed and launched in Q2 2013. Information will be put directly into user accounts and users will be able to view their laboratory reports results in binary format, meaning they will be able chart and graph this data.

- Ability to Attach Received Faxes to e-mail Notifications.

Users can elect to have records attached to the notification e-mail they receive when a new medical record is received into their account. This capability is intended to save users the extra step of logging into their account to view new records, which we believe creates a higher level of convenience and usability.

- Health History

Users can enter their personal health history, including information about doctors (such as a doctor's name, address and specialty), vaccinations and immunizations, hospitalizations/surgeries, allergies and other medical conditions that may affect ongoing healthcare.

- Appointment Calendar Feature

Users are able to take advantage of a calendar feature to schedule and generate reminders about upcoming doctor and other health-related appointments. These reminders appear when a user logs into his or her MyMedicalRecords PHR account and also can be sent to the user's e-mail address (or e-mail enabled cell phone) and imported into Microsoft® Outlook®.

- Prescription History and Refill Reminder Feature

Users are able to enter their prescriptions, pharmacies and refill dates into their MyMedicalRecords PHR accounts. The system generates reminders about refills, which are visible to users when they log into their accounts and are sent to their e-mail addresses (or e-mail enabled cell phone).

- Drug Information and Interaction Database

Users can check for potential interactions across multiple prescriptions and over the counter drugs with this comprehensive database, licensed from Multum. When each user adds a new drug to their MMR PHR prescription history, they can quickly determine if that medication has any kind of negative interaction with other prescriptions they take. This tool is especially vital because preventable adverse drug interactions kill as many as 100,000 and injure more than 1.5 million Americans each year. Consumers who see multiple providers are especially at risk.

- Voice Reminders and Messaging

We have created our MyMedicalRecords PHR product to promote more efficient communication between doctors and patients. In addition to using a patient's personal MyMedicalRecords PHR telephone number to fax health information to a patient's secure online account, people can use the telephone number to leave a voice message, such as an appointment reminder, in a secure voice mailbox that is only accessible by the MyMedicalRecords PHR user. Users can also take advantage of this feature to leave themselves a reminder message such as for a doctor appointment or prescription refill reminder. Our MyMedicalRecords PHR product is designed to send a user a notification via e-mail when he or she receives a voice message. This gives users a helpful tool that they can access remotely.

- Secondary Passwords on Selected File Folders

Users can assign a second password to four of the file folders in their MyMedicalRecords PHR account. This feature creates an additional layer of security for personal vital or medical documents that a MyMedicalRecords PHR user does not want a doctor to have access to in the event that the user has given the doctor access to the account, or if the user does not want other family members to be able to see selected information.

14

- Emergency Login For Physicians and Other Emergency Response Personnel

Users can create a special password, one for each family member, which doctors and other emergency response personnel can use to gain access to the particular family member's medical records in the event of a medical emergency. This password grants access to an account but does not allow any additions, changes or deletions to be made to the account. In addition, users can decide which records a doctor will be able to see in an emergency situation. Users can write this password on an emergency sticker they receive when they enroll in our MyMedicalRecords PHR service, which can be affixed to a driver's license or personal ID. Users can even include a photograph in their emergency profile.

- Health Information Library

Users have access to an interactive audio and visual encyclopedia, licensed from a third-party, of over 2,000 health information topics presented in both English and Spanish.

- Telemedicine.

We are integrating our PHR with the Alcatel Lucent ng Connect Telemedicine suite. This will take data directly from wireless Bluetooth monitoring devices, such as blood pressure monitors, and deposit readings directly into the MyMedicalRecords PHR. The Company believes that these enhancements will increase usability and make it easier for consumers to view their important medical records.

The Company is also working with a number of vendors to create mobile applications for its MyMedicalRecords.com PHR. This mobile application has already been deployed in beta mode for Android tablets and smartphones. A mobile version for iOS (iPhones and iPads) is also being developed.

Other Applications for Our MyMedicalRecords PHR Product Technologies

We believe our MyMedicalRecords PHR product technology presents potential market opportunities beyond its core "Personal Health Records" storage and management purpose. In the wake of recent hurricanes, tsunamis, earthquakes, fires and other disasters, a great deal of emphasis has been placed on families having a secure place to store their records and vital documents where they cannot be lost or damaged. Our MyMedicalRecords PHR product addresses this need because it allows for the fax transmission, upload and storage of insurance, financial and other personal documents, as well as a place to store digital files such as photographs. We believe this recent emphasis provides us with an opportunity to expand our core market and use our MyMedicalRecords PHR product technology to create the essential "safe deposit" box for all important documents and records of a family or small business. The MyEsafeDepositBox virtual storage product extends the MyMedicalRecords technology into these additional markets.

The Company also has a MyBlueButton.com initiative where veterans and Department of Defense personnel can upload their health information from their MyHealth e Vet account to a MyMedicalRecords PHR, where they can manage all their medical data and other important information in one secure location. In addition to safely storing their Blue Button data file, each MyMedicalRecords account comes with a password-protected voice mailbox, inbound and outbound fax, a drug interaction tool and many other features to manage and track their health. MyMedicalRecords also allows them to store medical records for their family members, including pets, in one account.

MyEsafeDepositBox - An Online Secure Document Storage System

Our MyEsafeDepositBox product is based on the same technology and architecture as the MyMedicalRecords PHR, however, rather than focusing on medical records, it is designed to meet the needs of businesses and individuals who are looking for a simple, efficient and economical way to securely store important legal, insurance and financial documents that they cannot afford to lose. Such documents may include copies of insurance policies, deeds of trust, passport, birth certificate, photos of property and other vital documents in addition to medical records that are critical to retrieve in the event of a natural disaster such as an earthquake, hurricane, flood or fire.

15

We believe that the MyEsafeDepositBox product offers distinctive value in the online storage market due to our telecommunications platform enabling users to fax vital records directly into their MyEsafeDepositBox account without having to first scan paper-based records and have access to a computer to upload information, though the system can receive and store uploaded documents as well. It also permits service providers, such as insurance agents or lenders, to fax documents directly into a user's secure online account. Users also benefit from the ability to sort, store and manage their vital records, while also using a free form text search to find records stored in their account with specific annotations. Our ability to provide private label branding of this product affords banks, insurance companies, escrow services and other financial and legal businesses to provide not only a useful product but also a product that reinforces that business's identity.

In addition, we believe our MyEsafeDepositBox product may also serve as a valuable tool for younger consumers who would not otherwise utilize a PHR storage system, but are looking for a secure way to organize their personal information to take better control over their financial affairs

Pricing for MyEsafeDepositBox is similar to the MyMedicalRecords PHR. Suggested retail price is $9.95 per month or $99.95 annually, and is also made available to corporations and membership groups on an access-fee basis.

MyMedicalRecordsMD also known as MMRPro - An Integrated Scanning and Web-Based Document Management Solution for Medical Providers

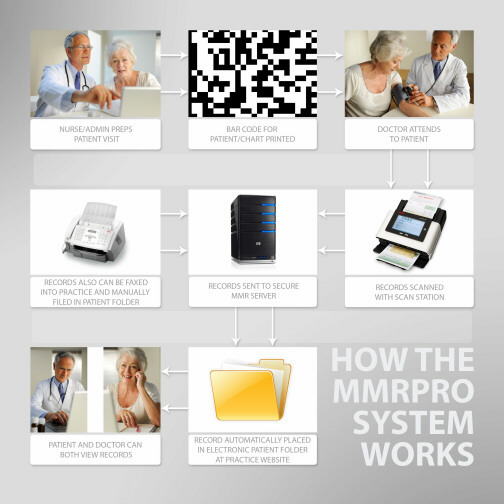

MyMedicalRecords Pro, or MMRPro was launched in late 2009. This product provides physician practices, particularly smaller practices that are still largely or entirely paper based and are resistant to making the significant investment required to convert to an Electronic Medical Records, or EMR system, a powerful, integrated solution that enables them to scan, digitize, store, manage, retrieve and share records with patients through a managed "Software As Service" web application created and managed by the Company.

A typical EMR implementation costs well in excess of $100,000 and can take several weeks or months to integrate into a doctor's practice. Even worse, during this implementation, a doctor's office is asked to significantly reduce their patient load by as much as 50% which means that the practice loses one-half of its revenue during the implementation period and possibly longer. In a healthcare economy where patient load is critical to a doctor's financial success, this can be very problematic. MMRPro is sold on a three-year license, which includes all hardware, software and system management; a typical four doctor practice would pay $21,600 for the system, which could be financed over the life of the license.

How It Works